Rising prices outnumbered declining ones by a solid margin, but the Main Market Index of the Jamaica Stock Exchange stocks slipped modestly on Thursday as the value of stocks trading remained close to Wednesday’s level.

Rising prices outnumbered declining ones by a solid margin, but the Main Market Index of the Jamaica Stock Exchange stocks slipped modestly on Thursday as the value of stocks trading remained close to Wednesday’s level.

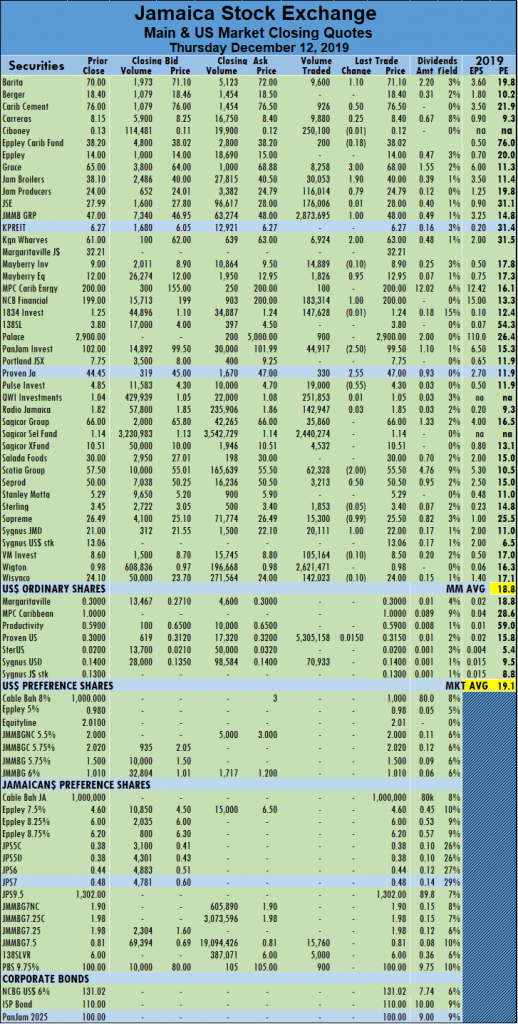

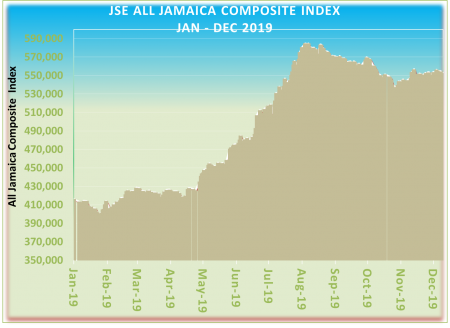

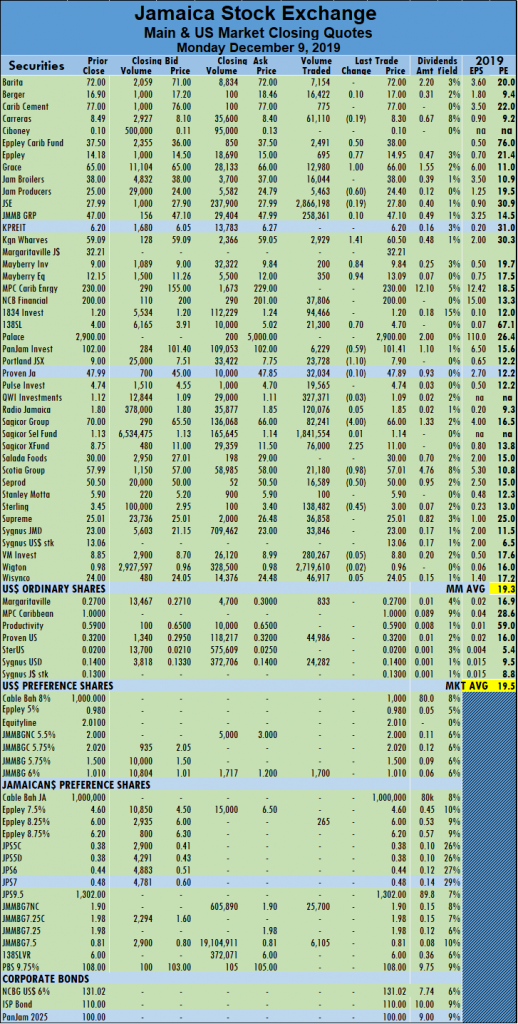

At the close, JSE All Jamaican Composite Index declined by 432.39 points to end at 552,352.79, the JSE Market Index lost 388.56 points to close at 502,923.21 and the JSE Financial Index fell 0.40 points to close at 135.87.

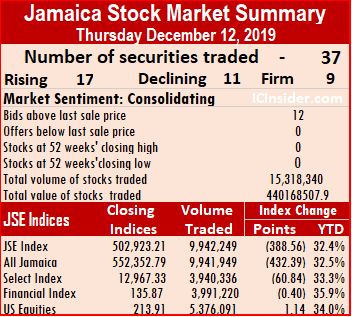

The market closed with 37 securities changing hands in the main and US dollar markets with 17 advancing, 11 declining and the prices of 9 stocks closed unchanged. JSE Main Market activity ended with 35 securities accounting for 9,942,249 units valued $213,225,571, in contrast to 26,501,648 units at $237,434,671 on Wednesday, from 37 securities.

JMMB Group dominated trading with 3.05 million shares for 31 percent of the day’s trade followed by Wigton Windfarm with 2.6 million shares and 26 percent of volumes traded and Sagicor Select Funds – Financials sector with 2.44 million shares for 25 percent market share. In the US dollar market, Proven Investments exchanged 5.3 million units.

The market closed with an average of 284,064 units valued at $6,092,159 for each security traded, in contrast to 716,261 units for $6,417,153 on Wednesday. The average volume and value for the month to date amounts to 351,921 units for $5,507,716 and previously, an average of 359,075 units valued at $5,438,139 for each security changing hands. The market closed out November with an average of 653,621 units valued at $8,699,916 for each security traded.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows 12 stocks ending with bids higher than their last selling prices and none closed with lower offers. The PE ratio of the market ended at 19.1, with the JSE Main Market ending at 18.8 times the current year’s earnings.

In the premier market, Barita Investments climbed $1.10 to settle at $71.10, with an exchange of 9,600 shares, Caribbean Cement recovered 50 cents to end at $76.50, with 926 units changing hands, Grace Kennedy gained $3 to close at $68, after transferring 8,258 shares. Jamaica Broilers added $1.90 to end at $40, with 30,053 shares crossing the exchange, Jamaica Producers traded 116,014 stock units and rose 79 cents to end at $24.79, JMMB Group gained $1 to end at $48 with 2,873,695 hares trading.  Kingston Wharves gained $2 to settle at $63, in trading 6,924 units, Mayberry Jamaican Equities rose 95 cents to end at $12.95, with 1,826 units changing hands, NCB Financial Group gained $1 to close at $200, in swapping 183,314 shares. PanJam Investment fell $2.50 to close at $99.50, in trading 44,917 shares. Proven Investments rose $2.55 to settle at $47, in trading 330 units, Pulse Investments fell 55 cents to $4.30, with 19,000 stock units changing hands, Scotia Group dropped $2 to settle at $55.50, in transferring 62,328 shares. Seprod gained 50 cents in trading 3,213 stocks to close at $50.50, Supreme lost 99 cents to close at $25.50 with 15,300 units crossing the market and Sygnus Credit Investments rose $1 to $22 while exchanging 20,111 shares.

Kingston Wharves gained $2 to settle at $63, in trading 6,924 units, Mayberry Jamaican Equities rose 95 cents to end at $12.95, with 1,826 units changing hands, NCB Financial Group gained $1 to close at $200, in swapping 183,314 shares. PanJam Investment fell $2.50 to close at $99.50, in trading 44,917 shares. Proven Investments rose $2.55 to settle at $47, in trading 330 units, Pulse Investments fell 55 cents to $4.30, with 19,000 stock units changing hands, Scotia Group dropped $2 to settle at $55.50, in transferring 62,328 shares. Seprod gained 50 cents in trading 3,213 stocks to close at $50.50, Supreme lost 99 cents to close at $25.50 with 15,300 units crossing the market and Sygnus Credit Investments rose $1 to $22 while exchanging 20,111 shares.

Trading in the US dollar market closed with 5,376,091 units valued at US$1,681,059 with the market index adding 1.14 points to close at 213.91. Proven Investments traded 5,305,158 shares to close with a gain of1.5 cents at 31.5 US cents and Sygnus Credit Investments exchanged 70,993 shares at 14 US cents.

JSE Main Market index slips

Gains for Junior Market

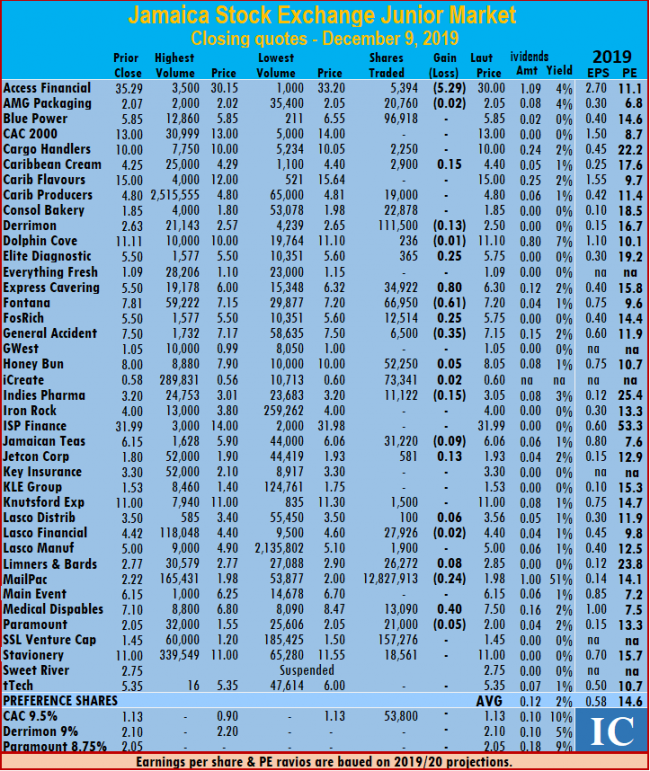

At the close of trading on Thursday, the Junior Market index recovered just 31.86 points of the 55.78 points lost on Wednesday and the 66.99 points fall on Monday as the market closed at 3,373.16 on Thursday.

At the close of trading on Thursday, the Junior Market index recovered just 31.86 points of the 55.78 points lost on Wednesday and the 66.99 points fall on Monday as the market closed at 3,373.16 on Thursday.

Market activity resulted in 25 securities changing hands with gains in just 13, while the prices of 4 declined and prices of 8 remained unchanged.

Junior Market activity, left the market’s average PE at 14.4. Trading ended with an exchange of 4,526,825 units in exchange for $11,980,216, compared to 8,280,200 units for $16,484,044 on Wednesday, from 30 securities trading on Tuesday.

Trading ended with an average of 181,073 units for an average of $479,209 in contrast to 276,007 units for an average of $549,468 on Wednesday. The average volume and value for the month to date amounts to 255,401 shares at $585,144 compared to an average of 263,515 shares at $596,709 for each security traded. In contrast, November closed with an average of 120,579 shares at $506,880 for each security traded.

IC bid-offer Indicator| At the end of trading, the Investors Choice bid-offer indicator with five stocks ending with bids higher than their last selling prices and two with lower offers.

At the close of the market, AMG Packaging gained 8 cents in trading of 9,207 units at $2, Blue Power exchanged 1,500 shares, after rising 10 cents to end at $6.03. Caribbean Cream fell 11 cents in trading 3,827 units at $4.29, Consolidated Bakeries climbed 37 cents to settle at $1.97 after trading 7,810 stock units, Elite Diagnostic traded 20,750 shares to close at $5.20 after falling 30 cents, Express Catering rose 7 cents in exchanging 103,107 shares to close at $6.32. FosRich rose 3 cents to settle at $4.28 in trading 12,878 stock units, General Accident fell 10 cents while exchanging 9,600 shares at $7.40, Indies Pharma gained 23 cents trading of 72,656 units at $3.24,  Iron rock Insurance closed at $3.80 after falling 20 cents with 13,000 shares trading. Jamaican Teas recovered the 7 cents lost on Wednesday with 6,306 units changing hands at $6.06, Jetcon Corporation exchanged 30,000 shares to close at $1.80 after falling 13 cents, Knutsford Express jumped $1.20 with just 100 shares crossing the exchange at $11.20, Limners and Bards rose 4 cents in trading 27,920 units at $2.85. MailPac rose 16 cents to end at $1.94 with 3,706,223 shares changing hands, Main Event gained 38 cents to settle at $6.45 while exchanging 74,342 units, Paramount Trading rose 45 cents with an exchange of 20,000 shares to close at $2 and tTech recovered 61 cents to close at $6.01 after an exchange of 55,296 shares.

Iron rock Insurance closed at $3.80 after falling 20 cents with 13,000 shares trading. Jamaican Teas recovered the 7 cents lost on Wednesday with 6,306 units changing hands at $6.06, Jetcon Corporation exchanged 30,000 shares to close at $1.80 after falling 13 cents, Knutsford Express jumped $1.20 with just 100 shares crossing the exchange at $11.20, Limners and Bards rose 4 cents in trading 27,920 units at $2.85. MailPac rose 16 cents to end at $1.94 with 3,706,223 shares changing hands, Main Event gained 38 cents to settle at $6.45 while exchanging 74,342 units, Paramount Trading rose 45 cents with an exchange of 20,000 shares to close at $2 and tTech recovered 61 cents to close at $6.01 after an exchange of 55,296 shares.

Prices of securities trading for the day are those at which the last trade took place.

More TTSE stock gains

JMMB closed at a record high of $2.75 on the TT Stock Exchange of Thursday

The Trinidad & Tobago Stock Exchange continued its upward climb on Thursday, but with modest index gains with advancing stocks, edged out decliners four to one.

The market added the second Ordinary shares listing on the Small and Medium Enterprise market on Thursday with Endeavor Holdings, a real estate investment company, starting trading and exchanged 500 shares at $12.50.

IC bid-offer Indicator| The Investor’s Choice bid-offer ended at four stocks with bids higher than their last selling prices and three with lower offers.

Trading ended with 15 securities changing hands, against 12 on Wednesday, with 4 advancing, 1 declining while 10 remained unchanged. Clico Investment Fund, JMMB Group and LJ Williams B share traded at a new 52 weeks’ high.

At the close of the market, the Composite Index added 2.41 points to close at 1,462.74. The All T&T Index gained just 0.18 points to 1,841.57, while the Cross Listed Index rose 0.64 points to end at 147.54.

Investors traded 562,988 units for $6,445,127, compared to 363,101 units valued at $10,508,456 on Wednesday.

Gains| Clico Investment Fund climbed $1 and settled at $26, with 18,400 units crossing the exchange, JMMB Group rose 21 cents and settled at $2.75, with investors exchanging 390,000 shares. Scotiabank gained 5 cents to end at $59.80 with 1,125 shares changing hands and LJ Williams closed with a gain of 15 cents and completed trading with 5,000 units at $1.50.

Losses| Massy Holdings lost 5 cents and settled at $59.70, with 100 units changing hands.

Firm Trades| First Caribbean International Bank ended at $8, after swapping of 14,452 shares, Guardian Holdings traded 5,000 units at $21, National Enterprises ended at $5.55, after exchanging 200 shares. NCB Financial settled at $11.30, with 4,862 stock units changing hands, One Caribbean Media concluded trading of 100 units at $9.50, Point Lisas ended at $3.58, with an exchange of 19,883 units. Republic Financial settled at $131, swapping 1,125 shares, Trinidad & Tobago NGL traded 1,700 shares to close at $21.50 and West Indian Tobacco ended at $42.50, with 101,200 stock units changing hands.

Prices of securities trading are those at which the last trade took place.

JSE Main Market in big recovery

Stocks surged on Wednesday to erase most of Tuesday’s sharp fall on the Main Market of the Jamaica Stock Exchange as advancing stocks just outnumbering declining ones.

Stocks surged on Wednesday to erase most of Tuesday’s sharp fall on the Main Market of the Jamaica Stock Exchange as advancing stocks just outnumbering declining ones.

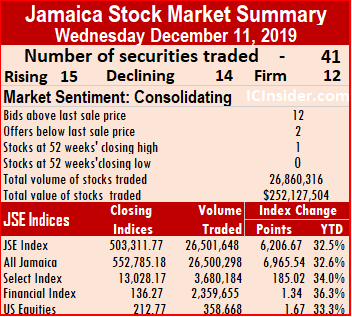

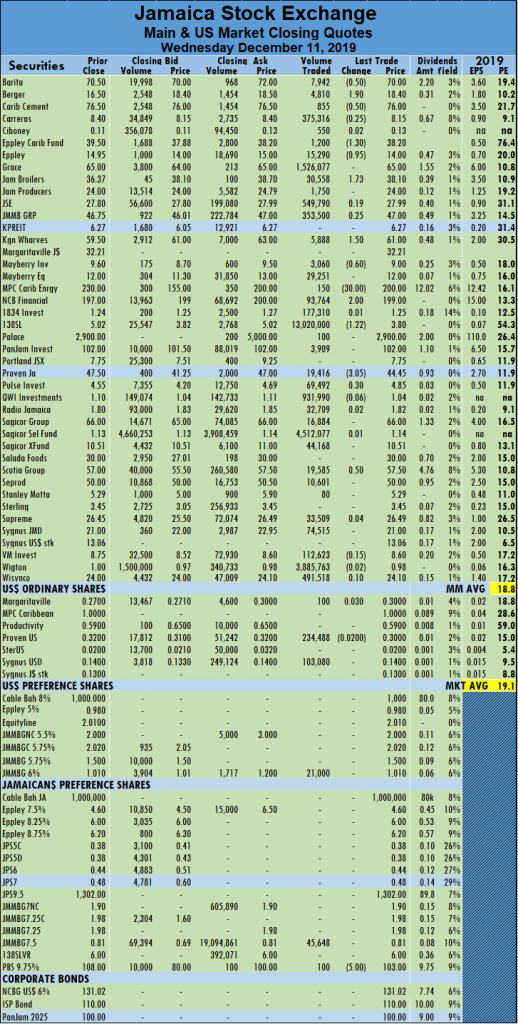

At the close, JSE All Jamaican Composite Index advanced 6,965.33 points to close at 552,785.17, the JSE Market Index gained 6,206.67 points to 503,311.77 and the JSE Financial Index rose 1.34 points to close at 136.27.

The market closed with 40 securities changing hands in the main and US dollar markets with 15 advancing, 14 declining and the prices of 12 closed unchanged. Main market activity ended with 37 securities accounting for 26,501,648 units for $237,434,671, in contrast to 9,259,581 units valued at $69,761,481 on Tuesday from 38 securities.

138 Student Living dominated trading with 13 million shares for 49 percent of the day’s trade followed by Sagicor Select Funds with 4.5 million shares and 17 percent of volumes traded and Wigton Windfarm with 3.9 million shares for 14.7 percent market share.

The market closed with an average of 716,261 units at $6,417,153 for each security traded, in contrast to 255,401 units valued at an average of $1,835,828 on Tuesday.  The average volume and value for the month to date amounts to 359,075 units valued at $5,438,139 units for $5,438,139 and previously, an average of 383,292 units valued at $5,297,192 for each security changing hands. The market closed out November with an average of 653,621 units valued at $8,699,916 for each security traded.

The average volume and value for the month to date amounts to 359,075 units valued at $5,438,139 units for $5,438,139 and previously, an average of 383,292 units valued at $5,297,192 for each security changing hands. The market closed out November with an average of 653,621 units valued at $8,699,916 for each security traded.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows 12 stocks ending with bids higher than their last selling prices and 2 with lower offers. The PE ratio of the market ended at 19.1, with the JSE Main Market ending at 18.8 times the current year’s earnings.

In the prime market, Barita Investments lost 50 cents to settle at $70, with an exchange of 7,942 shares, Berger Paints gained $1.90 to close at $18.40 trading 4,810 shares, Caribbean Cement lost 50 cents to end at $76, with 855 units changing hands, Eppley Caribbean Property Fund slid $1.30 to $38.20, after transferring 1,200 shares. Eppley closed 95 cents lower to $14, in switching ownership of 15,290 shares, Jamaica Broilers added $1.73 to end at $38.10, with 30,558 shares crossing the exchange, Kingston Wharves gained $1.50 to settle at $61, in trading 5,888 units,  Mayberry Investments lost 60 cents to end at $9, with 3,060 units changing hands. MPC Caribbean Clean Energy dived $30 to $200, after exchanging a mere 150 units, NCB Financial Group gained $2 to close at $199, in swapping 93,674 shares. 138 Student Living dropped $1.22 to close at $3.80, with 13,020,000 shares crossing the exchange, Proven Investments lost $3.05 to settle at $44.45, in trading 19,416 units, Pulse Investments closed with a gain of 30 cents at $4.85, with 69,492 units changing hands and Scotia Group gained 50 cents to settle at $57.50, in transferring 19,585 shares.

Mayberry Investments lost 60 cents to end at $9, with 3,060 units changing hands. MPC Caribbean Clean Energy dived $30 to $200, after exchanging a mere 150 units, NCB Financial Group gained $2 to close at $199, in swapping 93,674 shares. 138 Student Living dropped $1.22 to close at $3.80, with 13,020,000 shares crossing the exchange, Proven Investments lost $3.05 to settle at $44.45, in trading 19,416 units, Pulse Investments closed with a gain of 30 cents at $4.85, with 69,492 units changing hands and Scotia Group gained 50 cents to settle at $57.50, in transferring 19,585 shares.

Trading in the US dollar market closed with 358,568 units valued at US$108,806, with the market index climbing 1.67 points to 212.77. Margaritaville traded at a 52 weeks’ high of 30 cents after rising 3 cents with 100 units changing hands, Proven Investments exchanged 234,488 to close with a loss of 2 cents at 30 US cents, Sygnus Credit Investments exchanged 103,080 shares at 14 US cents and JMMB Group 6% preference share closed at US$1.01, with 21,000 units changing hands.

TTSE 2019 gains continue to grow

The Trinidad & Tobago Stock Exchange continued its upward climb on Wednesday as 2019 ages and the bull slowly awakens amidst the Trinidad warmth leading to two stocks closing at 52 weeks’ highs.

The Trinidad & Tobago Stock Exchange continued its upward climb on Wednesday as 2019 ages and the bull slowly awakens amidst the Trinidad warmth leading to two stocks closing at 52 weeks’ highs.

IC bid-offer Indicator| The Investor’s Choice bid-offer ended with three stocks closing with bids higher than their last selling prices and three with lower offers.

Trading ended with 12 securities changing hands, against 13 on Tuesday, with 5 advancing, 4 declining and 3 remained unchanged.

At the close of the market, the Composite Index added 5.49 points on Wednesday to 1,462.74. The All T&T Index gained 9.11 points to 1,841.39, while the Cross Listed Index gained 0.25 points to close at 146.90.

Investors traded 363,101 units valued at $10,508,456 compared to 158,719 shares amounting to $1,971,657 on Tuesday.

Gains| First Citizens Bank recovered the $1 lost on Tuesday to close at $44, with 4,550 units changing hands. JMMB Group closed with an increase of 1 cent at $2.54, after exchanging 8,500 shares, Republic Financial Holdings gained 85 cents with 3,675 shares changing hands to close at a 52 weeks’ high of $131.  Trinidad & Tobago NGL gained 39 cents in trading 6,196 shares to close at $21.50 and West Indian Tobacco added 50 cents to end at 52 weeks’ high of $42.50 after exchanging 203,080 shares.

Trinidad & Tobago NGL gained 39 cents in trading 6,196 shares to close at $21.50 and West Indian Tobacco added 50 cents to end at 52 weeks’ high of $42.50 after exchanging 203,080 shares.

Losses| National Enterprises lost 6 cents and closed at $5.49 with 549 stock units changing hands, NCB Financial shed 10 cents and settled at $11.30, with 69,222 stock units changing hands, Point Lisas declined by 2 cents to close at $3.58 while trading 2,026 shares, Scotiabank lost 25 cents in settling at $59.75, with 1,670 units changing hands and

Firm Trades| Guardian Holdings ended at $21, with 2,000 units crossing the exchange, Massy Holdings closed at $59.75, in trading 329 units and National Flour ended at $1.36, with investors exchanging 61,304 shares.

Prices of securities trading are those at which the last trade took place.

Junior Market ekes out minor gain

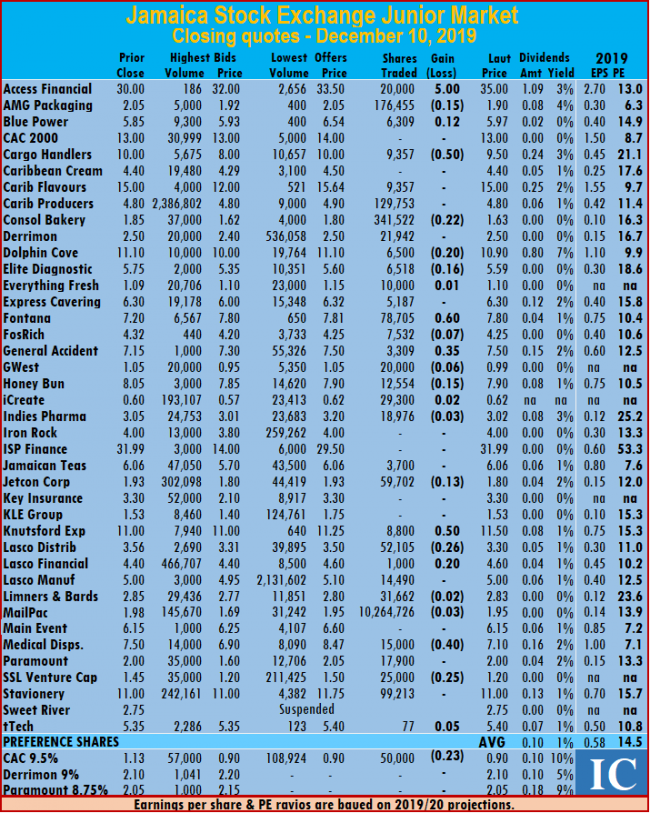

The Junior Market index inched 1.16 points higher to close at 3,397.08 on Tuesday after dropping sharply by 66.99 points on Monday, with declining stocks exceeding rising ones.

The Junior Market index inched 1.16 points higher to close at 3,397.08 on Tuesday after dropping sharply by 66.99 points on Monday, with declining stocks exceeding rising ones.

Market activity, resulted in 33 securities changing hands with gains in 9 securities, declines in 16 while the prices of 8 remained unchanged, but CAC 2000 Preference share, closing at a 52 weeks’ low.

Junior Market activity, left the markets average PE at 14.5. Trading ended with an exchange of 11,556,651 shares for $25,163,399 compared to 13,720,939 units for$30,393,491 from 28 securities trading on Monday.

Trading ended with an average of 350,202 units for $762,527 for each stock traded, in contrast to 490,034 units for $1,085,482 on Monday. The average volume and value for the month to date amounts to 261,632 shares at $603,830 compared to an average of 244,025 shares at $572,282 for each security traded. In contrast, November closed with an average of 120,579 shares at $506,880 for each security traded.

IC bid-offer Indicator| At the end of trading, the Investors Choice bid-offer indicator with five stocks ending with bids higher than their last selling prices and 4 with lower offers.

At the close of the market, Access Financial surged $5 to end at $35 with 20,000 stock units crossing the exchange, AMG Packaging fell 15 cents in trading of 176,455 units at $1.90, Blue Power ended with a transfer of 6,309 shares, after rising 12 cents to end at $5.97. Cargo Handlers fell 50 cents in trading of 9,357 units at $9.50, Consolidated Bakeries declined by 22 cents to settle at $1.63 after trading 341,522. Dolphin Cove exchanged 6,500 shares to close at $10.90 after falling 20 cents,

In the preference segment, CAC 2000 ended with a loss of 1 cent at a 52 weeks’ low of 90 cents with 50,000 stock units changing hands. Elite Diagnostic traded 5,187 shares to close at $5.59 after falling 16 cents, Everything Fresh inched 1 cent higher in trading 10,000 shares at $1.10, Fosrich lost 7 cents in exchanging 7,532 shares to close at $4.25. Fontana rose 60 cents to $7.80, with 78,705 stock units crossing the exchange, General Accident closed trading of 3,309 units and gained 35 cents to end at $7.50, GWest Corporation lost 6 cents to settle at 99 cents while exchanging 20,000 units, Honey Bun fell 15 cents in an exchange of 12,554 shares to close at $7.90. iCreate traded 29,300 units and gained 2 cents to end at 62 cents,  Indies Pharma declined 3 cents in trading of 18,976 units at $3.02, Jetcon Corporation ended market activity exchanging 59,702 shares to close at $1.80 after falling 13 cents. Knutsford Express climbed 50 cents and traded 8,800 shares at $11.50, Lasco Distributors declined 26 cents in trading of 52,105 units at $3.30, Lasco Financial exchanged 1,000 units and put on 20 cents to end at $4.60, Limners and Bards dipped 2 cents in trading of 31,662 units at $2.83. MailPac pulled back 3 cents to end at $1.95 with 10,264,726 shares changing hands, Medical Disposables declined by 40 cents to settle at $7.10 with an exchange of 156,000 units, SSL Venture exchanged 25,000 shares to close at $1.20 after falling 20 cents and tTech ended trading of a mere 77 shares, after rising 5 cents to $5.40.

Indies Pharma declined 3 cents in trading of 18,976 units at $3.02, Jetcon Corporation ended market activity exchanging 59,702 shares to close at $1.80 after falling 13 cents. Knutsford Express climbed 50 cents and traded 8,800 shares at $11.50, Lasco Distributors declined 26 cents in trading of 52,105 units at $3.30, Lasco Financial exchanged 1,000 units and put on 20 cents to end at $4.60, Limners and Bards dipped 2 cents in trading of 31,662 units at $2.83. MailPac pulled back 3 cents to end at $1.95 with 10,264,726 shares changing hands, Medical Disposables declined by 40 cents to settle at $7.10 with an exchange of 156,000 units, SSL Venture exchanged 25,000 shares to close at $1.20 after falling 20 cents and tTech ended trading of a mere 77 shares, after rising 5 cents to $5.40.

In the preference segment, CAC 2000 ended with a loss of 1 cent at a 52 weeks’ low of 90 cents with 50,000 stock units changing hands.

Prices of securities trading for the day are those at which the last trade took place.

Sharp drop for JSE Main Market

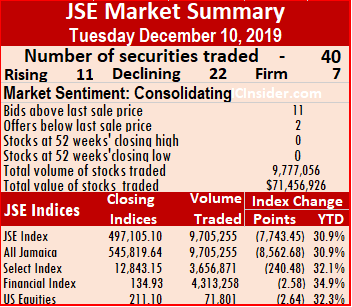

The Main Market of the Jamaica Stock Exchange suffered a significant fall at the close on Tuesday with declining stocks outnumbering advancers two to one.

The Main Market of the Jamaica Stock Exchange suffered a significant fall at the close on Tuesday with declining stocks outnumbering advancers two to one.

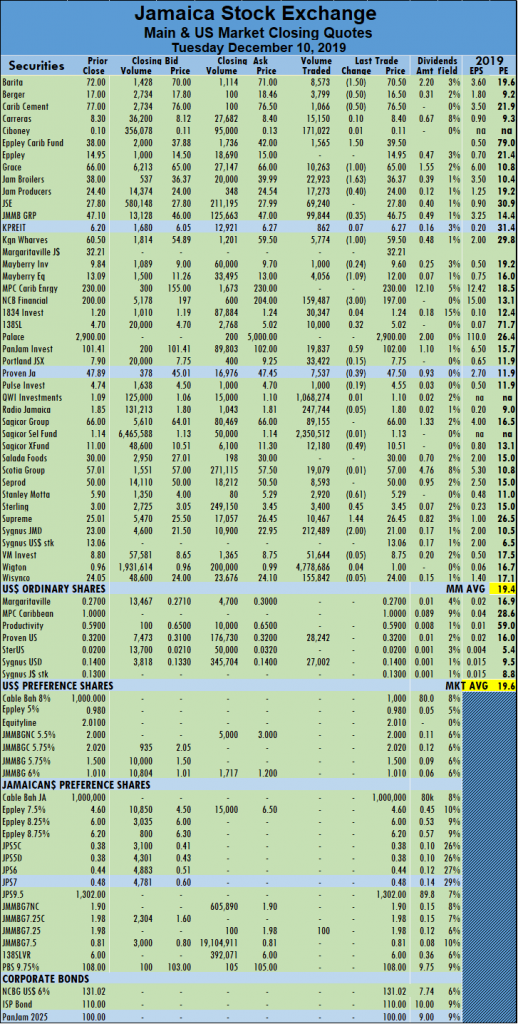

The market closed with 40 securities changing hands in the main and US dollar markets with 11 advancing, 22 declining, with prices of 7 unchanged. Main market activity ended with 38 securities accounting for 9,259,581 units valued at $69,761,481, in contrast to 5,684,180 units valued at $90,557,890 on Monday from 34 securities.

The JSE All Jamaican Composite Index dived 8,562.68 points to close at 545,819.64, the JSE Market Index plunged 7,743.45 points to 497,105.10 while the JSE Financial Index lost 2.58 points to close at 134.93.

Wigton Windfarm dominated trading with 4.8 million shares for 51.6 percent of the day’s trade, followed by Sagicor Select Funds with 2.3 million shares and 25 percent of volume and QWI Investments with 1.1 million shares and 11.5 percent.

The market closed with an average of 255,401 units valued at an average of $1,835,828 for each security traded, in contrast to 243,673 units for an average of $3,283,732 on Monday. The average volume and value for the month to date amounts to 383,292 units valued at $5,297,192 and previously, an average of 402,202 units valued at $5,897,793 for each security changing hands.  The market closed out November with an average of 653,621 units valued at $8,699,916 for each security traded.

The market closed out November with an average of 653,621 units valued at $8,699,916 for each security traded.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows 11 stocks ending with bids higher than their last selling prices and two with lower offers. The PE ratio of the market ended at 19.6, with the prime market stocks ending at 19.4 times 2019 current year’s earnings.

In the JSE Main Market, Barita Investments lost $1.50 to settle at $70.50, with 8,573 shares changing hands, Berger Paints fell 50 cents to $16.50 while trading 3,799 stock units, Caribbean Cement declined by 50 cents to end at $76.50, in swapping 1,066 units. Eppley Caribbean Property Fund added $1.50 to close at $39.50, with an exchange of 1,565 shares, Grace Kennedy declined by $1 to $65, in transferring 10,263 shares, Jamaica Broilers closed $1.63 lower to $36.37, with 22,923 shares crossing the exchange. Jamaica Producers lost 40 cents to settle at $24, after swapping 17,273 shares, JMMB Group closed at $46.75, after losing 35 cents in transferring 99,844 shares, Kingston Wharves ended at $59.50, with a loss of $1 trading 5,774 units. Mayberry Jamaican Equities closed $1.09 lower to $12 while exchanging 4,056 units, NCB Financial Group declined to $197, after losing $3 and trading 159,487 shares, 1 38 Student Living added 32 cents to close at $5.02, with 10,000 shares crossing the exchange. PanJam Investment gained 59 cents to settle at $102 in exchanging 19,837 units. Proven Investments lost 39 cents to close at $47.50, with 7,537 units changing hands, Sagicor Real Estate Fund fell to $10.51, after losing 49 cents and transferring 12,180 shares, Stanley Motta lost 61 cents to close at $5.29, in exchanging 2,920 shares. Sterling Investments gained 45 cents to end at $3.45, in swapping 3,400 shares, Supreme Ventures rose to $26.45, after climbing $1.44 with 10,467 units changing hands and Sygnus Investments closed $2 lower to $21, with an exchange of 212,489 shares.

38 Student Living added 32 cents to close at $5.02, with 10,000 shares crossing the exchange. PanJam Investment gained 59 cents to settle at $102 in exchanging 19,837 units. Proven Investments lost 39 cents to close at $47.50, with 7,537 units changing hands, Sagicor Real Estate Fund fell to $10.51, after losing 49 cents and transferring 12,180 shares, Stanley Motta lost 61 cents to close at $5.29, in exchanging 2,920 shares. Sterling Investments gained 45 cents to end at $3.45, in swapping 3,400 shares, Supreme Ventures rose to $26.45, after climbing $1.44 with 10,467 units changing hands and Sygnus Investments closed $2 lower to $21, with an exchange of 212,489 shares.

Trading in the US dollar market closed with 71,801 units valued at US$12,559, with the market index falling 2.64 points to 211.25. Proven Investments traded 28,242 to close at 32 US cents, and Sygnus Credit Investments exchanged 27,002 shares at 14 US cents.

T&TSE 2019 performance shatters 2018

Trinidad & Tobago Stock Exchange Head Quarters

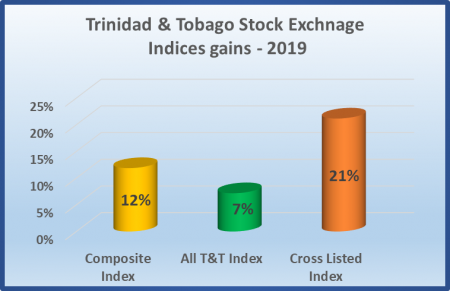

The Trinidad & Tobago Stock Exchange is ending the current year on a strong note with the three leading indices up on last year’s performance and seems set to close out 2019 much higher than the previous year.

Barring any reversals in fortunes in the last 13 trading days of the year, the Trinidad & Tobago Stock Exchange should close the year higher than it is now. Some stocks point to that development, with prices set to break higher. These stocks include First Citizens Bank, Guardian Holdings, Republic Holdings, Massy Holdings, NCB Group and West Indian Tobacco.

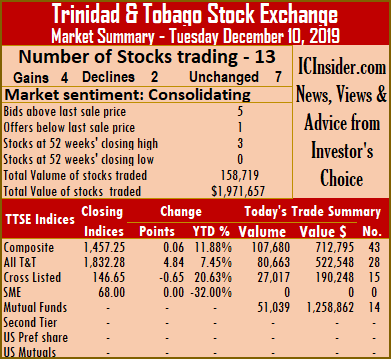

IC bid-offer Indicator| The Investor’s Choice bid-offer ended at Five stocks with bids higher than their last selling prices and one with a lower offer and is flashing positive signals of the fortune of the market ahead.

Compared to a rise of just 2.85 percent in the Composite Index last year, the index is up by a much stronger 11.88 percent to Tuesday this week, with apparently, more gains ahead before the year ends. The All T&T Index is up 7.45 percent for the year to date and while that may not sound like much, but it is far better than the 1.36 percent decline the index suffered for the entire 2018.  Cross-listed stocks posted gains of 20.63 percent to date, bettering the 12.17 percent increase last year.

Cross-listed stocks posted gains of 20.63 percent to date, bettering the 12.17 percent increase last year.

Trading ended Tuesday with 13 securities changing hands against 15 on Monday, with four rising, 2 declining and 6 remaining unchanged.

At the close of the market, the Composite Index added 0.06 points to end at 1,457.25. The All T&T Index rose 4.84 points to 1,832.28, while the Cross Listed Index declined 0.65 points to close at 146.65 as three stocks closed at 52 weeks’ highs.

Investors traded 158,719 shares amounting to $1,971,657 compared to 369,862 shares amounting to $5,832,895 on Monday.

Gains| Guardian Holdings gained 50 cents and ended at a 52 weeks’ high of $21, with 1,706 units crossing the exchange, the stock traded as high as $21.15 before ending lower but had a bid to buy 5,912 shares at $21, with the offer at $22 to sell 1,449 shares. JMMB Group closed with an increase of 3 cents at $2.53, after exchanging 10,140 shares, NCB Financial gained 10 cents and settled at $11.40, with 8,868 stock units changing hands and West Indian Tobacco climbed $1 to end at 52 weeks’ high of $42, after swapping 2,000 shares.

JMMB Group closed with an increase of 3 cents at $2.53, after exchanging 10,140 shares, NCB Financial gained 10 cents and settled at $11.40, with 8,868 stock units changing hands and West Indian Tobacco climbed $1 to end at 52 weeks’ high of $42, after swapping 2,000 shares.

Losses| First Caribbean International Bank dropped 22 cents lower to $8, after exchanging 8,009 shares and First Citizens Bank closed with a loss of $1 at $43, with 650 units changing hands.

Firm Trades| Angostura Holdings ended at $16.20, with investors exchanging 100 shares, Calypso Micro Index Fund traded 2,000 shares and closed at $15.75, Clico Investment Fund concluded trading of 49,039 units at $25, Massy Holdings closed at $59.75, in exchanging a mere seven units. National Flour ended at $1.36, with investors exchanging 63,645 shares, Scotiabank settled at $60, with 520 units changing hands and Trinidad & Tobago NGL traded 12,035 shares to close at $21.11.

Prices of securities trading are those at which the last trade took place.

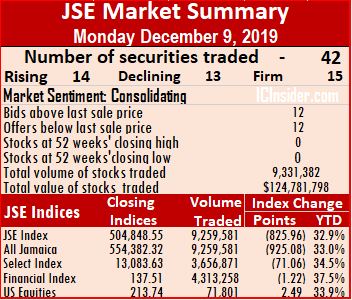

JSE declines at start of week

The Main Market of Jamaica Stock Exchange started the week on a negative note with declines in the major indices, even as advancing stocks edged out decliners.

The Main Market of Jamaica Stock Exchange started the week on a negative note with declines in the major indices, even as advancing stocks edged out decliners.

At the close, JSE All Jamaican Composite Index declined 925.08 points to close at 554,382.32, the JSE Market Index dipped 825.96 points to 504,848.55 and the JSE Financial Index lost 1.22 points to close at 137.51.

The market closed with 42 securities changing hands in the main and US dollar markets with 12 advancing, 10 declining and 16 changing hands with prices unchanged. Main market activity ended with 38 securities accounting for 9,259,581 units valued at $124,781,798, in contrast to 20,866,388 units valued at $599,807,083 on Friday from 35 securities.

Jamaica Stock Exchange stock dominated trading with 2.9 million units for 31 percent of the day’s trade, Wigton Windfarm followed with 2.7 million shares for 29 percent of the day’s volume and Sagicor Select Funds was next with 1.8 million shares for 20 percent of traded volume.

The market closed with an average of 243,673 units valued at an average of $3,283,732 for each security traded, in contrast to 162,405 units at $2,587,368 on Friday.  The average volume and value for the month to date amounts to 402,202 units valued at $5,897,793 and previously, an average of 429,709 units valued at $6,446,602 for each security changing hands. The market closed out November with an average of 653,621 units valued at $8,699,916 for each security traded.

The average volume and value for the month to date amounts to 402,202 units valued at $5,897,793 and previously, an average of 429,709 units valued at $6,446,602 for each security changing hands. The market closed out November with an average of 653,621 units valued at $8,699,916 for each security traded.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows 11 stocks ending with bids higher than their last selling prices and 9 with lower offers. The PE ratio of the market ended at 19.5, with the Main Market ending at 19.3 times 2019 current year’s earnings.

In the premier market segment, Eppley Caribbean Property Fund gained 50 cents to close at $38, with an exchange of 2,491 shares, Eppley closed 77 cents higher to end at $14.95 trading 695 units, Grace Kennedy climbed $1 to $66, in transferring 12,980 shares, Jamaica Producers lost 60 cents to settle at $24.40, after swapping 5,463 shares. Kingston Wharves gained $1.41 to close at $60.50, in swapping 2,929 units, Mayberry Investments rose to $9.84, after gaining 84 cents trading 200 units, Mayberry Jamaican Equities closed 94 cents higher at $13.09, with 350 shares changing hands,  138 Student Living closed 70 cents higher to $4.70, in swapping 21,300 shares. PanJam Investment lost 59 cents to settle at $101.41 after exchanging 6,229 units, Portland JSX closed a $7.90, after dropping $1.10 trading 23,728 stock units, Sagicor Group slumped of $4 to $66 in transferring 82,241 shares, Sagicor Real Estate Fund climbed $2.25 to end at $11 with 76,000 shares crossing the exchange. Scotia Group lost 98 cents to close at $57.01, in exchanging 21,180 shares, Seprod lost 50 cents in swapping 16,589 units, to end at $50 and Sterling Investments closed 45 cents lower to $3, with an exchange of 138,482 shares.

138 Student Living closed 70 cents higher to $4.70, in swapping 21,300 shares. PanJam Investment lost 59 cents to settle at $101.41 after exchanging 6,229 units, Portland JSX closed a $7.90, after dropping $1.10 trading 23,728 stock units, Sagicor Group slumped of $4 to $66 in transferring 82,241 shares, Sagicor Real Estate Fund climbed $2.25 to end at $11 with 76,000 shares crossing the exchange. Scotia Group lost 98 cents to close at $57.01, in exchanging 21,180 shares, Seprod lost 50 cents in swapping 16,589 units, to end at $50 and Sterling Investments closed 45 cents lower to $3, with an exchange of 138,482 shares.

Trading in the US dollar market closed with 71,801 units valued at US$19,617, with the market index falling 2.84 points to 211.25. Proven Investments traded 44,986 to close at 32 US cents, Sygnus Credit Investments exchanged 12,020 shares at 14 US cents, Margaritaville Turks ended at 27 US cents, with 833 units changing hands and JMMB Group 6% preference shares closed at US$1.01, with 1,700 units crossing the exchange.

Sharp drop for Junior Market

MailPac drops 24 cents to close at $1.98 on Monday.

The Junior Market suffered a significant fall on Monday with the market index dropping 66.99 points to close at 3,395.92 points resulting from gains in 11 securities declines in 10 while the prices of 6 remained unchanged.

Junior Market activity, left the market’s average PE at 14.6. Trading ended with 28 securities changing hands, resulting in an exchange of 13,720,939 shares for $30,393,491 compared to 18,043,694 units for $43,397,194 from 28 securities trading on Friday.

Trading ended with an average of 490,034 units for $1,085,482 for each stock traded, in contrast to 644,418 units for $1,549,900 on Friday. The average volume and value for the month to date amounts to 244,025 shares at $572,282 compared to an average of 194,110 shares at $468,155 for each security traded. In contrast, November closed with an average of 120,579 shares at $506,880 for each security traded.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator with seven stocks ending with bids higher than their last selling prices and 5 with lower offers.

At the close of the market, Access Financial traded 5,394 units to finish with a fall of $5.29 at $35.29, AMG Packaging dipped 2 cents in trading 20,760 shares at $2.05, Caribbean Cream gained 15 cents to close at $4.40 with 2.900 stock units crossing the exchange. Derrimon Trading lost 13 cents after a transfer of 115,500 shares at $2.50, Dolphin Cove lost 1 cent after exchanging just 236 stocks at $11.10, Elite Diagnostic rose 25 cents to end at $5.75 with the trading a mere 365 units. Express Catering jumped 80 cents to close at $6.30 with an exchange of 34,922 shares, Fontana suffered a sharp 61 cents fall to close at $7.20 in exchanging 66,950 stock units, FosRich traded 12,514 shares and rose 25 cents to end at $5.75. General Accident fell 35 cents to $7.15 while transferring 6,500 shares, Honey Bun closed with a rise of 5 cents to close at a 52 weeks’ high of $8.05, with 28,055 stock units crossing the exchange, iCreate traded 73,341 shares but rose 2 cents to end at 60 cents.  Indies Pharma traded 11,122 shares and lost 15 cents in closing at $3.05, Jamaican Teas fell 9 cents in exchanging 21,220 shares to end at $6.06, Jetcon Corporation traded just 581 shares and gained 13 cents to close at $1.93. Lasco Distributors closed with just 100 units changing hands after rising 6 cents to end at $3.56, Lasco Financial lost 2 cents with the trading of 27,926 shares at $4.40, Limners and Bards rose 8 cents with 26,272 shares changing hands at $2.85. Recently listed, MailPac, traded 12,827,913 shares with the price pulling back 24 cents to end at $1.98, Medical Disposables exchanged 13,090 shares after gaining 40 cents to close at $7.50 and Paramount Trading closed at $2 after slipping 5 cents with an exchange of 21,000 shares.

Indies Pharma traded 11,122 shares and lost 15 cents in closing at $3.05, Jamaican Teas fell 9 cents in exchanging 21,220 shares to end at $6.06, Jetcon Corporation traded just 581 shares and gained 13 cents to close at $1.93. Lasco Distributors closed with just 100 units changing hands after rising 6 cents to end at $3.56, Lasco Financial lost 2 cents with the trading of 27,926 shares at $4.40, Limners and Bards rose 8 cents with 26,272 shares changing hands at $2.85. Recently listed, MailPac, traded 12,827,913 shares with the price pulling back 24 cents to end at $1.98, Medical Disposables exchanged 13,090 shares after gaining 40 cents to close at $7.50 and Paramount Trading closed at $2 after slipping 5 cents with an exchange of 21,000 shares.

Prices of securities trading for the day are those at which the last trade took place.

- « Previous Page

- 1

- …

- 502

- 503

- 504

- 505

- 506

- …

- 1132

- Next Page »