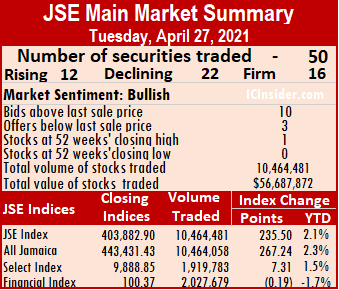

Stocks stretched gains for another day at the close of trading on Tuesday, making it the eleventh day of unbroken gains as the Jamaica Stock Exchange Main Market ended with an exchange of very low volume of stocks trading that still ended 31 percent more, with the value up 14 percent compared to Monday’s trades.

The All Jamaican Composite Index rose 267.24 points to 443,431.43, the Main Index gained 235.50 points to 403,882.90, but the JSE Financial Index slipped 0.19 points to settle at 100.37.

The All Jamaican Composite Index rose 267.24 points to 443,431.43, the Main Index gained 235.50 points to 403,882.90, but the JSE Financial Index slipped 0.19 points to settle at 100.37.

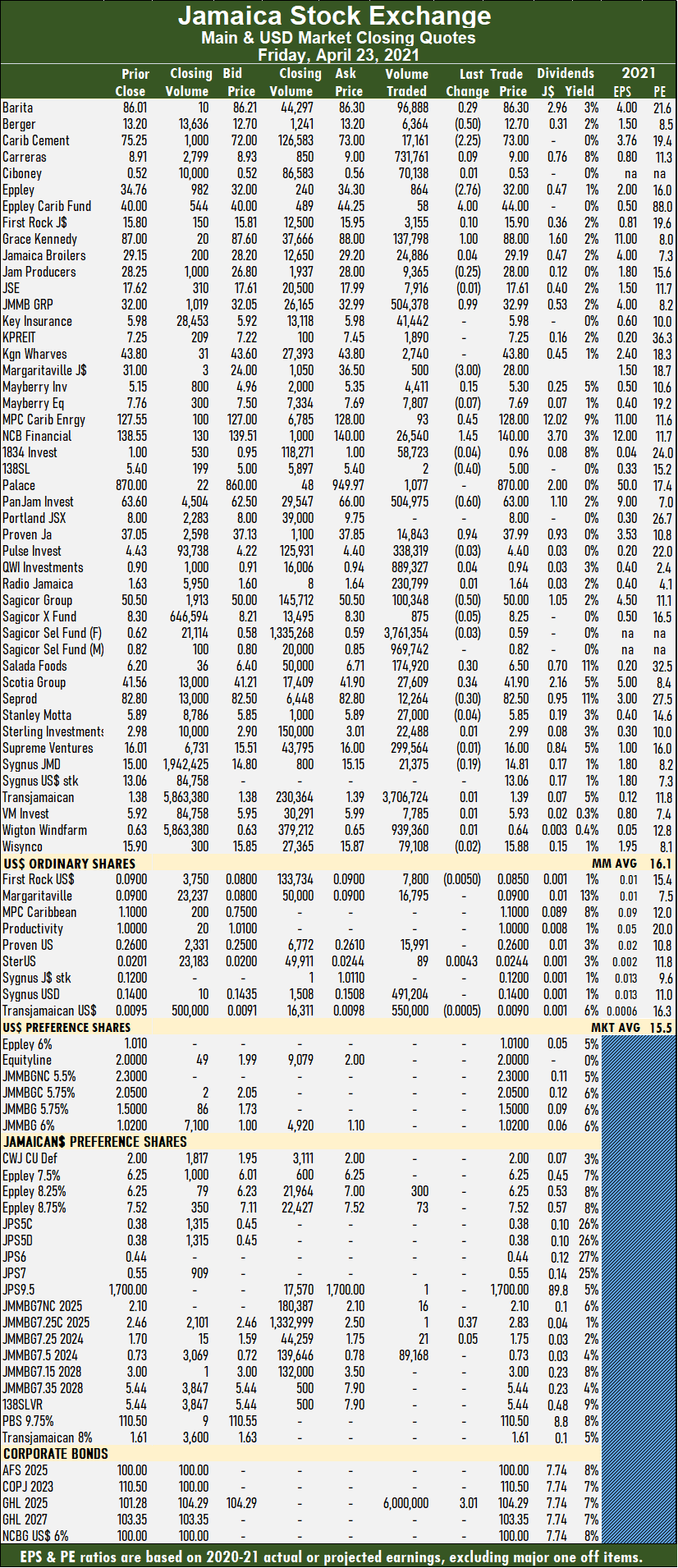

Trading ended with 50 securities, down from 52 on Monday and closed with prices of 19 stocks rising, 18 declining and 13 remaining unchanged. One stock traded at an intraday 52 weeks’ high and one ended at a closing 52 weeks’ high. The PE Ratio averages 16.1 based on ICInsider.com forecast of 2021-22 earnings.

Investors traded 10,464,481 shares for just $56,687,872 up from a paltry 7,978,781 units at $49,570,730 on Monday. Transjamaican Highway led trading with 25.2 percent of total volume for an exchange of 2.63 million shares, followed by Wigton Windfarm with 18.6 percent for 1.95 million units, QWI Investments 11.3 percent, with 1.19 million units and Sagicor Select Financial Fund 10.1 percent with 1.06 million units.

Trading averaged 209,290 units at $1,133,757, up from 153,438 shares at $953,283 on Monday. Month to date trading averages 229,131 units at $1,490,898, in contrast to 230,425 units at $1,514,180 on Monday. March averaged 354,304 units at $2,543,232.

Trading averaged 209,290 units at $1,133,757, up from 153,438 shares at $953,283 on Monday. Month to date trading averages 229,131 units at $1,490,898, in contrast to 230,425 units at $1,514,180 on Monday. March averaged 354,304 units at $2,543,232.

Investor’s Choice bid-offer indicator shows ten stocks ending with bids higher than their last selling prices and three with lower offers.

At the close, Barita Investments advanced 21 cents to $86.50 with an exchange of 4,593 shares, Berger Paints rose 80 cents to $13.50 after 5,678 stock units crossed the exchange, Caribbean Cement declined $1.70 to $74.25 with investors switching ownership of 7,814 units. Carreras gained 34 cents to close at $9.40 in the trading of 774,927 shares, Grace Kennedy fell $1 to close at $87 in the transfer of 76,808 shares, Jamaica Broilers rose $2.95 to a 52 weeks’ high of $32.15 in an exchange of 97,910 stocks, Jamaica Producers shed 80 cents to close at $27.70 with the swapping of 16,771 stock units. JMMB Group lost 50 cents to end at $32 after an exchange of 121,570 shares, Key Insurance rose 35 cents to $5.95 with 195,569 stocks changing hands, Kingston Properties picked up 20 cents in closing at $7.45 in trading 100 units. Margaritaville fell $1.01 to $28.99 with the swapping of 4,703 shares, Palace Amusement climbed $9 to $949 in switching ownership of 185 stocks, PanJam Investment declined $2.38 to $63.62 in the trading of 9,952 stock units, Salada Foods shed 43 cents to end at $6.50 with 649,659 shares changing hands after trading at a 52 weeks’ intraday high of $7.43. Scotia Group gained 50 cents to finish at $43 with 6,799 stocks crossing the market and Seprod closed 50 cents higher at $82.50 with the swapping of 63,099 stock units.

Salada Foods shed 43 cents to end at $6.50 with 649,659 shares changing hands after trading at a 52 weeks’ intraday high of $7.43. Scotia Group gained 50 cents to finish at $43 with 6,799 stocks crossing the market and Seprod closed 50 cents higher at $82.50 with the swapping of 63,099 stock units.

In the preference segment, Eppley 8.75% preference share dropped $1.01 to $6.51, with 25 units crossing the market.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Trading was halted towards the original close after the trading platform encountered problems, closing market activity until minutes to 3 pm ahead of the close for the day.

Trading was halted towards the original close after the trading platform encountered problems, closing market activity until minutes to 3 pm ahead of the close for the day. Trading averaged 153,438 units at $953,283, down from 272,764 shares at $2,129,432 on Friday. Month to date trading averages 230,425 units at $1,514,180, in contrast to 235,024 units at $1,554,972 on Friday. March averaged 354,304 units at $2,543,232.

Trading averaged 153,438 units at $953,283, down from 272,764 shares at $2,129,432 on Friday. Month to date trading averages 230,425 units at $1,514,180, in contrast to 235,024 units at $1,554,972 on Friday. March averaged 354,304 units at $2,543,232. Salada Foods gained 43 cents to close at a 52 weeks’ high of $6.93 in the trading of 118,708 stock units. Scotia Group gained 60 cents to end at $42.50 after exchanging 53,675 units, Seprod fell 50 cents to $82 with the swapping of 6,856 stocks and Victoria Mutual Investments gained 52 cents to end at $6.45 with 254,746 stock units changing hands.

Salada Foods gained 43 cents to close at a 52 weeks’ high of $6.93 in the trading of 118,708 stock units. Scotia Group gained 60 cents to end at $42.50 after exchanging 53,675 units, Seprod fell 50 cents to $82 with the swapping of 6,856 stocks and Victoria Mutual Investments gained 52 cents to end at $6.45 with 254,746 stock units changing hands. Future Energy Source

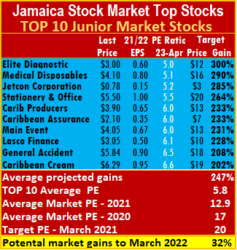

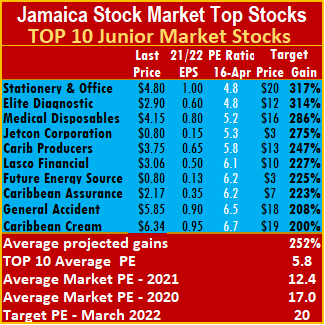

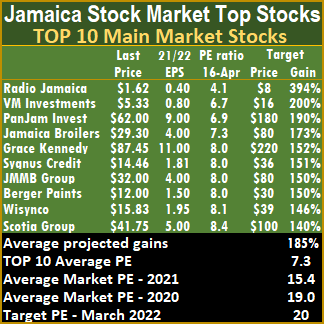

Future Energy Source  The top three stocks in the Junior Market are headed by Elite Diagnostic, followed by Medical Disposables and Jetcon Corporation, with the potential to gain between 285 to 300 percent. The top three Main Market stocks are Radio Jamaica in the number one spot, followed by PanJam Investment and VM Investments, with expected gains of 174 to 388 percent.

The top three stocks in the Junior Market are headed by Elite Diagnostic, followed by Medical Disposables and Jetcon Corporation, with the potential to gain between 285 to 300 percent. The top three Main Market stocks are Radio Jamaica in the number one spot, followed by PanJam Investment and VM Investments, with expected gains of 174 to 388 percent.

The targeted PE ratio for the market averages 20 based on profits of companies reporting full year’s results, up to the second quarter of 2022. Fiscal 2020-21 ended March 2021 with the average PE at 17 for Junior Stocks and 19 times for the Main Market. With interest rates on government paper below 5 percent and likely to remain there for a few years, the likelihood is for the average PE ratios to climb higher during the next twelve months.

The targeted PE ratio for the market averages 20 based on profits of companies reporting full year’s results, up to the second quarter of 2022. Fiscal 2020-21 ended March 2021 with the average PE at 17 for Junior Stocks and 19 times for the Main Market. With interest rates on government paper below 5 percent and likely to remain there for a few years, the likelihood is for the average PE ratios to climb higher during the next twelve months. The Main Market TOP 10 trades at a PE of 7.5 or 47 percent of the PE of that market and well off the potential of 20.

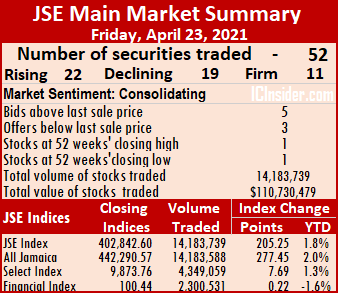

The Main Market TOP 10 trades at a PE of 7.5 or 47 percent of the PE of that market and well off the potential of 20. A total of 52 securities traded, up from 49 on Thursday, with prices of 22 rising, 19 declining and 11 remaining unchanged. The PE Ratio, based on ICInsider.com’s forecast of 2021-22 earnings, averages 16.1.

A total of 52 securities traded, up from 49 on Thursday, with prices of 22 rising, 19 declining and 11 remaining unchanged. The PE Ratio, based on ICInsider.com’s forecast of 2021-22 earnings, averages 16.1. Investor’s Choice bid-offer indicator reading has five stocks ending with bids higher than the last selling prices and three with lower offers.

Investor’s Choice bid-offer indicator reading has five stocks ending with bids higher than the last selling prices and three with lower offers. Salada Foods picked up 30 cents to end at $6.50, with 174,920 shares changing hands, Scotia Group closed 34 cents higher at $41.90 after exchanging 27,609 stock units and Seprod fell 30 cents to $82.50 with 12,264 stock units changing hands.

Salada Foods picked up 30 cents to end at $6.50, with 174,920 shares changing hands, Scotia Group closed 34 cents higher at $41.90 after exchanging 27,609 stock units and Seprod fell 30 cents to $82.50 with 12,264 stock units changing hands. Trading averaged 161,250 units at $1,642,104, compared to an average of 169,965 shares at $947,558 on Wednesday. Month to date trading averages 232,142 units at $1,509,917, in contrast to 238,879 units at $1,499,367 on Wednesday. March averaged 354,304 units at $2,543,232.

Trading averaged 161,250 units at $1,642,104, compared to an average of 169,965 shares at $947,558 on Wednesday. Month to date trading averages 232,142 units at $1,509,917, in contrast to 238,879 units at $1,499,367 on Wednesday. March averaged 354,304 units at $2,543,232. Sagicor Group gained 50 cents to close at $50.50 in trading 8,039 shares, Salada Foods picked up 25 cents to settle at a 52 weeks’ high of $6.20 with the swapping of 96,977 stock units and Seprod declined $1.19 to $82.80 in switching ownership of 22,436 shares.

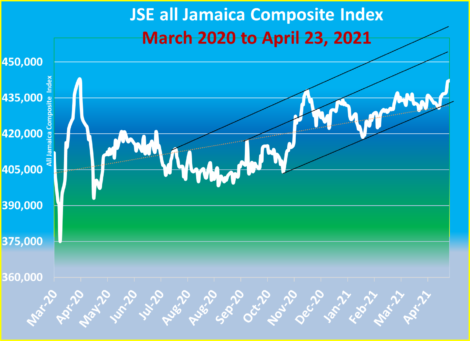

Sagicor Group gained 50 cents to close at $50.50 in trading 8,039 shares, Salada Foods picked up 25 cents to settle at a 52 weeks’ high of $6.20 with the swapping of 96,977 stock units and Seprod declined $1.19 to $82.80 in switching ownership of 22,436 shares. The market continues to get support for the upward rise, from three technical indicators, with one of the most powerful that suggests big gains from the channel that it has been trading in for months. It has broken out of the range and is heading for a new one.

The market continues to get support for the upward rise, from three technical indicators, with one of the most powerful that suggests big gains from the channel that it has been trading in for months. It has broken out of the range and is heading for a new one. Transjamaican Highway led trading with 26.2 percent for 2.05 million shares, followed by Wigton Windfarm with 24.1 percent for 1.88 million units and Sagicor Select Financial Fund with 16 percent for 1.25 million units.

Transjamaican Highway led trading with 26.2 percent for 2.05 million shares, followed by Wigton Windfarm with 24.1 percent for 1.88 million units and Sagicor Select Financial Fund with 16 percent for 1.25 million units. Proven Investments lost 39 cents to settle at $37.11 in the trading of 18,182 stocks, Salada Foods rose 65 cents to end at $5.95 with the swapping of 65,978 shares, Scotia Group shed 37 cents ending at $41.62 in transferring 8,910 stock units and Supreme Ventures rose 29 cents to close at $16.14 after 41,765 units crossed the market.

Proven Investments lost 39 cents to settle at $37.11 in the trading of 18,182 stocks, Salada Foods rose 65 cents to end at $5.95 with the swapping of 65,978 shares, Scotia Group shed 37 cents ending at $41.62 in transferring 8,910 stock units and Supreme Ventures rose 29 cents to close at $16.14 after 41,765 units crossed the market.

Trading averaged 359,225 units at $1,671,530, compared to 147,962 shares at $1,483,871 on Monday. Month to date trading averages 244,460 units at $1,544,056 in contrast to 232,625 units at $1,532,021 on Monday. March averaged 354,304 units at $2,543,232.

Trading averaged 359,225 units at $1,671,530, compared to 147,962 shares at $1,483,871 on Monday. Month to date trading averages 244,460 units at $1,544,056 in contrast to 232,625 units at $1,532,021 on Monday. March averaged 354,304 units at $2,543,232. Sagicor Group fell 49 cents to $50 with 16,629 shares changing hands, Scotia Group gained 34 cents to end at $41.99 in the transfer of 37,458 stock units, Seprod advanced $1.08 to close at a 52 weeks’ high of $84 with the swapping of 127,859 shares, Stanley Motta rose 61 cents to finish at $5.91 after an exchange of 25,420 stock units. Supreme Ventures advanced $1.75 to $15.85, trading 104,384 shares and Sygnus Credit Investments gained 50 cents in ending at $15 with an exchange of 74,006 stock units.

Sagicor Group fell 49 cents to $50 with 16,629 shares changing hands, Scotia Group gained 34 cents to end at $41.99 in the transfer of 37,458 stock units, Seprod advanced $1.08 to close at a 52 weeks’ high of $84 with the swapping of 127,859 shares, Stanley Motta rose 61 cents to finish at $5.91 after an exchange of 25,420 stock units. Supreme Ventures advanced $1.75 to $15.85, trading 104,384 shares and Sygnus Credit Investments gained 50 cents in ending at $15 with an exchange of 74,006 stock units. The All Jamaican Composite Index increased 351.51 points to 436,947.49, the JSE Main Index carved out a gain of 316.37 points to close at 398,063.87 and the JSE Financial Index advanced 0.16 points to 99.60.

The All Jamaican Composite Index increased 351.51 points to 436,947.49, the JSE Main Index carved out a gain of 316.37 points to close at 398,063.87 and the JSE Financial Index advanced 0.16 points to 99.60. Transjamaican Highway led trading with 46.2 percent of total volume for 3.49 million shares, followed by Wigton Windfarm with 17.6 percent for 1.33 million units and Caribbean Cement with 6.8 percent for 513,466 units changing hands.

Transjamaican Highway led trading with 46.2 percent of total volume for 3.49 million shares, followed by Wigton Windfarm with 17.6 percent for 1.33 million units and Caribbean Cement with 6.8 percent for 513,466 units changing hands. Sagicor Group gained 49 cents to close at $50.49 after exchanging 12,602 units, Seprod jumped $6.32 higher to a 52 weeks’ high of $82.92 with 8,914 stock units clearing the market. Supreme Ventures shed $1.90 in closing at $14.10 in the trading of 422,951 stocks and Victoria Mutual Investments gained 45 cents in ending at $5.78 with 58,944 units changing hands.

Sagicor Group gained 49 cents to close at $50.49 after exchanging 12,602 units, Seprod jumped $6.32 higher to a 52 weeks’ high of $82.92 with 8,914 stock units clearing the market. Supreme Ventures shed $1.90 in closing at $14.10 in the trading of 422,951 stocks and Victoria Mutual Investments gained 45 cents in ending at $5.78 with 58,944 units changing hands. Increased buying came into the market for

Increased buying came into the market for

The main market continues to trade in a narrow channel and now shows signs that a break out is imminent. First quarter results start coming in the latter part of this month and will determine the short-term move. In this regard, watch Barita Investments, Caribbean Cement, Grace Kennedy, Jamaica Producers, NCB Financial, PanJam Investment and Sagior Group.

The main market continues to trade in a narrow channel and now shows signs that a break out is imminent. First quarter results start coming in the latter part of this month and will determine the short-term move. In this regard, watch Barita Investments, Caribbean Cement, Grace Kennedy, Jamaica Producers, NCB Financial, PanJam Investment and Sagior Group.

The results show a marked improvement over November when revenues fell from $283 million to $149 million with a loss of $34 million. The results for the latest quarter supports ICInsider.com’s forecast for the company to return to profit for the 2022 fiscal year.

The results show a marked improvement over November when revenues fell from $283 million to $149 million with a loss of $34 million. The results for the latest quarter supports ICInsider.com’s forecast for the company to return to profit for the 2022 fiscal year. The JSE Main Market ended the week with an overall PE of 15.4, some distance from the 19 the market ended March at. The Main Market TOP 10 trades at a PE of 7.3 or 48 percent of the PE of that market and well off the potential of 20.

The JSE Main Market ended the week with an overall PE of 15.4, some distance from the 19 the market ended March at. The Main Market TOP 10 trades at a PE of 7.3 or 48 percent of the PE of that market and well off the potential of 20. The All Jamaican Composite Index rose 833.77 points to 436,595.98, the JSE Main Index advanced 740.65 points to 397,747.50 and the JSE Financial Index fell 0.54 points to settle at 99.44.

The All Jamaican Composite Index rose 833.77 points to 436,595.98, the JSE Main Index advanced 740.65 points to 397,747.50 and the JSE Financial Index fell 0.54 points to settle at 99.44. Trading averaged 329,212 units at $1,900,231, compared to 300,514 shares at $5,517,023 on Thursday. Month to date trading averages 242,960 units at $1,537,268, in contrast to 231,331 units at $1,496,747 on Thursday. March averaged 354,304 units at $2,543,232.

Trading averaged 329,212 units at $1,900,231, compared to 300,514 shares at $5,517,023 on Thursday. Month to date trading averages 242,960 units at $1,537,268, in contrast to 231,331 units at $1,496,747 on Thursday. March averaged 354,304 units at $2,543,232. Palace Amusement climbed $69 to close at $809 after trading 11 units, Portland JSX advanced 89 cents to $8 with investors switching ownership of 30,200 units, Proven Investments shed 70 cents in closing at $36 in an exchange of 10,779 stock units. Scotia Group lost 24 cents in closing at $41.75 in switching ownership of 89,361 shares. Seprod rose $1.10 to end at $76.60 after 12,053 stocks crossed the exchange, Supreme Ventures gained 49 cents to close at $16 with a transfer of 38,806 shares and Wisynco Group rose 73 cents to $15.83 in the swapping of 36,486 units.

Palace Amusement climbed $69 to close at $809 after trading 11 units, Portland JSX advanced 89 cents to $8 with investors switching ownership of 30,200 units, Proven Investments shed 70 cents in closing at $36 in an exchange of 10,779 stock units. Scotia Group lost 24 cents in closing at $41.75 in switching ownership of 89,361 shares. Seprod rose $1.10 to end at $76.60 after 12,053 stocks crossed the exchange, Supreme Ventures gained 49 cents to close at $16 with a transfer of 38,806 shares and Wisynco Group rose 73 cents to $15.83 in the swapping of 36,486 units.