The volume of stocks traded on the Jamaica Stock Exchange Main Market on Monday surged 97 percent above Friday trades but with a 32 percent fall in the value exchanged, leading to twice as many stocks falling as rising and resulting in a dip in the market index.

The All Jamaican Composite Index fell 1,166.89 points to 442,437.97, the JSE Main Index declined by 1,330.54 points to 388,227.31 and the JSE Financial Index slipped 0.39 points to settle at 91.59.

The All Jamaican Composite Index fell 1,166.89 points to 442,437.97, the JSE Main Index declined by 1,330.54 points to 388,227.31 and the JSE Financial Index slipped 0.39 points to settle at 91.59.

Similar to Friday, 54 securities were traded, with 14 rising, 29 declining and 11 ending unchanged.

Overall, 14,684,649 shares were exchanged for $86,847,608 versus 7,435,594 units at $128,125,542 on Friday. Trading averages 271,938 units at $1,608,289, compared to 137,696 shares at $2,372,695 on Friday and month to date, an average of 268,374 units at $1,794,355, compared to 267,179 units at $1,856,762 on the previous trading day. May closed with an average of 238,645 units at $3,561,016.

JMMB Group 7.5% led trading with 5.01 million shares for 34.1 percent of total volume, followed by Portland JSX with 2.0 million units for 13.6 percent of the day’s trade, Community & Workers Credit Union ended with 1.45 million units for 9.9 percent market share, Transjamaican Highway exchanged 1.43 million units for 9.7 percent of the market trade and QWI Investments with 1.08 million units for 7.4 percent market share.

The PE Ratio, a formula for certain appropriate stock values, averages 14.7 for the Main Market. The JSE Main and USD Market PE ratios are computed based on ICInsider.com’s forecasted earnings for companies with financial years, ending up to the close of August 2023.

Investor’s Choice bid-offer indicator shows nine stocks ended with bids higher than their last selling prices and seven stocks with lower offers.

At the close, Barita Investments lost 39 cents to end at $88.11, with 1,863 shares crossing the market, Caribbean Cement popped 50 cents to end at $66 after 5,858 units changed hands, Eppley climbed $1.05 to $49 trading 1,261 stock units. Eppley Caribbean Property Fund dropped $3.96 in closing at $42.75 with an exchange of 234 stocks, First Rock Capital gained 64 cents in ending at $12.65 after trading 35,649 units, GraceKennedy shed $1.97 to $107.53 in exchanging 19,373 shares. Guardian Holdings fell $14 to $520, with 1,140 stock units changing hands, Jamaica Broilers declined $1 to $27 with the swapping of 14,622 stocks, Jamaica Stock Exchange declined $1.50 in closing at $18 in an exchange of 132,344 stock units. JMMB Group lost 88 cents to end at $43.12 in switching ownership of 313,322 shares, Massy Holdings shed $2.75 to close at $92.50 with 44,883 stocks clearing the market, NCB Financial rose 48 cents to end at $101.50 while exchanging 151,031 units. PanJam Investment dropped $1.50 to $66 in exchanging 1,811 units, Portland JSX fell $1.69 to $8.56 after 2,000,000 stock units crossing the exchange, Proven Investments shed 69 cents in closing at $37.81 with an exchange of 12,031 stocks.

At the close, Barita Investments lost 39 cents to end at $88.11, with 1,863 shares crossing the market, Caribbean Cement popped 50 cents to end at $66 after 5,858 units changed hands, Eppley climbed $1.05 to $49 trading 1,261 stock units. Eppley Caribbean Property Fund dropped $3.96 in closing at $42.75 with an exchange of 234 stocks, First Rock Capital gained 64 cents in ending at $12.65 after trading 35,649 units, GraceKennedy shed $1.97 to $107.53 in exchanging 19,373 shares. Guardian Holdings fell $14 to $520, with 1,140 stock units changing hands, Jamaica Broilers declined $1 to $27 with the swapping of 14,622 stocks, Jamaica Stock Exchange declined $1.50 in closing at $18 in an exchange of 132,344 stock units. JMMB Group lost 88 cents to end at $43.12 in switching ownership of 313,322 shares, Massy Holdings shed $2.75 to close at $92.50 with 44,883 stocks clearing the market, NCB Financial rose 48 cents to end at $101.50 while exchanging 151,031 units. PanJam Investment dropped $1.50 to $66 in exchanging 1,811 units, Portland JSX fell $1.69 to $8.56 after 2,000,000 stock units crossing the exchange, Proven Investments shed 69 cents in closing at $37.81 with an exchange of 12,031 stocks.  Sagicor Group lost 48 cents to end at $53.77 trading 87,304 shares, Salada Foods dropped 44 cents to $5.50 after exchanging 5,684 units, Scotia Group declined $1 in closing at $36 and trading 86,051 stocks and Seprod rallied 50 cents to $71.50 with 5,524 stock units changing hands.

Sagicor Group lost 48 cents to end at $53.77 trading 87,304 shares, Salada Foods dropped 44 cents to $5.50 after exchanging 5,684 units, Scotia Group declined $1 in closing at $36 and trading 86,051 stocks and Seprod rallied 50 cents to $71.50 with 5,524 stock units changing hands.

In the preference segment, JMMB Group 7.25% preference share increased 41 cents to close at $3.20 in switching ownership of 12 shares and 138 Student Living preference share advanced $2.72 in ending at a 52 weeks’ high of $20.88 trading 463 stocks.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

JSE USD market eases back

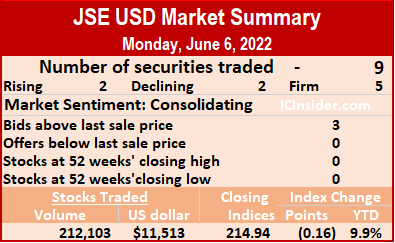

On Monday, the volume and value of shares traded on the Jamaica Stock Exchange US dollar market declined by 94 percent and 87 percent, respectively, resulting in an even number of stocks rising and falling.

A total of nine securities traded, compared to eight on Friday, with two rising, two declining and five ending unchanged.

A total of nine securities traded, compared to eight on Friday, with two rising, two declining and five ending unchanged.

The JSE US Denominated Equities Index slipped 0.16 points to end at 214.94.

The PE Ratio, a measure used in computing appropriate stock values, averages 8.9. The PE ratio uses ICInsider.com earnings forecasts for companies with financial years ending up to August 2023.

A total of 212,103 shares traded for US$11,513 down from 3,358,668 units at US$92,093 on Friday.

Trading averaged 23,567 units at US$1,279, compared to 419,834 shares at US$11,512 on Friday, with a month to date average of 124,804 shares at US$4,424 versus 161,249 units at US$5,556 on the previous day. May ended with an average of 47,916 units for US$3,528.

Investor’s Choice bid-offer indicator shows three ended with bids higher than the last selling prices and none with a lower offer.

At the close, First Rock Capital USD share remained at 7.5 US cents with 15,710 shares crossing the exchange, Margaritaville ended at 15 US cents with the swapping of 33 stocks,  Proven Investments ended unchanged at 26.5 US cents after the trading of 9,423 units. Sterling Investments shed 0.14 of a cent to end at 2 US cents in exchanging 606 stock units, Sygnus Credit Investments USD share rose 0.02 of a cent in closing at 11.1 US cents with 42,260 units changing hands, Sygnus Real Estate Finance USD share finished at 12 US cents in an exchange of 1,248 stock units and Transjamaican Highway ended at 0.9 of a US cent in trading 141,092 stocks.

Proven Investments ended unchanged at 26.5 US cents after the trading of 9,423 units. Sterling Investments shed 0.14 of a cent to end at 2 US cents in exchanging 606 stock units, Sygnus Credit Investments USD share rose 0.02 of a cent in closing at 11.1 US cents with 42,260 units changing hands, Sygnus Real Estate Finance USD share finished at 12 US cents in an exchange of 1,248 stock units and Transjamaican Highway ended at 0.9 of a US cent in trading 141,092 stocks.

In the preference segment, JMMB Group 5.75% lost 2 cents after ending at US$2.30 in exchanging one share and JMMB Group 6% gained 9 cents in closing at US$1.10 after trading 1,730 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Sharp jump in JSE USD trading

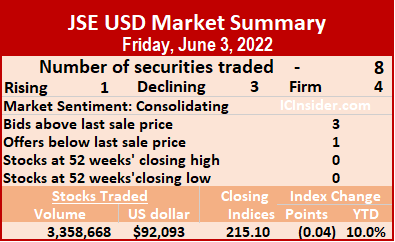

Trading jumped sharply on the Jamaica Stock Exchange US dollar market on Friday, with the volume of stocks traded jumping 675 percent and the value 175 percent more than on Thursday which resulted in more stocks falling than rising.

A total of eight securities traded, down from 10 on Thursday with one rising, three declining and four ending unchanged. The JSE US Denominated Equities Index slipped 0.04 points to end at 215.10.

A total of eight securities traded, down from 10 on Thursday with one rising, three declining and four ending unchanged. The JSE US Denominated Equities Index slipped 0.04 points to end at 215.10.

The PE Ratio, a measure used to compute appropriate stock values, averages 8.9. The PE ratio uses ICInsider.com earnings forecasts for companies with financial years ending, up to August 2023.

Overall, 3,358,668 shares traded for US$92,093, up from 433,478 units at US$33,431 on Thursday.

Trading averaged 419,834 units at US$11,512, up from 43,348 shares at US$3,343 on Thursday, with month to date average of 161,249 shares at US$5,556 versus 39,563 units at US$2,754 on the previous day. May ended with an average of 47,916 units for US$3,528.

Investor’s Choice bid-offer indicator shows three ended with a bid higher than the last selling prices and one with a lower offer.

At the close, First Rock Capital USD share dropped 0.35 of a cent to close at 7.5 US cents after exchanging 2,011 shares, Margaritaville ended at 15 US cents, with 5 stocks crossing the market, Productive Business Solutions finished at US$1.15 after exchanging one stock unit. Proven Investments advanced 0.5 of a cent to 26.5 US cents in trading 221,280 units, Sygnus Credit Investments USD share fell 0.02 of a cent in closing at 11.08 US cents while exchanging 52,041 shares and Transjamaican Highway ended unchanged at 0.90 of one US cents after 3,082,665 stock units changed hands.

At the close, First Rock Capital USD share dropped 0.35 of a cent to close at 7.5 US cents after exchanging 2,011 shares, Margaritaville ended at 15 US cents, with 5 stocks crossing the market, Productive Business Solutions finished at US$1.15 after exchanging one stock unit. Proven Investments advanced 0.5 of a cent to 26.5 US cents in trading 221,280 units, Sygnus Credit Investments USD share fell 0.02 of a cent in closing at 11.08 US cents while exchanging 52,041 shares and Transjamaican Highway ended unchanged at 0.90 of one US cents after 3,082,665 stock units changed hands.

In the preference segment, JMMB Group 5.75% remained at US$2.32 trading one and JMMB Group 6% declined 9 cents in closing at US$1.01 with the swapping of 664 stocks.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Slippage in trading for JSE USD market

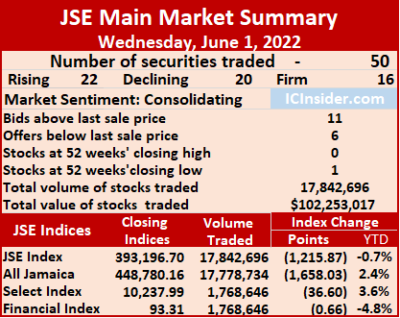

Trading closed on the Jamaica Stock Exchange US dollar market on Wednesday, with the volume of stocks traded declining 72 percent after 37 percent less funds entered the market compared to Tuesday, resulting in an even number of stocks rising and declining.

A total of seven securities traded, compared to nine on Tuesday with two rising, two declining and three ending unchanged. The JSE US Denominated Equities Index lost 1.46 points to end at 213.26.

A total of seven securities traded, compared to nine on Tuesday with two rising, two declining and three ending unchanged. The JSE US Denominated Equities Index lost 1.46 points to end at 213.26.

The PE Ratio, a measure used in valuing stocks, averages 9 for the JSE USD market. The PE ratios are calculated using projected earnings computed by ICInsider.com for companies with financial year ending, mainly between September 2022 and August 2023.

Overall, 239,089 shares traded, for US$13,384 compared to 841,912 units at US$21,187 on Tuesday.

Trading averaged 34,156 units at US$1,912, compared to 93,546 shares at US$2,354 on Tuesday. May ended with an average of 47,916 units for US$3,528.

Investor’s Choice bid-offer indicator shows three ended with a bid higher than the last selling prices and one with a lower offer.

At the close, First Rock Capital USD share rallied 0.85 of a cent to 7.85 US cents with the swapping of 803 shares, Margaritaville ended unchanged at 15 US cents in exchanging 5 units, Proven Investments remained at 26 US cents, with 15,106 stock units crossing the market.  Sterling Investments climbed 0.14 of a cent to 2.14 US cents, with 235 stocks changing hands, Sygnus Credit Investments USD share lost 0.7 of one cent in closing at 12 US cents as 63,342 shares were traded, Sygnus Real Estate Finance USD share ended at 12 US cents in trading 887 stocks and Transjamaican Highway dropped 0.06 of a cent in closing at 0.9 of one US cent after an exchange of 158,711 units.

Sterling Investments climbed 0.14 of a cent to 2.14 US cents, with 235 stocks changing hands, Sygnus Credit Investments USD share lost 0.7 of one cent in closing at 12 US cents as 63,342 shares were traded, Sygnus Real Estate Finance USD share ended at 12 US cents in trading 887 stocks and Transjamaican Highway dropped 0.06 of a cent in closing at 0.9 of one US cent after an exchange of 158,711 units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Gains for the JSE USD market

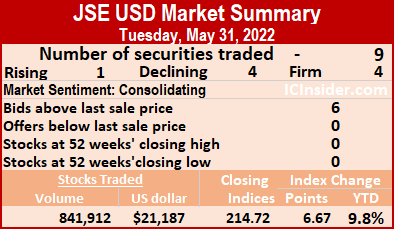

Trading on the Jamaica Stock Exchange US dollar market ended on Tuesday, with the volume of stocks traded rising 562 percent and the value falling 57 percent lower than on Monday, resulting in nine securities traded, compared to 10 on Monday with one rising, four declining and four ending unchanged.

The JSE US Denominated Equities Index gained 6.66 points to end at 214.72.

The JSE US Denominated Equities Index gained 6.66 points to end at 214.72.

The PE Ratio, a measure used in computing appropriate stock values, averages 9. The PE ratios incorporate earnings forecasted by ICInsider.com for companies with financial year ending, up to August 2023.

A total of 841,912 shares traded for US$21,187 compared to 127,202 units at US$49,782 on Monday.

Trading averaged 93,546 units at US$2,354, compared to 12,720 shares at US$4,978 on Monday, with a month to date average of 47,916 shares at US$3,528 versus 45,684 units at US$3,586 on the previous day. April ended with an average of 95,379 units for US$3,929.

Investor’s Choice bid-offer indicator shows six stocks ending with bids higher than the last selling prices and none with a lower offer.

At the close, First Rock Capital USD share shed 0.95 of a cent in closing at 7 US cents in an exchange of 15,332 shares, Margaritaville traded 6 units at 15 US cents, Productive Business Solutions remained at US$1 trading 3 stock units.  Proven Investments ended unchanged at 26 US cents after exchanging 19,643 stocks, Sterling Investments fell 0.15 of a cent to close at 2 US cents while exchanging 145,442 shares, Sygnus Credit Investments USD share remained at 12.7 US cents in exchanging 45,843 stocks. Sygnus Real Estate Finance USD share dropped 0.49 of one cent in closing at 12 US cents, with 2,381 units changing hands and Transjamaican Highway advanced 0.02 of a cent to close at 0.96 of one US cent and closed with 613,161 stock units changing hands.

Proven Investments ended unchanged at 26 US cents after exchanging 19,643 stocks, Sterling Investments fell 0.15 of a cent to close at 2 US cents while exchanging 145,442 shares, Sygnus Credit Investments USD share remained at 12.7 US cents in exchanging 45,843 stocks. Sygnus Real Estate Finance USD share dropped 0.49 of one cent in closing at 12 US cents, with 2,381 units changing hands and Transjamaican Highway advanced 0.02 of a cent to close at 0.96 of one US cent and closed with 613,161 stock units changing hands.

In the preference segment, JMMB Group 6% lost 8.77 cents to close at US$1.0123 with an exchange of 101 shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Slippage for JSE USD stocks

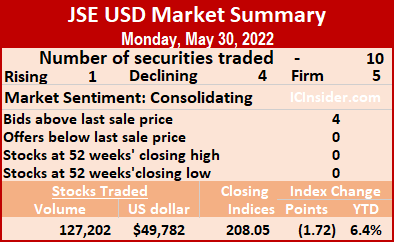

On the Jamaica Stock Exchange US dollar market, trading on Monday ended with the volume of stocks traded rising 239 percent and the value jumping 6,746 percent above trading on Friday, resulting in more stocks falling than rising.

A total of 10 securities traded, up from seven on Friday, with one rising, four declining and five were left unchanged. The JSE US Denominated Equities Index slipped 1.72 points to end at 208.05.

A total of 10 securities traded, up from seven on Friday, with one rising, four declining and five were left unchanged. The JSE US Denominated Equities Index slipped 1.72 points to end at 208.05.

The PE Ratio, a measure used in computing appropriate stock values, averages 9.1. The PE ratio uses ICInsider.com earnings forecasts for companies with financial years ending, up to August 2023.

Overall, 127,202 shares were traded for US$49,782 compared to 37,542 units at US$727 on Friday. Trading averaged 12,720 units at US$4,978, compared to 5,363 shares at US$104 on Friday, with a month to date average of 45,684 shares at US$3,586 versus 47,579 units at US$3,506 on the previous day. April ended with an average of 95,379 units for US$3,929.

Investor’s Choice bid-offer indicator shows four stocks ended with bids higher than the last selling prices and none with a lower offer.

At the close, First Rock Capital USD share remained at 7.95 US cents in exchanging 13,057 shares, Margaritaville ended unchanged at 15 US cents in an exchange of 6 stocks, Proven Investments lost 0.5 of a cent to end at 26 US cents with 43,887 units changing hands.  Sterling Investments popped 0.1 of a cent in closing at 2.15 US cents with one unit clearing the market, Sygnus Credit Investments USD share ended at 12.7 US cents while exchanging 2,825 stocks, Sygnus Real Estate Finance USD share declined 0.01 of a cent to 12.49 US cents after trading one stock unit and Transjamaican Highway fell 0.02 of a cent to end at 0.94 of one US cent after exchanging 46,418 shares.

Sterling Investments popped 0.1 of a cent in closing at 2.15 US cents with one unit clearing the market, Sygnus Credit Investments USD share ended at 12.7 US cents while exchanging 2,825 stocks, Sygnus Real Estate Finance USD share declined 0.01 of a cent to 12.49 US cents after trading one stock unit and Transjamaican Highway fell 0.02 of a cent to end at 0.94 of one US cent after exchanging 46,418 shares.

In the preference segment, Equityline Mortgage Investment preference share ended unchanged at US$1.70 with an exchange of one unit, JMMB Group 5.75% shed 29 cents in closing at US$2.03 with the swapping of 15,003 shares and JMMB Group 6% finished at US$1.10 trading 6,003 stocks.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

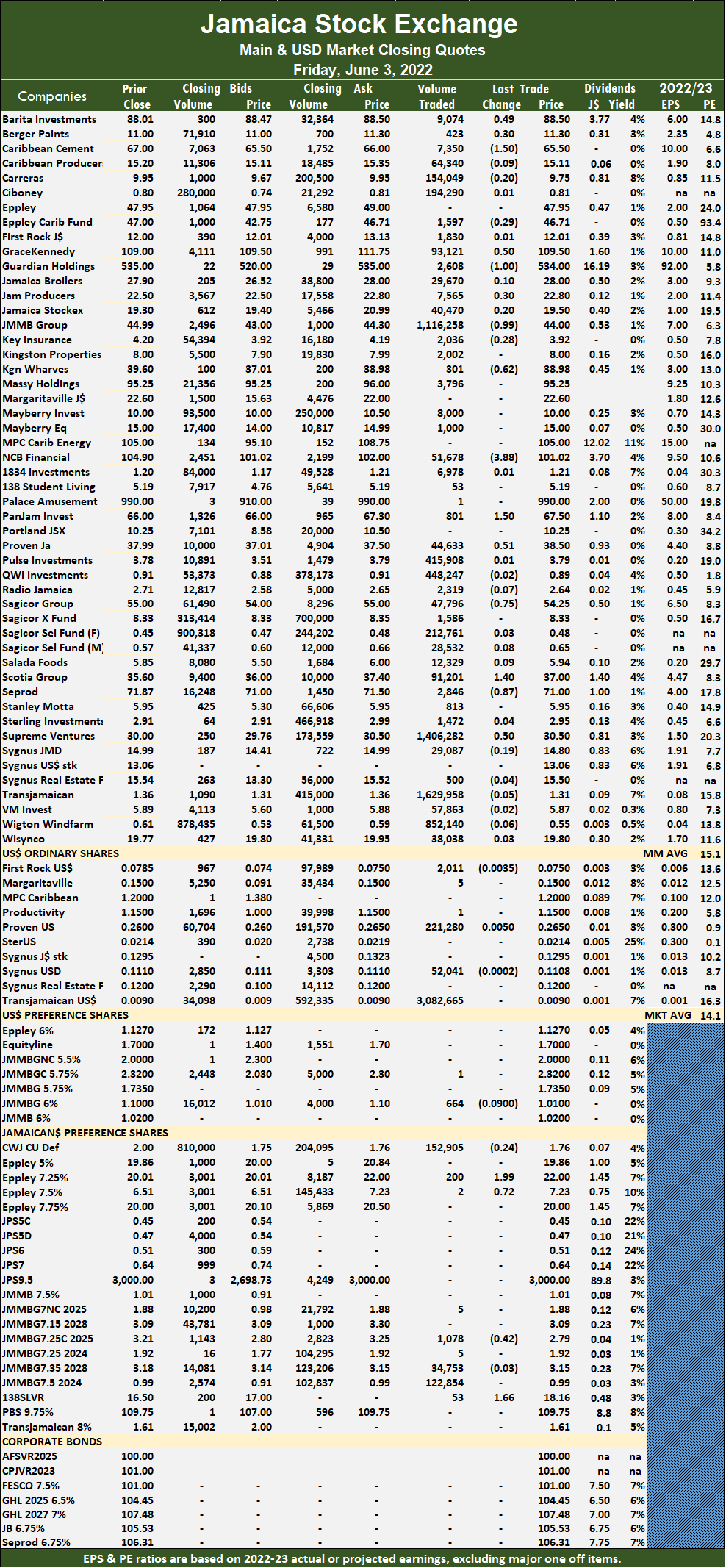

At the close, Barita Investments popped 49 cents in closing at $88.50 in trading 9,074 shares, Berger Paints advanced 30 cents to end at $11.30, with 423 stocks crossing the exchange, Caribbean Cement dropped $1.50 to close at $65.50 as 7,350 stock units changed hands. GraceKennedy rallied 50 cents to $109.50 in switching ownership of 93,121 units, Guardian Holdings shed $1 in ending at $534 with an exchange of 2,608 shares, Jamaica Producers gained 30 cents to $22.80 after 7,565 units crossed the market. JMMB Group declined 99 cents to close at $44 with 1,116,258 stock units clearing the market, Kingston Wharves lost 62 cents in ending at $38.98 after trading 301 stocks, NCB Financial fell $3.88 in closing at $101.02 in exchanging 51,678 stocks. PanJam Investment climbed $1.50 to end at $67.50 while exchanging 801 stock units, Proven Investments increased 51 cents to end at $38.50 after exchanging 44,633 shares, Sagicor Group dropped 75 cents to $54.25, with 47,796 units changing hands. Scotia Group rose $1.40 to close at $37, with 91,201 units crossing the market, Seprod declined 87 cents to $71 in an exchange of 2,846 shares and Supreme Ventures rallied 50 cents in closing at $30.50 with the swapping of 1,406,282 stocks.

At the close, Barita Investments popped 49 cents in closing at $88.50 in trading 9,074 shares, Berger Paints advanced 30 cents to end at $11.30, with 423 stocks crossing the exchange, Caribbean Cement dropped $1.50 to close at $65.50 as 7,350 stock units changed hands. GraceKennedy rallied 50 cents to $109.50 in switching ownership of 93,121 units, Guardian Holdings shed $1 in ending at $534 with an exchange of 2,608 shares, Jamaica Producers gained 30 cents to $22.80 after 7,565 units crossed the market. JMMB Group declined 99 cents to close at $44 with 1,116,258 stock units clearing the market, Kingston Wharves lost 62 cents in ending at $38.98 after trading 301 stocks, NCB Financial fell $3.88 in closing at $101.02 in exchanging 51,678 stocks. PanJam Investment climbed $1.50 to end at $67.50 while exchanging 801 stock units, Proven Investments increased 51 cents to end at $38.50 after exchanging 44,633 shares, Sagicor Group dropped 75 cents to $54.25, with 47,796 units changing hands. Scotia Group rose $1.40 to close at $37, with 91,201 units crossing the market, Seprod declined 87 cents to $71 in an exchange of 2,846 shares and Supreme Ventures rallied 50 cents in closing at $30.50 with the swapping of 1,406,282 stocks. In the preference segment, Eppley 7.25% preference share gained $1.99 in ending at $22 after exchanging 200 stock units, Eppley 7.50% preference share climbed 72 cents in closing at $7.23 in trading just two shares, JMMB Group 7.25% preference share lost 42 cents to close at $2.79 in trading 1,078 units and 138 Student Living s preference share advanced $1.66 to end at $18.16, with 53 stock units crossing the market.

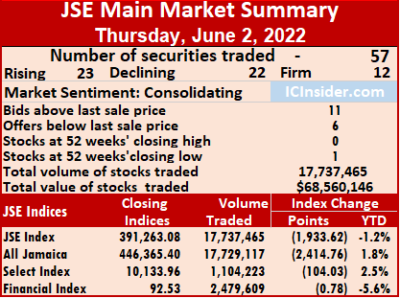

In the preference segment, Eppley 7.25% preference share gained $1.99 in ending at $22 after exchanging 200 stock units, Eppley 7.50% preference share climbed 72 cents in closing at $7.23 in trading just two shares, JMMB Group 7.25% preference share lost 42 cents to close at $2.79 in trading 1,078 units and 138 Student Living s preference share advanced $1.66 to end at $18.16, with 53 stock units crossing the market. The All Jamaican Composite Index declined 2,414.76 points to settle at 446,365.40, the JSE Main Index dipped 1,933.62 points to close at 391,263.08 and the JSE Financial Index shed 0.78 points to settle at 92.53.

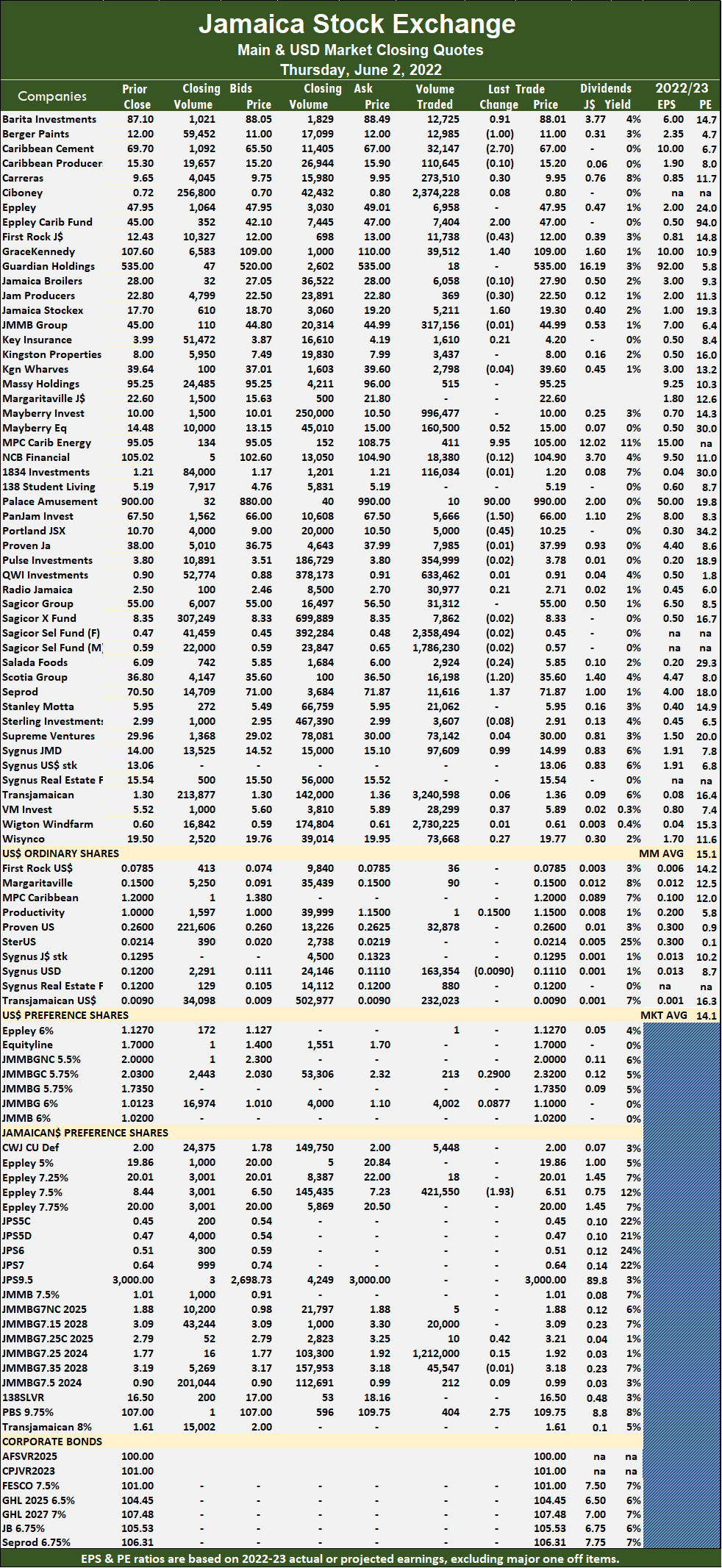

The All Jamaican Composite Index declined 2,414.76 points to settle at 446,365.40, the JSE Main Index dipped 1,933.62 points to close at 391,263.08 and the JSE Financial Index shed 0.78 points to settle at 92.53. At the close, Barita Investments rallied 91 cents to $88.01 in switching ownership of 12,725 shares, Berger Paints lost $1 to close at $11 in exchanging at 12,985 units, Caribbean Cement fell $2.70 to $67 after 32,147 stocks crossed the exchange. Carreras climbed 30 cents to end at $9.95 after exchanging 273,510 stock units, Eppley Caribbean Property Fund increased $2 in closing at $47 in exchanging 7,404 units, First Rock Capital shed 43 cents in closing at $12, with 11,738 stock units changing hands. GraceKennedy advanced $1.40 to $109 in trading 39,512 shares, Jamaica Producers declined 30 cents to close at $22.50 after 369 stocks crossed the market, Jamaica Stock Exchange gained $1.60 to end at $19.30 trading 5,211 stock units. Mayberry Jamaican Equities rose 52 cents to $15, with 160,500 stocks crossing the market, MPC Caribbean Clean Energy popped $9.95 to $105 while exchanging 411 shares, Palace Amusement rallied $90 in closing at $990 and exchanging ten units. PanJam Investment dropped $1.50 in ending at $66, with 5,666 shares clearing the market, Portland JSX fell 45 cents to end at $10.25 with the swapping of 5,000 stock units, Scotia Group lost $1.20 to close at $35.60 with an exchange of 16,198 stocks.

At the close, Barita Investments rallied 91 cents to $88.01 in switching ownership of 12,725 shares, Berger Paints lost $1 to close at $11 in exchanging at 12,985 units, Caribbean Cement fell $2.70 to $67 after 32,147 stocks crossed the exchange. Carreras climbed 30 cents to end at $9.95 after exchanging 273,510 stock units, Eppley Caribbean Property Fund increased $2 in closing at $47 in exchanging 7,404 units, First Rock Capital shed 43 cents in closing at $12, with 11,738 stock units changing hands. GraceKennedy advanced $1.40 to $109 in trading 39,512 shares, Jamaica Producers declined 30 cents to close at $22.50 after 369 stocks crossed the market, Jamaica Stock Exchange gained $1.60 to end at $19.30 trading 5,211 stock units. Mayberry Jamaican Equities rose 52 cents to $15, with 160,500 stocks crossing the market, MPC Caribbean Clean Energy popped $9.95 to $105 while exchanging 411 shares, Palace Amusement rallied $90 in closing at $990 and exchanging ten units. PanJam Investment dropped $1.50 in ending at $66, with 5,666 shares clearing the market, Portland JSX fell 45 cents to end at $10.25 with the swapping of 5,000 stock units, Scotia Group lost $1.20 to close at $35.60 with an exchange of 16,198 stocks.  Seprod climbed $1.37 to end at $71.87, trading 11,616 units, Sygnus Credit Investments advanced 99 cents to close at $14.99 in an exchange of 97,609 stock units and Victoria Mutual Investments gained 37 cents in closing at $5.89 as 28,299 stocks changed hands.

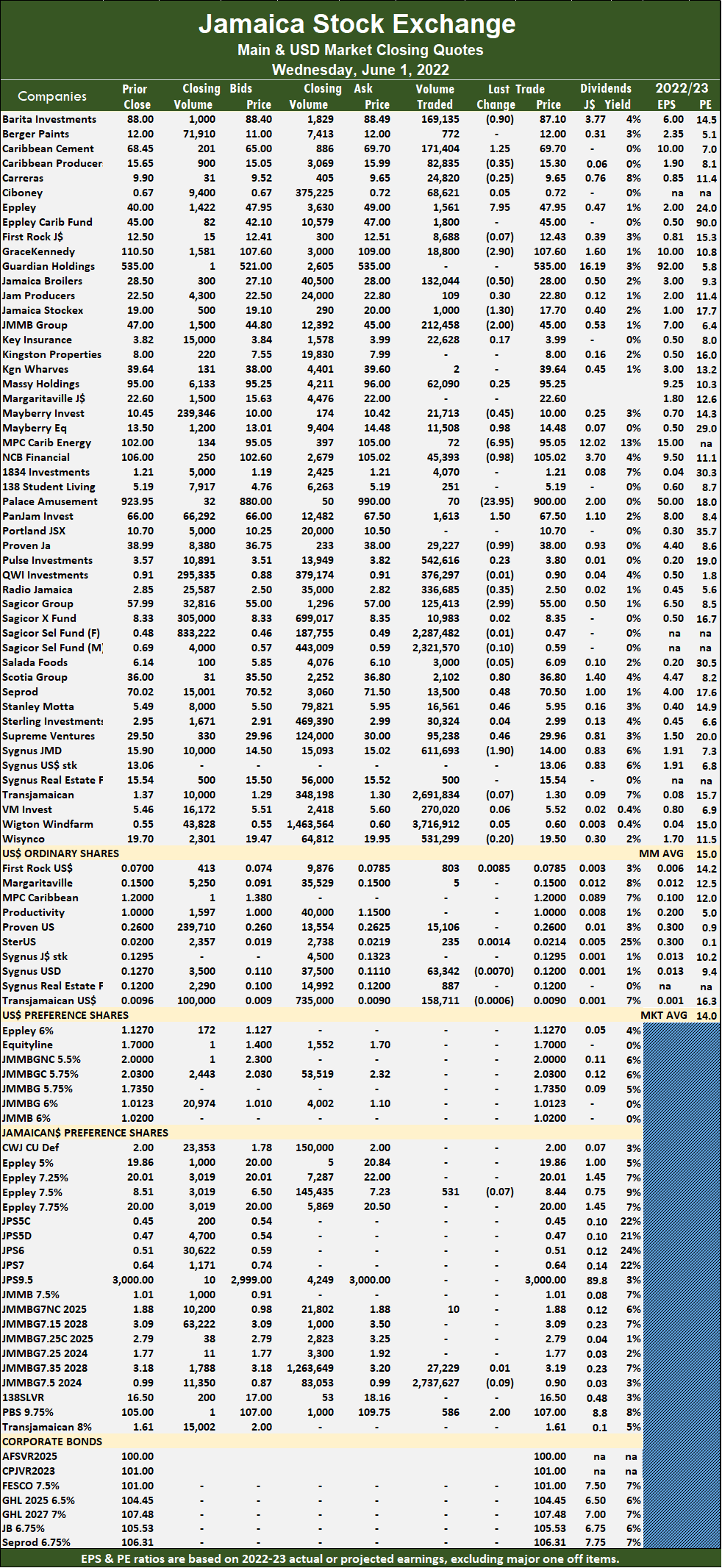

Seprod climbed $1.37 to end at $71.87, trading 11,616 units, Sygnus Credit Investments advanced 99 cents to close at $14.99 in an exchange of 97,609 stock units and Victoria Mutual Investments gained 37 cents in closing at $5.89 as 28,299 stocks changed hands. At the close, Barita Investments shed 90 cents to close at $87.10 while exchanging 169,135 shares, Caribbean Cement rose $1.25 to end at $69.70, with 171,404 stock units crossing the market, Caribbean Producers fell 35 cents in closing at $15.30 as 82,835 units were swapped. Eppley climbed $7.95 in ending at $47.95 in switching ownership of 1,561 stocks, GraceKennedy fell $2.90 to close at $107.60 with an exchange of 18,800 stocks, Jamaica Broilers dropped 50 cents to end at $28, with 132,044 units changing hands. Jamaica Producers popped 30 cents to $22.80 with the swapping of 109 stock units, Jamaica Stock Exchange lost $1.30 in closing at $17.70 with an exchange of 1,000 shares, JMMB Group declined $2 to $45 in exchanging 212,458 stocks. Mayberry Investments lost 45 cents to end at $10 after trading 21,713 stock units, Mayberry Jamaican Equities increased 98 cents to close at $14.48, with 11,508 units crossing the exchange, MPC Caribbean Clean Energy dropped $6.95 in closing at $95.05 after exchanging 72 shares. NCB Financial fell 98 cents to $105.02, with 45,393 units crossing the market, Palace Amusement shed $23.95 to $900 in trading 70 shares, PanJam Investment rose $1.50 to end at $67.50, trading 1,613 stock units.

At the close, Barita Investments shed 90 cents to close at $87.10 while exchanging 169,135 shares, Caribbean Cement rose $1.25 to end at $69.70, with 171,404 stock units crossing the market, Caribbean Producers fell 35 cents in closing at $15.30 as 82,835 units were swapped. Eppley climbed $7.95 in ending at $47.95 in switching ownership of 1,561 stocks, GraceKennedy fell $2.90 to close at $107.60 with an exchange of 18,800 stocks, Jamaica Broilers dropped 50 cents to end at $28, with 132,044 units changing hands. Jamaica Producers popped 30 cents to $22.80 with the swapping of 109 stock units, Jamaica Stock Exchange lost $1.30 in closing at $17.70 with an exchange of 1,000 shares, JMMB Group declined $2 to $45 in exchanging 212,458 stocks. Mayberry Investments lost 45 cents to end at $10 after trading 21,713 stock units, Mayberry Jamaican Equities increased 98 cents to close at $14.48, with 11,508 units crossing the exchange, MPC Caribbean Clean Energy dropped $6.95 in closing at $95.05 after exchanging 72 shares. NCB Financial fell 98 cents to $105.02, with 45,393 units crossing the market, Palace Amusement shed $23.95 to $900 in trading 70 shares, PanJam Investment rose $1.50 to end at $67.50, trading 1,613 stock units.  Proven Investments declined 99 cents to $38 in an exchange of 29,227 stocks, Radio Jamaica dropped 35 cents to $2.50, with 336,685 shares clearing the market, Sagicor Group shed $2.99 to end at $55 while exchanging 125,413 stocks. Scotia Group rallied 80 cents in closing at $36.80 after exchanging 2,102 stock units, Seprod gained 48 cents to close at $70.50 after 13,500 units changed hands, Stanley Motta rallied 46 cents to $5.95, with 16,561 units crossing the market. Supreme Ventures climbed 46 cents to close at $29.96 after trading 95,238 shares and Sygnus Credit Investments fell $1.90 in closing at $14 after 611,693 stock units changed hands.

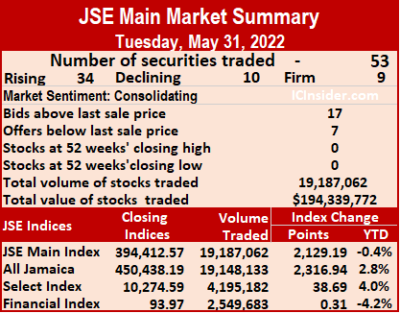

Proven Investments declined 99 cents to $38 in an exchange of 29,227 stocks, Radio Jamaica dropped 35 cents to $2.50, with 336,685 shares clearing the market, Sagicor Group shed $2.99 to end at $55 while exchanging 125,413 stocks. Scotia Group rallied 80 cents in closing at $36.80 after exchanging 2,102 stock units, Seprod gained 48 cents to close at $70.50 after 13,500 units changed hands, Stanley Motta rallied 46 cents to $5.95, with 16,561 units crossing the market. Supreme Ventures climbed 46 cents to close at $29.96 after trading 95,238 shares and Sygnus Credit Investments fell $1.90 in closing at $14 after 611,693 stock units changed hands. The All Jamaican Composite Index rallied 2,316.94 points to settle at 450,438.19, the JSE Main Index and the JSE Financial Index advanced 0.31 points to settle at 93.97.

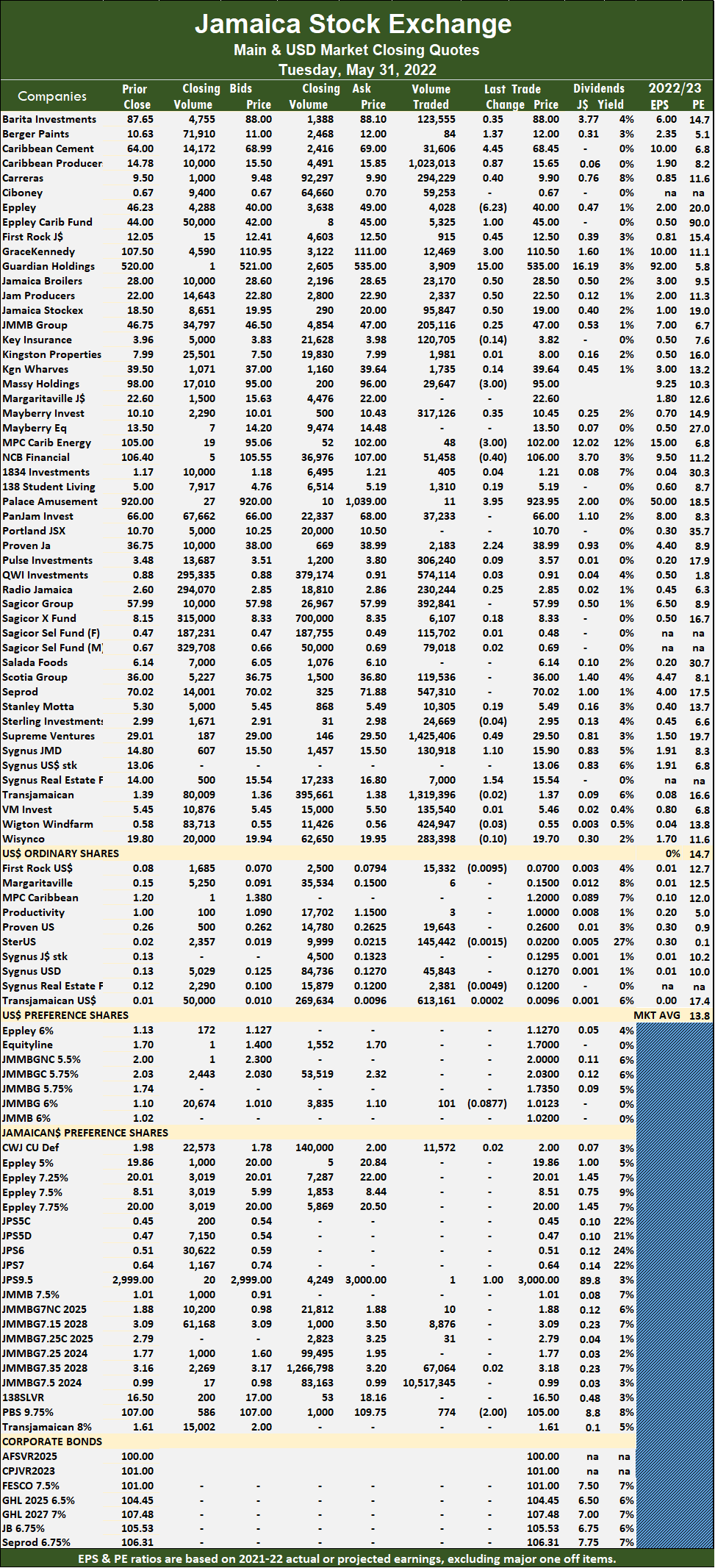

The All Jamaican Composite Index rallied 2,316.94 points to settle at 450,438.19, the JSE Main Index and the JSE Financial Index advanced 0.31 points to settle at 93.97. At the close, Barita Investments rallied 35 cents to end at $88 with an exchange of 123,555 shares, Berger Paints advanced $1.37 to $12, with just 84 units crossing the exchange, Caribbean Cement rose $4.45 to $68.45 after 31,606 stock units passed through the market. Caribbean Producers rallied 87 cents to $15.65 in switching ownership of 1,023,013 stocks, Carreras increased 40 cents to $9.90 after 294,229 units changed hands, Eppley dropped $6.23 to $40, with 4,028 stocks crossing the market. Eppley Caribbean Property Fund popped $1 to $45 while exchanging 5,325 shares, First Rock Capital climbed 45 cents in closing at $12.50 in an exchange of 915 stock units, GraceKennedy rose $3 to close at $110.50 as 12,469 shares changed hands. Guardian Holdings advanced $15 to end at $535, trading 3,909 stock units, Jamaica Broilers rallied 50 cents to close at $28.50 after exchanging 23,170 units, Jamaica Producers gained 50 cents in ending at $22.50 with the swapping of 2,337 stocks. Jamaica Stock Exchange popped 50 cents to $19, with 95,847 shares changing hands, Massy Holdings shed $3 in closing at $95 after exchanging 29,647 units, Mayberry Investments increased 35 cents to end at $10.45, with 317,126 stocks clearing the market. MPC Caribbean Clean Energy lost $3 after finishing at $102 in exchanging 48 stock units, NCB Financial fell 40 cents to $106 in trading 51,458 shares, Palace Amusement climbed $3.95 to close at $923.95 in exchanging 11 units. Proven Investments increased $2.24 to end at $38.99 after trading 2,183 stock units,

At the close, Barita Investments rallied 35 cents to end at $88 with an exchange of 123,555 shares, Berger Paints advanced $1.37 to $12, with just 84 units crossing the exchange, Caribbean Cement rose $4.45 to $68.45 after 31,606 stock units passed through the market. Caribbean Producers rallied 87 cents to $15.65 in switching ownership of 1,023,013 stocks, Carreras increased 40 cents to $9.90 after 294,229 units changed hands, Eppley dropped $6.23 to $40, with 4,028 stocks crossing the market. Eppley Caribbean Property Fund popped $1 to $45 while exchanging 5,325 shares, First Rock Capital climbed 45 cents in closing at $12.50 in an exchange of 915 stock units, GraceKennedy rose $3 to close at $110.50 as 12,469 shares changed hands. Guardian Holdings advanced $15 to end at $535, trading 3,909 stock units, Jamaica Broilers rallied 50 cents to close at $28.50 after exchanging 23,170 units, Jamaica Producers gained 50 cents in ending at $22.50 with the swapping of 2,337 stocks. Jamaica Stock Exchange popped 50 cents to $19, with 95,847 shares changing hands, Massy Holdings shed $3 in closing at $95 after exchanging 29,647 units, Mayberry Investments increased 35 cents to end at $10.45, with 317,126 stocks clearing the market. MPC Caribbean Clean Energy lost $3 after finishing at $102 in exchanging 48 stock units, NCB Financial fell 40 cents to $106 in trading 51,458 shares, Palace Amusement climbed $3.95 to close at $923.95 in exchanging 11 units. Proven Investments increased $2.24 to end at $38.99 after trading 2,183 stock units,  Supreme Ventures climbed 49 cents in closing at $29.50, with 1,425,406 stocks clearing the market, Sygnus Credit Investments advanced $1.10 to end at $15.90 trading 130,918 shares and Sygnus Real Estate Finance rallied $1.54 in closing at $15.54 in trading 7,000 stock units.

Supreme Ventures climbed 49 cents in closing at $29.50, with 1,425,406 stocks clearing the market, Sygnus Credit Investments advanced $1.10 to end at $15.90 trading 130,918 shares and Sygnus Real Estate Finance rallied $1.54 in closing at $15.54 in trading 7,000 stock units.