Trading plunged on Wednesday with the volume of shares trading declining by 8 percent, but the value dropped 72 percent lower than Tuesday leading to an equal number of stocks rising and falling at the close of the Jamaica Stock Exchange Main Market.

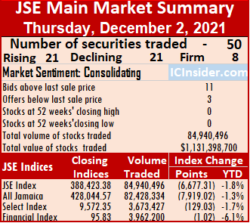

The All Jamaican Composite Index declined 1,097.95 points to settle at 428,730.13, the Main Index fell 1,056.44 points to 388,038.97 and the JSE Financial Index shed 0.72 points to close at 94.62.

The All Jamaican Composite Index declined 1,097.95 points to settle at 428,730.13, the Main Index fell 1,056.44 points to 388,038.97 and the JSE Financial Index shed 0.72 points to close at 94.62.

Trading ended with 45 securities compared to 50 on Tuesday, with 18 rising, 18 declining and nine ending unchanged. The PE Ratio, a formula for computing appropriate stock values, averages 15.6. The PE ratio for the JSE Main and USD Market closing quotes are based on earnings forecasted by ICInsider.com for companies with financial years ending between the current year and August 2022.

Trading ended with 6,971,534 shares changing hands for $42,325,701 versus 7,587,100 units at $150,880,078 on Tuesday. Wigton Windfarm led trading with 68.2 percent of total volume for an exchange of 4.75 million shares followed by Sagicor Select Manufacturing & Distribution Fund with 9.2 percent for 643,197 units and Transjamaican Highway with 3.1 percent after trading 213,071 units.

Trading averages 154,923 units at $940,571, compared to 151,742 shares at $3,017,602 on Tuesday and month to date, an average of 408,016 units at $5,431,440, compared to 453,032 units at $6,230,211 on Tuesday. November closed with an average of 233,949 units at $2,695,416.

Investor’s Choice bid-offer indicator shows 14 stocks ended with bids higher than their last selling prices and four with lower offers.

At the close, Barita Investments dipped 45 cents ending at $90 in switching ownership of 11,378 shares, Caribbean Cement shed $1.49 in closing at $75.99 after trading 42,732 stocks, Eppley advanced $2 to $38 in exchanging 439 stock units. First Rock Capital lost 60 cents to close at $10, with 19,949 units crossing the exchange, GraceKennedy gained 50 cents to end at $99 with a transfer of 55,967 units, Guardian Holdings fell $4 to $520 finishing with 3,104 shares changing hands. Jamaica Broilers advanced $1.19 to $30 with 11,382 stocks crossing the market, Jamaica Stock Exchange lost 40 cents to settle at $16.50 in exchanging 11,203 stock units, Kingston Properties fell 50 cents to $8.50 in transferring 1,010 stocks. Kingston Wharves popped $3 to close at $44 after trading 5,079 units, Palace Amusement dropped $35 to $995 trading 1 share, PanJam Investment rallied 60 cents to $68 with the swapping of 8,643 stock units. Proven Investments gained 34 cents in closing at $33.50 with 700 shares clearing the market, Sagicor Group shed $1.49 to end at $51 after exchanging 8,154 units, Salada Foods rose 33 cents to close at $6.35 in trading 292 stocks.

At the close, Barita Investments dipped 45 cents ending at $90 in switching ownership of 11,378 shares, Caribbean Cement shed $1.49 in closing at $75.99 after trading 42,732 stocks, Eppley advanced $2 to $38 in exchanging 439 stock units. First Rock Capital lost 60 cents to close at $10, with 19,949 units crossing the exchange, GraceKennedy gained 50 cents to end at $99 with a transfer of 55,967 units, Guardian Holdings fell $4 to $520 finishing with 3,104 shares changing hands. Jamaica Broilers advanced $1.19 to $30 with 11,382 stocks crossing the market, Jamaica Stock Exchange lost 40 cents to settle at $16.50 in exchanging 11,203 stock units, Kingston Properties fell 50 cents to $8.50 in transferring 1,010 stocks. Kingston Wharves popped $3 to close at $44 after trading 5,079 units, Palace Amusement dropped $35 to $995 trading 1 share, PanJam Investment rallied 60 cents to $68 with the swapping of 8,643 stock units. Proven Investments gained 34 cents in closing at $33.50 with 700 shares clearing the market, Sagicor Group shed $1.49 to end at $51 after exchanging 8,154 units, Salada Foods rose 33 cents to close at $6.35 in trading 292 stocks. Scotia Group declined $1.47 to $34.03 in an exchange of 37,793 stock units, Supreme Ventures spiked $1.19 to finish at $18.49 with 7,659 units changing hands, Sygnus Credit Investments dipped 49 cents to close at $15 in exchanging 86,031 stocks and Wisynco Group popped 26 cents in closing at $16.30 with 175,332 stock units crossing the market.

Scotia Group declined $1.47 to $34.03 in an exchange of 37,793 stock units, Supreme Ventures spiked $1.19 to finish at $18.49 with 7,659 units changing hands, Sygnus Credit Investments dipped 49 cents to close at $15 in exchanging 86,031 stocks and Wisynco Group popped 26 cents in closing at $16.30 with 175,332 stock units crossing the market.

In the preference segment, JMMB Group 7.35% – due 2028 rose 31 cents to $3.48 in exchanging 5,693 shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

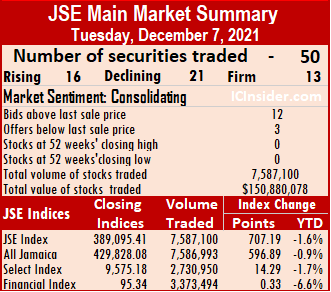

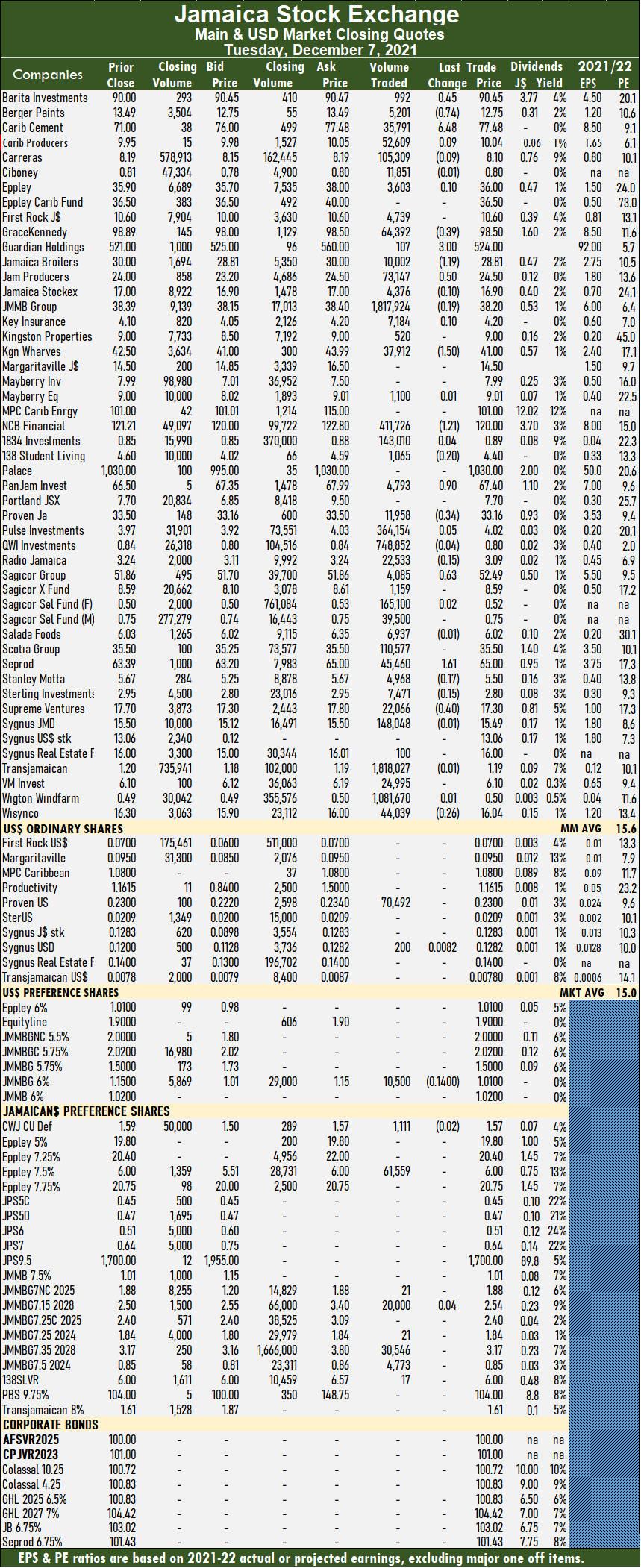

The All Jamaican Composite Index gained 596.89 points to end at 429,828.08, the Main Index rallied 707.19 points to 389,095.41 and the JSE Financial Index climbed 0.33 points to settle at 95.34.

The All Jamaican Composite Index gained 596.89 points to end at 429,828.08, the Main Index rallied 707.19 points to 389,095.41 and the JSE Financial Index climbed 0.33 points to settle at 95.34. Trading averages 151,742 units at $3,017,602, compared to 180,243 shares at $3,171,529 on Monday and month to date, an average of 453,032 units at $6,230,211, compared to 527,241 units at $7,021,494 on Monday. November closed with an average of 233,949 units at $2,695,416.

Trading averages 151,742 units at $3,017,602, compared to 180,243 shares at $3,171,529 on Monday and month to date, an average of 453,032 units at $6,230,211, compared to 527,241 units at $7,021,494 on Monday. November closed with an average of 233,949 units at $2,695,416. PanJam Investment spiked 90 cents in closing at $67.40 in switching ownership of 4,793 units, Proven Investments declined 34 cents to close at $33.16 in trading 11,958 shares, Sagicor Group advanced 63 cents to $52.49, with 4,085 stock units crossing the market. Seprod rallied $1.61 in closing at $65 while exchanging 45,460 stock units, Supreme Ventures lost 40 cents to end at $17.30 after exchanging 22,066 stocks and Wisynco Group fell 26 cents to $16.04 after trading 44,039 shares.

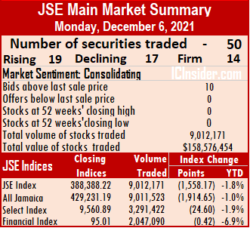

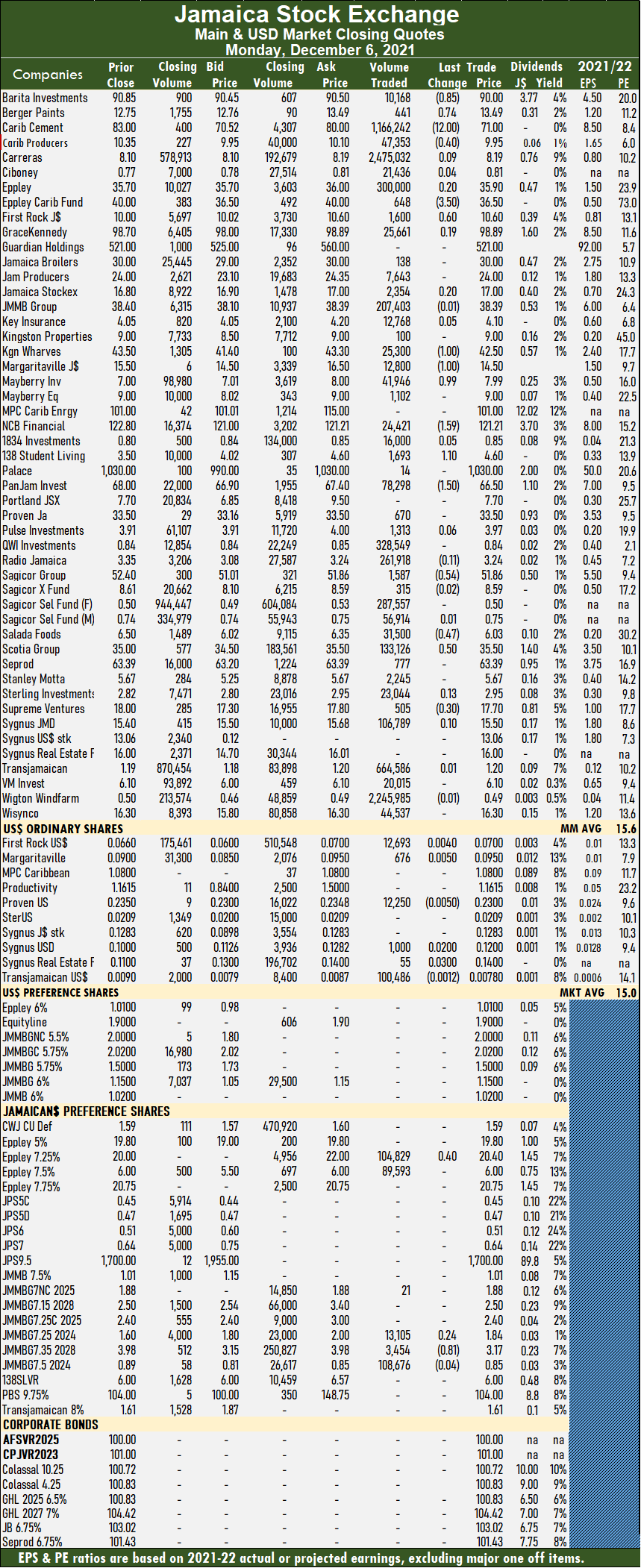

PanJam Investment spiked 90 cents in closing at $67.40 in switching ownership of 4,793 units, Proven Investments declined 34 cents to close at $33.16 in trading 11,958 shares, Sagicor Group advanced 63 cents to $52.49, with 4,085 stock units crossing the market. Seprod rallied $1.61 in closing at $65 while exchanging 45,460 stock units, Supreme Ventures lost 40 cents to end at $17.30 after exchanging 22,066 stocks and Wisynco Group fell 26 cents to $16.04 after trading 44,039 shares. The All Jamaican Composite Index declined 1,914.65 points to 429,231.19, the JSE Main Index dropped 1,558.17 points to end at 388,388.22 and the JSE Financial Index lost 0.42 points to close at 95.01.

The All Jamaican Composite Index declined 1,914.65 points to 429,231.19, the JSE Main Index dropped 1,558.17 points to end at 388,388.22 and the JSE Financial Index lost 0.42 points to close at 95.01. Trading averages 180,243 units at $3,171,529, versus 143,919 shares at $1,980,34 on Friday and for the month to date, trading averages 527,241 units at $7,021,494, compared to 640,639 units at $8,279,653 on Friday. November closed with an average of 233,949 units at $2,695,416.

Trading averages 180,243 units at $3,171,529, versus 143,919 shares at $1,980,34 on Friday and for the month to date, trading averages 527,241 units at $7,021,494, compared to 640,639 units at $8,279,653 on Friday. November closed with an average of 233,949 units at $2,695,416. NCB Financial shed $1.59 in closing at $121.21 with a transfer of 24,421 shares, 138 Student Living rallied $1.10 to $4.60, with 1,693 shares crossing the market, PanJam Investment fell $1.50 to $66.50 in an exchange of 78,298 units. Sagicor Group lost 54 cents to end at $51.86 in switching ownership of 1,587 stocks, Salada Foods shed 47 cents to finish at $6.03 with 31,500 stock units clearing the market, Scotia Group gained 50 cents after ending at $35.50 with 133,126 units changing hands and Supreme Ventures shed 30 cents to close at $17.70 with the swapping of 505 shares.

NCB Financial shed $1.59 in closing at $121.21 with a transfer of 24,421 shares, 138 Student Living rallied $1.10 to $4.60, with 1,693 shares crossing the market, PanJam Investment fell $1.50 to $66.50 in an exchange of 78,298 units. Sagicor Group lost 54 cents to end at $51.86 in switching ownership of 1,587 stocks, Salada Foods shed 47 cents to finish at $6.03 with 31,500 stock units clearing the market, Scotia Group gained 50 cents after ending at $35.50 with 133,126 units changing hands and Supreme Ventures shed 30 cents to close at $17.70 with the swapping of 505 shares. The All Jamaican Composite Index clawed back 39 percent of Thursday’s loss by jumping 3,101.27 points to 431,145.84, the JSE Main Index advanced 1,523.01 points, pulling back 23 percent of Thursday’s fall to close at 389,946.39 and the JSE Financial Index fell 0.40 points to finish at 95.43.

The All Jamaican Composite Index clawed back 39 percent of Thursday’s loss by jumping 3,101.27 points to 431,145.84, the JSE Main Index advanced 1,523.01 points, pulling back 23 percent of Thursday’s fall to close at 389,946.39 and the JSE Financial Index fell 0.40 points to finish at 95.43. Trading averages 143,919 units at $1,980,349, versus 1,698,810 shares at $22,627,974 on Thursday and month to date, an average of 640,639 units at $8,279,653, down from 896,377 units at $11,522,859 on Thursday. November closed with an average of 233,949 units at $2,695,416.

Trading averages 143,919 units at $1,980,349, versus 1,698,810 shares at $22,627,974 on Thursday and month to date, an average of 640,639 units at $8,279,653, down from 896,377 units at $11,522,859 on Thursday. November closed with an average of 233,949 units at $2,695,416. NCB Financial advanced $1.80 in closing at $122.80 with 26,559 stocks changing hands, Proven Investments dipped 30 cents to close at $33.50 in trading 7,122 stock units, Scotia Group fell $2 to $35 with the swapping of 97,734 stocks and Seprod lost 61 cents after ending at $63.39 in switching ownership of 8,854 shares.

NCB Financial advanced $1.80 in closing at $122.80 with 26,559 stocks changing hands, Proven Investments dipped 30 cents to close at $33.50 in trading 7,122 stock units, Scotia Group fell $2 to $35 with the swapping of 97,734 stocks and Seprod lost 61 cents after ending at $63.39 in switching ownership of 8,854 shares.

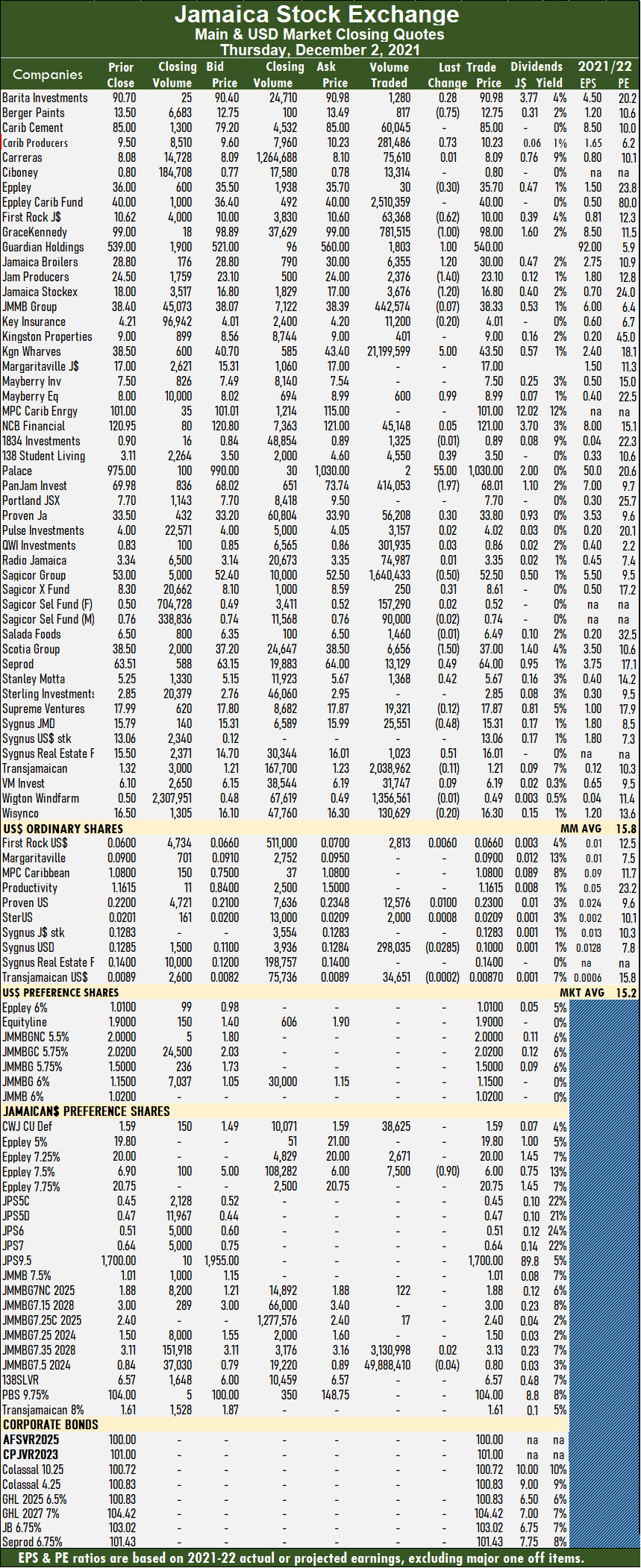

Trading averages 1,698,810 units at $22,627,974, versus 109,678 shares at $635,492 on Wednesday and month to date, an average of 896,377 units at $11,522,859. November closed with an average of 233,949 units at $2,695,416.

Trading averages 1,698,810 units at $22,627,974, versus 109,678 shares at $635,492 on Wednesday and month to date, an average of 896,377 units at $11,522,859. November closed with an average of 233,949 units at $2,695,416. Mayberry Jamaican Equities rose 99 cents to $8.99, owners switching 600 stocks. 138 Student Living gained 39 cents in ending at $3.50 with 4,550 shares changing hands, Palace Amusement advanced $55 to $1,030 with two stock units clearing the market, PanJam Investment declined $1.97 to end at $68.01 in trading 414,053 units. Proven Investments gained 30 cents in closing at $33.80 with an exchange of 56,208 shares, Sagicor Group dipped 50 cents to $52.50 with the swapping of 1,640,433 stock units, Sagicor Real Estate Fund rallied 31 cents to $8.61 after exchanging 250 stocks. Scotia Group shed $1.50 to end at $37, with 6,656 shares crossing the market, Seprod gained 49 cents to settle at $64 in transferring 13,129 units, Stanley Motta gained 42 cents after ending at $5.67 in switching ownership of 1,368 stocks. Sygnus Credit Investments fell 48 cents to $15.31, with 25,551 units changing hands, Sygnus Real Estate Finance rose 51 cents to $16.01 after trading 1,023 stock units.

Mayberry Jamaican Equities rose 99 cents to $8.99, owners switching 600 stocks. 138 Student Living gained 39 cents in ending at $3.50 with 4,550 shares changing hands, Palace Amusement advanced $55 to $1,030 with two stock units clearing the market, PanJam Investment declined $1.97 to end at $68.01 in trading 414,053 units. Proven Investments gained 30 cents in closing at $33.80 with an exchange of 56,208 shares, Sagicor Group dipped 50 cents to $52.50 with the swapping of 1,640,433 stock units, Sagicor Real Estate Fund rallied 31 cents to $8.61 after exchanging 250 stocks. Scotia Group shed $1.50 to end at $37, with 6,656 shares crossing the market, Seprod gained 49 cents to settle at $64 in transferring 13,129 units, Stanley Motta gained 42 cents after ending at $5.67 in switching ownership of 1,368 stocks. Sygnus Credit Investments fell 48 cents to $15.31, with 25,551 units changing hands, Sygnus Real Estate Finance rose 51 cents to $16.01 after trading 1,023 stock units. The All Jamaican Composite Index fell 1,704.80 points to 435,963.59, the JSE Main Index dived 2,729.98 points to 395,100.69 and the JSE Financial Index shed 1.43 points to end at 96.85.

The All Jamaican Composite Index fell 1,704.80 points to 435,963.59, the JSE Main Index dived 2,729.98 points to 395,100.69 and the JSE Financial Index shed 1.43 points to end at 96.85. Investor’s Choice bid-offer indicator shows 11 stocks ending with bids higher than their last selling prices and four with lower offers.

Investor’s Choice bid-offer indicator shows 11 stocks ending with bids higher than their last selling prices and four with lower offers. Scotia Group spiked 75 cents to end at $38.50 with 36,434 units crossing the market, Seprod popped 31 cents to $63.51 in switching ownership of 7,381 shares, Supreme Ventures rallied 49 cents in closing at $17.99 and trading 16,389 stocks. Sygnus Credit Investments popped 59 cents to $15.79 in transferring 60,631 stock units, Sygnus Real Estate Finance shed 51 cents to close at $15.50 in trading 2,224 units and Wisynco Group dipped 43 cents to $16.50 with the swapping of 80,624 stocks.

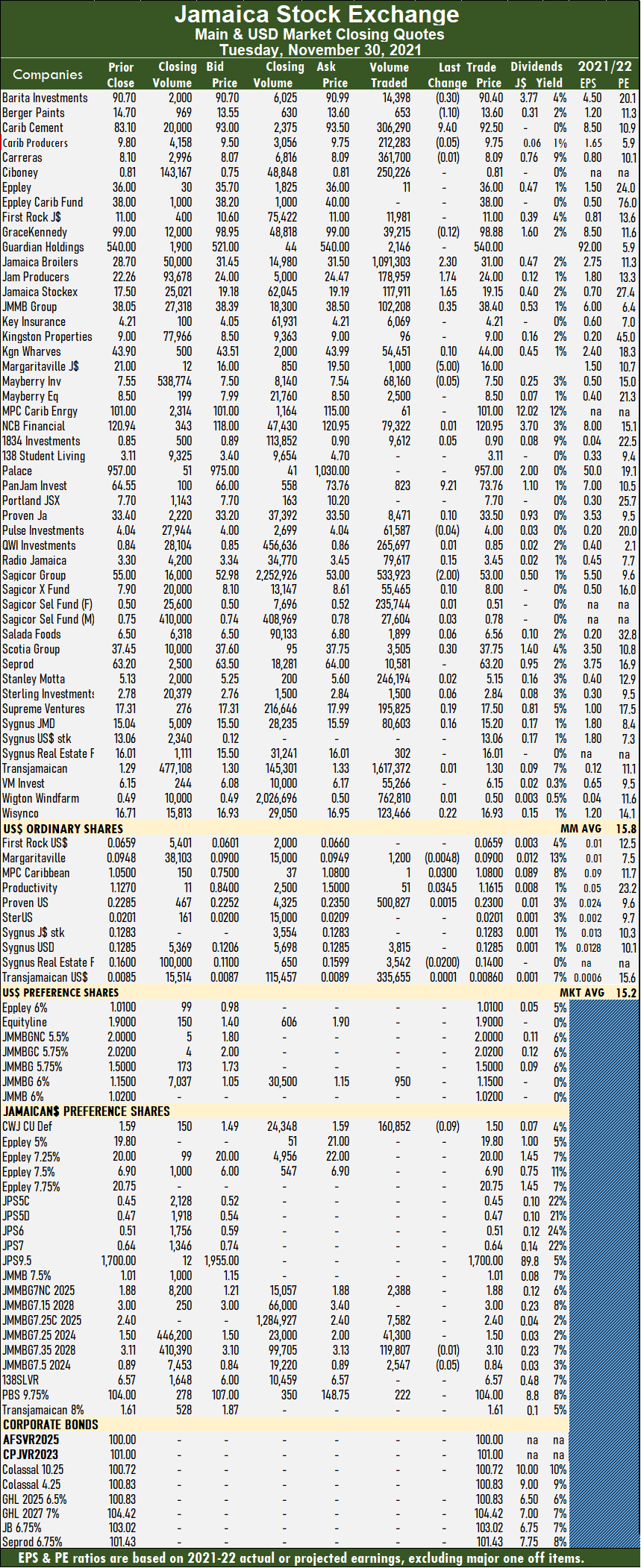

Scotia Group spiked 75 cents to end at $38.50 with 36,434 units crossing the market, Seprod popped 31 cents to $63.51 in switching ownership of 7,381 shares, Supreme Ventures rallied 49 cents in closing at $17.99 and trading 16,389 stocks. Sygnus Credit Investments popped 59 cents to $15.79 in transferring 60,631 stock units, Sygnus Real Estate Finance shed 51 cents to close at $15.50 in trading 2,224 units and Wisynco Group dipped 43 cents to $16.50 with the swapping of 80,624 stocks. Market activity ended on Tuesday with robust gains for the Jamaica Stock Exchange Main Market. The All Jamaican Composite Index jumped by 4,559.46 points to 437,668.39, just over 7,000 points below the close for October. The JSE Main Index surged 5,036.25 points to 397,830.67 and the JSE Financial Index rose 1.80 points to 98.28. The volume of stocks trading slipped at the close on Tuesday with the market ending, with rising stocks exceeding those decliners 2 to 1.

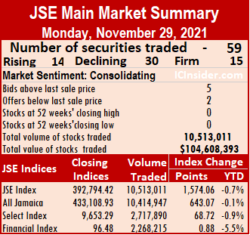

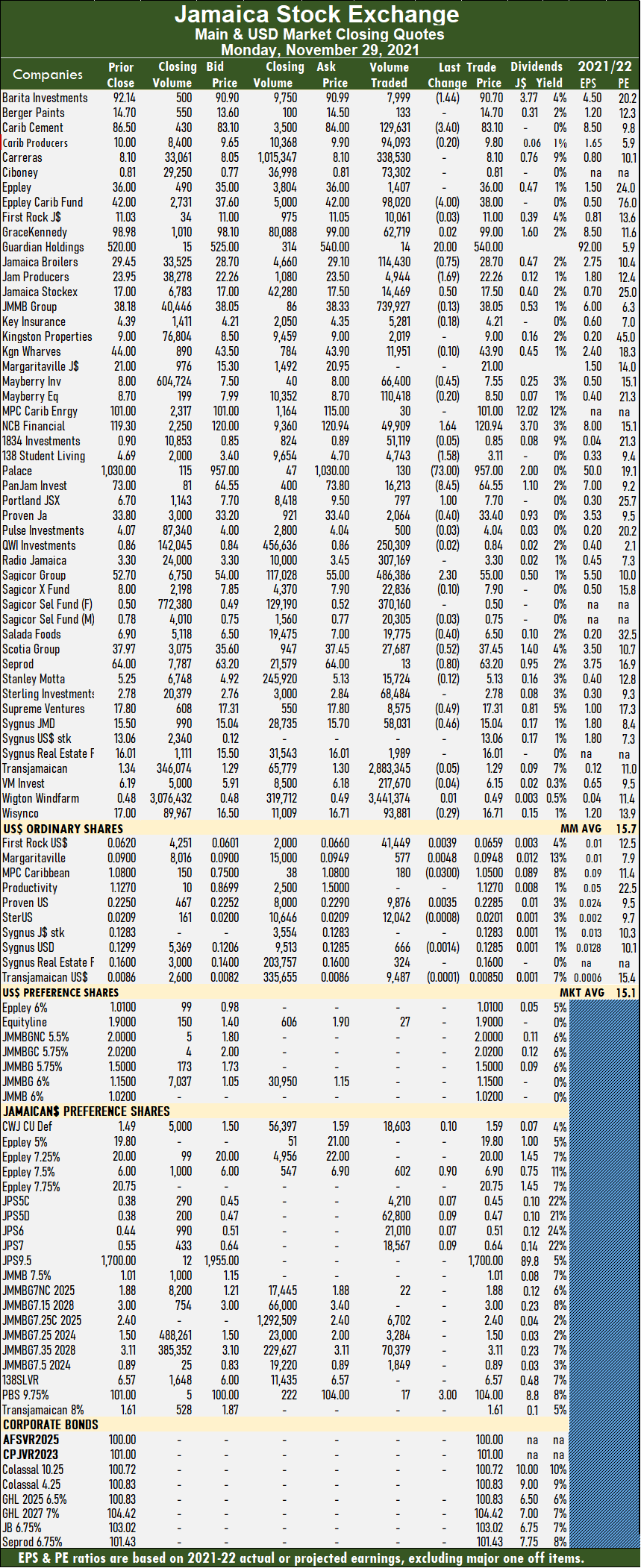

Market activity ended on Tuesday with robust gains for the Jamaica Stock Exchange Main Market. The All Jamaican Composite Index jumped by 4,559.46 points to 437,668.39, just over 7,000 points below the close for October. The JSE Main Index surged 5,036.25 points to 397,830.67 and the JSE Financial Index rose 1.80 points to 98.28. The volume of stocks trading slipped at the close on Tuesday with the market ending, with rising stocks exceeding those decliners 2 to 1. Trading on hauled out 7,613,507 shares for $134,588,814 in contrast to 10,513,011 units at $104,608,393 on Monday. Transjamaican Highway led trading with 21.2 percent of total volume after transferring 1.62 million shares, followed by Jamaica Broilers with 14.3 percent and 1.09 million units and Wigton Windfarm 10 percent with an exchange of 762,810 units.

Trading on hauled out 7,613,507 shares for $134,588,814 in contrast to 10,513,011 units at $104,608,393 on Monday. Transjamaican Highway led trading with 21.2 percent of total volume after transferring 1.62 million shares, followed by Jamaica Broilers with 14.3 percent and 1.09 million units and Wigton Windfarm 10 percent with an exchange of 762,810 units. JMMB Group popped 35 cents to close at $38.40 with 102,208 shares changing hands, Margaritaville fell $5 in closing at $16 with one stock unit crossing the market, PanJam Investment popped $9.21 to $73.76 in an exchange of 823 units. Sagicor Group shed $2 to close at $53 in transferring 533,923 stock units and Scotia Group gained 30 cents in ending at $37.75 with 3,505 stocks changing hands, Supreme Ventures rallied 19 cents in closing at $17.50 in switching ownership of 195,825 shares and Wisynco Group increased 22 cents to $16.93 trading 123,466 units.

JMMB Group popped 35 cents to close at $38.40 with 102,208 shares changing hands, Margaritaville fell $5 in closing at $16 with one stock unit crossing the market, PanJam Investment popped $9.21 to $73.76 in an exchange of 823 units. Sagicor Group shed $2 to close at $53 in transferring 533,923 stock units and Scotia Group gained 30 cents in ending at $37.75 with 3,505 stocks changing hands, Supreme Ventures rallied 19 cents in closing at $17.50 in switching ownership of 195,825 shares and Wisynco Group increased 22 cents to $16.93 trading 123,466 units. At the close, Barita Investments shed $1.44 to close at $90.70 with 7,999 stock units changing hands, Caribbean Cement declined $3.40 to $83.10, with 129,631 units clearing the market. Eppley Caribbean Property Fund advanced $4 to $38 in trading 98,020 stocks, Guardian Holdings spiked $20 to $540 with a transfer of 14 shares, Jamaica Broilers slipped 75 cents to end at $28.70 in exchanging 114,430 stock units. Jamaica Producers shed $1.69 to end at $22.26 with the swapping of 4,944 units, Jamaica Stock Exchange rallied 50 cents in closing at $17.50 with an exchange of 14,469 stocks, Mayberry Investments lost 45 cents to close at $7.55 with 66,400 stock units crossing the exchange. NCB Financial rose $1.64 to $120.94 in switching ownership of 49,909 stocks, 138 Student Living fell $1.58 in closing at $3.11 in exchanging 4,743 shares, Palace Amusement dropped $73 to $957 with 130 units crossing the market, PanJam Investment declined $8.45 to close at $64.55 in transferring 16,213 shares. Portland JSX spiked $1 in closing at $7.70 with the swapping of 797 stock units, Proven Investments lost 40 cents after ending at $33.40, with 2,064 stocks crossing the market, Sagicor Group popped $2.30 to end at $55 in an exchange of 486,386 units.

At the close, Barita Investments shed $1.44 to close at $90.70 with 7,999 stock units changing hands, Caribbean Cement declined $3.40 to $83.10, with 129,631 units clearing the market. Eppley Caribbean Property Fund advanced $4 to $38 in trading 98,020 stocks, Guardian Holdings spiked $20 to $540 with a transfer of 14 shares, Jamaica Broilers slipped 75 cents to end at $28.70 in exchanging 114,430 stock units. Jamaica Producers shed $1.69 to end at $22.26 with the swapping of 4,944 units, Jamaica Stock Exchange rallied 50 cents in closing at $17.50 with an exchange of 14,469 stocks, Mayberry Investments lost 45 cents to close at $7.55 with 66,400 stock units crossing the exchange. NCB Financial rose $1.64 to $120.94 in switching ownership of 49,909 stocks, 138 Student Living fell $1.58 in closing at $3.11 in exchanging 4,743 shares, Palace Amusement dropped $73 to $957 with 130 units crossing the market, PanJam Investment declined $8.45 to close at $64.55 in transferring 16,213 shares. Portland JSX spiked $1 in closing at $7.70 with the swapping of 797 stock units, Proven Investments lost 40 cents after ending at $33.40, with 2,064 stocks crossing the market, Sagicor Group popped $2.30 to end at $55 in an exchange of 486,386 units.  Salada Foods dipped 40 cents to $6.50 with 19,775 shares changing hands, Scotia Group lost 52 cents to $37.45 in trading 27,687 units, Seprod shed 80 cents to end at $63.20 in switching ownership of 13 shares. Supreme Ventures fell 49 cents to $17.31 in an exchange of 8,575 stock units, Sygnus Credit Investments dipped 46 cents to close at $15.04 after clearing the market with 58,031 stocks and Wisynco Group lost 29 cents to $16.71 with 93,881 shares changing hands.

Salada Foods dipped 40 cents to $6.50 with 19,775 shares changing hands, Scotia Group lost 52 cents to $37.45 in trading 27,687 units, Seprod shed 80 cents to end at $63.20 in switching ownership of 13 shares. Supreme Ventures fell 49 cents to $17.31 in an exchange of 8,575 stock units, Sygnus Credit Investments dipped 46 cents to close at $15.04 after clearing the market with 58,031 stocks and Wisynco Group lost 29 cents to $16.71 with 93,881 shares changing hands. The All Jamaican Composite Index surged 2,970.07 points to 430,207.92, the JSE Main Index climbed 2,743.08 points to 389,556.25 and the JSE Financial Index rose 0.65 points to end at 95.14.

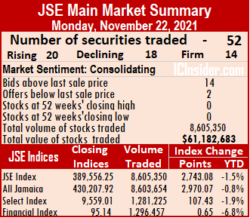

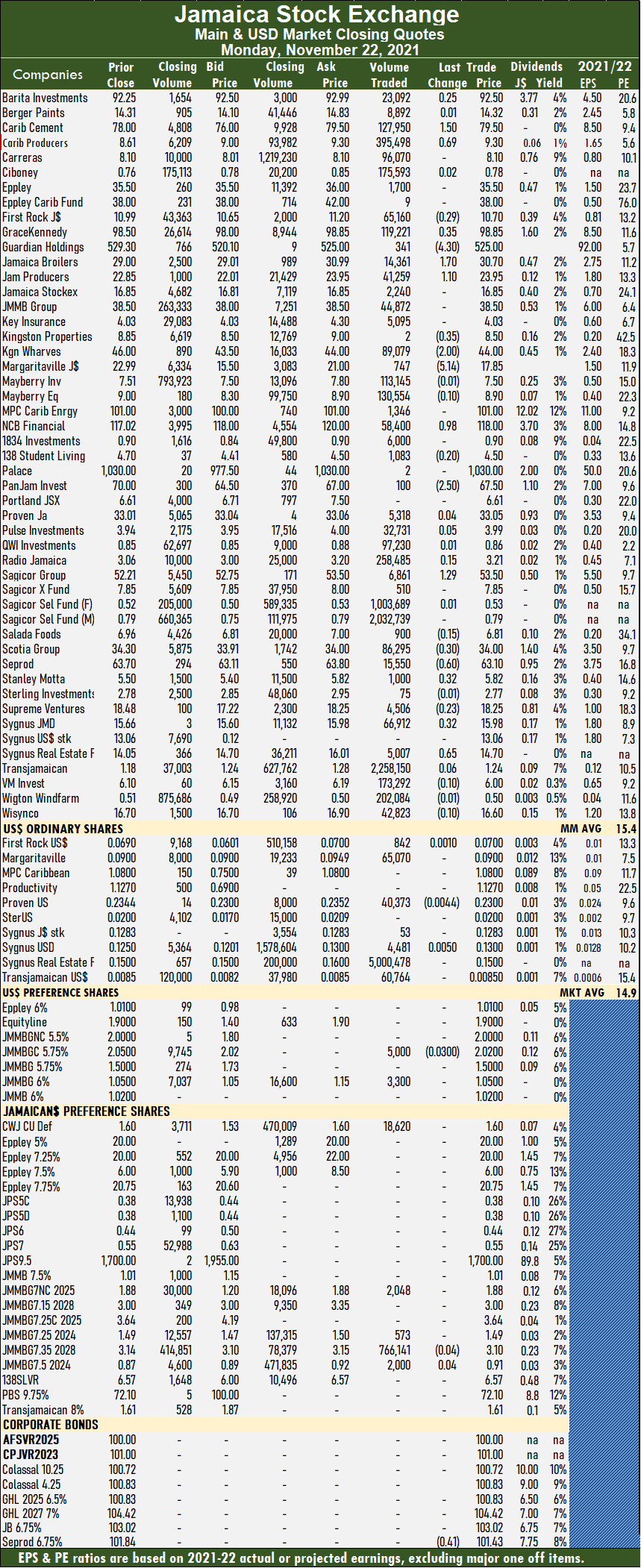

The All Jamaican Composite Index surged 2,970.07 points to 430,207.92, the JSE Main Index climbed 2,743.08 points to 389,556.25 and the JSE Financial Index rose 0.65 points to end at 95.14. Trading averaged 165,488 units at $1,176,590, down from 168,071 shares at $3,760,319 on Friday and month to date, an average of 253,830 units at $3,057,633, versus 259,804 units at $3,184,829 on Friday. October averaged 251,350 units at $2,773,208.

Trading averaged 165,488 units at $1,176,590, down from 168,071 shares at $3,760,319 on Friday and month to date, an average of 253,830 units at $3,057,633, versus 259,804 units at $3,184,829 on Friday. October averaged 251,350 units at $2,773,208. PanJam Investment fell $2.50 to $67.50 in exchanging 100 stocks, Sagicor Group advanced $1.29 to $53.50 after trading 6,861 stock units, Scotia Group lost 30 cents in closing at $34 with the swapping of 86,295 units. Seprod shed 60 cents to close at $63.10 in switching ownership of 15,550 shares, Stanley Motta gained 32 cents to end at $5.82 in trading 1,000 stock units, Sygnus Credit Investments popped 32 cents to $15.98 after an exchange of 66,912 shares and Sygnus Real Estate Finance climbed 65 cents to $14.70 with 5,007 stocks changing hands.

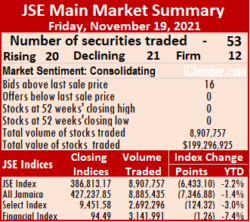

PanJam Investment fell $2.50 to $67.50 in exchanging 100 stocks, Sagicor Group advanced $1.29 to $53.50 after trading 6,861 stock units, Scotia Group lost 30 cents in closing at $34 with the swapping of 86,295 units. Seprod shed 60 cents to close at $63.10 in switching ownership of 15,550 shares, Stanley Motta gained 32 cents to end at $5.82 in trading 1,000 stock units, Sygnus Credit Investments popped 32 cents to $15.98 after an exchange of 66,912 shares and Sygnus Real Estate Finance climbed 65 cents to $14.70 with 5,007 stocks changing hands. Investor’s Choice bid-offer indicator shows 16 stocks ended with bids higher than their last selling prices and none with a lower offer.

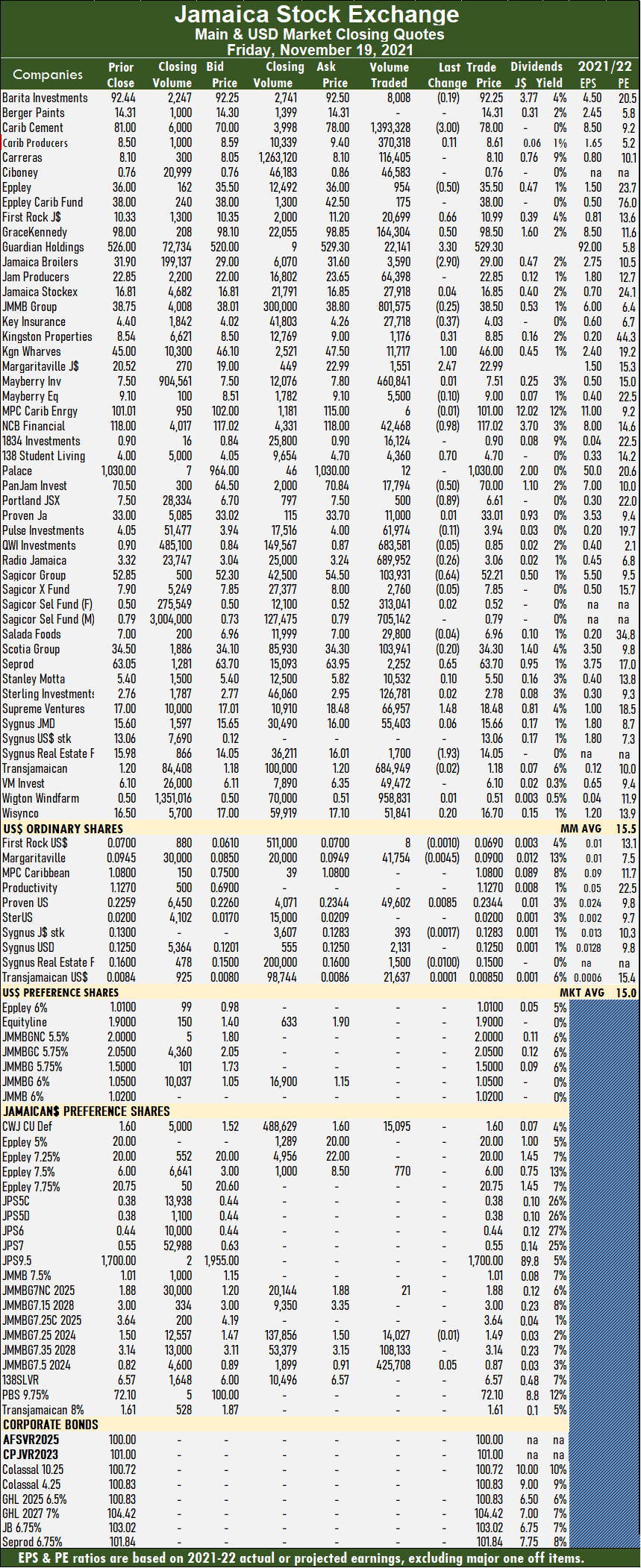

Investor’s Choice bid-offer indicator shows 16 stocks ended with bids higher than their last selling prices and none with a lower offer. NCB Financial shed 98 cents to end at $117.02 with an exchange of 42,468 stocks, 138 Student Living rose 70 cents to $4.70 in transferring 4,360 shares, PanJam Investment lost 50 cents to close at $70 after exchanging 17,794 units, Portland JSX fell 89 cents to $6.61 with 500 shares clearing the market. Radio Jamaica lost 26 cents to close at $3.06 in switching ownership of 689,952 stock units, Sagicor Group shed 64 cents in ending at $52.21 while trading 103,931 shares, Seprod popped 65 cents to finish at $63.70 after exchanging 2,252 stocks. Supreme Ventures rose $1.48 to $18.48 with 66,957 units changing hands and Sygnus Real Estate Finance declined $1.93 to $14.05 after 1,700 stock units crossed the market.

NCB Financial shed 98 cents to end at $117.02 with an exchange of 42,468 stocks, 138 Student Living rose 70 cents to $4.70 in transferring 4,360 shares, PanJam Investment lost 50 cents to close at $70 after exchanging 17,794 units, Portland JSX fell 89 cents to $6.61 with 500 shares clearing the market. Radio Jamaica lost 26 cents to close at $3.06 in switching ownership of 689,952 stock units, Sagicor Group shed 64 cents in ending at $52.21 while trading 103,931 shares, Seprod popped 65 cents to finish at $63.70 after exchanging 2,252 stocks. Supreme Ventures rose $1.48 to $18.48 with 66,957 units changing hands and Sygnus Real Estate Finance declined $1.93 to $14.05 after 1,700 stock units crossed the market.