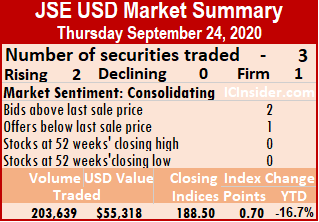

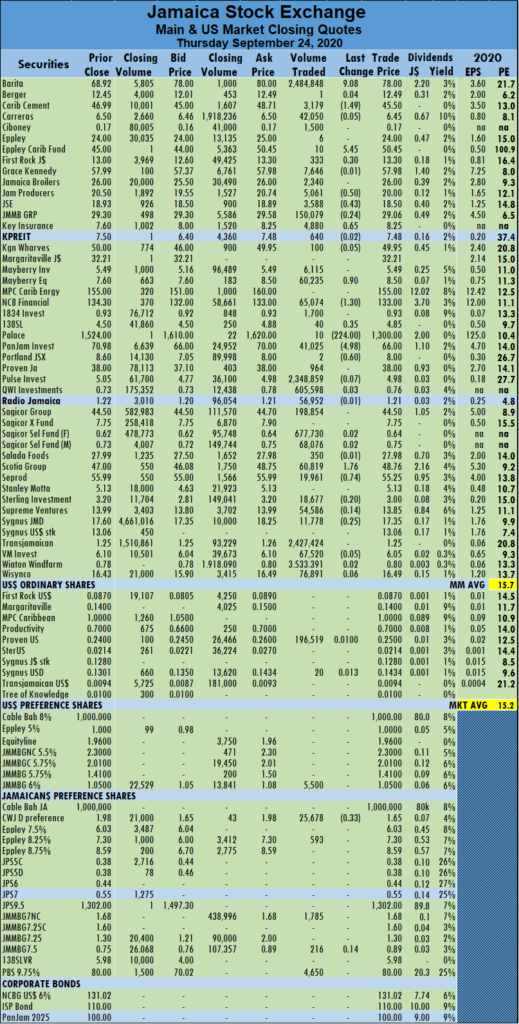

The US dollar market of the Jamaica Stock Exchange closed trading on Thursday, with the market inching higher after traded 50 percent more shares than on Wednesday, resulting in more stocks rising than falling.

At the close of the market, trading ended with three securities changing hands compared to three on Wednesday and ended with the prices of two stocks rising, none declining and one remaining unchanged.

At the close of the market, trading ended with three securities changing hands compared to three on Wednesday and ended with the prices of two stocks rising, none declining and one remaining unchanged.

The JSE USD Equities Index carved out a gain of 0.70 points to settle at 188.50, with the average PE Ratio ending at 13 based on IC Insider.com’s forecast of 2020-21 earnings.

The market closed with an exchange of 202,039 shares, accounting for US$54,918 compared to 135,825 units at US$9,628 on Wednesday.

The average trade for the day amounted to 67,346 units changing hands at US$18,306, in contrast to an average of 45,275 shares at US$3,209 on Wednesday. Trading ended, with an average of 86,489 units for the month to date at US$11,724 in contrast to 87,553 units at US$11,359. By comparison, August ended with an average of 83,402 units for US$7,526.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading for the market shows two stocks ended with bids higher than their last selling prices and one with a lower offer.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading for the market shows two stocks ended with bids higher than their last selling prices and one with a lower offer.

At the close of the market, Proven Investments carved out a gain of 1 US cent to end at 25 US cents with investors exchanging 196,519 shares and Sygnus Credit Investments gained 1.3 US cents to settle at 14.34 US cents in trading just 20 units.

In the preference segment of the market, JMMB Group 6% settled at US$1.05 in exchanging 5,500 stocks.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

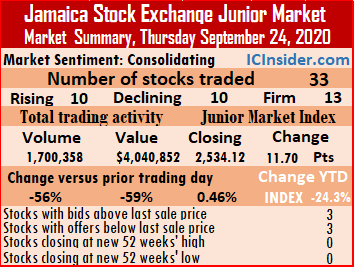

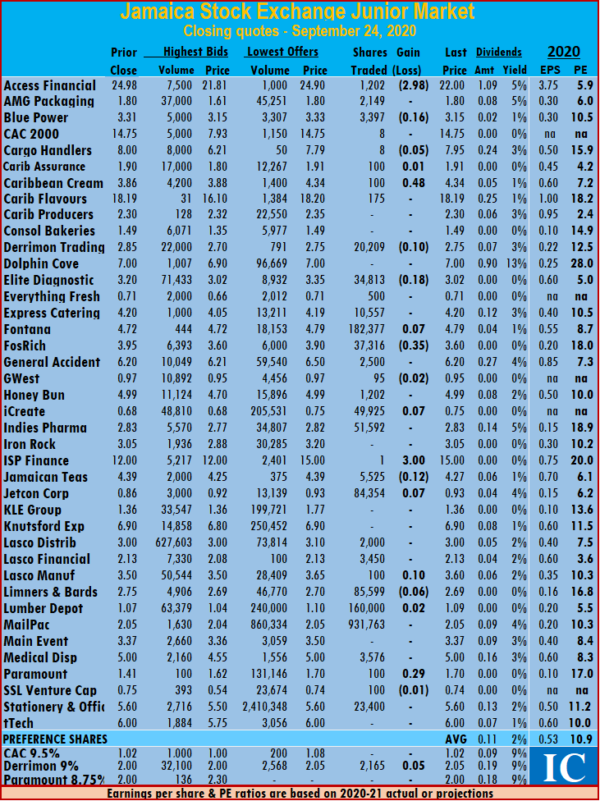

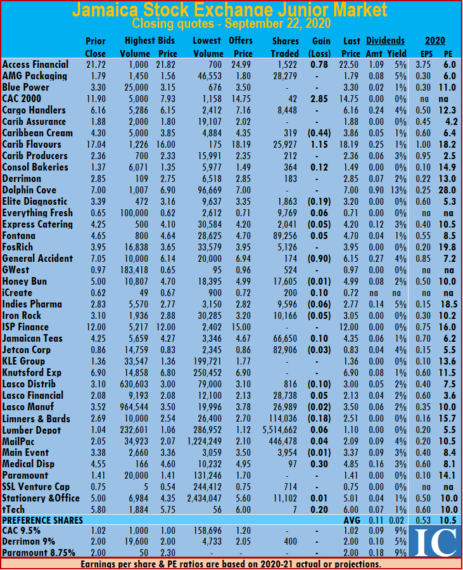

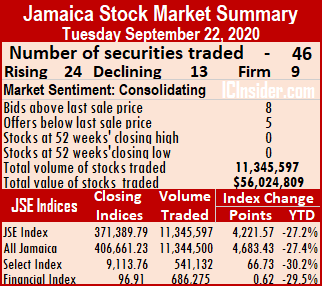

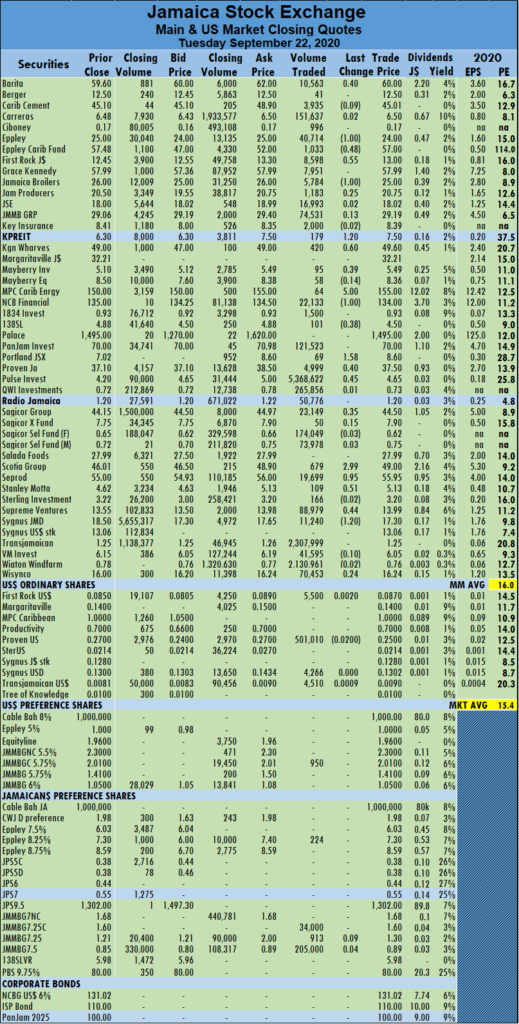

Trading concluded with 33 securities changing hands compared to 23 on Wednesday and ended, with the prices of 10 stocks rising, the prices of 10 declining and 13 with prices remaining unchanged.

Trading concluded with 33 securities changing hands compared to 23 on Wednesday and ended, with the prices of 10 stocks rising, the prices of 10 declining and 13 with prices remaining unchanged. For the month to date, the average trade resulted in an exchange of 107,083 units at $232,850 compared to 110,542 units at $239,724 on Wednesday. Trading in August resulted in an average of 104,414 units at $321,996.

For the month to date, the average trade resulted in an exchange of 107,083 units at $232,850 compared to 110,542 units at $239,724 on Wednesday. Trading in August resulted in an average of 104,414 units at $321,996. GWest Corporation slipped 2 cents to 95 cents with investors transferring 95 shares, iCreate gained 7 cents to finish at 75 cents with an exchange of 49,925 shares, ISP Finance climbed $3 to end at $15 with a mere 1 unit passing through the market. Jamaican Teas declined by 12 cents to settle at $4.27 with 5,525 stocks traded, Jetcon Corporation rose 7 cents to close at 93 cents with a transfer of 84,354 stock units, Lasco Manufacturing gained 10 cents to finish at $3.60 with 100 shares changing hands. Limners and Bards fell 6 cents to $2.69 with 85,599 units traded, Lumber Depot increased by 2 cents and exchanged 160,000 shares to settle at $1.09, Paramount Trading advanced 29 cents to end at $1.70 with investors trading 100 stocks and SSL Venture slipped 1 cent to 74 cents with 100 shares crossing the exchange.

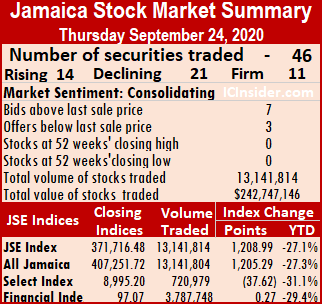

GWest Corporation slipped 2 cents to 95 cents with investors transferring 95 shares, iCreate gained 7 cents to finish at 75 cents with an exchange of 49,925 shares, ISP Finance climbed $3 to end at $15 with a mere 1 unit passing through the market. Jamaican Teas declined by 12 cents to settle at $4.27 with 5,525 stocks traded, Jetcon Corporation rose 7 cents to close at 93 cents with a transfer of 84,354 stock units, Lasco Manufacturing gained 10 cents to finish at $3.60 with 100 shares changing hands. Limners and Bards fell 6 cents to $2.69 with 85,599 units traded, Lumber Depot increased by 2 cents and exchanged 160,000 shares to settle at $1.09, Paramount Trading advanced 29 cents to end at $1.70 with investors trading 100 stocks and SSL Venture slipped 1 cent to 74 cents with 100 shares crossing the exchange. At the close, the All Jamaican Composite Index climbed 1,205.29 points to 407,251.72, the Main Index advanced by 1,208.99 points to 371,716.48 and the JSE Financial Index gained 0.27 points to settle at 97.07.

At the close, the All Jamaican Composite Index climbed 1,205.29 points to 407,251.72, the Main Index advanced by 1,208.99 points to 371,716.48 and the JSE Financial Index gained 0.27 points to settle at 97.07. Trading ended with an average of 285,692 units changing hands at $5,277,112 for each security compared to an average of 701,992 shares at $3,552,326 on Wednesday. The average trade for the month to date ended at 248,972 units at $1,760,892 for each security, in contrast to 246,626 units at $1,536,244. Trading month to date compares adversely to August’s average of 497,441 units at $3,201,918.

Trading ended with an average of 285,692 units changing hands at $5,277,112 for each security compared to an average of 701,992 shares at $3,552,326 on Wednesday. The average trade for the month to date ended at 248,972 units at $1,760,892 for each security, in contrast to 246,626 units at $1,536,244. Trading month to date compares adversely to August’s average of 497,441 units at $3,201,918. Key Insurance rose 65 cents and ended at $8.25 with 4,880 stock units clearing the market. Mayberry Jamaican Equities carved out a gain of 90 cents to finish at $8.50, in trading 60,235 shares, NCB Financial Group fell $1.30 to $133, with 65,074 shares changing hands, 138 Student Living rose 35 cents to $4.85 trading 40 units, Palace Amusement declined by $224 to close at $1,300, after transferring ten stock units. PanJam Investment dropped $4.98 to $66, in trading 41,025 shares, Portland JSX lost 60 cents to settle at $8 trading a mere two units, Scotia Group rose $1.76 to end at $48.76, with 60,819 shares passing through the market and Seprod shed 74 cents to close at $55.25, in trading 19,961 shares.

Key Insurance rose 65 cents and ended at $8.25 with 4,880 stock units clearing the market. Mayberry Jamaican Equities carved out a gain of 90 cents to finish at $8.50, in trading 60,235 shares, NCB Financial Group fell $1.30 to $133, with 65,074 shares changing hands, 138 Student Living rose 35 cents to $4.85 trading 40 units, Palace Amusement declined by $224 to close at $1,300, after transferring ten stock units. PanJam Investment dropped $4.98 to $66, in trading 41,025 shares, Portland JSX lost 60 cents to settle at $8 trading a mere two units, Scotia Group rose $1.76 to end at $48.76, with 60,819 shares passing through the market and Seprod shed 74 cents to close at $55.25, in trading 19,961 shares.

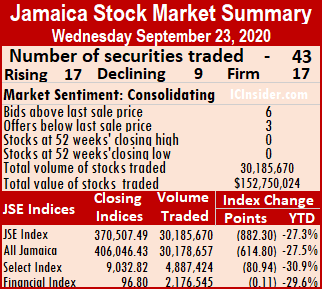

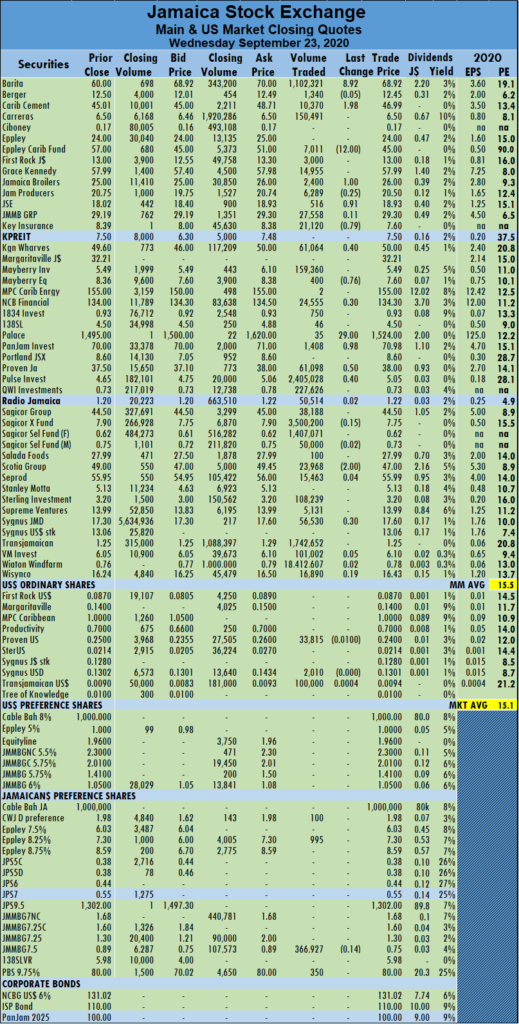

At the close, the All Jamaican Composite Index fell by 614.80 points to 406,046.43, the Main Index shed 882.30 points to 370,507.49 and the JSE Financial Index lost 0.11 points to settle at 96.80.

At the close, the All Jamaican Composite Index fell by 614.80 points to 406,046.43, the Main Index shed 882.30 points to 370,507.49 and the JSE Financial Index lost 0.11 points to settle at 96.80. Trading ended with an average of 701,992 units changing hands at $3,552,326 for each security, in comparison to an average of 246,643 shares at $1,217,931 on Tuesday. The average trade for the month to date ended at 246,626 units at $1,536,244 for each security, in contrast to 217,703 units at $1,408,192. Trading month to date compares adversely to August’s average of 497,442 units at $3,201,935.

Trading ended with an average of 701,992 units changing hands at $3,552,326 for each security, in comparison to an average of 246,643 shares at $1,217,931 on Tuesday. The average trade for the month to date ended at 246,626 units at $1,536,244 for each security, in contrast to 217,703 units at $1,408,192. Trading month to date compares adversely to August’s average of 497,442 units at $3,201,935. Key Insurance shed 79 cents to end at $7.60 in exchanging 21,120 stock units. Kingston Wharves gained 40 cents to finish at $50, with 61,064 shares passing through the market, Mayberry Jamaican Equities fell to $7.60, with a loss of 76 cents after exchanging 400 units, NCB Financial Group gained 30 cents to end at $134.30, with 24,555 stock units crossing the exchange. Palace Amusement advanced by $29 to $1,524 trading 35 units, PanJam Investment rose 98 cents to $70.98, with 1,408 units changing hands, Proven Investments gained 50 cents to settle at $38, in trading 61,098 shares. Pulse Investments ended at $5.05, with gains of 40 cents after exchanging 2,405,028 shares, Scotia Group fell $2 to $47, with investors transferring 23,968 stock units and Sygnus Credit Investments gained 30 cents ending at $17.60, after exchanging 56,530 shares.

Key Insurance shed 79 cents to end at $7.60 in exchanging 21,120 stock units. Kingston Wharves gained 40 cents to finish at $50, with 61,064 shares passing through the market, Mayberry Jamaican Equities fell to $7.60, with a loss of 76 cents after exchanging 400 units, NCB Financial Group gained 30 cents to end at $134.30, with 24,555 stock units crossing the exchange. Palace Amusement advanced by $29 to $1,524 trading 35 units, PanJam Investment rose 98 cents to $70.98, with 1,408 units changing hands, Proven Investments gained 50 cents to settle at $38, in trading 61,098 shares. Pulse Investments ended at $5.05, with gains of 40 cents after exchanging 2,405,028 shares, Scotia Group fell $2 to $47, with investors transferring 23,968 stock units and Sygnus Credit Investments gained 30 cents ending at $17.60, after exchanging 56,530 shares. At the close of the market, trading ended with three securities changing hands compared to five on Tuesday and closed with the price of one stock rising and two stocks declining.

At the close of the market, trading ended with three securities changing hands compared to five on Tuesday and closed with the price of one stock rising and two stocks declining. IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading for the market shows one stock ending with the bid higher than the last selling price and one with a lower offer.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading for the market shows one stock ending with the bid higher than the last selling price and one with a lower offer. IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading for the market shows three stocks ended with bids higher than their last selling prices and four with lower offers.

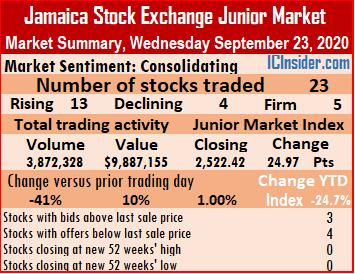

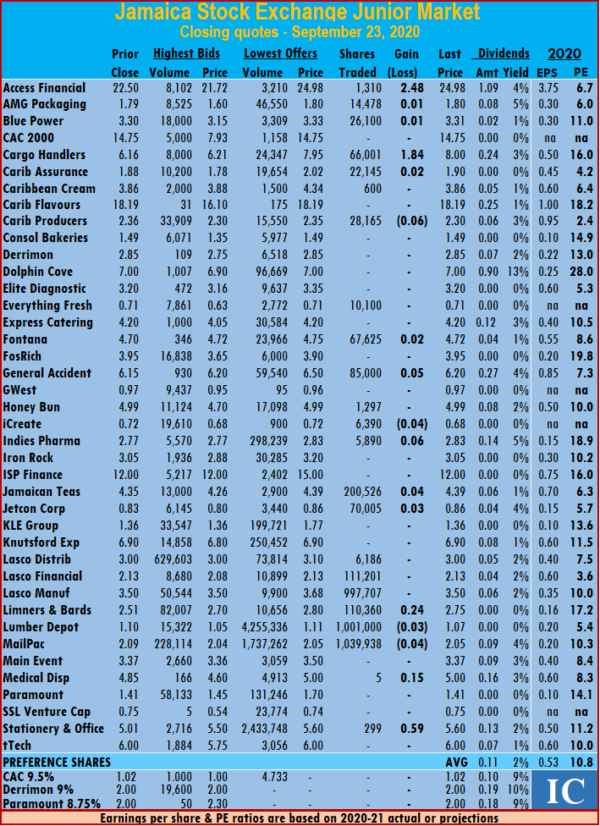

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading for the market shows three stocks ended with bids higher than their last selling prices and four with lower offers. Indies Pharma advanced 6 cents and traded 5,890 shares to settle at $2.83, Jamaican Teas closed 4 cents higher at $4.39 with 200,526 units traded, Jetcon Corporation climbed 3 cents to finish at 86 cents with 70,005 shares passing through the market. Limners and Bards gained 24 cents to end at $2.75 with investors switching ownership of 110,360 units, Lumber Depot exchanged 1,001,000 stock units and lost 3 cents to settle at $1.07, Mailpac Group fell 4 cents to $2.05 with 1,039,938 shares changing hands. Medical Disposables climbed 15 cents to close at $5 with a mere 5 units traded and Stationery and Office Supplies jumped 59 cents to finish at $5.60 with 299 shares crossing the exchange.

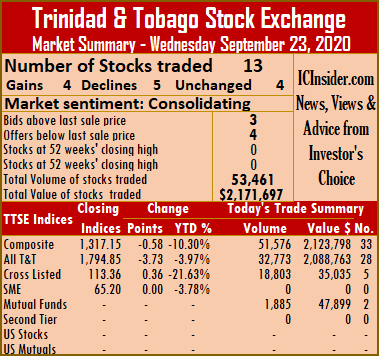

Indies Pharma advanced 6 cents and traded 5,890 shares to settle at $2.83, Jamaican Teas closed 4 cents higher at $4.39 with 200,526 units traded, Jetcon Corporation climbed 3 cents to finish at 86 cents with 70,005 shares passing through the market. Limners and Bards gained 24 cents to end at $2.75 with investors switching ownership of 110,360 units, Lumber Depot exchanged 1,001,000 stock units and lost 3 cents to settle at $1.07, Mailpac Group fell 4 cents to $2.05 with 1,039,938 shares changing hands. Medical Disposables climbed 15 cents to close at $5 with a mere 5 units traded and Stationery and Office Supplies jumped 59 cents to finish at $5.60 with 299 shares crossing the exchange. The market closed with thirteen securities trading with the prices of four stocks advancing, five declining and four unchanged. The volume of stocks passing through the market amounted to 53,461 shares valued at $2,171,697 compared to 214,801 shares for $1,071,798 on Tuesday from 10 securities.

The market closed with thirteen securities trading with the prices of four stocks advancing, five declining and four unchanged. The volume of stocks passing through the market amounted to 53,461 shares valued at $2,171,697 compared to 214,801 shares for $1,071,798 on Tuesday from 10 securities. Stocks declining│ Agostini’s shed 20 cents to end at $24.50, in exchanging 20 units, Clico Investments closed at $25.50, with a loss of 9 cents transferring 1,870 units, Grace Kennedy lost 1 cent to finish at $3.48, with 1,000 units changing hands. Scotiabank closed at $54.80 after losing 10 cents trading 192 shares and Trinidad and Tobago NGL slipped 2 cents to $16.01, with an exchange of 1,996 units.

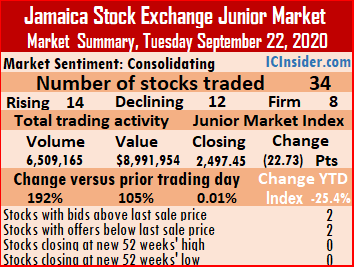

Stocks declining│ Agostini’s shed 20 cents to end at $24.50, in exchanging 20 units, Clico Investments closed at $25.50, with a loss of 9 cents transferring 1,870 units, Grace Kennedy lost 1 cent to finish at $3.48, with 1,000 units changing hands. Scotiabank closed at $54.80 after losing 10 cents trading 192 shares and Trinidad and Tobago NGL slipped 2 cents to $16.01, with an exchange of 1,996 units. Trading concluded with 34 securities changing hands compared to 32 on Monday and ended with 14 stocks rising, the prices of 12 declining and eight stock prices remaining unchanged.

Trading concluded with 34 securities changing hands compared to 32 on Monday and ended with 14 stocks rising, the prices of 12 declining and eight stock prices remaining unchanged. IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading for the market shows two stocks ended with bids higher than their last selling prices and two with lower offers.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading for the market shows two stocks ended with bids higher than their last selling prices and two with lower offers. Indies Pharma lost 6 cents to end at $2.77 with 9,596 stocks changing hands, Iron Rock Insurance declined 5 cents to close at $3.05 with 10,166 stock units traded, Jamaican Teas climbed 10 cents to end at $4.35 with investors switching ownership of 66,650 stock units. Jetcon Corporation slid 3 cents to 83 cents with 82,906 units passing through the market, Lasco Distributors dropped 10 cents to close at $3 in an exchange of 816 stock units, Lasco Financial rose 5 cents to finish at $2.13 with 28,738 stocks traded. Lasco Manufacturing slipped 2 cents to $3.50 with investors transferring 26,989 units, Limners and Bards shed 18 cents to end at $2.51 with 114,036 units passing through the market, Lumber Depot increased by 6 cents to finish at $1.10 with 5,514,662 stock units changing hands. Mailpac Group gained 4 cents to settle at $2.09 in an exchange of 446,478 stocks, Main Event lost 1 cent to close at $3.37 with investors switching ownership of 3,954 units, Medical Disposables climbed 30 cents to finish at $4.85 with 97 stock units changing hands. Stationery and Office Supplies rose 1 cent to end at $5.01 after trading 11,102 stock units and tTech advanced 20 cents to end at $6 with a mere seven stocks crossing the exchange.

Indies Pharma lost 6 cents to end at $2.77 with 9,596 stocks changing hands, Iron Rock Insurance declined 5 cents to close at $3.05 with 10,166 stock units traded, Jamaican Teas climbed 10 cents to end at $4.35 with investors switching ownership of 66,650 stock units. Jetcon Corporation slid 3 cents to 83 cents with 82,906 units passing through the market, Lasco Distributors dropped 10 cents to close at $3 in an exchange of 816 stock units, Lasco Financial rose 5 cents to finish at $2.13 with 28,738 stocks traded. Lasco Manufacturing slipped 2 cents to $3.50 with investors transferring 26,989 units, Limners and Bards shed 18 cents to end at $2.51 with 114,036 units passing through the market, Lumber Depot increased by 6 cents to finish at $1.10 with 5,514,662 stock units changing hands. Mailpac Group gained 4 cents to settle at $2.09 in an exchange of 446,478 stocks, Main Event lost 1 cent to close at $3.37 with investors switching ownership of 3,954 units, Medical Disposables climbed 30 cents to finish at $4.85 with 97 stock units changing hands. Stationery and Office Supplies rose 1 cent to end at $5.01 after trading 11,102 stock units and tTech advanced 20 cents to end at $6 with a mere seven stocks crossing the exchange. Trading ended with an average of 246,643 units changing hands at $1,217,931 for each security compared to an average of 184,185 shares at $670,702 on Monday. The average trade for the month to date ended at 215,025 units at $1,403,085 for each security, in contrast to 212,720 units at $1,416,583. Trading month to date compares adversely to August with an average of 497,441 units at $3,201,918.

Trading ended with an average of 246,643 units changing hands at $1,217,931 for each security compared to an average of 184,185 shares at $670,702 on Monday. The average trade for the month to date ended at 215,025 units at $1,403,085 for each security, in contrast to 212,720 units at $1,416,583. Trading month to date compares adversely to August with an average of 497,441 units at $3,201,918. NCB Financial Group carved out a loss $1 to end at $134 in an exchange of 22,133 shares, 138 Student Living declined by 38 cents in ending at $4.50 and exchanging 101 stocks. Portland JSX climbed $1.58 to $8.60, with just 69 stock units crossing the market, Proven Investments increased 40 cents to close at $37.50 after 4,999 units passed through the market, Pulse Investments rose 45 cents in ending at $4.65 as 5,368,622 stocks crossed the exchange. Sagicor Group carved out 35 cents rise to close at $44.50, with 23,149 units changing hands, Scotia Group gained $2.99 to end at $49 finished trading 679 shares, Seprod climbed 95 cents in closing at $55.95 and trading 19,699 units. Stanley Motta increased 51 cents to end at $5.13, with 109 stocks changing hands, Supreme Ventures gained 44 cents in closing at $13.99 in exchanging 88,979 shares and Sygnus Credit Investments declined by $1.20 to $17.30 and crossing the exchange with 11,240 units.

NCB Financial Group carved out a loss $1 to end at $134 in an exchange of 22,133 shares, 138 Student Living declined by 38 cents in ending at $4.50 and exchanging 101 stocks. Portland JSX climbed $1.58 to $8.60, with just 69 stock units crossing the market, Proven Investments increased 40 cents to close at $37.50 after 4,999 units passed through the market, Pulse Investments rose 45 cents in ending at $4.65 as 5,368,622 stocks crossed the exchange. Sagicor Group carved out 35 cents rise to close at $44.50, with 23,149 units changing hands, Scotia Group gained $2.99 to end at $49 finished trading 679 shares, Seprod climbed 95 cents in closing at $55.95 and trading 19,699 units. Stanley Motta increased 51 cents to end at $5.13, with 109 stocks changing hands, Supreme Ventures gained 44 cents in closing at $13.99 in exchanging 88,979 shares and Sygnus Credit Investments declined by $1.20 to $17.30 and crossing the exchange with 11,240 units.