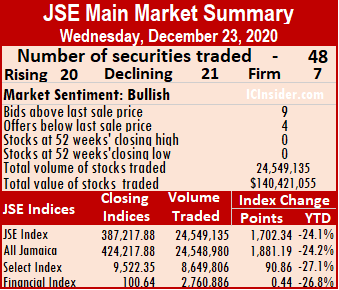

Trading on Wednesday, resulting in an almost even split between rising and declining stocks on the Jamaica Stock Exchange Main Market after the volume of shares exchanged was marginally lower than on Tuesday.

At the close, the All Jamaican Composite Index rose 1,881.19 points to settle at 424,217.88, the Main Index climbed 1,702.34 points to 387,217.88 and the JSE Financial Index added 0.44 points to close at 100.64.

At the close, the All Jamaican Composite Index rose 1,881.19 points to settle at 424,217.88, the Main Index climbed 1,702.34 points to 387,217.88 and the JSE Financial Index added 0.44 points to close at 100.64.

Trading ended with 48 securities changing hands compared to 46 on Tuesday and ended with prices of 20 stocks rising, 21 declining and seven ending unchanged. The PE Ratio closed with an average of 16.9 based on ICInsider.com’s forecast of 2020-21 earnings.

The market saw trading of 24,549,135 shares for $140,421,055 down from 24,954,720 units at $310,333,709 on Tuesday. Wigton Windfarm led trading with 44.7 percent of total volume after trading 10.98 million shares, followed by Sagicor Real Estate Fund with 25.5 percent for 6.27 million units, Transjamaican Highway 8.7 percent market share with 2.14 million units, QWI Investments 5.6 percent with 1.4 million units and Sagicor Select Financial Fund 4.7 percent market share with 1.15 million units.

Trading on Wednesday averaged 511,440 units at $2,925,439 for each security, compared to an average of 542,494 shares at $6,746,385 on Tuesday. Trading month to date averaged 372,792 units at $6,952,207 for each security, in contrast to 363,405 units at $7,224,823 on the prior trading day. November ended with an average of 623,120 units at $6,686,047.

Trading on Wednesday averaged 511,440 units at $2,925,439 for each security, compared to an average of 542,494 shares at $6,746,385 on Tuesday. Trading month to date averaged 372,792 units at $6,952,207 for each security, in contrast to 363,405 units at $7,224,823 on the prior trading day. November ended with an average of 623,120 units at $6,686,047.

Investor’s Choice bid-offer indicator reading has nine stocks ending with bids higher than their last selling prices and four with lower offers.

At the close of the market, Barita Investments carved out a gain of 57 cents to close at $83.97, with an exchange of 53,075 shares, Berger Paints lost 55 cents in ending at $14, with 2,926 stock units crossing the market, Caribbean Cement climbed $5 to $62 with 19,192 units clearing the market. Carreras gained 41 cents to close at $7, trading 615,139 stocks, with the bid at $7.10, to purchase 256,243 shares at the close, Eppley fell $3.90 to end at $25 in exchanging 11,000 shares. Grace Kennedy jumped $7.52 to close at $70.52 with 175,952 shares crossing the exchange, but 175,952 units of the stock were offered for sale at $63.85 at the close. Jamaica Broilers rose $2.74 to $28.99 in switching ownership of 37,777 shares, Jamaica Stock Exchange gained 40 cents to close at $19.80, with 1,758 stock units changing hands.  Kingston Wharves declined by $1.09 to $45.80 after exchanging 385 units, Mayberry Investments increased 38 cents to $6.15 in trading 12,925 stock units, NCB Financial shed $4.97 in ending at $140 with 128,875 stocks crossing the exchange. 138 Student Living increased 51 cents in closing at $4.86 and exchanging 1,838 shares, Palace Amusement rose $100 to $1300 after exchanging 16 units, Portland JSX climbed $1.50 to $9.50 exchanging 800 shares, Sagicor Real Estate Fund rose 47 cents to close at $7.75, with 6,265,503 stocks crossing the exchange. Salada Foods climbed $5.72 to $28.74 in an exchange of one share, Scotia Group increased $2.49 to $45 in trading 703,239 stocks and Sygnus Credit Investments advanced 90 cents to $16.90 while trading 21,929 stock units.

Kingston Wharves declined by $1.09 to $45.80 after exchanging 385 units, Mayberry Investments increased 38 cents to $6.15 in trading 12,925 stock units, NCB Financial shed $4.97 in ending at $140 with 128,875 stocks crossing the exchange. 138 Student Living increased 51 cents in closing at $4.86 and exchanging 1,838 shares, Palace Amusement rose $100 to $1300 after exchanging 16 units, Portland JSX climbed $1.50 to $9.50 exchanging 800 shares, Sagicor Real Estate Fund rose 47 cents to close at $7.75, with 6,265,503 stocks crossing the exchange. Salada Foods climbed $5.72 to $28.74 in an exchange of one share, Scotia Group increased $2.49 to $45 in trading 703,239 stocks and Sygnus Credit Investments advanced 90 cents to $16.90 while trading 21,929 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

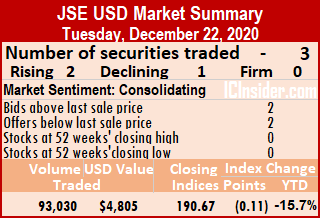

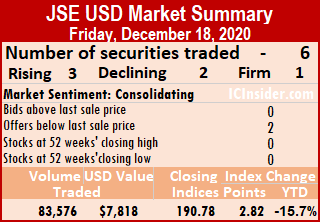

The market closed with seven securities changing hands, up from three on Tuesday, with three stocks rising, two declining and two remaining unchanged.

The market closed with seven securities changing hands, up from three on Tuesday, with three stocks rising, two declining and two remaining unchanged. At the close of the market, Rock Capital Investment rose 1 cent to end at 9 US cents in trading 9,962 shares, Productive Business Solutions closed at 66 US cents with an exchange of 52 stocks, Proven Investments dropped 0.04 of a cent to close at 25.89 US cents in exchanging 52,945 stocks. Sterling Investments rose 0.28 of a cent in closing at 2.38 US cents, trading 100 units, Sygnus Credit Investments ended at 15.7 US cents while exchanging 839 units, Transjamaican Highway climbed 0.06 of a cent in closing at 0.98 of a US cent with 995,361 stock units changing hands.

At the close of the market, Rock Capital Investment rose 1 cent to end at 9 US cents in trading 9,962 shares, Productive Business Solutions closed at 66 US cents with an exchange of 52 stocks, Proven Investments dropped 0.04 of a cent to close at 25.89 US cents in exchanging 52,945 stocks. Sterling Investments rose 0.28 of a cent in closing at 2.38 US cents, trading 100 units, Sygnus Credit Investments ended at 15.7 US cents while exchanging 839 units, Transjamaican Highway climbed 0.06 of a cent in closing at 0.98 of a US cent with 995,361 stock units changing hands. For the second consecutive day, three stocks changed hands at the close and ended with the prices of two stocks rising and one declining. The JSE USD equity index lost 0.11 points to end at 190.67.

For the second consecutive day, three stocks changed hands at the close and ended with the prices of two stocks rising and one declining. The JSE USD equity index lost 0.11 points to end at 190.67. Investor’s Choice bid-offer indicator shows two stocks ended with bids higher than their last selling prices and two with lower offers.

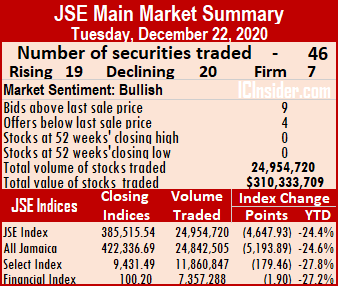

Investor’s Choice bid-offer indicator shows two stocks ended with bids higher than their last selling prices and two with lower offers. At the close, the All Jamaican Composite Index lost 5,193.89 points to settle at 422,336.69, the Main Index declined by 4,647.93 points to settle at 385,515.54 and the JSE Financial Index shed 1.90 points to settle at 100.20.

At the close, the All Jamaican Composite Index lost 5,193.89 points to settle at 422,336.69, the Main Index declined by 4,647.93 points to settle at 385,515.54 and the JSE Financial Index shed 1.90 points to settle at 100.20. Trading averaged 542,494 units at $6,746,385 for each security, compared to 376,600 shares at $33,442,451 on Monday. Trading month to date averaged 363,405 units at $7,224,823 for each security, in contrast to 350,980 units at $7,258,018 on the prior trading day. Trading in November averaged of 623,120 units at $6,686,047.

Trading averaged 542,494 units at $6,746,385 for each security, compared to 376,600 shares at $33,442,451 on Monday. Trading month to date averaged 363,405 units at $7,224,823 for each security, in contrast to 350,980 units at $7,258,018 on the prior trading day. Trading in November averaged of 623,120 units at $6,686,047. Kingston Properties climbed $1.04 to $7.25 in exchanging 1,500 shares, NCB Financial rose 47 cents to $144.97 after exchanging 22,631 stocks, Palace Amusement dived $100 to $1200 after exchanging 9 units. Sagicor Group lost 50 cents to close at $49.50 in trading 4,022,948 stocks, Salada Foods lost $1.98 after ending at $23.02 with investors swapping 54,260 stock units, Scotia Group shed 97 cents to end at $42.51, with 47,182 shares passing through the market and Sygnus Credit Investments fell 50 cents to $16 in an exchange of 194,763 shares.

Kingston Properties climbed $1.04 to $7.25 in exchanging 1,500 shares, NCB Financial rose 47 cents to $144.97 after exchanging 22,631 stocks, Palace Amusement dived $100 to $1200 after exchanging 9 units. Sagicor Group lost 50 cents to close at $49.50 in trading 4,022,948 stocks, Salada Foods lost $1.98 after ending at $23.02 with investors swapping 54,260 stock units, Scotia Group shed 97 cents to end at $42.51, with 47,182 shares passing through the market and Sygnus Credit Investments fell 50 cents to $16 in an exchange of 194,763 shares.

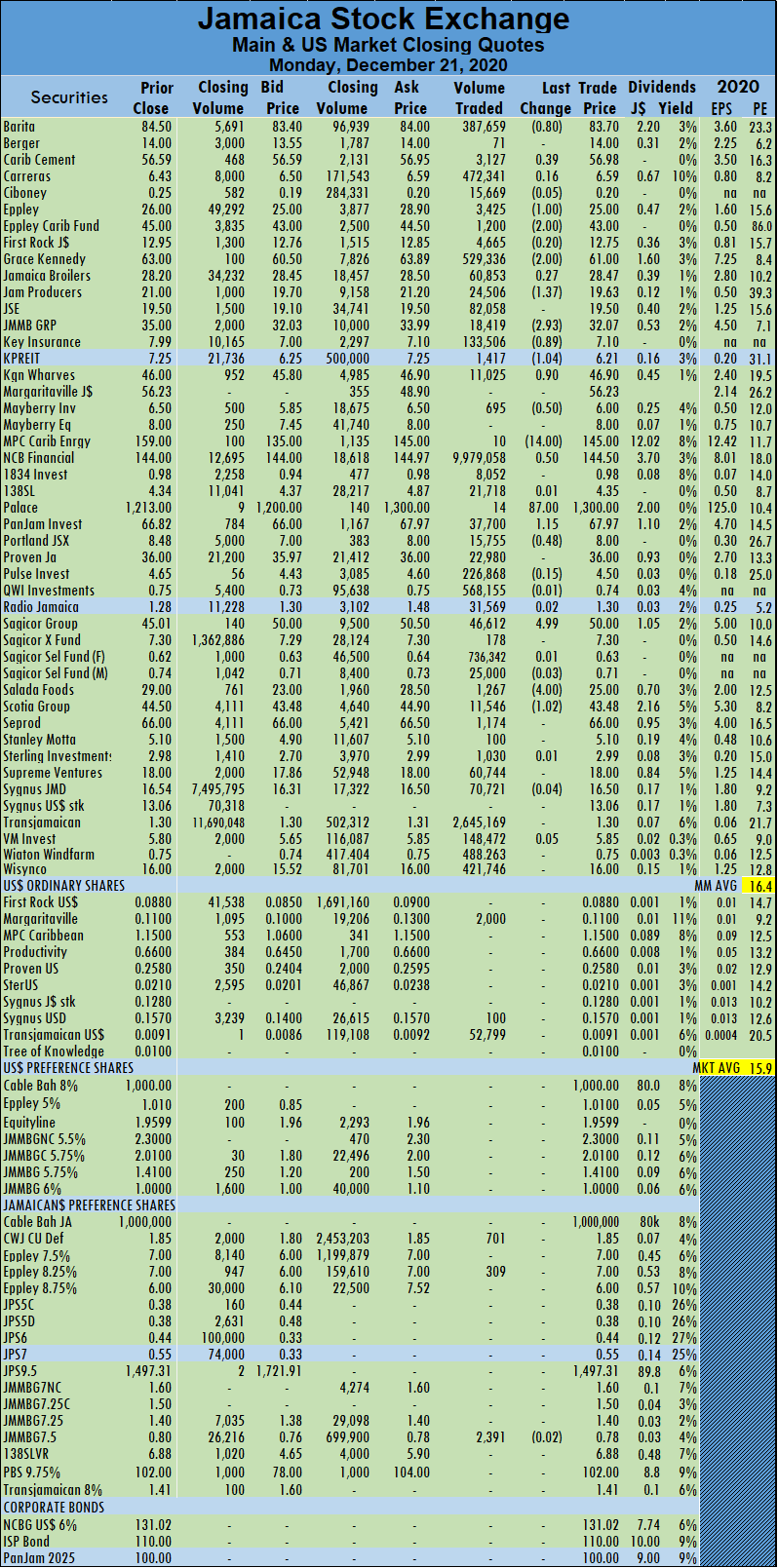

Trading averaged 376,600 units at $33,442,451 for each security, compared to 818,719 shares at $5,333,003 on Friday. Month to date averaged 350,980 units at $7,258,018 for each security, in contrast to 349,070 units at $5,305,856. November averaged 623,120 units at $6,686,047.

Trading averaged 376,600 units at $33,442,451 for each security, compared to 818,719 shares at $5,333,003 on Friday. Month to date averaged 350,980 units at $7,258,018 for each security, in contrast to 349,070 units at $5,305,856. November averaged 623,120 units at $6,686,047. Kingston Wharves advanced 90 cents to $46.90 after exchanging 11,025 stocks, Mayberry Investments lost 50 cents to end at $6 with 695 shares trading, MPC Caribbean Clean Energy shed $14 to end at $145 with an exchange of 10 stock units. NCB Financial climbed 50 cents to $144.50, with 9,979,058 shares crossing the exchange, Palace Amusement climbed $87 to $1300 in trading 14 units, PanJam Investment rose $1.15 to end at $67.97 trading 37,700 shares. Portland JSX lost 48 cents in ending at $8 trading 15,755 stock units, Sagicor Group climbed $4.99 to $50, with 46,612 units passing through the market, Salada Foods lost $4 to close at $25 in exchanging 1,267 shares and Scotia Group shed $1.02 to end at $43.48 trading 11,546 stock units.

Kingston Wharves advanced 90 cents to $46.90 after exchanging 11,025 stocks, Mayberry Investments lost 50 cents to end at $6 with 695 shares trading, MPC Caribbean Clean Energy shed $14 to end at $145 with an exchange of 10 stock units. NCB Financial climbed 50 cents to $144.50, with 9,979,058 shares crossing the exchange, Palace Amusement climbed $87 to $1300 in trading 14 units, PanJam Investment rose $1.15 to end at $67.97 trading 37,700 shares. Portland JSX lost 48 cents in ending at $8 trading 15,755 stock units, Sagicor Group climbed $4.99 to $50, with 46,612 units passing through the market, Salada Foods lost $4 to close at $25 in exchanging 1,267 shares and Scotia Group shed $1.02 to end at $43.48 trading 11,546 stock units. Only three securities changed hands versus six on Friday. At the close, the JSE USD equity index was unchanged at 190.78 points. The average PE Ratio ended at 13.3 based on ICInsider.com’s forecast of 2020-21 earnings.

Only three securities changed hands versus six on Friday. At the close, the JSE USD equity index was unchanged at 190.78 points. The average PE Ratio ended at 13.3 based on ICInsider.com’s forecast of 2020-21 earnings. Investor’s Choice bid-offer indicator reading shows no stock ended with bids higher than their last selling prices and one with a lower offer.

Investor’s Choice bid-offer indicator reading shows no stock ended with bids higher than their last selling prices and one with a lower offer. For a second consecutive day, trading ended with six securities changing hands at the close, ending with the prices of three stocks rising, two declining and one remaining unchanged.

For a second consecutive day, trading ended with six securities changing hands at the close, ending with the prices of three stocks rising, two declining and one remaining unchanged. Sterling Investments gained 0.1 of a cent to end at 2.1 US cents with investors swapping 9,250 units, Sygnus Credit Investments remained at 15.7 US cents after trading 785 stock units and Transjamaican Highway rose 0.1 of a cent trading 33,100 shares to close at 0.91 of a US cent.

Sterling Investments gained 0.1 of a cent to end at 2.1 US cents with investors swapping 9,250 units, Sygnus Credit Investments remained at 15.7 US cents after trading 785 stock units and Transjamaican Highway rose 0.1 of a cent trading 33,100 shares to close at 0.91 of a US cent. Trading ended with 46 securities changing hands compared to 45 on Thursday and closed with the prices of 22 stocks rising, 12 declining and 12 remaining unchanged, with Ciboney trading at a 52 weeks’ high of 25 cents. The average PE Ratio ended at 16.8 based on ICInsider.com’s forecast of 2020-21 earnings.

Trading ended with 46 securities changing hands compared to 45 on Thursday and closed with the prices of 22 stocks rising, 12 declining and 12 remaining unchanged, with Ciboney trading at a 52 weeks’ high of 25 cents. The average PE Ratio ended at 16.8 based on ICInsider.com’s forecast of 2020-21 earnings. Sagicor Group with 8 percent for 3 million units and Sagicor Select Financial Fund with a 3.6 percent market share for 1.35 million units.

Sagicor Group with 8 percent for 3 million units and Sagicor Select Financial Fund with a 3.6 percent market share for 1.35 million units. NCB Financial advanced $2 to $144 trading 21,418 stocks, Pan Jam Investment climbed $1.32 to $66.82, after 64,236 shares crossed the market, Sagicor Group dropped $4.49 to close at $45.01, with 3,004,520 shares clearing the market. Scotia Group gained 50 cents to finish at $44.50, trading 5,364 units, Seprod lost 45 cents in closing at $66 and exchanging 25,732 stock units and Wisynco Group increased 50 cents to $16, with 30,512 stock units passing through the market.

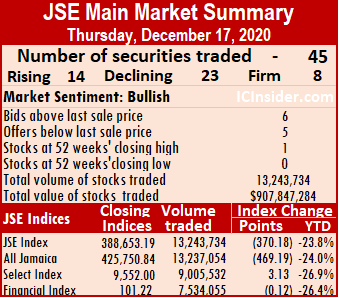

NCB Financial advanced $2 to $144 trading 21,418 stocks, Pan Jam Investment climbed $1.32 to $66.82, after 64,236 shares crossed the market, Sagicor Group dropped $4.49 to close at $45.01, with 3,004,520 shares clearing the market. Scotia Group gained 50 cents to finish at $44.50, trading 5,364 units, Seprod lost 45 cents in closing at $66 and exchanging 25,732 stock units and Wisynco Group increased 50 cents to $16, with 30,512 stock units passing through the market. At the close, the All Jamaican Composite Index shed 469.19 points to 425,750.84, the Main Index lost 370.18 points to 388,653.19 and the JSE Financial Index slipped 0.12 points to settle at 101.22.

At the close, the All Jamaican Composite Index shed 469.19 points to 425,750.84, the Main Index lost 370.18 points to 388,653.19 and the JSE Financial Index slipped 0.12 points to settle at 101.22. Month to date averaged 311,235 units at $5,303,669 for each security, in contrast to 312,683 units at $4,031,460 on Wednesday. November averaged 623,120 units at $6,686,047.

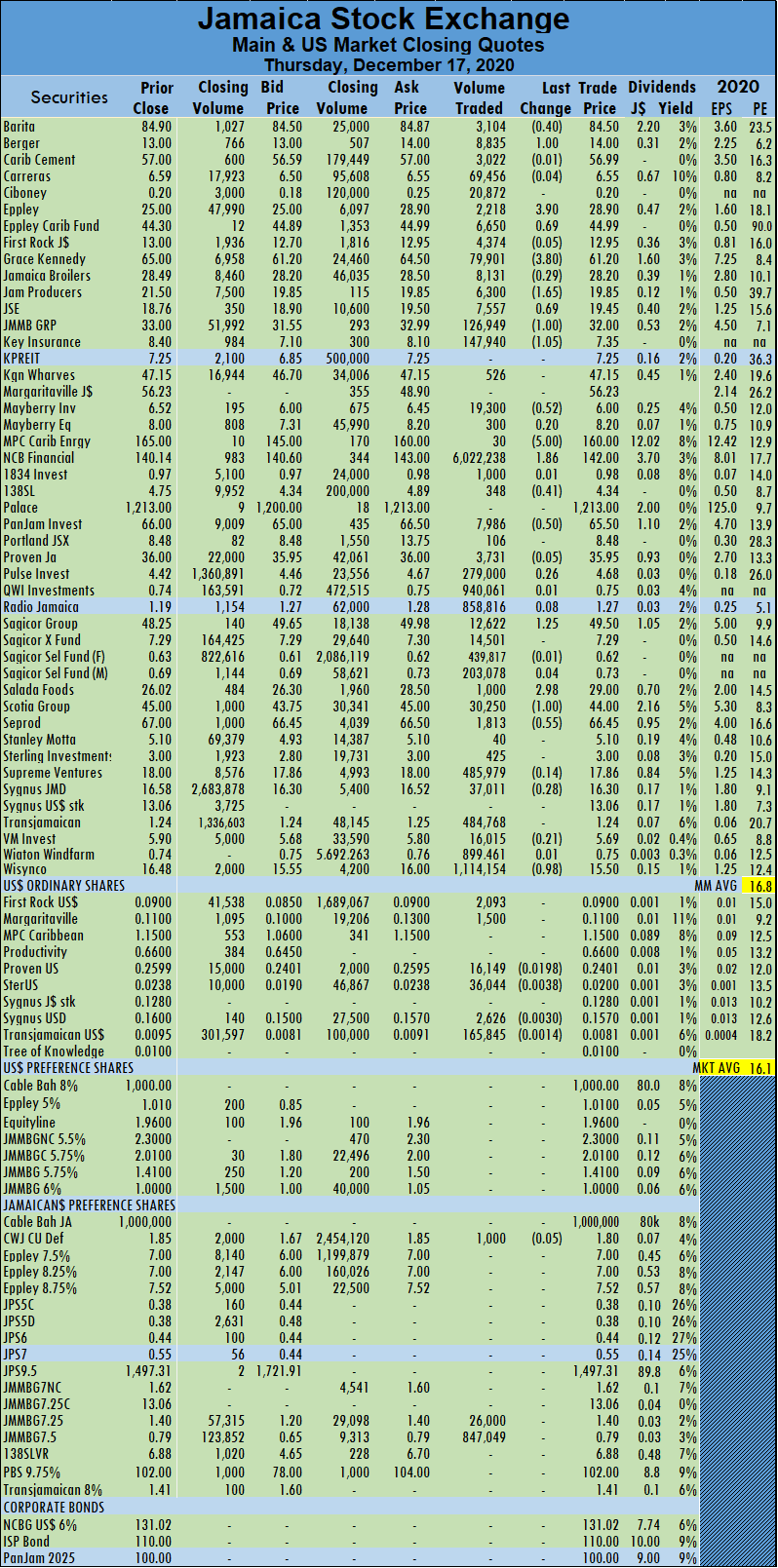

Month to date averaged 311,235 units at $5,303,669 for each security, in contrast to 312,683 units at $4,031,460 on Wednesday. November averaged 623,120 units at $6,686,047. NCB Financial climbed $1.86 to $142 in exchange 6,022,238 shares, 138 Student Living shed 41 cents to settle at $4.34, in an exchange of 348 units, Pan Jam Investment lost 50 cents in closing at $65.50 trading 7,986 units, Sagicor Group rose $1.25 to $49.50, with investors swapping 12,622 stock units. Salada Foods advanced by $2.98 to $29, in an exchange of 1,000 units, Scotia Group dropped $1 to close at $44, after the transferring of 30,250 shares, Seprod lost 55 cents in closing at $66.45, with 1,813 units changing hands and Wisynco Group slipped 98 cents to close at $15.50, with 1,114,154 shares passing through the market.

NCB Financial climbed $1.86 to $142 in exchange 6,022,238 shares, 138 Student Living shed 41 cents to settle at $4.34, in an exchange of 348 units, Pan Jam Investment lost 50 cents in closing at $65.50 trading 7,986 units, Sagicor Group rose $1.25 to $49.50, with investors swapping 12,622 stock units. Salada Foods advanced by $2.98 to $29, in an exchange of 1,000 units, Scotia Group dropped $1 to close at $44, after the transferring of 30,250 shares, Seprod lost 55 cents in closing at $66.45, with 1,813 units changing hands and Wisynco Group slipped 98 cents to close at $15.50, with 1,114,154 shares passing through the market. Trading ended with six securities changing hands, versus seven on Wednesday and ended with no stock rising, four declining and two remained unchanged.

Trading ended with six securities changing hands, versus seven on Wednesday and ended with no stock rising, four declining and two remained unchanged. Margaritaville remained at 11 US cents, with 1,500 stock units changing hands, Proven Investments lost 1.98 cents to end at 24.01 US cents in trading 16,149 stocks. Sterling Investments fell 0.38 of a cent in ending at 2 US cents with an exchange of 36,044 units, Sygnus Credit Investments shed 0.3 US cents in closing at 15.7 US cents, trading 2,626 stocks and Transjamaican Highway declined by 0.14 of a cent in ending at 0.81 of a US cent and clearing the market with 165,845 stock units.

Margaritaville remained at 11 US cents, with 1,500 stock units changing hands, Proven Investments lost 1.98 cents to end at 24.01 US cents in trading 16,149 stocks. Sterling Investments fell 0.38 of a cent in ending at 2 US cents with an exchange of 36,044 units, Sygnus Credit Investments shed 0.3 US cents in closing at 15.7 US cents, trading 2,626 stocks and Transjamaican Highway declined by 0.14 of a cent in ending at 0.81 of a US cent and clearing the market with 165,845 stock units.