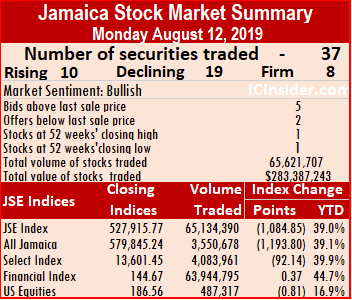

The past week, was fairly quiet for Jamaica Stock Exchange with earnings season for the second quarter just about ended.

The past week, was fairly quiet for Jamaica Stock Exchange with earnings season for the second quarter just about ended.

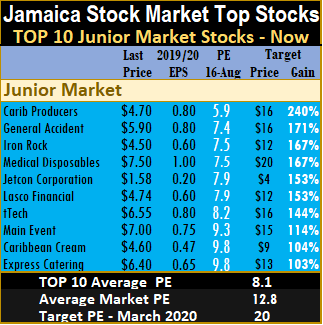

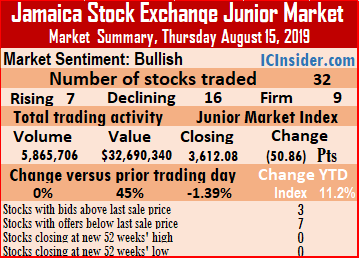

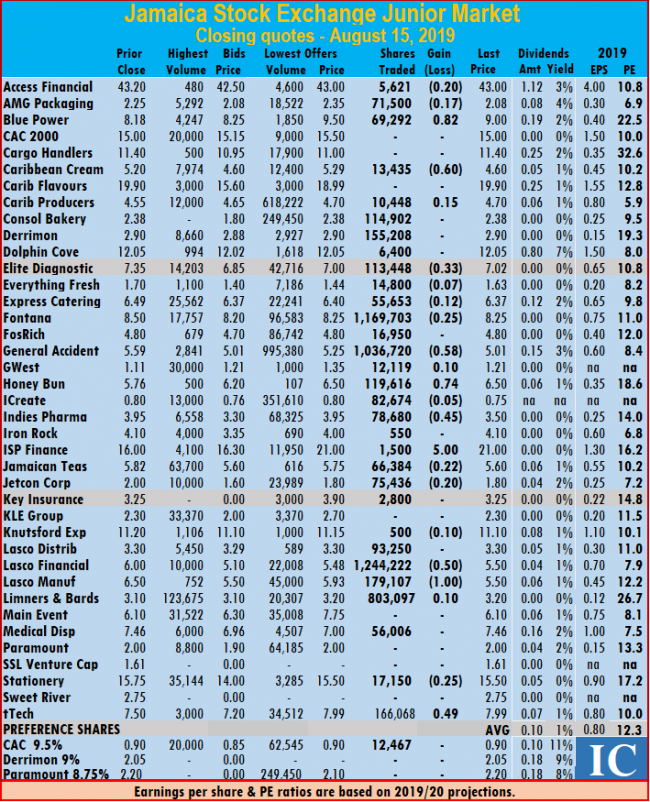

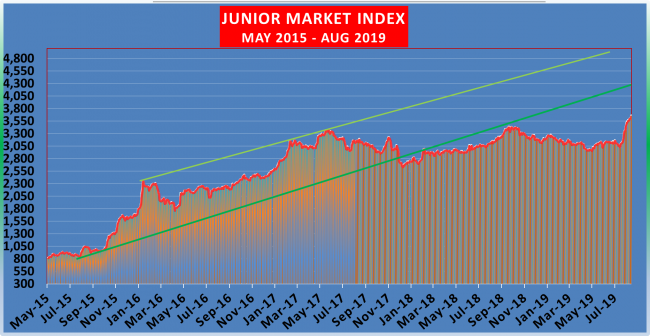

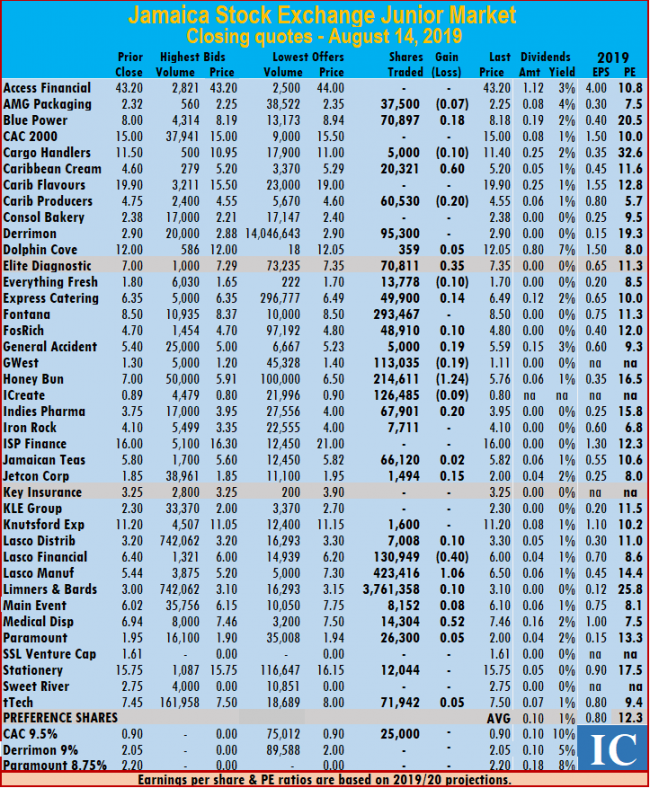

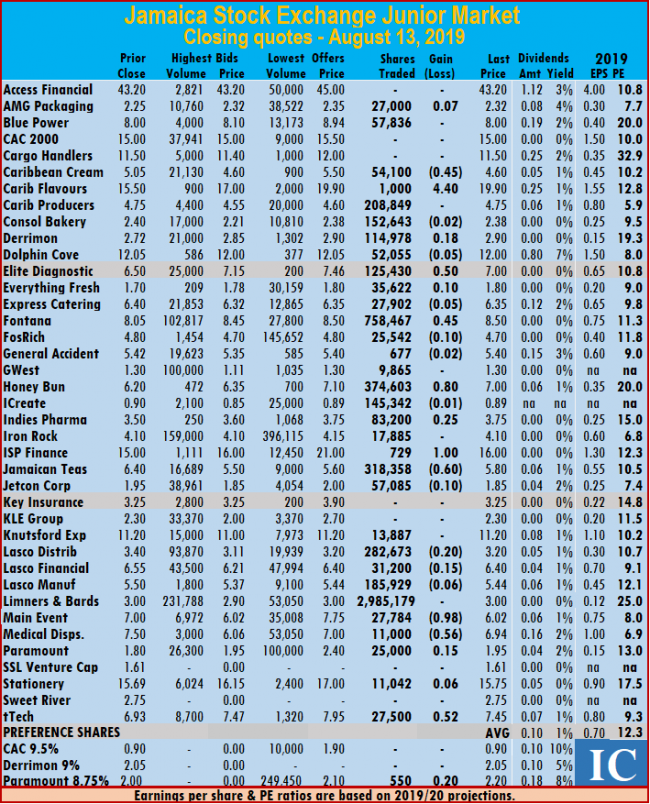

In the process, both markets reached new highs before pulling back to close the week below the record highs achieved earlier. The market activity led to a number of changes to the TOP 10 list. Consolidated Bakeries reported disappointing results for the June Quarter from strong growth in revenues and resulted in a downgrade in projected earnings, the stock along with CAC2000 and Caribbean Flavours fell from the Junior Market TOP 10. General Accident reported strong revenues and profit increase for the June quarter and half-year, resulting in earnings upgrade to 80 cents per share for the year and putting it back in the TOP 10 along with Caribbean Cream and Lasco Financial that fell under $5 on Friday.

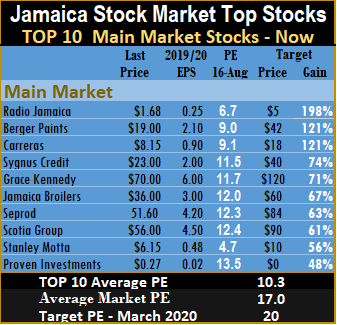

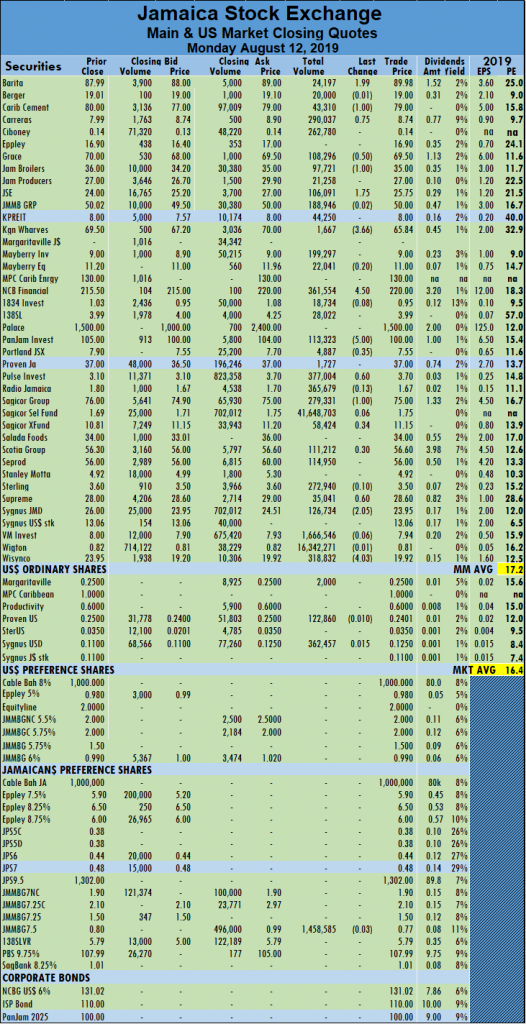

In the Main Market TOP 10, late bloomer, Sygnus Investments fell in price along with Seprod and return to the main market TOP 10, replacing by Pulse Investments and Palace Amusement.

The three most attractive Junior Market stocks are, Caribbean Producers with projected gains of 240 percent, followed General Accident with projected gains of 171 percent and by Iron Rock with likely gains of 167 percent.

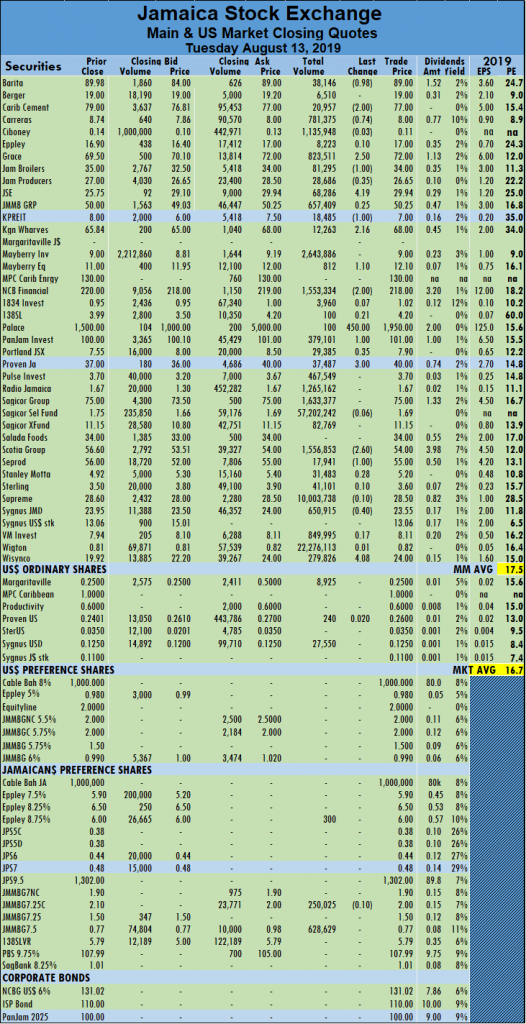

Radio Jamaica with projected gains of 198 percent leads the main market followed by Berger Paints and Carreras with potential gains of 121 percent each.

The main market closed the week with the overall PE of 17 and the Junior Market inched higher to 12.8 current year’s earnings.  The PE ratio for Junior Market Top 10 stocks averages 8.1 and the main market PE is now 10 3. These levels, point to big upside for TOP 10 stocks over the next 12 months and Junior Market stocks in particular as they lag, the values of the main market by a third.

The PE ratio for Junior Market Top 10 stocks averages 8.1 and the main market PE is now 10 3. These levels, point to big upside for TOP 10 stocks over the next 12 months and Junior Market stocks in particular as they lag, the values of the main market by a third.

The TOP 10 stocks now trade at an average discount of 37 percent to the average for the Junior Market Top stocks and main market stocks trade at a discount of 39 percent to the overall market.

TOP 10 stocks are likely to deliver the best returns within a 12 months period.  Projected earnings, for each company’s current fiscal year, are used in determining, the selected stocks. The PE for and projected earnings for each stock are computed to show potential gains for the year, which are ranked in descending order. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis as new information is received that can result in changes in and out of the list.

Projected earnings, for each company’s current fiscal year, are used in determining, the selected stocks. The PE for and projected earnings for each stock are computed to show potential gains for the year, which are ranked in descending order. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis as new information is received that can result in changes in and out of the list.

This report is compiled by persons who may have an interest in the securities commented on.

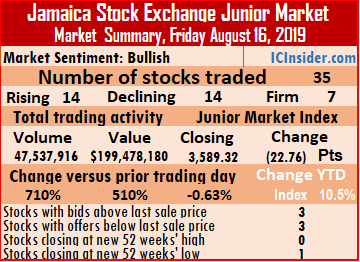

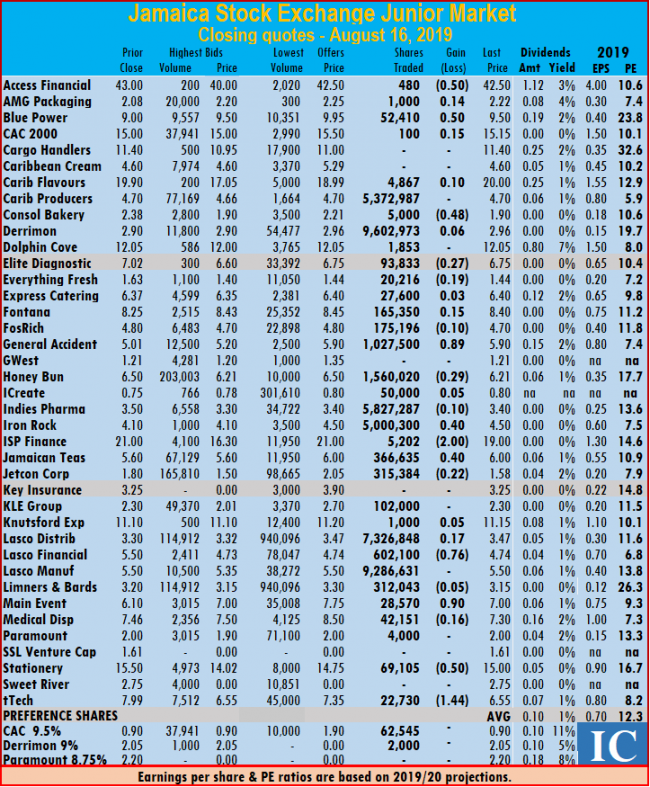

Stocks ending with price changes| Access Financial lost 50 cents in trading 480 shares to close at $42.50, AMG Packaging traded 1,000 shares, after rising 14 cents to end at $2.22, Blue Power climbed 50 cents and exchanged 52,410 shares at $9.50. CAC 2000 ended trading with 100 shares, after rising 15 cents to close at $15.15, Caribbean Flavours exchanged 4,867 shares, after rising 10 cents to end at $20. Consolidated Bakeries closed with a loss of 48 cents swapping 5,000 shares to settle at $1.90, Derrimon Trading closed 6 cents higher at $2.96, with 9,602,973 stock units changing hands, Express Catering climbed 3 cents in exchanging 27,600 shares to close at $6.40. Everything Fresh dipped 19 cents in trading of 20,216 units at $1.44, Elite Diagnostic shed 27 cents in trading of 93,833 units and ended at $6.75. Fosrich lost 10 cents trading of 175,196 units to close at $4.70, Fontana climbed 15 cents and exchanged 165,350 shares at $8.40, General Accident closed 89 cents higher at $5.90, with 1,027,500 stock units trading, Honey Bun fell 29 cents and ended market activity exchanging 1,560,020 shares to close at $6.21. iCreate climbed 5 cents and exchanged 50,000 shares at 80 cents, Indies Pharma dipped 10 cents in trading of 5,827,287 units at $3.40.

Stocks ending with price changes| Access Financial lost 50 cents in trading 480 shares to close at $42.50, AMG Packaging traded 1,000 shares, after rising 14 cents to end at $2.22, Blue Power climbed 50 cents and exchanged 52,410 shares at $9.50. CAC 2000 ended trading with 100 shares, after rising 15 cents to close at $15.15, Caribbean Flavours exchanged 4,867 shares, after rising 10 cents to end at $20. Consolidated Bakeries closed with a loss of 48 cents swapping 5,000 shares to settle at $1.90, Derrimon Trading closed 6 cents higher at $2.96, with 9,602,973 stock units changing hands, Express Catering climbed 3 cents in exchanging 27,600 shares to close at $6.40. Everything Fresh dipped 19 cents in trading of 20,216 units at $1.44, Elite Diagnostic shed 27 cents in trading of 93,833 units and ended at $6.75. Fosrich lost 10 cents trading of 175,196 units to close at $4.70, Fontana climbed 15 cents and exchanged 165,350 shares at $8.40, General Accident closed 89 cents higher at $5.90, with 1,027,500 stock units trading, Honey Bun fell 29 cents and ended market activity exchanging 1,560,020 shares to close at $6.21. iCreate climbed 5 cents and exchanged 50,000 shares at 80 cents, Indies Pharma dipped 10 cents in trading of 5,827,287 units at $3.40.  Iron Rock Insurance ended trading with 5,000,300 shares, after rising 40 cents to end at $4.50, ISP Finance closed with a loss of $2 at $19, in exchanging 5,202 shares, Jamaican Teas closed trading of 366,635 units and gained 40 cents to end at $6. Jetcon Corporation lost 22 cents in trading 315,384 shares to close at a 52 weeks’ low of $1.58, Knutsford Express climbed 5 cents and exchanged 1,000 shares at $11.15, Limners and Bards shed 5 cents in trading of 312,043 units at $3.15, Lasco Distributors ended trading with 7,326,848 shares, after rising 17 cents to end at $3.47. Lasco Financial closed with a loss of 76 cents at $4.74, as 602,100 shares changed hands, Medical Disposables ended market activity exchanging 42,151 shares to close at $7.30 after falling 16 cents. Main Event exchanged 28,570 units and gained 90 cents to end at $7, Stationery and Office Supplies fell 50 cents, trading 69,105 units to close at $15 and tTech dropped $1.44 in trading of 22,730 units to finish at $6.55.

Iron Rock Insurance ended trading with 5,000,300 shares, after rising 40 cents to end at $4.50, ISP Finance closed with a loss of $2 at $19, in exchanging 5,202 shares, Jamaican Teas closed trading of 366,635 units and gained 40 cents to end at $6. Jetcon Corporation lost 22 cents in trading 315,384 shares to close at a 52 weeks’ low of $1.58, Knutsford Express climbed 5 cents and exchanged 1,000 shares at $11.15, Limners and Bards shed 5 cents in trading of 312,043 units at $3.15, Lasco Distributors ended trading with 7,326,848 shares, after rising 17 cents to end at $3.47. Lasco Financial closed with a loss of 76 cents at $4.74, as 602,100 shares changed hands, Medical Disposables ended market activity exchanging 42,151 shares to close at $7.30 after falling 16 cents. Main Event exchanged 28,570 units and gained 90 cents to end at $7, Stationery and Office Supplies fell 50 cents, trading 69,105 units to close at $15 and tTech dropped $1.44 in trading of 22,730 units to finish at $6.55.

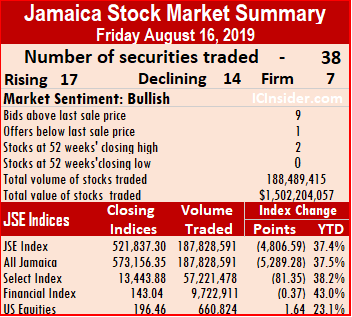

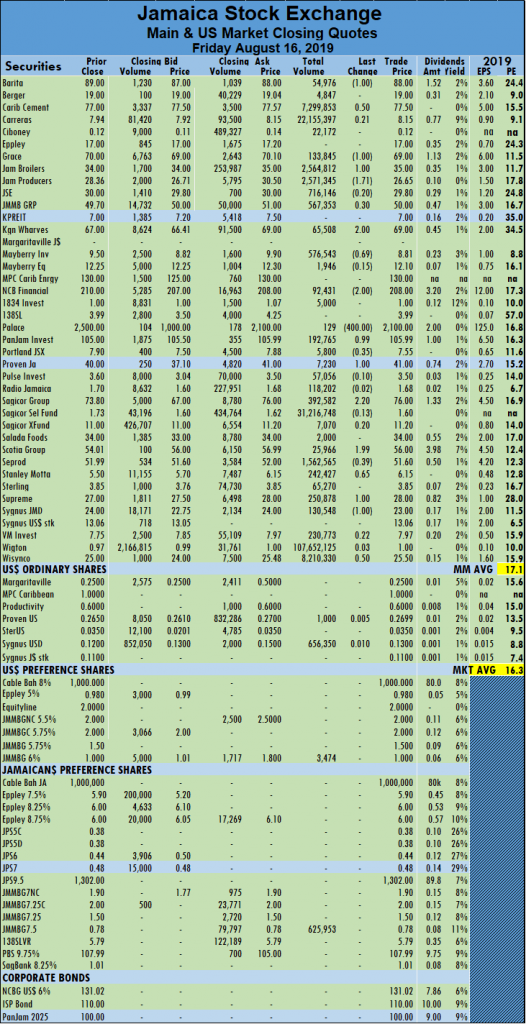

At the close of trading, Wigton Windfarm ended trading at a 52 weeks’ closing high of $1 and Stanley Motta at $6.15.

At the close of trading, Wigton Windfarm ended trading at a 52 weeks’ closing high of $1 and Stanley Motta at $6.15. Proven Investments rose $1 in trading 7,230 at $41, Sagicor Group jumped $2.20 in trading 392,582 shares to close at $76, Scotia Group climbed $1.99 to $56 with 25,966 shares changing hands, Seprod lost 39 cents in trading 1,562,565 shares at $51.60, Stanley Motta gained 65 cents in closing at an all-time high of $6.15 while swapping 242,427 stock units. Supreme Ventures rose $1 to close at $28 with an exchange of 250,878 shares, Sygnus Credit Investments fell $1 in trading 130,773 units to close at $23 and Wisynco Group climbed 50 cents to settle at $25.50 with 8,210,330 shares changing hands.

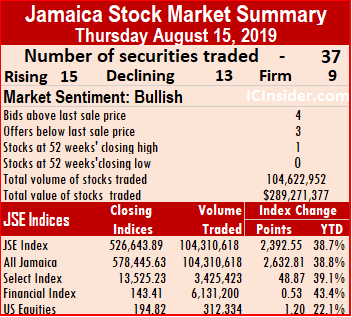

Proven Investments rose $1 in trading 7,230 at $41, Sagicor Group jumped $2.20 in trading 392,582 shares to close at $76, Scotia Group climbed $1.99 to $56 with 25,966 shares changing hands, Seprod lost 39 cents in trading 1,562,565 shares at $51.60, Stanley Motta gained 65 cents in closing at an all-time high of $6.15 while swapping 242,427 stock units. Supreme Ventures rose $1 to close at $28 with an exchange of 250,878 shares, Sygnus Credit Investments fell $1 in trading 130,773 units to close at $23 and Wisynco Group climbed 50 cents to settle at $25.50 with 8,210,330 shares changing hands. At the close on Thursday, the Jamaica Stock Exchange Junior Market pulled back from the record high reached on Wednesday and indications at the close suggest more declines are likely on Friday.

At the close on Thursday, the Jamaica Stock Exchange Junior Market pulled back from the record high reached on Wednesday and indications at the close suggest more declines are likely on Friday.

ISP Finance jumped $5 to end at $21, trading 1,500 shares, Jamaican Teas exchanged 66,384 shares to close at $5.60 after falling 22 cents. Jetcon Corporation dipped 20 cents in trading of 75,436 units at $1.80, Knutsford Express fell 10 cents in trading of 500 units at $11.10. Limners and Bards traded 803,097 shares, after rising 10 cents to end at $3.20, Lasco Financial fell 50 cents in trading of 1,244,222 units at $5.50 after the company posted slightly lower first quarter profits, Lasco Manufacturing ended with a loss of 1 cent at $5.50 with 179,107 stock units changing hands. Stationery and Office Supplies fell 25 cents in trading of 17,150 units at $15.50 and tTech Limited climbed 49 cents in exchanging 166,068 shares at $7.99.

ISP Finance jumped $5 to end at $21, trading 1,500 shares, Jamaican Teas exchanged 66,384 shares to close at $5.60 after falling 22 cents. Jetcon Corporation dipped 20 cents in trading of 75,436 units at $1.80, Knutsford Express fell 10 cents in trading of 500 units at $11.10. Limners and Bards traded 803,097 shares, after rising 10 cents to end at $3.20, Lasco Financial fell 50 cents in trading of 1,244,222 units at $5.50 after the company posted slightly lower first quarter profits, Lasco Manufacturing ended with a loss of 1 cent at $5.50 with 179,107 stock units changing hands. Stationery and Office Supplies fell 25 cents in trading of 17,150 units at $15.50 and tTech Limited climbed 49 cents in exchanging 166,068 shares at $7.99.

NCB Financial lost $4 trading 44,927 shares to close at $210, PanJam Investment ended with a loss of $1 at $105 with 150,865 stock units changing hands, Pulse Investments ended trading with 50,000 shares and rose 60 cents to end at $3.60. Scotia Group climbed $1.01 to $54.01 with 68,815 shares changing hands, Supreme Ventures ended with a loss of $1 at $27 with an exchange of 138,518 shares, Sygnus Credit fell 50 cents in trading of 105,993 units to close at $24 and Wisynco Group climbed $1.50 to settle at $25 with 1,050,510 shares changing hands.

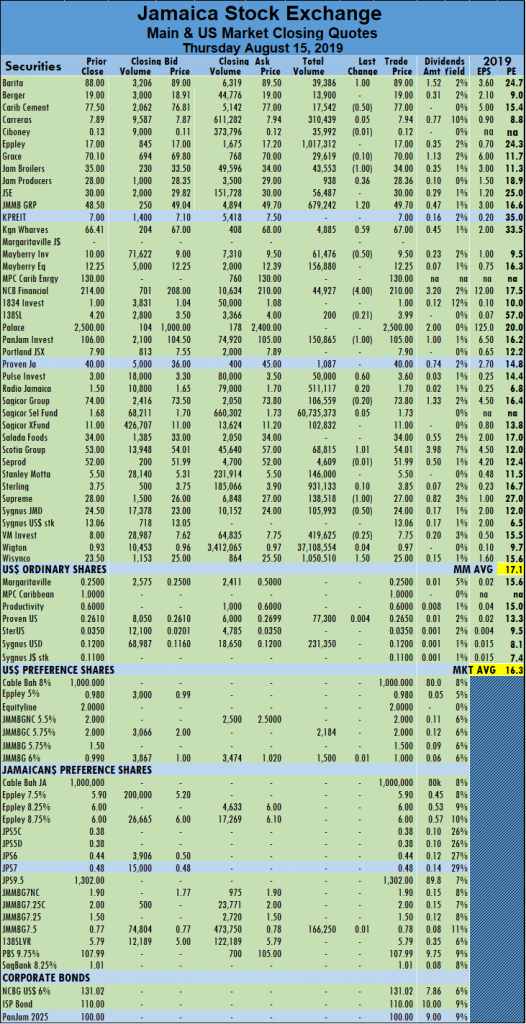

NCB Financial lost $4 trading 44,927 shares to close at $210, PanJam Investment ended with a loss of $1 at $105 with 150,865 stock units changing hands, Pulse Investments ended trading with 50,000 shares and rose 60 cents to end at $3.60. Scotia Group climbed $1.01 to $54.01 with 68,815 shares changing hands, Supreme Ventures ended with a loss of $1 at $27 with an exchange of 138,518 shares, Sygnus Credit fell 50 cents in trading of 105,993 units to close at $24 and Wisynco Group climbed $1.50 to settle at $25 with 1,050,510 shares changing hands. The main market of the Jamaica Stock Exchange failed to benefit from the improved profit results reported by companies ahead of trading, as the market pulled back with the heavily weighted NCB Financial falling $4 along with large declines by others that had reported results days earlier.

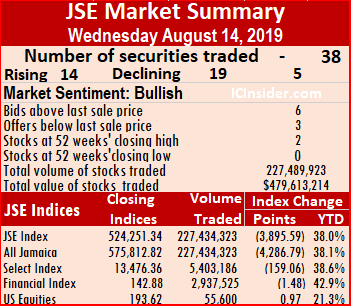

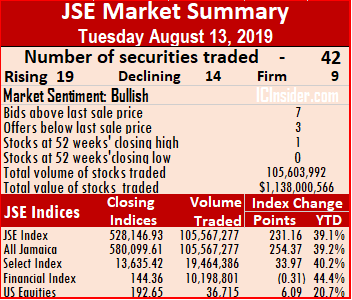

The main market of the Jamaica Stock Exchange failed to benefit from the improved profit results reported by companies ahead of trading, as the market pulled back with the heavily weighted NCB Financial falling $4 along with large declines by others that had reported results days earlier.  Sagicor Select Fund followed with 102 million shares accounting for 45 percent of the day’s trade and

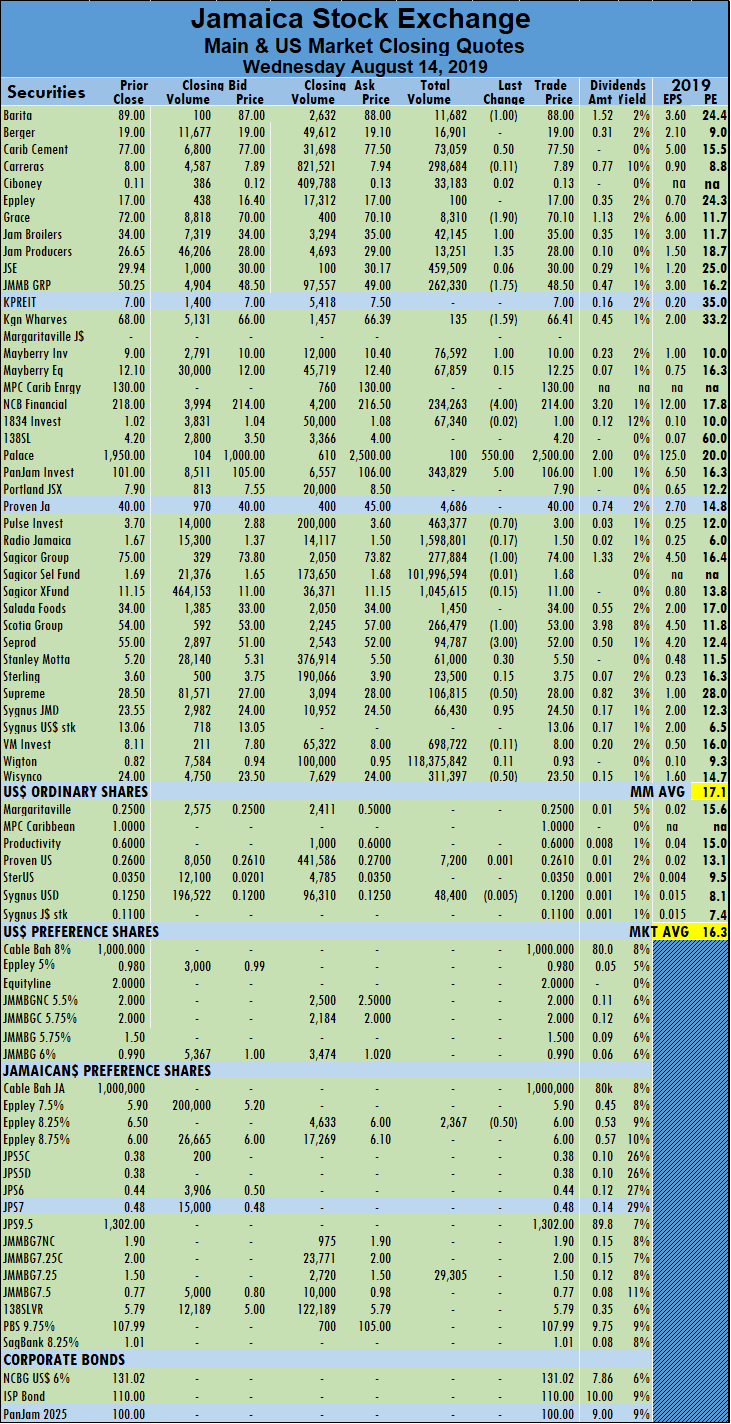

Sagicor Select Fund followed with 102 million shares accounting for 45 percent of the day’s trade and  NCB Financial lost $4 in exchanging 234,263 units to close $214. PanJam Investment added $5 in trading of 343,829 units at $106, Pulse Investments fell 70 cents in exchanging 463,377 shares at $3, Sagicor Group closed trading of 277,884 units but declined $1 to end at $74. Scotia Group dropped $1 to close at $53 in trading of 266,479 units, Seprod dipped $3 in trading 94,787 shares to end at $52, Sygnus Credit Investments rose 95 cents in trading 66,430 shares to end at $24.50 and Wisynco Group fell 50 cents to $23.50 after exchanging 311,397 units.

NCB Financial lost $4 in exchanging 234,263 units to close $214. PanJam Investment added $5 in trading of 343,829 units at $106, Pulse Investments fell 70 cents in exchanging 463,377 shares at $3, Sagicor Group closed trading of 277,884 units but declined $1 to end at $74. Scotia Group dropped $1 to close at $53 in trading of 266,479 units, Seprod dipped $3 in trading 94,787 shares to end at $52, Sygnus Credit Investments rose 95 cents in trading 66,430 shares to end at $24.50 and Wisynco Group fell 50 cents to $23.50 after exchanging 311,397 units.

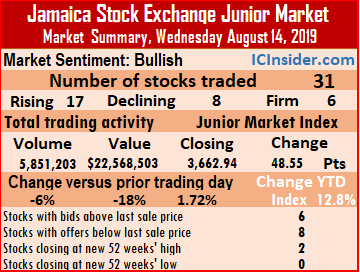

Market activities resulted in an exchange of 5,851,203 units valued at $22,568,503 compared to 6,250,912 units valued at $27,428,507 trading on Tuesday.

Market activities resulted in an exchange of 5,851,203 units valued at $22,568,503 compared to 6,250,912 units valued at $27,428,507 trading on Tuesday. Honey Bun close with a loss of $1.24 at $5.76, after swapping 214,611 shares, iCreate fell 9 cents trading of 126,485 units to end at 80 cents. Indies Pharma closed 20 cents higher at $3.95, with 67,901 stock units trading, Jamaican Teas closed trading of 66,120 units and gained 2 cents to end at $5.82, Jetcon Corporation exchanged 1,494 units and gained 15 cents to end at $2.

Honey Bun close with a loss of $1.24 at $5.76, after swapping 214,611 shares, iCreate fell 9 cents trading of 126,485 units to end at 80 cents. Indies Pharma closed 20 cents higher at $3.95, with 67,901 stock units trading, Jamaican Teas closed trading of 66,120 units and gained 2 cents to end at $5.82, Jetcon Corporation exchanged 1,494 units and gained 15 cents to end at $2.

Palace Amusement traded just 100 shares and jumped $450 to close at a record high of $1,950, PanJam Investment added $1 in trading of 379,101 units at $101, Portland JSX recovered the 35 cents lost on Monday in exchanging 29,385 shares at $7.90, Proven Investments closed trading of 37,487 units and gained $3 to end at $40. Scotia Group dropped $2.60 to close at $54 in trading of 1,556,853 units, Seprod dipped $1 in trading 17,941 shares to end at $55, Sygnus Credit Investments lost 40 cents in trading 650,915 shares to end at $23.55 and Wisynco Group jumped $4.08 to $24 after exchanging 279,826 units.

Palace Amusement traded just 100 shares and jumped $450 to close at a record high of $1,950, PanJam Investment added $1 in trading of 379,101 units at $101, Portland JSX recovered the 35 cents lost on Monday in exchanging 29,385 shares at $7.90, Proven Investments closed trading of 37,487 units and gained $3 to end at $40. Scotia Group dropped $2.60 to close at $54 in trading of 1,556,853 units, Seprod dipped $1 in trading 17,941 shares to end at $55, Sygnus Credit Investments lost 40 cents in trading 650,915 shares to end at $23.55 and Wisynco Group jumped $4.08 to $24 after exchanging 279,826 units.

Lasco Distributors lost 20 cents trading 282,673 units to close at $3.20, Lasco Financial dipped 15 cents with 31,200 units crossing the exchange at $6.40, Lasco Manufacturing declined 6 cents in exchanging 185,929 units to settle at $5.44. Medical Disposables lost 56 cents trading 11,000 shares to close at $6.94, Main Event fell 98 cents in exchanging 27,784 shares to close at $6.02. Paramount Trading closed with 25,000 units changing hands with a rise of 15 cents to end at $1.95, Stationery and Office Supplies climbed 6 cents and exchanged 11,042 shares to end at a record close of $15.75 and tTech Limited closed trading of 27,500 units and gained 52 cents to end at a 52 weeks’ high of $7.45.

Lasco Distributors lost 20 cents trading 282,673 units to close at $3.20, Lasco Financial dipped 15 cents with 31,200 units crossing the exchange at $6.40, Lasco Manufacturing declined 6 cents in exchanging 185,929 units to settle at $5.44. Medical Disposables lost 56 cents trading 11,000 shares to close at $6.94, Main Event fell 98 cents in exchanging 27,784 shares to close at $6.02. Paramount Trading closed with 25,000 units changing hands with a rise of 15 cents to end at $1.95, Stationery and Office Supplies climbed 6 cents and exchanged 11,042 shares to end at a record close of $15.75 and tTech Limited closed trading of 27,500 units and gained 52 cents to end at a 52 weeks’ high of $7.45.

PanJam Investment lost $5 in trading of 113,323 units at $100, Portland JSX fell 35 cents in exchanging 4,887 shares at $7.55, Pulse Investments closed trading of 377,004 units and gained 60 cents to end at $ 3.70, Sagicor Group dipped $1 in trading 279,331 shares to end at $7. Sagicor Real Estate Fund climbed 34 cents trading 58,424 shares to end $11.15, on the second day of trading on the local market. Scotia Group closed trading of 111,212 units and gained 30 cents to end at $ 56.60, Supreme Ventures climbed 60 cents and exchanged 35,041 shares at $28.60, Sygnus Credit Investments fell $2.05 in trading 126,734 shares to end at $23.95 and Wisynco Group exchanged 318,832 units after falling $4.03 to close at $19.92.

PanJam Investment lost $5 in trading of 113,323 units at $100, Portland JSX fell 35 cents in exchanging 4,887 shares at $7.55, Pulse Investments closed trading of 377,004 units and gained 60 cents to end at $ 3.70, Sagicor Group dipped $1 in trading 279,331 shares to end at $7. Sagicor Real Estate Fund climbed 34 cents trading 58,424 shares to end $11.15, on the second day of trading on the local market. Scotia Group closed trading of 111,212 units and gained 30 cents to end at $ 56.60, Supreme Ventures climbed 60 cents and exchanged 35,041 shares at $28.60, Sygnus Credit Investments fell $2.05 in trading 126,734 shares to end at $23.95 and Wisynco Group exchanged 318,832 units after falling $4.03 to close at $19.92.