Stationery and Office Supplies that issued shares to the public on the 19th of July should be listed on the Junior Market of the Jamaica Stock Exchange on August 9, after the public holidays, subject to the listing committee meeting to approve same, IC Insider.com has been informed by a person close to the issue.

Stationery and Office Supplies that issued shares to the public on the 19th of July should be listed on the Junior Market of the Jamaica Stock Exchange on August 9, after the public holidays, subject to the listing committee meeting to approve same, IC Insider.com has been informed by a person close to the issue.

JN Fund Managers announced the method of allocation of the 52 million shares that were offered to the public. The issue attracted 1,216 applications for 241.722 million shares.

Shares allocated to SOS’ staff members were not applied for in full and resulted in 4,061,000 units being added to the general public pool with the staff picking up 8.439 million units.

The general public were all allotted the minimum of 5,000 units with the balance allocated on a pro rata basis taking into account the number of units applied for as a percentage of the total application pool in this category. JN Fund Managers’ clients were allotted up to 77,585 units of the shares applied for. Cheques for refunds should start going out as of Thursday, IC Insider.com was reliably informed.

Stationery Company to list early August

Junior Market gains on Monday

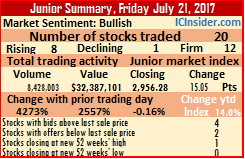

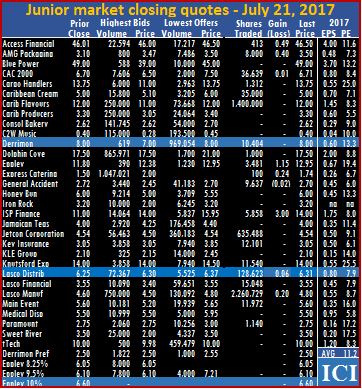

Trading on the Junior Market dropped sharply on Monday to 1,438.180 shares valued at $7,648,204.78, from 8,428,003 shares valued at $32,387,101 on Friday. At the close, the market index rose 32.62 points to 2,988.90.

Trading on the Junior Market dropped sharply on Monday to 1,438.180 shares valued at $7,648,204.78, from 8,428,003 shares valued at $32,387,101 on Friday. At the close, the market index rose 32.62 points to 2,988.90.

Trading ended with 17 securities changing hands, down from 20 on Friday with 5 gaining and 11 declining and with 6 stocks having a higher bids than the last traded price and 5 closing with lower offers.

The Junior Market ended trading with an average of 84,599 units for an average value of $449,894 compared to 421,400 units for an average value of $1,619,355 on Friday. The average volume and value for the month to date amounts to 74,820 units valued at $371,129 compared 74,208 units valued at $366,206 previously. In contrast, June closed with averages of 395,969 units valued at $1,799,200 for each security traded.

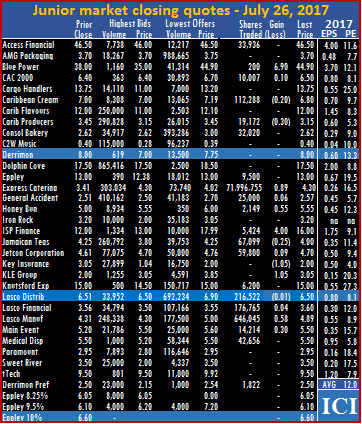

At the close of the market,  AMG Packaging closed at $3.50 with 7,486 units changing hands, Blue Power dived $4 to close at $45 with 143 units, CAC 2000 lost 31 cents with 500 shares trading to end at $6.40, Caribbean Cream jumped by $1 and closed trading with 3,205 units at $6, Caribbean Producers lost 23 cents to close trading with 700 units, at $3.07, General Accident lost 20 cents and closed trading with 14,242 shares at $2.50, ISP Finance slipped $2 and closed with 23,500 units changing hands at $12, Jetcon Corporation traded 142,419 shares to end at $4.50, after slipping 4 cents, KLE Group ended at $2 with 31,325 shares changing hands,

AMG Packaging closed at $3.50 with 7,486 units changing hands, Blue Power dived $4 to close at $45 with 143 units, CAC 2000 lost 31 cents with 500 shares trading to end at $6.40, Caribbean Cream jumped by $1 and closed trading with 3,205 units at $6, Caribbean Producers lost 23 cents to close trading with 700 units, at $3.07, General Accident lost 20 cents and closed trading with 14,242 shares at $2.50, ISP Finance slipped $2 and closed with 23,500 units changing hands at $12, Jetcon Corporation traded 142,419 shares to end at $4.50, after slipping 4 cents, KLE Group ended at $2 with 31,325 shares changing hands,  Knutsford Expressclimbed $1 in trading 591 shares to end at $15, Lasco Distributors closed 59 cents higher at $6.90 after trading 552,000 units, Lasco Financial lost 5 cents and ended with 235,000 shares changing hands at $3.50, Lasco Manufacturing shed 30 cents and ended with 418,482 shares trading at $4.50, Main Event lost 30 cents to close with 689 shares trading at $5.30, Medical Disposables rose 1 cent, ending at $5.51 with 250 units trading, Paramount Trading gained 20 cents and ended with 1,000 units changing hands at $2.95 and tTech traded 33,400 units, falling 40 cents to close at $9.60.

Knutsford Expressclimbed $1 in trading 591 shares to end at $15, Lasco Distributors closed 59 cents higher at $6.90 after trading 552,000 units, Lasco Financial lost 5 cents and ended with 235,000 shares changing hands at $3.50, Lasco Manufacturing shed 30 cents and ended with 418,482 shares trading at $4.50, Main Event lost 30 cents to close with 689 shares trading at $5.30, Medical Disposables rose 1 cent, ending at $5.51 with 250 units trading, Paramount Trading gained 20 cents and ended with 1,000 units changing hands at $2.95 and tTech traded 33,400 units, falling 40 cents to close at $9.60.

Lasco Financial setting for profit explosion

Lasco Financial enjoyed decent gains in profit for Q1

Revenues at Lasco Financial Services jumped 22.4 percent for first quarter over the similar 2016 period to reach $319 million for an increase of $58.5 million, but importantly trading income climbed 31 percent to $303 million.

According to Managing Director, Jacinth Hall-Tracey “this result represents year over year growth of and is being driven by our strategy of expansion which began in the previous financial year”.

Profit before taxation, moved from $69.7 million in 2016 to $81 million, a 16.5 percent increase with profit after tax increasing 15.8 percent to $66.9 million, compared with the corresponding financial period and resulting in earnings per share of 5.4 cents.

Total Expenses grew 24.6 percent over the 2016 quarter to $238 million with Selling and Promotion cost rising by 31 percent. The increase was “largely driven by increases in Selling and Promotion as we continue to push the LASCO Money consumer facing brand name. This brand has resonated well with our customers and has enabled us to fully explain all our services. Previously, most customers were only aware of our Cambio and MoneyGram services. This brand awareness has been paying off in the increased transactions in all our locations as our customers embrace our more friendly community brand,” Hall-Tracey advised shareholders in a release accompanying the financials.

In the previous financial year, Lasco began the implementation of a strategy to expand the Loans Division by adding a Business Loans Unit. This expansion gave rise to several new loan offices as well as an increase in administrative and sales staff. Increased focus on lending, resulted in 70 percent growth in the loan portfolio that should move the portfolio in the region of $340 million. At the end of March loans amounted to $282 million up 43 percent over the $197 million due at the end of March 2016, no figures for loan is disclosed in the quarterly.

The balance sheet shows assets of $1.54 billion, cash funds of $574 million and stockholder’s equity of $1.22 billion.

IC insider.com is forecasting earnings per share of 30 cents for 2018 and should go on to about double in 2019. Lasco Financial last traded on the Junior Market of the Jamaica Stock Exchange at $3.55.

Express Catering up 50c to $2

Express Catering started trading today with 102,100 shares trading at $2 to record a 33.33 percent gain of 50 cents over the initial public issue price of $1.50, if the price is allowed to stand.

Express Catering started trading today with 102,100 shares trading at $2 to record a 33.33 percent gain of 50 cents over the initial public issue price of $1.50, if the price is allowed to stand.

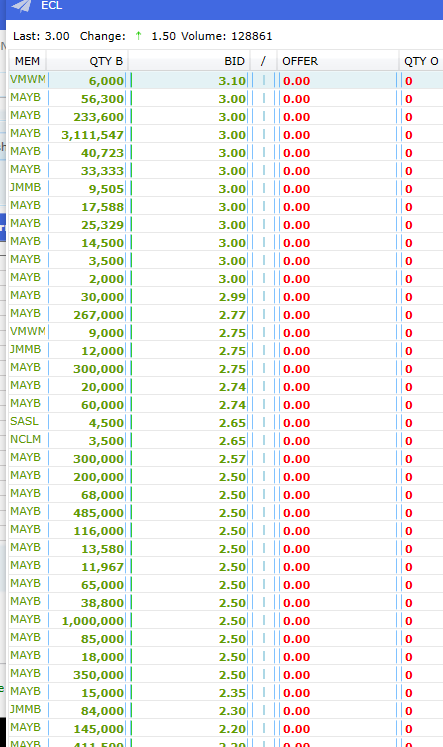

The opening price for the stock is $1.75, under the stock exchange rules, the maximum price change increase for the day is limited to 30 percent from the issue price of $1.50 or 45 cents.

On the bid are 2.33 million units ranging in price from $1.50 to $2.15 with only one offer of 26,661 units posted on the stock exchange trading platform at a price of $2.75.

The company’s shareholders sold 327.5 million shares valued at $491,250,000 just over a week ago to the public.

The stock price movement has helped the Junior Market index in adding 21.56 points to trade at 2,962.79 at 11.40am.

The Junior Market ended trading with an average of 3,673,879 units for an average value of $13,189,251 compared to 1,691,772 units for an average value of $5,936,576 on Tuesday. The average volume and value for the month to date amounts to 571,639 units valued at $2,009,287 compared to 239,926 units valued at $680,321 previously. In contrast, June closed with averages of 395,969 units valued at $1,799,200 for each security traded.

The Junior Market ended trading with an average of 3,673,879 units for an average value of $13,189,251 compared to 1,691,772 units for an average value of $5,936,576 on Tuesday. The average volume and value for the month to date amounts to 571,639 units valued at $2,009,287 compared to 239,926 units valued at $680,321 previously. In contrast, June closed with averages of 395,969 units valued at $1,799,200 for each security traded. Honey Bun gained 55 cents with 2,149 shares changing hands and closed at $5.55,

Honey Bun gained 55 cents with 2,149 shares changing hands and closed at $5.55,

The Junior Market ended trading with an average of 1,691,772 units for an average value of $5,936,576 compared to 84,599 units for an average of $449,894 on Monday. The average volume and value for the month to date amounts to 239,926 units at $680,321, compared to 74,820 units valued at $371,129 previously. In contrast, June closed with averages of 395,969 units valued at $1,799,200 for each security traded.

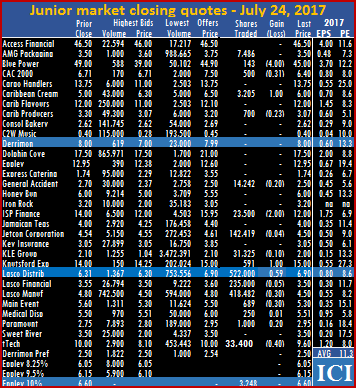

The Junior Market ended trading with an average of 1,691,772 units for an average value of $5,936,576 compared to 84,599 units for an average of $449,894 on Monday. The average volume and value for the month to date amounts to 239,926 units at $680,321, compared to 74,820 units valued at $371,129 previously. In contrast, June closed with averages of 395,969 units valued at $1,799,200 for each security traded. Consolidated Bakeries ended with 85,000 units changing hands, to close at $2.62. Dolphin Cove ended at $17.50 with 555 shares changing hands, Eppley gained 5 cents and closed trading with 16,985 shares at a new high of $13, General Accident added 1 cent and closed trading with 80,838 shares at $2.51, Honey Bun plunged $1 with 16,760 shares changing hands and closed at $5, ISP Finance slipped $2 and closed with 23,500 units changing hands at $12, Jetcon Corporation traded 62,653 shares to end at $4.61, after gaining 11 cents, Knutsford Express traded 4,481 shares to end at $15, Lasco Distributors closed 39 cents lower at $6.51 after trading 53,268 units, Lasco Financial rose 6 cents and ended with 57,505 shares changing hands at $3.56, Lasco Manufacturing shed 19 cents and ended with 2,107,735 shares trading at $4.31, Main Event lost 10 cents to close with 20,787 shares trading at $5.20, strong> Medical Disposables lost 1 cent in ending at $5.50 with 343 units trading, Paramount Trading ended with 72,354 units changing hands at $2.95 and tTech traded 4,699 units, falling 10 cents to close at $9.50.

Consolidated Bakeries ended with 85,000 units changing hands, to close at $2.62. Dolphin Cove ended at $17.50 with 555 shares changing hands, Eppley gained 5 cents and closed trading with 16,985 shares at a new high of $13, General Accident added 1 cent and closed trading with 80,838 shares at $2.51, Honey Bun plunged $1 with 16,760 shares changing hands and closed at $5, ISP Finance slipped $2 and closed with 23,500 units changing hands at $12, Jetcon Corporation traded 62,653 shares to end at $4.61, after gaining 11 cents, Knutsford Express traded 4,481 shares to end at $15, Lasco Distributors closed 39 cents lower at $6.51 after trading 53,268 units, Lasco Financial rose 6 cents and ended with 57,505 shares changing hands at $3.56, Lasco Manufacturing shed 19 cents and ended with 2,107,735 shares trading at $4.31, Main Event lost 10 cents to close with 20,787 shares trading at $5.20, strong> Medical Disposables lost 1 cent in ending at $5.50 with 343 units trading, Paramount Trading ended with 72,354 units changing hands at $2.95 and tTech traded 4,699 units, falling 10 cents to close at $9.50.

The Junior Market ended trading with an average of just 421,400 units for an average value of $1,619,355 compared to 26,921 units for an average value of $155,022 on Thursday. The average volume and value for the month to date amounts to 74,208 units valued at $366,206 compared 51,062 units valued at $282,663 previously. In contrast, June closed with averages of 395,969 units valued at $1,799,200 for each security traded.

The Junior Market ended trading with an average of just 421,400 units for an average value of $1,619,355 compared to 26,921 units for an average value of $155,022 on Thursday. The average volume and value for the month to date amounts to 74,208 units valued at $366,206 compared 51,062 units valued at $282,663 previously. In contrast, June closed with averages of 395,969 units valued at $1,799,200 for each security traded. Derrimon Trading ended at $8 with 10,404 shares changing hands, Dolphin Cove ended at $17.50 with 1,000 shares changing hands, Eppley jumped $1.15 and closed trading with 3.481 shares at $12.95, General Accident lost 2 cents and closed trading with 9,637 shares to end at $2.70, ISP Finance jumped $3 and closed with 5,858 units changing hands at $14, Jetcon Corporation traded 635,488 shares to end at $4.54, Key Insurance ended at $3.05 with 12,101 shares changing hands, Knutsford Express traded 11,540 shares to end at $14, Lasco Distributors closed 6 cents higher at $6.31 after trading 128,623 units, Lasco Financial ended with 15,048 shares changing hands at $3.55, Lasco Manufacturing gained 20 cents and ended with 2,260,729 shares trading at $4.80, Main Event closed with 11,972 shares trading at $5.60 and strong> Medical Disposables ended at $5.50 with 6,100 units trading, Paramount Trading ended with 1,140 units changing hands at $2.75.

Derrimon Trading ended at $8 with 10,404 shares changing hands, Dolphin Cove ended at $17.50 with 1,000 shares changing hands, Eppley jumped $1.15 and closed trading with 3.481 shares at $12.95, General Accident lost 2 cents and closed trading with 9,637 shares to end at $2.70, ISP Finance jumped $3 and closed with 5,858 units changing hands at $14, Jetcon Corporation traded 635,488 shares to end at $4.54, Key Insurance ended at $3.05 with 12,101 shares changing hands, Knutsford Express traded 11,540 shares to end at $14, Lasco Distributors closed 6 cents higher at $6.31 after trading 128,623 units, Lasco Financial ended with 15,048 shares changing hands at $3.55, Lasco Manufacturing gained 20 cents and ended with 2,260,729 shares trading at $4.80, Main Event closed with 11,972 shares trading at $5.60 and strong> Medical Disposables ended at $5.50 with 6,100 units trading, Paramount Trading ended with 1,140 units changing hands at $2.75.

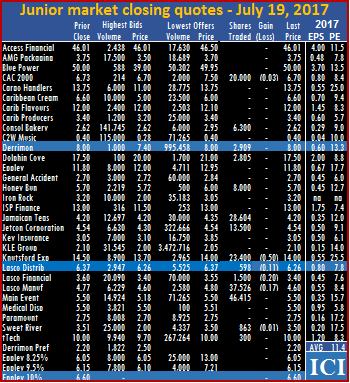

At the close of the market, AMG Packaging fell 65 cents to close at $3.10 with 18,689 units changing hands, Blue Power saw just 200 shares trading to end with a loss of $1 at $49, Cargo Handlers ended trading 24,500 shares to close at $13.75, Caribbean Cream closed trading with 8,000 units and fell $1.60 to end at a 52 weeks’ low of $5, Caribbean Flavours traded 2,500 units to end at $12, Caribbean Producers lost 10 cents and closed trading with 15,936 units, at $3.30. Derrimon Trading ended at $8 with 16,000 shares changing hands, Dolphin Cove ended at $17.50 with 1,900 shares changing hands, General Accident gained 2 cents and closed trading with 3,000 shares to end at $2.72,

At the close of the market, AMG Packaging fell 65 cents to close at $3.10 with 18,689 units changing hands, Blue Power saw just 200 shares trading to end with a loss of $1 at $49, Cargo Handlers ended trading 24,500 shares to close at $13.75, Caribbean Cream closed trading with 8,000 units and fell $1.60 to end at a 52 weeks’ low of $5, Caribbean Flavours traded 2,500 units to end at $12, Caribbean Producers lost 10 cents and closed trading with 15,936 units, at $3.30. Derrimon Trading ended at $8 with 16,000 shares changing hands, Dolphin Cove ended at $17.50 with 1,900 shares changing hands, General Accident gained 2 cents and closed trading with 3,000 shares to end at $2.72,  Honey Bun gained 30 cents and closed trading with 19,359 shares at $6, ISP Finance dropped $2 and closed with 31,752 units changing hands at $11, Jamaican Teas lost 20 cents and ended trading 82,972 shares at $4, Jetcon Corporation traded 266,595 shares to end at $4.54, Key Insurance ended at $3.05 with 12,101 shares changing hands, Knutsford Express traded 19,583 shares to end at $14, Lasco Distributors closed 1 cent lower at $6.25 after trading 7,138 units, Lasco Financial ended with 5,301 shares changing hands at $3.55, after rising 15 cents, Main Event rose 10 cents with 13,322 shares trading to end at $5.60, Medical Disposables ended at $5.50 with 6,100 units trading, Paramount Trading ended with 7,785 units changing hands at $2.75 and tTech traded 1,813 units to close at $10.

Honey Bun gained 30 cents and closed trading with 19,359 shares at $6, ISP Finance dropped $2 and closed with 31,752 units changing hands at $11, Jamaican Teas lost 20 cents and ended trading 82,972 shares at $4, Jetcon Corporation traded 266,595 shares to end at $4.54, Key Insurance ended at $3.05 with 12,101 shares changing hands, Knutsford Express traded 19,583 shares to end at $14, Lasco Distributors closed 1 cent lower at $6.25 after trading 7,138 units, Lasco Financial ended with 5,301 shares changing hands at $3.55, after rising 15 cents, Main Event rose 10 cents with 13,322 shares trading to end at $5.60, Medical Disposables ended at $5.50 with 6,100 units trading, Paramount Trading ended with 7,785 units changing hands at $2.75 and tTech traded 1,813 units to close at $10. Trading continued on a down ward path each day of the week and hit rock bottom on Wednesday as a mere 192,720 units traded on the Junior Market on Tuesday down from 401,316 units on Tuesday. Traded value declined to $1,219,105 from $2,286,974.

Trading continued on a down ward path each day of the week and hit rock bottom on Wednesday as a mere 192,720 units traded on the Junior Market on Tuesday down from 401,316 units on Tuesday. Traded value declined to $1,219,105 from $2,286,974.