Site plan of Stanley Motta’s 58 Half Way Tree Road.

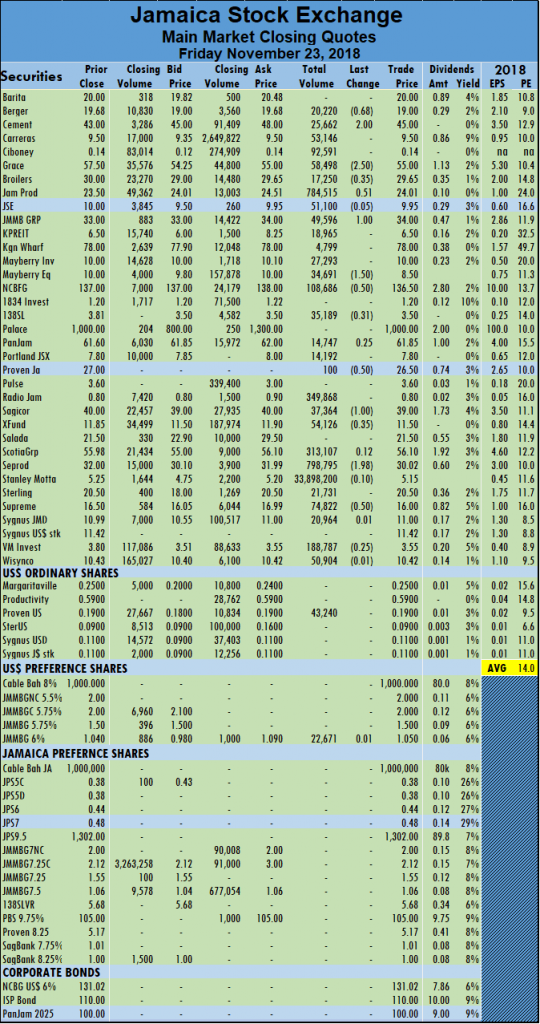

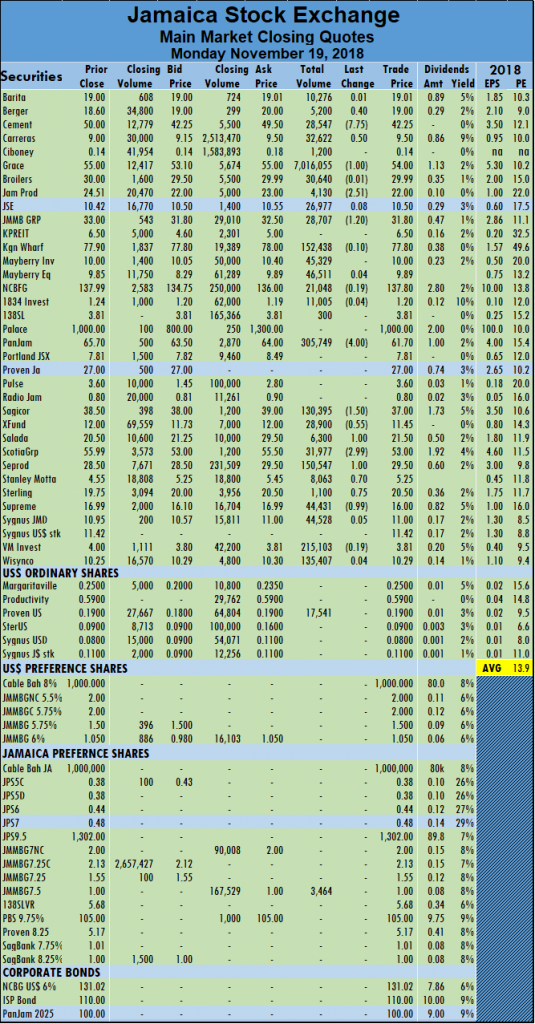

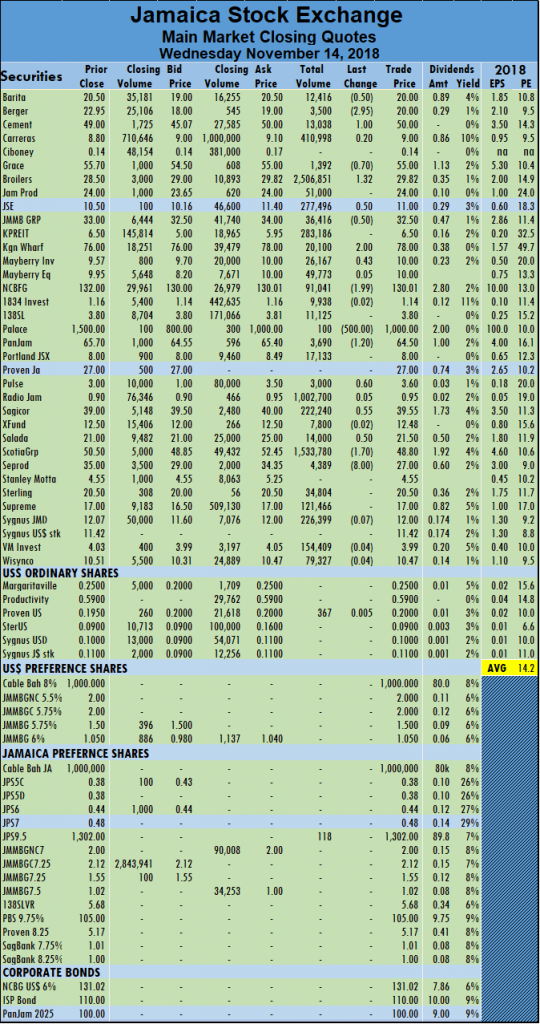

Stanley Motta traded nearly 34 million on the Jamaica Stock Exchange on Friday, helping

Site plan of Stanley Motta’s 58 Half Way Tree Road.to push the overall volume to 37,219,908 units valued at $266,712,510 changing hands, compared with 5,027,724 units valued at $221,393,103 being exchanged, on Thursday.

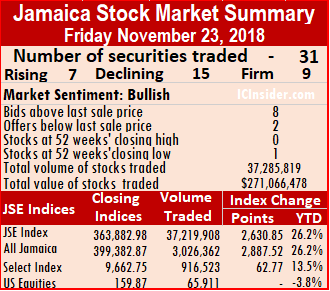

Market activity closed with 31 active securities in the main and US dollar markets trading, compared to a same number on Thursday, as the prices of 7 stocks rose, 15 declined and 9 remained unchanged.

Despite the higher level of stocks declining than advancing, the All Jamaica Index advanced 2,887.52 points to 399,382.8, while the JSE Index climbed 2,630.85 points to close at 363,882.98.

The main market ended with Stanley Motta trading 33,898,200 units and cornering 91 percent of the day’s volume, followed by Seprod with 798,795 units for just 2 percent of traded volume  and Jamaica Producers with 784,515 units, also with just 2 percent of the day’s volume.

and Jamaica Producers with 784,515 units, also with just 2 percent of the day’s volume.

IC bid-offer Indicator|The Investor’s Choice bid-offer indicator reading shows 8 stocks ending with bids higher than the last selling prices and 2 closing with lower offers.

Trading resulted in an average of 1,283,445 units valued at an average of $9,196,983 for each security traded, in contrast to 173,370 units valued at an average of $7,634,245 on Thursday. The average volume and value for the month to date, amounts to 329,574 valued at $6,496,704, compared to 271,338 valued at $6,321,909. October closed, with an average of 290,851 shares, valued $5,213,901, for each security traded.

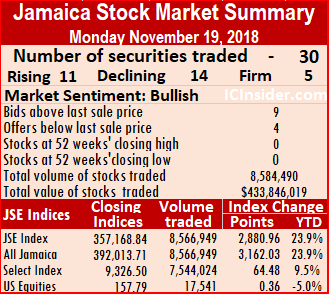

In main market activity, Berger Paints lost 68 cents in trading 20,220 shares to close at $19, Caribbean Cement gained $2 to close at $45 in trading 25,662 shares, Grace Kennedy fell $2.50 and ended trading of 58,498 shares at $55, JMMB Group rose $1 to $34, with an exchange of 49,596 shares, Jamaica Producers gained 51 cents and finished trading of 784,515 units  at $24.01, Mayberry Jamaica Equities lost $1.50 in trading 34,691 shares in closing at $8.50, NCB Financial Group lost 50 cents and ended trading of 108,686 shares at $136.50 after trading at a record high of $138, 138 Student Living traded 35,189 shares and declined by 31 cents to a 52 weeks’ low of $3.50, PanJam Investment rose 25 cents to $61.85, with an exchange of 14,747 stock units, Proven Investments ended with a loss of 50 cents at $26.50, with just 100 units changing hands, Sagicor Group lost $1 and finished trading at $39, with 37,364 shares, Seprod dropped $1.98 trading of 798,795 shares, to close at $30.02 and Supreme Ventures lost 50 cents to end at $16, with an exchange of 74,822 shares.

at $24.01, Mayberry Jamaica Equities lost $1.50 in trading 34,691 shares in closing at $8.50, NCB Financial Group lost 50 cents and ended trading of 108,686 shares at $136.50 after trading at a record high of $138, 138 Student Living traded 35,189 shares and declined by 31 cents to a 52 weeks’ low of $3.50, PanJam Investment rose 25 cents to $61.85, with an exchange of 14,747 stock units, Proven Investments ended with a loss of 50 cents at $26.50, with just 100 units changing hands, Sagicor Group lost $1 and finished trading at $39, with 37,364 shares, Seprod dropped $1.98 trading of 798,795 shares, to close at $30.02 and Supreme Ventures lost 50 cents to end at $16, with an exchange of 74,822 shares.

Trading in the US dollar market amounted to 65,911 units valued at over $32,014 as JMMB Group 6% USD with 22,671 units and rose 1 cent to close at us$1.05 and Proven Investments ended trading of 43,240 shares at 19 U$ cents. The JSE USD Equities Index closed unchanged at 159.87.

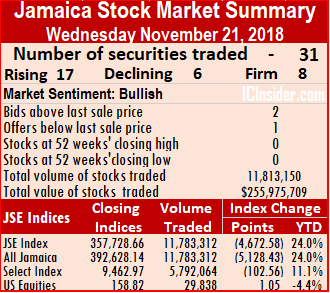

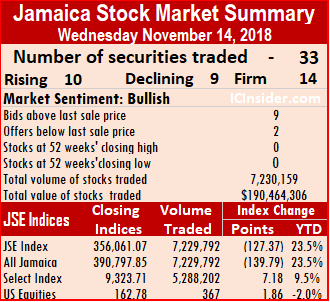

Investors pushed the Jamaica Stock Exchange main market sharply down on Wednesday, with the All Jamaica Index diving 5,128.43 points to 392,628.14 and JSE Index dropped 4,672.58 points, to close at 357,728.66.

Investors pushed the Jamaica Stock Exchange main market sharply down on Wednesday, with the All Jamaica Index diving 5,128.43 points to 392,628.14 and JSE Index dropped 4,672.58 points, to close at 357,728.66.

with 1.1 million shares, PanJam Investment fell $2 in closing at $62, with an exchange of 5,991 stock units, Portland JSX ended at $8.49, after gaining 68 cents with 5,736 units, Seprod gained $1.01 to end trading of 273,687 shares at $30.01, Sterling Investments rose 50 cents to close at $20.50, with 4,456 shares trading and Supreme Ventures added 50 cents and ended at $16.50, with an exchange of 28,417 shares.

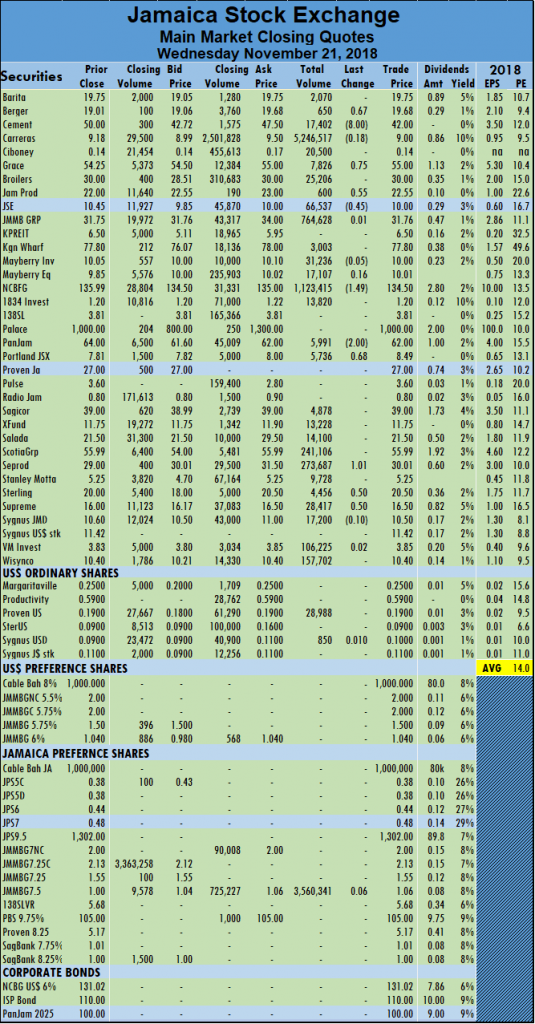

with 1.1 million shares, PanJam Investment fell $2 in closing at $62, with an exchange of 5,991 stock units, Portland JSX ended at $8.49, after gaining 68 cents with 5,736 units, Seprod gained $1.01 to end trading of 273,687 shares at $30.01, Sterling Investments rose 50 cents to close at $20.50, with 4,456 shares trading and Supreme Ventures added 50 cents and ended at $16.50, with an exchange of 28,417 shares. The Jamaica Stock Exchange main market indices were pushed sharply higher on Tuesday, sending the All Jamaica Index surging 5,742.86 points to 397,756.57 and JSE Index jumped 5,232.40 points to close at 362,401.24, thanks partially to jump in the price of NCB Financial.

The Jamaica Stock Exchange main market indices were pushed sharply higher on Tuesday, sending the All Jamaica Index surging 5,742.86 points to 397,756.57 and JSE Index jumped 5,232.40 points to close at 362,401.24, thanks partially to jump in the price of NCB Financial.

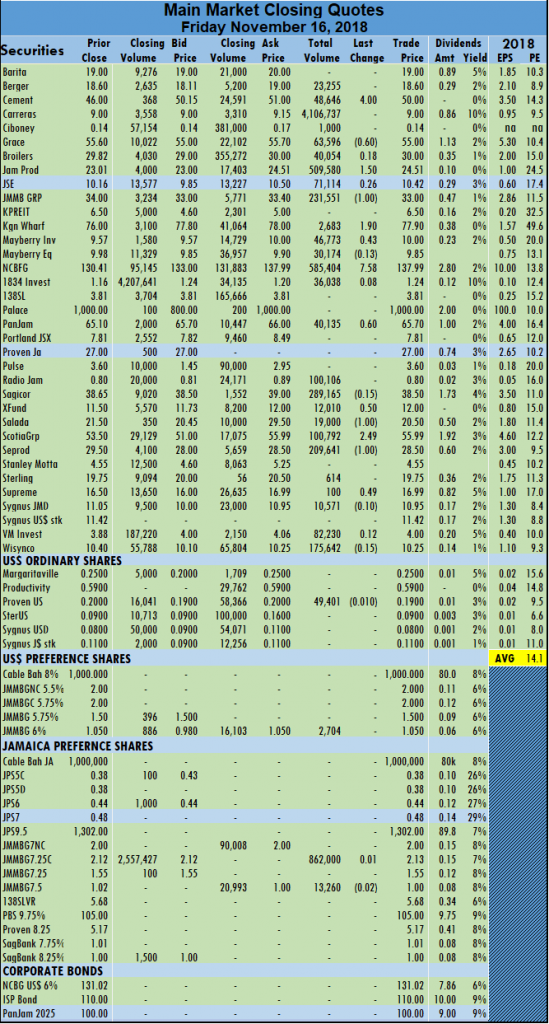

shares, Scotia Group gained $2.99 trading 31,977 to close at $55.99, Seprod shed 50 cents to end trading of 156,060 shares at $29.50 and Sterling Investments fell 50 cents and closed at $20, with 3,094 shares.

shares, Scotia Group gained $2.99 trading 31,977 to close at $55.99, Seprod shed 50 cents to end trading of 156,060 shares at $29.50 and Sterling Investments fell 50 cents and closed at $20, with 3,094 shares.

exchange of 305,749 stock units, Sagicor Group gave up $1.50 and settled at $37 with an exchange of 130,395 shares, Sagicor Real Estate Fund lost 55 cents and settled at $11.45, trading 28,900 shares, Salada Foods rose $1 to close at $21.50 trading 6,300 shares, Scotia Group dropped $2.99 trading 31,977 to close at $53, Seprod gained $1 to end trading of 150,547 shares at $29.50, traded 8,063 shares and rose Stanley Motta 70 cents to $5.25, Sterling Investments climbed 75 cents to $20.50, trading 1,100 shares and Supreme Ventures lost 99 cents and ended at $16, with an exchange of 44,431 shares.

exchange of 305,749 stock units, Sagicor Group gave up $1.50 and settled at $37 with an exchange of 130,395 shares, Sagicor Real Estate Fund lost 55 cents and settled at $11.45, trading 28,900 shares, Salada Foods rose $1 to close at $21.50 trading 6,300 shares, Scotia Group dropped $2.99 trading 31,977 to close at $53, Seprod gained $1 to end trading of 150,547 shares at $29.50, traded 8,063 shares and rose Stanley Motta 70 cents to $5.25, Sterling Investments climbed 75 cents to $20.50, trading 1,100 shares and Supreme Ventures lost 99 cents and ended at $16, with an exchange of 44,431 shares.

compared with 3,304,274 units valued at $77,547,412 being exchanged, on Thursday.

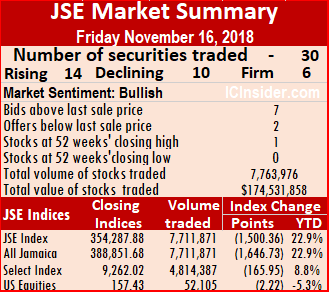

compared with 3,304,274 units valued at $77,547,412 being exchanged, on Thursday. gained 60 cents in closing at $65.70, with an exchange of 40,135 stock units, Sagicor Real Estate Fund rose 50 cents and settled at $12, trading 12,010 shares, Salada Foods lost $1 to close at $20.50 as 19,000 shares traded, Scotia Group rose $2.49 trading 100,792 to close at $55.99, Seprod lost $1 to end trading of 209,641 shares at $28.50 and Supreme Ventures added 49 cents and ended at $16.99, with an exchange of 100 shares.

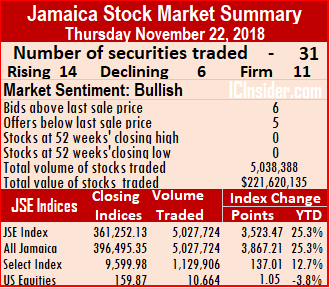

gained 60 cents in closing at $65.70, with an exchange of 40,135 stock units, Sagicor Real Estate Fund rose 50 cents and settled at $12, trading 12,010 shares, Salada Foods lost $1 to close at $20.50 as 19,000 shares traded, Scotia Group rose $2.49 trading 100,792 to close at $55.99, Seprod lost $1 to end trading of 209,641 shares at $28.50 and Supreme Ventures added 49 cents and ended at $16.99, with an exchange of 100 shares. The Jamaica Stock Exchange main market lost more ground on Thursday, with volume exceeding Wednesday’s levels by a wide margin.

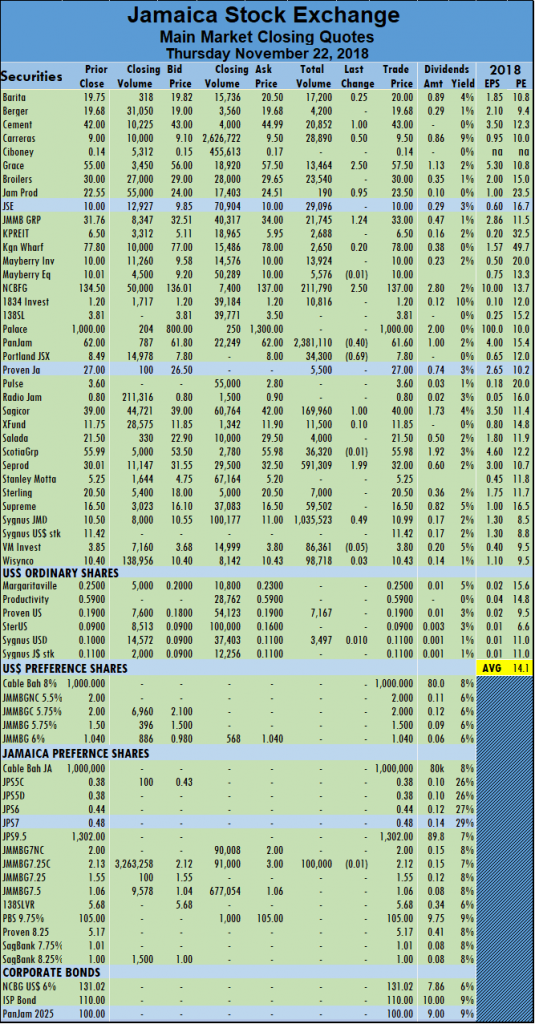

The Jamaica Stock Exchange main market lost more ground on Thursday, with volume exceeding Wednesday’s levels by a wide margin.

units, Sagicor Group declined 90 cents to $38.65, trading 37,603 shares, Sagicor Real Estate Fund fell 98 cents and settled at $11.50, trading 64,571 shares, Scotia Group rose $4.70 trading 90,583 to close at $55.99, Seprod rose $2.50 to end trading 616,205 shares at $29.50, Sterling Investments lost 75 cents and closed at $19.75, trading 800 shares, Supreme Ventures lost 50 cents and ended at $16.50, with an exchange of 156,532 shares and Sygnus Credit Investments Jamaican dollar based ordinary share dropped 95 cents in trading 33,550 units at $11.05.

units, Sagicor Group declined 90 cents to $38.65, trading 37,603 shares, Sagicor Real Estate Fund fell 98 cents and settled at $11.50, trading 64,571 shares, Scotia Group rose $4.70 trading 90,583 to close at $55.99, Seprod rose $2.50 to end trading 616,205 shares at $29.50, Sterling Investments lost 75 cents and closed at $19.75, trading 800 shares, Supreme Ventures lost 50 cents and ended at $16.50, with an exchange of 156,532 shares and Sygnus Credit Investments Jamaican dollar based ordinary share dropped 95 cents in trading 33,550 units at $11.05.

The Jamaica Stock Exchange main market lost ground on Tuesday but with the advancing stocks just edged out declining stocks by one.

The Jamaica Stock Exchange main market lost ground on Tuesday but with the advancing stocks just edged out declining stocks by one.

JMMB Group fell 90 cents and ended at $33, with an exchange of 110,598 shares, Kingston Wharves dropped $2 to $76 trading 4,800 shares, Mayberry Investments shed 43 cents to settle at $9.57, in exchanging 32,704 units, NCB Financial Group lost $1 and ended trading 127,194 shares at $132, after trading at a 52 weeks’ high of $135.01. PanJam Investment gained $1.70 in closing at $65.70, with an exchange of just 500 stock units, Sagicor Group rose 50 cents to $39, trading 13,945 shares, Sagicor Real Estate Fund gained 50 cents and settled at $12.50, trading 297 shares and Seprod fell $1 and finished trading 4,833 shares at $35.

JMMB Group fell 90 cents and ended at $33, with an exchange of 110,598 shares, Kingston Wharves dropped $2 to $76 trading 4,800 shares, Mayberry Investments shed 43 cents to settle at $9.57, in exchanging 32,704 units, NCB Financial Group lost $1 and ended trading 127,194 shares at $132, after trading at a 52 weeks’ high of $135.01. PanJam Investment gained $1.70 in closing at $65.70, with an exchange of just 500 stock units, Sagicor Group rose 50 cents to $39, trading 13,945 shares, Sagicor Real Estate Fund gained 50 cents and settled at $12.50, trading 297 shares and Seprod fell $1 and finished trading 4,833 shares at $35. The Jamaica Stock Exchange main market made modest gains in closing of Monday but with an adverse advance decline ratio.

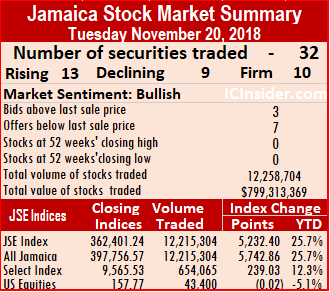

The Jamaica Stock Exchange main market made modest gains in closing of Monday but with an adverse advance decline ratio.  Trading resulted in an average of 93,722 units valued at over $2,151,133, in contrast to 177,673 shares valued at $7,645,204 on Friday. The average volume and value for the month to date, amounts to 292,443 valued at $2,890,696, compared to 317,399 valued at $2,996,910. October closed, with an average of 290,851 shares, valued $5,213,901, for each security traded.

Trading resulted in an average of 93,722 units valued at over $2,151,133, in contrast to 177,673 shares valued at $7,645,204 on Friday. The average volume and value for the month to date, amounts to 292,443 valued at $2,890,696, compared to 317,399 valued at $2,996,910. October closed, with an average of 290,851 shares, valued $5,213,901, for each security traded. settle at record high of $10, in exchanging 10,100 units, PanJam Investment gained $1 in closing at $64, with an exchange of just 500 stock units, Sagicor Group declined $1.50 to $38.50, trading 42,898 shares, Sagicor Real Estate Fund fell 50 cents and settled at $12, trading 943 shares, Scotia Group rose 50 cents in trading 145,471 shares to close at $50.50, Seprod lost $2 and finished trading of 17,539 shares at $36,and Supreme Ventures rose $1, ending at $17, trading 126,262 units.

settle at record high of $10, in exchanging 10,100 units, PanJam Investment gained $1 in closing at $64, with an exchange of just 500 stock units, Sagicor Group declined $1.50 to $38.50, trading 42,898 shares, Sagicor Real Estate Fund fell 50 cents and settled at $12, trading 943 shares, Scotia Group rose 50 cents in trading 145,471 shares to close at $50.50, Seprod lost $2 and finished trading of 17,539 shares at $36,and Supreme Ventures rose $1, ending at $17, trading 126,262 units.