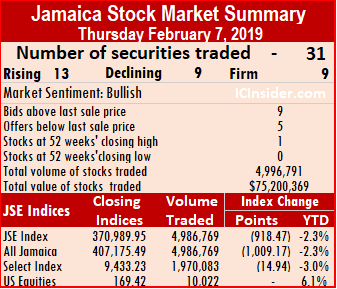

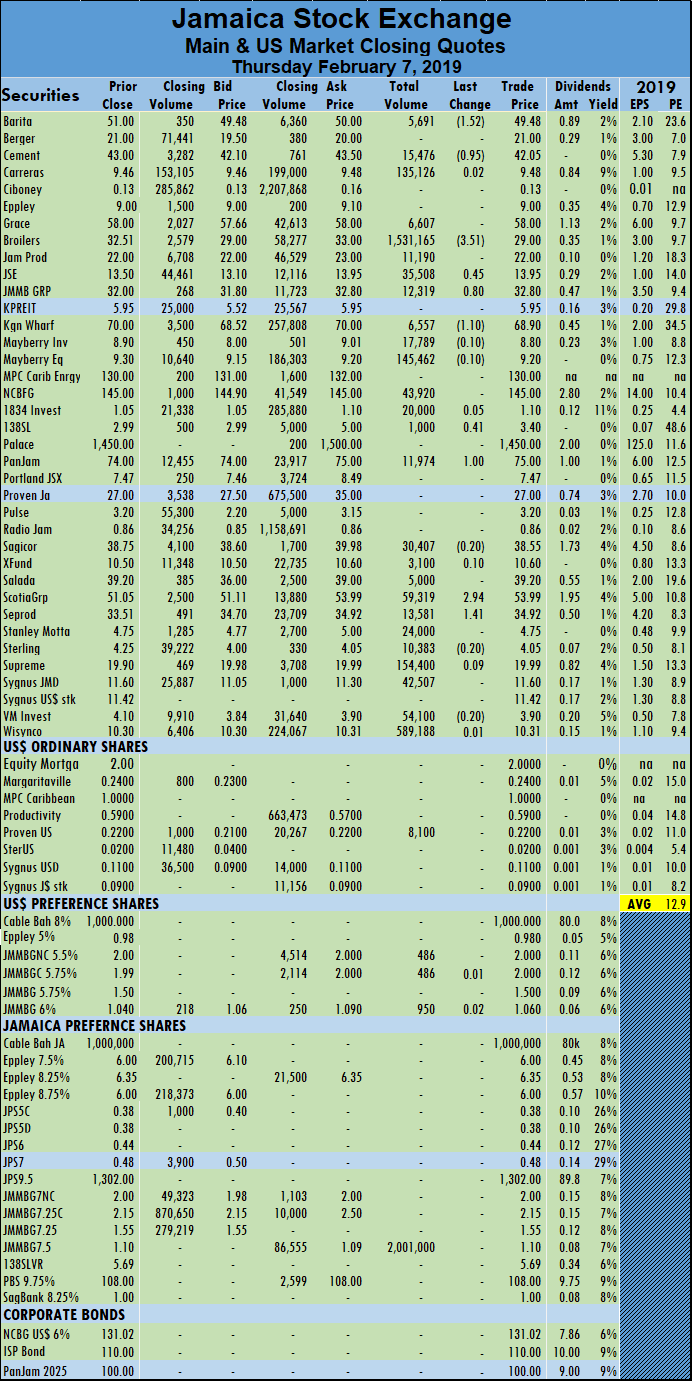

Trading picked up over that on Wednesday on the main market of the Jamaica Stock Exchange ended on Thursday with JSE All Jamaican Composite Index falling by 1,009.17 points to 407,175.49 and the JSE Index declining by 918.47 points to 370,989.95.

Trading picked up over that on Wednesday on the main market of the Jamaica Stock Exchange ended on Thursday with JSE All Jamaican Composite Index falling by 1,009.17 points to 407,175.49 and the JSE Index declining by 918.47 points to 370,989.95.

Main market activity ended with, 4,986,769 units valued at $74,552,633, in contrast with 2,541,810 units valued at $57,485,785 on Wednesday.

The main and US markets traded a total of 31 securities, with prices of 13 rising, 9 declining with 9 remaining unchanged, compared to 34 securities trading on Wednesday.

JMMB Group 7.5% preference share led trading with 2,001,000 units for 40 percent of the day’s volume, followed by Jamaica Broilers with 1,531,165 shares and accounting for 21 percent of the total main market volume changing hands and Wisynco Group with 589,188 stock units for 12 percent of the day’s volume.

IC bid-offer Indicator|The Investor’s Choice bid-offer indicator ended with the reading showing 9 stocks ending with bids higher than their last selling prices and 5 closing with lower offers.

An average of 184,695 units valued at $2,761,209, in contrast to 42,483 units valued at $1,358,497 on Wednesday. The average volume and value for the month to date amounts to 523,805 units valued $16,891,062 and previously, 523,805 units valued $16,891,062. Trading for January resulted in an average of 101,980 units, valued at $3,042,494, for each security traded.

In main market activity, Barita Investments fell $1.52 to close at $49.48, with 5,691 shares changing hands, Caribbean Cement shed 95 cents to finish at $42.05, trading 15,476 shares, Jamaica Broilers dropped $3.51 in trading of 1,531,165 units, to close at $29. Jamaica Stock Exchange closed trading with 35,508 units changing hands, with a rise of 45 cents to a record close of $13.95. JMMB Group concluded trading with 12,319 shares but rose 80 cents to $32.80, Kingston Wharves lost $1.10 and settled at $68.90, with 6,557 units changing hands, 138 Student Living rose 41 cents to $3.40, in trading 1,000 units, PanJam Investment rose $1 to end at $75 with 11,974 units changing hands. Sagicor Group fell by 20 cents in trading 30,407 stock units, to close at  $38.55, Scotia Group climbed $2.94 and finished trading of 59,319 shares at $53.99 and Seprod lose $1.41 to end at $34.92 with an exchange of 13,581 shares.

$38.55, Scotia Group climbed $2.94 and finished trading of 59,319 shares at $53.99 and Seprod lose $1.41 to end at $34.92 with an exchange of 13,581 shares.

Trading in the US dollar market resulted in 10,022 units valued at US$4,728 changing hands. JMMB Group 6% preference share concluded trading with a gain of 2 cents to settle at $1.06 with 950 units, JMMB Group 5.75% preference share finished with a rise of 1 cent to $2 with 486 shares trading, JMMB Group 5.5% preference share settled ended at $2 with 486 shares and Proven Investments traded 8,100 units and rose 1 cent to close at 22 US cents. The JSE USD Equities Index was unchanged at the close at 169.42.

JSE main market drops – Thursday

Robust JSE main market gain – Wednesday

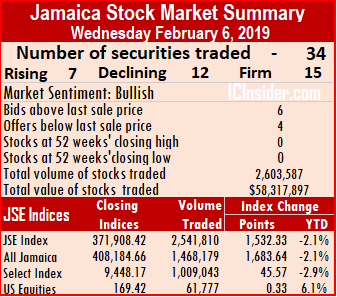

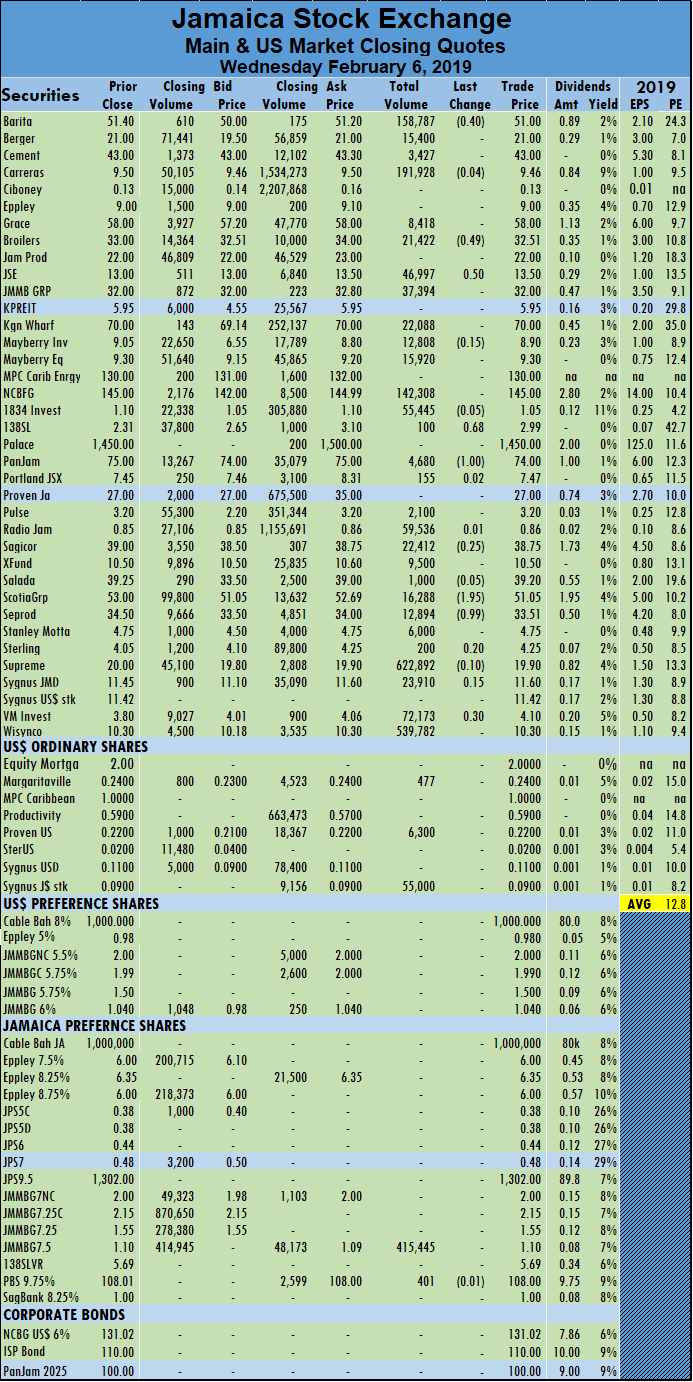

Trading on the main market of the Jamaica Stock Exchange ended on Wednesday with JSE All Jamaican Composite Index climbing 1,683.64 points to 408,184.66 and the JSE Index advancing by 1,532.33 points to close at 371,908.42.

Trading on the main market of the Jamaica Stock Exchange ended on Wednesday with JSE All Jamaican Composite Index climbing 1,683.64 points to 408,184.66 and the JSE Index advancing by 1,532.33 points to close at 371,908.42.

Main market activity ended with just 2,541,810 units valued at $57,485,785, in contrast with 1,062,072 units valued at over $33,962,415 on Tuesday.

The main and US markets traded a total of 34 securities, with prices of 7 rising, 12 declining with 15 remaining unchanged, compared to 29 securities trading on Tuesday.

Supreme Ventures led trading with 622,892 units for 24.5 percent of the day’s volume, followed by  Wisynco Group with 539,782 shares and accounting for 21 percent of the total main market volume changing hands and JMMB Group 7.5% preference share with 415,445 stock units for 16 percent of the day’s volume.

Wisynco Group with 539,782 shares and accounting for 21 percent of the total main market volume changing hands and JMMB Group 7.5% preference share with 415,445 stock units for 16 percent of the day’s volume.

IC bid-offer Indicator|The Investor’s Choice bid-offer indicator ended with the reading showing 6 stocks ending with bids higher than their last selling prices and 4 closing with lower offers.

An average of 81,994 units valued at an average of $1,854,380, in contrast to 42,483 units valued at $1,358,497 on Tuesday. The average volume and value for the month to date amounts to 523,805 units valued $16,891,062 and previously, 684,936 units valued at $22,375,029. Trading for January resulted in an average of 101,980 units valued at $3,042,494, for each security traded.

In main market activity, Barita Investments fell 40 cents to close at $51, with 158,787 shares changing hands, Jamaica Broilers fell by 49 cents in trading of 21,422 units at $32.51, Jamaica Stock Exchange closed trading with  46,997 units changing hands with a rise of 50 cents to $13.50. Kingston Wharves gained 80 cents and settled at $70.00, with 3,678 units changing hands, 138 Student Living rose 68 cents to $2.99, in trading 100 units, PanJam Investment lost $1 to end at $74 with 4,680 units changing hands. Sagicor Group fell by 25 cents trading 22,412 stock units, to close at $38.75, Scotia Group lost $1.95 and finished trading of 16,288 shares at $51.05 and Seprod lost 99 cents to end at $33.51 with an exchange of 12,894 shares.

46,997 units changing hands with a rise of 50 cents to $13.50. Kingston Wharves gained 80 cents and settled at $70.00, with 3,678 units changing hands, 138 Student Living rose 68 cents to $2.99, in trading 100 units, PanJam Investment lost $1 to end at $74 with 4,680 units changing hands. Sagicor Group fell by 25 cents trading 22,412 stock units, to close at $38.75, Scotia Group lost $1.95 and finished trading of 16,288 shares at $51.05 and Seprod lost 99 cents to end at $33.51 with an exchange of 12,894 shares.

Trading in the US dollar market resulted in 61,777 units valued at $6,450 changing hands. Margaritaville ended trading 477 shares at 24 US cents, Proven Investments traded 6,300 units and rose 1 cent to close at 22 US cents and Sygnus Credit Investments closed trading of 55,000 units to close at 9 US cents. The JSE USD Equities Index advanced 0.33 points to close at 169.42.

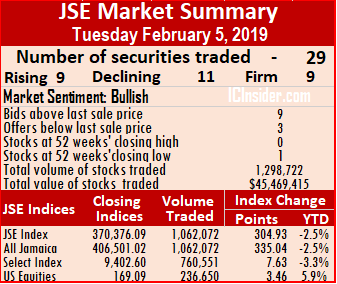

JSE trading volume drops 95% on Tuesday

The main market of the Jamaica Stock Exchange major indices roseat the close on Tuesday, but with sharply lower volume that dropped 95 percent from Monday’s levels.

The main market of the Jamaica Stock Exchange major indices roseat the close on Tuesday, but with sharply lower volume that dropped 95 percent from Monday’s levels.

Main market activity ended with just 1,062,072 units valued at over $33,962,415, in contrast with 22,820,352 units valued at $1,138,660,815 on Monday.

At the close, the All Jamaican Composite Index advanced by 335.04 points to end at 406,501.02 and the JSE Index gained 304.93 points to close at 370,376.09.

The main and US markets traded a total of 29 securities, with prices of 9 rising, 11 declining with 9 remaining unchanged, compared to 32 securities trading on Monday.

Scotia Group led trading with 216,870 units for 24 percent of the day’s volume, followed by Mayberry Jamaican Equities with 140,980 units and accounting for 22 percent of the total main market volume changing hands and Supreme Ventures with just 86,305 units for 8 percent of the day’s volume.

IC bid-offer Indicator|The Investor’s Choice bid-offer indicator ended with the reading showing 9 stocks ending with bids higher than their last selling prices and 3 closing with lower offers.

An average of 42,483 units valued at $1,358,497, in contrast to 786,909 shares valued at $39,264,166 on Monday. The average volume and value for the month to date amounts to 684,936 units valued at $22,375,029 and previously 952,625 units valued at $31,131,917. Trading for January resulted in an average of 101,980 units valued at $3,042,494, for each security traded.

In main market activity, Jamaica Broilers jumped $3 to finish trading of 66,896 units at $33, Jamaica Producers lost $1 to close at $22, with 12,548 shares changing hands, Jamaica Stock Exchange closed trading with 62,328 units changing hands with a rise of 35 cents to $13, JMMB Group fell 50 cents to close at $32, trading 10,248 shares. Kingston Wharves gained 80 cents and settled at $70.00, with 3,678 units  changing hands, Sagicor Group fell 99 cents trading 53,111 stock units, to close at $39, Salada Foods jumped $1.25 to $39.25 in trading 1,067 units. Scotia Group lost 97 cents and finished trading of 216,870 shares at $53 and Seprod rose $1.48 cents to end at $34.50 with an exchange of 20,208 shares.

changing hands, Sagicor Group fell 99 cents trading 53,111 stock units, to close at $39, Salada Foods jumped $1.25 to $39.25 in trading 1,067 units. Scotia Group lost 97 cents and finished trading of 216,870 shares at $53 and Seprod rose $1.48 cents to end at $34.50 with an exchange of 20,208 shares.

Trading in the US dollar market resulted in 236,650 units valued at $83,993 changing hands. JMMB 5.75% preference share traded 5,000 units and lost 1 cent to end at a 52 weeks’ low of US$1.99, JMMB 6% preference share concluded trading of 52,960 units at US$1.04, Proven Investments traded 26,040 units and rose 1 cent to close at 22 US cents and Sygnus Credit Investments closed trading of 152,650 units to close at 9 US cents. The JSE USD Equities Index advanced 3.46 points to close at 169.09.

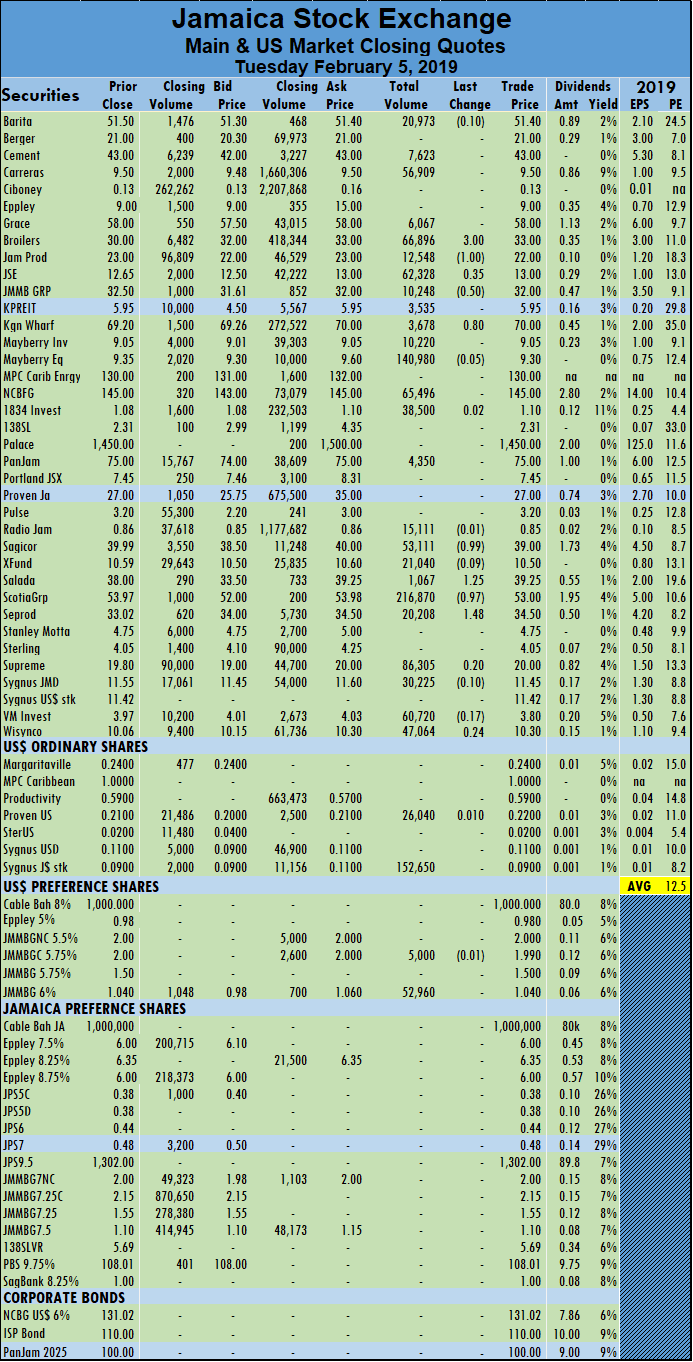

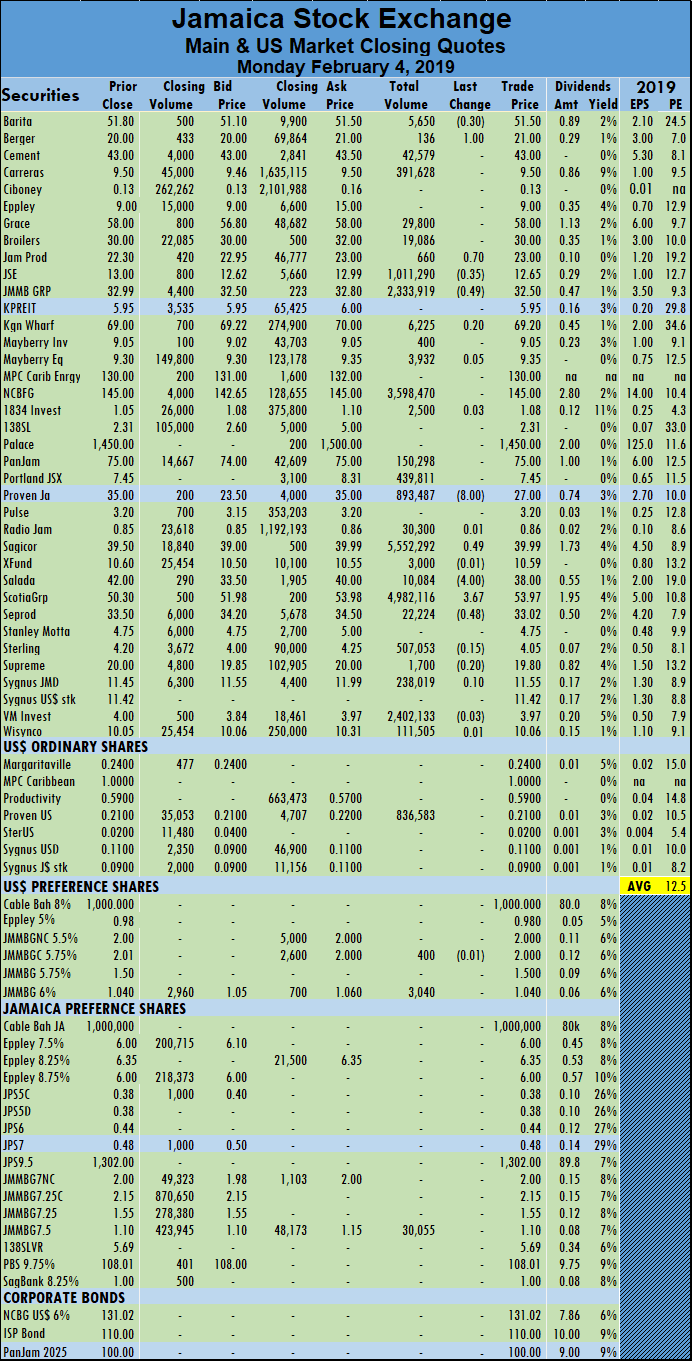

Heavy trading continues for JSE majors – Monday

The main market of the Jamaica Stock Exchange major indices suffered sharp lossesat the close on Monday, with the market having another day of big volume.

The main market of the Jamaica Stock Exchange major indices suffered sharp lossesat the close on Monday, with the market having another day of big volume.

Main market activity ended with 22,820,352 units valued at $1,138,660,815 compared with 34,337,150 units valued at $729,254,221, on Friday.

At the close, the All Jamaican Composite Index dived 8,017.57 points to close at 406,165.98 and the JSE Index plunged 7,297.03 points to close at 370,071.16. Adjustment to the average price of NCB Financial compared to that on Friday, was the major contributing factor to the sharp correction to the indices with the JSE reported closing price being $142.81 versus $148.99 on Friday as opposed to the last traded price of $145 on both days.

The main and US markets traded a total of 32 securities, with prices of 10 rising, 11 declining with 11 remaining unchanged, compared to 33 securities trading on Friday.

Sagicor Group led trading with 5,552,292 units for 24 percent of the day’s volume, followed by Scotia Group with 4,982,116 units and accounting for 22 percent of the total main market volume changing hands, NCB Financial Group traded 3,598,470 shares and 15.8 percent of main market volume. Also trading in large volumes are, Victoria Mutual Investments with 2,402,133 units, JMMB Group exchanging 2,333,919 shares and Jamaica Stock Exchange with 1,011,290 shares changing hands.

IC bid-offer Indicator|The Investor’s Choice bid-offer indicator ended with the reading showing 10 stocks ending with bids higher than their last selling prices and 2 closing with lower offers. The reading is far less bullish than the reading at the close of Friday, of 15 to 2.

An average of 786,909 units valued at $39,264,166, in contrast to 1,107,650 shares valued at $23,524,330 on Friday. The average volume and value for the month to date amounts to 952,625 units valued at $31,131,917. Trading for January resulted in an average of 101,980 units valued at $3,042,494, for each security traded.

In main market activity, Barita Investments lost 30 cents in closing at $51.50, with 5,650 shares changing hands, Berger Paints gained $1 to end at $21.00, with just 136 stock units trading, Jamaica Producers rose 70 cents to  close at $23, with 660 shares changing hands. Jamaica Stock Exchange closed trading with 1,011,290 units changing hands compared to 2,677,014 units on Friday with a decline of 35 cents to $12.65, JMMB Group fell 49 cents to close at $32.50, trading 2,333,919 shares, Proven Investments dropped $8 trading 893,487 units to close at $28. Sagicor Group rose 49 cents trading just under 5.6 million stock units, to close at $39.99, Salada Foods dropped $4 to $38 in trading 10,084 units, Scotia Group climbed $3.67 and finished trading of 4,982,116 shares at $53.97 and Seprod lost 48 cents to end at $33.02 with an exchange of 22,224 shares.

close at $23, with 660 shares changing hands. Jamaica Stock Exchange closed trading with 1,011,290 units changing hands compared to 2,677,014 units on Friday with a decline of 35 cents to $12.65, JMMB Group fell 49 cents to close at $32.50, trading 2,333,919 shares, Proven Investments dropped $8 trading 893,487 units to close at $28. Sagicor Group rose 49 cents trading just under 5.6 million stock units, to close at $39.99, Salada Foods dropped $4 to $38 in trading 10,084 units, Scotia Group climbed $3.67 and finished trading of 4,982,116 shares at $53.97 and Seprod lost 48 cents to end at $33.02 with an exchange of 22,224 shares.

Trading in the US dollar market resulted in 840,023 units valued at $179,653 changing hands. JMMB Group 5.75% preference share traded 400 units at US$2, JMMB Group 6% preference share concluded trading of 3,040 units at US$1.04 and Proven Investments traded 836,583 units at 21 US cents The JSE USD Equities Index closed unchanged at 165.63.

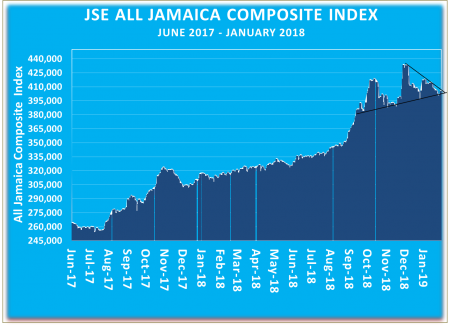

Strong February start for JSE majors

JSE main market showing strong bullish signal in breaking out of a triangle.

The main market of the Jamaica Stock Exchange enjoyed strong gains on Friday, with the market indices rising sharply on surging volume trading on the first day of February.

Main market activity ended with 34,337,150 units valued at $729,254,221, up sharply from 5,924,559 units valued at $242,360,666 on Thursday.

At the close, the All Jamaican Composite Index jumped 3,813.88 points to 414,183.55 and the JSE Index climbed 3,471.13 points to end at 377,368.19.

The main and US markets traded a total of 33 securities, with prices of 15 rising, 9 declining with 9 remaining unchanged, compared to 32 securities trading on Thursday.

Sterling Investments led trading with 14,492,015 units for 42 percent of the day’s volume, followed by Stanley Motta with 9,416,100 units and accounting for 27.4 percent of the total main market volume changing hands. Jamaica Stock Exchange with 2,677,014 units for 8 percent of the day’s volume NCB Financial Group traded 2.1 million shares and Sagicor Group traded just over 1 million units.

IC bid-offer Indicator|The Investor’s Choice bid-offer indicator ended with the reading showing 7 stocks ending  with bids higher than their last selling prices and 2 closing with lower offers. The reading is far less bullish than the reading at the close of Thursday, of 15 to 2.

with bids higher than their last selling prices and 2 closing with lower offers. The reading is far less bullish than the reading at the close of Thursday, of 15 to 2.

An average of 1,107,650 units valued at over $23,524,330, in contrast to 219,428 shares valued at $8,976,321 on Thursday. Trading for January resulted in an average of 101,980 units valued at $3,042,494, for each security traded.

In main market activity, Caribbean Cement added 50 cents to close at $43, with 946,432 shares changing hands, Grace Kennedy traded 287,170 stock units and lost $1.90 to close at $58, Jamaica Producers fell 70 cents to close at $22.30, with 5,838 shares changing hands. Jamaica Stock Exchange closed trading with 2,677,014 units changing hands with a rise of 50 cents to a 52 weeks’ high of $13.50, JMMB Group climbed 99 cents to close at $32.99, trading 27,642 shares, Kingston Wharves settled at $69, with an exchange of 11,574 units. NCB Financial Group lost the $7.90 it gained on Thursday, in trading 2,096,214 shares to end at $145, PanJam Investment jumped $3.85 and ended at $75, with 4,200 units trading, Proven Investments jumped $7 trading just 300 units to close at an all-time high of $35. Productivity Business preference  share gained $3 trading 1,110,200 shares at $108.01, Pulse Investments regained the 40 cents it gave up on Thursday, to finish at $3.20, with an exchange of just 100 shares, Sagicor Group dropped $1.55 trading 1,047,258 stock units, to close at $39.50. Seprod rose 38 cents to end at $33.50 with an exchange of 102,383 shares, Stanley Motta fell 50 cents in trading 9,416,100 units to close at $4.75 and Wisynco Group lost 50 cents to settle at $10.05, with an exchange of 48,385 shares.

share gained $3 trading 1,110,200 shares at $108.01, Pulse Investments regained the 40 cents it gave up on Thursday, to finish at $3.20, with an exchange of just 100 shares, Sagicor Group dropped $1.55 trading 1,047,258 stock units, to close at $39.50. Seprod rose 38 cents to end at $33.50 with an exchange of 102,383 shares, Stanley Motta fell 50 cents in trading 9,416,100 units to close at $4.75 and Wisynco Group lost 50 cents to settle at $10.05, with an exchange of 48,385 shares.

Trading in the US dollar market resulted in 73,267 units valued at $35,223 changing hands. JMMB 6% preference share concluded trading of 23,900 units at $1.04 and Proven Investments traded 49,367 units at 21 US cents The JSE USD Equities Index advanced by 0.11 points to close at 165.63.

Drop for JSE majors in Januray

Trading levels rose sharply on the main market of the Jamaica Stock Exchange on Thursday, with the market indices rising sharply with advancing stocks beating declining ones by 40 percent, that left the market still 1.6 percent below the 2018 close.

Trading levels rose sharply on the main market of the Jamaica Stock Exchange on Thursday, with the market indices rising sharply with advancing stocks beating declining ones by 40 percent, that left the market still 1.6 percent below the 2018 close.

At the close, the All Jamaican Composite Index surged 4,736.13 points to 410,369.67 and the JSE Index climbed 4,310.50 points to 373,897.06.

Main market activity ended with 5,924,559 units valued at $242,360,666 compared to 2,161,352 units valued at $54,090,319 on Wednesday.

The main and US markets traded a total of 32 securities, with prices of 14 rising, 10 declining with 8 remaining unchanged, compared to 36 securities trading on Wednesday.

Caribbean Cement led trading with 2,041,592 units for 34.5 percent of the day’s volume, followed by Scotia Group with 1,233,769 units and accounting for 21 percent of the total main market  volume changing hands and Sagicor Group with 761,021 units and 13 percent of the day’s volume.

volume changing hands and Sagicor Group with 761,021 units and 13 percent of the day’s volume.

IC bid-offer Indicator|The Investor’s Choice bid-offer indicator ended with the reading showing 15 stocks ending with bids higher than their last selling prices and 2 closing with lower offers.

An average of 219,428 units valued at an average of $8,976,321 for each security traded, in contrast to 65,496 units for an average of $1,639,101 on Wednesday. The average volume and value for the month to date amounts 101,980 units valued at $3,042,494 compared to 97,161 units valued at $2,776,359, previously. Trading for December ended, with an average of 835,037 units with a value of $25,906,477, for each security traded.

In main market activity, Caribbean Cement lost $1 to close at $42.50, with 2,041,592 shares changing hands, Grace Kennedy traded 499,561 stock units and gained $1.40 to close at $59.90, Jamaica Broilers gained $1.10 to close at $30, with an exchange of 63,683 units, Jamaica Producers rose $1.20 to close at $23, with 12,015 shares changing hands. JMMB Group fell 50 cents to close at $32 trading 159,216 shares, NCB Financial Group climbed $7.90 trading 92,786 shares to end at $152.90, PanJam Investment lost 85 cents and ended at $71.15, with 153,775 units trading,  Proven Investments traded 2,196 units with a rise of $1.50 to close at $28. Pulse Investments lost 40 cents and finished at $2.80, with an exchange of just 100 shares, Sagicor Group rose $2.55 in trading 761,021 stock units, to close at $41.05, Salada Foods jumped $4 and ended trading at an all-time high of $42, with 7,180 stock units trading. Scotia Group dropped $1.69 to end trading of 1,233,769 shares at $50.31, Seprod rose $1.12 to end at $33.12 with an exchange of 19,046 shares and Stanley Motta gained 25 cents in trading 7,000 units to close at $5.25.

Proven Investments traded 2,196 units with a rise of $1.50 to close at $28. Pulse Investments lost 40 cents and finished at $2.80, with an exchange of just 100 shares, Sagicor Group rose $2.55 in trading 761,021 stock units, to close at $41.05, Salada Foods jumped $4 and ended trading at an all-time high of $42, with 7,180 stock units trading. Scotia Group dropped $1.69 to end trading of 1,233,769 shares at $50.31, Seprod rose $1.12 to end at $33.12 with an exchange of 19,046 shares and Stanley Motta gained 25 cents in trading 7,000 units to close at $5.25.

Trading in the US dollar market resulted in 1,399,848 shares valued at US$319,369 changing hands. JMMB 6% preference share fell 3 cents and concluded trading of 18,207 units at $1.04, JMMB Group 5.75% preference share fell 5 cents and settled at US$2.01, trading 5,000 shares, Productivity Business traded 18,608 stock units at 59 US cents. Proven Investments traded 1,312,533 units at 21 US cents and Sygnus Credit Investments Jamaica dollar denominated shares traded 45,500 units to close at 8 US cents after rising 1 cent. The JSE USD Equities Index advanced by 1.16 points to close at 165.52.

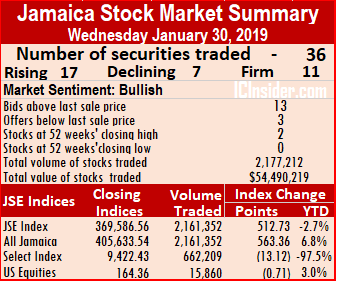

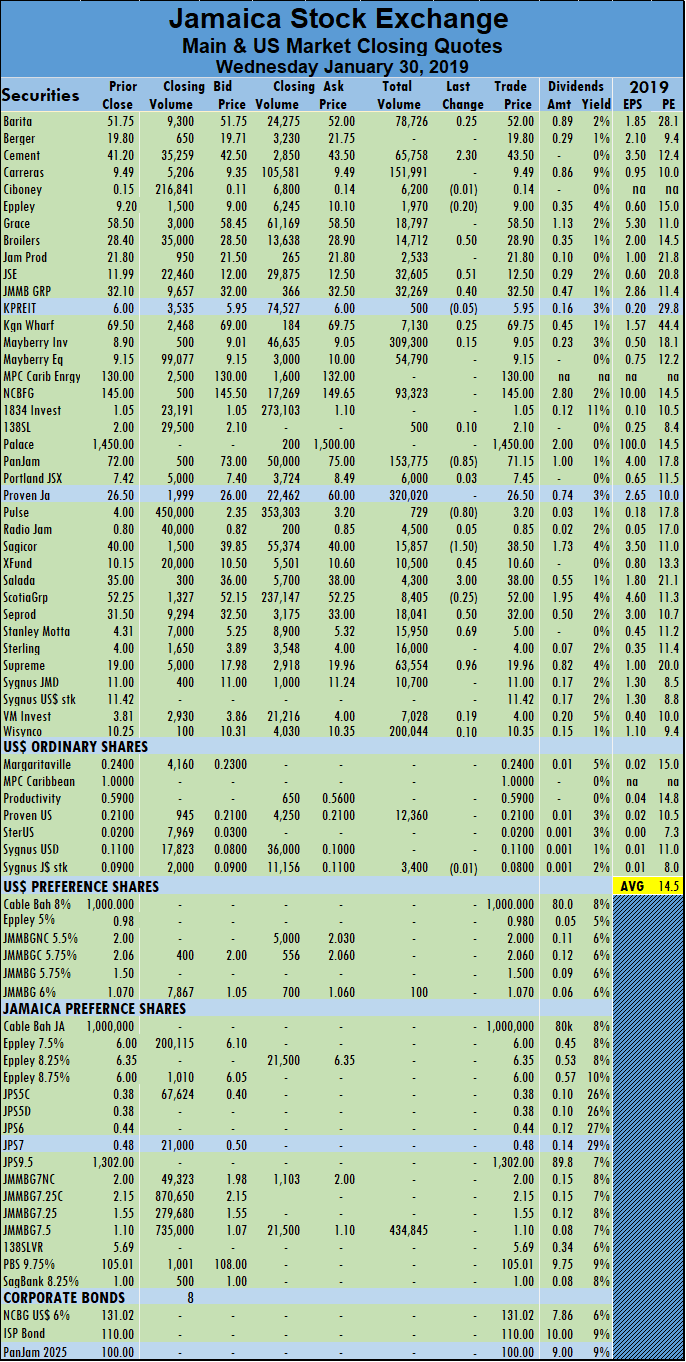

17 rising stocks for JSE – Wednesday

Trading levels slipped further on the main market of the Jamaica Stock Exchange on Wednesday, but the market indices rose moderately on the back of a strong advance decline ratio of 2 to 1.

Trading levels slipped further on the main market of the Jamaica Stock Exchange on Wednesday, but the market indices rose moderately on the back of a strong advance decline ratio of 2 to 1.

Main market activity ended with 2,161,352 units valued at $54,090,319, compared to 3,483,939 units valued at $97,848,026 on Tuesday.

The main and US markets traded a total of 36 securities, with prices of 17 rising, 8 declining with 11 remaining unchanged, compared to 29 securities trading on Tuesday.

At the close, the All Jamaican Composite Index increased by 563.36 points to 405,633.54 and the JSE Index advanced 512.73 points to close at 369,586.56.

JMMB Group 7.5% preference share led trading with just 434,845 units for 20 percent of the day’s volume, followed by Proven Investments with 320,020 units in the Jamaica market, accounting for 15 percent of the total main market volume changing hands and Mayberry Investments with 309,300 units and 14 percent of the day’s volume.

IC bid-offer Indicator|The Investor’s Choice bid-offer indicator ended with the reading showing 17 stocks ending with bids higher than their last selling prices and 8 closing with lower offers.

An average of 65,496 units valued at $1,639,101, in contrast to 129,035 shares valued at $3,624,001 on Tuesday. The average volume and value for the month to date amounts 97,161 units valued at $2,776,359 compared to 98,833 units valued at $2,713,553, previously. Trading for December ended, with an average of 835,037 units with a value of $25,906,477, for each security traded.

In main market activity, Caribbean Cement climbed $2.30 to close at $43.50, with 65,758 shares changing hands, Jamaica Broilers gained 50 cents to close at $28.90, with an exchange of 14,712 units, Jamaica Stock Exchange rose 50 cents to end at a 52 weeks’ high of $12.50, trading 32,605 shares. JMMB Group rose 40 cents to close at $32.50 trading of 32,269 shares. Kingston Wharves gained 25 cents and settled at $69.75, with 7,130 units changing hands, PanJam Investment lost 85 cents and ended at $71.15, with 153,775 units trading, Pulse Investments lost 80 cents and finished at $3.20, with an exchange of just 729 shares. Sagicor Group lost $1.50 in trading of 15,857 stock units, to close at $38.50, Sagicor Real Estate Fund gained 45 cents and settled at $10.60, with 10,500 shares changing hands, Salada Foods jumped $3 and ended trading at an all-time high of $38, with 4,300 stock units trading. Scotia Group lost 25 cents to end trading of 8,405 shares at $52, Seprod gained 50 cents to end at $32 with an exchange of 18,041 shares, Stanley Motta gained 69 cents in trading 15,950 units to close at $5 and Supreme Ventures climbed 96 cents and ended at $19.96, trading 63,554 shares.

Sagicor Group lost $1.50 in trading of 15,857 stock units, to close at $38.50, Sagicor Real Estate Fund gained 45 cents and settled at $10.60, with 10,500 shares changing hands, Salada Foods jumped $3 and ended trading at an all-time high of $38, with 4,300 stock units trading. Scotia Group lost 25 cents to end trading of 8,405 shares at $52, Seprod gained 50 cents to end at $32 with an exchange of 18,041 shares, Stanley Motta gained 69 cents in trading 15,950 units to close at $5 and Supreme Ventures climbed 96 cents and ended at $19.96, trading 63,554 shares.

Trading in the US dollar market resulted in 15,860 units valued at $2,984, changing hands. JMMB Group 6.00% preference share traded with 100 units at US$1.07, Proven Investments traded 12,360 units at 21 US cents and Sygnus Credit Investments Jamaica dollar denominated shares traded 3,400 units to close at 8 US cents after slipping 1 cent. The JSE USD Equities Index declined by 0.71 points to close at 164.36.

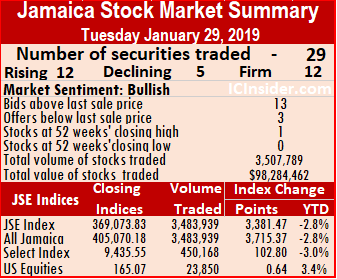

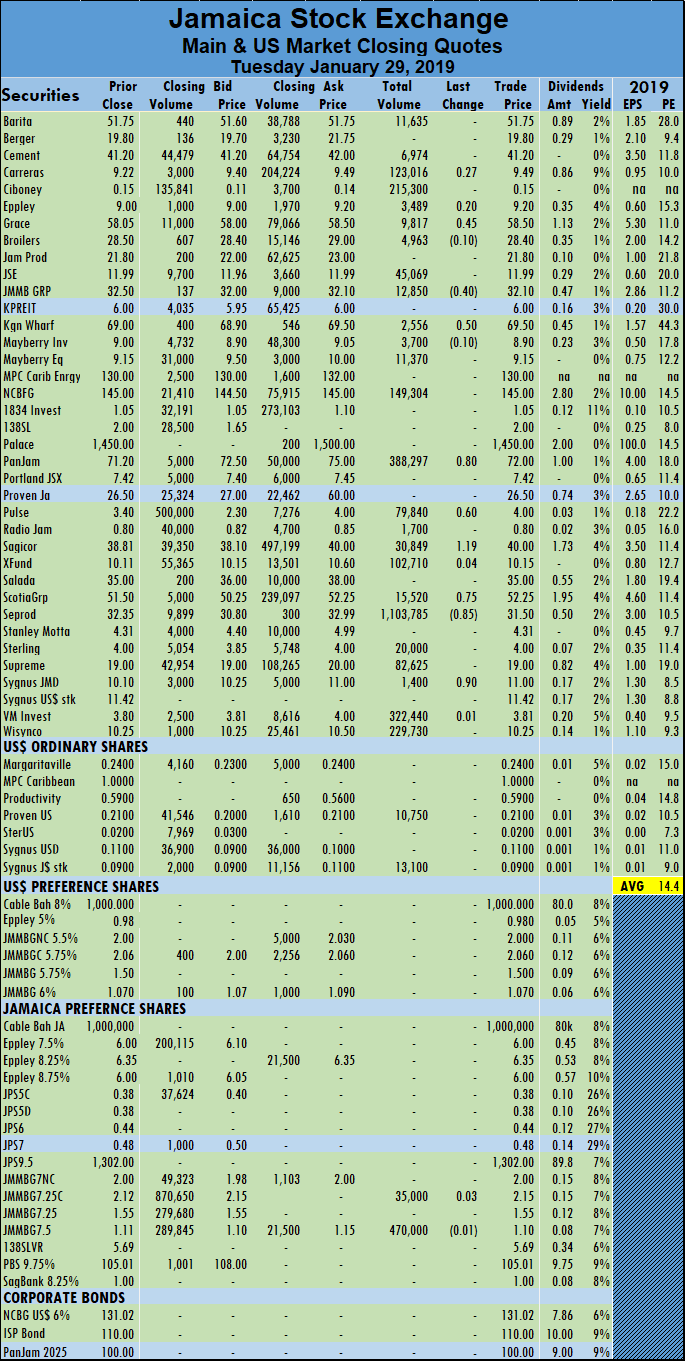

Rising stocks dominate JSE – Tuesday

Trading slipped on the main market of the Jamaica Stock Exchange on Tuesday, but the market indices rose sharply on the back of a strong advance decline ratio of more than 2 to 1.

Trading slipped on the main market of the Jamaica Stock Exchange on Tuesday, but the market indices rose sharply on the back of a strong advance decline ratio of more than 2 to 1.

At the close, the All Jamaican Composite Index jumped 3,715.37 points to close at 405,070.18 and the JSE Index climbed 3,381.47 points to close at 369,073.83.

Main market activity ended with 3,483,939 units valued at $97,848,026, compared to 7,589,172 units carrying a value of $145,956,290 on Monday.

The main and US markets traded a total of 29 securities, with prices of 12 rising, 5 declining with 12 remaining unchanged, compared to 33 securities trading on Monday.

Seprod led trading with 1,103,785 units for 31.7 percent of the day’s volume, followed by JMMB Group 7.5% preference share with 470,000 units accounting for 13.5 percent of the total main market volume changing hands and PanJam Investment with 388,297 units and 9 percent of the day’s volume.

IC bid-offer Indicator|The Investor’s Choice bid-offer indicator ended with the reading showing 13 stocks ending with bids higher than their last selling prices and 3 closing with lower offers.

An average of 129,035 units valued at an average of $3,624,001 traded, in contrast to 244,812 units valued at $4,708,267 on Monday. The average volume and value for the month to date amounts 98,833 units valued at $2,713,553 compared to 97,469 units valued at $2,670,351, previously. Trading for December ended, with an average of 835,037 units with a value of $25,906,477, for each security traded.

In main market activity, Carreras rose 27 cents and concluded trading at $9.49, with 123,016 units trading, Grace Kennedy rose 45 cents trading 9,817 stock units to close at $58.50, Jamaica Producers shed $1.20 and closed at $21.80, with 1,767 shares changing hands, JMMB Group fell 40 cents to close at $32.10 trading of 12,850 shares. Kingston Wharves gained 50 cents and settled at $69.50, with 2,556 units changing  hands, PanJam Investment rose 80 cents and ended at $72, with 388,297 units trading, Pulse Investments rose by 60 cents and finished at $4, with an exchange of 79,840 shares,the stock traded earlier in the day at a record high of $4.50. Sagicor Group added $1.19 trading of 30,849 stock units, to close at $40, Scotia Group gained 75 cents to end trading of 15,520 shares at $52.25, Seprod lost 85 cents to end at $31.50 with an exchange of 1,103,785 shares and Sygnus Credit Investments Jamaica dollar denominated shares, gained 90 cents in trading 1,400 units to close at $11.

hands, PanJam Investment rose 80 cents and ended at $72, with 388,297 units trading, Pulse Investments rose by 60 cents and finished at $4, with an exchange of 79,840 shares,the stock traded earlier in the day at a record high of $4.50. Sagicor Group added $1.19 trading of 30,849 stock units, to close at $40, Scotia Group gained 75 cents to end trading of 15,520 shares at $52.25, Seprod lost 85 cents to end at $31.50 with an exchange of 1,103,785 shares and Sygnus Credit Investments Jamaica dollar denominated shares, gained 90 cents in trading 1,400 units to close at $11.

Trading in the US dollar market resulted in 23,850 units valued at $3,437, changing hands. Proven Investments traded 10,750 units at 21 US cents and Sygnus Credit Investments Jamaica dollar denominated shares traded 33,100 units to close at 9 US cents. The JSE USD Equities Index advanced by 0.64 points to close at 165.07.

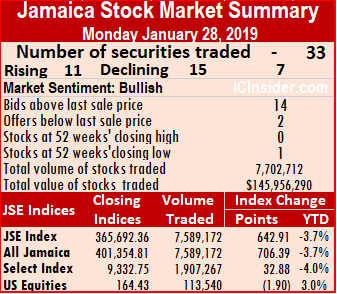

5 days of JSE declines end – Monday

The main market of the Jamaica Stock Exchange broke the 5 consecutive days of decline on Monday, with the market indices recording modest gains as 31 securities traded compared to 33 that changed hands on Friday.

The main market of the Jamaica Stock Exchange broke the 5 consecutive days of decline on Monday, with the market indices recording modest gains as 31 securities traded compared to 33 that changed hands on Friday.

The main and US markets traded a total of 33 securities, with prices of 11 rising, 15 declining with 7 remaining unchanged, compared to 36 securities trading on Friday.

At the close, the All Jamaican Composite Index gained 706.39 points to close at 401,354.81 and the SE Index advanced 642.91 points to 365,692.36.

Market activity ended with 7,589,172 units carrying a value of $145,956,290 compared to 4,205,246 units with a value of $112,762,089 on Friday.

Portland JSX led trading with 3,180,000 units for 41.90 percent of the day’s volume, followed by Grace Kennedy with 862,758 units accounting for 11.37 percent of the volume changing hands and 1834 Investments with 682,000 units and 9 percent of the day’s volume

IC bid-offer Indicator|The Investor’s Choice bid-offer indicator ended with the reading showing 14 stocks ending with bids higher than their last selling prices and 2 closing with lower offers.

An average of 244,812 units valued at over $4,708,267 traded, in contrast to 127,432 units valued at over $3,417,033 on Friday. The average volume and value for the month to date amounts 97,469 units valued at $2,670,351 compared to 89,414 units valued at $2,552,924, previously. Trading for December ended, with an average of 835,037 units with a value of $25,906,477, for each security traded.

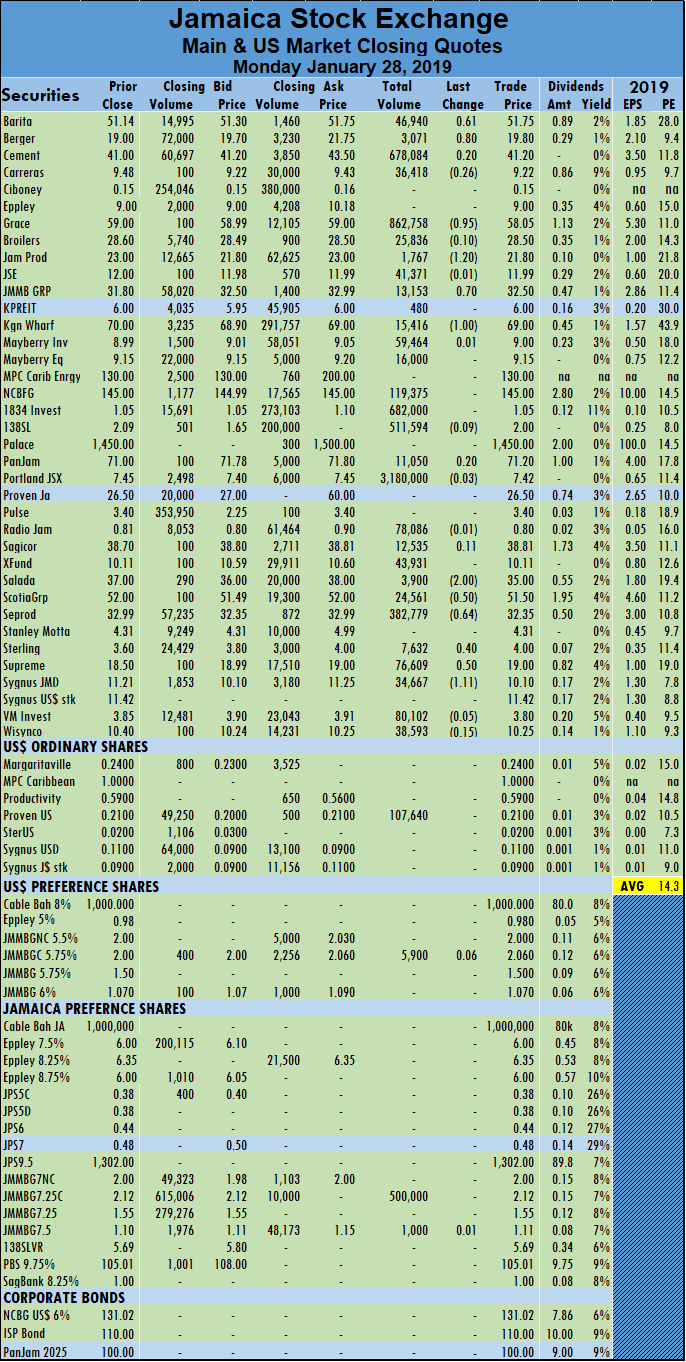

In main market activity, Barita Investments gained 61 cents to end at $51.75, trading 46,940 stock units, Berger Paints rose 80 cents and ended trading at $19.80, with 3,071 stock units changing hands, Carreras lost 26 cents and concluded trading at $9.22, with 36,418 units, Caribbean Cement gained 20 cents and finished the trading of 678,084 shares at $41.20. Grace Kennedy lost 95 cents trading 862,758 stock units to close at $58.05, Jamaica Producers shed $1.20 and closed at $21.80, with 1,767 shares changing hands, JMMB Group rose 70 cents to close at $32.50 trading of 13,153 shares. Kingston Wharves lost $1 and settled at $69, with 15,416 units changing hands, 138 Student Living finished trading 511,594 shares with a fall of 9 cents to a 52 weeks’ closing low of $2, after falling to an all-time low of $1.60 earlier, Salada Foods dropped $2 to settle at $35, in trading of 3,900 shares. Scotia Group lost 50 cents to end trading of 24,561  shares to close at $51.50, Seprod lost 64 cents to end at $32.35 with an exchange of 382,779 shares. Sterling Investments rose 40 cents and ended at $4, with 7,632 shares trading, Supreme Ventures rose 50 cents and concluded trading of 76,609 stock units, at $18.50 and Sygnus Credit Investments Jamaica dollar denominated shares traded 34,667 units with a fall of $1.11 to close at $10.10.

shares to close at $51.50, Seprod lost 64 cents to end at $32.35 with an exchange of 382,779 shares. Sterling Investments rose 40 cents and ended at $4, with 7,632 shares trading, Supreme Ventures rose 50 cents and concluded trading of 76,609 stock units, at $18.50 and Sygnus Credit Investments Jamaica dollar denominated shares traded 34,667 units with a fall of $1.11 to close at $10.10.

Trading in the US dollar market resulted in 113,540 shares valued US$34,627, changing hands. JMMB Group 5.75% preference share rose 6 cents and ended trading at $2.06 with 5,900 units and Proven Investments concluded trading of 107,640 units at 21 US cents. The JSE USD Equities Index declined by 1.90 points to close at 164.43.

TOP 15 JSE main market Stocks

TOP 15 JSE main market stocks for 2019

While Junior Market stocks seem poised to deliver better returns in 2019 than main market ones, there remain some attractive buys with great potential gains in the JSE premier market.

The average PE of the Main market for 2019 is 13 times estimated 2019 earnings, compared to nearly 16 at the end of 2018. This suggests potential for gains above 20 percent on average, for stocks in 2019. Stocks selling below the average for 2019, are poised to deliver above average growth for the year. Added to this, is the current PE ratio at 16 times 2018 earnings that should rise further before prices fully reflect earnings for 2018, which will take place by March. Stocks with PE at 8 or lower are likely to at least double during 2019.

Seprod – PE 7.5. The company acquired new business from Facey Group in 2018 as well as taking ownership of the former Nestle’ production facility in Bog Walk. Both activities will help swell revenues and profit as cost are lowered, giving greater leverage in the local and overseas markets. The sugar operation that has been bleeding for years, is getting greater attention with a view to cutting out the large loss. It should not be too long before action is taken to stop the bleeding. Elimination of the sugar losses will result in even more profit.

Sterling Investments – PE 7. The company underperformed the overall market for most of 2018 but has room for growth with the price bouncing after the announcement of a 5 for 1 stock split. They are now raising additional capital to diversify their investment objective, which could help expand profitability and lessen reliance on movements in foreign exchange gains. Investors should not expect explosive growth from this one but with the stock undervalued there is some amount of healthy gains that can be realised.

Victoria Mutual Investments – PE 7.5. The company recorded increased profit from ongoing operations in 2018 to September but the booking of $118 million impairment on Barbados bonds negatively affected the profit for year to date. The company also reported other comprehensive income separately from regular profit but this is likely to change for the full year and could well provide a kick to the final result, for the year. The company is active in seeking areas of growth. It has also added new unit trust funds to the market. The continued buoyancy of the local stock market bodes well for increased profits from this area as well as a result on its impact on fee income from its equity linked unit trust fund.

Caribbean Cement – PE 8. Caribbean Cement has not yet delivered on its potential. The plant that was previously leased, was acquired in 2018, and is now saving nearly $2 billion per annum. Shareholders enjoyed none of those savings last year.  That could change this year, as the company raised prices late in 2018 and will now be producing all of the cement they sell, thus lowering direct selling cost. For most of 2018, the company imported cement to meet a part of its demand while they were working on upgrading the plant to meet both local and export markets. With continued growth in the economy and strong expansion in the construction sector, the company should continue to enjoy increasing revenues and profit. Cement has partially refinanced some of its US dollar debt and started to pay down the US based debt as well, thus limiting FX losses.

That could change this year, as the company raised prices late in 2018 and will now be producing all of the cement they sell, thus lowering direct selling cost. For most of 2018, the company imported cement to meet a part of its demand while they were working on upgrading the plant to meet both local and export markets. With continued growth in the economy and strong expansion in the construction sector, the company should continue to enjoy increasing revenues and profit. Cement has partially refinanced some of its US dollar debt and started to pay down the US based debt as well, thus limiting FX losses.

Radio Jamaica – PE 9.5. RJR has so far not been able to deliver on the promise when the media business and that of the Gleaner, were merged. While they have cut out some cost, revenues have not grown to deliver improved results. They remain profitable and yet results have been below expectation and has dragged the stock price below 90 cents. Tightness in the local economy in the past few years and cost incurred to switch Television to digital telecast, added to the pressure on results. The biggest part of the problem is the failure to pull in more revenues. The improving economy is likely to help to improve revenues going forward as advertisers increase their marketing spend. Of note is the fact that the stock now trades below net asset value of 95 cents. Importantly, even as the company reported a loss of $133 million for the six months to September, operating cash flow generated was a positive $120 million.

Sagicor Group PE 9. The company has not delivered much in 2018 partially due to losses incurred in the write down of Barbados bonds that it holds. The company will benefit from increased revenues from the acquisition of the Scotia Group’s insurance business going forward and will also gain from investments in the local stock market as well as from the growth in the local economy and increased employment that should facilitate increased sales of life policies.

Sagicor Group PE 9. The company has not delivered much in 2018 partially due to losses incurred in the write down of Barbados bonds that it holds. The company will benefit from increased revenues from the acquisition of the Scotia Group’s insurance business going forward and will also gain from investments in the local stock market as well as from the growth in the local economy and increased employment that should facilitate increased sales of life policies.

Sygnus Credit – PE 9.2. This company is relatively new and it listed in 2018. The company provides financing to viable but growing businesses by direct lending or other types of funding including factoring that will provide above average rate of return. The original concept was to deliver around 8 percent per annum to its investors, but depending on the nature of the investments they make the rate could be better. They have investments in two Portfolio Companies with profit sharing features attached. Up to September, return on invested funds was almost 11 percent. At the end of the September quarter US18 million was invested in various companies, with a similar amount available to be invested. The company incurred a loss for the September quarter due to exchange rate movement, which resulted in foreign exchange loss of US$7,000. Since then the local dollar has revalued and this will reduce the loss incurred. The stock pulled back after reporting the release of the last results and now offers investors a nice entry point for appreciation, especially with PE ratios mostly around the 15 mark. The Company intends to pay out up to 85% of the earnings generated from these investments as dividends on a quarterly basis, after the end of the first financial year.

JMMB Group

JMMB Group – PE 9.5. JMMB shares have suffered from selling by insiders from time to time that has left it undervalued. It has a long history of good performance. Revenues and profit rose in the half year to September as a number of areas performed very well. Going forward, the group has a great deal of room to expand in the Dominican Republic with a population of 11 million, compared to Jamaica with 3 million. Effective April 1, 2018, the Group adopted IFRS 9 “Financial Instruments”. Prior period amounts are in accordance with IAS 39 “Financial Instruments: Recognition and Measurement”. IFRS 9 has resulted in changes in accounting policies related to the classification, measurement and impairment of financial assets and liabilities, the company stated.

Carreras – PE 9.5. Regular increases in taxes on cigarettes have pressured demand for the product and squeezed profits for several years. There was no increase in prices in the last year but revenues grew in the half year to September while administrative cost fell. The company should earn around 80 cents per share to March this year and that should increase for the 2020 fiscal year. Growth in the economy and more importantly, the buoyancy in the construction industry will increase disposable income for smokers and thus drive increased demand for the company’s products. The stock is currently trading at just over 11 times earnings, based on 2019 earnings well below the market average of 16. With the dividend yield around 7 percent, investors will get good value for an investment in the stock, but not big capital gains in the short term.

Proven Investments – PE 9.5. Proven has been expanding with new acquisitions in 2018 and recently the purchase of 20 percent of JMMB Group shares. Access Financial Services in which it owns the largest block of shares, just concluded the acquisition of a loan company in Florida, while Proven concluded the acquisition of brokerage business in Cayman Islands and their St Lucian bank was in the process of acquiring a Latin American bank. IC insider.com expects more acquisition going forward and this should augur well for continued growth of the group.

Jamaica Broilers – PE 10. The company has been expanding by acquisitions and agronomic growth, leading to group revenues for the October quarter increasing 18 percent to $13.6 billion, over the $11.5 billion achieved in the similar period in the previous year. Gross profit for the quarter was $3 billion, a 3% increase over the previous year. Profit for the quarter was not as positive as the gains in revenues but that will change going forward as the company improves on profit margins.

Wisynco Group – PE 9.5. Shares are selling at a discount to the average of the market. At the same time, profit for 2019 should rise well ahead of the 2018 results as the company fully overcome the added cost associated with the damage and dislocation caused by fire that destroyed their warehouse in 2016. Profit growth should increase with the addition of the distribution of sugar and rum as well as improvement from the operating from one site as opposed to two in 2018. Growth in the local economy will be beneficial to sales growth and profit as well.

Berger Paints – PE 10.5. The company has been undergoing changes since Ansa McAl took control in 2017. The Penta brand of paints is added to the product line, along with the strongly in demand Berger brand. Penta paints were previously imported, by a third party, with production locally, cost will be reduced and allow for greater profit margin. Other changes within the company will lead to increased sales at lower cost and greater profits going forward.

Jamaica Stock Exchange – PE 10.5. The JSE enjoyed its best year in trading ever, in 2018 with the value traded, almost doubling and bettering the highest level enjoyed in 2004. The company enjoyed more listings on the market last year and they expect a 20 percent increase in 2019. News listing not only bring added listing fee income but increased trustee fees as well. Additionally, new listings open up the market for new investors some of whom will start to be more frequent stock market traders, thus increasing fee income as further.

NCB Financial – PE 10.5. The group’s shares are not likely to be the top performer in 2019 but is expected to put in a decent return and could continue to increase in value for a number of years. NCB is currently on a strong growth path with operating profit increasing strongly with the December 2018 results rising 40 percent before onetime income. The planned acquisition of more shares in Guardian Holdings will only enhance the bright prospects ahead for the Group.

- « Previous Page

- 1

- …

- 133

- 134

- 135

- 136

- 137

- …

- 232

- Next Page »