Stocks rose to their highest level since mid-April on the Jamaican Stock Exchange Main Market in the past week, during the past week the Junior Market traded at the highest level in seven weeks, with moves in both markets confirming the bullish signal technical indicators been flashing for weeks.

Stocks rose to their highest level since mid-April on the Jamaican Stock Exchange Main Market in the past week, during the past week the Junior Market traded at the highest level in seven weeks, with moves in both markets confirming the bullish signal technical indicators been flashing for weeks.

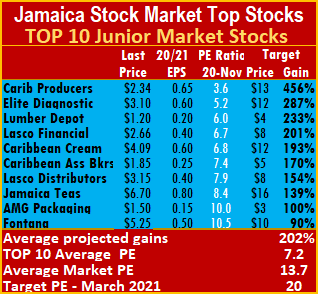

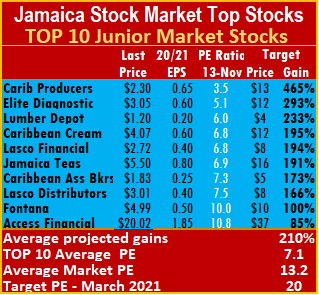

The movement in the markets resulted in shifts in the IC TOP 10. In the Junior Market Top 10, Access Financial dropped out after a week with the price moving from $20.02 to $22 while AMG Packaging moving in to sit in ninth position. Jamaican Teas shareholders approved a three for one stock split leading the stock up to $6.70 from $5.50.

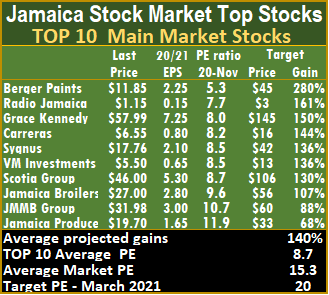

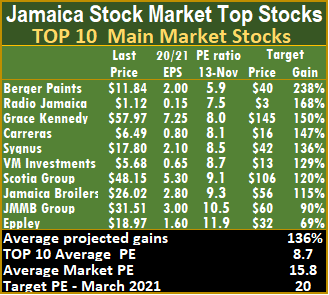

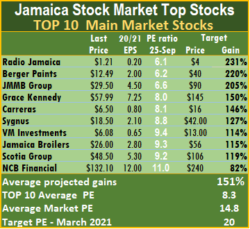

Eppley lost its Main Market TOP 10 position with the price moving up from $18.97 to $20.02 and is replaced by Jamaica Producers.

Eppley lost its Main Market TOP 10 position with the price moving up from $18.97 to $20.02 and is replaced by Jamaica Producers.

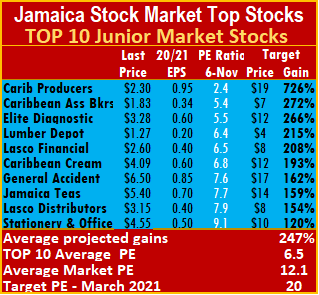

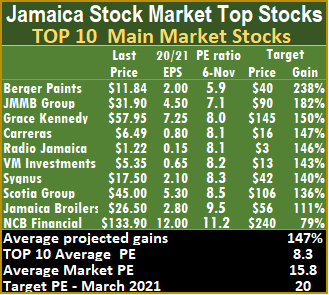

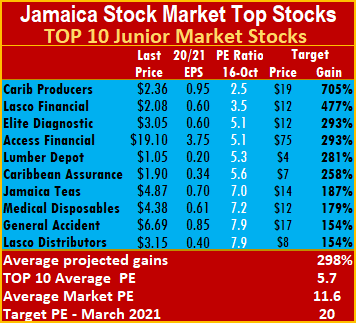

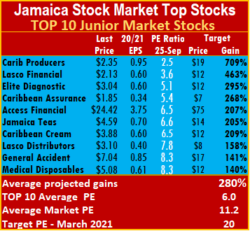

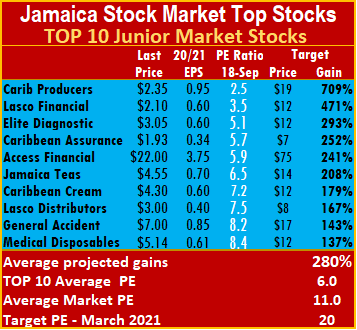

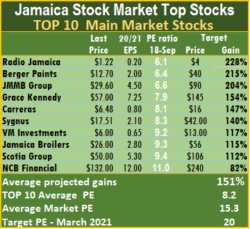

The top three stocks in the Junior Market with the potential to gain between 233 to 456 percent by March 2021are Caribbean Producers, followed by Elite Diagnostic and Limber Depot. With expected gains of 150 to 280 percent, the top three Main Market stocks are Berger Paints, followed by Radio Jamaica and Grace Kennedy in the third position.

The local stock market’s targeted average PE ratio is 20 based on profits of companies reporting full year’s results, from now to the second quarter in 2021. The Junior and Main markets are currently trading well below the market average, indicating the potential gains ahead.  The JSE Main Market ended the week, with an overall PE of 15.3 and the Junior Market 13.7, based on ICInsider.com’s projected 2020-21 earnings. The average PE ratio of the Junior Market has been slowly rising, with better profit opportunities than the Main Market and narrowing the gap. The PE ratio for the Junior Market Top 10 stocks average a mere 7.2 at just 53 percent to the average of the Junior Market. The Main Market TOP 10 stocks trade at a PE of 8.7 or 57 percent of the PE of that market.

The JSE Main Market ended the week, with an overall PE of 15.3 and the Junior Market 13.7, based on ICInsider.com’s projected 2020-21 earnings. The average PE ratio of the Junior Market has been slowly rising, with better profit opportunities than the Main Market and narrowing the gap. The PE ratio for the Junior Market Top 10 stocks average a mere 7.2 at just 53 percent to the average of the Junior Market. The Main Market TOP 10 stocks trade at a PE of 8.7 or 57 percent of the PE of that market.

The average projected gain for the Junior Market IC TOP 10 stocks is 202 percent and 140 percent for the JSE Main Market, based on 2020-21 earnings, indicating greater gains are likely in the Junior Market than the Main Market.

IC TOP 10 stocks are likely to deliver the best returns up to March 2021 and ranked in order of potential gains, based on likely gain for each company, taking into account the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in movements in and out of the lists weekly. Revisions to earnings per share are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

The move in the Main Market continues the move gradually higher ahead of the year-end and is in keeping with bullish signs that points to more gains ahead.

The move in the Main Market continues the move gradually higher ahead of the year-end and is in keeping with bullish signs that points to more gains ahead. The company is on target to earn 50 cents per share for the current financial year ending June 2021.

The company is on target to earn 50 cents per share for the current financial year ending June 2021. The PE ratio for the Junior Market Top 10 stocks average a mere 7.1 at just 54 percent to the Junior Market average. The Main Market TOP 10 stocks trade at a PE of 8.7 or 55 percent of the PE of that market.

The PE ratio for the Junior Market Top 10 stocks average a mere 7.1 at just 54 percent to the Junior Market average. The Main Market TOP 10 stocks trade at a PE of 8.7 or 55 percent of the PE of that market.

This week’s focus: Grace Kennedy continues to enjoy a phenomenal year, with profit attributed to the company’s shareholders, rising 33 percent to $1.68 billion in the September quarter, from $1.26 billion for the third quarter in the previous year and grew 35 percent for the nine months to September, to just $4.4 billion from $3.27 billion the corresponding period in 2019. Taxation more than doubled in both periods, but profit before tax grew 49 percent in the third quarter to $2.79 billion and for the nine-months, it rose 51.5 percent to $7.3 billion. Earnings per share are $1.69 for the quarter and $4.47 for the nine months and should exceed $6 for the full year.

This week’s focus: Grace Kennedy continues to enjoy a phenomenal year, with profit attributed to the company’s shareholders, rising 33 percent to $1.68 billion in the September quarter, from $1.26 billion for the third quarter in the previous year and grew 35 percent for the nine months to September, to just $4.4 billion from $3.27 billion the corresponding period in 2019. Taxation more than doubled in both periods, but profit before tax grew 49 percent in the third quarter to $2.79 billion and for the nine-months, it rose 51.5 percent to $7.3 billion. Earnings per share are $1.69 for the quarter and $4.47 for the nine months and should exceed $6 for the full year. With expected gains of 150 to 238 percent, the top three Main Market stocks are now, Berger Paints followed by JMMB Group and Grace Kennedy in the third position.

With expected gains of 150 to 238 percent, the top three Main Market stocks are now, Berger Paints followed by JMMB Group and Grace Kennedy in the third position. The average projected gain for the Junior Market IC TOP 10 stocks is 247 percent, and 147 percent for the JSE Main Market, based on 2020-21 earnings, indicating potentially greater gains in the Junior Market than the Main Market.

The average projected gain for the Junior Market IC TOP 10 stocks is 247 percent, and 147 percent for the JSE Main Market, based on 2020-21 earnings, indicating potentially greater gains in the Junior Market than the Main Market.

Remittances grew 11 percent and added $50 million to revenues while Cambio operations contributed 10.8 percent or $34 million to increased revenues, the company’s Managing Director Jacinth Hall-Tracey, informed shareholders in a commentary accompanying the quarterly report.

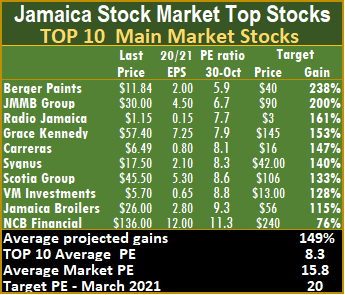

Remittances grew 11 percent and added $50 million to revenues while Cambio operations contributed 10.8 percent or $34 million to increased revenues, the company’s Managing Director Jacinth Hall-Tracey, informed shareholders in a commentary accompanying the quarterly report. With expected gains of 161 to 238 percent, the top three Main Market stocks are now Berger Paints followed by JMMB Group, Radio Jamaica replacing Grace Kennedy in the third position last week.

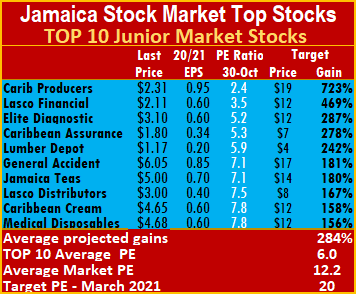

With expected gains of 161 to 238 percent, the top three Main Market stocks are now Berger Paints followed by JMMB Group, Radio Jamaica replacing Grace Kennedy in the third position last week. The average projected gain for the Junior Market IC TOP 10 stocks is 287 percent, and 149 percent for the JSE Main Market, based on 2020-21 earnings, indicates potentially greater gains in the Junior Market than the Main Market.

The average projected gain for the Junior Market IC TOP 10 stocks is 287 percent, and 149 percent for the JSE Main Market, based on 2020-21 earnings, indicates potentially greater gains in the Junior Market than the Main Market. The Main and Junior Markets closed the past week lower than the close of the previous week, with the Main market at a higher level than the third week of July, while the Junior Market continues at the lowest levels since the early summer months.

The Main and Junior Markets closed the past week lower than the close of the previous week, with the Main market at a higher level than the third week of July, while the Junior Market continues at the lowest levels since the early summer months.  Lasco Financial and Elite Diagnostic.

Lasco Financial and Elite Diagnostic.  The focus on all three is on the 2021 fiscal year profit, projected to recover from reduced profit for the 2020 financial year. With expected gains of 151 to 227 percent, the top three Main Market stocks are Berger Paints, followed by JMMB Group and Grace Kennedy.

The focus on all three is on the 2021 fiscal year profit, projected to recover from reduced profit for the 2020 financial year. With expected gains of 151 to 227 percent, the top three Main Market stocks are Berger Paints, followed by JMMB Group and Grace Kennedy.  The JSE Main Market ended the week, with an overall PE of 16.1 and the Junior Market 12.2, based on ICInsider.com’s projected 2020-21 earnings. The average PE ratio of the Junior Market has been slowly rising, with better profit opportunities than the Main Market and narrowing the gap. The PE ratio for the Junior Market Top 10 stocks average a mere 5.7 at just 47 percent to the Junior Market average. The Main Market TOP 10 stocks trade at a PE of 8.4 or 52 percent of the PE of that market.

The JSE Main Market ended the week, with an overall PE of 16.1 and the Junior Market 12.2, based on ICInsider.com’s projected 2020-21 earnings. The average PE ratio of the Junior Market has been slowly rising, with better profit opportunities than the Main Market and narrowing the gap. The PE ratio for the Junior Market Top 10 stocks average a mere 5.7 at just 47 percent to the Junior Market average. The Main Market TOP 10 stocks trade at a PE of 8.4 or 52 percent of the PE of that market. IC TOP 10 stocks are likely to deliver the best returns up to March 2021 and ranked in order of potential gains, based on likely gain for each company, taking into account the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in movements in and out of the lists for most weeks. Revisions to earnings per share are ongoing, based on receipt of new information.

IC TOP 10 stocks are likely to deliver the best returns up to March 2021 and ranked in order of potential gains, based on likely gain for each company, taking into account the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in movements in and out of the lists for most weeks. Revisions to earnings per share are ongoing, based on receipt of new information.

The top three stocks in each market saw no change in ranking, leaving the top three Junior Market stocks with the potential to gain between 293 to 705 percent by March 2021. Caribbean Producers heads the list, followed by Lasco Financial and Elite Diagnostic. The focus on all three is on the 2021 fiscal year profit, projected to recover from reduced profit for the 2020 financial year. With expected gains of 151 to 245 percent, the top three Main Market stocks are Berger Paints, followed by JMMB Group and

The top three stocks in each market saw no change in ranking, leaving the top three Junior Market stocks with the potential to gain between 293 to 705 percent by March 2021. Caribbean Producers heads the list, followed by Lasco Financial and Elite Diagnostic. The focus on all three is on the 2021 fiscal year profit, projected to recover from reduced profit for the 2020 financial year. With expected gains of 151 to 245 percent, the top three Main Market stocks are Berger Paints, followed by JMMB Group and The Junior and Main markets are currently trading well below this level, indicating the potential gains ahead. The JSE Main Market ended the week, with an overall PE of 15.8 and the Junior Market 11.6, based on ICInsider.com’s projected 2020-21 earnings. The average PE ratio of the Junior Market has been slowly rising, with better profit opportunities than the Main Market and narrowing the gap. The PE ratio for the Junior Market Top 10 stocks average a mere 5.7 at just 49 percent to the Junior Market average. The Main Market TOP 10 stocks trade at a PE of 8.5 or 54 percent of the PE of that market.

The Junior and Main markets are currently trading well below this level, indicating the potential gains ahead. The JSE Main Market ended the week, with an overall PE of 15.8 and the Junior Market 11.6, based on ICInsider.com’s projected 2020-21 earnings. The average PE ratio of the Junior Market has been slowly rising, with better profit opportunities than the Main Market and narrowing the gap. The PE ratio for the Junior Market Top 10 stocks average a mere 5.7 at just 49 percent to the Junior Market average. The Main Market TOP 10 stocks trade at a PE of 8.5 or 54 percent of the PE of that market. IC TOP 10 stocks are likely to deliver the best returns up to March 2021 and ranked in order of potential gains, based on likely gain for each company, taking into account the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in the selection process in and out of the lists for most weeks. Revisions to earnings per share are ongoing, based on receipt of new information.

IC TOP 10 stocks are likely to deliver the best returns up to March 2021 and ranked in order of potential gains, based on likely gain for each company, taking into account the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in the selection process in and out of the lists for most weeks. Revisions to earnings per share are ongoing, based on receipt of new information.

The markets moved moderately higher to close at their highest levels since mid-August for the. The Main Market closed the past week higher than the previous one, but the Junior Market closed the week lower than the prior one.

The markets moved moderately higher to close at their highest levels since mid-August for the. The Main Market closed the past week higher than the previous one, but the Junior Market closed the week lower than the prior one. With expected gains of 152 to 240 percent, the top three Main Market stocks are Berger Paints, followed by JMMB Group and Carreras. Radio Jamaica is now down to the fifth spot with slightly lower earnings per share of 15 cents from 20 cents previously.

With expected gains of 152 to 240 percent, the top three Main Market stocks are Berger Paints, followed by JMMB Group and Carreras. Radio Jamaica is now down to the fifth spot with slightly lower earnings per share of 15 cents from 20 cents previously. The average projected gain for the Junior Market IC TOP 10 stocks is 279 percent and 145 percent for the JSE Main Market, based on 2020-21 earnings, an indication of potentially greater gains in the Junior Market than in the Main Market.

The average projected gain for the Junior Market IC TOP 10 stocks is 279 percent and 145 percent for the JSE Main Market, based on 2020-21 earnings, an indication of potentially greater gains in the Junior Market than in the Main Market.

This week’s focus: Jamaican Teas came in for increased buying during the past week after the company advised the Jamaica Stock Exchange that the board of directors will meet to determine a new record date for the sub-division of the Company’s shares, following the deferral at the Annual General meeting. The stock traded at $4.30 on September 29 and closed at $4.83 on Wednesday, with 161,040 units changing hands, with the offer at $4.50. The volume ballooned to over one million units on Thursday, with the price hitting $5.55 during the day. The company completed the 2020 fiscal year at the end of September.

This week’s focus: Jamaican Teas came in for increased buying during the past week after the company advised the Jamaica Stock Exchange that the board of directors will meet to determine a new record date for the sub-division of the Company’s shares, following the deferral at the Annual General meeting. The stock traded at $4.30 on September 29 and closed at $4.83 on Wednesday, with 161,040 units changing hands, with the offer at $4.50. The volume ballooned to over one million units on Thursday, with the price hitting $5.55 during the day. The company completed the 2020 fiscal year at the end of September. The market’s targeted average PE ratio is 20 based on the profits of companies reporting full year’s results, from now to the second quarter in 2021. Both the Junior and Main markets are currently trading well below this level, indicating the potential gains ahead. The JSE Main Market ended the week, with an overall PE of 15.1 and the Junior Market 11.2, based on IC Insider.com’s projected 2020-21 earnings. The average PE ratio of the Junior Market has been slowly rising, with better profit opportunities than the Main Market and narrowing the gap. The PE ratio for the Junior Market Top 10 stocks average a mere 6.1 at just 54 percent to the overall Junior Market average. The Main Market TOP 10 stocks trade at a PE of 8.2 or 54 percent of the PE of the overall market.

The market’s targeted average PE ratio is 20 based on the profits of companies reporting full year’s results, from now to the second quarter in 2021. Both the Junior and Main markets are currently trading well below this level, indicating the potential gains ahead. The JSE Main Market ended the week, with an overall PE of 15.1 and the Junior Market 11.2, based on IC Insider.com’s projected 2020-21 earnings. The average PE ratio of the Junior Market has been slowly rising, with better profit opportunities than the Main Market and narrowing the gap. The PE ratio for the Junior Market Top 10 stocks average a mere 6.1 at just 54 percent to the overall Junior Market average. The Main Market TOP 10 stocks trade at a PE of 8.2 or 54 percent of the PE of the overall market. The average projected gain for the Junior Market IC TOP 10 stocks is 283 percent, and 153 percent for the JSE Main Market, based on 2020-21 earnings, indicates potentially greater gains in the Junior Market than in the Main Market.

The average projected gain for the Junior Market IC TOP 10 stocks is 283 percent, and 153 percent for the JSE Main Market, based on 2020-21 earnings, indicates potentially greater gains in the Junior Market than in the Main Market.

The top three stocks in each market saw no change in ranking for the top three Junior Market stocks, with the potential to gain between 295 to 709 percent by March 2021. Caribbean Producers heads the list, followed by Lasco Financial and Elite Diagnostic. The focus on all three is the 2021 fiscal year results, projected to show recovery from the 2020 financial year final numbers. The top three Main Market stocks, with expected gains of 205 to 231 percent, are Radio Jamaica, followed by Berger Paints and JMMB Group.

The top three stocks in each market saw no change in ranking for the top three Junior Market stocks, with the potential to gain between 295 to 709 percent by March 2021. Caribbean Producers heads the list, followed by Lasco Financial and Elite Diagnostic. The focus on all three is the 2021 fiscal year results, projected to show recovery from the 2020 financial year final numbers. The top three Main Market stocks, with expected gains of 205 to 231 percent, are Radio Jamaica, followed by Berger Paints and JMMB Group. The targeted average PE ratio of the market is 20 based on the profits of companies reporting full year’s results, from now to the second quarter in 2021. Both the Junior Market and the Main Market are currently trading well below this level, indicating the potential gains ahead. The JSE Main Market ended the week, with an overall PE of 14.8 and the Junior Market 11.2, based on IC Insider.com’s projected 2020-21 earnings. The average PE ratio of the Junior Market has been slowly rising, with better profit opportunities than the Main Market and narrowing the gap. The PE ratio for the Junior Market Top 10 stocks average a mere six at just 54 percent to the average of the overall Junior Market. The Main Market TOP 10 stocks trade at a PE of 8.3 or 56 percent of the PE of the overall market.

The targeted average PE ratio of the market is 20 based on the profits of companies reporting full year’s results, from now to the second quarter in 2021. Both the Junior Market and the Main Market are currently trading well below this level, indicating the potential gains ahead. The JSE Main Market ended the week, with an overall PE of 14.8 and the Junior Market 11.2, based on IC Insider.com’s projected 2020-21 earnings. The average PE ratio of the Junior Market has been slowly rising, with better profit opportunities than the Main Market and narrowing the gap. The PE ratio for the Junior Market Top 10 stocks average a mere six at just 54 percent to the average of the overall Junior Market. The Main Market TOP 10 stocks trade at a PE of 8.3 or 56 percent of the PE of the overall market. The average projected gain for the Junior Market IC TOP 10 stocks is 280 percent, and 151 percent for the JSE Main Market, based on 2020-21 earnings, indicates potentially more significant gains in the Junior Market than in the Main Market.

The average projected gain for the Junior Market IC TOP 10 stocks is 280 percent, and 151 percent for the JSE Main Market, based on 2020-21 earnings, indicates potentially more significant gains in the Junior Market than in the Main Market.

The focus on all three is on the 2021 fiscal year results projected to show recovery from the 2020 financial year final numbers. The top three Main Market stocks, with expected gains of 204 to 228 percent, are Radio Jamaica, followed by Berger Paints, with the price rising 7 percent during the week and JMMB Group.

The focus on all three is on the 2021 fiscal year results projected to show recovery from the 2020 financial year final numbers. The top three Main Market stocks, with expected gains of 204 to 228 percent, are Radio Jamaica, followed by Berger Paints, with the price rising 7 percent during the week and JMMB Group. The targeted average PE ratio of the market is 20 based on the profits of companies reporting full year’s results, from now to the second quarter in 2021. Both the Junior and Main markets are currently trading well below this level, indicating the potential gains ahead. The JSE Main Market ended the week, with an overall PE of 15.3 and the Junior Market 11, based on IC Insider.com’s projected 2020-21 earnings. The average PE ratio of the Junior Market has been slowly rising, with better profit opportunities than the Main Market and narrowing the gap. The PE ratio for the Junior Market Top 10 stocks average a mere six at just 55 percent to the average of the overall Junior Market. The Main Market TOP 10 stocks trade at a PE of 8.2 or 54 percent of the PE of the overall market.

The targeted average PE ratio of the market is 20 based on the profits of companies reporting full year’s results, from now to the second quarter in 2021. Both the Junior and Main markets are currently trading well below this level, indicating the potential gains ahead. The JSE Main Market ended the week, with an overall PE of 15.3 and the Junior Market 11, based on IC Insider.com’s projected 2020-21 earnings. The average PE ratio of the Junior Market has been slowly rising, with better profit opportunities than the Main Market and narrowing the gap. The PE ratio for the Junior Market Top 10 stocks average a mere six at just 55 percent to the average of the overall Junior Market. The Main Market TOP 10 stocks trade at a PE of 8.2 or 54 percent of the PE of the overall market. The average projected gain for the Junior Market IC TOP 10 stocks is 280 percent, and 151 percent for the JSE Main Market, based on 2020-21 earnings, indicates potentially more significant gains in the Junior Market than in the Main Market.

The average projected gain for the Junior Market IC TOP 10 stocks is 280 percent, and 151 percent for the JSE Main Market, based on 2020-21 earnings, indicates potentially more significant gains in the Junior Market than in the Main Market.