Trading on Wednesday, on the Jamaica Stock Exchange US dollar market with the volume of shares changing hands rising 227 percent, with 1071 percent higher value than on Tuesday, resulting in a three way split in stocks rising, falling and those closing unchanged.

Nine securities traded compared to six on Tuesday, with stocks rising, declining and ending unchanged sharing three each. The JSE US Denominated Equities Index rose 0.62 points to end at 198.91.

Nine securities traded compared to six on Tuesday, with stocks rising, declining and ending unchanged sharing three each. The JSE US Denominated Equities Index rose 0.62 points to end at 198.91.

PE Ratio, a measure used in computing appropriate stock values, averages 12.5.

The market’s PE ratios are computed using ICInsider.com earnings forecasts for companies with the financial year up to August 2022.

Overall, 397,370 shares traded for US$47,370 compared to 121,697 units at US$4,044 on Tuesday. Trading averages 44,152 units at US$5,263, compared to 20,283 shares at US$674 on the previous day and the month to date averages 81,287 shares at US$7,659 versus 84,663 units at US$7,876 on Tuesday. December ended with an average of 439,975 units for US$68,382.

Investor’s Choice bid-offer indicator shows no stock ending with the bid higher than the last selling price and one stock with a lower offer.

At the close, First Rock Capital USD share ended at 6.89 US cents with 38 shares crossing the exchange, MPC Caribbean Clean Energy fell 4.2 cents to end at US$1.20 in an exchange of 20 stocks, Proven Investments popped 0.45 of one cent to close at 21 US cents in switching ownership of 186,658 units. Sterling Investments ended at 2.1 US cents in exchanging 232 stock units, Sygnus Credit Investments USD share climbed 0.4 of a cent in ending at 12.7 US cents after 6,350 stock units crossed the market, Sygnus Real Estate Finance USD share shed 0.3 of a cent to 13.5 US cents after exchanging 1,463 stocks and Transjamaican Highway advanced 0.02 of a cent after ending at 0.85 of one US cent in trading 200,000 units.

At the close, First Rock Capital USD share ended at 6.89 US cents with 38 shares crossing the exchange, MPC Caribbean Clean Energy fell 4.2 cents to end at US$1.20 in an exchange of 20 stocks, Proven Investments popped 0.45 of one cent to close at 21 US cents in switching ownership of 186,658 units. Sterling Investments ended at 2.1 US cents in exchanging 232 stock units, Sygnus Credit Investments USD share climbed 0.4 of a cent in ending at 12.7 US cents after 6,350 stock units crossed the market, Sygnus Real Estate Finance USD share shed 0.3 of a cent to 13.5 US cents after exchanging 1,463 stocks and Transjamaican Highway advanced 0.02 of a cent after ending at 0.85 of one US cent in trading 200,000 units.

In the preference segment, Equityline Mortgage Investment preference share remained at US$1.999 after trading 9 shares and JMMB Group 5.75% dropped 12 cents to close at US$2.02 with an exchange of 2,600 shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Trading picks up on the JSE USD market

Big Jump in trading for JSE USD market

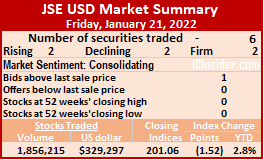

Trading on Friday, ended with the volume of shares changing hands rising after trading tenfold and the value climbing fifty times trading on Thursday, at the close of the Jamaica Stock Exchange US dollar market and resulting in a mild slippage in the market index.

Trading ended with six securities changing hands, compared to seven on Thursday with prices of two rising, two declining and two ending unchanged. The JSE US Denominated Equities Index lost 1.52 points to end at 201.06.

Trading ended with six securities changing hands, compared to seven on Thursday with prices of two rising, two declining and two ending unchanged. The JSE US Denominated Equities Index lost 1.52 points to end at 201.06.

The PE Ratio, a measure used in computing appropriate stock values averages 12.8. The PE ratio uses ICInsider.com earnings forecasts for companies with the financial year up to August 2022.

Overall, 1,856,215 shares traded, for US$329,297 compared to 165,073 units at US$6,369 on Thursday.

Trading averaged 309,369 units at US$54,883up from 23,582 shares at US$910 on Thursday and for the month to date an average of 85,682 shares at US$7,857 versus 69,113 units at US$4,373 on Thursday. December ended with an average of 439,975 units for US$68,382.

Investor’s Choice bid-offer indicator shows one stock ended with the bid higher than the last selling price and none with a lower offer.

At the close, First Rock Capital USD share fell 0.38 od one cent to end at 6.55 US cents in trading 401,918 shares,  Proven Investments shed 0.9 of a cents after ending at 23 US cents, with 1,295,052 units crossing the exchange, Sygnus Credit Investments USD share declined half a cent to close at 11.5 US cents, with 17,436 stocks changing hands. Sygnus Real Estate Finance USD share ended unchanged at 12 US cents in exchanging 965 stock units and Transjamaican Highway rallied 0.03 of a cent in closing at 0.86 US cents in exchanging 136,086 units.

Proven Investments shed 0.9 of a cents after ending at 23 US cents, with 1,295,052 units crossing the exchange, Sygnus Credit Investments USD share declined half a cent to close at 11.5 US cents, with 17,436 stocks changing hands. Sygnus Real Estate Finance USD share ended unchanged at 12 US cents in exchanging 965 stock units and Transjamaican Highway rallied 0.03 of a cent in closing at 0.86 US cents in exchanging 136,086 units.

In the preference segment, JMMB Group 6% advanced 4 cents to US$1.05 with an exchange of 4,758 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Trading activity and JSEUSD market slips

Trading the Jamaica Stock Exchange US dollar market sank sharply on Thursday, with the volume of shares changing hands declining 76 percent with 31 percent lower value than on Wednesday, resulting in rising stocks edging ended the day with the advantage.

Seven securities traded up from five on Wednesday with three rising, one declining and three ending unchanged. JSE US Denominated Equities Index lost 1.41 points to end at 202.58.

Seven securities traded up from five on Wednesday with three rising, one declining and three ending unchanged. JSE US Denominated Equities Index lost 1.41 points to end at 202.58.

The PE Ratio, a measure used in computing appropriate stock values, averages 12.8. The computation of the PE ratios uses ICInsider.com earnings forecasts for companies with the financial year up to August 2022.

A total of 165,073 shares traded for US$6,369 down from 683,860 units at US$9,230 on Wednesday. Trading averaged 23,582 units at US$910, compared to 136,772 shares at US$1,846 on the prior trading day and month to date averages 69,113 shares at US$4,373 versus 73,420 units at US$4,701 on Wednesday. December ended with an average of 439,975 units for US$68,382.

Investor’s Choice bid-offer indicator shows one stock ending with a bid higher than the last selling price and one with a lower offer.

At the close, First Rock Capital USD share increased 0.43 of a cent to close at 6.93 US cents after trading 1,000 shares, Margaritaville popped 3.45 cents to 14.95 US cents, with 5,398 stocks changing hands, Proven Investments rallied 0.4 of one cent to 23.9 US cents in an exchange of 5,401 units. Sterling Investments finished at 2.1 US cents with an exchange of 5,645 stock units, Sygnus Credit Investments USD share ended unchanged at 12 US cents after exchanging 26,829 stocks, Sygnus Real Estate Finance USD share dropped 2 cents to close at 12 US cents in trading 400 shares and Transjamaican Highway remained at 0.83 of one US cent with the swapping of 120,400 units.

At the close, First Rock Capital USD share increased 0.43 of a cent to close at 6.93 US cents after trading 1,000 shares, Margaritaville popped 3.45 cents to 14.95 US cents, with 5,398 stocks changing hands, Proven Investments rallied 0.4 of one cent to 23.9 US cents in an exchange of 5,401 units. Sterling Investments finished at 2.1 US cents with an exchange of 5,645 stock units, Sygnus Credit Investments USD share ended unchanged at 12 US cents after exchanging 26,829 stocks, Sygnus Real Estate Finance USD share dropped 2 cents to close at 12 US cents in trading 400 shares and Transjamaican Highway remained at 0.83 of one US cent with the swapping of 120,400 units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Trading picks up on JSE USD market

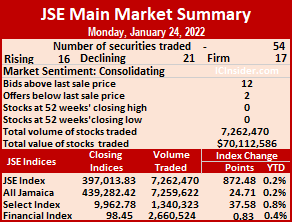

Trading on Tuesday ended with the volume of shares changing hands declining 18 percent with a 1,050 percent surge in the value of trades than on Monday, at the close of the Jamaica Stock Exchange US dollar market, resulting in declining stocks edging out those that rose.

Seven securities traded, compared to eight on Monday with two rising, three declining and two ending unchanged. The JSE US Denominated Equities Index popped 1.49 points to end at 203.73.

Seven securities traded, compared to eight on Monday with two rising, three declining and two ending unchanged. The JSE US Denominated Equities Index popped 1.49 points to end at 203.73.

The PE Ratio, a measure used in computing appropriate stock values, averages 12.5. The PE ratio uses ICInsider.com earnings forecasts for companies with the financial year, up to August 2022.

Overall, 689,580 shares traded, for US$151,286 compared to 842,964 units at US$13,152 on Monday.

Trading averaged 98,511 units at US$21,612, compared to 105,371 shares at US$1,644 on Monday and month to date averages 68,829 shares at US$4,908 versus 65,478 units at US$3,022 on Monday. December ended with an average of 439,975 units for US$68,382.

Investor’s Choice bid-offer indicator shows one stock ending with a bid higher than the last selling price and none with a lower offer.

At the close, First Rock Capital USD share fell 0.59 of a cent to 6.3 US cents trading 1,083 shares, Margaritaville remained at 11.5 US cents as 56,639 stock units were swapped, Proven Investments climbed 1.22 cents in closing at 23.94 US cents after exchanging 598,780 stocks. Sygnus Credit Investments USD share declined 0.3 of a cent before ending at 12.4 US cents and trading 10,437 units, Sygnus Real Estate Finance USD share finished at 14 US cents in exchanging 41 stock units and Transjamaican Highway popped 0.01 of a cent to 0.86 of one US cent with an exchange of 17,600 shares.

At the close, First Rock Capital USD share fell 0.59 of a cent to 6.3 US cents trading 1,083 shares, Margaritaville remained at 11.5 US cents as 56,639 stock units were swapped, Proven Investments climbed 1.22 cents in closing at 23.94 US cents after exchanging 598,780 stocks. Sygnus Credit Investments USD share declined 0.3 of a cent before ending at 12.4 US cents and trading 10,437 units, Sygnus Real Estate Finance USD share finished at 14 US cents in exchanging 41 stock units and Transjamaican Highway popped 0.01 of a cent to 0.86 of one US cent with an exchange of 17,600 shares.

In the preference segment, JMMB Group 6% lost 4 cents in closing at US$1.01 in an exchange of 5,000 units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

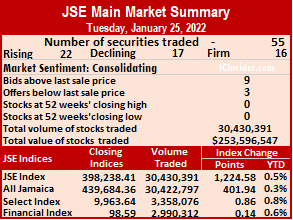

Trading averages 553,280 units at $4,610,846, on Tuesday, compared to 134,490 shares at $1,298,381 on Monday and month to date, an average of 194,064 units at $1,751,240, versus 170,766 units at $1,565,770 on the previous day. December closed with an average of 479,143 units at $6,686,322.

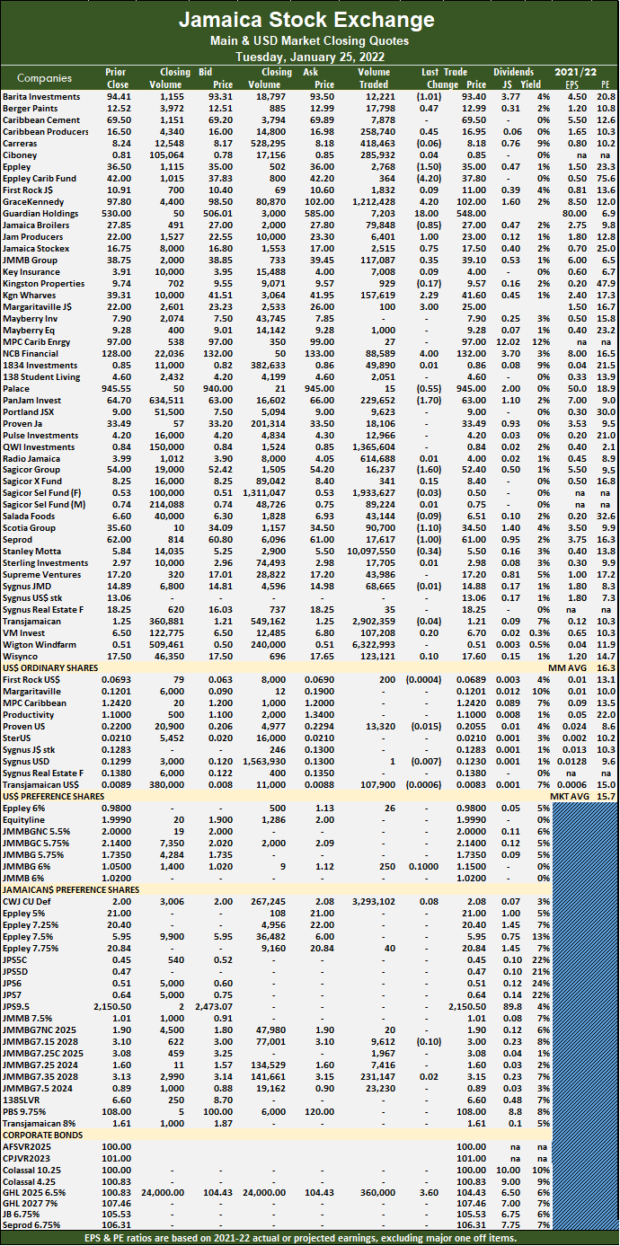

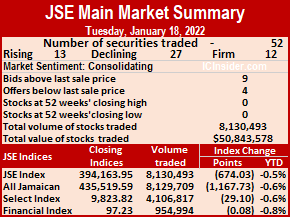

Trading averages 553,280 units at $4,610,846, on Tuesday, compared to 134,490 shares at $1,298,381 on Monday and month to date, an average of 194,064 units at $1,751,240, versus 170,766 units at $1,565,770 on the previous day. December closed with an average of 479,143 units at $6,686,322. Margaritaville advanced $3 to $25 with a transfer of 100 stocks, NCB Financial rallied $4 to close at $132 in switching ownership of 88,589 stock units, Palace Amusement lost 55 cents to end at $945 after crossing the exchange with 15 shares. PanJam Investment fell $1.70 to close at $63 in transferring 229,652 stock units, Sagicor Group shed $1.60 in ending at $52.40 after exchanging 16,237 shares, Scotia Group fell $1.10 to $34.50 with the swapping of 90,700 units. Seprod lost $1 to end at $61 with 17,617 stocks changing hands and Stanley Motta lost 34 cents in closing at $5.50 after trading 10,097,550 stock units.

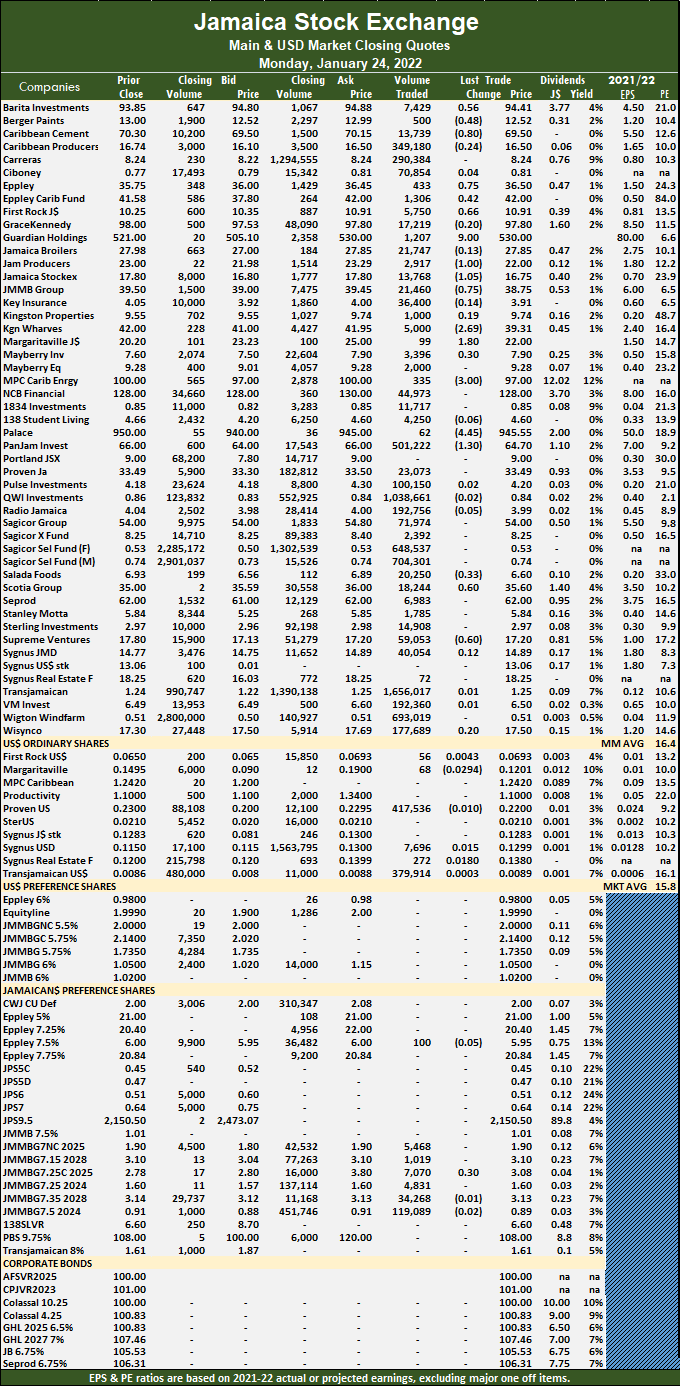

Margaritaville advanced $3 to $25 with a transfer of 100 stocks, NCB Financial rallied $4 to close at $132 in switching ownership of 88,589 stock units, Palace Amusement lost 55 cents to end at $945 after crossing the exchange with 15 shares. PanJam Investment fell $1.70 to close at $63 in transferring 229,652 stock units, Sagicor Group shed $1.60 in ending at $52.40 after exchanging 16,237 shares, Scotia Group fell $1.10 to $34.50 with the swapping of 90,700 units. Seprod lost $1 to end at $61 with 17,617 stocks changing hands and Stanley Motta lost 34 cents in closing at $5.50 after trading 10,097,550 stock units. At the close, Barita Investments gained 56 cents to end at $94.41 with 7,429 shares clearing the market, Berger Paints lost 48 cents in closing at $12.52 in exchanging 500 units, Caribbean Cement shed 80 cents to end at $69.50 with a transfer of 13,739 stock units. Eppley rose 75 cents to $36.50 trading 433 stocks, Eppley Caribbean Property Fund rallied 42 cents to $42 after 1,306 shares crossed the market, First Rock Capital advanced 66 cents to $10.91 with the swapping of 5,750 stocks. Guardian Holdings popped $9 to $530 after an exchange of 1,207 units, Jamaica Producers shed $1 to end at $22 in switching ownership of 2,917 stock units, Jamaica Stock Exchange fell $1.05 to finish at $16.75 after trading 13,768 units. JMMB Group shed 75 cents in closing at $38.75 with 21,460 stocks changing hands, Kingston Wharves declined $2.69 to $39.31 with the swapping of 5,000 shares, Margaritaville advanced $1.80 to $22 in trading 99 units. Mayberry Investments gained 30 cents to close at $7.90 with a transfer of 3,396 stocks, MPC Caribbean Clean Energy declined $3 to end at $97 in an exchange of 335 stock units, Palace Amusement dropped $4.45 in closing at $945.55 with 62 shares clearing the market.

At the close, Barita Investments gained 56 cents to end at $94.41 with 7,429 shares clearing the market, Berger Paints lost 48 cents in closing at $12.52 in exchanging 500 units, Caribbean Cement shed 80 cents to end at $69.50 with a transfer of 13,739 stock units. Eppley rose 75 cents to $36.50 trading 433 stocks, Eppley Caribbean Property Fund rallied 42 cents to $42 after 1,306 shares crossed the market, First Rock Capital advanced 66 cents to $10.91 with the swapping of 5,750 stocks. Guardian Holdings popped $9 to $530 after an exchange of 1,207 units, Jamaica Producers shed $1 to end at $22 in switching ownership of 2,917 stock units, Jamaica Stock Exchange fell $1.05 to finish at $16.75 after trading 13,768 units. JMMB Group shed 75 cents in closing at $38.75 with 21,460 stocks changing hands, Kingston Wharves declined $2.69 to $39.31 with the swapping of 5,000 shares, Margaritaville advanced $1.80 to $22 in trading 99 units. Mayberry Investments gained 30 cents to close at $7.90 with a transfer of 3,396 stocks, MPC Caribbean Clean Energy declined $3 to end at $97 in an exchange of 335 stock units, Palace Amusement dropped $4.45 in closing at $945.55 with 62 shares clearing the market.  PanJam Investment fell $1.30 to close at $64.70 after 501,222 units crossed the market, Salada Foods lost 33 cents to settle at $6.60 in switching ownership of 20,250 stock units, Scotia Group rose 60 cents to end at $35.60 in an exchange of 18,244 units and Supreme Ventures shed 60 cents to end at $17.20 in trading 59,053 stocks.

PanJam Investment fell $1.30 to close at $64.70 after 501,222 units crossed the market, Salada Foods lost 33 cents to settle at $6.60 in switching ownership of 20,250 stock units, Scotia Group rose 60 cents to end at $35.60 in an exchange of 18,244 units and Supreme Ventures shed 60 cents to end at $17.20 in trading 59,053 stocks. Trading averages 293,166 units at $7,400,258, compared to 130,869 shares at $1,165,276 on Thursday and month to date, an average of 173,233 units at $1,583,955, up from 164,655 units at $1,167,944 on Thursday. December closed with an average of 479,143 units at $6,686,322.

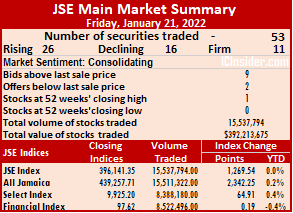

Trading averages 293,166 units at $7,400,258, compared to 130,869 shares at $1,165,276 on Thursday and month to date, an average of 173,233 units at $1,583,955, up from 164,655 units at $1,167,944 on Thursday. December closed with an average of 479,143 units at $6,686,322. PanJam Investment rallied $1.50 in closing at $66 in trading 510,923 shares, Portland JSX rose $1.20 to $9 in switching ownership of 800 units, Proven Investments gained 57 cents to settle at $33.49 with an exchange of 6,791 stocks. Scotia Group popped 44 cents to close at $35 after 111,106 stock units crossed the market, Stanley Motta gained 59 cents after ending at $5.84 with an exchange of 2,632 stocks, Supreme Ventures rose 80 cents to finish at $17.80 in transferring 19,195 units and Wisynco Group lost 30 cents to close at $17.30 with 87,163 shares crossing the exchange.

PanJam Investment rallied $1.50 in closing at $66 in trading 510,923 shares, Portland JSX rose $1.20 to $9 in switching ownership of 800 units, Proven Investments gained 57 cents to settle at $33.49 with an exchange of 6,791 stocks. Scotia Group popped 44 cents to close at $35 after 111,106 stock units crossed the market, Stanley Motta gained 59 cents after ending at $5.84 with an exchange of 2,632 stocks, Supreme Ventures rose 80 cents to finish at $17.80 in transferring 19,195 units and Wisynco Group lost 30 cents to close at $17.30 with 87,163 shares crossing the exchange. The All Jamaican Composite Index climbed 1,466.73 points to end at 436,915.46, the JSE Main Index advanced 1,250.84 points to close at 394,871.81 and the JSE Financial Index rallied 0.82 points to finish at 97.43.

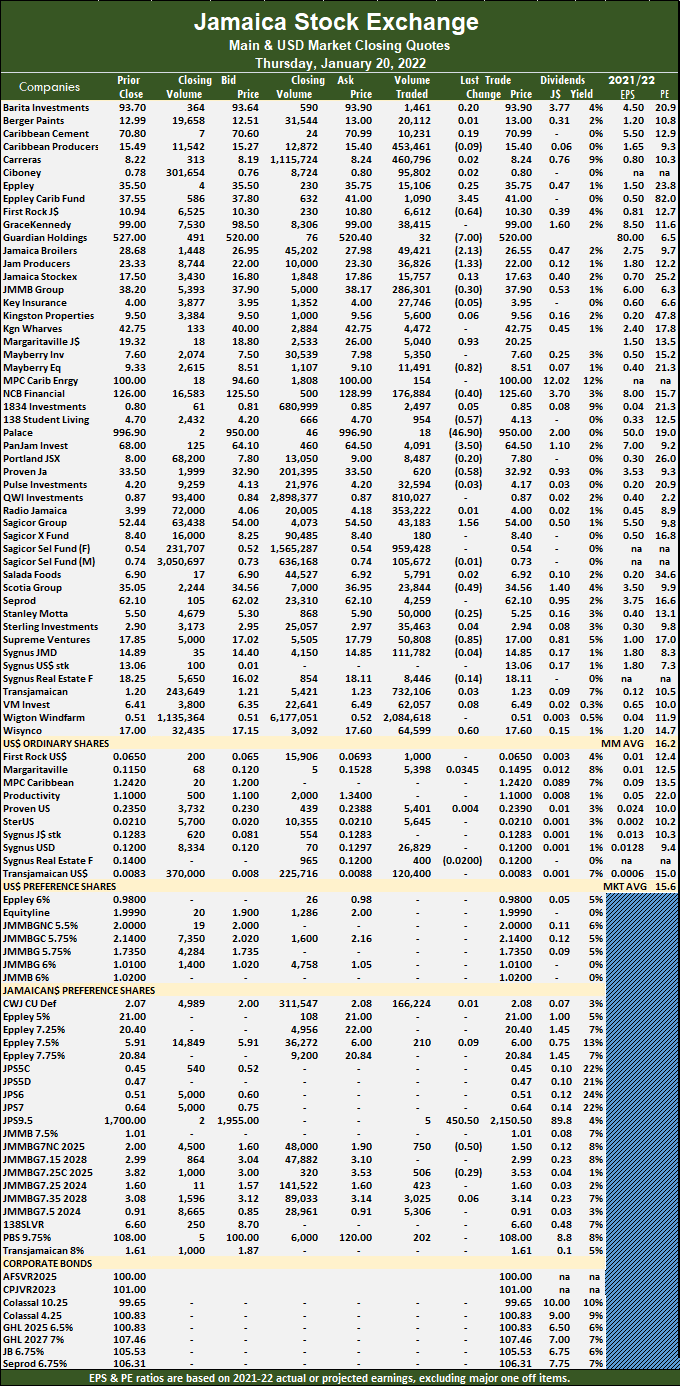

The All Jamaican Composite Index climbed 1,466.73 points to end at 436,915.46, the JSE Main Index advanced 1,250.84 points to close at 394,871.81 and the JSE Financial Index rallied 0.82 points to finish at 97.43. At the close, Eppley Caribbean Property Fund jumped $3.45 to $41 with an exchange of 1,090 units, First Rock Capital shed 64 cents to close at $10.30 in trading 6,612 stock units, Guardian Holdings shed $7 to end at $520 after transferring 32 stocks. Jamaica Broilers declined $2.13 in ending at $26.55 with 49,421 units changing hands, Jamaica Producers fell $1.33 to close at $22 in trading 36,826 stock units, JMMB Group lost 30 cents to finish at $37.90 with 286,301 shares clearing the market. Margaritaville popped 93 cents to $20.25 in swapping of 5,040 stocks, Mayberry Jamaican Equities shed 82 cents in closing at $8.51 with a transfer of 11,491 units, NCB Financial lost 40 cents to close at $125.60 in exchanging 176,884 shares. 138 Student Living declined 57 cents in closing at $4.13 after a switch in ownership of 954 units, Palace Amusement dropped $46.90 in closing at $950 with 18 stocks crossing the market, PanJam Investment declined $3.50 to close at $64.50 with the swapping of 4,091 stock units.

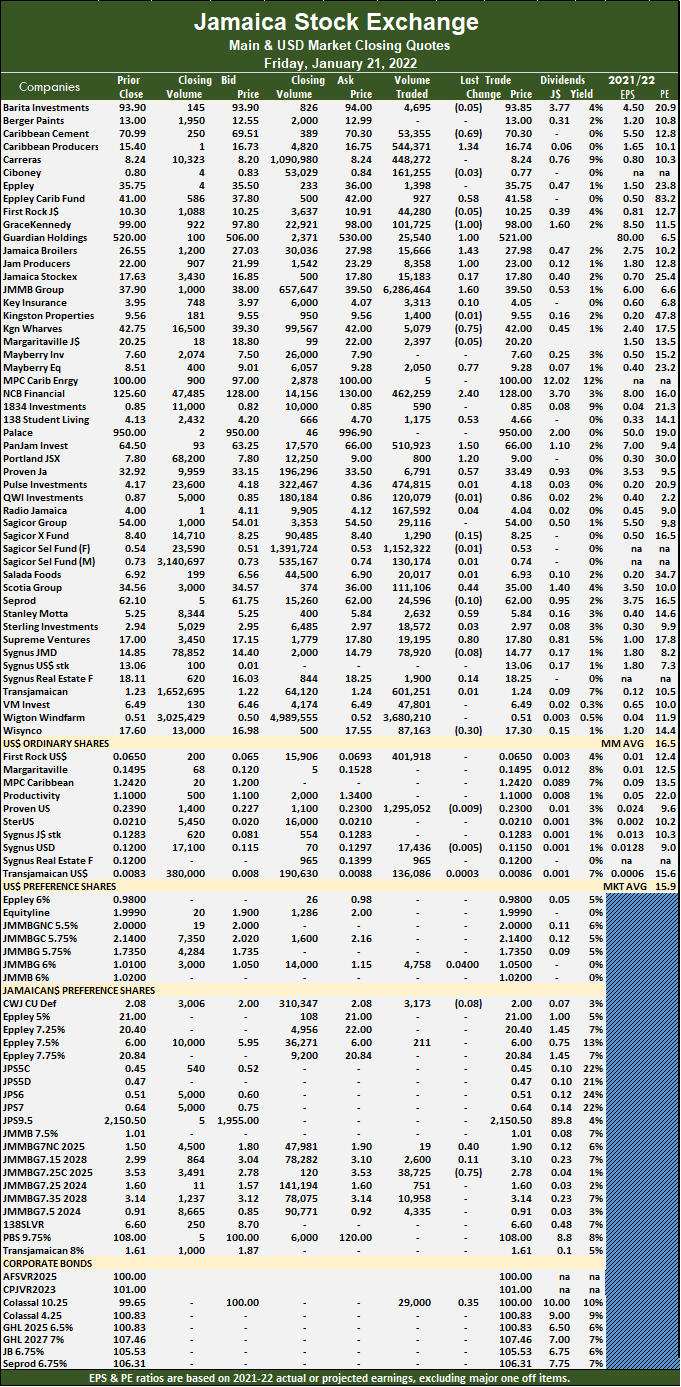

At the close, Eppley Caribbean Property Fund jumped $3.45 to $41 with an exchange of 1,090 units, First Rock Capital shed 64 cents to close at $10.30 in trading 6,612 stock units, Guardian Holdings shed $7 to end at $520 after transferring 32 stocks. Jamaica Broilers declined $2.13 in ending at $26.55 with 49,421 units changing hands, Jamaica Producers fell $1.33 to close at $22 in trading 36,826 stock units, JMMB Group lost 30 cents to finish at $37.90 with 286,301 shares clearing the market. Margaritaville popped 93 cents to $20.25 in swapping of 5,040 stocks, Mayberry Jamaican Equities shed 82 cents in closing at $8.51 with a transfer of 11,491 units, NCB Financial lost 40 cents to close at $125.60 in exchanging 176,884 shares. 138 Student Living declined 57 cents in closing at $4.13 after a switch in ownership of 954 units, Palace Amusement dropped $46.90 in closing at $950 with 18 stocks crossing the market, PanJam Investment declined $3.50 to close at $64.50 with the swapping of 4,091 stock units.  Proven Investments lost 58 cents to end at $32.92 in transferring 620 units, Sagicor Group rallied $1.56 to $54 after exchanging 43,183 stocks, Scotia Group lost 49 cents to end at $34.56 with 23,844 units changing hands. Supreme Ventures shed 85 cents to end at $17 in trading 50,808 shares and Wisynco Group rose 60 cents to $17.60 with 64,599 shares clearing the market.

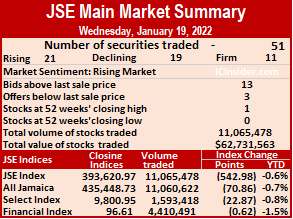

Proven Investments lost 58 cents to end at $32.92 in transferring 620 units, Sagicor Group rallied $1.56 to $54 after exchanging 43,183 stocks, Scotia Group lost 49 cents to end at $34.56 with 23,844 units changing hands. Supreme Ventures shed 85 cents to end at $17 in trading 50,808 shares and Wisynco Group rose 60 cents to $17.60 with 64,599 shares clearing the market. The All Jamaican Composite Index shed 70.86 points to 435,448.73, the JSE Main Index slipped 542.98 points to close at 393,620.97 and the JSE Financial Index lost 0.62 points to end at 96.61.

The All Jamaican Composite Index shed 70.86 points to 435,448.73, the JSE Main Index slipped 542.98 points to close at 393,620.97 and the JSE Financial Index lost 0.62 points to end at 96.61. Trading averaged 216,970 units at $1,230,031 compared to 156,356 shares at $977,761 on Tuesday and month to date, an average of 167,471 units at $1,168,166, up from 163,483 units at $1,163,182 on the prior day. December closed with an average of 479,143 units at $6,686,322.

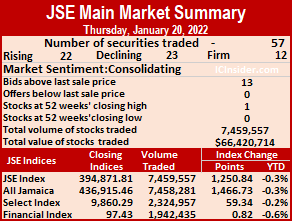

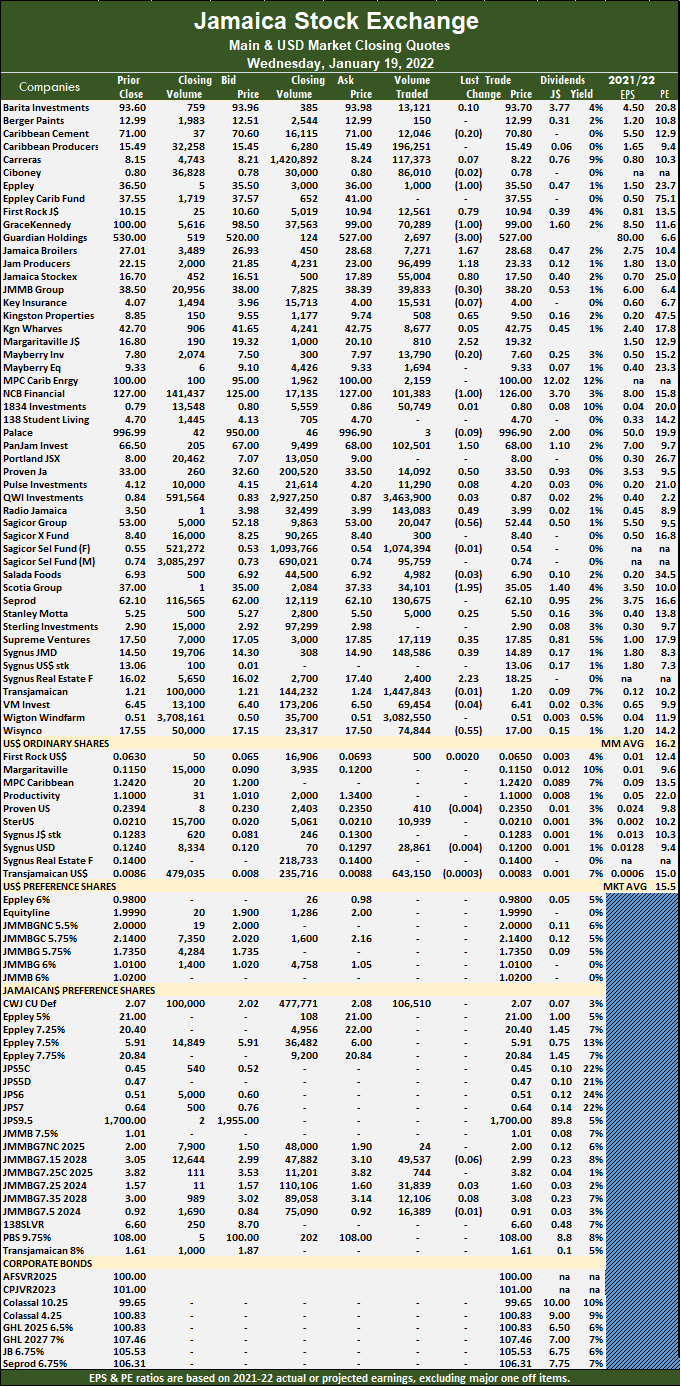

Trading averaged 216,970 units at $1,230,031 compared to 156,356 shares at $977,761 on Tuesday and month to date, an average of 167,471 units at $1,168,166, up from 163,483 units at $1,163,182 on the prior day. December closed with an average of 479,143 units at $6,686,322. Proven Investments gained 50 cents in closing at $33.50 with an exchange of 14,092 units, Radio Jamaica popped 49 cents to close at $3.99 in trading 143,083 shares, Sagicor Group shed 56 cents to end at $52.44 with the swapping of 20,047 stocks. Scotia Group fell $1.95 to $35.05 in an exchange of 34,101 shares, Supreme Ventures gained 35 cents to close at $17.85 with 17,119 stock units changing hands, Sygnus Credit Investments rose 39 cents to end at $14.89 after transferring 148,586 stocks. Sygnus Real Estate Finance advanced $2.23 to $18.25 in exchanging 2,400 shares and Wisynco Group declined 55 cents in closing at $17 with the swapping of 74,844 units.

Proven Investments gained 50 cents in closing at $33.50 with an exchange of 14,092 units, Radio Jamaica popped 49 cents to close at $3.99 in trading 143,083 shares, Sagicor Group shed 56 cents to end at $52.44 with the swapping of 20,047 stocks. Scotia Group fell $1.95 to $35.05 in an exchange of 34,101 shares, Supreme Ventures gained 35 cents to close at $17.85 with 17,119 stock units changing hands, Sygnus Credit Investments rose 39 cents to end at $14.89 after transferring 148,586 stocks. Sygnus Real Estate Finance advanced $2.23 to $18.25 in exchanging 2,400 shares and Wisynco Group declined 55 cents in closing at $17 with the swapping of 74,844 units. The All Jamaican Composite Index fell 1,167.73 points to 435,519.59, the Main Index shed 674.03 points to 394,163.95 and the JSE Financial Index lost 0.08 points to close at 97.23.

The All Jamaican Composite Index fell 1,167.73 points to 435,519.59, the Main Index shed 674.03 points to 394,163.95 and the JSE Financial Index lost 0.08 points to close at 97.23. Transjamaican Highway with 18.3 percent for 1.48 million units and Sagicor Select Financial Fund with 8.8 percent for 717,918 units changing hands.

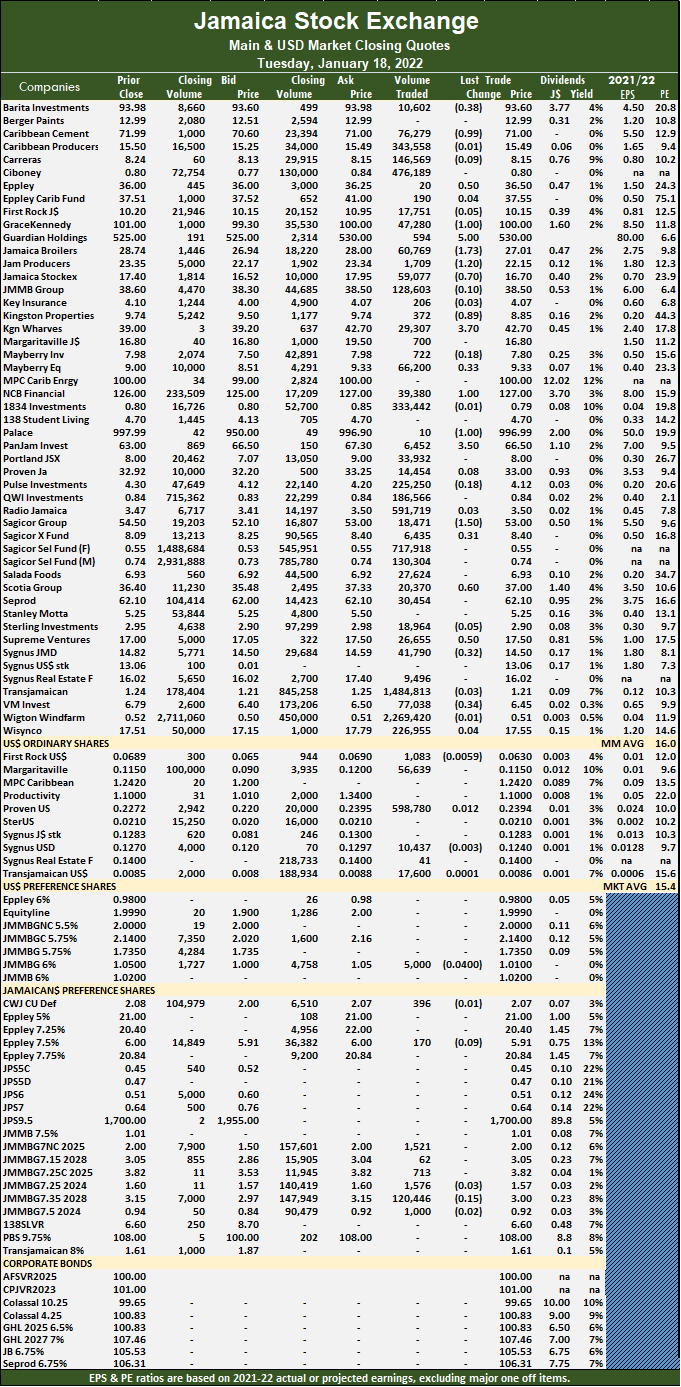

Transjamaican Highway with 18.3 percent for 1.48 million units and Sagicor Select Financial Fund with 8.8 percent for 717,918 units changing hands. Palace Amusement shed $1 to end at $996.99 after trading 10 stock units, PanJam Investment rose $3.50 to $66.50 with 6,452 stocks changing hands, Sagicor Group fell $1.50 in closing at $53 with the swapping of 18,471 shares. Sagicor Real Estate Fund gained 31 cents to end at $8.40 after exchanging 6,435 units, Scotia Group rallied 60 cents to close at $37 in transferring 20,370 stock units, Supreme Ventures popped 50 cents to end at $17.50 with an exchange of 26,655 units. Sygnus Credit Investments lost 32 cents in closing at $14.50 after 41,790 stocks crossed the market and VM Investments declined 34 cents to $6.45 in exchanging 77,038 shares.

Palace Amusement shed $1 to end at $996.99 after trading 10 stock units, PanJam Investment rose $3.50 to $66.50 with 6,452 stocks changing hands, Sagicor Group fell $1.50 in closing at $53 with the swapping of 18,471 shares. Sagicor Real Estate Fund gained 31 cents to end at $8.40 after exchanging 6,435 units, Scotia Group rallied 60 cents to close at $37 in transferring 20,370 stock units, Supreme Ventures popped 50 cents to end at $17.50 with an exchange of 26,655 units. Sygnus Credit Investments lost 32 cents in closing at $14.50 after 41,790 stocks crossed the market and VM Investments declined 34 cents to $6.45 in exchanging 77,038 shares.