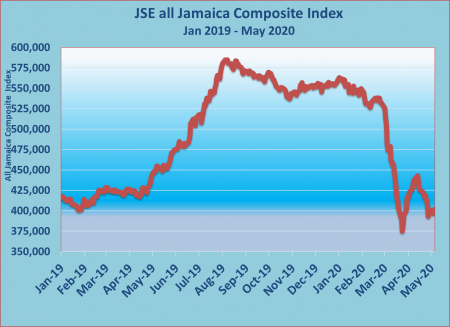

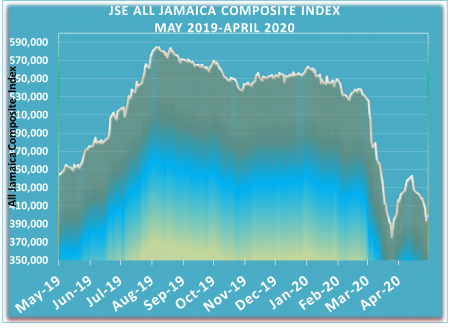

Jamaica Stock Exchange, US dollar market, closed upon the final trading day of May but lost just over three percent for the month and 16 percent for the year to date.

The US dollar market activity resulted in four securities changing hands, down from six on Thursday and ended with one declining and three stock closing unchanged. Investors traded 105,523 units at US$10,755, in contrast to 232,148 units for US$6,140 on Thursday.

The US dollar market activity resulted in four securities changing hands, down from six on Thursday and ended with one declining and three stock closing unchanged. Investors traded 105,523 units at US$10,755, in contrast to 232,148 units for US$6,140 on Thursday.

At the close, the market index rose 1.03 points to 190.29 and the PE ratio of the market closed with an average of 13.2 times 2020 earnings.

In trading, Productive Business Solutions fell 2 cents and closed at 75 US cents, after exchanging just one unit, Proven Investments traded 21,691 shares at 22.5 US cents. Sygnus Credit Investments closed at 13 US cents in transferring 42,000 stock units and Trans Jamaican ended at 0.99 US cents, with 41,831 shares changing hands.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

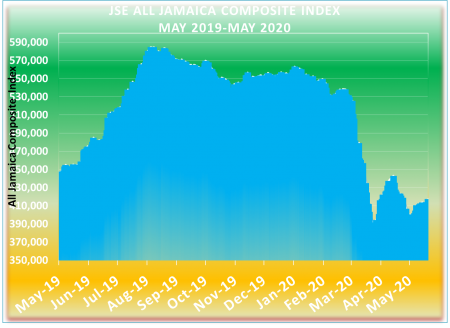

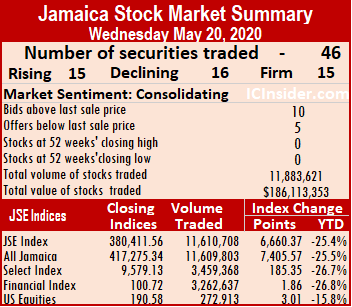

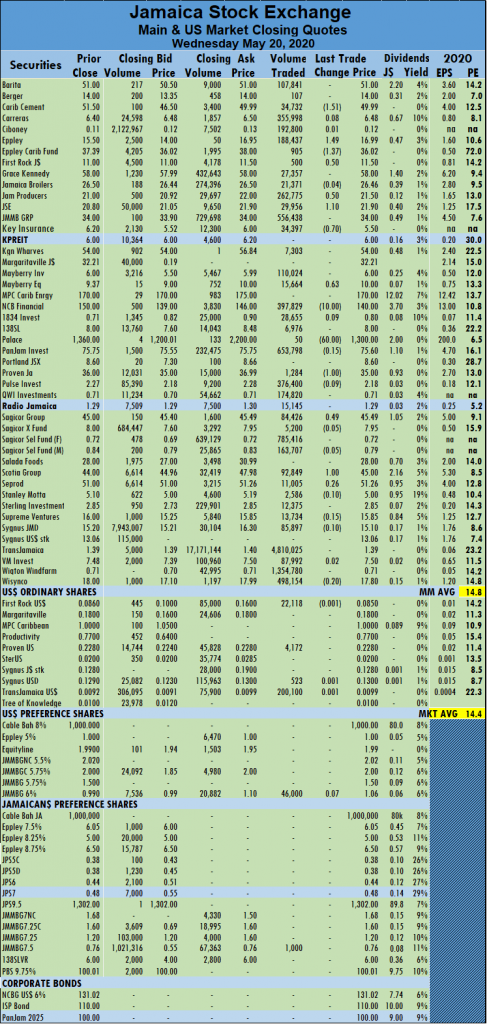

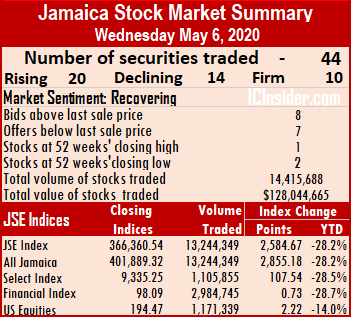

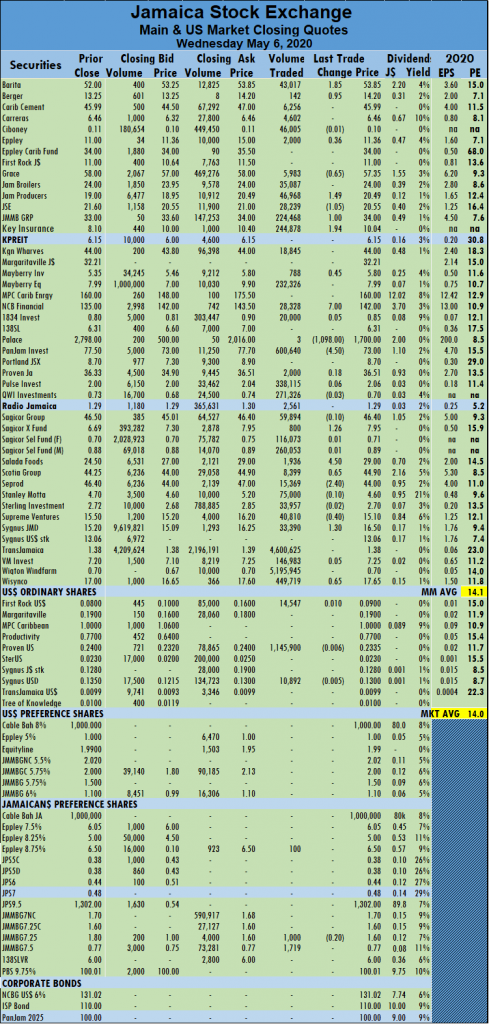

The market closed with 46 securities changing hands in the Main and US dollar markets with prices of 15 stocks advancing, 16 declining and 15 securities trading firm. The JSE Main Market activity ended with 41 securities changing hands accounting for 11,610,708 units valued at $178,231,093, in contrast to 17,254,018 units valued at $121,600,273 from 45 securities on Tuesday.

The market closed with 46 securities changing hands in the Main and US dollar markets with prices of 15 stocks advancing, 16 declining and 15 securities trading firm. The JSE Main Market activity ended with 41 securities changing hands accounting for 11,610,708 units valued at $178,231,093, in contrast to 17,254,018 units valued at $121,600,273 from 45 securities on Tuesday. The average volume and value for the month to date amount to 354,034 units valued at $2,919,802 for each security changing hands, compared to 359,042 units with an average of $2,811,232. Trading in April resulted in an average of 1,077,021 units valued at $3,829,201 for each security.

The average volume and value for the month to date amount to 354,034 units valued at $2,919,802 for each security changing hands, compared to 359,042 units with an average of $2,811,232. Trading in April resulted in an average of 1,077,021 units valued at $3,829,201 for each security. Jamaica Producers gained 50 cents transferring 262,775 shares and closed at $21.50, Jamaica Stock Exchange advanced $1.10 to $21.90, in trading 29,956 stock units. Key Insurance fell 70 cents to $5.50, with an exchange of 34,397 stock units, Mayberry Jamaican Equities gained 63 cents to end at $10, after swapping 15,664 units, NCB Financial Group declined by $10 to end at $140, after exchanging 397,829 shares. Palace Amusement ended the day’s trade $60 lower at $1,300, in transferring 50 units, Proven Investments fell $1 to $35, with 1,284 units changing hands, Sagicor Group picked up 49 cents to finish at $45.49, in trading 84,426 shares and Scotia Group closed at $45, with gains of $1 exchanging 92,849 shares.

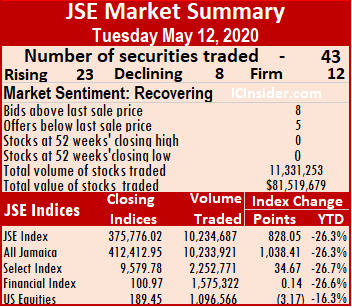

Jamaica Producers gained 50 cents transferring 262,775 shares and closed at $21.50, Jamaica Stock Exchange advanced $1.10 to $21.90, in trading 29,956 stock units. Key Insurance fell 70 cents to $5.50, with an exchange of 34,397 stock units, Mayberry Jamaican Equities gained 63 cents to end at $10, after swapping 15,664 units, NCB Financial Group declined by $10 to end at $140, after exchanging 397,829 shares. Palace Amusement ended the day’s trade $60 lower at $1,300, in transferring 50 units, Proven Investments fell $1 to $35, with 1,284 units changing hands, Sagicor Group picked up 49 cents to finish at $45.49, in trading 84,426 shares and Scotia Group closed at $45, with gains of $1 exchanging 92,849 shares. At the close of the market, the JSE All Jamaican Composite Index advanced by 1,038.41 points to 412,412.95, the JSE Market Index added 828.05 points to close at 375,776.02 and the JSE Financial Index rose 0.14 points to 100.97.

At the close of the market, the JSE All Jamaican Composite Index advanced by 1,038.41 points to 412,412.95, the JSE Market Index added 828.05 points to close at 375,776.02 and the JSE Financial Index rose 0.14 points to 100.97. The average volume and value for the month to date amount to 327,294 units valued at $2,813,578 for each security changing hands, compared to 336,031 units with an average of $2,945,387. Trading in April resulted in an average of 1,077,021 units valued at $3,829,201 for each security.

The average volume and value for the month to date amount to 327,294 units valued at $2,813,578 for each security changing hands, compared to 336,031 units with an average of $2,945,387. Trading in April resulted in an average of 1,077,021 units valued at $3,829,201 for each security. MPC Caribbean Clean Energy dropped $25.50 to close at $150, in swapping 666 units, NCB Financial Group closed $4 higher at $149.01, after transferring 76,046 shares, 138 Student Living rose 40 cents to settle at $6.45, in trading a mere 28 units. Pan Jam Investment gained 30 cents to settle at $78, with 115,267 shares changing hands, Sagicor Group closed 49 cents higher trading 152,383 shares to finish at $45.99, Sagicor Real Estate Fund ended the day with gains of $1.44 to hit $7.94, in swapping 250 units. Salada Foods advanced $1 to $30, in transferring 354 units, Scotia Group closed at $48, with gains of $1 after an exchange of 14,705 stock units, Seprod traded $1.50 higher at $49 with 19,359 units changing hands. Sygnus Credit Investments ended at $17.48, after rising $1.28 and trading 80,501 shares and Wisynco Group rose 37 cents to close at $17.90, with 560,921 shares crossing the exchange.

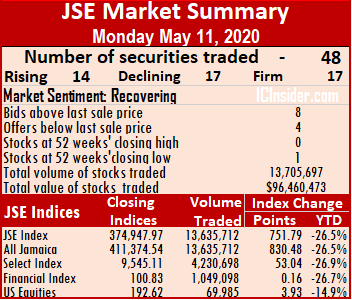

MPC Caribbean Clean Energy dropped $25.50 to close at $150, in swapping 666 units, NCB Financial Group closed $4 higher at $149.01, after transferring 76,046 shares, 138 Student Living rose 40 cents to settle at $6.45, in trading a mere 28 units. Pan Jam Investment gained 30 cents to settle at $78, with 115,267 shares changing hands, Sagicor Group closed 49 cents higher trading 152,383 shares to finish at $45.99, Sagicor Real Estate Fund ended the day with gains of $1.44 to hit $7.94, in swapping 250 units. Salada Foods advanced $1 to $30, in transferring 354 units, Scotia Group closed at $48, with gains of $1 after an exchange of 14,705 stock units, Seprod traded $1.50 higher at $49 with 19,359 units changing hands. Sygnus Credit Investments ended at $17.48, after rising $1.28 and trading 80,501 shares and Wisynco Group rose 37 cents to close at $17.90, with 560,921 shares crossing the exchange. The market closed with 48 securities changing hands in the Main and US dollar markets with prices of 14 stocks rising, 17 declining and 17 securities trading unchanged. The JSE All Jamaican Composite Index ended 830.48 points higher at 411,374.54, the JSE Market Index added 751.79 points to close at 374,947.97 and the JSE Financial Index inched 0.16 points higher to 100.83.

The market closed with 48 securities changing hands in the Main and US dollar markets with prices of 14 stocks rising, 17 declining and 17 securities trading unchanged. The JSE All Jamaican Composite Index ended 830.48 points higher at 411,374.54, the JSE Market Index added 751.79 points to close at 374,947.97 and the JSE Financial Index inched 0.16 points higher to 100.83. The average volume and value for the month to date amount to 336,031 units valued at $2,945,387 for each security changing hands, compared to 340,094 units with an average value of $3,082,315. Trading in April resulted in an average of 1,077,021 units valued at $3,829,201 for each security.

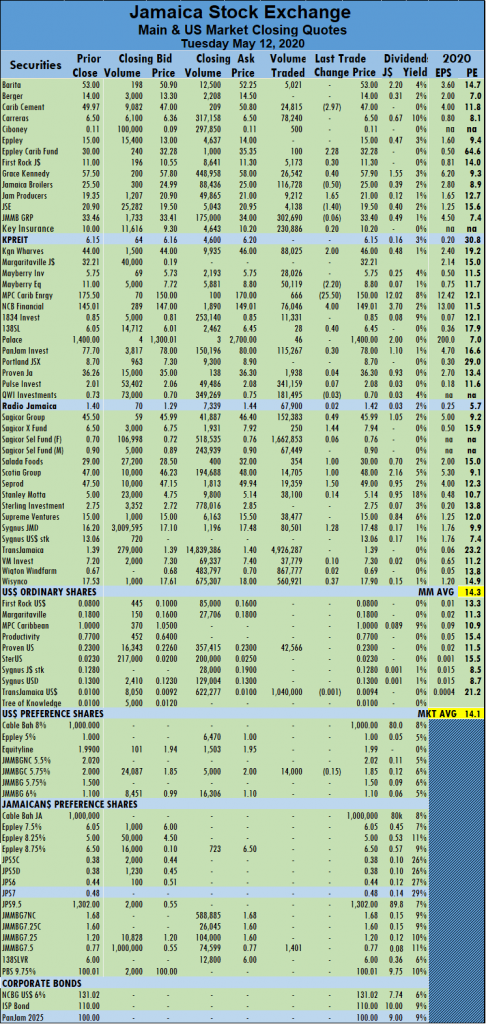

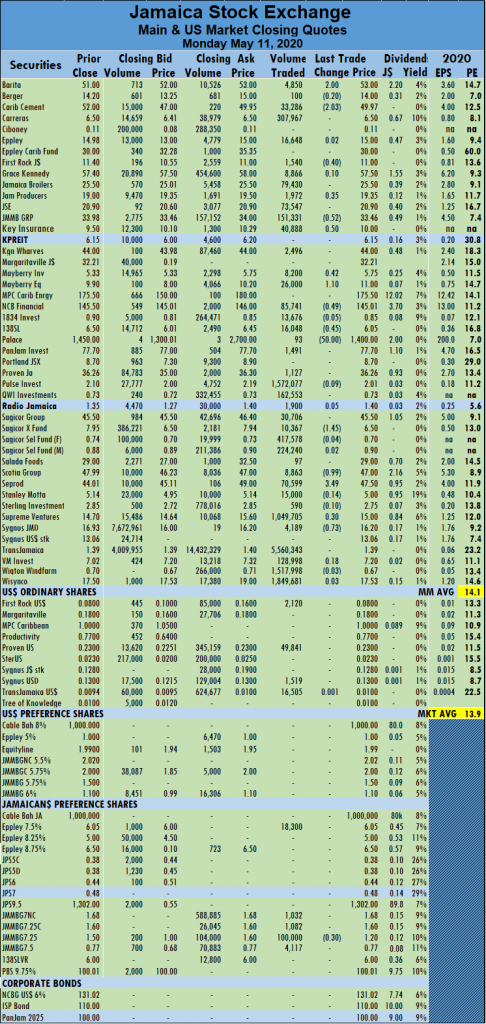

The average volume and value for the month to date amount to 336,031 units valued at $2,945,387 for each security changing hands, compared to 340,094 units with an average value of $3,082,315. Trading in April resulted in an average of 1,077,021 units valued at $3,829,201 for each security. Mayberry Investments picked up 42 cents trading 8,200 units to end at $5.75, Mayberry Jamaican Equities closed $1.10 higher at $11, with 26,000 shares crossing the exchange, NCB Financial Group fell 49 cents to settle at $145.01, in transferring 85,741 shares. 138 Student Living shed 45 cents swapping 16,048 units and closed at $6.05, Palace Amusement fell by $50 to $1,400, with 93 units changing hands, Sagicor Real Estate Fund ended $1.45 lower at $6.50, after transferring 10,367 units. Scotia Group closed at $47, with a loss of 99 cents exchanging 8,863 units, Seprod jumped $3.49 in trading 70,599 shares at $47.50 after the company reported first quarter profits that doubled that of last year and Sygnus Credit Investments fell 73 cents to end at $16.20, with 4,189 units changing hands.

Mayberry Investments picked up 42 cents trading 8,200 units to end at $5.75, Mayberry Jamaican Equities closed $1.10 higher at $11, with 26,000 shares crossing the exchange, NCB Financial Group fell 49 cents to settle at $145.01, in transferring 85,741 shares. 138 Student Living shed 45 cents swapping 16,048 units and closed at $6.05, Palace Amusement fell by $50 to $1,400, with 93 units changing hands, Sagicor Real Estate Fund ended $1.45 lower at $6.50, after transferring 10,367 units. Scotia Group closed at $47, with a loss of 99 cents exchanging 8,863 units, Seprod jumped $3.49 in trading 70,599 shares at $47.50 after the company reported first quarter profits that doubled that of last year and Sygnus Credit Investments fell 73 cents to end at $16.20, with 4,189 units changing hands.

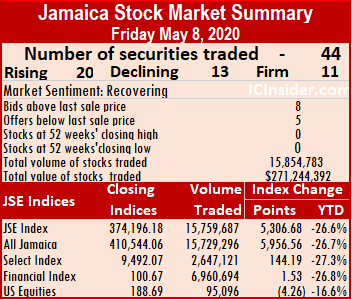

IC bid-offer Indicator│ At the end of trading, the Investor’s Choice bid-offer indicator reading shows eight stocks ending with bids higher than their last selling prices and five stocks closing with lower offers. The PE ratio of the market ended at 13.9, while the Main Market ended at 14.2 times 2020-21 earnings.

IC bid-offer Indicator│ At the end of trading, the Investor’s Choice bid-offer indicator reading shows eight stocks ending with bids higher than their last selling prices and five stocks closing with lower offers. The PE ratio of the market ended at 13.9, while the Main Market ended at 14.2 times 2020-21 earnings. NCB Financial Group added 50 cents to finish at $145.50, in trading 304,742 shares, Palace Amusement fell by $50 to $1,450, in swapping 238 units, Pulse Investments ended at $2.10, with a loss of 35 cents, with 4,295,911 shares changing hands. Sagicor Group shed 90 cents to finish at $45.50 trading 7,944 units, Scotia Group closed at $47.99, with gains of $3.99 transferring 949,370 shares, Seprod ended $1.99 lower at $44.01, with an exchange of 10,750 units. Supreme Ventures picked up 70 cents with the transfer of 171,031 shares and closed at $14.70, Sygnus Credit Investments gained 68 cents to end at $16.93, after swapping 33,349 stock units and Wisynco Group ended the day with a gain of 50 cents at $17.50, in trading 144,741 shares.

NCB Financial Group added 50 cents to finish at $145.50, in trading 304,742 shares, Palace Amusement fell by $50 to $1,450, in swapping 238 units, Pulse Investments ended at $2.10, with a loss of 35 cents, with 4,295,911 shares changing hands. Sagicor Group shed 90 cents to finish at $45.50 trading 7,944 units, Scotia Group closed at $47.99, with gains of $3.99 transferring 949,370 shares, Seprod ended $1.99 lower at $44.01, with an exchange of 10,750 units. Supreme Ventures picked up 70 cents with the transfer of 171,031 shares and closed at $14.70, Sygnus Credit Investments gained 68 cents to end at $16.93, after swapping 33,349 stock units and Wisynco Group ended the day with a gain of 50 cents at $17.50, in trading 144,741 shares.

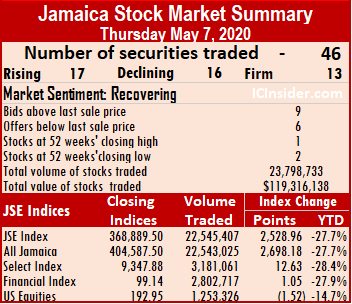

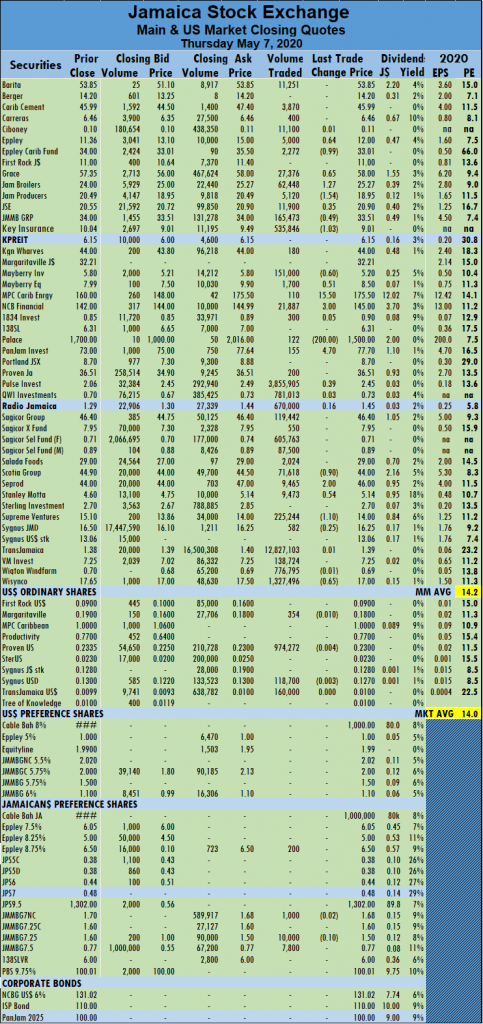

At the close of trading, the market was enjoying its third straight day of gains, with the JSE All Jamaican Composite Index climbing 2,698.18 points to 404,587.50, the JSE Market Index added 2,528.96 points to 368,889.50 and the JSE Financial Index gained 1.05 points to 99.14.

At the close of trading, the market was enjoying its third straight day of gains, with the JSE All Jamaican Composite Index climbing 2,698.18 points to 404,587.50, the JSE Market Index added 2,528.96 points to 368,889.50 and the JSE Financial Index gained 1.05 points to 99.14. IC bid-offer Indicator│ At the end of trading, the Investor’s Choice bid-offer indicator reading shows nine stocks ending with bids higher than their last selling prices and six stocks closing with lower offers. The PE ratio of the market ended at 14, while the Main Market ended at 14.2 times 2020-21 earnings.

IC bid-offer Indicator│ At the end of trading, the Investor’s Choice bid-offer indicator reading shows nine stocks ending with bids higher than their last selling prices and six stocks closing with lower offers. The PE ratio of the market ended at 14, while the Main Market ended at 14.2 times 2020-21 earnings. MPC Caribbean Clean Energy soared $15.50 to $175.50, after swapping 110 units, NCB Financial Group advanced by $3 to $145, with a transfer of 21,887 stock units. Palace Amusement tumbled to $1,500, after sustaining a loss of $200 in trading 122 shares, PanJam Investment advance by $4.70 to $77.70, with an exchange of 155 units, Pulse Investments gained 39 cents to finish at $2.45, after transferring 3,855,905 shares, following the release of nine months results. Scotia Group closed at $44, with a loss of 90 cents trading 71,618 stock units, Seprod ended $2 higher at $46, with 9,465 units crossing the exchange, Stanley Motta rose 54 cents to $5.14, after swapping 9,473 units. Supreme Ventures fell $1.10 to $14 after transferring 225,244 shares and Wisynco Group ended 65 cents lower at $17, with 1,327,496 shares changing hands.

MPC Caribbean Clean Energy soared $15.50 to $175.50, after swapping 110 units, NCB Financial Group advanced by $3 to $145, with a transfer of 21,887 stock units. Palace Amusement tumbled to $1,500, after sustaining a loss of $200 in trading 122 shares, PanJam Investment advance by $4.70 to $77.70, with an exchange of 155 units, Pulse Investments gained 39 cents to finish at $2.45, after transferring 3,855,905 shares, following the release of nine months results. Scotia Group closed at $44, with a loss of 90 cents trading 71,618 stock units, Seprod ended $2 higher at $46, with 9,465 units crossing the exchange, Stanley Motta rose 54 cents to $5.14, after swapping 9,473 units. Supreme Ventures fell $1.10 to $14 after transferring 225,244 shares and Wisynco Group ended 65 cents lower at $17, with 1,327,496 shares changing hands.

The Market closed with an average of 323,033 units at $2,225,976 for each security traded, in contrast to 230,295 units valued at an average of $2,034,185 on Tuesday. The average volume and value for the month to date amount to 362,134 units at $2,453,398 for each stock changing hands, compared to 375,605 units with an average value of $2,531,754 previously. Trading in April resulted in an average of 1,077,021 units valued at $3,829,201 for each security.

The Market closed with an average of 323,033 units at $2,225,976 for each security traded, in contrast to 230,295 units valued at an average of $2,034,185 on Tuesday. The average volume and value for the month to date amount to 362,134 units at $2,453,398 for each stock changing hands, compared to 375,605 units with an average value of $2,531,754 previously. Trading in April resulted in an average of 1,077,021 units valued at $3,829,201 for each security. NCB Financial Group advanced $7 to $142, in trading 28,328 units, Palace Amusement dived $1,098 trading just three shares to close at $1,700, PanJam Investment declined by $4.50 to a 52 weeks’ low of $73, with 600,640 shares changing hands. Sagicor Real Estate Fund closed at $7.95, with gains of $1.26 with 800 units crossing the market. Salada Foods climbed $4.50 to $29 in exchanging 1,936 units, Scotia Group gained 65 cents to end at $44.90, with a transfer of 8,399 units. Seprod fell to $44, with a loss of $2.40 trading 15,369 units, Supreme Ventures closed 40 cents lower to $15.10, with 40,810 stock units changing hands, Sygnus Credit Investments gained $1.30 to reach $16.50, after swapping 33,390 stock units and Wisynco Group ended the 65 cents higher at $17.65, with a transfer of 449,719 shares.

NCB Financial Group advanced $7 to $142, in trading 28,328 units, Palace Amusement dived $1,098 trading just three shares to close at $1,700, PanJam Investment declined by $4.50 to a 52 weeks’ low of $73, with 600,640 shares changing hands. Sagicor Real Estate Fund closed at $7.95, with gains of $1.26 with 800 units crossing the market. Salada Foods climbed $4.50 to $29 in exchanging 1,936 units, Scotia Group gained 65 cents to end at $44.90, with a transfer of 8,399 units. Seprod fell to $44, with a loss of $2.40 trading 15,369 units, Supreme Ventures closed 40 cents lower to $15.10, with 40,810 stock units changing hands, Sygnus Credit Investments gained $1.30 to reach $16.50, after swapping 33,390 stock units and Wisynco Group ended the 65 cents higher at $17.65, with a transfer of 449,719 shares.

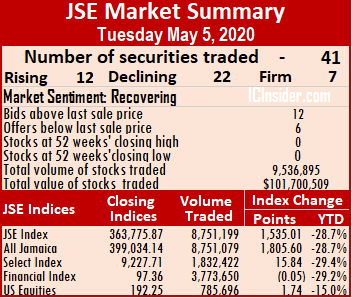

At the close, the JSE All Jamaican Composite Index advanced 1,805.60 points to 399,034.14, the JSE Market Index gained 1,535.01 points to end at 363,775.87 and the JSE Financial Index lost 0.05 points to 97.36.

At the close, the JSE All Jamaican Composite Index advanced 1,805.60 points to 399,034.14, the JSE Market Index gained 1,535.01 points to end at 363,775.87 and the JSE Financial Index lost 0.05 points to 97.36. Trading in April resulted in an average of 1,077,021 units valued at $3,829,201 for each security.

Trading in April resulted in an average of 1,077,021 units valued at $3,829,201 for each security. NCB Financial Group sustained a loss of $7.50 to close at $135, after transferring 140,023 shares, 138 Student Living closed 69 cents lower to $6.31, in swapping 250 units, PanJam Investment picked up $1 to end at $77.50 trading 13,244 stock units. Sagicor Group ended at $46.50, with gains of $1.50 exchanging 316,045 shares, Salada Foods tumbled $4 to $24.50, after trading a mere one stock unit, Seprod advanced $2.40 to $46.40, with an exchange of 17,376 stock units. Stanley Motta fell by 60 cents to $4.70, in transferring 9,346 units, Supreme Ventures ended 90 cents lower at $15.50, after swapping 187,479 shares, Sygnus Credit Investments closed at $15.20, with a loss of 80 cents exchanging 103,586 shares and Wisynco Group lost 40 cents trading 168,450 shares to finish at $17.

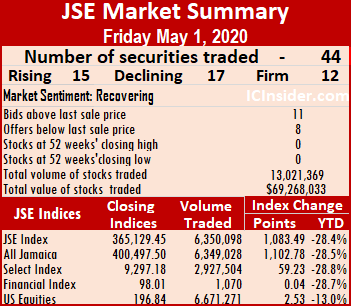

NCB Financial Group sustained a loss of $7.50 to close at $135, after transferring 140,023 shares, 138 Student Living closed 69 cents lower to $6.31, in swapping 250 units, PanJam Investment picked up $1 to end at $77.50 trading 13,244 stock units. Sagicor Group ended at $46.50, with gains of $1.50 exchanging 316,045 shares, Salada Foods tumbled $4 to $24.50, after trading a mere one stock unit, Seprod advanced $2.40 to $46.40, with an exchange of 17,376 stock units. Stanley Motta fell by 60 cents to $4.70, in transferring 9,346 units, Supreme Ventures ended 90 cents lower at $15.50, after swapping 187,479 shares, Sygnus Credit Investments closed at $15.20, with a loss of 80 cents exchanging 103,586 shares and Wisynco Group lost 40 cents trading 168,450 shares to finish at $17. At the close of trading, the JSE All Jamaican Composite Index advanced by 1,102.78 points to 400,497.50, the JSE Market Index climbed 1,083.49 points to 365,129.45 and the JSE Financial Index added 0.04 points to 98.01.

At the close of trading, the JSE All Jamaican Composite Index advanced by 1,102.78 points to 400,497.50, the JSE Market Index climbed 1,083.49 points to 365,129.45 and the JSE Financial Index added 0.04 points to 98.01. The Market closed with an average of 154,880 units at $1,669,401 for each security traded, in contrast to 1,949,150 units valued at an average of $3,182,761 on Thursday. Trading in April resulted in an average of 1,077,021 units valued at $3,829,201 for each security.

The Market closed with an average of 154,880 units at $1,669,401 for each security traded, in contrast to 1,949,150 units valued at an average of $3,182,761 on Thursday. Trading in April resulted in an average of 1,077,021 units valued at $3,829,201 for each security. Jamaica Stock Exchange fell $1.40 to $21.60, after exchanging 1,819 units. JMMB Group declined to $33, with a loss of 99 cents trading 360,765 shares, Mayberry Jamaican Equities closed $1.60 lower to $8.20 trading 4,411 units, NCB Financial Group closed at $145, with gains of $2 after swapping 85,918 shares. PanJam Investment gained 60 cents to close at $77, with 56,155 shares changing hands, Proven Investments shed 99 cents with a transfer of a mere 20 units and closed at $36.01, Sagicor Real Estate Fund gained 64 cents to settle at $7.75, in swapping 10,864 stock units. Scotia Group closed 50 cents higher at $44, in trading 56,801 shares and Supreme Ventures gained 90 cents to end at $15.90, trading 583,782 shares.

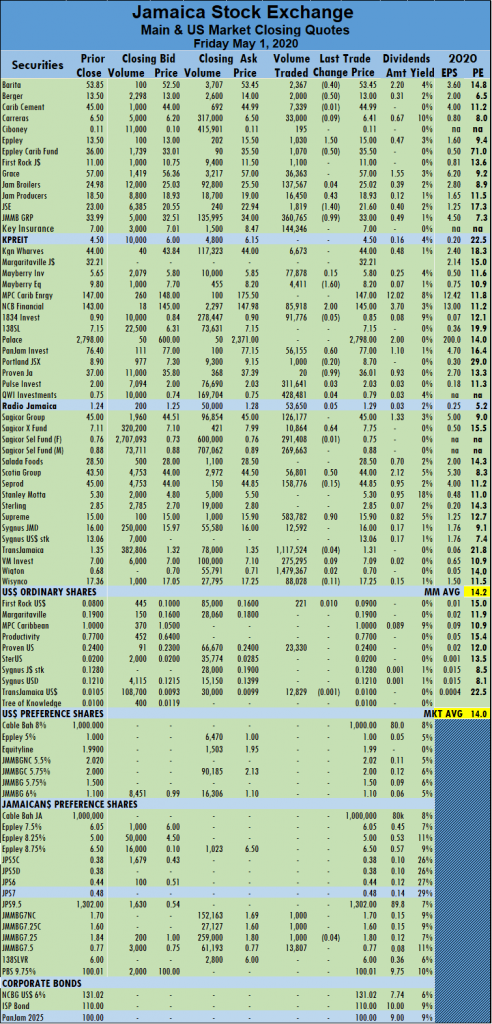

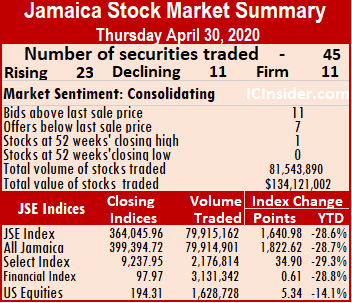

Jamaica Stock Exchange fell $1.40 to $21.60, after exchanging 1,819 units. JMMB Group declined to $33, with a loss of 99 cents trading 360,765 shares, Mayberry Jamaican Equities closed $1.60 lower to $8.20 trading 4,411 units, NCB Financial Group closed at $145, with gains of $2 after swapping 85,918 shares. PanJam Investment gained 60 cents to close at $77, with 56,155 shares changing hands, Proven Investments shed 99 cents with a transfer of a mere 20 units and closed at $36.01, Sagicor Real Estate Fund gained 64 cents to settle at $7.75, in swapping 10,864 stock units. Scotia Group closed 50 cents higher at $44, in trading 56,801 shares and Supreme Ventures gained 90 cents to end at $15.90, trading 583,782 shares. At the close, the JSE All Jamaican Composite Index increased 1,822.62 points to 399,394.72, the JSE Market Index gained 1,640.98 points to close at 364,045.96 and the JSE Financial Index rose 0.61 points to 97.97.

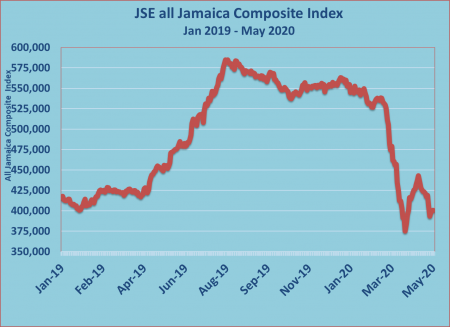

At the close, the JSE All Jamaican Composite Index increased 1,822.62 points to 399,394.72, the JSE Market Index gained 1,640.98 points to close at 364,045.96 and the JSE Financial Index rose 0.61 points to 97.97. The average volume and value for the month to date amount to 1,077,021 units valued at $3,829,201 for each security changing hands, compared to 1,033,414 units valued at $3,863,268 previously. Trading in March resulted in an average of 1,146,245 units valued at $7,550,295 for each security.

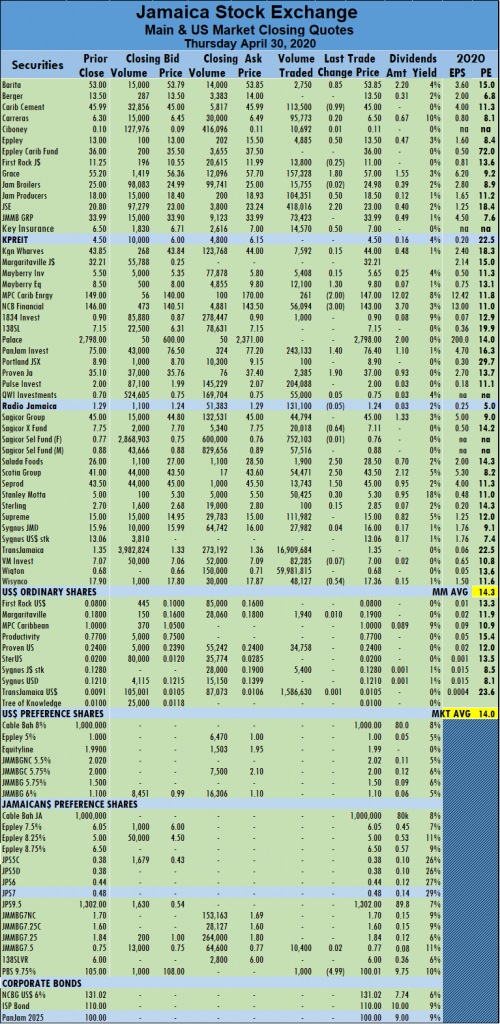

The average volume and value for the month to date amount to 1,077,021 units valued at $3,829,201 for each security changing hands, compared to 1,033,414 units valued at $3,863,268 previously. Trading in March resulted in an average of 1,146,245 units valued at $7,550,295 for each security. Mayberry Equities climbed $1.30 to $9.80 trading 12,100 units, MPC Caribbean Clean Energy dropped $2 to $147 after just 261 units crossed through the exchange. NCB Financial Group shed $3 in closing at $143, trading 56,094 shares, PanJam Investment closed $1.40 higher at $76.40, in exchanging 243,133 stock units, Proven Investments gained $1.90 to finish at $37, with 2,385 stock units changing hands. Sagicor Real Estate Fund lost 64 cents exchanging 20,018 units to settle at $7.11, Salada Foods climbed $2.50 to $28.50 after trading 1,900 units, Scotia Group rose $2.50 to $43.50, after transferring 54,471 stock units. Seprod picked up $1.50 to close at $45, in trading 13,743 shares and Wisynco Group lost 54 cents to end at $17.36, with 48,127 units crossing the exchange.

Mayberry Equities climbed $1.30 to $9.80 trading 12,100 units, MPC Caribbean Clean Energy dropped $2 to $147 after just 261 units crossed through the exchange. NCB Financial Group shed $3 in closing at $143, trading 56,094 shares, PanJam Investment closed $1.40 higher at $76.40, in exchanging 243,133 stock units, Proven Investments gained $1.90 to finish at $37, with 2,385 stock units changing hands. Sagicor Real Estate Fund lost 64 cents exchanging 20,018 units to settle at $7.11, Salada Foods climbed $2.50 to $28.50 after trading 1,900 units, Scotia Group rose $2.50 to $43.50, after transferring 54,471 stock units. Seprod picked up $1.50 to close at $45, in trading 13,743 shares and Wisynco Group lost 54 cents to end at $17.36, with 48,127 units crossing the exchange.