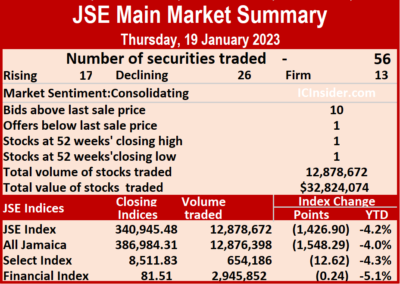

Stocks tumbled on the Jamaica Stock Exchange Main Market on Thursday with 56 securities trading up from 57 on Wednesday and leading to 17 rising, 26 declining and 13 ending unchanged as the volume of stocks traded rose 239 percent with the value increasing modestly over Wednesday.

A total of 12,878,672 shares were traded for $32,824,074 compared with 3,798,109 units at $31,876,506 on Wednesday.

A total of 12,878,672 shares were traded for $32,824,074 compared with 3,798,109 units at $31,876,506 on Wednesday.

Trading averaged 229,976 units at $586,144 compared to 66,633 shares at $559,237 on Wednesday and month to date, an average of 141,929 units at $1,382,448 compared with 134,731 units at $1,447,548 on the previous day. December closed with an average of 604,110 units at $4,072,598.

Wigton Windfarm led trading with 9.27 million shares for 72 percent of total volume followed by Pulse Investments with 1.11 million units for 8.6 percent of the day’s trade and Transjamaican Highway with 594,031 units for 4.6 percent market share.

The All Jamaican Composite Index shed 1,548.29 points to 386,984.31, the JSE Main Index dropped 1,426.90 points to 340,945.48 and the JSE Financial Index lost 0.24 points to end at 81.51.

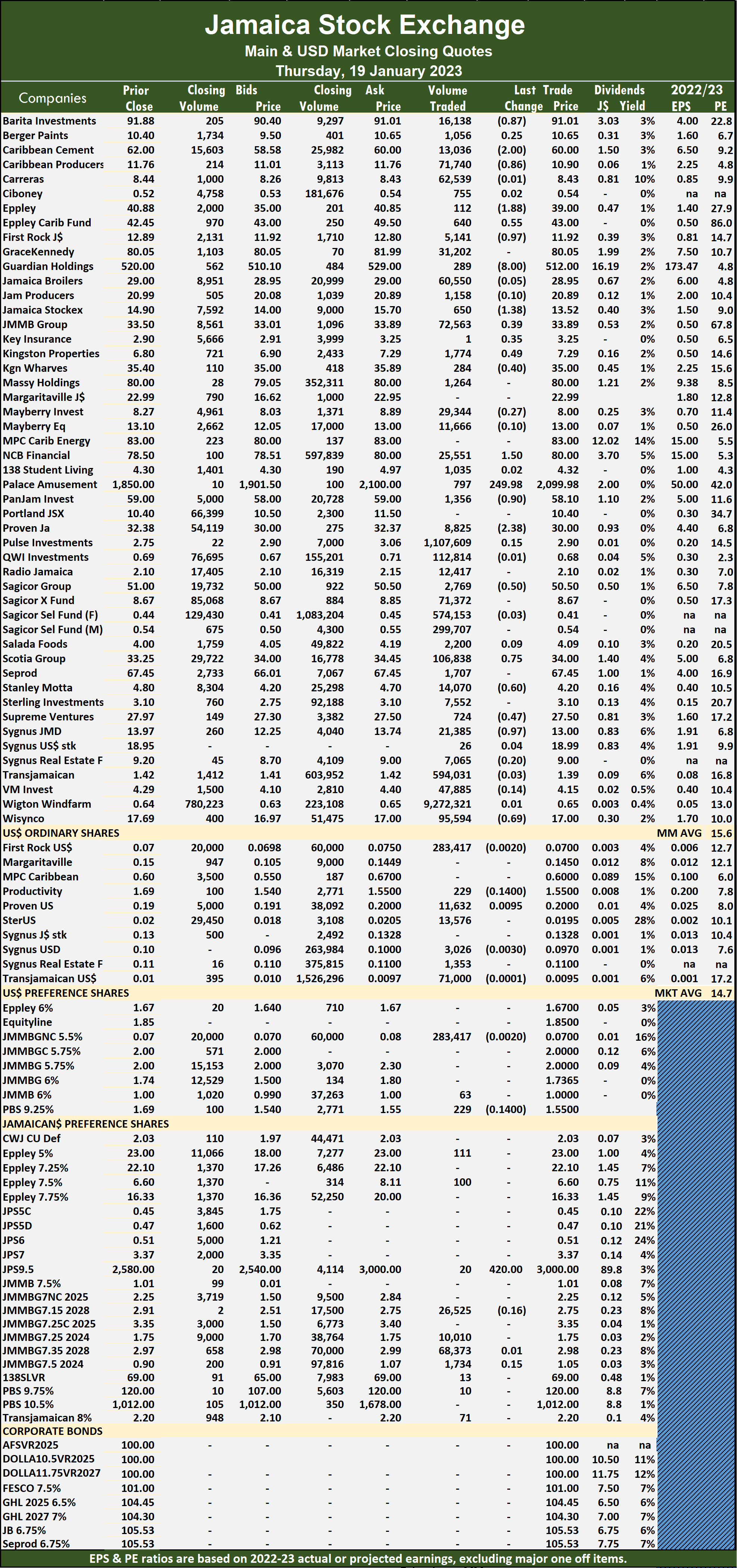

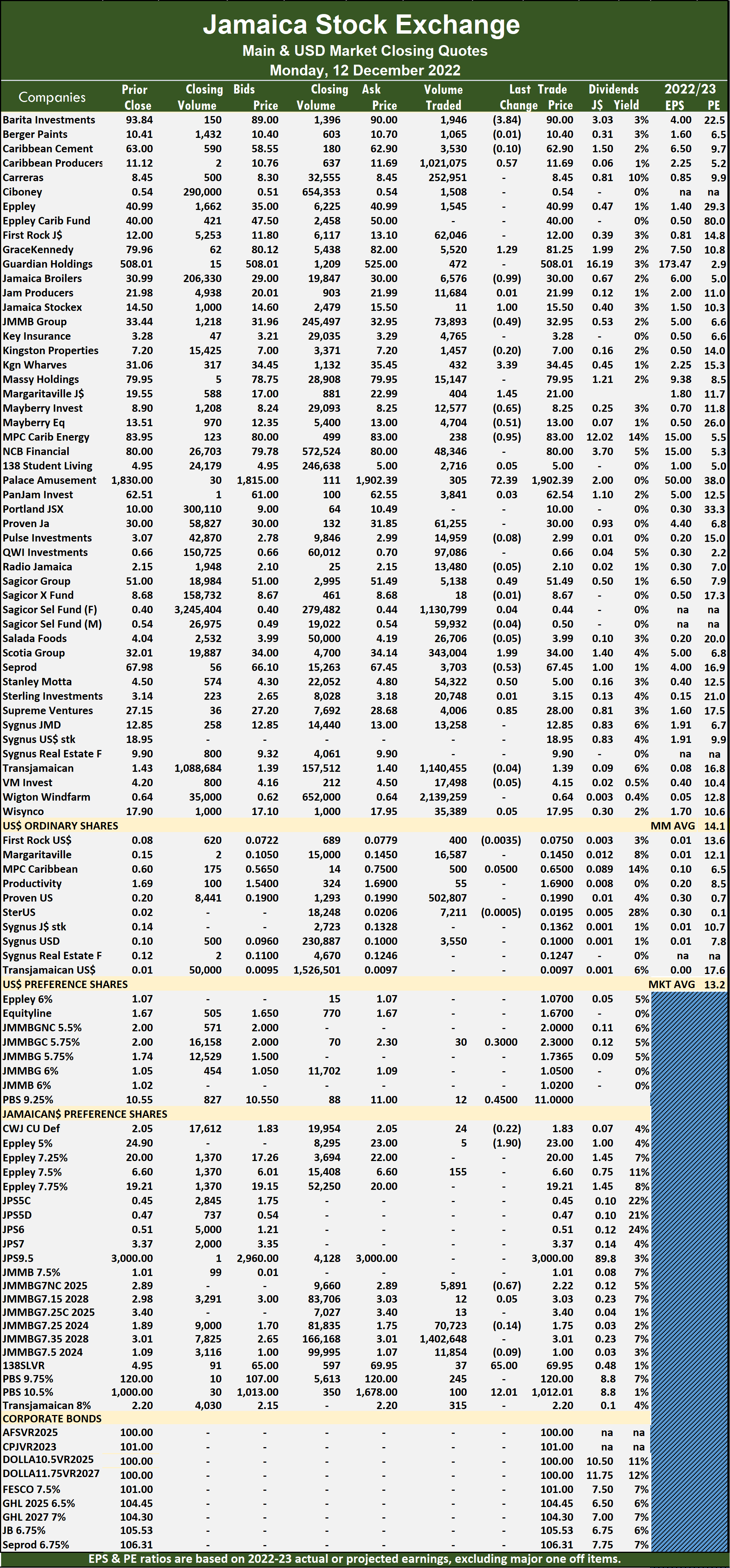

The PE Ratio, a formula to ascertain appropriate stock values, averages 15.6 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November 2022 and August 2023.

The PE Ratio, a formula to ascertain appropriate stock values, averages 15.6 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November 2022 and August 2023.

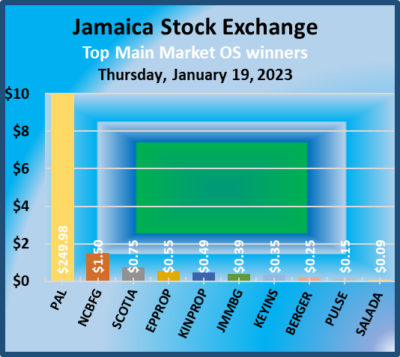

Investor’s Choice bid-offerindicator shows ten stocks ending with bids higher than their last selling prices and one with a lower offer.

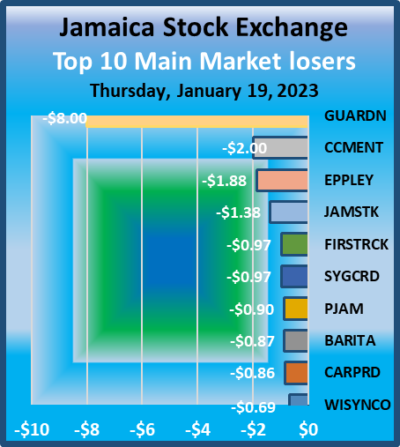

At the close, Barita Investments shed 87 cents to close at $91.01 with an exchange of 16,138 shares, Caribbean Cement declined by $2 in closing at $60 with the swapping of 13,036 stock units, Caribbean Producers dipped 86 cents to end at $10.90 trading 71,740 units. Eppley fell $1.88 to $39 after 112 stocks cleared the market,Eppley Caribbean Property Fund rose 55 cents to $43 in switching ownership of 640 stock units, First Rock Real Estate fell 97 cents to end at $11.92 after an exchange of 5,141 shares.  Guardian Holdings dropped $8 to close at $512 after a transfer of 289 units, Jamaica Stock Exchange declined $1.38 after ending at $13.52 after 650 stocks changed hands, Kingston Properties gained 49 cents to close at $7.29 after a transfer of 1,774 stock units. Kingston Wharves lost 40 cents in closing at $35 in trading 284 stocks, NCB Financial popped $1.50 to $80 in swapping 25,551 shares, Palace Amusement jumped $249.98 to a 52 weeks’ high of $2,099.98 in exchanging 797 units. PanJam Investment dipped 90 cents in closing at $58.10 with 1,356 units changing hands, Proven Investments declined $2.38 to $30 with investors transferring 8,825 stocks, Sagicor Group lost 50 cents to end at $50.50 after trading 2,769 stock units. Scotia Group gained 75 cents to close at $34 after an exchange of 106,838 shares, Stanley Motta shed 60 cents to finish at $4.20 as investors transferred 14,070 units, Supreme Ventures lost 47 cents in ending at $27.50 with an exchange of 724 shares.

Guardian Holdings dropped $8 to close at $512 after a transfer of 289 units, Jamaica Stock Exchange declined $1.38 after ending at $13.52 after 650 stocks changed hands, Kingston Properties gained 49 cents to close at $7.29 after a transfer of 1,774 stock units. Kingston Wharves lost 40 cents in closing at $35 in trading 284 stocks, NCB Financial popped $1.50 to $80 in swapping 25,551 shares, Palace Amusement jumped $249.98 to a 52 weeks’ high of $2,099.98 in exchanging 797 units. PanJam Investment dipped 90 cents in closing at $58.10 with 1,356 units changing hands, Proven Investments declined $2.38 to $30 with investors transferring 8,825 stocks, Sagicor Group lost 50 cents to end at $50.50 after trading 2,769 stock units. Scotia Group gained 75 cents to close at $34 after an exchange of 106,838 shares, Stanley Motta shed 60 cents to finish at $4.20 as investors transferred 14,070 units, Supreme Ventures lost 47 cents in ending at $27.50 with an exchange of 724 shares.  Sygnus Credit Investments declined 97 cents in closing at $13 trading 21,385 stock units and Wisynco Group shed 69 cents to end at $17 in clearing the market with 95,594 stocks.

Sygnus Credit Investments declined 97 cents in closing at $13 trading 21,385 stock units and Wisynco Group shed 69 cents to end at $17 in clearing the market with 95,594 stocks.

In the preference segment, Jamaica Public Service 9.5% advanced $420 to $3,000 with a transfer of 20 shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Big drop for JSE USD market

Prices fell on the Jamaica Stock Exchange US dollar market ended on Thursday and pulled the market index down sharply following a 12 percent decline in the volume of stocks changing hands as the value dropped 53 percent compared with Wednesday, resulting in eight securities trading, compared to five on Wednesday with one rising, four declining and three ending unchanged.

The JSE US Denominated Equities Index dropped 10.15 points to end at 219.13.

The JSE US Denominated Equities Index dropped 10.15 points to end at 219.13.

Overall, 384,296 shares were traded for US$23,978 down from 437,499 units at US$50,829 on Wednesday.

Trading averaged 48,037 shares at US$2,997 compared to 87,500 shares at US$10,166 on Wednesday, with a month to date average of 34,657 shares at US$3,207 compared with 33,608 units at US$3,224 on the previous day. December ended with an average of 39,679 units for US$1,494.

The PE Ratio, a measure used in computing appropriate stock values, averages 10.2. The PE ratio uses ICInsider.com earnings forecasts for companies with financial years ending between November and August 2023.

Investor’s Choice bid-offer indicator shows none ended with a bid higher than the last selling prices and one stock with a lower offer.

At the close, First Rock Real Estate USD share shed 0.2 of a cent to close at 7 US cents while exchanging 283,417 shares, Productive Business Solutions dipped 14 cents to end at US$1.55 with a transfer of 229 stock units,  Proven Investments popped 0.95 of one cent in closing at 20 US cents after a transfer of 11,632 stocks. Sterling Investments ended at 1.95 US cents with 13,576 units crossing the exchange, Sygnus Credit Investments USD share slipped 0.3 of a cent to 9.7 US cents after a transfer of 3,026 stocks, Sygnus Real Estate Finance USD share ended at 11 US cents after exchanging 1,353 units and Transjamaican Highway declined 0.01 of a cent in closing at 0.95 of one US cent in an exchange of 71,000 stock units.

Proven Investments popped 0.95 of one cent in closing at 20 US cents after a transfer of 11,632 stocks. Sterling Investments ended at 1.95 US cents with 13,576 units crossing the exchange, Sygnus Credit Investments USD share slipped 0.3 of a cent to 9.7 US cents after a transfer of 3,026 stocks, Sygnus Real Estate Finance USD share ended at 11 US cents after exchanging 1,353 units and Transjamaican Highway declined 0.01 of a cent in closing at 0.95 of one US cent in an exchange of 71,000 stock units.

In the preference segment, JMMB Group 6% remained at US$1 with the swapping of 63 shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Trading levels plunge of JSE USD market

Trading on the Jamaica Stock Exchange US dollar market declined sharply on Tuesday, with the volume of stocks changing hands falling 70 percent and the value 70 percent lower than on Monday, resulting from trading in nine securities, compared with five on Monday with one rising, four declining and four ending unchanged.

Just 48,759 shares were traded for US$9,034 down from 162,532 units at US$29,630 on Monday.

Just 48,759 shares were traded for US$9,034 down from 162,532 units at US$29,630 on Monday.

Trading averaged 5,418 units at US$1,004 versus 32,506 shares at US$5,926 on Monday, with a month to date average of 30,830 shares at US$2,866 compared to 33,429 units at US$3,056 on the previous day. December ended with an average of 39,679 units for US$1,494.

The JSE US Denominated Equities Index rose 0.19 points to end at 227.41.

The PE Ratio, a measure used in computing appropriate stock values, averages 9.4. The PE ratio uses ICInsider.com earnings forecasts for companies with financial years ending between November 2022 and August 2023.

Investor’s Choice bid-offer indicator shows one stock ended with a bid higher than the last selling prices and one stock with a lower offer.

At the close, First Rock Real Estate USD share fell 0.59 of a cent to close at 7.2 US cents in trading 38,000 shares, MPC Caribbean Clean Energy ended at 60 US cents with a transfer of 175 stock units, Productive Business Solutions remained at US$1.69 and finishing with eight units changing hands.  Sygnus Credit Investments J$ share ended at 13.28 US cents as 223 stocks passed through the market, Sygnus Credit Investments USD share ended at 10 US cents with 6,103 shares clearing the exchange, Sygnus Real Estate Finance USD share declined 1.4 cents to end at 11 US cents in trading 832 stocks and Transjamaican Highway gained 0.02 of a cent in closing at 0.97 US cents after trading 205 stock units.

Sygnus Credit Investments J$ share ended at 13.28 US cents as 223 stocks passed through the market, Sygnus Credit Investments USD share ended at 10 US cents with 6,103 shares clearing the exchange, Sygnus Real Estate Finance USD share declined 1.4 cents to end at 11 US cents in trading 832 stocks and Transjamaican Highway gained 0.02 of a cent in closing at 0.97 US cents after trading 205 stock units.

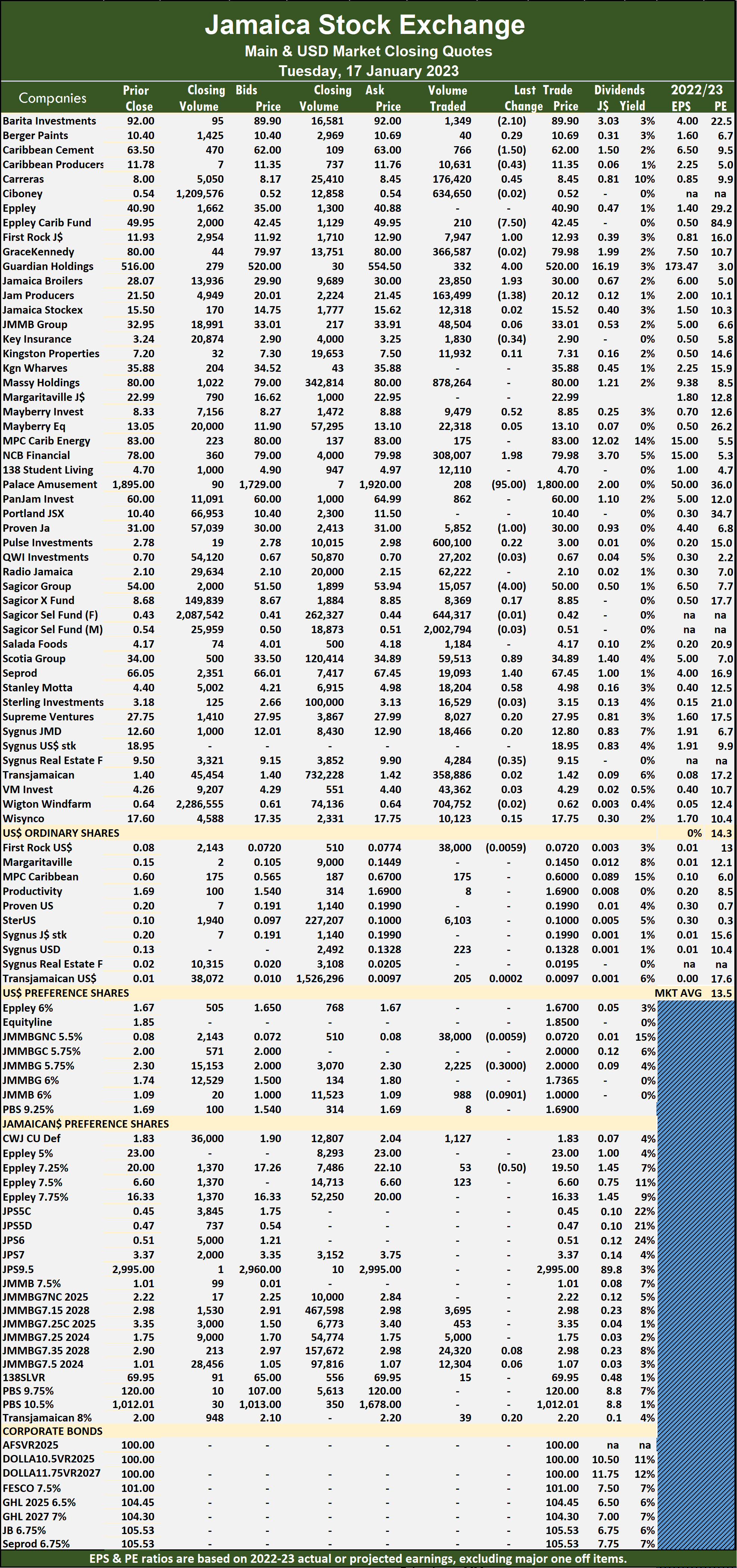

In the preference segment, JMMB Group 5.75% shed 30 cents to close at US$2, with 2,225 units changing hands and JMMB Group 6% lost 9.01 cents in ending at US$1 after 988 stock units crossed the exchange.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Trading volume climbs on the JSE USD market

Trading activity was fairly steady on the Jamaica Stock Exchange US dollar market on Monday, with the volume of stocks changing hands rising 271 percent and valued 347 percent more than on Friday, resulting in trading in five securities, compared to 10 on Friday with three rising, one declining and one ending unchanged.

A total of 162,532 shares were exchanged for US$29,630 versus 43,767 units at US$6,623 on Friday.

A total of 162,532 shares were exchanged for US$29,630 versus 43,767 units at US$6,623 on Friday.

Trading averaged 32,506 units at US$5,926 versus 4,377 shares at US$662 on Friday, with month to date average of 33,429 shares at US$3,056 compared with 33,484 units at US$2,883 on the previous trading day. December ended with an average of 39,679 units for US$1,494.

The JSE US Denominated Equities Index slipped 0.10 points to end at 227.22.

The PE Ratio, a measure used in computing appropriate stock values, averages 8.5. The PE ratio uses ICInsider.com earnings forecasts for companies with financial years ending between November 2022 and August 2023.

Investor’s Choice bid-offer indicator shows no stock ending with a bid higher than the last selling price and none with a lower offer.

At the close, First Rock Real Estate USD share popped 0.29 of a cent to end at 7.79 US cents after  34 shares were traded, Proven Investments increased 0.9 of one cent ending at 19.9 US cents as investors exchanged 153,626 stocks, Sterling Investments ended at 1.95 US cents after exchanging 8,685 stock units and Sygnus Credit Investments J$ share declined 0.34 of one cent in closing at 13.28 US cents with a mere eight units changing hands.

34 shares were traded, Proven Investments increased 0.9 of one cent ending at 19.9 US cents as investors exchanged 153,626 stocks, Sterling Investments ended at 1.95 US cents after exchanging 8,685 stock units and Sygnus Credit Investments J$ share declined 0.34 of one cent in closing at 13.28 US cents with a mere eight units changing hands.

In the preference segment, JMMB Group 6% climbed 4.01 cents to close at US$1.0901 as 179 stock units passed through the market.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

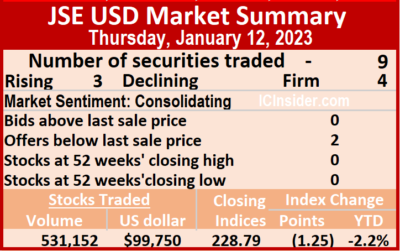

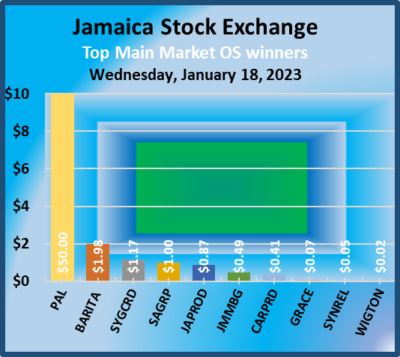

Jump in trading on JSE USD Market Thursday

Trading on the Jamaica Stock Exchange US dollar market climbed above with a 481 percent jump in the volume after 531,152 shares were traded, with a 924 percent greater value on Wednesday of US$99,750 changing hands compared to 91,439 units at US$9,740 on Wednesday.

The average trade for Thursday amounts to 59,017 shares at US$11,083, up from 10,160 units at US$1,082 on Wednesday. The month to date average amounts to 37,472 shares at US$3,188 up from the 34,442 units at US$2,077 on the previous day December ended with an average of 39,679 units for US$1,494.

The average trade for Thursday amounts to 59,017 shares at US$11,083, up from 10,160 units at US$1,082 on Wednesday. The month to date average amounts to 37,472 shares at US$3,188 up from the 34,442 units at US$2,077 on the previous day December ended with an average of 39,679 units for US$1,494.

While the volume of stocks traded rose, the number of securities that were exchanged remained at nine which is similar to that on Wednesday, with the market ending with prices of three rising, two declining and four ending unchanged.

The JSE US Denominated Equities Index slipped 1.25 points to end at 228.79.

The PE Ratio, a measure used in computing appropriate stock values, averages 8.6. The PE ratio uses ICInsider.com earnings forecasts for companies with financial years ending between November 2022 and August 2023.

Investor’s Choice bid-offer indicator shows no stock ended with a bid higher than the last selling price and two with lower offers.

At the close, First Rock Real Estate USD share lost 0.35 of a cent to close at 7.5 US cents after an exchange of 400 shares, Margaritaville remained at 14.5 US cents in trading 16,587 units, MPC Caribbean Clean Energy increased 5 cents to 65 US cents with investors swapping 500 stocks.  Productive Business Solutions ended at US$1.69 with a transfer of 55 stock units, Proven Investments remained at 19.9 US cents, with 502,807 units crossing the exchange, Sterling Investments dipped 0.05 of a cent in closing at 1.95 US cents after a transfer of 7,211 shares and Sygnus Credit Investments USD share ended at 10 US cents, with 3,550 stock units changing hands.

Productive Business Solutions ended at US$1.69 with a transfer of 55 stock units, Proven Investments remained at 19.9 US cents, with 502,807 units crossing the exchange, Sterling Investments dipped 0.05 of a cent in closing at 1.95 US cents after a transfer of 7,211 shares and Sygnus Credit Investments USD share ended at 10 US cents, with 3,550 stock units changing hands.

In the preference segment, Productive Business 9.25% preference share rallied 45 cents to end at US$11 in exchanging 12 stocks and JMMB Group 5.75% climbed 30 cents to US$2.30 while exchanging 30 stocks.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

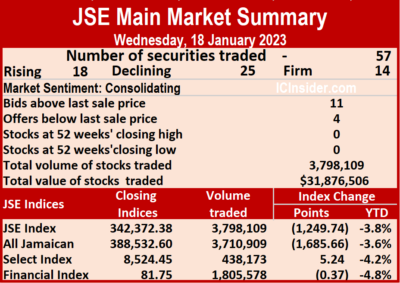

A total of 3,798,109 shares were traded for $31,876,506,down from 7,367,753 units at $142,989,772 on Tuesday.

A total of 3,798,109 shares were traded for $31,876,506,down from 7,367,753 units at $142,989,772 on Tuesday. The PE Ratio, a formula to ascertain appropriate stock values, averages 14 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November 2022 and August 2023.

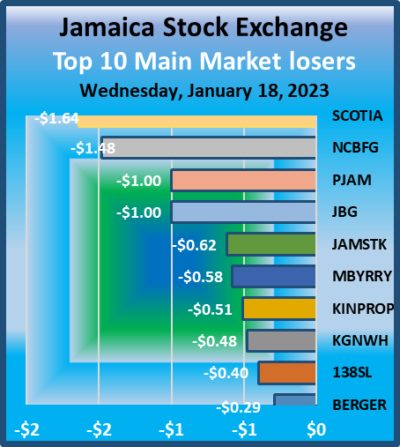

The PE Ratio, a formula to ascertain appropriate stock values, averages 14 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November 2022 and August 2023. Kingston Properties dipped 51 cents to $6.80 with 21,200 shares changing hands, Kingston Wharves shed 48 cents to end at $35.40 in swapping 159 stock units, Mayberry Investments lost 58 cents after finishing at $8.27 in an exchange of 9,044 units. NCB Financial declined $1.48 to $78.50, trading 30,418 stock units, 138 Student Living dropped 67 cents to $4.30 with a transfer of 15,687 shares, Palace Amusement popped $50 to close at $1,850 after 232 stocks cleared the market. PanJam Investment dipped $1, ending at $59 as investors switched ownership of 15,557 stock units, Proven Investments advanced $2.38 to close at $32.38 with 3,616 units changing hands, Sagicor Group rose $1 in closing at $51, trading 61,922 shares. Scotia Group declined $1.64 to $33.25 after exchanging 815 stocks and Sygnus Credit Investments rallied $1.17 after ending at $13.97 in transferring 47,726 stock units.

Kingston Properties dipped 51 cents to $6.80 with 21,200 shares changing hands, Kingston Wharves shed 48 cents to end at $35.40 in swapping 159 stock units, Mayberry Investments lost 58 cents after finishing at $8.27 in an exchange of 9,044 units. NCB Financial declined $1.48 to $78.50, trading 30,418 stock units, 138 Student Living dropped 67 cents to $4.30 with a transfer of 15,687 shares, Palace Amusement popped $50 to close at $1,850 after 232 stocks cleared the market. PanJam Investment dipped $1, ending at $59 as investors switched ownership of 15,557 stock units, Proven Investments advanced $2.38 to close at $32.38 with 3,616 units changing hands, Sagicor Group rose $1 in closing at $51, trading 61,922 shares. Scotia Group declined $1.64 to $33.25 after exchanging 815 stocks and Sygnus Credit Investments rallied $1.17 after ending at $13.97 in transferring 47,726 stock units.

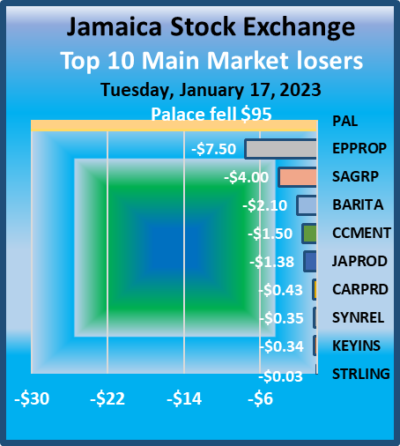

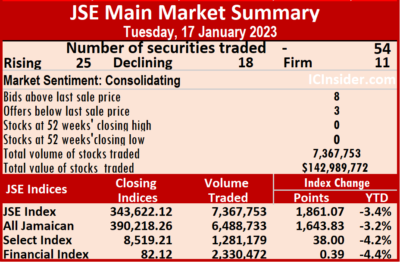

A total of 7,367,753 shares were traded for $142,989,772 up from 5,922,099 units at $55,983,304 on Monday.

A total of 7,367,753 shares were traded for $142,989,772 up from 5,922,099 units at $55,983,304 on Monday. Main Index advanced 1,861.07 points to 343,622.12 and the JSE Financial Index rose 0.39 points to close at 82.12.

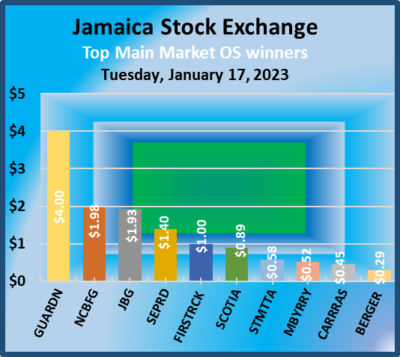

Main Index advanced 1,861.07 points to 343,622.12 and the JSE Financial Index rose 0.39 points to close at 82.12. First Rock Real Estate gained $1 to end at $12.93 after investors swapped 7,947 stocks. Guardian Holdings rose $4 to $520 with 332 units changing hands, Jamaica Broilers advanced $1.93 to $30 in trading 23,850 stock units, Jamaica Producers fell $1.38 to $20.12 after 163,499 stock units cleared the market. Mayberry Investments rallied 52 cents to end at $8.85 with a transfer of 9,479 stocks, NCB Financial climbed $1.98 to $79.98 trading 308,007 shares, Palace Amusement dropped $95 to close at $1,800 after 208 units were exchanged. Proven Investments shed $1 ending at $30 with investors swapping 5,852 stock units, Sagicor Group declined $4 to close at $50 in exchanging 15,057 stocks, Scotia Group popped 89 cents to $34.89 in switching ownership of 59,513 units. Seprod gained $1.40 in ending at $67.45 with 19,093 shares changing hands and Stanley Motta popped 58 cents in closing at $4.98 trading 18,204 units.

First Rock Real Estate gained $1 to end at $12.93 after investors swapped 7,947 stocks. Guardian Holdings rose $4 to $520 with 332 units changing hands, Jamaica Broilers advanced $1.93 to $30 in trading 23,850 stock units, Jamaica Producers fell $1.38 to $20.12 after 163,499 stock units cleared the market. Mayberry Investments rallied 52 cents to end at $8.85 with a transfer of 9,479 stocks, NCB Financial climbed $1.98 to $79.98 trading 308,007 shares, Palace Amusement dropped $95 to close at $1,800 after 208 units were exchanged. Proven Investments shed $1 ending at $30 with investors swapping 5,852 stock units, Sagicor Group declined $4 to close at $50 in exchanging 15,057 stocks, Scotia Group popped 89 cents to $34.89 in switching ownership of 59,513 units. Seprod gained $1.40 in ending at $67.45 with 19,093 shares changing hands and Stanley Motta popped 58 cents in closing at $4.98 trading 18,204 units.

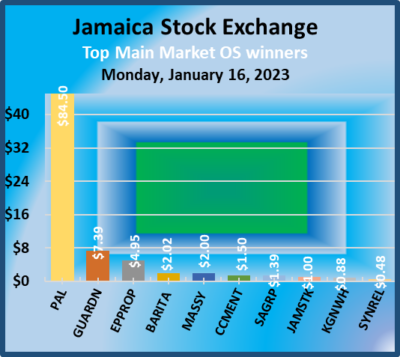

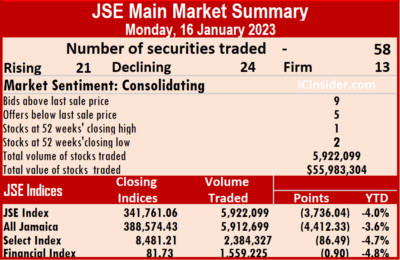

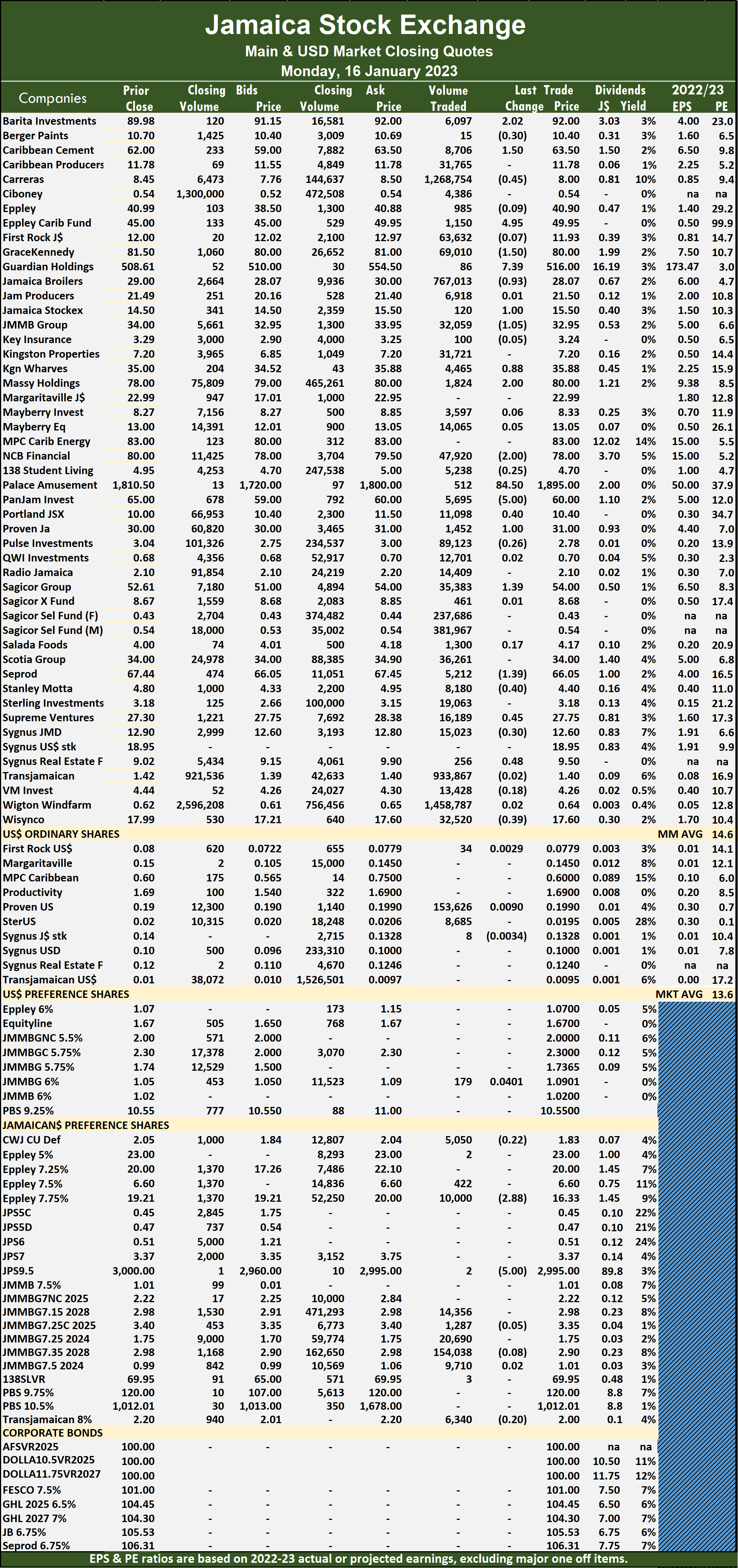

A mere 5,922,099 shares were traded for $55,983,304 versus 5,510,092 units at $150,228,385 on Friday.

A mere 5,922,099 shares were traded for $55,983,304 versus 5,510,092 units at $150,228,385 on Friday. The PE Ratio, a formula to ascertain appropriate stock values, averages 14.6 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November 2022 and August 2023.

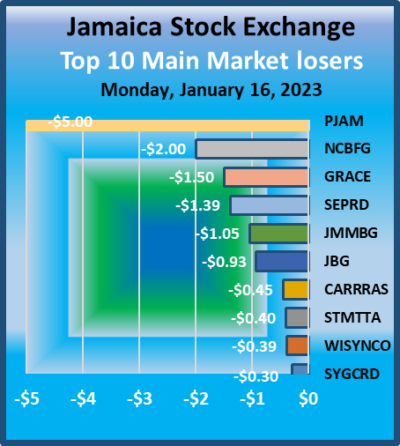

The PE Ratio, a formula to ascertain appropriate stock values, averages 14.6 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November 2022 and August 2023. Jamaica Stock Exchange popped $1 to $15.50 in trading 120 units, JMMB Group fell $1.05 to end at $32.95 after exchanging 32,059 units. Kingston Wharves rose 88 cents to close at $35.88 with the swapping of 4,465 stock units, Massy Holdings advanced $2 to $80 with a transfer of 1,824 shares, NCB Financial declined $2 in closing at a 52 weeks’ low of $78 after trading 47,920 stocks after the price hit a 52 weeks’ high of $2,004. Palace Amusement climbed $84.50 to $1,895 as investors switched ownership of 512 shares, PanJam Investment declined $5 in ending at $60 after 5,695 stock units passed through the market, Portland JSX gained 40 cents to close at $10.40 with investors transferring 11,098 units. Proven Investments popped $1 in closing at $31 in exchanging 1,452 stocks, Sagicor Group rallied $1.39 to finish at $54 with 35,383 stocks changing hands, Seprod dipped $1.39 to $66.05 trading 5,212 stock units. Stanley Motta lost 40 cents to end at $4.40 after a transfer of 8,180 units, Supreme Ventures popped 45 cents to close at $27.75 after an exchange of 16,189 shares and Sygnus Real Estate Finance gained 48 cents to end at $9.50 in switching ownership of 256 stocks.

Jamaica Stock Exchange popped $1 to $15.50 in trading 120 units, JMMB Group fell $1.05 to end at $32.95 after exchanging 32,059 units. Kingston Wharves rose 88 cents to close at $35.88 with the swapping of 4,465 stock units, Massy Holdings advanced $2 to $80 with a transfer of 1,824 shares, NCB Financial declined $2 in closing at a 52 weeks’ low of $78 after trading 47,920 stocks after the price hit a 52 weeks’ high of $2,004. Palace Amusement climbed $84.50 to $1,895 as investors switched ownership of 512 shares, PanJam Investment declined $5 in ending at $60 after 5,695 stock units passed through the market, Portland JSX gained 40 cents to close at $10.40 with investors transferring 11,098 units. Proven Investments popped $1 in closing at $31 in exchanging 1,452 stocks, Sagicor Group rallied $1.39 to finish at $54 with 35,383 stocks changing hands, Seprod dipped $1.39 to $66.05 trading 5,212 stock units. Stanley Motta lost 40 cents to end at $4.40 after a transfer of 8,180 units, Supreme Ventures popped 45 cents to close at $27.75 after an exchange of 16,189 shares and Sygnus Real Estate Finance gained 48 cents to end at $9.50 in switching ownership of 256 stocks. In the preference segment, Eppley 7.75% preference share fell $2.88 to a 52 weeks’ low of $16.33 with an exchange of 10,000 shares and Jamaica Public Service 9.5% declined $5 in closing at $2,995 as investors transferred two stock units.

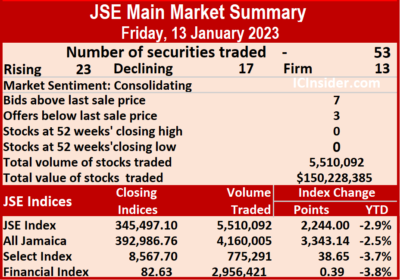

In the preference segment, Eppley 7.75% preference share fell $2.88 to a 52 weeks’ low of $16.33 with an exchange of 10,000 shares and Jamaica Public Service 9.5% declined $5 in closing at $2,995 as investors transferred two stock units. Trading ended with 5,510,092 shares at $150,228,385 versus 8,211,791 units at $46,473,139 on Thursday.

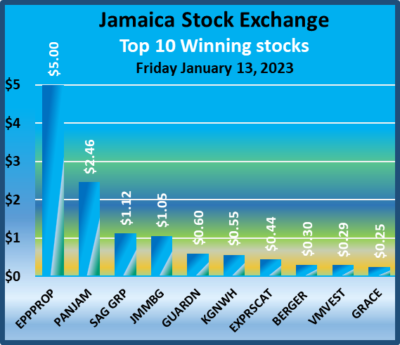

Trading ended with 5,510,092 shares at $150,228,385 versus 8,211,791 units at $46,473,139 on Thursday. rallied 2,244.00 points to 345,497.10 and the JSE Financial Index rose 0.39 points to 82.63.

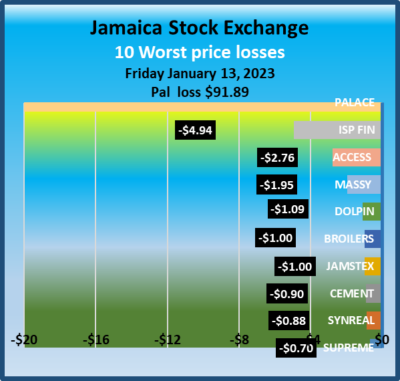

rallied 2,244.00 points to 345,497.10 and the JSE Financial Index rose 0.39 points to 82.63. Jamaica Broilers shed $1 to close at $29 in exchanging 231,447 stock units, Jamaica Producers lost 50 cents to end at $21.49 with a transfer of 438,161 shares, Jamaica Stock Exchange fell $1 to end at $14.50 in trading 3,001 stock units. JMMB Group advanced $1.05 to finish at $34 with an exchange of 278,837 units, Kingston Wharves gained 55 cents in ending at $3,5, trading 2,171 stocks, Margaritaville popped $1.99 to close at $22.99 with the swapping of 10 shares. Massy Holdings dipped $1.95 to $78 with investors exchanging 1,345,487 stocks, Palace Amusement dropped $91.89 to close at $1,810.50 after the price hit an intraday 52 weeks’ high of $2,000 with 648 shares changing hands, PanJam Investment advanced $2.46 to $65 in trading 693 stock units.

Jamaica Broilers shed $1 to close at $29 in exchanging 231,447 stock units, Jamaica Producers lost 50 cents to end at $21.49 with a transfer of 438,161 shares, Jamaica Stock Exchange fell $1 to end at $14.50 in trading 3,001 stock units. JMMB Group advanced $1.05 to finish at $34 with an exchange of 278,837 units, Kingston Wharves gained 55 cents in ending at $3,5, trading 2,171 stocks, Margaritaville popped $1.99 to close at $22.99 with the swapping of 10 shares. Massy Holdings dipped $1.95 to $78 with investors exchanging 1,345,487 stocks, Palace Amusement dropped $91.89 to close at $1,810.50 after the price hit an intraday 52 weeks’ high of $2,000 with 648 shares changing hands, PanJam Investment advanced $2.46 to $65 in trading 693 stock units.  Sagicor Group rose $1.12 to end at $52.61 after a transfer of 5,943 stock units, Supreme Ventures fell 70 cents to $27.30 in switching ownership of 9,231 stocks and Sygnus Real Estate Finance declined 88 cents ending at $9.02 with a transfer of 6,600 units.

Sagicor Group rose $1.12 to end at $52.61 after a transfer of 5,943 stock units, Supreme Ventures fell 70 cents to $27.30 in switching ownership of 9,231 stocks and Sygnus Real Estate Finance declined 88 cents ending at $9.02 with a transfer of 6,600 units. A total of 8,211,791 shares were exchanged for $46,473,139, down from 9,841,967 units at $126,164,786 on Wednesday.

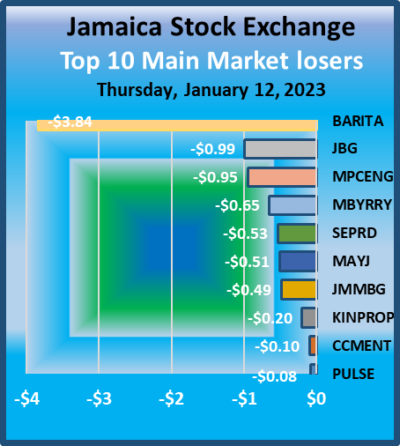

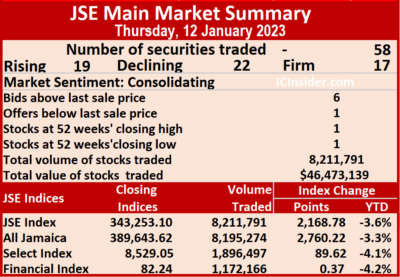

A total of 8,211,791 shares were exchanged for $46,473,139, down from 9,841,967 units at $126,164,786 on Wednesday. The All Jamaican Composite Index climbed 2,760.22 points to 389,643.62, the JSE Main Index rose 2,168.78 points to 343,253.10 and the JSE Financial Index popped 0.37 points to 82.24.

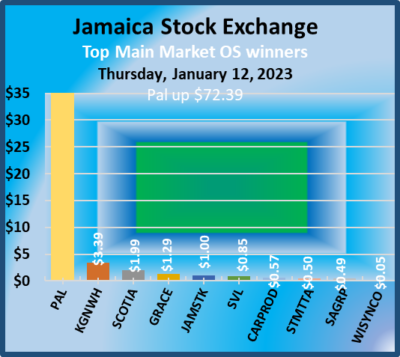

The All Jamaican Composite Index climbed 2,760.22 points to 389,643.62, the JSE Main Index rose 2,168.78 points to 343,253.10 and the JSE Financial Index popped 0.37 points to 82.24. Kingston Wharves climbed $3.39 to $34.45 with a transfer of 432 shares, Margaritaville rallied $1.45 to $21 in the swapping of 404 stocks, Mayberry Investments fell 65 cents to $8.25 after 12,577 stocks cleared the market. Mayberry Jamaican Equities fell 51 cents to $13 with 4,704 stock units changing hands, MPC Caribbean Clean Energy shed 95 cents in closing at $83, trading 238 units, Palace Amusement climbed $72.39 to a 52 weeks’ high of $1,902.39 after a transfer of 305 shares. Sagicor Group gained 49 cents to end at $51.49, trading 5,138 stocks, Scotia Group rose $1.99 to $34 in an exchange of 343,004 shares, Seprod fell 53 cents to $67.45 after 3,703 stock units passed through the market. Stanley Motta rallied 50 cents to $5 with investors transferring 54,322 units and Supreme Ventures advanced 85 cents to $28 with 4,006 shares changing hands.

Kingston Wharves climbed $3.39 to $34.45 with a transfer of 432 shares, Margaritaville rallied $1.45 to $21 in the swapping of 404 stocks, Mayberry Investments fell 65 cents to $8.25 after 12,577 stocks cleared the market. Mayberry Jamaican Equities fell 51 cents to $13 with 4,704 stock units changing hands, MPC Caribbean Clean Energy shed 95 cents in closing at $83, trading 238 units, Palace Amusement climbed $72.39 to a 52 weeks’ high of $1,902.39 after a transfer of 305 shares. Sagicor Group gained 49 cents to end at $51.49, trading 5,138 stocks, Scotia Group rose $1.99 to $34 in an exchange of 343,004 shares, Seprod fell 53 cents to $67.45 after 3,703 stock units passed through the market. Stanley Motta rallied 50 cents to $5 with investors transferring 54,322 units and Supreme Ventures advanced 85 cents to $28 with 4,006 shares changing hands. Eppley 5% preference share fell $1.90 to end at $23 in an exchange of 5 stocks, JMMB Group 7% preference share shed 67 cents to close at $2.22 with the swapping of 5,891 units and 138 Student Living preference share advanced $4.95 to $69.95 after exchanging 37 stocks.

Eppley 5% preference share fell $1.90 to end at $23 in an exchange of 5 stocks, JMMB Group 7% preference share shed 67 cents to close at $2.22 with the swapping of 5,891 units and 138 Student Living preference share advanced $4.95 to $69.95 after exchanging 37 stocks.