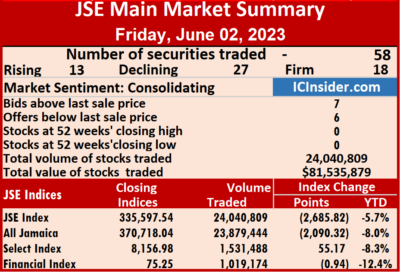

Trading activity on the Jamaica Stock Exchange Main Market ended on Friday with a 170 percent jump in the volume of stocks traded valued 54 percent more than on Thursday, following trading occurring in 58 securities compared to 54 on Thursday, with 13 rising, 27 declining and 18 ending unchanged.

A total of 24,040,809 shares changed hands amounting to $81,535,879 up from 8,887,886 units at $52,849,273 on Thursday.

A total of 24,040,809 shares changed hands amounting to $81,535,879 up from 8,887,886 units at $52,849,273 on Thursday.

Trading averaged 414,497 shares at $1,405,791 up from 164,590 shares at $978,690 on Thursday. Trading month to date, averaged 294,006 units at $1,199,867 compared to May with an average of 226,361 units at $1,362,447.

Transjamaican Highway led trading with 16.84 million shares for 70.1 percent of total volume followed by Wigton Windfarm with 4.06 million units for 16.9 percent of the day’s trade and Sagicor Select Financial Fund with 812,016 units for 3.4 percent market share.

The All Jamaican Composite Index lost 2,090.32 points to end at 370,718.04, the JSE Main Index dropped 2,685.82 points to 335,597.54 and the JSE Financial Index slipped 0.94 points to close at 75.25.

The PE Ratio, a formula used to compute appropriate stock values, averages 13.5 for the Main Market. The JSE Main and USD Market PE ratios are computed based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending up to August 2023.

The PE Ratio, a formula used to compute appropriate stock values, averages 13.5 for the Main Market. The JSE Main and USD Market PE ratios are computed based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending up to August 2023.

Investor’s Choice bid-offer indicator shows seven stocks ended with bids higher than their last selling prices and six with lower offers.

At the close, Barita Investments declined $1.20 to close at $75, with an exchange of at 11,174 shares, Caribbean Cement gained $1.85 to close at $55.85, with investors trading 868 stock units, Eppley Caribbean Property Fund increased $2.60 in closing at $43 after a transfer of 267 units, Guardian Holdings dropped $3 and ended at $482, with 2,277 stocks crossing the market, Jamaica Producers shed 49 cents to end at $20 after 17,454 units passed through the market, Jamaica Stock Exchange rallied 95 cents in closing at $13 in trading 228 stock units,  JMMB Group advanced $1.24 to close at $29.99 in an exchange of 4,998 stocks, Key Insurance dipped 49 cents to $2.80, with 24,924 shares changing hands, Massy Holdings lost $4.50 to end at $100 after an exchange of 105,204 stock units, MPC Caribbean Clean Energy fell $1 to $70 in switching ownership of 6 shares, NCB Financial lost $1.39 in closing at $68.60 with shareholders swapping 124,916 units, 138 Student Living dipped 36 cents to close at $5.15 after an exchange of 4,229 stocks, Pan Jamaica Group declined $2.90 ended at $54.09 while 12,829 units were exchanged, Portland JSX shed 54 cents to close at $11 with a transfer of 1,603 shares, Sagicor Group climbed $2.25 to end at $50.50 with an exchange of 8,854 stock units and Stanley Motta popped 30 cents to $5.40, with 15,163 stocks crossing the market.

JMMB Group advanced $1.24 to close at $29.99 in an exchange of 4,998 stocks, Key Insurance dipped 49 cents to $2.80, with 24,924 shares changing hands, Massy Holdings lost $4.50 to end at $100 after an exchange of 105,204 stock units, MPC Caribbean Clean Energy fell $1 to $70 in switching ownership of 6 shares, NCB Financial lost $1.39 in closing at $68.60 with shareholders swapping 124,916 units, 138 Student Living dipped 36 cents to close at $5.15 after an exchange of 4,229 stocks, Pan Jamaica Group declined $2.90 ended at $54.09 while 12,829 units were exchanged, Portland JSX shed 54 cents to close at $11 with a transfer of 1,603 shares, Sagicor Group climbed $2.25 to end at $50.50 with an exchange of 8,854 stock units and Stanley Motta popped 30 cents to $5.40, with 15,163 stocks crossing the market.

In the preference segment, Productive Business 10.50% preference share rose $25 to $1250 as investors exchanged 300 stocks, JMMB Group 7.25% preference share fell 64 cents to close at $3.61 in an exchange of 12,880 stock units and 138 Student Living preference share dropped $1.25 to end at $88 with 83 shares clearing the market.

In the preference segment, Productive Business 10.50% preference share rose $25 to $1250 as investors exchanged 300 stocks, JMMB Group 7.25% preference share fell 64 cents to close at $3.61 in an exchange of 12,880 stock units and 138 Student Living preference share dropped $1.25 to end at $88 with 83 shares clearing the market.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Increased funding for the JSEUSD market

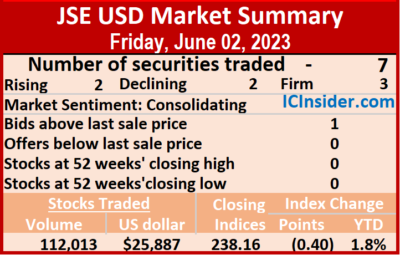

Trading on the Jamaica Stock Exchange US dollar market ended on Friday, with the volume of stocks changing hands declining 24 percent but with the value surging 878 percent over Thursday, resulting in trading in seven securities, compared to three on Thursday with two rising, two declining and three ending unchanged.

A total of 112,013 shares were traded for US$25,887 compared with 147,149 units at US$2,647 on Thursday.

A total of 112,013 shares were traded for US$25,887 compared with 147,149 units at US$2,647 on Thursday.

Trading averaged 16,002 units at US$3,698 compared t0 49,050 shares at US$882on Thursday, with a month to date average of 25,916 shares at US$2,853 compared to May with an average of 43,350 units for US$2,759.

The US Denominated Equities Index lost 0.40 points to settle at 238.16.

The PE Ratio, a measure used to compute stock values, averages 8.8. The PE ratio is computed based on the last traded price of each stock divided by projected earnings forecasts done by ICInsider.com for companies with their financial year ending between November 2023 and August 2024.

Investor’s Choice bid-offer indicator shows one stock ending with a bid higher than the last selling price and none with a lower offer.

At the close, Productive Business Solutions dipped 5.5 cents to US$1.845, with 5 shares crossing the exchange,  Proven Investments rose 0.1 of a cent to finish trading at 16.1 US cents after 29,361 stock units were traded, Sterling Investments ended at 1.68 US cents after 13,500 stocks changed hands, Sygnus Credit Investments fell 1.03 cents to end at 10 US cents with 2,208 units being traded and Transjamaican Highway climbed 0.2 of a cents to close at 1.4 US cents while exchanging 65,367 shares.

Proven Investments rose 0.1 of a cent to finish trading at 16.1 US cents after 29,361 stock units were traded, Sterling Investments ended at 1.68 US cents after 13,500 stocks changed hands, Sygnus Credit Investments fell 1.03 cents to end at 10 US cents with 2,208 units being traded and Transjamaican Highway climbed 0.2 of a cents to close at 1.4 US cents while exchanging 65,367 shares.

In the preference segment, Productive Business 9.25% preference share ended at US$12.50 with shareholders swapping 1,570 stock units and JMMB Group 5.75% ended at US$1.90 with an exchange of 2 units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Fall back for JSE USD Market

Trading on the Jamaica Stock Exchange US dollar market ended on Thursday with an 83 percent fall in the volume of stocks changing hands at a 97 percent lower value than on Wednesday, resulting from trading in just three securities, compared to seven on Wednesday with one rising, one declining and one ending unchanged.

A total of 147,149 shares were exchanged for US$2,647 compared with 842,727 units at US$97,351 on Wednesday.

A total of 147,149 shares were exchanged for US$2,647 compared with 842,727 units at US$97,351 on Wednesday.

Trading averaged 49,050 units at US$882 compared to 120,390 shares at US$13,907 on Wednesday. May ended with an average of 43,350 units for US$2,759.

The US Denominated Equities Index shed 4.12 points to settle at 238.57.

The PE Ratio, a measure used in computing appropriate stock values, averages 8.8. The PE ratio is computed based on the last traded price of each stock divided by projected earnings forecasts done by ICInsider.com for companies with their financial year ending between November 2023 and August 2024.

The Investor’s Choice bid-offer indicator shows two stocks ending with bids higher than their last selling prices and none with a lower offer.

The Investor’s Choice bid-offer indicator shows two stocks ending with bids higher than their last selling prices and none with a lower offer.

At the close, Sygnus Credit Investments rose 0.02 of a cent to 11.03 US cents after trading ended with 2,236 shares changing hands and Transjamaican Highway dipped 0.25 of a cent in closing at 1.2 US cents with a transfer of 144,438 stocks.

In the preference segment, JMMB Group 6% remained at US$1.20 after ending with 475 stock units changing hands.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

May ends with a blast for JSE USD Market

Trading on the Jamaica Stock Exchange US dollar market ended on Wednesday, with the volume of stocks changing hands surging 5,354 percent valued at 9,770 percent more than on Tuesday and resulting in seven securities trading, compared to six on Tuesday with prices of four rising, one declining and two ending unchanged.

Overall, 842,727 shares were traded for US$97,351 compared to 15,452 units at US$986 on Tuesday.

Overall, 842,727 shares were traded for US$97,351 compared to 15,452 units at US$986 on Tuesday.

Trading averaged 120,390 shares at US$13,907 versus 2,575 units at US$164 on Tuesday, with a month to date average of 43,350 shares at US$2,759 compared to 39,779 units at US$2,243 on the previous day. April ended with an average of 394,241 units for US$22,357.

The US Denominated Equities Index jumped 30.40 points to 242.69.

The PE Ratio, a measure used in computing appropriate stock values, averages 9. The PE ratio is computed based on the last traded price of each stock divided by projected earnings forecasts done by ICInsider.com for companies with their financial year ending between November 2023 and August 2024.

Investor’s Choice bid-offer indicator shows one stock ended with a bid higher than the last selling price and one with a lower offer.

At the close, Margaritaville advanced 2.47 cents to 11.48 US cents, with 8,600 shares crossing the market,  Productive Business Solutions climbed 44.92 cents to US$1.90 with an exchange of 41,899 stocks, Proven Investments lost 0.9 of a cents and ended at 16 US cents, with 918 units crossing the exchange, Sterling Investments ended at 1.68 US cents while investors traded 1,188 stock units and Transjamaican Highway rose 0.16 of a cent to close at a record high of 1.45 US cents after a transfer of 787,041 shares.

Productive Business Solutions climbed 44.92 cents to US$1.90 with an exchange of 41,899 stocks, Proven Investments lost 0.9 of a cents and ended at 16 US cents, with 918 units crossing the exchange, Sterling Investments ended at 1.68 US cents while investors traded 1,188 stock units and Transjamaican Highway rose 0.16 of a cent to close at a record high of 1.45 US cents after a transfer of 787,041 shares.

In the preference segment, Productive Business 9.25% preference share gained US$1 to close at US$12.50 after exchanging one unit and JMMB Group 5.75% ended at US$1.90 with investors transferring 3,080 stocks.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Trading dives on JSE USD Market

A 98 percent fall in stocks trading on the Jamaica Stock Exchange US dollar market ended on Tuesday, with the market climbing above the close on Monday and resulted in the trading of six securities, down from eight on Monday and ended with prices of three rising, none declining and three ending unchanged.

Overall, 15,452 shares were traded for US$986 compared to 959,588 units at US$46,217 on Monday.

Overall, 15,452 shares were traded for US$986 compared to 959,588 units at US$46,217 on Monday.

Trading averaged 2,575 shares at US$164 versus 119,949 units at US$5,777 on Monday, with a month to date average of 39,779 shares at US$2,243 compared with 41,318 units at US$2,329 on the previous day. April ended with an average of 394,241 units for US$22,357.

The US Denominated Equities Index popped 12.60 points to conclude trading at 212.29.

The PE Ratio, a measure used in computing appropriate stock values, averages 8.5. The PE ratio is calculated based on the last traded price of each stock divided by projected earnings forecasts done by ICInsider.com for companies with their financial year ending between November 2023 and August 2024.

Investor’s Choice bid-offer indicator shows three stocks ended with bids higher than their last selling prices and one with a lower offer.

At the close,  First Rock Real Estate USD share popped 0.5 of a cent after closing at 5 US cents, with shareholders swapping 560 shares, Proven Investments ended at 16.9 US cents after a transfer of 2,325 stock units, Sterling Investments remained at 1.68 US cents, with 5,741 stocks crossing the market and Transjamaican Highway rose 0.29 of a cent to end at 1.29 US cents after closing with an exchange of 6,616 units.

First Rock Real Estate USD share popped 0.5 of a cent after closing at 5 US cents, with shareholders swapping 560 shares, Proven Investments ended at 16.9 US cents after a transfer of 2,325 stock units, Sterling Investments remained at 1.68 US cents, with 5,741 stocks crossing the market and Transjamaican Highway rose 0.29 of a cent to end at 1.29 US cents after closing with an exchange of 6,616 units.

In the preference segment, JMMB Group 5.75% ended at US$1.90 with 204 shares changing hands and JMMB Group 6% increased 13 cents to US$1.20 as investors exchanged just 6 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Increased trading hits JSEUSD Market

The Jamaica Stock Exchange US dollar Market had another chunk of the index chopped off on Monday, with the volume of stocks changing hands surging 354 percent and valued 172 percent more than on Friday, resulting in the trading of eight securities, compared to seven on Friday with two rising, three declining and three ending unchanged.

Investors traded 959,588 shares for US$46,217 compared with 211,505 units at US$16,972 on Friday.

Investors traded 959,588 shares for US$46,217 compared with 211,505 units at US$16,972 on Friday.

Trading averaged 119,949 shares at US$5,777 versus 30,215 units at US$2,425 on Friday, with a month to date average of 41,318 shares at US$2,329 compared to 36,727 units at US$2,127 on the previous trading day. April ended with an average of 394,241 units for US$22,357.

The US Denominated Equities Index lost 10.51 points to end at 199.69.

The PE Ratio, a measure used in computing appropriate stock values, averages 8.2. The PE ratio is computed based on the last traded price of each stock divided by projected earnings forecasts done by ICInsider.com for companies with their financial year ending between November 2023 and August 2024.

Investor’s Choice bid-offer indicator shows three stocks ended with bids higher than their last selling prices and one with a lower offer.

At the close, First Rock Real Estate USD share fell 0.5 of a cent and ended at 4.5 US cents as 11,871 shares passed through the market, Margaritaville ended at 9.01 US cents while exchanging 570 units,  Proven Investments rose 0.9 of a cent to 16.9 US cents, with 233,554 stock units clearing the market, but only after trading at a 52 weeks’ intraday low of 13.6 cents. Sterling Investments ended at 1.68 US cents after trading 4,057 stocks, Sygnus Credit Investments popped 0.86 of one cent to 11.01 US cents, with 100 shares crossing the exchange, Sygnus Real Estate Finance USD share lost 0.1 of a cent in closing at 11 US cents after an exchange of 100 units and Transjamaican Highway dipped 0.3 cents to 1 US cent in trading 708,836 stocks.

Proven Investments rose 0.9 of a cent to 16.9 US cents, with 233,554 stock units clearing the market, but only after trading at a 52 weeks’ intraday low of 13.6 cents. Sterling Investments ended at 1.68 US cents after trading 4,057 stocks, Sygnus Credit Investments popped 0.86 of one cent to 11.01 US cents, with 100 shares crossing the exchange, Sygnus Real Estate Finance USD share lost 0.1 of a cent in closing at 11 US cents after an exchange of 100 units and Transjamaican Highway dipped 0.3 cents to 1 US cent in trading 708,836 stocks.

In the preference segment, JMMB Group 6% ended at US$1.07 and with 500 stock units changing hands.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

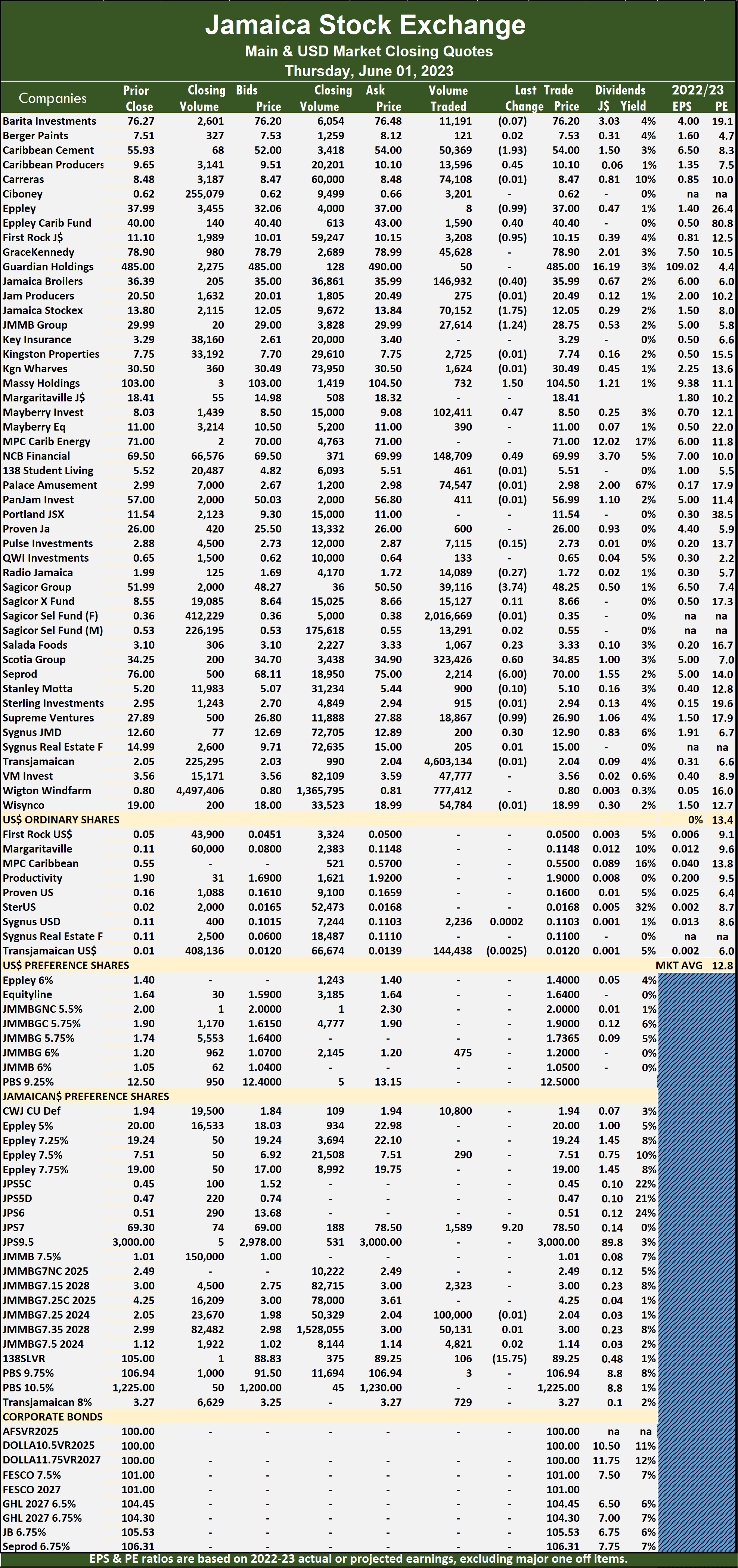

A total of 8,887,886 shares were traded for $52,849,273 compared to 4,443,891 units at $149,369,888 on Wednesday.

A total of 8,887,886 shares were traded for $52,849,273 compared to 4,443,891 units at $149,369,888 on Wednesday. The PE Ratio, a formula used to compute appropriate stock values, averages 13.4 for the Main Market. The JSE Main and USD Market PE ratios are computed based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending up to August 2023.

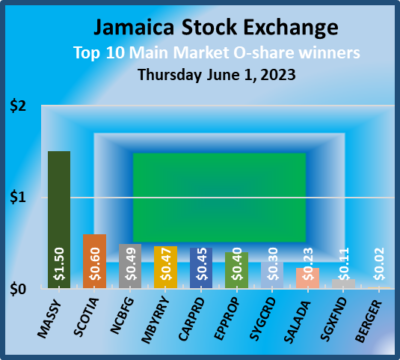

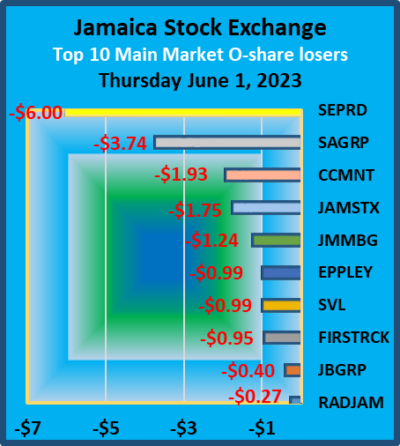

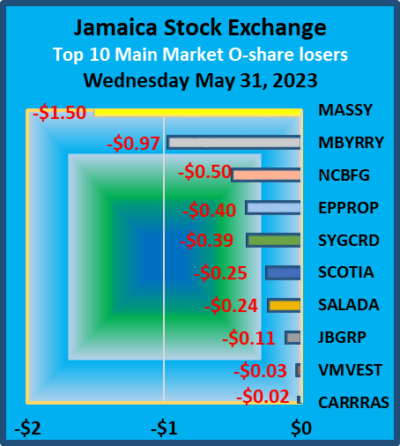

The PE Ratio, a formula used to compute appropriate stock values, averages 13.4 for the Main Market. The JSE Main and USD Market PE ratios are computed based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending up to August 2023. Massy Holdings climbed $1.50 to $104.50 with investors transferring 732 shares. Mayberry Investments rallied 47 cents to end at $8.50, with 102,411 units crossing the market, NCB Financial popped 49 cents to $69.99 as 148,709 stock units passed through the market, Sagicor Group dipped $3.74 and ended at $48.25 after investors ended trading of 39,116 stocks. Scotia Group advanced 60 cents to close at $34.85 while exchanging 323,426 shares, Seprod declined $6 to $70 with an exchange of 2,214 units, Supreme Ventures fell 99 cents to end at $26.90 with shareholders swapping 18,867 stock units and Sygnus Credit Investments rallied 30 cents to $12.90 with a transfer of 200 stocks.

Massy Holdings climbed $1.50 to $104.50 with investors transferring 732 shares. Mayberry Investments rallied 47 cents to end at $8.50, with 102,411 units crossing the market, NCB Financial popped 49 cents to $69.99 as 148,709 stock units passed through the market, Sagicor Group dipped $3.74 and ended at $48.25 after investors ended trading of 39,116 stocks. Scotia Group advanced 60 cents to close at $34.85 while exchanging 323,426 shares, Seprod declined $6 to $70 with an exchange of 2,214 units, Supreme Ventures fell 99 cents to end at $26.90 with shareholders swapping 18,867 stock units and Sygnus Credit Investments rallied 30 cents to $12.90 with a transfer of 200 stocks. In the preference segment, Jamaica Public Service 7% advanced $9.20 and ended at $78.50 after a transfer of 1,589 units and 138 Student Living preference share shed $15.75 to close at $89.25 with 106 stock units clearing the market.

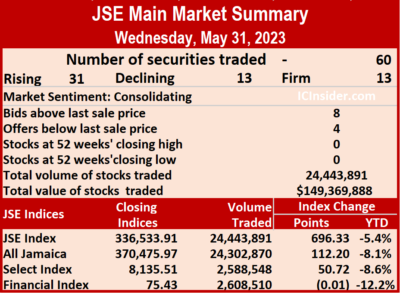

In the preference segment, Jamaica Public Service 7% advanced $9.20 and ended at $78.50 after a transfer of 1,589 units and 138 Student Living preference share shed $15.75 to close at $89.25 with 106 stock units clearing the market. A total of 24,443,891 shares were traded for $149,369,888 compared to 8,501,678 units at $53,413,585 on Tuesday.

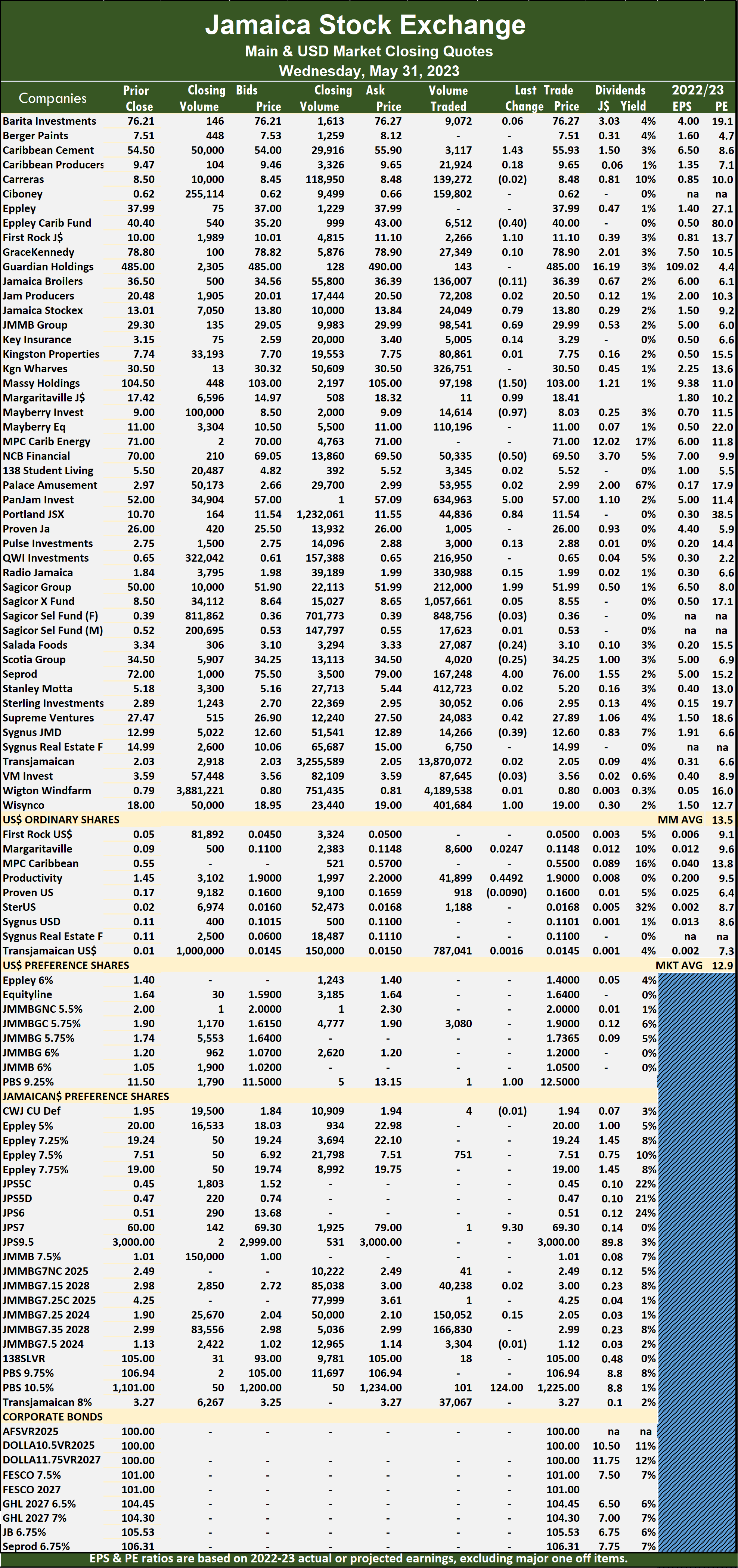

A total of 24,443,891 shares were traded for $149,369,888 compared to 8,501,678 units at $53,413,585 on Tuesday. The PE Ratio, a formula used to compute appropriate stock values, averages 13.5 for the Main Market. The JSE Main and USD Market PE ratios are computed based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending up to August 2023.

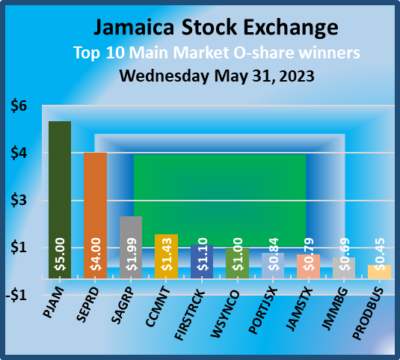

The PE Ratio, a formula used to compute appropriate stock values, averages 13.5 for the Main Market. The JSE Main and USD Market PE ratios are computed based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending up to August 2023. Margaritaville rose 99 cents to close at $18.41 with shareholders swapping 11 stocks, Massy Holdings dipped $1.50 and ended at $103 while exchanging 97,198 stock units. Mayberry Investments shed 97 cents to close at $8.03 after exchanging 14,614 shares, NCB Financial lost 50 cents in closing at $69.50 with investors trading 50,335 shares, Pan Jamaica Group climbed $5 to $57 with 634,963 stocks crossing the exchange, Portland JSX increased 84 cents to $11.54 after 44,836 stock units passed through the market, Sagicor Group gained $1.99 in closing at $51.99, with 212,000 units crossing the market, Seprod rallied $4 to $76 in an exchange of 167,248 units, Supreme Ventures advanced 42 cents to end at $27.89 with 24,083 shares clearing the market, Sygnus Credit Investments fell 39 cents to close at $12.60 with a transfer of 14,266 stocks and Wisynco Group climbed $1 to close at $19, with 401,684 stock units crossing the market.

Margaritaville rose 99 cents to close at $18.41 with shareholders swapping 11 stocks, Massy Holdings dipped $1.50 and ended at $103 while exchanging 97,198 stock units. Mayberry Investments shed 97 cents to close at $8.03 after exchanging 14,614 shares, NCB Financial lost 50 cents in closing at $69.50 with investors trading 50,335 shares, Pan Jamaica Group climbed $5 to $57 with 634,963 stocks crossing the exchange, Portland JSX increased 84 cents to $11.54 after 44,836 stock units passed through the market, Sagicor Group gained $1.99 in closing at $51.99, with 212,000 units crossing the market, Seprod rallied $4 to $76 in an exchange of 167,248 units, Supreme Ventures advanced 42 cents to end at $27.89 with 24,083 shares clearing the market, Sygnus Credit Investments fell 39 cents to close at $12.60 with a transfer of 14,266 stocks and Wisynco Group climbed $1 to close at $19, with 401,684 stock units crossing the market. In the preference segment, Productive Business 10.50% preference share popped $124 to $1225 in an exchange of 101 stocks and Jamaica Public Service 7% increased by $9.30 and ended at $69.30 with one stock unit changing hands.

In the preference segment, Productive Business 10.50% preference share popped $124 to $1225 in an exchange of 101 stocks and Jamaica Public Service 7% increased by $9.30 and ended at $69.30 with one stock unit changing hands. A total of 8,501,678 shares were traded for $53,413,585 compared to 19,055,221 units at $86,952,533 on Monday.

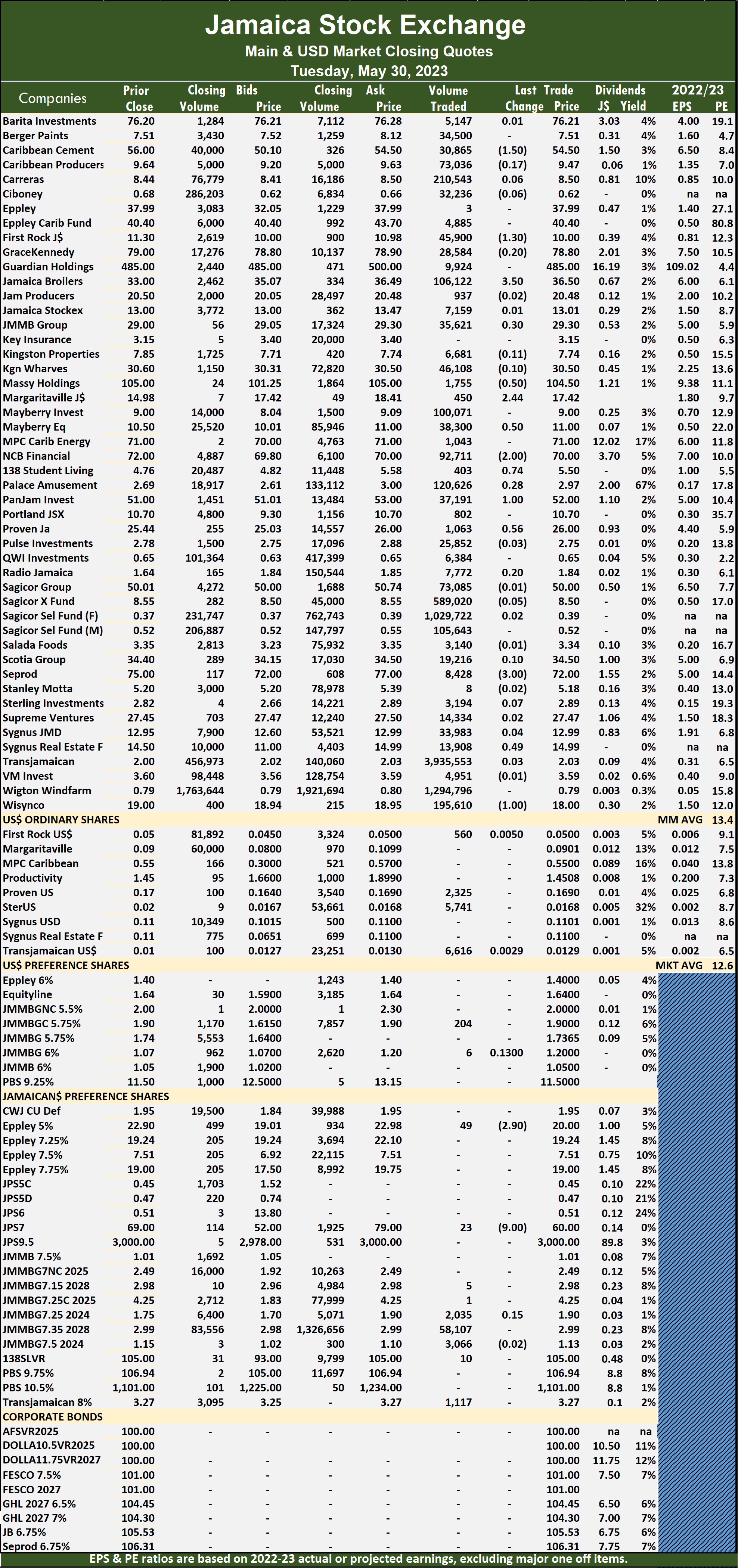

A total of 8,501,678 shares were traded for $53,413,585 compared to 19,055,221 units at $86,952,533 on Monday. The PE Ratio, a formula used to compute appropriate stock values, averages 13.4 for the Main Market. The JSE Main and USD Market PE ratios are computed based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending up to August 2023.

The PE Ratio, a formula used to compute appropriate stock values, averages 13.4 for the Main Market. The JSE Main and USD Market PE ratios are computed based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending up to August 2023. Massy Holdings drifted 50 cents lower to close at $104.50 after trading 1,755 stocks, Mayberry Jamaican Equities increased 50 cents in closing at $11 after 38,300 stocks cleared the market, NCB Financial fell $2 to end at $70 with an exchange of 92,711 shares. 138 Student Living gained 74 cents to end at $5.50 with a transfer of 403 shares, Pan Jamaica Group rallied $1 and ended at $52 with an exchange of 37,191 stock units, Proven Investments climbed 56 cents to $26, with 1,063 stock units crossing the market. Seprod shed $3 in closing at $72 as investors exchanged 8,428 units, Sygnus Real Estate Finance gained 49 cents to end at $14.99 and closed with an exchange of 13,908 stock units and Wisynco Group declined $1 to close at $18 after 195,610 shares changed hands.

Massy Holdings drifted 50 cents lower to close at $104.50 after trading 1,755 stocks, Mayberry Jamaican Equities increased 50 cents in closing at $11 after 38,300 stocks cleared the market, NCB Financial fell $2 to end at $70 with an exchange of 92,711 shares. 138 Student Living gained 74 cents to end at $5.50 with a transfer of 403 shares, Pan Jamaica Group rallied $1 and ended at $52 with an exchange of 37,191 stock units, Proven Investments climbed 56 cents to $26, with 1,063 stock units crossing the market. Seprod shed $3 in closing at $72 as investors exchanged 8,428 units, Sygnus Real Estate Finance gained 49 cents to end at $14.99 and closed with an exchange of 13,908 stock units and Wisynco Group declined $1 to close at $18 after 195,610 shares changed hands. In the preference segment, Eppley 5% preference share dropped $2.90 and ended at $20 in an exchange of 49 stocks and Jamaica Public Service 7% declined $9 to close at $60 while exchanging 23 units.

In the preference segment, Eppley 5% preference share dropped $2.90 and ended at $20 in an exchange of 49 stocks and Jamaica Public Service 7% declined $9 to close at $60 while exchanging 23 units.

The PE Ratio, a formula used to compute appropriate stock values, averages 13.3 for the Main Market. The JSE Main and USD Market PE ratios are computed based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending up to August 2023.

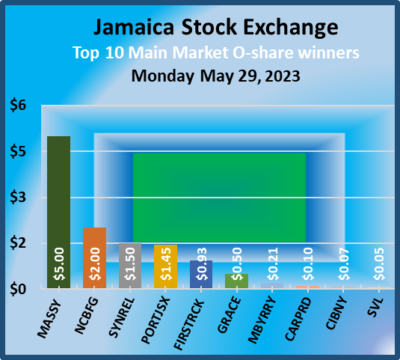

The PE Ratio, a formula used to compute appropriate stock values, averages 13.3 for the Main Market. The JSE Main and USD Market PE ratios are computed based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending up to August 2023. Massy Holdings advanced $5 to close at a 52 weeks’ high of $105, with 3,524 shares crossing the market, with the price still around 11 percent lower than in Trinidad. Mayberry Jamaican Equities fell 50 cents to $10.50 after a transfer of 171,230 shares, NCB Financial rose $2 and ended at $72 with investors transferring 50,904 units, 138 Student Living dipped 84 cents to close at $4.76 after trading 28,560 stocks, Pan Jamaica Group shed $2.99 to end at $51 with 2,058 stock units clearing the market. Portland JSX gained $1.45 to close at $10.70 in an exchange of 35 stocks, Proven Investments rose 34 cents to $25.44 with an exchange of 2,022 shares, Sagicor Group fell 49 cents in closing at $50.01, with 2,042 units changing hands, Seprod traded 61,632 shares at $75 after the price hit a 52 weeks’ intraday high of $79.80. Stanley Motta lost 44 cents to close at $5.20 after an exchange of 3,011,831 stock units, Sygnus Real Estate Finance rallied $1.50 to end at $14.50 after exchanging 2,734 shares and

Massy Holdings advanced $5 to close at a 52 weeks’ high of $105, with 3,524 shares crossing the market, with the price still around 11 percent lower than in Trinidad. Mayberry Jamaican Equities fell 50 cents to $10.50 after a transfer of 171,230 shares, NCB Financial rose $2 and ended at $72 with investors transferring 50,904 units, 138 Student Living dipped 84 cents to close at $4.76 after trading 28,560 stocks, Pan Jamaica Group shed $2.99 to end at $51 with 2,058 stock units clearing the market. Portland JSX gained $1.45 to close at $10.70 in an exchange of 35 stocks, Proven Investments rose 34 cents to $25.44 with an exchange of 2,022 shares, Sagicor Group fell 49 cents in closing at $50.01, with 2,042 units changing hands, Seprod traded 61,632 shares at $75 after the price hit a 52 weeks’ intraday high of $79.80. Stanley Motta lost 44 cents to close at $5.20 after an exchange of 3,011,831 stock units, Sygnus Real Estate Finance rallied $1.50 to end at $14.50 after exchanging 2,734 shares and  Wisynco Group declined 50 cents to close at $19 with shareholders swapping 162,231 stocks.

Wisynco Group declined 50 cents to close at $19 with shareholders swapping 162,231 stocks.