The JSE USD market inched higher at the close of the Jamaica Stock Exchange on Monday as the Main Market gained more than a thousand points but the Junior Market dropped for a third consecutive day, with fewer stocks changing hands, with the value traded falling sharply from that on the previous trading day, resulting in prices of 46 shares rising and 36 declining.

At the close of trading on Monday, the JSE Combined Market Index rallied 1,132.02 points to end at 340,293.63, the All Jamaican Composite Index rose 2,140.38 points to 367,297.93, the JSE Main Index rose 1,337.67 points to close at 327,756.09. The Junior Market Index sank 21.57 points to end the day at 3,744.99 and the JSE USD Market Index popped 0.96 points to settle at 244.99.

At the close of trading on Monday, the JSE Combined Market Index rallied 1,132.02 points to end at 340,293.63, the All Jamaican Composite Index rose 2,140.38 points to 367,297.93, the JSE Main Index rose 1,337.67 points to close at 327,756.09. The Junior Market Index sank 21.57 points to end the day at 3,744.99 and the JSE USD Market Index popped 0.96 points to settle at 244.99.

At the close of trading, 21,408,365 shares were exchanged in all three markets, down from 29,059,711 units on Friday, with the value of stocks traded on the Junior and Main markets with a value of $74.87 million, well off from $240.14, million on the previous trading day and the JSE USD market closed with an exchange of 130,853 shares for US$9,068 compared to 209,773 units at US$28,768 on Friday.

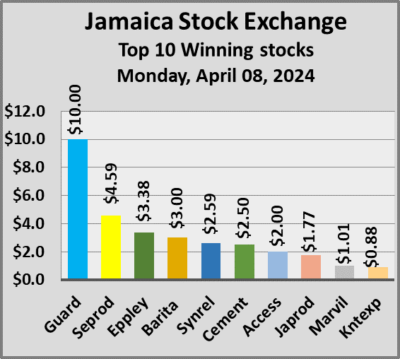

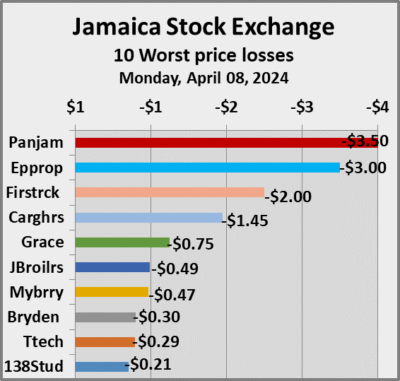

In Main Market activity, Transjamaican Highway led trading with 6.89 million shares followed by Wigton Windfarm with 1.38 million units and Radio Jamaica with 691,900 stocks.

In the Junior Market, Express Catering led trading with 3.61 million shares followed by ONE on ONE Educational with 1.63 million stock units and Fosrich with 1.02 million units.

In the preference segment Jamaica Public Service 9.5% dropped $50 to close at $2650 and Sygnus Credit Investments C10.5% declined $9 to finish at $101.

In the preference segment Jamaica Public Service 9.5% dropped $50 to close at $2650 and Sygnus Credit Investments C10.5% declined $9 to finish at $101.

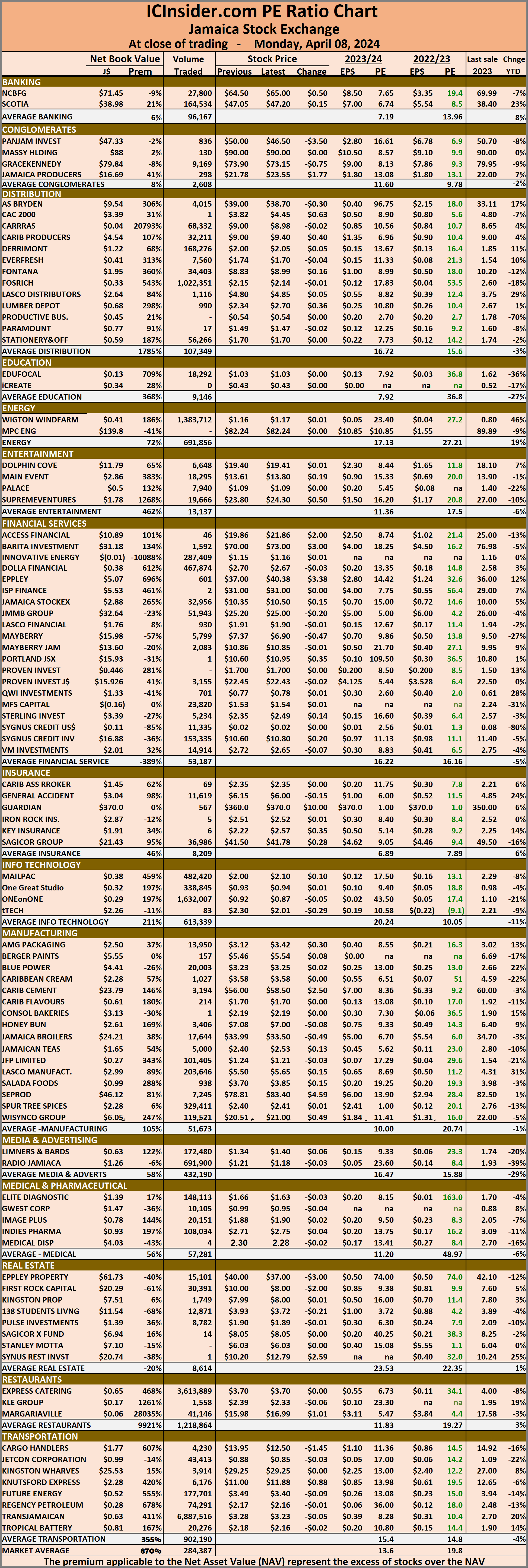

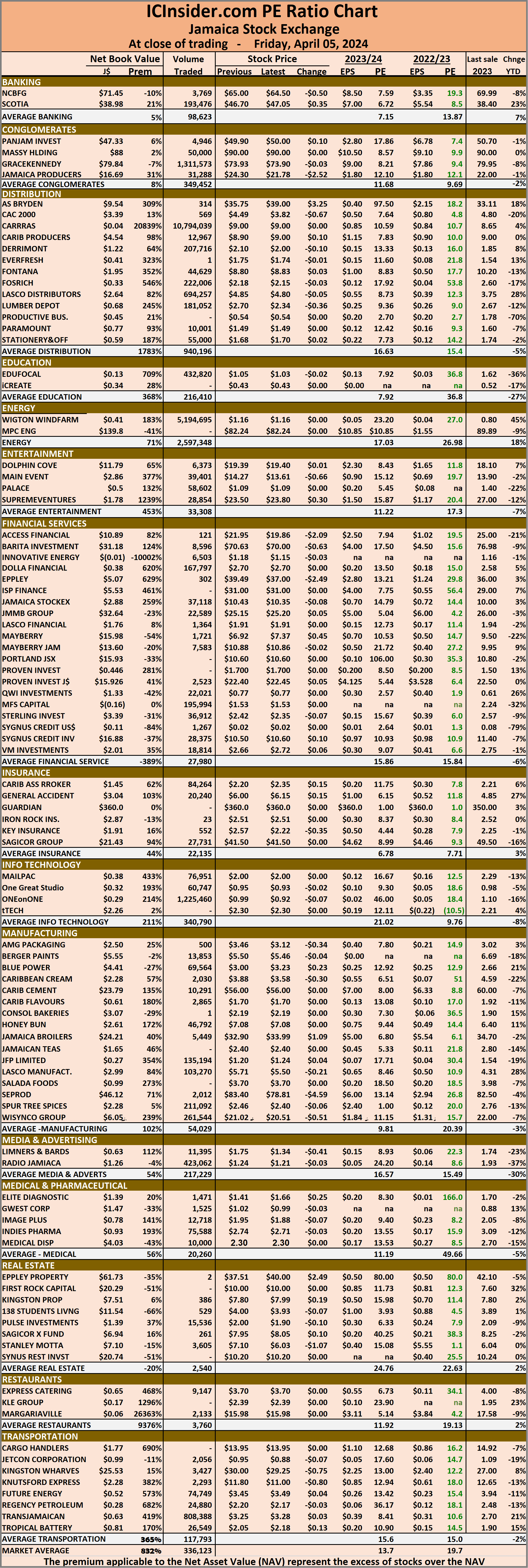

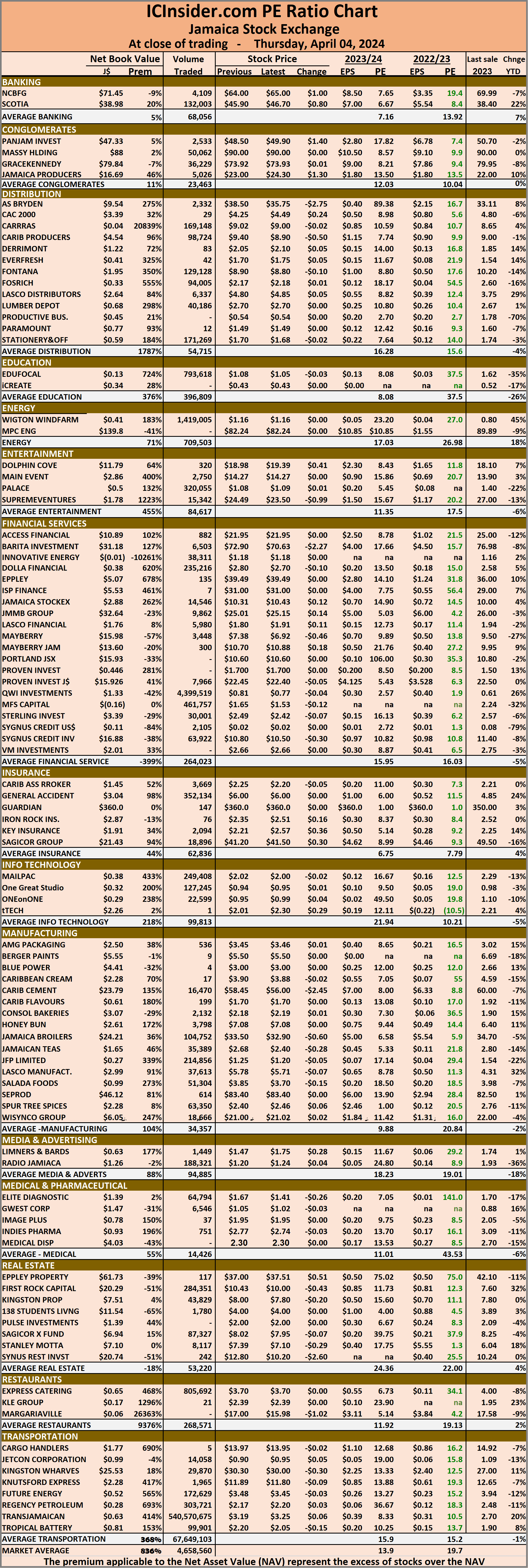

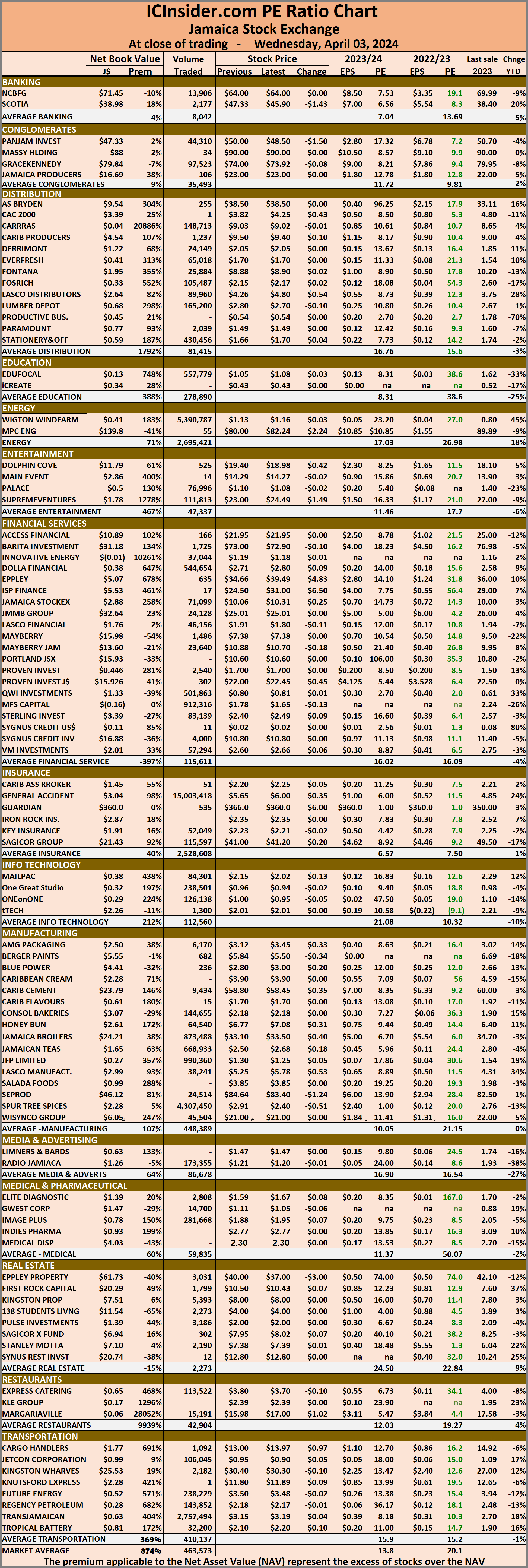

The market’s PE ratio, the most popular measure used to determine the value of stocks, ended at 19.8 on 2023-24 earnings and 13.6 times those for 2024-25 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily charts provide investors with regularly updated information to help decision-making.

The PE ratio chart covers all ordinary shares on the Jamaica Stock Exchange, grouped by industry, allowing for easy comparisons between the same sector companies and the overall market. The EPS & PE ratios are based on 2023 and 2024 actual or projected earnings, excluding major one off items.

Investors need pertinent information to navigate numerous investment options successfully in the stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

Investors should use the chart to help make rational decisions when investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The net asset value of each company is reported as a guide for investors to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

The net asset value of each company is reported as a guide for investors to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

Dividends paid or payable and yields for each company are shown in the Main and Junior Markets’ daily report charts, along with the closing volume of the highest bid and the lowest offer for each company.

Main Market rise Juniors fall

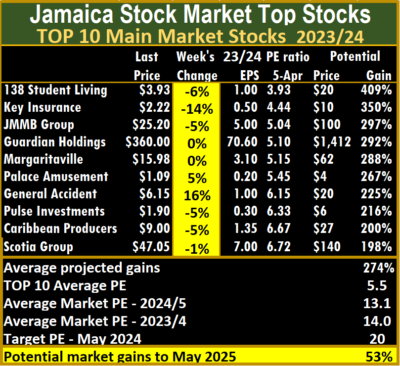

CPJ enters ICTOP10 Broilers out

With what has become the norm, the markets pulled back to start April from the pump-up end of month prices in March, resulting in varied outcomes for the ICTOP10 and ending with Jamaica Broilers falling from the Main Market TOP10 and Caribbean Producers entering at the number 9 spot.

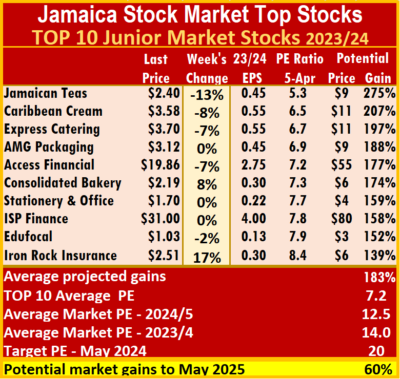

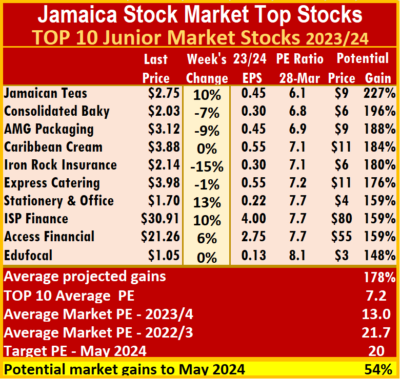

There were no changes to the list of companies in the Junior Market TOP10 this past week.

There were no changes to the list of companies in the Junior Market TOP10 this past week.

Caribbean Producers is the primary supplier of foods and beverages to the growing tourist industry on the north coast of Jamaica and St Lucia, the company is also expanding its meat processing arm as well as retail areas in both countries. ICInsider.com’s projected EPS is $1.35 for the fiscal year to June 2024. With plans for long term growth in the local tourism sector, the company has a B base for growth for many years to come.

Jamaica Broilers although out of the TOP10, is undervalued and possesses good long term growth prospects as they constantly spend resources to expand or modernise the operation.

In Main Market activity this past week, General Accident jumped 16 percent to $6.15, a 52 weeks’ high, with buying interest in recent weeks, being very high and active supply in the market low, a recipe for higher prices ahead and Key Insurance lost 14 percent to end at $2.22.

The Junior Market closed the week with a 17 percent jump for Iron Rock Insurance to $2.51 while Consolidated Bakeries gained 8 percent to $2.19 but Jamaican Teas dropped 13 percent to $2.40 and Caribbean Cream lost 8 percent to land at $3.58 while Express Catering and Access Financial fell by 7 percent to $3.70 and $19.86 respectively.

The average PE for the JSE Main Market ICTOP 10 stands at 5.5, well below the market average of 13.1 and the Junior Market TOP10 sits at 7.2 over half of the market, with an average of 12.5.

The average PE for the JSE Main Market ICTOP 10 stands at 5.5, well below the market average of 13.1 and the Junior Market TOP10 sits at 7.2 over half of the market, with an average of 12.5.

The Main Market ICTOP10 is projected to gain an average of 274 percent by May 2025, based on 2023 forecasted earnings, providing better values than the Junior Market with the potential to gain 183 percent over the same period.

In the Main Market ICTOP 10, a total of 17 of the most highly valued stocks representing 33 percent of the Main Market are priced at a PE of 15 to 106, with an average of 30 and 27 excluding the highest PE ratios, and a PE of 24 for the top half and 21 excluding the stocks with overweight values.

In the Junior Market IC TOP10 are 9 stocks, or 20 percent of the market, with PEs ranging from 15 to 50, averaging 22, well above the market’s average. The top half of the market has an average PE of 17, possibly the lowest fair value for stocks, currently.

Of great import is that the averages of both markets are now converging around a PE of 20 for close to a third of the market, as the year is coming to a close and with more information available on the full year’s earnings.

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market, but this is not always so. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market, but this is not always so. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

IC TOP10 stocks will likely deliver the best returns on or around May 2025 and are ranked in order of potential gains, computed using projected earnings for the current fiscal year. Expected values will change as stock prices fluctuate and result in weekly movements in and out of the lists. Revisions to earnings are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

Lasco companies out of ICTOP10

Shake up took place in the ICTOP10 with Lasco Manufacturing that closed up by 10 percent to $6.08 at the end of last week and Lasco Distributors that fell 7 percent to $4.25 and dropping out of the TOP10 following migration from the Junior to the Main Market last week Wednesday.

With the 2024 financial year ending in March, the two companies will see a bump in earnings for 2025 and likely put them in the ICTOP10 again. Since the switch in listing, the number of stocks offered for sale has declined sharply and so have the bids to buy.

With the 2024 financial year ending in March, the two companies will see a bump in earnings for 2025 and likely put them in the ICTOP10 again. Since the switch in listing, the number of stocks offered for sale has declined sharply and so have the bids to buy.

Coming into the Junior Market listing are Consolidated Bakeries, while AMG Packaging returns after a weeks’ absence, with the price falling to $3.12 from $3.27, EPS for the Consolidated Bakeries is projected at 30 cents for 2024, pushing it into position 2. The company promised much with a good brand but has delivered inadequate returns since being listed in 2013, but the operations have been undergoing changes with more focus on higher margin products and less on the regular breads, that faces greater competition in the market. A review of the 2023 audited statements shows that cost jumped but this was mostly for big wage increases which should moderate in 2025. Investing in the company is not without risk but it should benefit from continued growth and improved employment in the local economy going forward that should result in revenues growing faster than cost.

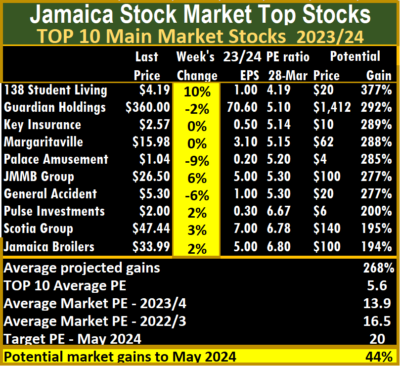

There were no new listing in the Main Market, but 138 Student Living rose 10 percent to $4.19 and JMMB Group gained 6 percent to close trading last week at $26.50, while Palace Amusements shed 9 percent to $1.04 and General Accident fell 6 percent to $5.30.

The Junior Market closed last week in positive territory as Stationery & Office Supplies climbed 13 percent to $1.70 while, Jamaican Teas, ISP Finance and Lasco Manufacturing all gained 10 percent, Iron Rock Insurance dropped 15 percent to $2.14 and Lasco Distributors fell 7 percent to $4.25.

There were no changes to the list of companies in the Main Market TOP10 this past week.

The average PE for the JSE Main Market ICTOP 10 stands at 5.6, well below the market average of 13.4 and the Junior Market TOP10 sits at 7.2 over half of the market, with an average of 13.3.

The Main Market ICTOP10 is projected to gain an average of 270 percent by May 2024, based on 2023 forecasted earnings, providing better values than the Junior Market with the potential to gain 178 percent over the same period.

The Main Market ICTOP10 is projected to gain an average of 270 percent by May 2024, based on 2023 forecasted earnings, providing better values than the Junior Market with the potential to gain 178 percent over the same period.

In the Main Market ICTOP 10, a total of 16 of the most highly valued stocks representing 31 percent of the Main Market are priced at a PE of 15 to 106, with an average of 32 and 23 excluding the highest PE ratios, and a PE of 24 for the top half and 19 excluding the stocks with overweight values.

In the Junior Market IC TOP10 are 9 stocks, or 20 percent of the market, with PEs ranging from 15 to 50, averaging 23, well above the market’s average. The top half of the market has an average PE of 18, possibly the lowest fair value for stocks, currently.

Of great import is that the averages of both markets are now converging around a PE of 20 for close to a third of the market, as the year is coming to a close and with more information available on the full year’s earnings.

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market, but this is not always so. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market, but this is not always so. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

IC TOP10 stocks will likely deliver the best returns on or around May 2024 and are ranked in order of potential gains, computed using projected earnings for the current fiscal year. Expected values will change as stock prices fluctuate and result in weekly movements in and out of the lists. Revisions to earnings are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

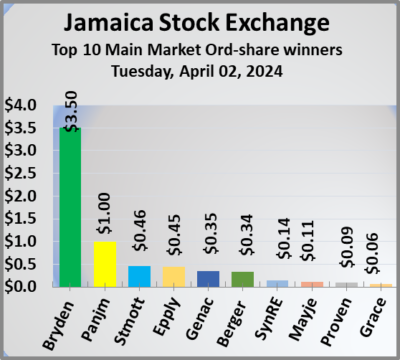

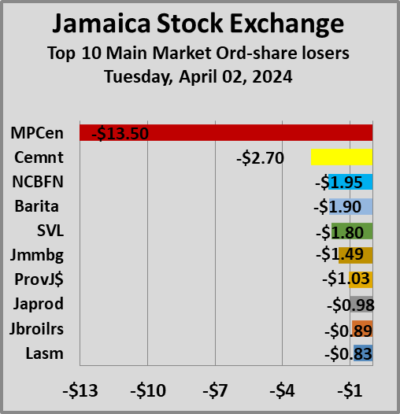

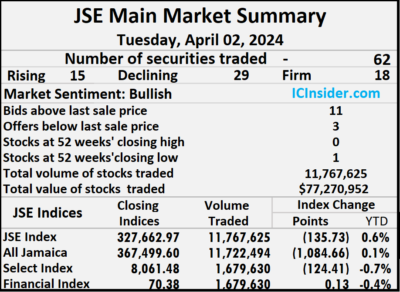

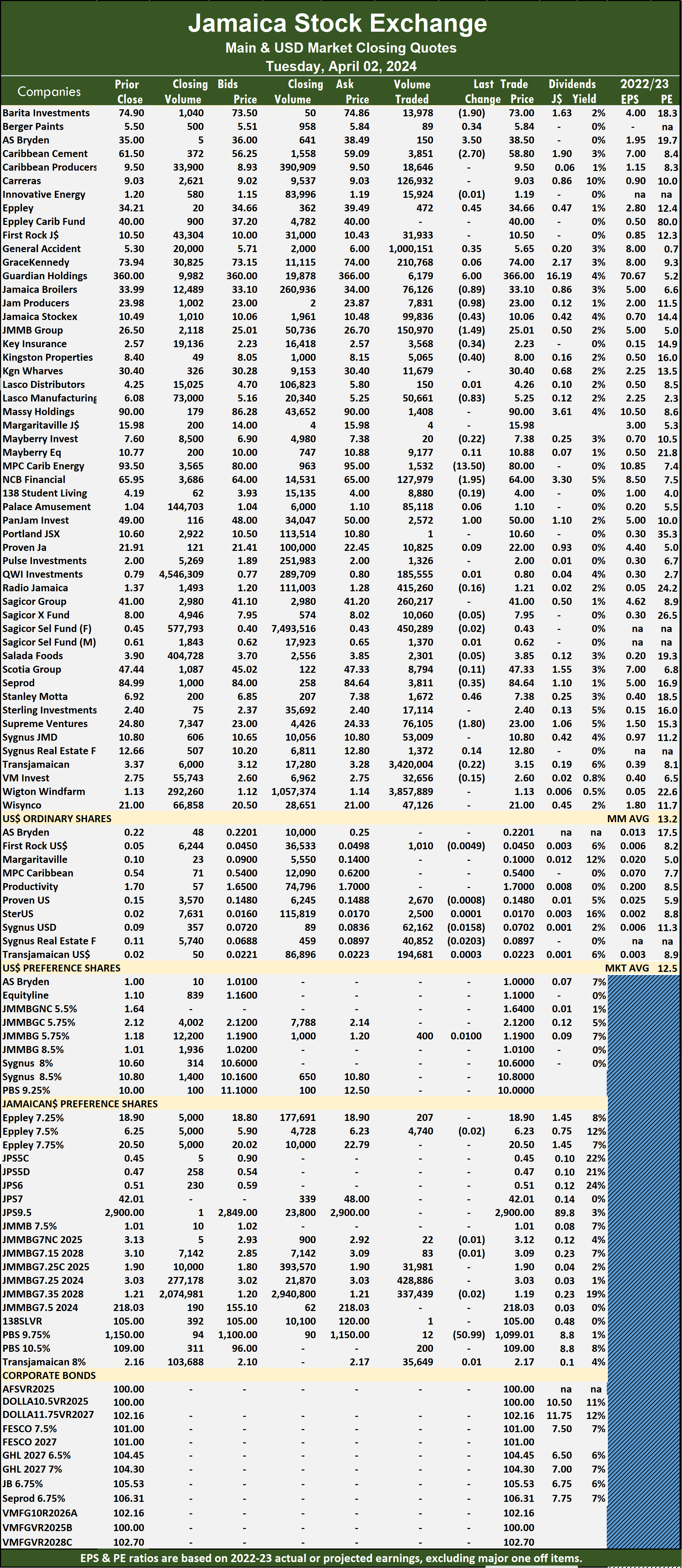

JSE Main Market slips into April

Following the closure of trading for the long Easter weekend, the Jamaica Stock Exchange Main Market ended on Tuesday, with declining stocks overpowering winning two to one following a 25 percent fall in the volume of stocks traded declining with a 54 percent drop in value compared to Thursday, with trading in 62 securities compared with 60 on Thursday, with prices of 15 stocks rising, 29 declining and 18 ending unchanged as Radio Jamaica closed at a 52 weeks’ low of $1.20.

The market closed with 11,767,625 shares being traded for $77,270,952 compared with 15,645,101 units at $167,372,295 on Thursday.

The market closed with 11,767,625 shares being traded for $77,270,952 compared with 15,645,101 units at $167,372,295 on Thursday.

Trading averaged 189,800 shares at $1,246,306 compared to 260,752 units at $2,789,538 on Thursday compared to March that closed with an average of 828,473 units at $2,341,254.

Wigton Windfarm led trading with 3.86 million shares for 32.8 percent of the overall volume followed by Transjamaican Highway with 3.42 million units for 29.1 percent of the day’s trade and General Accident with 1.0 million units for 8.5 percent of market share.

The All Jamaican Composite Index sank 1,084.66 points to close trading at 367,499.60, the JSE Main Index declined 135.73 points to settle at 327,662.97 and the JSE Financial Index rallied 0.13 points to 70.38.

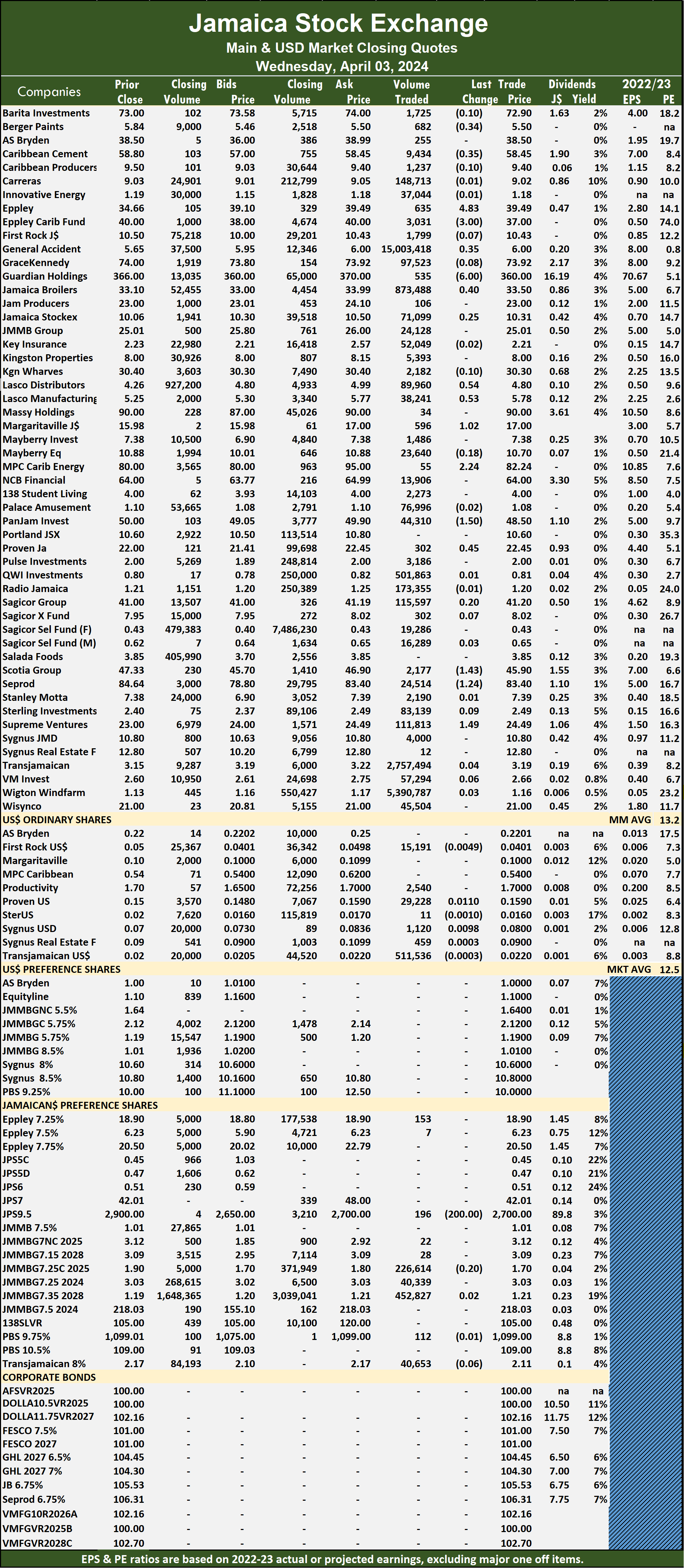

The Main Market ended trading with an average PE Ratio of 13.2. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024.

Investor’s Choice bid-offer indicator shows 11 stocks ended with bids higher than their last selling prices and three with lower offers.

Investor’s Choice bid-offer indicator shows 11 stocks ended with bids higher than their last selling prices and three with lower offers.

At the close, AS Bryden jumped $3.50 and ended at $38.50 in an exchange of 150 stocks, Barita Investments lost $1.90 to close at $73 with investors swapping 13,978 units, Berger Paints popped 34 cents to end at $5.84 after 89 shares passed through the market. Caribbean Cement sank $2.70 in closing at $58.80 after an exchange of 3,851 stock units, Eppley rallied 45 cents to close at $34.66 in switching ownership of 472 shares, General Accident increased 35 cents to $5.65 after a transfer of 1,000,151 stock units. Guardian Holdings climbed $6 to close at $366, with 6,179 units changing hands, Jamaica Broilers declined 89 cents to $33.10 in an exchange of 76,126 units. Jamaica Producers fell 98 cents to end at $23 with investors dealing in 7,831 stocks, Jamaica Stock Exchange skidded 43 cents to $10.06, with 99,836 shares crossing the market, JMMB Group dropped $1.49 and ended at $25.01 in trading 150,970 stock units. Key Insurance shed 34 cents to close at $2.23 after an exchange of 3,568 shares, Kingston Properties dipped 40 cents in closing at $8 after 5,065 stock units passed through the market,  Lasco Manufacturing sank 83 cents to end at $5.25 as investors traded 50,661 stocks. MPC Caribbean Clean Energy dropped $13.50 to $80 with an exchange of 1,532 units, NCB Financial lost $1.95 to end at $64 with investors trading 127,979 shares, Pan Jamaica gained $1 in closing at $50, with 2,572 units crossing the exchange. Seprod skidded 35 cents to close at $84.64 with investors transferring 3,811 stocks, Stanley Motta rose 46 cents and ended at $7.38 with 1,672 stock units clearing the market and Supreme Ventures fell $1.80 to $23 while exchanging 76,105 shares.

Lasco Manufacturing sank 83 cents to end at $5.25 as investors traded 50,661 stocks. MPC Caribbean Clean Energy dropped $13.50 to $80 with an exchange of 1,532 units, NCB Financial lost $1.95 to end at $64 with investors trading 127,979 shares, Pan Jamaica gained $1 in closing at $50, with 2,572 units crossing the exchange. Seprod skidded 35 cents to close at $84.64 with investors transferring 3,811 stocks, Stanley Motta rose 46 cents and ended at $7.38 with 1,672 stock units clearing the market and Supreme Ventures fell $1.80 to $23 while exchanging 76,105 shares.

In the preference segment, Productive Business Solutions 10.5% preference share dropped $50.99 to end at $1,099.01 with a transfer of 12 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

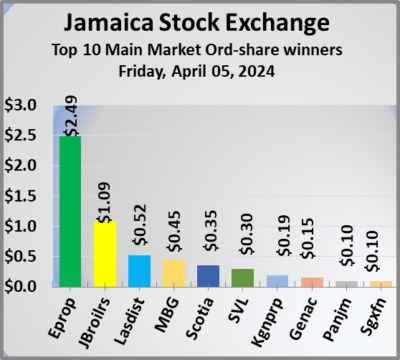

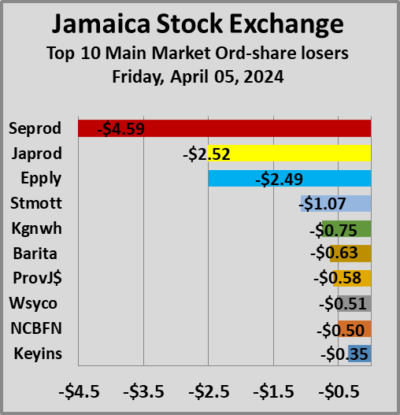

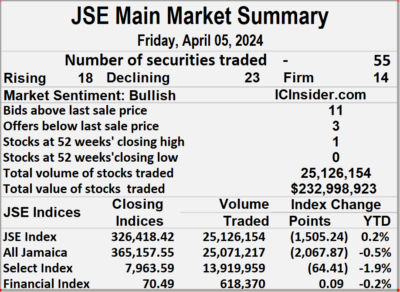

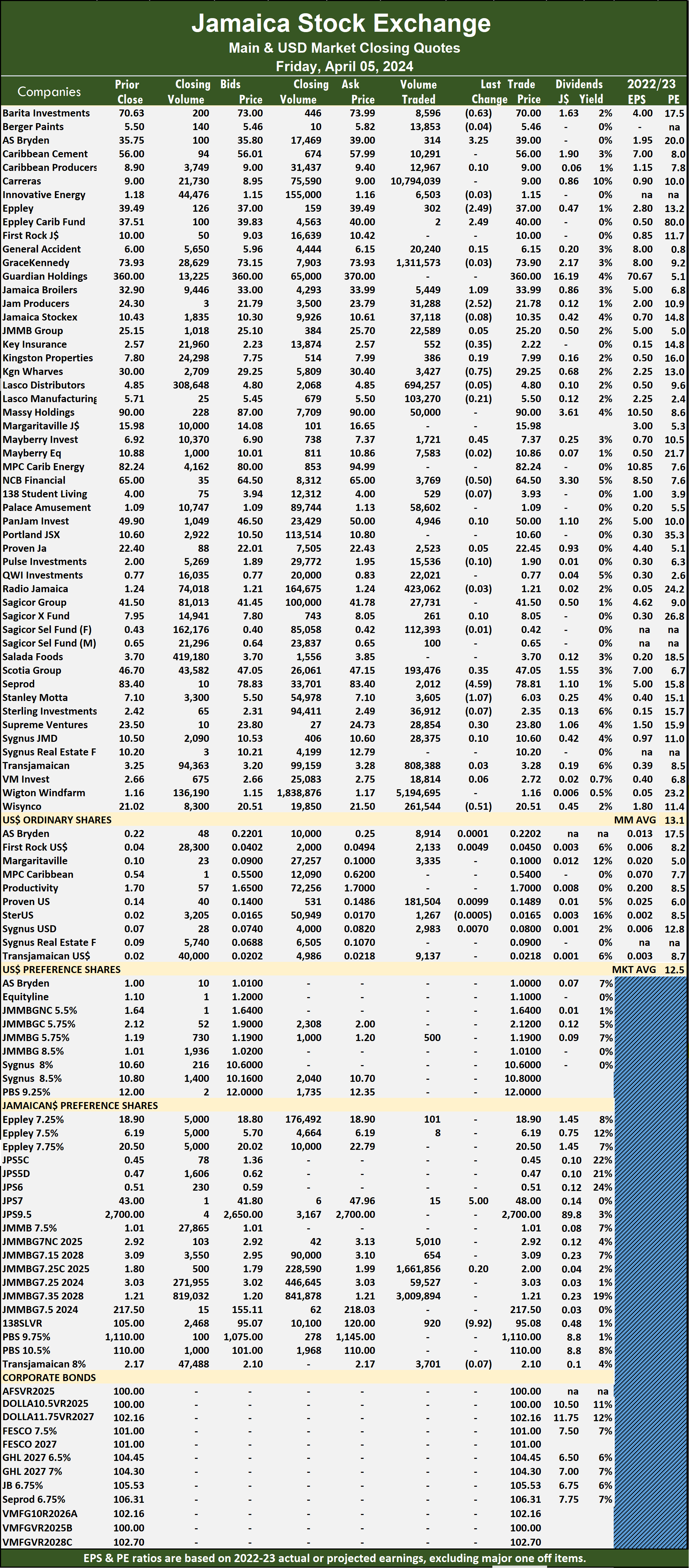

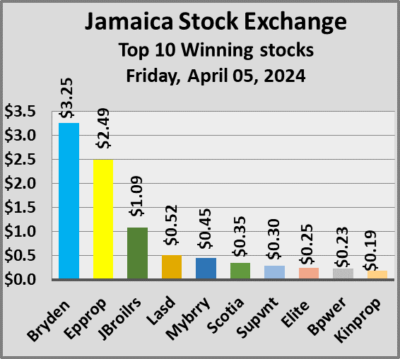

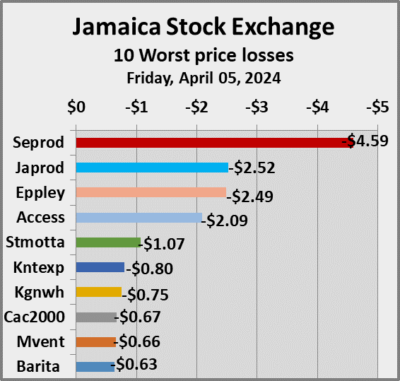

Trading drops & prices fall on Main Market

Trading slipped on the Jamaica Stock Exchange Main Market ended on Friday and pulled the Market indices with it after a 95 percent drop in the volume of stocks traded and an 87 percent fall in value compared with that on Thursday, with trading in 55 securities compared with 61 on Thursday and resulted in prices of 18 stocks rising, 23 declining and 14 ending unchanged.

The market closed with an exchange of 25,126,154 shares for $233,060,092, well down from 551,681,523 units at $1,798,734,217 on Thursday.

The market closed with an exchange of 25,126,154 shares for $233,060,092, well down from 551,681,523 units at $1,798,734,217 on Thursday.

Trading averaged 456,839 shares at $4,237,456 compared to 9,043,959 units at $29,487,446 on Thursday and month to date, an average of 2,585,174 units at $9,516,984 compared with 3,224,837 units at $11,103,727 on the previous day and March that closed with an average of 828,473 units at $2,341,254.

Carreras led trading with 10.79 million shares for 43 percent of total volume followed by Wigton Windfarm with 5.19 million units for 20.7 percent of the day’s trade, JMMB 9.5% preference share chipped in with 3.01 million units for 12 percent market share, as JMMB Group 7.25% preference share due 2024 ended with 1.66 million units for 6.6 percent total shares traded and GraceKennedy with 1.31 million units for 5.2 percent of the overall volume.

The All Jamaican Composite Index slipped 2,067.87 points to conclude trading at 365,157.55, the JSE Main Index skidded 1,505.24 points to wrap up trading at 326,418.42 and the JSE Financial Index rallied 0.09 points to 70.49.

The Main Market ended trading with an average PE Ratio of 13.1. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024.

The Main Market ended trading with an average PE Ratio of 13.1. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024.

Investor’s Choice bid-offer indicator shows 11 stocks ended with bids higher than their last selling prices and three with lower offers.

At the close, AS Bryden gained $3.25 in closing at $39 with an exchange of 314 stock units, Barita Investments lost 63 cents to end at $70, with 8,596 shares crossing the market, Eppley shed $2.49 to end at $37 with a transfer of 302 units. Eppley Caribbean Property Fund rose $2.49 to close at $40 after investors ended trading just two stocks, Jamaica Broilers rallied $1.09 and ended at $33.99 in an exchange of 5,449 shares, Jamaica Producers fell $2.52 to finish at $21.78 with 31,288 stock units clearing the market. Key Insurance dipped 35 cents and ended at $2.22 in trading 552 stocks, Kingston Wharves sank 75 cents to $29.25, with 3,427 units crossing the market, Mayberry Group increased 45 cents to close at $7.37 in an exchange of 1,721 shares.  NCB Financial skidded 50 cents to end at $64.50 with investors transferring 3,769 units, Scotia Group climbed 35 cents in closing at $47.05 in switching ownership of 193,476 stocks, Seprod shed $4.59 to finish at $78.81 and closed with an exchange of 2,012 stock units. Stanley Motta declined $1.07 to $6.03 after 3,605 shares passed through the market, Supreme Ventures popped 30 cents to finish at $23.80 after an exchange of 28,854 stock units and Wisynco Group dropped 51 cents and ended at $20.51 with investors trading 261,544 stocks.

NCB Financial skidded 50 cents to end at $64.50 with investors transferring 3,769 units, Scotia Group climbed 35 cents in closing at $47.05 in switching ownership of 193,476 stocks, Seprod shed $4.59 to finish at $78.81 and closed with an exchange of 2,012 stock units. Stanley Motta declined $1.07 to $6.03 after 3,605 shares passed through the market, Supreme Ventures popped 30 cents to finish at $23.80 after an exchange of 28,854 stock units and Wisynco Group dropped 51 cents and ended at $20.51 with investors trading 261,544 stocks.

In the preference segment, Jamaica Public Service 7% advanced $5 to end at $48 with 15 units crossing the exchange and Productive Business Solutions 9.75% preference share fell $9.92 in closing at $95.08 with traders dealing in 920 stocks.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

JSE suffers big decline on Friday

The Main and Junior markets suffered a sizable fall but the USD Market inched up higher, with trading on the Jamaica Stock Exchange coming back to earth on Friday, following the big bounce on Thursday with trading ended with the volume and value of stocks changing hands dropping sharply from that of the previous trading day, resulting in prices of only 27 shares rising and 39 declining.

At the close of trading, the JSE Combined Market Index dropped 1,798.83 points to 339,161.61, the All Jamaican Composite Index sank 2,067.87 points to end at 365,157.55, the JSE Main Index shed 1,505.24 points to end at 326,418.42. The Junior Market Index plunged 51.06 points to 3,766.56 and the JSE USD Market Index rallied 0.63 points to finish at 244.03.

At the close of trading, the JSE Combined Market Index dropped 1,798.83 points to 339,161.61, the All Jamaican Composite Index sank 2,067.87 points to end at 365,157.55, the JSE Main Index shed 1,505.24 points to end at 326,418.42. The Junior Market Index plunged 51.06 points to 3,766.56 and the JSE USD Market Index rallied 0.63 points to finish at 244.03.

At the close of trading, 29,059,711 shares were exchanged in all three markets, well off from 555,998,264 units on Thursday, with the value of stocks traded on the Junior and Main markets amounted to $240.14 million, vastly lower than the $1.808 billion on the previous trading day and the JSE USD market closed with an exchange of 209,773 shares for US$28,768 compared to 186,609 units at US$46,047 on Thursday.

In Main Market activity, Carreras led trading with 10.79 million shares followed by Wigton Windfarm with 5.19 million units, then JMMB 9.5% preference share with 3.01 million shares, JMMB Group 7.25% preference share due 2024 chipped in with 1.66 million units and GraceKennedy with 1.31 million stock units.

In the Junior Market, ONE on ONE Educational led trading with 1.23 million shares followed by EduFocal with 432,820 stock units and Fosrich with 222,006 units.

In the Junior Market, ONE on ONE Educational led trading with 1.23 million shares followed by EduFocal with 432,820 stock units and Fosrich with 222,006 units.

In the preference segment, Jamaica Public Service 7% advanced $5 to end at $48 and Productive Business Solutions 9.75% preference share fell $9.92 in closing at $95.08.

The market’s PE ratio, the most popular measure used to determine the value of stocks, ended at 19.7 on 2022-23 earnings and 13.7 times those for 2023-24 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily charts provide investors with regularly updated information to help decision-making.

The PE ratio chart covers all ordinary shares on the Jamaica Stock Exchange, grouped by industry, allowing for easy comparisons between the same sector companies and the overall market. The EPS & PE ratios are based on 2023 and 2024 actual or projected earnings, excluding major one off items.

Investors need pertinent information to navigate numerous investment options successfully in the stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

Investors should use the chart to help make rational decisions when investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors.  Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The net asset value of each company is reported as a guide for investors to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

Dividends paid or payable and yields for each company are shown in the Main and Junior Markets’ daily report charts, along with the closing volume of the highest bid and the lowest offer for each company.

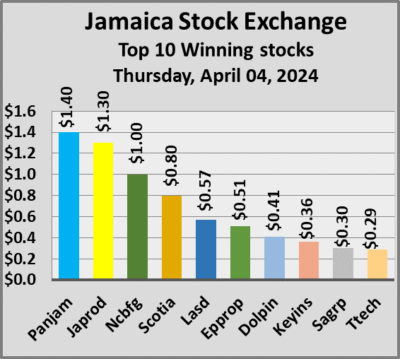

Transjamaican dominated JSE trading

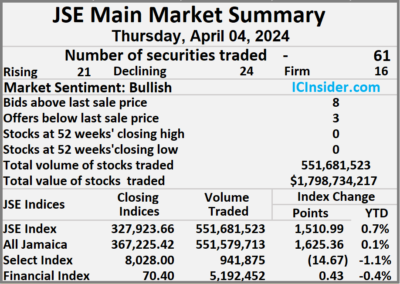

Transjamaican Highway dominated trading on the Jamaica Stock Exchange on Thursday with more than half a billion units traded valued at just over $1.75 billion, with trading resulted in the Main and USD Markets rising and the Junior Market JSE USD market closing lower as trading ended with the value and number of stocks changing hands surging sharply over the previous trading day and resulting in prices of 33 shares rising and 39 declining.

At the close of trading, the JSE Combined Market Index climbed 1,326.81 points to 340,960.44, the All Jamaican Composite Index gained 1,625.36 points to 367,225.42, the JSE Main Index rallied 1,510.99 points to 327,923.66. The Junior Market Index declined 17.46 points to end the day at 3,817.62 and the JSE USD Market Index rose 2.55 points to close at 243.40.

At the close of trading, the JSE Combined Market Index climbed 1,326.81 points to 340,960.44, the All Jamaican Composite Index gained 1,625.36 points to 367,225.42, the JSE Main Index rallied 1,510.99 points to 327,923.66. The Junior Market Index declined 17.46 points to end the day at 3,817.62 and the JSE USD Market Index rose 2.55 points to close at 243.40.

At the close of trading, 555,998,264 shares were exchanged in all three markets, well up on 37,702,741 units on Wednesday, with the value of stocks traded on the Junior and Main markets amounted to $1.808 billion, up from just $178.27 million on the previous trading day and the JSE USD market closed with an exchange of 186,609 shares for US$46,047 compared to 560,085 units at US$19,785 on Wednesday.

In the Main Market activity, Transjamaican Highway led trading with 540.57 million shares followed by QWI Investments with 4.40 million stocks, JMMB Group 7.25% preference share due 2024 ended with 1.98 million units and Wigton Windfarm closed with 1.42 million stock units being traded.

In the Junior Market, Express Catering led trading with 805,692 shares followed by EduFocal with 793,618 stock units and MFS Capital Partners with 461,757 units.

In the preference segment, Productive Business Solutions 10.5 % preference share advanced $11 to finish at $1,110 and Sygnus Credit Investments C10.5% popped $1 and ended at $110.

The market’s PE ratio, the most popular measure used to determine the value of stocks, ended at 21.93 on 2022-23 earnings and 14.3 times those for 2023-24 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily charts provide investors with regularly updated information to help decision-making.

The market’s PE ratio, the most popular measure used to determine the value of stocks, ended at 21.93 on 2022-23 earnings and 14.3 times those for 2023-24 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily charts provide investors with regularly updated information to help decision-making.

The PE ratio chart covers all ordinary shares on the Jamaica Stock Exchange, grouped by industry, allowing for easy comparisons between the same sector companies and the overall market. The EPS & PE ratios are based on 2023 and 2024 actual or projected earnings, excluding major one off items.

Investors need pertinent information to navigate numerous investment options successfully in the stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

Investors should use the chart to help make rational decisions when investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The net asset value of each company is reported as a guide for investors to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

The net asset value of each company is reported as a guide for investors to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

Dividends paid or payable and yields for each company are shown in the Main and Junior Markets’ daily report charts, along with the closing volume of the highest bid and the lowest offer for each company.

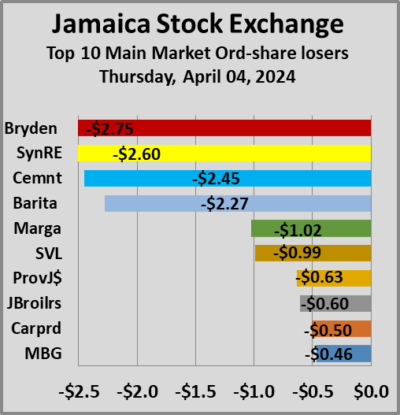

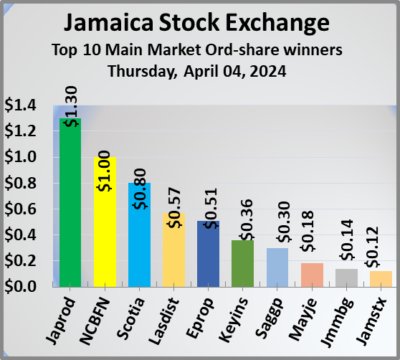

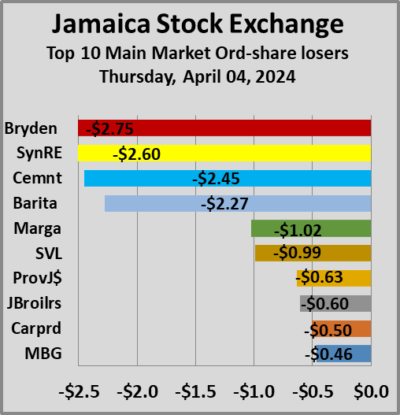

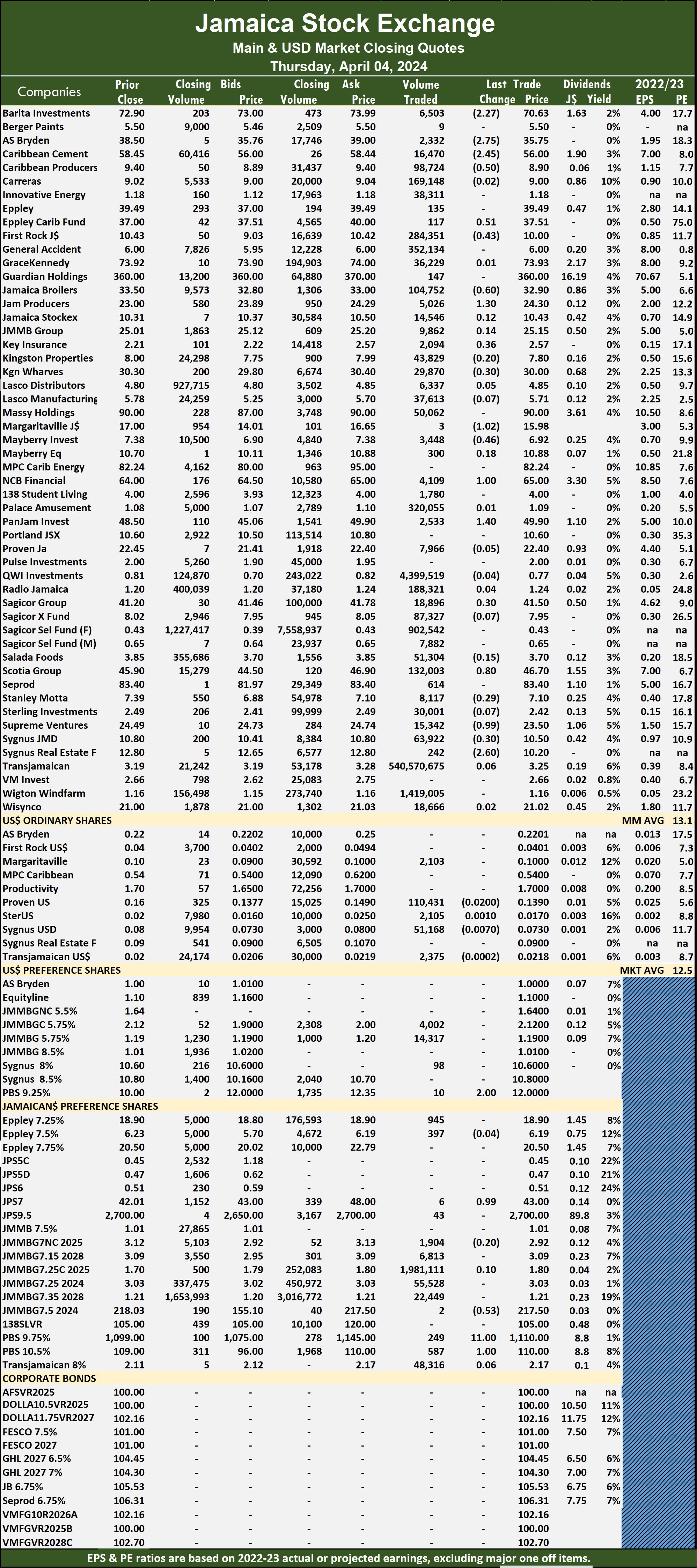

Transjamaican steals Main Market spotlight

Trading surged on the Jamaica Stock Exchange Main Market ended on Thursday, with Transjamaican Highway dominating with more than 540 million shares worth $1.756 billion, sending the volume of stocks traded up by a solid 1,967 percent with the value jumping 1,053 percent more than on Wednesday, with trading in 61 securities compared with 60 on Wednesday, with prices of 21 stocks rising, 24 declining and 16 ending unchanged.

The market closed after 551,681,523 shares were traded for $1,798,734,217 compared with 26,696,028 units at $155,976,938 on Wednesday.

The market closed after 551,681,523 shares were traded for $1,798,734,217 compared with 26,696,028 units at $155,976,938 on Wednesday.

Trading averaged 9,043,959 shares at $29,487,446 compared to 444,934 stocks at $2,599,616 on Wednesday. Trading for the month to date, ended with an average of 3,224,837 units at $11,103,727, compared with 315,276 units at $1,911,868 on the previous day and March that closed with an average of 828,473 units at $2,341,254.

Transjamaican Highway led trading with 540.57 million shares for 98 percent of total volume followed by QWI Investments with 4.40 million units for 0.8 percent of the day’s trade, JMMB Group 7.25% preference share due 2024 closed with 1.98 million units for 0.4 percent market share and Wigton Windfarm with 1.42 million units for 0.3 percent of total volume.

The All Jamaican Composite Index climbed 1,625.36 points to lock up trading at 367,225.42, the JSE Main Index jumped 1,510.99 points to close at 327,923.66 and the JSE Financial Index popped 0.43 points to end the day at 70.40.

The Main Market ended trading with an average PE Ratio of 13.2. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024.

The Main Market ended trading with an average PE Ratio of 13.2. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024.

Investor’s Choice bid-offer indicator shows eight stocks ended with bids higher than their last selling prices and three with lower offers.

At the close, AS Bryden shed $2.75 to close at $35.75 with investors trading 2,332 units, Barita Investments fell $2.27 in closing at $70.63, with 6,503 stocks changing hands, Caribbean Cement declined $2.45 and ended at $56 as investors exchanged 16,470 shares. Caribbean Producers shed 50 cents to finish at $8.90 in trading 98,724 stock units, Eppley Caribbean Property Fund climbed 51 cents to close at $37.51 after an exchange of 117 shares, First Rock Real Estate dropped 43 cents to end at $10 with investors swapping 284,351 stock units. Jamaica Broilers sank 60 cents to $32.90 in an exchange of 104,752 units, Jamaica Producers increased $1.30 to close at $24.30 with investors dealing in 5,026 stocks, Key Insurance popped 36 cents and ended at $2.57 with 2,094 shares clearing the market. Kingston Wharves skidded 30 cents to finish at $30 with investors transferring 29,870 units, Margaritaville lost $1.02 to end at $15.98 in switching ownership of 3 stocks, Mayberry Group slipped 46 cents in closing at $6.92 after 3,448 stock units passed through the market. NCB Financial advanced $1 to $65 in an exchange of 4,109 shares, Pan Jamaica rose $1.40 and ended at $49.90, with 2,533 stock units crossing the market, Sagicor Group gained 30 cents to finish at $41.50 after a transfer of 18,896 stocks. Scotia Group rallied 80 cents to end at $46.70 after 132,003 units were traded, Supreme Ventures sank 99 cents in closing at $23.50 with a transfer of 15,342 stocks, Sygnus Credit Investments skidded 30 cents to close at $10.50, with 63,922 units crossing the exchange and Sygnus Real Estate Finance fell $2.60 to $10.20 with traders dealing in 242 shares.

Kingston Wharves skidded 30 cents to finish at $30 with investors transferring 29,870 units, Margaritaville lost $1.02 to end at $15.98 in switching ownership of 3 stocks, Mayberry Group slipped 46 cents in closing at $6.92 after 3,448 stock units passed through the market. NCB Financial advanced $1 to $65 in an exchange of 4,109 shares, Pan Jamaica rose $1.40 and ended at $49.90, with 2,533 stock units crossing the market, Sagicor Group gained 30 cents to finish at $41.50 after a transfer of 18,896 stocks. Scotia Group rallied 80 cents to end at $46.70 after 132,003 units were traded, Supreme Ventures sank 99 cents in closing at $23.50 with a transfer of 15,342 stocks, Sygnus Credit Investments skidded 30 cents to close at $10.50, with 63,922 units crossing the exchange and Sygnus Real Estate Finance fell $2.60 to $10.20 with traders dealing in 242 shares.

In the preference segment, Jamaica Public Service 7% rose 99 cents in closing at $43, with 6 stock units crossing the market, 138 Student Living preference share dipped 53 cents to close at $217.50 after exchanging 2 shares. Productive Business Solutions 10.5 % preference share advanced $11 to finish at $1110 and closed with an exchange of 249 stock units and Sygnus Credit Investments C10.5% popped $1 and ended at $110 with an exchange of 587 units.

In the preference segment, Jamaica Public Service 7% rose 99 cents in closing at $43, with 6 stock units crossing the market, 138 Student Living preference share dipped 53 cents to close at $217.50 after exchanging 2 shares. Productive Business Solutions 10.5 % preference share advanced $11 to finish at $1110 and closed with an exchange of 249 stock units and Sygnus Credit Investments C10.5% popped $1 and ended at $110 with an exchange of 587 units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

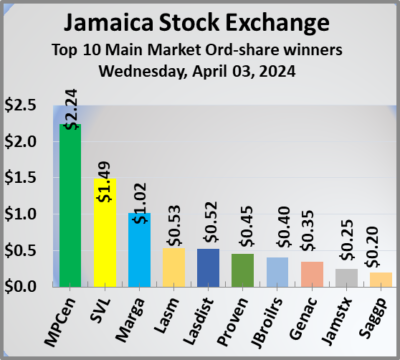

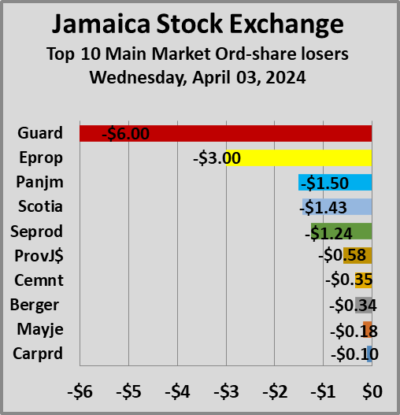

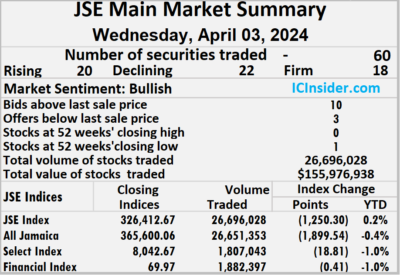

More declines for Main Market

Falling stocks just edged out those rising in trading on the Main Market of the Jamaica Stock Exchange on Wednesday, with trading in 60 securities compared with 62 on Tuesday, with prices of 20 stocks rising, 22 declining and 18 ending unchanged, with a surge of 127 percent in the volume of stocks traded and 102 percent greater value than on Tuesday.

The market closed with an exchange of 26,696,028 shares at $155,976,938 from 11,767,625 units at $77,270,952 on Tuesday.

The market closed with an exchange of 26,696,028 shares at $155,976,938 from 11,767,625 units at $77,270,952 on Tuesday.

Trading averaged 444,934 shares at $2,599,616 compared to 189,800 units at $1,246,306 on Tuesday and month to date, an average of 315,276 units at $1,911,868 compared with March that closed with an average of 828,473 units at $2,341,254.

General Accident led trading with 15.0 million shares for 56.2 percent of total volume followed by Wigton Windfarm with 5.39 million units for 20.2 percent of the day’s trade and Transjamaican Highway with 2.76 million stock units for 10.3 percent market share.

The All Jamaican Composite Index lost 1,899.54 points to end trading at 365,600.06, the JSE Main Index fell 1,250.30 points to 326,412.67 and the JSE Financial Index skidded 0.41 points to settle at 69.97.

The Main Market ended trading with an average PE Ratio of 13.2. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with financial year ending around August 2024.

The Main Market ended trading with an average PE Ratio of 13.2. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with financial year ending around August 2024.

Investor’s Choice bid-offer indicator shows 10 stocks ended with bids higher than their last selling prices and three with lower offers.

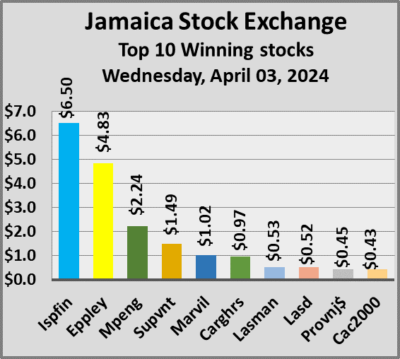

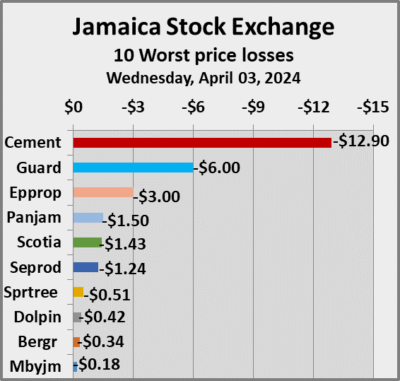

At the close, Berger Paints declined 34 cents and ended at $5.50 with investors trading 682 shares, Caribbean Cement lost 35 cents to close at $58.45 in an exchange of 9,434 stocks, Eppley gained $4.83 in closing at $39.49 as investors traded 635 units. Eppley Caribbean Property Fund fell $3 to end at $37 after investors ended trading 3,031 stock units, General Accident popped 35 cents to $6, with 15,003,418 shares crossing the market, Guardian Holdings skidded $6 to $360 in an exchange of 535 stock units. Jamaica Broilers advanced 40 cents and ended at $33.50 with investors dealing in 873,488 stocks, Lasco Distributors rose 54 cents to $4.80 with a transfer of 89,960 units,  Lasco Manufacturing rallied 53 cents to close at $5.78, with 38,241 shares crossing the exchange. Margaritaville gained $1.02 to end at $17 in trading 596 stock units, MPC Caribbean Clean Energy rose $2.24 to $82.24 after an exchange of 55 units, Pan Jamaica sank $1.50 and ended at $48.50 with investors trading 44,310 stocks. Proven Investments popped 45 cents in closing at $22.45 in switching ownership of 302 units, Scotia Group dropped $1.43 to $45.90 with traders dealing in 2,177 shares, Seprod shed $1.24 to close at $83.40 while exchanging 24,514 stock units and Supreme Ventures increased $1.49 to $24.49 after a transfer of 111,813 stocks.

Lasco Manufacturing rallied 53 cents to close at $5.78, with 38,241 shares crossing the exchange. Margaritaville gained $1.02 to end at $17 in trading 596 stock units, MPC Caribbean Clean Energy rose $2.24 to $82.24 after an exchange of 55 units, Pan Jamaica sank $1.50 and ended at $48.50 with investors trading 44,310 stocks. Proven Investments popped 45 cents in closing at $22.45 in switching ownership of 302 units, Scotia Group dropped $1.43 to $45.90 with traders dealing in 2,177 shares, Seprod shed $1.24 to close at $83.40 while exchanging 24,514 stock units and Supreme Ventures increased $1.49 to $24.49 after a transfer of 111,813 stocks.

In the preference segment, Jamaica Public Service 9.5% dropped $200 to close at 52 weeks’ low of $2700 with 196 shares clearing the market.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

JSE Main Market & Juniors rise

The Main Market of the Jamaica Stock Exchange and the JSE USD declined in trading on Wednesday but the Junior Market recovered a third of Tuesday’s big loss as the level of trading rose with the number of stocks changing hands rising sharply over that on Tuesday, with the value of stocks traded jumping sharply over the previous trading day, resulting in prices of 36 shares rising and 32 declining.

At the close of trading, the JSE Combined Market Index fell 1,050.46 points to close at 339,633.63, the All Jamaican Composite Index dropped 1,899.54 points to finish trading at 365,600.06, the JSE Main Index shed 1,250.30 points to end at 326,412.67. The Junior Market Index climbed 21.25 points to finish at 3,835.08 and the JSE USD Market Index declined by 5.57 points to end the day at 240.85.

At the close of trading, the JSE Combined Market Index fell 1,050.46 points to close at 339,633.63, the All Jamaican Composite Index dropped 1,899.54 points to finish trading at 365,600.06, the JSE Main Index shed 1,250.30 points to end at 326,412.67. The Junior Market Index climbed 21.25 points to finish at 3,835.08 and the JSE USD Market Index declined by 5.57 points to end the day at 240.85.

At the close of the market on Friday, 37,702,741 shares were exchanged in all three markets, well above the 19,286,548 units that were exchanged on Tuesday, with the value of stocks traded on the Junior and Main markets amounted to $178.27 million, up from $92.38, million on the previous trading day and the JSE USD market closed with an exchange of 560,085 shares for US$19,785 compared to 304,275 units at US$13,337 on Tuesday.

In the Main Market, General Accident led trading with 15.0 million shares followed by Wigton Windfarm with 5.39 million units and Transjamaican Highway with 2.76 million stock units.

In the Junior Market, Spur Tree Spices led trading with 4.31 million shares followed by JFP Ltd with 990,360 units and MFS Capital Partners with 912,316 stock units.

In the Junior Market, Spur Tree Spices led trading with 4.31 million shares followed by JFP Ltd with 990,360 units and MFS Capital Partners with 912,316 stock units.

In the preference segment, Jamaica Public Service 9.5% dropped $200 to close at $2,700.

The market’s PE ratio, the most popular measure used to determine the value of stocks, ended at 20.1 on 2022-23 earnings and 13.8 times those for 2023-24 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily charts provide investors with regularly updated information to help decision-making.

The PE ratio chart covers all ordinary shares on the Jamaica Stock Exchange, grouped by industry, allowing for easy comparisons between the same sector companies and the overall market. The EPS & PE ratios are based on 2023 and 2024 actual or projected earnings, excluding major one off items.

Investors need pertinent information to navigate numerous investment options successfully in the stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

Investors should use the chart to help make rational decisions when investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors.  Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The net asset value of each company is reported as a guide for investors to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

Dividends paid or payable and yields for each company are shown in the Main and Junior Markets’ daily report charts, along with the closing volume of the highest bid and the lowest offer for each company.

- « Previous Page

- 1

- 2

- 3

- 4

- 5

- …

- 264

- Next Page »