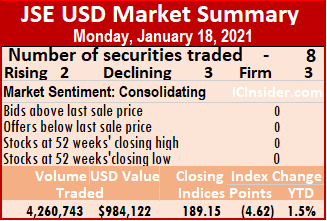

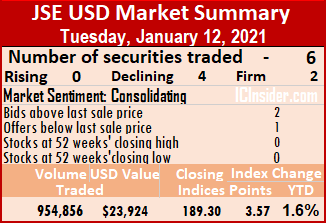

Market activity dropped on Tuesday to more sedate trading levels in recent weeks, with 89.8 percent fewer shares changing hands after surging on Monday and ended with the US dollar market of the Jamaica Stock Exchange closing higher, with declining stocks edging out those rising.

Trading ended with four securities changing hands, compared to eight on Monday and ended with the prices of one stock rising, two declining and one remaining unchanged.

Trading ended with four securities changing hands, compared to eight on Monday and ended with the prices of one stock rising, two declining and one remaining unchanged.

JSE USD Equity Index gained 3.42 points to end at 192.57 and the average PE Ratio ends at 13.2 based on ICInsider.com’s forecast of 2020-21 earnings.

The market closed with an exchange of 433,513 shares for US$35,736 compared to 4,260,743 units at US$984,122 on Monday.

Trading averaged 108,378 units at US$8,934, versus 532,593 shares at US$123,015 on Monday. Trading averaged 144,305 units for the month to date at US$21,351 in contrast to 146,966 units at US$22,270 on the prior trading day. By comparison, December ended with an average of 55,388 units for US$6,412.

Investor’s Choice bid-offer indicator shows two stocks ending with bids higher than their last selling prices and none with lower offers.

Investor’s Choice bid-offer indicator shows two stocks ending with bids higher than their last selling prices and none with lower offers.

At the close of trading, Proven Investments increased 2.35 cents to 25.85 US cents after exchanging 19,523 shares, Sterling Investments declined 0.2 of a cent to 2.1 US cents with an exchange of 10,000 stocks, Sygnus Credit Investments lost 1.5 cents in ending at 15 US cents with 183,990 units changing hands and Transjamaican Highway ended at 0.85 of a US cent after trading 220,000 units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Sterling Investments increased 0.28 of a cent ending at 2.3 US cents trading 2,598 shares, Sygnus Credit Investments carved out a loss 0.5 cents to close at 16.5 US cents with the swapping of 25,050 units, Transjamaican Highway remained at 0.85 of a US cent with an exchange of 110,631 stocks.

Sterling Investments increased 0.28 of a cent ending at 2.3 US cents trading 2,598 shares, Sygnus Credit Investments carved out a loss 0.5 cents to close at 16.5 US cents with the swapping of 25,050 units, Transjamaican Highway remained at 0.85 of a US cent with an exchange of 110,631 stocks. At the close, the All Jamaican Composite Index advanced 1,389.55 points to 428,311.48, the Main Index rose 1,200.38 points to 390,612.24 and the JSE Financial Index gained just 0.13 points to 100.59.

At the close, the All Jamaican Composite Index advanced 1,389.55 points to 428,311.48, the Main Index rose 1,200.38 points to 390,612.24 and the JSE Financial Index gained just 0.13 points to 100.59. Trading month to date averaged 307,009 units at $1,049,528 for each security, in contrast to 326,985 units at $1,105,486 on Friday. Trading in December averaged 455,206 units at $7,774,631.

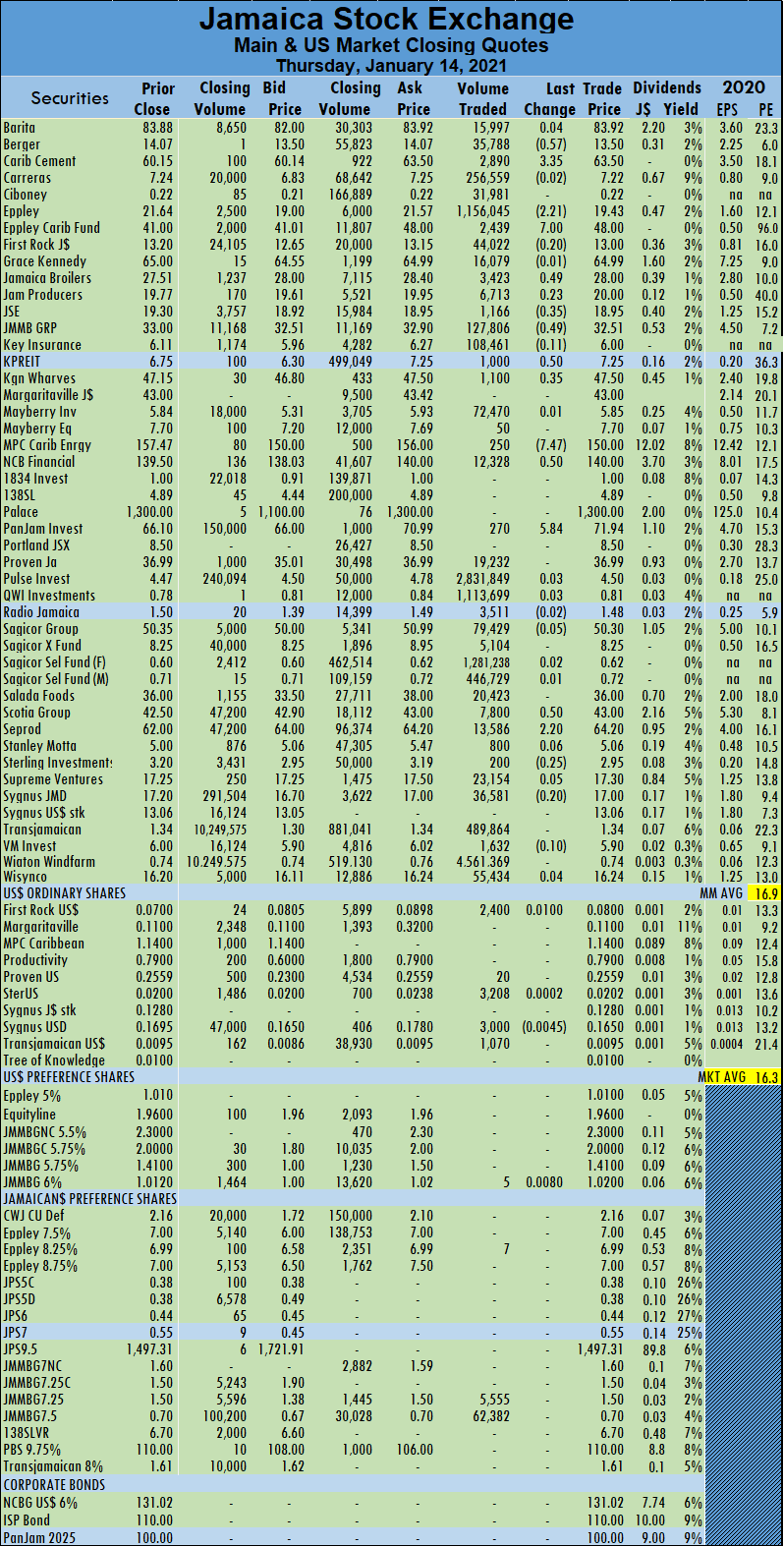

Trading month to date averaged 307,009 units at $1,049,528 for each security, in contrast to 326,985 units at $1,105,486 on Friday. Trading in December averaged 455,206 units at $7,774,631. Pan Jam Investment closed at $68, after losing $2.17 and trading 4,017 shares, Sagicor Real Estate Fund rose 70 cents to $8.95, in a transfer of 250 stocks, Salada Foods advanced to $35, with gains of $1.80 in switching ownership of 44,051 stock units. Scotia Group fell $1.90 to $42.10, exchanging 8,179 shares and Seprod gained 30 cents, ending at $63.80 after 10,198 stocks crossed the exchange.

Pan Jam Investment closed at $68, after losing $2.17 and trading 4,017 shares, Sagicor Real Estate Fund rose 70 cents to $8.95, in a transfer of 250 stocks, Salada Foods advanced to $35, with gains of $1.80 in switching ownership of 44,051 stock units. Scotia Group fell $1.90 to $42.10, exchanging 8,179 shares and Seprod gained 30 cents, ending at $63.80 after 10,198 stocks crossed the exchange. Investor’s Choice bid-offer indicator shows no stocks ended with bids higher than their last selling prices none with lower offers.

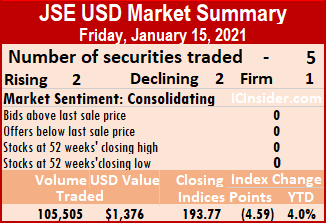

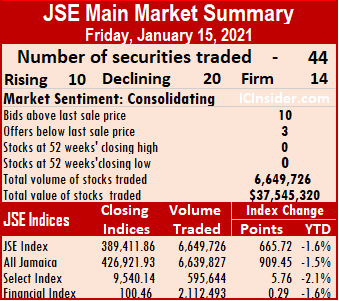

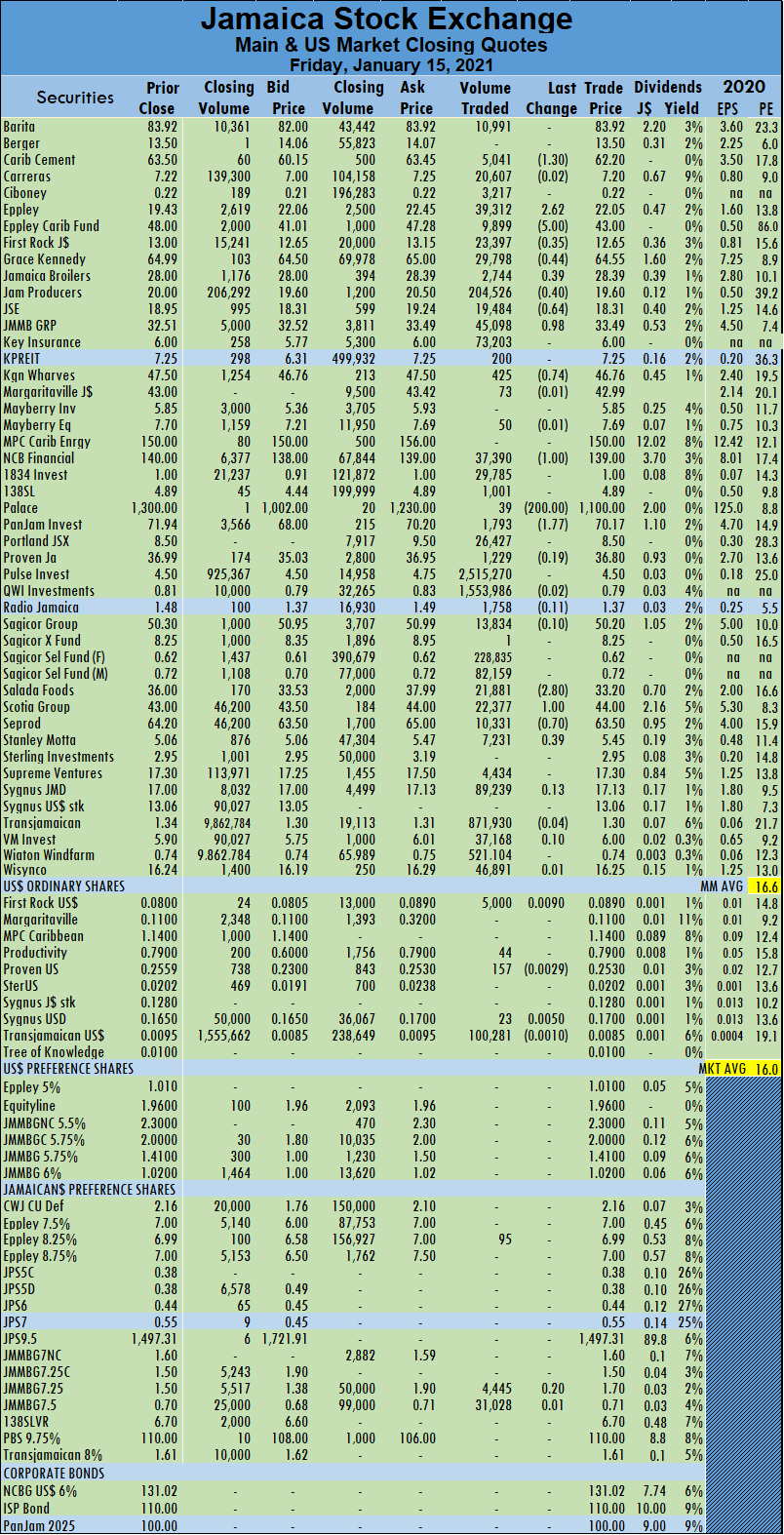

Investor’s Choice bid-offer indicator shows no stocks ended with bids higher than their last selling prices none with lower offers. Trading for the day averaged 151,130 units at $853,303, compared to 301,312 shares at $1,395,993 on Thursday. Trading month to date averaged 326,985 units at $1,105,486, in contrast to 346,427 units at $1,133,366 on Thursday. Trading in December averaged 455,206 units at $7,774,631.

Trading for the day averaged 151,130 units at $853,303, compared to 301,312 shares at $1,395,993 on Thursday. Trading month to date averaged 326,985 units at $1,105,486, in contrast to 346,427 units at $1,133,366 on Thursday. Trading in December averaged 455,206 units at $7,774,631. Kingston Wharves shed 74 cents to end at $46.76, in switching ownership of 425 units, NCB Financial fell $1 to $139, with 37,390 stock units crossing the market, Palace Amusement dropped $200 in closing at $1,100, with an exchange of 39 units. PanJam Investment fell $1.77 to $70.17, in transferring 1,793 units, Salada Foods ended at $33.20, with a loss of $2.80 trading 21,881 stocks, Scotia Group rose $1 to $44, after exchanging 22,377 shares, Seprod shed 70 cents in closing at $63.50, in an exchange of 10,331 stocks and Stanley Motta settled at $5.45, with gains of 39 cents while exchanging 7,231 stock units.

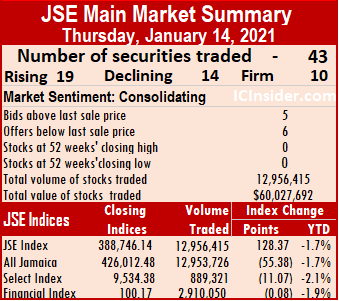

Kingston Wharves shed 74 cents to end at $46.76, in switching ownership of 425 units, NCB Financial fell $1 to $139, with 37,390 stock units crossing the market, Palace Amusement dropped $200 in closing at $1,100, with an exchange of 39 units. PanJam Investment fell $1.77 to $70.17, in transferring 1,793 units, Salada Foods ended at $33.20, with a loss of $2.80 trading 21,881 stocks, Scotia Group rose $1 to $44, after exchanging 22,377 shares, Seprod shed 70 cents in closing at $63.50, in an exchange of 10,331 stocks and Stanley Motta settled at $5.45, with gains of 39 cents while exchanging 7,231 stock units. At the close, the All Jamaican Composite Index dipped 55.38 points to 426,012.48, the Main Index gained 128.37 points to 388,746.14 and the JSE Financial Index slipped 0.08 points to settle at 100.17.

At the close, the All Jamaican Composite Index dipped 55.38 points to 426,012.48, the Main Index gained 128.37 points to 388,746.14 and the JSE Financial Index slipped 0.08 points to settle at 100.17. Trading for the day averaged 301,312 units at $1,395,993 for each security compared to an average of 361,368 shares at $1,264,797 on Wednesday. Trading month to date averaged 346,427 units at $1,133,366, in contrast to 351,891 units at $1,101,554 on the prior trading day. Trading in December averaged 455,206 units at $7,774,631.

Trading for the day averaged 301,312 units at $1,395,993 for each security compared to an average of 361,368 shares at $1,264,797 on Wednesday. Trading month to date averaged 346,427 units at $1,133,366, in contrast to 351,891 units at $1,101,554 on the prior trading day. Trading in December averaged 455,206 units at $7,774,631. Kingston Properties rose 50 cents to $7.25, in exchanging 1,000 units, Kingston Wharves gained 35 cents to $47.50 in exchanging 1,100 shares. MPC Caribbean Clean Energy dropped $7.47 to $150 after transferring 250 units, NCB Financial rose 50 cents to $140, trading 12,328 stocks. Pan Jam Investment advanced $5.84 to $71.94, with 270 units changing hands, Scotia Group gained 50 cents to close at $43 after exchanging 7,800 stock units and Seprod climbed $2.20 to $64.20, in trading 13,586 shares.

Kingston Properties rose 50 cents to $7.25, in exchanging 1,000 units, Kingston Wharves gained 35 cents to $47.50 in exchanging 1,100 shares. MPC Caribbean Clean Energy dropped $7.47 to $150 after transferring 250 units, NCB Financial rose 50 cents to $140, trading 12,328 stocks. Pan Jam Investment advanced $5.84 to $71.94, with 270 units changing hands, Scotia Group gained 50 cents to close at $43 after exchanging 7,800 stock units and Seprod climbed $2.20 to $64.20, in trading 13,586 shares. Trading ended with six securities changing hands, compared to four on Wednesday and ended with prices of three rising, one declining and two remaining unchanged.

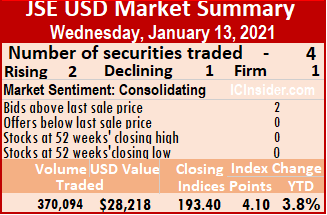

Trading ended with six securities changing hands, compared to four on Wednesday and ended with prices of three rising, one declining and two remaining unchanged. First Rock Capital Investment gained 1 cent to end at 8 US cents after 2,400 shares cross the market, Proven Investments stayed at 25.59 US cents with the 20 units changing hands, Sterling Investments climbed 0.02 of a cent to 2.02 US cents with the swapping of 3,208 stocks. Sygnus Credit Investments fell 0.45 of a cent to 16.5 US cents with an exchange of 3,000 units and Transjamaican Highway remained at 0.95 of a US cent in switching ownership of 1,070 shares.

First Rock Capital Investment gained 1 cent to end at 8 US cents after 2,400 shares cross the market, Proven Investments stayed at 25.59 US cents with the 20 units changing hands, Sterling Investments climbed 0.02 of a cent to 2.02 US cents with the swapping of 3,208 stocks. Sygnus Credit Investments fell 0.45 of a cent to 16.5 US cents with an exchange of 3,000 units and Transjamaican Highway remained at 0.95 of a US cent in switching ownership of 1,070 shares. Four securities changed hands, compared to six on Tuesday and trading ended with two stocks rising, one declining and one remaining unchanged.

Four securities changed hands, compared to six on Tuesday and trading ended with two stocks rising, one declining and one remaining unchanged. At the close of trading, Margaritaville traded 2,152 shares and closed at 11 US cents, Proven Investments rose 2.59 cents ending at 25.59 US cents, with 586 stock units changing hands, Sygnus Credit Investments fell 0.05 cents to 16.95 US cents after 157,556 stock units cleared the market and Transjamaican Highway climbed 0.09 cents to end at 0.95 US cents in exchanging 209,800 shares.

At the close of trading, Margaritaville traded 2,152 shares and closed at 11 US cents, Proven Investments rose 2.59 cents ending at 25.59 US cents, with 586 stock units changing hands, Sygnus Credit Investments fell 0.05 cents to 16.95 US cents after 157,556 stock units cleared the market and Transjamaican Highway climbed 0.09 cents to end at 0.95 US cents in exchanging 209,800 shares. The All Jamaican Composite Index slumped 3,448.73 points to 427,800.39, the Main Index dropped 3,105.44 points to close at 390,255.61 and the JSE Financial Index dipped 1.17 points to settle at 101.03.

The All Jamaican Composite Index slumped 3,448.73 points to 427,800.39, the Main Index dropped 3,105.44 points to close at 390,255.61 and the JSE Financial Index dipped 1.17 points to settle at 101.03. Investor’s Choice bid-offer indicator reading has seven stocks ending with bids higher than their last selling prices and five with lower offers.

Investor’s Choice bid-offer indicator reading has seven stocks ending with bids higher than their last selling prices and five with lower offers. Pulse Investments lost 30 cents to end at $4.45, with investors swapping 2,607,378 shares, Sagicor Group rose 85 cents to end at $50.35 after trading 10,629 stock units, Sagicor Real Estate Fund declined by $1.95 to $6.30, as investors swapped 10,000 shares and Salada Foods fell $2.75 to $26, with 871 units crossing the market.

Pulse Investments lost 30 cents to end at $4.45, with investors swapping 2,607,378 shares, Sagicor Group rose 85 cents to end at $50.35 after trading 10,629 stock units, Sagicor Real Estate Fund declined by $1.95 to $6.30, as investors swapped 10,000 shares and Salada Foods fell $2.75 to $26, with 871 units crossing the market. Trading ended with six securities changing hands, compared up from four on Monday with no stock rising, four declining and two remaining unchanged.

Trading ended with six securities changing hands, compared up from four on Monday with no stock rising, four declining and two remaining unchanged. At the market close, First Rock Capital Investment carved out a loss of 1.89 cents in closing at 7 US cents after 101,000 stock units cleared the market, Sterling Investments shed 0.4 of a cent, ending at 2 US cents in an exchange of 48,000 stock units, Sygnus Credit Investments settled at 17 US cents after exchanging 21,686 stocks and Transjamaican Highway shed 0.04 of a cent to close at 0.86 of a US cent in finishing trading with 779,120 units.

At the market close, First Rock Capital Investment carved out a loss of 1.89 cents in closing at 7 US cents after 101,000 stock units cleared the market, Sterling Investments shed 0.4 of a cent, ending at 2 US cents in an exchange of 48,000 stock units, Sygnus Credit Investments settled at 17 US cents after exchanging 21,686 stocks and Transjamaican Highway shed 0.04 of a cent to close at 0.86 of a US cent in finishing trading with 779,120 units.