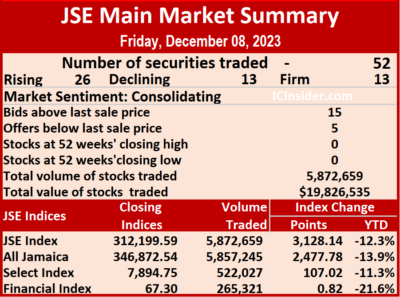

Rising stocks ran riot over decliners on the Main Market of the Jamaica Stock Exchange ended on Friday, with trading in 52 securities as was the case on Thursday, and ended with gains in 26 in contrast to just 13 declining and 13 ending unchanged after the volume of stocks traded declined 52 percent and the value 86 percent lower than on Thursday

A total of just 5,872,659 shares were exchanged for a mere $19,826,535 down from 12,317,838 units at $140,029,195 on Thursday.

A total of just 5,872,659 shares were exchanged for a mere $19,826,535 down from 12,317,838 units at $140,029,195 on Thursday.

Trading for the day averaged 112,936 shares at $381,280 versus 236,882

units at $2,692,869 on Thursday and month to date, an average of 158,823 units at $1,316,687, compared with 167,693 units at $1,497,509 on the previous day, well down on November that closed with an average of 275,587 units at $2,488,949.

Transjamaican Highway led trading with 2.33 million shares for 39.7 percent of total volume followed by Wigton Windfarm with 1.51 million units for 25.8 percent of the day’s trade and Ciboney Group with 483,576 units for 8.2 percent market share.

The All Jamaican Composite Index jumped 2,477.78 points to close trading at 346,872.54, the JSE Main Index rallied 3,128.14 points to 312,199.59 and the JSE Financial Index popped 0.82 points to close at 67.30.

The Main Market ended trading with an average PE Ratio of 12.8. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024.

The Main Market ended trading with an average PE Ratio of 12.8. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024.

Investor’s Choice bid-offer indicator shows 15 stocks ended with bids higher than their last selling prices and five with lower offers.

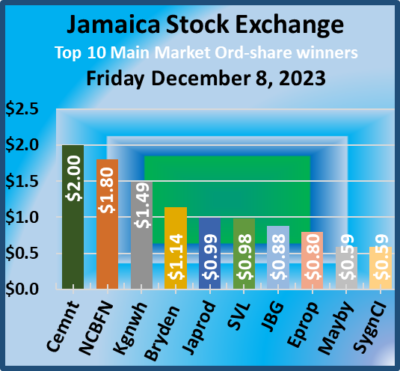

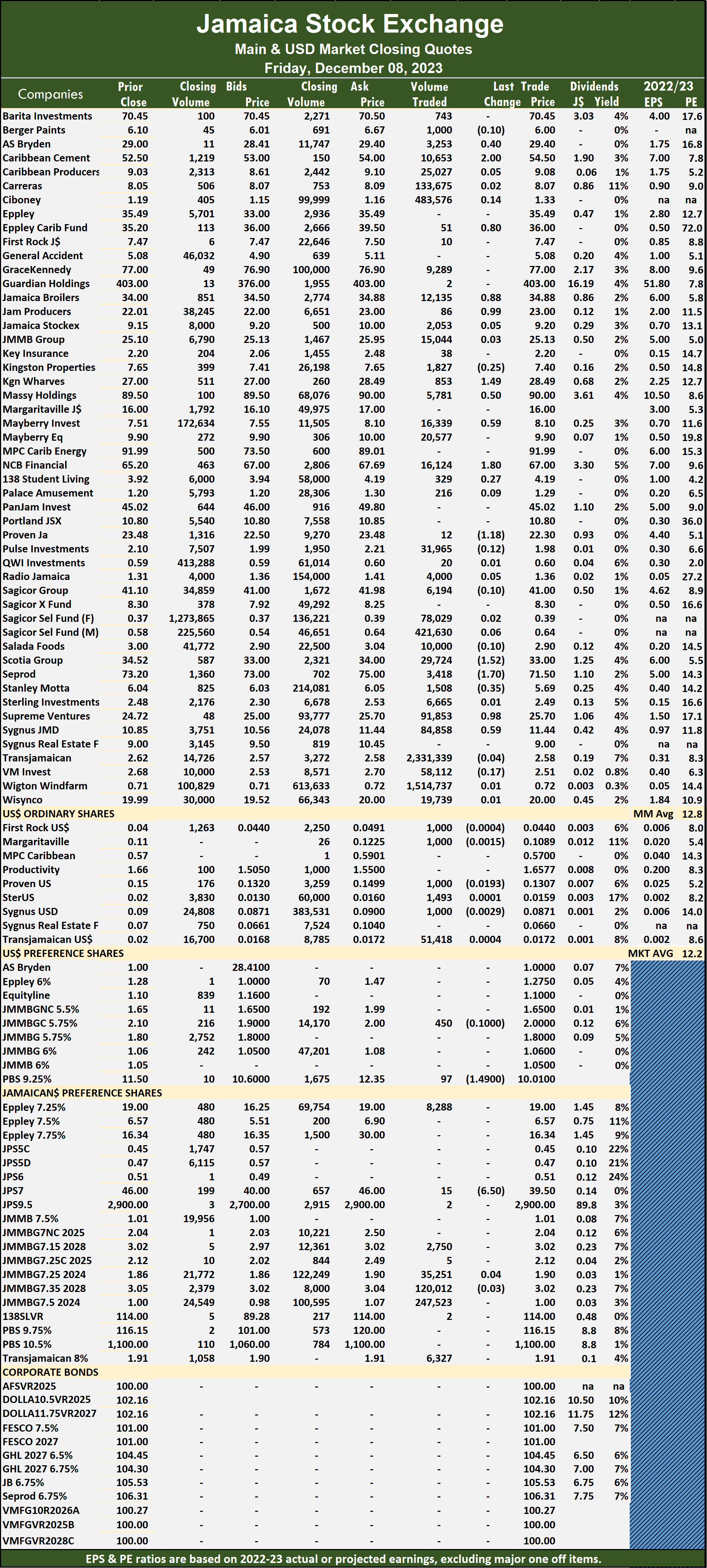

At the close, AS Bryden increased $1.14 to end at $29.40 as investors exchanged 3,253 stocks, Caribbean Cement climbed $2 to $54.50, with 10,653 units changing hands, Eppley Caribbean Property Fund rose 80 cents in closing at $36 with stakeholders exchanging 51 shares. Jamaica Broilers gained 88 cents and ended at $34.88 with a transfer of 12,135 stock units, Jamaica Producers popped 99 cents to close at $23 while exchanging 86 shares, Kingston Properties shed 25 cents to close at $7.40 with traders dealing in 1,827 stock units. Kingston Wharves advanced $1.49 and ended at $28.49, with 853 units crossing the exchange, Massy Holdings rallied 50 cents to $90 with investors swapping 5,781 stocks,  Mayberry Investments popped 59 cents in closing at $8.10 after an exchange of 16,339 shares. NCB Financial climbed $1.80 to close at $67 after 16,124 units passed through the market, 138 Student Living rose 27 cents to $4.19 with an exchange of 329 stocks, Proven Investments declined $1.18 in closing at $22.30, with 12 stock units clearing the market. Scotia Group lost $1.52 to end at $33 after a transfer of 29,724 shares, Seprod dipped $1.70 to close at $71.50, with 3,418 stock units crossing the market, Stanley Motta fell 35 cents and ended at $5.69 with investors dealing in 1,508 units. Supreme Ventures advanced 98 cents to $25.70 and closed with an exchange of 91,853 stocks and Sygnus Credit Investments gained 59 cents to end at $11.44 with investors transferring 84,858 units.

Mayberry Investments popped 59 cents in closing at $8.10 after an exchange of 16,339 shares. NCB Financial climbed $1.80 to close at $67 after 16,124 units passed through the market, 138 Student Living rose 27 cents to $4.19 with an exchange of 329 stocks, Proven Investments declined $1.18 in closing at $22.30, with 12 stock units clearing the market. Scotia Group lost $1.52 to end at $33 after a transfer of 29,724 shares, Seprod dipped $1.70 to close at $71.50, with 3,418 stock units crossing the market, Stanley Motta fell 35 cents and ended at $5.69 with investors dealing in 1,508 units. Supreme Ventures advanced 98 cents to $25.70 and closed with an exchange of 91,853 stocks and Sygnus Credit Investments gained 59 cents to end at $11.44 with investors transferring 84,858 units.

In the preference segment, Jamaica Public Service 7% dropped $6.50 in closing at $39.50 after an exchange of 15 stocks.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Rising stocks beat out Main Market decliners

Trading up prices fall on JSE Main Market

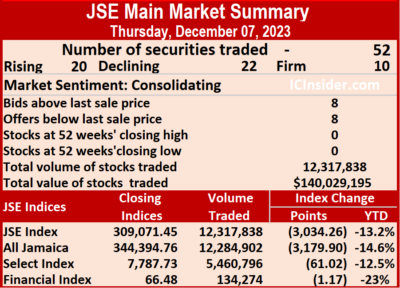

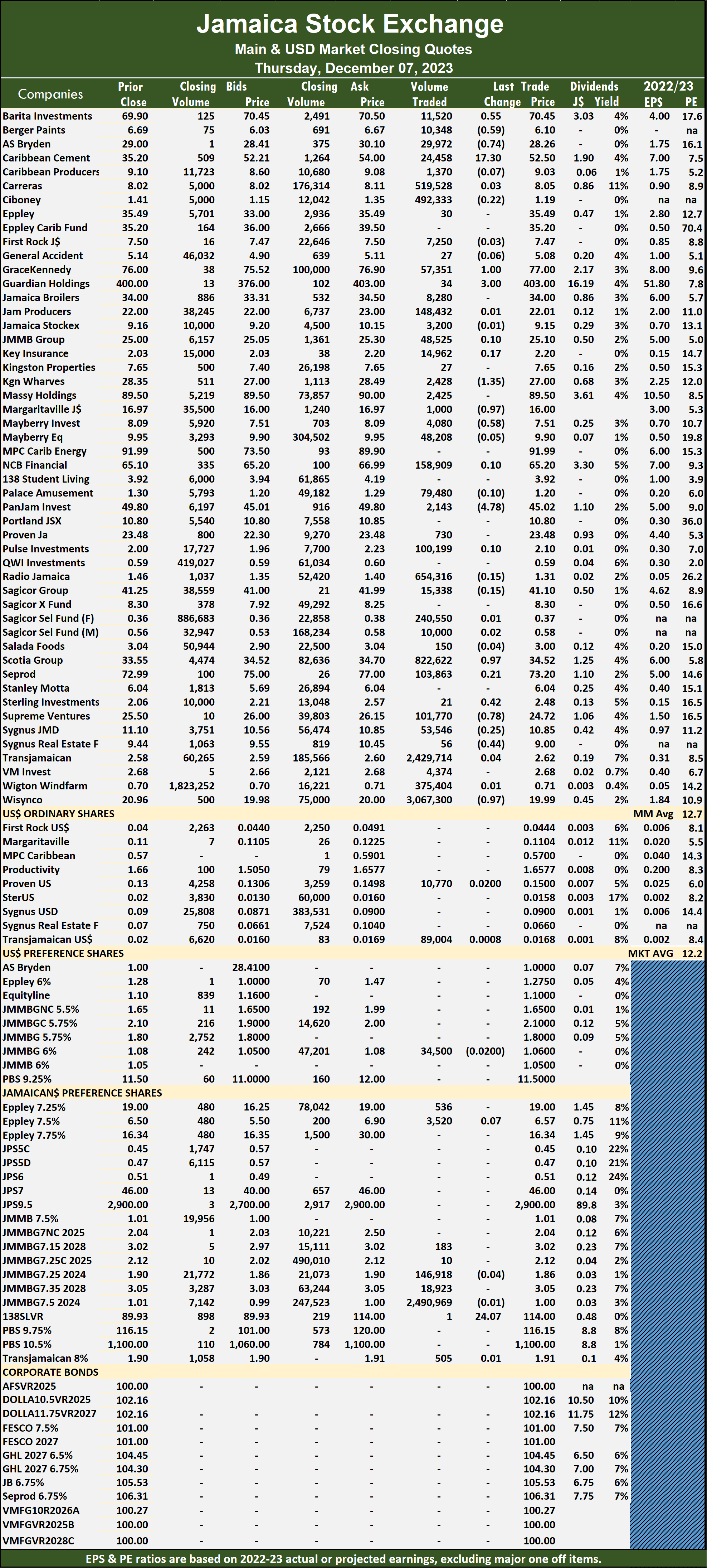

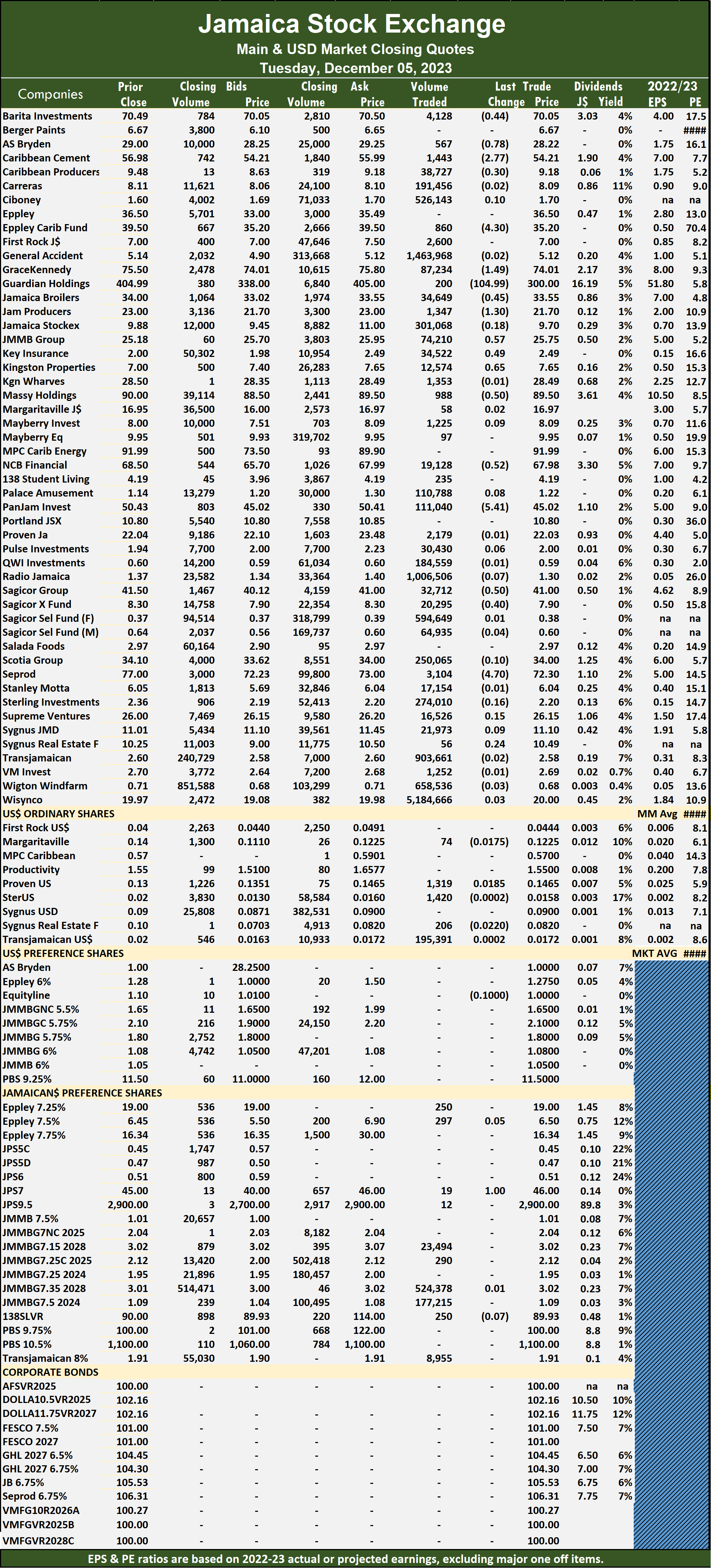

Trading activity jumped on the Jamaica Stock Exchange Main Market ended on Thursday, with the volume of stocks traded rising 59 percent and the value 175 percent more than on Wednesday, after trading in 52 securities compared with 55 on Wednesday and ended with prices of 20 rising, 22 declining and 10 ending unchanged.

A total of 12,317,838 shares were traded for $140,029,195 compared to just 7,745,089 units at $50,833,820 on Wednesday.

A total of 12,317,838 shares were traded for $140,029,195 compared to just 7,745,089 units at $50,833,820 on Wednesday.

Trading averaged 236,882 shares at $2,692,869 compared to 140,820 units at $924,251 on Wednesday and month to date, an average of 167,693 units at $1,497,509 compared to 151,113 units at $1,211,063 on the previous day. November closed with an average of 275,587 units at $2,488,949.

Wisynco Group led trading with 3.07 million shares for 24.9 percent of total volume and accounted for $61.3 million of the value of stocks traded, followed by JMMB Group 7.5% with 2.49 million units for 20.2 percent of the day’s trade and Transjamaican Highway with 2.43 million units for 19.7 percent of the day’s trade.

The All Jamaican Composite Index declined 3,179.90 points to 344,394.76, the JSE Main Index fell  3,034.26 points to close at 309,071.45 and the JSE Financial Index dipped 1.17 points to lock trading at 66.48.

3,034.26 points to close at 309,071.45 and the JSE Financial Index dipped 1.17 points to lock trading at 66.48.

The Main Market ended trading with an average PE Ratio of 12.7. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024.

Investor’s Choice bid-offer indicator shows 12 stocks ended with bids higher than their last selling prices and four with lower offers.

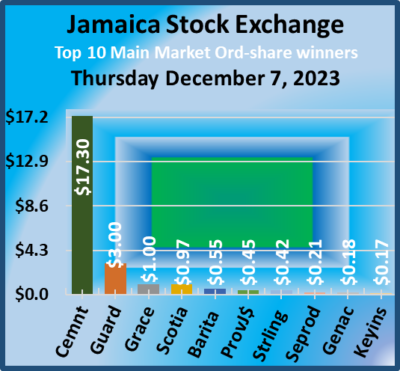

At the close, AS Bryden dipped 99 cents to close at $28.26 while exchanging 29,972 stocks, Barita Investments popped 55 cents to $70.45 in trading 11,520 units, Berger Paints fell 59 cents to end at $6.10 after an exchange of 10,348 shares. Caribbean Cement declined $1.50 in closing at $52.50 in a swapping of 24,458 stock units, GraceKennedy gained $1 and ended at $77 with traders dealing in 57,351 shares, Guardian Holdings rose $3 to $403 after a transfer of 34 stocks. Kingston Wharves lost $1.35 to close at $27, with 2,428 units clearing the market, Margaritaville dropped 97 cents to end at $16 after trading 1,000 stock units, Mayberry Investments shed 58 cents in closing at $7.51 with investors dealing in 4,080 shares.  Pan Jamaica skidded $4.78 and ended at $45.02 after 2,143 stocks passed through the market, Scotia Group advanced 97 cents to $34.52 with stakeholders exchanging 822,622 units, ahead of the likely announcement of an increase in dividend payment and a big jump in full year earnings to be made on Friday. Sterling Investments rallied 42 cents in closing at $2.48 in switching ownership of 21 stock units, Supreme Ventures fell 78 cents to end at $24.72 after an exchange of 101,770 shares, Sygnus Credit Investments dropped 25 cents and ended at $10.85 with a transfer of 53,546 stocks, Sygnus Real Estate Finance lost 44 cents to close at $9 as investors exchanged 56 units and Wisynco Group skidded 97 cents to $19.99 with shareholders swapping 3,067,300 stock units.

Pan Jamaica skidded $4.78 and ended at $45.02 after 2,143 stocks passed through the market, Scotia Group advanced 97 cents to $34.52 with stakeholders exchanging 822,622 units, ahead of the likely announcement of an increase in dividend payment and a big jump in full year earnings to be made on Friday. Sterling Investments rallied 42 cents in closing at $2.48 in switching ownership of 21 stock units, Supreme Ventures fell 78 cents to end at $24.72 after an exchange of 101,770 shares, Sygnus Credit Investments dropped 25 cents and ended at $10.85 with a transfer of 53,546 stocks, Sygnus Real Estate Finance lost 44 cents to close at $9 as investors exchanged 56 units and Wisynco Group skidded 97 cents to $19.99 with shareholders swapping 3,067,300 stock units.

In the preference segment, 138 Student Living preference share jumped $24.07 to close at $114 in an exchange of just one share.

In the preference segment, 138 Student Living preference share jumped $24.07 to close at $114 in an exchange of just one share.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

JSE Main Market bounce back

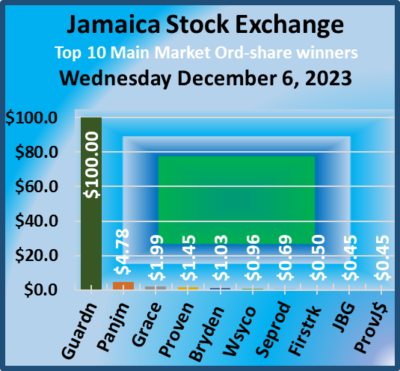

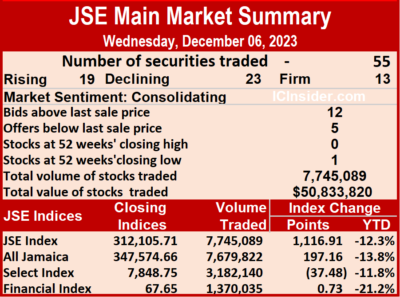

Advancing stocks were edged out by those declining in trading activity on the Jamaica Stock Exchange Main Market on Wednesday and yet the market indices managed to bounce with a number of the big losers on Tuesday enjoyed big rebounds even as the volume of stocks traded declined 41 percent with a 67 percent lower value than on Tuesday,  after trading occurred in 55 securities as was the case on Tuesday and ended with 19 rising, 23 declining and 13 unchanged.

after trading occurred in 55 securities as was the case on Tuesday and ended with 19 rising, 23 declining and 13 unchanged.

A total of 7,745,089 shares were traded for $50,833,820 versus 13,023,036 units at $151,822,598 on Tuesday.

Trading averaged 140,820 shares at $924,251 compared with 236,782 units at $2,760,411 on Tuesday and month to date, an average of 151,113 stocks at $1,211,063 compared to 154,608 units at $1,308,437 on the previous day. November closed with an average of 275,587 units at $2,488,949.

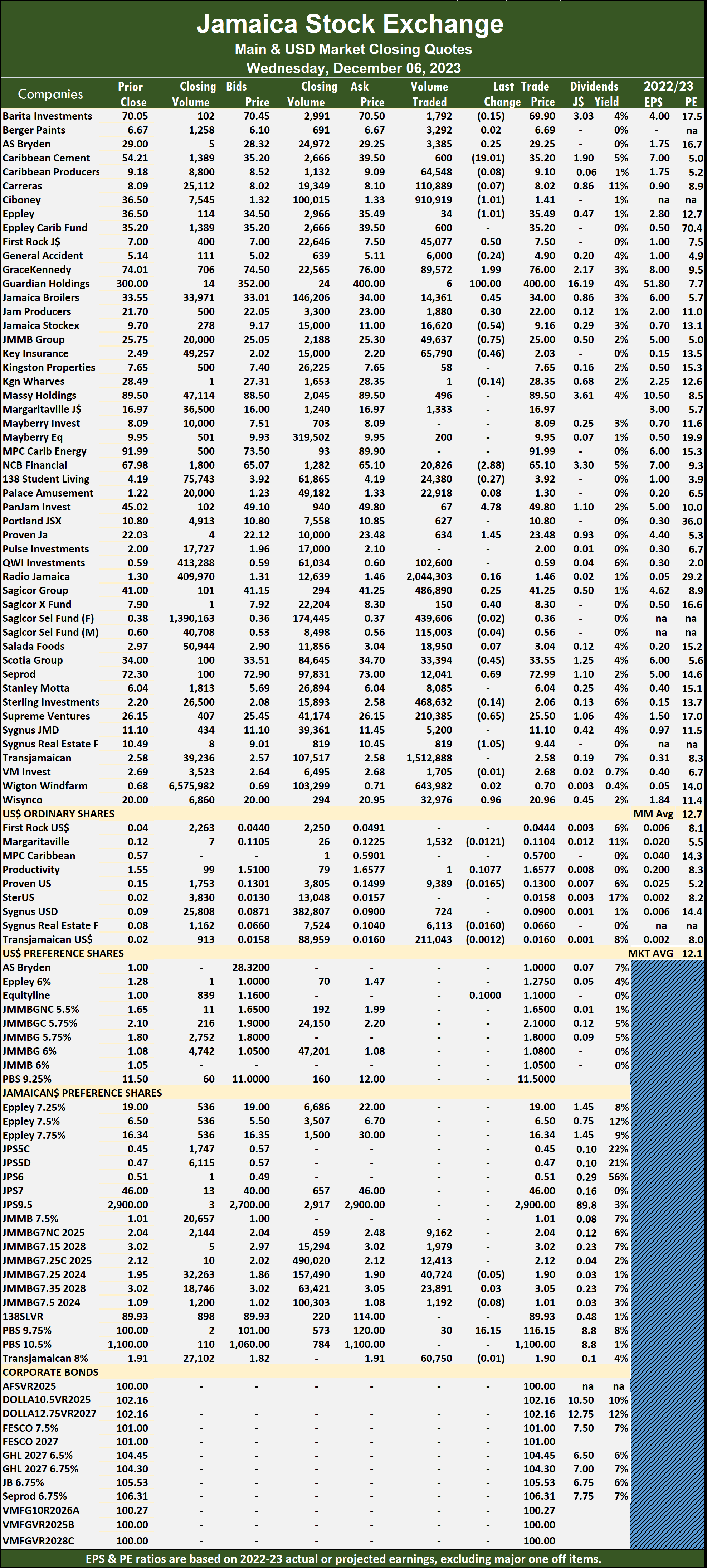

Radio Jamaica led trading with 2.04 million shares for 26.4 percent of total volume followed by Transjamaican Highway with 1.51 million units for 19.5 percent of the day’s trade and Ciboney Group with 910,919 units for 11.8 percent market share.

The All Jamaican Composite Index climbed 197.16 points to settle at 347,574.66, the JSE Main Index climbed 1,116.91 points to finish at 312,105.71 and the JSE Financial Index increased 0.73 points to culminate at 67.65.

The All Jamaican Composite Index climbed 197.16 points to settle at 347,574.66, the JSE Main Index climbed 1,116.91 points to finish at 312,105.71 and the JSE Financial Index increased 0.73 points to culminate at 67.65.

The Main Market ended trading with an average PE Ratio of 12.7. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024.

Investor’s Choice bid-offer indicator shows 12 stocks ended with bids higher than their last selling prices and five with lower offers.

At the close of market activity, AS Bryden advanced $1.03 to $29.25 in an exchange of 3,385 stock units, Ciboney Group declined 29 cents and ended at $1.41 with 910,919 shares clearing the market, Eppley lost $1.01 to end at $35.49 as investors exchanged 34 units. First Rock Real Estate popped 50 cents in closing at $7.50 after the trading of 45,077 stocks, GraceKennedy climbed $1.99 to close at $76, with 89,572 shares, crossing the exchange, Guardian Holdings rose $100 to $400, with a mere 6 stock units changing hands. Jamaica Broilers gained 45 cents and ended at $34 with investors dealing in 14,361 units, Jamaica Producers increased 30 cents to end at $22 after an exchange of 1,880 stocks, Jamaica Stock Exchange dropped 54 cents in closing at $9.16 after 16,620 shares passed through the market.  JMMB Group fell 75 cents to close at $25 with stakeholders exchanging 49,637 stocks, Key Insurance dropped 46 cents to $2.03, with 65,790 units crossing the market, NCB Financial shed $2.88 to close at $65.10 with traders dealing in 20,826 stock units. 138 Student Living skidded 27 cents and ended at $3.92 after an exchange of 24,380 shares, Pan Jamaica rallied $4.78 to end at $49.80 with investors transferring 67 stocks, Proven Investments popped $1.45 in closing at $23.48, with 634 units crossing the market. Sagicor Group climbed 25 cents to $41.25 with an exchange of 486,890 stock units, Sagicor Real Estate Fund increased 40 cents to end at $8.30 and closed with an exchange of 150 shares, Scotia Group lost 45 cents in closing at $33.55 with shareholders swapping 33,394 units. Seprod rallied 69 cents and ended at $72.99 while exchanging 12,041 stocks, Supreme Ventures shed 65 cents to close at $25.50 after a transfer of 210,385 stock units,

JMMB Group fell 75 cents to close at $25 with stakeholders exchanging 49,637 stocks, Key Insurance dropped 46 cents to $2.03, with 65,790 units crossing the market, NCB Financial shed $2.88 to close at $65.10 with traders dealing in 20,826 stock units. 138 Student Living skidded 27 cents and ended at $3.92 after an exchange of 24,380 shares, Pan Jamaica rallied $4.78 to end at $49.80 with investors transferring 67 stocks, Proven Investments popped $1.45 in closing at $23.48, with 634 units crossing the market. Sagicor Group climbed 25 cents to $41.25 with an exchange of 486,890 stock units, Sagicor Real Estate Fund increased 40 cents to end at $8.30 and closed with an exchange of 150 shares, Scotia Group lost 45 cents in closing at $33.55 with shareholders swapping 33,394 units. Seprod rallied 69 cents and ended at $72.99 while exchanging 12,041 stocks, Supreme Ventures shed 65 cents to close at $25.50 after a transfer of 210,385 stock units,  Sygnus Real Estate Finance fell $1.05 to $9.44 in switching ownership of 819 shares and Wisynco Group rose 96 cents in closing at $20.96 in an exchange of 32,976 units.

Sygnus Real Estate Finance fell $1.05 to $9.44 in switching ownership of 819 shares and Wisynco Group rose 96 cents in closing at $20.96 in an exchange of 32,976 units.

In the preference segment, Productive Business Solutions 9.75% preference share advanced $16.15 to close at $116.15 in trading 30 stocks.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

JSE Main Market hit by falling prices

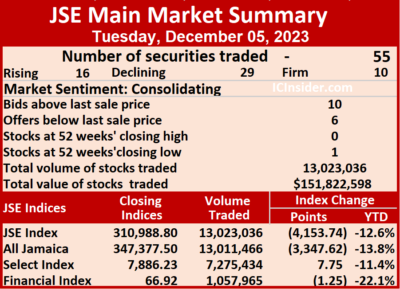

Declining stocks clobbered those rising at the close of trading activity on the Jamaica Stock Exchange Main Market on Tuesday, with no stock gaining more than 65 cents while losers fell as much as $105 with Guardian Holding dropping to A 52 weeks’ low of $300, followed by Pan Jamaica with a loss of $5.41 and Seprod $4.70, on a day when the volume of stocks traded jumped 131 percent and the value surged 443 percent above Monday’s levels.

with a loss of $5.41 and Seprod $4.70, on a day when the volume of stocks traded jumped 131 percent and the value surged 443 percent above Monday’s levels.

Trading ended with 55 securities changing hands compared with 53 on Monday and ended with prices of 16 rising, 29 declining and 10 unchanged, resulting in 13,023,036 shares traded for $151,822,598 up from 5,640,042 units at $27,974,248 on Monday.

Trading averaged 236,782 shares at $2,760,411 compared to 106,416 units at $527,816 on Monday and month to date, an average of 154,608 units at $1,308,437 versus 112,368 units at $562,096 on the previous day in contrast to November with an average of 275,587 units at $2,488,949.

Wisynco Group led trading with 5.18 million shares for 39.8 percent of total volume followed by General Accident with 1.46 million units for 11.2 percent of the day’s trade and Radio Jamaica with 1.01 million units for 7.7 percent of the day’s trade.

The All Jamaican Composite Index shed 3,347.62 points to end at 347,377.50, the JSE Main Index dumped 4,153.74 points to end trading at 310,988.80 and the JSE Financial Index skidded 1.25 points to lock up trading at 66.92.

The All Jamaican Composite Index shed 3,347.62 points to end at 347,377.50, the JSE Main Index dumped 4,153.74 points to end trading at 310,988.80 and the JSE Financial Index skidded 1.25 points to lock up trading at 66.92.

The Main Market ended trading with an average PE Ratio of 12.5. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024.

Investor’s Choice bid-offer indicator shows 10 stocks ended with bids higher than their last selling prices and six with lower offers.

At the close, AS Bryden dipped $1.78 in closing at $28.22 with investors dealing in 567 stock units, Barita Investments lost 44 cents to close at $70.05 after a transfer of 4,128 shares, Caribbean Cement skidded $2.77 and ended at $54.21, with 1,443 units crossing the market. Caribbean Producers fell 30 cents to close at $9.18 with shareholders swapping 38,727 stocks, Eppley Caribbean Property Fund shed $4.30 to end at $35.20, with 860 shares changing hands, GraceKennedy declined $1.49 to $74.01 in an exchange of 87,234 stocks.  Guardian Holdings dropped $104.99 to close at $300 with 200 units crossing the market, Jamaica Broilers lost 45 cents to end at $33.55 with a transfer of 34,649 stock units, Jamaica Producers dropped $1.30 in closing at $21.70 with an exchange of 1,347 shares. JMMB Group climbed 57 cents to $25.75 after investors traded 74,210 stocks, Key Insurance rose 49 cents to $2.49 after an exchange of 34,522 units, Kingston Properties advanced 65 cents in closing at $7.65 in trading 12,574 stock units. Massy Holdings fell 50 cents to close at $89.50 and closed with an exchange of 988 shares, NCB Financial skidded 52 cents to end at $67.98 with traders dealing in 19,128 stock units, Pan Jamaica declined $5.41 and ended at $45.02 in switching ownership of 111,040 stocks. Sagicor Group shed 50 cents to $41 after 32,712 units passed through the market, Sagicor Real Estate Fund dipped 40 cents in closing at $7.90 with investors transferring 20,295 shares and

Guardian Holdings dropped $104.99 to close at $300 with 200 units crossing the market, Jamaica Broilers lost 45 cents to end at $33.55 with a transfer of 34,649 stock units, Jamaica Producers dropped $1.30 in closing at $21.70 with an exchange of 1,347 shares. JMMB Group climbed 57 cents to $25.75 after investors traded 74,210 stocks, Key Insurance rose 49 cents to $2.49 after an exchange of 34,522 units, Kingston Properties advanced 65 cents in closing at $7.65 in trading 12,574 stock units. Massy Holdings fell 50 cents to close at $89.50 and closed with an exchange of 988 shares, NCB Financial skidded 52 cents to end at $67.98 with traders dealing in 19,128 stock units, Pan Jamaica declined $5.41 and ended at $45.02 in switching ownership of 111,040 stocks. Sagicor Group shed 50 cents to $41 after 32,712 units passed through the market, Sagicor Real Estate Fund dipped 40 cents in closing at $7.90 with investors transferring 20,295 shares and  Seprod fell $4.70 and ended at $72.30 with just 3,104 units clearing the market.

Seprod fell $4.70 and ended at $72.30 with just 3,104 units clearing the market.

In the preference segment, Jamaica Public Service 7% popped $1 to end at $46 with an exchange of 19 stocks.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Slippage in Main Market trading

Trading activity on the Jamaica Stock Exchange Main Market ended on Monday, with the volume of stocks traded declining 12 percent and the value 13 percent lower than on Friday, after trading 53 securities compared with 54 on Friday and resulted in prices of 22 rising, 16 declining and 15 ending unchanged.

A total of just 5,640,042 shares were traded for $27,974,248 down from 6,383,376 units at $32,170,003 on Friday.

A total of just 5,640,042 shares were traded for $27,974,248 down from 6,383,376 units at $32,170,003 on Friday.

Trading averaged 106,416 shares at $527,816 versus 118,211 units at $595,741 on Friday and month to date, an average of 112,368 units at $562,096, compared with November with an average of 275,587 units at $2,488,949.

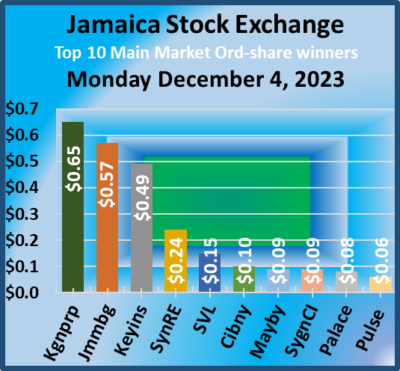

Transjamaican Highway led trading with 1.84 million shares for 32.6 percent of total volume followed by Wigton Windfarm with 1.80 million units for 31.9 percent of the day’s trade and Ciboney Group with 378,470 units for 6.7 percent market share.

The All Jamaican Composite Index lost 650.28 points to close at 350,725.12,  the JSE Main Index dropped 526.46 points to finish trading at 315,142.54 and the JSE Financial Index dipped 0.40 points to end trading at 68.17.

the JSE Main Index dropped 526.46 points to finish trading at 315,142.54 and the JSE Financial Index dipped 0.40 points to end trading at 68.17.

The Main Market ended trading with an average PE Ratio of 12.9. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024.

Investor’s Choice bid-offer indicator shows seven stocks ended with bids higher than their last selling prices and five with lower offers.

At the close, Barita Investments dipped 43 cents in closing at $70.49 in an exchange of 6,132 shares, Caribbean Cement fell $1.91 to $56.98 with traders dealing in 410 stocks, First Rock Real Estate skidded 99 cents to end at $7 after a transfer of 1,300 units.  GraceKennedy popped 75 cents to close at $75.50, with 65,161 stock units crossing the exchange, JMMB Group lost 42 cents and ended at $25.18 with shareholders swapping 129,520 shares, Mayberry Investments climbed 50 cents to $8 in trading 56,820 stocks. NCB Financial rose 50 cents and ended at $68.50, with 21,422 units clearing the market, Pan Jamaica gained 73 cents to close at $50.43 with a transfer of 5,880 stock units, Sagicor Group shed 45 cents in closing at $41.50 after trading 24,167 shares. Seprod advanced $3 to end at $77 with an exchange of 3,906 stocks and Supreme Ventures dropped 99 cents to $26, with 27,440 units crossing the market.

GraceKennedy popped 75 cents to close at $75.50, with 65,161 stock units crossing the exchange, JMMB Group lost 42 cents and ended at $25.18 with shareholders swapping 129,520 shares, Mayberry Investments climbed 50 cents to $8 in trading 56,820 stocks. NCB Financial rose 50 cents and ended at $68.50, with 21,422 units clearing the market, Pan Jamaica gained 73 cents to close at $50.43 with a transfer of 5,880 stock units, Sagicor Group shed 45 cents in closing at $41.50 after trading 24,167 shares. Seprod advanced $3 to end at $77 with an exchange of 3,906 stocks and Supreme Ventures dropped 99 cents to $26, with 27,440 units crossing the market.

In the preference segment,138 Student Living preference share declined $17 to close at $90 in an exchange of 50 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

JSE Main Market bounced on Friday

The Jamaica Stock Exchange Main Market ended on Friday, with gains to start the final month of 2023 positively but advancing stocks were overrun by those declining as the volume of stocks traded declined 62 percent and the value 44 percent lower than on Thursday, with 54 securities changing hands compared with 59 on Thursday and ended with 15 rising, 27 declining and 12 ending unchanged.

Trading slipped to a mere 6,383,376 shares being exchanged for just $32,170,003 down from 16,736,165 units at $57,402,800 on Thursday.

Trading slipped to a mere 6,383,376 shares being exchanged for just $32,170,003 down from 16,736,165 units at $57,402,800 on Thursday.

Trading averaged 118,211 shares at $595,741 versus 283,664 units at $972,929 on Thursday compared with November that averaged 275,587 units at $2,488,949.

Wigton Windfarm led trading with 3.55 million shares for 55.7 percent of total volume followed by Palace Amusement that ended with 799,934 units for 12.5 percent of the day’s trade and Transjamaican Highway with 559,854 units for 8.8 percent market share.

The All Jamaican Composite Index rose 1,439.55 points to wrap-up trading at 351,375.40, the JSE Main Index rose 521.37 points to close at 315,669.00 and the JSE Financial Index advanced 0.17 points to finish at 68.57.

The Main Market ended trading with an average PE Ratio of 12.9. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024.

Investor’s Choice bid-offer indicator shows nine stocks ended with bids higher than their last selling prices and six with lower offers.

Investor’s Choice bid-offer indicator shows nine stocks ended with bids higher than their last selling prices and six with lower offers.

At the close, AS Bryden rallied 60 cents to a 52 weeks’ closing high of $30.10 with an exchange of 242 shares, Barita Investments rose 62 cents to $70.92, with 6,634 units changing hands, Caribbean Cement advanced $4.90 to end at $58.89 with stakeholders exchanging 18,748 shares. Eppley Caribbean Property Fund popped $3.50 to close at $39.50 after 221 stock units crossed the market, First Rock Real Estate gained 49 cents and ended at $7.99 with an exchange of 11 shares, GraceKennedy declined $1.05 to $74.75 and closed with an exchange of 102,295 stock units. Guardian Holdings lost $15 in closing at $405 in trading 375 stocks, Kingston Properties skidded 70 cents to end at $7 after a transfer of 308 units, Mayberry Investments fell 50 cents to close at $7.50, with 5,100 shares crossing the exchange. NCB Financial dropped $1.20 and ended at $68 with investors dealing in 21,192 units, 138 Student Living climbed 30 cents to $4.21 in an exchange of 293 stocks, Pan Jamaica increased 70 cents to close at $49.70 with shareholders swapping 10,324 stock units.  Proven Investments shed $1.48 to end at $22.01 in an exchange of 15,848 shares, Sagicor Group popped 95 cents in closing at $41.95 with traders dealing in 175,260 units, Scotia Group gained $1.14 and ended at $33.99 after an exchange of 5,240 stocks. Seprod dipped $3.89 to $74, with 27,420 stock units crossing the market, Supreme Ventures rose 49 cents in closing at $26.99 in switching ownership of 11,913 shares and Sygnus Credit Investments fell 64 cents to end at $11.11 after exchanging 20,349 units.

Proven Investments shed $1.48 to end at $22.01 in an exchange of 15,848 shares, Sagicor Group popped 95 cents in closing at $41.95 with traders dealing in 175,260 units, Scotia Group gained $1.14 and ended at $33.99 after an exchange of 5,240 stocks. Seprod dipped $3.89 to $74, with 27,420 stock units crossing the market, Supreme Ventures rose 49 cents in closing at $26.99 in switching ownership of 11,913 shares and Sygnus Credit Investments fell 64 cents to end at $11.11 after exchanging 20,349 units.

In the preference segment,  Jamaica Public Service 7% shed $1 to close at $45, with 198 stocks clearing the market and JMMB Group 7% preference share lost 36 cents and ended at $2.04 with a transfer of 3,435 stock units.

Jamaica Public Service 7% shed $1 to close at $45, with 198 stocks clearing the market and JMMB Group 7% preference share lost 36 cents and ended at $2.04 with a transfer of 3,435 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Main market ends November with gains

Trading ended November with gains on the final trading day as the market closed the month lower than October’s close on the Jamaica Stock Exchange Main Market on Thursday, with the volume of stocks traded rising 68 percent but with a 79 percent drop in value than on Wednesday, following trading in 59 securities compared with 55 on Wednesday and closed with prices of 25 rising, 15 declining and 19 ending unchanged.

Trading ended after 16,736,165 shares were traded for $57,402,800 compared to 9,982,907 units at $279,360,313 on Wednesday.

Trading ended after 16,736,165 shares were traded for $57,402,800 compared to 9,982,907 units at $279,360,313 on Wednesday.

Trading averaged 283,664 shares at $972,929 compared with 181,507 units at $5,079,278 on Wednesday. Trading month to date averaged 275,587 units at $2,488,949 compared with 275,178 units at $2,565,792 on the previous day above October with an average of 214,410 units at $1,325,907.

Wigton Windfarm led trading with 9.16 million shares for 54.8 percent of total volume followed by Transjamaican Highway with 2.94 million units for 17.6 percent of the day’s trade and Sagicor Select Financial Fund with 1.0 million units for 6 percent of the day’s trade.

The All Jamaican Composite Index jumped 2,968.81 points to 349,935.85, the JSE Main Index climbed 1,982.67 points to conclude trading at 315,147.63 and the JSE Financial Index rose 0.40 points to end trading at 68.40.

The All Jamaican Composite Index jumped 2,968.81 points to 349,935.85, the JSE Main Index climbed 1,982.67 points to conclude trading at 315,147.63 and the JSE Financial Index rose 0.40 points to end trading at 68.40.

The Main Market ended trading with an average PE Ratio of 12.7. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024.

Investor’s Choice bid-offer indicator shows 15 stocks ended with bids higher than their last selling prices and five with lower offers.

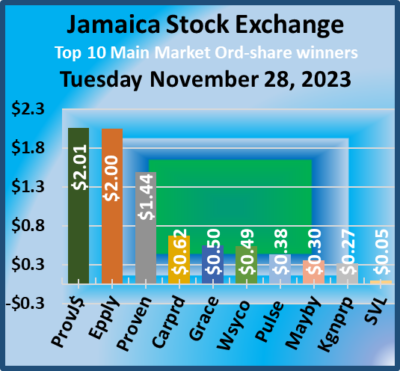

At the close, Eppley Caribbean Property Fund declined $3.50 to close at $36 in an exchange of 434 stocks, First Rock Real Estate increased 80 cents to $7.50 with investors dealing in 1,004 units, JMMB Group fell 99 cents and ended at $25.39 in switching ownership of 125,951 shares. Key Insurance lost 25 cents in closing at $1.95 with traders dealing in 1,446 stock units,  Kingston Wharves climbed $1.95 to end at $28.45 after an exchange of 505 shares, Margaritaville dipped 40 cents to $17 after 25 stocks were traded. Massy Holdings rose $1.40 to end at $90 with an exchange of 1,574 units, NCB Financial advanced $1.20 in closing at $69.20 with, 38,317 stock units changing hands, 138 Student Living shed 31 cents to close at $3.91 in trading 12,055 shares. Pan Jamaica popped $3.75 and ended at $49, with 64,091 stock units crossing the exchange, Proven Investments gained 99 cents to close at $23.49 after a transfer of 873 stocks, Seprod rallied $5.79 and ended at $77.89 while exchanging 60,013 units. Supreme Ventures popped 50 cents in closing at $26.50, as 120,308 stocks passed through the market and Wisynco Group rallied 31 cents to close at $20 as investors exchanged 327,965 shares.

Kingston Wharves climbed $1.95 to end at $28.45 after an exchange of 505 shares, Margaritaville dipped 40 cents to $17 after 25 stocks were traded. Massy Holdings rose $1.40 to end at $90 with an exchange of 1,574 units, NCB Financial advanced $1.20 in closing at $69.20 with, 38,317 stock units changing hands, 138 Student Living shed 31 cents to close at $3.91 in trading 12,055 shares. Pan Jamaica popped $3.75 and ended at $49, with 64,091 stock units crossing the exchange, Proven Investments gained 99 cents to close at $23.49 after a transfer of 873 stocks, Seprod rallied $5.79 and ended at $77.89 while exchanging 60,013 units. Supreme Ventures popped 50 cents in closing at $26.50, as 120,308 stocks passed through the market and Wisynco Group rallied 31 cents to close at $20 as investors exchanged 327,965 shares.

In the preference segment, 138 Student Living preference share rose 51 cents to end at $107, with 10,581 stock units clearing the market.

In the preference segment, 138 Student Living preference share rose 51 cents to end at $107, with 10,581 stock units clearing the market.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Trading climbed on JSE Main Market

Trading activity on the Jamaica Stock Exchange Main Market ended on Wednesday, with the volume of stocks traded rising 95 percent and the value 554 percent more than on Tuesday, with 55 securities trading compared with 54 on Tuesday, with 23 rising, 18 declining and 14 ending unchanged.

Overall, 9,982,907 shares were traded at $279,360,313 compared with 5,126,354 units at $42,703,699 on Tuesday.

Overall, 9,982,907 shares were traded at $279,360,313 compared with 5,126,354 units at $42,703,699 on Tuesday.

Trading averaged 181,507 shares at $5,079,278 versus 94,932 units at $790,809 on Tuesday and month to date, an average of 275,178 units at $2,565,792, compared with 279,823 units at $2,441,137 on the previous day. October closed with an average of 214,410 units at $1,325,907.

GraceKennedy led trading with 3.58 million shares for 35.8 percent of total volume followed by Wigton Windfarm with 2.82 million units for 28.2 percent of the day’s trade and Transjamaican Highway with 1.90 million units for 19 percent of the day’s trade.

The All Jamaican Composite Index shed 193.70 points to conclude trading at 346,967.04,  the JSE Main Index gained 939.00 points to close at 313,164.96 and the JSE Financial Index advanced 0.70 points to 68.00.

the JSE Main Index gained 939.00 points to close at 313,164.96 and the JSE Financial Index advanced 0.70 points to 68.00.

The Main Market ended trading with an average PE Ratio of 12.8. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024.

Investor’s Choice bid-offer indicator shows seven stocks ended with bids higher than their last selling prices and seven with lower offers.

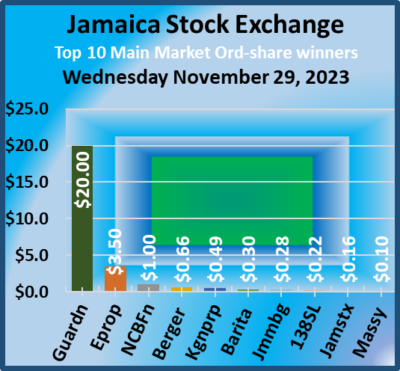

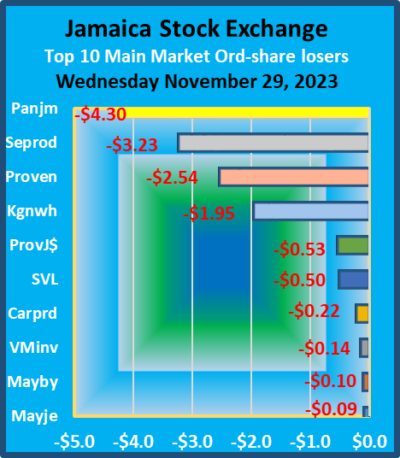

At the close, Barita Investments rallied 30 cents to $70.30 while exchanging 2,230 stocks, Berger Paints increased 66 cents to end at $6.67 with 4,086 units clearing the market, Eppley Caribbean Property Fund climbed $3.50 in closing at $39.50 after an exchange of 881 shares. Guardian Holdings popped $20 to close at $420 with shareholders swapping just one stock unit, JMMB Group advanced 28 cents and ended at $26.38 in an exchange of 23,742 shares,  Kingston Properties rose 49 cents to $7.49 after investors exchanged 63,164 units. Kingston Wharves declined $1.95 to close at $26.50 with stakeholders exchanging 2,398 stocks, NCB Financial gained $1 to end at $68 in trading 20,469 stock units, Pan Jamaica lost $4.30 in closing at $45.25, with 3,329 shares crossing the market. Proven Investments skidded $2.54 and ended at $22.50 after an exchange of 200 stocks, Seprod fell $3.23 to $72.10 in switching ownership of 1,243 units and Supreme Ventures dropped 50 cents to close at $26 as investors exchanged 151,520 stock units.

Kingston Properties rose 49 cents to $7.49 after investors exchanged 63,164 units. Kingston Wharves declined $1.95 to close at $26.50 with stakeholders exchanging 2,398 stocks, NCB Financial gained $1 to end at $68 in trading 20,469 stock units, Pan Jamaica lost $4.30 in closing at $45.25, with 3,329 shares crossing the market. Proven Investments skidded $2.54 and ended at $22.50 after an exchange of 200 stocks, Seprod fell $3.23 to $72.10 in switching ownership of 1,243 units and Supreme Ventures dropped 50 cents to close at $26 as investors exchanged 151,520 stock units.

In the preference segment, Eppley 7.50% preference share rose 70 cents and ended at $6.20 after 87 shares crossed the market and 138 Student Living preference share rallied $17.21 to close at $106.49 after an exchange of 39 stocks.

In the preference segment, Eppley 7.50% preference share rose 70 cents and ended at $6.20 after 87 shares crossed the market and 138 Student Living preference share rallied $17.21 to close at $106.49 after an exchange of 39 stocks.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Fall for JSE Main Market

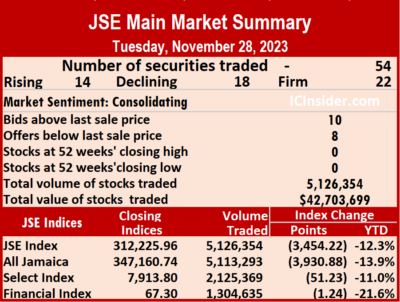

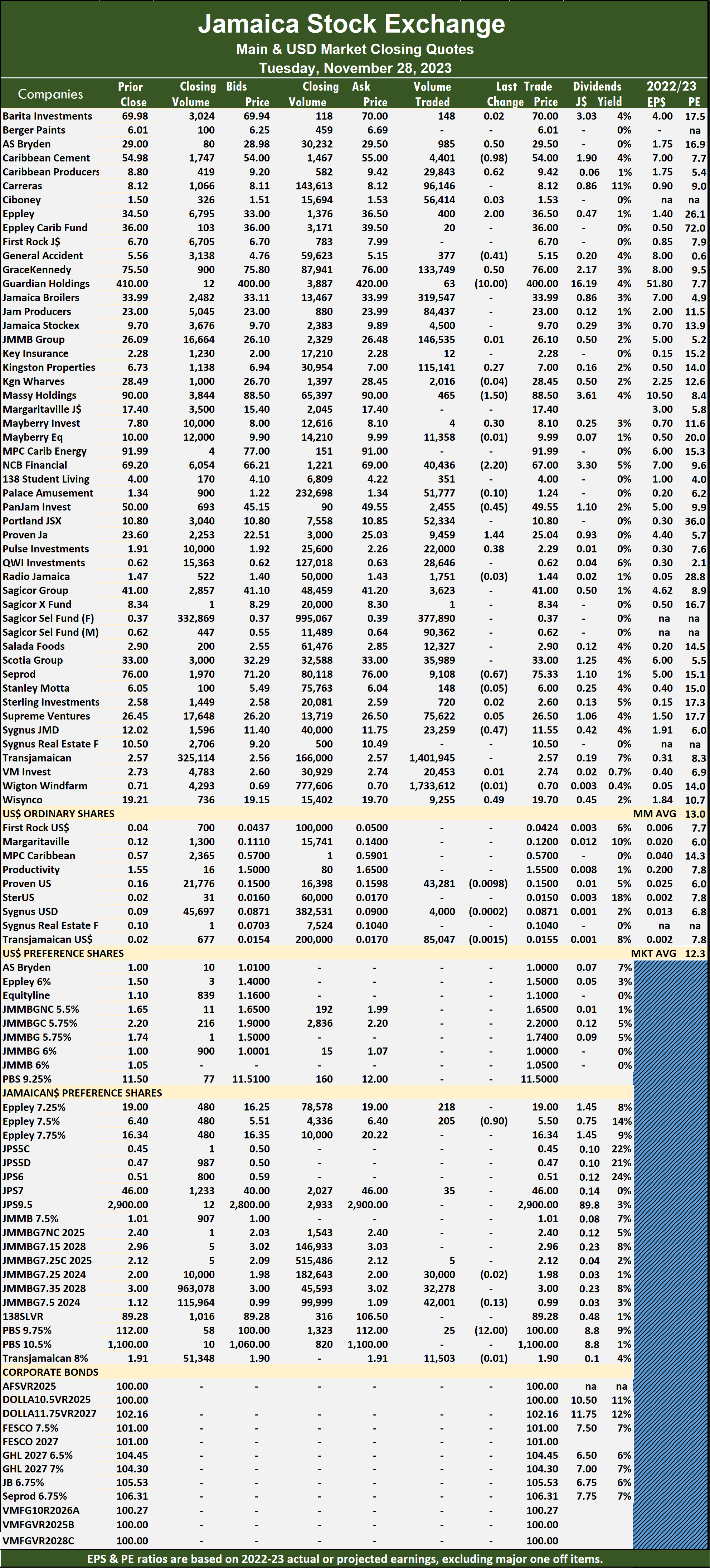

Trading activity on the Jamaica Stock Exchange Main Market ended on Tuesday, with the volume of stocks traded declining 23 percent but with a 14 percent higher value than on Monday, after trading in 54 securities compared with 58 on Monday, with 14 rising, 18 declining and 22 ending unchanged.

A total of 5,126,354 shares were traded for $42,703,699 compared with 6,629,759 units at $37,460,689 on Monday.

A total of 5,126,354 shares were traded for $42,703,699 compared with 6,629,759 units at $37,460,689 on Monday.

Trading averaged 94,932 shares at $790,809 versus 114,306 units at $645,874 on Monday and month to date, an average of 279,823 units at $2,441,137, compared with 289,287 units at $2,525,609 on the previous day and better than October with an average of 214,410 units at $1,325,907.

Wigton Windfarm led trading with 1.73 million shares for 33.8 percent of total volume followed by Transjamaican Highway with 1.40 million units for 27.3 percent of the day’s trade and Sagicor Select Financial Fund with 377,890 units for 7.4 percent market share.

The All Jamaican Composite Index shed 3,930.88 points to end the day at 347,160.74, the JSE Main Index dropped 3,454.22 points to lock up trading at 312,225.96 and the JSE Financial Index shed 1.24 points to cease trading at 67.30.

The Main Market ended trading with an average PE Ratio of 13. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024.

The Main Market ended trading with an average PE Ratio of 13. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024.

Investor’s Choice bid-offer indicator shows 10 stocks ended with bids higher than their last selling prices and eight with lower offers.

At the close, Caribbean Cement shed 98 cents to end at $54 as investors exchanged 4,401 stocks, Caribbean Producers rose 62 cents to $9.42 with a transfer of 29,843 units, Eppley gained $2 in closing at $36.50, with 400 shares crossing the market. GraceKennedy popped 50 cents and ended at $76 with an exchange of 133,749 stock units, Guardian Holdings declined $10 to close at $400 with 63 shares clearing the market, Kingston Properties climbed 27 cents to $7 after an exchange of 115,141 stock units. Massy Holdings lost $1.50 in closing at $88.50 in switching ownership of 465 units, Mayberry Investments increased 30 cents to close at $8.10 with, 4 stocks changing hands, NCB Financial dipped $2.20 and ended at $67 after trading ended with 40,436 units changing hands. Pan Jamaica fell 45 cents to end at $49.55 and closed with 2,455 shares passing through the market, Proven Investments advanced $1.44 in closing at $25.04 with shareholders swapping 9,459 stock units, Pulse Investments rallied 38 cents to $2.29, with 22,000 stocks crossing the exchange. Seprod dropped 67 cents and ended at $75.33 with traders dealing in 9,108 units, Sygnus Credit Investments skidded 47 cents to close at $11.55 in an exchange of 23,259 stocks and Wisynco Group rose 49 cents to end at $19.70 as 9,255 shares passed through the market.

Mayberry Investments increased 30 cents to close at $8.10 with, 4 stocks changing hands, NCB Financial dipped $2.20 and ended at $67 after trading ended with 40,436 units changing hands. Pan Jamaica fell 45 cents to end at $49.55 and closed with 2,455 shares passing through the market, Proven Investments advanced $1.44 in closing at $25.04 with shareholders swapping 9,459 stock units, Pulse Investments rallied 38 cents to $2.29, with 22,000 stocks crossing the exchange. Seprod dropped 67 cents and ended at $75.33 with traders dealing in 9,108 units, Sygnus Credit Investments skidded 47 cents to close at $11.55 in an exchange of 23,259 stocks and Wisynco Group rose 49 cents to end at $19.70 as 9,255 shares passed through the market.

In the preference segment, Eppley 7.50% preference share fell 90 cents to $5.50 with investors transferring 205 stock units and Productive Business Solutions 9.75% preference share dropped $12 to end at $100 in an exchange of 25 shares.

In the preference segment, Eppley 7.50% preference share fell 90 cents to $5.50 with investors transferring 205 stock units and Productive Business Solutions 9.75% preference share dropped $12 to end at $100 in an exchange of 25 shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Fall for JSE Main Market

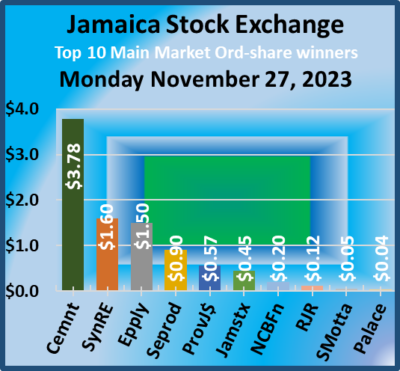

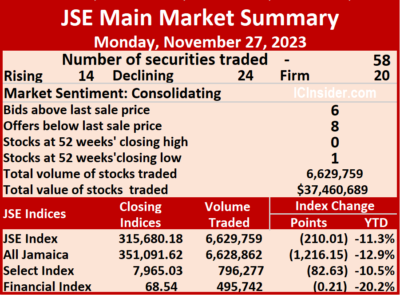

Declining stocks overwhelmed those rising in trading activity on the Jamaica Stock Exchange Main Market on Monday, sending the indices careening downwards at the close of the market, with a 42 percent decline in the volume of stocks traded at a 65 percent lower value than on Friday, with trading taking place in 58 securities compared with 55 on Friday, and ended with 14 rising, 24 declining and 20 ending unchanged.

A total of 6,629,759 shares were traded for $37,460,689 down from 11,457,646 units at $107,505,758 on Friday.

A total of 6,629,759 shares were traded for $37,460,689 down from 11,457,646 units at $107,505,758 on Friday.

Trading averaged 114,306 shares at $645,874 down from 208,321 units at $1,954,650 on Friday and month to date, an average of 289,287 units at $2,525,609, compared with 299,466 units at $2,634,962 on the previous trading day, well above October with an average of 214,410 units at $1,325,907.

Transjamaican Highway led trading with 1.98 million shares for 29.8 percent of total volume followed by Wigton Windfarm with 1.72 million units for 26 percent of the day’s trade and JMMB Group 7.35% – 2028 with 776,731 units for 11.7 percent market share.

The All Jamaican Composite Index dropped 1,216.15 points to end the day at 351,091.62, the JSE Main Index dropped 210.01 points to finish at 315,680.18 and the JSE Financial Index declined 0.21 points to close at 68.54.

The Main Market ended trading with an average PE Ratio of 13. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024.

The Main Market ended trading with an average PE Ratio of 13. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024.

Investor’s Choice bid-offer indicator shows six stocks ended with bids higher than their last selling prices and eight with lower offers.

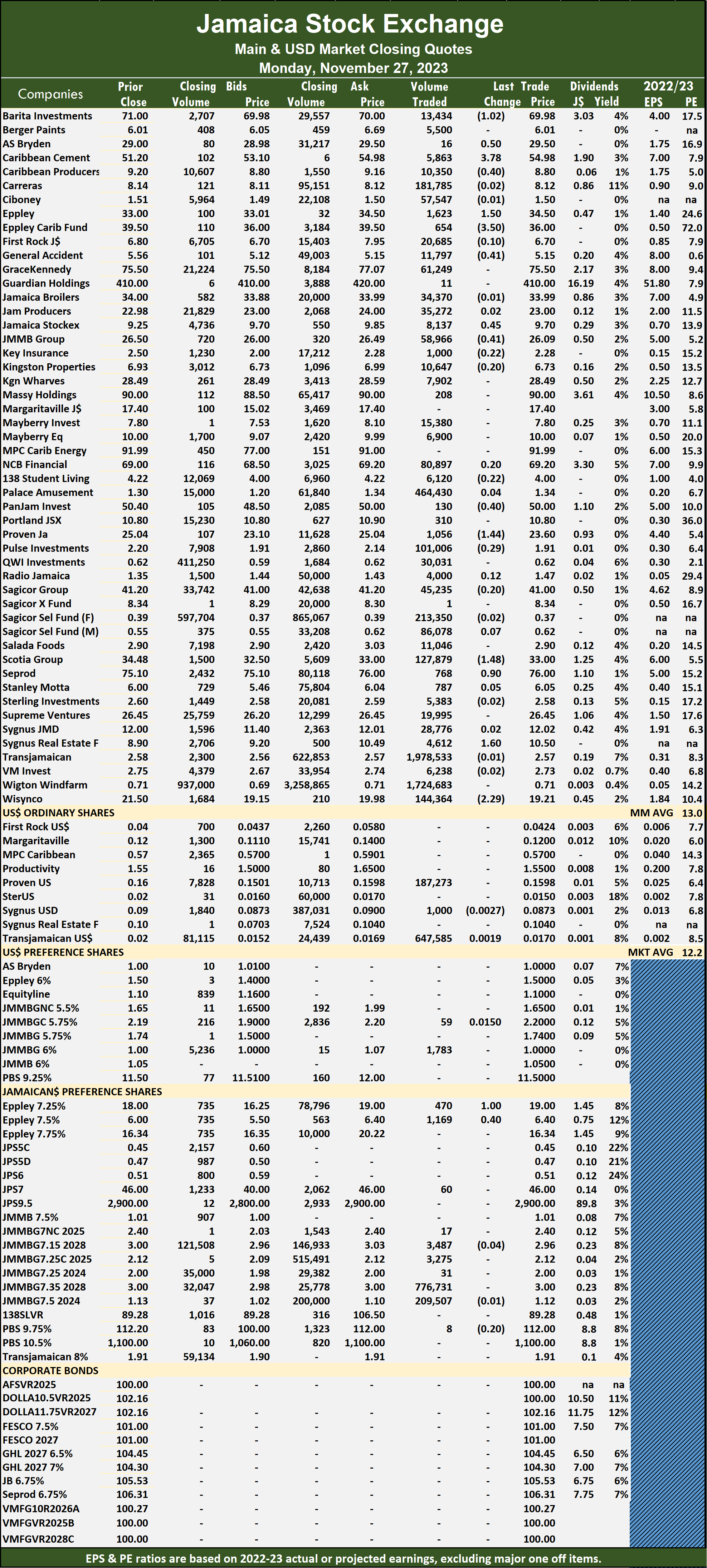

At the close, Barita Investments fell $1.02 and ended at $69.98 after closing with an exchange of 13,434 shares, Caribbean Cement gained $3.78 to close at $54.98 with shareholders swapping 5,863 units, Caribbean Producers lost 40 cents to close at $8.80 in trading 10,350 stocks. Eppley popped $1.50 to end at $34.50 after a transfer of 1,623 stock units, Eppley Caribbean Property Fund dropped $3.50 in closing at $36 with traders dealing in 654 shares, Jamaica Stock Exchange advanced 45 cents to $9.70 in switching ownership of 8,137 stock units. JMMB Group shed 41 cents to close at $26.09 with investors dealing in 58,966 units, Pan Jamaica declined 40 cents and ended at $50 after an exchange of 130 stocks, Proven Investments dropped $1.44 to end at $23.60, with 1,056 shares crossing the market. Pulse Investments skidded 29 cents in closing at $1.91 in an exchange of 101,006 stock units, Scotia Group lost $1.48 to $33 after 127,879 stocks passed through the market, Seprod rose 90 cents to end at $76 with a transfer of 768 units. Sygnus Real Estate Finance rallied $1.60 in closing at $10.50, with 4,612 stocks clearing the market and Wisynco Group fell $2.29 and ended at $19.21 with stakeholders exchanging 144,364 shares.

JMMB Group shed 41 cents to close at $26.09 with investors dealing in 58,966 units, Pan Jamaica declined 40 cents and ended at $50 after an exchange of 130 stocks, Proven Investments dropped $1.44 to end at $23.60, with 1,056 shares crossing the market. Pulse Investments skidded 29 cents in closing at $1.91 in an exchange of 101,006 stock units, Scotia Group lost $1.48 to $33 after 127,879 stocks passed through the market, Seprod rose 90 cents to end at $76 with a transfer of 768 units. Sygnus Real Estate Finance rallied $1.60 in closing at $10.50, with 4,612 stocks clearing the market and Wisynco Group fell $2.29 and ended at $19.21 with stakeholders exchanging 144,364 shares.

In the preference segment, Eppley 7.25% preference share increased $1 to close at $19, with 470 stock units crossing the market and Eppley 7.50% preference share climbed 40 cents to $6.40 with an exchange of 1,169 units.

In the preference segment, Eppley 7.25% preference share increased $1 to close at $19, with 470 stock units crossing the market and Eppley 7.50% preference share climbed 40 cents to $6.40 with an exchange of 1,169 units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

- « Previous Page

- 1

- …

- 14

- 15

- 16

- 17

- 18

- …

- 164

- Next Page »