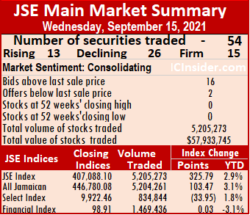

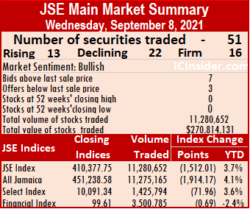

The number of securities trading rose above Tuesday’s level but the volume of stocks plunged 58 percent and the value 70 percent below Tuesday’s as market activity ended Wednesday, with the Jamaica Stock Exchange Main Market with the market indices recording modest gains at the close as the Investor’s Choice bid-offer indicator was flashing one of the strongest short term bull signals for some time.

The All Jamaican Composite Index rose 103.47 points to 446,780.08, the Main Index advanced 325.79 points to 407,088.10 and JSE Financial Index popped 0.03 points to end at 98.91.

The All Jamaican Composite Index rose 103.47 points to 446,780.08, the Main Index advanced 325.79 points to 407,088.10 and JSE Financial Index popped 0.03 points to end at 98.91.

Trading ended with 54 securities up from 50 on Tuesday, with just 13 rising, 26 declining and 15 ending unchanged.

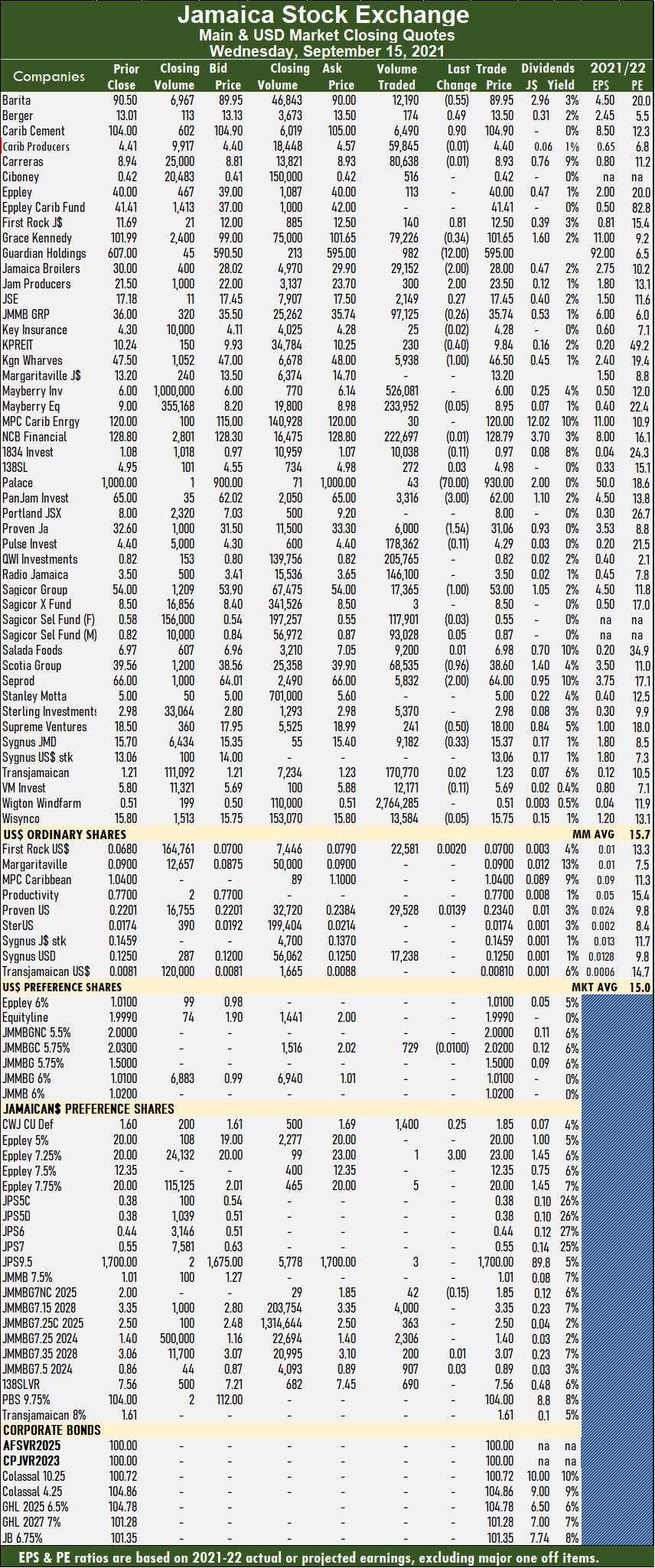

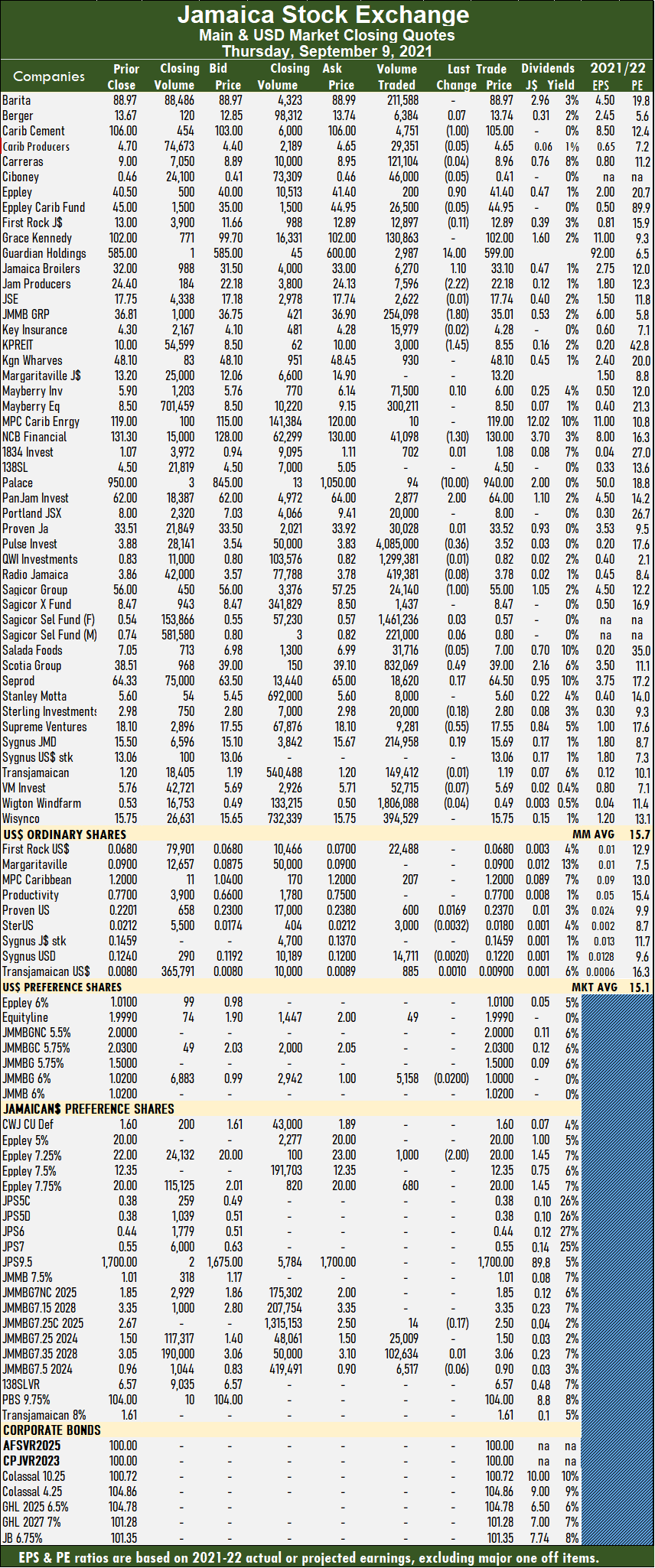

The PE Ratio, a measure used in computing appropriate stock values, averages 15.7 based on ICInsider.com forecast of 2021-22 earnings.

At the close, 5,205,273 shares traded for $57,933,745 versus 12,260,493 units at $193,948,042 on Tuesday. Wigton Windfarm led trading with 53.1 percent of total volume for an exchange of 2.76 million shares followed by Mayberry Investments 10.1 percent, with 526,081 units and Mayberry Jamaican Equities 4.5 percent, with 233,952 shares.

Trading averages 96,394 units at $1,072,847, compared to 245,210 shares at $3,878,961 on Tuesday and the month to date averages 371,981 units at $3,990,142, compared to 402,106 units at $4,309,037 on Tuesday. August closed with an average of 480,039 units at $8,561,549.

Investor’s Choice bid-offer indicator shows sixteen stocks ended with bids higher than their last selling prices and two with lower offers.

Investor’s Choice bid-offer indicator shows sixteen stocks ended with bids higher than their last selling prices and two with lower offers.

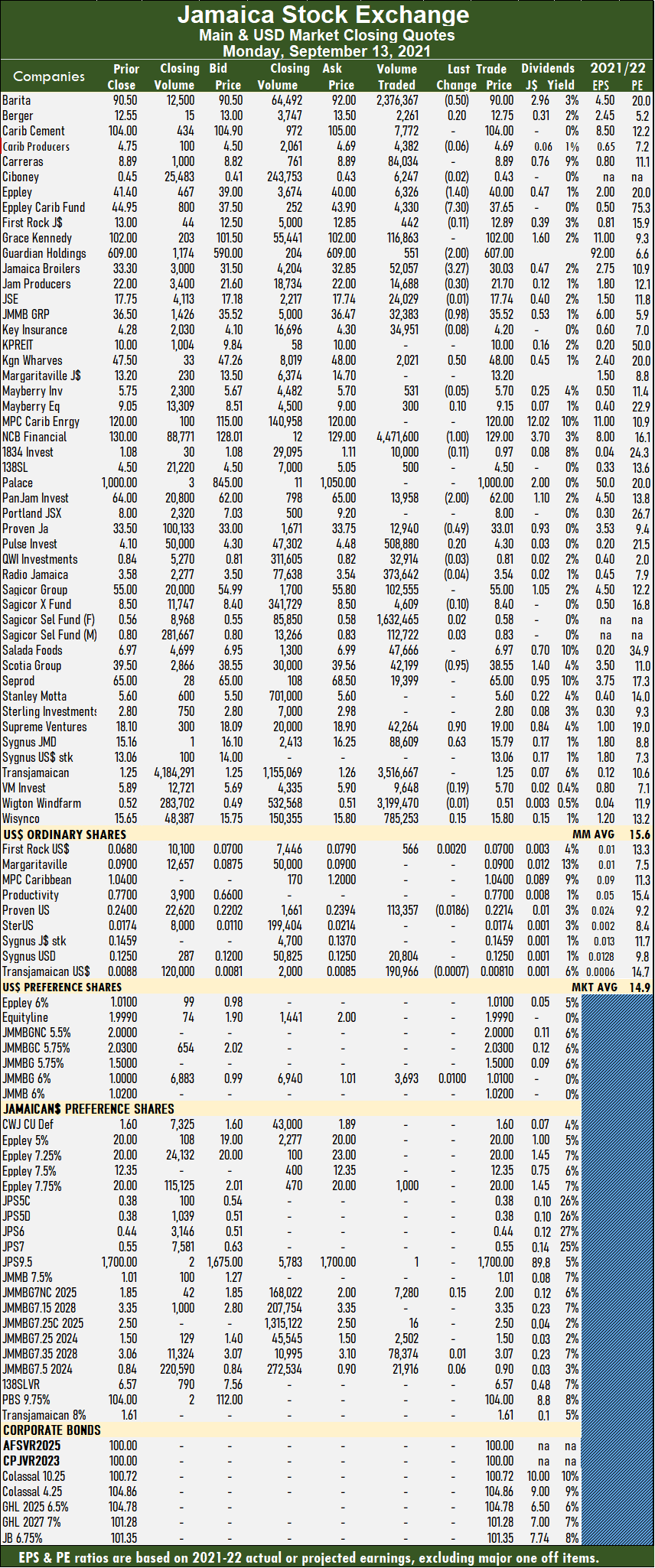

At the close, Barita Investments shed 55 cents in closing at $89.95 in an exchange of 12,190 shares, Berger Paints gained 49 cents to end at $13.50 with a transfer of 174 stock units, Caribbean Cement rallied 90 cents to $104.90 after 6,490 stocks cleared the market. First Rock Capital popped 81 cents to $12.50 with 140 units trading, GraceKennedy slipped 34 cents to $101.65 with the swapping of 79,226 stocks, Guardian Holdings dropped $12 to $595 in switching ownership of 982 stock units. Jamaica Broilers fell $2 to $28 in transferring 29,152 shares, Jamaica Producers advanced $2 to $23.50 in trading 300 units, Jamaica Stock Exchange rose 27 cents to $17.45 with an exchange of 2,149 stock units. JMMB Group lost 26 cents to close at $35.74 with 97,125 shares clearing the market, Kingston Properties lost 40 cents to $9.84 after 230 units crossed the market, Kingston Wharves fell $1 to $46.50 in exchanging 5,938 stocks. Palace Amusement dropped $70 to $930 with the swapping of 43 units, PanJam Investment declined $3 to $62 with an exchange of 3,316 stock units, Proven Investments shed $1.54 to close at $31.06 after trading 6,000 stocks.  Sagicor Group slipped $1 to $53 in exchanging 17,365 shares, Scotia Group shed 96 cents to end at $38.60 after a transfer of 68,535 stocks, Seprod declined $2 to $64 with an exchange of 5,832 units. Supreme Ventures fell 50 cents to $18 in switching ownership of 241 shares, Sygnus Credit Investments dipped 33 cents to $15.37 in trading 9,182 stock units.

Sagicor Group slipped $1 to $53 in exchanging 17,365 shares, Scotia Group shed 96 cents to end at $38.60 after a transfer of 68,535 stocks, Seprod declined $2 to $64 with an exchange of 5,832 units. Supreme Ventures fell 50 cents to $18 in switching ownership of 241 shares, Sygnus Credit Investments dipped 33 cents to $15.37 in trading 9,182 stock units.

In the preference segment, Community & Workers Credit Union popped 25 cents to $1.85 in exchanging 1,400 units and Eppley 7.25 climbed $3 to $23 with 1 stock crossing the exchange.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

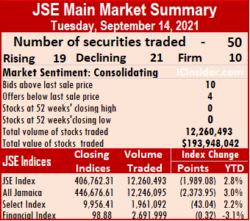

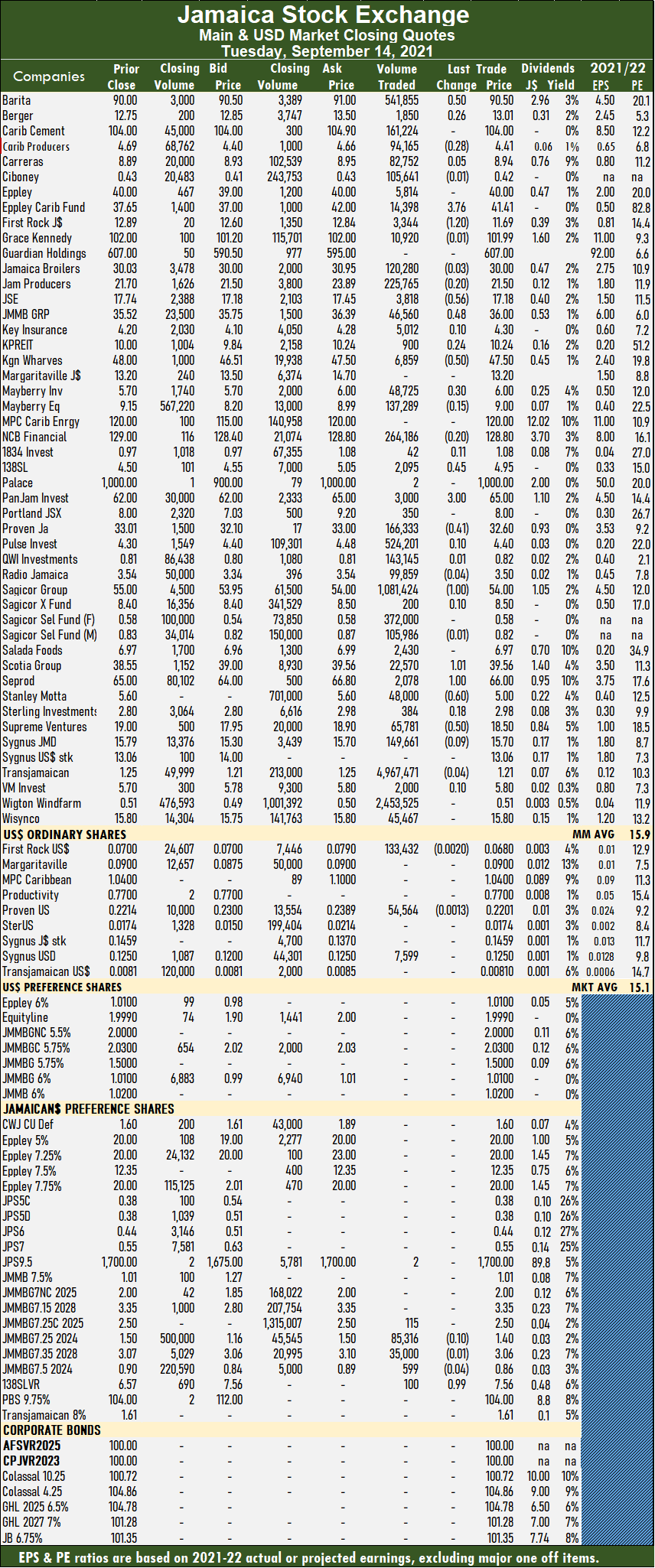

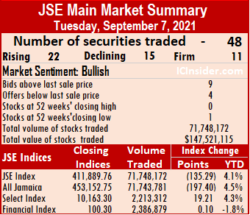

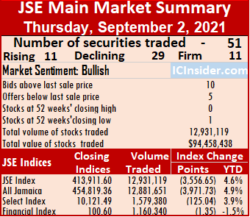

A total of 50 securities traded, up from 47 on Monday, with 19 stocks rising, 21 declining and 10 ending unchanged. The All Jamaican Composite Index lost 2,373.95 points to 446,676.61, the Main Index fell 1,989.08 points to settle at 406,762.31 and the JSE Financial Index fell 0.32 points to 98.88.

A total of 50 securities traded, up from 47 on Monday, with 19 stocks rising, 21 declining and 10 ending unchanged. The All Jamaican Composite Index lost 2,373.95 points to 446,676.61, the Main Index fell 1,989.08 points to settle at 406,762.31 and the JSE Financial Index fell 0.32 points to 98.88.

Sagicor Group lost $1 to end at $54 after exchanging 1,081,424 stock units, Scotia Group rallied $1.01 to $39.56 in an exchange of 22,570 shares, Seprod popped $1 to close at $66 with 2,078 stocks changing hands. Stanley Motta declined 60 cents to $5 after trading 48,000 units and Supreme Ventures shed 50 cents to close at $18.50, with 65,781 stock units crossing the market.

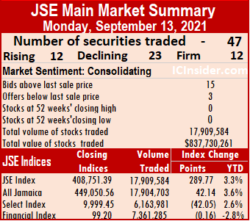

Sagicor Group lost $1 to end at $54 after exchanging 1,081,424 stock units, Scotia Group rallied $1.01 to $39.56 in an exchange of 22,570 shares, Seprod popped $1 to close at $66 with 2,078 stocks changing hands. Stanley Motta declined 60 cents to $5 after trading 48,000 units and Supreme Ventures shed 50 cents to close at $18.50, with 65,781 stock units crossing the market. The All Jamaican Composite Index rose 42.14 points to 449,050.56, the Main Index gained 289.77 points to close at 408,751.39 and the JSE Financial Index lost 0.16 points to settle at 99.20.

The All Jamaican Composite Index rose 42.14 points to 449,050.56, the Main Index gained 289.77 points to close at 408,751.39 and the JSE Financial Index lost 0.16 points to settle at 99.20. Trading averages 381,055 units at $17,824,048 compared to 306,157 shares at $2,969,880 on Friday and month to date, an average of 419,775 units at $4,357,469 compared to 424,359 units at $2,763,188 on Friday. August ended with an average of 480,039 units at $8,561,549.

Trading averages 381,055 units at $17,824,048 compared to 306,157 shares at $2,969,880 on Friday and month to date, an average of 419,775 units at $4,357,469 compared to 424,359 units at $2,763,188 on Friday. August ended with an average of 480,039 units at $8,561,549. Scotia Group fell 95 cents to $38.55 after trading 42,199 stock units. Supreme Ventures spiked 90 cents to $19, with 42,264 shares crossing the market and Sygnus Credit Investments advanced 63 cents to $15.79 after 88,609 stock units crossed the exchange.

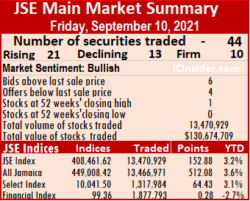

Scotia Group fell 95 cents to $38.55 after trading 42,199 stock units. Supreme Ventures spiked 90 cents to $19, with 42,264 shares crossing the market and Sygnus Credit Investments advanced 63 cents to $15.79 after 88,609 stock units crossed the exchange. The market closed with 13,470,929 shares trading for $130,674,709 versus 12,534,457 units at $121,087,956 on Thursday. Pulse Investments led trading with 36.6 percent of total volume after trading 4.93 million shares, followed by Transjamaican Highway 22.5 percent, with 3.03 million units and Wigton Windfarm 13.1 percent, with 1.76 million units changing hands.

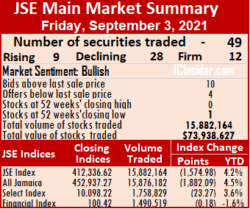

The market closed with 13,470,929 shares trading for $130,674,709 versus 12,534,457 units at $121,087,956 on Thursday. Pulse Investments led trading with 36.6 percent of total volume after trading 4.93 million shares, followed by Transjamaican Highway 22.5 percent, with 3.03 million units and Wigton Windfarm 13.1 percent, with 1.76 million units changing hands. Trading ended with 44 securities compared to 51 on Thursday, with 21 stocks rising, 13 declining and 10 ending unchanged.

Trading ended with 44 securities compared to 51 on Thursday, with 21 stocks rising, 13 declining and 10 ending unchanged. Pulse Investments rose 58 cents in closing at $4.10 with 4,934,043 shares crossing the market. Scotia Group rallied 50 cents to $39.50 in exchanging 38,983 stocks, Seprod spiked 50 cents to $65 with the swapping of 176,170 units, Supreme Ventures popped 55 cents to $18.10 with 34,730 stock units crossing the market and Sygnus Credit Investments fell 53 cents to $15.16 in trading 43,083 shares.

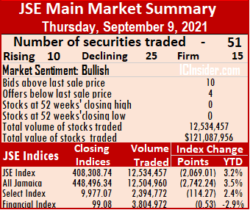

Pulse Investments rose 58 cents in closing at $4.10 with 4,934,043 shares crossing the market. Scotia Group rallied 50 cents to $39.50 in exchanging 38,983 stocks, Seprod spiked 50 cents to $65 with the swapping of 176,170 units, Supreme Ventures popped 55 cents to $18.10 with 34,730 stock units crossing the market and Sygnus Credit Investments fell 53 cents to $15.16 in trading 43,083 shares. The All Jamaican Composite Index dropped 2,742.24 points to close at 448,496.34, the Main Index declined 2,069.01 points to 408,308.74 and the JSE Financial Index shed 0.53 points to end 99.08.

The All Jamaican Composite Index dropped 2,742.24 points to close at 448,496.34, the Main Index declined 2,069.01 points to 408,308.74 and the JSE Financial Index shed 0.53 points to end 99.08. Investor’s Choice bid-offer indicator shows ten stocks ending with bids higher than their last selling prices and four with lower offers.

Investor’s Choice bid-offer indicator shows ten stocks ending with bids higher than their last selling prices and four with lower offers. PanJam Investment increased $2 to end at $64 in an exchange of 2,877 shares, Pulse Investments dropped 36 cents to $3.52 after exchanging 4,085,000 stock units, Sagicor Group fell $1 to $55 while exchanging 24,140 stocks. Scotia Group popped 49 cents in closing at $39 with an exchange of 832,069 shares after the price hit a 52 weeks’ intraday low of $38 and Supreme Ventures shed 55 cents to close at $17.55, trading 9,281 units.

PanJam Investment increased $2 to end at $64 in an exchange of 2,877 shares, Pulse Investments dropped 36 cents to $3.52 after exchanging 4,085,000 stock units, Sagicor Group fell $1 to $55 while exchanging 24,140 stocks. Scotia Group popped 49 cents in closing at $39 with an exchange of 832,069 shares after the price hit a 52 weeks’ intraday low of $38 and Supreme Ventures shed 55 cents to close at $17.55, trading 9,281 units. August closed with an average of 480,039 units at $8,561,549.

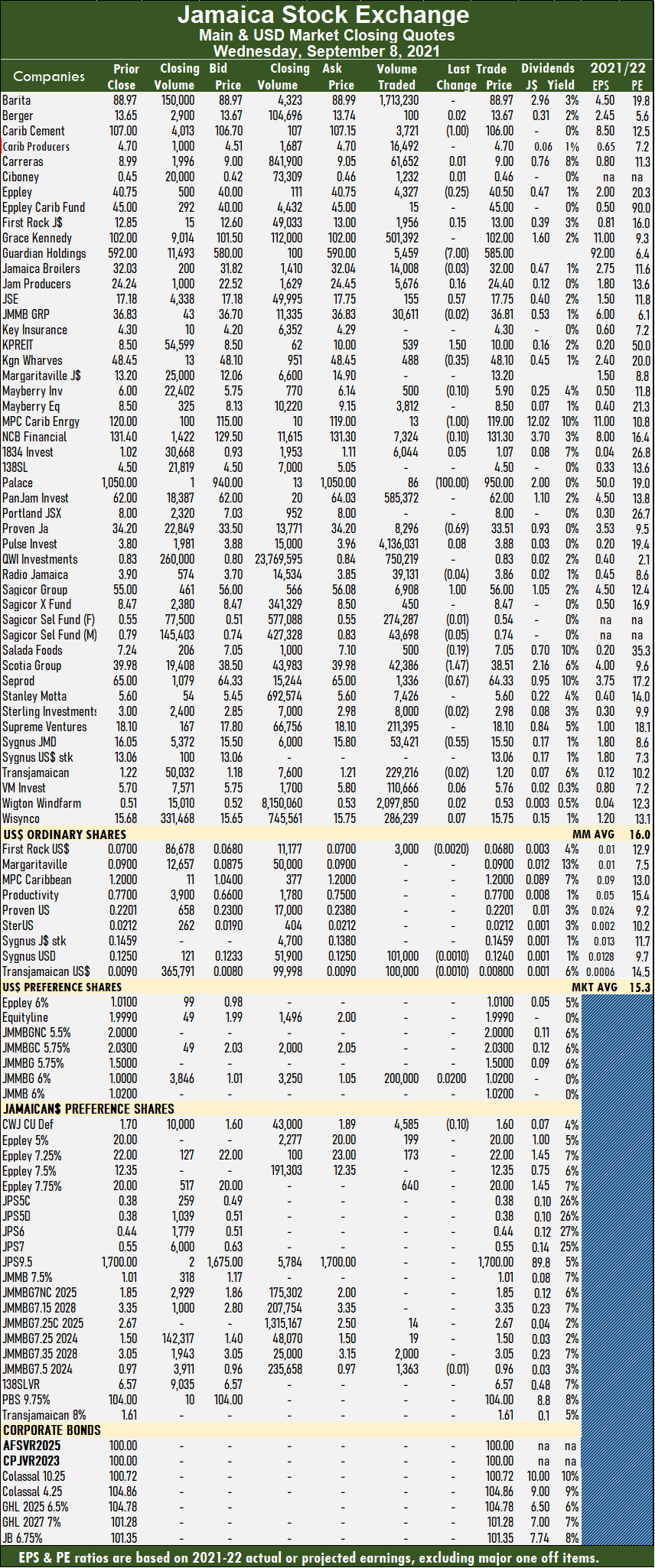

August closed with an average of 480,039 units at $8,561,549. Sagicor Group advanced $1 to $56 in transferring 6,908 stock units, Scotia Group declined $1.47 to $38.51 with the swapping of 42,386 units, Seprod fell 67 cents to $64.33 with 1,336 shares crossing the market and Sygnus Credit Investments shed 55 cents to $15.50 in exchanging 53,421 stocks.

Sagicor Group advanced $1 to $56 in transferring 6,908 stock units, Scotia Group declined $1.47 to $38.51 with the swapping of 42,386 units, Seprod fell 67 cents to $64.33 with 1,336 shares crossing the market and Sygnus Credit Investments shed 55 cents to $15.50 in exchanging 53,421 stocks. The All Jamaican Composite Index dropped 197.40 points to 453,152.75, the Main Index shed 135.29 points to end at 411,889.76 and the JSE Financial Index popped 0.10 points to settle at 100.30.

The All Jamaican Composite Index dropped 197.40 points to 453,152.75, the Main Index shed 135.29 points to end at 411,889.76 and the JSE Financial Index popped 0.10 points to settle at 100.30. Investor’s Choice bid-offer indicator shows nine stocks ending with bids higher than their last selling prices and four with lower offers.

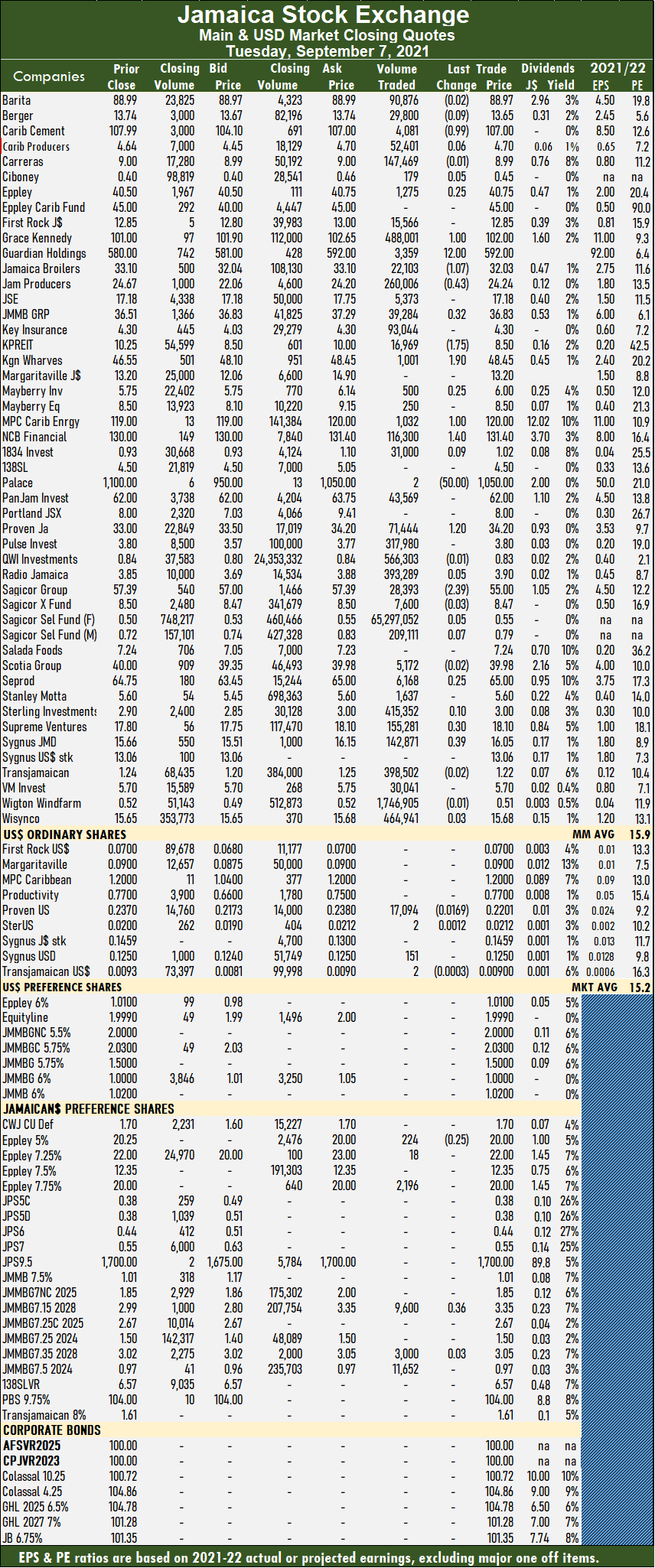

Investor’s Choice bid-offer indicator shows nine stocks ending with bids higher than their last selling prices and four with lower offers. Seprod climbed 25 cents to end at $65, with 6,168 units clearing the market, Supreme Ventures rose 30 cents to $18.10 with the swapping of 155,281 stock units and Sygnus Credit Investments rallied 39 cents to $16.05 after trading 142,871 units.

Seprod climbed 25 cents to end at $65, with 6,168 units clearing the market, Supreme Ventures rose 30 cents to $18.10 with the swapping of 155,281 stock units and Sygnus Credit Investments rallied 39 cents to $16.05 after trading 142,871 units. Trading averages 500,714 units at $4,373,298 compared to 324,126 shares at $1,508,952 on Friday and month to date, an average of 292,789 units at $2,102,896, compared to 228,400 units at $1,399,804 on Friday. August closed with an average of 480,039 units at $8,561,549.

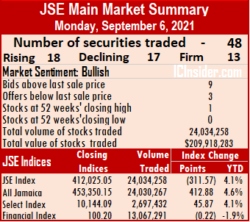

Trading averages 500,714 units at $4,373,298 compared to 324,126 shares at $1,508,952 on Friday and month to date, an average of 292,789 units at $2,102,896, compared to 228,400 units at $1,399,804 on Friday. August closed with an average of 480,039 units at $8,561,549. NCB Financial spiked $2 to $130 in trading 1,002,106 shares, PanJam Investment lost $1 to close at $62 in an exchange of 18,348 stocks, Pulse Investments popped advanced 27 cents to $3.80 after exchanging 2,998,236 units. Radio Jamaica jumped 68 cents to $3.85, trading 670,770 units, Sagicor Group popped $2.39 to $57.39 after trading 52,177 stocks, Scotia Group gained 50 cents in ending at $40, with 665,109 shares crossing the exchange. Seprod rallied $1.26 to $64.75, trading 11,304 stock units and Sygnus Credit Investments declined 64 cents to $15.66, trading 74,497 shares.

NCB Financial spiked $2 to $130 in trading 1,002,106 shares, PanJam Investment lost $1 to close at $62 in an exchange of 18,348 stocks, Pulse Investments popped advanced 27 cents to $3.80 after exchanging 2,998,236 units. Radio Jamaica jumped 68 cents to $3.85, trading 670,770 units, Sagicor Group popped $2.39 to $57.39 after trading 52,177 stocks, Scotia Group gained 50 cents in ending at $40, with 665,109 shares crossing the exchange. Seprod rallied $1.26 to $64.75, trading 11,304 stock units and Sygnus Credit Investments declined 64 cents to $15.66, trading 74,497 shares. Investor’s Choice bid-offer indicator reading has ten stocks ending with bids higher than their last selling prices and four stocks with lower offers.

Investor’s Choice bid-offer indicator reading has ten stocks ending with bids higher than their last selling prices and four stocks with lower offers. Sagicor Group fell $1 to $55 with the swapping of 64,105 shares, Salada Foods lost 24 cents in closing at $7.01 after 49,882 stock units crossed the market, Seprod shed $1.50 to settle at $63.49 with 13,866 stocks changing hands, Supreme Ventures lost 28 cents to close at $17.77 in trading 23,689 shares and Wigton Windfarm lost 3 cents to close at a 52 weeks’ low of 50 cents, trading 6,607,371 stocks, as investors continue to desert the stock.

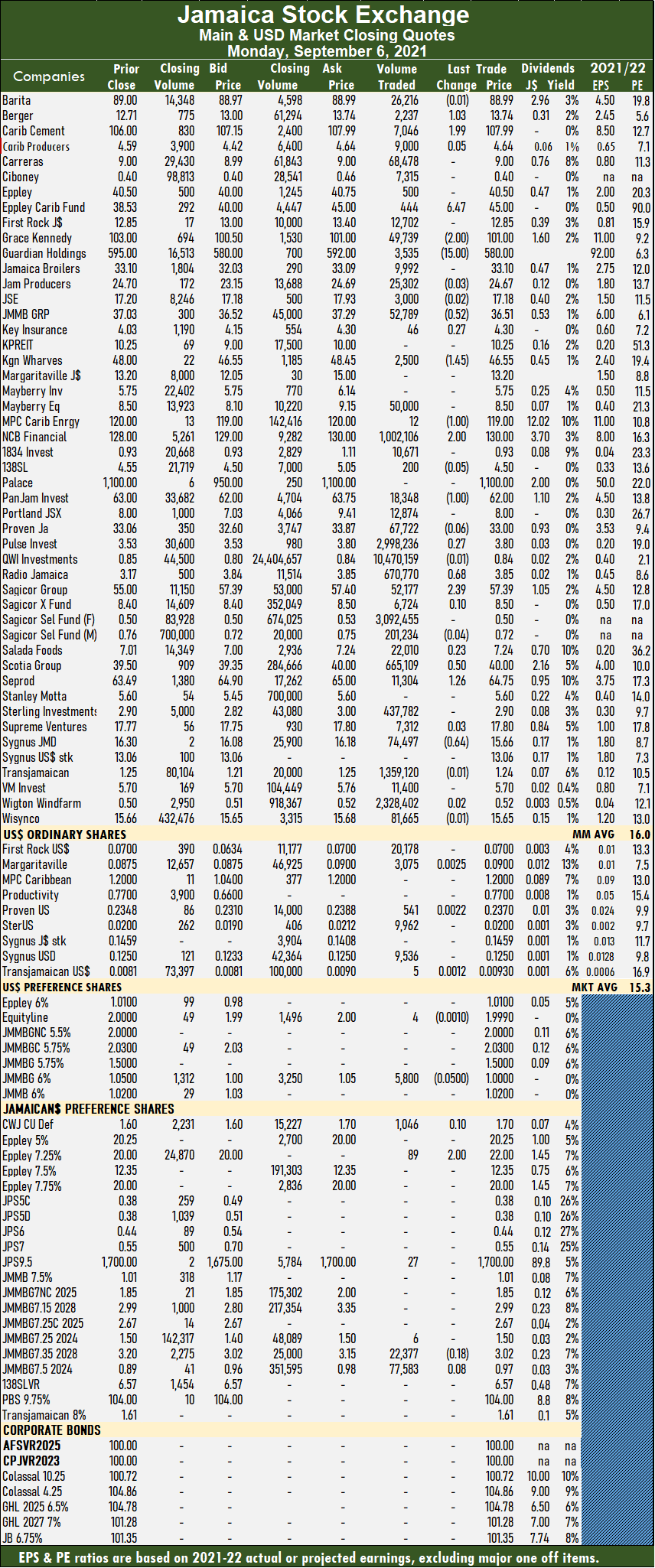

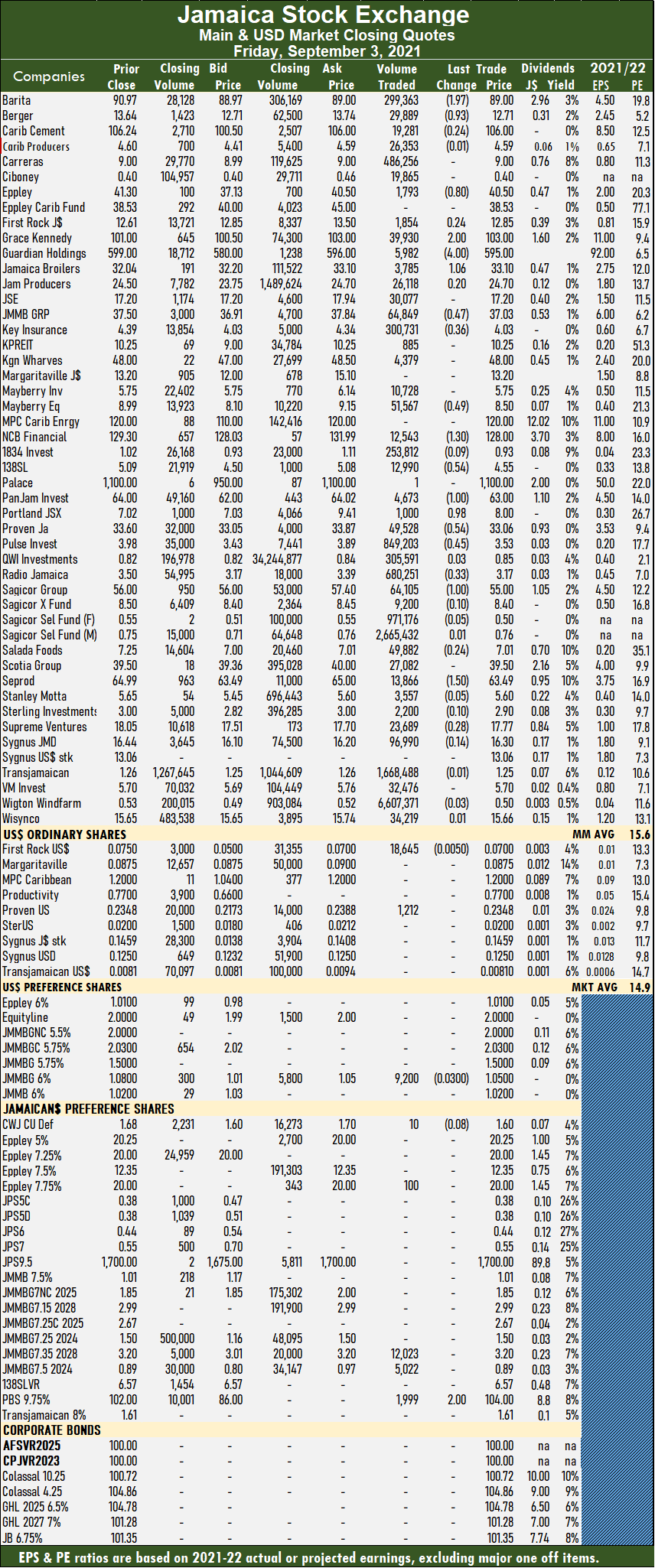

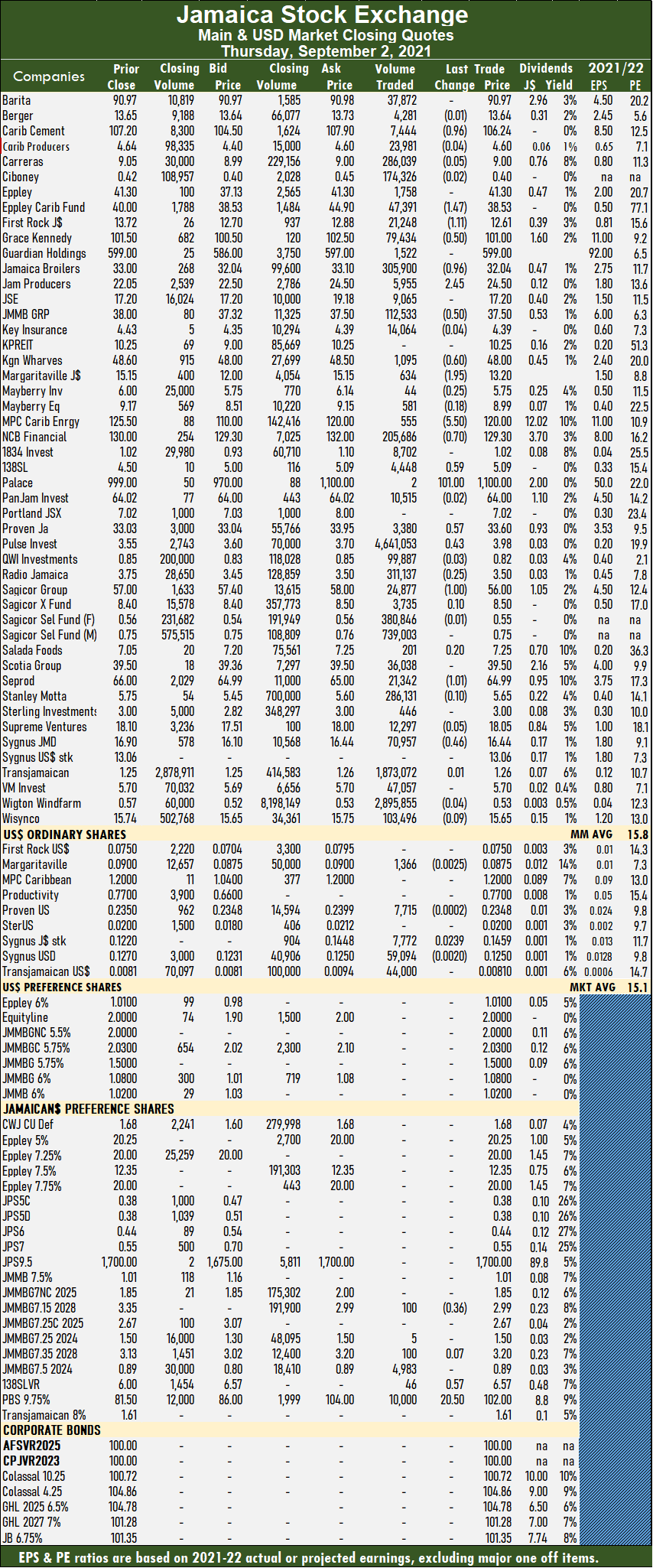

Sagicor Group fell $1 to $55 with the swapping of 64,105 shares, Salada Foods lost 24 cents in closing at $7.01 after 49,882 stock units crossed the market, Seprod shed $1.50 to settle at $63.49 with 13,866 stocks changing hands, Supreme Ventures lost 28 cents to close at $17.77 in trading 23,689 shares and Wigton Windfarm lost 3 cents to close at a 52 weeks’ low of 50 cents, trading 6,607,371 stocks, as investors continue to desert the stock. The All Jamaican Composite Index declined 3,971.73 points to settle at 454,819.36, the Main Index fell 3,556.65 points to 413,911.60 and the JSE Financial Index shed 1.35 points to close at 100.60.

The All Jamaican Composite Index declined 3,971.73 points to settle at 454,819.36, the Main Index fell 3,556.65 points to 413,911.60 and the JSE Financial Index shed 1.35 points to close at 100.60. At the close, Caribbean Cement shed 96 cents in closing at $106.24 in an exchange of 7,444 units, Eppley Caribbean Property Fund declined $1.47 to $38.53 with 47,391 shares crossing the market, First Rock Capital fell $1.11 to $12.61 with 21,248 stocks changing hands. GraceKennedy dipped 50 cents to $101 with the swapping of 79,434 shares, Jamaica Broilers shed 96 cents to close at $32.04 after 305,900 units crossed the exchange, Jamaica Producers advanced $2.45 to $24.50 in transferring 5,955 stocks. JMMB Group lost 50 cents to end at $37.50, with the swapping of 112,533 shares, Kingston Wharves dipped 60 cents to $48 in exchanging 1,095 stock units. Margaritaville fell $1.95 to close at a 52 weeks’ low of $13.20, with an exchange of 634 stock units. Mayberry Investments lost 25 cents in ending at $5.75 and trading 44 stocks. MPC Caribbean Clean Energy dropped $5.50 to $120 in trading 555 shares, NCB Financial fell 70 cents to $129.30 in switching ownership of 205,686 stock units, 138 Student Living popped 59 cents to $5.09 in an exchange of 4,448 shares, Palace Amusement surged $101 to $1,100 with 2 units crossing the exchange. Proven Investments rose 57 cents to $33.60 in transferring 3,380 stocks, Pulse Investments rallied 43 cents to $3.98 with the swapping of 4,641,053 shares, Radio Jamaica lost 25 cents to end at $3.50 in switching ownership of 311,137 stocks.

At the close, Caribbean Cement shed 96 cents in closing at $106.24 in an exchange of 7,444 units, Eppley Caribbean Property Fund declined $1.47 to $38.53 with 47,391 shares crossing the market, First Rock Capital fell $1.11 to $12.61 with 21,248 stocks changing hands. GraceKennedy dipped 50 cents to $101 with the swapping of 79,434 shares, Jamaica Broilers shed 96 cents to close at $32.04 after 305,900 units crossed the exchange, Jamaica Producers advanced $2.45 to $24.50 in transferring 5,955 stocks. JMMB Group lost 50 cents to end at $37.50, with the swapping of 112,533 shares, Kingston Wharves dipped 60 cents to $48 in exchanging 1,095 stock units. Margaritaville fell $1.95 to close at a 52 weeks’ low of $13.20, with an exchange of 634 stock units. Mayberry Investments lost 25 cents in ending at $5.75 and trading 44 stocks. MPC Caribbean Clean Energy dropped $5.50 to $120 in trading 555 shares, NCB Financial fell 70 cents to $129.30 in switching ownership of 205,686 stock units, 138 Student Living popped 59 cents to $5.09 in an exchange of 4,448 shares, Palace Amusement surged $101 to $1,100 with 2 units crossing the exchange. Proven Investments rose 57 cents to $33.60 in transferring 3,380 stocks, Pulse Investments rallied 43 cents to $3.98 with the swapping of 4,641,053 shares, Radio Jamaica lost 25 cents to end at $3.50 in switching ownership of 311,137 stocks. Sagicor Group declined $1 to $56 in exchanging 24,877 shares, Salada Foods traded 201 shares and gained 20 cents to close at $7.25, Seprod shed $1.01 in ending at $64.99 after 21,342 stock units crossed the market and Sygnus Credit Investments lost 46 cents in closing at $16.44 in switching ownership of 70,957 stocks.

Sagicor Group declined $1 to $56 in exchanging 24,877 shares, Salada Foods traded 201 shares and gained 20 cents to close at $7.25, Seprod shed $1.01 in ending at $64.99 after 21,342 stock units crossed the market and Sygnus Credit Investments lost 46 cents in closing at $16.44 in switching ownership of 70,957 stocks.