Corporate taxes continue to be a star performer for Jamaica government revenues, having increased their input by a strong 23 percent over forecast, to February.

Corporate taxes continue to be a star performer for Jamaica government revenues, having increased their input by a strong 23 percent over forecast, to February.

According to the government fiscal report, businesses paid $34 billion in corporate taxes to February or just over $6 billion more than projected. In spite of that level of performance, PAYE contributed more in taxes, at $48 billion even as government raised the threshold to $1.5 billion for individuals and cutting around $25 billion in the individual tax bill.

Corporations will be making big payments in March that should hike the amount they will pay for the fiscal year to be well ahead of the February figure. The forecast at the start of the fiscal year, was for a total take of $50.6 billion compared to $46 billion for 2016. The forecast for 2018/19 is for an intake of $63.9 billion or an increase of 26 percent over the 2018 forecast. If the trend for the just concluded fiscal year holds to March, the projected increase for the new fiscal would be just around $3 billion.

Scotia Group to contribute most to 2017/18 corporate taxes

Other areas performing well above budget projections include, Travel taxes up by 12.5% to $17.5 billion, GCT on local goods and services 4.8 percent to $83 billion, Education taxes up 6 percent to $24 billion and special consumption taxes on local goods up 10 percent to $26 billion.

Listed companies will contribute around $21 billion to the corporate tax take for the just concluded fiscal year according to data taken from financial statements. The bulk of the listed companies’ contribution will come from Scotia Group with $5.7 billion, NCB Financial $5 billion, Sagicor Group $2.9 billion, Carreras just over $1 billion, Grace Kennedy around $1 billion, JPSCo and JMMB Group just under $1 billion. Other billion dollar contributors should include Desnoes and Geddes and Wray and Nephew.

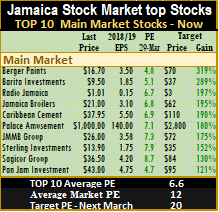

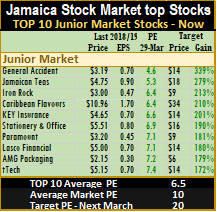

At the close of Friday, the average PE ratio for Junior Market Top stocks ended at 6.5 compared to an average PE for the overall main market is 10 based on 2018 estimated earnings. The main market PE is 6.6 for the top stocks compared to a market average of 12.

At the close of Friday, the average PE ratio for Junior Market Top stocks ended at 6.5 compared to an average PE for the overall main market is 10 based on 2018 estimated earnings. The main market PE is 6.6 for the top stocks compared to a market average of 12. Collection of

Collection of

Figures released by the Ministry of Finance, show that the operations to February, resulted in an overall surplus of almost $3 billion well above the projection of a deficit of $23 billion. The vast improvement arose from an $11 billion increase in revenues over budget, to reach $476 billion and less spending of $15 billion, with the latter benefiting from the late payment of increased salaries for the civil service. Revenues would have been far better but for tax refunds on interest that saw a reduction in inflows of more than $5 billion.

Figures released by the Ministry of Finance, show that the operations to February, resulted in an overall surplus of almost $3 billion well above the projection of a deficit of $23 billion. The vast improvement arose from an $11 billion increase in revenues over budget, to reach $476 billion and less spending of $15 billion, with the latter benefiting from the late payment of increased salaries for the civil service. Revenues would have been far better but for tax refunds on interest that saw a reduction in inflows of more than $5 billion.