Supreme Ventures traded at a new record high on Wednesday.

Jamaican Stocks made another sizable push higher in trading on the main market of the Jamaica Stock Exchange on Wednesday with the market, indices rising more than 2,000 points gained on Tuesday.

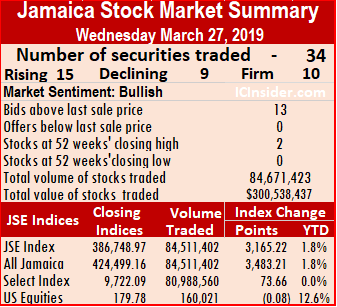

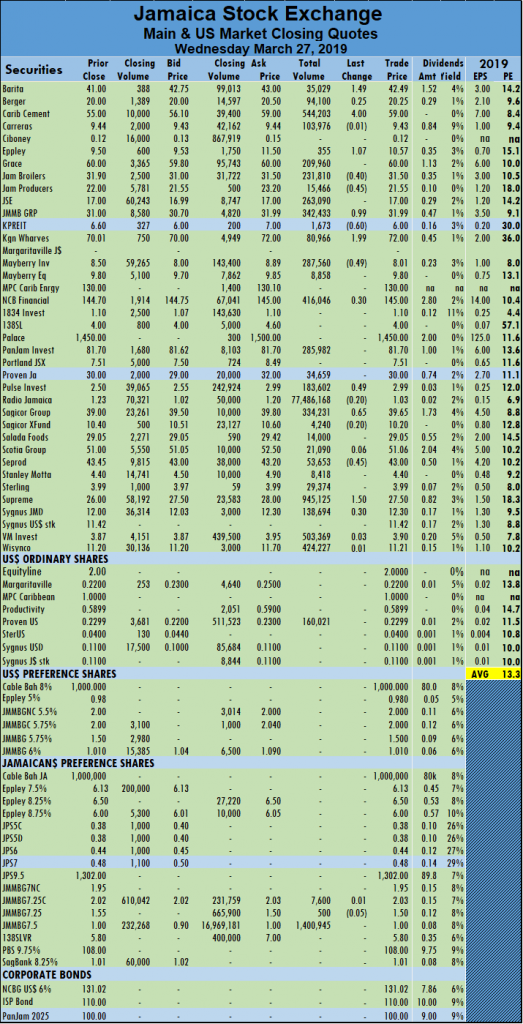

At the close of trading, the JSE All Jamaican Composite Index jumped 3,483.21 points to 424,499.16 and the JSE Index climbed a strong 3,165.22 points to 386,748.97.

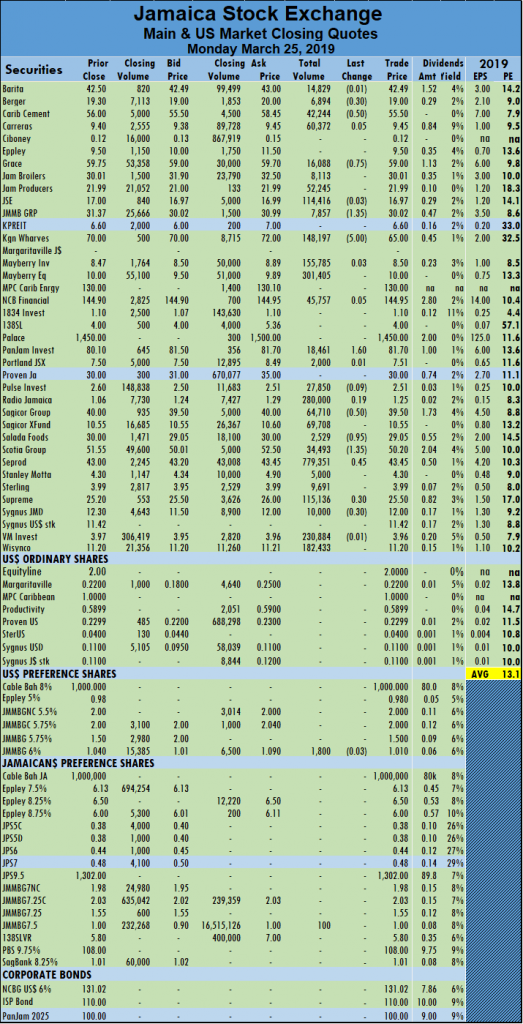

At the close of the main and US markets, 34 securities traded, compared to 33 on Tuesday and leading to 15 advancing, 9 declining and 10 closing unchanged. Caribbean Cement and Supreme Ventures ended at 52 weeks’ closing high.

Trading ended with 84,511,402 units at $295,941,707 compared to 3,652,445 units at $151,937,909, changing hands on Tuesday. Radio Jamaica led trading with 84.5 million shares, accounting for 92 percent of the day’s volume in the main market, followed by JMMB Group 7.5% preference share with 1.4 million units or 1.7 percent of the volume traded and Supreme Ventures with 945,125 shares amounting to one percent of the overall volume.

Market activity ended with an average of 2,560,952 units valued at an average of $8,967,930 for each security traded. In contrast to 121,748 units for an average of $5,064,597 on Tuesday. The average volume and value for the month to date, amounts to 468,945 shares at $10,386,003 for each security traded, in contrast to 347,829 shares at $10,473,147 on the prior trading day. Trading for February resulted in an average of 281,016 shares with a value of $11,715,160, for each security traded.

IC bid-offer Indicator|The Investor’s Choice bid-offer indicator ended with the reading showing 13 stocks ending with bids higher than their last selling prices and none closing with a lower offer.

In main market activity, Barita Investments closed with a rise of $1.49 at $42.49, with 35,029 shares trading, Berger Paints gained 25 cents to $20.25, in exchanging 94,100 stock units, Caribbean Cement jumped $4 to a record close of $59, with 544,203 shares changing hands. Eppley traded 355 shares and jumped $1.07 to $10.57, Jamaica Broilers dropped 40 cents and finished trading 231,810 units at $31.50, Jamaica Producers lost 45 cents to close at $21.55, with 15,466 shares changing  hands, JMMB Group rose 99 cents trading of 342,433 shares to close at $31.99. Kingston Properties lost 60 cents to settle at $6, trading 1,673 units, Kingston Wharves jumped $1.99 and finished at $72, with an exchange of 80,966 stock units, Mayberry Investments lost 49 cents trading 287,560 shares to close at $8.01, NCB Financial Group gained 30 cents trading 416,046 shares at $145. Pulse Investments gained 49 cents to finish at $2.99, with 183,602 shares trading, Sagicor Group rose 65 cents to settle at $39.65, with 334,231 shares changing hands. Seprod fell 45 cents to close at $43 in trading 53,653 shares and Supreme Ventures rose $1.50 to finish at a 52 weeks’ closing high of $27.50, with an exchange of 945,125 units.

hands, JMMB Group rose 99 cents trading of 342,433 shares to close at $31.99. Kingston Properties lost 60 cents to settle at $6, trading 1,673 units, Kingston Wharves jumped $1.99 and finished at $72, with an exchange of 80,966 stock units, Mayberry Investments lost 49 cents trading 287,560 shares to close at $8.01, NCB Financial Group gained 30 cents trading 416,046 shares at $145. Pulse Investments gained 49 cents to finish at $2.99, with 183,602 shares trading, Sagicor Group rose 65 cents to settle at $39.65, with 334,231 shares changing hands. Seprod fell 45 cents to close at $43 in trading 53,653 shares and Supreme Ventures rose $1.50 to finish at a 52 weeks’ closing high of $27.50, with an exchange of 945,125 units.

Trading in the US dollar market resulted in 160,021 units for US$36,774 changing hands with Proven Investments traded 160,021 units at 22.99 US cents. The JSE USD Equities Index lost 0.08 points to close at 179.78.

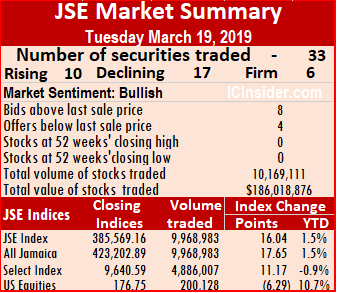

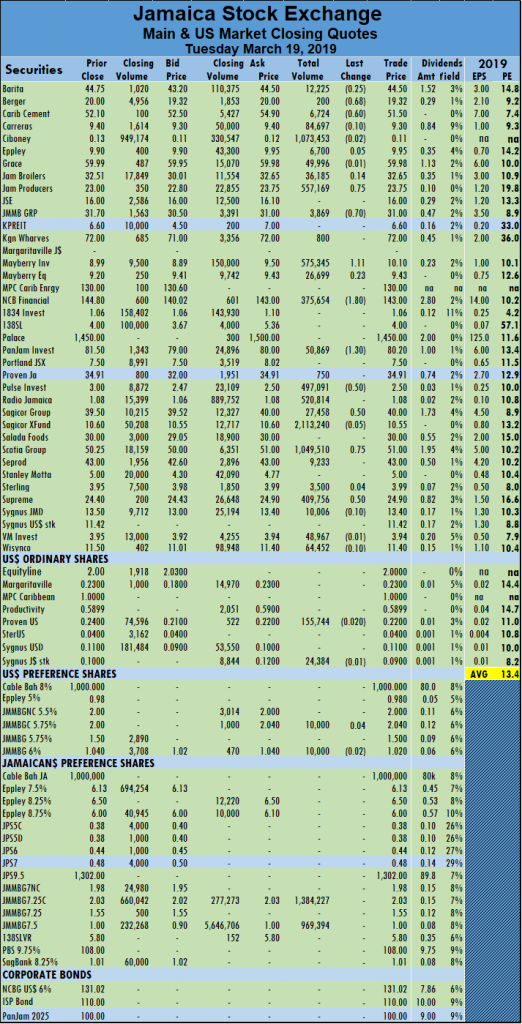

Trading on the main market of the Jamaica Stock Exchange ended on Tuesday with JSE All Jamaican Composite Index recovered 2,246.27 points it lost on Monday to reach 421,015.95 and the JSE Index regained 2,041.20 points to end at 383,583.75.

Trading on the main market of the Jamaica Stock Exchange ended on Tuesday with JSE All Jamaican Composite Index recovered 2,246.27 points it lost on Monday to reach 421,015.95 and the JSE Index regained 2,041.20 points to end at 383,583.75. and Victoria Mutual Investments with 367,668 shares amounting to 10 percent of the overall volume.

and Victoria Mutual Investments with 367,668 shares amounting to 10 percent of the overall volume. 50 cents to close at $55, with 41,992 shares changing hands. Grace Kennedy gained $1 trading 1,667,776 stock units, to close at $59, Jamaica Broilers climbed $1.89 and finished trading 4,783 units at $31.90, JMMB Group rose 98 cents trading of 57,316 shares to close at $31. Kingston Wharves jumped $5.01 and finished at $70.01, with an exchange of 2,179 stock units, NCB Financial Group lost 25 cents and ended trading 85,329 shares at $144.70, Sagicor Group lost 50 cents to settle at $39, with 10,211 shares changing hands. Scotia Group gained 80 cents, trading 1,672 shares, to close at $51, Supreme Ventures rose 50 cents to finish at a 52 weeks’ closing high of $26, with an exchange of 120,455 units.

50 cents to close at $55, with 41,992 shares changing hands. Grace Kennedy gained $1 trading 1,667,776 stock units, to close at $59, Jamaica Broilers climbed $1.89 and finished trading 4,783 units at $31.90, JMMB Group rose 98 cents trading of 57,316 shares to close at $31. Kingston Wharves jumped $5.01 and finished at $70.01, with an exchange of 2,179 stock units, NCB Financial Group lost 25 cents and ended trading 85,329 shares at $144.70, Sagicor Group lost 50 cents to settle at $39, with 10,211 shares changing hands. Scotia Group gained 80 cents, trading 1,672 shares, to close at $51, Supreme Ventures rose 50 cents to finish at a 52 weeks’ closing high of $26, with an exchange of 120,455 units.

148,197 stock units, PanJam Investment rose $1.60 to close at $81.70, trading 18,461 units, Sagicor Group lost 50 cents to settle at $39.50, with 64,710 shares changing hands. Salada Foods fell 95 cents in trading 2,529 units at $29.05, Scotia Group dropped $1.35 trading 34,493 shares, to close at $50.20,

148,197 stock units, PanJam Investment rose $1.60 to close at $81.70, trading 18,461 units, Sagicor Group lost 50 cents to settle at $39.50, with 64,710 shares changing hands. Salada Foods fell 95 cents in trading 2,529 units at $29.05, Scotia Group dropped $1.35 trading 34,493 shares, to close at $50.20,

JMMB Group rose 37 cents in concluding trading of 25,478 shares at $31.37. Kingston Wharves dropped $2 and finished at $70, with an exchange of 2,518 stock units, Mayberry Investments lost 53 cents to end trading of 79,692 shares at $8.47, Mayberry Jamaica Equities traded 38,242 shares after rising by 55 cents to close at $10. PanJam Investment fell $1.60 to close at $80.10, trading 70,826 units, Sagicor Group gained 45 cents and settled at $40, with 18,955 shares changing hands, Scotia Group climbed $1.35 trading 1,148,109 shares to close at $51.55 and Sygnus Credit Investments fell $1.05 to close of $12.30, with 180,000 units changing hands.

JMMB Group rose 37 cents in concluding trading of 25,478 shares at $31.37. Kingston Wharves dropped $2 and finished at $70, with an exchange of 2,518 stock units, Mayberry Investments lost 53 cents to end trading of 79,692 shares at $8.47, Mayberry Jamaica Equities traded 38,242 shares after rising by 55 cents to close at $10. PanJam Investment fell $1.60 to close at $80.10, trading 70,826 units, Sagicor Group gained 45 cents and settled at $40, with 18,955 shares changing hands, Scotia Group climbed $1.35 trading 1,148,109 shares to close at $51.55 and Sygnus Credit Investments fell $1.05 to close of $12.30, with 180,000 units changing hands. Volume traded on the Jamaica Stock Exchange on Thursday dived sharply, to be well below normal levels, with just 1,589,969 units valued $46,193,207 crossing the market,

Volume traded on the Jamaica Stock Exchange on Thursday dived sharply, to be well below normal levels, with just 1,589,969 units valued $46,193,207 crossing the market,  389,701 shares at $11,692,398 for each security traded, in contrast to 414,746 shares at $12,506,920 on the prior trading day. Trading for February resulted in an average of 281,016 shares with a value of $11,715,160, for each security traded.

389,701 shares at $11,692,398 for each security traded, in contrast to 414,746 shares at $12,506,920 on the prior trading day. Trading for February resulted in an average of 281,016 shares with a value of $11,715,160, for each security traded. concluding trading with 96,005 shares at $31, Mayberry Investments lost 50 cents to end trading of 21,120 shares at $9. PanJam Investment gained 70 cents to $81.70, trading 14,162 units, Portland JSX fell 99 cents in trading 4,991 stock units to close at $7.50, Proven Investments dropped $5 to $30 trading 26,000 shares, Pulse Investments fell 39 cents to $2.60, with an exchange of 81,700 stock units, Scotia Group lost 80 cents trading 11,974 shares to close at $50.20 and Supreme Ventures rose 30 cents and finished at record close of $25.30, with 221,684 units changing hands.

concluding trading with 96,005 shares at $31, Mayberry Investments lost 50 cents to end trading of 21,120 shares at $9. PanJam Investment gained 70 cents to $81.70, trading 14,162 units, Portland JSX fell 99 cents in trading 4,991 stock units to close at $7.50, Proven Investments dropped $5 to $30 trading 26,000 shares, Pulse Investments fell 39 cents to $2.60, with an exchange of 81,700 stock units, Scotia Group lost 80 cents trading 11,974 shares to close at $50.20 and Supreme Ventures rose 30 cents and finished at record close of $25.30, with 221,684 units changing hands.

contrast to 389,292 shares at $5,984,735 on the prior trading day. Trading for February resulted in an average of 281,016 shares with a value of $11,715,160, for each security traded.

contrast to 389,292 shares at $5,984,735 on the prior trading day. Trading for February resulted in an average of 281,016 shares with a value of $11,715,160, for each security traded. to close at $144.90. PanJam Investment gained 80 cents to $81, trading 5,113 units, Portland JSX gained 99 cents in trading 11,119 stock units to close at $8.49, Pulse Investments gained 49 cents to $2.99, with an exchange of 11,555 stock units, Sagicor Group lost 48 cents in trading 196,108 shares, to close at $39.52.

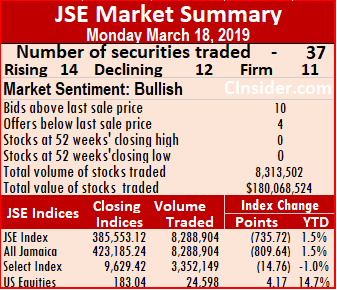

to close at $144.90. PanJam Investment gained 80 cents to $81, trading 5,113 units, Portland JSX gained 99 cents in trading 11,119 stock units to close at $8.49, Pulse Investments gained 49 cents to $2.99, with an exchange of 11,555 stock units, Sagicor Group lost 48 cents in trading 196,108 shares, to close at $39.52. The volume of stocks traded on the main and US dollar markets of the Jamaica Stock Exchange on Tuesday rose over Monday’s level, with just a minimal decline in value as less securities were active.

The volume of stocks traded on the main and US dollar markets of the Jamaica Stock Exchange on Tuesday rose over Monday’s level, with just a minimal decline in value as less securities were active.

50,869 units, Pulse Investments shed 50 cents and closed at $2.50, with an exchange of 497,091 stock units, Sagicor Group gained 50 cents in trading 27,458 shares, to close at $40. Scotia Group gained 75 cents in trading 1,049,510 stock units to close at $51 and Supreme Ventures concluded trading with a gain of 50 cents to end at $24.90, with 409,756 stock units changing hands.

50,869 units, Pulse Investments shed 50 cents and closed at $2.50, with an exchange of 497,091 stock units, Sagicor Group gained 50 cents in trading 27,458 shares, to close at $40. Scotia Group gained 75 cents in trading 1,049,510 stock units to close at $51 and Supreme Ventures concluded trading with a gain of 50 cents to end at $24.90, with 409,756 stock units changing hands.

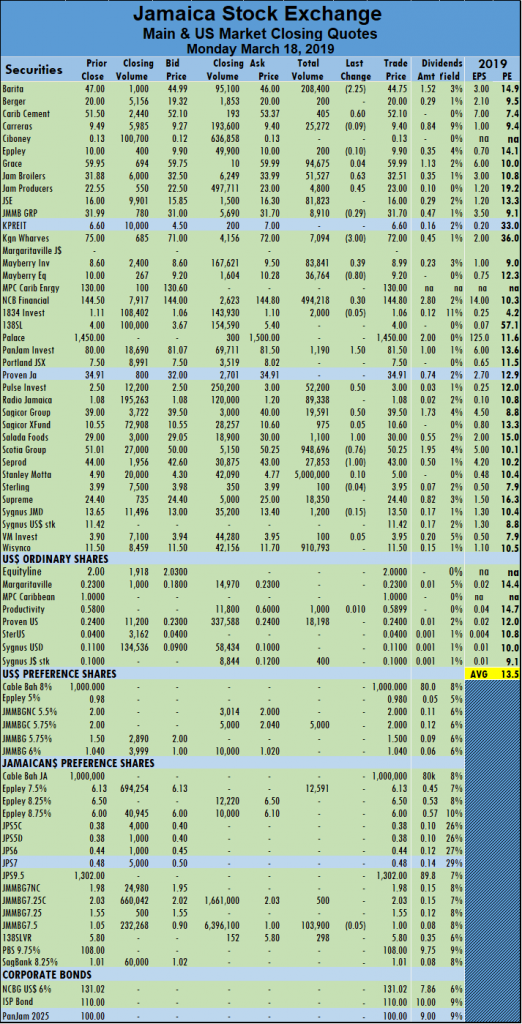

and closed at $3, with an exchange of 52,200 stock units, Sagicor Group gained 50 cents in trading 19,591 shares, to close at $39.50. Salada Foods gained $1 trading 1,100 units to close at $30, Scotia Group fell 76 cents in trading 948,696 stock units to close at $50.25 and Seprod lost $1 to close at $43, with 27,853 shares changing hands.

and closed at $3, with an exchange of 52,200 stock units, Sagicor Group gained 50 cents in trading 19,591 shares, to close at $39.50. Salada Foods gained $1 trading 1,100 units to close at $30, Scotia Group fell 76 cents in trading 948,696 stock units to close at $50.25 and Seprod lost $1 to close at $43, with 27,853 shares changing hands. The market indices of the main market of the Jamaica Stock Exchange rose at the end of trading on Friday, with JSE All Jamaican Composite Index increased by 805.06 points to 423,994.88 and the JSE Index advanced 731.56 points to 386,288.84.

The market indices of the main market of the Jamaica Stock Exchange rose at the end of trading on Friday, with JSE All Jamaican Composite Index increased by 805.06 points to 423,994.88 and the JSE Index advanced 731.56 points to 386,288.84.

trading 18,701 shares, to close at $39. Salada Foods lost 95 cents trading 1,808 units to close at $29.05, Scotia Group fell 39 cents to end trading at $51.01, with 150,247 units, Seprod lost 50 cents to close at $44, with 31,309 shares changing hands, Supreme Ventures concluded trading at $24.40, with 237,378 stock units, Sygnus Credit Investments added 35 cents to close at $13.65 trading 17,212 shares and Wisynco Group fell 50 cents settled at $11.50, with an exchange of 6,381,077 shares.

trading 18,701 shares, to close at $39. Salada Foods lost 95 cents trading 1,808 units to close at $29.05, Scotia Group fell 39 cents to end trading at $51.01, with 150,247 units, Seprod lost 50 cents to close at $44, with 31,309 shares changing hands, Supreme Ventures concluded trading at $24.40, with 237,378 stock units, Sygnus Credit Investments added 35 cents to close at $13.65 trading 17,212 shares and Wisynco Group fell 50 cents settled at $11.50, with an exchange of 6,381,077 shares.