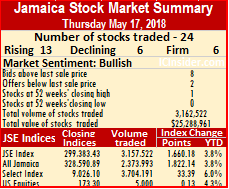

Trading on the main market of the Jamaica Stock Exchange ended on Thursday with JSE All Jamaican Composite Index jumped 1,822.14 points to 328,590.89 and the JSE Index climbed 1,660.18 points to 299,383.43.

Trading on the main market of the Jamaica Stock Exchange ended on Thursday with JSE All Jamaican Composite Index jumped 1,822.14 points to 328,590.89 and the JSE Index climbed 1,660.18 points to 299,383.43.

Volume traded on the Jamaica Stock Exchange fell sharply from Wednesday’s level, ending with 3,157,522 units valued at $24,916,371 compared to 7,688,997 units valued at $220,155,817 changing hands on the main market on Wednesday.

The lower volume was built from Ciboney Group with 1,660,000 units accounting for 52.57 percent, followed by JMMB Group 7.25% preference share with 345,000 units or 10.93 percent of the day’s volume.

At the end of market activities, 24 securities traded, compared to 23 on Wednesday, in the main and US dollar markets. Only 13 stocks rose, 6 declined and 5 traded firm.

Stocks with major price changes are, Caribbean Cement losing $2 to $35.50, Grace Kennedy rising $1.45 to $49.65, JMMB Group rising $1.50 to $28, Kingston Wharves climbed $1.90 to $48.40, Sagicor Real Estate Fund gained $1 to end at $15 and Supreme Ventures climbed $2.30 to an all-time high of $15.

Stocks with major price changes are, Caribbean Cement losing $2 to $35.50, Grace Kennedy rising $1.45 to $49.65, JMMB Group rising $1.50 to $28, Kingston Wharves climbed $1.90 to $48.40, Sagicor Real Estate Fund gained $1 to end at $15 and Supreme Ventures climbed $2.30 to an all-time high of $15.

Trading resulted in an average of 137,284 units valued at an average of $1,083,320 for each security traded. In contrast to 366,143 units for an average of $10,483,610 on Thursday. The average for the month to date is 292,000 shares with a value of $13,757,854, previously 303,017 shares with a value of $14,739,384. In contrast, April closed with an average of 708,206 shares with a value of $6,395,518 for each security traded.

In the US dollar market, Productivity Business ended trading at 59 US cents with 5,000 shares. The JSE USD Equities Index advanced by 0.13 points to close at 173.30.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows 8 stocks ended with bids higher than their last selling prices and 2 closing with lower offers.

For more details of market activities see – JSE main market volume down prices up – Thursday.

JSE main market attempts recovery – Thursday

JSE main market volume jumps – Wednesday

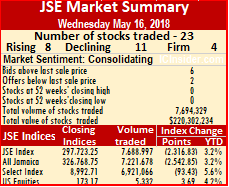

Volume traded on the Jamaica Stock Exchange picked from the very low levels on Tuesday, and ended with 7,688,997 units valued at $220,155,817 changing hands, compared to only 1,229,027 units valued at $11,204,886 trading on the main market on Tuesday.

Volume traded on the Jamaica Stock Exchange picked from the very low levels on Tuesday, and ended with 7,688,997 units valued at $220,155,817 changing hands, compared to only 1,229,027 units valued at $11,204,886 trading on the main market on Tuesday.

The increased volume was built from high volumes in JMMB Group that ended with 1,999,978 units amounting to 26.01 percent of the day’s volume, followed by Kingston Wharves with 1,801,850 units accounting for 23.43 percent of volume traded, PanJam Investment with 1,094,320 units or 14.23 percent of the volume. Supreme Ventures traded 1,012,460 units and the Jamaica Stock Exchange ended with 1,033,290 shares changing hands.

At the end of market activities, 22 securities traded, compared to 28 on Tuesday, in the main and US dollar markets. Only 8 stocks rose, 11 declined and 10 traded firm. At the close, the All Jamaican Composite Index dropped 2,542.85 points to 326,768.75 and the JSE Index dived 2,316.83 points to 297,723.25.

Stocks with major price changes are, Jamaica Broilers rose $1.10 to $21.70, Proven Investments trading in the main market jumped $1.99 to a new high of $28.50 but countering these gains were, a fall of $2.49 in the price of Kingston Wharves to $46.50, a drop of $1.64 for PanJam Investment to $45.36 and Scotia Group falling $3.39 to $50.10.

Trading resulted in an average of 366,143 units valued at an average of $10,483,610 for each security traded. In contrast to 51,209 units for an average of $466,870 on Tuesday. The average for the month to date is 303,017 shares with a value of $14,739,384, previously 298,627 shares with a value of $18,119,875. In contrast, April closed with an average of 708,206 shares with a value of $6,395,518 for each security traded.

Trading resulted in an average of 366,143 units valued at an average of $10,483,610 for each security traded. In contrast to 51,209 units for an average of $466,870 on Tuesday. The average for the month to date is 303,017 shares with a value of $14,739,384, previously 298,627 shares with a value of $18,119,875. In contrast, April closed with an average of 708,206 shares with a value of $6,395,518 for each security traded.

In the US dollar market, Proven Investments traded 5,332 shares at 22 US cents. The JSE USD Equities Index advanced by 3.69 points to close at 173.17.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows 6 stocks ended with bids higher than their last selling prices and 2 closing with lower offers.

For more details of market activities see – JSE main market make big gains – Wednesday.

Big JSE main market losses- Wednesday

Stocks declined sharply in trading on the main market on Wednesday, with the JSE All Jamaican Composite Index dropping 2,542.85 points to 326,768.75 and the JSE Index diving 2,316.83 points to 297,723.25.

Stocks declined sharply in trading on the main market on Wednesday, with the JSE All Jamaican Composite Index dropping 2,542.85 points to 326,768.75 and the JSE Index diving 2,316.83 points to 297,723.25.

The main market closed with 7,688,997 units valued at $220,155,817 trading from 22 securities changing hands, resulting from 5 securities trading more than 1 million units each and in 8 rising, 11 falling and 3 trading firm.

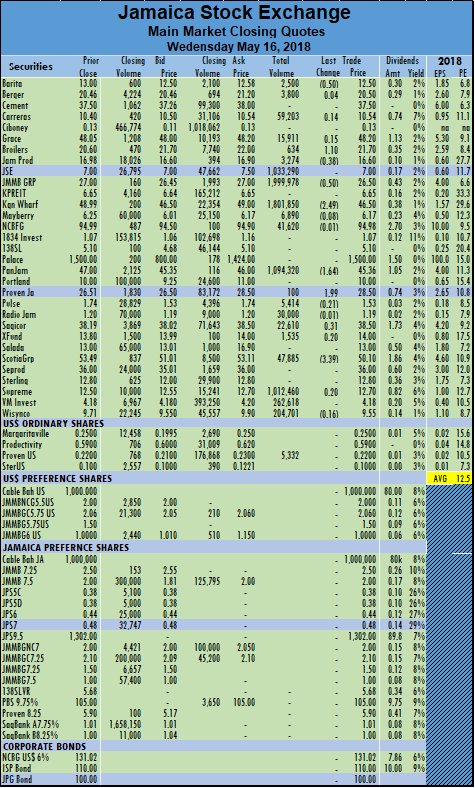

In market activity, Barita Investments lost 50 cents and closed at $12.50, with 2,500 shares trading, Berger Paints rose 4 cents to end at $20.50, with 4,608 stock units, Carreras rose 14 cents and concluded trading at $10.54, with 59,203 units, Grace Kennedy ended trading at $48.20, after rising 15 cents with 15,911 shares, Jamaica Broilers jumped $1.10 to $21.70, trading a mere 634 stock units.  Jamaica Producers lost 38 cents in finishing trading at $16.60, with 17,774 units, Jamaica Stock Exchange closed at $7, with 1,033,290 shares, JMMB Group fell 50 cents to $26.50, with 1,999,978 shares changing hands, Kingston Wharves dropped $2.49 to $46.50, with 1,801,850 stock units. Mayberry Investments settled at $6.17, with 6,890 units traded after falling 8 cents, NCB Financial Group lost just 1 cent and ended trading at $94.98, with 41,620 shares, PanJam Investment dropped $1.64 and closed at $45.36, with 1,094,320 stock units, Proven Investments traded in the main market with a rise of $1.99 to $28.50 while trading just 100 shares,

Jamaica Producers lost 38 cents in finishing trading at $16.60, with 17,774 units, Jamaica Stock Exchange closed at $7, with 1,033,290 shares, JMMB Group fell 50 cents to $26.50, with 1,999,978 shares changing hands, Kingston Wharves dropped $2.49 to $46.50, with 1,801,850 stock units. Mayberry Investments settled at $6.17, with 6,890 units traded after falling 8 cents, NCB Financial Group lost just 1 cent and ended trading at $94.98, with 41,620 shares, PanJam Investment dropped $1.64 and closed at $45.36, with 1,094,320 stock units, Proven Investments traded in the main market with a rise of $1.99 to $28.50 while trading just 100 shares,  Pulse Investments fell 21 cents and concluded trading at $1.60, with 5,414 units. Radio Jamaica lost 1 cents and finished trading at $1.19, with 30,000 shares, Sagicor Group settled at $38.50, after rising 31 cents with 22,610 shares, Sagicor Real Estate Fund gained 20 cents and finished at $14, with 1,535 units. Scotia Group dived $3.39 to $50.10, with 70,981 units, Supreme Ventures rose 20 cents and concluded trading at $12.70, with 1,012,460 shares, Victoria Mutual Investments ended at $4.18, with 262,618 shares and Wisynco Group concluded trading at $9.55, after falling 16 cents with 204,701 stock units.

Pulse Investments fell 21 cents and concluded trading at $1.60, with 5,414 units. Radio Jamaica lost 1 cents and finished trading at $1.19, with 30,000 shares, Sagicor Group settled at $38.50, after rising 31 cents with 22,610 shares, Sagicor Real Estate Fund gained 20 cents and finished at $14, with 1,535 units. Scotia Group dived $3.39 to $50.10, with 70,981 units, Supreme Ventures rose 20 cents and concluded trading at $12.70, with 1,012,460 shares, Victoria Mutual Investments ended at $4.18, with 262,618 shares and Wisynco Group concluded trading at $9.55, after falling 16 cents with 204,701 stock units.

Prices of securities trading for the day are those at which the last trade took place. For more details of market activities, see “JSE main market volume jumps – Wednesday.”

Big recovery for JSE main market – Friday

Caribbean Cement jumped $4.45 to close at $40.05

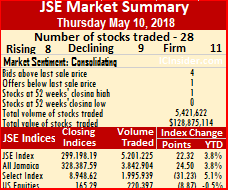

Investors pushed the Jamaica Stock Exchange the market up strongly on Friday and the market recovered a large portion of what was lost since the record high on the previous week.

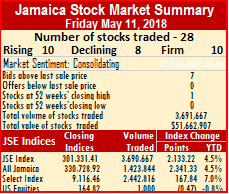

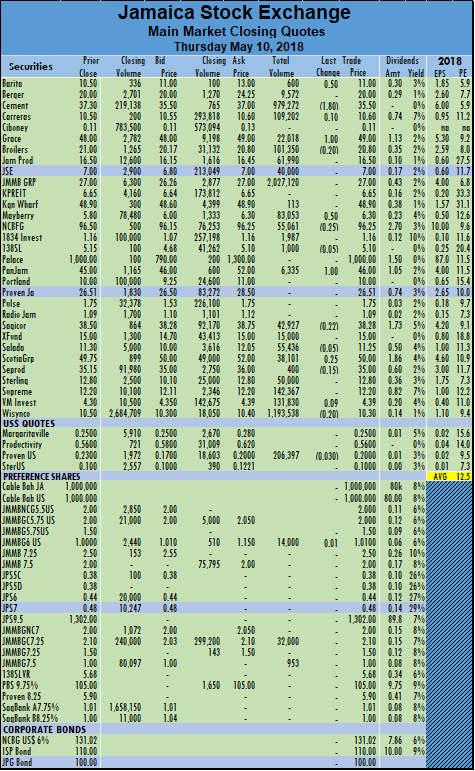

At the end of market activities, 28 securities traded, compared to 28 on Thursday, in the main and US dollar markets with the price of 10 stocks rising, 8 falling and 10 trading firm. At the close, the All Jamaican Composite Index jumped sharply by 2,341.33 points to 330,728.92 and the JSE Index climbed 2,133.22 points to 301,331.41.

Stocks with major price changes are, Caribbean Cement jumped $4.45 to close at $40.05, JMMB Group jumped $1 to $28, Palace Amusement jumped $300 to $1,300, followed by NCB Financial that dropped $1.25 to $95. PanJam Investment traded at a 52 weeks’ high of $46.01 while Jamaica Broilers and Supreme Ventures traded at intraday highs.

Trading activity resulted in 3,690,667 units valued at $51,637,707 compared to 3,519,415 units valued at $33,476,075 changing hands on Friday.

The major trades for the day are, Wisynco Group with 1,214,450 units and accounting for 32.91 percent of the day’s volume, followed by Victoria Mutual Investments with 723,173 units or 19.59 percent of trades and Ciboney Group with 402,832 units and 10.91 percent of the volume traded.

The major trades for the day are, Wisynco Group with 1,214,450 units and accounting for 32.91 percent of the day’s volume, followed by Victoria Mutual Investments with 723,173 units or 19.59 percent of trades and Ciboney Group with 402,832 units and 10.91 percent of the volume traded.

Trading resulted in an average of 136,691 units valued at an average of $1,912,508 for each security traded. In contrast to 200,047 units for an average of $4,687,155 on Thursday. The average for the month to date is 342,839 shares with a value of $18,119,875 and previously 367,467 shares with a value of $20,307,869. In contrast, April closed with an average of 708,206 shares with a value of $6,395,518 for each security traded.

In the US dollar market, Proven Investments traded 1,000 shares and fell by 3 cents to 20 US cents and the market index ended at down 0.47 points to 164.82 and JMMB Group 5.75% US preference share traded 5,000 units at $2.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows 7 stocks ended with bids higher than their last selling prices and none closing with a lower offer.

For more details of market activities see – Big gains for JSE main market – Friday.

Big gains for JSE main market – Friday

Palace jumped $300 back to $1,300 on small volume.

Trading activity was moderate on the main market on Friday, but the market gained much ground to recover a major portion of losses incurred since closing at record high on the previous Friday.

The main market closed with 3,690,667 units valued at $51,637,707 trading from 27 securities changing hands, resulting in 11 securities rising, 5 falling and 9 trading. There were three new intraday highs, with PanJam Investment closing at a new high of $46.01. Jamaica Broilers and Supreme Ventures traded at intraday highs of $22 and $13.50 respectively before pulling back by the close of trading.

The JSE All Jamaican Composite Index jumped 2,341.33 points to 330,728.92 and the JSE Index climbed 2,133.22 points to 301,331.41.

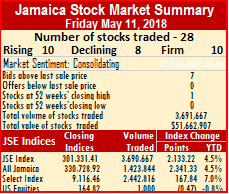

In market activity, Barita Investments rose by 50 cents and closed at $11.50, with 4,564 shares, changing hands, Berger Paints closed at $20 with 6,431 units trading, Carreras lost 20 cents and ended at $10.40, with 75,013 stock units, Caribbean Cement concluded trading at $40.05, after jumping $4.55 with 100,591 units, changing hands, Ciboney Group finished at 11 cents, with 402,832 shares, Grace Kennedy settled at $49, with 16,778 shares. Jamaica Broilers ended trading at $20.80, with 6,639 shares, after trading at an intraday high of $22. Jamaica Producers traded at $16.50, with 17,858 stock units, Jamaica Stock Exchange fell 14 cents and finished trading at $6.86, with 25,000 units, JMMB Group jumped $1 to close at $28, with 69,179 shares. Kingston Properties ended at $6.65, with 4,600 shares, Kingston Wharves concluded trading at $48.61, with 9,370 shares, after declining 29 cents, Mayberry Investments lost 9 cents and finished at $6.21, with 39,950 stock units, NCB Financial Group ended down by $1.25 to $95, with 71,713 shares changing hands, Palace Amusement ended trading after posting a $300 jump to $1,300, with just 104 shares.

In market activity, Barita Investments rose by 50 cents and closed at $11.50, with 4,564 shares, changing hands, Berger Paints closed at $20 with 6,431 units trading, Carreras lost 20 cents and ended at $10.40, with 75,013 stock units, Caribbean Cement concluded trading at $40.05, after jumping $4.55 with 100,591 units, changing hands, Ciboney Group finished at 11 cents, with 402,832 shares, Grace Kennedy settled at $49, with 16,778 shares. Jamaica Broilers ended trading at $20.80, with 6,639 shares, after trading at an intraday high of $22. Jamaica Producers traded at $16.50, with 17,858 stock units, Jamaica Stock Exchange fell 14 cents and finished trading at $6.86, with 25,000 units, JMMB Group jumped $1 to close at $28, with 69,179 shares. Kingston Properties ended at $6.65, with 4,600 shares, Kingston Wharves concluded trading at $48.61, with 9,370 shares, after declining 29 cents, Mayberry Investments lost 9 cents and finished at $6.21, with 39,950 stock units, NCB Financial Group ended down by $1.25 to $95, with 71,713 shares changing hands, Palace Amusement ended trading after posting a $300 jump to $1,300, with just 104 shares.  PanJam Investment gained just 1 cent to trade at a 52 weeks’ high of $46.01, with 5,000 shares, Pulse Investments fell 3 cents and closed at $1.75, with 40,150 stock units, Radio Jamaica rose 11 cents and ended at $1.20, with 74,597 units, Sagicor Group lost 26 cents and concluded trading at $38.02, with 31,526 shares. Salada Foods rose 1 cents and finished at $11.26, with 5,000 shares, Scotia Group added just 1 cents to settle at $50.01, with 325,267 shares after dropping $3.98, Seprod rose just 1 cent and ended trading at $35.01, with 2,500 stock units, Supreme Ventures traded at an intraday record high of $13.50 but finished trading up 1 cent at $12.21, with 89,182 shares. Victoria Mutual Investments lost 9 cents to close at $4.30, with 723,173 shares and Wisynco Group fell 30 cents and ended at $10, with 1,214,450 shares. In the main market preference segment, JMMB Group 7.25%concluded trading at $2.10, with 324,200 shares.

PanJam Investment gained just 1 cent to trade at a 52 weeks’ high of $46.01, with 5,000 shares, Pulse Investments fell 3 cents and closed at $1.75, with 40,150 stock units, Radio Jamaica rose 11 cents and ended at $1.20, with 74,597 units, Sagicor Group lost 26 cents and concluded trading at $38.02, with 31,526 shares. Salada Foods rose 1 cents and finished at $11.26, with 5,000 shares, Scotia Group added just 1 cents to settle at $50.01, with 325,267 shares after dropping $3.98, Seprod rose just 1 cent and ended trading at $35.01, with 2,500 stock units, Supreme Ventures traded at an intraday record high of $13.50 but finished trading up 1 cent at $12.21, with 89,182 shares. Victoria Mutual Investments lost 9 cents to close at $4.30, with 723,173 shares and Wisynco Group fell 30 cents and ended at $10, with 1,214,450 shares. In the main market preference segment, JMMB Group 7.25%concluded trading at $2.10, with 324,200 shares.

Prices of securities trading for the day are those at which the last trade took place. For more details of market activities, see “Big recovery for JSE main market – Friday.”

JSE main market pull back ends – Thursday

JSE slowly moving upwards.

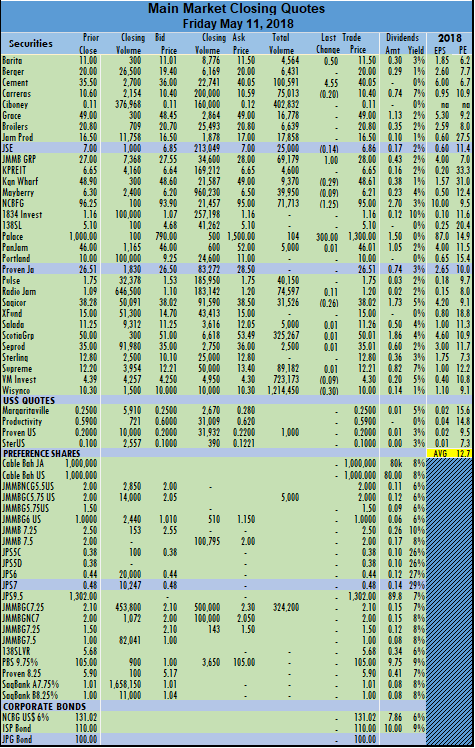

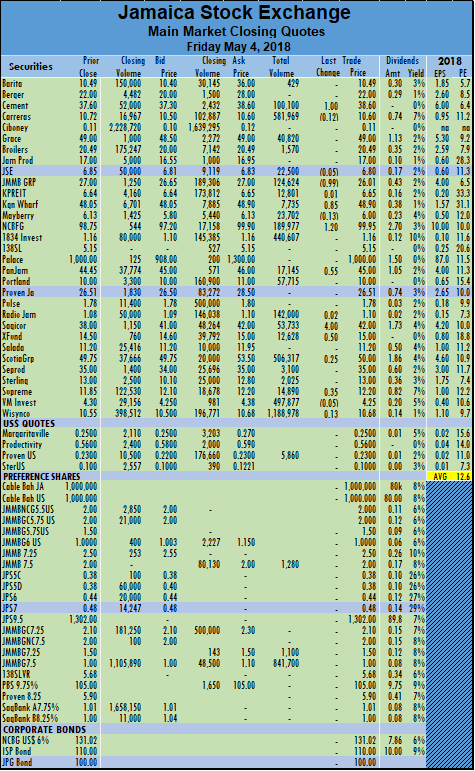

The pull back from the record reached on Friday by Jamaica Stock Exchange ended with a modest rise in the market index on Thursday as the price of 8 stocks rose, 9 declined and 11 traded firm.

At the close, the JSE All Jamaican Composite Index rose modestly and ended with an increased by 24.50 points at 328,387.59 and the JSE Index advanced by 22.32 points to 299,198.19.

Caribbean Cement shed $1.80 to close at $35.50, Grace Kennedy rose $1 to $49 and PanJam Investments traded at a new high of $46 with a rise of $1.

At the end of market activities, 28 securities traded, compared to 29 on Wednesday, in the main and US dollar markets and resulted in 5,201,225 units valued at $121,866,039  compared to 4,614,305 units valued at $109,133,839 changing hands in the main market, on Wednesday.

compared to 4,614,305 units valued at $109,133,839 changing hands in the main market, on Wednesday.

JMMB Group trade 2,027,120 units and accounted for 38.97 percent of trading volume, followed by Wisynco Group with 1,193,538 units and 22.95 percent of the volume and Caribbean Cement with 979,272 units and 18.83 percent of the day’s volume.

Trading resulted in an average of 200,047 units valued at an average of $4,687,155 for each security traded. In contrast to 170,900 units for an average of $4,041,993 on Wednesday. The average for the month to date is 367,467 shares with a value of $20,307,869 and previously 389,231 shares with a value of $49,857,592.  In contrast, April closed with an average of 708,206 shares with a value of $6,395,518 for each security traded.

In contrast, April closed with an average of 708,206 shares with a value of $6,395,518 for each security traded.

In the US dollar market, Proven Investments traded with 206.397 shares and fell 3 cents to 20 US cents and the market index dropped 8.89 ended at unchanged at 165.29. JMMB Group 5.75% US preference share traded 14,000 units at US$1.01, up by a cent.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows 4 stocks ended with bids higher than their last selling prices and 1 closing with a lower offer.

For more details of market activities see – .

Record close for JSE main market – Friday

Investors pushed the Jamaica Stock Exchange the market up strongly to reach the highest levels ever on Friday with the price of 11 stocks rising, 5 falling and 11 trading firm.

Investors pushed the Jamaica Stock Exchange the market up strongly to reach the highest levels ever on Friday with the price of 11 stocks rising, 5 falling and 11 trading firm.

Friday’s record move is fourth day for the week that the main market closed at new record highs.

At the close, the JSE All Jamaican Composite Index jumped 3,775.73 points to end at 332,501.11 and the JSE Index climbed 3,440.11 points to a record close of 302,946.08. Only Wisynco Group traded more than 1 million shares, ending with 1,188,978 units to be followed by JMMB Group 7.5% preference share with 841,700 stock units.

At the end of market activities, 27 securities traded, compared to 24 on Thursday, in the main and US dollar markets. Caribbean Cement rose $1 to close at $38.60, JMMB Group fell 99 cents to $26.01, NCB Financial ended with a rise of $1.20 to $99.95, and Sagicor Group jumped $4 to $42.

Trading activity resulted in 4,887,322 units valued at $81,394,524 changing hands, compared 39,156,142 units valued at $3,462,726,542 trading on Thursday.

Trading resulted in an average of 187,974 units valued at an average of $3,130,559 for each security traded. In contrast to 1,702,441 units for an average of $150,553,328 on Thursday. The average for the month to date is 613,556 shares with a value of $37,585,846 and previously 765,133 shares with a value of $49,857,592. In contrast, April closed with an average of 708,206 shares with a value of $6,395,518 for each security traded.

Trading resulted in an average of 187,974 units valued at an average of $3,130,559 for each security traded. In contrast to 1,702,441 units for an average of $150,553,328 on Thursday. The average for the month to date is 613,556 shares with a value of $37,585,846 and previously 765,133 shares with a value of $49,857,592. In contrast, April closed with an average of 708,206 shares with a value of $6,395,518 for each security traded.

In the US dollar market, Proven Investments traded with 5,860 shares at 23 US cents and the market index ended at unchanged at 177.12.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows 7 stocks ended with bids higher than their last selling prices and 2 closing with a lower offers.

For more details of market activities see – JSE trading back to norm on Friday.

JSE all Jamaica index over 332,500 points

The main market of the Jamaica Stock Exchange is closing the week the way it started with a new recording high.

The main market of the Jamaica Stock Exchange is closing the week the way it started with a new recording high.

With minutes to go before trading the all Jamaica Index rose over 3,004.09 points to hit 331,729.47 and the JSE index rose 2,737.07 to 302,243.04.

Helping to push the indices were strong gains in NCB Financial shares to $99.95, Sagicor Group shares to $42 while Supreme Venture closed up at $12.20 and Caribbean Cement closed at $38.60.

The market eventually closed on Friday with the JSE All Jamaican Composite Index jumping 3,775.73 points to end at an all-time record high of 332,501.11 and the JSE Index surged 3,440.11 points to a record close of 302,946.08.

JSE trading back to norm on Friday

The Jamaica Stock Exchange main market closed at a record on Friday as the market continues to gradually grind its way forward.

Trading activity declined in main market on Friday, but the market gained much ground to land at a new record close, as 4,887,322 units valued at $81,394,524 traded, compared with 39,156,142 units valued at $3,462,726,542 on Thursday.

The main market closed with 26 securities changing hands, 11 securities rose, 5 declined and 10 traded firm, as the JSE All Jamaican Composite Index surged 3,775.73 points to end at a record high of 332,501.11 and the JSE Index jumped 3,440.11 points to a record close of 302,946.08.

In market activity, Barita Investments closed at $10.49, with 429 shares, Carreras concluded trading at $10.60, with a loss of 12 cents trading 581,969 units, Caribbean Cement jumped $1 and finished at $38.60, with 100,100 shares,  Grace Kennedy ended trading at $49, with 40,820 shares, Jamaica Broilers traded at $20.49, with 1,570 stock units. Jamaica Stock Exchange last 5 cents and closed at $6.80, with 22,500 shares, JMMB Group fell 99 cent and ended at $26.01, with 124,624 shares, Kingston Properties concluded trading at $6.65, with 12,801 shares, Kingston Wharves gained 85 cents to finish at $48.90, with 7,735 stock units. Mayberry Investments lost 13 cents in settling at $6, with 23,702 units traded, NCB Financial Group climbed $1 and ended trading at $99.95, with 189,977 shares, 1834 Investments traded at $1.16, with 440,607 shares, PanJam Investment rose 55 cents and closed at $45, with 17,145 stock units. Portland JSX ended at $10, with 57,715 units, Radio Jamaica finished at $1.10, after rising 2 cents with 142,000 shares, Sagicor Group jumped $4 and settled at $42, with 53,733 shares and Sagicor Real Estate Fund gained 50 cents to close at $15, with 12,628 shares, Scotia Group added 25 cents to trade at $50, with 506,317 units changing hands.

Grace Kennedy ended trading at $49, with 40,820 shares, Jamaica Broilers traded at $20.49, with 1,570 stock units. Jamaica Stock Exchange last 5 cents and closed at $6.80, with 22,500 shares, JMMB Group fell 99 cent and ended at $26.01, with 124,624 shares, Kingston Properties concluded trading at $6.65, with 12,801 shares, Kingston Wharves gained 85 cents to finish at $48.90, with 7,735 stock units. Mayberry Investments lost 13 cents in settling at $6, with 23,702 units traded, NCB Financial Group climbed $1 and ended trading at $99.95, with 189,977 shares, 1834 Investments traded at $1.16, with 440,607 shares, PanJam Investment rose 55 cents and closed at $45, with 17,145 stock units. Portland JSX ended at $10, with 57,715 units, Radio Jamaica finished at $1.10, after rising 2 cents with 142,000 shares, Sagicor Group jumped $4 and settled at $42, with 53,733 shares and Sagicor Real Estate Fund gained 50 cents to close at $15, with 12,628 shares, Scotia Group added 25 cents to trade at $50, with 506,317 units changing hands.  Seprod finished trading at $35, with 3,100 shares, Sterling Investments closed at $13, with 2,025 shares trded, Supreme Ventures rose 35 cents nd ended at $12.20, with 14,890 shares, Victoria Mutual Investments concluded trading at $4.25,fter declining 5 cents with 497,877 stock units trading and Wisynco Group rose 13 cents and finished at $10.68, with 1,188,978 units. In the main market preference segment, Jamaica Money Market 7.5% traded unchanged at $2, with 1,280 stock units, JMMB Group 7.25% concluded trading at $1.50, with 1,100 shares, JMMB Group 7.5% finished at $1, with 841,700 stock units, changing hands.

Seprod finished trading at $35, with 3,100 shares, Sterling Investments closed at $13, with 2,025 shares trded, Supreme Ventures rose 35 cents nd ended at $12.20, with 14,890 shares, Victoria Mutual Investments concluded trading at $4.25,fter declining 5 cents with 497,877 stock units trading and Wisynco Group rose 13 cents and finished at $10.68, with 1,188,978 units. In the main market preference segment, Jamaica Money Market 7.5% traded unchanged at $2, with 1,280 stock units, JMMB Group 7.25% concluded trading at $1.50, with 1,100 shares, JMMB Group 7.5% finished at $1, with 841,700 stock units, changing hands.

Prices of securities trading for the day are those at which the last trade took place. For more details of market activities, see “Record close for JSE main market – Friday.”

Record breather for JSE main market – Thursday

NCB had 35 million shares of its shares trading on Thursday.

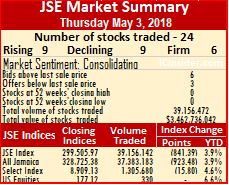

Trading surged on the Jamaica Stock Exchange main market on Thursday as NCB Financial dominated trading with 35 million shares but the market ended down at the close as it took a break from three days of record close.

The All Jamaican Composite Index lost 923.48 points to end at 328,725.38 and the JSE Index declined 841.39 points to a record close of 299,505.97.

At the close, 24 securities traded, compared to 23 on Wednesday and ended with the prices of 9 stocks rising, 9 falling and 7 trading firm, in the main and US dollar markets.

At the close of trading, Berger Paints closed at $22 with a rise of $2 and Kingston Wharves lost $1.75 to $48.05. All other price changes were at 50 cents and below.

NCB Financial Group dominated trading on Tuesday on the main market of the Jamaica Stock Exchange with an exchange of 35,067,960 units accounting for 89.56 percent of the volume traded. Wisynco Group with 1,606,426 units was the next big trade followed by Ciboney with 722,522 units as trading activity resulted in 39,156,142 units valued at $3,462,726,542 compared 14,312,143 units valued at $130,374,672 trading on Wednesday.

Trading resulted in an average of 1,702,441 units valued at over $150,553,328, in contrast to 650,552 shares valued at $5,926,121 on Wednesday. The average for the month to date is 765,133 shares with a value of $49,857,592 and previously 333,972 shares with a value of $3,537,553. In contrast, April closed with an average of 708,206 shares with a value of $6,395,518 for each security traded.

Trading resulted in an average of 1,702,441 units valued at over $150,553,328, in contrast to 650,552 shares valued at $5,926,121 on Wednesday. The average for the month to date is 765,133 shares with a value of $49,857,592 and previously 333,972 shares with a value of $3,537,553. In contrast, April closed with an average of 708,206 shares with a value of $6,395,518 for each security traded.

In the US dollar market, Proven Investments traded with 330 shares at 23 US cents and the market index ended at unchanged at 177.12.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows 6 stocks ended with bids higher than their last selling prices and 2 closing with a lower offers.

For more details of market activities see – NCB dominates JSE trading on Tuesday.

- « Previous Page

- 1

- …

- 155

- 156

- 157

- 158

- 159

- …

- 332

- Next Page »