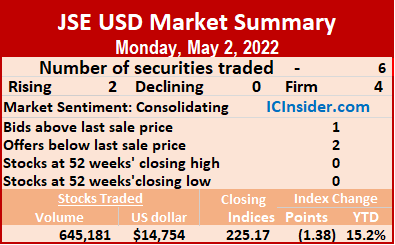

Trading ended on Monday on the Jamaica Stock Exchange US dollar market, with the volume of shares changing hands climbing 4,868 percent with a 366 percent higher value than on Friday, resulting in six securities trading, compared to eight on Friday with two rising and four ending unchanged.

The JSE US Denominated Equities Index fell 1.38 points to end at 225.17. The PE Ratio, a measure used in computing appropriate stock values, averages 9.6. The PE ratio uses ICInsider.com earnings forecasts for companies with financial years ending up to the end of August 2023.

The JSE US Denominated Equities Index fell 1.38 points to end at 225.17. The PE Ratio, a measure used in computing appropriate stock values, averages 9.6. The PE ratio uses ICInsider.com earnings forecasts for companies with financial years ending up to the end of August 2023.

A total of 645,181 shares traded for US$14,754 compared to 12,986 units at US$3,165 on Friday.

Trading on Monday averaged 107,530 units at US$2,459, compared to 1,623 shares at US$396 on Friday. April ended with an average of 95,379 units for US$3,929.

Investor’s Choice bid-offer indicator shows one stock ending with a bid higher than the last selling price and two with lower offers.

At the close, First Rock Capital USD share finished at 7.95 US cents while exchanging eight shares,  Margaritaville ended unchanged at 16 US cents, with 66 stocks crossing the market, Proven Investments ended at 25.99 US cents after 26,010 units changing hands. Sygnus Credit Investments USD share increased 0.05 of a cent to end at 12.95 US cents in trading 14,537 stock units and Transjamaican Highway rose 0.03 of a cent to close at 1.02 US cents after an exchange of 604,558 units.

Margaritaville ended unchanged at 16 US cents, with 66 stocks crossing the market, Proven Investments ended at 25.99 US cents after 26,010 units changing hands. Sygnus Credit Investments USD share increased 0.05 of a cent to end at 12.95 US cents in trading 14,537 stock units and Transjamaican Highway rose 0.03 of a cent to close at 1.02 US cents after an exchange of 604,558 units.

In the preference segment, JMMB Group 6% finished at US$1.10, trading two stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Slippage for JSEUSD market

Big gains for several ICTOP10 stocks

With just one third of 2022 elapsing, it is an excellent time to look at what the markets and ICInsider.com forecast have done. The Junior Market gained 29.85 percent to the end of April, or half of the entire year forecast of 60 percent, made at the start of the year and in the process, the market has surpassed the 29.7 percent gains it achieved in 2021 for the entire year.

The Main Market that ICInsider.com forecast to deliver a 14 percent rise for the year struggles to break from consolidation so far, with a rise of just 4.8 for the four months to April and is consistent with a 14 percent increase for the year. It is quite likely that the market PE could climb closer to a PE of 18, which will push the annual gains to around 30 percent if the financial stocks show good increases in profit for the year. That is a very likely situation as the hike in interest rates is driving net interest income sharply upwards.

The Main Market that ICInsider.com forecast to deliver a 14 percent rise for the year struggles to break from consolidation so far, with a rise of just 4.8 for the four months to April and is consistent with a 14 percent increase for the year. It is quite likely that the market PE could climb closer to a PE of 18, which will push the annual gains to around 30 percent if the financial stocks show good increases in profit for the year. That is a very likely situation as the hike in interest rates is driving net interest income sharply upwards.

At the beginning of the year, ICInsider.com stated, “the market is technically at a support level that is steering the index upwards. More importantly, it is caught in a triangular formation setting to push the market sharply upwards once it breaks out, which is not far off. The market is trading in a channel that goes back to May 2020, pointing to a record high of over 4,000 points in a few months.” So far, the above forecast is spot on.

In addition to the Top15 selection for each market at the start of the year, we added a few stocks. There were nine winning stocks with good gains. The list includes AMG Packaging 73 percent, Dolphin Cove 47 percent, Elite up 26 percent, Everything Fresh 83 percent, iCreate 263 percent, Jetcon 75 percent, Spur Tree Spices 215 percent, Stationery and Office Supplies 46 percent and Tropical Batteries up 124 percent for the year to date and up 64 percent since ICInsider.com added it was added to the TOP10 on February 25. Caribbean Cream, down 7 percent, is the only Junior Market stock selection to fall.

In addition to the Top15 selection for each market at the start of the year, we added a few stocks. There were nine winning stocks with good gains. The list includes AMG Packaging 73 percent, Dolphin Cove 47 percent, Elite up 26 percent, Everything Fresh 83 percent, iCreate 263 percent, Jetcon 75 percent, Spur Tree Spices 215 percent, Stationery and Office Supplies 46 percent and Tropical Batteries up 124 percent for the year to date and up 64 percent since ICInsider.com added it was added to the TOP10 on February 25. Caribbean Cream, down 7 percent, is the only Junior Market stock selection to fall.

The big TOP15 winners for the Main Market are Caribbean Producers, up 42 percent, Jamaica Stock Exchange at 22 percent, JMMB Group at 16 percent and Proven at 14 percent. Berger Paints, down 7 percent, Jamaica Broilers, with a fall of 3 percent and Scotia Group, down one percent, are the only losers in this segment.

The big TOP15 winners for the Main Market are Caribbean Producers, up 42 percent, Jamaica Stock Exchange at 22 percent, JMMB Group at 16 percent and Proven at 14 percent. Berger Paints, down 7 percent, Jamaica Broilers, with a fall of 3 percent and Scotia Group, down one percent, are the only losers in this segment.

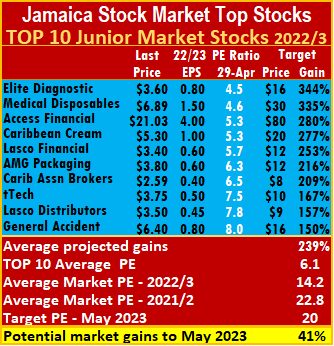

For the week, the only new listing to TOP10 is tTech replacing Jetcon, that held on to a gain of 16 percent to top the ICTOP10 Junior Market movers and dropped out of the TOP10, followed by Medical Disposables with 14 percent after a block of shares that was overhanging the market was taken out by buyers. AMG Packaging rose 9 percent, Caribbean Cream rose 6 percent and Caribbean Assurance Brokers shed 9 percent.

In the Main Market, Sygnus Credit Investments rose 8 percent to end at $16.48 and Caribbean Cement gained 6 percent to close at $75.18.

The average PE for the JSE Main Market TOP 10 ends the week at 6.2, well below the market average of 15, while the Junior Market PE for the Top 10 sits at 6.1 versus the market at 14.2. The Junior Market TOP10 is projected to gain an average of 239 percent to May 2023 and the Main Market 197 percent.

ICTOP10 focuses on likely yearly winners, accordingly, the list may or may not include the best companies in the market. ICInsider.com ranks stocks based on projected earnings to highlight winners from the rest, allowing investors to focus on potential winning stocks and helping to remove emotional attachments to stocks that often result in costly mistakes.

ICTOP10 focuses on likely yearly winners, accordingly, the list may or may not include the best companies in the market. ICInsider.com ranks stocks based on projected earnings to highlight winners from the rest, allowing investors to focus on potential winning stocks and helping to remove emotional attachments to stocks that often result in costly mistakes.

IC TOP10 stocks are likely to deliver the best returns up to the end of May 2023. They are ranked in order of potential gains, based on the possible increase for each company, considering the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in weekly movements in and out of the lists. Revisions to earnings are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

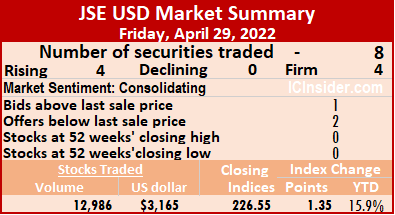

JSE USD Market ends April up

The JSE US Denominated Equities Index gained 1.35 points to end at 226.55.

The JSE US Denominated Equities Index gained 1.35 points to end at 226.55.At the close, First Rock Capital USD share gained 0.05 of a cent to 7.95 US cents in switching ownership of 2,484 shares,

Margaritaville closed at 16 US cents after 133 units were traded, MPC Caribbean Clean Energy remained at US$1.26, with two stock units crossing the market. Productive Business Solutions traded 17 stocks at US$1.19, Proven Investments popped 1.68 cents to 25.99 US cents with 5,357 shares changing hands, Sygnus Credit Investments USD share ended at 12.9 US cents in an exchange of 27 stock units and Sygnus Real Estate Finance USD share increased 0.89 of a cent to close at 14.69 US cents with an exchange of 4,150 units.

Margaritaville closed at 16 US cents after 133 units were traded, MPC Caribbean Clean Energy remained at US$1.26, with two stock units crossing the market. Productive Business Solutions traded 17 stocks at US$1.19, Proven Investments popped 1.68 cents to 25.99 US cents with 5,357 shares changing hands, Sygnus Credit Investments USD share ended at 12.9 US cents in an exchange of 27 stock units and Sygnus Real Estate Finance USD share increased 0.89 of a cent to close at 14.69 US cents with an exchange of 4,150 units.Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Recovery for JSE USD Market

Trading on Thursday, ended the Jamaica Stock Exchange US dollar market, with the volume and value of shares changing hands rising by 2,008 percent and 169 percent respectively higher than on Wednesday, resulting in more stocks rising than falling.

A total of 10 securities traded, up from five on Wednesday, with five rising, two declining and three ending unchanged.

A total of 10 securities traded, up from five on Wednesday, with five rising, two declining and three ending unchanged.

The JSE US Denominated Equities Index rose 11.21 points to end at 225.20.

The PE Ratio, a measure used in computing appropriate stock values, averages 9.7. The PE ratio uses ICInsider.com earnings forecasts for companies with financial years ending, up to the end of August 2023.

A total of 1,085,520 shares were traded, for US$33,620 compared to 51,502 units at US$12,484 on Wednesday. Trading averaged 108,552 units at US$3,362, compared to 10,300 shares at US$2,497 on Wednesday, with the month to date average of 100,814 shares at US$4,134 versus 100,209 units at US$4,194 on the previous day. March ended with an average of 59,258 units for US$6,669.

Investor’s Choice bid-offer indicator shows two stocks ended with a bid higher than the last selling prices and two with lower offers.

At the close, First Rock Capital USD share remained at 7.9 US cents after 75 shares crossed the market, Margaritaville ended unchanged at 16 US cents with the swapping of 24 stocks, Productive Business Solutions rallied 16 cents to US$1.19, with 410 stock units clearing the market.  Proven Investments popped 0.2 of a cent to close at 24.31 US cents in switching ownership of 12,818 units, Sterling Investments increased 0.1 of one cent in closing at 2.2 US cents in trading 143 shares, Sygnus Credit Investments USD share finished at 12.9 US cents while exchanging 12,045 units. Sygnus Real Estate Finance USD share gained 1.73 cents to end at 13.8 US cents in trading 130 stocks and Transjamaican Highway fell 0.07 of a cent to close at 0.99 of one US cent, with 1,042,640 shares changing hands.

Proven Investments popped 0.2 of a cent to close at 24.31 US cents in switching ownership of 12,818 units, Sterling Investments increased 0.1 of one cent in closing at 2.2 US cents in trading 143 shares, Sygnus Credit Investments USD share finished at 12.9 US cents while exchanging 12,045 units. Sygnus Real Estate Finance USD share gained 1.73 cents to end at 13.8 US cents in trading 130 stocks and Transjamaican Highway fell 0.07 of a cent to close at 0.99 of one US cent, with 1,042,640 shares changing hands.

In the preference segment, Eppley 6% preference share advanced 14.4 cents to US$1.104 in exchanging 2,000 stock units and JMMB Group 6% lost 0.99 of one cent in ending at 99.01 US cents after trading 15,235 shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

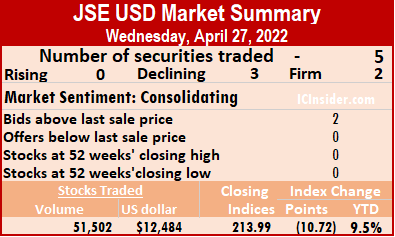

Big fall for JSE USD market

Trading on Wednesday on the Jamaica Stock Exchange US dollar market ended with the volume of shares changing hands declining 64 percent, with 32 percent less than on Tuesday and resulted in five securities traded, compared to nine on Tuesday with none rising, three falling and two ending unchanged.

The JSE US Denominated Equities Index dropped 10.72 points to end at 203.91.

The JSE US Denominated Equities Index dropped 10.72 points to end at 203.91.

The PE Ratio, a measure used in computing appropriate stock values, averages 9.6. The PE ratio uses ICInsider.com earnings forecasts for companies with financial years ending in August 2023.

51,502 shares traded for US$12,484 compared to 144,543 units at US$18,342 on Tuesday. Trading averaged 10,300 units at US$2,497 compared to 16,060 shares at US$2,038 on Tuesday, with month to date average of 100,209 shares at US$4,194 versus 103,864 units at US$4,263 on the previous day. March ended with an average of 59,258 units for US$6,669.

Investor’s Choice bid-offer indicator shows two stocks ended with bids higher than the last selling prices and none with a lower offer.

At the close, First Rock Capital USD share remained at 7.9 US cents with 82 shares clearing the market, Productive Business Solutions declined 16 cents to close at US$1.03 after exchanging 31 stocks, Proven Investments shed 0.89 of a cent to end at 24.11 US cents in swapping 48,279 units. Sygnus Credit Investments USD share ended unchanged at 12.9 US cents, with 2,610 stock units crossing the exchange and Sygnus Real Estate Finance USD share fell 2.62 cents in closing at 12.07 US cents with the swapping of 500 units.

At the close, First Rock Capital USD share remained at 7.9 US cents with 82 shares clearing the market, Productive Business Solutions declined 16 cents to close at US$1.03 after exchanging 31 stocks, Proven Investments shed 0.89 of a cent to end at 24.11 US cents in swapping 48,279 units. Sygnus Credit Investments USD share ended unchanged at 12.9 US cents, with 2,610 stock units crossing the exchange and Sygnus Real Estate Finance USD share fell 2.62 cents in closing at 12.07 US cents with the swapping of 500 units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Trading picks up on JSE USD Market

Trading on the Jamaica Stock Exchange US dollar market on Tuesday ended with the volume of shares changing hands rising 15 percent as 174 percent more funds went after stocks than on Monday, resulting in nine trading compared to seven on Monday, with none rising, two declining and seven ending unchanged.

The JSE US Denominated Equities Index dipped 0.06 points to end at 224.71.

The JSE US Denominated Equities Index dipped 0.06 points to end at 224.71.

The PE Ratio, a measure used in computing appropriate stock values, averages 9.6. The PE ratio uses ICInsider.com earnings forecasts for companies with financial years closing by the up to the end of August 2023.

Overall, 144,543 shares traded for US$18,342 compared to 125,525 units at US$6,699 on Monday.

Trading averaged 16,060 units at US$2,038, compared to 17,932 shares at US$957 on Monday, with a month to date average of 103,864 shares at US$4,263 versus 110,796 units at US$4,439 on the previous day. March averaged 59,258 units for US$6,669.

Investor’s Choice bid-offer indicator shows two stocks ended with bids higher than the last selling prices and none closed with a lower offer.

At the close, First Rock Capital USD share ended unchanged at 7.9 US cents, with 2,240 shares traded, Margaritaville finished at 16 US cents in exchanging 246 stocks, MPC Caribbean Clean Energy remained at US$1.26 after one share crossed the market.  Productive Business Solutions remained at US$1.19 after 43units changed hands, Proven Investments ended at 25 US cents while exchanging 65,131 stocks, Sterling Investments lost 0.12 of a cent in ending at 2.1 US cents after trading 5,210 units. Sygnus Credit Investments USD share finished at 12.9 US cents with an exchange of 7,183 shares, Sygnus Real Estate Finance USD share shed 0.01 of a cent in closing at 14.69 US cents after trading 500 units and Transjamaican Highway ended unchanged at 1.06 US cents with 63,989 stock units crossing the market.

Productive Business Solutions remained at US$1.19 after 43units changed hands, Proven Investments ended at 25 US cents while exchanging 65,131 stocks, Sterling Investments lost 0.12 of a cent in ending at 2.1 US cents after trading 5,210 units. Sygnus Credit Investments USD share finished at 12.9 US cents with an exchange of 7,183 shares, Sygnus Real Estate Finance USD share shed 0.01 of a cent in closing at 14.69 US cents after trading 500 units and Transjamaican Highway ended unchanged at 1.06 US cents with 63,989 stock units crossing the market.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Gains for JSE USD market

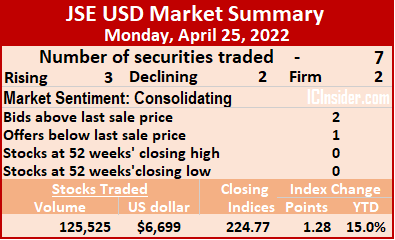

A total of seven securities traded, compared to six on Friday with three rising, two declining and two ending unchanged. The JSE US Denominated Equities Index gained 1.28 points to end at 224.77.

A total of seven securities traded, compared to six on Friday with three rising, two declining and two ending unchanged. The JSE US Denominated Equities Index gained 1.28 points to end at 224.77.The PE Ratio, a measure used in computing appropriate stock values, averages 9.6. The PE ratio uses ICInsider.com earnings forecasts for companies with financial years ending, to the end of August 2023.

Overall, 125,525 shares traded, for US$6,699 compared to 213,719 units at US$4,901 on Friday. Trading averaged 17,932 units at US$957, compared to 35,620 shares at US$817 on Friday, with month to date average of 110,796 shares at US$4,439 versus 116,871 units at US$4,666 on the previous day. March ended with an average of 59,258 units for US$6,669.

Productive Business Solutions ended unchanged at US$1.19 while exchanging 10 stocks. Proven Investments rose 0.02 of a cent to 25 US cents with the swapping of 21,924 units, Sterling Investments rallied 0.21 cents to 2.22 US cents in trading 3,000 shares, Sygnus Credit Investments USD share popped 0.1 of a cent in ending at 12.9 US cents in switching ownership of 14 stocks and Transjamaican Highway fell 0.05 of a cent to close at 1.06 US cents in trading 99,702 units.

Productive Business Solutions ended unchanged at US$1.19 while exchanging 10 stocks. Proven Investments rose 0.02 of a cent to 25 US cents with the swapping of 21,924 units, Sterling Investments rallied 0.21 cents to 2.22 US cents in trading 3,000 shares, Sygnus Credit Investments USD share popped 0.1 of a cent in ending at 12.9 US cents in switching ownership of 14 stocks and Transjamaican Highway fell 0.05 of a cent to close at 1.06 US cents in trading 99,702 units.Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Former ICTOP10 stock jumps 130%

The star performer for the week was iCreate, up 132 percent and Supreme Ventures, with a 30 percent price movement in the market during the week, but several ICTOP10 stocks had some noted moves as well.

iCreate hits a low of 80 cents on Thursday.

iCreate, more than doubled, surging from the previous week’s $1.36 close to $3.16. The move coincides primarily with two acquisition announcements with little or no information given as to the cost and funding, leading to wild speculation in the stock. Supreme Ventures (SVL) stock jumped to a 52 weeks’ high of $33.41 from $24.49 at the end of the previous week. The SVL was more solidly based as the company reported solid increased profits for the March quarter as investors pushed the price sharply higher in response.

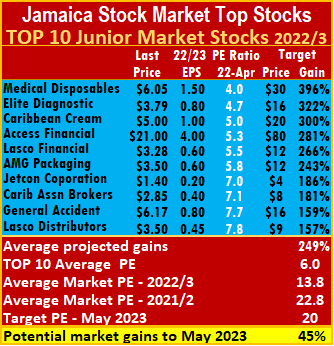

There are two changes to this week’s ICTOP10 listing. Lasco Distributors returns to the Junior Market TOP10 as Stationery and Office Supplies slipped out. The latter rose 15 percent to close the week at $9.11. The expectations are that the company will have blowout first quarter results, helped by school opening and following a strong 2021 fourth quarter. The Main Market welcomed back Jamaica Stock Exchange share that will benefit from an upsurge in trading activity in the first quarter as Scotia Group fell out, still looking attractively priced at $35.20, with Bank of Jamaica increasing interest rates is positively impacting the results.

The Junior Market ended with three stocks rising from 8 to 15 percent. Caribbean Assurance Brokers climbed 10 percent for the week while Jetcon Corporation rose 8 percent to close at $1.40. Declining were Lasco Financial, down 8 percent and Access Financial and AMG Packaging, down 5 percent, as buying eased markedly following improved results released at the close of the market ahead of the Easter weekend. Investors seem not to be factoring in cost savings and increased efficiency that the newly installed machine brings to the business following the close of the recent quarter. With a 5 percent rise, Guardian Holdings was the biggest mover in the Main Market.

The Junior Market ended with three stocks rising from 8 to 15 percent. Caribbean Assurance Brokers climbed 10 percent for the week while Jetcon Corporation rose 8 percent to close at $1.40. Declining were Lasco Financial, down 8 percent and Access Financial and AMG Packaging, down 5 percent, as buying eased markedly following improved results released at the close of the market ahead of the Easter weekend. Investors seem not to be factoring in cost savings and increased efficiency that the newly installed machine brings to the business following the close of the recent quarter. With a 5 percent rise, Guardian Holdings was the biggest mover in the Main Market.

The average PE for the JSE Main Market TOP 10 ends the week at 6.2, well below the market average of 14.8, while the Junior Market PE for the Top 10 sits at 6 versus the market at 13.8. The Junior Market TOP10 is projected to gain an average of 249 percent by May 2023 and the Main Market 200 percent.

ICTOP10 focuses on likely yearly winners; accordingly, the list may or may not include the best companies in the market. ICInsider.com ranks stocks based on projected earnings to highlight winners from the rest, allowing investors to focus on potential winning stocks and helping to remove emotional attachments to stocks that often result in costly mistakes.

ICTOP10 focuses on likely yearly winners; accordingly, the list may or may not include the best companies in the market. ICInsider.com ranks stocks based on projected earnings to highlight winners from the rest, allowing investors to focus on potential winning stocks and helping to remove emotional attachments to stocks that often result in costly mistakes.

IC TOP10 stocks are likely to deliver the best returns up to the end of May 2023. They are ranked in order of potential gains, based on the possible increase for each company, considering the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in weekly movements in and out of the lists. Revisions to earnings are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

Trading falls on JSE USD Market

A total of six securities were traded, down from 10 on Thursday, with one rising, three declining and two unchanged.

A total of six securities were traded, down from 10 on Thursday, with one rising, three declining and two unchanged.The JSE US Denominated Equities Index gained 2.49 points to end at 223.49. Overall, 213,719 shares traded for US$4,901 compared to 627,113 units at US$21,458 on Thursday.

The PE Ratio, a measure used in computing appropriate stock values, averages 9.7. The PE ratio uses ICInsider.com earnings forecasts for companies with the financial year closing at the end of August 2023.

Trading averaged 35,620 units at US$817, compared to 62,711 shares at US$2,146 on Thursday, with month to date average of 116,871 shares at US$4,666 versus 121,698 units at US$4,895 on the previous day. March ended with an average of 59,258 units for US$6,669.Investor’s Choice bid-offer indicator shows two stocks ended with bids higher than the last selling prices and none with a lower offer.

At the close, First Rock Capital USD share ended at 7.95 US cents after exchanging 136 shares, Margaritaville ended at 16 US cents with an exchange of 683 units, Proven Investments lost 0.01 of a cent to 24.98 US cents, with 115 stock units crossing the market. Sterling Investments fell 0.22 of a cent to end at 2.01 US cents, closed at 55,791 stocks, Sygnus Credit Investments USD share dropped 0.1 of a cent in ending at 12.8 US cents crossing the market 16,994 units and Transjamaican Highway rallied 0.1 o one cent to end at 1.11 US cents with the swapping of 140,000 stock units.

At the close, First Rock Capital USD share ended at 7.95 US cents after exchanging 136 shares, Margaritaville ended at 16 US cents with an exchange of 683 units, Proven Investments lost 0.01 of a cent to 24.98 US cents, with 115 stock units crossing the market. Sterling Investments fell 0.22 of a cent to end at 2.01 US cents, closed at 55,791 stocks, Sygnus Credit Investments USD share dropped 0.1 of a cent in ending at 12.8 US cents crossing the market 16,994 units and Transjamaican Highway rallied 0.1 o one cent to end at 1.11 US cents with the swapping of 140,000 stock units.Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Trading picks up for JSE USD Market

On Thursday, a sharp bounce in the trading ended with the volume of stocks changing hands surging 1,334 percent as the value traded rose 12 percent higher than Wednesday on the Jamaica Stock Exchange US dollar market, resulting in more stocks trading than Wednesday.

A total of 10 securities were traded, compared to seven on Wednesday, with two rising, three fell and five ended unchanged.

A total of 10 securities were traded, compared to seven on Wednesday, with two rising, three fell and five ended unchanged.

The JSE US Denominated Equities Index fell 3.97 points to end at 221.00. The PE Ratio, a measure used in computing appropriate stock values, averages 9.5. The PE ratio uses ICInsider.com earnings forecasts for companies with financial years, ending up to the close in August 2023.

Overall, 627,113 shares were traded, for US$21,458, up from 43,738 units at US$19,092 on Wednesday. Trading averaged 62,711 units at US$2,146, compared to 6,248 shares at US$2,727 on Wednesday, with a month to date average of 121,698 shares at US$4,895 versus 128,180 units at US$5,197 on the previous day. March ended with an average of 59,258 units for US$6,669.

Investor’s Choice bid-offer indicator shows two stocks ended with bids higher than the last selling prices and one with a lower offer.

At the close, First Rock Capital USD share ended unchanged at 7.95 US cents in exchanging 24 shares, Margaritaville remained at 16 US cents while exchanging 781 stock units, MPC Caribbean Clean Energy finished at US$1.26 after trading one stock.  Productive Business Solutions finished at US$1.19 trading one unit, Proven Investments gained 0.99 of a cent in closing at 24.99 US cents after finishing trading of 30,121 stock units, Sterling Investments declined 0.01 of a cent in ending at 2.23 US cents after exchanging 3,068 units. Sygnus Credit Investments USD share popped 0.01 of a cent in closing at 12.9 US cents after 4,109 stocks changed hands and Transjamaican Highway lost 0.1 of a cent to end at 1.01 US cents, with 581,490 shares crossing the exchange.

Productive Business Solutions finished at US$1.19 trading one unit, Proven Investments gained 0.99 of a cent in closing at 24.99 US cents after finishing trading of 30,121 stock units, Sterling Investments declined 0.01 of a cent in ending at 2.23 US cents after exchanging 3,068 units. Sygnus Credit Investments USD share popped 0.01 of a cent in closing at 12.9 US cents after 4,109 stocks changed hands and Transjamaican Highway lost 0.1 of a cent to end at 1.01 US cents, with 581,490 shares crossing the exchange.

In the preference segment, Equityline Mortgage Investments preference share remained at US$1.999 in an exchange of 18 stock units and JMMB Group 6% preference share shed 14 cents to close at US$1 with 7,500 units crossing the market.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.