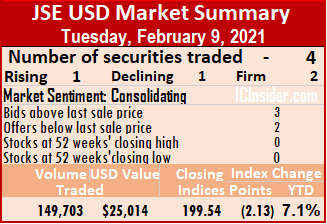

Securities trading on Tuesday climbed above Monday’s level but delivered less volume in trading on the US dollar market of the Jamaica Stock Exchange. The market index rose after the trading of 42 percent fewer shares than on Monday, resulting in a third of the stocks advancing after the value of stocks traded fell by 41 percent.

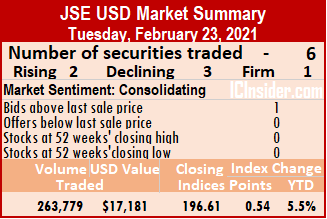

Trading ended with six securities changing hands at the close, compared to four on Monday and closed with the prices of two stocks rising, three declining and one remaining unchanged, with the JSE USD Equity Index gaining 0.54 points to end at 196.61. The PE Ratio averages 13.6 based on ICInsider.com forecast of 2020-21 earnings.

Trading ended with six securities changing hands at the close, compared to four on Monday and closed with the prices of two stocks rising, three declining and one remaining unchanged, with the JSE USD Equity Index gaining 0.54 points to end at 196.61. The PE Ratio averages 13.6 based on ICInsider.com forecast of 2020-21 earnings.

The market closed with an exchange of 263,779 shares, for US$17,181 compared to 457,310 units at US$29,021 on Monday.

Trading averaged 43,963 units changing hands at US$2,863, in contrast to 114,328 shares at US$7,255 on Monday. Trading averaged 72,353 units for the month to date at US$9,917, in contrast to 74,357 units at US$10,415 on Monday. January ended with an average of 121,154 units for US$15,408.

Investor’s Choice bid-offer indicator shows one stock ending with the bid higher than the last selling price and none with a lower offer.

At the close of trading, First Rock Capital added 0.01 of a cent to close at 9 US cents in trading 31,935 shares, Proven Investments shed 0.15 of a cent to 25.85 US cents trading 18,047 units. Sygnus Credit Investments dropped 0.45 of a cent to close at 14.50 US cents, with 3,358 shares crossing the exchange and Transjamaican Highway squeezed out a gain of 0.01 of a cent to end at 0.95 US cents, in switching ownership of 203,258 stocks.

At the close of trading, First Rock Capital added 0.01 of a cent to close at 9 US cents in trading 31,935 shares, Proven Investments shed 0.15 of a cent to 25.85 US cents trading 18,047 units. Sygnus Credit Investments dropped 0.45 of a cent to close at 14.50 US cents, with 3,358 shares crossing the exchange and Transjamaican Highway squeezed out a gain of 0.01 of a cent to end at 0.95 US cents, in switching ownership of 203,258 stocks.

In the preference segment, Equityline Mortgage Investment preference share closed at US$1.96 trading 101 units and JMMB Group 6% lost 1 US cent to close at US$1, in switching ownership of 7,080 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

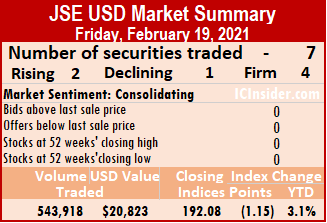

Trading closed with the prices of two stocks rising, one declining and four remaining unchanged, with the JSE USD Equity Index losing 1.15 points to end at 192.08. The PE Ratio averages 13.7 based on ICInsider.com forecast of 2020-21 earnings.

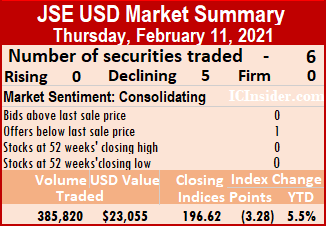

Trading closed with the prices of two stocks rising, one declining and four remaining unchanged, with the JSE USD Equity Index losing 1.15 points to end at 192.08. The PE Ratio averages 13.7 based on ICInsider.com forecast of 2020-21 earnings. At the close of the market, First Rock Capital shed 0.08 of a cent to close at 8.9 US cents, in exchanging 3,767 stocks, Margaritaville settled at 11 US cents with the transfer of 3,500 stock units, Proven Investments gained 0.29 of a cent to close at 25.99 US cents trading 2,255 units. Sterling Investments ended at 2.39 US cents, with 1,000 stock units changing hands, Sygnus Credit Investments remained at 14.95 US cents after transferring 16,675 shares and Transjamaican Highway gained 0.06 of a cent in closing at 0.91 of a US cent, trading 510,377 shares.

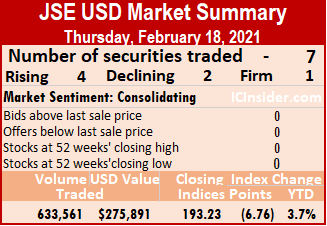

At the close of the market, First Rock Capital shed 0.08 of a cent to close at 8.9 US cents, in exchanging 3,767 stocks, Margaritaville settled at 11 US cents with the transfer of 3,500 stock units, Proven Investments gained 0.29 of a cent to close at 25.99 US cents trading 2,255 units. Sterling Investments ended at 2.39 US cents, with 1,000 stock units changing hands, Sygnus Credit Investments remained at 14.95 US cents after transferring 16,675 shares and Transjamaican Highway gained 0.06 of a cent in closing at 0.91 of a US cent, trading 510,377 shares. Seven securities changed hands, the same as Tuesday, with four rising, two declining and one remaining unchanged, with the JSE USD Equity Index losing 6.76 points to end at 193.23. The PE Ratio averages 13.6 based on ICInsider.com’s forecast of 2020-21 earnings.

Seven securities changed hands, the same as Tuesday, with four rising, two declining and one remaining unchanged, with the JSE USD Equity Index losing 6.76 points to end at 193.23. The PE Ratio averages 13.6 based on ICInsider.com’s forecast of 2020-21 earnings. Sygnus Credit Investments J$ stock dropped 2.5 cents to 12 US cents trading just 4 stock units. Sygnus Credit Investments US$ stock rose 0.45 of a cent to 14.95 US cents with 38,258 stock units changing hands and Transjamaican Highway slipped 0.09 of a cent to 0.85 of a US cent with 434,924 units crossing the exchange.

Sygnus Credit Investments J$ stock dropped 2.5 cents to 12 US cents trading just 4 stock units. Sygnus Credit Investments US$ stock rose 0.45 of a cent to 14.95 US cents with 38,258 stock units changing hands and Transjamaican Highway slipped 0.09 of a cent to 0.85 of a US cent with 434,924 units crossing the exchange. Seven securities traded, compared to six on Monday with four rising, two declining and one remaining unchanged.

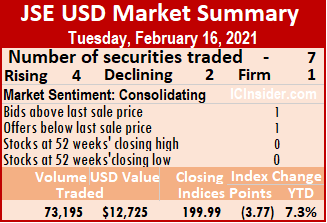

Seven securities traded, compared to six on Monday with four rising, two declining and one remaining unchanged. Sterling Investments rose 0.09 of a cent to 2.39 US cents with 900 stocks clearing the market. Sygnus Credit Investments settled at 14.5 US cents trading 2,901 stock units, Sygnus Credit Investments dropped 0.5 of a cent to end at 14.5 US cents trading 2,400 stock units and Transjamaican Highway advanced 0.03 of a cent to 0.94 of a US cent with 23,060 units crossing the exchange.

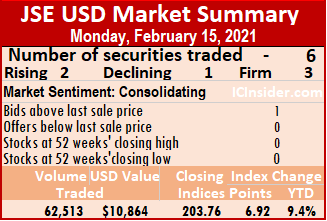

Sterling Investments rose 0.09 of a cent to 2.39 US cents with 900 stocks clearing the market. Sygnus Credit Investments settled at 14.5 US cents trading 2,901 stock units, Sygnus Credit Investments dropped 0.5 of a cent to end at 14.5 US cents trading 2,400 stock units and Transjamaican Highway advanced 0.03 of a cent to 0.94 of a US cent with 23,060 units crossing the exchange. Trading ended with six securities changing hands at the close, compared to seven on Friday and ended with two stocks rising, one declining and three remaining unchanged. The average PE Ratio ends at 13.9 based on ICInsider.com’s forecast of 2020-21 earnings.

Trading ended with six securities changing hands at the close, compared to seven on Friday and ended with two stocks rising, one declining and three remaining unchanged. The average PE Ratio ends at 13.9 based on ICInsider.com’s forecast of 2020-21 earnings. Proven Investments added 1.39 US cents to close at 26.4 US cents in exchanging 7,345 units, Sygnus Credit Investments closed at 14.5 US cents, trading 599 shares. Sygnus Credit Investments slipped 0.04 of a cent to 15 US cents after exchanging 44,116 stocks and Transjamaican Highway eked out a gain of 0.01 of a cent to 0.91 of a US cent with four stock units crossing the exchange.

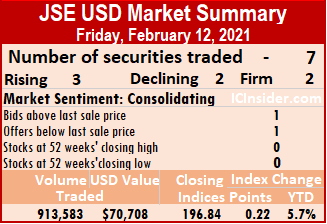

Proven Investments added 1.39 US cents to close at 26.4 US cents in exchanging 7,345 units, Sygnus Credit Investments closed at 14.5 US cents, trading 599 shares. Sygnus Credit Investments slipped 0.04 of a cent to 15 US cents after exchanging 44,116 stocks and Transjamaican Highway eked out a gain of 0.01 of a cent to 0.91 of a US cent with four stock units crossing the exchange. Trading ended with seven securities changing hands at the close, compared to six on Thursday and ended with the prices of three stocks rising, two declining and two remaining unchanged.

Trading ended with seven securities changing hands at the close, compared to six on Thursday and ended with the prices of three stocks rising, two declining and two remaining unchanged. The Jamaican dollar-based Sygnus Credit Investments gained 2.5 cents ending at 14.5 US cents in exchanging 400 shares, Sygnus Credit Investments shed 0.84 of a cent to close at 15.04 US cents in trading 7,911 stocks and Transjamaican Highway shed 0.05 of a cent to close at 0.9 of a US cent with 230,224 stocks changing hands.

The Jamaican dollar-based Sygnus Credit Investments gained 2.5 cents ending at 14.5 US cents in exchanging 400 shares, Sygnus Credit Investments shed 0.84 of a cent to close at 15.04 US cents in trading 7,911 stocks and Transjamaican Highway shed 0.05 of a cent to close at 0.9 of a US cent with 230,224 stocks changing hands. Proven Investments shed 1 cent in closing at 25 US cents in switching ownership of 10,040 units, Sygnus Credit Investments lost 0.03 of a cent to close at 15.88 US cents trading 744 stocks and Transjamaican Highway lost 0.02 of a cent to close at O.95 of one US cent, with 148,775 stock units changing hands.

Proven Investments shed 1 cent in closing at 25 US cents in switching ownership of 10,040 units, Sygnus Credit Investments lost 0.03 of a cent to close at 15.88 US cents trading 744 stocks and Transjamaican Highway lost 0.02 of a cent to close at O.95 of one US cent, with 148,775 stock units changing hands. Seven securities changed hands, compared to four on Tuesday and ended with three stocks rising, three declining and one remaining unchanged.

Seven securities changed hands, compared to four on Tuesday and ended with three stocks rising, three declining and one remaining unchanged. At the close of trading, First Rock Capital lost 0.78 of a cent to end at 8 US cents trading 148,485 stocks, Margaritaville closed at 11 US cents with an exchange of 14,000 stock units, MPC Caribbean Clean Energy gained 1 cent in closing at US$1.15, with 197 stock units crossing the market. Proven Investments declined 0.95 of a cent in closing at 26 US cents with 35,261 shares changing hands, Sterling Investments rose 0.2 of a cent to end at 2.3 US cents in exchanging 1,170 units, Sygnus Credit Investments increased 0.87 of a cent to close at 15.91 US cents, with 10,649 stock units crossing the market and Transjamaican Highway shed 0.01 of a cent in closing at 0.97 US cents in trading 36,740 stocks.

At the close of trading, First Rock Capital lost 0.78 of a cent to end at 8 US cents trading 148,485 stocks, Margaritaville closed at 11 US cents with an exchange of 14,000 stock units, MPC Caribbean Clean Energy gained 1 cent in closing at US$1.15, with 197 stock units crossing the market. Proven Investments declined 0.95 of a cent in closing at 26 US cents with 35,261 shares changing hands, Sterling Investments rose 0.2 of a cent to end at 2.3 US cents in exchanging 1,170 units, Sygnus Credit Investments increased 0.87 of a cent to close at 15.91 US cents, with 10,649 stock units crossing the market and Transjamaican Highway shed 0.01 of a cent in closing at 0.97 US cents in trading 36,740 stocks. Trading ended with the prices of one stock rising, one declining and two remaining unchanged.

Trading ended with the prices of one stock rising, one declining and two remaining unchanged. At the close of the market, First Rock Capital remained at 8.78 US cents while exchanging 140 shares. Proven Investments lost 0.04 of a cent at 26.95 US cents, with an exchange of 92,650 stock units, Sygnus Credit Investments closed at 15.04 US cents trading 2,000 shares and Transjamaican Highway inched 0.01 of a cent higher in closing at 0.98 of a US cent, with 54,913 shares changing hands.

At the close of the market, First Rock Capital remained at 8.78 US cents while exchanging 140 shares. Proven Investments lost 0.04 of a cent at 26.95 US cents, with an exchange of 92,650 stock units, Sygnus Credit Investments closed at 15.04 US cents trading 2,000 shares and Transjamaican Highway inched 0.01 of a cent higher in closing at 0.98 of a US cent, with 54,913 shares changing hands. Similar to trading on Friday, the market ended with five securities changing hands and with three rising, none declining and two closing unchanged.

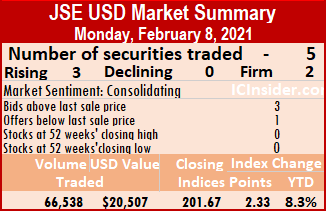

Similar to trading on Friday, the market ended with five securities changing hands and with three rising, none declining and two closing unchanged. Investor’s Choice bid-offer indicator shows three stocks ended with bids higher than the last selling prices and one with a lower offer.

Investor’s Choice bid-offer indicator shows three stocks ended with bids higher than the last selling prices and one with a lower offer.