Eight consecutive days of record close, for the Jamaica Stock Exchange ended last week, but that did not prevent new additions to the main market IC Insider.com’s TOP 10.

Eight consecutive days of record close, for the Jamaica Stock Exchange ended last week, but that did not prevent new additions to the main market IC Insider.com’s TOP 10.

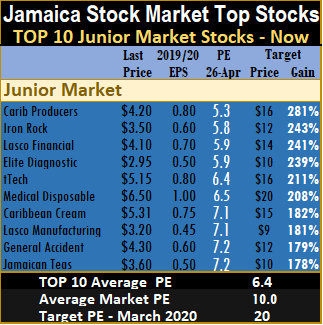

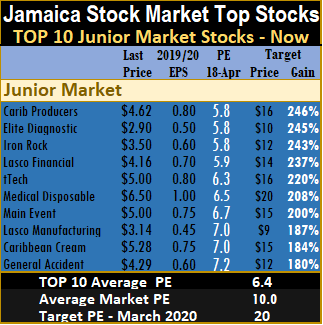

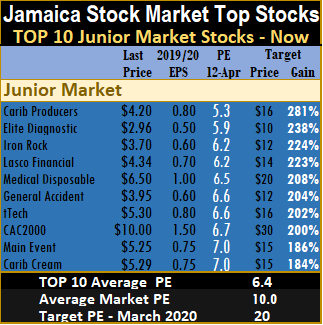

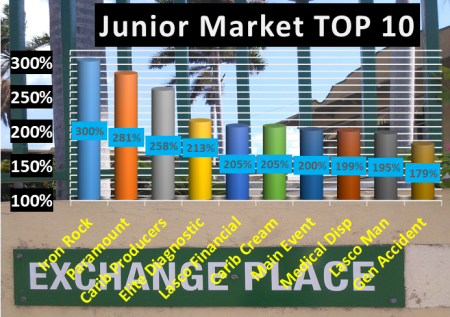

At the same time, the Junior Market recorded strong gains in the week and reduced the year to date loss of nearly 10 percent to April down to just 5.3 percent. While a number of companies released profit results last week many more are due this past and the market could get a jolt from some of them.

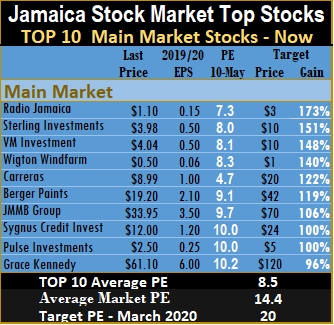

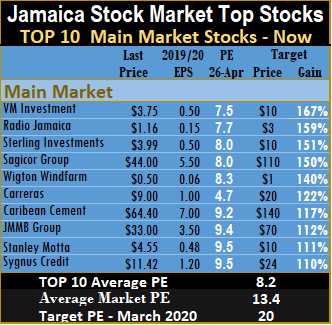

At the end of the past week, Jamaica Broilers and Stanley Motta moved out of the main market TOP 10 while Lasco Manufacturing and tTech moved up in price and left the Junior Market TOP 10.

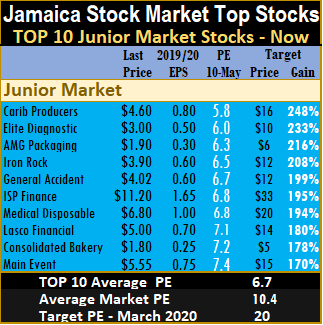

Consolidated Bakeries and Main Event are the new additions to the Junior Market TOP 10 while IC Insider’s long standing TOP 10 main market stock, welcomed back, Sygnus Credit Investments that dropped out the previous week returns to the main market TOP 10 along with Grace Kennedy that reported below average first quarter results.

The three leading Junior Market stocks for the coming week are, Caribbean Producers with projected gains of 248 percent, Elite Diagnostic with likely gains of 233 percent, followed by AMG Packaging with potential gains of 216 percent.

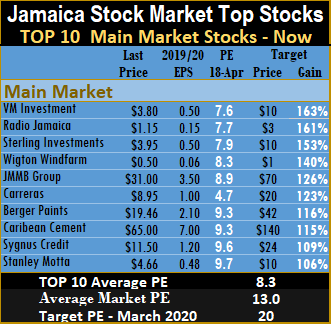

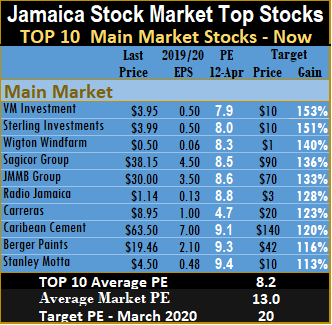

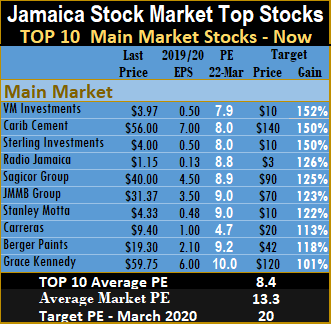

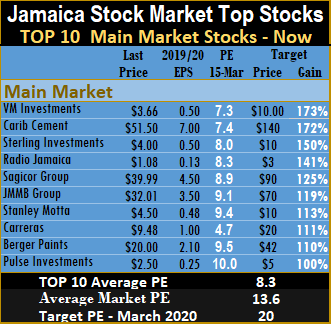

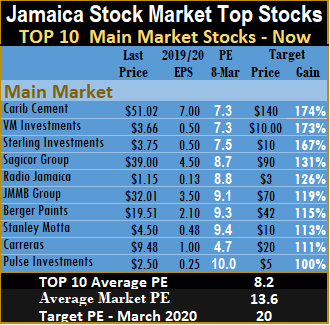

Radio Jamaica with potential gains of 173 percent leads main market stocks, followed by Sterling Investments with 151 percent likely gain and Victoria Mutual Investments in third spot with potential to gain 148 percent.

Wigton Windfarm, Jamaica’s latest initial public share offer, sits in at the 4 position on the main market stock list.  The stock comes to the market at 50 cents per share and boast a PE of 8.3 times normalized earnings for the year to March 2019. With the heavy oversubscription, the top investors will get just a fraction of what they applied for will certainly pushed the price higher when it lists and start trading.

The stock comes to the market at 50 cents per share and boast a PE of 8.3 times normalized earnings for the year to March 2019. With the heavy oversubscription, the top investors will get just a fraction of what they applied for will certainly pushed the price higher when it lists and start trading.

The main market, closed the week with the overall PE at 14.4 and the Junior Market at just 10.4. The PE ratio for Junior Market Top 10 stocks averages 6.7 and the main market PE is now 8.5. These levels, point to the huge upside for the TOP 10 stocks over the next 12 months and Junior Market stocks in particular.

The TOP 10 stocks now trade at an average discount of 36 percent to the average for the Junior Market Top stocks and main market stocks trade at a discount of 41 percent to the overall market.

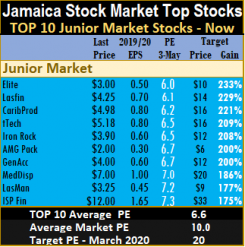

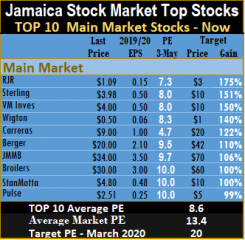

TOP 10 stocks are likely to deliver the best returns within a 12 months period. Projected earnings, for each company’s current fiscal year, are used in determining, the selected stocks. The PE for and projected earnings for each stock are computed to show potential gains for the year, which are ranked in descending order. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis as new information is received that can result in changes in and out of the list.

This report is compiled by persons who may have interest in the securities commented on.

each company’s current fiscal year, are used in determining, the selected stocks. The PE for and projected earnings for each stock are computed to show potential gains for the year, which are ranked in descending order. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis as new information is received that can result in changes in and out of the list.

each company’s current fiscal year, are used in determining, the selected stocks. The PE for and projected earnings for each stock are computed to show potential gains for the year, which are ranked in descending order. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis as new information is received that can result in changes in and out of the list.

normalized earnings for the year to March 2019.

normalized earnings for the year to March 2019.  each company’s current fiscal year, are used in determining, the selected stocks. The PE for and projected earnings for each stock are computed to show potential gains for the year, which are ranked in descending order. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis as new information is received that can result in changes in and out of the list.

each company’s current fiscal year, are used in determining, the selected stocks. The PE for and projected earnings for each stock are computed to show potential gains for the year, which are ranked in descending order. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis as new information is received that can result in changes in and out of the list.

used in determining, the selected stocks. The PE for and projected earnings for each stock are computed to show potential gains for the year, which are ranked in descending order. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis as new information is received that can result in changes in and out of the list.

used in determining, the selected stocks. The PE for and projected earnings for each stock are computed to show potential gains for the year, which are ranked in descending order. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis as new information is received that can result in changes in and out of the list.

negative impact on stock prices as investors gather funds to invest in what is proving to be a very popular issue. Reports reaching this publication is that a number of brokerage houses saw heavy traffic of applicants to purchase

negative impact on stock prices as investors gather funds to invest in what is proving to be a very popular issue. Reports reaching this publication is that a number of brokerage houses saw heavy traffic of applicants to purchase  close of the previous week and Jamaican Teas closed at $4.05, up from the bid price of $3.50 to move out of the top tier of stocks.

close of the previous week and Jamaican Teas closed at $4.05, up from the bid price of $3.50 to move out of the top tier of stocks.

roadworks around the area of their offices, could see this one being down in price for a while, until investors see it as just temporary. Everything Fresh makes it to the list in eight position and Jamaican Teas returns with the price hit down to $3 but closed with the bid at $3.50.

roadworks around the area of their offices, could see this one being down in price for a while, until investors see it as just temporary. Everything Fresh makes it to the list in eight position and Jamaican Teas returns with the price hit down to $3 but closed with the bid at $3.50.

each company’s current fiscal year, are used in determining, the selected stocks. The PE for and projected earnings for each stock are computed to show potential gains for the year, which are ranked in descending order. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis as new information is received that can result in changes in and out of the list.

each company’s current fiscal year, are used in determining, the selected stocks. The PE for and projected earnings for each stock are computed to show potential gains for the year, which are ranked in descending order. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis as new information is received that can result in changes in and out of the list. The major change in IC Insider.com’s TOP 10 this pass week, is a sharp change in the stocks showing highest potential gains.

The major change in IC Insider.com’s TOP 10 this pass week, is a sharp change in the stocks showing highest potential gains.

Main Market stocks have gone in the opposite direction with a fall in the price of Sterling Investments to $3.50, the stock now boost potential to gains 186 percent, followed by Victoria Mutual investments with 156 percent likely gain and Radio Jamaica at 152 percent, being third.

Main Market stocks have gone in the opposite direction with a fall in the price of Sterling Investments to $3.50, the stock now boost potential to gains 186 percent, followed by Victoria Mutual investments with 156 percent likely gain and Radio Jamaica at 152 percent, being third.  The PE ratio for Junior Market Top 10 stocks average 6.9 and the main market PE is now 8.4. These levels, point to the huge upside for the TOP 10 stocks over the next 12 months.

The PE ratio for Junior Market Top 10 stocks average 6.9 and the main market PE is now 8.4. These levels, point to the huge upside for the TOP 10 stocks over the next 12 months. year, are used in determining, the selected stocks. The PE for and projected earnings for each stock are computed to show potential gains for the year, which are ranked in descending order. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis as new information is received that can result in changes in and out of the list.

year, are used in determining, the selected stocks. The PE for and projected earnings for each stock are computed to show potential gains for the year, which are ranked in descending order. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis as new information is received that can result in changes in and out of the list.

slipped in price to close the week at $59.75 and that was enough for it to edge its way back in the TOP main market stocks.

slipped in price to close the week at $59.75 and that was enough for it to edge its way back in the TOP main market stocks. percent in the prior week and Sterling Investments with 150 percent.

percent in the prior week and Sterling Investments with 150 percent. projected earnings for each stock are computed to show potential gains for the year, which are ranked in descending order. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis as new information is received that can result in changes in and out of the list.

projected earnings for each stock are computed to show potential gains for the year, which are ranked in descending order. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis as new information is received that can result in changes in and out of the list.

reentered the TOP 10.

reentered the TOP 10. for the year and Sterling Investments with 150 percent.

for the year and Sterling Investments with 150 percent. the projected gains are computed to show potential gains for the year. The projected gains are ranked to arrive at the selections, with the potential gains ranked in descending order. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis as new information is received that can result in changes in and out of the list.

the projected gains are computed to show potential gains for the year. The projected gains are ranked to arrive at the selections, with the potential gains ranked in descending order. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis as new information is received that can result in changes in and out of the list.

can be expected. The earnings downgrade moved the company to the 10th spot on the list.

can be expected. The earnings downgrade moved the company to the 10th spot on the list.

TOP 10 stocks are likely to deliver the best returns within a 12 months period. Stocks are selected based on projected earnings for each company’s current fiscal year. Based on an assumed PE for each, the likely gains are determined and then ranked, with the stocks with the highest potential gains ranked first followed by the rest, in descending order. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis as new information is received that can result in changes in and out of the list.

TOP 10 stocks are likely to deliver the best returns within a 12 months period. Stocks are selected based on projected earnings for each company’s current fiscal year. Based on an assumed PE for each, the likely gains are determined and then ranked, with the stocks with the highest potential gains ranked first followed by the rest, in descending order. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis as new information is received that can result in changes in and out of the list.