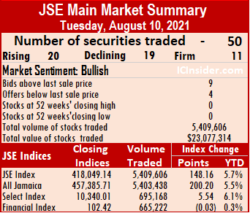

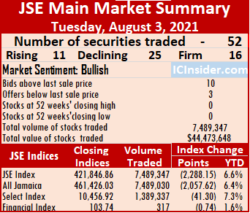

Funds chasing after stocks tumbled big time at the close of market activity on Tuesday, with the market rising modestly after the volume of shares exchanged fell 46 percent with the value plunging 71 percent from Monday levels at the close of the Jamaica Stock Exchange Main Market.

At the close, the All Jamaican Composite Index rose 200.20 points to 457,385.71, the JSE Main Index popped 148.16 points to end at 418,049.14, and the JSE Financial Index shed 0.03 points to 102.42.

At the close, the All Jamaican Composite Index rose 200.20 points to 457,385.71, the JSE Main Index popped 148.16 points to end at 418,049.14, and the JSE Financial Index shed 0.03 points to 102.42.

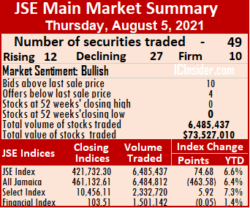

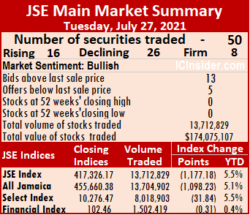

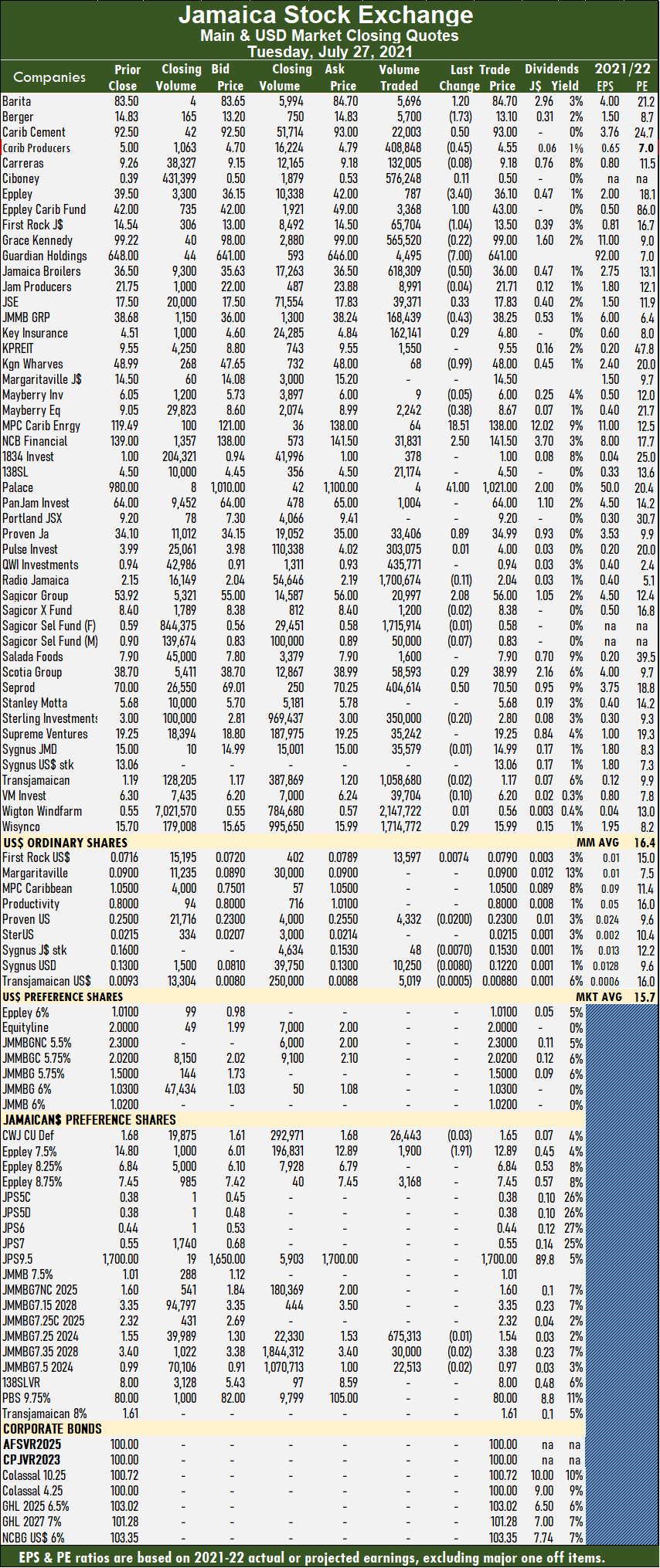

Trading ended with 50 securities similar to Monday, with 20 stocks rising, 19 declining and 11 remaining unchanged. The PE Ratio, a measure used to determine appropriate stock values, averages 16.4 based on ICInsider.com’s forecast of 2021-22 earnings.

The market closed with 5,409,606 shares trading for a mere $23,077,314 versus 9,969,713units at $73,681,632 on Monday. Transjamaican Highway led trading with 43.5 percent of total volume after trading 2.35 million shares followed by Sagicor Select Financial Fund with 9.7 percent for 522,144 units and Wigton Windfarm ended with 7.5 percent after exchanging 404,484 units.

Trading averaged 108,192 units at $461,546, compared to 199,394 shares at $1,473,633 on Monday. Trading month to date averages 144,517 units at $1,284,834, in contrast to 153,737 units at $1,493,790 on Monday. July ended with an average of 322,932 units at $15,201,099.

Trading averaged 108,192 units at $461,546, compared to 199,394 shares at $1,473,633 on Monday. Trading month to date averages 144,517 units at $1,284,834, in contrast to 153,737 units at $1,493,790 on Monday. July ended with an average of 322,932 units at $15,201,099.

Investor’s Choice bid-offer indicator reading has nine stocks ending with bids higher than their last selling prices and four stocks with lower offers.

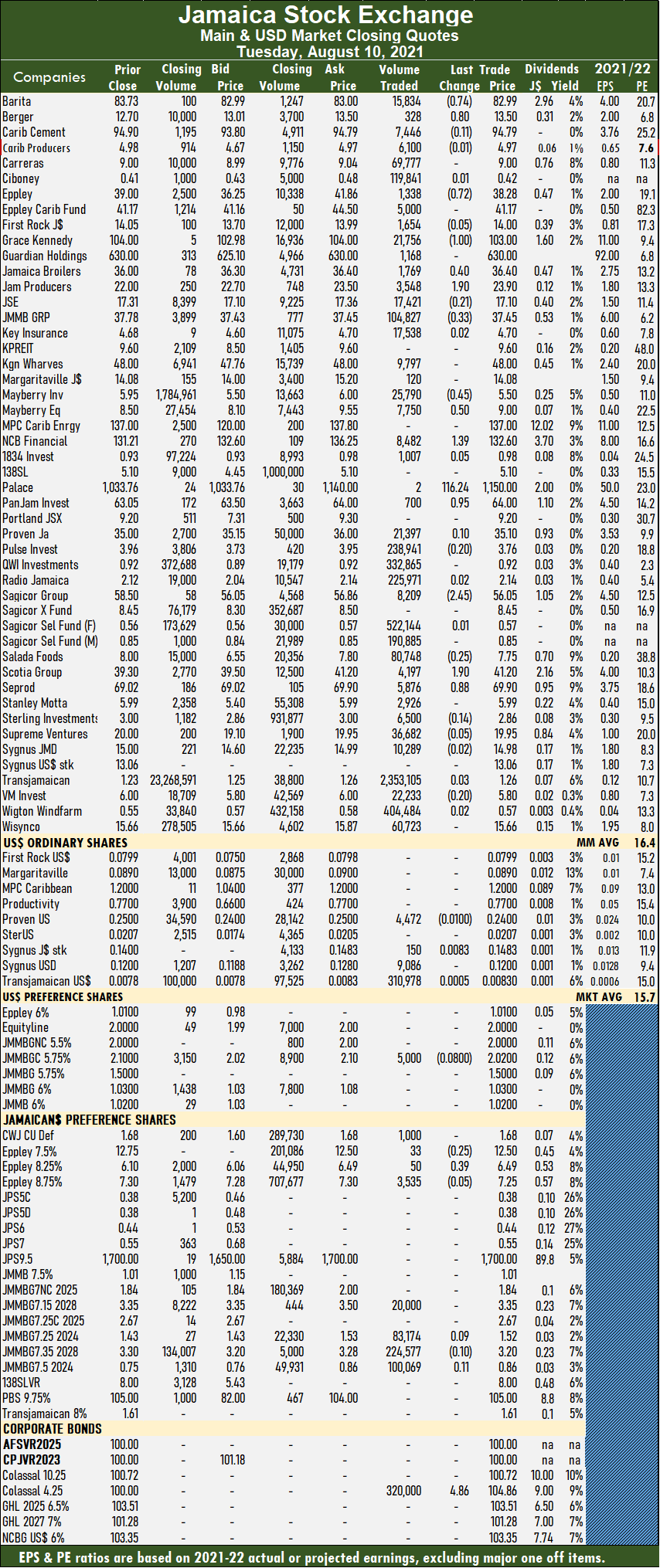

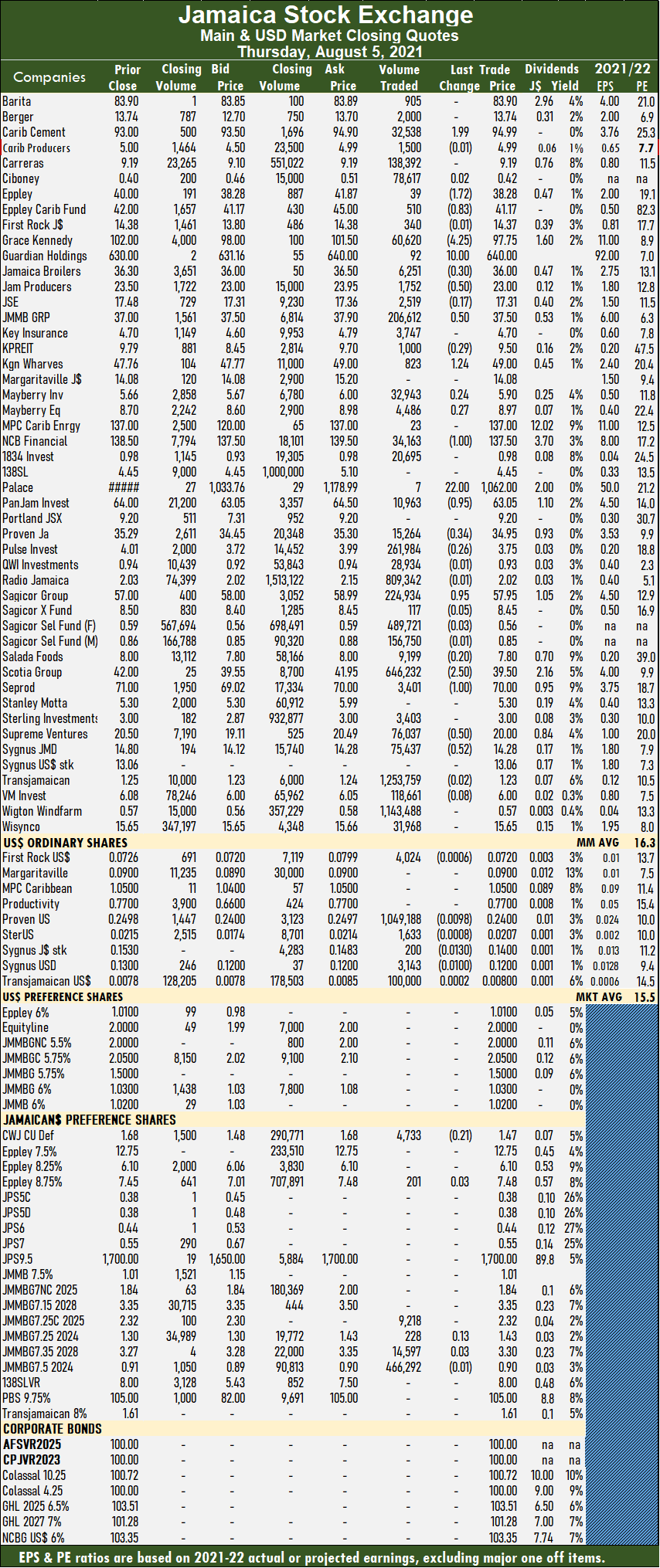

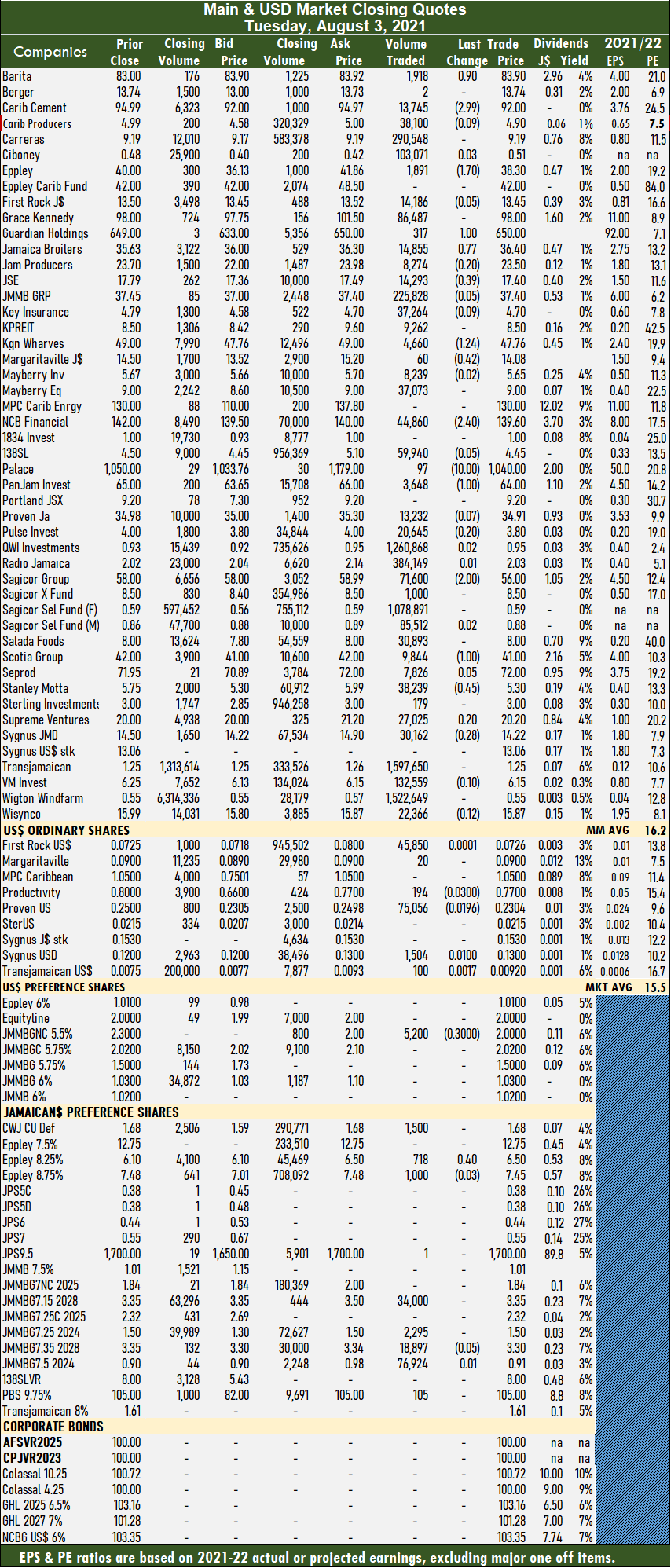

At the close, Barita Investments shed 74 cents at $82.99 after exchanging 15,834 shares, Berger Paints rose 80 cents to $13.50 with 328 units crossing the market. Eppley dipped 72 cents to $38.28 in trading 1,338 stocks, GraceKennedy declined $1 to $103 with an exchange of 21,756 units, Jamaica Broilers popped 40 cents to $36.40 after 1,769 stock units crossed the exchange, Jamaica Producers jumped $1.90 to $23.90 in switching ownership of 3,548 stocks. Jamaica Stock Exchange lost 21 cents at $17.10 with 17,421 shares clearing the market, JMMB Group dipped 33 cents to $37.45 in exchanging 104,827 stock units, Mayberry Investments lost 45 cents to end at $5.50 in trading 25,790 units, Mayberry Jamaican Equities rallied 50 cents to $9 with a transfer of 7,750 shares, NCB Financial popped $1.39 to $132.60 with 8,482 stocks changing hands.  Palace Amusement spiked $116.24 to $1,150 in switching ownership of 2 stock units, Pan Jam Investment rose 95 cents to $64 with an exchange of 700 stocks, Pulse Investments slipped 20 cents to $3.76 in transferring 238,941 shares, Sagicor Group dropped $2.45 to $56.05 with the swapping of 8,209 stock units, Salada Foods fell 25 cents to $7.75 in trading 80,748 shares. Scotia Group advanced $1.90 $41.20 after clearing the market of 4,197 shares, Seprod rose 88 cents to $69.90 in trading 5,876 stock units and Victoria Mutual Investments lost 20 cents to close at $5.80 with 22,233 stocks crossing the market.

Palace Amusement spiked $116.24 to $1,150 in switching ownership of 2 stock units, Pan Jam Investment rose 95 cents to $64 with an exchange of 700 stocks, Pulse Investments slipped 20 cents to $3.76 in transferring 238,941 shares, Sagicor Group dropped $2.45 to $56.05 with the swapping of 8,209 stock units, Salada Foods fell 25 cents to $7.75 in trading 80,748 shares. Scotia Group advanced $1.90 $41.20 after clearing the market of 4,197 shares, Seprod rose 88 cents to $69.90 in trading 5,876 stock units and Victoria Mutual Investments lost 20 cents to close at $5.80 with 22,233 stocks crossing the market.

In the preference segment, Eppley 7.5% preference share lost 25 cents in ending at $12.50 after exchanging 33 stocks and Eppley 8.25% rallied 39 cents to $6.49 in swapping ownership of 50 units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

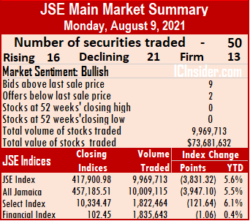

The All Jamaican Composite Index dropped 3,947.10 points to 457,185.51, the Main Index dived 3,831.32 points to 417,900.98 and the JSE Financial Index slipped 1.06 points to end at 102.45.

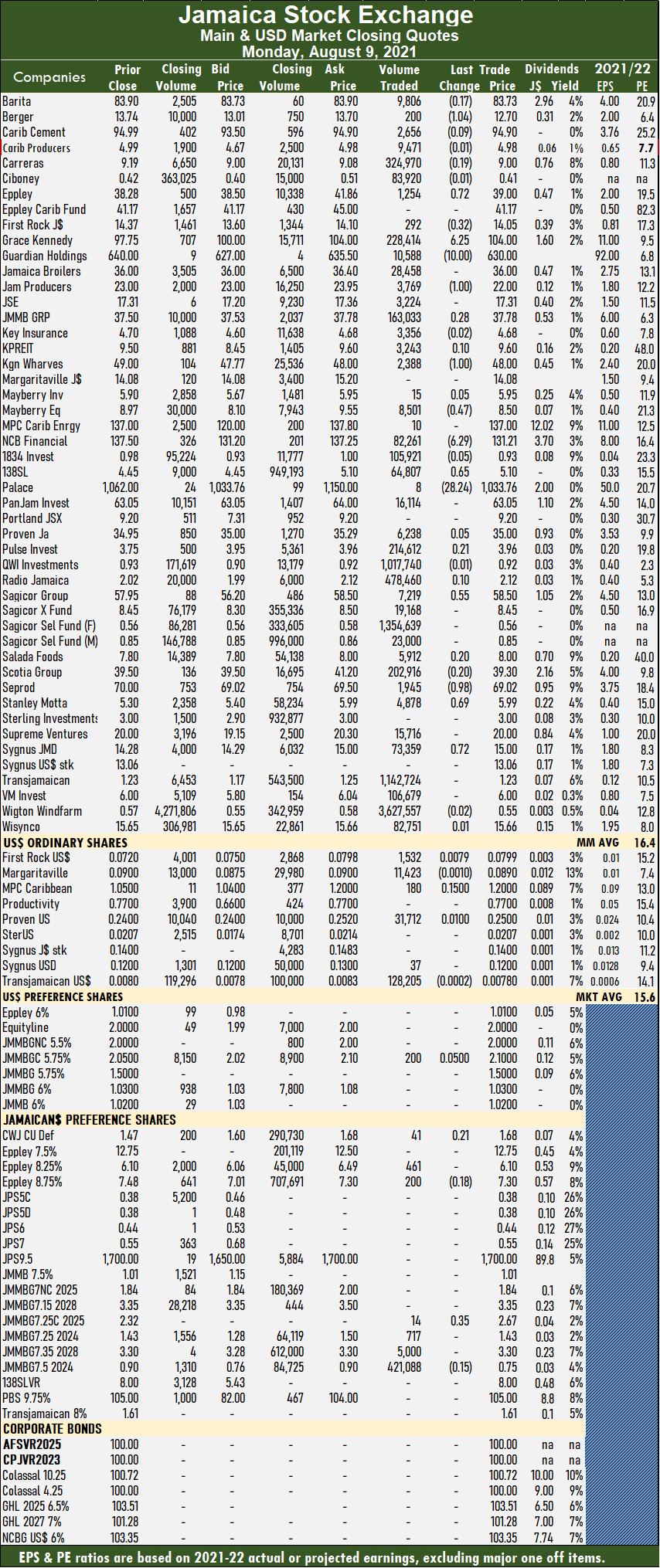

The All Jamaican Composite Index dropped 3,947.10 points to 457,185.51, the Main Index dived 3,831.32 points to 417,900.98 and the JSE Financial Index slipped 1.06 points to end at 102.45. At the close, Berger Paints fell $1.04 to $12.70 after exchanging 200 shares, Eppley spiked 72 cents to $39 in an exchange of 1,254 units, First Rock Capital fell 32 cents to end at $14.05 in exchanging 292 stock units. GraceKennedy popped $6.25 to $104, with 228,414 shares crossing the market, Guardian Holdings shed $10 to $630 with the swapping of 10,588 stocks, Jamaica Producers declined $1 in closing at $22 trading 3,769 stock units. JMMB Group rallied 28 cents to close at $37.78, with 163,033 shares clearing the market, Kingston Wharves lost $1 to end at $48 while exchanging 2,388 units. Mayberry Jamaican Equities dropped 47 cents to $8.50 after trading 8,501 units, NCB Financial Group shed $6.29 to close at $131.21 after an exchange of 82,261 stock units. 138 Student Living rallied 65 cents to $5.10, with 64,807 shares changing hands, Palace Amusement dropped $28.24 to $1033.76, with an exchange of 8 stocks, Pulse Investments rose 21 cents in closing at $3.96 trading 214,612 stock units. Sagicor Group popped 55 cents to $58.50 in exchanging 7,219 shares, Salada Foods gained 20 cents ending at $8, with 5,912 stocks crossing the market.

At the close, Berger Paints fell $1.04 to $12.70 after exchanging 200 shares, Eppley spiked 72 cents to $39 in an exchange of 1,254 units, First Rock Capital fell 32 cents to end at $14.05 in exchanging 292 stock units. GraceKennedy popped $6.25 to $104, with 228,414 shares crossing the market, Guardian Holdings shed $10 to $630 with the swapping of 10,588 stocks, Jamaica Producers declined $1 in closing at $22 trading 3,769 stock units. JMMB Group rallied 28 cents to close at $37.78, with 163,033 shares clearing the market, Kingston Wharves lost $1 to end at $48 while exchanging 2,388 units. Mayberry Jamaican Equities dropped 47 cents to $8.50 after trading 8,501 units, NCB Financial Group shed $6.29 to close at $131.21 after an exchange of 82,261 stock units. 138 Student Living rallied 65 cents to $5.10, with 64,807 shares changing hands, Palace Amusement dropped $28.24 to $1033.76, with an exchange of 8 stocks, Pulse Investments rose 21 cents in closing at $3.96 trading 214,612 stock units. Sagicor Group popped 55 cents to $58.50 in exchanging 7,219 shares, Salada Foods gained 20 cents ending at $8, with 5,912 stocks crossing the market.  Scotia Group fell 20 cents to $39.30 in switching ownership of 202,916 stock units, Seprod dropped 98 cents to $69.02, with 1,945 units crossing the market, Stanley Motta spiked 69 cents to $5.99 after 4,878 stocks crossed the exchange and Sygnus Credit Investments rallied 72 cents to $15, with 73,359 shares changing hands.

Scotia Group fell 20 cents to $39.30 in switching ownership of 202,916 stock units, Seprod dropped 98 cents to $69.02, with 1,945 units crossing the market, Stanley Motta spiked 69 cents to $5.99 after 4,878 stocks crossed the exchange and Sygnus Credit Investments rallied 72 cents to $15, with 73,359 shares changing hands.

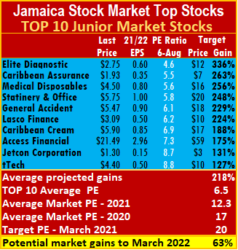

The top three stocks in the Junior Market, continue to be Elite Diagnostic, followed by Caribbean Assurance Brokers and Medical Disposables, with the potential to gain between 256 percent and 336 percent compared to 221 and 287 percent, last week. Medical Disposables continues the addition of new products to its portfolio that will add revenues and profit going forward. The acquisition of the 60 percent majority ownership in Cornwall Enterprises, will result in economies of scale and an expanded portfolio to market nationally to an expanded clientele.

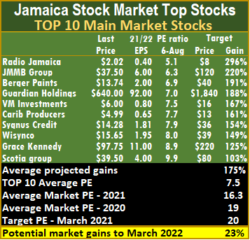

The top three stocks in the Junior Market, continue to be Elite Diagnostic, followed by Caribbean Assurance Brokers and Medical Disposables, with the potential to gain between 256 percent and 336 percent compared to 221 and 287 percent, last week. Medical Disposables continues the addition of new products to its portfolio that will add revenues and profit going forward. The acquisition of the 60 percent majority ownership in Cornwall Enterprises, will result in economies of scale and an expanded portfolio to market nationally to an expanded clientele. The Top10 Main Market leader Radio Jamaica continues to enjoy buying interest that is whittling away the supply of stocks on offer in the market. A barrage of new results are due this coming week as the final reporting day for the period will be Saturday this coming week.

The Top10 Main Market leader Radio Jamaica continues to enjoy buying interest that is whittling away the supply of stocks on offer in the market. A barrage of new results are due this coming week as the final reporting day for the period will be Saturday this coming week. The JSE Main Market ended the week with an overall PE of 16.3, a little distance from the 19 the market ended at in March, suggesting a 17 percent rise at a PE of 19 and 23 percent at a PE of 20 from now to March 2022. The Main Market TOP 10 trades at a PE of 7.5, with a 54 percent discount to the PE of that market, well off the potential of 20.

The JSE Main Market ended the week with an overall PE of 16.3, a little distance from the 19 the market ended at in March, suggesting a 17 percent rise at a PE of 19 and 23 percent at a PE of 20 from now to March 2022. The Main Market TOP 10 trades at a PE of 7.5, with a 54 percent discount to the PE of that market, well off the potential of 20. IC ranked stocks to filter out the big winners, allowing investors to focus on potentially big winners and help to keep out emotional attachments to stocks.

IC ranked stocks to filter out the big winners, allowing investors to focus on potentially big winners and help to keep out emotional attachments to stocks. Trading averaged 132,356 units at $1,500,551, compared to 137,862 shares at $2,230,311 on Wednesday. Trading month to date averages 138,207 units at $1,500,646, in contrast to 141,133units at $1,500,693 on Wednesday. July ended with an average of 322,932 units at $15,201,099.

Trading averaged 132,356 units at $1,500,551, compared to 137,862 shares at $2,230,311 on Wednesday. Trading month to date averages 138,207 units at $1,500,646, in contrast to 141,133units at $1,500,693 on Wednesday. July ended with an average of 322,932 units at $15,201,099. NCB Financial shed $1 to $137.50 with an exchange of 34,163 units, Palace Amusement popped $22 to $1,062 after 7 stocks cleared the market, PanJam Investment dipped 95 cents to $63.05 with the swapping of 10,963 stock units. Proven Investments lost 34 cents to settle at $34.95 in switching ownership of 15,264 units, Pulse Investments dipped 26 cents to $3.75 in trading 261,984 stock units, Sagicor Group spiked 95 cents to end at $57.95 after exchanging 224,934 shares. Salada Foods lost 20 cents to close at $7.80 with 9,199 units clearing the market. Scotia Group declined $2.50 to $39.50 in trading 646,232 shares, Seprod fell $1 to $70 after an exchange of 3,401 stock units, Supreme Ventures shed 50 cents in closing at $20 with 76,037 stocks changing hands and Sygnus Credit Investments slipped 52 cents to $14.28 with 75,437 stock units crossing the market.

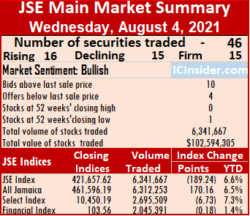

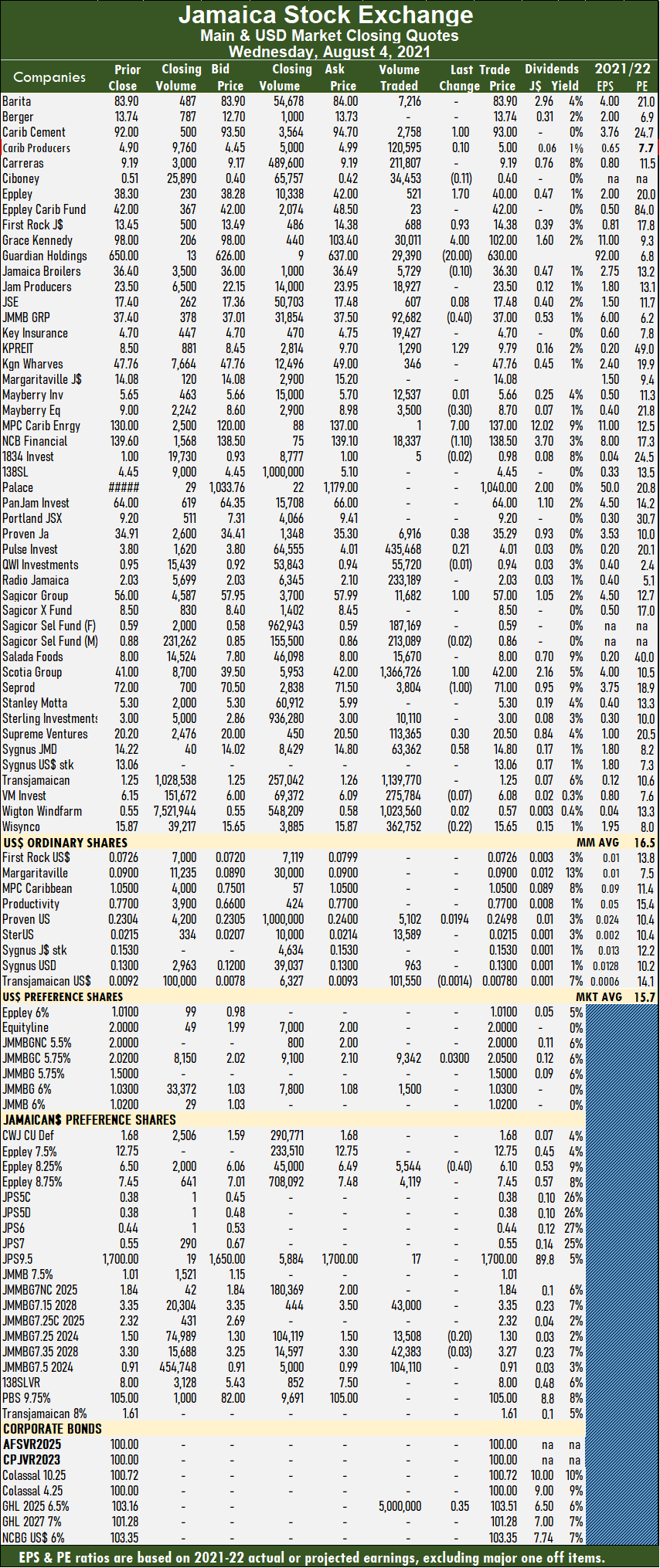

NCB Financial shed $1 to $137.50 with an exchange of 34,163 units, Palace Amusement popped $22 to $1,062 after 7 stocks cleared the market, PanJam Investment dipped 95 cents to $63.05 with the swapping of 10,963 stock units. Proven Investments lost 34 cents to settle at $34.95 in switching ownership of 15,264 units, Pulse Investments dipped 26 cents to $3.75 in trading 261,984 stock units, Sagicor Group spiked 95 cents to end at $57.95 after exchanging 224,934 shares. Salada Foods lost 20 cents to close at $7.80 with 9,199 units clearing the market. Scotia Group declined $2.50 to $39.50 in trading 646,232 shares, Seprod fell $1 to $70 after an exchange of 3,401 stock units, Supreme Ventures shed 50 cents in closing at $20 with 76,037 stocks changing hands and Sygnus Credit Investments slipped 52 cents to $14.28 with 75,437 stock units crossing the market. The All Jamaican Composite Index rose 170.16 points to 461,596.19, the JSE Main Index shed 189.24 points to end at 421,657.62 and the JSE Financial Index dipped 0.18 points to 103.56.

The All Jamaican Composite Index rose 170.16 points to 461,596.19, the JSE Main Index shed 189.24 points to end at 421,657.62 and the JSE Financial Index dipped 0.18 points to 103.56.  Investor’s Choice bid-offer indicator reading has ten stocks ending with bids higher than their last selling prices and four with lower offers.

Investor’s Choice bid-offer indicator reading has ten stocks ending with bids higher than their last selling prices and four with lower offers. Sygnus Credit Investments popped 58 cents to $14.80 after exchanging 63,362 shares but after trading at a 52 weeks’ intraday low of $13.99 and Wisynco Group lost 22 cents to settle at $15.65 with 362,752 stocks crossing the market.

Sygnus Credit Investments popped 58 cents to $14.80 after exchanging 63,362 shares but after trading at a 52 weeks’ intraday low of $13.99 and Wisynco Group lost 22 cents to settle at $15.65 with 362,752 stocks crossing the market.

The top three stocks in the Junior Market, continue, with Elite Diagnostic, followed by Caribbean Assurance Brokers and Medical Disposables, with the potential to gain between 221 percent and 287 percent compared to 237 and 291 percent, last week. The top three Main Market stocks are Radio Jamaica in the number one spot, followed by JMMB Group and Guardian Holdings, with expected gains of 184 to 296 percent, versus last weeks’ 183 to 292 percent.

The top three stocks in the Junior Market, continue, with Elite Diagnostic, followed by Caribbean Assurance Brokers and Medical Disposables, with the potential to gain between 221 percent and 287 percent compared to 237 and 291 percent, last week. The top three Main Market stocks are Radio Jamaica in the number one spot, followed by JMMB Group and Guardian Holdings, with expected gains of 184 to 296 percent, versus last weeks’ 183 to 292 percent. The JSE Main Market ended the week with an overall PE of 16.4, a little distance from the 19 the market ended at in March, suggesting just a 17 percent rise at a PE of 19 and 23 percent at a PE of 20 from now to March 2022. The Main Market TOP 10 trades at a PE of 7.6 or 46 percent of the PE of that market, well off the potential of 20.

The JSE Main Market ended the week with an overall PE of 16.4, a little distance from the 19 the market ended at in March, suggesting just a 17 percent rise at a PE of 19 and 23 percent at a PE of 20 from now to March 2022. The Main Market TOP 10 trades at a PE of 7.6 or 46 percent of the PE of that market, well off the potential of 20. The TOP10 stocks are not always the best stocks in the market but ones that are most likely to be the best winners within a fifteen months period. IC ranked stocks to filter out the big winners, allowing investors to focus on potentially big winners and help to keep out emotional attachments to stocks.

The TOP10 stocks are not always the best stocks in the market but ones that are most likely to be the best winners within a fifteen months period. IC ranked stocks to filter out the big winners, allowing investors to focus on potentially big winners and help to keep out emotional attachments to stocks. Investor’s Choice bid-offer indicator reading has ten stocks ending with bids higher than their last selling prices and three with lower offers.

Investor’s Choice bid-offer indicator reading has ten stocks ending with bids higher than their last selling prices and three with lower offers. PanJam Investment shed $1 to close at $64 in trading 3,648 stocks, Pulse Investments fell 20 cents to $3.80 with 20,645 shares clearing the market. Sagicor Group shed $2 to settle at $56 with 71,600 stocks changing hands, Scotia Group fell $1 to $41 after crossing the exchange with 9,844 units, Stanley Motta shed 45 cents at $5.30 with a transfer of 38,239 stocks, Supreme Ventures popped 20 cents to $20.20 in trading 27,025 units and Sygnus Credit Investments lost 28 cents to close at $14.22 in switching ownership of 30,162 stocks.

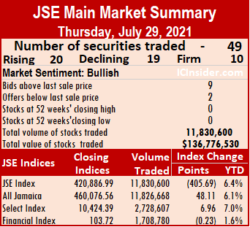

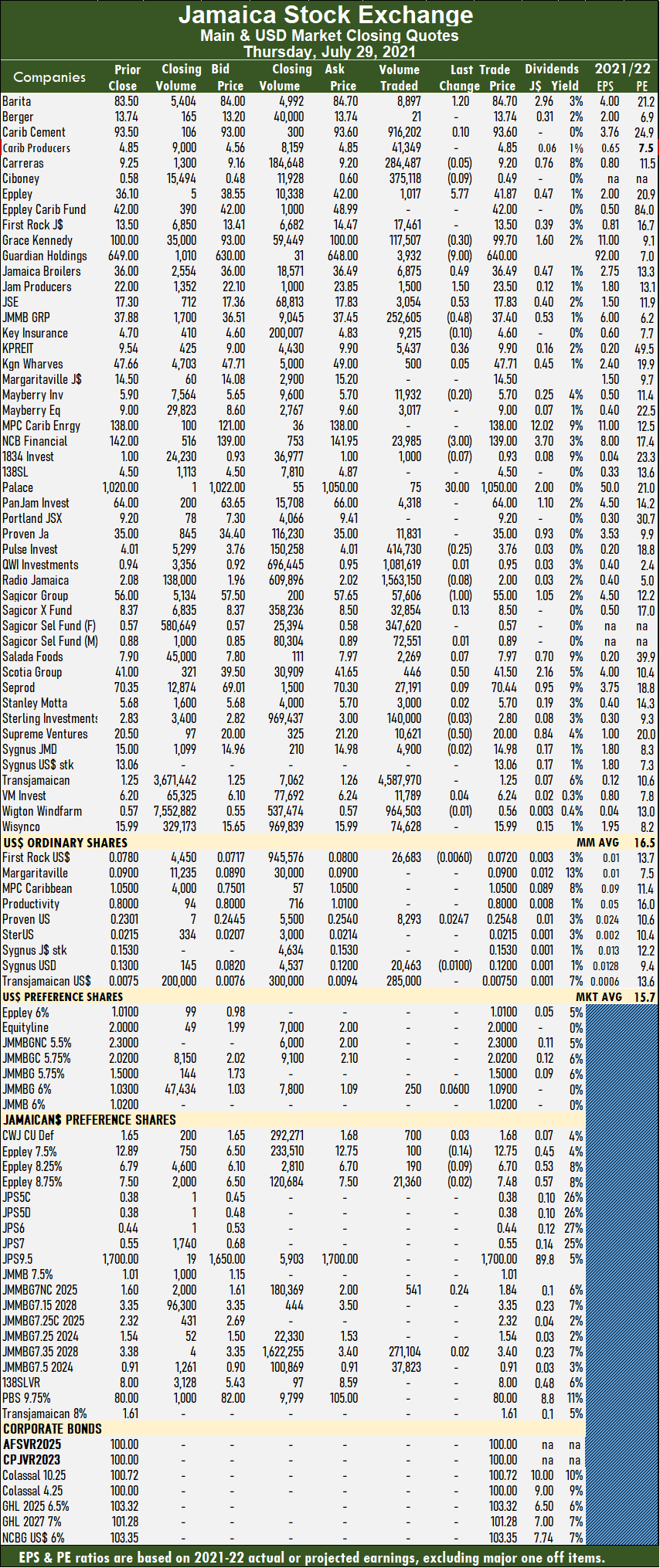

PanJam Investment shed $1 to close at $64 in trading 3,648 stocks, Pulse Investments fell 20 cents to $3.80 with 20,645 shares clearing the market. Sagicor Group shed $2 to settle at $56 with 71,600 stocks changing hands, Scotia Group fell $1 to $41 after crossing the exchange with 9,844 units, Stanley Motta shed 45 cents at $5.30 with a transfer of 38,239 stocks, Supreme Ventures popped 20 cents to $20.20 in trading 27,025 units and Sygnus Credit Investments lost 28 cents to close at $14.22 in switching ownership of 30,162 stocks. The All Jamaican Composite Index added just 48.11 points to end at 460,076.56, the JSE Main Index shed 405.69 points to finish at 420,886.99 and the JSE Financial Index slipped 0.23 points to 103.72.

The All Jamaican Composite Index added just 48.11 points to end at 460,076.56, the JSE Main Index shed 405.69 points to finish at 420,886.99 and the JSE Financial Index slipped 0.23 points to 103.72.  Investor’s Choice bid-offer indicator reading has nine stocks ending with bids higher than their last selling prices and two with lower offers.

Investor’s Choice bid-offer indicator reading has nine stocks ending with bids higher than their last selling prices and two with lower offers. Sagicor Group declined $1 to $55 with 57,606 stock units crossing the market, Scotia Group spiked 50 cents to $41.50 with 446 units clearing the market and Supreme Ventures shed 50 cents at $20 in switching ownership of 10,621 stocks.

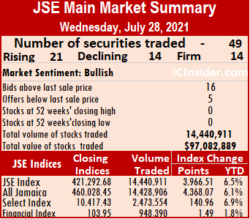

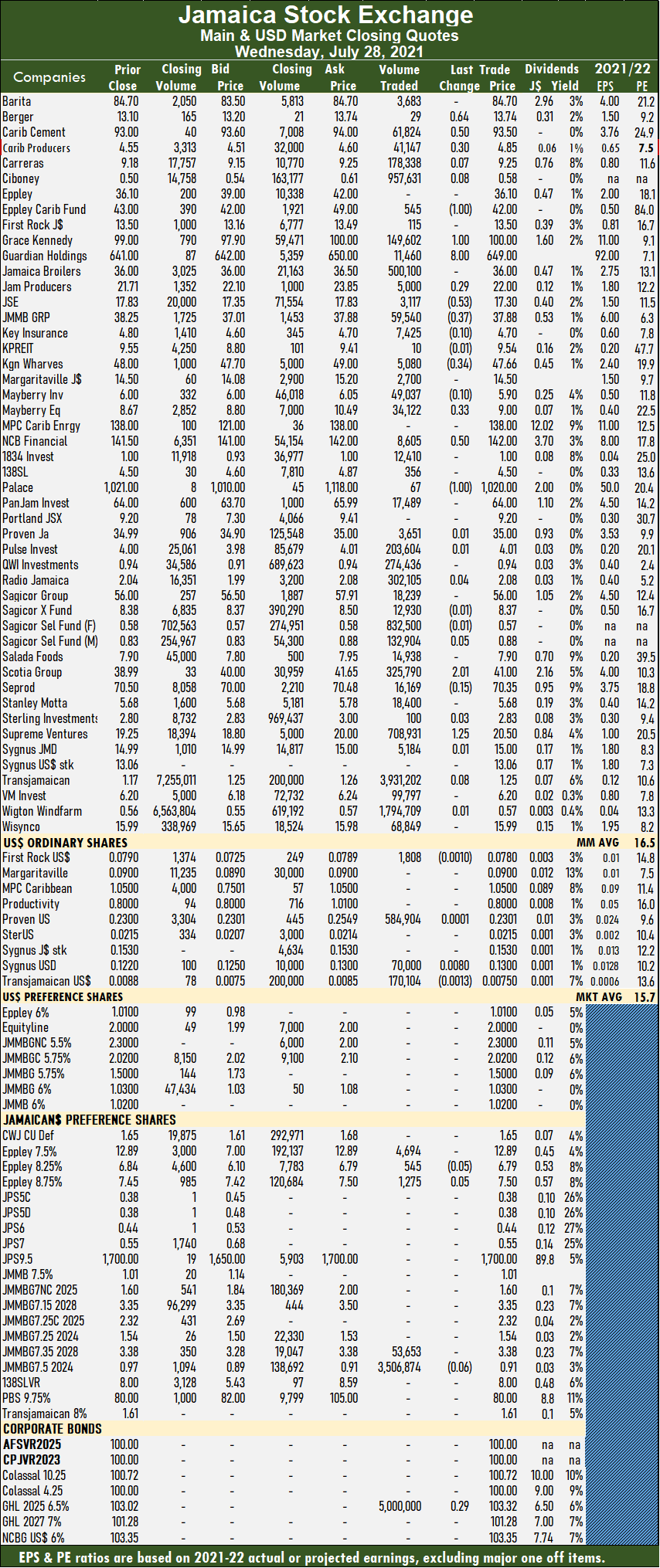

Sagicor Group declined $1 to $55 with 57,606 stock units crossing the market, Scotia Group spiked 50 cents to $41.50 with 446 units clearing the market and Supreme Ventures shed 50 cents at $20 in switching ownership of 10,621 stocks. At the close at trading, the All Jamaican Composite Index bolted 4,368.07 points to 460,028.45, the JSE Main Index climbed 3,966.51 points to end at 421,292.68 and the JSE Financial Index rose 1.49 points to 103.95.

At the close at trading, the All Jamaican Composite Index bolted 4,368.07 points to 460,028.45, the JSE Main Index climbed 3,966.51 points to end at 421,292.68 and the JSE Financial Index rose 1.49 points to 103.95.  June ended with an average of 249,610 units at $3,877,606.

June ended with an average of 249,610 units at $3,877,606. NCB Financial Group rose 50 cents to $142 with 8,605 stocks clearing the market, Palace Amusement shed $1 to end at $1,020 in transferring 67 units, Scotia Group popped $2.01 to $41 after 325,790 stock units crossed the exchange and Supreme Ventures advanced $1.25 to $20.50, with 708,931 shares changing hands.

NCB Financial Group rose 50 cents to $142 with 8,605 stocks clearing the market, Palace Amusement shed $1 to end at $1,020 in transferring 67 units, Scotia Group popped $2.01 to $41 after 325,790 stock units crossed the exchange and Supreme Ventures advanced $1.25 to $20.50, with 708,931 shares changing hands. The All Jamaican Composite Index declined by 1,098.23 points to 455,660.38, the JSE Main Index dropped 1,177.18 points to end at 417,326.17 and the JSE Financial Index shed 0.31 points to close at 102.46.

The All Jamaican Composite Index declined by 1,098.23 points to 455,660.38, the JSE Main Index dropped 1,177.18 points to end at 417,326.17 and the JSE Financial Index shed 0.31 points to close at 102.46. Investor’s Choice bid-offer indicator shows 13 stocks ending with bids higher than their last selling prices and five with lower offers.

Investor’s Choice bid-offer indicator shows 13 stocks ending with bids higher than their last selling prices and five with lower offers. Proven Investments popped 89 cents to $34.99 with 33,406 units clearing the market, Sagicor Group rose $2.08 to $56 with 20,997 shares crossing the exchange, Scotia Group spiked 29 cents to $38.99, with 58,593 stocks trading. Seprod popped 50 cents to $70.50 in transferring 404,614 units, Sterling Investments shed 20 cents to end at $2.80 with the swapping of 350,000 stock units and Wisynco Group gained 29 cents to finish at $15.99 in switching ownership of 1,714,772 shares.

Proven Investments popped 89 cents to $34.99 with 33,406 units clearing the market, Sagicor Group rose $2.08 to $56 with 20,997 shares crossing the exchange, Scotia Group spiked 29 cents to $38.99, with 58,593 stocks trading. Seprod popped 50 cents to $70.50 in transferring 404,614 units, Sterling Investments shed 20 cents to end at $2.80 with the swapping of 350,000 stock units and Wisynco Group gained 29 cents to finish at $15.99 in switching ownership of 1,714,772 shares.