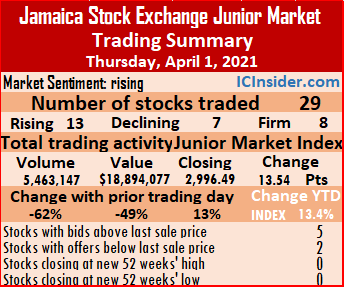

Trading closed on Thursday with the market climbing over the 3,000-point mark but failing for a second week to close above it on a day when more stocks rose than declined after a 62 percent decline in the volume of shares traded valued 49 percent less than on Wednesday on the Junior Market of the Jamaica Stock Exchange.

Trading ended with 29 active securities, down from 30 on Wednesday, resulting in prices of 13 rising, seven declining and nine remaining unchanged. At the close, the Junior Market Index advanced 13.54 points to settle at 2,996.49.

Trading ended with 29 active securities, down from 30 on Wednesday, resulting in prices of 13 rising, seven declining and nine remaining unchanged. At the close, the Junior Market Index advanced 13.54 points to settle at 2,996.49.

The average PE Ratio ended at 17.2 based on ICInsider.com’s forecast of 2020-21 earnings.

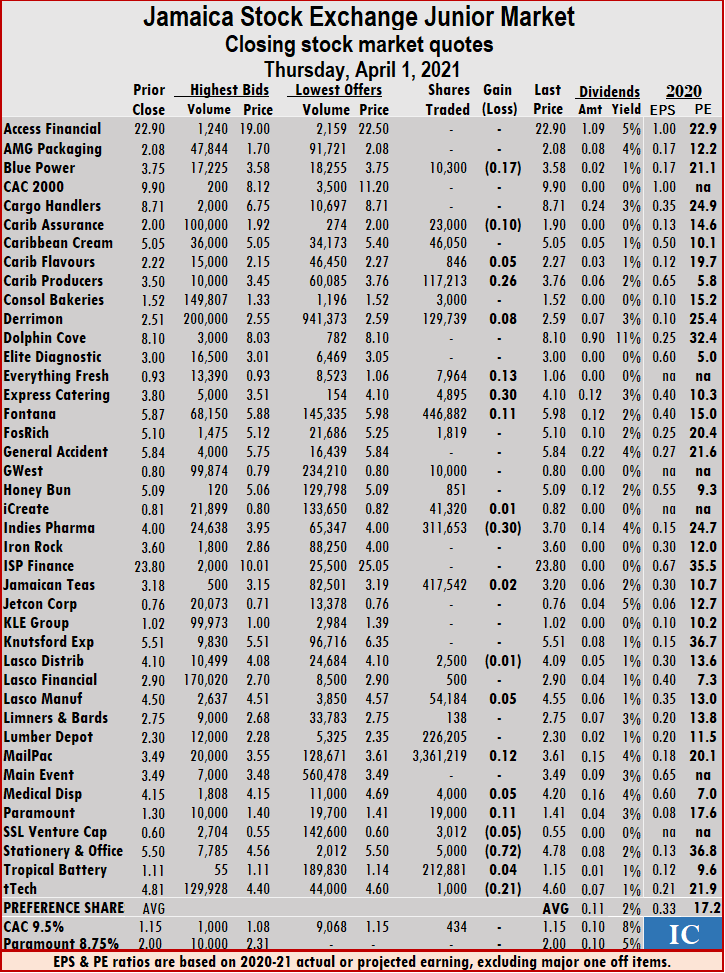

The market closed with an exchange of 5,463,147 shares for $18,894,077 compared to 14,376,733 units at $36,855,263 on Wednesday. Mailpac Group dominated trading with 61.5 percent of total volume for 3.36 million shares followed by Fontana with 8.2 percent for 446,882 units and Jamaican Teas with 7.6 percent market share for 417,542 units.

Trading averaged 188,384 units at $651,520, in contrast to 479,224 at $1,228,509 on Wednesday. March closed with an average of 252,633 units at $733,196.

Investor’s Choice bid-offer indicator shows five stocks ending with bids higher than their last selling prices and two with lower offers.

Investor’s Choice bid-offer indicator shows five stocks ending with bids higher than their last selling prices and two with lower offers.

At the close of the market, Blue Power shed 17 cents in closing at $3.58 and exchanging 10,300 shares, Caribbean Assurance Brokers slipped 10 cents to $1.90 with the swapping of 23,000 shares, Caribbean Flavours picked up 5 cents to finish at $2.27 in an exchange of 846 stocks. Caribbean Producers rose 26 cents to close at $3.76 after trading 117,213 units, Derrimon Trading gained 8 cents to settle at $2.59 trading 129,739 stocks, Everything Fresh rose 13 cents to $1.06 in switching ownership of 7,964 shares. Express Catering gained 30 cents to close at $4.10, with 4,895 stock units clearing the market, Fontana added 11 cents to finish at $5.98 with 446,882 units changing hands, Indies Pharma lost 30 cents to end at $3.70 with the swapping of 311,653 stock units. Lasco Manufacturing picked up 5 cents in closing at $4.55 in switching ownership of 54,184 shares, Mailpac Group rose 12 cents to $3.61 in trading 3,361,219 stock units, Medical Disposables gained 5 cents in closing at $4.20 after 4,000 shares changed hands.  Paramount Trading ended 11 cents higher at $1.41 trading 19,000 stock units, SSL Venture closed 5 cents lower at 55 cents in switching ownership of 3,012 units, Stationery and Office Supplies fell 72 cents to $4.78 with the transfer of 5,000 stocks. Tropical Battery increased 4 cents to end at $1.15 with an exchange of 212,881 stock units and tTech shed 21 cents to end at $4.60 in trading 1,000 stock units.

Paramount Trading ended 11 cents higher at $1.41 trading 19,000 stock units, SSL Venture closed 5 cents lower at 55 cents in switching ownership of 3,012 units, Stationery and Office Supplies fell 72 cents to $4.78 with the transfer of 5,000 stocks. Tropical Battery increased 4 cents to end at $1.15 with an exchange of 212,881 stock units and tTech shed 21 cents to end at $4.60 in trading 1,000 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

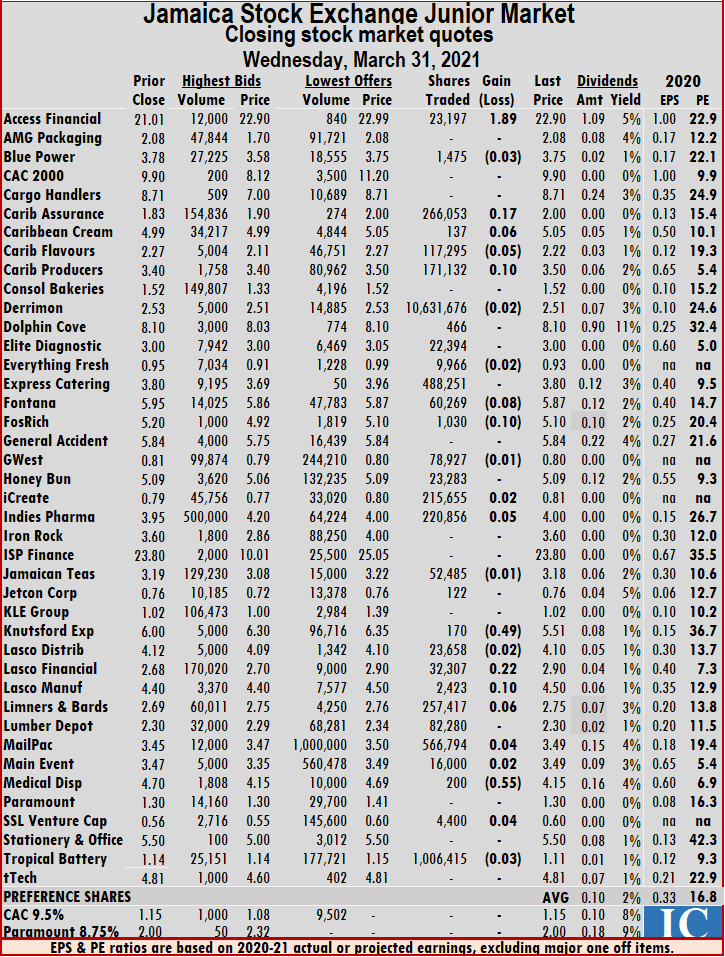

The market index climbed 13.95 points to finish at 2,982.95. Just 30 securities traded, down from 38 on Tuesday, resulting in 13 stocks rising, 12 declining and five closed unchanged, resulting in 14,376,733 shares trading for $36,855,263, up from 3,008,031 shares for $7,749,677 on Monday. The average PE Ratio ended at 16.8 based on ICInsider.com’s forecast of 2020-21 earnings.

The market index climbed 13.95 points to finish at 2,982.95. Just 30 securities traded, down from 38 on Tuesday, resulting in 13 stocks rising, 12 declining and five closed unchanged, resulting in 14,376,733 shares trading for $36,855,263, up from 3,008,031 shares for $7,749,677 on Monday. The average PE Ratio ended at 16.8 based on ICInsider.com’s forecast of 2020-21 earnings. Trading led trading with 74 percent, with a transfer of 10.7 million units, followed by Tropical Battery with one million units for 7 percent of the day’s trade and Mailpac with 3.9 percent after trading 566,794 shares,

Trading led trading with 74 percent, with a transfer of 10.7 million units, followed by Tropical Battery with one million units for 7 percent of the day’s trade and Mailpac with 3.9 percent after trading 566,794 shares, Limners and Bards rose 6 cents to $2.75, with 257,417 stock units changing hands, Lumber Depot slipped 7 cents to $2.30 with a transfer of 359,623 units, Mailpac Group picked up 4 cents to finish at $3.49 trading 566,794 stock units. Medical Disposables traded 200 shares but lost 55 cents to close at $4.15 and SSL Venture Capital rose 4 cents to 60 cents while trading 4.400 shares.

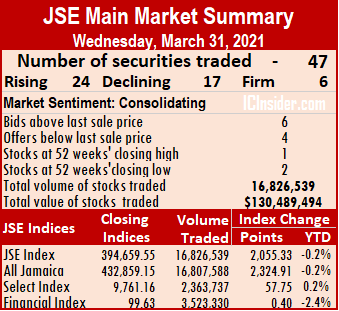

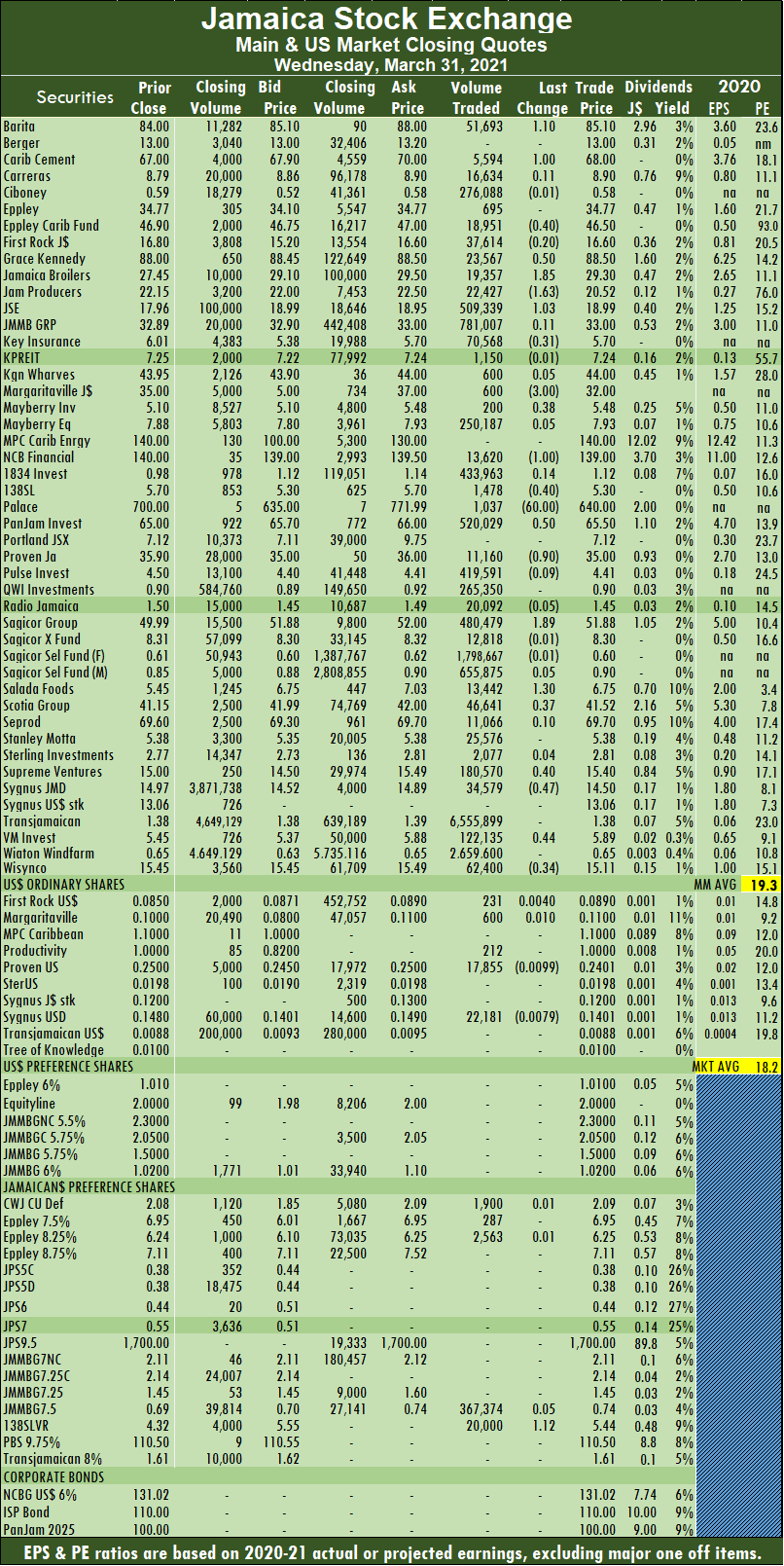

Limners and Bards rose 6 cents to $2.75, with 257,417 stock units changing hands, Lumber Depot slipped 7 cents to $2.30 with a transfer of 359,623 units, Mailpac Group picked up 4 cents to finish at $3.49 trading 566,794 stock units. Medical Disposables traded 200 shares but lost 55 cents to close at $4.15 and SSL Venture Capital rose 4 cents to 60 cents while trading 4.400 shares. The All Jamaican Composite Index advanced 2,324.91 points to 432,859.15, the Main Index rose 2,055.33 points to 394,659.55 and the JSE Financial Index gained 0.40 points to settle at 99.63.

The All Jamaican Composite Index advanced 2,324.91 points to 432,859.15, the Main Index rose 2,055.33 points to 394,659.55 and the JSE Financial Index gained 0.40 points to settle at 99.63. Investor’s Choice bid-offer indicator reading has twelve stocks ending with bids higher than their last selling prices and three with lower offers.

Investor’s Choice bid-offer indicator reading has twelve stocks ending with bids higher than their last selling prices and three with lower offers. Proven Investments shed 90 cents to close at $35 with an exchange of 11,160 stocks, Sagicor Group advanced $1.89 to close at $51.88 in trading 480,479 shares, Salada Foods rose $1.30 to close at a 52 weeks’ high of $6.75 with a transfer of 13,442 stocks, Scotia Group gained 37 cents to close at $41.52 trading 46,641 units. Supreme Ventures rose 40 cents to close at $15.40 with the swapping of 180,570 stock units, Sygnus Credit Investments declined 47 cents to $14.50 trading 34,579 units, Victoria Mutual Investments advanced 44 cents to $5.89 with the swapping of 122,135 shares, Wisynco Group shed 34 cents to close at $15.11 in exchanging 62,400 shares.

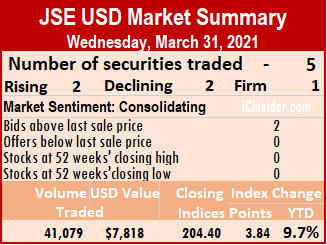

Proven Investments shed 90 cents to close at $35 with an exchange of 11,160 stocks, Sagicor Group advanced $1.89 to close at $51.88 in trading 480,479 shares, Salada Foods rose $1.30 to close at a 52 weeks’ high of $6.75 with a transfer of 13,442 stocks, Scotia Group gained 37 cents to close at $41.52 trading 46,641 units. Supreme Ventures rose 40 cents to close at $15.40 with the swapping of 180,570 stock units, Sygnus Credit Investments declined 47 cents to $14.50 trading 34,579 units, Victoria Mutual Investments advanced 44 cents to $5.89 with the swapping of 122,135 shares, Wisynco Group shed 34 cents to close at $15.11 in exchanging 62,400 shares. Five securities traded, compared to four on Tuesday, with the prices of two rising, two declining and one remaining unchanged.

Five securities traded, compared to four on Tuesday, with the prices of two rising, two declining and one remaining unchanged. Margaritaville rose by 1 cent to end at 11 US cents trading 600 stock units, Productive Business Solutions ended at US$1 in switching ownership of 212 stock units. Proven Investments shed 0.99 cents to end at 24.01 US cents while trading 17,855 units and Sygnus Credit Investments declined 0.79 of a cent to close at 14.01 US cents in exchanging 22,181 units.

Margaritaville rose by 1 cent to end at 11 US cents trading 600 stock units, Productive Business Solutions ended at US$1 in switching ownership of 212 stock units. Proven Investments shed 0.99 cents to end at 24.01 US cents while trading 17,855 units and Sygnus Credit Investments declined 0.79 of a cent to close at 14.01 US cents in exchanging 22,181 units.

Trading averaged 739,966 units at $5,962,582, up from an average of 279,882 shares at $2,106,961 on Monday. Trading month to date averages 354,133 units at $2,532,457, up from 338,336 units at $2,392,022 on Monday. February closed with an average of 419,015 units at $2,509,660.

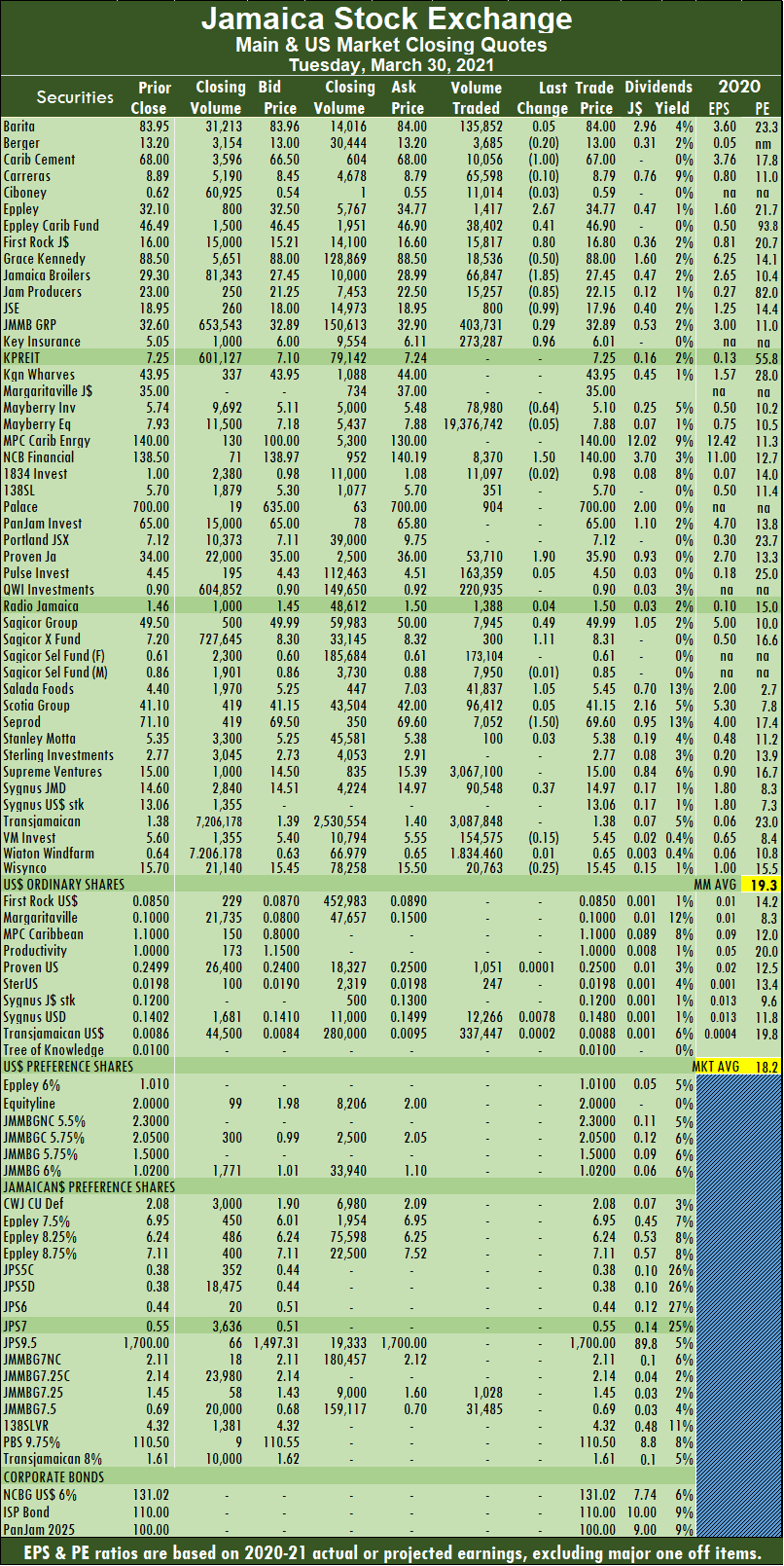

Trading averaged 739,966 units at $5,962,582, up from an average of 279,882 shares at $2,106,961 on Monday. Trading month to date averages 354,133 units at $2,532,457, up from 338,336 units at $2,392,022 on Monday. February closed with an average of 419,015 units at $2,509,660.  NCB Financial rose $1.50 to $140 in exchanging 8,370 shares, Proven Investments gained $1.90 to $35.90 trading 53,710 stock units. Sagicor Group advanced 49 cents to $49.99 with the swapping of 7,945 units. Sagicor Real Estate Fund rose $1.11 to $8.31 after a transfer of 300 stocks, Salada Foods jumped $1.05 to a record close of $5.45, trading 41,837 stock units. Seprod shed $1.50 to close at $69.60 in an exchange of 7,052 stock units, Sygnus Credit Investments gained 37 cents in ending at $14.97 trading 90,548 units and Wisynco Group fell 25 cents to $15.45 after a transfer of 20,763 shares.

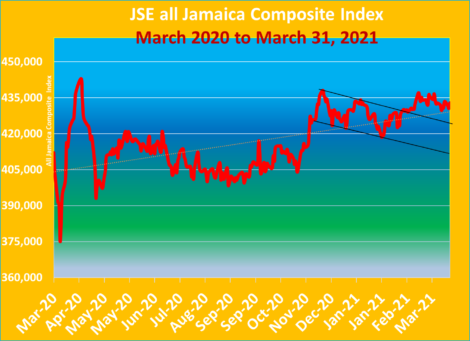

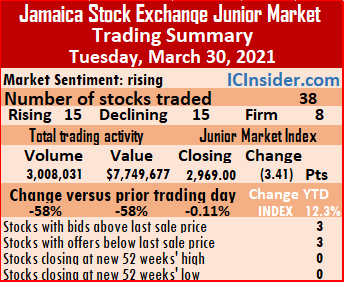

NCB Financial rose $1.50 to $140 in exchanging 8,370 shares, Proven Investments gained $1.90 to $35.90 trading 53,710 stock units. Sagicor Group advanced 49 cents to $49.99 with the swapping of 7,945 units. Sagicor Real Estate Fund rose $1.11 to $8.31 after a transfer of 300 stocks, Salada Foods jumped $1.05 to a record close of $5.45, trading 41,837 stock units. Seprod shed $1.50 to close at $69.60 in an exchange of 7,052 stock units, Sygnus Credit Investments gained 37 cents in ending at $14.97 trading 90,548 units and Wisynco Group fell 25 cents to $15.45 after a transfer of 20,763 shares. At the close, the market index slipped 3.41 points to finish at 2,969, with the market enjoying a 12.3 percent rise for the year, with just one more day left for the first quarter to end. This year’s performance contrast with a 32.7 fall in the market index at the same time in 2020. Since then, the market has gained 32 percent in value.

At the close, the market index slipped 3.41 points to finish at 2,969, with the market enjoying a 12.3 percent rise for the year, with just one more day left for the first quarter to end. This year’s performance contrast with a 32.7 fall in the market index at the same time in 2020. Since then, the market has gained 32 percent in value. Trading averaged 79,159 units at $203,939, down from 195,011 at $497,993 on Monday. Trading month to date averages 243,918 units at $714,145, verusu 252,356 units at $740,275 on Monday. February closed with an average of 365,365 units at $881,118.

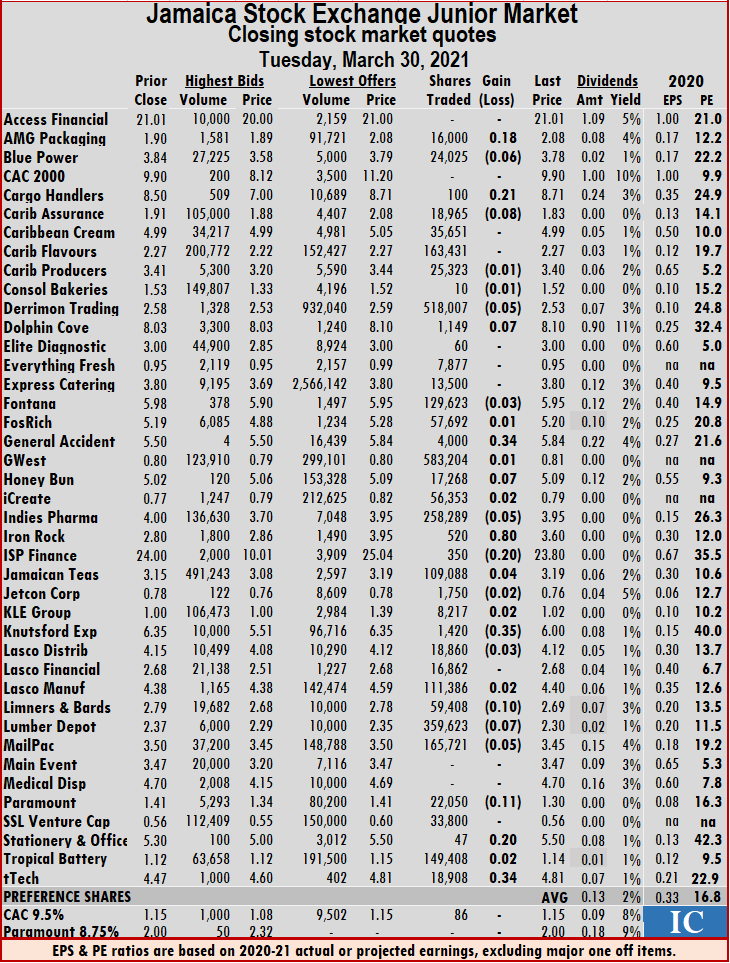

Trading averaged 79,159 units at $203,939, down from 195,011 at $497,993 on Monday. Trading month to date averages 243,918 units at $714,145, verusu 252,356 units at $740,275 on Monday. February closed with an average of 365,365 units at $881,118. Limners and Bards fell 10 cents to $2.69, with 59,408 stock units changing hands, Lumber Depot slipped 7 cents to $2.30 with a transfer of 359,623 units, Mailpac Group lost 5 cents to finish at $3.45 with an exchange of 165,721 stock units. Paramount Trading declined by 11 cents to end at $1.30 with investors swapping 22,050 units, Stationery and Office Supplies advanced 20 cents to $5.50 with 47 units traded and tTech climbed 34 cents to $4.81 with 18,908 shares crossing the exchange.

Limners and Bards fell 10 cents to $2.69, with 59,408 stock units changing hands, Lumber Depot slipped 7 cents to $2.30 with a transfer of 359,623 units, Mailpac Group lost 5 cents to finish at $3.45 with an exchange of 165,721 stock units. Paramount Trading declined by 11 cents to end at $1.30 with investors swapping 22,050 units, Stationery and Office Supplies advanced 20 cents to $5.50 with 47 units traded and tTech climbed 34 cents to $4.81 with 18,908 shares crossing the exchange. rising, none declining and one remaining unchanged.

rising, none declining and one remaining unchanged. At the close, Proven Investments rose 0.01 of a cent to 25 US cents, with 1,051 shares changing hands, Sterling Investments settled at 1.98 US cents with an exchange of 247 units, Sygnus Credit Investments carved out a gain of 0.78 cents in ending at 14.8 US cents and trading 12,266 shares and Transjamaican Highway increased 0.02 of one cent to close at 0.88 US cents, with 337,447 units changing hands.

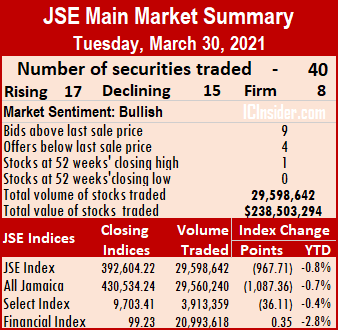

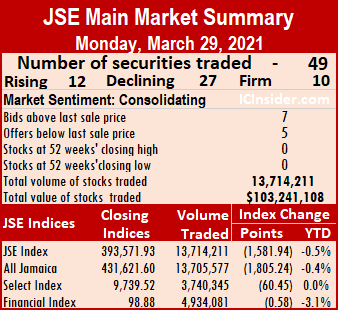

At the close, Proven Investments rose 0.01 of a cent to 25 US cents, with 1,051 shares changing hands, Sterling Investments settled at 1.98 US cents with an exchange of 247 units, Sygnus Credit Investments carved out a gain of 0.78 cents in ending at 14.8 US cents and trading 12,266 shares and Transjamaican Highway increased 0.02 of one cent to close at 0.88 US cents, with 337,447 units changing hands. The All Jamaican Composite Index declined 1,805.24 points to 431,621.60, the JSE Main Index retreated 1,581.94 points to 393,571.93 and the JSE Financial Index lost 0.58 points to close at 98.88.

The All Jamaican Composite Index declined 1,805.24 points to 431,621.60, the JSE Main Index retreated 1,581.94 points to 393,571.93 and the JSE Financial Index lost 0.58 points to close at 98.88. Trading month to date averaged 338,137 units at $2,423,642, in contrast to 341,423 units at $2,407,074 on Friday. February closed with an average of 419,015 units at $2,509,660.

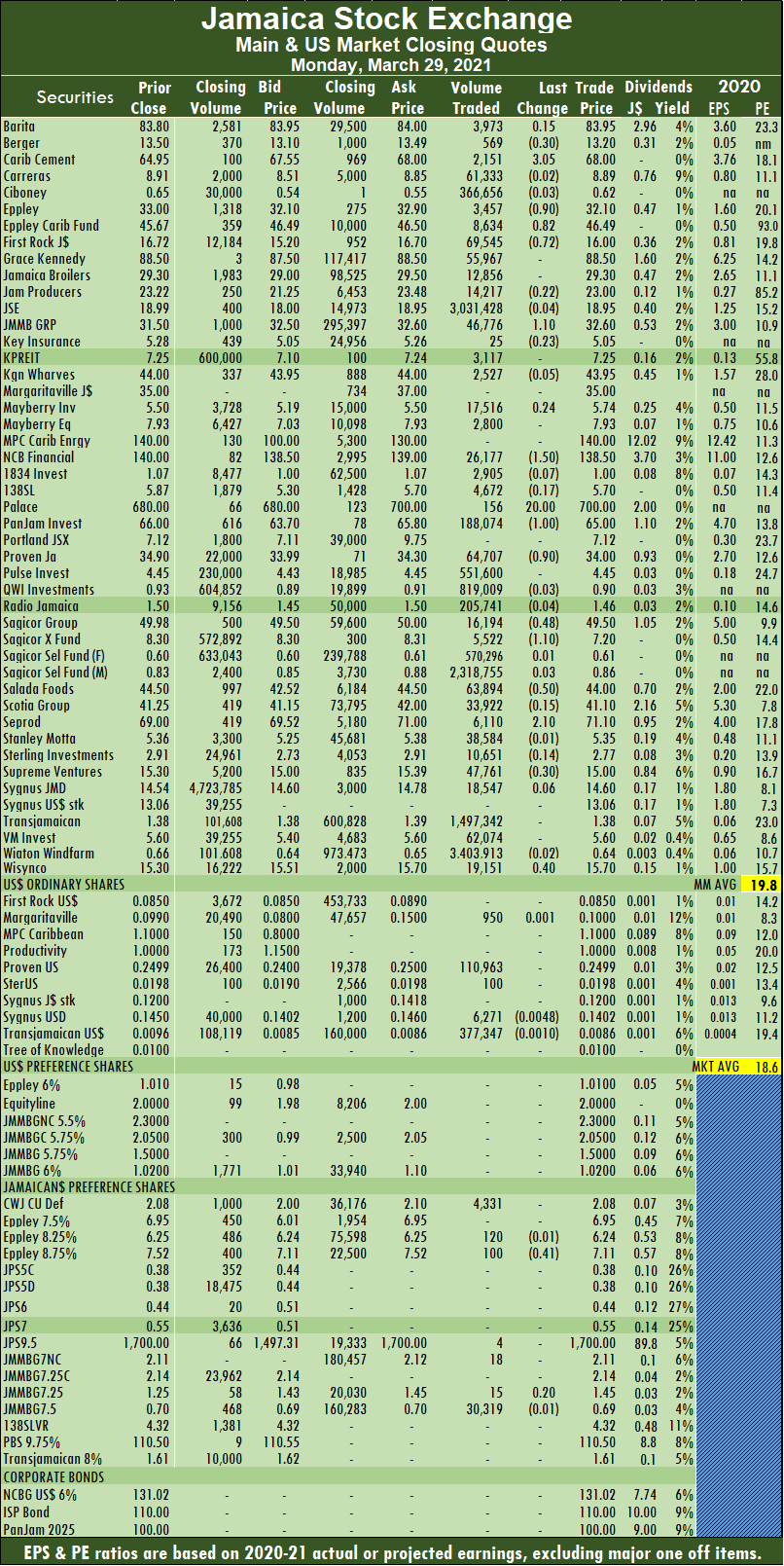

Trading month to date averaged 338,137 units at $2,423,642, in contrast to 341,423 units at $2,407,074 on Friday. February closed with an average of 419,015 units at $2,509,660.  Salada Foods lost 50 to finish at $44 with 63,894 stock units crossing the market, Seprod advanced $2.10 to $71.10 with 6,110 units changing hands. Supreme Ventures lost 30 cents to end at $15 with the swapping of 47,761 shares and Wisynco Group rose 40 cents to $15.70 with an exchange of 19,151 stock units.

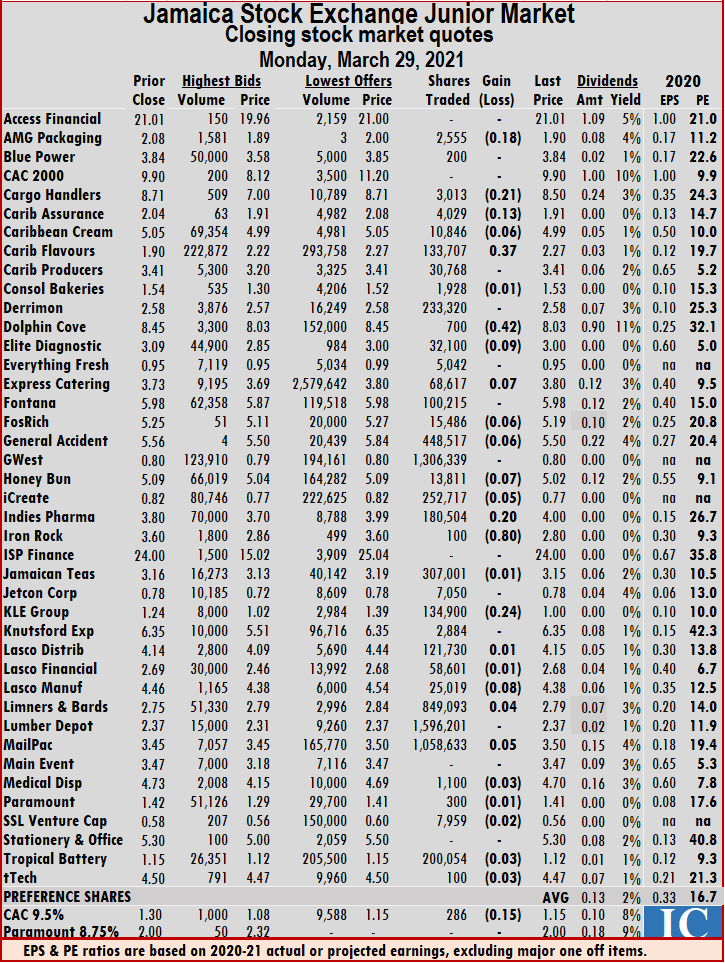

Salada Foods lost 50 to finish at $44 with 63,894 stock units crossing the market, Seprod advanced $2.10 to $71.10 with 6,110 units changing hands. Supreme Ventures lost 30 cents to end at $15 with the swapping of 47,761 shares and Wisynco Group rose 40 cents to $15.70 with an exchange of 19,151 stock units. Trading accounted for 37 securities, up from 33 on Friday, with the prices of six rising, 22 declining and nine remaining unchanged. The Junior Market Index shed 12.29 points to settle at 2,972.41. The average PE Ratio ended at 16.7 based on ICInsider.com’s forecast of 2020-21 earnings.

Trading accounted for 37 securities, up from 33 on Friday, with the prices of six rising, 22 declining and nine remaining unchanged. The Junior Market Index shed 12.29 points to settle at 2,972.41. The average PE Ratio ended at 16.7 based on ICInsider.com’s forecast of 2020-21 earnings. At the close, AMG Packaging fell 18 cents to $1.90 in trading 2,555 units, Cargo Handlers shed 21 cents to close at $8.50, with 3,013 stock units crossing the market, Caribbean Assurance Brokers finished 13 cents lower at $1.91, after 4,029 stocks cleared the market. Caribbean Cream lost 6 cents in closing at $4.99 in exchanging 10,846 units, Caribbean Flavours rose 37 cents to close at $2.27 trading 133,707 stocks, Dolphin Cove shed 42 cents to close at $8.03 in a transfer of 700 units, Elite Diagnostic lost 9 cents to settle at $3 trading 32,100 stocks. Express Catering gained 7 cents in closing at $3.80, after exchanging 68,617 shares, Fosrich ended 6 cents lower at $5.19 in exchanging 15,486 units, General Accident lost 6 cents to end at $5.50 with 448,517 stocks changing hands, Honey Bun slipped 7 cents to $5.02 with the swapping of 13,811 shares. iCreate lost 5 cents to end at 77 cents and finished with a transfer of 252,717 stock units, Indies Pharma gained 20 cents to close at $4 in the swapping of 180,504 units, Iron Rock Insurance fell 80 cents to $2.80 in switching ownership of 100 stocks.

At the close, AMG Packaging fell 18 cents to $1.90 in trading 2,555 units, Cargo Handlers shed 21 cents to close at $8.50, with 3,013 stock units crossing the market, Caribbean Assurance Brokers finished 13 cents lower at $1.91, after 4,029 stocks cleared the market. Caribbean Cream lost 6 cents in closing at $4.99 in exchanging 10,846 units, Caribbean Flavours rose 37 cents to close at $2.27 trading 133,707 stocks, Dolphin Cove shed 42 cents to close at $8.03 in a transfer of 700 units, Elite Diagnostic lost 9 cents to settle at $3 trading 32,100 stocks. Express Catering gained 7 cents in closing at $3.80, after exchanging 68,617 shares, Fosrich ended 6 cents lower at $5.19 in exchanging 15,486 units, General Accident lost 6 cents to end at $5.50 with 448,517 stocks changing hands, Honey Bun slipped 7 cents to $5.02 with the swapping of 13,811 shares. iCreate lost 5 cents to end at 77 cents and finished with a transfer of 252,717 stock units, Indies Pharma gained 20 cents to close at $4 in the swapping of 180,504 units, Iron Rock Insurance fell 80 cents to $2.80 in switching ownership of 100 stocks.  KLE Group shed 24 cents to end at $1 after 134,900 stocks crossed the exchange, Lasco Manufacturing lost 8 cents to end at $4.38 with an exchange of 25,019 stock units. Limners and Bards gained 4 cents in closing at $2.79 after trading 849,093 units and Mailpac Group picked up 5 cents to close at $3.50 with 1,058,633 shares changing hands.

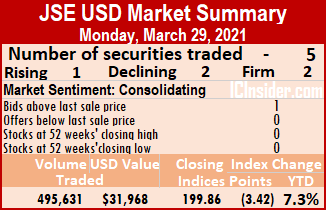

KLE Group shed 24 cents to end at $1 after 134,900 stocks crossed the exchange, Lasco Manufacturing lost 8 cents to end at $4.38 with an exchange of 25,019 stock units. Limners and Bards gained 4 cents in closing at $2.79 after trading 849,093 units and Mailpac Group picked up 5 cents to close at $3.50 with 1,058,633 shares changing hands. Similar to Friday, trading ended on Monday, with five securities and the price of one rising, two declining and two remaining unchanged.

Similar to Friday, trading ended on Monday, with five securities and the price of one rising, two declining and two remaining unchanged. At the close, Margaritaville rose 0.1 of a cent to end at 10 US cents in exchanging 950 shares, Proven Investments closed at 24.99 US cents with an exchange of 110,963 units, Sterling Investments ended at 1.98 US cents in trading 100 units. Sygnus Credit Investments lost 0.48 of a cent to end at 14.02 US cents with an exchange of 6,271 shares and Transjamaican Highway shed 0.1 of a cent to end at 0.86 US cents, with 377,347 stocks clearing the market.

At the close, Margaritaville rose 0.1 of a cent to end at 10 US cents in exchanging 950 shares, Proven Investments closed at 24.99 US cents with an exchange of 110,963 units, Sterling Investments ended at 1.98 US cents in trading 100 units. Sygnus Credit Investments lost 0.48 of a cent to end at 14.02 US cents with an exchange of 6,271 shares and Transjamaican Highway shed 0.1 of a cent to end at 0.86 US cents, with 377,347 stocks clearing the market.