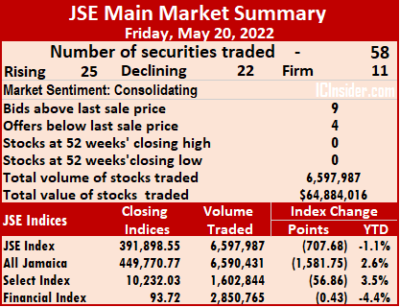

Market activity ended on the Jamaica Stock Exchange Main Market on Friday, with the volume of stocks traded declining 33 percent and the value nosediving 48 percent from Thursday’s activity as rising stocks exceeded those declining by a moderate margin.

The All Jamaican Composite Index lost 1,581.75 points to settle at 449,770.77, the JSE Main Index slipped by 707.68 points to 391,898.55 and the JSE Financial Index lost 0.43 points to settle at 93.72. Trading ended with 58 securities compared to 51 on Thursday, with 25 rising, 22 declining and 11 ending unchanged.

The All Jamaican Composite Index lost 1,581.75 points to settle at 449,770.77, the JSE Main Index slipped by 707.68 points to 391,898.55 and the JSE Financial Index lost 0.43 points to settle at 93.72. Trading ended with 58 securities compared to 51 on Thursday, with 25 rising, 22 declining and 11 ending unchanged.

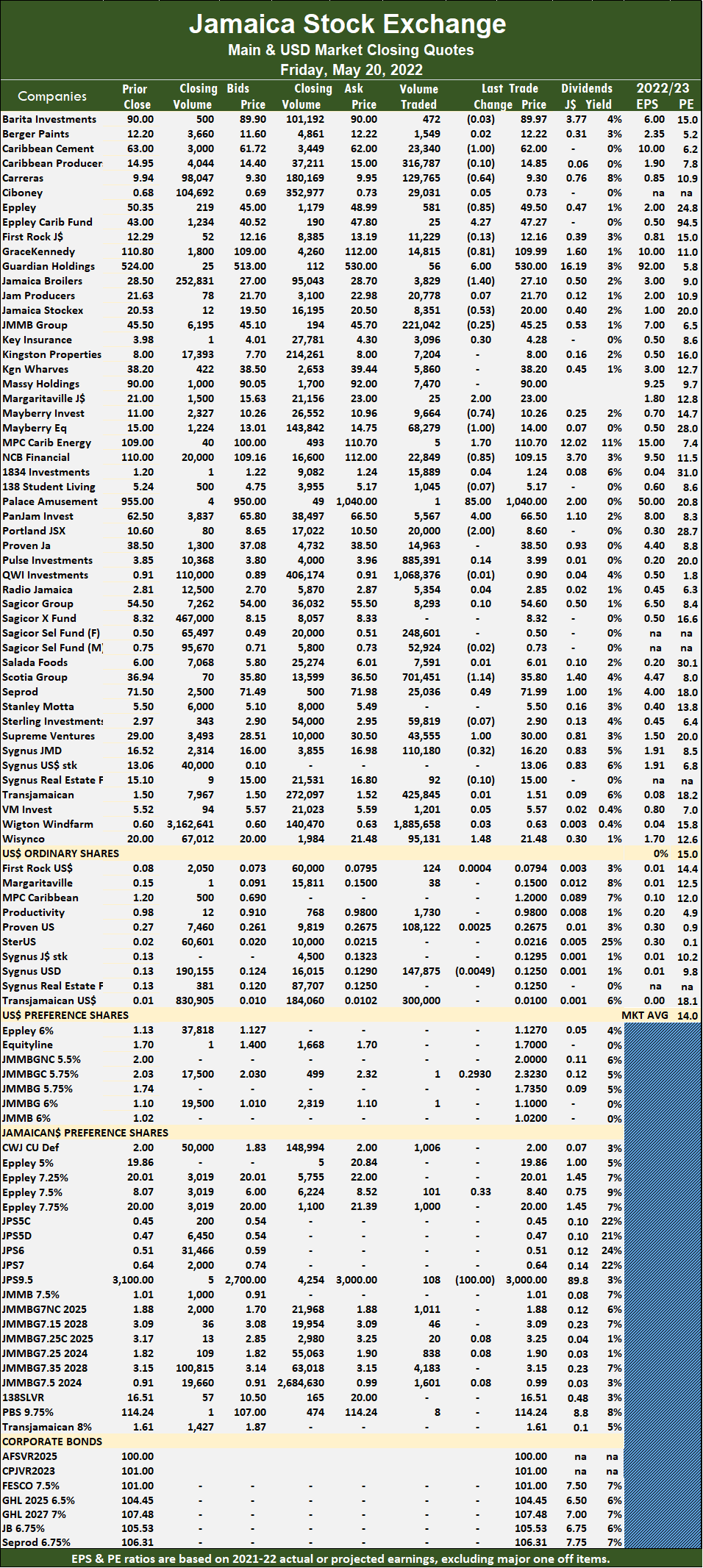

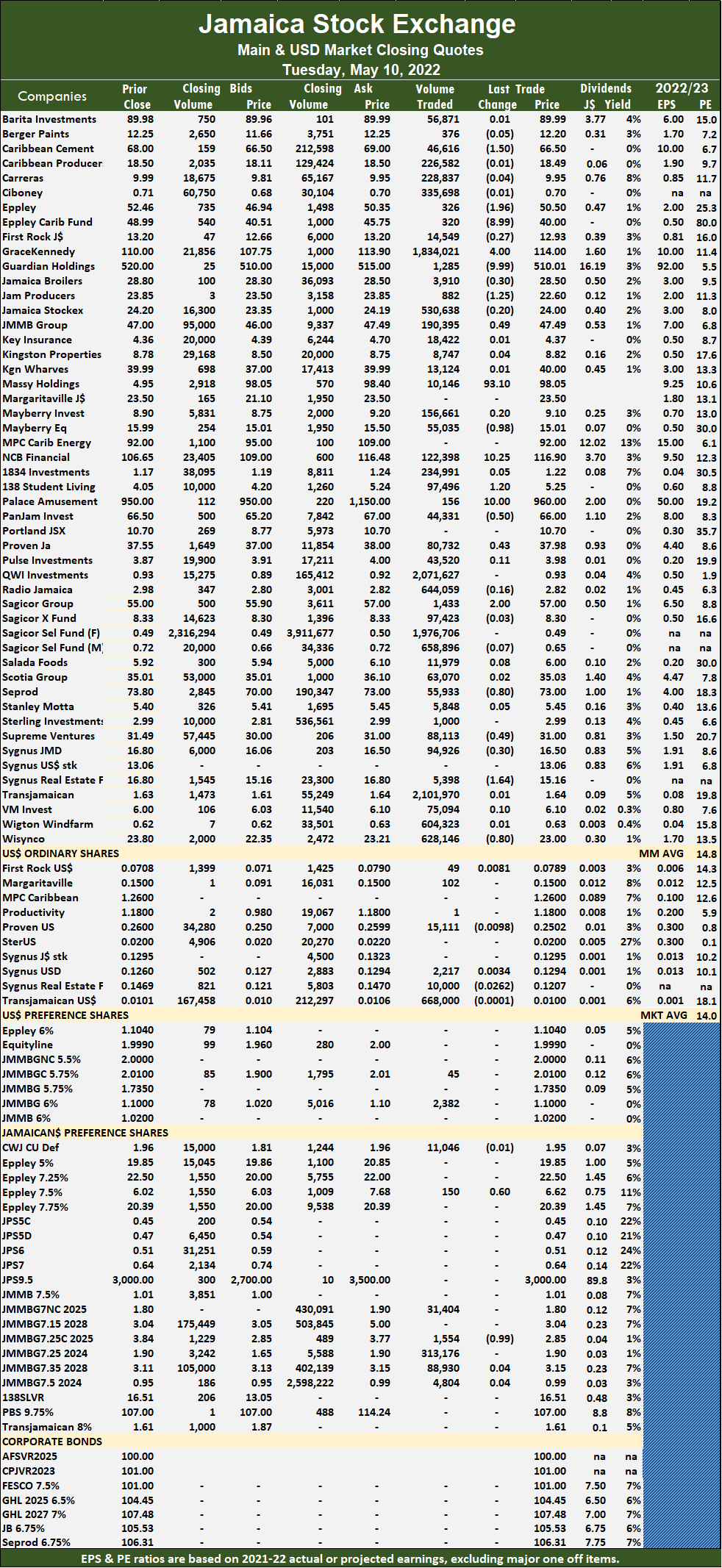

The PE Ratio, a formula for computing appropriate stock values, averages 15. The JSE Main and USD Market PE ratios are computed based on ICInsider.com’s forecasted earnings for companies with financial years ending up to the close of August 2023.

A total of 6,597,987 shares were exchanged for $64,884,016 versus 9,880,109 units at $124,533,581 on Thursday. Trading averages 113,758 units at $1,118,690, compared to 193,728 shares at $2,441,835 on Thursday and month to date, an average of 229,769 units at $4,160,020 compared to 238,407 units at $4,385,460 on the previous trading day. April closed with an average of 532,209 units at $5,709,319.

Wigton Windfarm led trading with 1.89 million shares for 28.6 percent of total volume, followed by QWI Investments with 1.07 million units for 16.2 percent of the day’s trade and Pulse Investments with 885,391 units for 13.4 percent market share.

Investor’s Choice bid-offer indicator shows nine stocks ended with bids higher than their last selling prices and four with lower offers.

At the close, Caribbean Cement dropped $1 to $62 trading 23,340 shares, Carreras declined 64 cents to close at $9.30 after 129,765 units were traded, Eppley lost 85 cents in ending at $49.50 after exchanging 581 stocks. Eppley Caribbean Property Fund popped $4.27 in closing at $47.27 after an exchange of 25 stock units, GraceKennedy fell 81 cents to end at $109.99, with 14,815 units crossing the market, Guardian Holdings gained $6 to end at $530 after exchanging 56 shares. Jamaica Broilers shed $1.40 in closing at $27.10 after 3,829 stock units cleared the market, Jamaica Stock Exchange dropped 53 cents to close at $20 in trading 8,351 stocks, Key Insurance rose 30 cents to close at $4.28 with the swapping of 3,096 stocks. Margaritaville climbed $2 to $23 in switching ownership of 25 units, Mayberry Investments shed 74 cents to close at $10.26 while exchanging 9,664 shares,Mayberry Jamaican Equities fell $1 in ending at $14, with 68,279 stock units crossing the market. MPC Caribbean Clean Energy advanced $1.70 to $110.70 trading five units, NCB Financial lost 85 cents to end at $109.15, with 22,849 shares crossing the exchange, Palace Amusement increased $85 in closing at $1040 with an exchange of one stock unit.

At the close, Caribbean Cement dropped $1 to $62 trading 23,340 shares, Carreras declined 64 cents to close at $9.30 after 129,765 units were traded, Eppley lost 85 cents in ending at $49.50 after exchanging 581 stocks. Eppley Caribbean Property Fund popped $4.27 in closing at $47.27 after an exchange of 25 stock units, GraceKennedy fell 81 cents to end at $109.99, with 14,815 units crossing the market, Guardian Holdings gained $6 to end at $530 after exchanging 56 shares. Jamaica Broilers shed $1.40 in closing at $27.10 after 3,829 stock units cleared the market, Jamaica Stock Exchange dropped 53 cents to close at $20 in trading 8,351 stocks, Key Insurance rose 30 cents to close at $4.28 with the swapping of 3,096 stocks. Margaritaville climbed $2 to $23 in switching ownership of 25 units, Mayberry Investments shed 74 cents to close at $10.26 while exchanging 9,664 shares,Mayberry Jamaican Equities fell $1 in ending at $14, with 68,279 stock units crossing the market. MPC Caribbean Clean Energy advanced $1.70 to $110.70 trading five units, NCB Financial lost 85 cents to end at $109.15, with 22,849 shares crossing the exchange, Palace Amusement increased $85 in closing at $1040 with an exchange of one stock unit.  PanJam Investment rallied $4 to close at $66.50 in exchanging 5,567 stocks, Portland JSX declined $2 in closing at $8.60, with 20,000 stock units changing hands, Scotia Group declined $1.14 in ending at $35.80, with 701,451 stocks crossing the exchange. Seprod gained 49 cents to close at $71.99 in switching ownership of 25,036 shares, Supreme Ventures advanced $1 to end at $30 with an exchange of 43,555 units, Sygnus Credit Investments fell 32 cents in closing at $16.20, with 110,180 shares crossing the market and Wisynco Group rallied $1.48 to $21.48 in an exchange of 95,131 stocks.

PanJam Investment rallied $4 to close at $66.50 in exchanging 5,567 stocks, Portland JSX declined $2 in closing at $8.60, with 20,000 stock units changing hands, Scotia Group declined $1.14 in ending at $35.80, with 701,451 stocks crossing the exchange. Seprod gained 49 cents to close at $71.99 in switching ownership of 25,036 shares, Supreme Ventures advanced $1 to end at $30 with an exchange of 43,555 units, Sygnus Credit Investments fell 32 cents in closing at $16.20, with 110,180 shares crossing the market and Wisynco Group rallied $1.48 to $21.48 in an exchange of 95,131 stocks.

In the preference segment, Eppley 7.50% preference share increased 33 cents to close at $8.40, with 101 stock units clearing the market and Jamaica Public Service 9.5% dropped $100 in ending at $3000, with 108 units changing hands.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Main market falters in Friday’s trades

Bounce for JSE main market

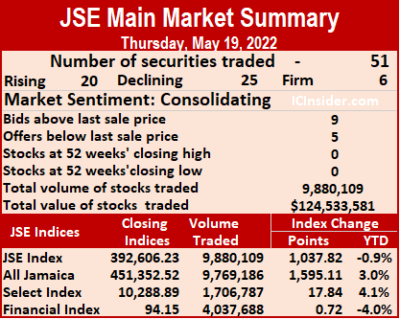

Market activity ended on the Jamaica Stock Exchange Main Market on Thursday, with the volume of stocks traded declining 19 percent and the value diving 63 percent lower than on Wednesday, leading to declining stocks outstripping rising ones.

The All Jamaican Composite Index rose 1,595.11 points to 451,352.52, the JSE Main Index popped 1,037.82 points to 392,606.23 and the JSE Financial Index inched 0.72 points higher to 94.15.

The All Jamaican Composite Index rose 1,595.11 points to 451,352.52, the JSE Main Index popped 1,037.82 points to 392,606.23 and the JSE Financial Index inched 0.72 points higher to 94.15.

Trading ended with 51 securities compared to 53 on Wednesday, with 20 rising, 25 declining and six ending unchanged.

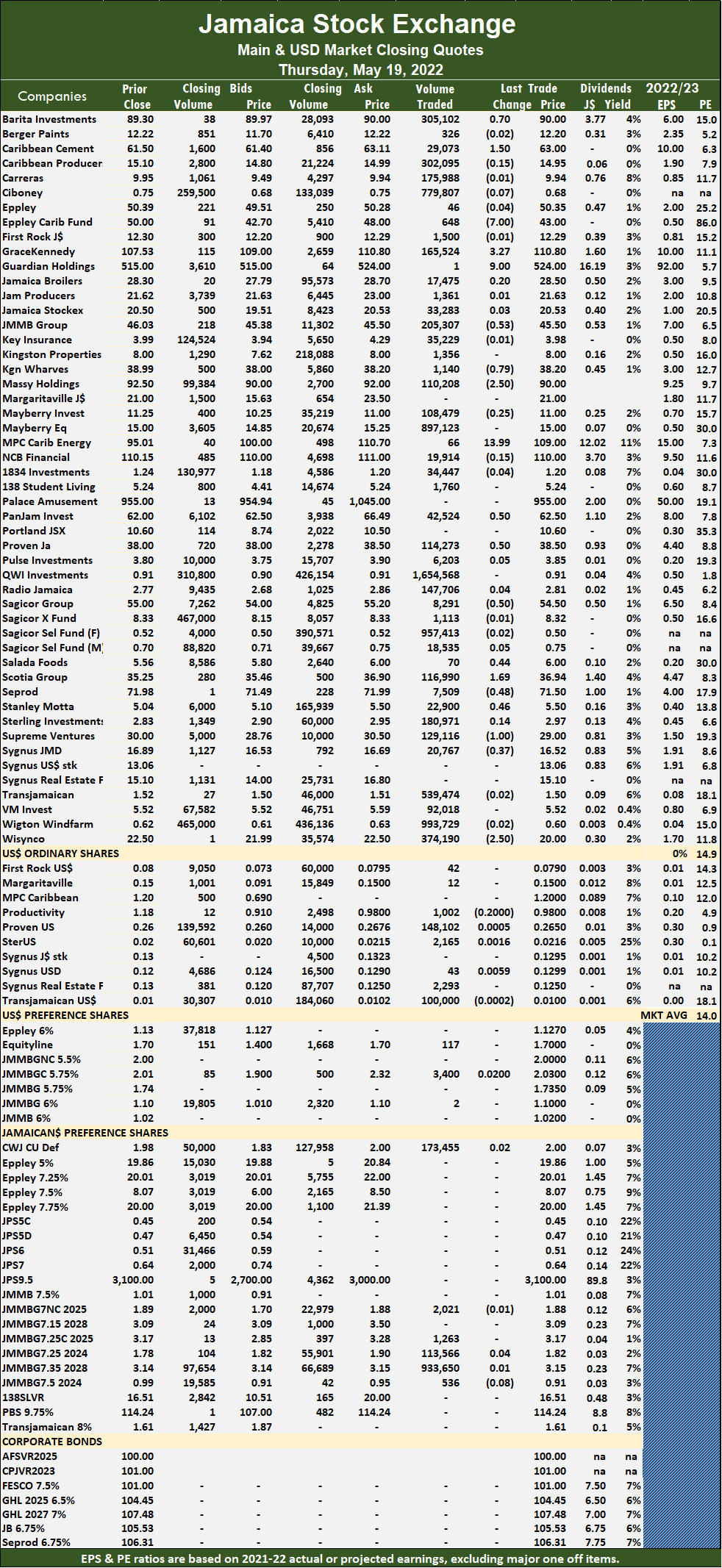

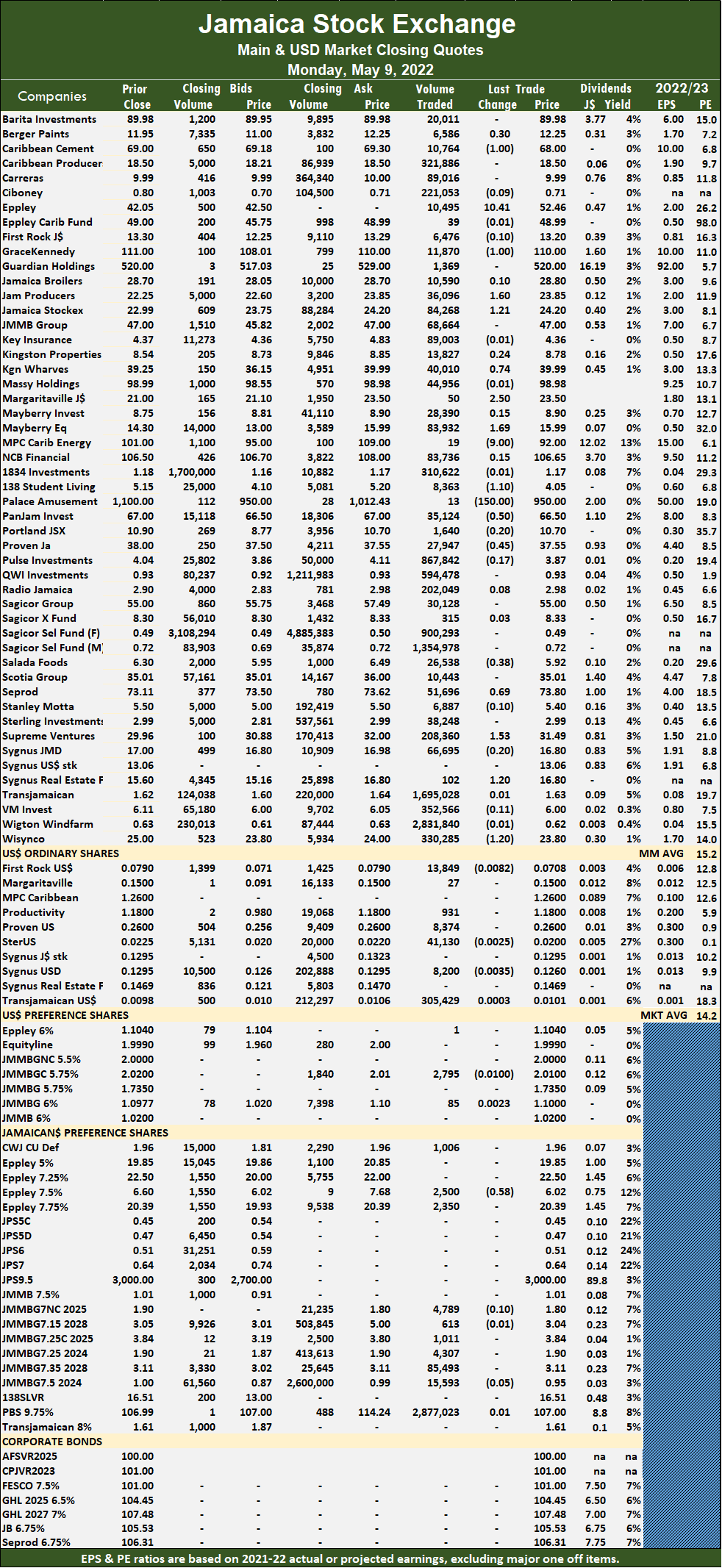

The PE Ratio, a formula for computing appropriate stock values, averages 14.9. The JSE Main and USD Market PE ratios are computed based on ICInsider.com’s forecasted earnings for companies with financial years ending up to the close of August 2023.

Overall, 9,880,109 shares were traded for $124,533,581 versus 12,251,051 units at $339,534,037 on Wednesday. Trading averages 193,728 units at $2,441,835, compared to 231,152 shares at $6,406,303 on Wednesday and month to date, an average of 238,407 units at $4,386,460, compared to 241,537 units at $4,522,691 on the previous trading day. April closed with an average of 532,209 units at $5,709,319.

QWI Investments led trading with 1.65 million shares for 16.7 percent of total volume, followed by Wigton Windfarm, with 993,729 units for 10.1 percent of the day’s trade and Sagicor Select Financial Fund with 957,413 units for 9.7 percent market share.

QWI Investments led trading with 1.65 million shares for 16.7 percent of total volume, followed by Wigton Windfarm, with 993,729 units for 10.1 percent of the day’s trade and Sagicor Select Financial Fund with 957,413 units for 9.7 percent market share.

Investor’s Choice bid-offer indicator shows nine stocks ended with bids higher than their last selling prices and five with lower offers.

At the close, Barita Investments advanced 70 cents in ending at $90, trading 305,102 shares, Caribbean Cement popped $1.50 in closing at $63 while exchanging 29,073 stock units, Eppley Caribbean Property Fund declined $7 to $43 after 648 stocks changed hands. GraceKennedy climbed $3.27 to end at $110.80 after 165,524 units were exchanged, Guardian Holdings rallied $9 to $524 in an exchange of one stock unit, JMMB Group lost 53 cents in closing at $45.50, with 205,307 shares crossing the market. Kingston Wharves shed 79 cents to end at $38.20 after finishing trading 1,140 stocks, Massy Holdings dropped $2.50 to close at $90 after exchanging 110,208 units, MPC Caribbean Clean Energy gained $13.99 to $109 with the swapping of 66 stocks. PanJam Investment rose 50 cents to $62.50 after exchanging 42,524 stock units, Proven Investments gained 50 cents in ending at $38.50, with 114,273 units crossing the market, Sagicor Group fell 50 cents to $54.50 while trading 8,291 shares.  Salada Foods gained 44 cents in closing at $6 with an exchange of 70 shares, Scotia Group increased $1.69 to end at $36.94 in switching ownership of 116,990 stock units, Seprod declined 48 cents to $71.50 in exchanging 7,509 stocks. Stanley Motta rallied 46 cents to end at $5.50, with 22,900 units crossing the exchange, Supreme Ventures dropped $1 to $29, with 129,116 units changing hands, Sygnus Credit Investments lost 37 cents to close at $16.52 while exchanging 20,767 stocks and Wisynco Group shed $2.50 in ending at $20 and trading 374,190 stock units.

Salada Foods gained 44 cents in closing at $6 with an exchange of 70 shares, Scotia Group increased $1.69 to end at $36.94 in switching ownership of 116,990 stock units, Seprod declined 48 cents to $71.50 in exchanging 7,509 stocks. Stanley Motta rallied 46 cents to end at $5.50, with 22,900 units crossing the exchange, Supreme Ventures dropped $1 to $29, with 129,116 units changing hands, Sygnus Credit Investments lost 37 cents to close at $16.52 while exchanging 20,767 stocks and Wisynco Group shed $2.50 in ending at $20 and trading 374,190 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

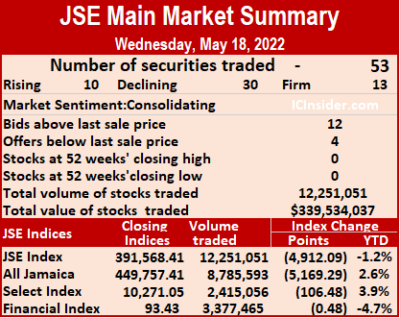

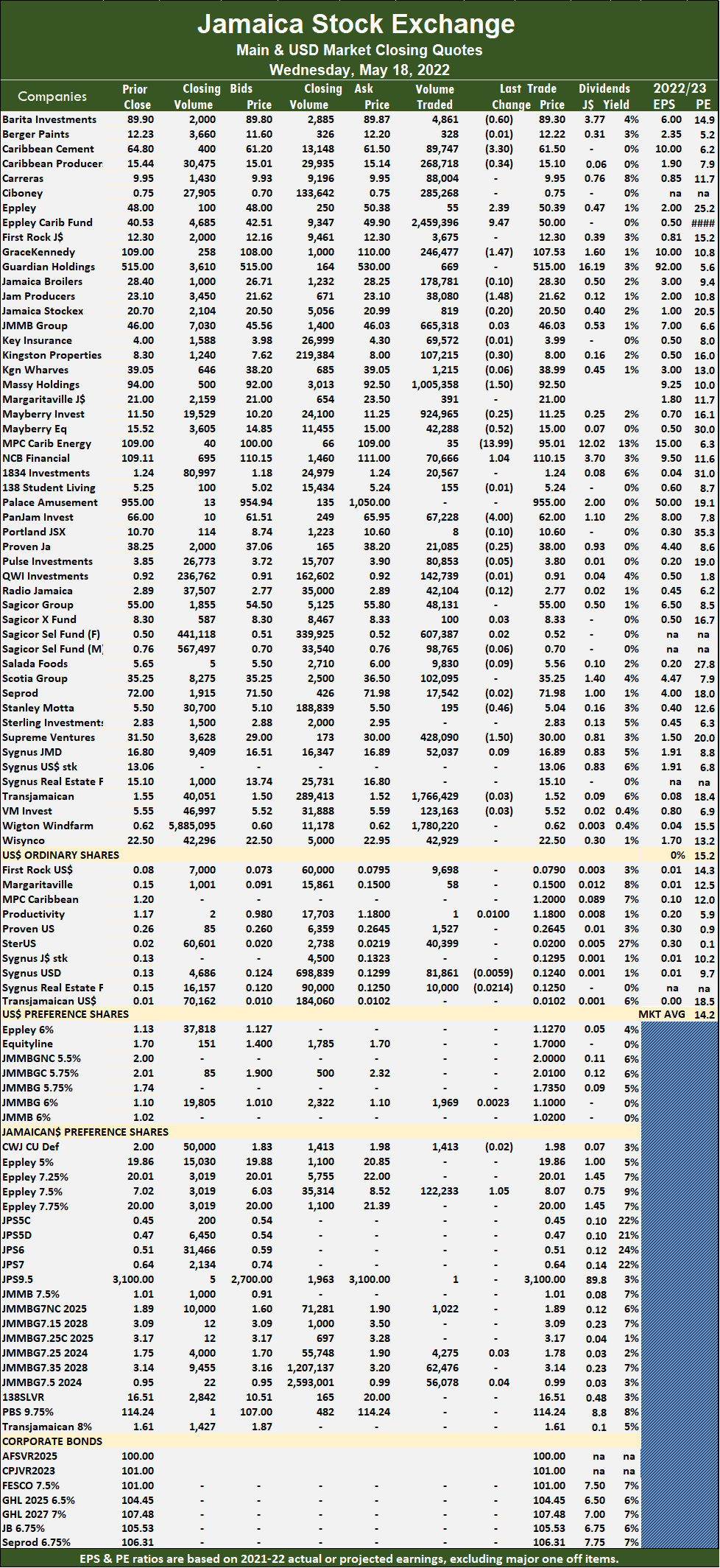

Sellers pressure JSE Main Market stocks

Stocks mostly dropped in prices at the end of trading on the Jamaica Stock Exchange Main Market on Wednesday, with the volume of stocks traded declining 26 percent from that on Tuesday, with a slightly higher value.

The All Jamaican Composite Index sank 5,169.29 points to 449,757.41, the JSE Main Index dropped 4,912.09 points to close at 391,568.41 and the JSE Financial Index dipped 0.48 points to settle at 93.43. Trading ended with 53 securities down from 57 on Tuesday, with ten rising, 30 declining and 13 ending unchanged.

The All Jamaican Composite Index sank 5,169.29 points to 449,757.41, the JSE Main Index dropped 4,912.09 points to close at 391,568.41 and the JSE Financial Index dipped 0.48 points to settle at 93.43. Trading ended with 53 securities down from 57 on Tuesday, with ten rising, 30 declining and 13 ending unchanged.

Overall, 12,251,051 shares were exchanged for $339,534,037 versus 16,623,237 units at $309,172,008 on Tuesday.

Trading averages 231,152 units at $6,406,303, compared to 291,636 shares at $5,424,070 on Tuesday and month to date, an average of 241,868 units at $4,528,727, compared to 242,352 units at $4,374,792 on the previous trading day. The trade for April averaged 532,209 units at $5,709,319.

Eppley Caribbean Property Fund led trading with 2.46 million shares for 20.1 percent of total volume, followed by Wigton Windfarm with 1.78 million units for 14.5 percent of the day’s trade. Transjamaican Highway ended with 1.77 million units for 14.4 percent market share and Massy Holdings with 1.01 million units for 8.2 percent of traded shares.

The PE Ratio, a formula for computing appropriate stock values, averages 15.2. The JSE Main and USD Market PE ratios are computed based on ICInsider.com’s forecasted earnings for companies with financial years ending up to the close of August 2023.

Investor’s Choice bid-offer indicator shows 12 stocks ended with bids higher than their last selling prices and four with lower offers.

At the close, Barita Investments fell 60 cents to $89.30 with the swapping of 4,861 shares, Caribbean Cement dropped $3.30 to close at $61.50, trading 89,747 stocks, Caribbean Producers shed 34 cents in closing at $15.10, with 268,718 stock units crossing the exchange. Eppley increased $2.39 to $50.39, with 55 units changing hands, Eppley Caribbean Property Fund rallied $9.47 to end at $50 after trading 2,459,396 stocks, GraceKennedy lost $1.47 to $107.53 after an exchange of 246,477 units. Jamaica Producers declined $1.48 to close at $21.62 in an exchange of 38,080 shares, Kingston Properties shed 30 cents to end at $8 with an exchange of 107,215 stock units, Massy Holdings dropped $1.50 in closing at $92.50 while exchanging 1,005,358 stocks. Mayberry Jamaican Equities fell 52 cents to end at $15 in switching ownership of 42,288 units, MPC Caribbean Clean Energy lost $13.99 to end at $95.01 in trading 35 stock units, NCB Financial advanced $1.04 to $110.15, exchanging 70,666 shares.

At the close, Barita Investments fell 60 cents to $89.30 with the swapping of 4,861 shares, Caribbean Cement dropped $3.30 to close at $61.50, trading 89,747 stocks, Caribbean Producers shed 34 cents in closing at $15.10, with 268,718 stock units crossing the exchange. Eppley increased $2.39 to $50.39, with 55 units changing hands, Eppley Caribbean Property Fund rallied $9.47 to end at $50 after trading 2,459,396 stocks, GraceKennedy lost $1.47 to $107.53 after an exchange of 246,477 units. Jamaica Producers declined $1.48 to close at $21.62 in an exchange of 38,080 shares, Kingston Properties shed 30 cents to end at $8 with an exchange of 107,215 stock units, Massy Holdings dropped $1.50 in closing at $92.50 while exchanging 1,005,358 stocks. Mayberry Jamaican Equities fell 52 cents to end at $15 in switching ownership of 42,288 units, MPC Caribbean Clean Energy lost $13.99 to end at $95.01 in trading 35 stock units, NCB Financial advanced $1.04 to $110.15, exchanging 70,666 shares.  PanJam Investment declined $4 after ending at $62, with 67,228 stocks crossing the market, Stanley Motta shed 46 cents in closing at $5.04 after exchanging 195 units and Supreme Ventures dropped $1.50 to close at $30 after finishing trading of 428,090 stock units.

PanJam Investment declined $4 after ending at $62, with 67,228 stocks crossing the market, Stanley Motta shed 46 cents in closing at $5.04 after exchanging 195 units and Supreme Ventures dropped $1.50 to close at $30 after finishing trading of 428,090 stock units.

In the preference segment, Eppley 7.50% preference share climbed $1.05 to end at $8.07 after trading 122,233 shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

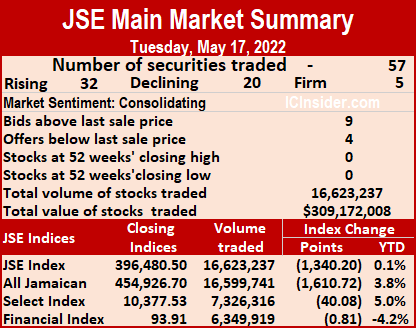

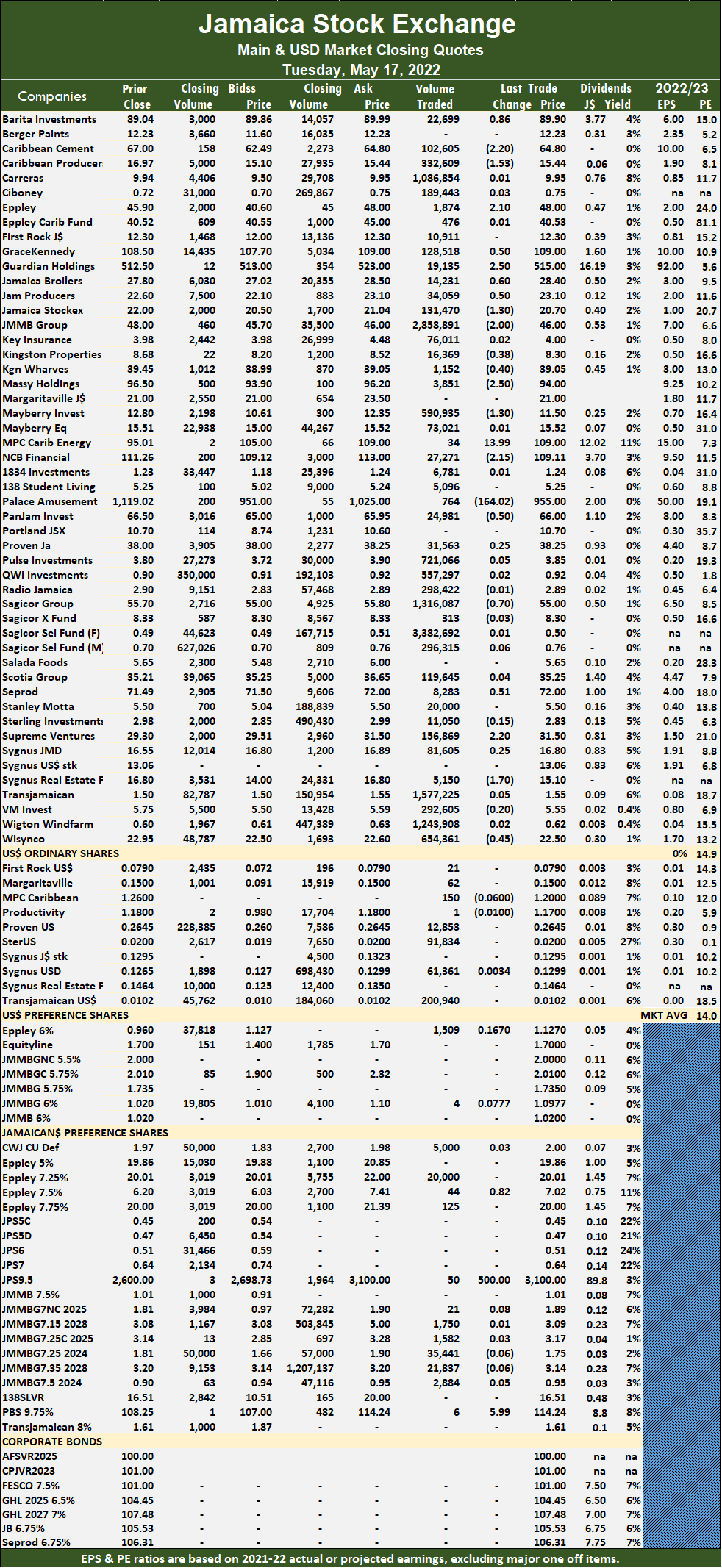

Many more stocks rose than fell Tuesday

More than 56 percent of stocks trading on Tuesday rose, beating out those declining by a wide margin, but did not prevent the market indices from slipping at the close of the Jamaica Stock Exchange, with the volume of stocks traded rising 19 percent and the value up 37 percent over Monday.

Trading ended with 57 securities compared to 56 on Monday, with 32 rising, 20 declining and five ending unchanged.

Trading ended with 57 securities compared to 56 on Monday, with 32 rising, 20 declining and five ending unchanged.

The All Jamaican Composite Index dropped 1,610.72 points to 454,926.70, the JSE Main Index 1,340.20 points to close at 396,480.50 and the JSE Financial Index fell 0.81 points to 93.91.

The PE Ratio, a formula for computing appropriate stock values, averages 15. The JSE Main and USD Market PE ratios are computed using earnings forecasted by ICInsider.com’s for companies with financial years ending up to August 2023.

Overall, 16,623,237 shares were exchanged for $309,172,008 versus 13,950,999 units at $225,110,985 on Monday. Trading averages 291,636 units at $5,424,070, compared to 249,125 shares at $4,019,839 on Monday and month to date, an average of 242,711 units at $4,381,084, compared to 238,191 units at $4,284,731 on the previous trading day. April closed with an average of 532,209 units at $5,709,319.

Sagicor Select Financial Fund led trading with 3.38 million shares for 20.3 percent of total volume, followed by JMMB Group with 2.86 million units for 17.2 percent of the day’s trade, Transjamaican Highway traded 1.58 million units for 9.5 percent of market share. Sagicor Group chipped in with 1.32 million units for 7.9 percent market, Wigton Windfarm with 1.24 million units for 7.5 percent share and Carreras with 1.09 million units for 6.5 percent of the day’s trade.

Investor’s Choice bid-offer indicator shows nine stocks ended with bids higher than their last selling prices and four stocks with lower offers.

At the close, Barita Investments rose 86 cents to $89.90 after exchanging 22,699 shares, Caribbean Cement fell $2.20 to close at $64.80 after trading 102,605 stocks, Caribbean Producers shed $1.53 to $15.44, with an exchange of 332,609 stock units. Eppley advanced $2.10 to end at $48, trading 1,874 units, GraceKennedy popped 50 cents in closing at $109, with 128,518 shares changing hands, Guardian Holdings gained $2.50 to close at $515 with the swapping of 19,135 units. Jamaica Broilers climbed 60 cents to $28.40 in trading 14,231 stocks, Jamaica Producers gained 50 cents to $23.10 after exchanging 34,059 stock units, Jamaica Stock Exchange declined $1.30 to $20.70, with 131,470 stock units crossing the market. JMMB Group dropped $2 to end at $46 in an exchange of 2,858,891 shares, Kingston Properties lost 38 cents at $8.30 in switching ownership of 16,369 units, Kingston Wharves declined 40 cents in closing at $39.05, with 1,152 stocks clearing the market. Massy Holdings fell $2.50 to $94 with an exchange of 3,851 shares, Mayberry Investments shed $1.30 to close at $11.50, with 590,935 stocks changing hands, MPC Caribbean Clean Energy rallied $13.99 to end at $109 while exchanging 34 stock units. NCB Financial lost $2.15 in closing at $109.11 after 27,271 units crossed the market, Palace Amusement dropped $164.02 to $955 in exchanging 764 units, PanJam Investment fell 50 cents to $66 after an exchange of 24,981 stock units. Sagicor Group shed 70 cents to end at $55 in switching ownership of 1,316,087 stocks, Seprod increased 51 cents to $72 while exchanging 8,283 shares and Supreme Ventures rallied $2.20 in closing at $31.50 after trading 156,869 shares.

At the close, Barita Investments rose 86 cents to $89.90 after exchanging 22,699 shares, Caribbean Cement fell $2.20 to close at $64.80 after trading 102,605 stocks, Caribbean Producers shed $1.53 to $15.44, with an exchange of 332,609 stock units. Eppley advanced $2.10 to end at $48, trading 1,874 units, GraceKennedy popped 50 cents in closing at $109, with 128,518 shares changing hands, Guardian Holdings gained $2.50 to close at $515 with the swapping of 19,135 units. Jamaica Broilers climbed 60 cents to $28.40 in trading 14,231 stocks, Jamaica Producers gained 50 cents to $23.10 after exchanging 34,059 stock units, Jamaica Stock Exchange declined $1.30 to $20.70, with 131,470 stock units crossing the market. JMMB Group dropped $2 to end at $46 in an exchange of 2,858,891 shares, Kingston Properties lost 38 cents at $8.30 in switching ownership of 16,369 units, Kingston Wharves declined 40 cents in closing at $39.05, with 1,152 stocks clearing the market. Massy Holdings fell $2.50 to $94 with an exchange of 3,851 shares, Mayberry Investments shed $1.30 to close at $11.50, with 590,935 stocks changing hands, MPC Caribbean Clean Energy rallied $13.99 to end at $109 while exchanging 34 stock units. NCB Financial lost $2.15 in closing at $109.11 after 27,271 units crossed the market, Palace Amusement dropped $164.02 to $955 in exchanging 764 units, PanJam Investment fell 50 cents to $66 after an exchange of 24,981 stock units. Sagicor Group shed 70 cents to end at $55 in switching ownership of 1,316,087 stocks, Seprod increased 51 cents to $72 while exchanging 8,283 shares and Supreme Ventures rallied $2.20 in closing at $31.50 after trading 156,869 shares.

Sygnus Real Estate Finance lost $1.70 to $15.10 after 5,150 units changed hands and Wisynco Group declined 45 cents to $22.50 in trading 654,361 stocks.

Sygnus Real Estate Finance lost $1.70 to $15.10 after 5,150 units changed hands and Wisynco Group declined 45 cents to $22.50 in trading 654,361 stocks.

In the preference segment, Eppley 7.50% preference share popped 82 cents to end at $7.02 with the swapping of 44 stock units, Jamaica Public Service 9.5% advanced $500 to close at $3100 in trading 50 shares and Productive Business Solutions 9.75% preference share gained $5.99 to $114.24 in an exchange of 6 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

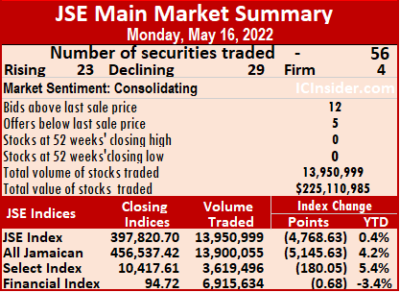

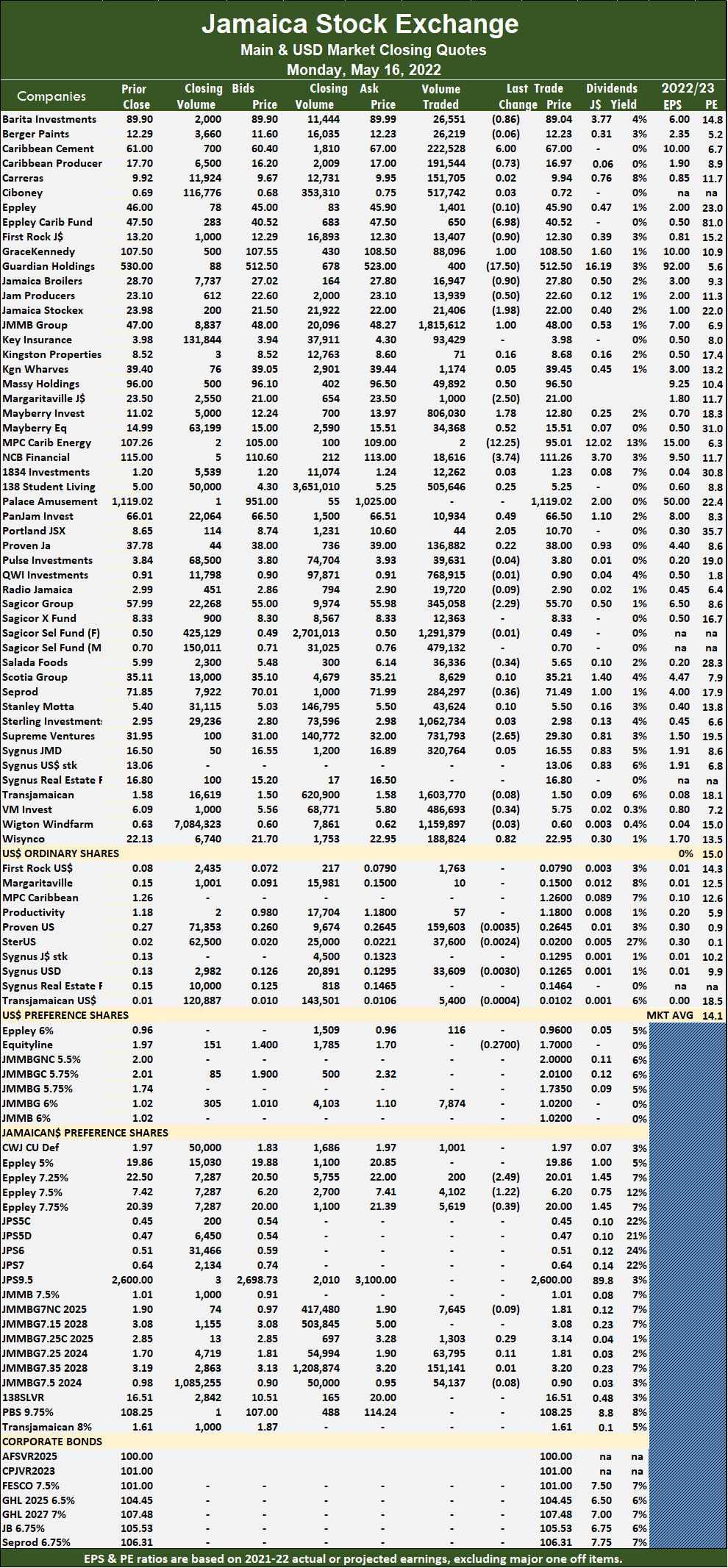

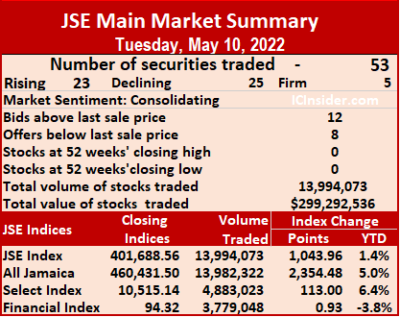

JSE stocks retreat on Monday

Stocks ended trading on Monday, with prices softening as the volume exchanged climbed 45 percent and the value rose 150 percent over Friday’s trade on the Jamaica Stock Exchange main market as the market indices plunged at the close after Mayberry Investment traded at a record high of $14.15 and Proven Investment posted at 52 weeks’ high of $39.

The All Jamaican Composite Index lost 5,145.63 points to close at 456,537.42, the JSE Main Index and the JSE Financial Index dipped 0.68 points to settle at 94.72.

The All Jamaican Composite Index lost 5,145.63 points to close at 456,537.42, the JSE Main Index and the JSE Financial Index dipped 0.68 points to settle at 94.72.

A total of 56 securities traded up from 54 on Friday, with 23 rising, 29 declining and four ending unchanged.

The PE Ratio, a formula for computing appropriate stock values, averages 15. The JSE Main and USD Market PE ratios are computed based on ICInsider.com’s forecasted earnings for companies with financial years ending up to August 2023.

Overall, 13,950,999 shares were exchanged for $225,110,985 versus 9,627,205 units at $89,895,589 on Friday. Trading averages 249,125 units at $4,019,839, compared to 178,282 shares at $1,664,733 on Friday and month to date, an average of 237,807 units at $4,278,04, compared to 236,679 units at $4,303,740 on the previous trading day. April closed with an average of 532,209 units at $5,709,319.

JMMB Group led trading with 1.82 million shares for 13 percent of total volume, followed by Transjamaican Highway with 1.60 million units for 11.5 percent of the day’s trade, Sagicor Select Financial Fund ended with 1.29 million units for 9.3 percent of market share, after the price hit a 52 weeks’ intraday low of 40 cents. Wigton Windfarm traded 1.16 million units for 8.3 percent market share and Sterling Investments, 1.06 million units for 7.6 percent market share.

Investor’s Choice bid-offer indicator shows12 stocks ended with bids higher than their last selling prices and five with lower offers.

At the close, Barita Investments shed 86 cents to close at $89.04 in trading 26,551 shares, Caribbean Cement rose $6 to $67 after exchanging 222,528 stock units, Caribbean Producers lost 73 cents in closing at $16.97 after exchanging 191,544 units. Eppley Caribbean Property Fund dropped $6.98 to $40.52, with 650 stocks clearing the market, First Rock Capital fell 90 cents to $12.30, with 13,407 stock units crossing the market, GraceKennedy gained $1 to end at $108.50 with the swapping of 88,096 stocks. Guardian Holdings dropped $17.50 to $512.50, with400 units crossing the market, Jamaica Broilers lost 90 cents to close at $27.80 after trading 16,947 shares, Jamaica Producers declined 50 cents in closing at $22.60, with 13,939 stocks changing hands. Jamaica Stock Exchange dropped $1.98 in ending at $22 in an exchange of 21,406 units, JMMB Group advanced $1 to close at $48 with 1,815,612 shares changing hands, Margaritaville fell $2.50 to $21 while exchanging 1,000 stock units. Massy Holdings climbed 50 cents in closing at $96.50 in swapping ownership of 49,892 units, Mayberry Investments popped $1.78 to end at a 52 weeks’ closing high of $12.80 in switching ownership of 806,030 stock units, Mayberry Jamaican Equities gained 52 cents in ending at $15.51 after trading 34,368 shares. MPC Caribbean Clean Energy shed $12.25 to end at $95.01 after two shares crossed the exchange, NCB Financial declined $3.74 to $111.26 in trading 18,616 shares, PanJam Investment rallied 49 cents to end at $66.50 after exchanging 10,934 units.

At the close, Barita Investments shed 86 cents to close at $89.04 in trading 26,551 shares, Caribbean Cement rose $6 to $67 after exchanging 222,528 stock units, Caribbean Producers lost 73 cents in closing at $16.97 after exchanging 191,544 units. Eppley Caribbean Property Fund dropped $6.98 to $40.52, with 650 stocks clearing the market, First Rock Capital fell 90 cents to $12.30, with 13,407 stock units crossing the market, GraceKennedy gained $1 to end at $108.50 with the swapping of 88,096 stocks. Guardian Holdings dropped $17.50 to $512.50, with400 units crossing the market, Jamaica Broilers lost 90 cents to close at $27.80 after trading 16,947 shares, Jamaica Producers declined 50 cents in closing at $22.60, with 13,939 stocks changing hands. Jamaica Stock Exchange dropped $1.98 in ending at $22 in an exchange of 21,406 units, JMMB Group advanced $1 to close at $48 with 1,815,612 shares changing hands, Margaritaville fell $2.50 to $21 while exchanging 1,000 stock units. Massy Holdings climbed 50 cents in closing at $96.50 in swapping ownership of 49,892 units, Mayberry Investments popped $1.78 to end at a 52 weeks’ closing high of $12.80 in switching ownership of 806,030 stock units, Mayberry Jamaican Equities gained 52 cents in ending at $15.51 after trading 34,368 shares. MPC Caribbean Clean Energy shed $12.25 to end at $95.01 after two shares crossed the exchange, NCB Financial declined $3.74 to $111.26 in trading 18,616 shares, PanJam Investment rallied 49 cents to end at $66.50 after exchanging 10,934 units.  Portland JSX gained $2.05 to $10.70, with 44 stocks crossing the market, Sagicor Group shed $2.29 to close at $55.70 while exchanging 345,058 stock units, Salada Foods dipped 34 cents in closing at $5.65, with 36,336 units clearing the market. Seprod lost 36 cents to end at $71.49 with an exchange of 284,297 stocks, Supreme Ventures fell $2.65 in ending at $29.30 after exchanging 731,793 stock units, Victoria Mutual Investments fell 34 cents to close at $5.75, trading 486,693 shares and Wisynco Group advanced 82 cents to $22.95 with an exchange of 188,824 shares.

Portland JSX gained $2.05 to $10.70, with 44 stocks crossing the market, Sagicor Group shed $2.29 to close at $55.70 while exchanging 345,058 stock units, Salada Foods dipped 34 cents in closing at $5.65, with 36,336 units clearing the market. Seprod lost 36 cents to end at $71.49 with an exchange of 284,297 stocks, Supreme Ventures fell $2.65 in ending at $29.30 after exchanging 731,793 stock units, Victoria Mutual Investments fell 34 cents to close at $5.75, trading 486,693 shares and Wisynco Group advanced 82 cents to $22.95 with an exchange of 188,824 shares.

In the preference segment, Eppley 7.25% preference share shed $2.49 in ending at $20.01 after exchanging 200 units, Eppley 7.50% preference share dropped $1.22 to end at $6.20, with 4,102 stock units changing hands and Eppley 7.75% preference share lost 39 cents in closing at $20 trading 5,619 stocks.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

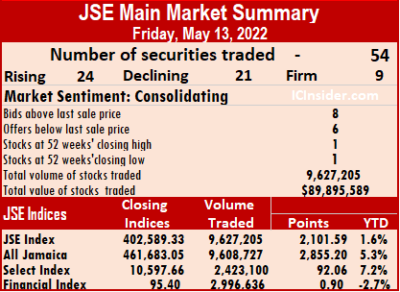

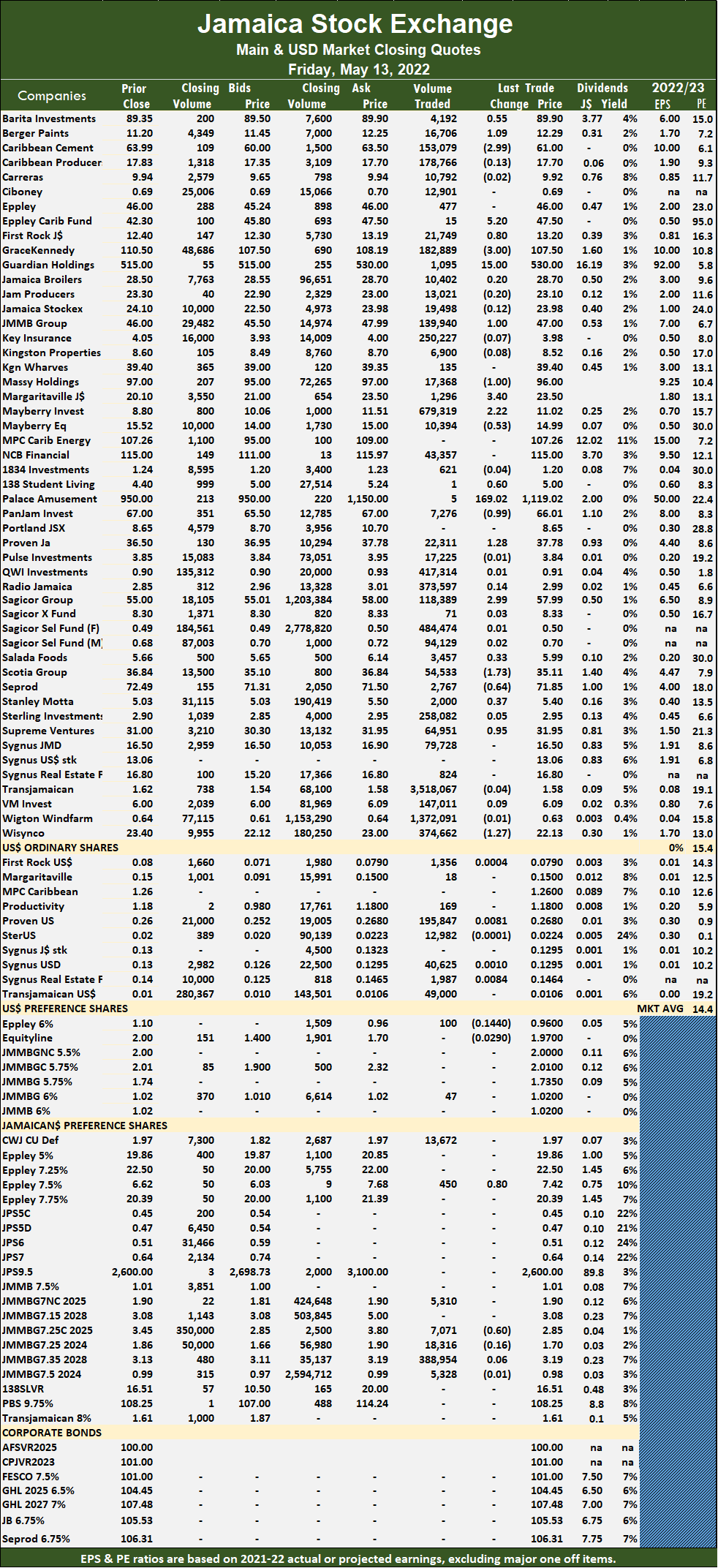

JSE Main Market rises

Market activity ended on Friday, with the volume of stocks traded declining 53 percent and the value dropping 82 percent lower than on Thursday on the Jamaica Stock Exchange Main Market as rising stocks exceeded those falling.

The All Jamaican Composite Index rallied 2,855.20 points to close at 461,683.05, the JSE Main Index rose 2,101.59 points to 402,589.33 and the JSE Financial Index popped 0.90 points to settle at 95.40.

The All Jamaican Composite Index rallied 2,855.20 points to close at 461,683.05, the JSE Main Index rose 2,101.59 points to 402,589.33 and the JSE Financial Index popped 0.90 points to settle at 95.40.

Trading ended with 54 securities down from 57 on Thursday, with 24 rising, 21 declining and nine ending unchanged. Caribbean Cement closed trading at a 52 weeks’ low of $60 and Key Insurance traded at an intraday 52 weeks’ low of $3.81, while Mayberry Investments closed at a 52 weeks’ high of $11.02.

The PE Ratio, a formula for computing appropriate stock values, averages 15.4. The JSE Main and USD Market PE ratios are computed based on ICInsider.com’s forecasted earnings for companies with financial years ending up to the close of August 2023.

Overall, 9,627,205 shares were exchanged for $89,895,589 down from 20,316,947 units at $488,632,009 on Thursday. Trading averages 178,282 units at $1,664,733, compared to 356,438 shares at $8,572,491 on Thursday and month to date, an average of 228,535 units at $4,080,209, compared to 242,886 units at $4,584,264 on the previous trading day. April closed with an average of 532,209 units at $5,709,319.

Transjamaican Highway led trading with 3.52 million shares for 36.5 percent of total volume, followed by Wigton Windfarm with 1.37 million units for 14.3 percent of the day’s trade and Mayberry Investments with 679,319 units for 7.1 percent market share.

Investor’s Choice bid-offer indicator shows eight stocks ended with bids higher than their last selling prices and six with lower offers.

At the close, Barita Investments popped 55 cents to close at $89.90 with an exchange of 4,192 shares, Berger Paints advanced $1.09, in closing at $12.29 in an exchange of 6,706 stocks, Caribbean Cement lost $2.99 to end at $61, with 153,079 units crossing the exchange. Eppley Caribbean Property Fund gained $5.20 in ending at $47.50, with 15 stock units changing hands, First Rock Capital rose 80 cents to $13.20 after trading 21,749 stocks, GraceKennedy dropped $3 to $107.50 with 182,889 stock units changing hands. Guardian Holdings climbed $15 in ending at $530, with 1,095 shares crossing the market, JMMB Group rose $1 to close at $47 after 139,940 units changed hands, Massy Holdings fell $1 in closing at $96 while exchanging 17,368 shares. Mayberry Investments rallied $2.22 to end at $11.02 in trading 679,319 stocks, Mayberry Jamaican Equities shed 53 cents to end at $14.99, with 10,394 units clearing the market, 138 Student Living popped 60 cents to $5 after exchanging one stock unit. Palace Amusement advanced $169.02 to $1119.02 in trading five stocks, PanJam Investment declined 99 cents to $66.01 in trading 7,276 shares, Proven Investments increased $1.28 to close at $37.78 with the swapping of 22,311 stock units.

At the close, Barita Investments popped 55 cents to close at $89.90 with an exchange of 4,192 shares, Berger Paints advanced $1.09, in closing at $12.29 in an exchange of 6,706 stocks, Caribbean Cement lost $2.99 to end at $61, with 153,079 units crossing the exchange. Eppley Caribbean Property Fund gained $5.20 in ending at $47.50, with 15 stock units changing hands, First Rock Capital rose 80 cents to $13.20 after trading 21,749 stocks, GraceKennedy dropped $3 to $107.50 with 182,889 stock units changing hands. Guardian Holdings climbed $15 in ending at $530, with 1,095 shares crossing the market, JMMB Group rose $1 to close at $47 after 139,940 units changed hands, Massy Holdings fell $1 in closing at $96 while exchanging 17,368 shares. Mayberry Investments rallied $2.22 to end at $11.02 in trading 679,319 stocks, Mayberry Jamaican Equities shed 53 cents to end at $14.99, with 10,394 units clearing the market, 138 Student Living popped 60 cents to $5 after exchanging one stock unit. Palace Amusement advanced $169.02 to $1119.02 in trading five stocks, PanJam Investment declined 99 cents to $66.01 in trading 7,276 shares, Proven Investments increased $1.28 to close at $37.78 with the swapping of 22,311 stock units. Sagicor Group gained $2.99 to end at $57.99 in switching ownership of 118,389 units, Salada Foods climbed 33 cents in ending at $5.99 after exchanging 3,457 shares, Scotia Group declined $1.73 to close at $35.11 after 54,533 stocks changed hands. Seprod lost 64 cents to close at $71.85, trading 2,767 units, Stanley Motta rose 37 cents to $5.40, with 2,000 stock units changing hands, Supreme Ventures rallied 95 cents to $31.95 in trading 64,951 stocks and Wisynco Group fell $1.27 to close at $22.13, with 374,662 units crossing the market.

Sagicor Group gained $2.99 to end at $57.99 in switching ownership of 118,389 units, Salada Foods climbed 33 cents in ending at $5.99 after exchanging 3,457 shares, Scotia Group declined $1.73 to close at $35.11 after 54,533 stocks changed hands. Seprod lost 64 cents to close at $71.85, trading 2,767 units, Stanley Motta rose 37 cents to $5.40, with 2,000 stock units changing hands, Supreme Ventures rallied 95 cents to $31.95 in trading 64,951 stocks and Wisynco Group fell $1.27 to close at $22.13, with 374,662 units crossing the market.

In the preference segment, Eppley 7.50% preference share climbed 80 cents to $7.42 in an exchange of 450 stock units and JMMB Group 7.25% preference share dropped 60 cents to $2.85 while exchanging 7,071 shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

JSE Main Market drops

Market activity ended on Thursday, with the volume of stocks traded rising 54 percent and the value 455 percent more than on Wednesday at the close of the Jamaica Stock Exchange Main Market as rising stocks were edged out by those declining.

The All Jamaican Composite Index lost 2,109.81 points to settle at 458,827.85, the JSE Main Index declined 1,867.86 points to close at 400,487.74 and the JSE Financial Index remained unchanged at 94.50.

The All Jamaican Composite Index lost 2,109.81 points to settle at 458,827.85, the JSE Main Index declined 1,867.86 points to close at 400,487.74 and the JSE Financial Index remained unchanged at 94.50.

Trading ended with 57 securities compared to 55 on Wednesday, with 21 rising, 24 declining and 12 ending unchanged.

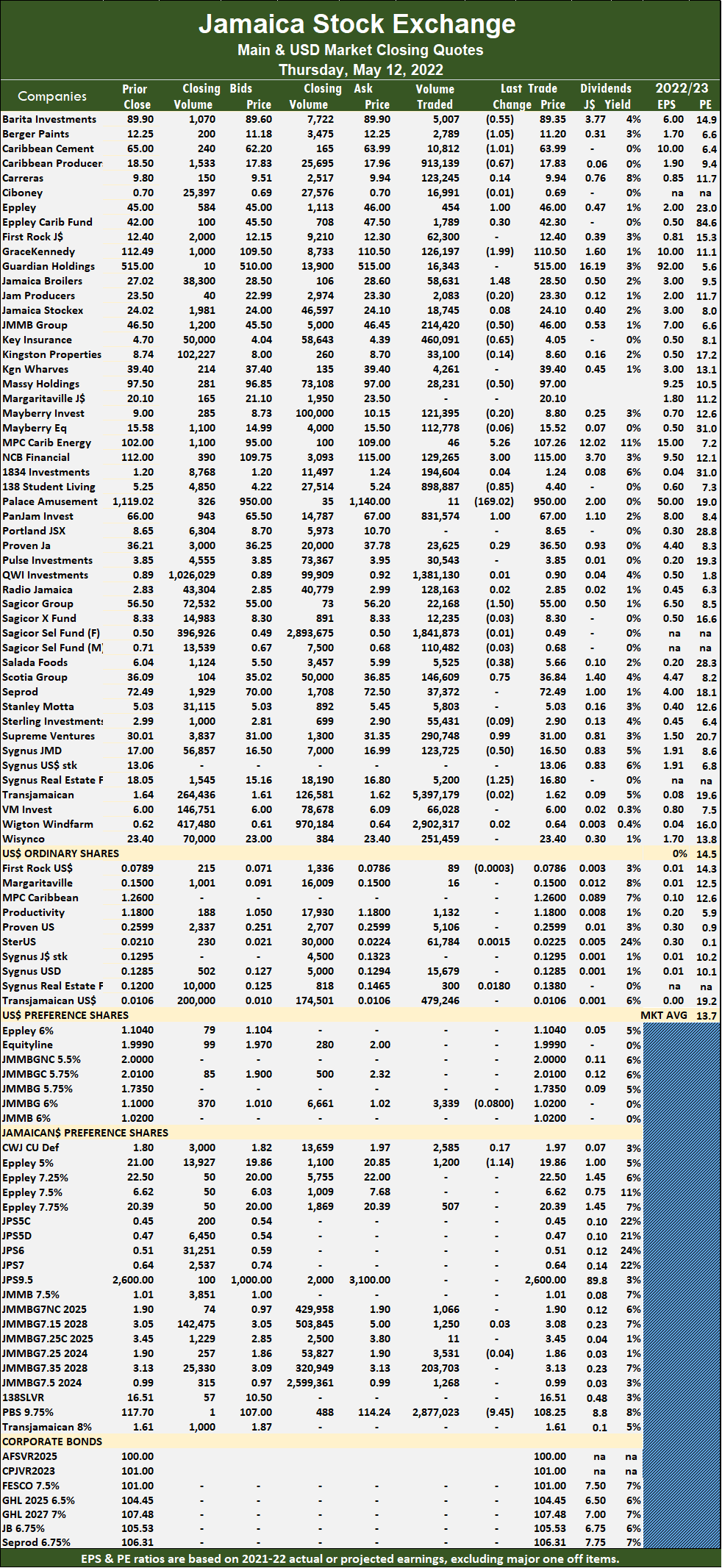

The PE Ratio, a formula for computing appropriate stock values, averages 14.5. The JSE Main and USD Market PE ratios are computed based on ICInsider.com’s forecasted earnings for companies with financial years ending up to August 2023.

Overall, 20,316,947 shares were exchanged for $488,632,009 versus 13,212,264 units at $88,081,914 on Wednesday. Transjamaican Highway led trading with 5.40 million shares for 26.6 percent of total volume, followed by Wigton Windfarm with 2.90 million units for 14.3 percent of the day’s trade, Productive Business Solutions 9.75% preference share chipped in with 2.88 million units for 14.2 percent market share, Sagicor Select Financial Fund with 1.84 million units for 9.1 percent market share and QWI Investments with 1.38 million units for 6.8 percent market share.

Trading averages 356,438 units at $8,572,491, compared to 240,223 shares at $1,601,489 on Wednesday and month to date, an average of 242,886 units at $4,584,264, compared to 228,534 units at $4,080,209 on the previous trading day. April closed with an average of 532,209 units at $5,709,319.

Investor’s Choice bid-offer indicator shows nine stocks ended with bids higher than their last selling prices and three with lower offers.

At the close, Barita Investments shed 55 cents to end at $89.35 in exchanging 5,007 shares, Berger Paints lost $1.05 in closing at $11.20, with 2,789 stocks crossing the exchange, Caribbean Cement declined $1.01 to $63.99, with 10,812 units clearing the market. Caribbean Producers fell 67 cents to end at $17.83 with an exchange of 913,139 stock units, Eppley advanced $1 to $46 while exchanging 454 units, Eppley Caribbean Property Fund increased 30 cents to end at $42.30 in switching ownership of 1,789 stock units. GraceKennedy lost $1.99 to $110.50 in trading 126,197 shares, Jamaica Broilers climbed $1.48 to close at $28.50, with 58,631 stocks changing hands, JMMB Group dropped 50 cents in closing at $46 after exchanging 214,420 units. Key Insurance fell 65 cents to $4.05 and closed with an exchange of 460,091 shares, Massy Holdings slipped 50 cents to $97, with 28,231 stock units crossing the market, MPC Caribbean Clean Energy rallied $15.26 in ending at $107.26 after trading 46 stocks. NCB Financial popped $3 in closing at $115 in an exchange of 129,265 units, 138 Student Living shed 85 cents to end at $4.40, with 898,887 stocks crossing the market, Palace Amusement declined $169.02 to close at $950 in exchanging 11 shares. PanJam Investment gained $1 to $67 with the swapping of 831,574 stock units, Sagicor Group declined $1.50 to end at $55 after trading 22,168 stocks, Salada Foods shed 38 cents in ending at $5.66 while exchanging 5,525 shares.

At the close, Barita Investments shed 55 cents to end at $89.35 in exchanging 5,007 shares, Berger Paints lost $1.05 in closing at $11.20, with 2,789 stocks crossing the exchange, Caribbean Cement declined $1.01 to $63.99, with 10,812 units clearing the market. Caribbean Producers fell 67 cents to end at $17.83 with an exchange of 913,139 stock units, Eppley advanced $1 to $46 while exchanging 454 units, Eppley Caribbean Property Fund increased 30 cents to end at $42.30 in switching ownership of 1,789 stock units. GraceKennedy lost $1.99 to $110.50 in trading 126,197 shares, Jamaica Broilers climbed $1.48 to close at $28.50, with 58,631 stocks changing hands, JMMB Group dropped 50 cents in closing at $46 after exchanging 214,420 units. Key Insurance fell 65 cents to $4.05 and closed with an exchange of 460,091 shares, Massy Holdings slipped 50 cents to $97, with 28,231 stock units crossing the market, MPC Caribbean Clean Energy rallied $15.26 in ending at $107.26 after trading 46 stocks. NCB Financial popped $3 in closing at $115 in an exchange of 129,265 units, 138 Student Living shed 85 cents to end at $4.40, with 898,887 stocks crossing the market, Palace Amusement declined $169.02 to close at $950 in exchanging 11 shares. PanJam Investment gained $1 to $67 with the swapping of 831,574 stock units, Sagicor Group declined $1.50 to end at $55 after trading 22,168 stocks, Salada Foods shed 38 cents in ending at $5.66 while exchanging 5,525 shares.  Scotia Group rose 75 cents to $36.84 after exchanging 146,609 units, Supreme Ventures advanced 99 cents to close at $31 with an exchange of 290,748 stock units, Sygnus Credit Investments fell 50 cents to $16.50, with 123,725 shares crossing the market and Sygnus Real Estate Finance popped $1.64 to $16.80 after exchanging 5,200 units.

Scotia Group rose 75 cents to $36.84 after exchanging 146,609 units, Supreme Ventures advanced 99 cents to close at $31 with an exchange of 290,748 stock units, Sygnus Credit Investments fell 50 cents to $16.50, with 123,725 shares crossing the market and Sygnus Real Estate Finance popped $1.64 to $16.80 after exchanging 5,200 units.

In the preference segment, Productive Business Solutions 9.75% preference share rallied $1.25 to $108.25, closing after 2,877,023 stocks changed hands.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

JSE Main Market ekes out gains

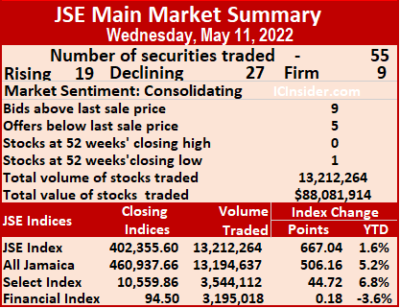

On Wednesday, the value of funds flowing into the Jamaica Stock Exchange Main Market plunged 71 percent lower than Tuesday trade and led to a minor fall in the volume of stocks changing hands, with the market closing after declining stocks exceeded those rising.

The All Jamaican Composite Index rallied 506.16 points to 460,937.66, the JSE Main Index rose 667.03 points to 402,355.60 and the JSE Financial Index popped 0.18 points to settle at 94.50.

The All Jamaican Composite Index rallied 506.16 points to 460,937.66, the JSE Main Index rose 667.03 points to 402,355.60 and the JSE Financial Index popped 0.18 points to settle at 94.50.

Trading ended with 55 securities compared to 53 on Tuesday, with 19 rising, 27 declining and nine ending unchanged.

Caribbean Cement closed at a 52 weeks’ low of $65, Mayberry Investments traded at an intraday 52 weeks’ high of $10 and Sterling Investments traded at an intraday 52 weeks’ low of $2.52.

The PE Ratio, a formula for computing appropriate stock values, averages 14.7. The JSE Main and USD Market PE ratios are computed based on ICInsider.com’s forecasted earnings for companies with financial years ending up to the close of August 2023.

Overall, 13,212,264 shares were exchanged for $88,081,914 versus 13,994,073 units at $299,292,536 on Tuesday. Trading averages 240,223 units at $1,601,489, compared to 264,039 shares at $5,647,029 on Tuesday and month to date, an average of 228,534 units at $4,080,209, compared to 226,911 units at $4,424,476 on the previous trading day. April closed with an average of 532,209 units at $5,709,319.

Wigton Windfarm was the top traded stock with 3.97 million shares for 30.1 percent of total volume, followed by Transjamaican Highway with 2.14 million units for 16.2 percent of the day’s trade, Pulse Investments chipped in with 1.91 million units for 14.4 percent market share and Sagicor Select Financial Fund exchanged 1.42 million units for 10.7 percent market share.

Investor’s Choice bid-offer indicator shows nine stocks ended with bids higher than their last selling prices and five with lower offers.

At the close, Caribbean Cement fell $1.50 to end at a closing 52 weeks’ low of $65 after trading at an intraday low of $60, with 294,882 shares changing hands, Carreras declined 15 cents to end at $9.80 in switching ownership of 227,026 stocks, Eppley shed $5.50 to close at $45 after an exchange of 542 units. Eppley Caribbean Property Fund advanced $2 in closing at $42 while exchanging 1,040 stock units, First Rock Capital lost 53 cents to end at $12.40 in trading 9,527 shares and GraceKennedy dropped $1.51 in closing at $112.49 in exchanging 9,851 stock units. Guardian Holdings rallied $4.99 to close at $515 after 15,264 stocks changed hands, Jamaica Broilers lost $1.48 to end at $27.02 after exchanging 29,977 units, Jamaica Producers rose 90 cents to $23.50, with 18,483 stocks crossing the exchange. JMMB Group declined 99 cents to $46.50, with 140,169 stock units crossing the market, Key Insurance increased 33 cents to $4.70 after exchanging 367,349 shares, Kingston Wharves shed 60 cents ending at $39.40, with 6,866 units crossing the market. Massy Holdings dropped 55 cents to close at $97.50 with the swapping of 1,323 stock units, Mayberry Investments fell 10 cents to end at $9 after exchanging 442,970 units, Mayberry Jamaican Equities gained 57 cents in closing at $15.58, with 69,259 stock units clearing the market.

At the close, Caribbean Cement fell $1.50 to end at a closing 52 weeks’ low of $65 after trading at an intraday low of $60, with 294,882 shares changing hands, Carreras declined 15 cents to end at $9.80 in switching ownership of 227,026 stocks, Eppley shed $5.50 to close at $45 after an exchange of 542 units. Eppley Caribbean Property Fund advanced $2 in closing at $42 while exchanging 1,040 stock units, First Rock Capital lost 53 cents to end at $12.40 in trading 9,527 shares and GraceKennedy dropped $1.51 in closing at $112.49 in exchanging 9,851 stock units. Guardian Holdings rallied $4.99 to close at $515 after 15,264 stocks changed hands, Jamaica Broilers lost $1.48 to end at $27.02 after exchanging 29,977 units, Jamaica Producers rose 90 cents to $23.50, with 18,483 stocks crossing the exchange. JMMB Group declined 99 cents to $46.50, with 140,169 stock units crossing the market, Key Insurance increased 33 cents to $4.70 after exchanging 367,349 shares, Kingston Wharves shed 60 cents ending at $39.40, with 6,866 units crossing the market. Massy Holdings dropped 55 cents to close at $97.50 with the swapping of 1,323 stock units, Mayberry Investments fell 10 cents to end at $9 after exchanging 442,970 units, Mayberry Jamaican Equities gained 57 cents in closing at $15.58, with 69,259 stock units clearing the market.  NCB Financial fell $4.90 to $112 with an exchange of 89,197 shares, Palace Amusement popped $159.02 in closing at $1119.02 trading five stocks, Portland JSX declined $2.05 to $8.65 after investors cleared the market of 1,500 shares. Proven Investments lost $1.77 to close at $36.21, with 10,782 stock units changing hands, Pulse Investments dropped 13 cents to $3.85, with 1,907,657 units crossing the exchange, Sagicor Group shed 50 cents to $56.50 in an exchange of 9,681 stock units. Scotia Group climbed $1.06 in closing at $36.09 after trading 6,536 units, Seprod dropped 51 cents to end at $72.49, with 18,923 stocks crossing the market, Stanley Motta lost 42 cents in ending at $5.03 after exchanging 13,642 shares. Supreme Ventures shed 99 cents to close at $30.01 with the swapping of 157,225 stock units, Sygnus Credit Investments climbed 50 cents to end at $17, with 59,533 stocks crossing the market, Victoria Mutual Investments fell 10 cents to $6 after exchanging 112,291 units and Wisynco Group popped 40 cents to close at $23.40 while trading 81,340 shares.

NCB Financial fell $4.90 to $112 with an exchange of 89,197 shares, Palace Amusement popped $159.02 in closing at $1119.02 trading five stocks, Portland JSX declined $2.05 to $8.65 after investors cleared the market of 1,500 shares. Proven Investments lost $1.77 to close at $36.21, with 10,782 stock units changing hands, Pulse Investments dropped 13 cents to $3.85, with 1,907,657 units crossing the exchange, Sagicor Group shed 50 cents to $56.50 in an exchange of 9,681 stock units. Scotia Group climbed $1.06 in closing at $36.09 after trading 6,536 units, Seprod dropped 51 cents to end at $72.49, with 18,923 stocks crossing the market, Stanley Motta lost 42 cents in ending at $5.03 after exchanging 13,642 shares. Supreme Ventures shed 99 cents to close at $30.01 with the swapping of 157,225 stock units, Sygnus Credit Investments climbed 50 cents to end at $17, with 59,533 stocks crossing the market, Victoria Mutual Investments fell 10 cents to $6 after exchanging 112,291 units and Wisynco Group popped 40 cents to close at $23.40 while trading 81,340 shares.

In the preference segment, Community & Workers Credit Union declined 15 cents to $1.80 in switching ownership of 63,678 units, Jamaica Public Service 9.5% shed $400 in closing at $2600 with an exchange of 314 shares and JMMB Group 7.25% preference share rose 60 cents in closing at $3.45 after trading 13 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

JSE Main Market bounces

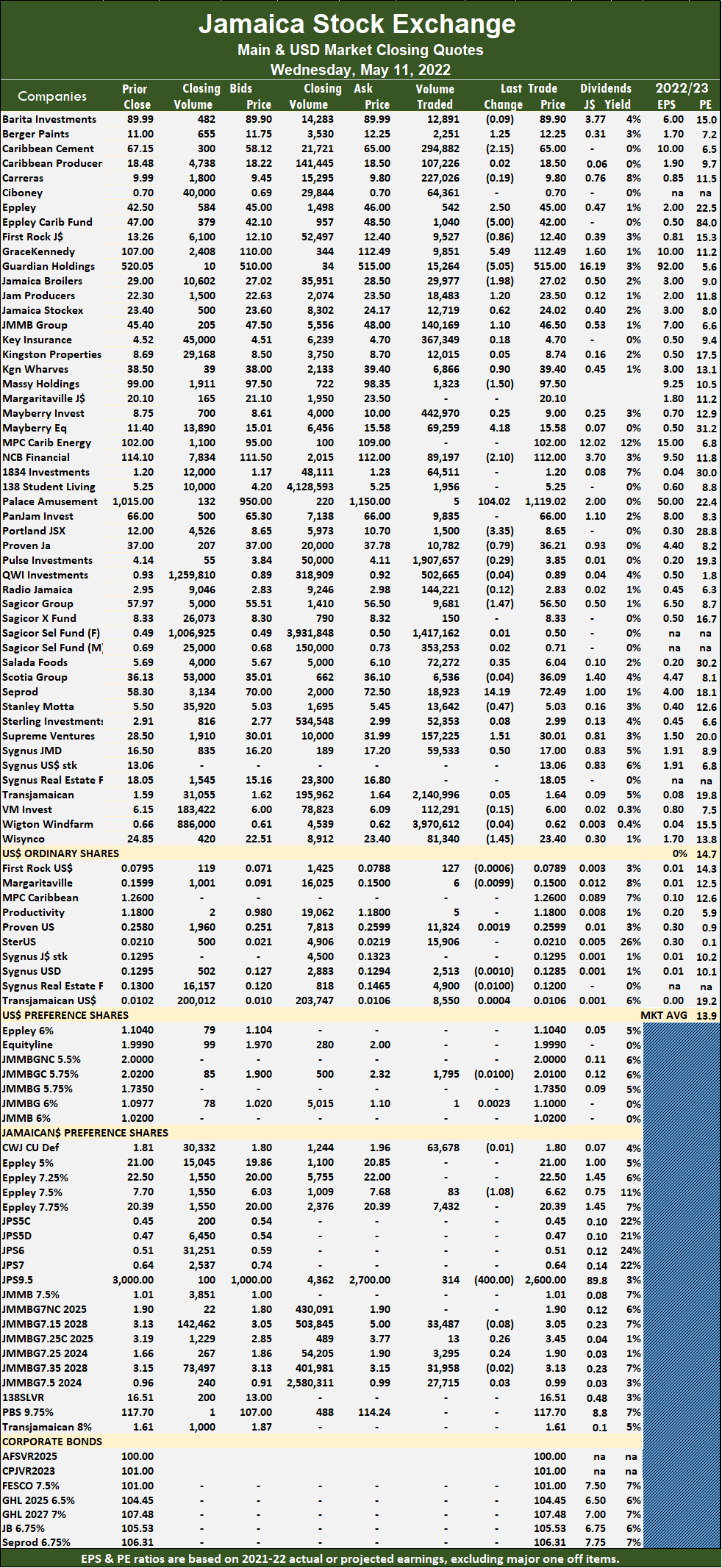

Market activity ended on Tuesday, with the stock volume slipping mildly after the value declined 22 percent from Monday’s trade on the Jamaica Stock Exchange Main Market as falling stocks exceeded those gaining, but the market index rose.

The All Jamaican Composite Index gained 2,354.48 points to settle at 460,431.50, the JSE Main Index added 1,043.96 points to end at 401,688.56 and the JSE Financial Index popped 0.93 points to settle at 94.32.

The All Jamaican Composite Index gained 2,354.48 points to settle at 460,431.50, the JSE Main Index added 1,043.96 points to end at 401,688.56 and the JSE Financial Index popped 0.93 points to settle at 94.32.

Trading ended with 53 securities compared to 59 on Monday, with 23 rising, 25 declining and five ending unchanged.

The PE Ratio, a formula for computing appropriate stock values, averages 14.8. The JSE Main and USD Market PE ratios are computed based on ICInsider.com’s forecasted earnings for companies with financial years ending up to the close of August 2023.

Overall, 13,994,073 shares were exchanged for $299,292,536 versus 14,230,271 units at $381,343,934 on Monday. Transjamaican Highway led trading with 2.10 million shares for 15 percent of total volume followed by QWI Investments with 2.07 million units for 14.8 percent of the day’s trade, Sagicor Select Financial Fund chipped in with 1.98 million units for 14.1 percent market share and GraceKennedy, 1.83 million units for 13.1 percent market share.

Trading averages 264,039 units at $5,647,029, compared to 241,191 shares at $6,463,457 on Monday and month to date, an average of 226,911 units at $4,424,476, compared to 221,174 units at $4,235,568 on the previous trading day. April closed with an average of 532,209 units at $5,709,319.

Investor’s Choice bid-offer indicator shows 12 stocks ended with bids higher than their last selling prices and eight stocks with lower offers.

At the close, Caribbean Cement dropped $1.50 ending at $66.50 in switching ownership of 46,616 shares, Eppley fell $1.96 in closing at $50.50 after 326 stock units were traded, Eppley Caribbean Property Fund shed $8.99 to close at $40 in an exchange of 320 units. GraceKennedy advanced $4 to end at $114 after exchanging 1,834,021 stocks, Guardian Holdings dipped $9.99 to $510.01 in exchanging 1,285 stocks, Jamaica Broilers lost 30 cents in closing at $28.50 after clearing the market with 3,910 shares. Jamaica Producers shed $1.25 to $22.60, trading 882 stock units, JMMB Group rallied 49 cents to end at $47.49 after 190,395 units passed through the market, Massy Holdings dropped 93 cents ending to $98.05 with the swapping of 10,146 shares. Mayberry Jamaican Equities declined 98 cents to close at $15.01 in trading 55,035 stocks, NCB Financial popped $10.25 to $116.90, with 122,398 stock units changing hands, 138 Student Living increased $1.20 to close at $5.25 in trading 97,496 units. Palace Amusement rose $10 in closing at $960 with an exchange of 156 units,PanJam Investment lost 50 cents to end at $66, with 44,331 stock units crossing the exchange, Proven Investments gained 43 cents to end at $37.98 after 80,732 stocks crossed the market. Sagicor Group climbed $2 in closing at $57 while exchanging 1,433 shares, Seprod fell 80 cents to end at $73 in an exchange of 55,933 stock units, Supreme Ventures lost 49 cents in ending at $31 while exchanging 88,113 stocks.

At the close, Caribbean Cement dropped $1.50 ending at $66.50 in switching ownership of 46,616 shares, Eppley fell $1.96 in closing at $50.50 after 326 stock units were traded, Eppley Caribbean Property Fund shed $8.99 to close at $40 in an exchange of 320 units. GraceKennedy advanced $4 to end at $114 after exchanging 1,834,021 stocks, Guardian Holdings dipped $9.99 to $510.01 in exchanging 1,285 stocks, Jamaica Broilers lost 30 cents in closing at $28.50 after clearing the market with 3,910 shares. Jamaica Producers shed $1.25 to $22.60, trading 882 stock units, JMMB Group rallied 49 cents to end at $47.49 after 190,395 units passed through the market, Massy Holdings dropped 93 cents ending to $98.05 with the swapping of 10,146 shares. Mayberry Jamaican Equities declined 98 cents to close at $15.01 in trading 55,035 stocks, NCB Financial popped $10.25 to $116.90, with 122,398 stock units changing hands, 138 Student Living increased $1.20 to close at $5.25 in trading 97,496 units. Palace Amusement rose $10 in closing at $960 with an exchange of 156 units,PanJam Investment lost 50 cents to end at $66, with 44,331 stock units crossing the exchange, Proven Investments gained 43 cents to end at $37.98 after 80,732 stocks crossed the market. Sagicor Group climbed $2 in closing at $57 while exchanging 1,433 shares, Seprod fell 80 cents to end at $73 in an exchange of 55,933 stock units, Supreme Ventures lost 49 cents in ending at $31 while exchanging 88,113 stocks.  Sygnus Credit Investments fell 30 cents to close at $16.50 with the swapping of 94,926 shares, Sygnus Real Estate Finance shed $1.64 to $15.16 after finishing trading of 5,398 units and Wisynco Group declined 80 cents to end at $23 after exchanging 628,146 shares.

Sygnus Credit Investments fell 30 cents to close at $16.50 with the swapping of 94,926 shares, Sygnus Real Estate Finance shed $1.64 to $15.16 after finishing trading of 5,398 units and Wisynco Group declined 80 cents to end at $23 after exchanging 628,146 shares.

In the preference segment, Eppley 7.50% preference share climbed 60 cents to $6.62, with 150 stock units crossing the market and JMMB Group 7.25% preference share dropped 99 cents to close at $2.85 in trading 1,554 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

JSE Main Market slides

Market activity ended on Monday on the Jamaica Stock Exchange Main Market, with the volume of stocks traded rising 33 percent and the value jumping 253 percent over Friday as the market pulled back at the close with falling stocks having the upper hand.

The All Jamaican Composite Index fell 1,039.72 points to settle at 458,077.02, the JSE Main Index fell 1,070.82 points to 400,644.60 and the JSE Financial Index added 0.06 points to settle at 93.39.

Trading ended with 59 securities compared to 56 on Friday, with 18 rising, 25 declining and 16 ending unchanged. Three stocks ended at 52 weeks’ closing highs, with Eppley closing at $52.46, followed by Jamaica Stock Exchange at $24.20 and Mayberry Jamaican Equities at $15.99.

Trading ended with 59 securities compared to 56 on Friday, with 18 rising, 25 declining and 16 ending unchanged. Three stocks ended at 52 weeks’ closing highs, with Eppley closing at $52.46, followed by Jamaica Stock Exchange at $24.20 and Mayberry Jamaican Equities at $15.99.

The PE Ratio, a formula for computing appropriate stock values, averages 15.2. The JSE Main and USD Market PE ratios are computed based on ICInsider.com’s forecasted earnings for companies with financial years ending up to August 2023.

Overall, 14,230,271 shares were exchanged for $381,343,934 versus 10,706,458 units at $108,028,666 on Friday. Productive Business Solutions 9.75% Preference share led trading with 2.88 million shares for 20.2 percent of total volume, followed by Wigton Windfarm with 2.83 million units for 19.9 percent of the day’s trade, Transjamaican Highway with 1.70 million units for 11.9 percent market share and Sagicor Select Manufacturing & Distribution Fund with 1.35 million units for 9.5 percent market share.

Trading averaged 241,191 units at $6,463,457, up from 191,187 shares at $1,929,083 on Friday and month to date, an average of 221,174 units at $4,235,568, compared to 217,015 units at $3,772,732 on the previous trading day. April closed with an average of 532,209 units at $5,709,319.

Investor’s Choice bid-offer indicator shows 12 stocks ended with bids higher than their last selling prices and four with lower offers.

At the close, Berger Paints increased 30 cents in closing at $12.25 while exchanging 6,586 shares, Caribbean Cement lost $1 to $68 in trading 10,764 stocks, Eppley surged $10.41 to close at a 52 weeks’ high of $52.46, with 10,495 stock units crossing the exchange. GraceKennedy fell $1 to $110 in an exchange of 11,870 units, Jamaica Producers rose $1.60 to end at $23.85, with 36,096 stocks changing hands, Jamaica Stock Exchange popped $1.21 to end at a 52 weeks’ high of $24.20 after 84,268 shares cleared the market. Kingston Wharves rallied 74 cents in closing at $39.99 with the swapping of 40,010 units, Margaritaville climbed $2.50 to $23.50 in exchanging 50 stock units, Mayberry Jamaican Equities advanced $1.69 to close at a 52 weeks’ high of $15.99 with 83,932 shares changing hands. MPC Caribbean Clean Energy declined $9 in ending at $92 trading 19 stocks, 138 Student Living dropped $1.10 to close at $4.05 after exchanging 8,363 units, Palace Amusement shed $150 to end at $950 in switching ownership of 13 stock units. PanJam Investment declined 50 cents to $66.50, with 35,124 stock units crossing the market, Proven Investments fell 45 cents to close at $37.55 with an exchange of 27,947 stocks, Salada Foods lost 38 cents to close at $5.92 after an exchange of 26,538 units.

At the close, Berger Paints increased 30 cents in closing at $12.25 while exchanging 6,586 shares, Caribbean Cement lost $1 to $68 in trading 10,764 stocks, Eppley surged $10.41 to close at a 52 weeks’ high of $52.46, with 10,495 stock units crossing the exchange. GraceKennedy fell $1 to $110 in an exchange of 11,870 units, Jamaica Producers rose $1.60 to end at $23.85, with 36,096 stocks changing hands, Jamaica Stock Exchange popped $1.21 to end at a 52 weeks’ high of $24.20 after 84,268 shares cleared the market. Kingston Wharves rallied 74 cents in closing at $39.99 with the swapping of 40,010 units, Margaritaville climbed $2.50 to $23.50 in exchanging 50 stock units, Mayberry Jamaican Equities advanced $1.69 to close at a 52 weeks’ high of $15.99 with 83,932 shares changing hands. MPC Caribbean Clean Energy declined $9 in ending at $92 trading 19 stocks, 138 Student Living dropped $1.10 to close at $4.05 after exchanging 8,363 units, Palace Amusement shed $150 to end at $950 in switching ownership of 13 stock units. PanJam Investment declined 50 cents to $66.50, with 35,124 stock units crossing the market, Proven Investments fell 45 cents to close at $37.55 with an exchange of 27,947 stocks, Salada Foods lost 38 cents to close at $5.92 after an exchange of 26,538 units.  Seprod popped 69 cents to $73.80, trading 51,696 shares, Supreme Ventures rallied $1.53 in closing at $31.49 after exchanging 208,360 units, Sygnus Real Estate Finance climbed $1.20 to $16.80 after exchanging 102 stocks and Wisynco Group shed $1.20 to close at $23.80 in trading 330,285 shares.

Seprod popped 69 cents to $73.80, trading 51,696 shares, Supreme Ventures rallied $1.53 in closing at $31.49 after exchanging 208,360 units, Sygnus Real Estate Finance climbed $1.20 to $16.80 after exchanging 102 stocks and Wisynco Group shed $1.20 to close at $23.80 in trading 330,285 shares.

In the preference segment, Eppley 7.50% preference share dropped 58 cents to end at $6.02 in an exchange of 2,500 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

- « Previous Page

- 1

- …

- 54

- 55

- 56

- 57

- 58

- …

- 129

- Next Page »