Barita climbs to a new closing high of $33.45 on Friday.

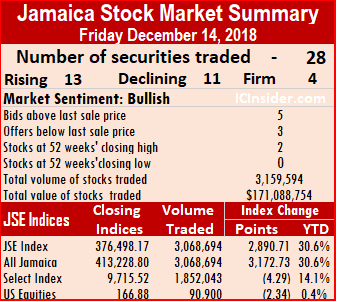

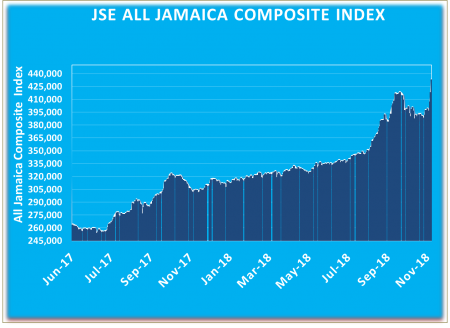

At the close of the market, the All Jamaican Composite Index climbed 3,172.73 points to 413,228.80 and the JSE Index advanced by 2,890.71 points to end at 376,498.17.

Trading ended with 3,068,694 units valued at $164,573,042 changing hands, compared with 5,840,821 units valued at over $422,371,897 on Thursday. A total of 28 securities changed hands in the main and US dollar markets, with prices of 13 rising, 11 declining and 4 remaining unchanged compared to 29 securities trading on Thursday. At the end of trading two stocks ended at record closing highs.

At the close, an average of 113,655 units valued at over $6,095,298 traded, in contrast to 224,647 units valued at $16,245,073 on Thursday. The average volume and value for the month to date, amounts to 123,423 units with a value of $4,686,819, compared to 124,399 units with a value of $4,530,322,

previously. November closed, with an average of 405,528 valued at $7,755,942, for each security traded.

previously. November closed, with an average of 405,528 valued at $7,755,942, for each security traded.NCB Financial led trading for the second consecutive day with 743,620 units in accounting for 24.2 percent of the day’s volume, followed by Sagicor Real Estate Fund with 462,923 units or 15 percent of the overall volume and Sagicor Group with 400,607 units and 13 percent of the day’s volume.

IC bid-offer Indicator|The Investor’s Choice bid-offer indicator reading shows 5 stocks ending with bids higher than the last selling prices and 3 closing with lower offers.

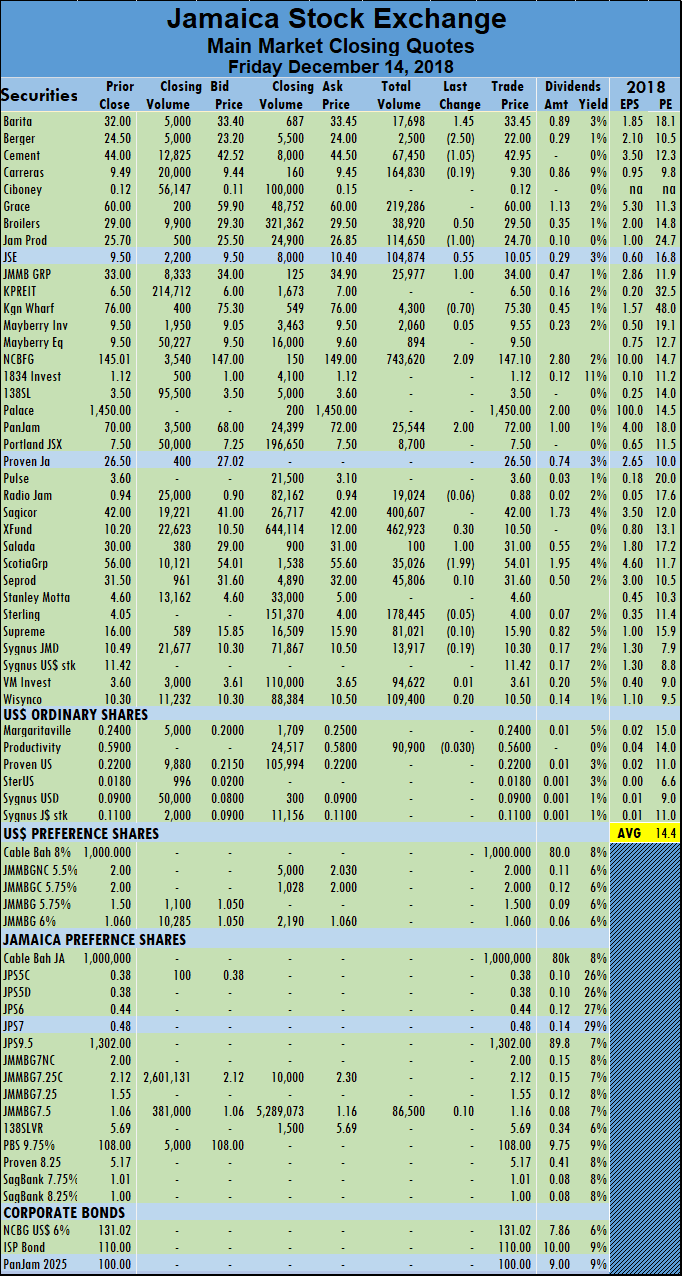

In main market activity, Barita Investments climbed $1.45 and ended at a all-time closing high of $33.45, with an exchange of 17,698 shares, Berger Paints dipped $2.50 to close at $22, with just 2,500 stock units changing hands, Caribbean Cement fell $1.05 to close at $42.95, with 67,450 shares traded, Jamaica Broilers rose 50 cents in trading 38,920 stock units at $29.50, Jamaica Producers finished trading 114,650 units with a fall of

$1 to close at $24.70, Jamaica Stock Exchange rose 55 cents to close at $10.05, in trading 104,874 shares, JMMB Group added $1 in trading 25,977 shares to close at $34. Kingston Wharves finished at $75.30, after falling by 70 cents in trading 4,300 stock units, NCB Financial Group rose $2.09 in ending trading of 743,620 shares at $147.10, PanJam Investment rose $2 to close at $72, with an exchange of 25,544 stock units, Sagicor Real Estate Fund rose 30 cents to close at $10.50, with 462,923 shares changing hands, Salada Foods gained $1 and ended trading of just 100 stock units at a record close of $31 and Scotia Group dropped $1.99 in trading 35,026 units to close at $54.01.

$1 to close at $24.70, Jamaica Stock Exchange rose 55 cents to close at $10.05, in trading 104,874 shares, JMMB Group added $1 in trading 25,977 shares to close at $34. Kingston Wharves finished at $75.30, after falling by 70 cents in trading 4,300 stock units, NCB Financial Group rose $2.09 in ending trading of 743,620 shares at $147.10, PanJam Investment rose $2 to close at $72, with an exchange of 25,544 stock units, Sagicor Real Estate Fund rose 30 cents to close at $10.50, with 462,923 shares changing hands, Salada Foods gained $1 and ended trading of just 100 stock units at a record close of $31 and Scotia Group dropped $1.99 in trading 35,026 units to close at $54.01.Trading in the US dollar market amounted to 90,900 units valued at over $50,904 with Productivity Business being the sole stock trading as the price ended trading with a loss of 3 cents to end at 56 US cents. The JSE USD Equities Index declined by 2.34 points to close at 166.88.

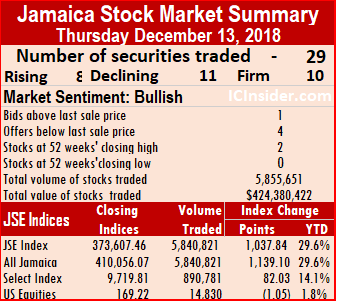

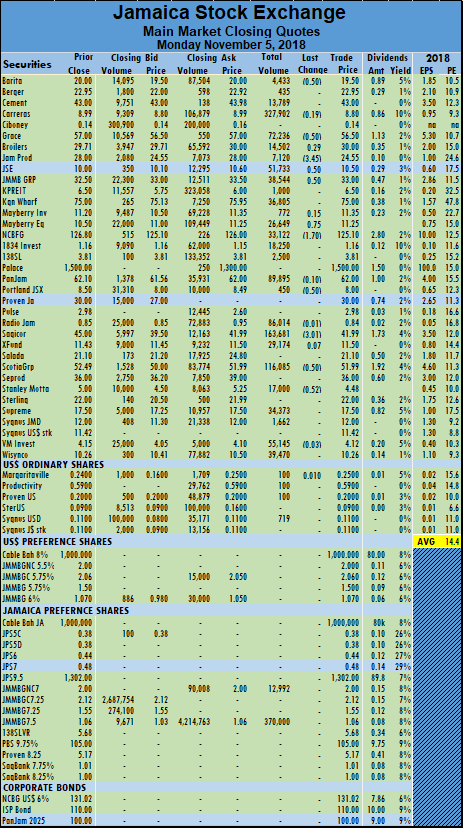

Declining stocks beat out on advancing ones again on the main market of the Jamaica Stock Exchange but market indices rose to halt the recent daily decline as the volume and value of stocks climbed sharply from Wednesday’s out turn.

Declining stocks beat out on advancing ones again on the main market of the Jamaica Stock Exchange but market indices rose to halt the recent daily decline as the volume and value of stocks climbed sharply from Wednesday’s out turn.  124,399 units with a value of $4,530,322, compared to 113,717 units with a value of $3,126,711, previously. November closed, with an average of 405,528 valued at $7,755,942, for each security traded.

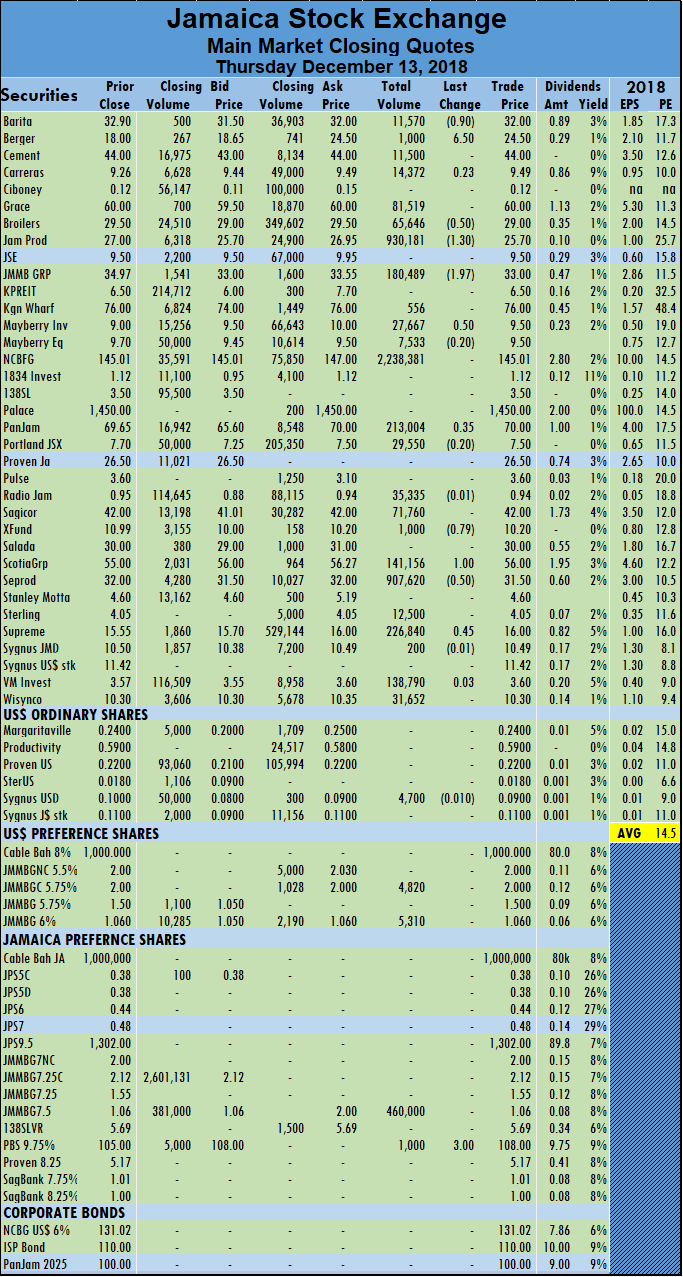

124,399 units with a value of $4,530,322, compared to 113,717 units with a value of $3,126,711, previously. November closed, with an average of 405,528 valued at $7,755,942, for each security traded. settled at $9.50, with 27,667 units changing hands, PanJam Investment rose 35 cents to close at $70, with an exchange of 213,004 stock units, Sagicor Real Estate Fund lost 79 cents to close at $10.20, with 1,000 shares changing hands, Scotia Group gained $1 trading 141,156 units to close at $56, Seprod traded 907,620 shares after declining by 50 cents to close at $31.50, Supreme Ventures rose 45 cents to $16, with 226,840 shares changing hands.

settled at $9.50, with 27,667 units changing hands, PanJam Investment rose 35 cents to close at $70, with an exchange of 213,004 stock units, Sagicor Real Estate Fund lost 79 cents to close at $10.20, with 1,000 shares changing hands, Scotia Group gained $1 trading 141,156 units to close at $56, Seprod traded 907,620 shares after declining by 50 cents to close at $31.50, Supreme Ventures rose 45 cents to $16, with 226,840 shares changing hands. The main market of the Jamaica Stock Exchange, surged to a

The main market of the Jamaica Stock Exchange, surged to a

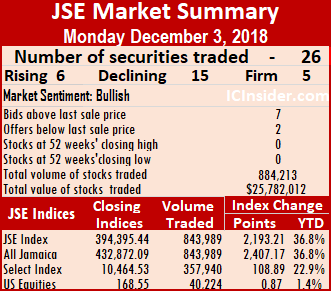

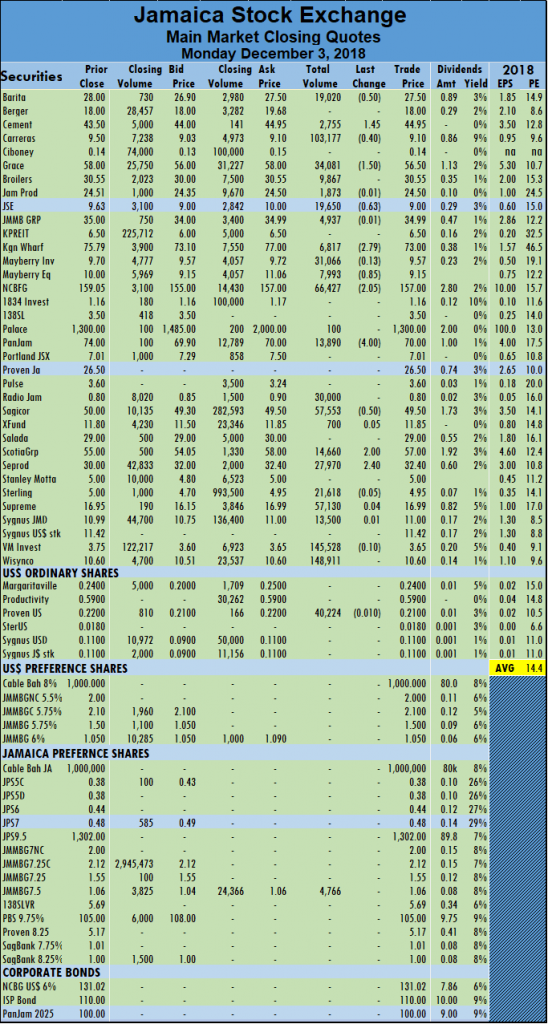

after falling 40 cents, Grace Kennedy dropped $1.50 in trading of 34,081 shares at $56.50, Jamaica Stock Exchange fell 63 cents and closed at $9, trading 19,650 shares, Kingston Wharves fell $2.79 to $73, with 6,817 stock units changing hands. Mayberry Jamaica Equities lost 85 cents trading 7,993 shares in closing at $9.15, NCB Financial Group declined by $2.05 to end trading of 66,427 shares at $157, PanJam Investment dropped $4 to $70, with an exchange of 13,890 stock units, Sagicor Group fell 50 cents to finish trading of 57,553 shares at $49.50, Scotia Group traded 14,660 shares and rose $2 to close at $57, Seprod added $2.40 trading of 27,970 shares, to close at $32.40.

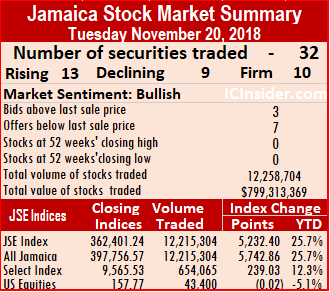

after falling 40 cents, Grace Kennedy dropped $1.50 in trading of 34,081 shares at $56.50, Jamaica Stock Exchange fell 63 cents and closed at $9, trading 19,650 shares, Kingston Wharves fell $2.79 to $73, with 6,817 stock units changing hands. Mayberry Jamaica Equities lost 85 cents trading 7,993 shares in closing at $9.15, NCB Financial Group declined by $2.05 to end trading of 66,427 shares at $157, PanJam Investment dropped $4 to $70, with an exchange of 13,890 stock units, Sagicor Group fell 50 cents to finish trading of 57,553 shares at $49.50, Scotia Group traded 14,660 shares and rose $2 to close at $57, Seprod added $2.40 trading of 27,970 shares, to close at $32.40. The Jamaica Stock Exchange main market indices were pushed sharply higher on Tuesday, sending the All Jamaica Index surging 5,742.86 points to 397,756.57 and JSE Index jumped 5,232.40 points to close at 362,401.24, thanks partially to jump in the price of NCB Financial.

The Jamaica Stock Exchange main market indices were pushed sharply higher on Tuesday, sending the All Jamaica Index surging 5,742.86 points to 397,756.57 and JSE Index jumped 5,232.40 points to close at 362,401.24, thanks partially to jump in the price of NCB Financial.

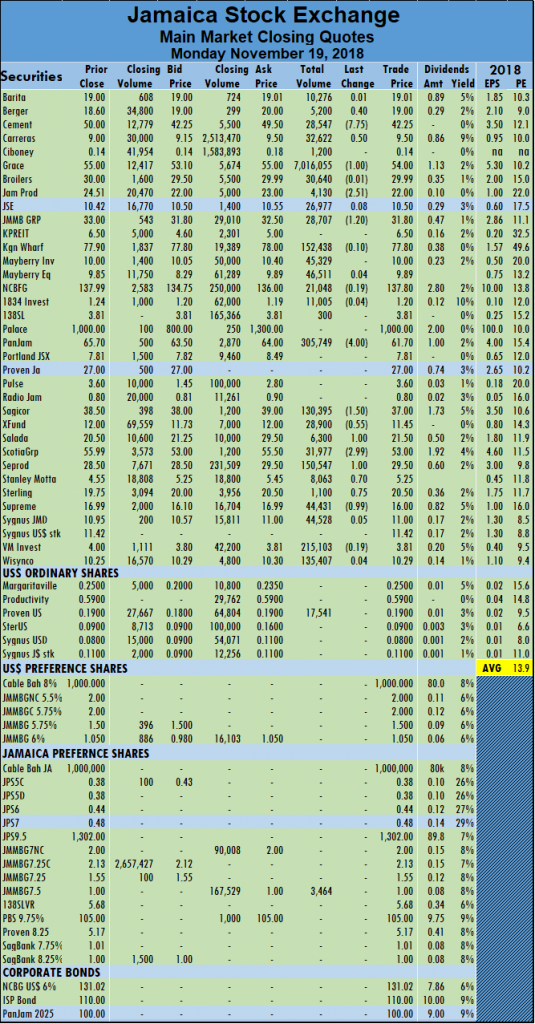

shares, Scotia Group gained $2.99 trading 31,977 to close at $55.99, Seprod shed 50 cents to end trading of 156,060 shares at $29.50 and Sterling Investments fell 50 cents and closed at $20, with 3,094 shares.

shares, Scotia Group gained $2.99 trading 31,977 to close at $55.99, Seprod shed 50 cents to end trading of 156,060 shares at $29.50 and Sterling Investments fell 50 cents and closed at $20, with 3,094 shares.

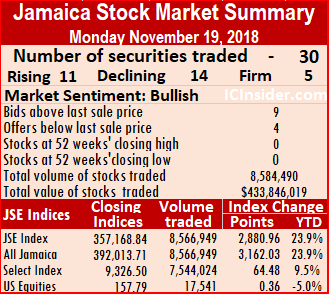

exchange of 305,749 stock units, Sagicor Group gave up $1.50 and settled at $37 with an exchange of 130,395 shares, Sagicor Real Estate Fund lost 55 cents and settled at $11.45, trading 28,900 shares, Salada Foods rose $1 to close at $21.50 trading 6,300 shares, Scotia Group dropped $2.99 trading 31,977 to close at $53, Seprod gained $1 to end trading of 150,547 shares at $29.50, traded 8,063 shares and rose Stanley Motta 70 cents to $5.25, Sterling Investments climbed 75 cents to $20.50, trading 1,100 shares and Supreme Ventures lost 99 cents and ended at $16, with an exchange of 44,431 shares.

exchange of 305,749 stock units, Sagicor Group gave up $1.50 and settled at $37 with an exchange of 130,395 shares, Sagicor Real Estate Fund lost 55 cents and settled at $11.45, trading 28,900 shares, Salada Foods rose $1 to close at $21.50 trading 6,300 shares, Scotia Group dropped $2.99 trading 31,977 to close at $53, Seprod gained $1 to end trading of 150,547 shares at $29.50, traded 8,063 shares and rose Stanley Motta 70 cents to $5.25, Sterling Investments climbed 75 cents to $20.50, trading 1,100 shares and Supreme Ventures lost 99 cents and ended at $16, with an exchange of 44,431 shares.

compared with 3,304,274 units valued at $77,547,412 being exchanged, on Thursday.

compared with 3,304,274 units valued at $77,547,412 being exchanged, on Thursday. gained 60 cents in closing at $65.70, with an exchange of 40,135 stock units, Sagicor Real Estate Fund rose 50 cents and settled at $12, trading 12,010 shares, Salada Foods lost $1 to close at $20.50 as 19,000 shares traded, Scotia Group rose $2.49 trading 100,792 to close at $55.99, Seprod lost $1 to end trading of 209,641 shares at $28.50 and Supreme Ventures added 49 cents and ended at $16.99, with an exchange of 100 shares.

gained 60 cents in closing at $65.70, with an exchange of 40,135 stock units, Sagicor Real Estate Fund rose 50 cents and settled at $12, trading 12,010 shares, Salada Foods lost $1 to close at $20.50 as 19,000 shares traded, Scotia Group rose $2.49 trading 100,792 to close at $55.99, Seprod lost $1 to end trading of 209,641 shares at $28.50 and Supreme Ventures added 49 cents and ended at $16.99, with an exchange of 100 shares.

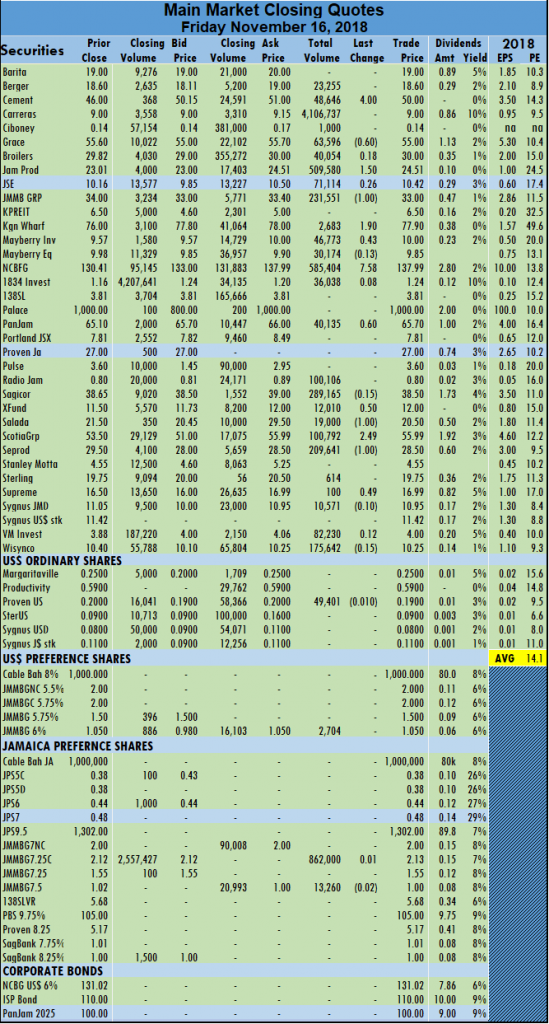

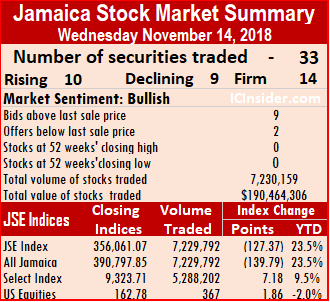

shares, Mayberry Investments added 43 cents to settle at $10, in exchanging 26,167 units, NCB Financial Group dropped $1.99 in trading of 91,041 shares at $130.01. Palace Amusement traded just 100 units but fell $500 in closing at $1,000, PanJam Investment lost $1.20 in closing at $64.50, with an exchange of just 3,690 stock units, Pulse Investments rose 60 cents in trading 3,000 units at $3.60, Sagicor Group rose 55 cents to $39.55, trading 222,240 shares, Salada Foods gained 50 cents and settled at $21.50, trading 14,000 shares, Scotia Group traded 1,533,780 shares and declined $1.70 at $48.80 and Seprod dived $8 to end trading 4,389 shares at $27.

shares, Mayberry Investments added 43 cents to settle at $10, in exchanging 26,167 units, NCB Financial Group dropped $1.99 in trading of 91,041 shares at $130.01. Palace Amusement traded just 100 units but fell $500 in closing at $1,000, PanJam Investment lost $1.20 in closing at $64.50, with an exchange of just 3,690 stock units, Pulse Investments rose 60 cents in trading 3,000 units at $3.60, Sagicor Group rose 55 cents to $39.55, trading 222,240 shares, Salada Foods gained 50 cents and settled at $21.50, trading 14,000 shares, Scotia Group traded 1,533,780 shares and declined $1.70 at $48.80 and Seprod dived $8 to end trading 4,389 shares at $27. The Jamaica Stock Exchange main market made more gains in the indices in closing of Friday further eroding the 13,784 points lost between Monday and Wednesday.

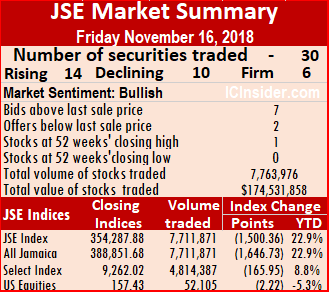

The Jamaica Stock Exchange main market made more gains in the indices in closing of Friday further eroding the 13,784 points lost between Monday and Wednesday.

JMMB Group rose 89 cents and ended at $33.90, with an exchange of 37,478 shares, Mayberry Investments shed $2.50 to settle at $10.50, in exchanging 15,799 units,

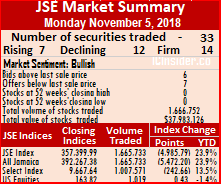

JMMB Group rose 89 cents and ended at $33.90, with an exchange of 37,478 shares, Mayberry Investments shed $2.50 to settle at $10.50, in exchanging 15,799 units,  The volume of stocks trading on the Jamaica Stock Exchange slipped further on Tuesday, leading to more stocks falling than rising and resulting in another fall in the market indices.

The volume of stocks trading on the Jamaica Stock Exchange slipped further on Tuesday, leading to more stocks falling than rising and resulting in another fall in the market indices.  Main market trading closed with Victoria Mutual Investments leading with 1,026,110 units, or 39.9 percent of the day’s volume and

Main market trading closed with Victoria Mutual Investments leading with 1,026,110 units, or 39.9 percent of the day’s volume and  trading 27,735 shares, Kingston Wharves gained 95 cents to close at $75.95 with 4,281 stock units trading, Mayberry Investments lost $1.35 to settle at $10, in exchanging 20,365 units,

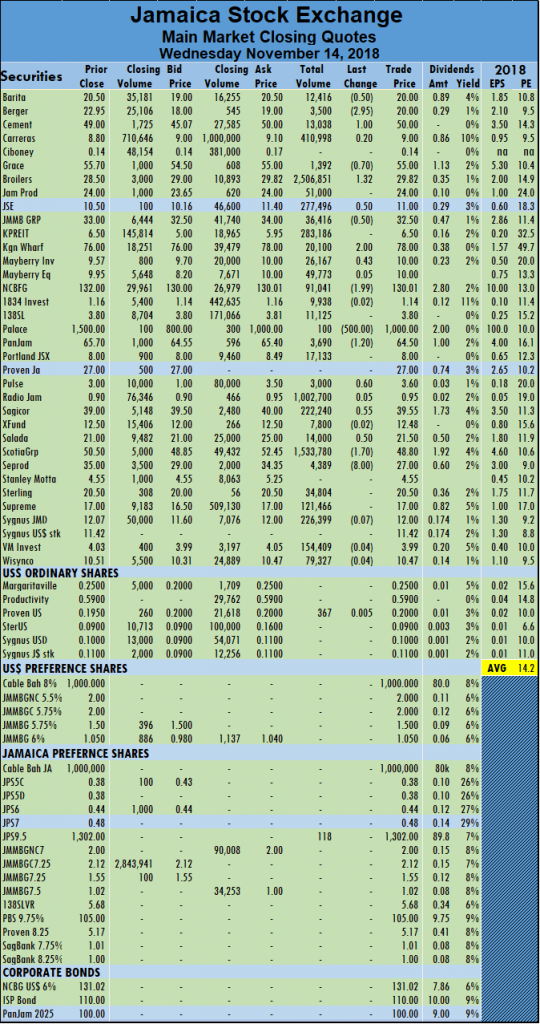

trading 27,735 shares, Kingston Wharves gained 95 cents to close at $75.95 with 4,281 stock units trading, Mayberry Investments lost $1.35 to settle at $10, in exchanging 20,365 units,  The volume of stocks trading on the Jamaica Stock Exchange declined to very low levels on Monday, leading to more stocks falling than rising and resulting in a big drop in the market indices.

The volume of stocks trading on the Jamaica Stock Exchange declined to very low levels on Monday, leading to more stocks falling than rising and resulting in a big drop in the market indices.  the day’s volume, Carreras with 327,902 units and 19.7 percent of volume traded and Sagicor group with 163,681 units with 10 percent of the day’s volume.

the day’s volume, Carreras with 327,902 units and 19.7 percent of volume traded and Sagicor group with 163,681 units with 10 percent of the day’s volume. to end at $33, trading 38,544 shares, Kingston Wharves lost 95 cents to close at $75 with 2,792 stock units trading, Mayberry Jamaica Equities traded 26,649 units and rose 75 cents to close at $11.25, NCB Financial Group lost $1.70 and ended trading 33,122 shares to close at $125.10. Portland JSX declined by 50 cents and ended at $8, with 450 units changing hands, Sagicor Group dropped $3.01 to settle at $41.99, with 163,681 shares, Scotia Group lost 50 cents to end at $51.99, trading 116,085 units and Stanley Motta traded 17,000 shares after falling 52 cents to end at $4.48.

to end at $33, trading 38,544 shares, Kingston Wharves lost 95 cents to close at $75 with 2,792 stock units trading, Mayberry Jamaica Equities traded 26,649 units and rose 75 cents to close at $11.25, NCB Financial Group lost $1.70 and ended trading 33,122 shares to close at $125.10. Portland JSX declined by 50 cents and ended at $8, with 450 units changing hands, Sagicor Group dropped $3.01 to settle at $41.99, with 163,681 shares, Scotia Group lost 50 cents to end at $51.99, trading 116,085 units and Stanley Motta traded 17,000 shares after falling 52 cents to end at $4.48.