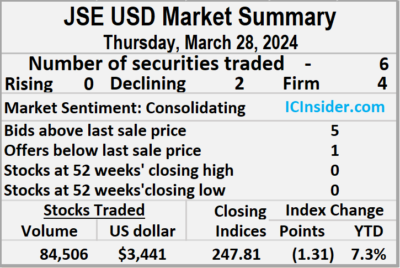

Trading on the Jamaica Stock Exchange US dollar market ended on Thursday, with the volume of stocks exchanged declining 72 percent after 91 percent fall in value than on Wednesday, resulting in trading in six securities, compared to nine on Wednesday with price of no stock rising, two declining and four ending unchanged.

The market closed with an exchange of 84,506 shares for US$3,441 compared to 303,812 units at US$36,667 on Wednesday.

The market closed with an exchange of 84,506 shares for US$3,441 compared to 303,812 units at US$36,667 on Wednesday.

Trading averaged 14,084 units at US$574 versus 33,757 shares at US$4,074 on Wednesday, with a month to date average of 49,394 shares at US$3,593 compared with 50,886 units at US$3,720 on the previous day and February that ended with an average of 46,765 units for US$6,084.

The US Denominated Equities Index skidded 1.31 points to close at 247.81.

The PE Ratio, a measure used in computing appropriate stock values, averages 9.7. The PE ratio is computed based on the last traded price divided by projected earnings done by ICInsider.com for companies with their financial year ending and or around August 2024.

Investor’s Choice bid-offer indicator shows five stocks ended with bids higher than their last selling prices and none with a lower offer.

At the close, AS Bryden shed 0.39 of one cent to 22.01 US cents while exchanging one share, First Rock Real Estate USD share ended at 4.99 US cents with traders dealing in 50 stocks, Margaritaville remained at 10 US cents, with 25 shares crossing the market. Proven Investments dropped 0.11 of a cent and ended at 14.88 US cents after trading 3,233 stocks and Transjamaican Highway remained at 2.2 US cents with investors dealing in 80,197 shares.

At the close, AS Bryden shed 0.39 of one cent to 22.01 US cents while exchanging one share, First Rock Real Estate USD share ended at 4.99 US cents with traders dealing in 50 stocks, Margaritaville remained at 10 US cents, with 25 shares crossing the market. Proven Investments dropped 0.11 of a cent and ended at 14.88 US cents after trading 3,233 stocks and Transjamaican Highway remained at 2.2 US cents with investors dealing in 80,197 shares.

In the preference segment, JMMB Group US8.5% preference share ended at US$1.18 with 1,000 units clearing the market.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Trading drops on JSE USD market

Trading surged on the JSE USD market

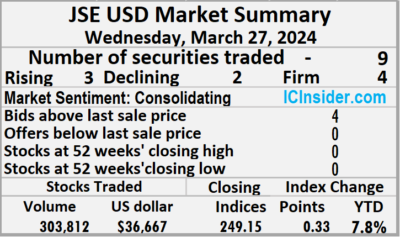

Trading surged on Wednesday with a 97 percent jump in the volume of stocks changing hands on the Jamaica Stock Exchange US dollar market following a 221 percent jump in the value of stocks changing hands compared to Tuesday, resulting from trading in nine securities, up from eight on Tuesday and ended with prices of three rising, two declining and four ending unchanged.

The market closed with an exchange of 303,812 shares for US$36,667 up from 154,383 units at US$11,426 on Tuesday.

The market closed with an exchange of 303,812 shares for US$36,667 up from 154,383 units at US$11,426 on Tuesday.

Trading averaged 33,757 units at US$4,074 versus 19,298 shares at US$1,428 on Tuesday, with a month to date average of 50,886 shares at US$3,720 compared with 52,045 units at US$3,696 on the previous day and February that ended with an average of 46,765 units for US$6,084.

The US Denominated Equities Index popped 0.33 points to settle at 249.15.

The PE Ratio, a measure used in computing appropriate stock values, averages 9.7. The PE ratio is computed based on the last traded price divided by projected earnings done by ICInsider.com for companies with their financial year ending and or around August 2024.

Investor’s Choice bid-offer indicator shows four stocks ended with bids higher than their last selling prices and none with a lower offer.

At the close, First Rock Real Estate USD share remained at 4.99 US cents while investors exchanged 3,813 stocks, Margaritaville dipped 0.99 of one cent to 10 US cents, with 22,170 units crossing the market, Proven Investments ended at 14.99 US cents after an exchange of 9,156 shares. Sterling Investments advanced 0.07 of a cent to close at 1.69 US cents with 58 stock units crossing the market, Sygnus Credit Investments lost 0.1 of a cent to end at 8.6 US cents in switching ownership of 11 shares, Sygnus Real Estate Finance USD share ended at 11 US cents, with 1,000 stocks changing hands and Transjamaican Highway rose 0.03 of a cent to 2.2 US cents and closed with an exchange of 245,862 units.

Sterling Investments advanced 0.07 of a cent to close at 1.69 US cents with 58 stock units crossing the market, Sygnus Credit Investments lost 0.1 of a cent to end at 8.6 US cents in switching ownership of 11 shares, Sygnus Real Estate Finance USD share ended at 11 US cents, with 1,000 stocks changing hands and Transjamaican Highway rose 0.03 of a cent to 2.2 US cents and closed with an exchange of 245,862 units.

In the preference segment, JMMB Group US8.5% preference share rallied 1 cent to end at US$1.18 with 19,754 stock units clearing the market and JMMB Group 5.75% remained at US$2.12 with investors dealing in 1,988 shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Falling stocks dominate the JSE USD Market

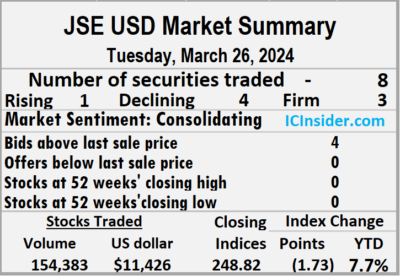

Trading on the Jamaica Stock Exchange US dollar market ended on Tuesday, with a 70 percent rise in the exchange the volume of stocks changing hands after a 39 percent drop in value compared with Monday, resulting from trading in eight securities, compared to six on Monday with prices of one rising, four declining and three ending unchanged.

The market closed with an exchange of 154,383 shares for US$11,426 compared to 90,769 units at US$18,681 on Monday.

The market closed with an exchange of 154,383 shares for US$11,426 compared to 90,769 units at US$18,681 on Monday.

Trading averaged 19,298 units at US$1,428 versus 15,128 shares at US$3,113 on Monday, with a month to date average of 52,045 shares at US$3,696 compared with 54,141 units at US$3,842 on the previous day and February that ended with an average of 46,765 units for US$6,084.

The US Denominated Equities Index sank 1.73 points to settle at 248.82.

The PE Ratio, a measure used in computing appropriate stock values, averages 9.7. The PE ratio is computed based on the last traded price divided by projected earnings done by ICInsider.com for companies with their financial year ending and or around August 2024.

Investor’s Choice bid-offer indicator shows four stocks ended with bids higher than their last selling prices and none with a lower offer.

At the close, First Rock Real Estate USD share ended at 4.99 US cents after investors cleared the market with 945 stock units, Margaritaville climbed 0.99 of one cent in closing at 10.99 US cents after an exchange of 990 shares,  Productive Business Solutions remained at US$1.70, with 58 units crossing the market. Proven Investments fell 1 cent and ended at 14.99 US cents with investors swapping 13,000 stocks, Sterling Investments sank 0.07 of a cent to close at 1.62 US cents, with 103,138 shares crossing the market, Sygnus Credit Investments remained at 8.7 US cents with investors dealing in 16 stock units and Transjamaican Highway dipped 0.02 of a cent to end at 2.17 US cents in an exchange of 33,026 stocks.

Productive Business Solutions remained at US$1.70, with 58 units crossing the market. Proven Investments fell 1 cent and ended at 14.99 US cents with investors swapping 13,000 stocks, Sterling Investments sank 0.07 of a cent to close at 1.62 US cents, with 103,138 shares crossing the market, Sygnus Credit Investments remained at 8.7 US cents with investors dealing in 16 stock units and Transjamaican Highway dipped 0.02 of a cent to end at 2.17 US cents in an exchange of 33,026 stocks.

In the preference segment, JMMB Group 5.75% lost 2.5 cents in closing at US$2.12 after trading 3,210 units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

No rising stock on the JSE USD Market

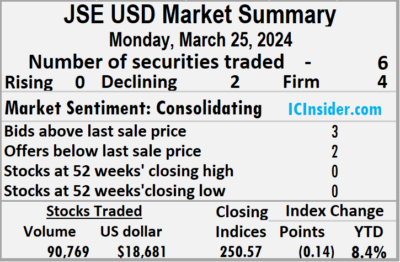

Trading on the Jamaica Stock Exchange US dollar market ended Monday, with the volume of stocks exchanged rising 9 percent after 625 percent more US dollars entered the market compared with Friday, resulting in trading in six securities, compared to eight on Friday with prices of none rising, two declining and four ending unchanged.

The market closed with an exchange of 90,769 shares for US$18,681 up from 83,304 units at US$2,577 on Friday.

The market closed with an exchange of 90,769 shares for US$18,681 up from 83,304 units at US$2,577 on Friday.

Trading averaged 15,128 units at US$3,113 versus 10,413 shares at US$322 on Friday, well below the month to date average of 54,141 shares at US$3,842 compared with 56,108 units at US$3,878 on the previous day and February that ended with an average of 46,765 units for US$6,084.

The US Denominated Equities Index lost 0.14 points to cease trading at 250.57.

The PE Ratio, a measure used in computing appropriate stock values, averages 9.7. The PE ratio is computed based on the last traded price divided by projected earnings done by ICInsider.com for companies with their financial year ending and or around August 2024.

Investor’s Choice bid-offer indicator shows three stocks ended with bids higher than their last selling prices and two with lower offers.

At the close, Margaritaville slipped 1 cent to end at 10 US cents with 70,084 stocks clearing the market, Productive Business Solutions ended at US$1.70 in switching just one unit, Proven Investments ended at 15.99 US cents after investors traded 1,918 shares. Sygnus Real Estate Finance USD share dipped 1.74 cents to close at 11 US cents after 7,038 units crossed the exchange and Transjamaican Highway remained at 2.19 US cents after a transfer of 2,728 shares.

At the close, Margaritaville slipped 1 cent to end at 10 US cents with 70,084 stocks clearing the market, Productive Business Solutions ended at US$1.70 in switching just one unit, Proven Investments ended at 15.99 US cents after investors traded 1,918 shares. Sygnus Real Estate Finance USD share dipped 1.74 cents to close at 11 US cents after 7,038 units crossed the exchange and Transjamaican Highway remained at 2.19 US cents after a transfer of 2,728 shares.

In the preference segment, JMMB Group US8.5% preference share ended at US$1.17 with investors swapping 9,000 stocks.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Winning stocks lead JSE USD Market higher

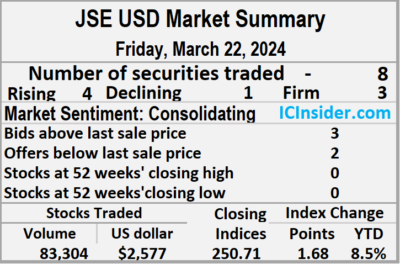

Trading on the Jamaica Stock Exchange US dollar market ended on Friday, with a 183 percent rise in the volume of stocks exchanged after a 50 percent drop in US dollars inflows compared with Thursday, resulting in trading in eight securities, up from four on Thursday with prices of four rising, one declining and three ending unchanged.

The market closed with an exchange of 83,304 shares for US$2,577 compared to 29,463 units at US$5,112 on Thursday.

The market closed with an exchange of 83,304 shares for US$2,577 compared to 29,463 units at US$5,112 on Thursday.

Trading averaged 10,413 units at US$322 versus 7,366 shares at US$1,278 on Thursday, with a month to date average of 56,108 shares at US$3,878 compared with 59,402 units at US$4,135 on the previous day and February with an average of 46,765 units for US$6,084.

The US Denominated Equities Index popped 1.68 points to end the day at 250.71.

The PE Ratio, a measure used in computing appropriate stock values, averages 9.8. The PE ratio is computed based on the last traded price divided by projected earnings done by ICInsider.com for companies with their financial year ending and or around August 2024.

Investor’s Choice bid-offer indicator shows three stocks ended with bids higher than their last selling prices and two with lower offers.

At the close, AS Bryden rallied 0.39 of a cent in closing at 22.4 US cents after trading of 1,400 shares, First Rock Real Estate USD share closed at 4.99 US cents after 7,200 stocks were traded, Margaritaville increased 0.99 of one cent to end at 11 US cents, with 452 shares crossing the exchange. Proven Investments remained at 15.99 US cents with investors swapping 321 stock units, Sterling Investments fell 0.01 of a cent and ended at 1.69 US cents with a transfer of 65 shares, Sygnus Credit Investments ended at 8.7 US cents with 3,327 stocks crossing the market and Transjamaican Highway climbed 0.03 of a cent in closing at 2.19 US cents in an exchange of 70,538 units.

At the close, AS Bryden rallied 0.39 of a cent in closing at 22.4 US cents after trading of 1,400 shares, First Rock Real Estate USD share closed at 4.99 US cents after 7,200 stocks were traded, Margaritaville increased 0.99 of one cent to end at 11 US cents, with 452 shares crossing the exchange. Proven Investments remained at 15.99 US cents with investors swapping 321 stock units, Sterling Investments fell 0.01 of a cent and ended at 1.69 US cents with a transfer of 65 shares, Sygnus Credit Investments ended at 8.7 US cents with 3,327 stocks crossing the market and Transjamaican Highway climbed 0.03 of a cent in closing at 2.19 US cents in an exchange of 70,538 units.

In the preference segment, Sygnus Credit Investments E8.5% rose 40 cents and ended at US$10.80 with traders dealing in one stock unit.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

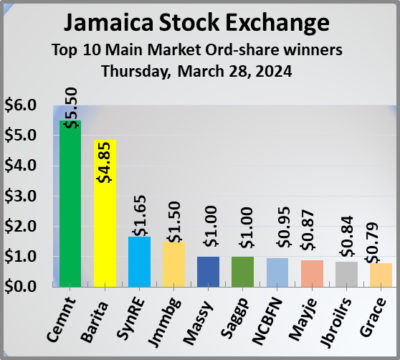

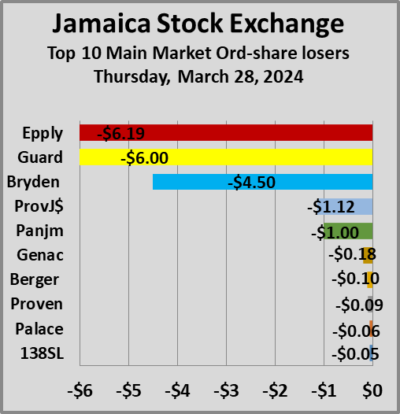

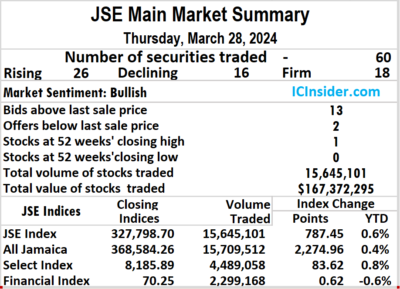

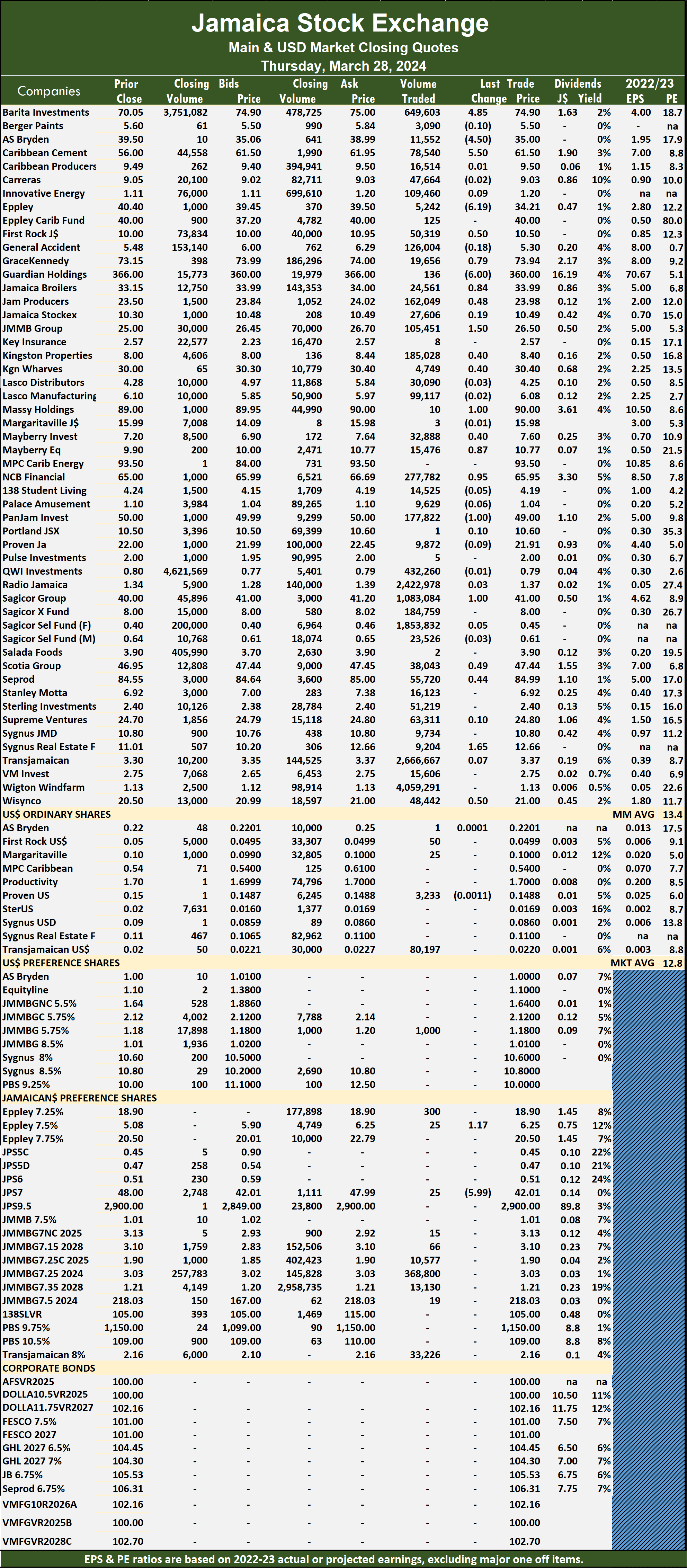

The market closed after 15,645,101 shares were traded for $167,372,295 compared with 8,091,866 units at $89,053,515, on Wednesday.

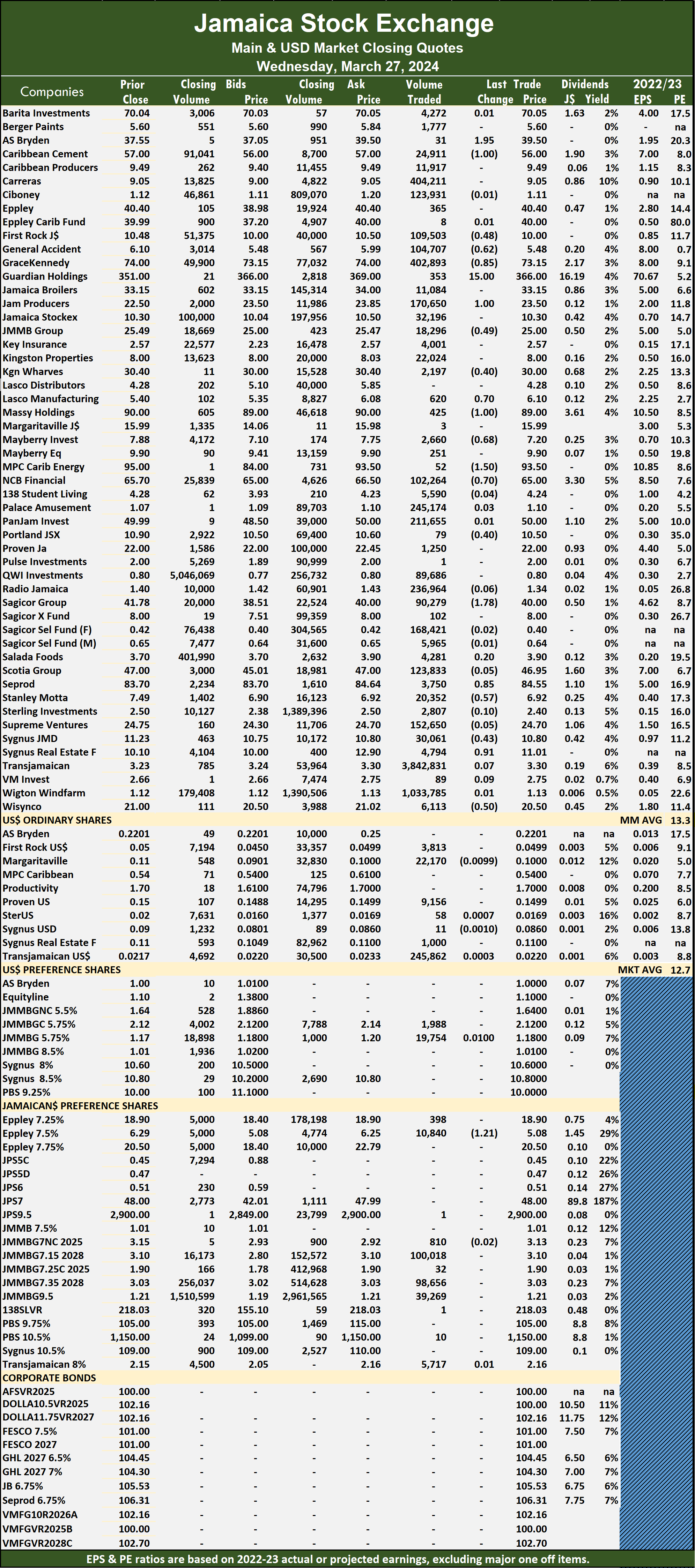

The market closed after 15,645,101 shares were traded for $167,372,295 compared with 8,091,866 units at $89,053,515, on Wednesday. The Main Market ended trading with an average PE Ratio of 13.4. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024.

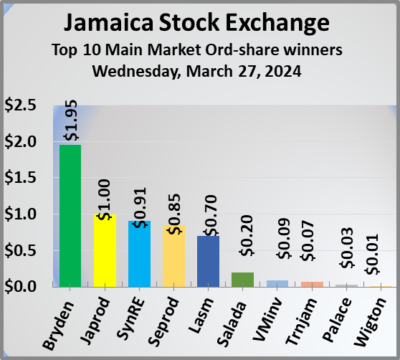

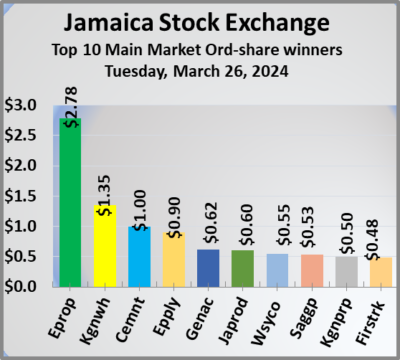

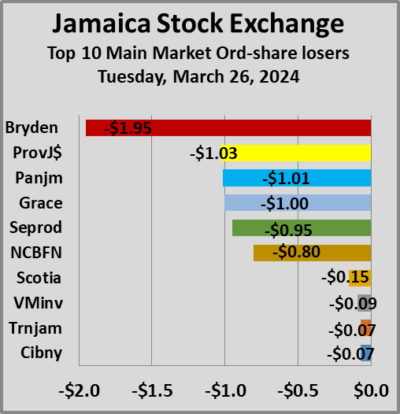

The Main Market ended trading with an average PE Ratio of 13.4. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024. JMMB Group gained $1.50 and ended at $26.50 with investors trading 105,451 shares, Kingston Properties popped 40 cents to $8.40 with 185,028 stock units clearing the market, Kingston Wharves advanced 40 cents and ended at $30.40 after an exchange of 4,749 units. Massy Holdings rose $1 in closing at $90 in trading 10 shares, Mayberry Group gained 40 cents to end at $7.60 after an exchange of 32,888 units, Mayberry Jamaican Equities climbed 87 cents to close at $10.77 after 15,476 stocks passed through the market. NCB Financial increased 95 cents to $65.95 in an exchange of 277,782 stock units, Pan Jamaica skidded $1 and ended at $49 with 177,822 shares crossing the market, Sagicor Group rallied $1 to end at $41 while exchanging 1,083,084 stock units. Scotia Group rose 49 cents in closing at a 52 weeks’ high of $47.44 with traders dealing in 38,043 stocks, Seprod climbed 44 cents to close at $84.99 in an exchange of 55,720 units,

JMMB Group gained $1.50 and ended at $26.50 with investors trading 105,451 shares, Kingston Properties popped 40 cents to $8.40 with 185,028 stock units clearing the market, Kingston Wharves advanced 40 cents and ended at $30.40 after an exchange of 4,749 units. Massy Holdings rose $1 in closing at $90 in trading 10 shares, Mayberry Group gained 40 cents to end at $7.60 after an exchange of 32,888 units, Mayberry Jamaican Equities climbed 87 cents to close at $10.77 after 15,476 stocks passed through the market. NCB Financial increased 95 cents to $65.95 in an exchange of 277,782 stock units, Pan Jamaica skidded $1 and ended at $49 with 177,822 shares crossing the market, Sagicor Group rallied $1 to end at $41 while exchanging 1,083,084 stock units. Scotia Group rose 49 cents in closing at a 52 weeks’ high of $47.44 with traders dealing in 38,043 stocks, Seprod climbed 44 cents to close at $84.99 in an exchange of 55,720 units,  Sygnus Real Estate Finance increased $1.65 to $12.66 with investors trading 9,204 shares and Wisynco Group popped 50 cents to end at $21, with 48,442 stock units crossing the market.

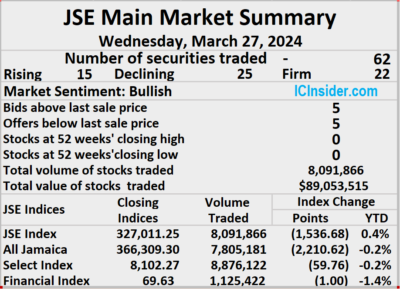

Sygnus Real Estate Finance increased $1.65 to $12.66 with investors trading 9,204 shares and Wisynco Group popped 50 cents to end at $21, with 48,442 stock units crossing the market. The market closed with 8,091,866 shares being traded for $89,053,515 compared with 13,924,449 units at $141,822,725 on Tuesday.

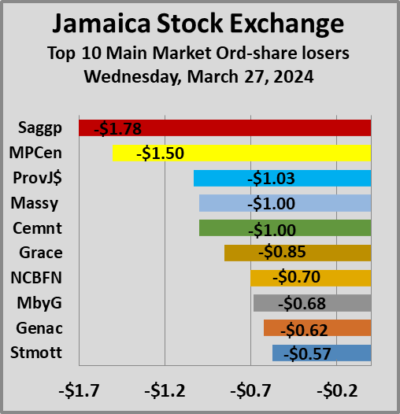

The market closed with 8,091,866 shares being traded for $89,053,515 compared with 13,924,449 units at $141,822,725 on Tuesday. The Main Market ended trading with an average PE Ratio of 13.3. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with financial year ending around August 2024.

The Main Market ended trading with an average PE Ratio of 13.3. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with financial year ending around August 2024. Lasco Manufacturing migrated to the Main market on Wednesday and rose 70 cents to end at $6.10 in an exchange of a mere 620 units, following an absence of meaningful offers to sell. Massy Holdings sank $1 in closing at $89, with 425 shares changing hands, Mayberry Group dropped 68 cents to $7.20 with an exchange of 2,660 stock units. MPC Caribbean Clean Energy sank $1.50 and ended at $93.50, with investors trading 52 shares, NCB Financial declined 70 cents to close at $65 with a transfer of 102,264 stocks, Portland JSX fell 40 cents to end at $10.50 after exchanging 79 units. Sagicor Group skidded $1.78 in closing at $40 with investors swapping 90,279 stock units, Seprod rallied 85 cents to $84.55 with 3,750 shares clearing the market, Stanley Motta lost 57 cents to close at $6.92 in switching ownership of 20,352 stock units. Sygnus Credit Investments shed 43 cents to end at $10.80, with 30,061 stocks crossing the market,

Lasco Manufacturing migrated to the Main market on Wednesday and rose 70 cents to end at $6.10 in an exchange of a mere 620 units, following an absence of meaningful offers to sell. Massy Holdings sank $1 in closing at $89, with 425 shares changing hands, Mayberry Group dropped 68 cents to $7.20 with an exchange of 2,660 stock units. MPC Caribbean Clean Energy sank $1.50 and ended at $93.50, with investors trading 52 shares, NCB Financial declined 70 cents to close at $65 with a transfer of 102,264 stocks, Portland JSX fell 40 cents to end at $10.50 after exchanging 79 units. Sagicor Group skidded $1.78 in closing at $40 with investors swapping 90,279 stock units, Seprod rallied 85 cents to $84.55 with 3,750 shares clearing the market, Stanley Motta lost 57 cents to close at $6.92 in switching ownership of 20,352 stock units. Sygnus Credit Investments shed 43 cents to end at $10.80, with 30,061 stocks crossing the market,  Sygnus Real Estate Finance increased 91 cents and ended at $11.01 in trading 4,794 units and Wisynco Group dropped 50 cents to $20.50 after a transfer of 6,113 stocks.

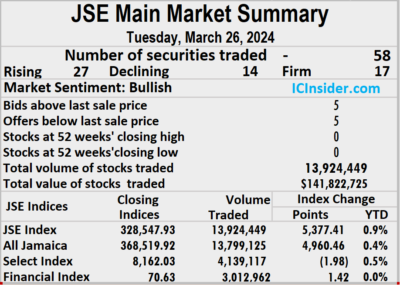

Sygnus Real Estate Finance increased 91 cents and ended at $11.01 in trading 4,794 units and Wisynco Group dropped 50 cents to $20.50 after a transfer of 6,113 stocks. The market closed on Tuesday with the trading of 13,924,449 shares with a value of $141,822,725 compared with 25,850,445 units at $206,255,781 on Monday.

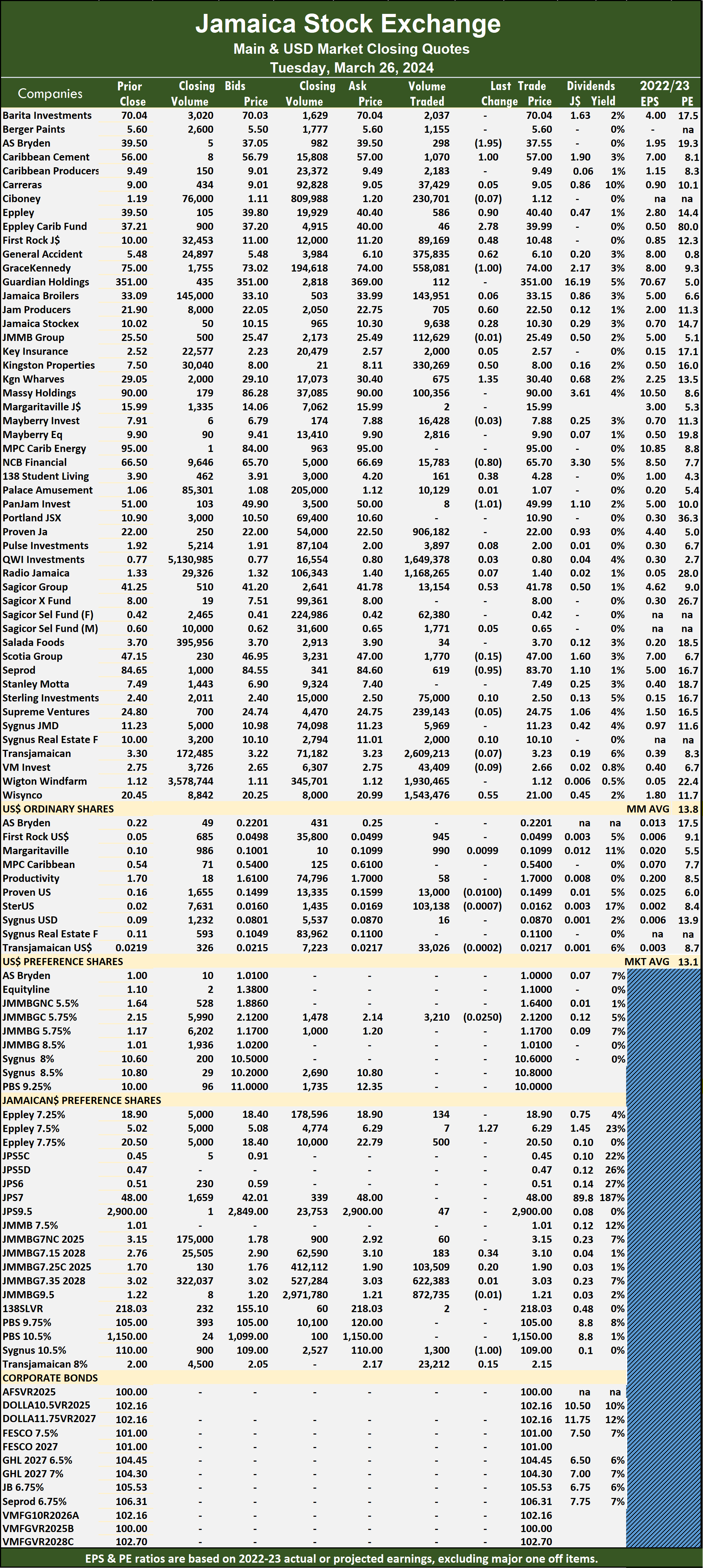

The market closed on Tuesday with the trading of 13,924,449 shares with a value of $141,822,725 compared with 25,850,445 units at $206,255,781 on Monday. The Main Market ended trading with an average PE Ratio of 13.8. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024.

The Main Market ended trading with an average PE Ratio of 13.8. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024. NCB Financial shed 80 cents to end at $65.70 after a transfer of 15,783 stocks, 138 Student Living gained 38 cents to end at $4.28 after 161 stock units passed through the market. Pan Jamaica declined $1.01 in closing at $49.99 while exchanging 8 shares, Sagicor Group popped 53 cents to close at $41.78 with investors trading 13,154 units, Seprod sank 95 cents and ended at $83.70 with an exchange of 619 stocks and Wisynco Group increased 55 cents to $21, with 1,543,476 stock units changing hands.

NCB Financial shed 80 cents to end at $65.70 after a transfer of 15,783 stocks, 138 Student Living gained 38 cents to end at $4.28 after 161 stock units passed through the market. Pan Jamaica declined $1.01 in closing at $49.99 while exchanging 8 shares, Sagicor Group popped 53 cents to close at $41.78 with investors trading 13,154 units, Seprod sank 95 cents and ended at $83.70 with an exchange of 619 stocks and Wisynco Group increased 55 cents to $21, with 1,543,476 stock units changing hands. Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

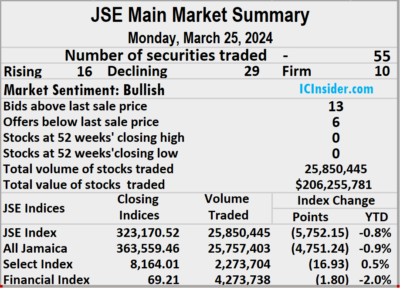

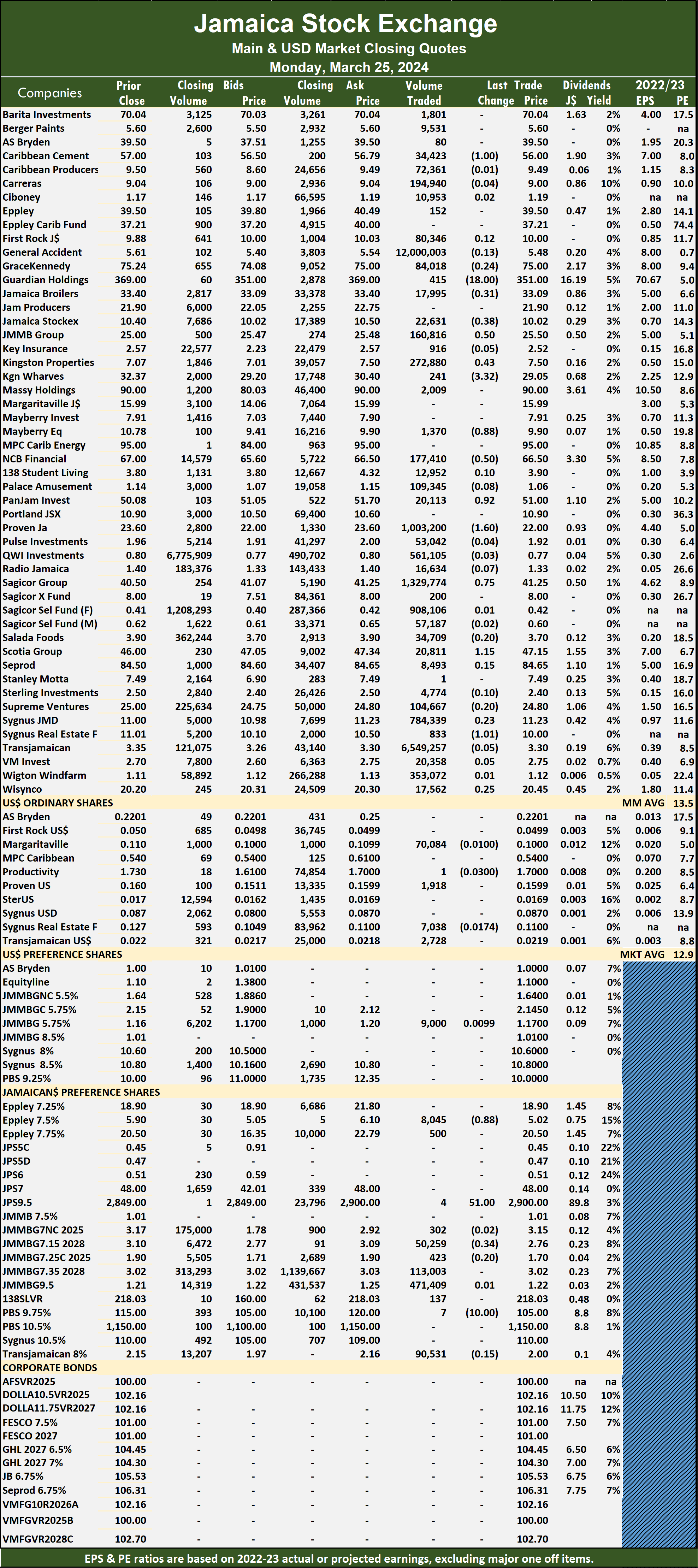

Prices of securities trading are those for the last transaction of each stock unless otherwise stated. The market closed on Monday with an exchange of 25,850,445 shares at $206,255,781 compared to 9,443,669 units at $30,041,719 on Friday.

The market closed on Monday with an exchange of 25,850,445 shares at $206,255,781 compared to 9,443,669 units at $30,041,719 on Friday. The Main Market ended trading with an average PE Ratio of 13.5. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024.

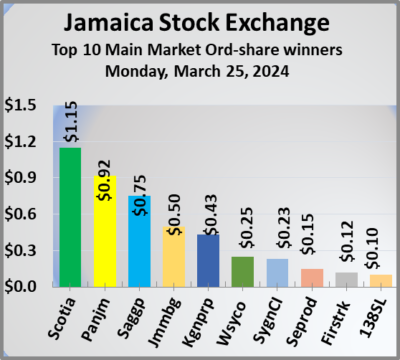

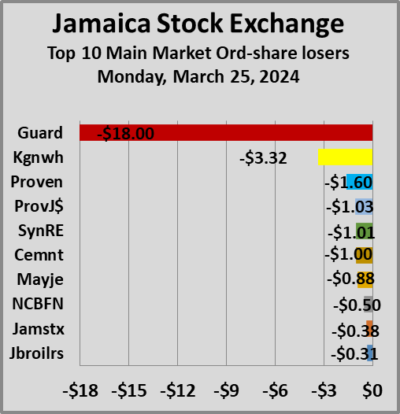

The Main Market ended trading with an average PE Ratio of 13.5. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024. Pan Jamaica rose 92 cents to end at $51 after an exchange of 20,113 stock units, Proven Investments dipped $1.60 to $22 with investors trading 1,003,200 stocks, Sagicor Group advanced 75 cents to end at $41.25 after an exchange of 1,329,774 units. Scotia Group gained $1.15 in closing at $47.15 with investors dealing in 20,811 shares and Sygnus Real Estate Finance fell $1.01 to close at $10 after a transfer of 833 units.

Pan Jamaica rose 92 cents to end at $51 after an exchange of 20,113 stock units, Proven Investments dipped $1.60 to $22 with investors trading 1,003,200 stocks, Sagicor Group advanced 75 cents to end at $41.25 after an exchange of 1,329,774 units. Scotia Group gained $1.15 in closing at $47.15 with investors dealing in 20,811 shares and Sygnus Real Estate Finance fell $1.01 to close at $10 after a transfer of 833 units. Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

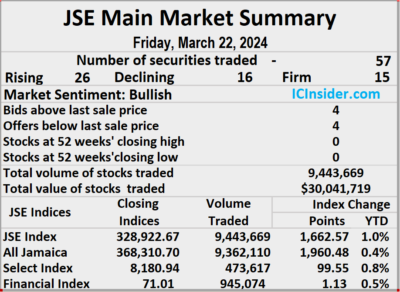

Prices of securities trading are those for the last transaction of each stock unless otherwise stated. The market closed with 9,443,669 shares trading for a mere $30,041,719 down sharply from 25,385,635 units at $76,122,713 on Thursday.

The market closed with 9,443,669 shares trading for a mere $30,041,719 down sharply from 25,385,635 units at $76,122,713 on Thursday. Main Index increased 1,662.57 points to finish at 328,922.67 and the JSE Financial Index advanced 1.13 points to settle at 71.01.

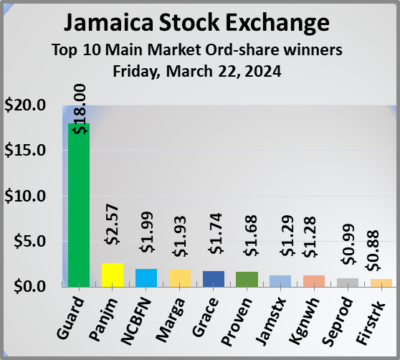

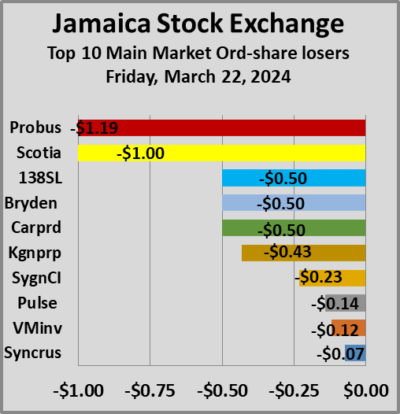

Main Index increased 1,662.57 points to finish at 328,922.67 and the JSE Financial Index advanced 1.13 points to settle at 71.01. Jamaica Stock Exchange climbed $1.29 in closing at $10.40 with a transfer of 3,774 stock units, Key Insurance rallied 36 cents to end at $2.57, with 94 shares crossing the market. Kingston Properties dipped 43 cents to close at $7.07 in trading 5,360 stock units, Kingston Wharves rose $1.28 to $32.37 and closed with an exchange of 78,002 units, Margaritaville advanced $1.93 in closing at $15.99 with investors transferring a mere two stocks. NCB Financial popped $1.99 to end at $67 after 1,539 shares passed through the market, 138 Student Living lost 50 cents to close at $3.80, with 161,336 stock units changing hands, Pan Jamaica increased $2.57 and ended at $50.08 as investors exchanged 756 units. Proven Investments climbed $1.68 to $23.60 after a transfer of 419 stocks, Scotia Group shed $1 to close at $46, with 4,002 shares crossing the exchange, Seprod rallied 99 cents and ended at $84.50 with investors dealing in 135 stock units and Stanley Motta gained 49 cents to end at $7.49 in an exchange of 16 units.

Jamaica Stock Exchange climbed $1.29 in closing at $10.40 with a transfer of 3,774 stock units, Key Insurance rallied 36 cents to end at $2.57, with 94 shares crossing the market. Kingston Properties dipped 43 cents to close at $7.07 in trading 5,360 stock units, Kingston Wharves rose $1.28 to $32.37 and closed with an exchange of 78,002 units, Margaritaville advanced $1.93 in closing at $15.99 with investors transferring a mere two stocks. NCB Financial popped $1.99 to end at $67 after 1,539 shares passed through the market, 138 Student Living lost 50 cents to close at $3.80, with 161,336 stock units changing hands, Pan Jamaica increased $2.57 and ended at $50.08 as investors exchanged 756 units. Proven Investments climbed $1.68 to $23.60 after a transfer of 419 stocks, Scotia Group shed $1 to close at $46, with 4,002 shares crossing the exchange, Seprod rallied 99 cents and ended at $84.50 with investors dealing in 135 stock units and Stanley Motta gained 49 cents to end at $7.49 in an exchange of 16 units. Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.