The PNP must abandon socialism or suffer a slow near death experience. Those persons within the party who are product of the heady days of the 1970 period will probably rubbish this view, but facts are pointing clearly in that direction.

The PNP must abandon socialism or suffer a slow near death experience. Those persons within the party who are product of the heady days of the 1970 period will probably rubbish this view, but facts are pointing clearly in that direction.

An analysis of voting pattern since the 1980s is very clear new voters are embracing the JLP in larger numbers than the PNP, the change started after the huge swing to the PNP in the 1970 with the enhanced focus on democratic socialism. Young persons out of school especially UWI, were mesmerized by Michael Manley’s oratory and charisma and overwhelmingly gave the PNP their full support. Back then, the PNPYO, the Social Development Commission and the National Youth Service programs were three of the top entities pushing the social agenda to young people.

Left with empty shelves and mass migration of the middle class, the children of the 70s and 80s have not embraced the PNP the way their parents did. Increasingly, the post 1960 children look to North America as the standard fueled by the advent of the ubiquitous Cable Television and computers beaming capitalistic policies daily.

Dr. Peter Phillips – President of the PNP

Today’s young adults many who are schooled in North America or spent several holidays there have no real love for Socialism and that is showing up in the voting pattern. In the 1970s the local stock market is estimated to have had around 10,000 investors owning stocks directly, today that number have climbed to well over 120,000 around 15 percent of the persons who voted in 2016, with younger persons flocking to the market like never before and this growth trend will continue. That is another example of the switch in the political landscape. Those are reasons why the voting pattern is showing the Labour Party increasing their vote tally sharply over the PNP. That trend shows up in the Eastern Portland election now and in the past. Although there were 2,000 new voters on the list than in 2016, the PNP only received around 25 percent to the JLP’s 75 percent.

Except for a few seats, the PNP is fast becoming a minority party. Up to the 1970s the party, dominated St James and St Ann areas that the JLP could only win 1 seat in each, now they hold a minority and where they win its marginal, except for Lisa Hanna’s seat. The picture is the same in St Mary, with the PNP having only one seat in that parish where they used to have two solid seats. They used to dominate the corporate area, but now primarily holds just the seats bordering on the waterfront, with the exception of two.

If the party does not radically change its policies, it will take a long time for them to swing the majority of young persons to support them in the long-term, by then a lot of their current support will pass on, thus reducing them to a minority party country wide.

Christopher Burns writing in Jamaica Observer after the 2016 elections set out a detailed assessment of the trends of voting between 1993 and 2016. The details are one that we of IC Insider wrote about some time ago and reported in Investors Choice.

Burns stated “a review of the voting pattern between 1993 and 2016 reveals a few interesting findings as far as votes for the PNP are concerned, vis-Ã -vis votes for the JLP. In the 1993 General Election, of the 678,572 votes cast, the PNP received 401,476 (59.2 percent) to the JLP’s 263,472 (38.83 percent).’ The PNP received 138,274 or 20.38 percent more votes than the JLP.”

“Over the six general elections (1993 – 2016) the PNP, in 2016, netted only 31,989 more votes than it did in 1993, while the JLP netted 173,500 more than it did in 1993.” “The PNP received high vote counts between 1993 and 2007, but “its highest vote performance in 2011, produced roughly 62,318 or 15.51 percent more votes than it did in 1993. However, even though the JLP lost the 2011 General Election, its 2011 vote performance produced 142,448 (54.07 percent) more votes than in 1993.”

“In the 2016 elections, the JLP received 436,972 votes, while the PNP secured 433,735, from the 2016 voters list of eligible voters that grew by 176,376 or 10.70 percent over 2011, the PNP received 30,329 (6.54 percent) fewer votes than it got in 2011. The JLP increased its 2016 votes by 31,052 (7.65 percent) over 2011.”

There are a number of developments that suggest that the Labour Party support has grown since 2016, while that of the PNP has not. The Eastern Portland seat by-election represented a 4.5 percent swing from the 2011 election results. The 2011 election is a better base to use than the 2016 results that went against the general swing of that election. Public opinion polls suggest that the current swing nationally, is much greater than 4.5 percent. The performance of the stock market, business and consumer confidence levels that are all at record highs, point to a margin that is in excess of what the swing is in East Portland based on the 2011 results.

The PNP needs to change strategies and many of its policies. It needs to be articulating a cohesive set of policies that can appeal to the younger generation and there are a series of issues that they can focus on that can set them apart from the JLP government.

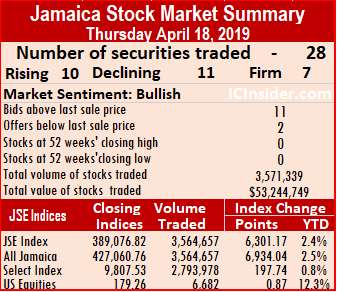

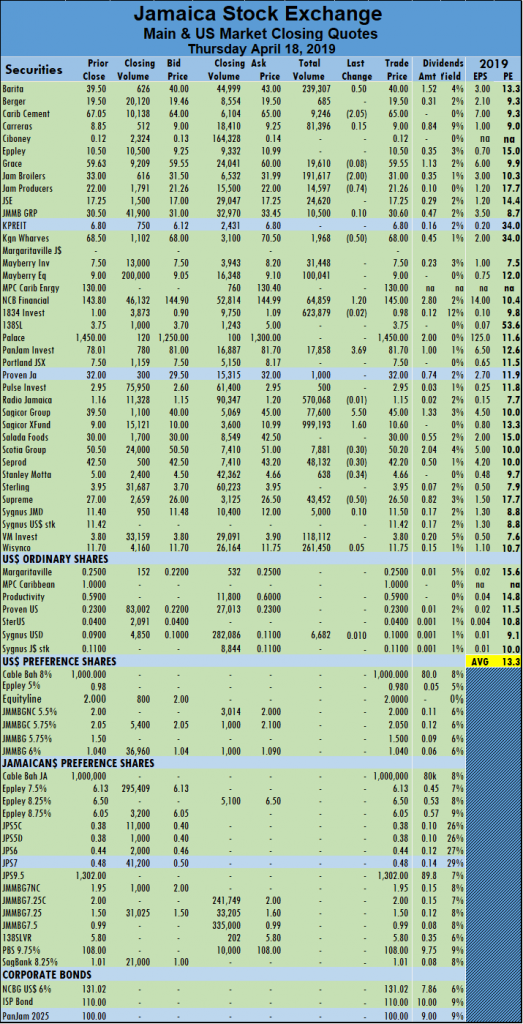

50 cents to settle at $68, with 1,968 units changing hands. NCB Financial Group recovered the $1.20 lost on Wednesday in trading 64,859 shares, to close at $145, PanJam Investment jumped $3.69 to close at $81.70 after trading 17,858 units, Sagicor Group jumped $5.50 to $45 in an exchange of 77,600 shares. Sagicor Real Estate Fund jumped $1.60 to $10.60, in trading 999,193 shares, Scotia Group fell 30 cents and finished trading 7,881 shares at $50.20, Seprod closed at $42.20 with a loss of 30 cents while trading 48,132 shares. Stanley Motta lost 34 cents and ended at $4.66, in trading 638 shares and Supreme Ventures lost 50 cents in finishing at $26.50, with 43,452 units changing hands.

50 cents to settle at $68, with 1,968 units changing hands. NCB Financial Group recovered the $1.20 lost on Wednesday in trading 64,859 shares, to close at $145, PanJam Investment jumped $3.69 to close at $81.70 after trading 17,858 units, Sagicor Group jumped $5.50 to $45 in an exchange of 77,600 shares. Sagicor Real Estate Fund jumped $1.60 to $10.60, in trading 999,193 shares, Scotia Group fell 30 cents and finished trading 7,881 shares at $50.20, Seprod closed at $42.20 with a loss of 30 cents while trading 48,132 shares. Stanley Motta lost 34 cents and ended at $4.66, in trading 638 shares and Supreme Ventures lost 50 cents in finishing at $26.50, with 43,452 units changing hands.

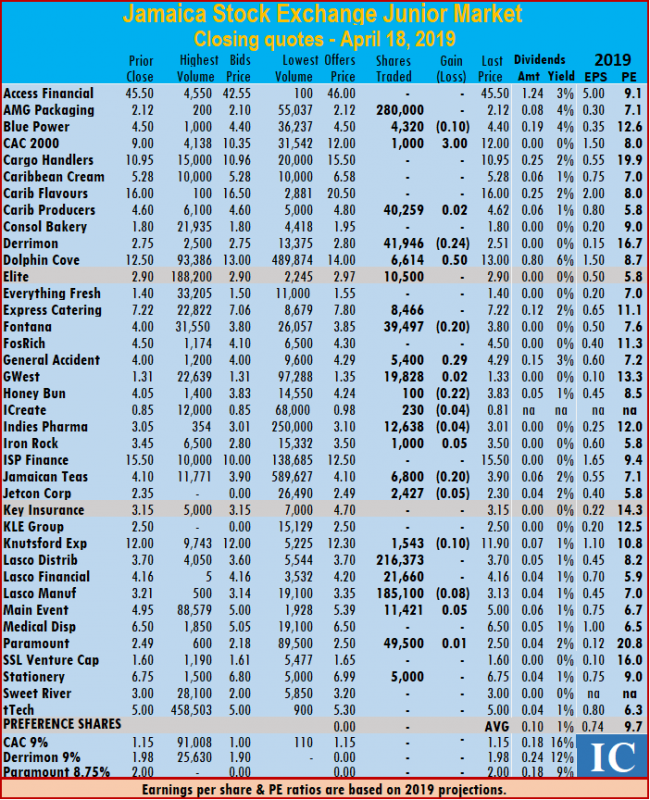

At the close of the market, AMG Packaging exchanged 280,000 stock units and ended at $2.12, Blue Power concluded trading with 4,320 units and lost 10 cents in closing at $4.40, CAC 2000 jumped $3 to close at $12, with 1,000 shares changing hands, Caribbean Producers finished trading 40,259 units, and rose 2 cents to end at $4.62. Derrimon Trading ended with a loss of 24 cents at $2.51, with an exchange of 41,946 shares. Dolphin Cove concluded trading 6,614 shares and rose 50 cents higher to $13, Elite Diagnostic settled at $2.90, with 10,500 units changing hands, Express Catering ended trading of 8,466 shares to close at $7.22, Fontana finished trading 39,497 shares with a loss of 20 cents at $3.80. General Accident closed 29 cents higher at $4.29, with an exchange of 5,400 stock units, GWest Corporation ended 2 cents higher at $1.33, with 19,828 units changing hands, Honey Bun traded 100 shares with a loss of 22 cents at $3.83, iCreate lost 4 cents in closing at 81 cents, with an exchange of

At the close of the market, AMG Packaging exchanged 280,000 stock units and ended at $2.12, Blue Power concluded trading with 4,320 units and lost 10 cents in closing at $4.40, CAC 2000 jumped $3 to close at $12, with 1,000 shares changing hands, Caribbean Producers finished trading 40,259 units, and rose 2 cents to end at $4.62. Derrimon Trading ended with a loss of 24 cents at $2.51, with an exchange of 41,946 shares. Dolphin Cove concluded trading 6,614 shares and rose 50 cents higher to $13, Elite Diagnostic settled at $2.90, with 10,500 units changing hands, Express Catering ended trading of 8,466 shares to close at $7.22, Fontana finished trading 39,497 shares with a loss of 20 cents at $3.80. General Accident closed 29 cents higher at $4.29, with an exchange of 5,400 stock units, GWest Corporation ended 2 cents higher at $1.33, with 19,828 units changing hands, Honey Bun traded 100 shares with a loss of 22 cents at $3.83, iCreate lost 4 cents in closing at 81 cents, with an exchange of  230 shares. Indies Pharma ended trading of 12,638 shares, with a loss of 4 cents at $3.01, Iron Rock settled 5 cents higher at $3.50, with 1,000 shares changing hands, Jamaican Teas traded with a loss of 20 cents at $3.90, with the swapping of 6,800 units. Jetcon Corporation finished trading with a loss of 5 cents at $2.30, with 2,427 shares passing through the exchange, Knutsford Express concluded trading of 1,543 stock units with a loss of 10 cents at $11.90, Lasco Distributors finished at $3.70, with an exchange of 216,373 units, Lasco Financial settled at $4.16, trading 21,660 shares. Lasco Manufacturing ended trading 185,100 shares, with a loss of 8 cents at $3.13, Main Event traded 5 cents higher at $5, with an exchange of 11,421 shares, Paramount Trading closed 1 cent higher at $2.50, with 49,500 units trading and Stationery and Office concluded trading at $6.75, with 5,000 shares changing hands.

230 shares. Indies Pharma ended trading of 12,638 shares, with a loss of 4 cents at $3.01, Iron Rock settled 5 cents higher at $3.50, with 1,000 shares changing hands, Jamaican Teas traded with a loss of 20 cents at $3.90, with the swapping of 6,800 units. Jetcon Corporation finished trading with a loss of 5 cents at $2.30, with 2,427 shares passing through the exchange, Knutsford Express concluded trading of 1,543 stock units with a loss of 10 cents at $11.90, Lasco Distributors finished at $3.70, with an exchange of 216,373 units, Lasco Financial settled at $4.16, trading 21,660 shares. Lasco Manufacturing ended trading 185,100 shares, with a loss of 8 cents at $3.13, Main Event traded 5 cents higher at $5, with an exchange of 11,421 shares, Paramount Trading closed 1 cent higher at $2.50, with 49,500 units trading and Stationery and Office concluded trading at $6.75, with 5,000 shares changing hands. Market activity picked up on the main market of the Jamaica Stock Exchange on Wednesday with 3,197,837 units valued $101,850,841 traded compared to 1,271,826 units valued $41,461,461 on Tuesday.

Market activity picked up on the main market of the Jamaica Stock Exchange on Wednesday with 3,197,837 units valued $101,850,841 traded compared to 1,271,826 units valued $41,461,461 on Tuesday.  The average volume and value for the month to date amounts to 142,996 shares at $2,404,318 for each security, compared to 145,107 shares at $2,305,661 previously. Trading for March resulted in an average of 438,501 shares at $9,851,307, for each security traded.

The average volume and value for the month to date amounts to 142,996 shares at $2,404,318 for each security, compared to 145,107 shares at $2,305,661 previously. Trading for March resulted in an average of 438,501 shares at $9,851,307, for each security traded. 69,600 shares, to close at $7.50, Mayberry Jamaican Equities fell 50 cents trading 138,162 shares at $9.50. NCB Financial Group dropped $1.20 in trading with 14,174 shares, to close at $143.80, PanJam Investment lost 99 cents after ending at $78.01 and trading 41,290 units, Sagicor Group rose 45 cents to $39.50 in an exchange of 10,772 shares. Scotia Group rose 30 cents and finished trading 28,076 shares at $50.50, Seprod closed at $42.50 with a gain of 50 cents while trading 11,100 shares, Supreme Ventures gained $2 in finishing at $27, with 278,135 units changing hands and Wisynco Group gained 35 cents trading 670,925 units, to close at $11.70.

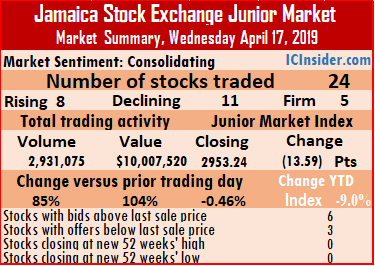

69,600 shares, to close at $7.50, Mayberry Jamaican Equities fell 50 cents trading 138,162 shares at $9.50. NCB Financial Group dropped $1.20 in trading with 14,174 shares, to close at $143.80, PanJam Investment lost 99 cents after ending at $78.01 and trading 41,290 units, Sagicor Group rose 45 cents to $39.50 in an exchange of 10,772 shares. Scotia Group rose 30 cents and finished trading 28,076 shares at $50.50, Seprod closed at $42.50 with a gain of 50 cents while trading 11,100 shares, Supreme Ventures gained $2 in finishing at $27, with 278,135 units changing hands and Wisynco Group gained 35 cents trading 670,925 units, to close at $11.70. The Junior Market of the Jamaica Stock Exchange closed with volume rising 85 percent and value increasing 104 percent over Tuesday’s levels, but the market index lost 13.59 points to 2,953.24, down 9 percent for 2019 so far.

The Junior Market of the Jamaica Stock Exchange closed with volume rising 85 percent and value increasing 104 percent over Tuesday’s levels, but the market index lost 13.59 points to 2,953.24, down 9 percent for 2019 so far. units 100,529 valued $356,911 and previously 98,795 valued $352,089 for each security traded. In contrast, March closed with an average of 195,942 shares valued at $777,498 for each security traded.

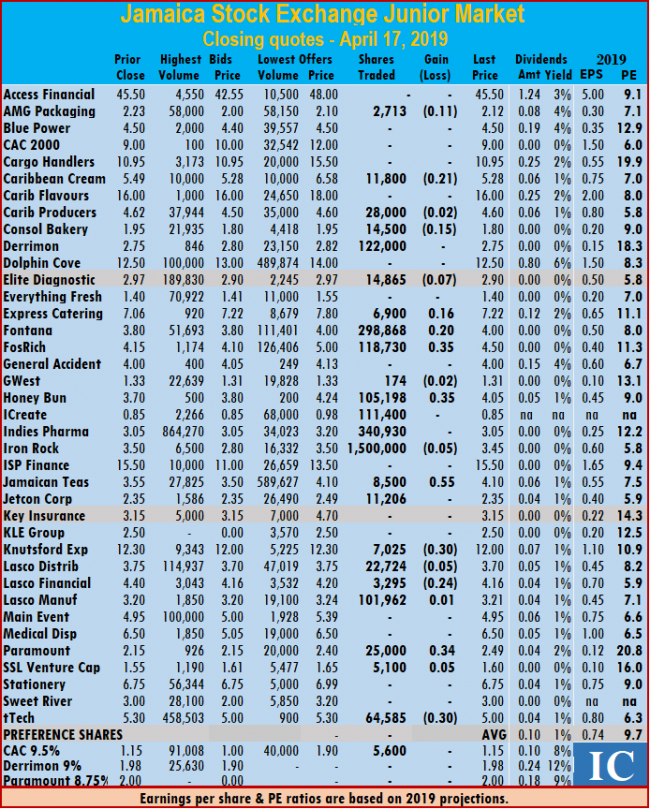

units 100,529 valued $356,911 and previously 98,795 valued $352,089 for each security traded. In contrast, March closed with an average of 195,942 shares valued at $777,498 for each security traded. Iron Rock settled with a loss of 5 cents at $3.45, with 1,500,000 shares. Jamaican Teas traded 55 cents higher at $4.10, with 8,500 units, Jetcon Corporation finished trading at $2.35, with 11,206 shares, Knutsford Express concluded trading with a loss of 30 cents at $12, with 7,025 stock units, Lasco Distributors finished with a loss of 5 cents at $3.70, with 22,724 units changing hands. Lasco Financial settled with an exchange of 3,295 shares and lost 24 cents at $4.16, Lasco Manufacturing ended trading 101,962 shares and closed 1 cent higher at $3.21, Paramount Trading closed 34 cents higher at $2.49, with 25,000 units changing hands. SSL Venture Capital ended 5 cents higher at $1.60, with an exchange of 5,100 shares and tTech settled with a loss of 30 cents at $5, with 64,585 stock units changing hands. In the junior market preference segment, CAC 2000 9% closed at $1.15, trading 5,600 shares.

Iron Rock settled with a loss of 5 cents at $3.45, with 1,500,000 shares. Jamaican Teas traded 55 cents higher at $4.10, with 8,500 units, Jetcon Corporation finished trading at $2.35, with 11,206 shares, Knutsford Express concluded trading with a loss of 30 cents at $12, with 7,025 stock units, Lasco Distributors finished with a loss of 5 cents at $3.70, with 22,724 units changing hands. Lasco Financial settled with an exchange of 3,295 shares and lost 24 cents at $4.16, Lasco Manufacturing ended trading 101,962 shares and closed 1 cent higher at $3.21, Paramount Trading closed 34 cents higher at $2.49, with 25,000 units changing hands. SSL Venture Capital ended 5 cents higher at $1.60, with an exchange of 5,100 shares and tTech settled with a loss of 30 cents at $5, with 64,585 stock units changing hands. In the junior market preference segment, CAC 2000 9% closed at $1.15, trading 5,600 shares.

Mayberry Jamaican Equities rose 90 cents trading 276,530 shares at $9.50, PanJam Investment fell $2 and ended at $79 trading 10,830 units, Sagicor Real Estate Fund dropped $1.30 in an exchange of 146,545 shares to close at a 52 weeks’ low of $9, Seprod closed at $42 with a loss of 50 cents while trading 1,236 shares. Stanley Motta gained 50 cents to end at $5, exchanging 986 shares, Supreme Ventures gave up $1 in finishing at $25, with 34,782 units changing hands Sygnus Credit Investments shed 60 cents in trading 13,800 units to close at $11.40 and Wisynco Group gained 29 cents trading 64,250 units, to close at $11.35.

Mayberry Jamaican Equities rose 90 cents trading 276,530 shares at $9.50, PanJam Investment fell $2 and ended at $79 trading 10,830 units, Sagicor Real Estate Fund dropped $1.30 in an exchange of 146,545 shares to close at a 52 weeks’ low of $9, Seprod closed at $42 with a loss of 50 cents while trading 1,236 shares. Stanley Motta gained 50 cents to end at $5, exchanging 986 shares, Supreme Ventures gave up $1 in finishing at $25, with 34,782 units changing hands Sygnus Credit Investments shed 60 cents in trading 13,800 units to close at $11.40 and Wisynco Group gained 29 cents trading 64,250 units, to close at $11.35.

shares, Jamaican Teas traded 3,000 units with a loss of 55 cents at $3.55. Jetcon Corporation ended market activity with 62,000 shares and lost 13 cents to close at $2.35, KLE Group ended with a loss of 20 cents at $2.50, with 964 shares changing hands, Lasco Distributors finished 5 cents higher at $3.75, with 15,000 units traded, Lasco Financial rose 20 cents and higher settled at $4.40, while trading 600 shares. Lasco Manufacturing ended trading 70,318 shares, with a loss of 25 cents to close at $3.20, Main Event ended with a loss of 5 cents at $4.95, with 10,400 shares changing hands, Stationery and Office concluded trading of 9,000 shares at $6.75 and tTech settled at $5.30, with 5,500 stock units trading.

shares, Jamaican Teas traded 3,000 units with a loss of 55 cents at $3.55. Jetcon Corporation ended market activity with 62,000 shares and lost 13 cents to close at $2.35, KLE Group ended with a loss of 20 cents at $2.50, with 964 shares changing hands, Lasco Distributors finished 5 cents higher at $3.75, with 15,000 units traded, Lasco Financial rose 20 cents and higher settled at $4.40, while trading 600 shares. Lasco Manufacturing ended trading 70,318 shares, with a loss of 25 cents to close at $3.20, Main Event ended with a loss of 5 cents at $4.95, with 10,400 shares changing hands, Stationery and Office concluded trading of 9,000 shares at $6.75 and tTech settled at $5.30, with 5,500 stock units trading.

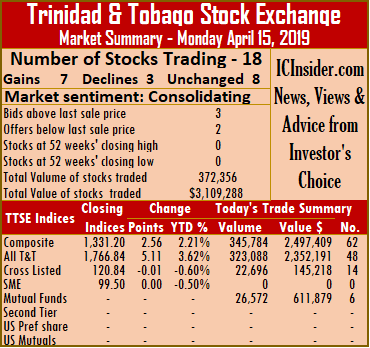

At the close, investors exchanged 372,356 shares at $3,109,288, compared to 102,669 shares at $1,954,012 on Friday.

At the close, investors exchanged 372,356 shares at $3,109,288, compared to 102,669 shares at $1,954,012 on Friday. $8.79, after exchanging 13,754 shares.

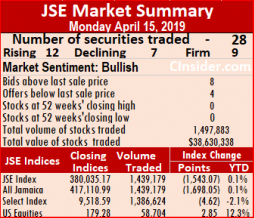

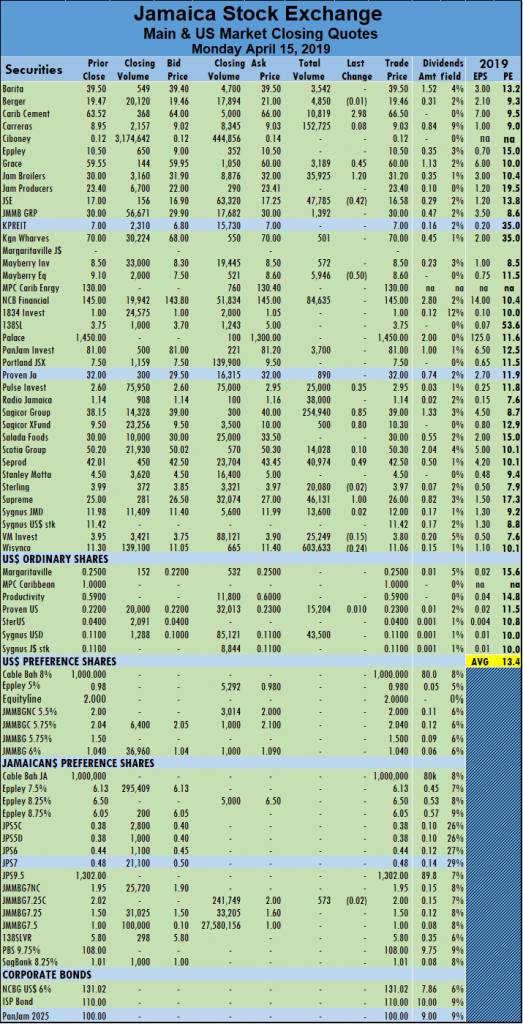

$8.79, after exchanging 13,754 shares. Trading on the main market of the Jamaica Stock Exchange ended Monday as the JSE All Jamaican Composite Index sank 1,698.05 points to 417,110.99 and the JSE Index dropping 1,543.07 points to close at 380,035.17, with a positive advance decline ratio.

Trading on the main market of the Jamaica Stock Exchange ended Monday as the JSE All Jamaican Composite Index sank 1,698.05 points to 417,110.99 and the JSE Index dropping 1,543.07 points to close at 380,035.17, with a positive advance decline ratio.  volume, followed by Sagicor Group with 254,940 units with 18 percent of the day’s trades and Carreras with a mere 152,725 units for 11 percent of volume traded.

volume, followed by Sagicor Group with 254,940 units with 18 percent of the day’s trades and Carreras with a mere 152,725 units for 11 percent of volume traded. Jamaica Stock Exchange fell 42 cents to close at $16.58, after trading 47,785 shares, Mayberry Jamaican Equities lost 50 cents trading 5,946 shares at $8.6, Pulse Investments rose 35 cents and finished at $2.95, with 25,000 shares crossing the exchange, Sagicor Group rose 85 cents in trading 254,940 shares to close at $39. Sagicor Real Estate Fund exchanged just 500 shares to close at $10.30, after gaining 80 cents, Supreme Ventures rose $1 and finished at $26, with 46,131 units changing hands and Wisynco Group fell 24 cents trading 603,633 units to close at $11.06.

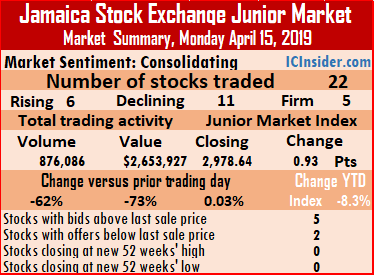

Jamaica Stock Exchange fell 42 cents to close at $16.58, after trading 47,785 shares, Mayberry Jamaican Equities lost 50 cents trading 5,946 shares at $8.6, Pulse Investments rose 35 cents and finished at $2.95, with 25,000 shares crossing the exchange, Sagicor Group rose 85 cents in trading 254,940 shares to close at $39. Sagicor Real Estate Fund exchanged just 500 shares to close at $10.30, after gaining 80 cents, Supreme Ventures rose $1 and finished at $26, with 46,131 units changing hands and Wisynco Group fell 24 cents trading 603,633 units to close at $11.06. The Junior Market of the Jamaica Stock Exchange closed almost unchanged on Monday, with reduced trading levels. The market inched higher by just 0.93 points to 2,978.64.

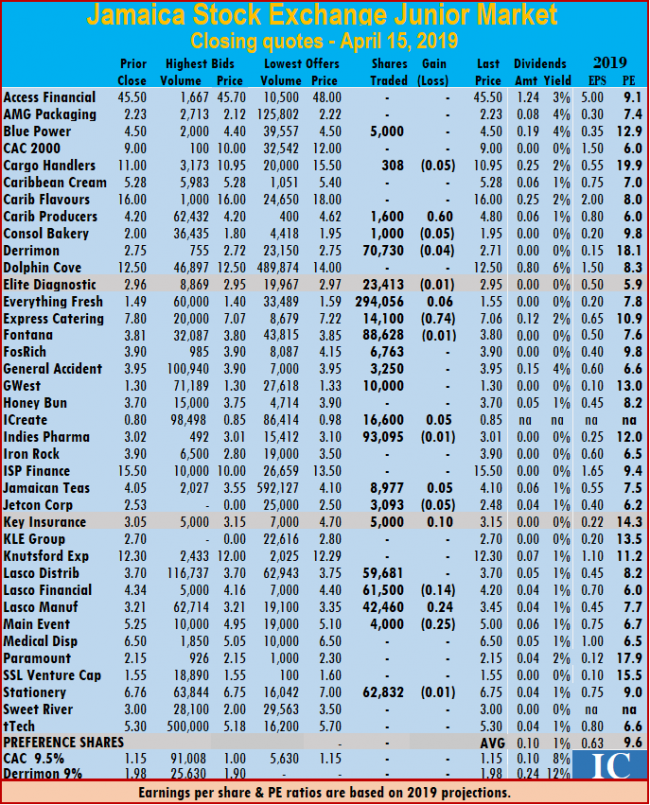

The Junior Market of the Jamaica Stock Exchange closed almost unchanged on Monday, with reduced trading levels. The market inched higher by just 0.93 points to 2,978.64. average of $120,633 in contrast to 86,294 units for an average of $361,409 on Friday. The average volume and value for the month to date amounts to units 100,553 valued $361,045 and previously 105,772 valued at $381,706 for each security traded. In contrast, March closed with an average of 195,942 shares valued at $777,498 for each security traded.

average of $120,633 in contrast to 86,294 units for an average of $361,409 on Friday. The average volume and value for the month to date amounts to units 100,553 valued $361,045 and previously 105,772 valued at $381,706 for each security traded. In contrast, March closed with an average of 195,942 shares valued at $777,498 for each security traded. 3,250 stock units, GWest Corporation ended at $1.30, while trading 10,000 units, iCreate gained 5 cents to close at 85 cents, with an exchange of 16,600 shares, Indies Pharma finished with a loss of 1 cent at $3.01, with 93,095 shares crossing the exchange. Jamaican Teas traded 8,977 units and rose 5 cents to close at $4.10, Jetcon Corporation finished trading 3,093 shares, with a loss of 5 cents at $2.48, Key Insurance closed 10 cents higher at $3.15, with the trading of 5,000 shares, Lasco Distributors closed at $3.70, with an exchange of 59,681 units. Lasco Financial settled with a loss of 14 cents at $4.20, with 61,500 shares changing hands, Lasco Manufacturing ended trading of 42,460 shares, with a rise of 24 cents to $3.45, Main Event traded with 4,000 shares and lost 25 cents to end at $5 and Stationery and Office concluded trading of 62,832 shares with a loss of 1 cent at $6.75.

3,250 stock units, GWest Corporation ended at $1.30, while trading 10,000 units, iCreate gained 5 cents to close at 85 cents, with an exchange of 16,600 shares, Indies Pharma finished with a loss of 1 cent at $3.01, with 93,095 shares crossing the exchange. Jamaican Teas traded 8,977 units and rose 5 cents to close at $4.10, Jetcon Corporation finished trading 3,093 shares, with a loss of 5 cents at $2.48, Key Insurance closed 10 cents higher at $3.15, with the trading of 5,000 shares, Lasco Distributors closed at $3.70, with an exchange of 59,681 units. Lasco Financial settled with a loss of 14 cents at $4.20, with 61,500 shares changing hands, Lasco Manufacturing ended trading of 42,460 shares, with a rise of 24 cents to $3.45, Main Event traded with 4,000 shares and lost 25 cents to end at $5 and Stationery and Office concluded trading of 62,832 shares with a loss of 1 cent at $6.75.