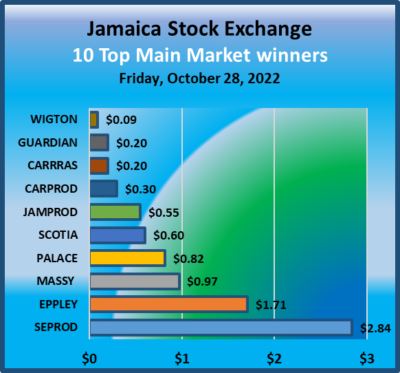

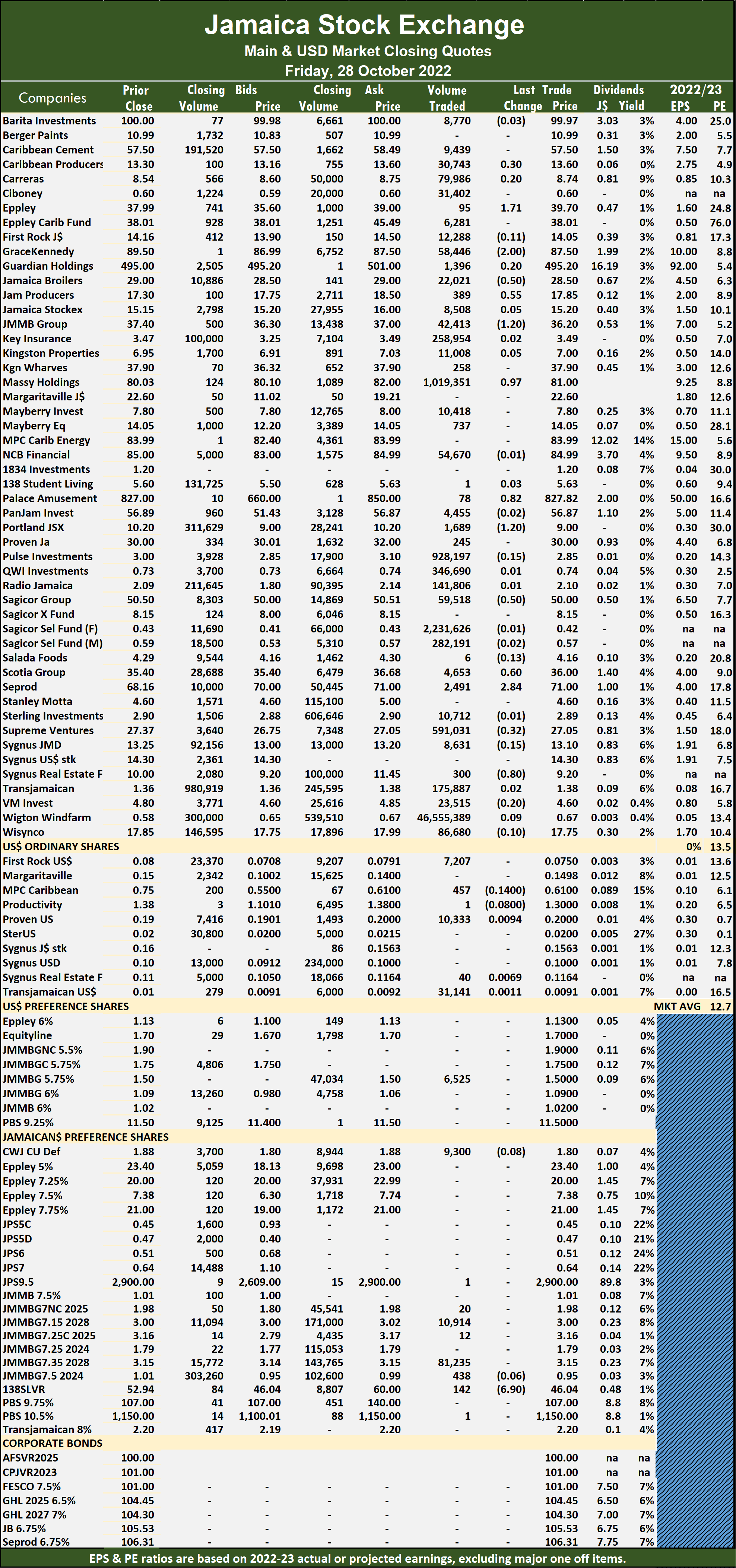

Stocks registered solid gains for the Jamaica Stock Exchange on Friday ended, with Guardian Holdings jumping $24, GraceKennedy nearly $5, Seprod $3.50 and Scotia Group $3, helping to drive the market index solidly up, with funds chasing stocks rising 29percent over Thursday even as the volume of stocks trading declined 24 percent and resulting in trading in 54 securities traded compared to 56 on Thursday, with 22 rising, 17 declining and 15 ending unchanged.

A total of 10,072,258 shares were exchanged for $74,070,561 against 13,269,863 units at $57,335,875 on Thursday.

A total of 10,072,258 shares were exchanged for $74,070,561 against 13,269,863 units at $57,335,875 on Thursday.

Trading averaged 186,523 shares at $1,371,677 compared to 236,962 stocks at $1,023,855 on Thursday and month to date, an average of 171,730 units at $1,075,008 versus 166,859 units at $977,324 on the previous day. October closed with an average of 231,243 units at $1,464,224.

Transjamaican Highway was the lead trade, with 5.93 million shares for 58.9 percent of total volume, followed by Wigton Windfarm with 1.08 million units for 10.7 percent of the day’s trade and Pulse Investments with 564,202 units for 5.6 percent market share.

The All Jamaican Composite Index climbed 3,654.63 points to 397,953.05, the JSE Main Index advanced 4,247.25 points to 349,150.16 and the JSE Financial Index popped 1.10 points to end at 83.66.

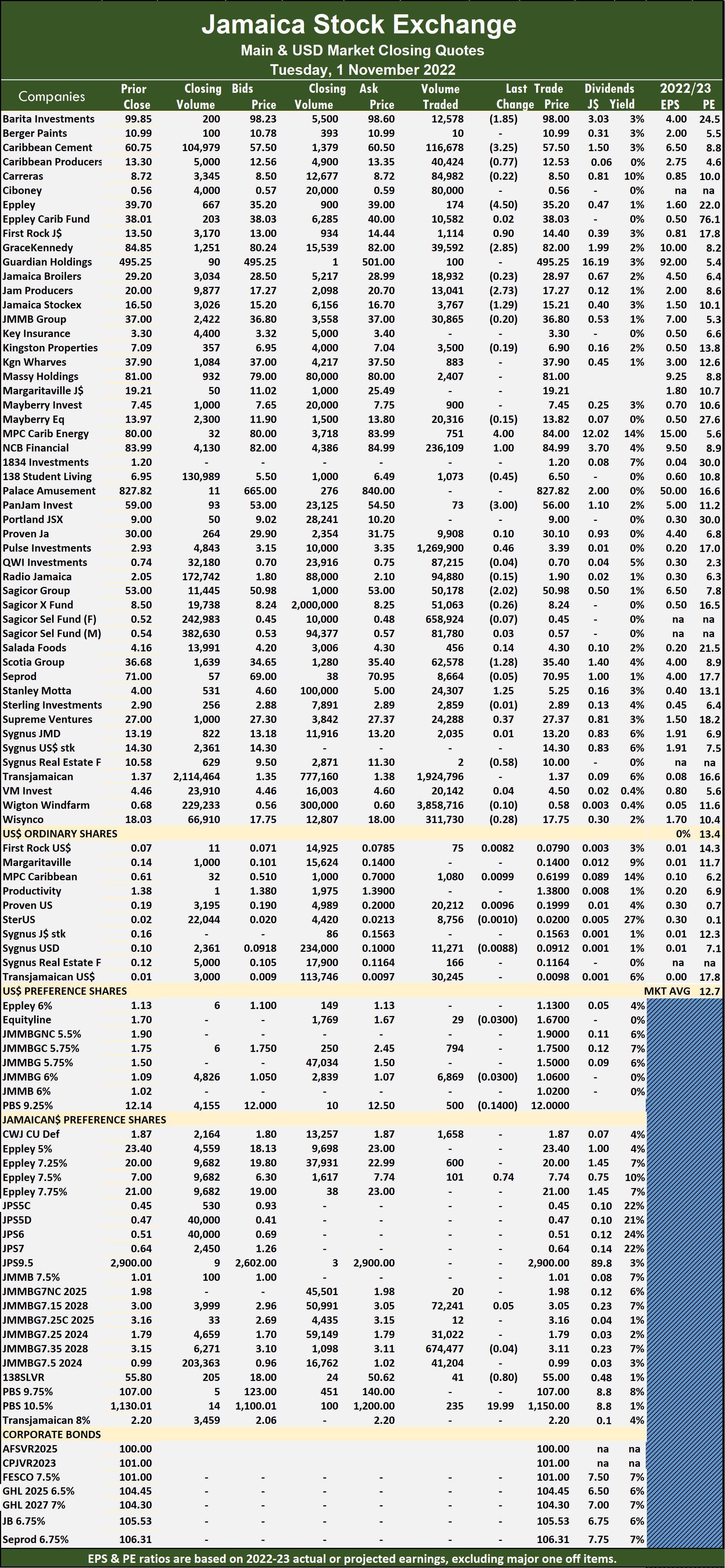

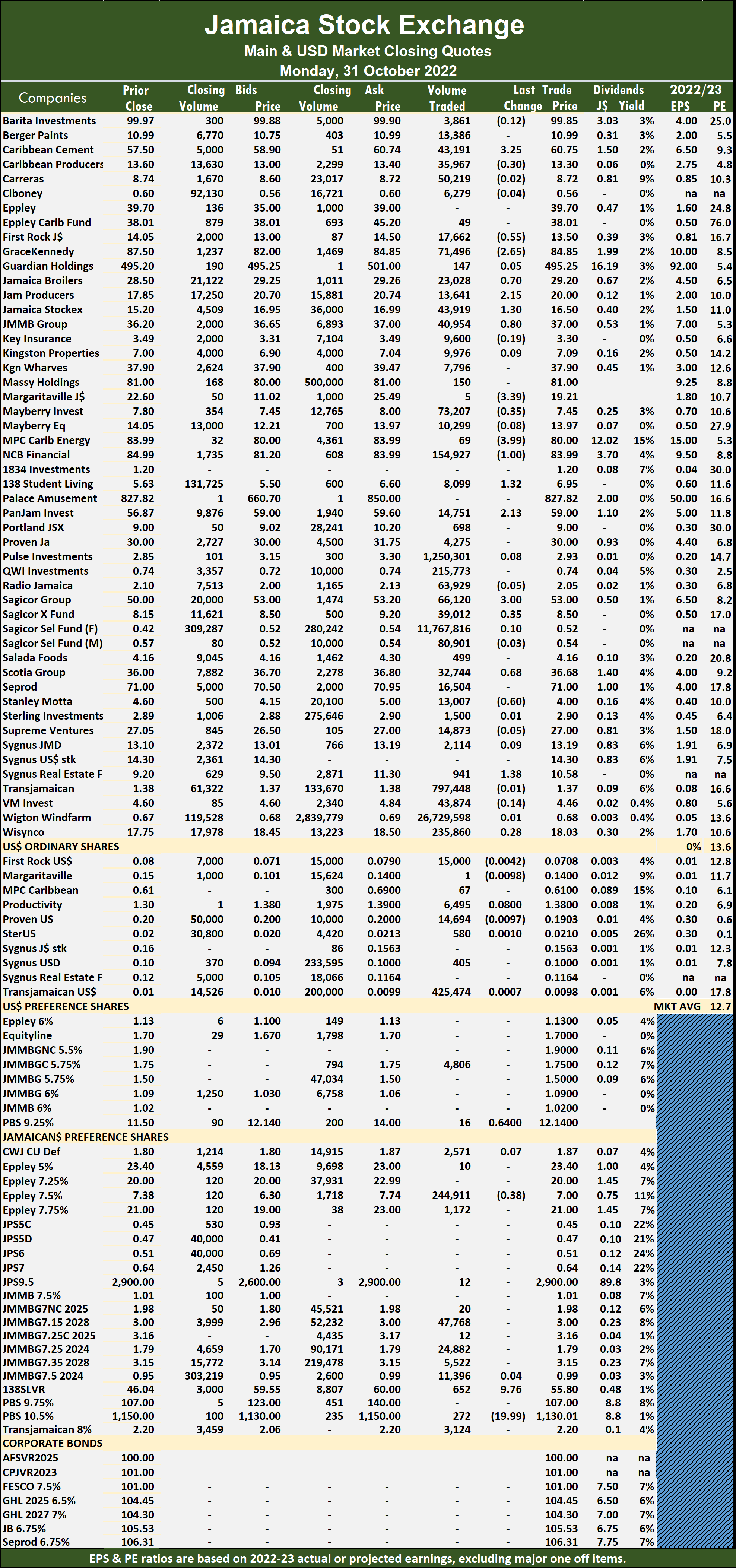

The PE Ratio, a formula to ascertain appropriate stock values, averages 13.6 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November and August 2023.

Investor’s Choice bid-offer indicator shows ten stocks ending with bids higher than their last selling prices and two with lower offers.

At the close, Caribbean Cement dipped $4 to $57.50, trading 227,991 shares, First Rock Real  Estate rose $1.44 to $14.44 in exchanging 10,904 stock units, GraceKennedy rallied $4.98 to end at $86.98 with the transfer of 8,513 stocks. Guardian Holdings climbed $24 to $519 with 3,296 units changing hands, Jamaica Broilers increased $1.03 in closing at $29.13 after 613 stock units crossed the market, Kingston Properties gained 47 cents to close at $7.32 in transferring 77,215 shares. Kingston Wharves popped 50 cents in closing at $37.50 in trading 2,599 stocks, Mayberry Investments rose 50 cents to end at $8 with an exchange of 20,000 units, Mayberry Jamaican Equities gained 78 cents to close at $13.78 with investors transferring 3,100 stock units. MPC Caribbean Clean Energy declined $4 to $80 with the swapping of 32 units, NCB Financial increased $1 in closing at $86 with 345,924 stocks clearing the market, 138 Student Living shed $1 to end at $4.50 after trading 35,857 shares. Palace Amusement dropped $107.82 to end at $720 as investors exchanged just six shares,

Estate rose $1.44 to $14.44 in exchanging 10,904 stock units, GraceKennedy rallied $4.98 to end at $86.98 with the transfer of 8,513 stocks. Guardian Holdings climbed $24 to $519 with 3,296 units changing hands, Jamaica Broilers increased $1.03 in closing at $29.13 after 613 stock units crossed the market, Kingston Properties gained 47 cents to close at $7.32 in transferring 77,215 shares. Kingston Wharves popped 50 cents in closing at $37.50 in trading 2,599 stocks, Mayberry Investments rose 50 cents to end at $8 with an exchange of 20,000 units, Mayberry Jamaican Equities gained 78 cents to close at $13.78 with investors transferring 3,100 stock units. MPC Caribbean Clean Energy declined $4 to $80 with the swapping of 32 units, NCB Financial increased $1 in closing at $86 with 345,924 stocks clearing the market, 138 Student Living shed $1 to end at $4.50 after trading 35,857 shares. Palace Amusement dropped $107.82 to end at $720 as investors exchanged just six shares,  Scotia Group rose $3 to close at $36 with a transfer of 69,965 stock units, Seprod advanced $3.50 to $71 with 12,086 units changing hands. Victoria Mutual Investments popped 61 cents in closing at $4.80 after an exchange of 751 stocks.

Scotia Group rose $3 to close at $36 with a transfer of 69,965 stock units, Seprod advanced $3.50 to $71 with 12,086 units changing hands. Victoria Mutual Investments popped 61 cents in closing at $4.80 after an exchange of 751 stocks.

In the preference segment, Eppley 5% preference share fell 46 cents to $22.99 with an exchange of 20 stock units and 138 Student Living preference share climbed $7.52 to $50.62 after a transfer of 11 shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

3 JSEUSD stocks rose none fell

Trading on the Jamaica Stock Exchange US dollar market ended on Thursday, with the volume of stocks exchanged rising 100 percent but with a 51 percent drop in value than on Wednesday, resulting in six securities trading similar to Wednesday with three rising, none declining and three ending unchanged.

A total of 390,586 shares were traded for US$29,911 versus 195,049 units at US$60,952 on Wednesday.

A total of 390,586 shares were traded for US$29,911 versus 195,049 units at US$60,952 on Wednesday.

Trading averaged 65,098 units at US$4,985 versus 32,508 shares at US$10,159 on Wednesday, with month to date averaging 28,941 shares at US$4,857 versus 16,179 units at US$4,812 on the previous day. October ended with an average of 40,972 units for US$2,277.

The JSE US Denominated Equities Index lost 1.19 points to end at 212.57.

The PE Ratio, a measure used in computing appropriate stock values, averages 8.6. The PE ratio uses ICInsider.com earnings forecasts for companies with financial years ending between November and August 2023.

Investor’s Choice bid-offer indicator shows no stock ended with a bid higher than the last selling price and four ended with lower offers.

At the close, First Rock Real Estate USD share advanced 0.1 of a cent in ending at 8 US cents, with 351,650 shares crossing the exchange, Proven Investments remained at 20 US cents after an exchange of 453 stocks, Sterling Investments ended at 2 US cents as investors traded 4,896 units. Sygnus Credit Investments USD share remained at 10 US cents after 498 stock units changed hands and Transjamaican Highway popped 0.01 of a cent in closing at 0.95 of one US cent, with 31,550 stocks crossing the market.

At the close, First Rock Real Estate USD share advanced 0.1 of a cent in ending at 8 US cents, with 351,650 shares crossing the exchange, Proven Investments remained at 20 US cents after an exchange of 453 stocks, Sterling Investments ended at 2 US cents as investors traded 4,896 units. Sygnus Credit Investments USD share remained at 10 US cents after 498 stock units changed hands and Transjamaican Highway popped 0.01 of a cent in closing at 0.95 of one US cent, with 31,550 stocks crossing the market.

In the preference segment, JMMB Group 6% popped 1 cent to close at US$1.06 after trading 1,539 units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Gains for JSE USD based stocks

The Jamaica Stock Exchange US dollar market rose on Wednesday, with four rising, one declining and one ending unchanged after six securities traded, compared to 11 on Tuesday following a 144 percent rise in the volume of stocks traded after 192 percent increase in funds passing through the than on Tuesday.

Overall, 195,049 shares traded for US$60,952 versus 79,997 units at US$20,849 on Tuesday.

Overall, 195,049 shares traded for US$60,952 versus 79,997 units at US$20,849 on Tuesday.

Trading averaged 32,508 units at US$10,159, versus 7,272 shares at US$1,895 on Tuesday, with month to date average 16,179 shares at US$4,812. Trading in October ended with an average of 40,972 units for US$2,277.

The JSE US Denominated Equities Index gained 0.85 points to end at 213.76.

The PE Ratio, a measure used in computing appropriate stock values, averages 8.7. The PE ratio uses ICInsider.com earnings forecasts for companies with financial years ending between November and August 2023.

Investor’s Choice bid-offer indicator shows no stock ended with a bid higher than the last selling price and two with a lower offer.

At the close, Proven Investments popped 0.01 cents to close at 20 US cents while exchanging 10,000 shares,  Sygnus Credit Investments USD share increased 0.88 of one cent to 10 US cents in trading 20,100 stock units and Transjamaican Highway fell 0.04 of a cent in closing at 0.94 US cents, with 158,500 units changing hands.

Sygnus Credit Investments USD share increased 0.88 of one cent to 10 US cents in trading 20,100 stock units and Transjamaican Highway fell 0.04 of a cent in closing at 0.94 US cents, with 158,500 units changing hands.

In the preference segment, Productive Business 9.25% preference share rallied US$1.02 after ending at a record US$13.02 with a transfer of 4,420 stocks, Equityline Mortgage Investment preference share ended at US$1.67 after trading 29 stocks and JMMB Group 6% dipped 1 cent to US$1.05 after a transfer of 2,000 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Gains for the JSE USD market

Trading activity on the Jamaica Stock Exchange US dollar market declined on Tuesday, with the volume of stocks exchanged slipping 83 percent valued 18 percent less than Monday’s trade, following trading in 11 securities, compared to 10 on Monday with three rising, five declining and three ending unchanged.

Investors traded 79,997 shares with a value of US$20,849 versus 467,538 units at US$25,574 on Monday.

Investors traded 79,997 shares with a value of US$20,849 versus 467,538 units at US$25,574 on Monday.

Trading averaged 7,272 stock units at US$1,895 on Tuesday versus 46,754 shares at US$2,557 on Monday. October ended with an average of 40,972 units for US$2,277.

The JSE US Denominated Equities Index gained 1.82 points to end at 212.91.

The PE Ratio, a measure used in computing appropriate stock values, averages 8.6, The PE ratio uses ICInsider.com earnings forecasts for companies with financial years ending between November and August 2023.

Investor’s Choice bid-offer indicator shows one stock ended with a bid higher than the last selling price and two with lower offers.

At the close, First Rock Real Estate USD share rallied 0.82 of one cent to end at 7.9 US cents as 75 shares passed through the market, MPC Caribbean Clean Energy gained 0.99 of a cent ending at 61.99 US cents as investors exchanged 1,080 stocks, Proven Investments advanced 0.96 of one cent to 19.99 US cents after a transfer of 20,212 stock units. Sterling Investments dipped 0.1 of a cent to 2 US cents, with 8,756 units changing hands.  Sygnus Credit Investments USD share fell 0.88 of a cent to close at 9.12 US cents with the swapping of 11,271 stock units, Sygnus Real Estate Finance USD share remained at 11.64 US cents after 166 shares passed through the market and Transjamaican Highway ended at 0.98 of one US cent after an exchange of 30,245 stock units.

Sygnus Credit Investments USD share fell 0.88 of a cent to close at 9.12 US cents with the swapping of 11,271 stock units, Sygnus Real Estate Finance USD share remained at 11.64 US cents after 166 shares passed through the market and Transjamaican Highway ended at 0.98 of one US cent after an exchange of 30,245 stock units.

In the preference segment, Productive Business 9.25% preference share declined 14 cents in closing at US$12 in exchanging 500 units, Equityline Mortgage Investment preference share shed 3 cents to close at US$1.67 while exchanging 29 shares. JMMB Group 5.75% ended at US$1.75 after trading 794 stocks and JMMB Group 6% dropped 3 cents to US$1.06 with an exchange of 6,869 units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

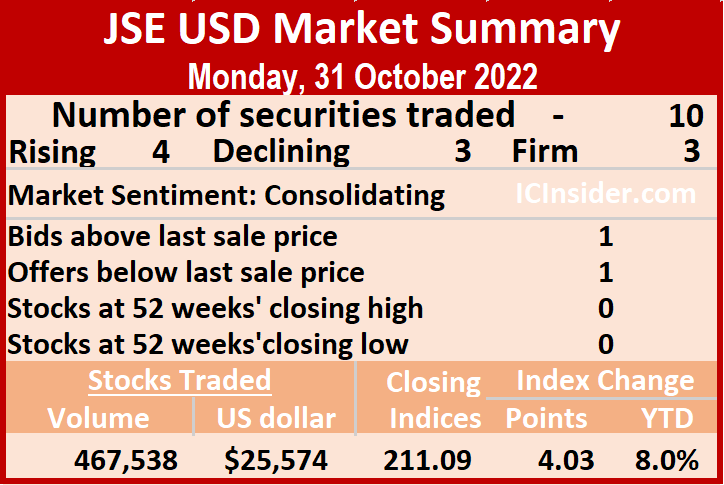

Trading picks up on JSE USD Market

Trading on the Jamaica Stock Exchange US dollar market ended on Monday, with the volume of stocks exchanged jumping 739 percent, valued 97 percent more than on Friday, resulting in 10 securities trading, compared to seven on Friday with four rising, three declining and three ending unchanged.

A total of 467,538 shares were traded for US$25,574 up from 55,754 units at US$12,962 on Friday.

A total of 467,538 shares were traded for US$25,574 up from 55,754 units at US$12,962 on Friday.

Trading averaged 46,754 shares at US$2,557 versus 7,965 units at US$1,851 on Friday, with the month to date average of 40,972 shares at US$2,277 up from 40,613 units at US$2,258 on the previous trading day. September ended with an average of 87,926 units for US$4,746.

The JSE US Denominated Equities Index climbed 4.03 points to end at 211.09.

The PE Ratio, a measure used in computing appropriate stock values, averages 8.5. The PE ratio uses ICInsider.com earnings forecasts for companies with financial years ending between November and August 2023.

Investor’s Choice bid-offer indicator shows one stock ended with a bid higher than the last selling price and one stock with a lower offer.

At the close, First Rock Real Estate USD share dipped 0.42 of one cent ending at 7.08 US cents with a transfer of 15,000 shares, Margaritaville lost 0.98 of a cent to end at 14 US cents with just one unit trading, MPC Caribbean Clean Energy ended at 61 US cents with an exchange of 67 stock units. Productive Business Solutions advanced 8 cents to US$1.38, with 6,495 stocks crossing the market,  Proven Investments declined 0.97 of a cent in closing at 19.03 US cents in switching ownership of 14,694 stock units, Sterling Investments rose 0.1 of a cent to 2.1 US cents after investors traded 580 stocks. Sygnus Credit Investments USD share remained at 10 US cents with 405 units clearing the market and Transjamaican Highway rose 0.07 of a cent to 0.98 US of one cent, with 425,474 shares crossing the exchange.

Proven Investments declined 0.97 of a cent in closing at 19.03 US cents in switching ownership of 14,694 stock units, Sterling Investments rose 0.1 of a cent to 2.1 US cents after investors traded 580 stocks. Sygnus Credit Investments USD share remained at 10 US cents with 405 units clearing the market and Transjamaican Highway rose 0.07 of a cent to 0.98 US of one cent, with 425,474 shares crossing the exchange.

In the preference segment, Productive Business 9.25% preference share popped 64 cents in closing at a record high of US$12.14, with 16 units crossing the market and JMMB Group 5.75% remained at US$1.75 after an exchange of 4,806 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

A total of 13,269,863 shares were exchanged for $57,335,875 versus 4,010,188 units at $42,902,377 on Wednesday.

A total of 13,269,863 shares were exchanged for $57,335,875 versus 4,010,188 units at $42,902,377 on Wednesday. At the close, Barita Investments declined $1.48 to $95 with the swapping of 5,489 shares, Caribbean Cement climbed $3.40 in closing at $61.50 trading 9,217 stock units, First Rock Real Estate shed $1.44 after ending at $13 in exchanging 201,319 stocks. Jamaica Producers rose $2.80 to finish at $20.60 with the swapping of 2,795 units, JMMB Group advanced 70 cents to close at $37.30 with 23,906 stocks clearing the market, Kingston Wharves lost 50 cents to settle at $37 with 54,906 units changing hands. Mayberry Jamaican Equities rose 87 cents in closing at $13 in switching ownership of 200 stock units, PanJam Investment dipped $1.50 to end at $54.50 after closing with 1,491 shares clearing the market, Sagicor Group dropped $1.10 to $50 after the trading of 29,692 units. Scotia Group fell $2.40 to close at $33 in an exchange of 87,784 stock units, Seprod shed $3.45 to end at $67.50 with investors transferring 8,839 shares,

At the close, Barita Investments declined $1.48 to $95 with the swapping of 5,489 shares, Caribbean Cement climbed $3.40 in closing at $61.50 trading 9,217 stock units, First Rock Real Estate shed $1.44 after ending at $13 in exchanging 201,319 stocks. Jamaica Producers rose $2.80 to finish at $20.60 with the swapping of 2,795 units, JMMB Group advanced 70 cents to close at $37.30 with 23,906 stocks clearing the market, Kingston Wharves lost 50 cents to settle at $37 with 54,906 units changing hands. Mayberry Jamaican Equities rose 87 cents in closing at $13 in switching ownership of 200 stock units, PanJam Investment dipped $1.50 to end at $54.50 after closing with 1,491 shares clearing the market, Sagicor Group dropped $1.10 to $50 after the trading of 29,692 units. Scotia Group fell $2.40 to close at $33 in an exchange of 87,784 stock units, Seprod shed $3.45 to end at $67.50 with investors transferring 8,839 shares, Supreme Ventures dropped 76 cents in closing at $26.70 in an exchange of 8,082 stocks and Victoria Mutual Investments fell 41 cents to end at $4.19 with a transfer of 80,815 stock units.

Supreme Ventures dropped 76 cents in closing at $26.70 in an exchange of 8,082 stocks and Victoria Mutual Investments fell 41 cents to end at $4.19 with a transfer of 80,815 stock units. A total of 4,010,188 shares were exchanged for $42,902,377 versus 10,084,883 units at $60,042,941 on Tuesday.

A total of 4,010,188 shares were exchanged for $42,902,377 versus 10,084,883 units at $60,042,941 on Tuesday. At the close, Barita Investments declined $1.52 in closing at $96.48 after exchanging 4,775 shares, Caribbean Cement gained 60 cents to close at $58.10 with the swapping of 1,283 stock units, Caribbean Producers popped 82 cents to $13.35 with investors transferring 82,145 units. Eppley climbed $2.23 to close at $37.43 after transferring 3,126 stocks, Eppley Caribbean Property Fund rose $1.97 to end at $40 with 1,500 shares changing hands, Jamaica Broilers lost 97 cents to close at $28 in trading 44,230 units. Jamaica Producers advanced 53 cents to $17.80 in exchanging 2,355 stocks, Kingston Wharves fell 40 cents in closing at $37.50 with 4,217 stock units clearing the market, Massy Holdings dropped $1.04 after ending at $79.96 in an exchange of 352 units. Mayberry Jamaican Equities dipped $1.69 to end at $12.13 trading 3,581 stock units, 138 Student Living shed 98 cents to close at $5.52 in an exchange of 25 stocks, Proven Investments gained $1.90 to end at $32 after 12,646 shares cleared the market.

At the close, Barita Investments declined $1.52 in closing at $96.48 after exchanging 4,775 shares, Caribbean Cement gained 60 cents to close at $58.10 with the swapping of 1,283 stock units, Caribbean Producers popped 82 cents to $13.35 with investors transferring 82,145 units. Eppley climbed $2.23 to close at $37.43 after transferring 3,126 stocks, Eppley Caribbean Property Fund rose $1.97 to end at $40 with 1,500 shares changing hands, Jamaica Broilers lost 97 cents to close at $28 in trading 44,230 units. Jamaica Producers advanced 53 cents to $17.80 in exchanging 2,355 stocks, Kingston Wharves fell 40 cents in closing at $37.50 with 4,217 stock units clearing the market, Massy Holdings dropped $1.04 after ending at $79.96 in an exchange of 352 units. Mayberry Jamaican Equities dipped $1.69 to end at $12.13 trading 3,581 stock units, 138 Student Living shed 98 cents to close at $5.52 in an exchange of 25 stocks, Proven Investments gained $1.90 to end at $32 after 12,646 shares cleared the market. In the preference segment, Eppley 7.50% preference share dropped $1.44 in closing at $6.30 with 202 units changing hands and Productive Business Solutions 9.75% preference share rallied $33 to $140 after a transfer of one stock unit.

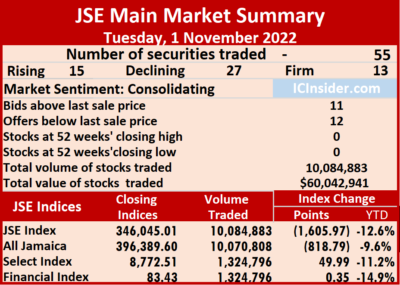

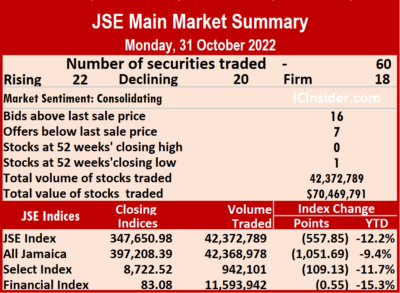

In the preference segment, Eppley 7.50% preference share dropped $1.44 in closing at $6.30 with 202 units changing hands and Productive Business Solutions 9.75% preference share rallied $33 to $140 after a transfer of one stock unit. A total of 10,084,883 shares were exchanged for $60,042,941 versus 42,372,789 units at $70,469,791 on Monday.

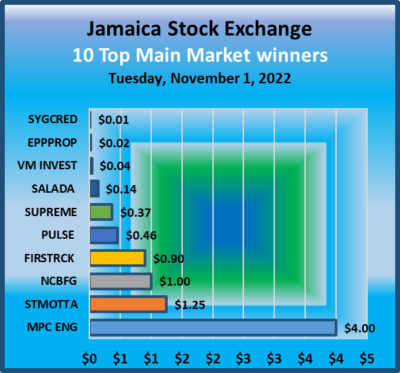

A total of 10,084,883 shares were exchanged for $60,042,941 versus 42,372,789 units at $70,469,791 on Monday. At the close, Barita Investments dropped $1.85 to $98 with 12,578 stocks crossing the market, Caribbean Cement declined $3.25 to $57.50 with 116,678 stock units clearing the exchange, Caribbean Producers dipped 77 cents in closing at $12.53 after a transfer of 40,424 units, Eppley shed $4.50 to close at $35.20 with 174 stock units changing hands, First Rock Real Estate advanced 90 cents to $14.40 in an exchange of 1,114 units. GraceKennedy fell $2.85 to close at $82 with the swapping of 39,592 shares, Jamaica Producers lost $2.73 to end at $17.27 after trading 13,041 stocks, Jamaica Stock Exchange dipped $1.29 in closing at $15.21 with 3,767 stocks clearing the market. MPC Caribbean Clean Energy rallied $4 to $84 after trading 751 shares, NCB Financial gained $1 to close at $84.99 in exchanging 236,109 units, 138 Student Living dropped 45 cents to $6.50 in switching ownership of 1,073 stock units. PanJam Investment shed $3 to end at $56 as investors exchanged 73 stock units, Pulse Investments rose 46 cents after finishing at $3.39 with investors transferring 1,269,900 units, Sagicor Group lost $2.02 to close at $50.98 with the swapping of 50,178 stocks.

At the close, Barita Investments dropped $1.85 to $98 with 12,578 stocks crossing the market, Caribbean Cement declined $3.25 to $57.50 with 116,678 stock units clearing the exchange, Caribbean Producers dipped 77 cents in closing at $12.53 after a transfer of 40,424 units, Eppley shed $4.50 to close at $35.20 with 174 stock units changing hands, First Rock Real Estate advanced 90 cents to $14.40 in an exchange of 1,114 units. GraceKennedy fell $2.85 to close at $82 with the swapping of 39,592 shares, Jamaica Producers lost $2.73 to end at $17.27 after trading 13,041 stocks, Jamaica Stock Exchange dipped $1.29 in closing at $15.21 with 3,767 stocks clearing the market. MPC Caribbean Clean Energy rallied $4 to $84 after trading 751 shares, NCB Financial gained $1 to close at $84.99 in exchanging 236,109 units, 138 Student Living dropped 45 cents to $6.50 in switching ownership of 1,073 stock units. PanJam Investment shed $3 to end at $56 as investors exchanged 73 stock units, Pulse Investments rose 46 cents after finishing at $3.39 with investors transferring 1,269,900 units, Sagicor Group lost $2.02 to close at $50.98 with the swapping of 50,178 stocks.  Scotia Group declined $1.28 to end at $35.40 with a transfer of 62,578 shares, Stanley Motta popped $1.25 to close at $5.25 in trading 24,307 stocks, Sygnus Real Estate Finance fell 58 cents in closing at $10 after investors transferred two stock units.

Scotia Group declined $1.28 to end at $35.40 with a transfer of 62,578 shares, Stanley Motta popped $1.25 to close at $5.25 in trading 24,307 stocks, Sygnus Real Estate Finance fell 58 cents in closing at $10 after investors transferred two stock units. The JSE Financial Index declined 0.55 points to settle at 83.08.

The JSE Financial Index declined 0.55 points to settle at 83.08. At the close,

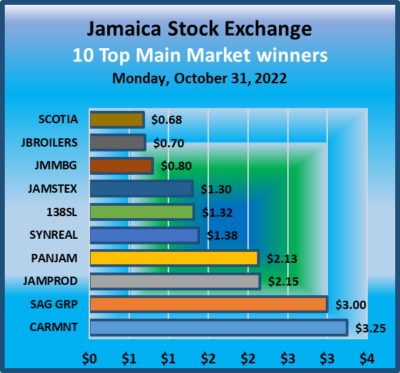

At the close,  PanJam Investment climbed $2.13 to end at $59 in exchanging 14,751 stocks, Sagicor Group increased $3 to close at $53 with a transfer of 66,120 shares, Scotia Group rallied 68 cents to $36.68 with the swapping of 32,744 units. Stanley Motta fell 60 cents in closing at $4 after a transfer of 13,007 stock units and Sygnus Real Estate Finance advanced $1.38 to $10.58 with investors transferring 941 stocks.

PanJam Investment climbed $2.13 to end at $59 in exchanging 14,751 stocks, Sagicor Group increased $3 to close at $53 with a transfer of 66,120 shares, Scotia Group rallied 68 cents to $36.68 with the swapping of 32,744 units. Stanley Motta fell 60 cents in closing at $4 after a transfer of 13,007 stock units and Sygnus Real Estate Finance advanced $1.38 to $10.58 with investors transferring 941 stocks. Three stocks traded at one year lows, with NCB Group hitting an intraday low of $80 before closing at a yearly low of $84.99, Pulse Investment closed at a low of $2.85 and Sagicor Select Financial Fund hit a year’s low of 36 cents but closed at 42 cents.

Three stocks traded at one year lows, with NCB Group hitting an intraday low of $80 before closing at a yearly low of $84.99, Pulse Investment closed at a low of $2.85 and Sagicor Select Financial Fund hit a year’s low of 36 cents but closed at 42 cents. The PE Ratio, a formula used to ascertain appropriate stock values, averages 13.5 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November and August 2023.

The PE Ratio, a formula used to ascertain appropriate stock values, averages 13.5 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November and August 2023. Scotia Group rose 60 cents to $36, closing with an exchange of 4,653 stocks, Seprod popped $2.84 to $71 with the swapping of 2,491 shares and Sygnus Real Estate Finance dipped 80 cents to end at $9.20 in an exchange of 300 stock units.

Scotia Group rose 60 cents to $36, closing with an exchange of 4,653 stocks, Seprod popped $2.84 to $71 with the swapping of 2,491 shares and Sygnus Real Estate Finance dipped 80 cents to end at $9.20 in an exchange of 300 stock units.