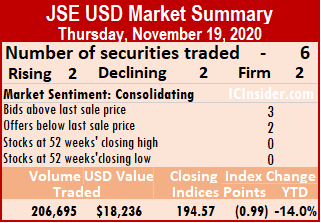

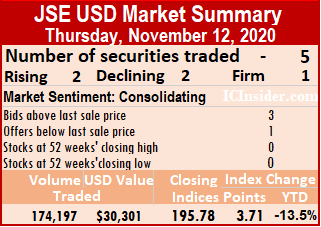

Market activity on Thursday led to the trading of shares in more companies on the US dollar market of the Jamaica Stock Exchange than Wednesday, but the market declined after the total volume fell 70 percent from the previous day.

At the close of the market, six securities changed hands compared to four on Wednesday and closed with the prices of two stocks rising, two declining and two remaining unchanged.

At the close of the market, six securities changed hands compared to four on Wednesday and closed with the prices of two stocks rising, two declining and two remaining unchanged.

The JSE USD Equities Index declined by 0.99 points to settle at 194.57. The average PE Ratio ended at 13.8 based on ICInsider.com’s forecast of 2020-21 earnings.

Trading resulted in an exchange of 206,695 shares for US$18,236 compared to 700,105 units at US$38,808 on Wednesday. The average trade amounts to 34,449 units at US$3,039, in contrast to an average of 175,026 shares at US$9,702 on Wednesday. Trading ended with an average of 49,514 units for the month to date at US$5,468, in contrast to 51,128 units at US$5,728 on Wednesday. By comparison, October ended with an average of 697,808 units for US$17,320.

At the end of trading, the Investor’s Choice bid-offer indicator reading shows three stocks ending with bids higher than their last selling prices and two with lower offers.

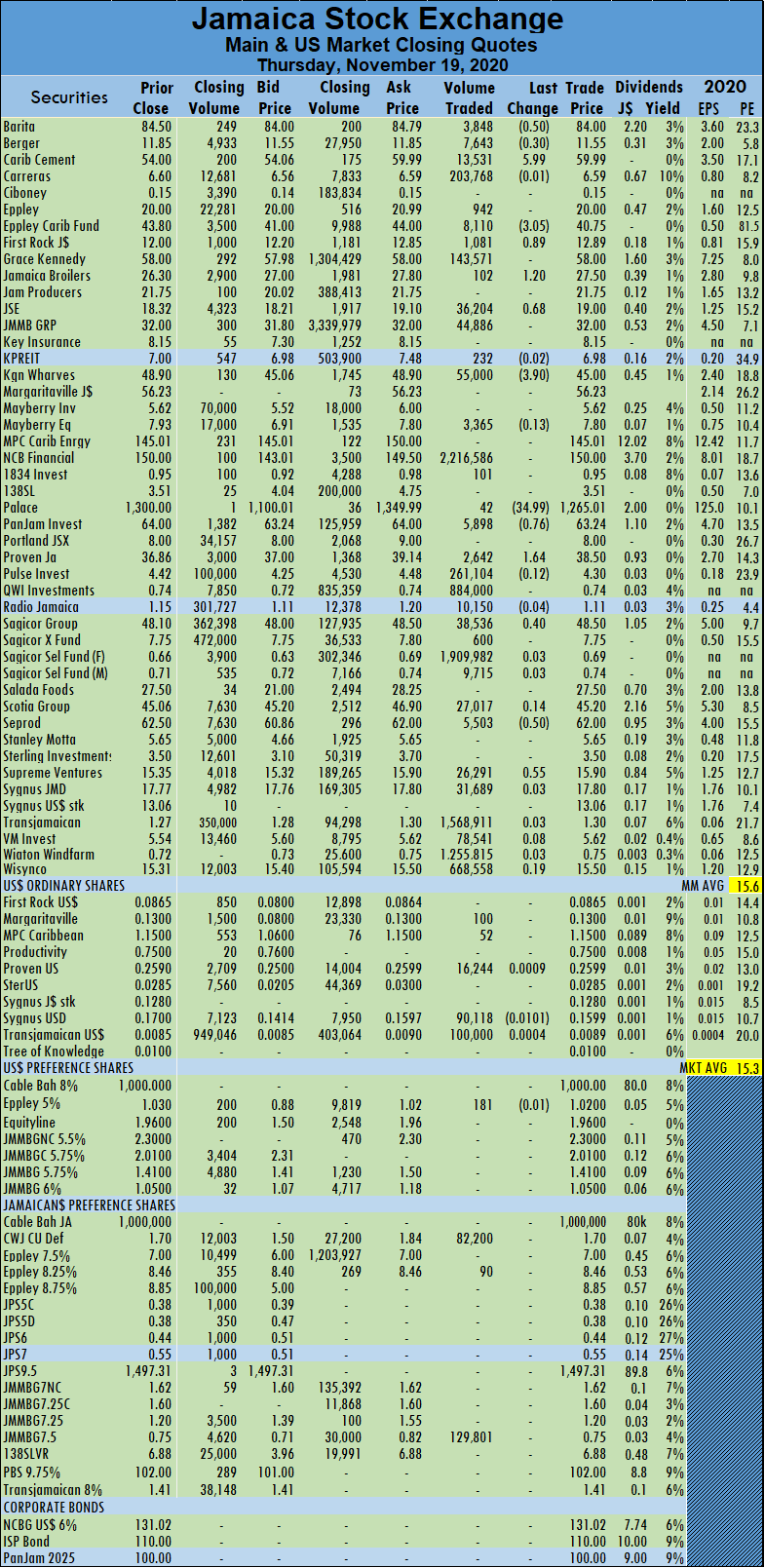

At the close of the market, Margaritaville traded 100 shares at 13 US cents, MPC Caribbean Clean Energy settled at US$1.15, in exchanging 52 units. Proven Investments lost 0.09 of a cent and ended at 25.99 US cents trading 16,244 stocks, Sygnus Credit Investments shed 1.01 US cents to close at 15.99 US cents, with 90,118 units changing hands and Transjamaican Highway gained 0.04 of a cent to end at 0.89 of a US cent after exchanging 100,000 shares.

At the close of the market, Margaritaville traded 100 shares at 13 US cents, MPC Caribbean Clean Energy settled at US$1.15, in exchanging 52 units. Proven Investments lost 0.09 of a cent and ended at 25.99 US cents trading 16,244 stocks, Sygnus Credit Investments shed 1.01 US cents to close at 15.99 US cents, with 90,118 units changing hands and Transjamaican Highway gained 0.04 of a cent to end at 0.89 of a US cent after exchanging 100,000 shares.

In the preference segment, Eppley 5% preference share lost 1 US cent to end at US$1.02, with the trading of 181 units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

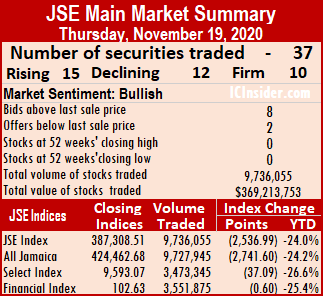

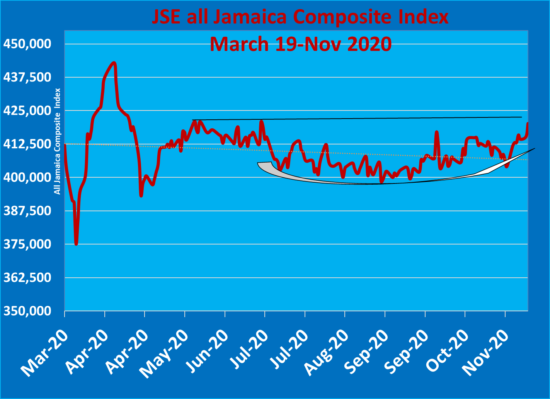

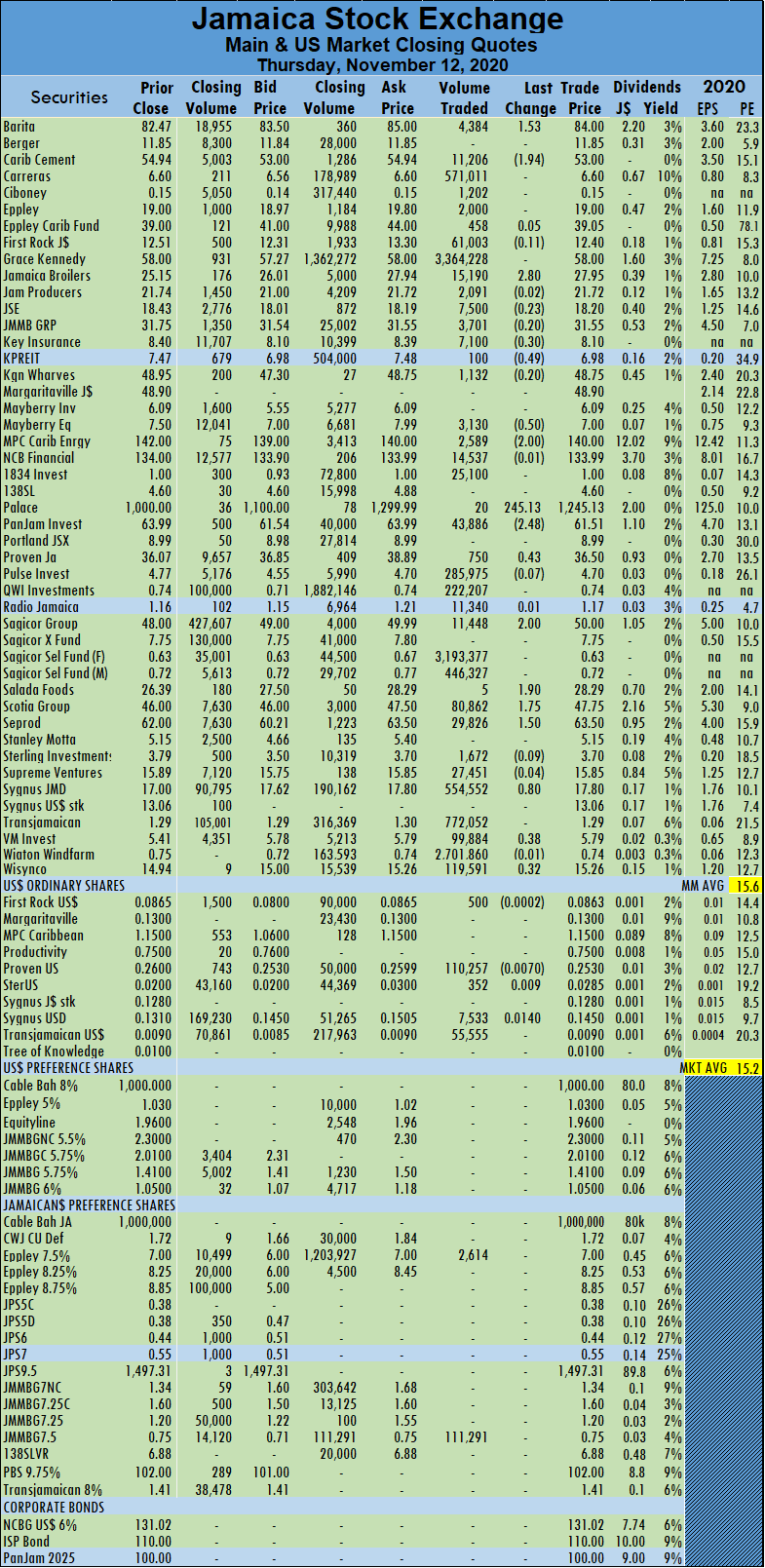

At the close, the All Jamaican Composite Index dropped 2,741.60 points to 424,462.68, the Main Index fell by 2,536.99 points to 387,308.51 and the JSE Financial Index lost 0.60 points to settle at 102.63.

At the close, the All Jamaican Composite Index dropped 2,741.60 points to 424,462.68, the Main Index fell by 2,536.99 points to 387,308.51 and the JSE Financial Index lost 0.60 points to settle at 102.63. Trading averaged 263,137 units changing hands at $9,978,750 for each security, compared to 366,759 shares at $16,456,068 on Wednesday. Month to date average trade ends at 267,957 units at $5,429,235 in contrast to 268,282 units at $5,122,619 on Wednesday. Trading for October averaged 398,200 units at $4,622,532.

Trading averaged 263,137 units changing hands at $9,978,750 for each security, compared to 366,759 shares at $16,456,068 on Wednesday. Month to date average trade ends at 267,957 units at $5,429,235 in contrast to 268,282 units at $5,122,619 on Wednesday. Trading for October averaged 398,200 units at $4,622,532. Jamaica Stock Exchange rose 68 cents to settle at $19, with investors switching ownership of 36,204 shares, Kingston Wharves dropped $3.90 to $45 in trading 55,000 shares, Palace Amusement dived $34.99 to $1,265.01, in an exchange of 42 units. Pan Jam Investment shed 76 cents to end at $63.24 after trading 5,898 units, Proven Investments settled at $38.50, with gains of $1.64, in clearing the market with 2,642 units, Sagicor Group gained 40 cents to close at $48.50, with 38,536 shares crossing the exchange. Seprod ended at $62, with a loss of 50 cents trading 5,503 units and Supreme Ventures rose 55 cents to $15.90, with an exchange of 26,291 stock units.

Jamaica Stock Exchange rose 68 cents to settle at $19, with investors switching ownership of 36,204 shares, Kingston Wharves dropped $3.90 to $45 in trading 55,000 shares, Palace Amusement dived $34.99 to $1,265.01, in an exchange of 42 units. Pan Jam Investment shed 76 cents to end at $63.24 after trading 5,898 units, Proven Investments settled at $38.50, with gains of $1.64, in clearing the market with 2,642 units, Sagicor Group gained 40 cents to close at $48.50, with 38,536 shares crossing the exchange. Seprod ended at $62, with a loss of 50 cents trading 5,503 units and Supreme Ventures rose 55 cents to $15.90, with an exchange of 26,291 stock units. At the close of the market, trading ended with four stocks changing hands compared to two on Tuesday and closed with the prices of two stocks rising, two declining and none remaining unchanged.

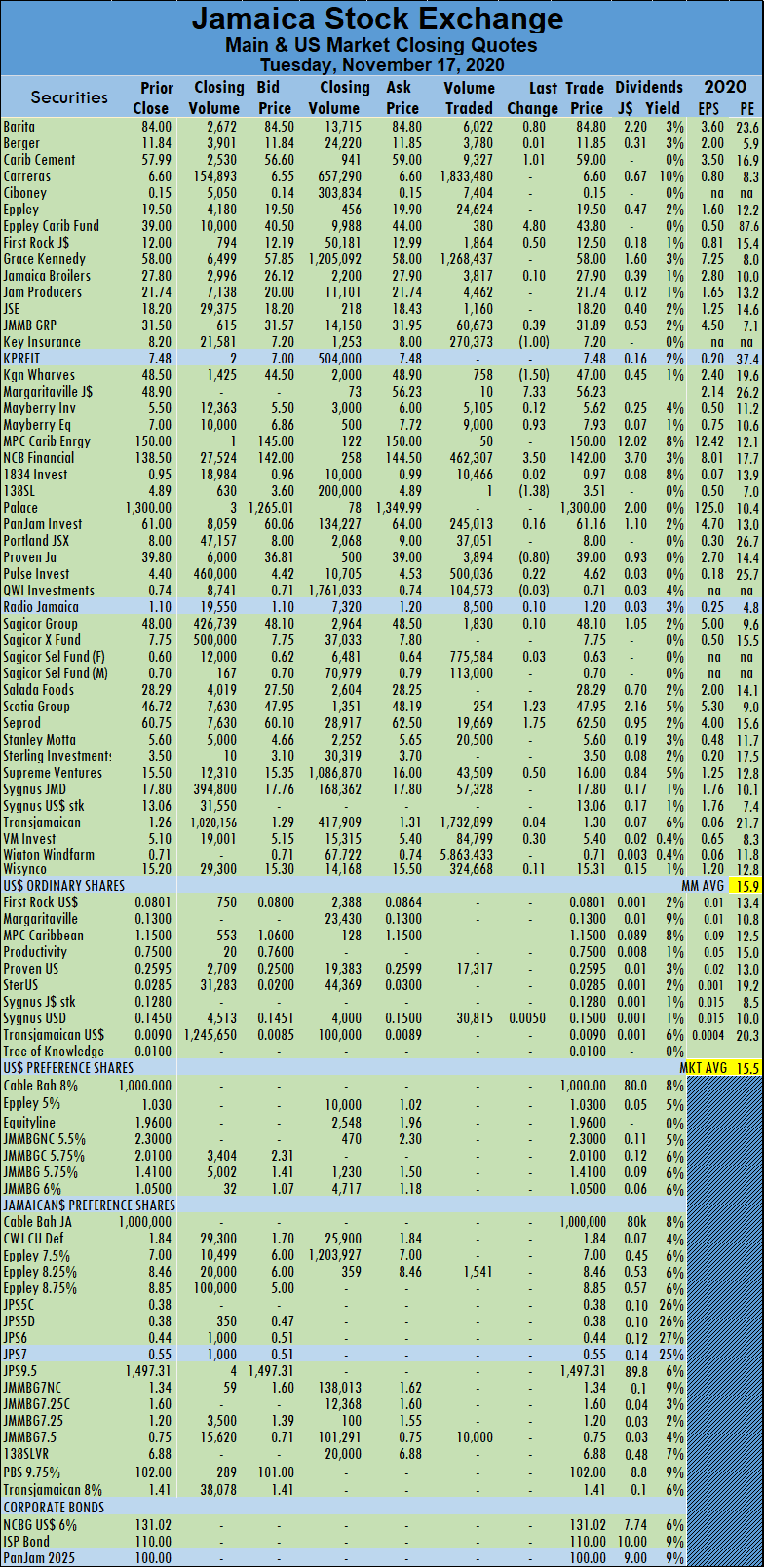

At the close of the market, trading ended with four stocks changing hands compared to two on Tuesday and closed with the prices of two stocks rising, two declining and none remaining unchanged. At the close of the market, First Rock Capital Investment gained 0.64 of a cent to end at 8.65 US cents, trading 36,020 shares, Proven Investments slipped 0.05 of a cent and settled at 25.9 US cents, with 65,344 units changing hands. Sygnus Credit Investments rose 2 US cents to 17 US cents and finishing with an exchange of 85,717 shares and Transjamaican Highway lost 0.05 of a cent to end at 0.85 of a US cent after trading 513,024 stock units.

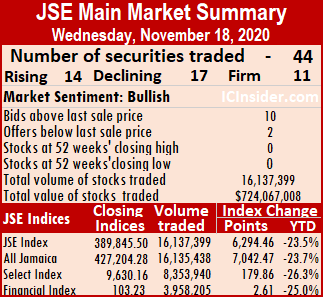

At the close of the market, First Rock Capital Investment gained 0.64 of a cent to end at 8.65 US cents, trading 36,020 shares, Proven Investments slipped 0.05 of a cent and settled at 25.9 US cents, with 65,344 units changing hands. Sygnus Credit Investments rose 2 US cents to 17 US cents and finishing with an exchange of 85,717 shares and Transjamaican Highway lost 0.05 of a cent to end at 0.85 of a US cent after trading 513,024 stock units. At the close, the All Jamaican Composite Index surged 7,042.47 points to 427,204.28, the Main Index jumped 6,294.46 points to 389,845.50 and the JSE Financial Index added 2.61 points to settle at 103.23.

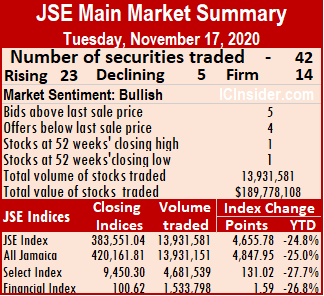

At the close, the All Jamaican Composite Index surged 7,042.47 points to 427,204.28, the Main Index jumped 6,294.46 points to 389,845.50 and the JSE Financial Index added 2.61 points to settle at 103.23. The average trade amounts to 366,759 units at $16,456,068 for each security, compared to an average of 331,704 shares at $4,518,526 on Tuesday. The average trade for the month to date ended at 268,282 units at $5,122,619 for each security, in contrast to 259,701 units at $4,135,150 on Tuesday. Trading for October averaged 398,200 units at $4,622,532 .

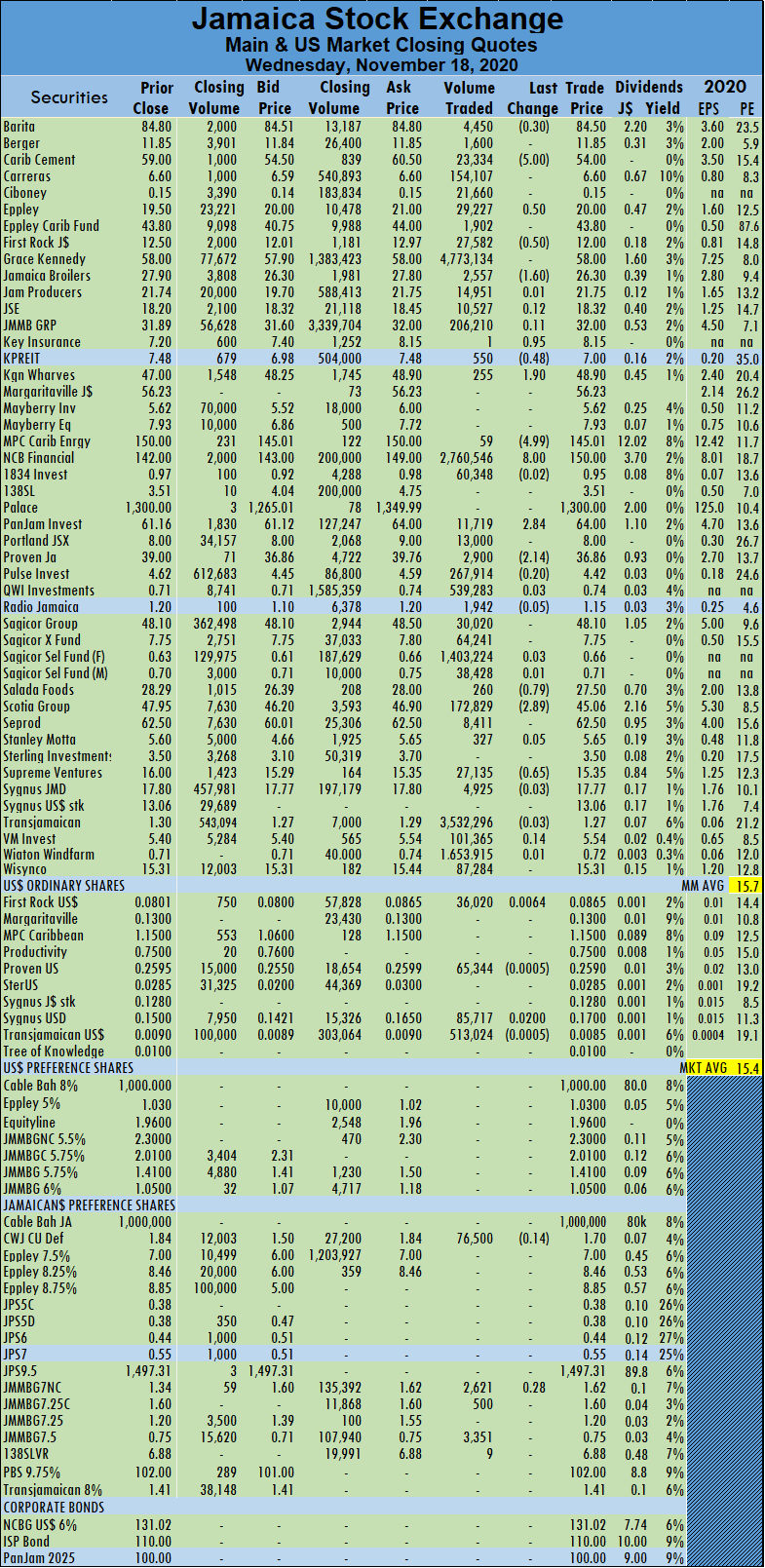

The average trade amounts to 366,759 units at $16,456,068 for each security, compared to an average of 331,704 shares at $4,518,526 on Tuesday. The average trade for the month to date ended at 268,282 units at $5,122,619 for each security, in contrast to 259,701 units at $4,135,150 on Tuesday. Trading for October averaged 398,200 units at $4,622,532 . NCB Financial climbed $8 to $150, with 2,760,546 shares changing hands, Pan Jam Investment advanced by $2.84 to $64 after exchanging 11,719 units, Proven Investments declined by $2.14 in closing at $36.86, in trading 2,900 units. Salada Foods shed 79 cents to end at $27.50, with an exchange of 260 units, Scotia Group fell by $2.89 in closing at $45.06, with 172,829 shares changing hands and Supreme Ventures lost 65 cents to end at $15.35, after 27,135 stock units passed through the market.

NCB Financial climbed $8 to $150, with 2,760,546 shares changing hands, Pan Jam Investment advanced by $2.84 to $64 after exchanging 11,719 units, Proven Investments declined by $2.14 in closing at $36.86, in trading 2,900 units. Salada Foods shed 79 cents to end at $27.50, with an exchange of 260 units, Scotia Group fell by $2.89 in closing at $45.06, with 172,829 shares changing hands and Supreme Ventures lost 65 cents to end at $15.35, after 27,135 stock units passed through the market.

Trading ended with an average of 331,704 units changing hands at $4,518,526 for each security compared to an average of 157,521 shares at $2,873,676 on Monday. The average trade for the month to date ended at 259,701 units at $4,135,150 for each security,in contrast to 253,170 units at $4,100,373. Trading month to date compares adversely to October’s average of 398,200 units at $4,622,532.

Trading ended with an average of 331,704 units changing hands at $4,518,526 for each security compared to an average of 157,521 shares at $2,873,676 on Monday. The average trade for the month to date ended at 259,701 units at $4,135,150 for each security,in contrast to 253,170 units at $4,100,373. Trading month to date compares adversely to October’s average of 398,200 units at $4,622,532. Mayberry Jamaican Equities gained 93 cents with 9,000 stock units passing through the market to end at $7.93, NCB Financial climbed $3.50 to $142 after 462,307 units changed hands, 138 Student Living declined by $1.38 to $3.51, with the swapping of one stock unit, Proven Investments shed 80 cents to end at $39 after trading 3,894 stocks. Scotia Group rose by $1.23 to $47.95 with 254 units changed hands, Seprod ended at $62.50, with gains of $1.75 after investors switched ownership of 19,669 stock units, Supreme Ventures finished 50 cents higher at $16, in trading 43,509 shares and Victoria Mutual Investments gained 30 cents to settle at $5.40, with 84,799 shares changing hands.

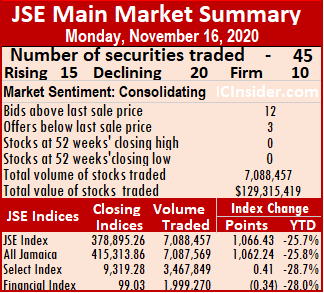

Mayberry Jamaican Equities gained 93 cents with 9,000 stock units passing through the market to end at $7.93, NCB Financial climbed $3.50 to $142 after 462,307 units changed hands, 138 Student Living declined by $1.38 to $3.51, with the swapping of one stock unit, Proven Investments shed 80 cents to end at $39 after trading 3,894 stocks. Scotia Group rose by $1.23 to $47.95 with 254 units changed hands, Seprod ended at $62.50, with gains of $1.75 after investors switched ownership of 19,669 stock units, Supreme Ventures finished 50 cents higher at $16, in trading 43,509 shares and Victoria Mutual Investments gained 30 cents to settle at $5.40, with 84,799 shares changing hands. At the close, the All Jamaican Composite Index advanced by 1,062.24 points to 415,313.86, the Main Index climbed 1,066.43 points to 378,895.26 and the JSE Financial Index lost 0.34 points to settle at 99.03.

At the close, the All Jamaican Composite Index advanced by 1,062.24 points to 415,313.86, the Main Index climbed 1,066.43 points to 378,895.26 and the JSE Financial Index lost 0.34 points to settle at 99.03. Trading ends with an average of 157,521 units at $2,873,676 for each security, in comparison to an average of 297,192 shares at $8,760,017 on Friday. The average trade for the month to date ended at 253,170 units at $4,100,373 for each security, in contrast to 263,467 units at $4,232,434. Trading month to date compares adversely to October’s average of 398,200 units at $4,622,532.

Trading ends with an average of 157,521 units at $2,873,676 for each security, in comparison to an average of 297,192 shares at $8,760,017 on Friday. The average trade for the month to date ended at 253,170 units at $4,100,373 for each security, in contrast to 263,467 units at $4,232,434. Trading month to date compares adversely to October’s average of 398,200 units at $4,622,532. Sagicor Group closed at $48, with a loss of $1 with 20,399 stock units changing hands, Scotia Group carved out a loss of $1.43, in ending at $46.72, after 726 units cleared the market, Seprod declined $3.25 to $60.75 after exchanging 11,015 units. Stanley Motta gained 45 cents to close at $5.60, with 380 units changing hands, Supreme Ventures lost 47 cents to close at $15.50 after exchanging 99,556 shares and Victoria Mutual Investments shed 58 cents in closing at $5.10, with 487,968 shares crossing the exchange.

Sagicor Group closed at $48, with a loss of $1 with 20,399 stock units changing hands, Scotia Group carved out a loss of $1.43, in ending at $46.72, after 726 units cleared the market, Seprod declined $3.25 to $60.75 after exchanging 11,015 units. Stanley Motta gained 45 cents to close at $5.60, with 380 units changing hands, Supreme Ventures lost 47 cents to close at $15.50 after exchanging 99,556 shares and Victoria Mutual Investments shed 58 cents in closing at $5.10, with 487,968 shares crossing the exchange.

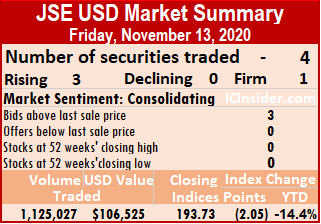

At the end of trading, the Investor’s Choice bid-offer indicator reading for the market shows three stocks ending with bids higher than their last selling prices and one with lower offers.

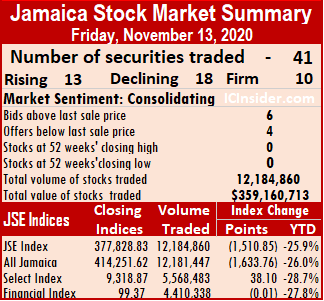

At the end of trading, the Investor’s Choice bid-offer indicator reading for the market shows three stocks ending with bids higher than their last selling prices and one with lower offers. At the close, the All Jamaican Composite Index shed 1,633.76 points to 414,251.62, the Main Index declined by 1,510.85 points to 377,828.83 and the JSE Financial Index slipped just 0.01 point to settle at 99.37. The average PE Ratio ended at 15.4 based on ICInsider.com’s forecast of 2020-21 earnings.

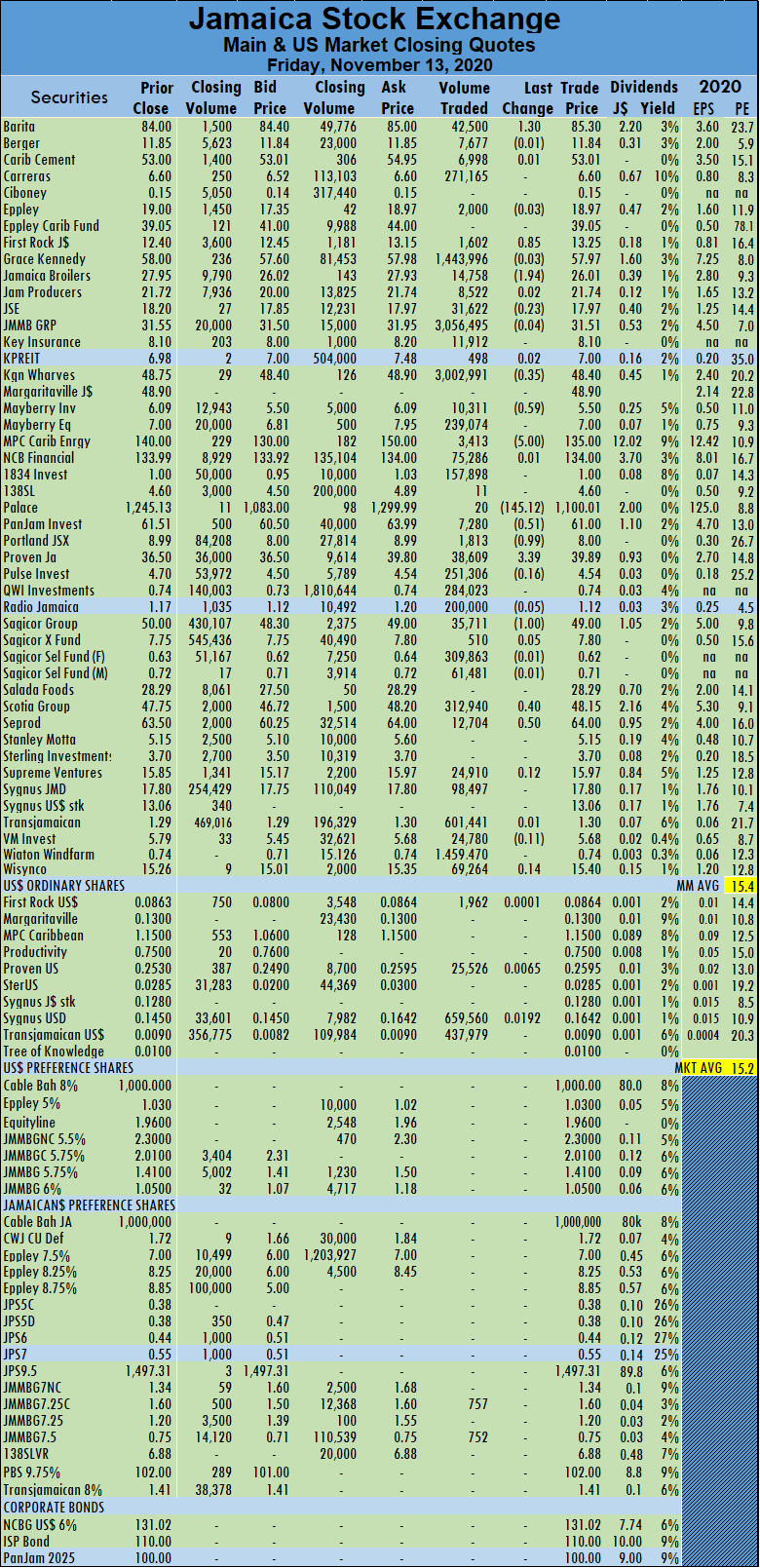

At the close, the All Jamaican Composite Index shed 1,633.76 points to 414,251.62, the Main Index declined by 1,510.85 points to 377,828.83 and the JSE Financial Index slipped just 0.01 point to settle at 99.37. The average PE Ratio ended at 15.4 based on ICInsider.com’s forecast of 2020-21 earnings. Trading ended with an average of 297,192 units changing hands at $8,760,017 for each security, versus an average of 320,366 shares at $5,764,643 on Thursday. The average trade for the month to date ended at 263,467 units at $4,232,434 for each security, in contrast to 259,799 units at $3,740,044 on Thursday. Trading month to date compares adversely to October’s average of 398,200 units at $4,622,532.

Trading ended with an average of 297,192 units changing hands at $8,760,017 for each security, versus an average of 320,366 shares at $5,764,643 on Thursday. The average trade for the month to date ended at 263,467 units at $4,232,434 for each security, in contrast to 259,799 units at $3,740,044 on Thursday. Trading month to date compares adversely to October’s average of 398,200 units at $4,622,532. MPC Caribbean Clean Energy dropped $5 in closing at $135 after clearing the market with 3,413 units. Palace Amusement declined $145.12 to end at $1,100.01, with 20 units crossing the exchange, Pan Jam Investment shed 51 cents to settle at $61 while trading 7,280 units, Portland JSX finished at $8, with a loss of 99 cents and 1,813 units trading. Proven Investments climbed $3.39 to $39.89 and finishing with an exchange of 38,609 shares, Sagicor Group fell $1 to $49 after 35,711 shares crossed the market, Scotia Group gained 40 cents to close at $48.15 trading 312,940 shares and Seprod ended 50 cents higher at $64, with an exchange of 12,704 stock units.

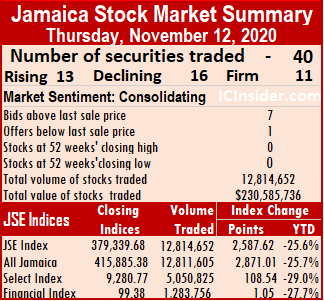

MPC Caribbean Clean Energy dropped $5 in closing at $135 after clearing the market with 3,413 units. Palace Amusement declined $145.12 to end at $1,100.01, with 20 units crossing the exchange, Pan Jam Investment shed 51 cents to settle at $61 while trading 7,280 units, Portland JSX finished at $8, with a loss of 99 cents and 1,813 units trading. Proven Investments climbed $3.39 to $39.89 and finishing with an exchange of 38,609 shares, Sagicor Group fell $1 to $49 after 35,711 shares crossed the market, Scotia Group gained 40 cents to close at $48.15 trading 312,940 shares and Seprod ended 50 cents higher at $64, with an exchange of 12,704 stock units. The average traded was 320,366 units changing hands at $5,764,643 for each security, compared to 575,470 shares at $4,947,800 on Wednesday. The average trade for the month to date ends at 259,799 units at $3,740,044 for each security, in contrast to 252,610 units at $3,499,735 on Wednesday. Trading month to date compares adversely to October’s average of 398,200 units at $4,622,532.

The average traded was 320,366 units changing hands at $5,764,643 for each security, compared to 575,470 shares at $4,947,800 on Wednesday. The average trade for the month to date ends at 259,799 units at $3,740,044 for each security, in contrast to 252,610 units at $3,499,735 on Wednesday. Trading month to date compares adversely to October’s average of 398,200 units at $4,622,532. Scotia Group rose $1.75 to $47.75, after trading 80,862 shares, Seprod closed $1.50 higher at $63.50, with investors switching ownership of 29,826 stock units, Sygnus Credit Investments gained 80 cents to end at $17.80, in exchanging 554,552 units. Victoria Mutual Investments rose 38 cents to end at $5.79, with 99,884 shares changing hands and Wisynco Group gained 32 cents to close at $15.26 after 119,591 stocks passed through the market.

Scotia Group rose $1.75 to $47.75, after trading 80,862 shares, Seprod closed $1.50 higher at $63.50, with investors switching ownership of 29,826 stock units, Sygnus Credit Investments gained 80 cents to end at $17.80, in exchanging 554,552 units. Victoria Mutual Investments rose 38 cents to end at $5.79, with 99,884 shares changing hands and Wisynco Group gained 32 cents to close at $15.26 after 119,591 stocks passed through the market. At the close of the market, trading ended with five securities changing hands compared to three on Wednesday and closed with the prices of two stocks rising, two declining and one remaining unchanged.

At the close of the market, trading ended with five securities changing hands compared to three on Wednesday and closed with the prices of two stocks rising, two declining and one remaining unchanged. At the close of the market, First Rock Capital Investment lost 0.02 of a cent to settle at 8.63 US cents trading 500 units, Proven Investments fell seven-tenths of a cent to 25.30 US cents in exchanging 110,257 shares, Sterling Investments gained nine-tenths of a cent to close at 2.85 US cents, with 352 units changing hands. Sygnus Credit Investments rose 1.4 cents to end at 14.50 US cents, in trading 7,533 stock units and Transjamaican Highway unchanged at 0.9 of a US cent, with 55,555 shares crossing the market.

At the close of the market, First Rock Capital Investment lost 0.02 of a cent to settle at 8.63 US cents trading 500 units, Proven Investments fell seven-tenths of a cent to 25.30 US cents in exchanging 110,257 shares, Sterling Investments gained nine-tenths of a cent to close at 2.85 US cents, with 352 units changing hands. Sygnus Credit Investments rose 1.4 cents to end at 14.50 US cents, in trading 7,533 stock units and Transjamaican Highway unchanged at 0.9 of a US cent, with 55,555 shares crossing the market.