One aspect of successful investment is not to go after every fad that’s out there. Since the US stock market bottomed after the 2007 collapse and started moving up and the FED kept pushing interest rates lower, the rage has been the gains to be made in this market.

But investors ought to note some elements of successful investments. Markets don’t go up or down for ever. The role interest rate plays in market movement don’t seem to be fully appreciated by many. This applies to real estate, stocks and bond investing alike.

Some feel that Jamaican real estate is cheap, because of crime but that is only a fraction of truth. The undervaluation is tied to high interest rates that require a higher rate of return on investment to compensate, hence a lower valuation of properties. The US stock market has been fueled a great deal by super low interest rates, not unlike what happened in the real estate boom prior to the fall in 2007.

When rates start reversing there is going to be some shake out. Rising interest rates and uncertainty drove down stocks value in Jamaica since 2013. Last year Interest rates started to fall and the local stock market started to respond by June last year, slowly at first, but it gradually gathered momentum and by October really started to move up and accumulating in a rise of 36 percent in the main market stocks since.

When rates start reversing there is going to be some shake out. Rising interest rates and uncertainty drove down stocks value in Jamaica since 2013. Last year Interest rates started to fall and the local stock market started to respond by June last year, slowly at first, but it gradually gathered momentum and by October really started to move up and accumulating in a rise of 36 percent in the main market stocks since.

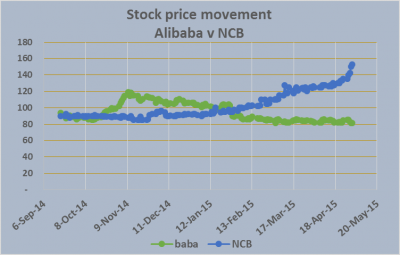

Jamaica has undergone a very long bear market, possibly the longest in history, having peaked in 2005, but more so since 2009, when the market fell in response to higher local interest rates. It was the sort of market that causes some investors to want to give up. On the other hand the US market gave the impression that one cannot go wrong by investing therein. The chart below tells why one should be careful when entering markets after several years of strong gains and to focus on investing in stocks that are severely undervalued instead. The payout in one, is highly risky and there are huge payoff for investing in undervalued ones. Its will just be a matter of time for the break out to take place.

Around November last year, an investors sold out National Commercial Bank shares to invest in the newest investing fad at the time – Alibaba. At the time Alibaba was around US$100 and NCB was sold around J$17. The chart below tells how wrong the investor was. NCB shot up 79 percent in Jamaican Dollar terms. Dividends payable adds to the  NCB returns less the effect of devaluation of the Jamaican dollar which still leaves a huge gain. On the other hand, Alibaba is now at US$81 and looks like it may well head lower while NCB is definitely heading higher. the details above indicates that all that glitters is not gold, but it indicates how tough a lesson some investors have to learn to make money.

NCB returns less the effect of devaluation of the Jamaican dollar which still leaves a huge gain. On the other hand, Alibaba is now at US$81 and looks like it may well head lower while NCB is definitely heading higher. the details above indicates that all that glitters is not gold, but it indicates how tough a lesson some investors have to learn to make money.

NCB whips Alibaba in stock gains

Juniors near all-time high

Activity on the Junior Market closed with 6 securities trading and ending with 680,118 units changing hands valued at $867,840. The JSE Junior Market Index declined 25.07 points to close at 811.00, with the price of 3 stocks advancing and 4 declining, two stocks reached new 52 weeks high, with one hitting an all-time high.

Activity on the Junior Market closed with 6 securities trading and ending with 680,118 units changing hands valued at $867,840. The JSE Junior Market Index declined 25.07 points to close at 811.00, with the price of 3 stocks advancing and 4 declining, two stocks reached new 52 weeks high, with one hitting an all-time high.

The index is just 29 points from the all-time high of 840.18 reached in July 2013, this level is likely to be history once the Lasco companies report earnings, which should be the end of May, based on past reporting time frame. With nearly a third of the market closing with bids ahead of the last traded price, the all-time high should be easily taken out in a matter of days. The junior market is lagging the gains of the main market Jamaican stocks with gains of just 14 percent in 2015 and 33 percent from the low of July 2014, compared to 26 percent for the Main market and 39 percent respectively.

At the close of the market, there were 7 stocks with bids higher than their last selling prices and only 2 with lower offers. The junior market ended with 3 securities closing with no bids to buy and 9 securities that had no stocks being offered for sale. Stocks trading in the junior market are, AMG Packaging with 37,855 shares at $3, Cargo Handlers with 3,700 units at a new all time high of $20.11, after putting on 1 cent, Caribbean Producers had 501,000 shares trading at $3.10 with a gain of 10 cents, with the offer at the close, was $2.99 to buy 100,000 units. Lasco Distributors with only 1,285 shares trading, closed at $1.43, Lasco Financial Services had 134,913 units trading and ended at $1.30 with a gain of 10 cents and Lasco Manufacturing traded just 1,355 shares with a gain of 14 cents to $1.35, for a new 52 weeks’ high.

Stocks trading in the junior market are, AMG Packaging with 37,855 shares at $3, Cargo Handlers with 3,700 units at a new all time high of $20.11, after putting on 1 cent, Caribbean Producers had 501,000 shares trading at $3.10 with a gain of 10 cents, with the offer at the close, was $2.99 to buy 100,000 units. Lasco Distributors with only 1,285 shares trading, closed at $1.43, Lasco Financial Services had 134,913 units trading and ended at $1.30 with a gain of 10 cents and Lasco Manufacturing traded just 1,355 shares with a gain of 14 cents to $1.35, for a new 52 weeks’ high.

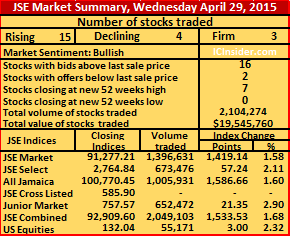

JSE on a gallop to 31/2 year high

As if to make up for lost time the Jamaica Stock Exchange is now on a gallop, putting in another day of outsized gains. The market unlike most of the past 5 days, shot out of the box with a number of trades within 5 minutes of opening. By the close the prices of 16 securities rose with 8 of them closing at 52 weeks’ high and pushing the market to its highest level since mid-November 2011.

As if to make up for lost time the Jamaica Stock Exchange is now on a gallop, putting in another day of outsized gains. The market unlike most of the past 5 days, shot out of the box with a number of trades within 5 minutes of opening. By the close the prices of 16 securities rose with 8 of them closing at 52 weeks’ high and pushing the market to its highest level since mid-November 2011.

The prices of only 2 stocks declined as 23 securities changed hands, ending in 3,992,674 units trading, valued at $35,124,269, in all market segments. Even the junior market that has been a laggard this year, moved up sharply on Friday and is now just 29 points away from its all-time high reached in 2013.

The JSE Market Index gained 2,824.66 points to 96,089.09, the JSE All Jamaican Composite Index jumped 3,158.10 points to close at 106,150.35, just below the level reached on November 11, 2011 and the JSE Combined Index leaped 2,890.21 points to close at 97,932.95.

IC bid-offer Indicator| At the end of trading, in the main and junior markets, the Investor’s Choice bid-offer indicator shows stocks with bids higher than their last selling prices and with offers that were lower.

In trading, Cable & Wireless ended with 1,037,588 units to close lower by 4 cents at 48 cents, Caribbean Cement with 902,807 shares changing hands, closed higher by 15 cents to $4,in continued response to excellent Q1 results. Carreras finished with 8,774 shares trading with a gain of 42 cents to a new 52 weeks’ high of $47.50, Desnoes & Geddes finished trading with only 28,000 shares, gaining 47 cents to a new 52 weeks’ high of $6.49, Grace Kennedy concluded trading with 172,590 shares but the price dropped 39 cents to $63.60, Jamaica Broilers ended up trading 66,500 units to close with a gain of 35 cents to $5.10. Jamaica Producers finished trading with just 2,812 shares, with the price rising $1.25 to $18.50. There was dealing in 168,500 units of Mayberry Investments as the stock put on 5 cents to close at a new 52 weeks’ high of $2.65, National Commercial Bank contributed 433,054 shares to end with an increase of 42 cents to close at a new 52 weeks’ high of $30.50, the stock traded as high as $31. Sagicor Group ended with 212,335 units changing hands and put on 52 cents, to a new 52 weeks’ high of $11.53 after trading as high as $12.20. Scotia Group closed with 8,627 units and put on $2.26 to a new 52 weeks’ high of $25.49, Jamaica Money Market Brokers 7.50% preference share traded 140,900 units to end at $2.30 and Jamaica Money Market Brokers 8.75% preference share had 80,000 units changing hands at $3.20.

There was dealing in 168,500 units of Mayberry Investments as the stock put on 5 cents to close at a new 52 weeks’ high of $2.65, National Commercial Bank contributed 433,054 shares to end with an increase of 42 cents to close at a new 52 weeks’ high of $30.50, the stock traded as high as $31. Sagicor Group ended with 212,335 units changing hands and put on 52 cents, to a new 52 weeks’ high of $11.53 after trading as high as $12.20. Scotia Group closed with 8,627 units and put on $2.26 to a new 52 weeks’ high of $25.49, Jamaica Money Market Brokers 7.50% preference share traded 140,900 units to end at $2.30 and Jamaica Money Market Brokers 8.75% preference share had 80,000 units changing hands at $3.20.

Unemployment worsens

Jamaica’s unemployment worsened in December last year compared with a year ago according to the main findings of the Labour Force Survey, conducted by the Statistical Institute of Jamaica (STATIN) between December 14 and 20, last year.

Jamaica’s unemployment worsened in December last year compared with a year ago according to the main findings of the Labour Force Survey, conducted by the Statistical Institute of Jamaica (STATIN) between December 14 and 20, last year.

According to Statin, the Unemployment Rate for December 2014 was 14.2 percent compared to 13.4 in December 2014 leaving the Employment Rate at 85.8 percent, a fall from the 86.6 percent in December 2013.

A total of 188,100 persons were unemployed in December last year, an increase of 13,100 when compared with 175,000 in December 2013. The deterioration did not stem from less persons being employed as the number of persons in the Labour Force rose to 1,320,800, or 15,700 higher than the 1,305,100 recorded in December 2013. The Employed Labour Force for December 2014 was 1,132,700, or 2,600 more than the 1,130,100 recorded in December 2013.

Jamaica’s Minister of Finance. At the last election his party promised jobs & more jobs. Tight economic policies won’t deliver them in the short term

The number of persons employed in the group ‘Manufacturing’ increased by 7,200 persons or 10 percent, while ‘Transport, Storage and Communication’ increased by 5,500 persons (7.7 percent). Agriculture, Hunting, Forestry & Fishing’ declined by 7,400 persons (3.6 percent) followed by ‘Real Estate, Renting & Business Activities’, which declined by 6,100 persons or 8.6 percent.

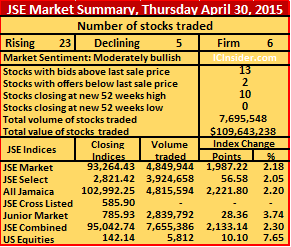

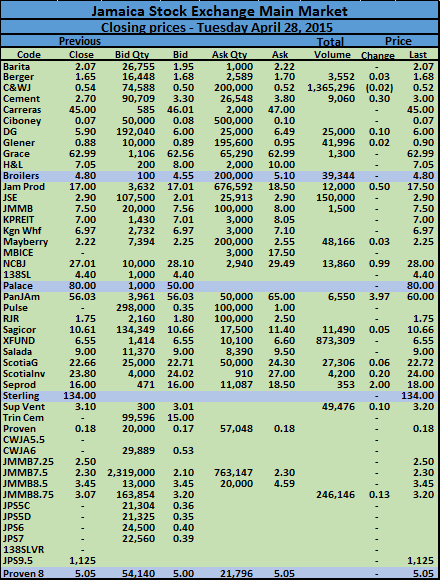

JSE jumps Thursday up 11% for April

The strong market activity on Thursday, resulted in the prices of 23 stocks rising, 5 declining as 34 securities changed hands, ending in 7,695,548 units trading, valued at $109,643,238, in all market segments. The JSE Market Index gained 1,987.22 points to 93,264.43, the

JSE All Jamaican Composite index jumped 2,221.80 points to close at 102,992.25 and the JSE combined index gained 2,133.14 points to close at 95,042.74. At one point during trading, the market recorded more than 3,000 points gain on the all Jamaica Composite index.

JSE All Jamaican Composite index jumped 2,221.80 points to close at 102,992.25 and the JSE combined index gained 2,133.14 points to close at 95,042.74. At one point during trading, the market recorded more than 3,000 points gain on the all Jamaica Composite index.IC bid-offer Indicator| At the end of trading, in the main and junior markets, the Investor’s Choice bid-offer indicator shows 13 stocks with bids higher than their last selling prices and only 2 with offers that were lower. This out turn indicates another strong day ahead for price movements.

The main stocks trading| Caribbean Cement traded only 100 shares, gained 55 cents to end at $3.85, but closed with the bid at $3.88, Carreras ended trading with 31,886 shares to close at a new 52 weeks’ high of $47.08, but ended with a bid at $47.49, followed by Desnoes & Geddes with only 500 units in closing at a new 52 weeks’ high of $6.02. Hardware & Lumber had only 480 units changing hands, gained 45 cents to end at $7.50,

Jamaica Broilers closed with 24,500 shares at $4.75, after falling by 35 cents, Jamaica Producers lost 25 cents with 60,000 shares to end at $17.25. JMMB Group gained 50 cents and closed at a new 52 weeks’ high of $8 with 13,250 shares changing hands, Kingston Wharves traded 16,105 units with the price declining 56 cents to $5.95. Mayberry Investments had 711,200 units changing hands a new 52 weeks’ high of $2.60, National Commercial Bank traded 3,066,787 shares between $29.50 and the closing price and closed with a gain of $1.58 at a new 52 weeks’ high of $30.08. Pan Jamaican Investment price fell $3 with only 885 units trading at $57, Sagicor Group had 290,390 shares and closed 21 cents higher for a new 52 weeks’ high of $11.01. Scotia Group traded 58,380 shares to gain 25 cents and end at a new 52 weeks’ high of $23.25, Scotia Investments traded just 910 units to gain $2.90 and closed at $27, Seprod had only 630 units trading, to end at $18.50 and Supreme Ventures traded 515,400 units to close at $3.50, but traded as high as $3.75, for a new 52 weeks intraday high.

Jamaica Broilers closed with 24,500 shares at $4.75, after falling by 35 cents, Jamaica Producers lost 25 cents with 60,000 shares to end at $17.25. JMMB Group gained 50 cents and closed at a new 52 weeks’ high of $8 with 13,250 shares changing hands, Kingston Wharves traded 16,105 units with the price declining 56 cents to $5.95. Mayberry Investments had 711,200 units changing hands a new 52 weeks’ high of $2.60, National Commercial Bank traded 3,066,787 shares between $29.50 and the closing price and closed with a gain of $1.58 at a new 52 weeks’ high of $30.08. Pan Jamaican Investment price fell $3 with only 885 units trading at $57, Sagicor Group had 290,390 shares and closed 21 cents higher for a new 52 weeks’ high of $11.01. Scotia Group traded 58,380 shares to gain 25 cents and end at a new 52 weeks’ high of $23.25, Scotia Investments traded just 910 units to gain $2.90 and closed at $27, Seprod had only 630 units trading, to end at $18.50 and Supreme Ventures traded 515,400 units to close at $3.50, but traded as high as $3.75, for a new 52 weeks intraday high.

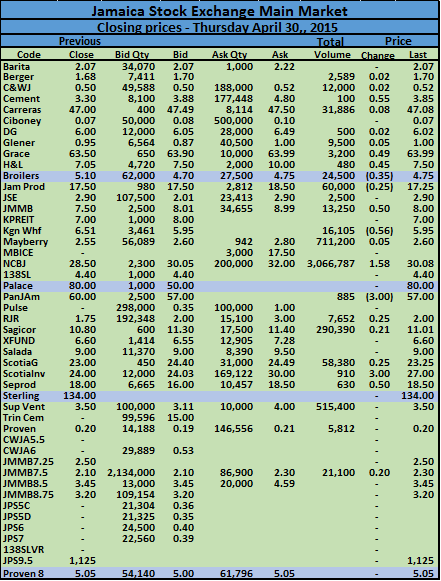

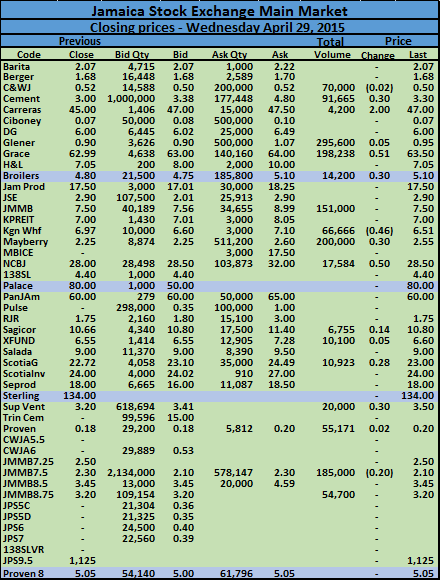

JSE now at 40 months’ high

Trading resulted in the prices of 15 stocks rising, 4 declining as 22 securities changed hands, ending in 2,104,274 units trading, valued at $19,545,760, in all market segments.

Main Market| The JSE Market Index gained 1,419.14 points to 91,277.21, the JSE All Jamaican Composite Index rose 1,586.66 points to close at 100,770.45 and the JSE Combined Index gained 1,533.53 points to close at 92,909.60. The market is at its highest since January 5, 2012 when it closed then at 101,108.42 on the all Jamaican Composite index.

IC bid-offer Indicator| At the end of trading, in the main and junior markets, the Investor’s Choice bid-offer indicator shows 16 stocks with bids higher than their last selling prices and 2 with offers that were lower.

Wednesday session closed with, Caribbean Cement gained 30 cents in trading 91,665 units at $3.30, Carreras having 4,200 units changing hands to end with a gain of $2, at a new 52 weeks’ high of $47, Gleaner closed with 295,600 shares being active to end at 95 cents, up by 5 cents. Grace Kennedy put on 51 cents with 198,238 shares traded, at $63.50, Jamaica Broilers traded 14,200 units at a new 52 weeks’ high of $5.10,for a 30 cents increase, JMMB Group traded 151,000 units at $7.50, Kingston Wharves

traded 66,666 shares at $6.51,as the price fell 46 cents. Mayberry Investments traded 200,000 units at a new 52 weeks’ high of $2.55, after putting on 30 cents on the price.

National Commercial Bank had 17,584 units changing hands for 50 cents higher to end at a new 52 weeks’ high of $28.50. Sagicor Group traded 6,755 shares at a new 52 weeks’ high of $10.80, after gaining 14 cents, Scotia Group exchanged 10,923 shares for a new 52 weeks’ high of $23, with an increase of 28 cents, Supreme Ventures gained 30 cents in trading 20,000 units, at a new 52 weeks’ high of $3.50. Proven Investments traded 55,171 ordinary shares at 20 US cents, for a 2 cents increase, Jamaica Money Market Brokers 7.50% preference share, traded 185,000 units at $2.10 and Jamaica Money Market Brokers 8.75% preference share traded 54,700 units at $3.20.

National Commercial Bank had 17,584 units changing hands for 50 cents higher to end at a new 52 weeks’ high of $28.50. Sagicor Group traded 6,755 shares at a new 52 weeks’ high of $10.80, after gaining 14 cents, Scotia Group exchanged 10,923 shares for a new 52 weeks’ high of $23, with an increase of 28 cents, Supreme Ventures gained 30 cents in trading 20,000 units, at a new 52 weeks’ high of $3.50. Proven Investments traded 55,171 ordinary shares at 20 US cents, for a 2 cents increase, Jamaica Money Market Brokers 7.50% preference share, traded 185,000 units at $2.10 and Jamaica Money Market Brokers 8.75% preference share traded 54,700 units at $3.20.

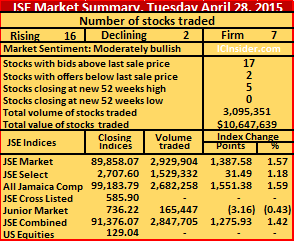

JSE breaks resistance & heading higher

Main Market| The JSE Market Index gained 1,387.58 points to 89,858.07, the JSE All Jamaican Composite index rose 1,551.38 points to close at 99,183.79 and the JSE combined index climbed by 1,275.93 points to close at 91,376.07. At the close the market had pierced the resistance just under 99,000 points on the all Jamaica composite Index and seems poised to test the next major level of 109,000 points.

IC bid-offer Indicator| At the end of trading, in the main and junior markets, the Investor’s Choice bid-offer indicator shows 17 stocks with bids higher than their last selling prices and just 2 with offers that were lower.

IC bid-offer Indicator| At the end of trading, in the main and junior markets, the Investor’s Choice bid-offer indicator shows 17 stocks with bids higher than their last selling prices and just 2 with offers that were lower.Cable & Wireless traded 1,365,296 shares at 52 cents, Caribbean Cement traded 9,060 units at $3, up by 30 cents, there was an attempt to trade at $3.30 but that trade was cancelled as it exceeded the level permitted at that time of the trade. The stock was responding to a big jump in the company’s first quarter results for 2015 with profit after tax of $248 million versus just $35 million the year before, these results suggest that full year earnings could rise to $1 per share, as such the stock has much more room to run. Jamaica Broilers ended with 39,344shares at $4.80,

Jamaica Producers gained 50 cents with 12,000 units changing hands at $17.50, the Jamaica Stock Exchange had 150,000 units changing hands at $2.90. National Commercial Bank traded 13,860 shares to close at $28, for a gain of 99 cents. At the close there was a bid for 10,000 units at $28.10 and 600,000 units at $28. Pan Jamaican Investment climbed $3.97 to $60 with 6,550 shares, Sagicor Real Estate X Fund had a large trade of 873,309 units at $6.55,Jamaica Money Market Brokers 8.75% preference share traded 246,146 units at $3.20 after gaining 13 cents. Scotia Group traded only 27,306 shares to close at $22.72 with a gain of 5 cents, Seprod traded only 353 units as the price jumped $2 to $18 and Supreme Ventures closed at a new 52 weeks’ high of $3.20 by gaining 10 cents with 49,476 shares trading.

Jamaica Producers gained 50 cents with 12,000 units changing hands at $17.50, the Jamaica Stock Exchange had 150,000 units changing hands at $2.90. National Commercial Bank traded 13,860 shares to close at $28, for a gain of 99 cents. At the close there was a bid for 10,000 units at $28.10 and 600,000 units at $28. Pan Jamaican Investment climbed $3.97 to $60 with 6,550 shares, Sagicor Real Estate X Fund had a large trade of 873,309 units at $6.55,Jamaica Money Market Brokers 8.75% preference share traded 246,146 units at $3.20 after gaining 13 cents. Scotia Group traded only 27,306 shares to close at $22.72 with a gain of 5 cents, Seprod traded only 353 units as the price jumped $2 to $18 and Supreme Ventures closed at a new 52 weeks’ high of $3.20 by gaining 10 cents with 49,476 shares trading.

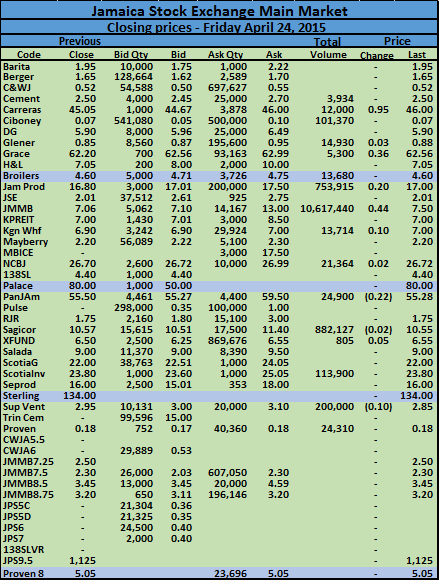

Positive end to strong week – JSE

Main Market| The JSE Market Index gained 768.58 points on Friday to end at 87,414.75, for the week 2,324.62 points were added. The JSE All Jamaican Composite index rose 859.30 points to close at 96,452.04, for the week the index gained 2,599.03 points

and the JSE combined index gained 739.54 points to close at 89,146.88 and put on 2,209.08 for the week.

and the JSE combined index gained 739.54 points to close at 89,146.88 and put on 2,209.08 for the week.IC bid-offer Indicator| At the end of trading, in the main and junior markets, the Investor’s Choice bid-offer indicator shows 14 stocks with bids higher than their last selling prices and only 2 with offers that were lower, a very strong indication of a robust day for gains on Monday.

In trading, Carreras has fully recovered from the sell off when the Government announced new taxes on cigarettes in February and traded 12,000 shares to close at new 52 weeks’ high of $46 by rising 95 cents, Grace Kennedy closed with 5,300 shares changing hands at $62.56 by gaining 36 cents. Jamaica Producers continues to trade in heavy volume, this week and closed the week with 753,915 units trading at $17, for a gain of 20 cents,

JMMB Group had heavy trading amounting 10,617,440 ordinary shares valued at $79,623,408 to end at a new 52 weeks’ high of $7.50 after posting a 44 cents rise. Kingston Wharves’ 13,714 that traded led to a new 52 weeks’ high of $7, after putting on 10 cents, National Commercial Bank traded 21364 units to close at a new 52 weeks’ high of 26.72 and gained 2 cents but closed with the offer at $26.99. Pan Jamaican Investment traded 24,900 shares at $55.28 to record a 22 cents decline. Sagicor Group traded 882,127 shares ending at $10.50, Scotia Investments traded 113,900 units and gained 20 cents to end at $23.80 and Supreme Ventures traded 200,000 units at $2.85, down 10 cents but the bid ended at $3 to purchase 10,131 shares

JMMB Group had heavy trading amounting 10,617,440 ordinary shares valued at $79,623,408 to end at a new 52 weeks’ high of $7.50 after posting a 44 cents rise. Kingston Wharves’ 13,714 that traded led to a new 52 weeks’ high of $7, after putting on 10 cents, National Commercial Bank traded 21364 units to close at a new 52 weeks’ high of 26.72 and gained 2 cents but closed with the offer at $26.99. Pan Jamaican Investment traded 24,900 shares at $55.28 to record a 22 cents decline. Sagicor Group traded 882,127 shares ending at $10.50, Scotia Investments traded 113,900 units and gained 20 cents to end at $23.80 and Supreme Ventures traded 200,000 units at $2.85, down 10 cents but the bid ended at $3 to purchase 10,131 shares

Prices up in March down for year

The Statistical Institute of Jamaica (Statin) reports that for March 2015 that inflation rose by 0.5 percent over the February which had a fall of 0.7 percent. The calendar year-to-date inflation rate is minus 0.6 percent. This is the first increase in the index after recording four consecutive months of decline”, Statin said.

The Statistical Institute of Jamaica (Statin) reports that for March 2015 that inflation rose by 0.5 percent over the February which had a fall of 0.7 percent. The calendar year-to-date inflation rate is minus 0.6 percent. This is the first increase in the index after recording four consecutive months of decline”, Statin said.

Contributing significantly to this advance in the index was a 2.9 percent increase in the index for the Housing, Water, Electricity, Gas and Other Fuels due mainly higher rates for electricity. Lower prices for vegetables and starchy foods helped in moderating the increase with a small reduction in prices.

The divisions that recorded increases in prices are, ‘Alcoholic Beverages and Tobacco’ 0.3 percent, ‘Clothing and Footwear’ 0.4 percent, ‘Furnishings, Household Equipment and Routine Household Maintenance’ 0.3 percent, ‘Health’ 0.2 percent, ‘Transportation 0.7 percent, ‘Recreation and Culture’ 0.1 percent, ‘Restaurants and Accommodation Services’ 0.3 percent ‘, ‘Miscellaneous Goods and Services’ 1.3 percent, while ‘Education’, and ‘Communication’ each remained unchanged.

The divisions that recorded increases in prices are, ‘Alcoholic Beverages and Tobacco’ 0.3 percent, ‘Clothing and Footwear’ 0.4 percent, ‘Furnishings, Household Equipment and Routine Household Maintenance’ 0.3 percent, ‘Health’ 0.2 percent, ‘Transportation 0.7 percent, ‘Recreation and Culture’ 0.1 percent, ‘Restaurants and Accommodation Services’ 0.3 percent ‘, ‘Miscellaneous Goods and Services’ 1.3 percent, while ‘Education’, and ‘Communication’ each remained unchanged.

BOJ cut interest rate

The Bank of Jamaica’s 30-day Certificate of Deposit interest rate was reduced on Friday, 17 April 2015 Thursday to 5.50 percent from 5.75 percent, the central bank announced on Thursday. This is the first such reduction since February 2013, when the rate was cut by 50 basis points from 6.25 percent to 5.75 percent.

The Bank of Jamaica’s 30-day Certificate of Deposit interest rate was reduced on Friday, 17 April 2015 Thursday to 5.50 percent from 5.75 percent, the central bank announced on Thursday. This is the first such reduction since February 2013, when the rate was cut by 50 basis points from 6.25 percent to 5.75 percent.

BOJ in its release stated, “this adjustment to the BOJ policy rate, reflects the Bank’s expectation that the rate of increase in consumer prices is likely to remain low in the coming year”.

“The recently announced inflation rate of 4 per cent for FY 2014/15 is the lowest in 48 years. The sharper than expected decline in inflation for the fiscal year was due in part to the fall in oil prices but also to the moderation in price increases that has resulted from fiscal consolidation and economic reforms. The impact of these changes will help to moderate inflation impulses over the medium term” the central bank concluded.

The reduction is also in line with a decline in Treasury bill rates over the past year, coupled with increased inflows of foreign exchange into the system that led to some amount of revaluation of the Jamaican dollar.

- « Previous Page

- 1

- …

- 488

- 489

- 490

- 491

- 492

- …

- 497

- Next Page »