Caribbean Cement traded at a new high of $45 on Tuesday.

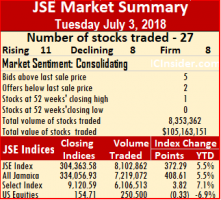

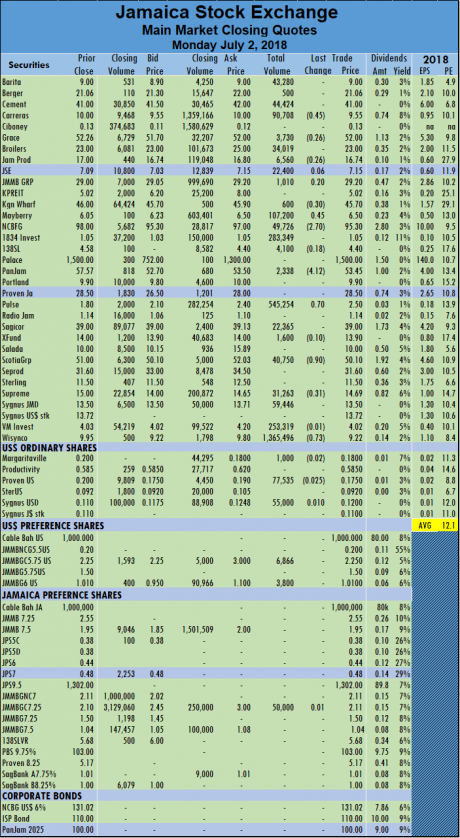

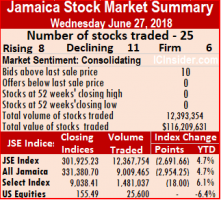

The volume traded on the Jamaica Stock Exchange declined sharply on Tuesday to 8,102,862 units valued $101,385,351 compared to 3,063,437 units valued at $29,501,732 on Monday.

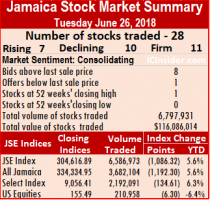

Market activities in the main and US dollar markets resulted in 27 securities trading including just 1 from the US dollar market. At the close, the prices of 11 stocks advanced, 8 declined and 8 closed unchanged, compared to 30 securities trading on Monday.

At the close of the market, the All Jamaican Composite Index rose 408.61 points to close at 334,056.93 while the JSE Index gained 372.29 points to 304,363.58.

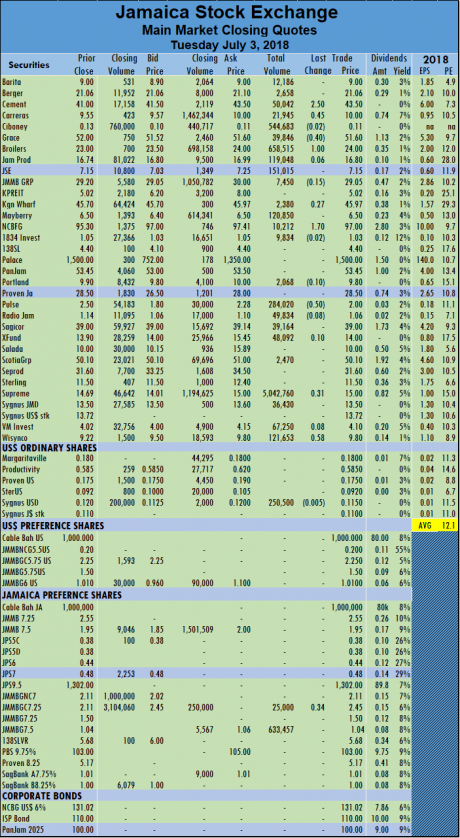

Tuesday’s volume was led by Supreme Ventures with 5,042,760 units accounting for 62 percent of the day’s volume, followed by  Jamaica Broilers with 658,515 units representing 8 percent of the volume traded and JMMB Group 7.50% preference share with 633,457 units or 7.8 percent of the day’s volume.

Jamaica Broilers with 658,515 units representing 8 percent of the volume traded and JMMB Group 7.50% preference share with 633,457 units or 7.8 percent of the day’s volume.

Stocks with major price changes are, Caribbean Cement rising $2.50 to close at $43.50 but only after trading at an all-time high of $45, Carreras regained 45 cents and closed at $10, Jamaica Broilers rose $1 to end at $24, NCB Financial rallied $1.70 to $97, Pulse Investments dropped 50 cents to close at $2, Wisynco Group rose 58 cents and ended at $9.80 and JMMB Group 7.25% preference share rose 34 cents to close at an all-time high of $2.45.

In the US dollar market, 250,500 units traded valued at $29,060 with Sygnus Credit being the only stock trading in the segment, with the price slipping 0.05 cent to end at 11.5 US cents.  The JSE USD Equities Index slipped 0.33 points to 154.71.

The JSE USD Equities Index slipped 0.33 points to 154.71.

Trading resulted in an average of 311,649 units valued at $3,899,437 for each security traded, in contrast to 122,537 units valued at an average of $1,180,069 on Monday. The average volume and value for the month to date amounts to 218,947 units valued at $2,566,413. June closed with an average of 250,168 shares with a value of $5,895,281, for each security traded.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows 5 stocks ended with bids higher than their last selling prices and 2 closing with lower offers.

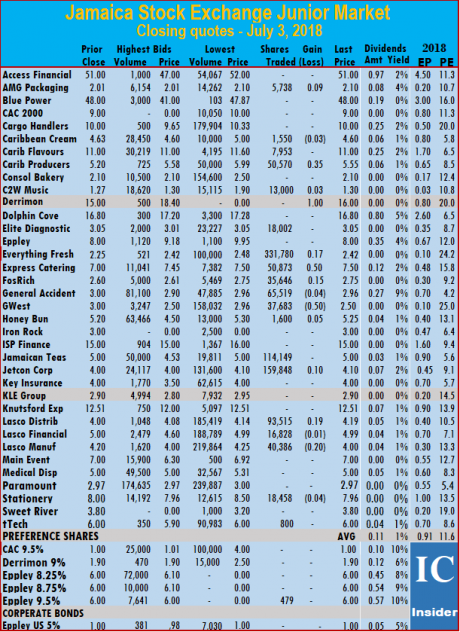

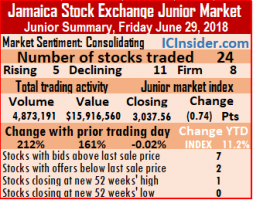

Trading ended with an average of 53,219 units for an average of $199,382 in contrast to 75,319 units for an average of $318,052 on Monday. The average volume and value for the month to date amounts to 64,795 units valued at $261,543. June closed with an average of 139,543 units, valued at $671,002 for each security traded.

Trading ended with an average of 53,219 units for an average of $199,382 in contrast to 75,319 units for an average of $318,052 on Monday. The average volume and value for the month to date amounts to 64,795 units valued at $261,543. June closed with an average of 139,543 units, valued at $671,002 for each security traded. GWest Corporation ended with a loss of 50 cents at $2.50, with 37,683 units traded, Honey Bun gained 5 cents to end at $5.25, with 1,600 shares, Jamaican Teas ended trading at $5, with 114,149 stock units, Jetcon Corporation traded at $4.10, with 159,848 units. Lasco Distributors concluded trading 93,515 stock units and rose 19 cents to $4.19, Lasco Financial finished with a loss of 1 cent at $4.99, after exchanging 16,828 units, Lasco Manufacturing settled with a loss of 20 cents at $4 and the trading of 40,386 shares, Stationery and Office closed with a loss of 4 cents at $7.96, with 18,458 units and tTech concluded trading at $6, with 800 shares changing hands. In the junior market preference segment, Eppley 9.5% ended trading at $6, with 479 shares changing hands.

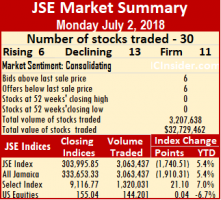

GWest Corporation ended with a loss of 50 cents at $2.50, with 37,683 units traded, Honey Bun gained 5 cents to end at $5.25, with 1,600 shares, Jamaican Teas ended trading at $5, with 114,149 stock units, Jetcon Corporation traded at $4.10, with 159,848 units. Lasco Distributors concluded trading 93,515 stock units and rose 19 cents to $4.19, Lasco Financial finished with a loss of 1 cent at $4.99, after exchanging 16,828 units, Lasco Manufacturing settled with a loss of 20 cents at $4 and the trading of 40,386 shares, Stationery and Office closed with a loss of 4 cents at $7.96, with 18,458 units and tTech concluded trading at $6, with 800 shares changing hands. In the junior market preference segment, Eppley 9.5% ended trading at $6, with 479 shares changing hands. The volume traded on the Jamaica Stock Exchange declined sharply on Monday to 3,063,437 units valued at $29,501,732 compared to a much larger 16,726,086 shares valued at $358,993,001 on Friday.

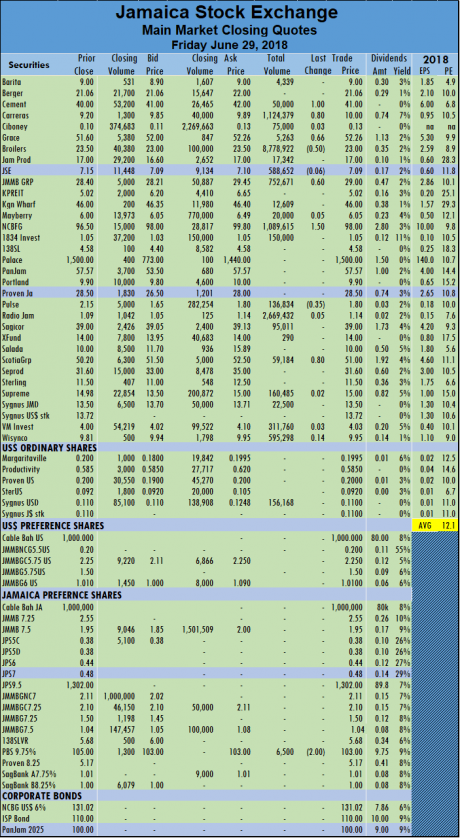

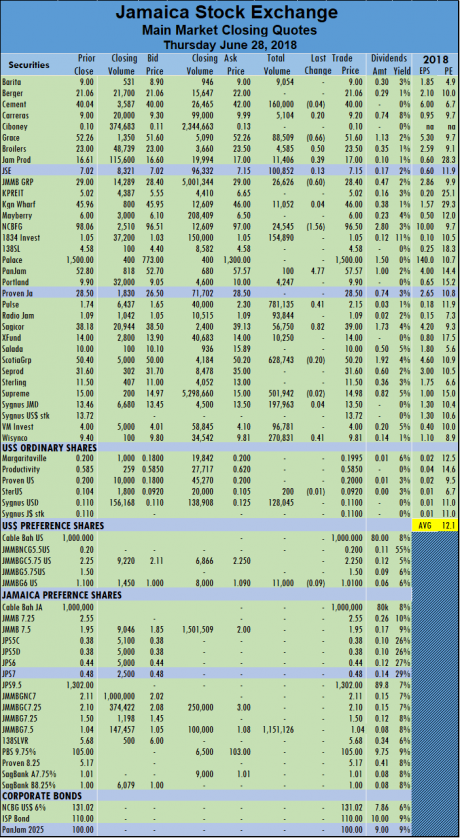

The volume traded on the Jamaica Stock Exchange declined sharply on Monday to 3,063,437 units valued at $29,501,732 compared to a much larger 16,726,086 shares valued at $358,993,001 on Friday.  Stocks with major price changes are, Carreras fell 45 cents and closed at $9.55, Mayberry Investments rose 45 cents to $6.50, NCB Financial dropped $2.70 to $95.30, PanJam Investment dropped $4.12 to close at $53.45, Pulse Investments climbed 70 cents to $2.50, Scotia Group lost 90 cents to end at $50.10 and Wisynco Group lost 73 cents and ended at $9.22.

Stocks with major price changes are, Carreras fell 45 cents and closed at $9.55, Mayberry Investments rose 45 cents to $6.50, NCB Financial dropped $2.70 to $95.30, PanJam Investment dropped $4.12 to close at $53.45, Pulse Investments climbed 70 cents to $2.50, Scotia Group lost 90 cents to end at $50.10 and Wisynco Group lost 73 cents and ended at $9.22. Proven Investments traded 77,535 units and fell 2.5 cents to 17.5 cents and Sygnus Credit traded 55,000 units and closed with the price rising 1 cent to end at 12 US cents. The JSE USD Equities Index closed with a rise of just 0.04 points to 155.04.

Proven Investments traded 77,535 units and fell 2.5 cents to 17.5 cents and Sygnus Credit traded 55,000 units and closed with the price rising 1 cent to end at 12 US cents. The JSE USD Equities Index closed with a rise of just 0.04 points to 155.04.

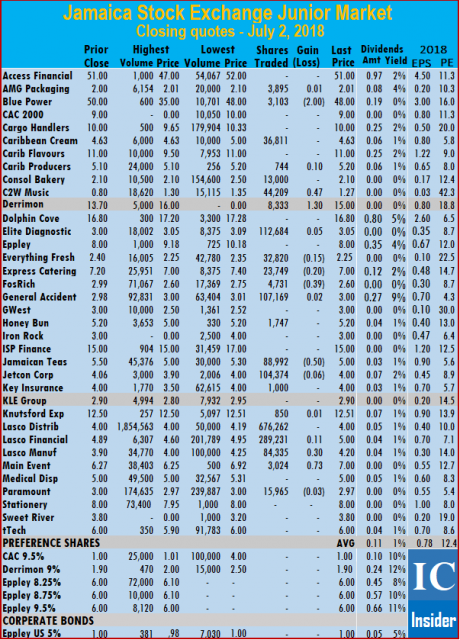

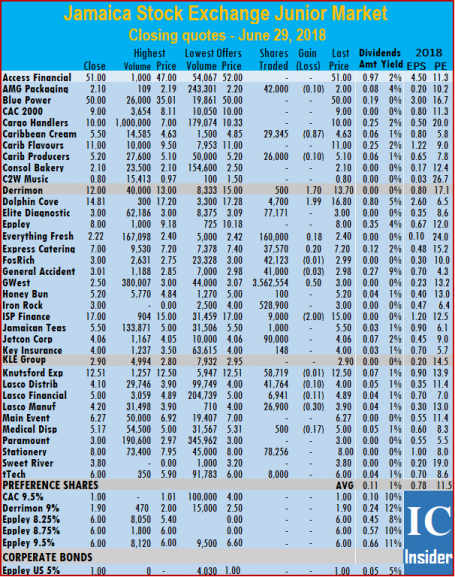

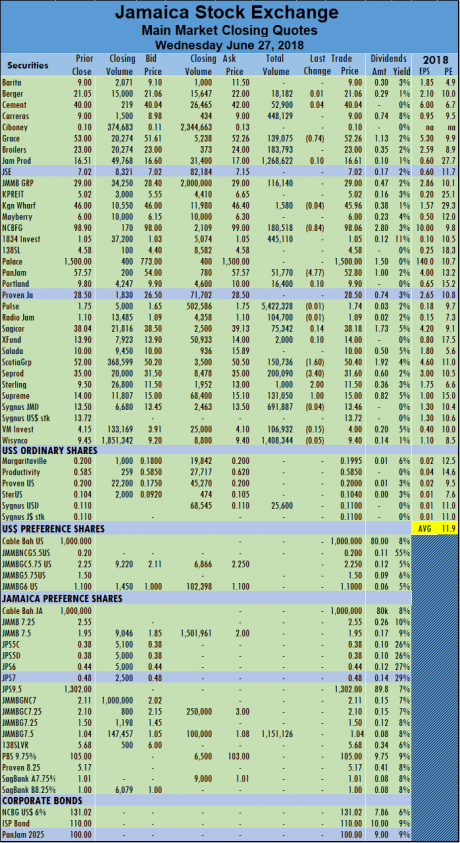

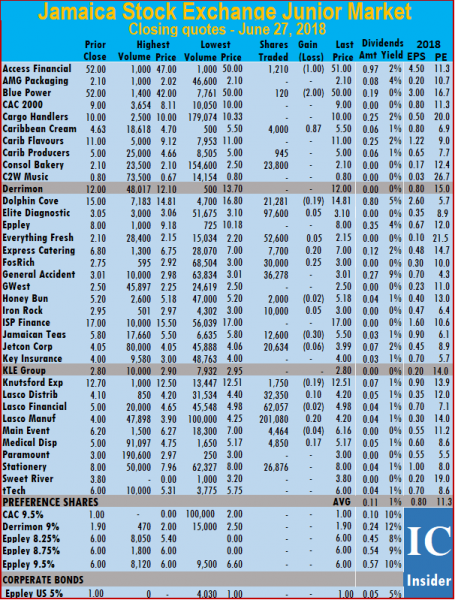

At the close of trading, AMG Packaging ended 1 cent higher at $2.01, with 3,895 stock units changing hands, Blue Power concluded trading with a loss of 2 cents at $48, with 3,103 units, Caribbean Cream closed trading at $4.63, with 36,811 shares, Caribbean Producers finished trading 10 cents higher at $5.20, with 744 units, Consolidated Bakeries closed trading at $2.10, with 13,000 shares. C2W Music ended 47 cents higher at a 52 weeks’ high of $1.27, with 44,209 shares trading, Derrimon Trading concluded trading $1.30 up at an all-time closing high of $15, with 8,333 shares, after it traded at an intraday high of $16, Elite Diagnostic settled 5 cents higher at $3.05, with 112,684 units, Everthing Fresh traded 32,820 shares but fell 15 cents, to end at $2.25, Express Catering traded with a loss of 20 cents at $7, in exchanging 23,749 shares. FosRich Group finished trading with a loss of 39 cents at $2.60, while just 4,731 shares changed hands,

At the close of trading, AMG Packaging ended 1 cent higher at $2.01, with 3,895 stock units changing hands, Blue Power concluded trading with a loss of 2 cents at $48, with 3,103 units, Caribbean Cream closed trading at $4.63, with 36,811 shares, Caribbean Producers finished trading 10 cents higher at $5.20, with 744 units, Consolidated Bakeries closed trading at $2.10, with 13,000 shares. C2W Music ended 47 cents higher at a 52 weeks’ high of $1.27, with 44,209 shares trading, Derrimon Trading concluded trading $1.30 up at an all-time closing high of $15, with 8,333 shares, after it traded at an intraday high of $16, Elite Diagnostic settled 5 cents higher at $3.05, with 112,684 units, Everthing Fresh traded 32,820 shares but fell 15 cents, to end at $2.25, Express Catering traded with a loss of 20 cents at $7, in exchanging 23,749 shares. FosRich Group finished trading with a loss of 39 cents at $2.60, while just 4,731 shares changed hands,  General Accident closed 2 cents higher at $3, with 107,169 stock units traded, Honey Bun concluded trading at $5.20, with 1,747 shares, Jamaican Teas ended trading with a loss of 50 cents at $5, after 88,992 stock units were exchanged. Jetcon Corporation closed at $4 higher at $4, with 104,374 shares, Key Insurance traded at $4, with 1,000 units, Knutsford Express rose 1 cent to end at $12.51, with 850 shares trading, Lasco Distributors ended at $4, with 676,262 shares, Lasco Financial concluded trading 11 cents higher at $5, with 289,231 stock units. Lasco Manufacturing rose 30 cents to $4.20, with 84,335 units, Main Event settled 73 cents higher at $7, with 3,024 shares trading and Paramount Trading fell 3 cents to end at $2.97, with 15,965 shares changing hands.

General Accident closed 2 cents higher at $3, with 107,169 stock units traded, Honey Bun concluded trading at $5.20, with 1,747 shares, Jamaican Teas ended trading with a loss of 50 cents at $5, after 88,992 stock units were exchanged. Jetcon Corporation closed at $4 higher at $4, with 104,374 shares, Key Insurance traded at $4, with 1,000 units, Knutsford Express rose 1 cent to end at $12.51, with 850 shares trading, Lasco Distributors ended at $4, with 676,262 shares, Lasco Financial concluded trading 11 cents higher at $5, with 289,231 stock units. Lasco Manufacturing rose 30 cents to $4.20, with 84,335 units, Main Event settled 73 cents higher at $7, with 3,024 shares trading and Paramount Trading fell 3 cents to end at $2.97, with 15,965 shares changing hands.

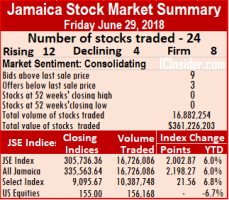

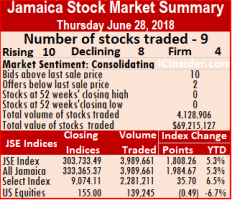

At the close on the Jamaica Stock Exchange on Thursday, the main market indices rose with All Jamaican Composite Index climbing 2,198.27 points at 335,563.64, while the JSE Index rose 2,002.87 points to 305,736.36. The market closed out the half year mark with an increase of just 6 percent.

At the close on the Jamaica Stock Exchange on Thursday, the main market indices rose with All Jamaican Composite Index climbing 2,198.27 points at 335,563.64, while the JSE Index rose 2,002.87 points to 305,736.36. The market closed out the half year mark with an increase of just 6 percent.  In the US dollar market, 156,168 units traded valued at $17,178 with

In the US dollar market, 156,168 units traded valued at $17,178 with

Trading ended with an average of 203,050 units for an average of $663,190 in contrast to 91,982 units for an average of $358,532 on Thursday. The average volume and value for the month to date, amounts to 139,543 units valued at $671,002 and previously 136,164 units valued at 671,284. May closed with an average of 217,589 units, valued at $1,322,452 for each security traded.

Trading ended with an average of 203,050 units for an average of $663,190 in contrast to 91,982 units for an average of $358,532 on Thursday. The average volume and value for the month to date, amounts to 139,543 units valued at $671,002 and previously 136,164 units valued at 671,284. May closed with an average of 217,589 units, valued at $1,322,452 for each security traded. GWest Corporation jumped 50 cents higher to $3, with 3,562,554 stock units, Honey Bun ended at $5.20, trading just 100 units, Iron Rock concluded trading at $3, with 528,900 shares, ISP Finance finished with a loss of 2 cents at $15, after trading 9,000 shares. Jamaican Teas settled at $5.50, with 1,000 shares, Jetcon Corporation ended trading at $4.06, with 90,000 stock units, Key Insurance traded at $4, with 148 units, Knutsford Express closed with a loss of 1 cent at $12.50, trading 58,719 shares. Lasco Distributors ended at $4, after shedding 10 cents exchanging 41,764 shares, Lasco Financial concluded trading of 6,941 stock units and fell 11 cents to $4.89, Lasco Manufacturing declined 30 cents to close at $3.90, with 26,900 units, Medical Disposables fell 17 cents to $5, with 500 shares, Stationery and Office finished trading 78,256 stock units at $8 and tTech ended at $6, with 8,000 shares changing hands.

GWest Corporation jumped 50 cents higher to $3, with 3,562,554 stock units, Honey Bun ended at $5.20, trading just 100 units, Iron Rock concluded trading at $3, with 528,900 shares, ISP Finance finished with a loss of 2 cents at $15, after trading 9,000 shares. Jamaican Teas settled at $5.50, with 1,000 shares, Jetcon Corporation ended trading at $4.06, with 90,000 stock units, Key Insurance traded at $4, with 148 units, Knutsford Express closed with a loss of 1 cent at $12.50, trading 58,719 shares. Lasco Distributors ended at $4, after shedding 10 cents exchanging 41,764 shares, Lasco Financial concluded trading of 6,941 stock units and fell 11 cents to $4.89, Lasco Manufacturing declined 30 cents to close at $3.90, with 26,900 units, Medical Disposables fell 17 cents to $5, with 500 shares, Stationery and Office finished trading 78,256 stock units at $8 and tTech ended at $6, with 8,000 shares changing hands. Trading on the Jamaica Stock Exchange fell sharply on Thursday to just 3,989,661 units valued at $65,937,392, down from 12,393,354 units valued at $115,843,551 on Wednesday with Pulse as the lead trade.

Trading on the Jamaica Stock Exchange fell sharply on Thursday to just 3,989,661 units valued at $65,937,392, down from 12,393,354 units valued at $115,843,551 on Wednesday with Pulse as the lead trade.  For the second consecutive day, Pulse Investments led trading and closed on Thursday with 781,135 units trading, accounting for nearly 20 percent of the day’s volume and was followed by JMMB Group 7.25% preference share with 750,000 shares and Scotia Group with 628,743 units.

For the second consecutive day, Pulse Investments led trading and closed on Thursday with 781,135 units trading, accounting for nearly 20 percent of the day’s volume and was followed by JMMB Group 7.25% preference share with 750,000 shares and Scotia Group with 628,743 units. Trading resulted in an average of 166,236 units valued at an average of $2,747,391 for each security traded, in contrast to 515,323 units valued at an average of $4,826,815 on Wednesday. For the month to date, 229,774 units traded with an average value of $5,182,608 and on the previous day, 232,741 units traded with an average value of $5,302,373. May closed with an average of 589,414 shares with a value of $16,532.367, for each security traded.

Trading resulted in an average of 166,236 units valued at an average of $2,747,391 for each security traded, in contrast to 515,323 units valued at an average of $4,826,815 on Wednesday. For the month to date, 229,774 units traded with an average value of $5,182,608 and on the previous day, 232,741 units traded with an average value of $5,302,373. May closed with an average of 589,414 shares with a value of $16,532.367, for each security traded.

At the close of market activity, 12,367,754 units valued at $115,843,551 changed hands compared to 6,586,973 units valued at $111,180,207, on Tuesday.

At the close of market activity, 12,367,754 units valued at $115,843,551 changed hands compared to 6,586,973 units valued at $111,180,207, on Tuesday. The JSE USD Equities Index closed unchanged at 155.49.

The JSE USD Equities Index closed unchanged at 155.49. A report that Everything Fresh is negotiating to acquire an unnamed company seems to have provided some support for the stocks on the Junior Market on Wednesday. The price gained 5 cents to close at $2.15 with 52,600 shares traded.

A report that Everything Fresh is negotiating to acquire an unnamed company seems to have provided some support for the stocks on the Junior Market on Wednesday. The price gained 5 cents to close at $2.15 with 52,600 shares traded.  Trading ended with an average of 29,736 units for an average of $131,196 in contrast to 72,971 units for an average of $369,404 on Tuesday. The average volume and value for the month to date, amounts to 137,894 units valued at $683,354 and previously 143,670 units valued at $713,028. May closed with an average of 217,589 units, valued at $1,322,452 for each security traded.

Trading ended with an average of 29,736 units for an average of $131,196 in contrast to 72,971 units for an average of $369,404 on Tuesday. The average volume and value for the month to date, amounts to 137,894 units valued at $683,354 and previously 143,670 units valued at $713,028. May closed with an average of 217,589 units, valued at $1,322,452 for each security traded. General Accident closed at $3.01, with 36,278 stock units, Honey Bun concluded trading with a loss of 2 cents at $5.18, after exchanging 2,000 shares, Iron Rock finished 5 cents higher at $3, with 10,000 shares, Jamaican Teas ended trading with a loss of 30 cents at $5.50, with 12,600 stock units. Jetcon Corporation traded with a loss of 6 cents at $3.99, with 20,634 units, Knutsford Express ended with a loss of 19 cents at $12.51, as 1,750 shares traded, Lasco Distributors rose 10 cents to $4.20, with 32,350 stock units, Lasco Financial finished with a loss of 2 cents at $4.98, trading 62,057 units. Lasco Manufacturing settled 20 cents higher at $4.20, with 201,080 shares, Main Event lost 4 cents to close at $6.16, with 4,464 shares, Medical Disposables traded 17 cents higher at $5.17, with 4,850 shares and Stationery and Office closed at $8, with 26,876 units changing hands.

General Accident closed at $3.01, with 36,278 stock units, Honey Bun concluded trading with a loss of 2 cents at $5.18, after exchanging 2,000 shares, Iron Rock finished 5 cents higher at $3, with 10,000 shares, Jamaican Teas ended trading with a loss of 30 cents at $5.50, with 12,600 stock units. Jetcon Corporation traded with a loss of 6 cents at $3.99, with 20,634 units, Knutsford Express ended with a loss of 19 cents at $12.51, as 1,750 shares traded, Lasco Distributors rose 10 cents to $4.20, with 32,350 stock units, Lasco Financial finished with a loss of 2 cents at $4.98, trading 62,057 units. Lasco Manufacturing settled 20 cents higher at $4.20, with 201,080 shares, Main Event lost 4 cents to close at $6.16, with 4,464 shares, Medical Disposables traded 17 cents higher at $5.17, with 4,850 shares and Stationery and Office closed at $8, with 26,876 units changing hands.

Trading volume was dominated by

Trading volume was dominated by  Proven Investments traded 203,000 units at 20 US cents. The JSE USD Equities Index dropped 6.30 points to close at 155.49.

Proven Investments traded 203,000 units at 20 US cents. The JSE USD Equities Index dropped 6.30 points to close at 155.49.