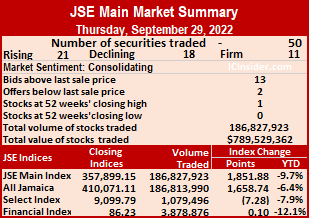

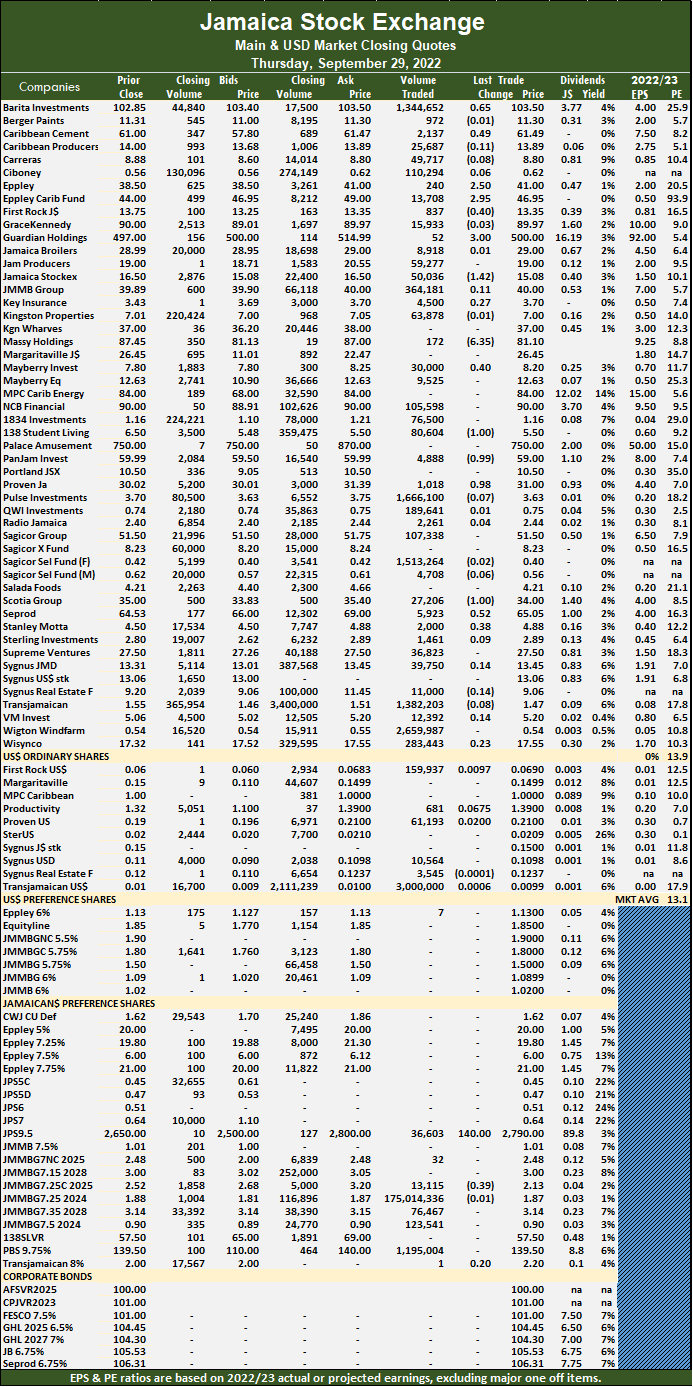

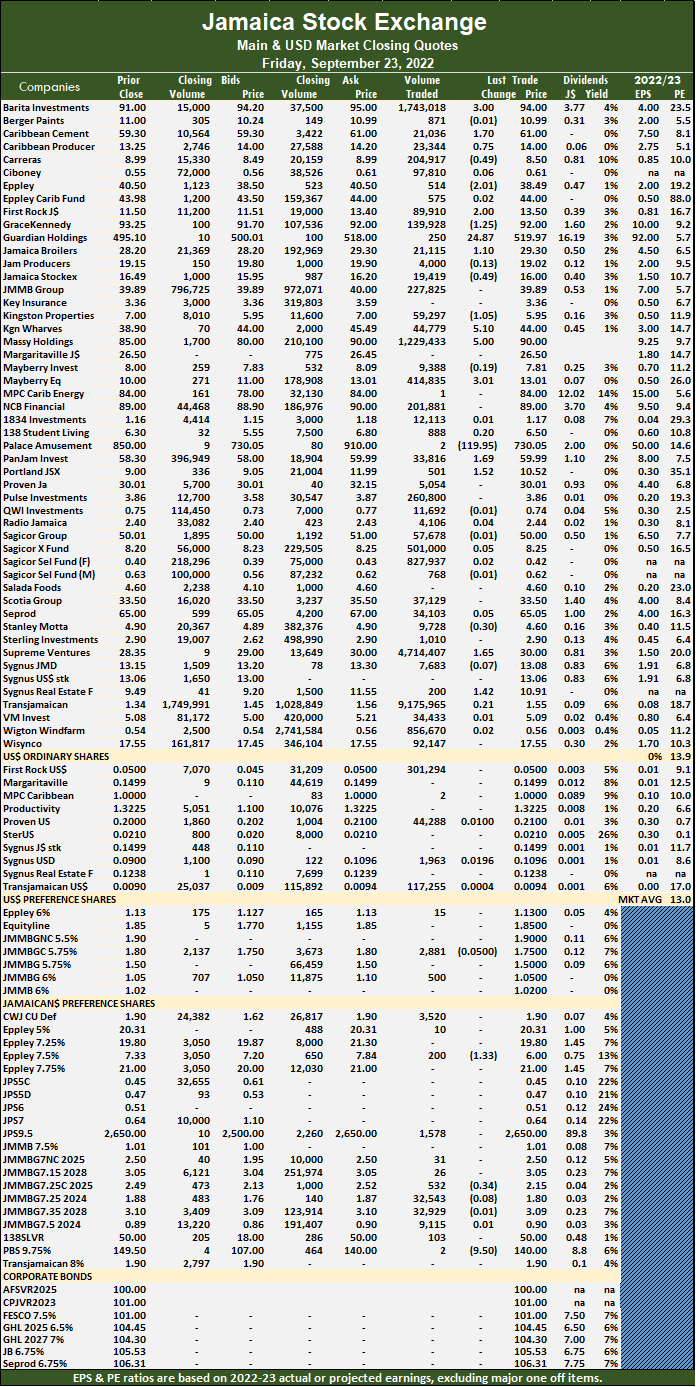

Investors pushed the Jamaica Stock Exchange Main Market higher on Thursday, with the volume of stocks traded rising 561 percent, with 116 percent greater value than Wednesday, following trading in 50 securities compared to 57 on Wednesday, with prices of 21 rising, 18 declining and 11 ending unchanged.

A total of 186,827,923 shares were traded for $789,529,362 up from 28,254,323 units at $365,934,690 on Wednesday.

A total of 186,827,923 shares were traded for $789,529,362 up from 28,254,323 units at $365,934,690 on Wednesday.

Trading averaged 3,736,558 units at $15,790,587 versus 495,690 shares at $6,419,907 on Wednesday and month to date, an average of 377,970 units at $3,714,938, compared to 226,546 units at $3,170,510 on the previous day. August closed with an average of 738,534 units at $5,975,613.

JMMB Group 7.25% preference share due 2024, led trading with 175 million shares for 93.7 percent of total volume traded, followed by Wigton Windfarm with 2.66 million units for 1.4 percent of the day’s trade, Pulse Investments accounted for 1.67 million units with 0.9 percent market share. Sagicor Select Financial Fund closed with 1.51 million units for 0.8 percent of traded shares, Transjamaican Highway had an exchange of 1.38 million units for 0.7 percent of market share and Barita Investments ended with 1.34 million units for 0.7 percent of trading.

The All Jamaican Composite Index rallied 1,658.74 points to 410,071.11, the JSE Main Index increased 1,851.88 points to 357,899.15 and the JSE Financial Index inched 0.10 points to 86.23.

The PE Ratio, a formula used to ascertain appropriate stock values, averages 13.9 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November and August 2023.

The PE Ratio, a formula used to ascertain appropriate stock values, averages 13.9 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November and August 2023.

Investor’s Choice bid-offer indicator shows 13 stocks ending with bids higher than their last selling prices and two with lower offers.

At the close, Barita Investments advanced 65 cents to end at $103.50 with the swapping of 1,344,652 shares, Caribbean Cement rose 49 cents in ending at $61.49 with an exchange of 2,137 stock units, Eppley gained $2.50 in closing at $41 after exchanging 240 units. Eppley Caribbean Property Fund popped $2.95 to close at $46.95, with 13,708 stocks crossing the market, First Rock Real Estate lost 40 cents to close at $13.35, with 837 stock units changing hands, Guardian Holdings rallied $3 in closing at $500 after exchanging 52 stock units. Jamaica Stock Exchange declined $1.42 to close at $15.08 after trading 50,036 units, Massy Holdings dropped $6.35 to $81.10 after 172 shares were exchanged, Mayberry Investments increased 40 cents to $8.20 after a transfer of 30,000 stock units. 138 Student Living fell $1 to end at $5.50 as investors exchanged 80,604 units, PanJam Investment dipped 99 cents to close at $59 with an exchange of 4,888 shares, Proven Investments climbed 98 cents to end at $31 in trading 1,018 stocks. Scotia Group shed $1 to end at $34 while exchanging 27,206 shares and Seprod rose 52 cents in closing at $65.05 with investors transferring 5,923 units.

Proven Investments climbed 98 cents to end at $31 in trading 1,018 stocks. Scotia Group shed $1 to end at $34 while exchanging 27,206 shares and Seprod rose 52 cents in closing at $65.05 with investors transferring 5,923 units.

In the preference segment, Jamaica Public Service 9.5% gained $140 to close at $2,790, after 36,603 stocks changed hands.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Big jump in main market trading

Main Market slips on trading spike

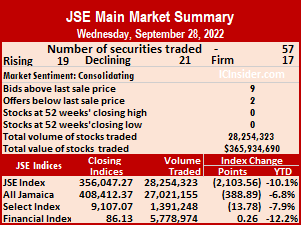

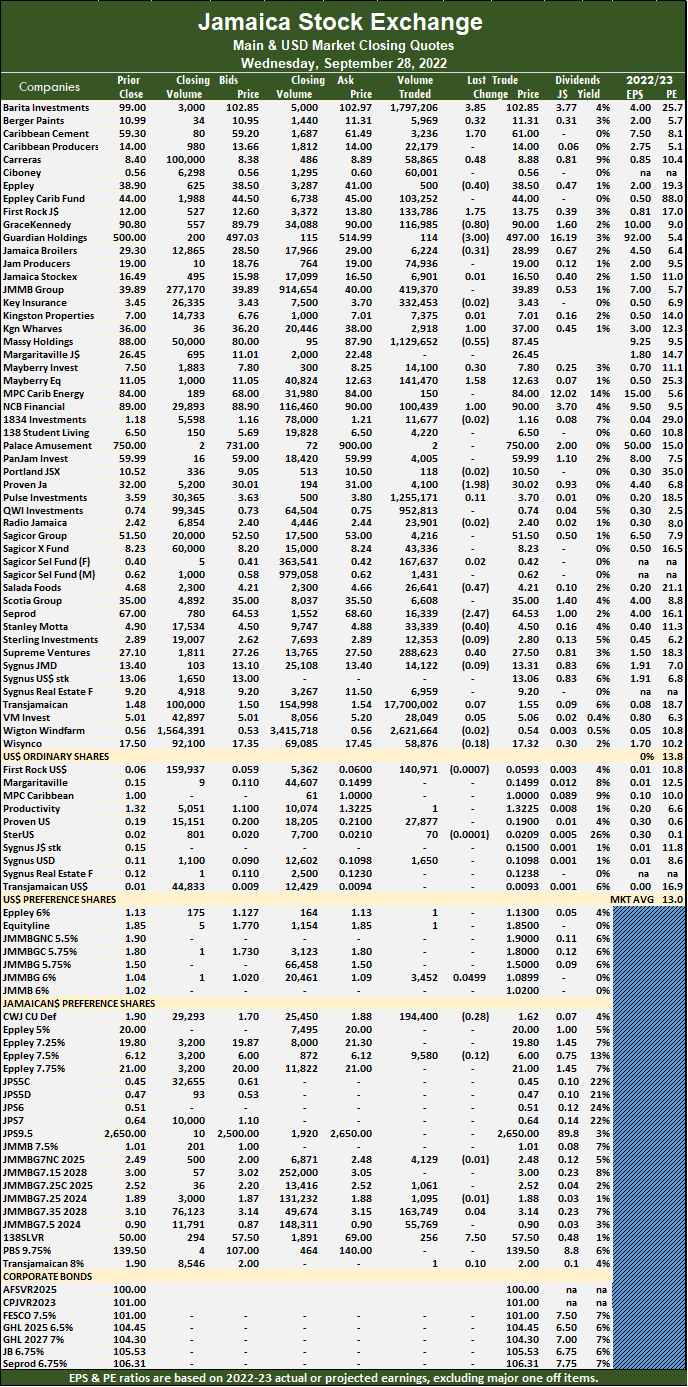

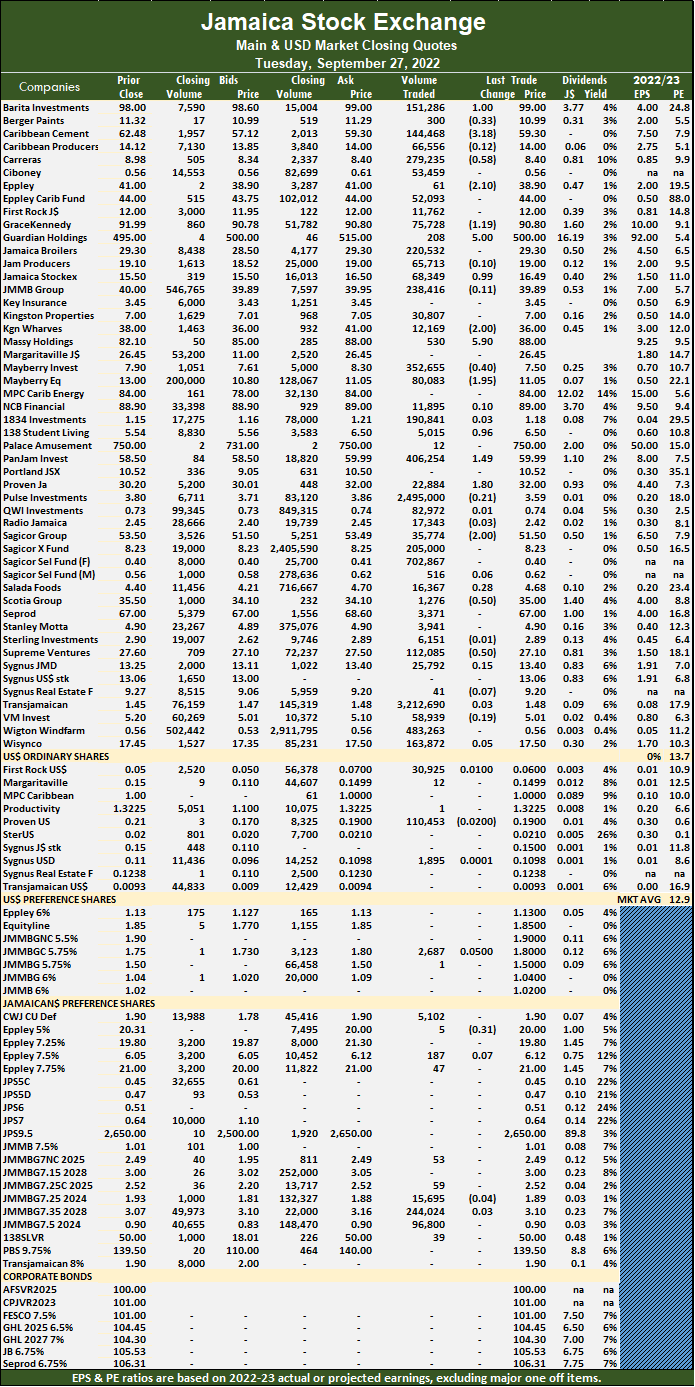

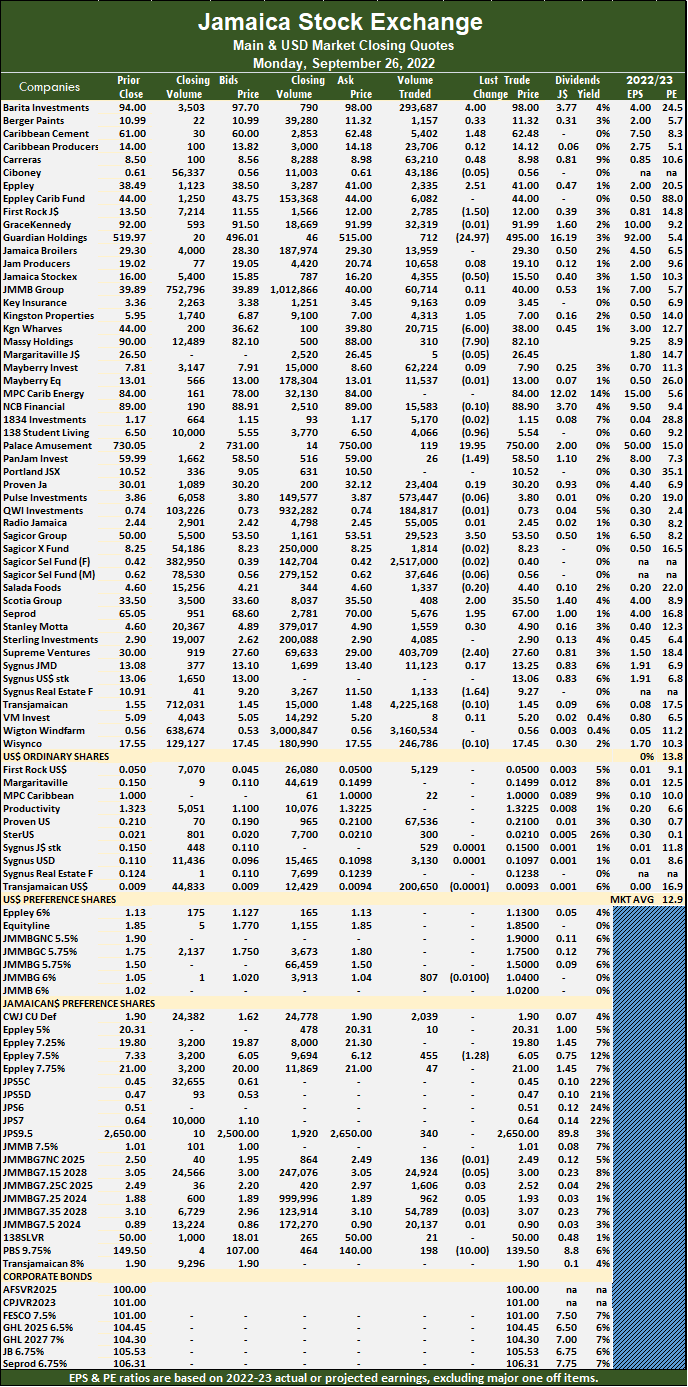

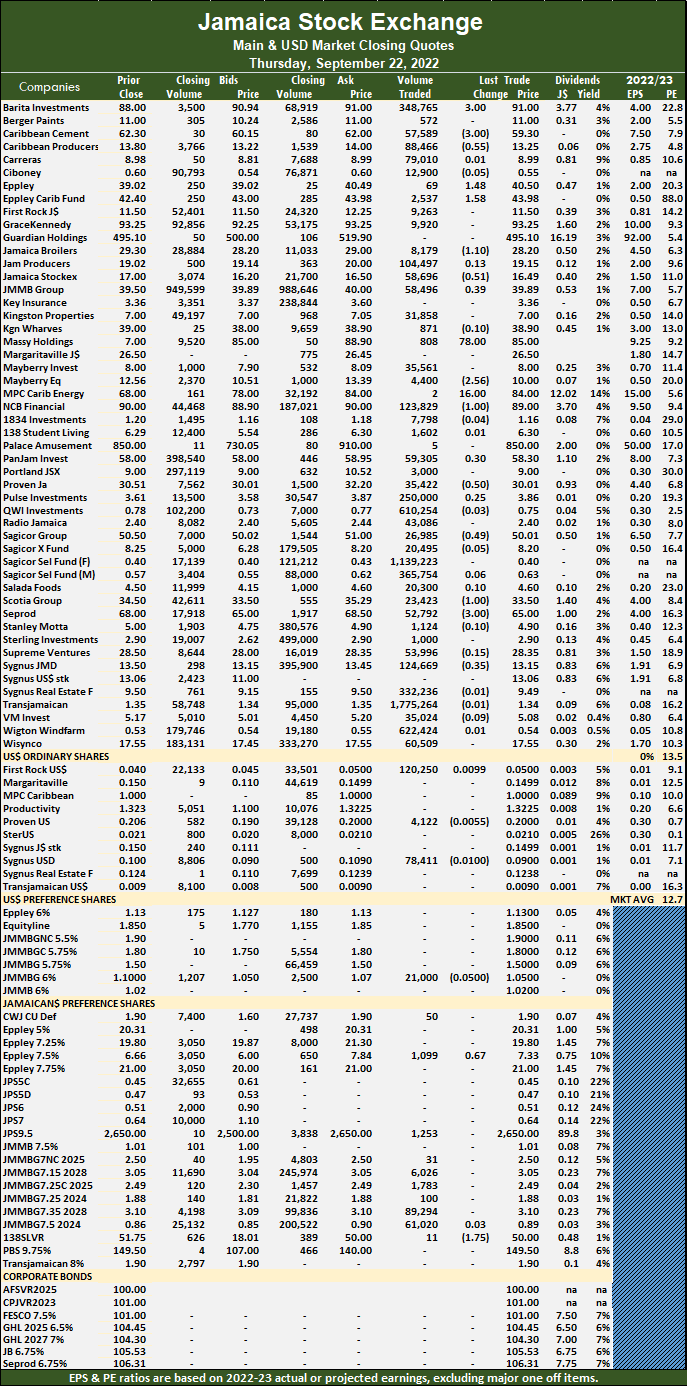

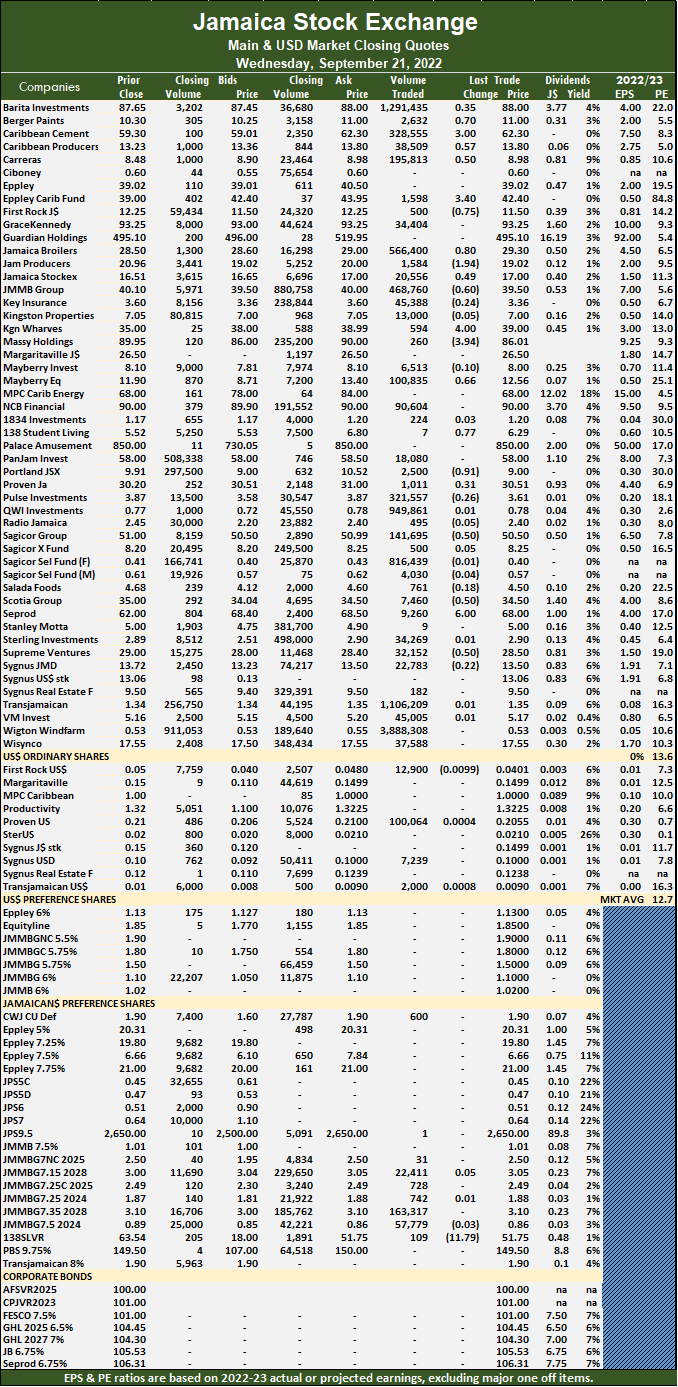

Market activity on the Jamaica Stock Exchange Main Market ended on Wednesday, with the volume of stocks traded rising 168 percent with 231 percent higher value than Tuesday, with Barita Investments accounting for 49 percent of the total value of stocks traded on the Main Market after activity ended in 57 securities compared to 55 on Tuesday, with 19 rising, 21 declining and 17 ending unchanged.

Barita Investments headquarters

A total of 28,254,323 shares were traded for $365,934,690 versus 10,530,582 units at $110,705,795 on Tuesday.

Trading on Wednesday averaged 495,690 units at $6,419,907 versus 191,465 shares at $2,012,833 on Tuesday and month to date, an average of 226,546 units at $3,170,510, compared with 211,963 stock units at $2,994,449 on the previous day. August closed with an average of 738,534 units at $5,975,613.

Transjamaican Highway led trading with 17.70 million shares for 62.6 percent of total volume, followed by Wigton Windfarm with 2.62 million units for 9.3 percent of the day’s trade, Barita Investments ended with 1.80 million units for 6.4 percent of the market, Pulse Investments with 1.26 million units for 4.4 percent of shares traded and Massy Holdings with 1.13 million units for 4 percent market share.

The All Jamaican Composite Index dropped 388.89 points to end at 408,412.37, the JSE Main Index shed 2,103.56 points to 356,047.27 and the JSE Financial Index popped 0.26 points to settle at 86.13.

The All Jamaican Composite Index dropped 388.89 points to end at 408,412.37, the JSE Main Index shed 2,103.56 points to 356,047.27 and the JSE Financial Index popped 0.26 points to settle at 86.13.

The PE Ratio, a formula used to ascertain appropriate stock values, averages 13.8 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November and August 2023.

Investor’s Choice bid-offer indicator shows seven stocks ended with bids higher than their last selling prices and two with lower offers.

At the close, Barita Investments climbed $3.85 to $102.85 in trading 1,797,206 shares, Caribbean Cement popped $1.70 to end at $61, with 3,236 stock units crossing the market, Carreras gained 48 cents in closing at $8.88 after exchanging 58,865 stocks. Eppley dipped 40 cents to $38.50 after trading 500 units, First Rock Real Estate increased $1.75 to close at $13.75, with 133,786 units clearing the market, GraceKennedy dropped 80 cents to close at $90, with 116,985 stocks changing hands. Guardian Holdings fell $3 to $497 in an exchange of 114 shares, Kingston Wharves advanced $1 in ending at $37 as investors exchanged 2,918 stock units, Massy Holdings declined 55 cents in closing at $87.45, after 1,129,652 stocks changed hands. Mayberry Jamaican Equities rose $1.58 to end at $12.63 with an exchange of 141,470 shares, NCB Financial rallied $1 to end at $90, with a transfer of 100,439 stock units, Proven Investments shed $1.98 in closing at $30.02, with 4,100 units crossing the exchange.  Salada Foods lost 47 cents in ending at $4.21 after exchanging 26,641 stocks, Seprod shed $2.47 to close at $64.53 in switching ownership of 16,339 units and Stanley Motta declined 40 cents to end at $4.50 after trading 33,339 shares and Supreme Ventures rose 40 cents to $27.50 with the swapping of 288,623 stock units.

Salada Foods lost 47 cents in ending at $4.21 after exchanging 26,641 stocks, Seprod shed $2.47 to close at $64.53 in switching ownership of 16,339 units and Stanley Motta declined 40 cents to end at $4.50 after trading 33,339 shares and Supreme Ventures rose 40 cents to $27.50 with the swapping of 288,623 stock units.

In the preference segment, 138 Student Living preference share rallied $7.50 to close at $57.50 with investors transferring 256 shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Main Market slippage

Market activity on the Jamaica Stock Exchange Main Market ended on Tuesday, with the volume of stocks traded declining 14 percent as 56 percent more funds passed through the market than on Monday, following trading in 55 securities compared to 60 on Monday, with 17 rising, 21 declining and 17 ending unchanged.

At the close, 10,530,582 shares were exchanged for $110,705,795 ccompared to 12,287,344 units at $70,856,504 on Monday.

At the close, 10,530,582 shares were exchanged for $110,705,795 ccompared to 12,287,344 units at $70,856,504 on Monday.

Wednesday’s trading averaged 191,465 units at $2,012,833 versus 204,781 shares at $1,180,942 on Monday and month to date, an average of 211,963 units at $2,994,449 versus 213,094 units at $3,048,601 on the previous day. August closed with an average of 738,534 units at $5,975,613.

Transjamaican Highway led trading with 3.21 million shares for 30.5 percent of total volume followed by Pulse Investments with 2.50 million units for 23.7 percent of the day’s trade and Sagicor Select Financial Fund with 702,867 units for 6.7 percent market share.

The All Jamaican Composite Index declined 1,892.98 points to 408,801.26, the JSE Main Index fell 248.44 points to 358,150.83 and the JSE Financial Index rallied 0.39 points to settle at 85.87.

The PE Ratio, a formula to ascertain appropriate stock values, averages 13.7 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November and August 2023.

Investor’s Choice bid-offer indicator shows nine stocks ended with bids higher than their last selling prices and three with lower offers.

At the close, Barita Investments popped $1 to $99, with 151,286 shares crossing the market, Caribbean Cement dipped $3.18 to $59.30 in an exchange of 144,468 stock units, Carreras declined 58 cents to $8.40 in trading 279,235 units. Eppley shed $2.10 to $38.90 with an exchange of 61 stocks, GraceKennedy fell $1.19 to close at $90.80 with investors transferring 75,728 units, Guardian Holdings rallied $5 to $500 with the swapping of 208 stocks. Jamaica Stock Exchange advanced 99 cents to $16.49 after 68,349 stock units crossed the market, Kingston Wharves lost $2 to close at $36 trading 12,169 shares, Massy Holdings gained $5.90 in closing at $88 after 530 stocks crossed the exchange. Mayberry Investments dropped 40 cents to close at $7.50 trading 352,655 shares, Mayberry Jamaican Equities dipped $1.95 to $11.05 as investors exchanged 80,083 units, 138 Student Living increased 96 cents to end at $6.50 after exchanging 5,015 stock units.

At the close, Barita Investments popped $1 to $99, with 151,286 shares crossing the market, Caribbean Cement dipped $3.18 to $59.30 in an exchange of 144,468 stock units, Carreras declined 58 cents to $8.40 in trading 279,235 units. Eppley shed $2.10 to $38.90 with an exchange of 61 stocks, GraceKennedy fell $1.19 to close at $90.80 with investors transferring 75,728 units, Guardian Holdings rallied $5 to $500 with the swapping of 208 stocks. Jamaica Stock Exchange advanced 99 cents to $16.49 after 68,349 stock units crossed the market, Kingston Wharves lost $2 to close at $36 trading 12,169 shares, Massy Holdings gained $5.90 in closing at $88 after 530 stocks crossed the exchange. Mayberry Investments dropped 40 cents to close at $7.50 trading 352,655 shares, Mayberry Jamaican Equities dipped $1.95 to $11.05 as investors exchanged 80,083 units, 138 Student Living increased 96 cents to end at $6.50 after exchanging 5,015 stock units.  PanJam Investment rose $1.49 in closing at $59.99, with 406,254 stock units clearing the market, Proven Investments climbed $1.80 to close at $32, with 22,884 units changing hands, Sagicor Group shed $2 in ending at $51.50 after an exchange of 35,774 shares. Scotia Group lost 50 cents to end at $35 in exchanging 1,276 stocks and Supreme Ventures declined 50 cents to $27.10 in switching ownership of 112,085 stocks.

PanJam Investment rose $1.49 in closing at $59.99, with 406,254 stock units clearing the market, Proven Investments climbed $1.80 to close at $32, with 22,884 units changing hands, Sagicor Group shed $2 in ending at $51.50 after an exchange of 35,774 shares. Scotia Group lost 50 cents to end at $35 in exchanging 1,276 stocks and Supreme Ventures declined 50 cents to $27.10 in switching ownership of 112,085 stocks.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Rally for JSE Main Market

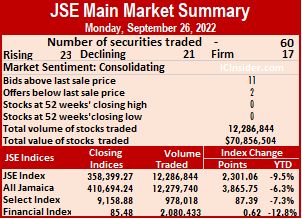

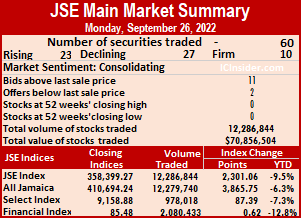

Market activity on the Jamaica Stock Exchange Main Market ended on Monday, with the volume of stocks traded declining 42 percent with an 85 percent lower value than on Friday, leading to gains in the major indices after 60 securities were exchanged compared to 58 on Friday, resulting in 23 rising, 27 declining and 10 ending unchanged.

Investors traded 12,286,844 shares for $70,856,504 against 21,314,565 units at $485,002,686 on Friday.

Investors traded 12,286,844 shares for $70,856,504 against 21,314,565 units at $485,002,686 on Friday.

Trading averaged 204,781 shares at $1,180,942 versus 367,493 stock units at $8,362,115 on Friday and month to date, an average of 213,094 units at $3,048,601, against 213,626 units at $3,168,195 on the previous trading day. August closed with an average of 738,534 units at $5,975,613.

Transjamaican Highway led trading with 4.23 million shares for 34.4 percent of total volume, followed by Wigton Windfarm with 3.16 million units for 25.7 percent of the day’s trade and Sagicor Select Financial Fund with 2.52 million units for 20.5 percent market share.

The All Jamaican Composite Index advanced 3,865.75 points to 410,694.24, the JSE Main Index rallied 2,301.06 points to 358,399.27 and the JSE Financial Index gained 0.62 points to close at 85.48.

The PE Ratio, a formula to ascertain appropriate stock values, averages 13.8 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November and August 2023.

Investor’s Choice bid-offer indicator shows 11 stocks ending with bids higher than their last selling prices and two with lower offers.

At the close, Barita Investments gained $4 to close at $98 after trading 293,687 shares, Caribbean Cement popped $1.48 to $62.48 after 5,402 units crossed the exchange, Carreras increased 48 cents to $8.98 with a transfer of 63,210 stocks. Eppley climbed $2.51 to $41 in trading 2,335 stock units, First Rock Real Estate dropped $1.50 to $12 as investors exchanged 2,785 stock units, Guardian Holdings fell $24.97 to close at $495 in switching ownership of 712 units. Jamaica Stock Exchange declined 50 cents to $15.50, with 4,355 shares crossing the market, Kingston Properties advanced $1.05 in closing at $7 after exchanging 4,313 stocks, Kingston Wharves shed $6 to $38, with 20,715 stocks changing hands. Massy Holdings lost $7.90 to end at $82.10 after exchanging 310 shares, 138 Student Living dipped 96 cents to close at $5.54 with an exchange of 4,066 stock units, Palace Amusement rallied $19.95 to $750 after exchanging 119 units. PanJam Investment dropped $1.49 to $58.50 while exchanging 26 stocks, Sagicor Group rose $3.50 in closing at $53.50 with the swapping of 29,523 units, Scotia Group rallied $2 to end at $35.50, with 408 shares clearing the market.

At the close, Barita Investments gained $4 to close at $98 after trading 293,687 shares, Caribbean Cement popped $1.48 to $62.48 after 5,402 units crossed the exchange, Carreras increased 48 cents to $8.98 with a transfer of 63,210 stocks. Eppley climbed $2.51 to $41 in trading 2,335 stock units, First Rock Real Estate dropped $1.50 to $12 as investors exchanged 2,785 stock units, Guardian Holdings fell $24.97 to close at $495 in switching ownership of 712 units. Jamaica Stock Exchange declined 50 cents to $15.50, with 4,355 shares crossing the market, Kingston Properties advanced $1.05 in closing at $7 after exchanging 4,313 stocks, Kingston Wharves shed $6 to $38, with 20,715 stocks changing hands. Massy Holdings lost $7.90 to end at $82.10 after exchanging 310 shares, 138 Student Living dipped 96 cents to close at $5.54 with an exchange of 4,066 stock units, Palace Amusement rallied $19.95 to $750 after exchanging 119 units. PanJam Investment dropped $1.49 to $58.50 while exchanging 26 stocks, Sagicor Group rose $3.50 in closing at $53.50 with the swapping of 29,523 units, Scotia Group rallied $2 to end at $35.50, with 408 shares clearing the market.  Seprod climbed $1.95 to $67 after a transfer of 5,676 stock units, Supreme Ventures lost $2.40 to end at $27.60, with 403,709 stock units changing hands and Sygnus Real Estate Finance shed $1.64 in closing at $9.27 in an exchange of 1,133 shares.

Seprod climbed $1.95 to $67 after a transfer of 5,676 stock units, Supreme Ventures lost $2.40 to end at $27.60, with 403,709 stock units changing hands and Sygnus Real Estate Finance shed $1.64 in closing at $9.27 in an exchange of 1,133 shares.

In the preference segment, Productive Business Solutions 9.75% preference share dipped 50 cents to $139.50 and closed with 198 stocks traded.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Barita corners a third of value traded

Barita trading high volumes since announcing to buy shares to populate the staff option portfolio.

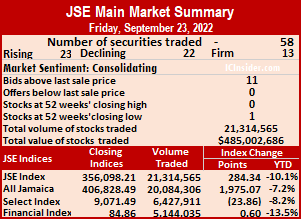

Barita Investments, one of the volume leaders in the Main Market on Friday accounted for more than a third of the value of stocks traded on the Jamaica Stock Exchange Main Market and helped to push the volume of stocks traded up 211 percent and the value 491 percent higher than on Thursday, with 58 securities trading compared to 56 on Thursday, with prices of 25 rising, 19 declining and 14 ending unchanged.

Investors exchanged 21,314,565 shares for $485,002,686 up from 6,862,645 units at $82,023,834 on Thursday. Trading averaged 367,493 units at $8,362,115, versus 122,547 shares at $1,464,711 on Thursday and month to date, an average of 213,626 units at $3,168,195, compared to 203,473 units at $2,825,479 on the previous day. August closed with an average of 738,534 units at $5,975,613.

Transjamaican Highway led trading with 9.18 million shares for 43.1 percent of total volume followed by Supreme Ventures with 4.71 million units for 22.1 percent of the day’s trade, Barita Investments ended with 1.74 million units for 8.2 percent of trade share and Massy Holdings with 1.23 million units for 5.8 percent market share.

The All Jamaican Composite Index increased 1,975.07 points to 406,828.49, the JSE Main Index increased 284.34 points to 356,098.21 and the JSE Financial Index gained 0.60 points to settle at 84.86.

The PE Ratio, a formula to ascertain appropriate stock values, averages 13.9 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November and August 2023.

Investor’s Choice bid-offer indicator shows 11 stocks ended with bids higher than their last selling prices and four with lower offers.

At the close, Barita Investments popped $3 to $94 with 1,743,018 shares crossing the exchange, Caribbean Cement rose $1.70 to $61 as investors exchanged 21,036 stock units, Caribbean Producers rose 75 cents to $14 in an exchange of 23,344 stocks. Carreras dropped 49 cents to end at $8.50 with 204,917 units crossing the market, Eppley lost $2.01 to close at $38.49 with the swapping of 514 stock units, First Rock Real Estate climbed $2 to $13.50 while exchanging 89,910 stocks. GraceKennedy dipped $1.25 to end at $92 in switching ownership of 139,928 units, Guardian Holdings gained $24.87 to close at $519.97 with a transfer of 250 shares, Jamaica Broilers advanced $1.10 to $29.30 with an exchange of 21,115 stock units. Jamaica Stock Exchange fell 49 cents in closing at $16 after trading 19,419 units, Kingston Properties declined $1.05 in ending at a 52 weeks’ low of $5.95 after a transfer of 59,297 stocks, Kingston Wharves rallied $5.10 to $44, with 44,779 shares clearing the market. Massy Holdings increased $5 in closing at $90, with 1,229,433 units changing hands, Mayberry Jamaican Equities climbed $3.01 to end at $13.01 with investors transferring 414,835 stock units, Palace Amusement shed $119.95 to close at $730.05 trading two shares. PanJam Investment rallied $1.69 to close at $59.99 after exchanging 33,816 stocks, Portland JSX advanced $1.52 to end at $10.52 in trading 501 units, Supreme Ventures rose $1.65 to $30 in exchanging 4,714,407 stocks.

At the close, Barita Investments popped $3 to $94 with 1,743,018 shares crossing the exchange, Caribbean Cement rose $1.70 to $61 as investors exchanged 21,036 stock units, Caribbean Producers rose 75 cents to $14 in an exchange of 23,344 stocks. Carreras dropped 49 cents to end at $8.50 with 204,917 units crossing the market, Eppley lost $2.01 to close at $38.49 with the swapping of 514 stock units, First Rock Real Estate climbed $2 to $13.50 while exchanging 89,910 stocks. GraceKennedy dipped $1.25 to end at $92 in switching ownership of 139,928 units, Guardian Holdings gained $24.87 to close at $519.97 with a transfer of 250 shares, Jamaica Broilers advanced $1.10 to $29.30 with an exchange of 21,115 stock units. Jamaica Stock Exchange fell 49 cents in closing at $16 after trading 19,419 units, Kingston Properties declined $1.05 in ending at a 52 weeks’ low of $5.95 after a transfer of 59,297 stocks, Kingston Wharves rallied $5.10 to $44, with 44,779 shares clearing the market. Massy Holdings increased $5 in closing at $90, with 1,229,433 units changing hands, Mayberry Jamaican Equities climbed $3.01 to end at $13.01 with investors transferring 414,835 stock units, Palace Amusement shed $119.95 to close at $730.05 trading two shares. PanJam Investment rallied $1.69 to close at $59.99 after exchanging 33,816 stocks, Portland JSX advanced $1.52 to end at $10.52 in trading 501 units, Supreme Ventures rose $1.65 to $30 in exchanging 4,714,407 stocks.  Sygnus Real Estate Finance gained $1.42 after ending at $10.91, with 200 stock units changing hands.

Sygnus Real Estate Finance gained $1.42 after ending at $10.91, with 200 stock units changing hands.

In the preference segment, Eppley 7.50% preference share lost $1.33 in closing at $6, with 200 shares crossing the market and Productive Business Solutions 9.75% preference share fell $9.50 in ending at $140 after exchanging two shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Main Market treading drops

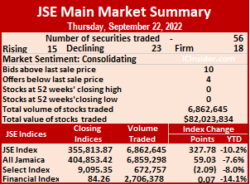

The Jamaica Stock Exchange Main Market ended on Thursday, with modest gains following a 37 percent fall in the volume of stocks traded as 59 percent less money entered the market compared to Wednesday, with 56 securities trading compared to 52 on Wednesday, resulting in prices of 15 stocks rising, 23 declining and 18 unchanged.

Investors traded 6,862,645 shares for $82,023,834 down from 10,894,043 units at $200,361,949 on Wednesday. Trading averages 122,547 units at $1,464,711, versus 209,501 shares at $3,853,114 on Wednesday and month to date, an average of 203,473 units at $2,825,479, compared to 208,980 units at $2,918,070 on the previous day. August closed with an average of 738,534 units at $5,975,613.

Investors traded 6,862,645 shares for $82,023,834 down from 10,894,043 units at $200,361,949 on Wednesday. Trading averages 122,547 units at $1,464,711, versus 209,501 shares at $3,853,114 on Wednesday and month to date, an average of 203,473 units at $2,825,479, compared to 208,980 units at $2,918,070 on the previous day. August closed with an average of 738,534 units at $5,975,613.

Transjamaican Highway led trading with 1.78 million shares for 25.9 percent of total volume followed by Sagicor Select Financial Fund with 1.14 million units for 16.6 percent of the day’s trade and Wigton Windfarm with 622,424 units for 9.1 percent market share.

The All Jamaican Composite Index advanced 59.03 points to 404,853.42, the JSE Main Index rallied 327.78 points to 355,813.87 and the JSE Financial Index gained 0.07 points to settle at 84.26.

The PE Ratio, a formula to ascertain appropriate stock values, averages 13.5 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November and August 2023.

Investor’s Choice bid-offer indicator shows ten stocks ended with bids higher than their last selling prices and four with lower offers.

At the close, Barita Investments advanced $3 to $91 in an exchange of 348,765 shares, Caribbean Cement dropped $3 to end at $59.30 after trading 57,589 stock units, Caribbean Producers fell 55 cents to $13.25 with the swapping of 88,466 stocks. Eppley rose $1.48 in closing at $40.50, with 69 units crossing the market, Eppley Caribbean Property Fund gained $1.58 to close at $43.98 with investors transferring 2,537 stock units, Jamaica Broilers dipped $1.10 to close at $28.20 after an exchange of 8,179 units. Jamaica Stock Exchange declined 51 cents to end at $16.49, with 58,696 shares crossing the market, Massy Holdings fell $1.01 to $85 with a transfer of 808 stocks, Mayberry Jamaican Equities shed $2.56 in ending at $10 after exchanging 4,400 units. MPC Caribbean Clean Energy increased $16 in closing at $84 with a mere two stock units traded, NCB Financial dipped $1 to $89 in trading 123,829 shares, Proven Investments declined 50 cents in closing at $30.01 after exchanging 35,422 stocks.

At the close, Barita Investments advanced $3 to $91 in an exchange of 348,765 shares, Caribbean Cement dropped $3 to end at $59.30 after trading 57,589 stock units, Caribbean Producers fell 55 cents to $13.25 with the swapping of 88,466 stocks. Eppley rose $1.48 in closing at $40.50, with 69 units crossing the market, Eppley Caribbean Property Fund gained $1.58 to close at $43.98 with investors transferring 2,537 stock units, Jamaica Broilers dipped $1.10 to close at $28.20 after an exchange of 8,179 units. Jamaica Stock Exchange declined 51 cents to end at $16.49, with 58,696 shares crossing the market, Massy Holdings fell $1.01 to $85 with a transfer of 808 stocks, Mayberry Jamaican Equities shed $2.56 in ending at $10 after exchanging 4,400 units. MPC Caribbean Clean Energy increased $16 in closing at $84 with a mere two stock units traded, NCB Financial dipped $1 to $89 in trading 123,829 shares, Proven Investments declined 50 cents in closing at $30.01 after exchanging 35,422 stocks.  Sagicor Group dropped 49 cents to $50.01 after trading 26,985 units, Scotia Group lost $1 to close at $33.50 after 23,423 stock units changed hands and Seprod shed $3 to end at $65, with 52,792 stocks crossing the exchange.

Sagicor Group dropped 49 cents to $50.01 after trading 26,985 units, Scotia Group lost $1 to close at $33.50 after 23,423 stock units changed hands and Seprod shed $3 to end at $65, with 52,792 stocks crossing the exchange.

In the preference segment, Eppley 7.50% preference share popped 67 cents to end at $7.33 as investors exchanged 1,099 shares and 138 Student Living preference share fell $1.75 to $50, with 11 stocks clearing the market.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Trading falls on JSE Main Market

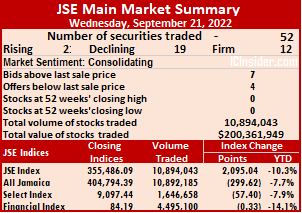

Market activity on the Jamaica Stock Exchange Main Market ended on Wednesday, with the volume of stocks traded declining 18 percent with 58 percent less value than Tuesday, resulting in 52 securities trading compared to 56 on Tuesday, with 21 rising, 19 declining and 12 ending unchanged.

A total of 10,894,043 shares were exchanged for $200,361,949, down from 13,347,493 units at $482,583,082 on Tuesday. Trading averages 209,501 units at $3,853,114, versus 238,348 shares at $8,617,555 on Tuesday and month to date, an average of 208,980 units at $2,918,070, compared to 208,945 units at $2,855,006 on the previous trading day. August closed with an average of 738,534 units at $5,975,613.

A total of 10,894,043 shares were exchanged for $200,361,949, down from 13,347,493 units at $482,583,082 on Tuesday. Trading averages 209,501 units at $3,853,114, versus 238,348 shares at $8,617,555 on Tuesday and month to date, an average of 208,980 units at $2,918,070, compared to 208,945 units at $2,855,006 on the previous trading day. August closed with an average of 738,534 units at $5,975,613.

Wigton Windfarm led trading with 3.89 million shares for 35.7 percent of total volume followed by Barita Investments with 1.29 million units for 11.9 percent of the day’s trade and Transjamaican Highway with 1.11 million units for 10.2 percent market share.

The All Jamaican Composite Index fell 299.62 points to 404,794.39, the JSE Main Index climbed 2,095.04 points to 355,486.09 and the JSE Financial Index slipped 0.33 points to 84.19.

The PE Ratio, a formula to ascertain appropriate stock values, averages 13.6 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November and August 2023.

Investor’s Choice bid-offer indicator shows seven stocks ended with bids higher than their last selling prices and four with lower offers.

At the close, Berger Paints climbed 70 cents in closing at $11 after a transfer of 2,632 shares, Caribbean Cement gained $3 in ending at $62.30 with the swapping of 328,555 units, Caribbean Producers rose 57 cents to close at $13.80 with an exchange of 38,509 stocks. Carreras rallied 50 cents to $8.98, with 195,813 stock units clearing the market, Eppley Caribbean Property Fund advanced $3.40 to end at $42.40 changing hands 1,598 shares, First Rock Real Estate shed 75 cents to end at $11.50 in an exchange of 500 stock units. Jamaica Broilers increased 80 cents to $29.30 after exchanging 566,400 stocks, Jamaica Producers dipped $1.94 to $19.02 after exchanging 1,584 units, Jamaica Stock Exchange popped 49 cents to $17, with 20,556 shares crossing the market. JMMB Group fell 60 cents to close at $39.50 trading 468,760 stocks, Kingston Wharves advanced $4 in closing at $39 in switching ownership of 594 stock units, Massy Holdings lost $3.94 to $86.01 after trading 260 units. Mayberry Jamaican Equities increased 66 cents to close at $12.56, with 100,835 shares crossing the market, 138 Student Living rose 77 cents to end at $6.29 with an exchange if seven stock units,

At the close, Berger Paints climbed 70 cents in closing at $11 after a transfer of 2,632 shares, Caribbean Cement gained $3 in ending at $62.30 with the swapping of 328,555 units, Caribbean Producers rose 57 cents to close at $13.80 with an exchange of 38,509 stocks. Carreras rallied 50 cents to $8.98, with 195,813 stock units clearing the market, Eppley Caribbean Property Fund advanced $3.40 to end at $42.40 changing hands 1,598 shares, First Rock Real Estate shed 75 cents to end at $11.50 in an exchange of 500 stock units. Jamaica Broilers increased 80 cents to $29.30 after exchanging 566,400 stocks, Jamaica Producers dipped $1.94 to $19.02 after exchanging 1,584 units, Jamaica Stock Exchange popped 49 cents to $17, with 20,556 shares crossing the market. JMMB Group fell 60 cents to close at $39.50 trading 468,760 stocks, Kingston Wharves advanced $4 in closing at $39 in switching ownership of 594 stock units, Massy Holdings lost $3.94 to $86.01 after trading 260 units. Mayberry Jamaican Equities increased 66 cents to close at $12.56, with 100,835 shares crossing the market, 138 Student Living rose 77 cents to end at $6.29 with an exchange if seven stock units,  Portland JSX dropped 91 cents in ending at $9 as investors exchanged 2,500 stocks. Sagicor Group declined 50 cents to end at $50.50 in exchanging 141,695 units, Scotia Group dipped 50 cents to $34.50 while exchanging 7,460 units, Seprod popped $6 to $68 in trading 9,260 stocks and Supreme Ventures declined 50 cents in closing at $28.50 after trading 32,152 shares.

Portland JSX dropped 91 cents in ending at $9 as investors exchanged 2,500 stocks. Sagicor Group declined 50 cents to end at $50.50 in exchanging 141,695 units, Scotia Group dipped 50 cents to $34.50 while exchanging 7,460 units, Seprod popped $6 to $68 in trading 9,260 stocks and Supreme Ventures declined 50 cents in closing at $28.50 after trading 32,152 shares.

In the preference segment, 138 Student Living preference share shed $11.79 to close at $51.75 with investors transferring 109 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

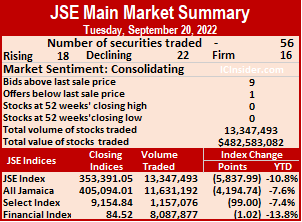

Trading jumps on JSE Main Market, prices fall

Market activity jumped on the Jamaica Stock Exchange Main Market on Tuesday, but that could not save the market from sinking at the close with the volume of stocks traded rising 58 percent with the value jumping 261 percent higher than Monday, after 56 securities traded similar to Monday, and resulting in prices of 18 rising, 22 declining and 16 ending unchanged.

A total of 13,347,493 shares were exchanged for $482,583,082 up from 8,448,292 units at $133,833,060 on Monday. Trading averages 238,348 units at $8,617,555, versus 150,862 shares at $2,389,876 on Monday and month to date, an average of 208,945 units at $2,855,006 compared to 206,642 units at $2,403,674 on the previous trading day. August closed with an average of 738,534 units at $5,975,613.

A total of 13,347,493 shares were exchanged for $482,583,082 up from 8,448,292 units at $133,833,060 on Monday. Trading averages 238,348 units at $8,617,555, versus 150,862 shares at $2,389,876 on Monday and month to date, an average of 208,945 units at $2,855,006 compared to 206,642 units at $2,403,674 on the previous trading day. August closed with an average of 738,534 units at $5,975,613.

Wigton Windfarm led trading with 2.99 million shares for 22.4 percent of total volume followed by Barita Investments with 2.56 million units for 19.2 percent of the day’s trade, Transjamaican Highway with 1.93 million units for 14.5 percent market share, Massy Holdings with 1.70 million units for 12.8 percent of the market and PanJam Investment ended with 1.05 million units for 7.8 percent of trading.

The All Jamaican Composite Index dropped 4,194.74 points to 405,094.01 the JSE Main Index dived 5,837.99 points to 353,391.05 and the JSE Financial Index slipped 1.02 points to 85.54.

The PE Ratio, a formula to ascertain appropriate stock values, averages 13.1 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November and August 2023.

Investor’s Choice bid-offer indicator shows nine stocks ended with bids higher than their last selling prices and one stock with a lower offer.

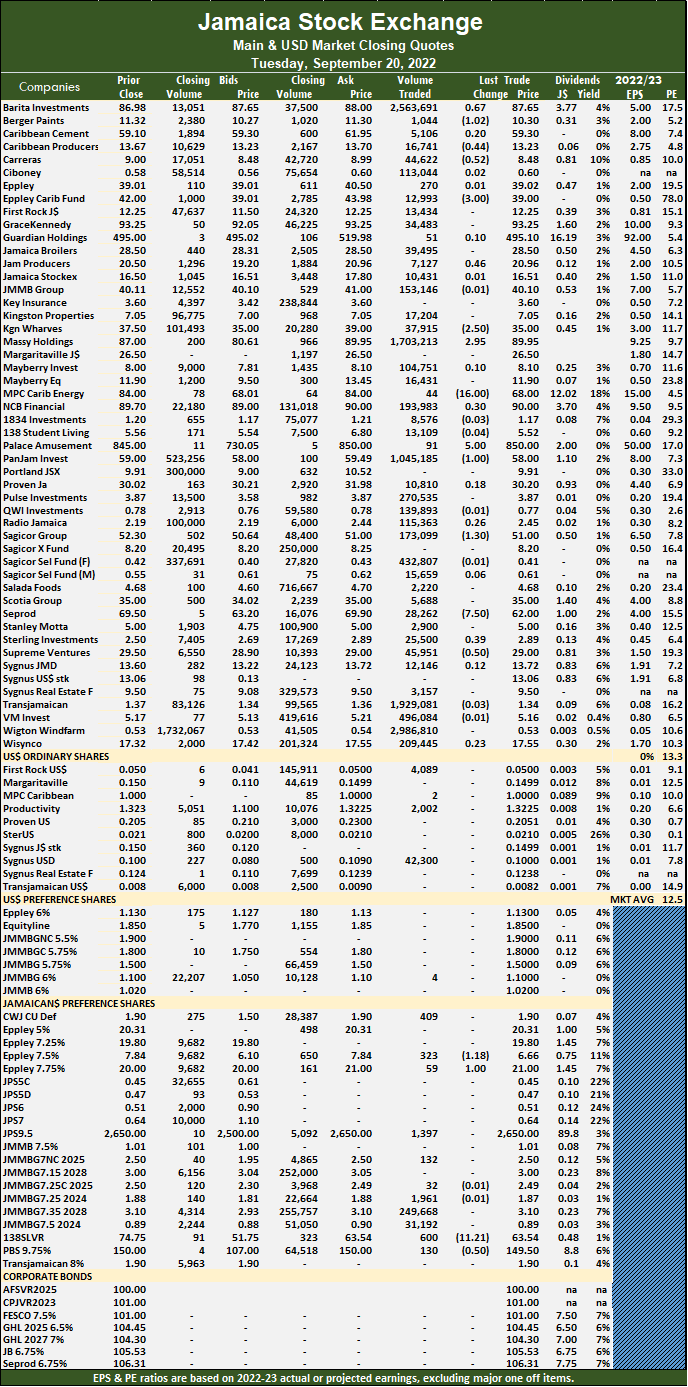

At the close, Barita Investments advanced 67 cents to $87.65 and closed with 2,563,691 shares being traded, Berger Paints shed $1.02 in closing at $10.30 while exchanging 1,044 stock units, Caribbean Producers lost 44 cents after ending at $13.23, with 16,741 stocks changing hands. Carreras dropped 52 cents to $8.48 after 44,622 units crossed the market, Eppley Caribbean Property Fund fell $3 to close at $39, with an exchange of 12,993 units, Jamaica Producers popped 46 cents to end at $20.96 in trading 7,127 shares. Kingston Wharves declined $2.50 to $35 after 37,915 stocks crossed the exchange, Massy Holdings climbed $2.95 to $89.95 after trading 1,703,213 stock units, MPC Caribbean Clean Energy dipped $16 to close at $68, with 44 stock units clearing the market. Palace Amusement increased $5 in closing at $850 after exchanging 91 units, PanJam Investment declined $1 to $58 with the swapping of 1,045,185 shares, Sagicor Group dropped $1.30 to end at $51 in exchanging 173,099 stocks. Seprod shed $7.50 to $62 with a transfer of 28,262 shares and Supreme Ventures lost 50 cents in closing at $29 after exchanging 45,951 stock units.

At the close, Barita Investments advanced 67 cents to $87.65 and closed with 2,563,691 shares being traded, Berger Paints shed $1.02 in closing at $10.30 while exchanging 1,044 stock units, Caribbean Producers lost 44 cents after ending at $13.23, with 16,741 stocks changing hands. Carreras dropped 52 cents to $8.48 after 44,622 units crossed the market, Eppley Caribbean Property Fund fell $3 to close at $39, with an exchange of 12,993 units, Jamaica Producers popped 46 cents to end at $20.96 in trading 7,127 shares. Kingston Wharves declined $2.50 to $35 after 37,915 stocks crossed the exchange, Massy Holdings climbed $2.95 to $89.95 after trading 1,703,213 stock units, MPC Caribbean Clean Energy dipped $16 to close at $68, with 44 stock units clearing the market. Palace Amusement increased $5 in closing at $850 after exchanging 91 units, PanJam Investment declined $1 to $58 with the swapping of 1,045,185 shares, Sagicor Group dropped $1.30 to end at $51 in exchanging 173,099 stocks. Seprod shed $7.50 to $62 with a transfer of 28,262 shares and Supreme Ventures lost 50 cents in closing at $29 after exchanging 45,951 stock units.

In the preference segment, Eppley 7.50% preference share fell $1.18 to $6.66 after a transfer of 323 stocks. Eppley 7.75% preference share gained $1 to close at $21 in an exchange of 59 units, 138 Student Living s preference share dipped $11.21 to $63.54 as investors exchanged 600 stock units and Productive Business Solutions 9.75% preference share dipped 50 cents in closing at $149.50 with investors transferring 130 units.

In the preference segment, Eppley 7.50% preference share fell $1.18 to $6.66 after a transfer of 323 stocks. Eppley 7.75% preference share gained $1 to close at $21 in an exchange of 59 units, 138 Student Living s preference share dipped $11.21 to $63.54 as investors exchanged 600 stock units and Productive Business Solutions 9.75% preference share dipped 50 cents in closing at $149.50 with investors transferring 130 units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

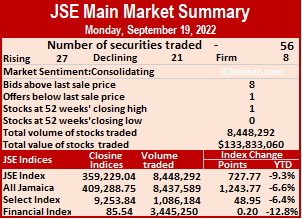

JSE Main Market stocks gain

Stocks rose on Monday on the Jamaica Stock Exchange Main Market, as the volume of stocks traded rising 11 percent with a 23 percent fall. In value compared to Friday, following activity in 56 securities up from 54 on Friday, resulting in 27 rising, 21 declining and eight ending unchanged.

A total of 8,448,292 shares were traded for $133,833,060 compared to 7,640,097 units at $172,839,636 on Friday.

A total of 8,448,292 shares were traded for $133,833,060 compared to 7,640,097 units at $172,839,636 on Friday.

Monday’s trading averaged 150,862 units at $2,389,876 versus 141,483 shares at $3,200,734 on Friday and month to date, an average of 206,642 units at $2,403,674 compared to 211,382 units at $2,404,846 on the previous trading day. August closed with an average of 738,534 units at $5,975,613.

Wigton Windfarm led trading with 4.18 million shares for 49.5 percent of total volume followed by Transjamaican Highway with 864,808 units for 10.2 percent of the day’s trade and Barita Investments with 712,307 units for 8.4 percent market share.

The All Jamaican Composite Index climbed 1,243.77 points to 409,288.75, the JSE Main Index advanced 727.77 points to 359,229.04 and the JSE Financial Index gained 0.20 points to settle at 85.54.

The PE Ratio, a formula to ascertain appropriate stock values, averages 13.5 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November and August 2023.

Investor’s Choice bid-offer indicator shows eight stocks ended with bids higher than their last selling prices and one stock with a lower offer.

At the close, Barita Investments rose 58 cents to $86.98, trading 712,307 shares, Berger Paints climbed 79 cents to $11.32 in switching ownership of 269,675 units, Eppley dropped $1.49 to $39.01 in an exchange of 700 stock units. Jamaica Broilers fell $1.50 to $28.50 after transferring 34,709 stocks, Jamaica Producers advanced $1 to $20.50, with 6,958 units crossing the exchange, Jamaica Stock Exchange popped 56 cents in closing at $16.50 after trading 14,324 shares. JMMB Group shed $1.39 to close at $40.11 trading 197,333 stock units, Mayberry Investments rallied 45 cents to $8 in exchanging 2,877 stocks, MPC Caribbean Clean Energy increased by 50 cents to $84 with investors transferring 148 units. NCB Financial gained $1.19 to $89.70 in exchanging 96,142 shares, PanJam Investment rose 70 cents to $59 after a transfer of 30,000 stocks, Proven Investments declined $1.96 to close at $30.02 with an exchange of 8,218 stock units. Sagicor Group lost $1.21 in closing at $52.30 with the swapping of 9,259 units, Salada Foods popped 58 cents to end at $4.68 while exchanging 28,857 shares, Seprod dipped 40 cents to $69.50 after 389 stocks crossed the market and Supreme Ventures rallied $2 to $29.50 and closed after 44,852 stock units changed hands.

At the close, Barita Investments rose 58 cents to $86.98, trading 712,307 shares, Berger Paints climbed 79 cents to $11.32 in switching ownership of 269,675 units, Eppley dropped $1.49 to $39.01 in an exchange of 700 stock units. Jamaica Broilers fell $1.50 to $28.50 after transferring 34,709 stocks, Jamaica Producers advanced $1 to $20.50, with 6,958 units crossing the exchange, Jamaica Stock Exchange popped 56 cents in closing at $16.50 after trading 14,324 shares. JMMB Group shed $1.39 to close at $40.11 trading 197,333 stock units, Mayberry Investments rallied 45 cents to $8 in exchanging 2,877 stocks, MPC Caribbean Clean Energy increased by 50 cents to $84 with investors transferring 148 units. NCB Financial gained $1.19 to $89.70 in exchanging 96,142 shares, PanJam Investment rose 70 cents to $59 after a transfer of 30,000 stocks, Proven Investments declined $1.96 to close at $30.02 with an exchange of 8,218 stock units. Sagicor Group lost $1.21 in closing at $52.30 with the swapping of 9,259 units, Salada Foods popped 58 cents to end at $4.68 while exchanging 28,857 shares, Seprod dipped 40 cents to $69.50 after 389 stocks crossed the market and Supreme Ventures rallied $2 to $29.50 and closed after 44,852 stock units changed hands.

In the preference segment, Eppley 5% preference share lost $3Sharon ending at $20.31, with two shares clearing the market,Jamaica Public Service 9.5% dropped $350to $2650 after exchanging 6,511 stock units. JMMB Group 7% preference share increased 55 cents to end at $2.50 crossing the market 19,040 stocks. Investors continue to push two preference shares to unrealistic values that defile logic, with 138 Student Living preference share advancing $9.75 to close at a record high of $74.75 after trading 78 units and Productive Business Solutions 9.75% preference share gaining $5 to $150 as investors exchanged six stocks.

In the preference segment, Eppley 5% preference share lost $3Sharon ending at $20.31, with two shares clearing the market,Jamaica Public Service 9.5% dropped $350to $2650 after exchanging 6,511 stock units. JMMB Group 7% preference share increased 55 cents to end at $2.50 crossing the market 19,040 stocks. Investors continue to push two preference shares to unrealistic values that defile logic, with 138 Student Living preference share advancing $9.75 to close at a record high of $74.75 after trading 78 units and Productive Business Solutions 9.75% preference share gaining $5 to $150 as investors exchanged six stocks.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Trading climbs on JSE main market

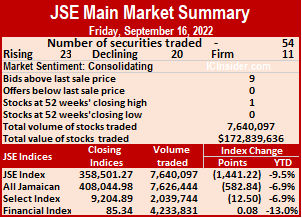

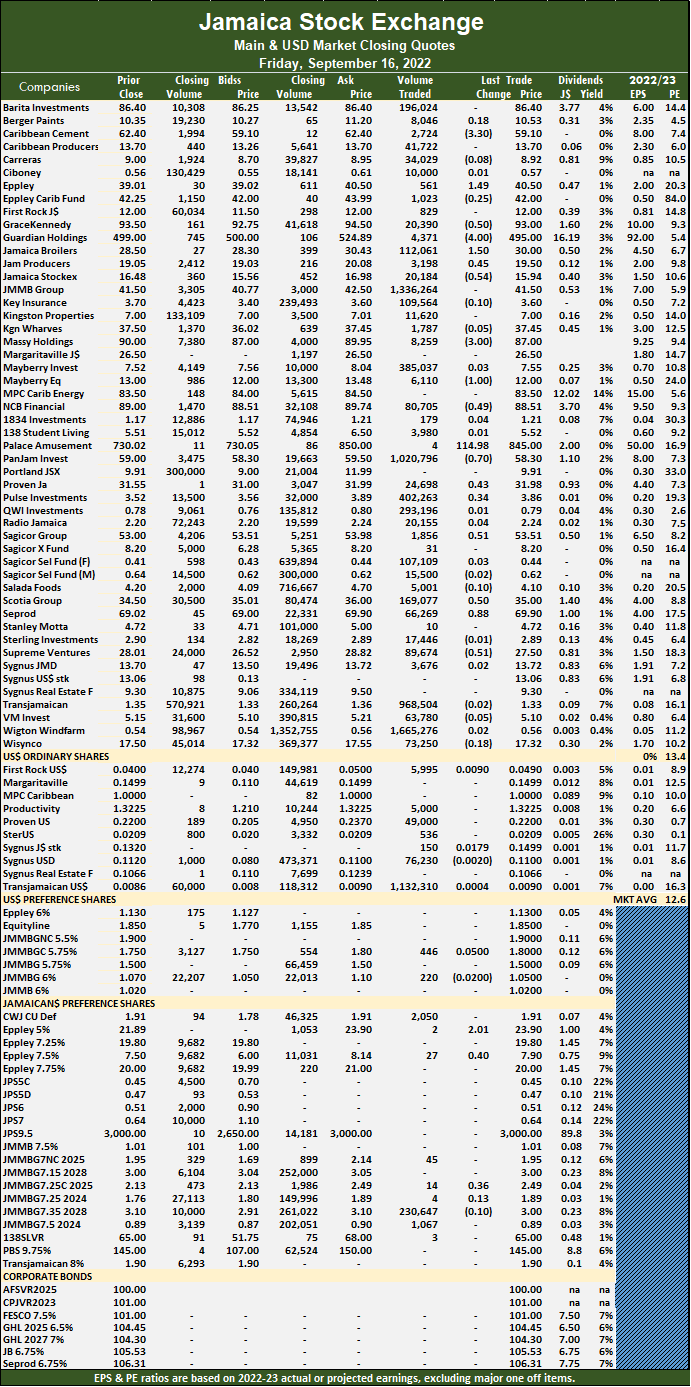

More shares were traded on the Jamaica Stock Exchange Main Market on Friday, than on Thursday with the market value falling at the close after the volume of stocks traded rose 67 percent and the value jumped 204 percent more than on Thursday, with 54 securities trading compared to 50 on Thursday, with 23 rising, 20 declining and 11 ending unchanged.

A total of 7,640,097 shares were exchanged for $172,839,636, up from 4,582,527 units at $56,809,986 on Thursday. Trading averaged 141,483 units at $3,200,734 versus 91,651 shares at $1,136,200 on Thursday and month to date, an average of 211,382 shares at $2,404,846 compared to 217,620 units at $2,333,808 on the prior day. August closed with an average of 738,534 units at $5,975,613.

A total of 7,640,097 shares were exchanged for $172,839,636, up from 4,582,527 units at $56,809,986 on Thursday. Trading averaged 141,483 units at $3,200,734 versus 91,651 shares at $1,136,200 on Thursday and month to date, an average of 211,382 shares at $2,404,846 compared to 217,620 units at $2,333,808 on the prior day. August closed with an average of 738,534 units at $5,975,613.

Wigton Windfarm led trading with 1.67 million shares for 21.8 percent of total volume followed by JMMB Group with 1.34 million units for 17.5 percent of the day’s trade and PanJam Investment with 1.02 million units for 13.4 percent market share.

The All Jamaican Composite Index shed 582.84 points to end at 408,044.98, the JSE Main Index fell 1,441.22 points to end the week at 358,501.27 and the JSE Financial Index popped 0.08 points to close at 85.34.

The PE Ratio, a formula to ascertain appropriate stock values, averages 13.4 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November and August 2023.

Investor’s Choice bid-offer indicator shows nine stocks ended with bids higher than their last selling prices and none with a lower offer.

At the close, Caribbean Cement lost $3.30 in closing at $59.10 after exchanging 2,724 shares, Eppley rose $1.49 to close at $40.50, with 561 stock units crossing the market, GraceKennedy declined 50 cents to $93, with an exchange of 20,390 stocks. Guardian Holdings dipped $4 to $495 in exchanging 4,371 units, Jamaica Broilers climbed $1.50 to $30 as investors traded 112,061 shares, Jamaica Producers gained 45 cents to end at $19.50 in switching ownership of 3,198 stock units. Jamaica Stock Exchange shed 54 cents to close at $15.94 while exchanging 20,184 units, Massy Holdings dropped $3 in closing at $87, with 8,259 stocks changing hands, Mayberry Jamaican Equities fell $1 to $12 with a transfer of 6,110 shares. NCB Financial fell 49 cents to $88.51, with 80,705 units changing hands, Palace Amusement rallied $114.98 to $845 with investors transferring four stocks, PanJam Investment dipped 70 cents to close at $58.30, with 1,020,796 stock units clearing the market. Proven Investments popped 43 cents to end at $31.98 after a transfer of 24,698 shares, Sagicor Group increased 51 cents in ending at $53.51 after trading 1,856 stock units, Scotia Group advanced 50 cents in closing at $35, with 169,077 units crossing the market.

At the close, Caribbean Cement lost $3.30 in closing at $59.10 after exchanging 2,724 shares, Eppley rose $1.49 to close at $40.50, with 561 stock units crossing the market, GraceKennedy declined 50 cents to $93, with an exchange of 20,390 stocks. Guardian Holdings dipped $4 to $495 in exchanging 4,371 units, Jamaica Broilers climbed $1.50 to $30 as investors traded 112,061 shares, Jamaica Producers gained 45 cents to end at $19.50 in switching ownership of 3,198 stock units. Jamaica Stock Exchange shed 54 cents to close at $15.94 while exchanging 20,184 units, Massy Holdings dropped $3 in closing at $87, with 8,259 stocks changing hands, Mayberry Jamaican Equities fell $1 to $12 with a transfer of 6,110 shares. NCB Financial fell 49 cents to $88.51, with 80,705 units changing hands, Palace Amusement rallied $114.98 to $845 with investors transferring four stocks, PanJam Investment dipped 70 cents to close at $58.30, with 1,020,796 stock units clearing the market. Proven Investments popped 43 cents to end at $31.98 after a transfer of 24,698 shares, Sagicor Group increased 51 cents in ending at $53.51 after trading 1,856 stock units, Scotia Group advanced 50 cents in closing at $35, with 169,077 units crossing the market. Seprod rose 88 cents in ending at $69.90 after an exchange of 66,269 stocks and Supreme Ventures shed 51 cents to close at $27.50 in trading 89,674 stocks.

Seprod rose 88 cents in ending at $69.90 after an exchange of 66,269 stocks and Supreme Ventures shed 51 cents to close at $27.50 in trading 89,674 stocks.

In the preference segment, Eppley 5% preference share gained $2.01 to end at a 52 weeks’ high of $23.90 in exchanging two units and Eppley 7.50% preference share increased 40 cents to $7.90 after trading 27 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

- « Previous Page

- 1

- …

- 39

- 40

- 41

- 42

- 43

- …

- 183

- Next Page »