Long time Junior Market ICTOP10 listed Access Financial, finally broke away from resistance and jumped 31 percent for the week to $26.28, but traded at a 52 weeks’ high of $28 on Wednesday and just barely hung on to the top ten in the tenth spot.

Access Financial Services top performing ICTOP10 stock for the past week.

In the Main Market, Radio Jamaica rose 19 percent to $4.10, the 2021 ICTOP10 top performer, Caribbean Producers, climbed 5 percent and finally slipped out of the top 10 after a ride lasting more than a year and a gain of 573 percent, but the stock has more room for healthy gains.

Sagicor Group returns to the TOP10 Main Market and Stationery & Office Supplies returns to the Junior Market listing after an earnings upgrade, following a review of the forecasted numbers as the company continues to recover to pre-Covid-19 sales and Fontana dropped out with a 4 percent rise, but has much more room to grow in 2022.

Junior Market Elite Diagnostic gained 10 percent to $3.50, Honey Bun rose 7 percent. AMG Packaging lost 10 percent to end at $3.05, Lasco Financial lost 8 percent, Caribbean Assurance Brokers fell 7 percent and General Accident slipped 5 percent.

The week ended with the supplies for some stocks becoming very limited, this applies to Access and Radio Jamaica. Newly listed Spur Tree Spices came in for profit taking on Thursday and Friday after the price peaked at $2.75 and closed the week at $2.15 a fall of 22 percent from the peak, which suggests suggesting more room for decline before the price bottoms. That could take it to around $1.95 based on declines from peak to through of some previous IPOs.

The week ended with the supplies for some stocks becoming very limited, this applies to Access and Radio Jamaica. Newly listed Spur Tree Spices came in for profit taking on Thursday and Friday after the price peaked at $2.75 and closed the week at $2.15 a fall of 22 percent from the peak, which suggests suggesting more room for decline before the price bottoms. That could take it to around $1.95 based on declines from peak to through of some previous IPOs.

The sharp price movements in the Junior Market reduced the potential gains markedly, with the average increase projected for the TOP 10 Junior Market stocks now at 119 percent versus 122 percent last week.

The top three stocks are Lasco Distributors followed by Caribbean Assurance Brokers and Lasco Financial to gain between 131 and 150 percent, compared to 124 and 160 percent, previously.

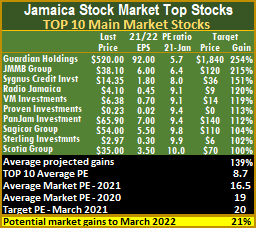

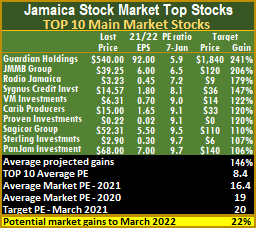

The potential gains for Main Market stocks moved from 144 percent to this weeks’ 139 percent this week, with the top three stocks being Guardian Holdings followed by JMMB Group and Sygnus Credit Investments all projected to gain between 151 and 254 percent down from 161 and 257 percent last week.

The potential gains for Main Market stocks moved from 144 percent to this weeks’ 139 percent this week, with the top three stocks being Guardian Holdings followed by JMMB Group and Sygnus Credit Investments all projected to gain between 151 and 254 percent down from 161 and 257 percent last week.

After trading at a big discount to the Main Market for two years, the average PE for both the JSE primary markets have virtually merged around 16 times earnings multiple based on 2021 earnings, with the Junior Market looking poised to surpass the main Market soon. The difference in potential gains for both TOP10 listings shows the Junior Market with an average rise of 118 percent versus 139 percent for the Main Market. That is an indication that the Junior Market is priced slightly higher than the Main Market.

The Junior Market closed the week, with an average PE of 16 based on ICInsider.com’s 2021-22 earnings and is currently below the target of 20 and the average of 17 at the end of March last year based on 2020 earnings. The TOP 10 stocks trade at a PE of a mere 9.2, with a 43 percent discount to that market’s average.

The Junior Market can gain 25 percent to March this year, based on an average PE of 20 and 6 percent based on an average PE of 17. Twelve stocks representing 29 percent of all Junior Market stocks with positive earnings are trading at or above this level averaging 25.

The Junior Market can gain 25 percent to March this year, based on an average PE of 20 and 6 percent based on an average PE of 17. Twelve stocks representing 29 percent of all Junior Market stocks with positive earnings are trading at or above this level averaging 25.

The average PE for the JSE Main Market is 16.5 just 15 percent less than the PE of 19 at the end of March and 21 percent below the target of 20 to March 2022. The Main Market TOP 10 average PE is 8.7 representing a 47 percent discount to the market and well below the potential of 20. A total of 14 stocks or 30 percent of the market trade at or above a PE of 19, with most over 20, for an average roundabout 25, suggesting that the accepted multiple is between 20 and 25 times the current year’s earnings.

ICTOP10 focuses on likely yearly winners, accordingly, the list may or may not include the best companies in the market.  ICInsider.com ranks stocks based on projected earnings to highlight winners from the rest, allowing investors to focus on potential winning stocks and helping to remove emotional attachments to stocks that often result in costly mistakes.

ICInsider.com ranks stocks based on projected earnings to highlight winners from the rest, allowing investors to focus on potential winning stocks and helping to remove emotional attachments to stocks that often result in costly mistakes.

IC TOP10 stocks are likely to deliver the best returns up to March 2022 and ranked in order of potential gains, based on the possible increase for each company, considering the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in weekly movements in and out of the lists. Revisions to earnings per share are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

Other stocks that were in the spotlight this past week were ones that lasted off to record new all-time highs and include

Other stocks that were in the spotlight this past week were ones that lasted off to record new all-time highs and include Junior Market,

Junior Market,  The top three stocks are

The top three stocks are  The TOP 10 stocks trade at a PE of a mere 9.1, with a 38 percent discount to that market’s average.

The TOP 10 stocks trade at a PE of a mere 9.1, with a 38 percent discount to that market’s average. ICTOP10 focuses on likely yearly winners, accordingly, the list may or may not include the best companies in the market. ICInsider.com ranks stocks based on projected earnings to highlight winners from the rest, allowing investors to focus on potential winning stocks and helping to remove emotional attachments to stocks that often result in costly mistakes.

ICTOP10 focuses on likely yearly winners, accordingly, the list may or may not include the best companies in the market. ICInsider.com ranks stocks based on projected earnings to highlight winners from the rest, allowing investors to focus on potential winning stocks and helping to remove emotional attachments to stocks that often result in costly mistakes.

Elsewhere, investors in the Spur Tree Spices Initial Public offer will receive just over 11.76 percent of the shares they applied for in the heavily oversubscribed issue that is sure to drive the stock price with a big bang in the first week of trading which should be ahead of the end of January.

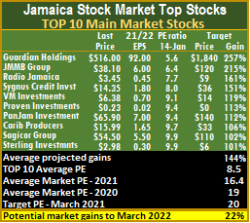

Elsewhere, investors in the Spur Tree Spices Initial Public offer will receive just over 11.76 percent of the shares they applied for in the heavily oversubscribed issue that is sure to drive the stock price with a big bang in the first week of trading which should be ahead of the end of January. The average gains projected for the TOP 10 Junior Market stocks is 148 percent and Main Market stocks moved from 152 percent to this weeks’ 146 percent.

The average gains projected for the TOP 10 Junior Market stocks is 148 percent and Main Market stocks moved from 152 percent to this weeks’ 146 percent. The average PE for the JSE Main Market is 16.4, just 16 percent less than the PE of 19 at the end of March and 22 percent below the target of 20 to March 2022. The Main Market TOP 10 average PE is 8.4 representing a 49 percent discount to the market and well below the potential of 20. A total of 14 stocks or 30 percent of the market trade at or above a PE of 19, with most over 20, for an average roundabout 25, suggesting that the accepted multiple is between 20 and 25 times the current year’s earnings.

The average PE for the JSE Main Market is 16.4, just 16 percent less than the PE of 19 at the end of March and 22 percent below the target of 20 to March 2022. The Main Market TOP 10 average PE is 8.4 representing a 49 percent discount to the market and well below the potential of 20. A total of 14 stocks or 30 percent of the market trade at or above a PE of 19, with most over 20, for an average roundabout 25, suggesting that the accepted multiple is between 20 and 25 times the current year’s earnings. ICInsider.com ranks stocks based on projected earnings to highlight winners from the rest, allowing investors to focus on potential winning stocks and helping to remove emotional attachments to stocks that often result in costly mistakes.

ICInsider.com ranks stocks based on projected earnings to highlight winners from the rest, allowing investors to focus on potential winning stocks and helping to remove emotional attachments to stocks that often result in costly mistakes.