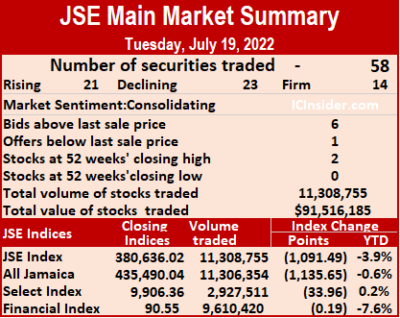

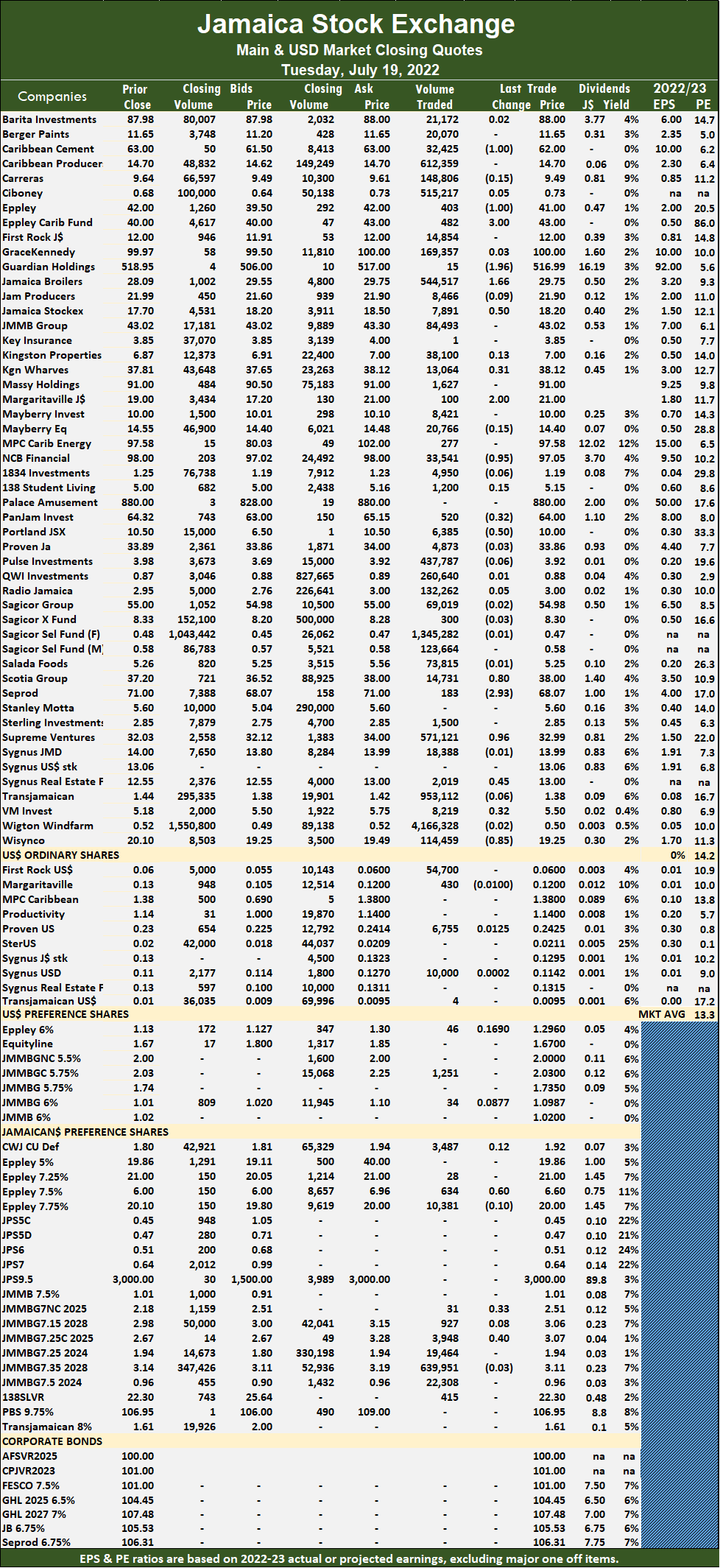

Trading on the Jamaica Stock Exchange Main Market ended on Tuesday, with the volume of stocks climbing 67 percent with a 10 percent greater value than on Monday, with stocks declining edging out those rising on a day when the market indices recorded lost altitude, even as Supreme Ventures price hits a record high.

Overall, 11,308,755 shares were traded for $91,516,185 versus 6,753,577 units at $83,525,119 on Monday. Trading averages 194,979 units at $1,577,865, compared to 114,467 shares at $1,415,680 on Monday and month to date, an average of 176,489 units at $1,633,153, versus 174,862 units at $1,638,019 on the previous trading day. June closed with an average of 281,913 units at $5,309,050.

Overall, 11,308,755 shares were traded for $91,516,185 versus 6,753,577 units at $83,525,119 on Monday. Trading averages 194,979 units at $1,577,865, compared to 114,467 shares at $1,415,680 on Monday and month to date, an average of 176,489 units at $1,633,153, versus 174,862 units at $1,638,019 on the previous trading day. June closed with an average of 281,913 units at $5,309,050.

Wigton Windfarm led trading with 4.17 million shares for 36.8 percent of total volume followed by Sagicor Select Financial Fund with 1.35 million units for 11.9 percent of the day’s trade and Transjamaican Highway with 953,112 units for 8.4 percent market share.

The All Jamaican Composite Index fell 1,135.65 points to 435,490.04, the JSE Main Index shed 1,091.49 points to 380,636.02 and the JSE Financial Index fell 0.19 points to settle at 90.55.

The All Jamaican Composite Index fell 1,135.65 points to 435,490.04, the JSE Main Index shed 1,091.49 points to 380,636.02 and the JSE Financial Index fell 0.19 points to settle at 90.55.

Trading ended with 58 securities down from 59 on Monday, with 21 rising, 23 declining and 14 ending unchanged.

The PE Ratio, a formula to ascertain appropriate stock values, averages 14.2 for the Main Market. The JSE Main and USD Market PE ratios are computed based on ICInsider.com’s forecasted earnings for companies with financial years ending up to August 2023.

Investor’s Choice bid-offer indicator shows six stocks ending with higher bids than the last selling prices and one with a lower offer.

At the close, Caribbean Cement shed $1 in ending at $62 after trading 32,425 shares, Eppley lost $1 to close at $41 while exchanging 403 units, Eppley Caribbean Property Fund advanced $3 in closing at $43 in trading 482 stocks. Guardian Holdings dropped $1.96 to end at $516.99 with the swapping of 15 stock units, Jamaica Broilers climbed $1.66 to $29.75 with an exchange of 544,517 units, Jamaica Stock Exchange rallied 50 cents to close at $18.20 with the swapping of 7,891 stocks. Margaritaville gained $2 to end at $21, with 100 units crossing the market, NCB Financial declined 95 cents to $97.05, with 33,541 shares switching owners, Portland JSX lost 50 cents to close at $10 in an exchange of 6,385 stocks. Scotia Group advanced 80 cents in closing at $38 after trading 14,731 stock units, Seprod declined $2.93 to $68.07 in an exchange of 183 units,  Supreme Ventures rose 96 cents to close at a 52 weeks’ closing high at $32.99 with 571,121 shares changing hands after trading at an intraday 52 weeks’ high. Sygnus Real Estate Finance popped 45 cents to close at $13 after trading 2,019 stocks and Wisynco Group dropped 85 cents to finish at $19.25 in an exchange of 114,459 units.

Supreme Ventures rose 96 cents to close at a 52 weeks’ closing high at $32.99 with 571,121 shares changing hands after trading at an intraday 52 weeks’ high. Sygnus Real Estate Finance popped 45 cents to close at $13 after trading 2,019 stocks and Wisynco Group dropped 85 cents to finish at $19.25 in an exchange of 114,459 units.

In the preference segment, Eppley 7.50% preference share rose 60 cents to $6.60, with 634 stock units clearing the market and JMMB Group 7.25% preference share gained 40 cents to $3.07 after an exchange of 3,948 shares and JMMB Group 7% preference share rose 33 cents and closed at a 52 weeks’ high of $2.51 after trading 31 units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Main Market stocks lose altitude

Gains for JSE Main Market

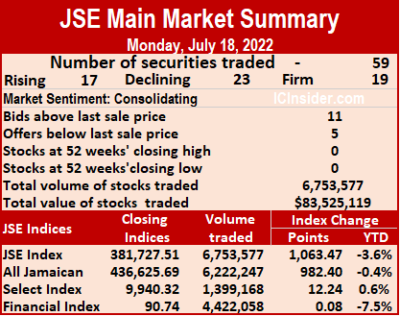

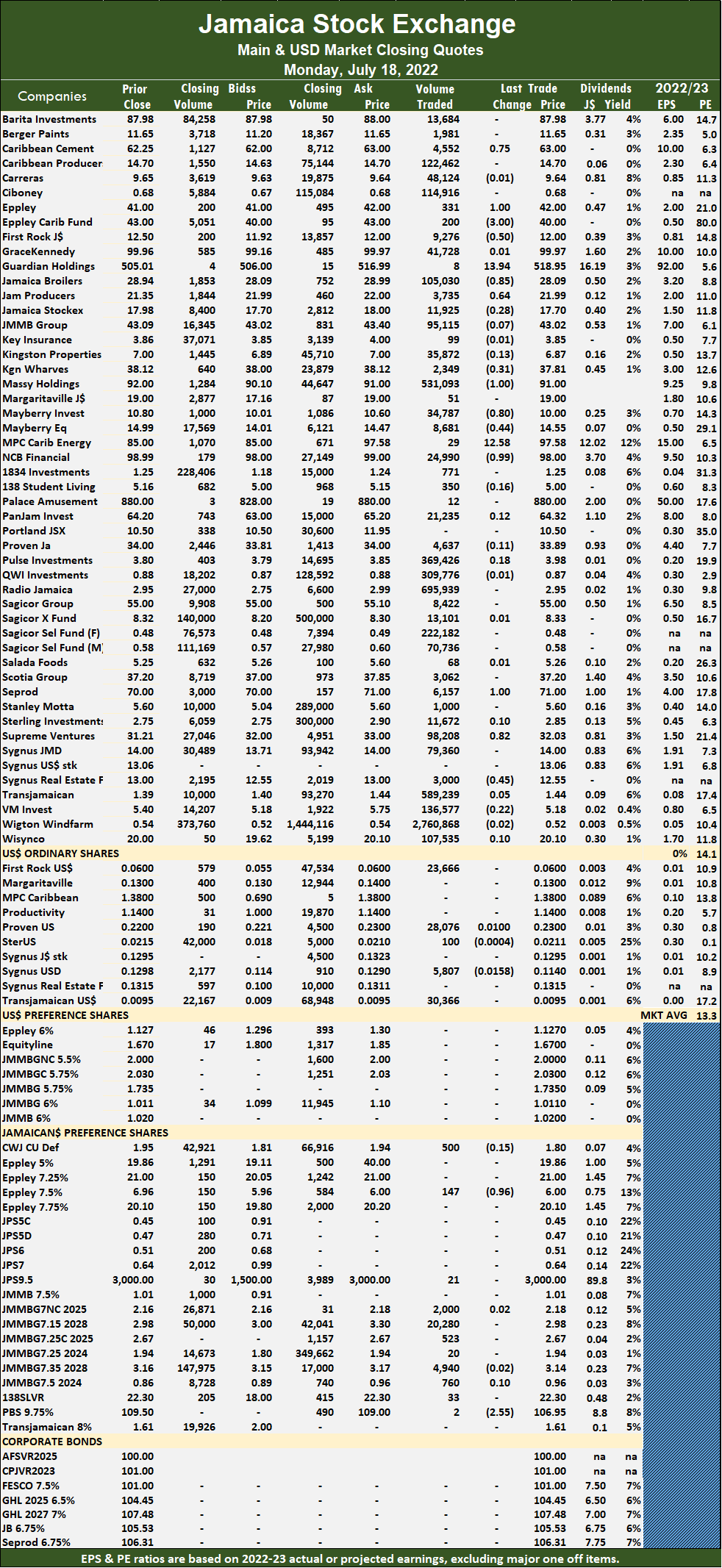

Jamaica Stock Exchange Main Market activity ended on Monday, with the volume of stocks traded slipping slightly, with a 65 percent higher value than on Friday as trading ended with 59 securities compared to 55 on Friday, with 17 rising, 23 declining and 19 ending unchanged.

The All Jamaican Composite Index added 982.40 points to 436,625.69, the JSE Main Index rose 1,063.47 to 381,727.51 and the JSE Financial Index popped 0.08 points to 90.74.

The All Jamaican Composite Index added 982.40 points to 436,625.69, the JSE Main Index rose 1,063.47 to 381,727.51 and the JSE Financial Index popped 0.08 points to 90.74.

The PE Ratio, a formula to ascertain appropriate stock values, averages 14.1 for the Main Market. The JSE Main and USD Market PE ratios are computed based on ICInsider.com’s forecasted earnings for companies with financial years ending up to the close of August 2023.

A total of 6,753,577 shares were exchanged for $83,525,119 versus 6,917,755 units at $50,532,632 on Friday. Trading averages 114,467 units at $1,415,680 compared to 125,777 shares at $918,775 on Friday and month to date, an average of 174,862 units at $1,638,019, compared to 180,801 units at $1,659,883 on the previous trading day. June closed with an average of 281,913 units at $5,309,050.

Wigton Windfarm led trading with 2.76 million shares for 40.9 percent of total volume, followed by Radio Jamaica with 695,939 units for 10.3 percent of the day’s trade and Transjamaican Highway with 589,239 units for 8.7 percent market share.

Wigton Windfarm led trading with 2.76 million shares for 40.9 percent of total volume, followed by Radio Jamaica with 695,939 units for 10.3 percent of the day’s trade and Transjamaican Highway with 589,239 units for 8.7 percent market share.

Investor’s Choice bid-offer indicator shows 11 stocks ended with bids higher than their last selling prices and five stocks with lower offers.

At the close, Caribbean Cement advanced 75 cents in ending at $63, trading 4,552 shares, Eppley rose $1 in closing at $42 after an exchange of 331 stock units, Eppley Caribbean Property Fund dropped $3 to $40, with 200 stocks changing hands. First Rock Capital fell 50 cents to $12 after finishing trading of 9,276 units,Guardian Holdings rallied $13.94 to close at $518.95, with eight stocks crossing the market, Jamaica Broilers dropped 85 cents to $28.09 in an exchange of 105,030 units. Jamaica Producers climbed 64 cents after ending at $21.99, with 3,735 stock units clearing the market, Massy Holdings fell $1 in closing at $91 while exchanging 531,093 shares, Mayberry Investments shed 80 cents to end at $10 after 34,787 stock units crossed the exchange. Mayberry Jamaican Equities declined 44 cents to close at $14.55 after exchanging 8,681 units. MPC Caribbean Clean Energy increased by $12.58 to close at $97.58 with the swapping of 29 stocks,  NCB Financial shed 99 cents to end at $98 with an exchange of 24,990 shares. Seprod gained $1 in closing at $71 as 6,157 stocks changed hands, Supreme Ventures popped 82 cents to $32.03 after exchanging 98,208 shares and Sygnus Real Estate Finance lost 45 cents in ending at $12.55, with 3,000 units crossing the market.

NCB Financial shed 99 cents to end at $98 with an exchange of 24,990 shares. Seprod gained $1 in closing at $71 as 6,157 stocks changed hands, Supreme Ventures popped 82 cents to $32.03 after exchanging 98,208 shares and Sygnus Real Estate Finance lost 45 cents in ending at $12.55, with 3,000 units crossing the market.

In the preference segment, Eppley 7.50% preference share dropped 96 cents in closing at $6 after trading 147 stock units and Productive Business Solutions 9.75% preference share fell $2.55 in ending at $106.95 in switching ownership of a mere two shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Trading value plunges on JSE Main Market

Volume traded rose on Friday but with a much lower value than on Thursday at the close of the Jamaica Stock Exchange Main Market, with the volume of stocks traded increasing 26 percent, with 42 percent less than on Thursday after rising stocks just edged out those declining.

Overall, 6,917,755 shares were exchanged for just $50,532,632 versus 5,480,966 units at $87,344,674 on Thursday. Trading averaged 125,777 units at $918,775, compared to 99,654 shares at $1,588,085 on Thursday and month to date, an average of 180,801 units at $1,659,883, versus 186,354 units at $1,734,673 on the previous trading day. June closed with an average of 281,913 units at $5,309,050.

Overall, 6,917,755 shares were exchanged for just $50,532,632 versus 5,480,966 units at $87,344,674 on Thursday. Trading averaged 125,777 units at $918,775, compared to 99,654 shares at $1,588,085 on Thursday and month to date, an average of 180,801 units at $1,659,883, versus 186,354 units at $1,734,673 on the previous trading day. June closed with an average of 281,913 units at $5,309,050.

Transjamaican Highway led trading with 1.66 million shares for 23.9 percent of total volume, followed by Wigton Windfarm with 1.50 million units for 21.7 percent of the day’s trade and Caribbean Producers with 607,959 units for 8.8 percent of market share.

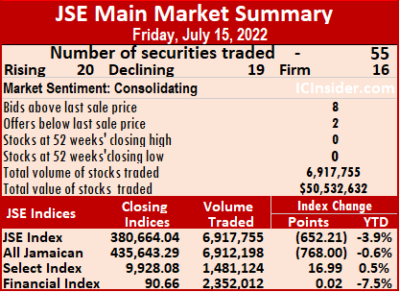

The All Jamaican Composite Index lost 768.00 points to 435,643.29, the JSE Main Index lost 652.21 points to close at 380,664.04 and the JSE Financial Index increased 0.02 points to 90.66.

Trading ended with 55 securities, similar to Thursday, with 20 rising, 19 declining and 16 ending unchanged.

The PE Ratio, a formula to ascertain appropriate stock values, averages 14.2 for the Main Market. The JSE Main and USD Market PE ratios are computed based on ICInsider.com’s forecasted earnings for companies with financial years ending to the close of August 2023.

The PE Ratio, a formula to ascertain appropriate stock values, averages 14.2 for the Main Market. The JSE Main and USD Market PE ratios are computed based on ICInsider.com’s forecasted earnings for companies with financial years ending to the close of August 2023.

Investor’s Choice bid-offer indicator shows eight stocks ended with bids higher than their last selling prices and two stocks with lower offers.

At the close, Caribbean Cement fell 97 cents to end at $62.25 while exchanging 6,742 shares, Eppley Caribbean Property Fund rallied $3 to $43 after exchanging 3,685 stocks, First Rock Capital increased 59 cents to $12.50 with 19,005 units changing hands. GraceKennedy shed $2.01 in ending at $99.96 after trading 16,371 stock units, Jamaica Stock Exchange lost 62 cents to close at $17.98, with 18,511 shares crossing the exchange, Margaritaville declined $2 to $19, with 132 stock units clearing the market. Mayberry Investments rose 35 cents to $10.80 with 234,085 stocks changing hands, Mayberry Jamaican Equities gained 59 cents to close at $14.99 in exchanging 59,671 units, MPC Caribbean Clean Energy climbed $5 to end at $85 with an exchange of 1,000 stocks.  Palace Amusement advanced $60 in closing at $880 in switching ownership of 157 units, Proven Investments dropped $1 to $34 after finishing the trading of 4,258 shares, Seprod shed $1 to end at $70 in trading 15,960 stock units and Sygnus Credit Investments popped 39 cents in closing at $14 in an exchange of 8,041 stocks.

Palace Amusement advanced $60 in closing at $880 in switching ownership of 157 units, Proven Investments dropped $1 to $34 after finishing the trading of 4,258 shares, Seprod shed $1 to end at $70 in trading 15,960 stock units and Sygnus Credit Investments popped 39 cents in closing at $14 in an exchange of 8,041 stocks.

In the preference segment, Productive Business Solutions 9.75% preference share gained $2.50 to close at $109.50 with the swapping of 160 units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Trading plunged on JSE Main Market

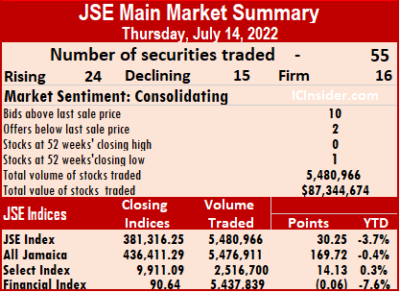

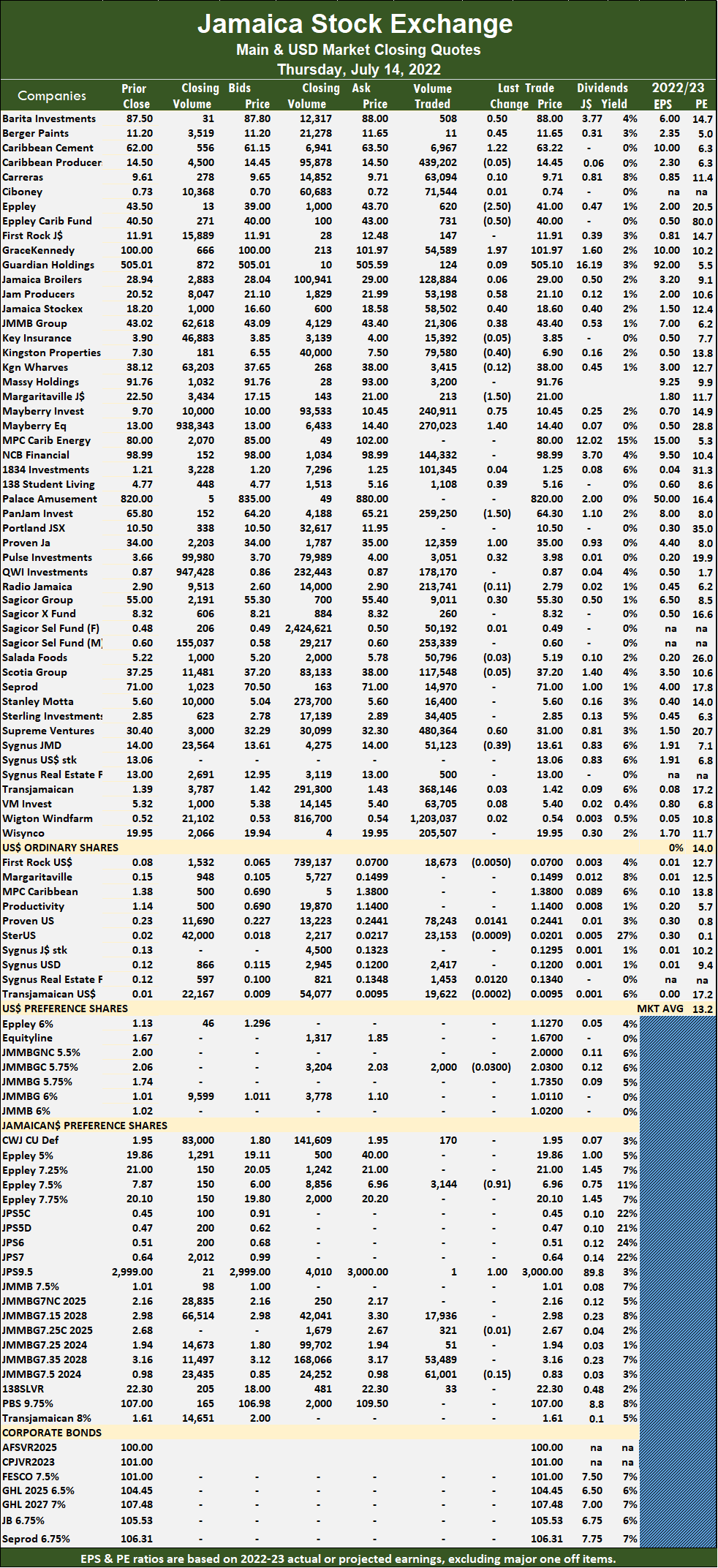

Man Market trading volumes plunged on Thursday after trading 66 percent less shares with 45 percent higher value than on Wednesday on the Jamaica Stock Exchange Main Market as 55 securities traded compared to 54 on Wednesday, with 24 rising, 15 declining and 16 ending unchanged.

Just 5,480,966 shares were exchanged for $87,344,674 compared to 16,023,046 units at $60,117,325 at the close on Wednesday. Trading averages 99,654 units at $1,588,085, compared to 296,723 shares at $1,113,284 on Wednesday and month to date, an average of 186,354 units at $1,734,673, compared to 196,085 units at $1,751,127 on the previous trading day. June closed with an average of 281,913 units at $5,309,050.

Just 5,480,966 shares were exchanged for $87,344,674 compared to 16,023,046 units at $60,117,325 at the close on Wednesday. Trading averages 99,654 units at $1,588,085, compared to 296,723 shares at $1,113,284 on Wednesday and month to date, an average of 186,354 units at $1,734,673, compared to 196,085 units at $1,751,127 on the previous trading day. June closed with an average of 281,913 units at $5,309,050.

Wigton Windfarm led trading with 1.20 million shares for 21.9 percent of total volume followed by Supreme Ventures with 480,364 units for 8.8 percent of the day’s trade and Caribbean Producers with 439,202 units for 8 percent market share.

The All Jamaican Composite Index popped 169.72 points to settle at 436,411.29, the JSE Main Index added 30.25 points to close at 381,316.25and the JSE Financial Index declined 0.06 points to settle at 90.64.

The PE Ratio, a formula to ascertain appropriate stock values, averages 14 for the Main Market. The JSE Main and USD Market PE ratios are computed based on ICInsider.com’s forecasted earnings for companies with financial years, ending to the close of August 2023.

Investor’s Choice bid-offer indicator shows ten stocks ended with bids higher than their last selling prices and two stocks with lower offers.

At the close, Barita Investments advanced 50 cents in ending at $88, with 508 shares crossing the market, Berger Paints gained 45 cents to end at $11.65 after trading 11 stock units, Caribbean Cement rose $1.22 in closing at $63.22 with 6,967 stocks clearing the market. Eppley dropped $2.50 to $41 in exchanging 620 units, Eppley Caribbean Property Fund shed 50 cents to close at $40 while exchanging 731 stock units, GraceKennedy popped $1.97 in closing at $101.97, with changing hands 54,589 units. Jamaica Producers climbed 58 cents to $21.10 after finishing treading of 53,198 shares, Jamaica Stock Exchange rallied 40 cents to end at $18.60 in switching ownership of 58,502 stocks, JMMB Group increased 38 cents to close at $43.40 with the swapping of 21,306 stocks. Kingston Properties declined 40 cents to $6.90 after trading 79,580 shares, Margaritaville lost $1.50 in ending at $21 and exchanging 213 stock units, Mayberry Investments increased 75 cents to $10.45 after 240,911 units crossed the market. Mayberry Jamaican Equities advanced $1.40 to end at $14.40 after exchanging 270,023 stocks, 138 Student Living gained 39 cents to close at $5.16 in an exchange of 1,108 shares, PanJam Investment fell $1.50 to $64.30, with 259,250 stock units crossing the exchange.

At the close, Barita Investments advanced 50 cents in ending at $88, with 508 shares crossing the market, Berger Paints gained 45 cents to end at $11.65 after trading 11 stock units, Caribbean Cement rose $1.22 in closing at $63.22 with 6,967 stocks clearing the market. Eppley dropped $2.50 to $41 in exchanging 620 units, Eppley Caribbean Property Fund shed 50 cents to close at $40 while exchanging 731 stock units, GraceKennedy popped $1.97 in closing at $101.97, with changing hands 54,589 units. Jamaica Producers climbed 58 cents to $21.10 after finishing treading of 53,198 shares, Jamaica Stock Exchange rallied 40 cents to end at $18.60 in switching ownership of 58,502 stocks, JMMB Group increased 38 cents to close at $43.40 with the swapping of 21,306 stocks. Kingston Properties declined 40 cents to $6.90 after trading 79,580 shares, Margaritaville lost $1.50 in ending at $21 and exchanging 213 stock units, Mayberry Investments increased 75 cents to $10.45 after 240,911 units crossed the market. Mayberry Jamaican Equities advanced $1.40 to end at $14.40 after exchanging 270,023 stocks, 138 Student Living gained 39 cents to close at $5.16 in an exchange of 1,108 shares, PanJam Investment fell $1.50 to $64.30, with 259,250 stock units crossing the exchange.  Proven Investments rose $1 in closing at $35 with 12,359 units changing hands, Supreme Ventures rallied 60 cents to $31 with an exchange of 480,364 stock units and Sygnus Credit Investments shed 39 cents to end at $13.61 while exchanging 51,123 shares.

Proven Investments rose $1 in closing at $35 with 12,359 units changing hands, Supreme Ventures rallied 60 cents to $31 with an exchange of 480,364 stock units and Sygnus Credit Investments shed 39 cents to end at $13.61 while exchanging 51,123 shares.

In the preference segment, Eppley 7.50% preference share fell 91 cents to $6.96 after 3,144 units changed hands and Jamaica Public Service 9.5% climbed $1 to close at $3000 with the swapping of one stock unit.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Falling stocks beat those declining

Trading ended on the Jamaica Stock Exchange Main Market on Wednesday, with the volume of stocks traded rising 55 percent and 16 percent lower than Tuesday as 54 securities changed hands against 55 on Tuesday, but advancing stocks were outnumbered by those declining, with 18 rising, 27 declining and nine ending unchanged.

The All Jamaican Composite Index popped 495.68 points to 436,241.57, the JSE Main Index rose 374.06 points to 381,286.00 and the JSE Financial Index popped 0.16 points to end at 90.70.

The All Jamaican Composite Index popped 495.68 points to 436,241.57, the JSE Main Index rose 374.06 points to 381,286.00 and the JSE Financial Index popped 0.16 points to end at 90.70.

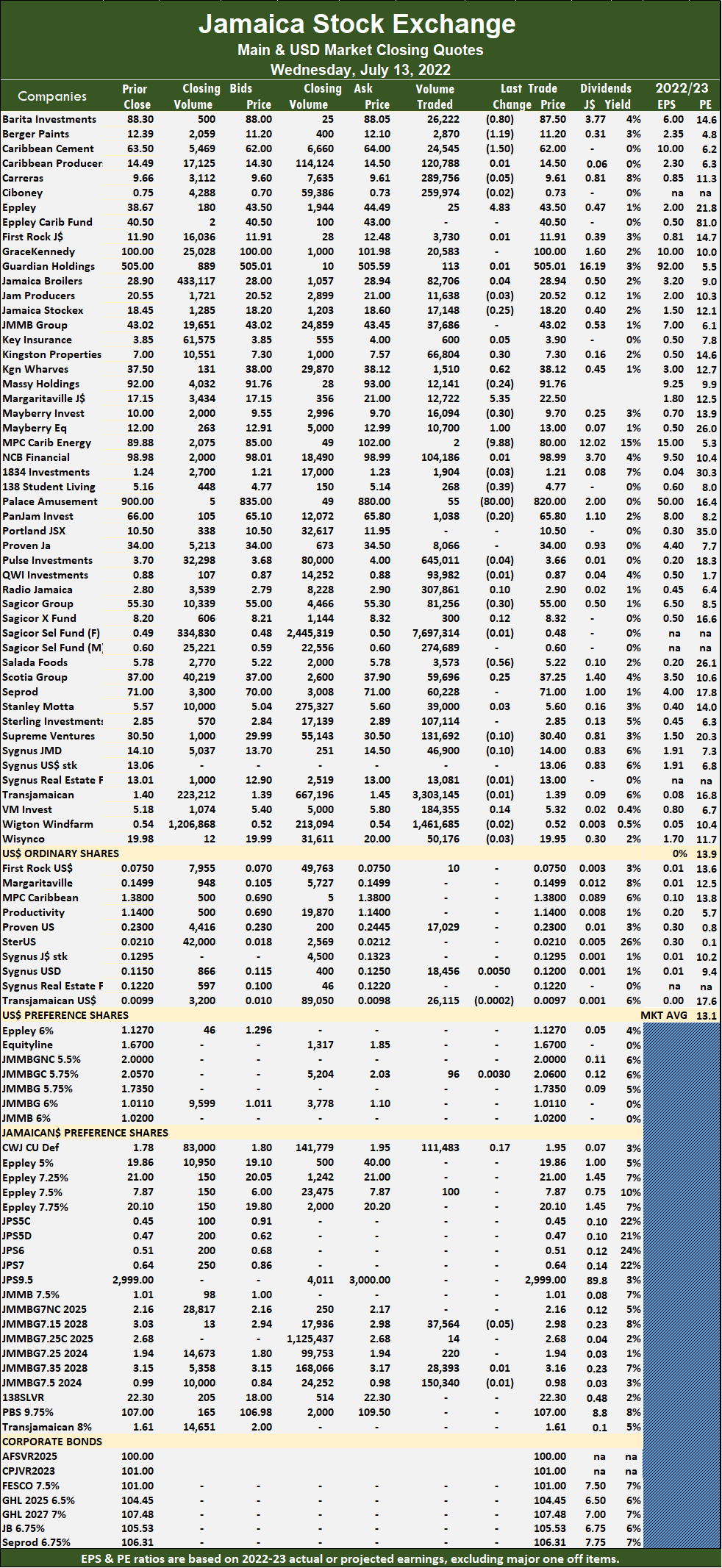

The PE Ratio, a formula to ascertain appropriate stock values, averages 13.9 for the Main Market. The JSE Main and USD Market PE ratios are computed based on ICInsider.com’s forecasted earnings for companies with financial years ending up to the close of August 2023.

A total of 16,023,046 shares were exchanged for $60,117,325 versus 10,333,462 units at $71,873,511 on Tuesday. Trading averages 296,723 units at $1,113,284, compared to 187,881 shares at $1,306,791 on Tuesday and month to date, an average of 196,085 units at $1,751,127, compared to 183,621 units at $1,830,126 on the previous trading day. June closed with an average of 281,913 units at $5,309,050.

Sagicor Select Financial Fund led trading with 7.70 million shares for 48 percent of total volume, followed by Transjamaican Highway with 3.30 million units for 20.6 percent of the day’s trade and Wigton Windfarm with 1.46 million units for 9.1 percent of market share.

Sagicor Select Financial Fund led trading with 7.70 million shares for 48 percent of total volume, followed by Transjamaican Highway with 3.30 million units for 20.6 percent of the day’s trade and Wigton Windfarm with 1.46 million units for 9.1 percent of market share.

Investor’s Choice bid-offer indicator shows 11 stocks ended with bids higher than their last selling prices and two with lower offers.

At the close, Barita Investments declined 80 cents after ending at $87.50 with 26,222 shares clearing the market, Berger Paints dropped $1.19 to end at $11.20 in switching ownership of 2,870 units, Caribbean Cement lost $1.50 in closing at $62, with 24,545 stock units crossing the market. Eppley rose $4.83 to close at $43.50 in exchanging 25 stocks, Jamaica Stock Exchange lost 25 cents in trading 17,148 shares at $18.20, Kingston Wharves rallied 62 cents to $38.12 while trading 1,510 stocks, Kingston Properties traded 1,510 shares and gained 30 cents in closing at $7.30, Margaritaville climbed $5.35 to close at $22.50, with 12,722 units crossing the exchange. Mayberry Jamaican Equities advanced $1 in closing at $13 in trading 10,700 shares, MPC Caribbean Clean Energy fell $9.88, ending in at $80 while exchanging two stock units,  Massy Holdings fell 24 cents to $91.76 after trading 12,141 stock units, 138 Student Living shed 39 cents to close at $4.77after 268 stock units crossed the market. Palace Amusement dropped $80 to end at $820 with the swapping of 55 units, Sagicor Group had an exchange of 81,256 shares after falling 30 cents to close at $55 and Salada Foods fell 56 cents to close at $5.22 and finished trading of 3,573 shares.

Massy Holdings fell 24 cents to $91.76 after trading 12,141 stock units, 138 Student Living shed 39 cents to close at $4.77after 268 stock units crossed the market. Palace Amusement dropped $80 to end at $820 with the swapping of 55 units, Sagicor Group had an exchange of 81,256 shares after falling 30 cents to close at $55 and Salada Foods fell 56 cents to close at $5.22 and finished trading of 3,573 shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Gains for JSE Main Market

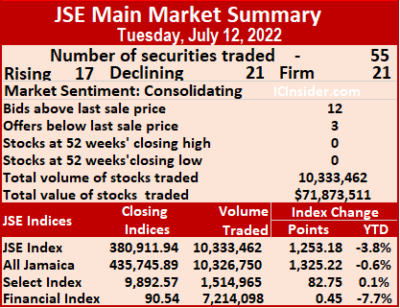

Market activity ended on the Jamaica Stock Exchange Main Market on Tuesday, with the volume of stocks traded rising 15 percent with an 11 percent lower value than on Monday as rising stocks exceeded those declining with 55 securities similar to Monday, ended with 23 and rising, 21 declining and 11 ending unchanged.

The All Jamaican Composite Index rallied 1,325.22 points to 435,745.89, the JSE Main Index rose 1,253.18 to 380,911.94 and the JSE Financial Index popped 0.45 points to settle at 90.54.

The All Jamaican Composite Index rallied 1,325.22 points to 435,745.89, the JSE Main Index rose 1,253.18 to 380,911.94 and the JSE Financial Index popped 0.45 points to settle at 90.54.

The PE Ratio, a formula to ascertain appropriate stock values, averages 13.9 for the Main Market. The JSE Main and USD Market PEs are computed using ICInsider.com’s forecasted earnings for companies with financial years ending up to the close of August 2023.

Overall, 10,333,462 shares were exchanged for $71,873,511 compared to 8,975,299 units at $80,967,249 on Monday. Trading averages 187,881 units at $1,306,791, compared to 163,187 shares at $1,472,132 on Monday and month to date, an average of 183,621 units at $1,830,126, versus 183,006 units at $1,905,673 on the previous trading day. June closed with an average of 281,913 units at $5,309,050.

QWI Investments led trading with 3.46 million shares for 33.5 percent of total volume followed by Wigton Windfarm with 1.26 million units for 12.2 percent of the day’s trade and Transjamaican Highway, 836,971 units for 8.1 percent of market share.

Investor’s Choice bid-offer indicator shows 12 stocks ended with bids higher than their last selling prices and three with lower offers.

At the close, Berger Paints rose 88 cents to end at $12.39 in switching ownership of 9 shares, Caribbean Cement shed 50 cents to finish at $63.50 in exchanging 2,526 stocks, Eppley Caribbean Property Fund advanced $1 to $40.50, with 1,111 units crossing the market. GraceKennedy fell $2.48 to $100 after finishing trading 4,960 stock units, Guardian Holdings gained $3 in closing at $505, with 1,018 units crossing the exchange, Jamaica Broilers rallied $1.88 to $28.90 with 601,198 stocks clearing the market. Jamaica Stock Exchange popped 45 cents to end at $18.45 after 19,861 shares crossed the market, Kingston Properties lost 45 cents to close at $7 in trading 71,060 stock units, Mayberry Jamaican Equities declined $1.66 in closing at $12 with 40,646 units changing hands. NCB Financial increased $1.98 to $98.98 with an exchange of 123,916 stock units, Palace Amusement climbed $40 in closing at $900 with the swapping of 3 stocks, Portland JSX dropped 50 cents to close at $10.50, with 1,376 shares changing hands.

At the close, Berger Paints rose 88 cents to end at $12.39 in switching ownership of 9 shares, Caribbean Cement shed 50 cents to finish at $63.50 in exchanging 2,526 stocks, Eppley Caribbean Property Fund advanced $1 to $40.50, with 1,111 units crossing the market. GraceKennedy fell $2.48 to $100 after finishing trading 4,960 stock units, Guardian Holdings gained $3 in closing at $505, with 1,018 units crossing the exchange, Jamaica Broilers rallied $1.88 to $28.90 with 601,198 stocks clearing the market. Jamaica Stock Exchange popped 45 cents to end at $18.45 after 19,861 shares crossed the market, Kingston Properties lost 45 cents to close at $7 in trading 71,060 stock units, Mayberry Jamaican Equities declined $1.66 in closing at $12 with 40,646 units changing hands. NCB Financial increased $1.98 to $98.98 with an exchange of 123,916 stock units, Palace Amusement climbed $40 in closing at $900 with the swapping of 3 stocks, Portland JSX dropped 50 cents to close at $10.50, with 1,376 shares changing hands.  Proven Investments fell $1.50 to $34 in an exchange of 3,919 stock units, Pulse Investments lost 47 cents in ending at $3.70 while exchanging 509,000 shares, Salada Foods gained 39 cents to end at $5.78 trading 5,235 units. Scotia Group rallied 50 cents in closing at $37 after exchanging 26,741 stocks and Seprod declined 50 cents to end at $71 after trading 133,083 stocks.

Proven Investments fell $1.50 to $34 in an exchange of 3,919 stock units, Pulse Investments lost 47 cents in ending at $3.70 while exchanging 509,000 shares, Salada Foods gained 39 cents to end at $5.78 trading 5,235 units. Scotia Group rallied 50 cents in closing at $37 after exchanging 26,741 stocks and Seprod declined 50 cents to end at $71 after trading 133,083 stocks.

In the preference segment, Jamaica Public Service 9.5% dropped $1 to $2999 after exchanging 101 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Trading drifts lower for JSE Main Market

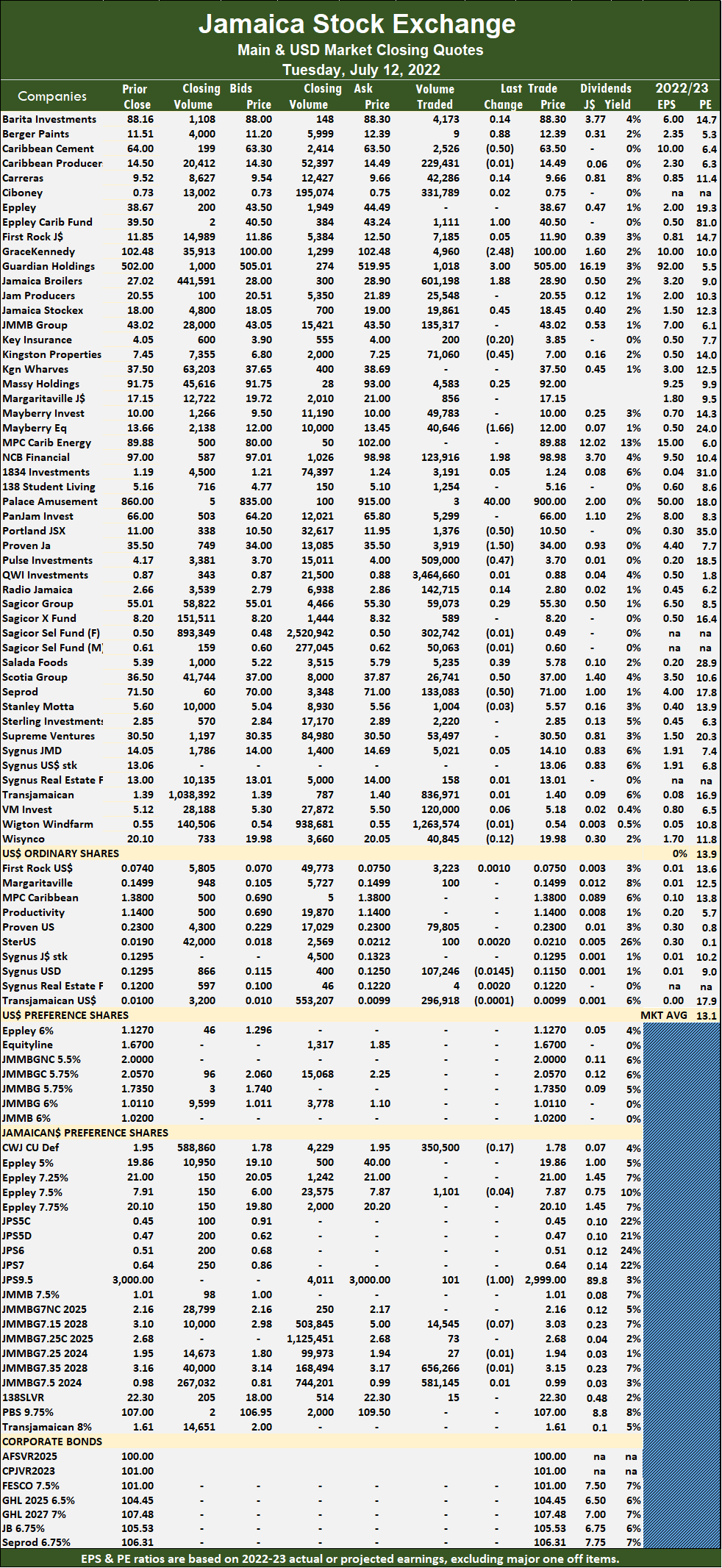

Market activity ended on the Jamaica Stock Exchange Main Market on Monday, with the volume of stocks traded declining slightly, after 16 percent less shares changed hands than on Friday, following 55 active securities compared to 51 on Friday, with 15 rising, 29 declining and 11 ending unchanged.

Overall, 8,975,299 shares were traded for $80,967,249 down from 9,624,890 units at $96,004,491 on Friday. Trading averages 163,187 units at $1,472,132, compared to 188,723 shares at $1,882,441 on Friday and month to date, an average of 183,006 units at $1,905,673, versus 186,350 units at $1,978,817 on the preceding trading day. June closed with an average of 281,913 units at $5,309,050.

Overall, 8,975,299 shares were traded for $80,967,249 down from 9,624,890 units at $96,004,491 on Friday. Trading averages 163,187 units at $1,472,132, compared to 188,723 shares at $1,882,441 on Friday and month to date, an average of 183,006 units at $1,905,673, versus 186,350 units at $1,978,817 on the preceding trading day. June closed with an average of 281,913 units at $5,309,050.

Pulse Investments led trading with 2.08 million shares for 23.2 percent of total volume, followed by Wigton Windfarm with 1.93 million units for 21.5 percent of the day’s trade and Sterling Investments with 977,830 units for 10.9 percent market share.

The All Jamaican Composite Index dropped 1,589.45 points to settle at 434,420.67, the JSE Main Index last 1,076.84 points to 379,658.76 and the JSE Financial Index shed 0.30 points to settle at 90.09.

The PE Ratio, a formula to ascertain appropriate stock values, averages 13.9 for the Main Market. The JSE Main and USD Market PE ratios are computed based on ICInsider.com’s forecasted earnings for companies with financial years ending up to the close of August 2023.

Investor’s Choice bid-offer indicator shows 15 stocks ended with bids higher than their last selling prices and three stocks with lower offers.

At the close, Barita Investments shed $1.74 in closing at $88.16, with 223,812 shares changing hands, Berger Paints gained 51 cents to $11.51, crossing the market 15,598 units, Caribbean Cement popped $1 after ending at $64, with 44,874 stock units crossing the exchange. Eppley dropped $3.83 to close at $38.67 while exchanging 1,082 stocks, First Rock Capital lost 65 cents to end at $11.85 in exchanging 14,054 units, GraceKennedy jumped $3.88 in closing at $102.48 in an exchange of 60,999 shares. Jamaica Producers declined 47 cents to end at $20.55 after closing with 17,201 stocks changing hands, Mayberry Jamaican Equities increased 66 cents to $13.66 in finishing trading 2,862 stock units, NCB Financial fell 50 cents to $97 with an exchange of 61,488 shares. 138 Student Living rose 39 cents to close at $5.16 in trading 4,272 units, Portland JSX dropped 95 cents to $11, with 75 stock units clearing the market, Proven Investments declined 50 cents to close at $35.50 after trading 99 stocks. Scotia Group fell 90 cents to end at $36.50 in switching ownership of 2,115 stocks, Seprod lost 45 cents after finishing at $71.50 in exchanging 1,859 units, Supreme Ventures shed 48 cents to $30.50, with 98,014 stock units crossing the market.

At the close, Barita Investments shed $1.74 in closing at $88.16, with 223,812 shares changing hands, Berger Paints gained 51 cents to $11.51, crossing the market 15,598 units, Caribbean Cement popped $1 after ending at $64, with 44,874 stock units crossing the exchange. Eppley dropped $3.83 to close at $38.67 while exchanging 1,082 stocks, First Rock Capital lost 65 cents to end at $11.85 in exchanging 14,054 units, GraceKennedy jumped $3.88 in closing at $102.48 in an exchange of 60,999 shares. Jamaica Producers declined 47 cents to end at $20.55 after closing with 17,201 stocks changing hands, Mayberry Jamaican Equities increased 66 cents to $13.66 in finishing trading 2,862 stock units, NCB Financial fell 50 cents to $97 with an exchange of 61,488 shares. 138 Student Living rose 39 cents to close at $5.16 in trading 4,272 units, Portland JSX dropped 95 cents to $11, with 75 stock units clearing the market, Proven Investments declined 50 cents to close at $35.50 after trading 99 stocks. Scotia Group fell 90 cents to end at $36.50 in switching ownership of 2,115 stocks, Seprod lost 45 cents after finishing at $71.50 in exchanging 1,859 units, Supreme Ventures shed 48 cents to $30.50, with 98,014 stock units crossing the market.  Sygnus Credit Investments dropped 75 cents to end at $14.05 after exchanging 34,740 shares and Victoria Mutual Investments lost 81 cents in closing at $5.12 with the swapping of 68,219 stock units.

Sygnus Credit Investments dropped 75 cents to end at $14.05 after exchanging 34,740 shares and Victoria Mutual Investments lost 81 cents in closing at $5.12 with the swapping of 68,219 stock units.

In the preference segment, Eppley 7.50% preference share rallied 36 cents after ending at $7.91 after trading 146 units and Productive Business Solutions 9.75% preference share fell $1.26 to $107 and closed with ten shares changing hands.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

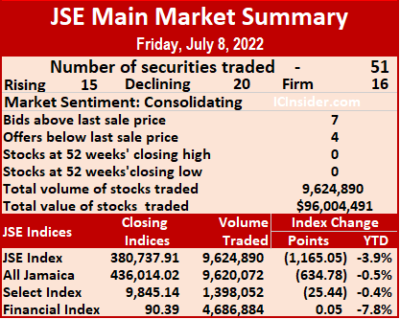

Pull back for JSE Main Market

Market activity ended on Friday, with the volume of stocks traded declining after trading 7 percent less valued 42 percent less than on Thursday on the Jamaica Stock Exchange Main Market as declining stocks exceeded those rising with just 51 securities compared to 56 on Thursday, with 15 rising, 20 declining and 16 ending unchanged.

Overall, 9,624,890 shares were traded for $96,004,491 versus 10,333,128 units at $164,852,282 on Thursday. Trading averages 188,723 units at $1,882,441, versus 184,520 shares at $2,943,791 on Thursday and month to date, an average of 186,350 units at $1,978,817, compared to 185,910 units at $1,996,690 on the previous trading day. June closed with an average of 281,913 units at $5,309,050.

Overall, 9,624,890 shares were traded for $96,004,491 versus 10,333,128 units at $164,852,282 on Thursday. Trading averages 188,723 units at $1,882,441, versus 184,520 shares at $2,943,791 on Thursday and month to date, an average of 186,350 units at $1,978,817, compared to 185,910 units at $1,996,690 on the previous trading day. June closed with an average of 281,913 units at $5,309,050.

The All Jamaican Composite Index lost 638.68 points to settle at 436,010.12, the JSE Main Index fell 1,167.36 points to end at 380,735.60 and the JSE Financial Index rose 0.05 points to settle at 90.39.

The PE Ratio, a formula to ascertain appropriate stock values, averages 14.1 for the Main Market. The JSE Main and USD Market PE ratios are computed based on ICInsider.com’s forecasted earnings for companies with financial years ending up to the close of August 2023.

Wigton Windfarm led trading with 2.54 million shares for 26.4 percent of total volume, followed by Transjamaican Highway with 1.61 million units for 16.8 percent of the day’s trade and Sagicor Select Manufacturing & Distribution Fund with 1.15 million units for 12 percent market share.

Investor’s Choice bid-offer indicator shows seven stocks ended with bids higher than their last selling prices and four stocks with lower offers.

At the close, Barita Investments advanced $1.93 to $89.90 in switching ownership of 212,065 shares, Berger Paints shed $1.40 to end at $11 in exchanging 164,617 stocks, Caribbean Cement climbed $1, ending at $63, trading 10,140 units. GraceKennedy dropped $3.59 to $98.60 after exchanging 57,747 stock units, Jamaica Broilers rose $1.10 to $27 in an exchange of 29,735 shares, Jamaica Producers declined 95 cents to close at $21.02, finishing at 15,069 units. Jamaica Stock Exchange fell 44 cents to end at $18.06 with the swapping of 11,560 stock units, Kingston Properties lost 55 cents ending at $7.65 with an exchange of 54,458 stocks, Kingston Wharves shed $1.31 to $37.68, closed at 11,984 stocks. Massy Holdings lost $2.36 in closing at $91.64, crossing the market 3,614 shares, Mayberry Investments rose 80 cents to close at $10 in exchanging 115,934 stock units, NCB Financial dropped 50 cents to end at $97.50, changing hands 337,156 units.

At the close, Barita Investments advanced $1.93 to $89.90 in switching ownership of 212,065 shares, Berger Paints shed $1.40 to end at $11 in exchanging 164,617 stocks, Caribbean Cement climbed $1, ending at $63, trading 10,140 units. GraceKennedy dropped $3.59 to $98.60 after exchanging 57,747 stock units, Jamaica Broilers rose $1.10 to $27 in an exchange of 29,735 shares, Jamaica Producers declined 95 cents to close at $21.02, finishing at 15,069 units. Jamaica Stock Exchange fell 44 cents to end at $18.06 with the swapping of 11,560 stock units, Kingston Properties lost 55 cents ending at $7.65 with an exchange of 54,458 stocks, Kingston Wharves shed $1.31 to $37.68, closed at 11,984 stocks. Massy Holdings lost $2.36 in closing at $91.64, crossing the market 3,614 shares, Mayberry Investments rose 80 cents to close at $10 in exchanging 115,934 stock units, NCB Financial dropped 50 cents to end at $97.50, changing hands 337,156 units.  Sagicor Group gained $1.20 in closing at $55.20, crossing the market 41,672 stock units, Scotia Group rallied $1.40, ending at $37.40, clearing the market with 12,611 shares, Seprod popped 70 cents to $71.95 trading 11,533 units and Sygnus Credit Investments climbed 80 cents to end at $14.80 crossing the exchange 359,348 stocks.

Sagicor Group gained $1.20 in closing at $55.20, crossing the market 41,672 stock units, Scotia Group rallied $1.40, ending at $37.40, clearing the market with 12,611 shares, Seprod popped 70 cents to $71.95 trading 11,533 units and Sygnus Credit Investments climbed 80 cents to end at $14.80 crossing the exchange 359,348 stocks.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

JSE Main Market rise with increased trades

Trading picked on the Jamaica Stock Exchange Main Market on Thursday, with the volume of stocks traded rising 10 percent with an 85 percent greater value than on Wednesday as declining stocks exceeded those rising.

Trading accounted for 56 securities on Thursday and Wednesday, with 18 rising, 23 declining and 15 ending unchanged.

Trading accounted for 56 securities on Thursday and Wednesday, with 18 rising, 23 declining and 15 ending unchanged.

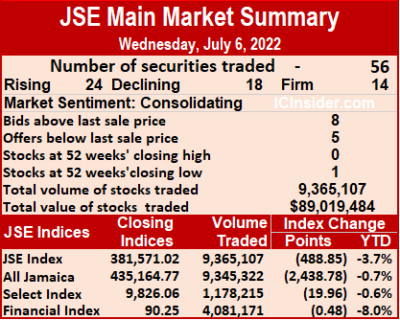

A total of 10,333,128 shares were traded for $164,852,282, up from 9,365,107 units at $89,019,484 on Wednesday.

Trading averages 184,520 units at $2,943,791, versus 167,234 shares at $1,589,634 on Wednesday. Month to date, trading averaged 185,910 units at $1,996,690, compared to 186,265 units at $1,754,509 on the previous trading day. June closed with an average of 281,913 units at $5,309,050.

The All Jamaican Composite Index popped 1,484.03 points to settle at 436,648.80, the JSE Main Index rallied 331.94 points to 381,902.96 and the JSE Financial Index advanced 0.09 points to settle at 90.34.

Wigton Windfarm led trading with 2.17 million shares for 21 percent of total volume, followed by JMMB Group with 1.96 million units for 19 percent of the day’s trade. Sagicor Select Financial Fund ended with 1.42 million units for 13.7 percent market share and Transjamaican Highway with 1.38 million units for 13.3 percent of shares transferred.

The PE Ratio, a formula to ascertain appropriate stock values, averages 14.3 for the Main Market. The JSE Main and USD Market PE ratios are computed based on ICInsider.com’s forecasted earnings for companies with financial years ending up to the close of August 2023.

Investor’s Choice bid-offer indicator shows ten stocks ended with bids higher than their last selling prices and one with a lower offer.

At the close, Caribbean Cement lost $2 in closing at $62 while exchanging 21,813 shares, Eppley Caribbean Property Fund declined $1 in ending at $39.50 and trading 2,118 units, GraceKennedy shed 45 cents to close at $102.19 in an exchange of 30,898 stock units. Guardian Holdings dropped $19.79 to end at $502 after trading 1,135 stocks, Jamaica Broilers fell $2.10 to $25.90 and closed with 46,373 stock units changing hands, Jamaica Producers gained 87 cents to close at $21.97, with an exchange of 9,299 units. Jamaica Stock Exchange climbed 44 cents to $18.50 with 1,083 shares clearing the market, Kingston Wharves advanced $1.29 to $38.99 with the swapping of 28 stocks, Massy Holdings shed $1 in closing at $94 with an exchange of 111 shares. Mayberry Investments declined 79 cents to end at $9.20 in switching ownership of 303 stock units, NCB Financial fell $1 to $98, with 275,137 stocks crossing the market, PanJam Investment rallied $1 to end at $66witg 4,065 units changing hands. Portland JSX popped $1.35 to $11.85 after trading 90 units, Proven Investments increased $3 to close at $36, with 9,446 shares crossing the market, Sagicor Group dropped $1 in closing at $54 in exchanging 104,607 stock units.

At the close, Caribbean Cement lost $2 in closing at $62 while exchanging 21,813 shares, Eppley Caribbean Property Fund declined $1 in ending at $39.50 and trading 2,118 units, GraceKennedy shed 45 cents to close at $102.19 in an exchange of 30,898 stock units. Guardian Holdings dropped $19.79 to end at $502 after trading 1,135 stocks, Jamaica Broilers fell $2.10 to $25.90 and closed with 46,373 stock units changing hands, Jamaica Producers gained 87 cents to close at $21.97, with an exchange of 9,299 units. Jamaica Stock Exchange climbed 44 cents to $18.50 with 1,083 shares clearing the market, Kingston Wharves advanced $1.29 to $38.99 with the swapping of 28 stocks, Massy Holdings shed $1 in closing at $94 with an exchange of 111 shares. Mayberry Investments declined 79 cents to end at $9.20 in switching ownership of 303 stock units, NCB Financial fell $1 to $98, with 275,137 stocks crossing the market, PanJam Investment rallied $1 to end at $66witg 4,065 units changing hands. Portland JSX popped $1.35 to $11.85 after trading 90 units, Proven Investments increased $3 to close at $36, with 9,446 shares crossing the market, Sagicor Group dropped $1 in closing at $54 in exchanging 104,607 stock units.  Stanley Motta rose 58 cents to close at $5.58 in exchanging 30,300 stocks, Sterling Investments climbed 40 cents in closing at $2.90 after trading 18,904 stock units, Sygnus Credit Investments fell 75 cents to $14 in transferring 89,703 stocks and Sygnus Real Estate Finance shed $2 to $13 while exchanging 1,922 shares.

Stanley Motta rose 58 cents to close at $5.58 in exchanging 30,300 stocks, Sterling Investments climbed 40 cents in closing at $2.90 after trading 18,904 stock units, Sygnus Credit Investments fell 75 cents to $14 in transferring 89,703 stocks and Sygnus Real Estate Finance shed $2 to $13 while exchanging 1,922 shares.

In the preference segment, Eppley 7.25% preference share fell 99 cents to end at $21 with the swapping of 50 units and Eppley 7.50% preference share popped 69 cents to end at $7.59, with 50 stock units clearing the market.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Steady trading for JSE Main Market

Market activity was steady on Wednesday, versus Tuesday with the volume and value of stocks trading differed, marginally from Tuesday’s levels on the Jamaica Stock Exchange Main Market as rising stocks exceeded those declining but that failed to prevent the market indices from slipping.

Overall, 9,365,107 shares were traded for $89,019,484 versus 9,657,015 units at $85,919,427 on Tuesday. Trading averages 167,234 units at $1,589,634, compared to 178,834 shares at $1,591,100 on Tuesday and month to date, an average of 186,265 units at $1,754,509, compared to 192,803 units at $1,811,153 on the previous trading day. June closed with an average of 281,913 units at $5,309,050.

Overall, 9,365,107 shares were traded for $89,019,484 versus 9,657,015 units at $85,919,427 on Tuesday. Trading averages 167,234 units at $1,589,634, compared to 178,834 shares at $1,591,100 on Tuesday and month to date, an average of 186,265 units at $1,754,509, compared to 192,803 units at $1,811,153 on the previous trading day. June closed with an average of 281,913 units at $5,309,050.

Community & Workers Credit Union led trading with 2.44 million shares for 26.1 percent of total volume followed by Transjamaican Highway with 1.53 million units for 16.3 percent of the day’s trade and Sagicor Select Financial Fund with 1.35 million units for 14.5 percent market share.

The All Jamaican Composite Index dropped 2,438.78 points to 435,164.77, the JSE Main Index fell 488.85 points to 381,571.02 and the JSE Financial Index declined 0.48 points to 90.25.

Trading ended with 56 securities compared to 54 on Tuesday, with 24 rising, 18 declining and 14 ending unchanged.

The PE Ratio, a formula to ascertain appropriate stock values, averages 14.3 for the Main Market. The JSE Main and USD Market PE ratios are computed based on ICInsider.com’s forecasted earnings for companies with financial years, ending up to the close of August 2023.

Investor’s Choice bid-offer indicator shows eight stocks ended with bids higher than their last selling prices and five stocks with lower offers.

At the close, Eppley Caribbean Property Fund rose $1 to $40.50, with 13 shares crossing the market, First Rock Capital gained 94 cents to end at $12.70 with an exchange of 3,903 stock units, Guardian Holdings rallied $20.79 to $521.79 after trading 733 stocks. JMMB Group lost 64 cents in closing at $43 in switching ownership of 55,562 units, Kingston Properties increased 50 cents to close at $8.20, with 23,543 units crossing the market, Kingston Wharves fell $1.30 to $37.70, with 1,558 stocks changing hands. Margaritaville climbed 65 cents to end at $17.15 and closed after 2,121 stock units passed through the exchange, Massy Holdings advanced $3 in closing at $95 with 18,357 shares clearing the market, Mayberry Investments popped 82 cents in ending at $9.99 after exchanging 190 stocks. Mayberry Jamaican Equities shed 91 cents to close at $12.99 in trading 312,293 shares, MPC Caribbean Clean Energy dropped $16.62 in ending $89.88 while exchanging 682 stock units, Proven Investments fell $3.50 to end at $33 in trading 195,898 units. Sagicor Group lost 49 cents in closing at $55 in an exchange of 96,640 stock units, Scotia Group dropped 94 cents to close at $36, with 6,402 units crossing the exchange, Stanley Motta shed 60 cents to $5 after the trading of 11,200 stocks.

At the close, Eppley Caribbean Property Fund rose $1 to $40.50, with 13 shares crossing the market, First Rock Capital gained 94 cents to end at $12.70 with an exchange of 3,903 stock units, Guardian Holdings rallied $20.79 to $521.79 after trading 733 stocks. JMMB Group lost 64 cents in closing at $43 in switching ownership of 55,562 units, Kingston Properties increased 50 cents to close at $8.20, with 23,543 units crossing the market, Kingston Wharves fell $1.30 to $37.70, with 1,558 stocks changing hands. Margaritaville climbed 65 cents to end at $17.15 and closed after 2,121 stock units passed through the exchange, Massy Holdings advanced $3 in closing at $95 with 18,357 shares clearing the market, Mayberry Investments popped 82 cents in ending at $9.99 after exchanging 190 stocks. Mayberry Jamaican Equities shed 91 cents to close at $12.99 in trading 312,293 shares, MPC Caribbean Clean Energy dropped $16.62 in ending $89.88 while exchanging 682 stock units, Proven Investments fell $3.50 to end at $33 in trading 195,898 units. Sagicor Group lost 49 cents in closing at $55 in an exchange of 96,640 stock units, Scotia Group dropped 94 cents to close at $36, with 6,402 units crossing the exchange, Stanley Motta shed 60 cents to $5 after the trading of 11,200 stocks.  Sterling Investments fell 40 cents to a 52 weeks’ low of $2.50 in exchanging 77,690 shares, Supreme Ventures advanced $1.54 to end at $30.69 with the swapping of 68,794 units and Sygnus Credit Investments rallied 75 cents to close at $14.75 after 10,990 shares crossed the market.

Sterling Investments fell 40 cents to a 52 weeks’ low of $2.50 in exchanging 77,690 shares, Supreme Ventures advanced $1.54 to end at $30.69 with the swapping of 68,794 units and Sygnus Credit Investments rallied 75 cents to close at $14.75 after 10,990 shares crossed the market.

In the preference segment, Eppley 7.50% preference share popped 90 cents in closing at $6.90 in exchanging 100 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

- « Previous Page

- 1

- …

- 44

- 45

- 46

- 47

- 48

- …

- 117

- Next Page »