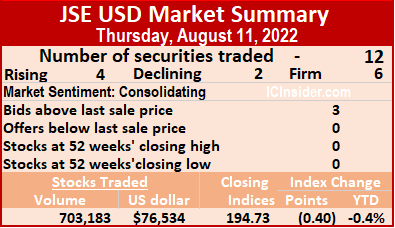

Trading on the Jamaica Stock Exchange US dollar market ended on Thursday, with the volume of stocks traded declining 78 percent less valued 92 percent lower than on Wednesday, resulting in 12 securities trading, compared to nine on Wednesday, with four rising, two declining and six ending unchanged.

Investors exchanged 394,179 shares for US$26,302 compared to 1,690,663 units at US$286,936 on Wednesday. Trading averaged 32,848 units at US$2,192, versus 187,851 shares at US$31,882 on Wednesday, with month to date average of 45,865 shares at US$7,629 versus 47,248 units at US$8,206 on the previous trading day. July ended with an average of 49,665 units for US$3,449.

Investors exchanged 394,179 shares for US$26,302 compared to 1,690,663 units at US$286,936 on Wednesday. Trading averaged 32,848 units at US$2,192, versus 187,851 shares at US$31,882 on Wednesday, with month to date average of 45,865 shares at US$7,629 versus 47,248 units at US$8,206 on the previous trading day. July ended with an average of 49,665 units for US$3,449.

The JSE US Denominated Equities Index rose 5.99 points to end at 214.30.

The PE Ratio, a measure used in computing appropriate stock values, averages 8.2. The PE ratio uses ICInsider.com earnings forecasts for companies with financial years ending between November and August 2023.

Investor’s Choice bid-offer indicator shows none ended with a bid higher than the last selling prices and one stock with a lower offer.

At the close, First Rock Real Estate USD share fell 0.3 of a cent in closing at a 52 weeks’ low of 4 US cents after exchanging 336,734 shares, MPC Caribbean Clean Energy ended at US$1.30 in trading three units, Productive Business Solutions remained at US$1.32 in switching ownership of four stocks. Proven Investments popped 0.3 of one cent to 21.5 US cents while exchanging 38,021 stock units, Sygnus Credit Investments Jamaica dollar share rallied 0.23 of a cent to 13.23 US cents, with 62 shares changing hands,  Sygnus Credit Investments USD share climbed 0.79 of one cent to 11.99 US cents with an exchange of 1,857 units. Sygnus Real Estate Finance USD share increased 1.85 cents in closing at 12.5 US cents and exchanging ten stocks and Transjamaican Highway shed 0.01 of a cent to close at 0.95 of one US cent with investors transferring 3,179 stock units.

Sygnus Credit Investments USD share climbed 0.79 of one cent to 11.99 US cents with an exchange of 1,857 units. Sygnus Real Estate Finance USD share increased 1.85 cents in closing at 12.5 US cents and exchanging ten stocks and Transjamaican Highway shed 0.01 of a cent to close at 0.95 of one US cent with investors transferring 3,179 stock units.

In the preference segment, Equityline Mortgage Investment preference share ended unchanged at US$1.85 after a transfer of six units, JMMB Group 5.5% remained at US$2 with a transfer of seven stock units, JMMB Group 5.75% remained at US$1.74, with stocks crossing the market and JMMB Group6% ended unchanged at US$1.10 trading seven shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Stocks gains on the JSE USD Market

No JSE USD stocks gained on Wednesday

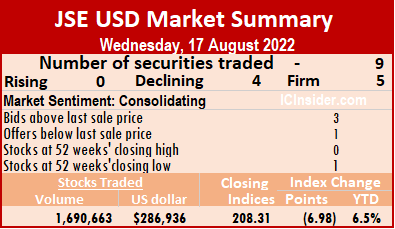

Trading activity jumped sharply on the Jamaica Stock Exchange US dollar market ended on Wednesday, with the volume of stocks traded surging 397 percent with a greater value than on Tuesday, resulting in nine securities traded, the same number on Tuesday with no rising, four declining and five ending unchanged.

The JSE US Denominated Equities Index lost 6.98 points to end at 208.31.

The JSE US Denominated Equities Index lost 6.98 points to end at 208.31.

The PE Ratio, a measure used in computing appropriate stock values, averages 8.1. The PE ratio uses ICInsider.com earnings forecasts for companies with financial years ending between November and August 2023.

Overall, 1,690,663 shares traded, for US$286,936 up from 340,214 units at US$68,279 on Tuesday. Trading averaged 187,851 units at US$31,882 versus 37,802 shares at US$7,587 on Tuesday, with month to date average of 47,248 shares at US$8,206 versus 35,080 units at US$6,157 on the previous trading day. July ended with an average of 49,665 units for US$3,449.

Investor’s Choice bid-offer indicator shows two stocks ended with higher bids than the last selling prices and one with a lower offer.

At the close of trading, First Rock Real Estate USD share dropped 0.7 of a cent to close at a 52 weeks’ low of 4.3 US cents in an exchange of 278,487 shares, Margaritaville lost 3.5 cents in ending at 10.5 US cents after trading 132 stock units, Productive Business Solutions ended unchanged at US$1.32 after exchanging ten units.  Proven Investments remained at 21.2 US cents with investors transferring 1,244,860 stocks, Sterling Investments ended at 2.05 US cents with an exchange of 5,000 stocks, Sygnus Credit Investments USD share declined 0.01 of a cent to close at 11.2 US cents, with 34,015 shares crossing the market and Transjamaican Highway dipped 0.02 of a cent in closing at 0.96 of one US cent with the swapping of 125,074 units.

Proven Investments remained at 21.2 US cents with investors transferring 1,244,860 stocks, Sterling Investments ended at 2.05 US cents with an exchange of 5,000 stocks, Sygnus Credit Investments USD share declined 0.01 of a cent to close at 11.2 US cents, with 34,015 shares crossing the market and Transjamaican Highway dipped 0.02 of a cent in closing at 0.96 of one US cent with the swapping of 125,074 units.

In the preference segment, JMMB Group 5.75% remained at US$1.74 in exchanging 3,080 stock units and JMMB Group 6% remained at US$1.10 as investors exchanged five units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Sharp jump for JSE USD Market

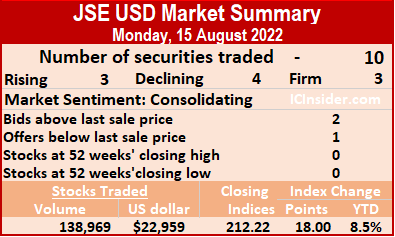

At the close of the Jamaica Stock Exchange US dollar market on Monday, trading fell back sharply from Friday’s levels with the volume of stocks traded declining a sizable 86 percent with an 84 percent lower value than on Friday, resulting in 10 securities traded, compared to 12 on Friday, with three rising, four declining and three ending unchanged and US Denominated Equities Index jumping 18 points to end at 212.22.

Investors exchanged 138,969 shares for US$22,959 versus 983,310 units at US$145,667 on Friday. The average trade on Monday was 13,897 units at US$2,296, down from 81,943 shares at US$12,139 on Friday, with a month to date average of 34,822 shares at US$6,022 versus 37,284 units at US$6,460 the previous day. July ended with an average of 49,665 units for US$3,449.

Investors exchanged 138,969 shares for US$22,959 versus 983,310 units at US$145,667 on Friday. The average trade on Monday was 13,897 units at US$2,296, down from 81,943 shares at US$12,139 on Friday, with a month to date average of 34,822 shares at US$6,022 versus 37,284 units at US$6,460 the previous day. July ended with an average of 49,665 units for US$3,449.

The PE Ratio, a measure used in computing appropriate stock values, averages 8.5. The PE ratio uses ICInsider.com earnings forecasts for companies with financial years ending up to August 2023.

Investor’s Choice bid-offer indicator shows two stocks ended with bids higher than the last selling prices and one with a lower offer.

At the close, First Rock Real Estate USD share ended unchanged at 5 US cents after exchanging 56,277 shares, Margaritaville finished at 14.98 US cents closed with 1,991 stock units changing hands, Productive Business Solutions climbed 32.25 cents to US$1.3225 with an exchange of 35 units. Proven Investments lost 0.93 of one cent to close at 22.01 US cents, with 61,159 stocks clearing the market,  Sterling Investments rallied 0.05 of a cent to 2.05 US cents, with 5,400 stock units crossing the exchange, Sygnus Credit Investments USD share remained at 11.2 US cents, with 7,100 stocks crossing the market. Sygnus Real Estate Finance USD share dropped 1.85 cents to 10.65 US cents with the swapping of 1,000 units and Transjamaican Highway shed 0.11 of a cent to end at 0.86 of one US cent, with 3,000 shares crossing the market.

Sterling Investments rallied 0.05 of a cent to 2.05 US cents, with 5,400 stock units crossing the exchange, Sygnus Credit Investments USD share remained at 11.2 US cents, with 7,100 stocks crossing the market. Sygnus Real Estate Finance USD share dropped 1.85 cents to 10.65 US cents with the swapping of 1,000 units and Transjamaican Highway shed 0.11 of a cent to end at 0.86 of one US cent, with 3,000 shares crossing the market.

In the preference segment, JMMB Group 5.75% declined 0.25 of one cent to close at US$1.74 while exchanging 3,000 stocks and JMMB Group 6% rose 5 cents to US$1.10 trading seven stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Trading climbs on JSE USD Market

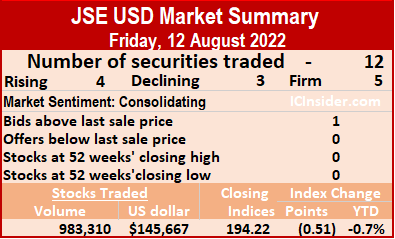

Trading on the Jamaica Stock Exchange US dollar market ended on Friday, with the volume of stocks traded rising 40 percent, with the value 90 percent higher than on Thursday, resulting from trading of 12 securities, similar to Thursday, with the prices of four rising, three declining and five ending unchanged.

Overall, 983,310 shares traded for US$145,667, up from 703,183 units at US$76,534 on Thursday. Trading averaged 81,943 units at US$12,139 compared to 58,599 shares at US$6,378 on Thursday, with month to date average of 37,284 shares at US$6,460 versus 29,943 units at US$5,526 on the preceding day. July ended with an average of 49,665 units for US$3,449.

Overall, 983,310 shares traded for US$145,667, up from 703,183 units at US$76,534 on Thursday. Trading averaged 81,943 units at US$12,139 compared to 58,599 shares at US$6,378 on Thursday, with month to date average of 37,284 shares at US$6,460 versus 29,943 units at US$5,526 on the preceding day. July ended with an average of 49,665 units for US$3,449.

The JSE US Denominated Equities Index lost 0.51 points to end at 194.22.

The PE Ratio, a measure used in computing appropriate stock values, averages 8.7. The PE ratio uses ICInsider.com earnings forecasts for companies with financial years ending up to August 2023.

Investor’s Choice bid-offer indicator shows one stock ended with a higher bid than the last selling price and none with a lower offer.

At the close, First Rock Real Estate USD share dropped 0.1 of a cent after ending at 5 US cents with the swapping of 604,420 shares, Margaritaville finished at 14.98 US cents in trading ten stocks, MPC Caribbean Clean Energy remained at US$1.30 in an exchange of one stock unit. Productive Business Solutions ended unchanged at US$1 while exchanging 616 units, Proven Investments declined 0.01 of a cent to end at 22.94 US cents and trading 4,023 stock units,  Sygnus Credit Investments USD share fell 0.8 cents to end at 11.2 US cents with 4,000 stocks changing hands. Sygnus Real Estate Finance USD share increased 1.89 cents ending at 12.5 US cents, with 46 shares crossing the market and Transjamaican Highway popped 0.1 of a cent to close at 0.97 US cents with an exchange of 294,151 units.

Sygnus Credit Investments USD share fell 0.8 cents to end at 11.2 US cents with 4,000 stocks changing hands. Sygnus Real Estate Finance USD share increased 1.89 cents ending at 12.5 US cents, with 46 shares crossing the market and Transjamaican Highway popped 0.1 of a cent to close at 0.97 US cents with an exchange of 294,151 units.

In the preference segment, Eppley 6% preference share finished at US$1.15 in switching ownership of two stock units, Equityline Mortgage Investment preference share ended unchanged at US$1.85 in exchanging one stock, JMMB Group 5.75% remained at US$1.7425 with an exchange of 43,301 units and JMMB Group 6% lost 5 cents in closing at US$1.05 with 32,739 shares changing hands.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Winning stocks lead JSE USD Market

Trading picked up on the Jamaica Stock Exchange US dollar market Thursday, with 12 securities traded, up from nine on Wednesday, with four rising, two declining and six ending unchanged, with the volume of stocks traded rising 48 percent and 196 percent greater value than on Wednesday.

The JSE US Denominated Equities Index slipped 0.40 points to end at 194.73.

The JSE US Denominated Equities Index slipped 0.40 points to end at 194.73.

The PE Ratio, a measure used in computing appropriate stock values, averages 8.4. The PE ratio uses ICInsider.com earnings forecasts for companies with financial years ending up to August 2023.

Overall, 703,183 shares were traded for US$76,534, up from 475,460 units at US$25,818 on Wednesday. Trading averaged 58,599 units at US$6,378 compared to 52,829 shares at US$2,869 on Wednesday, with month to date average of 29,943 shares at US$5,526 versus 24,305 units at US$5,359 on the previous day. July ended with an average of 49,665 units for US$3,449.

Investor’s Choice bid-offer indicator shows one ended with the bid higher than the last selling price and none with a lower offer.

At the close, First Rock Real Estate USD share remained at 5.1 US cents, with 430,350 shares changing hands, Margaritaville popped 0.98 of one cent to close at 14.98 US cents in switching ownership of 2,537 stocks, Productive Business Solutions finished at US$1 with 1,901 units crossing the exchange. Proven Investments rallied 0.94 of a cent in closing at 22.95 US cents after exchanging 2,000 stock units, Sterling Investments ended at 2 US cents after 8,092 shares crossed the market, Sygnus Credit Investments USD share increased 0.89 of one cent and ended at 12 US cents with 888 stocks changing hands.  Sygnus Real Estate Finance USD share fell 1.89 cents to 10.61 US cents after exchanging 501 units and Transjamaican Highway lost 0.01 of a cent in closing at 0.87 of one cent US cents after trading 228,441 stock units.

Sygnus Real Estate Finance USD share fell 1.89 cents to 10.61 US cents after exchanging 501 units and Transjamaican Highway lost 0.01 of a cent in closing at 0.87 of one cent US cents after trading 228,441 stock units.

In the preference segment, Eppley 6% preference share ended unchanged at US$1.15, with 12 units crossing the market. Equityline Mortgage Investment preference share remained at US$1.85 in an exchange of 5 stock units, JMMB Group 5.75% finished at US$1.7425, with 28,323 shares clearing the market and JMMB Group 6% climbed 6 cents to close at US$1.10 in trading 133 stocks.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

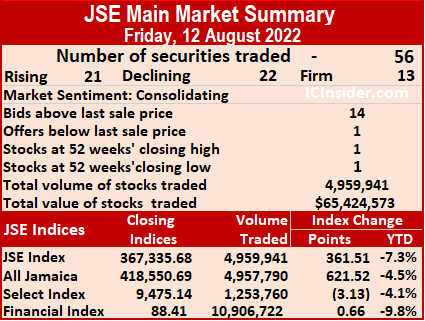

Trading ended with 55 securities, the same as Tuesday, with 14 rising, 27 declining and 14 ending unchanged. The All Jamaican Composite Index shed 2,917.62 points to 414,850.94, the Main Index fell 847.36 points to 365,868.63 and the JSE Financial Index slipped 0.20 points to 87.71.

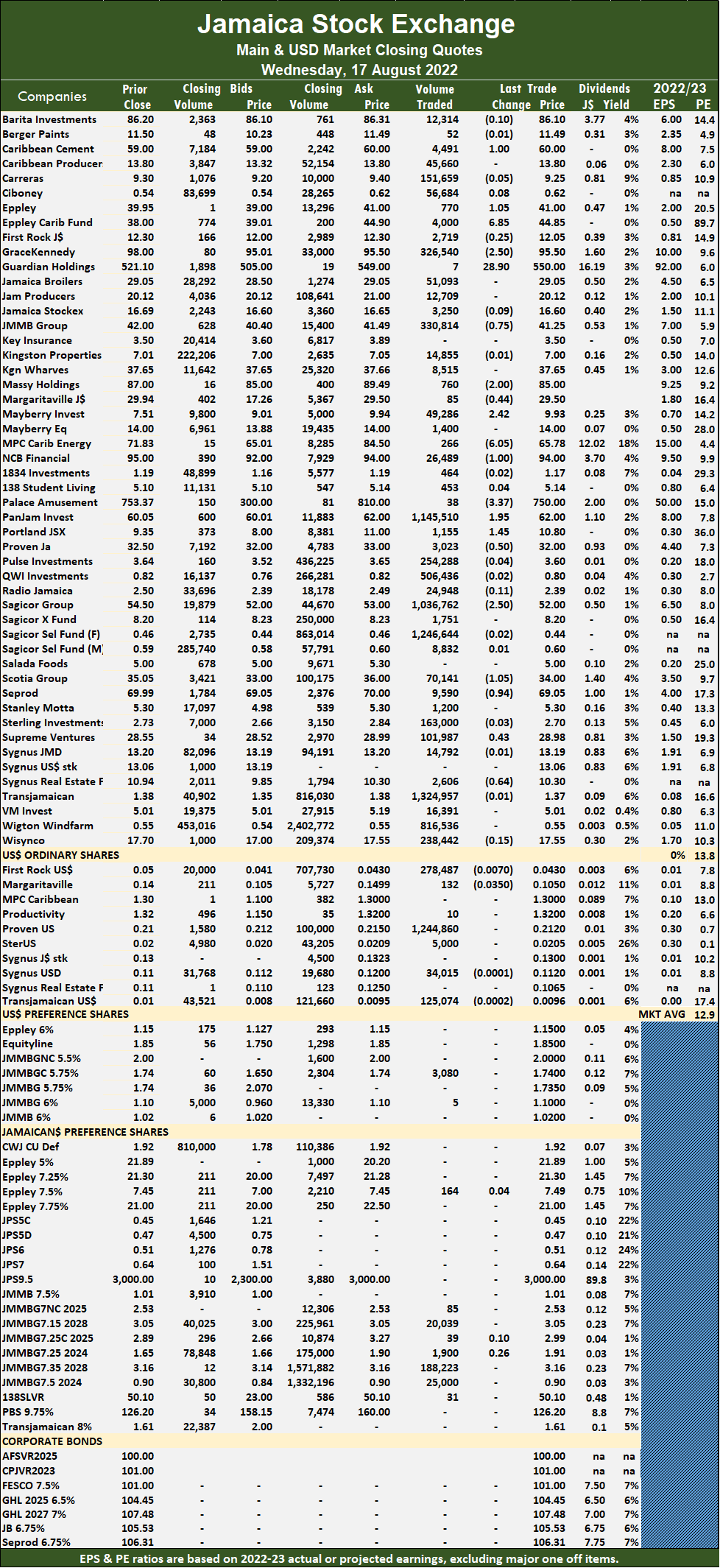

Trading ended with 55 securities, the same as Tuesday, with 14 rising, 27 declining and 14 ending unchanged. The All Jamaican Composite Index shed 2,917.62 points to 414,850.94, the Main Index fell 847.36 points to 365,868.63 and the JSE Financial Index slipped 0.20 points to 87.71. At the close, Caribbean Cement increased $1 to $60 with the swapping of 4,491 shares, Eppley rose $1.05 to $41 trading 770 stocks, Eppley Caribbean Property Fund climbed $6.45 to $44.85 in switching ownership of 4,000 stock units. GraceKennedy dropped $2.50 in closing at $95.50 in trading 326,540 units, Guardian Holdings gained $28.90 to close at $550, with seven stock units crossing the market, JMMB Group shed 75 cents to close at $41.25 as investors exchanged 330,814 shares. Margaritaville lost 44 cents in ending at $29.50 after trading 85 stocks, Massy Holdings dipped $2 to $85 with a transfer of 760 units, Mayberry Investments rallied $2.42 in closing at $9.93 in an exchange of 49,286 shares. MPC Caribbean Clean Energy fell $6.05 to end at $65.78 after a transfer of 266 units, NCB Financial declined $1 to end at $94, with 26,489 crossing the exchange, Palace Amusement fell $3.37 to close at a 52 weeks’ low of $750 with 38 stock units clearing the market. PanJam Investment advanced $1.95 in closing at $62 after exchanging 1,145,510 stocks, Portland JSX popped $1.45 to $10.80 with an exchange of 1,155 shares, Proven Investments fell 50 cents to $32 after exchanging 3,023 units.

At the close, Caribbean Cement increased $1 to $60 with the swapping of 4,491 shares, Eppley rose $1.05 to $41 trading 770 stocks, Eppley Caribbean Property Fund climbed $6.45 to $44.85 in switching ownership of 4,000 stock units. GraceKennedy dropped $2.50 in closing at $95.50 in trading 326,540 units, Guardian Holdings gained $28.90 to close at $550, with seven stock units crossing the market, JMMB Group shed 75 cents to close at $41.25 as investors exchanged 330,814 shares. Margaritaville lost 44 cents in ending at $29.50 after trading 85 stocks, Massy Holdings dipped $2 to $85 with a transfer of 760 units, Mayberry Investments rallied $2.42 in closing at $9.93 in an exchange of 49,286 shares. MPC Caribbean Clean Energy fell $6.05 to end at $65.78 after a transfer of 266 units, NCB Financial declined $1 to end at $94, with 26,489 crossing the exchange, Palace Amusement fell $3.37 to close at a 52 weeks’ low of $750 with 38 stock units clearing the market. PanJam Investment advanced $1.95 in closing at $62 after exchanging 1,145,510 stocks, Portland JSX popped $1.45 to $10.80 with an exchange of 1,155 shares, Proven Investments fell 50 cents to $32 after exchanging 3,023 units. Sagicor Group shed $2.50 in closing at $52 with 1,036,762 stock units changing hands, Scotia Group dipped $1.05 to $34 after exchanging 70,141 units, Seprod lost 94 cents to end at $69.05, with 9,590 stock units crossing the market. Supreme Ventures increased 43 cents to $28.98 with investors transferring 101,987 stocks and Sygnus Real Estate Finance dropped 64 cents to close at $10.30 while trading 2,606 shares.

Sagicor Group shed $2.50 in closing at $52 with 1,036,762 stock units changing hands, Scotia Group dipped $1.05 to $34 after exchanging 70,141 units, Seprod lost 94 cents to end at $69.05, with 9,590 stock units crossing the market. Supreme Ventures increased 43 cents to $28.98 with investors transferring 101,987 stocks and Sygnus Real Estate Finance dropped 64 cents to close at $10.30 while trading 2,606 shares. A total of 6,129,079 shares were exchanged for $50,321,427 versus 7,396,135 units at $31,788,226 on Monday. Trading averaged 111,438 units at $914,935, compared to 125,358 shares at $538,783 on Monday, with the month to date, averaging 160,435 units at $1,135,635, compared to 165,265 units at $1,157,389 on the previous trading day. July averaged173,643 units at $1,683,017.

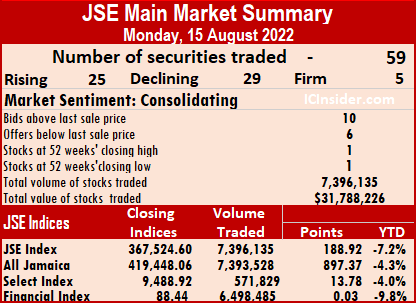

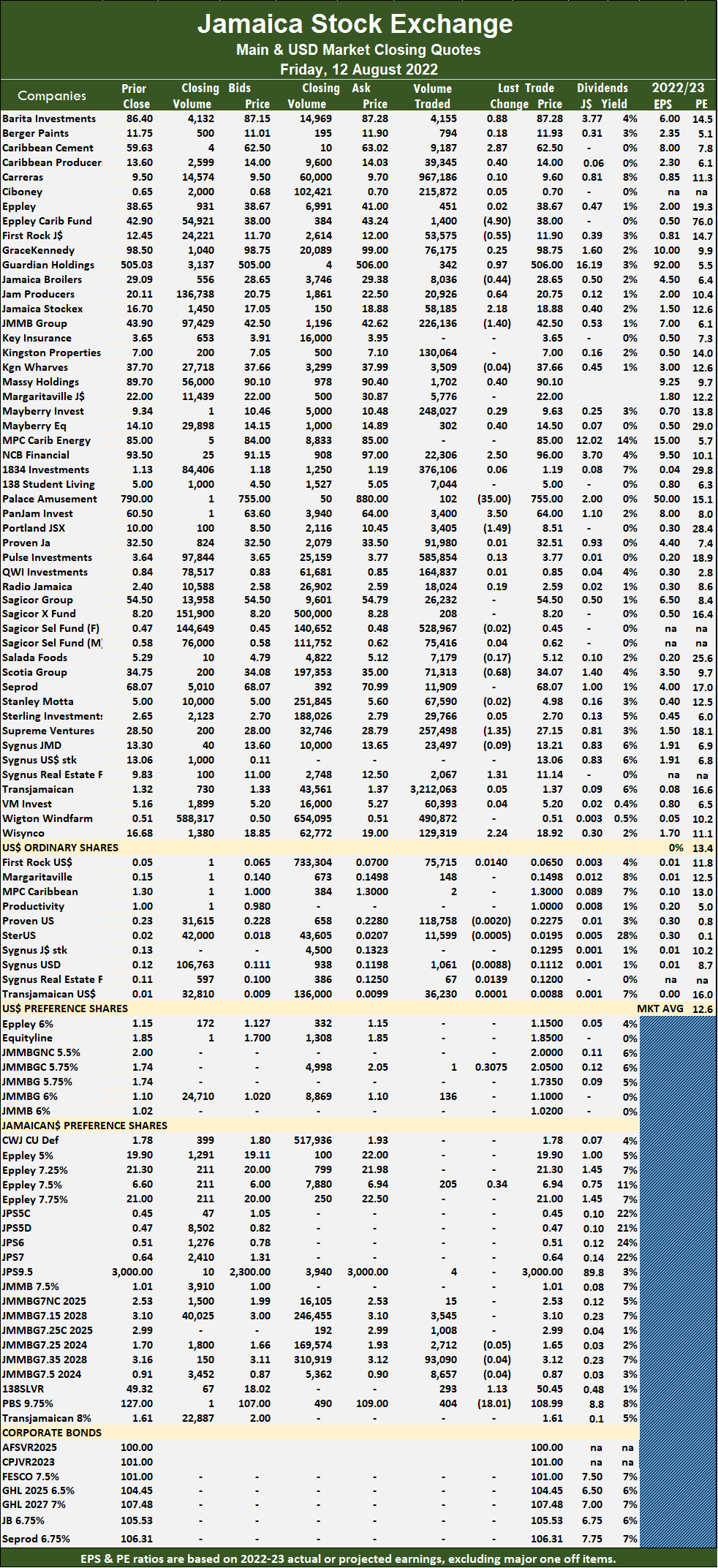

A total of 6,129,079 shares were exchanged for $50,321,427 versus 7,396,135 units at $31,788,226 on Monday. Trading averaged 111,438 units at $914,935, compared to 125,358 shares at $538,783 on Monday, with the month to date, averaging 160,435 units at $1,135,635, compared to 165,265 units at $1,157,389 on the previous trading day. July averaged173,643 units at $1,683,017. At the close, Caribbean Cement declined 80 cents to close at $59, with 13,474 shares crossing the exchange, GraceKennedy rallied $2.50 to $98 after exchanging 84,925 units, Guardian Holdings advanced $16.10 in ending at $521.10, with 60 stock units changing hands. JMMB Group shed 50 cents in closing at $42, with 144,349 stocks crossing the market, Margaritaville gained $5.74 to close at a 52 weeks’ high of $29.94 after exchanging 100 stock units, Massy Holdings fell $2 to end at $87 and closed with 781 shares changing hands. Mayberry Investments lost $2.44 to close at $7.51, with 98,300 stocks clearing the market, NCB Financial increased $1 in closing at $95 after exchanging 101,809 units, Palace Amusement dropped $66.62 after ending at $753.37 in trading 196 shares. PanJam Investment fell 95 cents to $60.05 in an exchange of 814 stocks, Portland JSX shed $1.65 in ending at $9.35 while exchanging 245 units, Scotia Group declined $1.45 to close at $35.05 after transferring 5,742 stock units and Wisynco traded 54,729 shares and gained 30 cents in closing at $17.70.

At the close, Caribbean Cement declined 80 cents to close at $59, with 13,474 shares crossing the exchange, GraceKennedy rallied $2.50 to $98 after exchanging 84,925 units, Guardian Holdings advanced $16.10 in ending at $521.10, with 60 stock units changing hands. JMMB Group shed 50 cents in closing at $42, with 144,349 stocks crossing the market, Margaritaville gained $5.74 to close at a 52 weeks’ high of $29.94 after exchanging 100 stock units, Massy Holdings fell $2 to end at $87 and closed with 781 shares changing hands. Mayberry Investments lost $2.44 to close at $7.51, with 98,300 stocks clearing the market, NCB Financial increased $1 in closing at $95 after exchanging 101,809 units, Palace Amusement dropped $66.62 after ending at $753.37 in trading 196 shares. PanJam Investment fell 95 cents to $60.05 in an exchange of 814 stocks, Portland JSX shed $1.65 in ending at $9.35 while exchanging 245 units, Scotia Group declined $1.45 to close at $35.05 after transferring 5,742 stock units and Wisynco traded 54,729 shares and gained 30 cents in closing at $17.70. In the preference segment, 138 Student Living preference share rose 78 cents to end at $50.10 after trading 21 stock units and Productive Business Solutions 9.75% preference share dropped $38.80 in closing at $126.20 with an exchange of 373 shares.

In the preference segment, 138 Student Living preference share rose 78 cents to end at $50.10 after trading 21 stock units and Productive Business Solutions 9.75% preference share dropped $38.80 in closing at $126.20 with an exchange of 373 shares. Overall, 7,396,135 shares were exchanged for $31,788,226 versus 4,959,941 units at $65,424,573 on Friday. Trading averaged 125,358 units at $538,783 compared to 88,570 shares at $1,168,2961 on Friday and month to date, an average of 165,265 units at $1,157,389, compared to 169,983 units at $1,230,531 on the previous trading day. July averaged 173,643 units at $1,683,017.

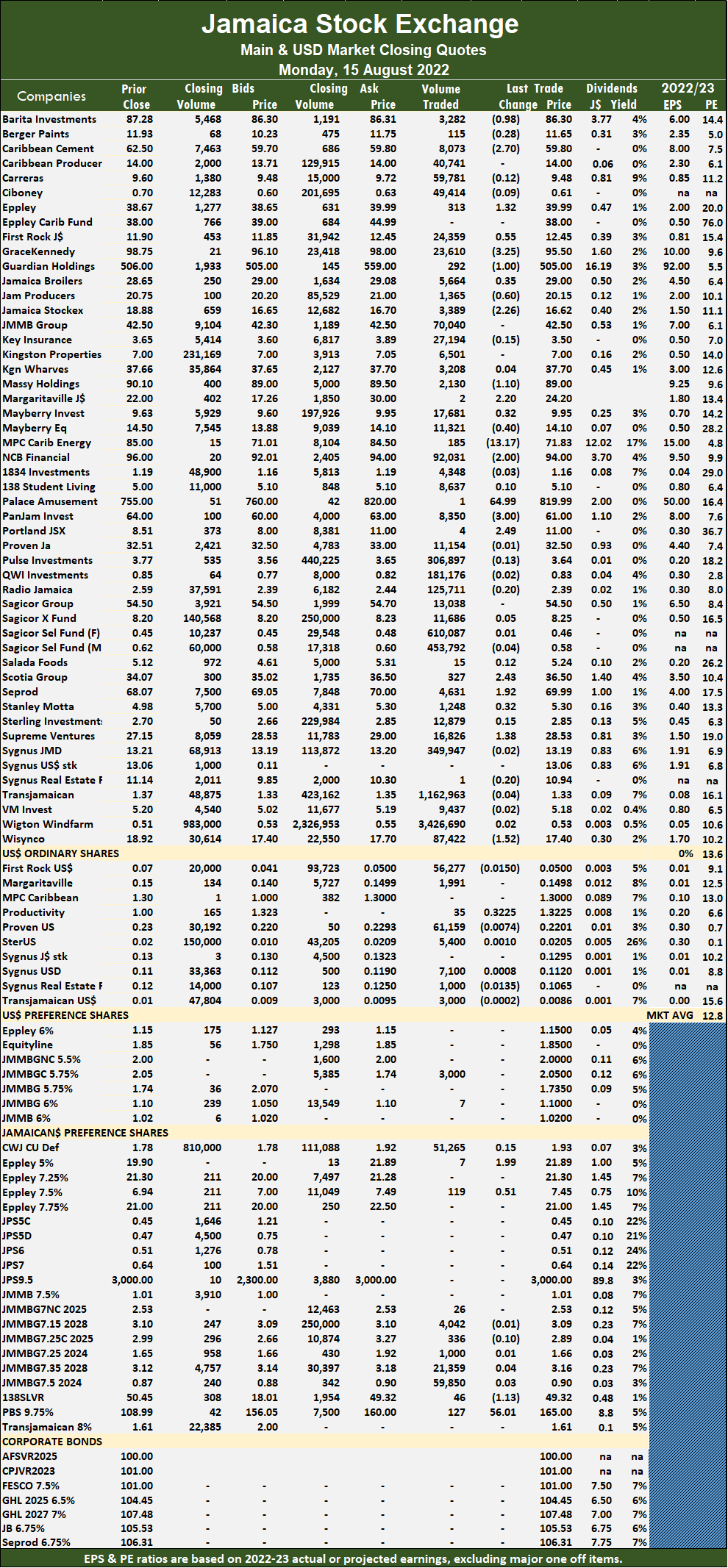

Overall, 7,396,135 shares were exchanged for $31,788,226 versus 4,959,941 units at $65,424,573 on Friday. Trading averaged 125,358 units at $538,783 compared to 88,570 shares at $1,168,2961 on Friday and month to date, an average of 165,265 units at $1,157,389, compared to 169,983 units at $1,230,531 on the previous trading day. July averaged 173,643 units at $1,683,017. At the close, Barita Investments fell 98 cents to $86.30 after exchanging 3,282 shares, Caribbean Cement dropped $2.70 to close at $59.80 after an exchange of 8,073 shares, Eppley jumped $1.32 in closing at $39.39, with 313 stocks crossing the market. First Rock traded 24,359 shares after rising 55 cents to $12.45. GraceKennedy dropped $3.25 to end at $95.50, with 23,610 units changing hands, Guardian Holdings fell $1 to close at $505 after trading 292 stock units, Jamaica Broilers rose 35 cents to $29 after exchanging 5,664 stocks. Jamaica Producers fell 60 cents in closing at $20.15, with an exchange of 1,365 shares, Jamaica Stock Exchange fell $2.26 to $16.70 after an exchange of 3,389 shares, Massy Holdings shed $1.10 in ending at $89, with 2,130 units crossing the exchange, Margaritaville climbed $2.20 to $24.20, with just two stocks changing hands. Mayberry Jamaican Equities fell 40 cents to close at $14.10 after trading 11,321 stock units. MPC Carib Energy fell $13.17 to close at a 52 weeks’ low of $71.83 after trading 185 shares, NCB Financial lost $2 to end at $94 with an exchange of 92,031 shares, PanJam Investment shed $3 in closing at $61 in an exchange of 8,350 units.

At the close, Barita Investments fell 98 cents to $86.30 after exchanging 3,282 shares, Caribbean Cement dropped $2.70 to close at $59.80 after an exchange of 8,073 shares, Eppley jumped $1.32 in closing at $39.39, with 313 stocks crossing the market. First Rock traded 24,359 shares after rising 55 cents to $12.45. GraceKennedy dropped $3.25 to end at $95.50, with 23,610 units changing hands, Guardian Holdings fell $1 to close at $505 after trading 292 stock units, Jamaica Broilers rose 35 cents to $29 after exchanging 5,664 stocks. Jamaica Producers fell 60 cents in closing at $20.15, with an exchange of 1,365 shares, Jamaica Stock Exchange fell $2.26 to $16.70 after an exchange of 3,389 shares, Massy Holdings shed $1.10 in ending at $89, with 2,130 units crossing the exchange, Margaritaville climbed $2.20 to $24.20, with just two stocks changing hands. Mayberry Jamaican Equities fell 40 cents to close at $14.10 after trading 11,321 stock units. MPC Carib Energy fell $13.17 to close at a 52 weeks’ low of $71.83 after trading 185 shares, NCB Financial lost $2 to end at $94 with an exchange of 92,031 shares, PanJam Investment shed $3 in closing at $61 in an exchange of 8,350 units.  Portland JSX jumped $2.49 to $11 in switching ownership of a mere four stocks, Scotia Group popped $2.43 to end at $36.50 with the swapping of 327 stock units, Seprod rose $1.92 to $69.99, with 4,631 stocks crossing the market, Supreme Ventures climbed $1.38 to close at $28.53 in exchanging 16,826 shares and Wisynco dropped $1.52 in closing at $10.21, in trading 87,422 stocks.

Portland JSX jumped $2.49 to $11 in switching ownership of a mere four stocks, Scotia Group popped $2.43 to end at $36.50 with the swapping of 327 stock units, Seprod rose $1.92 to $69.99, with 4,631 stocks crossing the market, Supreme Ventures climbed $1.38 to close at $28.53 in exchanging 16,826 shares and Wisynco dropped $1.52 in closing at $10.21, in trading 87,422 stocks. At the close, Caribbean Producers popped 42 cents to $14.02 after trading 20,482 stocks. Eppley increased $1.28 to close at $39.93, with 75 stock units changing hands. Eppley Caribbean Property Fund fell $4.50 to end at $38.40 with the swapping of 300 stocks, First Rock Real Estate lost 40 cents in ending at $12.05 after trading 5,075 shares, Guardian Holdings surged $64.96 to $569.99 after exchanging 352 stocks.Massy Holdings lost $2.70 in closing at $87, with 1,178 stock units crossing the exchange. Mayberry Investments climbed 65 cents to close at $9.99 in exchanging 99 stocks, Mayberry Jamaican Equities shed 22 cents in closing at $13.88 in trading 104,177 units, MPC Caribbean Clean Energy lost 50 cents in ending at $84.50 while exchanging 321 stock units. NCB Financial rose $1.50 to end at $95 in trading 236,805 shares, Palace Amusement dropped $30 to $760 with an exchange of 10 stocks, PanJam Investment shed 50 cents to end at $60 in switching ownership of 5,628 stock units, Seprod climbed $3.37 in closing at $71.44 in an exchange of 97,364 units and Stanley Motta popped 50 cents to $5.50 after trading 1,600 stocks.

At the close, Caribbean Producers popped 42 cents to $14.02 after trading 20,482 stocks. Eppley increased $1.28 to close at $39.93, with 75 stock units changing hands. Eppley Caribbean Property Fund fell $4.50 to end at $38.40 with the swapping of 300 stocks, First Rock Real Estate lost 40 cents in ending at $12.05 after trading 5,075 shares, Guardian Holdings surged $64.96 to $569.99 after exchanging 352 stocks.Massy Holdings lost $2.70 in closing at $87, with 1,178 stock units crossing the exchange. Mayberry Investments climbed 65 cents to close at $9.99 in exchanging 99 stocks, Mayberry Jamaican Equities shed 22 cents in closing at $13.88 in trading 104,177 units, MPC Caribbean Clean Energy lost 50 cents in ending at $84.50 while exchanging 321 stock units. NCB Financial rose $1.50 to end at $95 in trading 236,805 shares, Palace Amusement dropped $30 to $760 with an exchange of 10 stocks, PanJam Investment shed 50 cents to end at $60 in switching ownership of 5,628 stock units, Seprod climbed $3.37 in closing at $71.44 in an exchange of 97,364 units and Stanley Motta popped 50 cents to $5.50 after trading 1,600 stocks. In the preference segment, Eppley 7.50% preference share increased 87 cents to $7.47, with 201 shares crossing the market. Eppley 7.75% preference share declined $1 to end at $20 with one stock changing hands, JMMB Group 7.25% preference share rallied 28 cents to close at $3.27 in exchanging 90 stock units and Productive Business Solutions 9.75% preference share gained $29.05 to close at a 52 weeks’ high of $156.05, with 105 shares crossing the exchange.

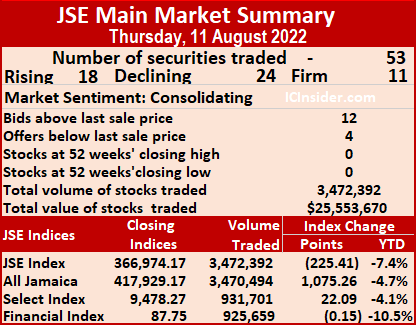

In the preference segment, Eppley 7.50% preference share increased 87 cents to $7.47, with 201 shares crossing the market. Eppley 7.75% preference share declined $1 to end at $20 with one stock changing hands, JMMB Group 7.25% preference share rallied 28 cents to close at $3.27 in exchanging 90 stock units and Productive Business Solutions 9.75% preference share gained $29.05 to close at a 52 weeks’ high of $156.05, with 105 shares crossing the exchange. Only 3,472,392 shares valued $25,553,670 were traded on Thursday versus 6,419,042 units at $56,245,124 on Wednesday. Trading averaged 65,517 units at $482,145 down from 112,615 shares at $986,757 Wednesday and month to date, an average of 180,275 units at $1,238,398, compared to 195,870 units at $1,341,170 on the previous trading day. July closed with an average of 173,643 units at $1,683,017.

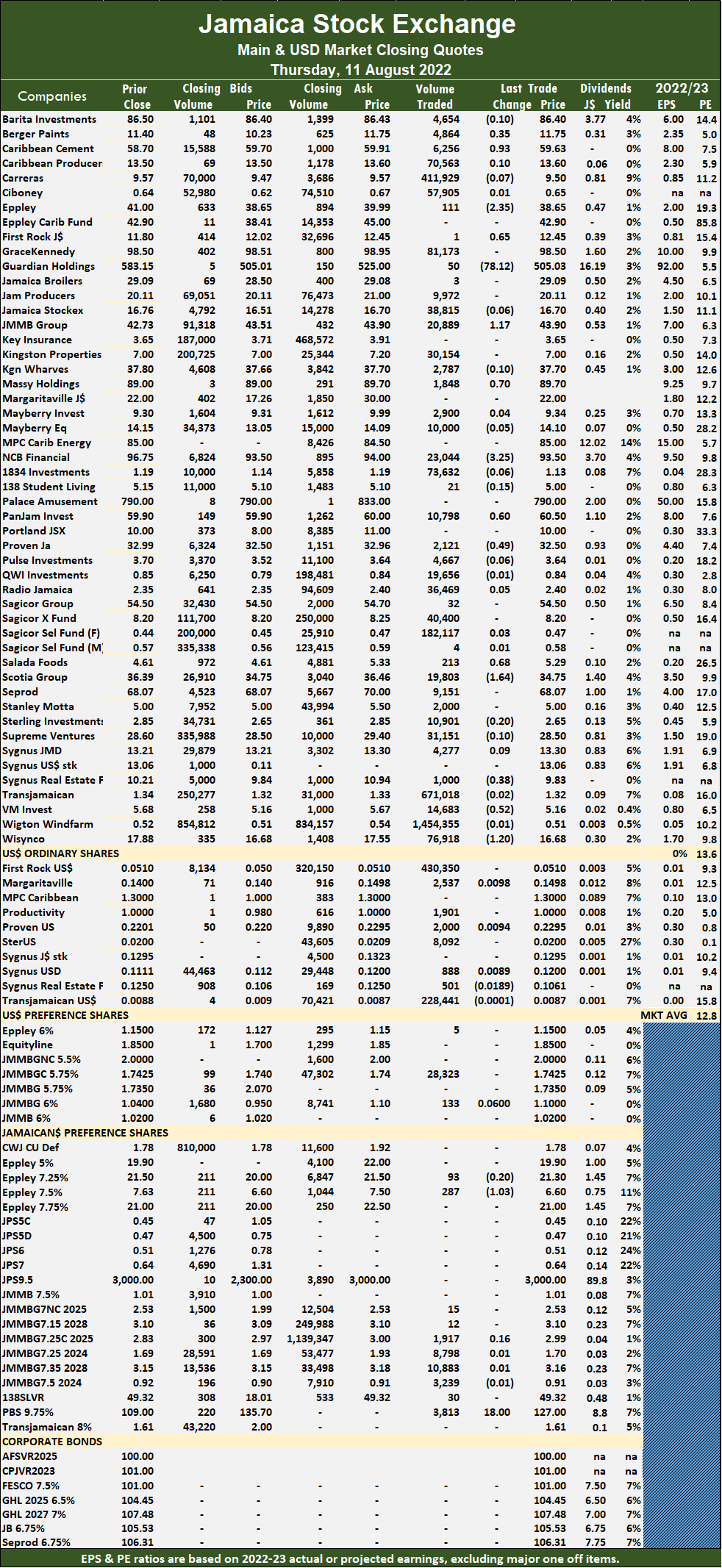

Only 3,472,392 shares valued $25,553,670 were traded on Thursday versus 6,419,042 units at $56,245,124 on Wednesday. Trading averaged 65,517 units at $482,145 down from 112,615 shares at $986,757 Wednesday and month to date, an average of 180,275 units at $1,238,398, compared to 195,870 units at $1,341,170 on the previous trading day. July closed with an average of 173,643 units at $1,683,017. At the close, Caribbean Cement climbed 93 cents to $59.63 after the price hit an intraday 52 weeks’ low of $55.12 in trading 6,256 shares, Eppley fell $2.35 in closing at $38.65 while exchanging 111 stock units, First Rock Real Estate rallied 65 cents to end at $12.45 in trading one share. Guardian Holdings declined $78.12 to close at $505.03 in trading 50 units, JMMB Group increased $1.17 to $43.90, with 20,889 shares crossing the exchange, Massy Holdings gained 70 cents to end at $89.70 in an exchange of 1,848 stocks. NCB Financial dropped $3.25 to end at $93.50 in trading 23,044 stock units, PanJam Investment advanced 60 cents to close at $60.50, with 10,798 units changing hands, Proven Investments shed 49 cents in closing at $32.50 with 2,121 units clearing the market. Salada Foods rose 68 cents to $5.29 after exchanging 213 stocks, Scotia Group lost $1.64 to close at $34.75, with 19,803 stock units crossing the market, Victoria Mutual Investments dropped 52 cents in closing at $5.16 after trading 14,683 shares and Wisynco Group lost $1.20 to end at $16.68 as investors transferred 76,918 stock units.

At the close, Caribbean Cement climbed 93 cents to $59.63 after the price hit an intraday 52 weeks’ low of $55.12 in trading 6,256 shares, Eppley fell $2.35 in closing at $38.65 while exchanging 111 stock units, First Rock Real Estate rallied 65 cents to end at $12.45 in trading one share. Guardian Holdings declined $78.12 to close at $505.03 in trading 50 units, JMMB Group increased $1.17 to $43.90, with 20,889 shares crossing the exchange, Massy Holdings gained 70 cents to end at $89.70 in an exchange of 1,848 stocks. NCB Financial dropped $3.25 to end at $93.50 in trading 23,044 stock units, PanJam Investment advanced 60 cents to close at $60.50, with 10,798 units changing hands, Proven Investments shed 49 cents in closing at $32.50 with 2,121 units clearing the market. Salada Foods rose 68 cents to $5.29 after exchanging 213 stocks, Scotia Group lost $1.64 to close at $34.75, with 19,803 stock units crossing the market, Victoria Mutual Investments dropped 52 cents in closing at $5.16 after trading 14,683 shares and Wisynco Group lost $1.20 to end at $16.68 as investors transferred 76,918 stock units. In the preference segment, Eppley 7.50% preference share fell $1.03 to end at $6.60 in switching ownership of 287 stocks and Productive Business Solutions 9.75% preference share popped $18, ending at a record closing high of $127, with 3,813 shares changing hands.

In the preference segment, Eppley 7.50% preference share fell $1.03 to end at $6.60 in switching ownership of 287 stocks and Productive Business Solutions 9.75% preference share popped $18, ending at a record closing high of $127, with 3,813 shares changing hands.