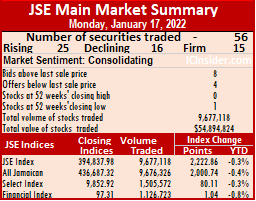

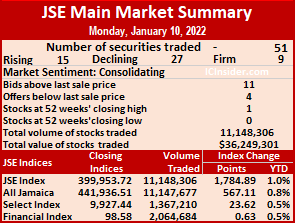

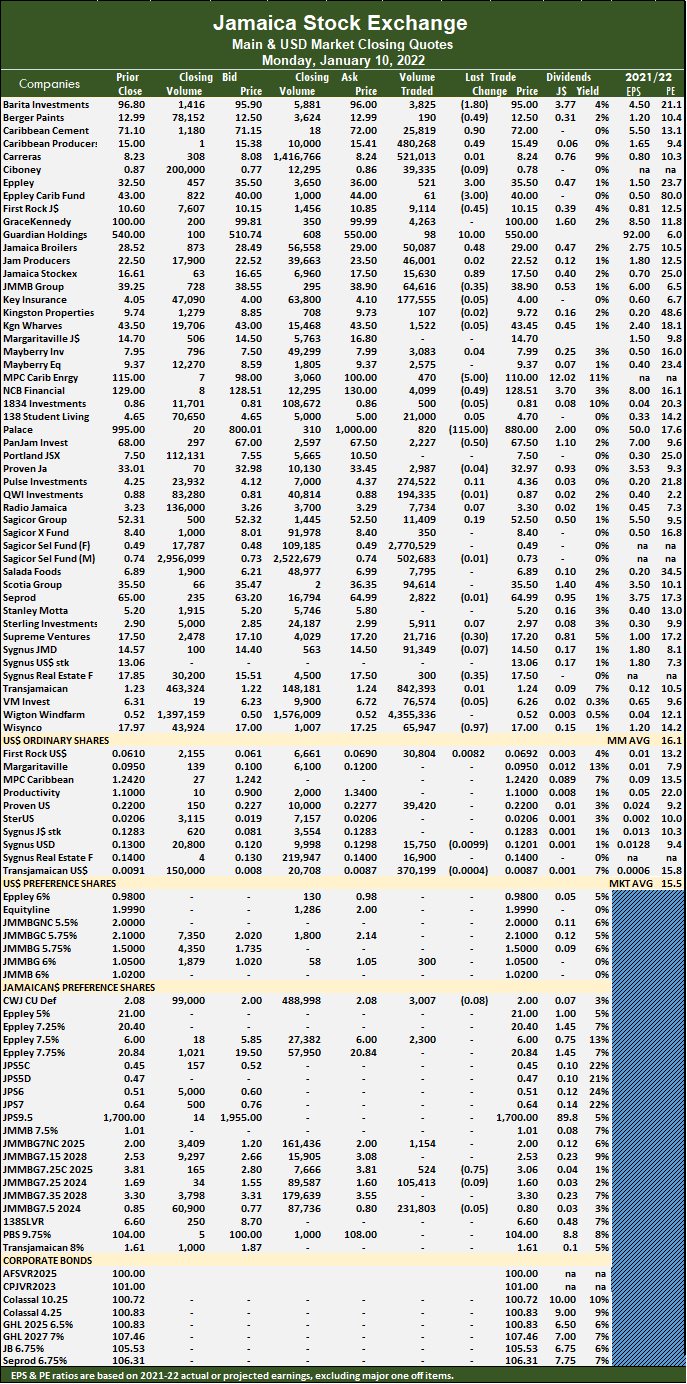

Market activity ended on Monday with an increase in the number of active securities than the case previously, leading to a 21 percent rise in the volume of shares trading but a 22 percent fall in the value traded from Friday levels as the Jamaica Stock Exchange Main Market closed with rising stocks exceeding those declining by a decent margin at the conclusion of a moderate trading session.

The All Jamaican Composite Index climbed 2,000.74 points to 436,687.32, the Main Index climbed 2,047.08 points to close at 394,837.98 and the JSE Financial Index rose 1.04 points to 97.31.

The All Jamaican Composite Index climbed 2,000.74 points to 436,687.32, the Main Index climbed 2,047.08 points to close at 394,837.98 and the JSE Financial Index rose 1.04 points to 97.31.

Trading ended with 56 securities compared to 55 on Friday, with 25 rising, 16 declining and 15 ending unchanged.

The PE Ratio, a formula for computing appropriate stock values, averages 16.1. The PE ratio for the JSE Main and USD Market closing quotes are based on ICInsider.com earnings forecasts for companies with financial years, ending up to August 2022.

Trading ended with 9,677,118 shares changing hands for $54,894,824 versus 8,020,198 units at $70,531,082 on Friday. Wigton Windfarm led trading with 24.5 percent of total volume for an exchange of 2.37 million shares followed by JMMB Group 7.5% preference share with 19.9 percent for 1.92 million units, Transjamaican Highway accounted for 13.2 percent with 1.27 million units and Sagicor Select Financial Fund, 12.7 percent after trading 1.23 million units.

Trading averages 172,806 units at $980,265, compared to 145,822 shares at $1,282,383 on Friday and month to date, an average of 164,121 units at $1,179,777 versus 163,194 units at $1,201,059 on the previous trading day. December closed with an average of 479,143 units at $6,686,322.

Investor’s Choice bid-offer indicator shows eight stocks ended with bids higher than their last selling prices and four with lower offers.

At the close, Barita Investments shed 82 cents to end at $93.98 with 19,554 shares crossing the market, Caribbean Producers dipped 49 cents at $15.50 in trading 302,535 units, Eppley lost 50 cents to finish at $36 with an exchange of 318 stocks. Eppley Caribbean Property Fund declined $3.49 in closing at $37.51 in switching ownership of 281 stock units, First Rock Capital lost 35 cents to close at $10.20 with 12,241 shares crossing the market, GraceKennedy advanced $2 to $101 after exchanging 175,533 stock units. Guardian Holdings popped $9 to $525 with the swapping of 509 units, Jamaica Broilers advanced $1.24 to $28.74 in transferring 58,677 stocks, Jamaica Producers rose $1.15 to $23.35 after trading 1,890 stock units. Jamaica Stock Exchange rallied 90 cents to $17.40 with 4,835 shares changing hands, JMMB Group gained 50 cents to end at $38.60 after 140,283 units cleared the market, Kingston Wharves fell $2.97 to close at $39 in an exchange of 75,266 shares. Mayberry Investments gained 48 cents to finish at $7.98 in trading 12,601 stocks, Mayberry Jamaican Equities lost 37 cents after ending at $9 in switching ownership of 11,606 stock units, NCB Financial advanced $1 to $126 with an exchange of 8,902 shares. Palace Amusement climbed $17.32 to end at $997.99 with 38 units changing hands, PanJam Investment declined $2.90 to $63 with the swapping of 7,562 units, Portland JSX popped 45 cents to $8 with a transfer of 2,468 shares.

At the close, Barita Investments shed 82 cents to end at $93.98 with 19,554 shares crossing the market, Caribbean Producers dipped 49 cents at $15.50 in trading 302,535 units, Eppley lost 50 cents to finish at $36 with an exchange of 318 stocks. Eppley Caribbean Property Fund declined $3.49 in closing at $37.51 in switching ownership of 281 stock units, First Rock Capital lost 35 cents to close at $10.20 with 12,241 shares crossing the market, GraceKennedy advanced $2 to $101 after exchanging 175,533 stock units. Guardian Holdings popped $9 to $525 with the swapping of 509 units, Jamaica Broilers advanced $1.24 to $28.74 in transferring 58,677 stocks, Jamaica Producers rose $1.15 to $23.35 after trading 1,890 stock units. Jamaica Stock Exchange rallied 90 cents to $17.40 with 4,835 shares changing hands, JMMB Group gained 50 cents to end at $38.60 after 140,283 units cleared the market, Kingston Wharves fell $2.97 to close at $39 in an exchange of 75,266 shares. Mayberry Investments gained 48 cents to finish at $7.98 in trading 12,601 stocks, Mayberry Jamaican Equities lost 37 cents after ending at $9 in switching ownership of 11,606 stock units, NCB Financial advanced $1 to $126 with an exchange of 8,902 shares. Palace Amusement climbed $17.32 to end at $997.99 with 38 units changing hands, PanJam Investment declined $2.90 to $63 with the swapping of 7,562 units, Portland JSX popped 45 cents to $8 with a transfer of 2,468 shares.  Scotia Group advanced $1.39 to close at $36.40 after exchanging 103,819 stocks, Seprod declined $1.40 in closing at $62.10 in trading 3,736 stock units, Sygnus Credit Investments gained 47 cents to settle at $14.82 with a transfer of 46,820 shares. Sygnus Real Estate Finance fell $1.25 to $16.02 with 21,980 stocks changing hands, Victoria Mutual Investments rallied 41 cents to close at $6.79 with an exchange of 73,058 shares and Wisynco Group lost 39 cents to end at $17.51 in switching ownership of 60,431 units.

Scotia Group advanced $1.39 to close at $36.40 after exchanging 103,819 stocks, Seprod declined $1.40 in closing at $62.10 in trading 3,736 stock units, Sygnus Credit Investments gained 47 cents to settle at $14.82 with a transfer of 46,820 shares. Sygnus Real Estate Finance fell $1.25 to $16.02 with 21,980 stocks changing hands, Victoria Mutual Investments rallied 41 cents to close at $6.79 with an exchange of 73,058 shares and Wisynco Group lost 39 cents to end at $17.51 in switching ownership of 60,431 units.

In the preference segment, JMMB Group 7.15% preference share due – 2028 rose 52 cents in closing at $3.05 with 450 stocks crossing the market.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Stocks gain in moderate trading session

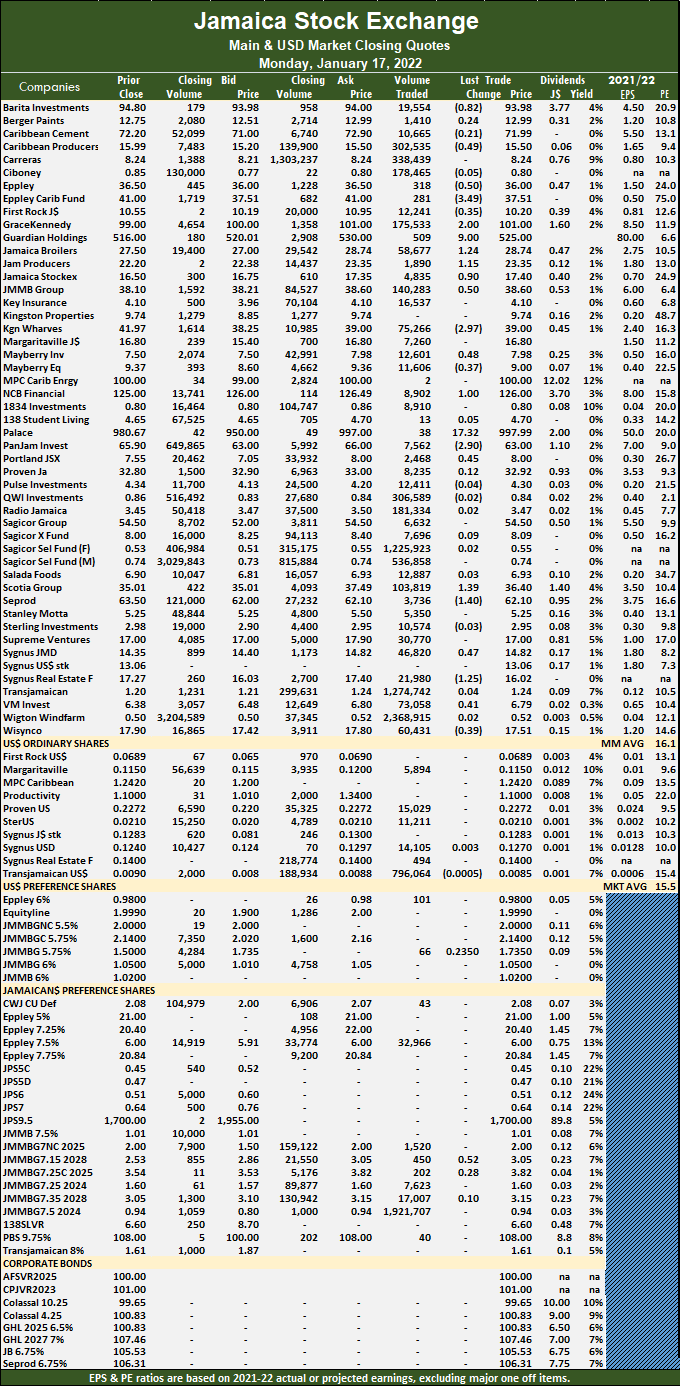

The Main Market 15 for Investment2022

The 15 Jamaica Stock Exchange Main Market companies that seem poised to score big in 2022 are shown below. As is the case in the past some of these stocks may do better than projected and some may not do a swell, others may take longer to deliver the returns depending on how investors react to new to come about the companies or the industry they operate in. an example of this is the financial sector that ICInsider.com gathers had some negative results from Jamaican bonds with the rise in interest rates and reduction in trading activity as interest rate changes in Jamaica and pending rate change in the overseas markets.

The 15 Jamaica Stock Exchange Main Market companies that seem poised to score big in 2022 are shown below. As is the case in the past some of these stocks may do better than projected and some may not do a swell, others may take longer to deliver the returns depending on how investors react to new to come about the companies or the industry they operate in. an example of this is the financial sector that ICInsider.com gathers had some negative results from Jamaican bonds with the rise in interest rates and reduction in trading activity as interest rate changes in Jamaica and pending rate change in the overseas markets.

Radio Jamaica – Earnings per share is projected at 65 cents for the year to March 2023 but they should end up with 45 cents for the 2022 fiscal year. The stock rose sharply with a strong increase in volume, followed by strong June quarter profits, with the stock price hitting $4.80 at the peak in 2021.

Radio Jamaica – Earnings per share is projected at 65 cents for the year to March 2023 but they should end up with 45 cents for the 2022 fiscal year. The stock rose sharply with a strong increase in volume, followed by strong June quarter profits, with the stock price hitting $4.80 at the peak in 2021.

Management has done an excellent job in turning around the operations in 2020 and the group is benefitting from a leaner operation as well as a boost in revenues in 2021 and beyond. With growth expected in the local economy over the next several years, revenues and profit should continue to hit new record levels. In addition, management continues to focus on increased efficiency, implementation of new technology in various aspects of the operation that will drive growth and profit. There are plans to extract revenues out of other assets that are not readily visible to the general public currently. Not to be missed is the impact an improving economy will have on increasing revenues as businesses increase advertising spend. Futuristically, with the digitization of the network, the company will be in a position to provide internet facilities to its customers as an additional potential income stream.

Berger Paints

Berger Paints – Earnings per share is projected at $2.25 for 2022. The stock is not every bodies’ favourite, but the company is coming back into its own and benefitting from rapid expansion in the construction sector. Expect continued growth to take place as it benefits from the booming housing market locally.

Guardian Holdings – Earnings per share is projected at J$90 for 2022. This stock has been beaten down in the Jamaican market, but it is selling at a much higher price in Trinidad. It is a very good company but has never gotten the valuation that it deserves. They are expected to continue to show profit growth which may falter from time to time based on the nature of their asset base and income stream. The decision of the directors to hold foolishly to the limited number of issued shares is hurting the price badly but they will learn that it is not in the best interest of investors to continue to do so. At that time the stocks will perform better.

JMMB Group – Earnings per share is projected at $7 for the year to March 2023. It is one of the more undervalued stocks on the market, the price is about 6 times earnings. The company has a great deal of room for above average growth in the future. The group’s exposure to doing business in the Dominican Republic is a huge market of 11 million relative to Jamaica, where it can expand in a major way, either by acquisitions or just expanding the current footprints. Historically, the stock tends to move sideways until early summer, if that holds there may be time to focus elsewhere and return to this one. Investors should think long about this one. The company gets permission to buy back shares and the directors set later in the second quarter this year to start doing that and it could mop a lot of selling pressure.

JMMB

Sygnus Credit Investment – Earnings per share is projected at $2.60 for the year to June 2023. At a PE ratio of 5.5 2023 earnings the stock is undervalued and is so based likely 2022 earnings of less than a PE of 10. It operates in a sector that is not well known to the investing public, but that is where above average gains can be made. Management is on target to extract optimal gains from the operations. An example of this is when they raise funds before listing, the planned rate of return was around 8 percent now in the range of 12 percent. The company announced the acquisition of a credit investment company in Puerto Rico that should close later in the year. This will help drive revenues and profit as it broadens its reach and be in a position to attract more capital to allow for greater expansion.

Sterling Investments – Earnings per share is projected at 45 cents for the year to December 2022. The stock is seriously undervalued but investors don’t care much about this one seeing it more as a dividend provider than one with capital growth potential. Earnings should approach 40 cents for 2021 and be higher in 2022. Revenues and profits will benefit from higher interest rates locally and overseas in 2022 that will enhance profitability.

In the year just ended, revenues totaled $185 million for the first nine months, 8.6 percent higher than the $170 million earned for the same period in 2020, driven primarily by increases in interest income and gains on the sale of debt securities. Total foreign exchange gains declined year on year, from $80 million for the 9 months ended September 2020 to $55 million for the nine months to September 2021 and seem set to reverse in the final quarter of the year. Net income totaled $105 million for the first months of 2021, higher by 10.9 percent than the $94 million for the same period in 2020.

Caribbean Producers traded 52 weeks’ high during the week following a near US$2 quarterly profit.

Caribbean Producers – Earnings per share is projected at J$2 for the year to June 2023. Cost cutting and a sharp rebound in the tourism sector with visitor arrivals just 20 percent down on November 2019 numbers augur very well for increased income and profit and the stock that was one of ICInsider.com’s 2021 picks with a 435 percent increase since the start of 2021. ICInsider.com puts the stock price at $40 for 2022 as the company reports record profits and completes the acquisition of an overseas business during the year. Investors should look to a big bounce in the December quarterly profits that should triple the US$1.6 million profit made in the September quarter as revenues for the last quarter of 2021 come in around US$35 million compared to US$25 million for the September quarter.

Caribbean Cement – Earnings per share is projected at $10 for 2022. The company was on target to earn around $8 per share last year but lower sales in the September quarter, due partly to the impact of several days when Jamaicans were not allowed to leave home and a very rainy period reduced sales volume. The stock was trading around the $115 range before the release of the third quarter results was knocked down to trade around the $100 level. The company announced a proposal for a management fee levy by Cemex at which time sellers pushed the price to the low $70 level. The selloff seems overdone, with the company having good prospects to go on to deliver good profits for investors as it benefits from the boom now taking place in the building industry.

This sector is set to continue to grow with government fiscal operations creating more space for the private sector thus taking pressure off interest rates and helping to keep them low to provide a continual stimulus for the sector and the wider economy.

VM Investments – Earnings per share is projected at 80 cents for 2022. The company had good results up to the September quarter, with revenues climbing a strong 33 percent for the September quarter and year to date and profit surging 82 percent in the third quarter and 69 percent year to date. One gather that many financial institutions had negative effects from the changes in interest rates during the December quarter as trading activities slowed thus generating less fee income than previously. The group is set to acquire a pool of mutual funds in the Eastern Caribbean with net assets around J$1.6 billion that will generate increased management fees as the company continues to look for growth going forward.

Audrey Tugwell Henry Scotia group’s CEO

Scotia Group -Earnings per share is projected at $3.65 for the year to October 2022. The group has been focusing on restructuring its operations to fit the new way of banking that relies less on physical branches than before. That has led to some branch closures and changes to services provided. This will result in reduced operating costs that will start to show in the current year.

The advent of Covid-19 in 2020 led to increased nonperforming loan provisions and a contraction in lending, with loans net of loan provisioning, falling from $221 billion in October 2020 to $209 billion in 2021 and declining from $216 billion at the end of July 2021. The fall in the loan growth should be reversed in 2022 with expansion in the local economy and continued buoyancy in the building market. Additionally, interest rates were kept to a minimum in the local economy that result in reduced interest income but with the Bank of Jamaica hike rates from half a percent to the range of 4 percent, the group will generate much increase in interest income. The increased rates could add around $9 billion to revenues in a full year and increase profit.

Investors should be focusing on the medium term prospects than on the recent past that was negatively affected by short term developments that won’t last.

PanJam Investment – Earnings per share is projected at $8 for the year. A diversified group, with focus on the property market commercial and more recently the hotel sector, liquid investments managed directly by themselves and through its 30 percent associate, Sagicor Group. Investment in the stock is likely to deliver good long term returns, but the stock seems undervalued currently with quite a bit of upside potential.

For the quarter ending September last year, profit attributable to shareholders amounted to $2.5 billion, up from $1.5 billion in 2020 and $4.8 billion for the nine months versus $2 billion in 2020, resulting in Earnings per stock unit for the quarter of $2.33 and $4.52 for the nine that should push the full year results around $7 placing the stock that traded at $66 at the end of December as undervalued at a PE of 9.6 compared to the market average of just over 16.

Christopher Williams, Proven Investments CEO.

Proven Investments – Earnings per share is projected at 0.28 US cents for the year to March 2023. Proven stock has not performed over the past year but it could do so this year as acquisitions made recently, starts to contribute to improvement in revenues and profit. Investors would recall that the company raised fresh capital in late 2020 amounting to US$29 million in addition to sums raised a year or two before that was not fully utilized to acquire new business that would deliver a rate of return on investment that was much greater than cash funds. During the last year, the company closed on some acquisitions that are set to contribute to increased profits and enhanced earnings per share. The company also plans to rationalize some of the geographically diverse holdings to generate economies of scale and thus improve profitability further.

Grace Kennedy – Earnings per share is projected at $12 for the year. Earnings of $12 may appear steep, but that is possible, with continued growth in the food division and recovery in the financial sector as well as strong economic recovery in the main markets it operates in. regardless the stock is currently undervalued and will be a good vehicle for long term growth.

QWI Investments – Earnings per share is projected at 88 cents for the year to September 2022. The numbers appear rich but ICInsider.com expects Access Financial Services to come into its own in the current year and drive its stock price well into the $50 region or more and along with other excellent holdings of QWI that are poised to deliver great returns during the year. The stock was one of the better performers on the Main Market last year with a rise of 14 percent and the NAV increasing 21.5 percent. Last year NCB Group had a block of shares on sale that pressured the price for months but those are taken out and the company may be in a position to buy back shares as such 2022 is likely to be a year of improving fortunes.

Christopher Levy – Jamaica Broilers President and Chief Executive.

Jamaica Broilers – Earnings per share is projected at $3 for the year to April 2023. The group has been expanding with a good degree of focus on the North American market.

For the year to October, last year’s group revenues for the six months amounted to $35.8 billion, 35 percent higher than the $26.5 billion achieved in the corresponding six months of the previous year. Gross profit for the six months increased less than the growth in revenues at 14 percent to $7.3 billion, Gross profit as a percentage of sales declined from 24 percent in the prior year to 20 percent. The decline is primarily attributable to increased input costs that were partially mitigated by the significant growth in the US business. For the six months ended 30 October 2021, the net profit after tax was $872 million, a 21 percent decrease versus the corresponding period in the prior year. The decrease is primarily due to foreign exchange gains of $290 million in the previous year, including in finance costs, compared to foreign exchange losses of $70 million in the current year. The prior year’s gains were mainly in the Haiti Operations where the Haitian Gourdes experienced significant revaluation against the US dollar. Operating profit of $1.7 billion was aligned with the prior year.

The case for Main Market stocks in 2022

Investors’ attention turned to the Junior Market in both 2020 and 2021 as that market provided better values for stocks and therefore greater opportunities to make higher profits. Projected earnings of the listed companies suggest that the situation is unlikely to change in 2022.

Investors’ attention turned to the Junior Market in both 2020 and 2021 as that market provided better values for stocks and therefore greater opportunities to make higher profits. Projected earnings of the listed companies suggest that the situation is unlikely to change in 2022.

The Main Market of the Jamaica Stock Exchange eked out a modest gain of 1.1 percent in the All Jamaica Composite index at the end of 2021, the index was 21.7 percent lower than the end of 2019.

The PE for the Main market is 14 times 2022 earnings compared to 16 based on 2021 earnings, that does not suggest a big uptick for the market with just a 14 percent increase expected in 2022 over 2021 that would push the index to 499,694 points, still well below the 559,853.26 points the market closed out 2019 at.

There are several stocks in the market, data suggest could more than double in 2022 and investor would be wise to not only pay attention but pick up some of these undervalued stocks in preparation for long term growth as the Jamaican economy rebounds and move into a new stage of long term positive growth that a number of these companies will benefit from.

Banks could be amongst the big performer as they shed the need for continued heavy provisioning of loans as well as grow their book of loans to deliver more income to profits. Added the increase in interest rates will help improve their net interest income.

Banks could be amongst the big performer as they shed the need for continued heavy provisioning of loans as well as grow their book of loans to deliver more income to profits. Added the increase in interest rates will help improve their net interest income.

ICInsider.com data indicates that there are 8 stocks that can double in the Main Market in 2022 into early 2023. 2021 finished with several stocks trading at or above 20 times earnings in the Main Market if that level of valuation continues into 2022 and is more widespread, then the gain in the market could exceed the above potential gains. In the final analysis, the market index is just a simple measure as to how the overall market is doing. It comes down to individual stocks that can do well and that is the case for ICInsider.com TOP15 stocks.

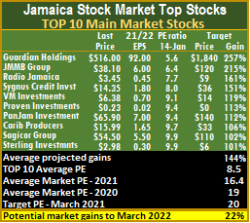

3 new ICTOP10 listings as Spur Tree exists

The Junior Market ICTOP10 stocks have three new listings in a week that saw Spur Tree Spices trading for the first time on Friday with the price climbing to $1.32 for a rise of 32 percent since the Initial Public offer at the end of 2021, there are no new Main Market listings.

Other stocks that were in the spotlight this past week were ones that lasted off to record new all-time highs and include AMG Packaging, Caribbean Assurance Brokers, Caribbean Producers and Dolphin Cove a TOP10 contender up to the week ending December 2, also hit a 52 weeks’ high of $23.50 this past week to be up more than 100% since it came into the top flight in August last year at $9.86.

Other stocks that were in the spotlight this past week were ones that lasted off to record new all-time highs and include AMG Packaging, Caribbean Assurance Brokers, Caribbean Producers and Dolphin Cove a TOP10 contender up to the week ending December 2, also hit a 52 weeks’ high of $23.50 this past week to be up more than 100% since it came into the top flight in August last year at $9.86.

With the rise in the price of Spur Tree Spices, the stock is one of four to move out of the TOP10, followed by Medical Disposables that 16 percent for the week and Caribbean Cream that reported terrible third quarter results with a loss being made in the period as revenues climbed 14 percent in the quarter. Coming into the TOP10 are Lumber Depot, Fontana and General Accident.

Junior Market, AMG Packaging rose a strong 45 percent, ahead of the first quarter results to November that showed profit after tax jumping a big 146 percent over 2020. Investors can expect more gains to come this coming week as the stock traded up $3.90 last week. Caribbean Assurance Brokers climbed to a new 52 weeks’ high during the week and closed $3.12 up 26 percent, Access Financial Services continues to seesaw and recovered 17 percent to $20 this past week and Elite Diagnostic gained 8 percent to $3.18.

Junior Market, AMG Packaging rose a strong 45 percent, ahead of the first quarter results to November that showed profit after tax jumping a big 146 percent over 2020. Investors can expect more gains to come this coming week as the stock traded up $3.90 last week. Caribbean Assurance Brokers climbed to a new 52 weeks’ high during the week and closed $3.12 up 26 percent, Access Financial Services continues to seesaw and recovered 17 percent to $20 this past week and Elite Diagnostic gained 8 percent to $3.18.

The sharp price movements in the Junior Market reduced the potential gains markedly, with the average gains projected for the TOP 10 Junior Market stocks now 122 percent versus 148 percent last week.

The top three stocks are Access Financial Services followed by Lasco Distributors and Caribbean Assurance Brokers can gain between 124 and 160 percent, sharply down from 182 and 204 percent, previously.

The top three stocks are Access Financial Services followed by Lasco Distributors and Caribbean Assurance Brokers can gain between 124 and 160 percent, sharply down from 182 and 204 percent, previously.

Major Main Market TOP10 moving stocks are Caribbean Producers up 7 percent, to $15.99 and Radio Jamaica rallying 7 percent to $3.45 as increased buying interest came in for the stock.

The potential gains for Main Market stocks moved from 146 percent to this weeks’ 144 percent this week, with top three Main Market stocks being Guardian Holdings followed by JMMB Group and Radio Jamaica all projected to gain between 161 and 257 percent up from 199 and 258 percent last week.

The Junior Market closed the week, with an average PE of 14.7 based on ICInsider.com’s 2021-22 earnings and is currently well below the target of 20 and the average of 17 at the end of March this year based on 2020 earnings.  The TOP 10 stocks trade at a PE of a mere 9.1, with a 38 percent discount to that market’s average.

The TOP 10 stocks trade at a PE of a mere 9.1, with a 38 percent discount to that market’s average.

The Junior Market can gain 36 percent to March this year, based on an average PE of 20 and 16 percent based on an average PE of 17. Eleven stocks representing 26 percent of all Junior Market stocks with positive earnings are trading at or above this level averaging 25.

The average PE for the JSE Main Market is 16.4, just 16 percent less than the PE of 19 at the end of March and 22 percent below the target of 20 to March 2022. The Main Market TOP 10 average PE is 8.5 representing a 48 percent discount to the market and well below the potential of 20. A total of 14 stocks or 30 percent of the market trade at or above a PE of 19, with most over 20, for an average roundabout 25, suggesting that the accepted multiple is between 20 and 25 times the current year’s earnings.

ICTOP10 focuses on likely yearly winners, accordingly, the list may or may not include the best companies in the market. ICInsider.com ranks stocks based on projected earnings to highlight winners from the rest, allowing investors to focus on potential winning stocks and helping to remove emotional attachments to stocks that often result in costly mistakes.

ICTOP10 focuses on likely yearly winners, accordingly, the list may or may not include the best companies in the market. ICInsider.com ranks stocks based on projected earnings to highlight winners from the rest, allowing investors to focus on potential winning stocks and helping to remove emotional attachments to stocks that often result in costly mistakes.

IC TOP10 stocks are likely to deliver the best returns up to March 2022 and ranked in order of potential gains, based on the possible increase for each company, considering the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in weekly movements in and out of the lists. Revisions to earnings per share are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

Faltering main market performance

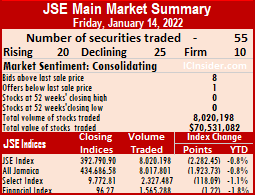

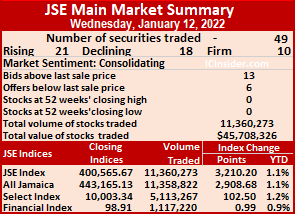

More Main Market stock fell than those gaining at the close of trading sending the primary indices sliding downwards at the close on Friday, following a 37 percent slippage in the volume of shares trading and a 24 percent lower value than Thursday on the Jamaica Stock Exchange Main Market.

The All Jamaican Composite Index dropped 1,923.73 points to 434,686.58, the JSE Main Index plunged 2,282.45 points to 392,790.90 and the JSE Financial Index fell 1.22 points to end at 96.27.

The All Jamaican Composite Index dropped 1,923.73 points to 434,686.58, the JSE Main Index plunged 2,282.45 points to 392,790.90 and the JSE Financial Index fell 1.22 points to end at 96.27.

Trading ended with 55 securities up from 50 on Thursday, with 20 rising, 25 declining and 10 ending unchanged.

A total of 8,020,198 shares traded for $70,531,082 compared to 12,654,913 units at $92,312,652 on Thursday. Wigton Windfarm led trading with 29.3 percent of total volume in exchanging 2.35 million shares, followed by Transjamaican Highway with 23.2 percent for 1.86 million units and Caribbean Producers, 7 percent with 560,506 units.

Trading averages 145,822 units at $1,282,383, compared to 253,098 shares at $1,846,253 on Thursday and month to date, an average of 163,194 units at $1,201,059, compared to 165,227 units at $1,191,542 on Thursday. December closed with an average of 479,143 units at $6,686,322.

The PE Ratio, a formula for computing appropriate stock values, averages 16.1. The PE ratio for the JSE Main and USD Market closing quotes are based on ICInsider.com earnings forecasts for companies with financial years ending up to August 2022.

Investor’s Choice bid-offer indicator shows eight stocks ended with bids higher than their last selling prices and one with a lower offer.

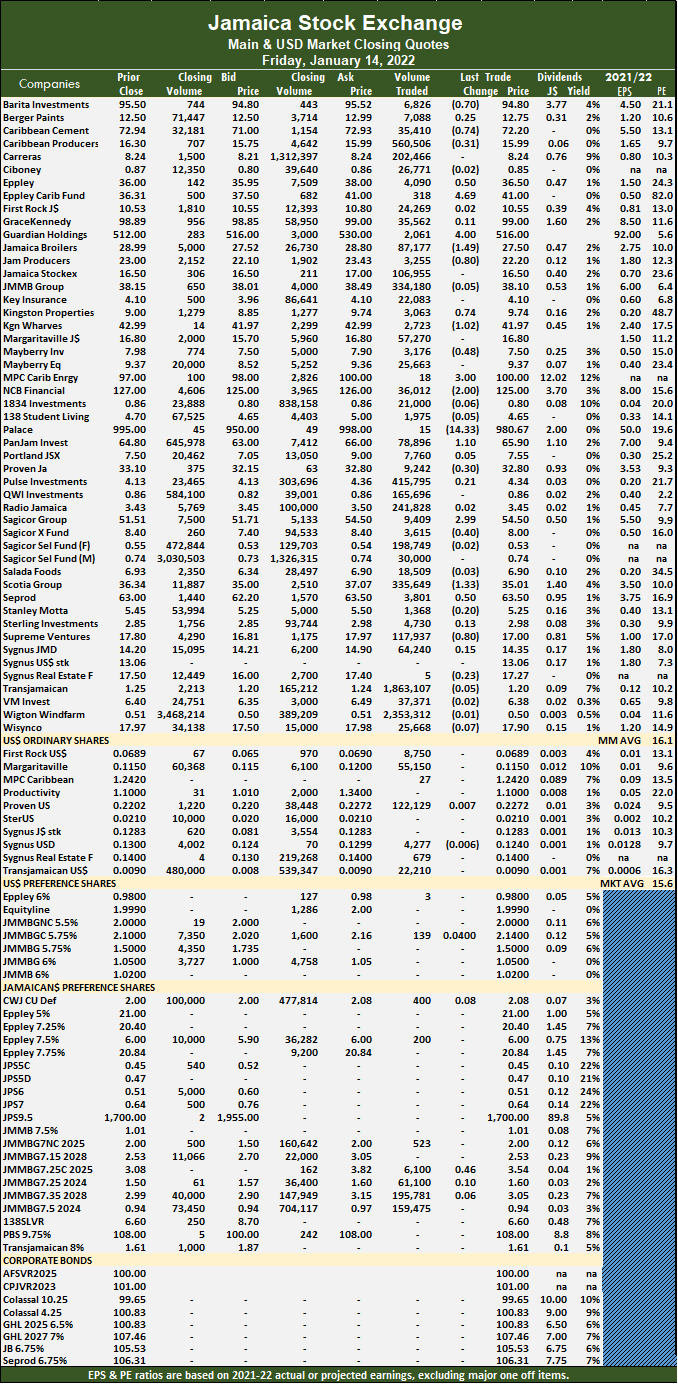

At the close, Barita Investments lost 70 cents to close at $94.80 with an exchange of 6,826 shares, Caribbean Cement shed 74 cents in ending at $72.20 with the swapping of 35,410 units, Caribbean Producers lost 31 cents to close at $15.99 with 560,506 stocks crossing the exchange. Eppley rallied 50 cents to $36.50 in trading 4,090 stock units, Eppley Caribbean Property Fund advanced $4.69 to $41 with 318 units clearing the market, Guardian Holdings rose $4 to end at $516 in an exchange of 2,061 shares. Jamaica Broilers fell $1.49 to close at $27.50 with the swapping of 87,177 stock units, Jamaica Producers shed 80 cents in closing at $22.20 after trading 3,255 stocks, Kingston Properties gained 74 cents ending at $9.74 in switching ownership of 3,063 units. Kingston Wharves fell $1.02 to $41.97 with 2,723 stock units changing hands, Mayberry Investments lost 48 cents to finish at $7.50 after 3,176 stocks crossed the market, MPC Caribbean Clean Energy advanced $3 to close at $100 in switching ownership of 18 shares. NCB Financial declined $2 in closing at $125 with a transfer of 36,012 stocks, Palace Amusement dropped $14.33 to $980.67 with 15 units changing hands, PanJam Investment popped $1.10 to close at $65.90 in transferring 78,896 stock units.

At the close, Barita Investments lost 70 cents to close at $94.80 with an exchange of 6,826 shares, Caribbean Cement shed 74 cents in ending at $72.20 with the swapping of 35,410 units, Caribbean Producers lost 31 cents to close at $15.99 with 560,506 stocks crossing the exchange. Eppley rallied 50 cents to $36.50 in trading 4,090 stock units, Eppley Caribbean Property Fund advanced $4.69 to $41 with 318 units clearing the market, Guardian Holdings rose $4 to end at $516 in an exchange of 2,061 shares. Jamaica Broilers fell $1.49 to close at $27.50 with the swapping of 87,177 stock units, Jamaica Producers shed 80 cents in closing at $22.20 after trading 3,255 stocks, Kingston Properties gained 74 cents ending at $9.74 in switching ownership of 3,063 units. Kingston Wharves fell $1.02 to $41.97 with 2,723 stock units changing hands, Mayberry Investments lost 48 cents to finish at $7.50 after 3,176 stocks crossed the market, MPC Caribbean Clean Energy advanced $3 to close at $100 in switching ownership of 18 shares. NCB Financial declined $2 in closing at $125 with a transfer of 36,012 stocks, Palace Amusement dropped $14.33 to $980.67 with 15 units changing hands, PanJam Investment popped $1.10 to close at $65.90 in transferring 78,896 stock units.  Proven Investments lost 30 cents after ending at $32.80 with an exchange of 9,242 shares, Sagicor Group rose $2.99 to end at $54.50 after trading 9,409 stocks, Sagicor Real Estate Fund shed 40 cents to close at $8 with 3,615 stock units changing hands. Scotia Group fell $1.33 to finish at $35.01 with an exchange of 335,649 shares, Seprod popped 50 cents to $63.50 in switching ownership of 3,801 units and Supreme Ventures shed 80 cents to $17 in an exchange of 117,937 units.

Proven Investments lost 30 cents after ending at $32.80 with an exchange of 9,242 shares, Sagicor Group rose $2.99 to end at $54.50 after trading 9,409 stocks, Sagicor Real Estate Fund shed 40 cents to close at $8 with 3,615 stock units changing hands. Scotia Group fell $1.33 to finish at $35.01 with an exchange of 335,649 shares, Seprod popped 50 cents to $63.50 in switching ownership of 3,801 units and Supreme Ventures shed 80 cents to $17 in an exchange of 117,937 units.

In the preference segment, JMMB Group 7.25% preference share gained 46 cents to close at $3.54 with 6,100 shares crossing the market.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

JSE Main Market plunges

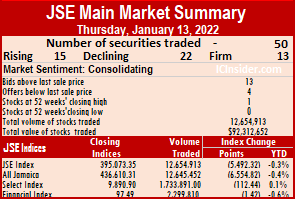

Market activity ended on Thursday with the money entering the more than doubling trading on Wednesday on the Jamaica Stock Exchange Main Market and ended with a sharp fall in the market with the All Jamaican Composite Index plunging 6,554.82 points to 436,610.31, the JSE Main Index dived 5,492.32 points to 395,073.35 and the JSE Financial Index fell 1.42 points to end at 97.49.

Fifty securities traded, compared to 49 on Wednesday, with 15 rising, 22 declining and 13 ending unchanged.

Fifty securities traded, compared to 49 on Wednesday, with 15 rising, 22 declining and 13 ending unchanged.

The PE Ratio, a formula for computing appropriate stock values, averages 16. The PE ratio for the JSE Main and USD Market closing quotes are computed based on ICInsider.com earnings forecasts for companies with financial years ending up to August 2022.

A total of 12,654,913 shares changing hands for $92,312,652 versus 11,360,273 units at $45,708,326 on Wednesday. Sagicor Select Financial Fund led trading with 26.4 percent of total volume with a transfer of 3.34 million shares followed by Wigton Windfarm with 22.3 percent after trading 2.82 million units, JMMB Group 7.5% preference share accounted for 12.7 percent with 1.61 million and JMMB Group 7.35% – 2028 preference share contributed 9.5 percent after trading 1.21 million units.

Trading averages 253,098 units at $1,846,253, up from 231,842 shares at $932,823 on Wednesday and month to date, an average of 165,227 units at $1,191,542, compared to 154,766 units at $1,113,600 on the previous day. December closed with an average of 479,143 units at $6,686,322.

Investor’s Choice bid-offer indicator shows 13 stocks ended with bids higher than their last selling prices and four with lower offers.

At the close, Barita Investments lost 42 cents to end at $95.50 in exchanging 10,909 shares, Berger Paints shed 49 cents in closing at $12.50 with a transfer of 10,109 stock units, Caribbean Producers popped 91 cents to close at a 52 weeks’ high of $16.30 in trading 338,318 units. Eppley Caribbean Property Fund declined $7.49 to close at $36.31 in switching ownership of 4,500 stocks, GraceKennedy fell 61 cents to $98.89 after 129,890 units crossed the market, Guardian Holdings dropped $18 to end at $512 with the swapping of 4,265 shares. Jamaica Stock Exchange shed 50 cents to finish at $16.50 with 74,726 stock units changing hands, JMMB Group lost 35 cents to close at $38.15 with an exchange of 97,814 stocks, Kingston Properties fell 71 cents to $9 in switching ownership of 382 stock units. Margaritaville rose $2.10 to $16.80 in trading 450 stocks, MPC Caribbean Clean Energy declined $3 to a 52 weeks’ low of $97 with the swapping of 696 shares, NCB Financial shed $1.50 to end at $127 with 44,195 units crossing the market. Palace Amusement climbed $95 to close at $995 in exchanging 59 stock units, PanJam Investment fell $1.20 to $64.80 after 4,950 stocks cleared the market, Sagicor Group declined $5.46 in closing at $51.51 and switching ownership of 13,479 shares.

At the close, Barita Investments lost 42 cents to end at $95.50 in exchanging 10,909 shares, Berger Paints shed 49 cents in closing at $12.50 with a transfer of 10,109 stock units, Caribbean Producers popped 91 cents to close at a 52 weeks’ high of $16.30 in trading 338,318 units. Eppley Caribbean Property Fund declined $7.49 to close at $36.31 in switching ownership of 4,500 stocks, GraceKennedy fell 61 cents to $98.89 after 129,890 units crossed the market, Guardian Holdings dropped $18 to end at $512 with the swapping of 4,265 shares. Jamaica Stock Exchange shed 50 cents to finish at $16.50 with 74,726 stock units changing hands, JMMB Group lost 35 cents to close at $38.15 with an exchange of 97,814 stocks, Kingston Properties fell 71 cents to $9 in switching ownership of 382 stock units. Margaritaville rose $2.10 to $16.80 in trading 450 stocks, MPC Caribbean Clean Energy declined $3 to a 52 weeks’ low of $97 with the swapping of 696 shares, NCB Financial shed $1.50 to end at $127 with 44,195 units crossing the market. Palace Amusement climbed $95 to close at $995 in exchanging 59 stock units, PanJam Investment fell $1.20 to $64.80 after 4,950 stocks cleared the market, Sagicor Group declined $5.46 in closing at $51.51 and switching ownership of 13,479 shares. Scotia Group fell $1.15 to $36.34 after exchanging 19,909 units and Seprod gained 90 cents to settle at $63 in an exchange of 110,300 units.

Scotia Group fell $1.15 to $36.34 after exchanging 19,909 units and Seprod gained 90 cents to settle at $63 in an exchange of 110,300 units.

In the preference segment, Productive Business Solutions 9.75% preference share spiked $4 to end at $108 in switching ownership of 758 stocks.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Rally for JSE Main market

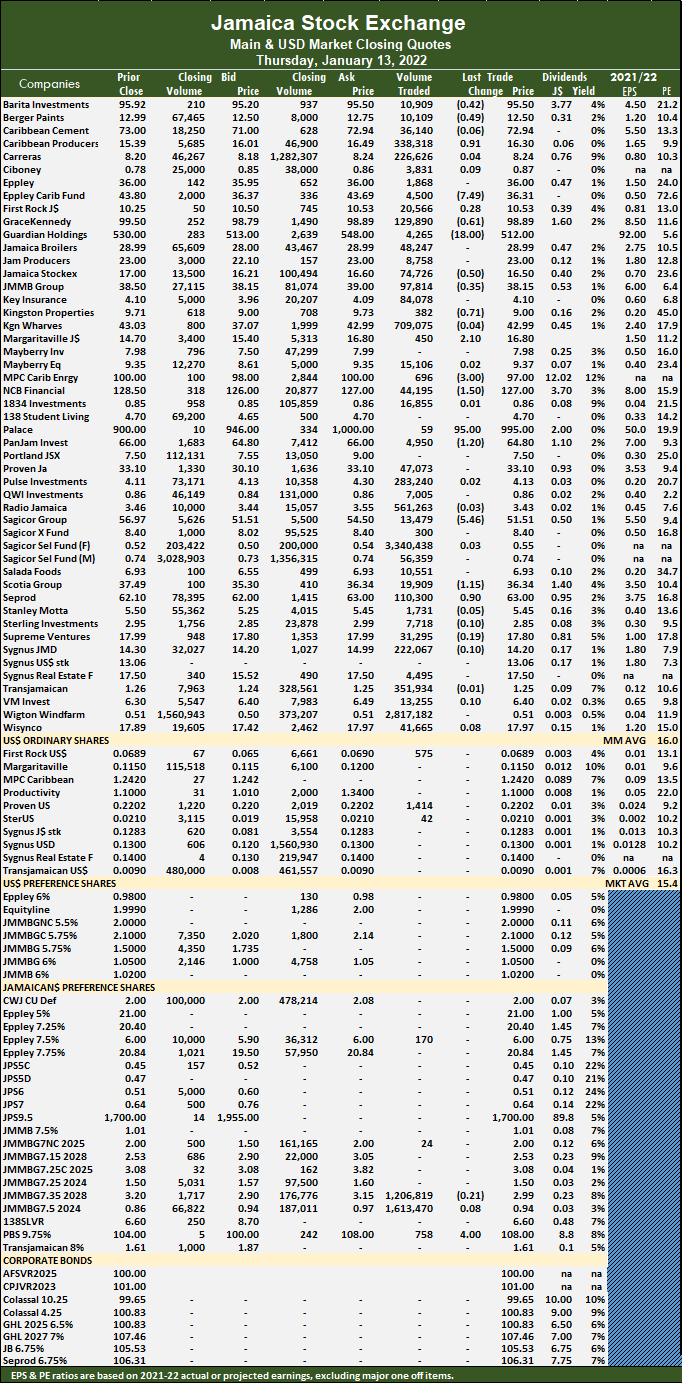

Stocks prices rebounded in market activity on Wednesday, with the volume of shares trading rising 127 percent more than on Tuesday as the value rose just 26 percent higher at the close of the Jamaica Stock Exchange Main Market, with rising stocks exceeding declining ones.

The All Jamaican Composite Index advanced 2,908.68 points to 443,165.13, the JSE Main Index rallied 3,210.20 points to end at 400,565.67 and the JSE Financial Index popped 0.99 points to settle at 98.91.

The All Jamaican Composite Index advanced 2,908.68 points to 443,165.13, the JSE Main Index rallied 3,210.20 points to end at 400,565.67 and the JSE Financial Index popped 0.99 points to settle at 98.91.

Overall, 49 securities traded versus 53 on Tuesday, with 21 rising, 18 declining and 10 ending unchanged.

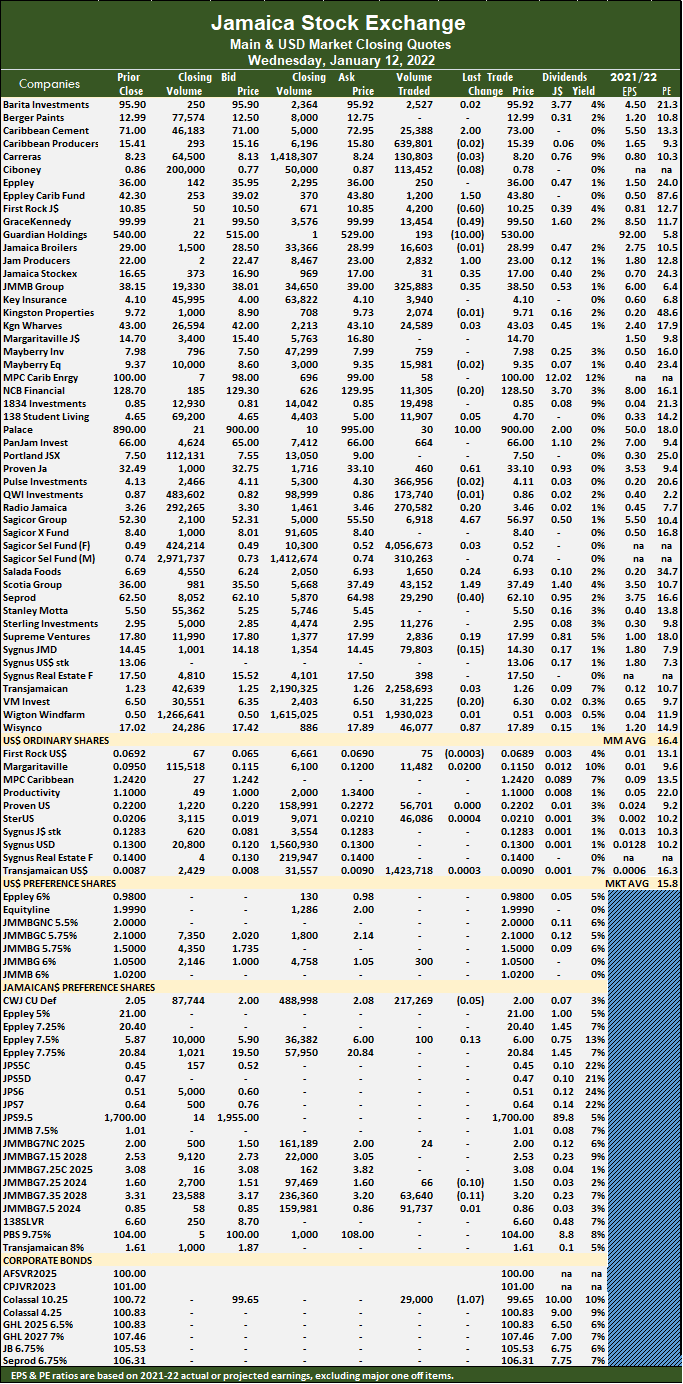

A total of 11,360,273 shares traded for $45,708,326 versus 4,998,746 units at $36,379,818 on Tuesday. Sagicor Select Financial Fund led trading with 35.7 of total volume after an exchange of 4.06 million shares followed by Transjamaican Highway, 19.9 percent with 2.26 million units and Wigton Windfarm with 17 percent for 1.93 million shares.

The PE Ratio, a formula for computing appropriate stock values, averages 16.4. The PE ratio for the JSE Main and USD Market closing quotes are based on ICInsider.com earnings forecasts for companies with financial years ending up to August 2022.

The average trade for the day was 231,842 units at $932,823 compared to 94,316 shares at $686,412 on Tuesday and month to date, an average of 154,766 units at $1,113,600, against 144,586 units at $1,137,476 on Tuesday. December closed with an average of 479,143 units at $6,686,322.

The average trade for the day was 231,842 units at $932,823 compared to 94,316 shares at $686,412 on Tuesday and month to date, an average of 154,766 units at $1,113,600, against 144,586 units at $1,137,476 on Tuesday. December closed with an average of 479,143 units at $6,686,322.

Investor’s Choice bid-offer indicator shows thirteen stocks ending with bids higher than their last selling prices and six with lower offers.

At the close, Caribbean Cement advanced $2 to $73 with 25,388 shares crossing the exchange, Eppley Caribbean Property Fund rose $1.50 in closing at $43.80 after trading 1,200 stocks, First Rock Capital shed 60 cents in ending at $10.25 with the swapping of 4,200 units. GraceKennedy fell 49 cents to close at $99.50 with a transfer of 13,454 stock units, Guardian Holdings dropped $10 to end at $530 in an exchange of 193 units, Jamaica Producers rose $1 to $23 after 2,832 shares cleared the market. Jamaica Stock Exchange gained 35 cents to finish at $17 with 31 stocks changing hands, JMMB Group spiked 35 cents to close at $38.50 in exchanging 325,883 stock units, Palace Amusement popped $10 to $900 after swapping of 30 units.  Proven Investments rallied 61 cents to end at $33.10 after 460 shares crossed the market, Sagicor Group climbed $4.67 in closing at $56.97 with 6,918 stock units clearing the market, Scotia Group advanced $1.49 to end at $37.49 with investors switching ownership of 43,152 stocks. Seprod fell 40 cents to end at $62.10 in transferring 29,290 shares and Wisynco Group rallied 87 cents to $17.89 in trading 46,077 stock units.

Proven Investments rallied 61 cents to end at $33.10 after 460 shares crossed the market, Sagicor Group climbed $4.67 in closing at $56.97 with 6,918 stock units clearing the market, Scotia Group advanced $1.49 to end at $37.49 with investors switching ownership of 43,152 stocks. Seprod fell 40 cents to end at $62.10 in transferring 29,290 shares and Wisynco Group rallied 87 cents to $17.89 in trading 46,077 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Subdued trading for JSE Main Market

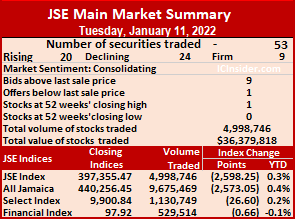

Market activity ended on Tuesday with the volume of shares trading declining 55 percent, but with the value holding close to Monday’s level at the close of the Jamaica Stock Exchange Main Market as rising stocks were less than those declining.

The All Jamaican Composite Index shed 1,680.06 points to end at 440,256.45, the JSE Main Index dipped 2,598.25 points to finish at 397,355.47 and the JSE Financial Index fell 0.66 points to close at 97.92.

The All Jamaican Composite Index shed 1,680.06 points to end at 440,256.45, the JSE Main Index dipped 2,598.25 points to finish at 397,355.47 and the JSE Financial Index fell 0.66 points to close at 97.92.

A total of 53 securities traded compared to 51 on Monday, with 20 rising, 24 declining and nine ending unchanged.

The PE Ratio, a formula used in computing appropriate stock values, averages 16.2. The PE ratio for the JSE Main and USD Market closing quotes are based on ICInsider.com earnings forecasts for companies with financial years ending up to August 2022.

Overall, 4,998,746 shares traded for $36,379,818 versus 11,148,306 units at $36,249,301 on Monday. Sagicor Select Financial Fund led trading with 22.1 percent of total volume transferring 1.11 million shares followed by Sagicor Select Manufacturing & Distribution Fund, 17.1 percent, with 856,909 units and Transjamaican Highway accounting for 15.9 percent trading 793,717 units.

Trading averaged 94,316 units at $686,412, compared to 218,594 shares at $710,771 on Monday and month to date, an average of 144,586 units at $1,137,476, compared to 152,965 units at $1,212,654 on Monday. December ended with an average of 479,143 units at $6,686,322.

Investor’s Choice bid-offer indicator shows nine stocks ended with bids higher than their last selling prices and one with a lower offer.

Investor’s Choice bid-offer indicator shows nine stocks ended with bids higher than their last selling prices and one with a lower offer.

At the close, Barita Investments popped 90 cents to end at $95.90 with the swapping of 10,281 shares, Berger Paints rallied 49 cents to close at $12.99 in exchanging 608 stocks, Caribbean Cement shed $1 in closing at $71 after switching ownership of 25,329 units. Eppley gained 50 cents to finish at $36 after exchanging 1,105 stock units, Eppley Caribbean Property Fund advanced $2.30 after ending at $42.30 in trading 700 stocks, First Rock Capital rose 70 cents to close at $10.85, with 6,146 stock units clearing the market. Guardian Holdings declined $10 after ending at $540 with 1,535 shares changing hands, Jamaica Producers lost 52 cents to close at $22 with a transfer of 76,000 units, Jamaica Stock Exchange shed 85 cents to $16.65 with 675 stocks crossing the market. JMMB Group fell 75 cents in closing at $38.15 with the swapping of 145,580 shares, Kingston Wharves lost 45 cents to end at $43 n trading 20,566 stock units, MPC Caribbean Clean Energy declined $10 to $100 with investors exchanging 158 shares.  Palace Amusement advanced $10 to end at $890 in transferring 46 stocks, PanJam Investment shed $1.50 after ending at $66 with 53,482 units crossing the market, Proven Investments dipped 48 cents in closing at $32.49 with 13,577 shares changing hands. Scotia Group gained 50 cents to finish at $36 in switching ownership of 61,922 stock units, Seprod shed $2.49 to end at $62.50 in an exchange of 2,778 shares, Stanley Motta popped 30 cents in closing at $5.50 after trading 7,000 stock units and Supreme Ventures rose 60 cents to end at $17.80 in an exchange of 55,675 stocks.

Palace Amusement advanced $10 to end at $890 in transferring 46 stocks, PanJam Investment shed $1.50 after ending at $66 with 53,482 units crossing the market, Proven Investments dipped 48 cents in closing at $32.49 with 13,577 shares changing hands. Scotia Group gained 50 cents to finish at $36 in switching ownership of 61,922 stock units, Seprod shed $2.49 to end at $62.50 in an exchange of 2,778 shares, Stanley Motta popped 30 cents in closing at $5.50 after trading 7,000 stock units and Supreme Ventures rose 60 cents to end at $17.80 in an exchange of 55,675 stocks.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Many more losses than winners for JSE majors

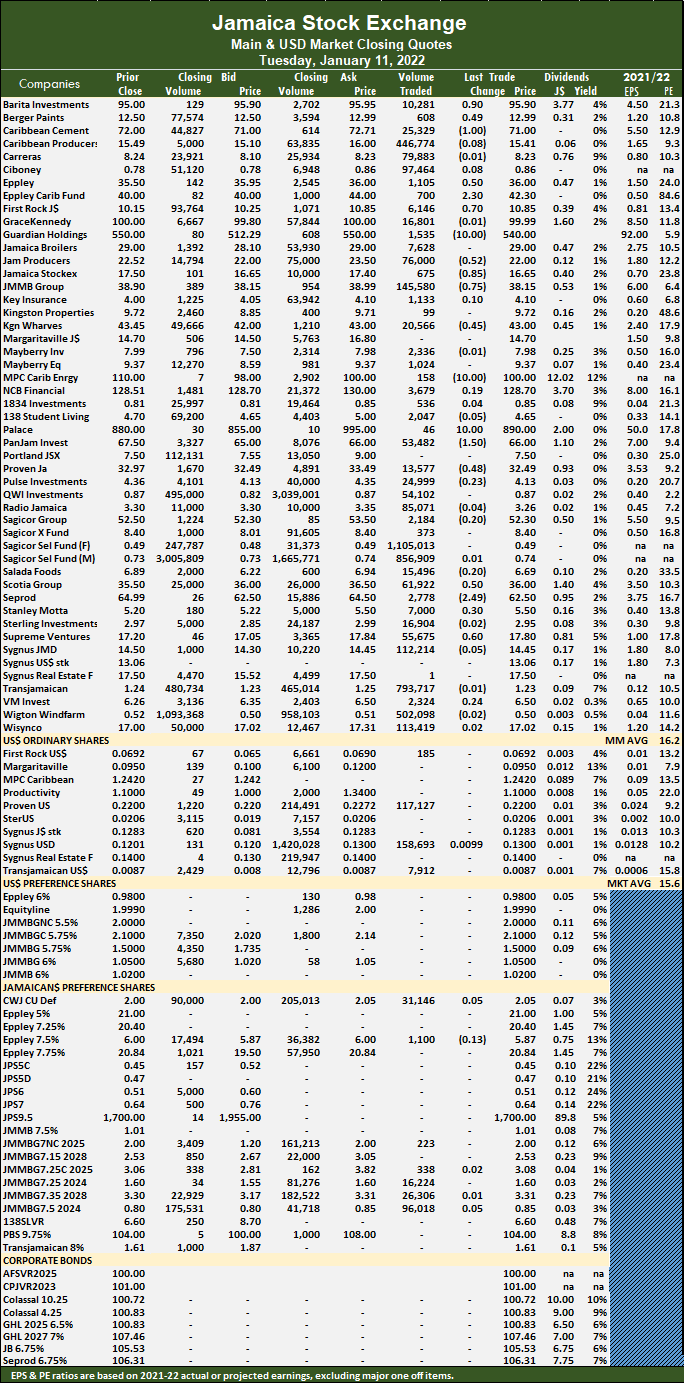

Market activity ended on Monday with the volume of shares traded rising 42 percent and the value dropping 76 percent below Friday’s activities on the Jamaica Stock Exchange Main Market as rising stocks fell well below those declining.

The All Jamaican Composite Index rose 567.11 points and closed at 441,936.51, the JSE Main Index advanced 1,784.89 points to 399,953.72 and the JSE Financial Index rose 0.63 points to settle at 98.58.

The All Jamaican Composite Index rose 567.11 points and closed at 441,936.51, the JSE Main Index advanced 1,784.89 points to 399,953.72 and the JSE Financial Index rose 0.63 points to settle at 98.58.

A total of 51 securities traded up from 48 on Friday, with 15 rising, 27 declining and nine ending unchanged.

The PE Ratio, a formula for computing appropriate stock values averages 16.1. The PE ratio for the JSE Main and USD Market closing quotes are based on ICInsider.com earnings forecasts for companies with financial years ending up to August 2022.

A total of 11,148,306 shares traded for $36,249,301 versus 7,837,782 units at $148,024,848 on Friday. Wigton Windfarm ended trading with 39.1 percent of total volume for an exchange of 4.36 million shares followed by Sagicor Select Financial Fund with 24.9 percent for 2.77 million units and Transjamaican Highway 7.6 percent after trading 842,393 units.

Trading averages 218,594 units at $710,771 versus 163,287 shares at $3,083,851 on Friday and month to date, an average of 152,965 units at $1,212,654 compared to 140,429 units at $1,308,519 on Friday. December closed with an average of 479,143 units at $6,686,322.

Trading averages 218,594 units at $710,771 versus 163,287 shares at $3,083,851 on Friday and month to date, an average of 152,965 units at $1,212,654 compared to 140,429 units at $1,308,519 on Friday. December closed with an average of 479,143 units at $6,686,322.

Investor’s Choice bid-offer indicator shows eleven stocks ending with bids higher than their last selling prices and four with lower offers.

At the close, Barita Investments dropped $1.80 to $95 in exchanging 3,825 shares, Berger Paints fell 49 cents to $12.50 with 190 stocks changing hands, Caribbean Cement spiked 90 cents to $72 after 25,819 stock units crossed the exchange. Caribbean Producers gained 49 cents to close at a 52 weeks’ high of $15.49 with a transfer of 480,268 units, Eppley popped $3 to end at $35.50 in trading 521 stock units, Eppley Caribbean Property Fund declined $3 in closing at $40 with an exchange of 61 units. First Rock Capital lost 45 cents after ending at $10.15 in exchanging 9,114 shares, Guardian Holdings advanced $10 to close at $550 with 98 stocks crossing the market, Jamaica Broilers gained 48 cents to end at $29 with 50,087 shares changing hands.  Jamaica Stock Exchange rose 89 cents to $17.50 in trading 15,630 stock units, JMMB Group shed 35 cents to end at $38.90 after exchanging 64,616 units, MPC Caribbean Clean Energy shed $5 to close at $110 with the swapping of 470 stocks. NCB Financial lost 49 cents to end at $128.51 in switching ownership of 4,099 units, Palace Amusement dropped $115 to close at $880 in transferring 820 shares, PanJam Investment fell 50 cents to $67.50 with 2,227 stock units crossing the market. Supreme Ventures lost 30 cents in closing at $17.20 after an exchange of 21,716 stocks, Sygnus Real Estate Finance fell 35 cents to end at $17.50 with 300 stocks clearing the market and Wisynco Group shed 97 cents after ending at $17 with the swapping of 65,947 shares.

Jamaica Stock Exchange rose 89 cents to $17.50 in trading 15,630 stock units, JMMB Group shed 35 cents to end at $38.90 after exchanging 64,616 units, MPC Caribbean Clean Energy shed $5 to close at $110 with the swapping of 470 stocks. NCB Financial lost 49 cents to end at $128.51 in switching ownership of 4,099 units, Palace Amusement dropped $115 to close at $880 in transferring 820 shares, PanJam Investment fell 50 cents to $67.50 with 2,227 stock units crossing the market. Supreme Ventures lost 30 cents in closing at $17.20 after an exchange of 21,716 stocks, Sygnus Real Estate Finance fell 35 cents to end at $17.50 with 300 stocks clearing the market and Wisynco Group shed 97 cents after ending at $17 with the swapping of 65,947 shares.

In the preference segment, JMMB Group 7.25% shed 75 cents to close at $3.06 with 524 units crossing the market.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Jamaican economy looking good for investment in 2022

Things are setting up nicely in the investment world for 2022, following two somewhat lousy years for the JSE Main Market that fell 22.6 percent in 2020 and rose a mere two percent in 2021, but technical reading is not very positive in the short term, but that is likely to change in the second half. The opposite is true for the Junior Market that is caught in a triangular formation that suggests a big break higher to take the market into record territory and most likely over the 4,000 index mark.

The genesis of such optimism is ro0ted in a number of positive developments in the wider economy and for some individual companies. Results of companies for the 2021 third quarter were some of the best seen for some time, with many doing better than in 2019, before the advent of the Covid19 that resulted in dislocation pressured the bottom line of many and for some opportunities that helped the topline and the bottom line.

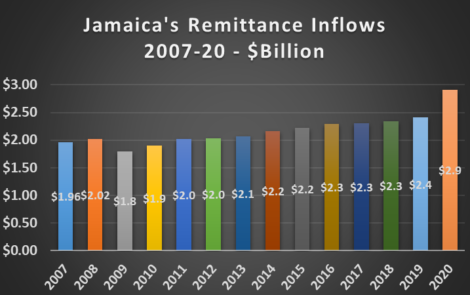

Those developments bode well for profits and stock prices in 2022 when the economy is expected to recover from the sharp decline in 2020. Remittances for 2021 are expected to be over US$600 million more than for the record $2.9 billion intakes in 2020 and the tourism industry is expected to be back at 2019 levels or close to it but is expected to far exceed that in 2020 all things being equal. More growth is expected from exports and the BPO sector, accordingly, the country should see significant additional foreign exchange inflows in 2022 than at any time in its history. Bear in mind that the signal of how well the country is doing in international trade, the net international reserves rose US$104 million in December over November to close the year at $$4 billion and is up fromUS$3.1 billion at the end of 2020. The early signal of tourism performance shows December 2021 behind a similar period in 2019 by just 24 percent compared to a fall of 45 percent for all of 2021 versus 2019.

Those developments bode well for profits and stock prices in 2022 when the economy is expected to recover from the sharp decline in 2020. Remittances for 2021 are expected to be over US$600 million more than for the record $2.9 billion intakes in 2020 and the tourism industry is expected to be back at 2019 levels or close to it but is expected to far exceed that in 2020 all things being equal. More growth is expected from exports and the BPO sector, accordingly, the country should see significant additional foreign exchange inflows in 2022 than at any time in its history. Bear in mind that the signal of how well the country is doing in international trade, the net international reserves rose US$104 million in December over November to close the year at $$4 billion and is up fromUS$3.1 billion at the end of 2020. The early signal of tourism performance shows December 2021 behind a similar period in 2019 by just 24 percent compared to a fall of 45 percent for all of 2021 versus 2019.

Unemployment will dip further in 2022 as most of the economy is expected back to near normal operations that will add to the spending power of Jamaicans and help to lift revenues.

In the financial sector, profits were on the mend and bankers are lending again with good growth taking place in the loan portfolio of some financial institutions.

Tourism expected end 2022 close to that of 2019

In 2021 banks and financial institutions with a few exceptions were pressured with the majority ending the year with a fall in price. These institutions will benefit from the rise in interest rates that will result in increased net interest income. The JSE financial index, a measure of the performance sector in 2020 down 6.5 percent for the year. The star performer was by far the Junior Market with gains of 30 percent with five stocks gaining between 95 and 266 percent.

In the second half of the year, inflation raised its head and the Bank of Jamaica hiked interest rates in response, so far there are no visible effects on the stock market, even as higher interest rates tend to negatively affect stock prices.

On the fiscal side, revenues for 2021 were healthy bettering the 2020/21 fiscal year b some distance. The effect is that the fiscal deficit should return to the 90 percent range again during 2022. Fiscal year 2022/23 should be much better and there could be some tax relief granted. It could be reduced GCT or an increase in the tax threshold. But it should stir the government into doing a comprehensive tax reform thus eliminating many of the minor tax categories. Whether there is tax relief or not, what is clear is that there will be no new taxes for the coming fiscal year.

In our 2021, ICInsider.com stated the period ahead, “seems set to be the year of surprises as many stocks that suffered badly in 2020 could be making a major turnaround in revenues and profit, while some that may not fully recover could start showing good signs of returning to normalcy.” That is exactly what happened during the year with strong gains from the likes of Caribbean Producers, Express Catering, Main Event, Medical Disposables, Radio Jamaica, Stationery and Office Supplies and Dolphin Cove, all of which suffered major setbacks in 2020.

In our 2021, ICInsider.com stated the period ahead, “seems set to be the year of surprises as many stocks that suffered badly in 2020 could be making a major turnaround in revenues and profit, while some that may not fully recover could start showing good signs of returning to normalcy.” That is exactly what happened during the year with strong gains from the likes of Caribbean Producers, Express Catering, Main Event, Medical Disposables, Radio Jamaica, Stationery and Office Supplies and Dolphin Cove, all of which suffered major setbacks in 2020.

The economy is clearly on the mend but there are still lingering concerns with the inability to seriously reduce the spread worldwide as well as in Jamaica. The latest Omicron strain is an example that we may not be out of the woods as yet. The ongoing vaccination of the population in Jamaica although not going as fast as planned continues apace and could support general positive expectations for the near term.

Importantly, PE ratios are rising as investor demand pushes values up as selling wanes at the end of 2021, the average PE ratio of the Junior Market suggests a 60 percent rise for the market while the Main Market is put at just 20 percent, with companies in the latter at a greater stage of developments than the former.

The country should see a full recovery from the important tourism sector during 2022 and this publication expects greater flows of foreign exchange with tourism back to normal and remittances holding close to the trend of 2021.

Coming soon – Junior Market could jump 60% in 2022

- « Previous Page

- 1

- …

- 59

- 60

- 61

- 62

- 63

- …

- 197

- Next Page »