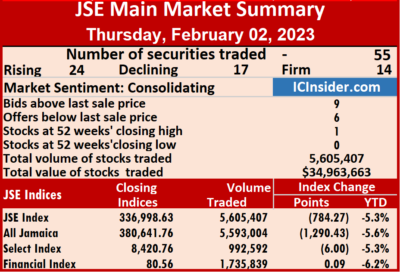

For a second consecutive day, trading on the Jamaica Stock Exchange Main Market fell at the close of market activity on Thursday, flowing from a 41 percent decline in the volume of stocks passing through the market with a 53 percent fall in value compared to Wednesday, resulting from 55 securities trading versus 57 on Wednesday, with 24 rising, 17 declining and 14 ending unchanged.

A total of 5,605,407 shares were exchanged for $34,963,663 versus 9,458,006 units at $74,659,322 on Wednesday.

A total of 5,605,407 shares were exchanged for $34,963,663 versus 9,458,006 units at $74,659,322 on Wednesday.

Trading averaged 101,916 units at $635,703 compared with 165,930 shares at $1,309,813 on Wednesday and month to date, an average of 134,495 units at $978,777 well below the average of 205,236 units at $1,805,558 for January.

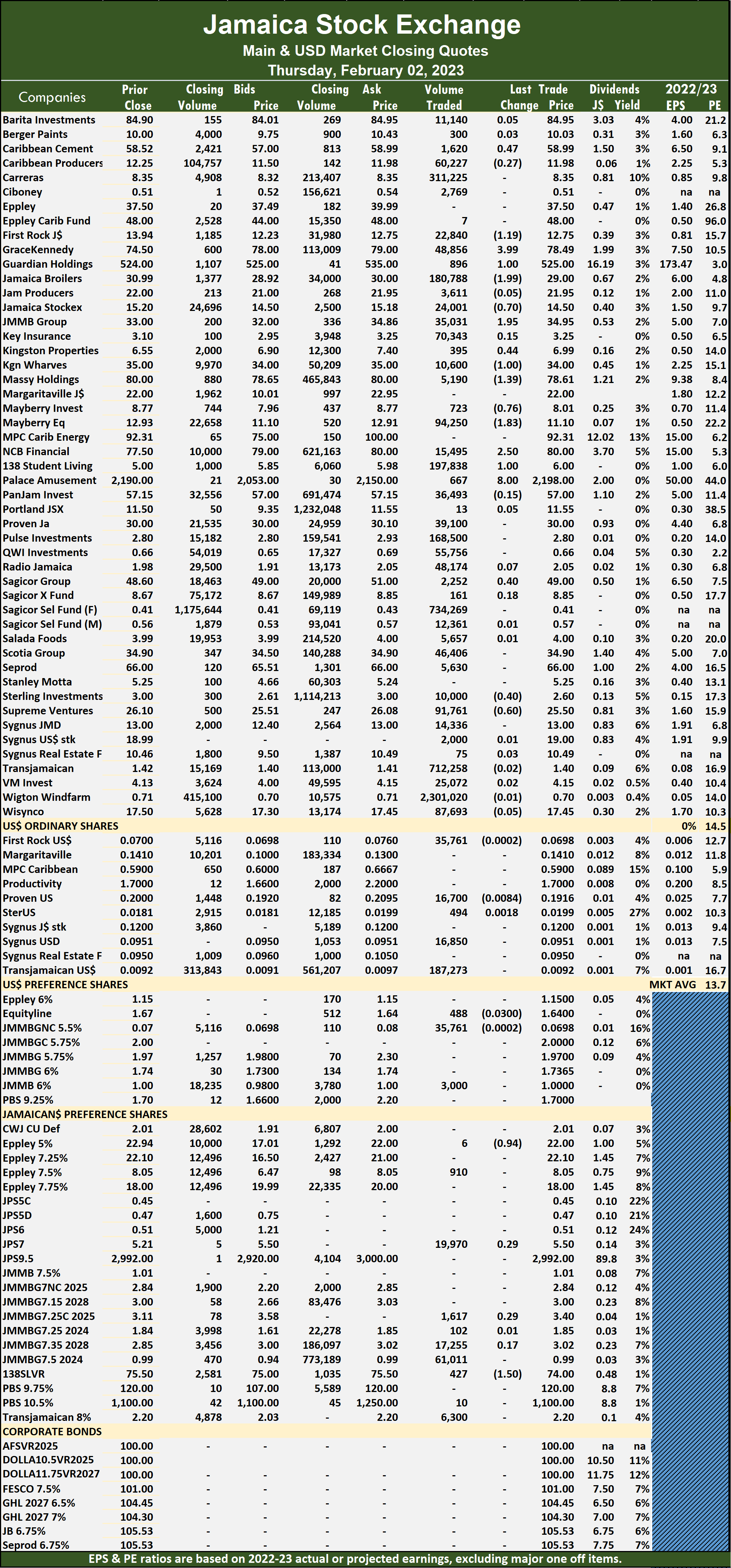

Wigton Windfarm led trading with 2.30 million shares for 41.1 percent of total volume, followed by Sagicor Select Financial Fund with 734,269 units for 13.1 percent of the day’s trade and Transjamaican Highway with 712,258 units for 12.7 percent market share.

The All Jamaican Composite Index shed 1,290.43 points to end at 380,641.76, the JSE Main Index dipped 784.27 points to 336,998.63 and the JSE Financial Index popped 0.09 points to close at 80.56.

The PE Ratio, a formula to ascertain appropriate stock values, averages 14.3 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with their financial year ends between November 2022 and August 2023.

The PE Ratio, a formula to ascertain appropriate stock values, averages 14.3 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with their financial year ends between November 2022 and August 2023.

Investor’s Choice bid-offer indicator shows nine stocks ending with bids higher than their last selling prices and six with lower offers.

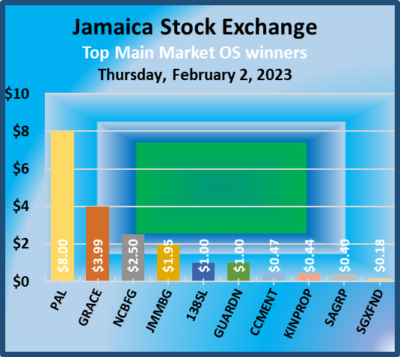

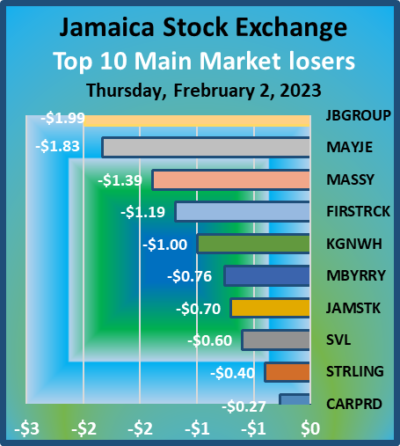

At the close, Caribbean Cement gained 47 cents to end at $58.99 after 1,620 shares were traded, First Rock Real Estate fell $1.19 to $12.75 as investors traded 22,840 stock units, GraceKennedy advanced $3.99 to $78.49 with 48,856 stocks changing hands. Guardian Holdings rose $1 to close at $525 with 896 units crossing the market, Jamaica Broilers fell $1.99 ending at $29 with the transfer of 180,788 shares, Jamaica Stock Exchange shed 70 cents to finish at $14.50 with the swapping of 24,001 units. JMMB Group advanced $1.95 to $34.95 in an exchange of 35,031 stock units,  Kingston Properties rallied 44 cents to $6.99 after 395 stocks cleared the market, Kingston Wharves dipped $1 to $34 trading 10,600 stock units. Massy Holdings declined $1.39 in closing at $78.61 after switching ownership of 5,190 units, Mayberry Investments shed 76 cents to end at $8.01 with investors transferring 723 shares, Mayberry Jamaican Equities declined $1.83 to close at $11.10 after 94,250 stocks passed through the market. NCB Financial advanced $2.50 in closing at $80 in transferring 15,495 units, 138 Student Living popped $1 to $6 with 197,838 shares changing hands, Palace Amusement climbed $8 in ending at $2,198 with a transfer of 667 stocks. Sagicor Group gained 40 cents to settle at $49 trading 2,252 stock units,

Kingston Properties rallied 44 cents to $6.99 after 395 stocks cleared the market, Kingston Wharves dipped $1 to $34 trading 10,600 stock units. Massy Holdings declined $1.39 in closing at $78.61 after switching ownership of 5,190 units, Mayberry Investments shed 76 cents to end at $8.01 with investors transferring 723 shares, Mayberry Jamaican Equities declined $1.83 to close at $11.10 after 94,250 stocks passed through the market. NCB Financial advanced $2.50 in closing at $80 in transferring 15,495 units, 138 Student Living popped $1 to $6 with 197,838 shares changing hands, Palace Amusement climbed $8 in ending at $2,198 with a transfer of 667 stocks. Sagicor Group gained 40 cents to settle at $49 trading 2,252 stock units,  Sterling Investments lost 40 cents to close at $2.60 with the swapping of 10,000 shares and Supreme Ventures shed 60 cents to end at $25.50 after an exchange of 91,761 units.

Sterling Investments lost 40 cents to close at $2.60 with the swapping of 10,000 shares and Supreme Ventures shed 60 cents to end at $25.50 after an exchange of 91,761 units.

In the preference segment, Eppley 5% preference share lost 94 cents to end at $22 after a transfer of 6 stocks and 138 Student Living preference share fell $1.50 in closing at $74 in switching ownership of 427 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

JSE USD market dips for a second day

Trading on the Jamaica Stock Exchange US dollar market ended on Thursday, with the volume of stocks changing hands declining 9 percent and resulting in a 33 percent fall in the value compared to Wednesday, following trading in seven securities, compared with seven on Wednesday with one rising, three declining and three ending unchanged.

Overall, 260,566 shares were traded for US$12,989 compared with 287,125 units at US$19,364 on Wednesday.

Overall, 260,566 shares were traded for US$12,989 compared with 287,125 units at US$19,364 on Wednesday.

Trading averaged 37,224 units at US$1,856 down from 41,018 shares at US$2,766 on Wednesday, with month to date average of 39,121 shares at US$2,311. January ended with an average of 48,604 units for US$4,865.

The JSE USD Equities Index slipped 0.54 points to end at 222.95.

The PE Ratio, a measure used in computing appropriate stock values, averages 10. The PE ratio uses ICInsider.com earnings forecasts for companies with financial years ending between November 2022 and August 2023.

Investor’s Choice bid-offer indicator shows four stocks ended with bids higher than the last selling prices and one with a lower offer.

At the close, First Rock Real Estate USD share dropped 0.02 of a cent in ending at 6.98 US cents after 35,761 shares were traded,  Proven Investments lost 0.84 of a cent to end at 19.16 US cents while exchanging 16,700 stock units, Sterling Investments popped 0.18 of a cent in closing at 1.99 US cents as 494 stocks passed through the market. Sygnus Credit Investments USD share ended at 9.51 US cents 16,850 units crossing the market and Transjamaican Highway remained at 0.92 of one US cent with investors exchanging 187,273 stocks.

Proven Investments lost 0.84 of a cent to end at 19.16 US cents while exchanging 16,700 stock units, Sterling Investments popped 0.18 of a cent in closing at 1.99 US cents as 494 stocks passed through the market. Sygnus Credit Investments USD share ended at 9.51 US cents 16,850 units crossing the market and Transjamaican Highway remained at 0.92 of one US cent with investors exchanging 187,273 stocks.

In the preference segment, Equityline Mortgage Investment preference share fell 3 cents to US$1.64 after a transfer of 488 units and JMMB Group 6% ended at US$1 trading 3,000 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Slippage for JSE USD Market

Trading plunged on the Jamaica Stock Exchange US dollar market on Wednesday from Tuesday’s levels with a 74 percent fall in the volume of stocks changing hands with the value declining 48 percent from Tuesday’s level with trading in seven securities compared to eight on Tuesday with the price of one rising, two declining and four ending unchanged.

Overall, 287,125 shares were traded for US$19,364 down from 1,121,685 units at US$37,070 on Tuesday.

Overall, 287,125 shares were traded for US$19,364 down from 1,121,685 units at US$37,070 on Tuesday.

Trading averaged 41,018 units at US$2,766 versus 140,211 shares at US$4,634 on Tuesday. January ended with an average of 48,604 units for US$4,865.

The JSE USD Equities Index lost 1.96 points to end at 223.47.

The PE Ratio, a measure used in computing appropriate stock values, averages 10. The PE ratio uses ICInsider.com earnings forecasts for companies with financial years ending between November 2022 and August 2023.

Investor’s Choice bid-offer indicator shows two stocks ended with bids higher than the last selling prices and one with a lower offer.

At the close, First Rock Real Estate USD share remained at 7 US cents as investors exchanged 19,429 shares, Margaritaville dipped 0.07 of a cent ending at 14.1 US cents with two stocks crossing the exchange,  Proven Investments ended at 20 US cents after 11,350 units were traded. Sterling Investments popped 0.01 of a cent to close at 1.81 US cents with 63,007 stock units changing hands, Sygnus Credit Investments USD share ended at 9.51 US cents after exchanging 12,385 stock units and Transjamaican Highway lost 0.07 of a cent to 0.92 of one US cent while exchanging 169,103 units.

Proven Investments ended at 20 US cents after 11,350 units were traded. Sterling Investments popped 0.01 of a cent to close at 1.81 US cents with 63,007 stock units changing hands, Sygnus Credit Investments USD share ended at 9.51 US cents after exchanging 12,385 stock units and Transjamaican Highway lost 0.07 of a cent to 0.92 of one US cent while exchanging 169,103 units.

In the preference segment, JMMB Group 6% ended at US$1 after trading 11,849 shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

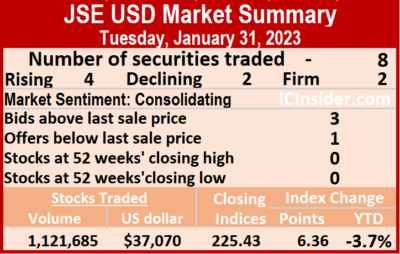

Big gain for JSEUSD Market

Stocks mostly rose in trading on the Jamaica Stock Exchange US dollar market on Tuesday and resulting in trading in eight securities, compared to 10 on Monday with four rising, two declining and two ending unchanged, following a 96 percent increase in the volume of stocks changing hands but with an 86 percent lower value than on Monday.

Overall, 1,121,685 shares were traded for US$37,070 compared with 571,649 units at US$267,767 on Monday.

Overall, 1,121,685 shares were traded for US$37,070 compared with 571,649 units at US$267,767 on Monday.

Trading averaged 140,211 units at US$4,634 versus 57,165 shares at US$26,777 on Monday, with month to date average of 48,604 shares at US$4,865 compared with 44,293 units at US$4,876 on the previous day. December ended with an average of 39,679 units for US$1,494.

The JSE USD Equities Index gained 6.36 points to end at 225.43.

The PE Ratio, a measure used in computing appropriate stock values, averages 10.1. The PE ratio uses ICInsider.com earnings forecasts for companies with financial years ending between November 2022 and August 2023.

Investor’s Choice bid-offer indicator shows three stocks ended with bids higher than the last selling prices and one stock with a lower offer.

At the close, First Rock Real Estate USD share declined 0.69 of a cent in closing at 7 US cents with a transfer of 21,828 shares, Productive Business Solutions increased 5 cents to US$1.70 after an exchange of 12,460 stock units,  Proven Investments popped 0.01 of a cent to 20 US cents with the swapping of 8,932 stocks. Sterling Investments lost 0.07 of a cent to end at 1.8 US cents with an exchange of 36,993 units, Sygnus Credit Investments USD share rallied 0.01 of a cent to end at 9.51 US cents with an exchange of 20,712 stocks and Transjamaican Highway rose 0.02 of a cent to close at 0.99 of one US cent and closed with an exchange of 1,020,720 shares.

Proven Investments popped 0.01 of a cent to 20 US cents with the swapping of 8,932 stocks. Sterling Investments lost 0.07 of a cent to end at 1.8 US cents with an exchange of 36,993 units, Sygnus Credit Investments USD share rallied 0.01 of a cent to end at 9.51 US cents with an exchange of 20,712 stocks and Transjamaican Highway rose 0.02 of a cent to close at 0.99 of one US cent and closed with an exchange of 1,020,720 shares.

In the preference segment, Productive Business 9.25% preference share remained at US$11.11 in trading 27 stock units and JMMB Group 6% ended at US$1, with 13 units changing hands.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

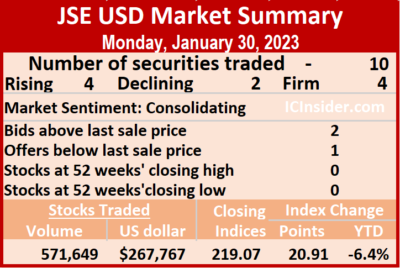

Huge jump for JSE USD Market

The JSE USD Equities market had a solid bounce in trading on Monday, with the market index jumping 11 percent with a 20.91 points surge to end at 219.07 following a sharp 3,350 percent surge in monies entering the market on Monday and ended with a 158 percent jump the volume of stocks trading over Friday.

Trading ended with ten securities changing hands, up from six on Friday, with four rising, two declining and four ending unchanged.

Trading ended with ten securities changing hands, up from six on Friday, with four rising, two declining and four ending unchanged.

Investors traded 571,649 shares for US$267,767 compared with 221,731 units at US$7,760 on Friday.

Trading averaged 57,165 units at US$26,777, up from 36,955 shares at US$1,293 on Friday, with a month to date average of 44,293 shares at US$4,876 compared with 43,489 units at US$3,507 on the previous trading day. December ended with an average of 39,679 units for US$1,494.

The PE Ratio, a measure used in computing appropriate stock values, averages 10.2. The PE ratio uses ICInsider.com earnings forecasts for companies with financial years ending between November 2022 and August 2023.

Investor’s Choice bid-offer indicator shows two stocks ended with bids higher than the last selling prices and one with a lower offer.

At the close, First Rock Real Estate USD share dropped 0.06 of a cent in closing at 7.69 US cents with an exchange of 2,825 shares,  Margaritaville rallied 1.85 cents to close at 14.17 US cents, trading 129 units, MPC Caribbean Clean Energy advanced 4 cents to 59 US cents after trading of 3,009 stocks. Productive Business Solutions popped 37.5 cents to end at US$1.65 in trading 110,849 stock units, Proven Investments dipped 0.01 of a cent to 19.99 US cents and closed with an exchange of 450,043 shares and Transjamaican Highway remained at 0.97 of one US cent as investors traded 1,159 units.

Margaritaville rallied 1.85 cents to close at 14.17 US cents, trading 129 units, MPC Caribbean Clean Energy advanced 4 cents to 59 US cents after trading of 3,009 stocks. Productive Business Solutions popped 37.5 cents to end at US$1.65 in trading 110,849 stock units, Proven Investments dipped 0.01 of a cent to 19.99 US cents and closed with an exchange of 450,043 shares and Transjamaican Highway remained at 0.97 of one US cent as investors traded 1,159 units.

In the preference segment, Productive Business 9.25% preference share ended at US$11.11 as four stock units passed through the market, Eppley 6% preference share increased 10.5 cents in closing at US$1.15 after a transfer of 3 stocks, Equityline Mortgage Investment preference share ended at US$1.67 with one stock crossing the exchange and JMMB Group 6% remained at US$1 with a transfer of 3,627 shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

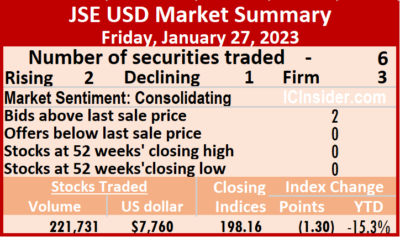

More decline for the JSE USD Market

Trading fell on Friday on the Jamaica Stock Exchange US dollar market, with the volume of stocks changing hands declining by 47 percent and the value falling by 79 percent compared to Thursday, resulting in six securities traded, compared to nine on Thursday with two rising, one declining and three ending unchanged.

Overall, 221,731 shares were traded for US$7,760 compared with 417,724 units at US$36,261 on Thursday.

Overall, 221,731 shares were traded for US$7,760 compared with 417,724 units at US$36,261 on Thursday.

Trading averaged 36,955 shares at US$1,293 down from 46,414 units at US$4,029 on Thursday, with month to date average of 43,489 shares at US$3,507 compared with 43,744 units at US$3,593 on the previous day. December ended with an average of 39,679 units for US$1,494.

The JSE USD Equities Index lost 1.30 points to end at 198.16.

The PE Ratio, a measure used in computing appropriate stock values, averages 9.8. The PE ratio uses ICInsider.com earnings forecasts for companies with financial years ending between November and August 2023.

Investor’s Choice bid-offer indicator shows two stocks ended with bids higher than the last selling prices and none with a lower offer.

At the close, First Rock Real Estate USD share dipped 0.04 of a cent to end at 7.75 US cents in switching ownership of 65 shares,  Proven Investments ended at 20 US cents after 1,539 units were traded, Sygnus Credit Investments USD share remained at 9.5 US cents in swapping of 2,125 stocks and Transjamaican Highway advanced 0.06 of a cent to 0.97 of one US cent after a transfer of 212,897 stock units.

Proven Investments ended at 20 US cents after 1,539 units were traded, Sygnus Credit Investments USD share remained at 9.5 US cents in swapping of 2,125 stocks and Transjamaican Highway advanced 0.06 of a cent to 0.97 of one US cent after a transfer of 212,897 stock units.

In the preference segment, Productive Business 9.25% preference share gained 11 cents in closing at US$11.11, with 19 stocks clearing the market and JMMB Group 6% ended at US$1 in trading 5,086 shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

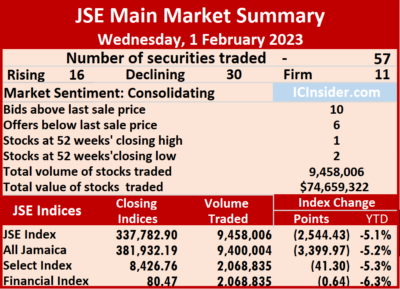

A total of 9,458,006 shares were traded for $74,659,322 down from 16,071,684 units at $99,612,685 on Tuesday.

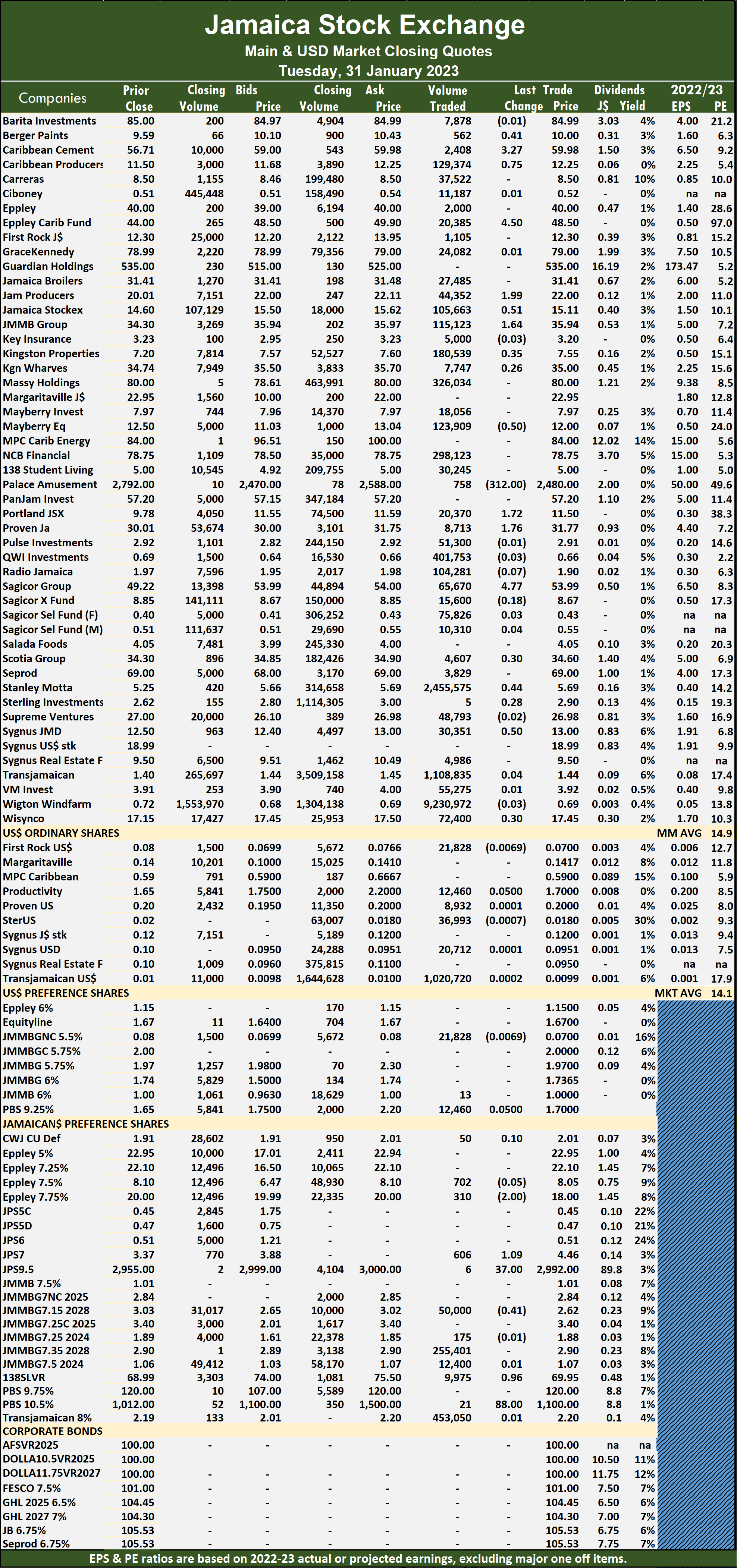

A total of 9,458,006 shares were traded for $74,659,322 down from 16,071,684 units at $99,612,685 on Tuesday. The PE Ratio, a formula to ascertain appropriate stock values, averages 14.6 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasts by ICInsider.com for companies with the financial year ending between November 2022 and August 2023.

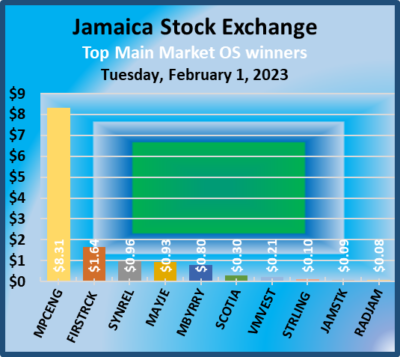

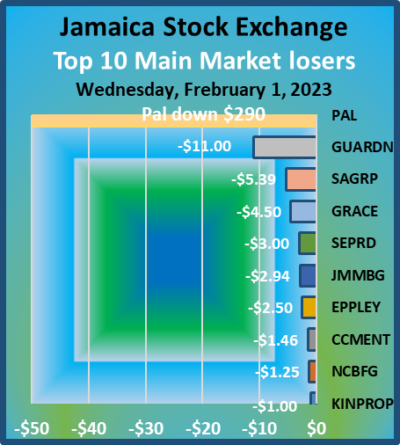

The PE Ratio, a formula to ascertain appropriate stock values, averages 14.6 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasts by ICInsider.com for companies with the financial year ending between November 2022 and August 2023. Kingston Properties fell $1 to $6.55 after a transfer of 14,251 stocks. Margaritaville fell 95 cents to close at $22 with an exchange of 200 stock units, Mayberry Investments rose 80 cents to $8.77 in trading 29,833 shares, Mayberry Jamaican Equities advanced 93 cents to close at $12.93 with 1,840 units changing hands. MPC Caribbean Clean Energy climbed $8.31 to end at $92.31, with 42 stocks clearing the market, NCB Financial declined $1.25 in closing at a 52 weeks’ low of $77.50 in switching ownership of 52,385 stock units, Palace Amusement dropped $290 in ending at $2,190 trading 824 shares. Proven Investments dipped $1.77 to $30 after a transfer of 10,369 units, Sagicor Group declined $5.39 to end at $48.60 after trading 4,020 units, Seprod shed $3 to close at $66 with the swapping of 18,765 shares. Stanley Motta lost 44 cents in ending at $5.25 with investors transferring 10,687 stock units,

Kingston Properties fell $1 to $6.55 after a transfer of 14,251 stocks. Margaritaville fell 95 cents to close at $22 with an exchange of 200 stock units, Mayberry Investments rose 80 cents to $8.77 in trading 29,833 shares, Mayberry Jamaican Equities advanced 93 cents to close at $12.93 with 1,840 units changing hands. MPC Caribbean Clean Energy climbed $8.31 to end at $92.31, with 42 stocks clearing the market, NCB Financial declined $1.25 in closing at a 52 weeks’ low of $77.50 in switching ownership of 52,385 stock units, Palace Amusement dropped $290 in ending at $2,190 trading 824 shares. Proven Investments dipped $1.77 to $30 after a transfer of 10,369 units, Sagicor Group declined $5.39 to end at $48.60 after trading 4,020 units, Seprod shed $3 to close at $66 with the swapping of 18,765 shares. Stanley Motta lost 44 cents in ending at $5.25 with investors transferring 10,687 stock units,  Supreme Ventures dipped 88 cents to $26.10 with 42,297 stocks changing hands and Sygnus Real Estate Finance rallied 96 cents to close at $10.46 in trading one stock unit.

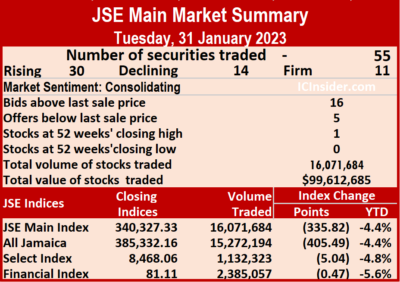

Supreme Ventures dipped 88 cents to $26.10 with 42,297 stocks changing hands and Sygnus Real Estate Finance rallied 96 cents to close at $10.46 in trading one stock unit. A total of 16,071,684 shares were exchanged for $99,612,685 versus 18,191,600 units at $322,436,055 on Monday.

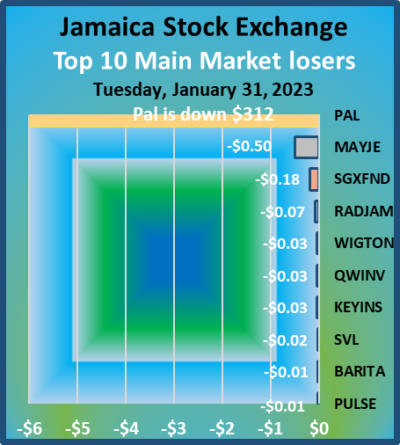

A total of 16,071,684 shares were exchanged for $99,612,685 versus 18,191,600 units at $322,436,055 on Monday. Market Index fell 335.82 points to 340,327.33 and the JSE Financial Index shed 0.47 points to close at 81.11.

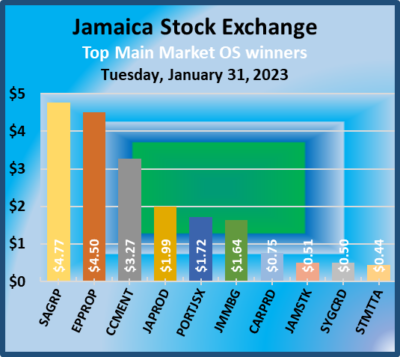

Market Index fell 335.82 points to 340,327.33 and the JSE Financial Index shed 0.47 points to close at 81.11. JMMB Group advanced $1.64 to end at $35.94 in an exchange of 115,123 stock units, Mayberry Jamaican Equities dipped 50 cents to close at $12 with 123,909 shares changing hands, Palace Amusement dropped $312 to $2,480 with the swapping of 758 units. Portland JSX rose $1.72 to $11.50 after an exchange of 20,370 stocks, Proven Investments advanced $1.76 to $31.77 in trading 8,713 shares, Sagicor Group climbed $4.77 to t $53.99 in transferring 65,670 stock units. Stanley Motta popped 44 cents in closing at $5.69, with 2,455,575 stock units crossing the market and Sygnus Credit Investments gained 50 cents ending at $13 in trading 30,351 units.

JMMB Group advanced $1.64 to end at $35.94 in an exchange of 115,123 stock units, Mayberry Jamaican Equities dipped 50 cents to close at $12 with 123,909 shares changing hands, Palace Amusement dropped $312 to $2,480 with the swapping of 758 units. Portland JSX rose $1.72 to $11.50 after an exchange of 20,370 stocks, Proven Investments advanced $1.76 to $31.77 in trading 8,713 shares, Sagicor Group climbed $4.77 to t $53.99 in transferring 65,670 stock units. Stanley Motta popped 44 cents in closing at $5.69, with 2,455,575 stock units crossing the market and Sygnus Credit Investments gained 50 cents ending at $13 in trading 30,351 units. Jamaica Public Service 7% gained $1.09 to end at 52 weeks’ high of $4.46 in switching ownership of 606 shares, Jamaica Public Service 9.5% rallied $37 in ending at $2,992 with six stock units crossing the market. JMMB Group 7.15% – 2028 fell 41 cents to close at $2.62 with the swapping of 50,000 stocks and 138 Student Living preference share rose 96 cents to $69.95 with an exchange of 9,975 units.

Jamaica Public Service 7% gained $1.09 to end at 52 weeks’ high of $4.46 in switching ownership of 606 shares, Jamaica Public Service 9.5% rallied $37 in ending at $2,992 with six stock units crossing the market. JMMB Group 7.15% – 2028 fell 41 cents to close at $2.62 with the swapping of 50,000 stocks and 138 Student Living preference share rose 96 cents to $69.95 with an exchange of 9,975 units. A total of 18,191,600 shares were exchanged for $322,436,055, up sharply from 10,834,252 units at $176,431,924 on Friday.

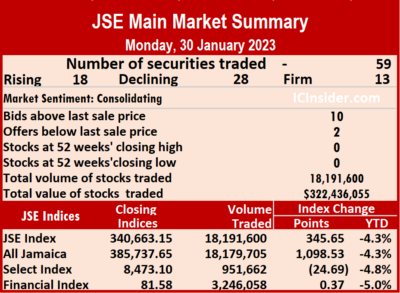

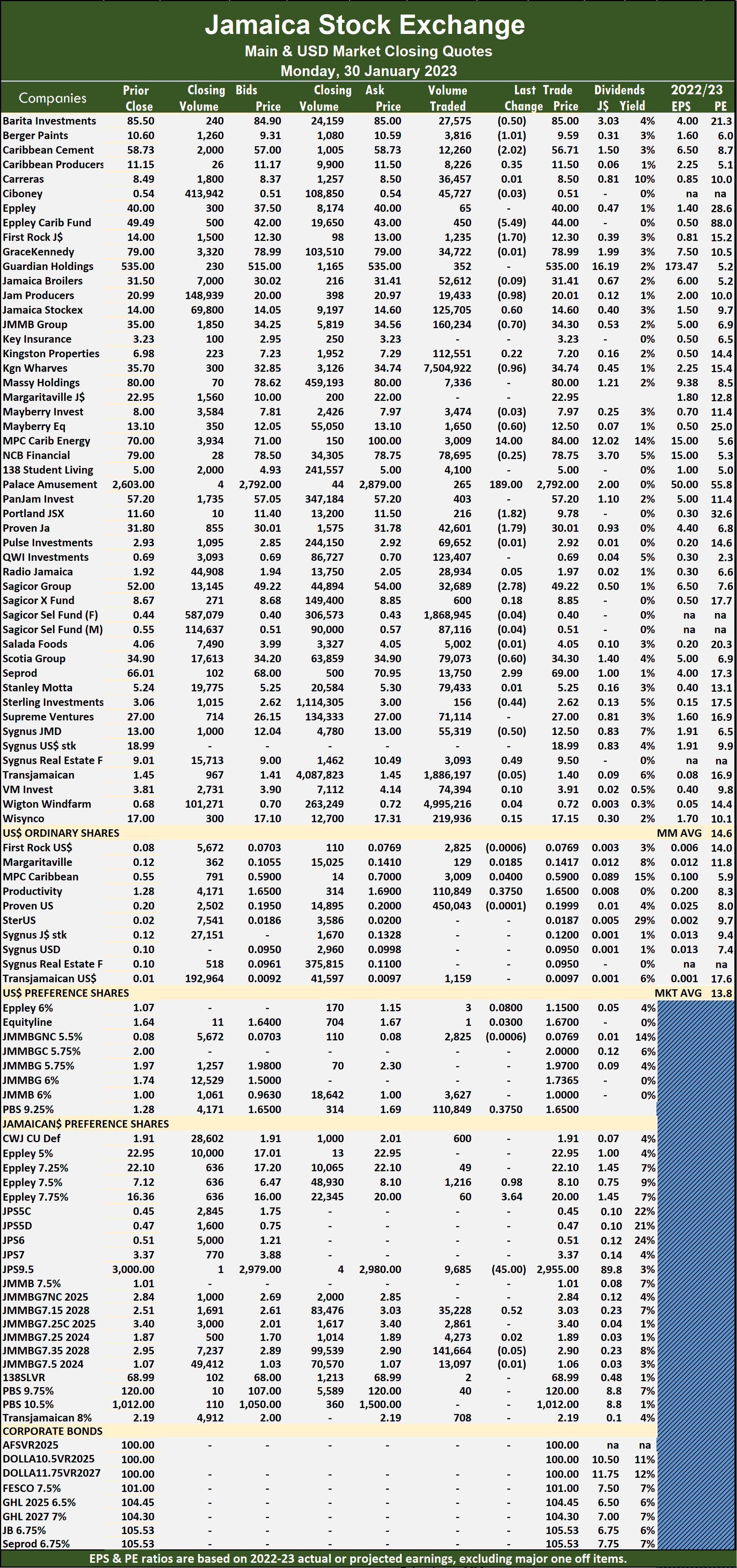

A total of 18,191,600 shares were exchanged for $322,436,055, up sharply from 10,834,252 units at $176,431,924 on Friday. The PE Ratio, a formula to ascertain appropriate stock values, averages 14.6 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November 2022 and August 2023.

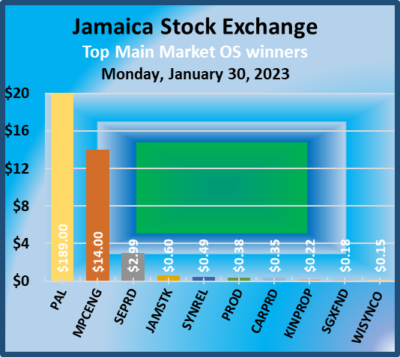

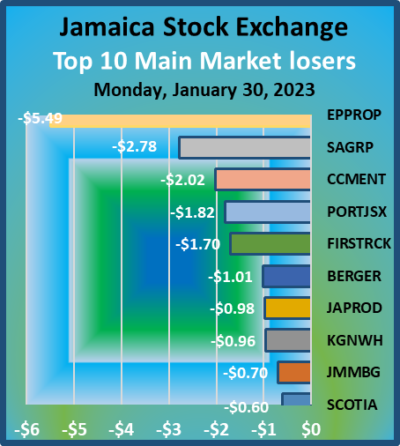

The PE Ratio, a formula to ascertain appropriate stock values, averages 14.6 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November 2022 and August 2023. JMMB Group dipped 70 cents to close at $34.30 with a transfer of 160,234 units, Kingston Wharves shed 96 cents to $34.74 in switching ownership of 7,504,922 stock units. Mayberry Jamaican Equities lost 60 cents to settle at $12.50 with 1,650 units changing hands, MPC Caribbean Clean Energy jumped $14 to $84 after a transfer of 3,009 stocks, Palace Amusement surged $189 to close at $2,792 after an exchange of 265 shares. Portland JSX dropped $1.82 to $9.78 with 216 stock units crossing the market, Proven Investments fell $1.79 to $30.01 after 42,601 units passed through the market, Sagicor Group declined $2.78 to close at $49.22 in the trading of 32,689 stocks. Scotia Group lost 60 cents to finish at $34.30 with the swapping of 79,073 shares, Seprod popped $2.99 in closing at $69 in an exchange of 13,750 stock units, Sterling Investments lost 44 cents to close at $2.62 with investors transferring a mere 156 units.

JMMB Group dipped 70 cents to close at $34.30 with a transfer of 160,234 units, Kingston Wharves shed 96 cents to $34.74 in switching ownership of 7,504,922 stock units. Mayberry Jamaican Equities lost 60 cents to settle at $12.50 with 1,650 units changing hands, MPC Caribbean Clean Energy jumped $14 to $84 after a transfer of 3,009 stocks, Palace Amusement surged $189 to close at $2,792 after an exchange of 265 shares. Portland JSX dropped $1.82 to $9.78 with 216 stock units crossing the market, Proven Investments fell $1.79 to $30.01 after 42,601 units passed through the market, Sagicor Group declined $2.78 to close at $49.22 in the trading of 32,689 stocks. Scotia Group lost 60 cents to finish at $34.30 with the swapping of 79,073 shares, Seprod popped $2.99 in closing at $69 in an exchange of 13,750 stock units, Sterling Investments lost 44 cents to close at $2.62 with investors transferring a mere 156 units.  Sygnus Credit Investments shed 50 cents in ending at $12.50 after switching ownership of 55,319 shares and Sygnus Real Estate Finance rose 49 cents to $9.50 in an exchange of 3,093 stocks.

Sygnus Credit Investments shed 50 cents in ending at $12.50 after switching ownership of 55,319 shares and Sygnus Real Estate Finance rose 49 cents to $9.50 in an exchange of 3,093 stocks. A total of 10,834,252 shares were traded for $176,431,924 versus 16,679,571 units at $253,751,659 on Thursday.

A total of 10,834,252 shares were traded for $176,431,924 versus 16,679,571 units at $253,751,659 on Thursday. The PE Ratio, a formula to ascertain appropriate stock values, averages 15 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November 2022 and August 2023.

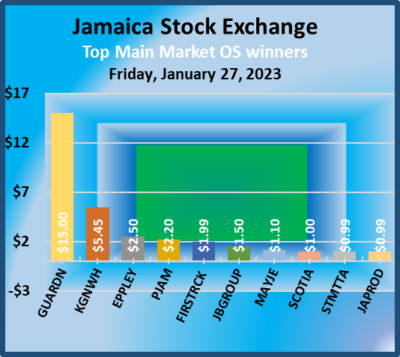

The PE Ratio, a formula to ascertain appropriate stock values, averages 15 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November 2022 and August 2023. Jamaica Broilers popped $1.50 to close at $31.50 in exchange for 178,129 shares, Jamaica Producers rallied 99 cents to $20.99 with 168 units changing hands, JMMB Group lost 50 cents to close at $35 following trading of 206,544 stocks. Kingston Wharves advanced $5.45 to $35.70 with a transfer of 319 units, Mayberry Jamaican Equities gained $1.10 while ending at $13.10 with 5,497 stock units changing hands, Palace Amusement dropped a hefty $647 to end at $2,603 following investors exchanging 2,483 shares and pushing the stock to an intraday record high of $3,300. PanJam Investment rose $2.20 to $57.20 after trading 2,238,835 units, Proven Investments popped 80 cents to close at $31.80 with the swapping of 38,842 stock units, Scotia Group rallied $1 in closing at $34.90 in trading 3,504 shares.

Jamaica Broilers popped $1.50 to close at $31.50 in exchange for 178,129 shares, Jamaica Producers rallied 99 cents to $20.99 with 168 units changing hands, JMMB Group lost 50 cents to close at $35 following trading of 206,544 stocks. Kingston Wharves advanced $5.45 to $35.70 with a transfer of 319 units, Mayberry Jamaican Equities gained $1.10 while ending at $13.10 with 5,497 stock units changing hands, Palace Amusement dropped a hefty $647 to end at $2,603 following investors exchanging 2,483 shares and pushing the stock to an intraday record high of $3,300. PanJam Investment rose $2.20 to $57.20 after trading 2,238,835 units, Proven Investments popped 80 cents to close at $31.80 with the swapping of 38,842 stock units, Scotia Group rallied $1 in closing at $34.90 in trading 3,504 shares.  Seprod shed $1.89 to end at $66.01 with an exchange of 6,860 stocks, Stanley Motta advanced 99 cents to $5.24 with investors transferring 1,778,058 stock units and Supreme Ventures popped 85 cents in closing at $27 after 132,915 units crossing the market.

Seprod shed $1.89 to end at $66.01 with an exchange of 6,860 stocks, Stanley Motta advanced 99 cents to $5.24 with investors transferring 1,778,058 stock units and Supreme Ventures popped 85 cents in closing at $27 after 132,915 units crossing the market.