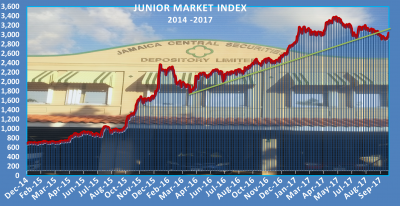

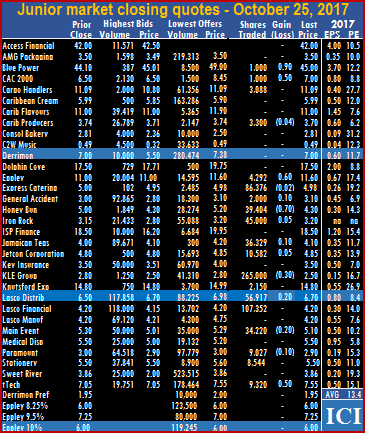

The Junior Market on Friday closed for the 10th consecutive day with unbroken gains leading the market index climbing 37.73 points to close at 3,143.71 with 21 securities changing hands compared to 18 on Thursday.

The Junior Market on Friday closed for the 10th consecutive day with unbroken gains leading the market index climbing 37.73 points to close at 3,143.71 with 21 securities changing hands compared to 18 on Thursday.

At the close of market activities, the prices of 8 securities advanced, 10 declined and 3 remained unchanged and 554,767 units valued at $2,609,944 traded compared to 2,819,581 units valued at $17,224,051 on Thursday.

Trading ended with an average of 26,417 units for an average of $124,283 in contrast to 156,643 units for an average of $956,892 on Thursday.  The average volume and value for the month to date amounts to 75,683 units valued at $359,339 and previously, 78,762 units valued at $374,030. In contrast, September closed with average of 116,176 units valued at $538,652 for each security traded.

The average volume and value for the month to date amounts to 75,683 units valued at $359,339 and previously, 78,762 units valued at $374,030. In contrast, September closed with average of 116,176 units valued at $538,652 for each security traded.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows 3 stocks with bids higher than their last selling prices and 5 with lower offers.

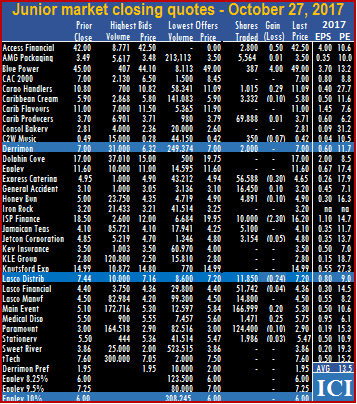

At the close of the market, Access Financial gained 50 cents to settle at $42.50, with 2,800 shares, AMG Packaging finished trading 1 cent higher at $3.50, with 5,564 units, Blue Power jumped $4 to $49, with 387 shares changing hands, C2W Music finished with a loss of 7 cents at 42 cents, with 350 stock units, Cargo Handlers rose 29 cents to $11.09, with 1,015 units, Caribbean Cream concluded trading with a loss of 10 cents at $5.80, with 3,332 stock units.  Caribbean Producers traded 1 cent higher at $3.71, with 69,888 units being traded. Derrimon Trading ended at $7 with 2,000 units, Express Catering finished trading with a loss of 30 cents at $4.65, with 56,588 stock units trading, General Accident ended trading 10 cents higher at $3.20, with 16,450 units, Honey Bun closed with a loss of 10 cents at $4.90, with 4,891 stock units changing hands. ISP Finance dropped $2.30 to $16.20, with 10,000 units, Jamaican Teas concluded trading at $4.10, with 5,100 shares, Jetcon Corporation finished with a loss of 5 cents at $4.80, with 3,154 shares trading, Lasco Distributors closed with a loss of 24 cents at $7.20, with 11,850 units, Lasco Financial ended with a loss of 4 cents at $4.36, with 51,742 stock units. Lasco Manufacturing closed at $4.50, with 14,800 units, Main Event traded 20 cents higher at $5.30, with 166,999 shares, Medical Disposables traded 25 cents higher at $5.75, with 1,471 stock units, Paramount Trading settled with a loss of 10 cents at $2.90, with 124,400 units being exchanged and Stationery and Office settled with a loss of 3 cents at $5.47, with 1,986 units.

Caribbean Producers traded 1 cent higher at $3.71, with 69,888 units being traded. Derrimon Trading ended at $7 with 2,000 units, Express Catering finished trading with a loss of 30 cents at $4.65, with 56,588 stock units trading, General Accident ended trading 10 cents higher at $3.20, with 16,450 units, Honey Bun closed with a loss of 10 cents at $4.90, with 4,891 stock units changing hands. ISP Finance dropped $2.30 to $16.20, with 10,000 units, Jamaican Teas concluded trading at $4.10, with 5,100 shares, Jetcon Corporation finished with a loss of 5 cents at $4.80, with 3,154 shares trading, Lasco Distributors closed with a loss of 24 cents at $7.20, with 11,850 units, Lasco Financial ended with a loss of 4 cents at $4.36, with 51,742 stock units. Lasco Manufacturing closed at $4.50, with 14,800 units, Main Event traded 20 cents higher at $5.30, with 166,999 shares, Medical Disposables traded 25 cents higher at $5.75, with 1,471 stock units, Paramount Trading settled with a loss of 10 cents at $2.90, with 124,400 units being exchanged and Stationery and Office settled with a loss of 3 cents at $5.47, with 1,986 units.

Prices of securities trading for the day are those at which the last trade took place.

Archives for October 2017

Profit surges 137% at Express Catering

Starbucks one of the brands Express Catering will sell at the Montego Bay Airport.

Recent Junior Market listed Express Catering, enjoyed a big surge in profit of 137 percent to US$834,447 for the quarter to August, this year.

With management fees removed and revenues jumping 9.7 percent, in line with increased visitor arrivals to Jamaica, Express Catering, operators of a series of restaurants within the Montego Bay’s Sangster International Airport good performance, came from revenues of US$3.8 million for the quarter.

The removal of management fees saw administrative and other expenses falling from US$2 million to US$1.7 million, but gross profit rose by US$157,000 as cost of sales grew faster than the top line, at 21 percent thus reducing profit margin. Management in their commentary on the results states that “they have since raised prices to compensate for increased input cost.” Express reported earnings per share of 0.051 US cents. IC Insider.com places full year’s earnings at 26 Jamaican cents and that for 2019 at 40 Jamaican cents.

“The addition of the Starbucks Coffee to the offerings in the airport is expected to be completed during the third quarter. Work as already commenced on this initiative and will see 3 locations within the Airport,” the directors’ report stated.

The balance sheet shows US$4.56 million due from related party an increase from $3.64 million at the end of May and cash funds at $497,000.

The stock currently trades at a PE ratio of 19 with the price at $4.95 against the market average of 13.6.

Jamaican $ makes modest gain – Thursday

Sale of US dollar by dealers, fell to US$33.84 million at an average rate of $127.49 to the US dollar, at the close of trading, on Thursday, down from US$44.57 million at an average rate of $127.53 on Wednesday.

Sale of US dollar by dealers, fell to US$33.84 million at an average rate of $127.49 to the US dollar, at the close of trading, on Thursday, down from US$44.57 million at an average rate of $127.53 on Wednesday.

US currency purchases declined from the previous day to US$35.96 million on Thursday, at an average rate of $126.59 compared to Wednesday, with US$44.40 million at $126.63.

Dealers purchased US$46.14 million, versus US$58.58 million on Wednesday in all currencies in Jamaica’s forex market and sold US$43.23 million compared with US$56.55 million previously.

At Midday, dealers bought US$10.58 million at J$126.80 and sold US$5.35 million at J$127.43 compared to the buying of US$20 million at J$127.10 and selling of US$12.5 million at J$127.59 at the same time on Wednesday.

The selling rate for the Canadian dollar dropped to J$100.21 from J$102.37 at the close on Wednesday. The selling rate for the British Pound climbed to J$168.47 versus J$167.80 on Wednesday and the euro inched up in value against the Jamaican dollar, to J$151.76 to buy the European common currency, versus J$150.68 previously.

NCB at J$114 and JMMB at J$35 on TTSE

NCB Financial Group closed at a record TT$5.95 or J$114 equivalent on Thursday on TTSE.

NCB Financial Group jumped to a record close of $5.95 or the equivalent of J$114 the Trinidad & Tobago Stock Exchange on Thursday, while JMMB Group climbed to new high of $1.85 or J$35 while they trade well below these levels in Kingston.

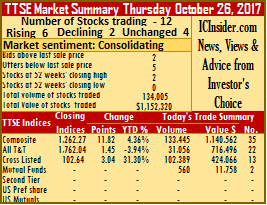

Trading on the market closed with 12 securities changing hands compared to 16 on Wednesday resulting in low trading levels. At the close, 6 stocks advanced, 2 declined and 4 were unchanged as 134,005 shares traded at a value of $1,152,320 compared to Wednesday’s trades of 120,210 valued at $4,165,527.

All three indices posted gains with a number of stock rising sharply. At the close, the Composite Index advancing 11.82 points to 1,262.27, the All T&T Index gained 1.45 points to 1,762.04 and the Cross Listed Index added 3.04 points, surpassing the 100 points mark to close at an all-time record of 102.64, since the index was started in June 2008.

IC bid-offer Indicator| The Investor’s Choice bid-offer ended with 2 stocks with bids higher than last selling prices and 5 with lower offers.

Gains| The last traded price of the securities rising and the volume changing hands are JMMB Group with gains of 9 cents, to close at a 52 weeks’ high of $1.85 with 48,889 shares trading. National Flour Mills closed at $2, gaining 1 cent with 1,272 units, NCB Financial Group jumped 40 cents to a 52 weeks’ high of $5.95 while exchanging 45,000 shares, Sagicor Financial traded 25 cents higher to $8 with 8,500 shares, Scotiabank rose 44 cents and ended at $58.50, with 610 units and  Trinidad & Tobago NGL closed at $23.12, having gained 1 cent with 6,350 shares traded.

Trinidad & Tobago NGL closed at $23.12, having gained 1 cent with 6,350 shares traded.

Losses| Securities changing hands with loses are Ansa McAL that closed 4 cents lower to $63.01 with 1,536 units and Guardian Holdings with a loss of 5 cents, settling at $15.10 while trading 16,230 shares.

Firm Trades| The last traded prices of securities and the volume traded unchanged at the close of trading are Clico Investment that remained at $21 with 560 units changing hands, First Citizens trading 700 units to close at $31.80, Massy Holdings exchanged 3,158 shares at $49 and National Enterprises ended at $10 with 1,200 units changing hands.

Carib Cement Q3 profit $748m

Carib Cement silos.

Profits arose from revenues of $4.18 billion, up from sales of $3.68 billion in 2016, due mainly to a 15 percent increase in volume sales locally. The result compares to a loss of $81 million in the similar quarter last year. For the nine months to September, profit after tax ends at $1.8 billion versus $973 million in 2016 and well ahead of the $1.3 million reported for the 12 months to December 2016. Revenues for the nine months, amounted to $12.26 billion, up from $12 billion in 2016.

Cost were mostly kept within the levels incurred in 2016 except for a sharp increase in fuel and electricity cost that jumped from $530 million to $759 million in the quarter and moved from $1.87 billion to $2.2 billion for the nine months, but repairs and maintenance fell to $254 million from $358 million in the 2016 third quarter but was slightly down for the nine months at $650 million.

Cement ended the quarter with cash at $1.6 billion after $1.57 billion was expended on additional fixed assets.

Earnings per share for the quarter amounted to 88 cents and $2.13 for the nine months, with the full year looking to exceed $3. Importantly, the results should be looked at not so much for the out turn for 2017, but what it means for full year earnings in 2018. IC Insider.com expects demand for cement to continue to rise as the economy gathers steam and the company renegotiates the leasing arrangement for equipment that is expected to lower the cost in that area going forward, pushing earnings well over $4 per share. The stock closed on the Jamaica Stock Exchange on Wednesday at $29.01.

When the main market of the Jamaica Stock Exchange ended on Friday with big gains in both major market indices, it marked the fourth week on a trot that the market was ending at record weekly highs.

When the main market of the Jamaica Stock Exchange ended on Friday with big gains in both major market indices, it marked the fourth week on a trot that the market was ending at record weekly highs. The average volume and value for the month to date amounts to 1,279,786 units valued at $17,897,455 and 1,352,159 units with an average value of $18,809,431, previously. In contrast, September closed with average of 283,480 units at $3630990 for each security traded.

The average volume and value for the month to date amounts to 1,279,786 units valued at $17,897,455 and 1,352,159 units with an average value of $18,809,431, previously. In contrast, September closed with average of 283,480 units at $3630990 for each security traded. The Junior Market Index enjoyed another day of mostly rising prices, leading to the market index increasing for the 9th consecutive day with an increase of 18.55 points to close at 3,105.98 on Thursday.

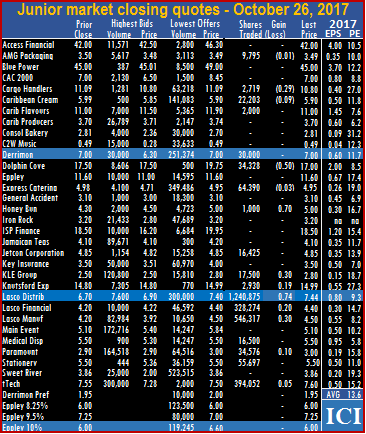

The Junior Market Index enjoyed another day of mostly rising prices, leading to the market index increasing for the 9th consecutive day with an increase of 18.55 points to close at 3,105.98 on Thursday.  Trading ended with an average of 156,643 units for an average of $956,892 in contrast to 38,153 units for an average of $156,449 on Wednesday. The average volume and value for the month to date amounts to 78,762 units valued at $374,030 and previously, 74,354 shares with an average value of $341,038. In contrast, September closed with average of 116,176 units valued at $538,652 for each security traded.

Trading ended with an average of 156,643 units for an average of $956,892 in contrast to 38,153 units for an average of $156,449 on Wednesday. The average volume and value for the month to date amounts to 78,762 units valued at $374,030 and previously, 74,354 shares with an average value of $341,038. In contrast, September closed with average of 116,176 units valued at $538,652 for each security traded. Dolphin Cove ended trading with a loss of 50 cents at $17, with 34,328 units trading, Express Catering concluded trading with a loss of 3 cents at $4.95, with 64,390 shares, Honey Bun traded 70 cents higher at $5, with 1,000 stock units, Jetcon Corporation ended trading at $4.85, with 16,425 shares trading. KLE Group closed 30 cents higher at $2.80, with 17,500 units, Knutsford Express settled 19 cents higher at $14.99, trading 2,930 shares, Lasco Distributors rose 74 cents to close at $7.44, with 1,240,875 stock units, Lasco Financial traded 20 cents higher at $4.40, with 328,274 shares, Lasco Manufacturing traded 30 cents higher at $4.50, with 546,317 stock units. Medical Disposables settled at $5.50, with 16,500 shares, Paramount Trading closed 10 cents higher at $3, with 34,576 shares, Stationery and Office ended at $5.50, with 55,697 stock units and tTech ended 5 cents higher at $7.60, with 394,052 shares.

Dolphin Cove ended trading with a loss of 50 cents at $17, with 34,328 units trading, Express Catering concluded trading with a loss of 3 cents at $4.95, with 64,390 shares, Honey Bun traded 70 cents higher at $5, with 1,000 stock units, Jetcon Corporation ended trading at $4.85, with 16,425 shares trading. KLE Group closed 30 cents higher at $2.80, with 17,500 units, Knutsford Express settled 19 cents higher at $14.99, trading 2,930 shares, Lasco Distributors rose 74 cents to close at $7.44, with 1,240,875 stock units, Lasco Financial traded 20 cents higher at $4.40, with 328,274 shares, Lasco Manufacturing traded 30 cents higher at $4.50, with 546,317 stock units. Medical Disposables settled at $5.50, with 16,500 shares, Paramount Trading closed 10 cents higher at $3, with 34,576 shares, Stationery and Office ended at $5.50, with 55,697 stock units and tTech ended 5 cents higher at $7.60, with 394,052 shares. The

The  traded 75 cents higher at $16.75, with 149,835 units, 54 percent above the Ansa Coatings offer price. Cable & Wireless closed 1 cent higher at $1.02, with just 6,715 shares, Caribbean Cement traded $3.99 higher to $33, with 55,758 stock units trading, Carreras rose $1.50 to $13, with 375,369 shares, Grace Kennedy concluded trading 7 cents higher at $42.83, with 100,966 shares, Jamaica Broilers ended with a gain of 49 cents to $18.49, with 1,126,834 units. Jamaica Producers closed 40 cents higher at $16, with 109,041 shares, Jamaica Stock Exchange ended trading with a loss of 47 cents at $6.50, with 4,072 units, JMMB Group ended trading 40 cents higher at a 52 weeks’ closing high of $28, with 110,531 shares, Kingston Wharves ended with a loss of 49 cents at $32.50, with 5,657 shares,

traded 75 cents higher at $16.75, with 149,835 units, 54 percent above the Ansa Coatings offer price. Cable & Wireless closed 1 cent higher at $1.02, with just 6,715 shares, Caribbean Cement traded $3.99 higher to $33, with 55,758 stock units trading, Carreras rose $1.50 to $13, with 375,369 shares, Grace Kennedy concluded trading 7 cents higher at $42.83, with 100,966 shares, Jamaica Broilers ended with a gain of 49 cents to $18.49, with 1,126,834 units. Jamaica Producers closed 40 cents higher at $16, with 109,041 shares, Jamaica Stock Exchange ended trading with a loss of 47 cents at $6.50, with 4,072 units, JMMB Group ended trading 40 cents higher at a 52 weeks’ closing high of $28, with 110,531 shares, Kingston Wharves ended with a loss of 49 cents at $32.50, with 5,657 shares, NCB Financial lost 36 cents and closed at $105.65 with 157,631 shares trading, 138 Student Living closed at $5.40, with 10,000 units, PanJam Investment traded 50 cents higher at $42, with 1,500 shares, Pulse Investments finished 19 cents higher at $1.80, with 105,000 units, Radio Jamaica ended trading with a loss of 1 cent at $1.13, with 125,960 shares, Sagicor Group finished trading with a loss of 3.47 cents at $34.53, with 24,735 units, Sagicor Real Estate Fund ended trading with a loss of 10 cents at $14.40, with 21,217 stock units, Scotia Group traded with a loss of $2 at $50, with 281,355 units, Seprod traded $1.25 higher at $30, with 12,346 shares changing hands, Supreme Ventures ended trading at $11.99, with 67,955 stock units and in the main market preference segment, JMMB Group 7.5% closed at $1.10, with 20,000 stock units, while Productivity Business Solutions traded 1,100 US dollar denominated ordinary shares at 57.5 US cents.

NCB Financial lost 36 cents and closed at $105.65 with 157,631 shares trading, 138 Student Living closed at $5.40, with 10,000 units, PanJam Investment traded 50 cents higher at $42, with 1,500 shares, Pulse Investments finished 19 cents higher at $1.80, with 105,000 units, Radio Jamaica ended trading with a loss of 1 cent at $1.13, with 125,960 shares, Sagicor Group finished trading with a loss of 3.47 cents at $34.53, with 24,735 units, Sagicor Real Estate Fund ended trading with a loss of 10 cents at $14.40, with 21,217 stock units, Scotia Group traded with a loss of $2 at $50, with 281,355 units, Seprod traded $1.25 higher at $30, with 12,346 shares changing hands, Supreme Ventures ended trading at $11.99, with 67,955 stock units and in the main market preference segment, JMMB Group 7.5% closed at $1.10, with 20,000 stock units, while Productivity Business Solutions traded 1,100 US dollar denominated ordinary shares at 57.5 US cents. The Main Market of the Jamaica Stock Exchange broke its winning streak of

The Main Market of the Jamaica Stock Exchange broke its winning streak of  $238,441 on Tuesday. The average volume and value for the month to date amounts to 76,654 units valued at $352,768 compared to 76,654 units valued at $352,768 previously. In contrast, September closed with average of 116,176 units valued at $538,652 for each security traded.

$238,441 on Tuesday. The average volume and value for the month to date amounts to 76,654 units valued at $352,768 compared to 76,654 units valued at $352,768 previously. In contrast, September closed with average of 116,176 units valued at $538,652 for each security traded. Iron Rock ended trading 5 cents higher at $3.20, with 45,000 units changing hands, Jamaican Teas gained 10 cents to close at $4.10, with 36,329 units trading. Jetcon Corporation settled 5 cents higher at $4.85, with 10,582 shares, KLE Group concluded trading with a loss of 30 cents at $2.50, with 265,000 units changing hands, Knutsford Express closed at $14.80, with 2,150 stock units, Lasco Distributors ended trading after rising 20 cents to $6.70, with 56,917 shares, Lasco Financial closed at $4.20, with 107,352 stock units trading. Main Event traded with a loss of 20 cents at $5.10, with 34,220 shares, Paramount Trading settled with a loss of 10 cents at $2.90, with 9,027 stock units, Stationery and Office ended at $5.50, with 8,544 units trading and tTech added 50 cents to close at $7.55, with 9,320 shares changing hands.

Iron Rock ended trading 5 cents higher at $3.20, with 45,000 units changing hands, Jamaican Teas gained 10 cents to close at $4.10, with 36,329 units trading. Jetcon Corporation settled 5 cents higher at $4.85, with 10,582 shares, KLE Group concluded trading with a loss of 30 cents at $2.50, with 265,000 units changing hands, Knutsford Express closed at $14.80, with 2,150 stock units, Lasco Distributors ended trading after rising 20 cents to $6.70, with 56,917 shares, Lasco Financial closed at $4.20, with 107,352 stock units trading. Main Event traded with a loss of 20 cents at $5.10, with 34,220 shares, Paramount Trading settled with a loss of 10 cents at $2.90, with 9,027 stock units, Stationery and Office ended at $5.50, with 8,544 units trading and tTech added 50 cents to close at $7.55, with 9,320 shares changing hands.