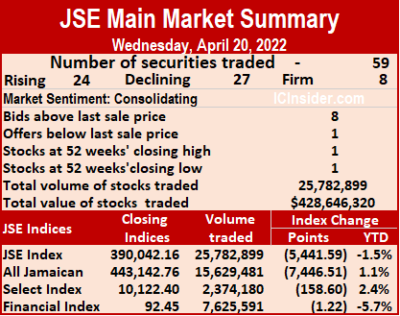

Market activity surged on the Jamaica Stock Exchange Main Market on Wednesday, as the volume of shares trading climbed 79 per cent, with the value jumping 205 percent higher than on Tuesday and ended with declining stocks exceeding those rising.

The All Jamaican Composite Index dived 7,446.51 points to 443,142.76, the JSE Main Index dropped 5,441.59 points to 390,042.16 and the JSE Financial Index slipped 1.22 points to settle at 92.45.

The All Jamaican Composite Index dived 7,446.51 points to 443,142.76, the JSE Main Index dropped 5,441.59 points to 390,042.16 and the JSE Financial Index slipped 1.22 points to settle at 92.45.

Trading ended with 59 securities up from 58 on Tuesday, with 24 rising, 27 declining and eight ending unchanged.

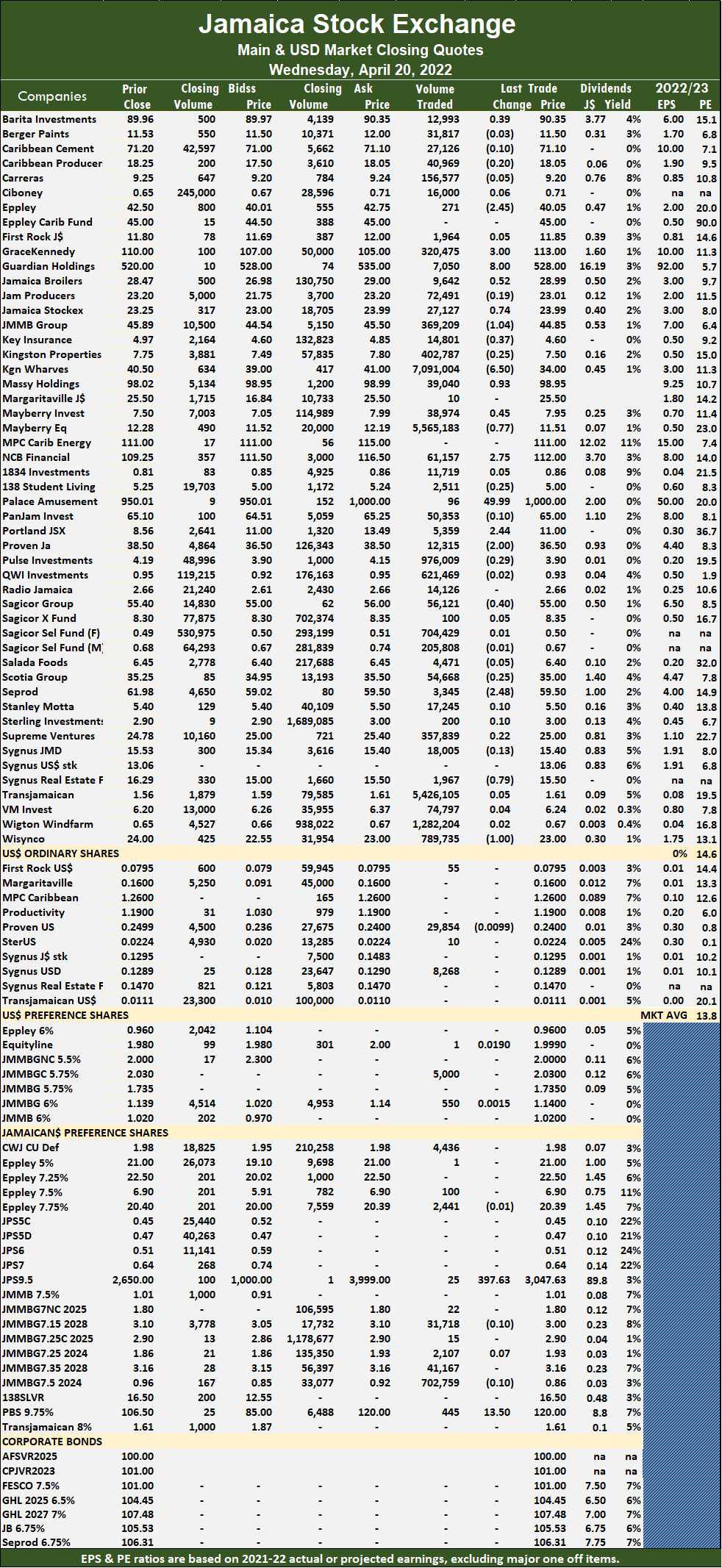

The PE Ratio, a formula for computing appropriate stock values, averages 14.6. The PE ratio for the JSE Main and USD Market closing quotes is based on ICInsider.com earnings forecasts for companies with financial years ending by the end of August 2023.

Overall, 25,782,899 shares traded for $428,646,320 versus 14,387,651 units at $140,647,485 on Tuesday. Kingston Wharves led trading with 7.09 million shares for 27.5 percent of total volume, followed by Mayberry Jamaican Equities with 5.57 million units for 21.6 percent of the day’s trade, Transjamaican Highway ended with 5.43 million units for 21 percent of market share and Wigton Windfarm ended with 1.28 million units changing hands for 5 percent market share.

Trading averaged 436,998 units at $7,265,192, compared to 248,063 shares at $2,424,957 on Tuesday and month to date, an average of 693,901 units at $7,327,393, compared to 717,999 units at $7,333,227 on the previous trading day. March closed with an average of 610,787 units at $6,967,031.

Investor’s Choice bid-offer indicator shows eight stocks ending with bids higher than their last selling prices and one with a lower offer.

At the close, Barita Investmentsrallied 39 cents to close at $90.35 after 12,993 shares crossed the market, Eppley fell $2.45 in closing at $40.05 with an exchange of 271 stock units, GraceKennedy climbed $3 in ending at a 52 weeks’ high of $113 with the swapping of 320,475 units. Guardian Holdings increased $8 to end at $528 after exchanging 7,050 stocks, Jamaica Broilers gained 52 cents to close at $28.99 in exchanging 9,642 units, Jamaica Stock Exchange rose 74 cents to $23.99 in switching ownership of 27,127 stock units. JMMB Group declined $1.04 to $44.85, with 369,209 stocks crossing the market, Key Insurance dropped 37 cents to end at $4.60 after trading 14,801 shares, Kingston Wharves shed $6.50 in closing at a 52 weeks’ low of $34, with 7,091,004 stock units changing hands. Massy Holdings advanced 93 cents to close at $98.95 in an exchange of 39,040 stocks, Mayberry Investments popped 45 cents to $7.95 in exchanging 38,974 shares, Mayberry Jamaican Equities lost 77 cents to close at $11.51, with 5,565,183 units clearing the market. NCB Financial rose $2.75 to end at $112 and closed with 61,157 units changing hands, Palace Amusement advanced $49.99, ending at $1000, with 96 stocks crossing the exchange, Portland JSX gained $2.44 in closing at $11 in trading 5,359 stock units.

At the close, Barita Investmentsrallied 39 cents to close at $90.35 after 12,993 shares crossed the market, Eppley fell $2.45 in closing at $40.05 with an exchange of 271 stock units, GraceKennedy climbed $3 in ending at a 52 weeks’ high of $113 with the swapping of 320,475 units. Guardian Holdings increased $8 to end at $528 after exchanging 7,050 stocks, Jamaica Broilers gained 52 cents to close at $28.99 in exchanging 9,642 units, Jamaica Stock Exchange rose 74 cents to $23.99 in switching ownership of 27,127 stock units. JMMB Group declined $1.04 to $44.85, with 369,209 stocks crossing the market, Key Insurance dropped 37 cents to end at $4.60 after trading 14,801 shares, Kingston Wharves shed $6.50 in closing at a 52 weeks’ low of $34, with 7,091,004 stock units changing hands. Massy Holdings advanced 93 cents to close at $98.95 in an exchange of 39,040 stocks, Mayberry Investments popped 45 cents to $7.95 in exchanging 38,974 shares, Mayberry Jamaican Equities lost 77 cents to close at $11.51, with 5,565,183 units clearing the market. NCB Financial rose $2.75 to end at $112 and closed with 61,157 units changing hands, Palace Amusement advanced $49.99, ending at $1000, with 96 stocks crossing the exchange, Portland JSX gained $2.44 in closing at $11 in trading 5,359 stock units.  Proven Investments dropped $2 to $36.50 while exchanging 12,315 shares, Sagicor Group shed 40 cents to end at $55, trading 56,121 units, Seprod fell $2.48, ending at $59.50 after trading 3,345 stocks. Sygnus Real Estate Finance declined 79 cents to close at $15.50 with an exchange of 1,967 stock units and Wisynco Group lost $1 in closing at $23 after trading 789,735 shares.

Proven Investments dropped $2 to $36.50 while exchanging 12,315 shares, Sagicor Group shed 40 cents to end at $55, trading 56,121 units, Seprod fell $2.48, ending at $59.50 after trading 3,345 stocks. Sygnus Real Estate Finance declined 79 cents to close at $15.50 with an exchange of 1,967 stock units and Wisynco Group lost $1 in closing at $23 after trading 789,735 shares.

In the preference segment, Jamaica Public Service 9.5% surged $397.63 in, ending at a 52 weeks’ high of $3047.63 after 25 units crossed the market and Productive Business Solutions 9.75% Preference share rallied $13.50 to end at $120 after exchanging 445 shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

JSE Main Market suffers big drop

JSE Main Market closes up

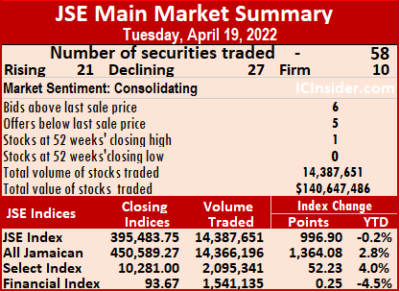

Market activity ended on Tuesday, with the volume of shares trading declining by 80 percent, with a sharp 89 percent drop in value than trading on Thursday on the Jamaica Stock Exchange Main Market as declining stocks exceeded those that rose.

The All Jamaican Composite Index rose 1,364.08 points to settle at 450,589.27, the JSE Main Index gained 996.90 points to end at 395,483.75 and the JSE Financial Index rallied 0.25 points to settle at 93.67.

The All Jamaican Composite Index rose 1,364.08 points to settle at 450,589.27, the JSE Main Index gained 996.90 points to end at 395,483.75 and the JSE Financial Index rallied 0.25 points to settle at 93.67.

Trading ended with 58 securities compared to 60 on Thursday, with 21 rising, 27 declining and 10 ending unchanged.

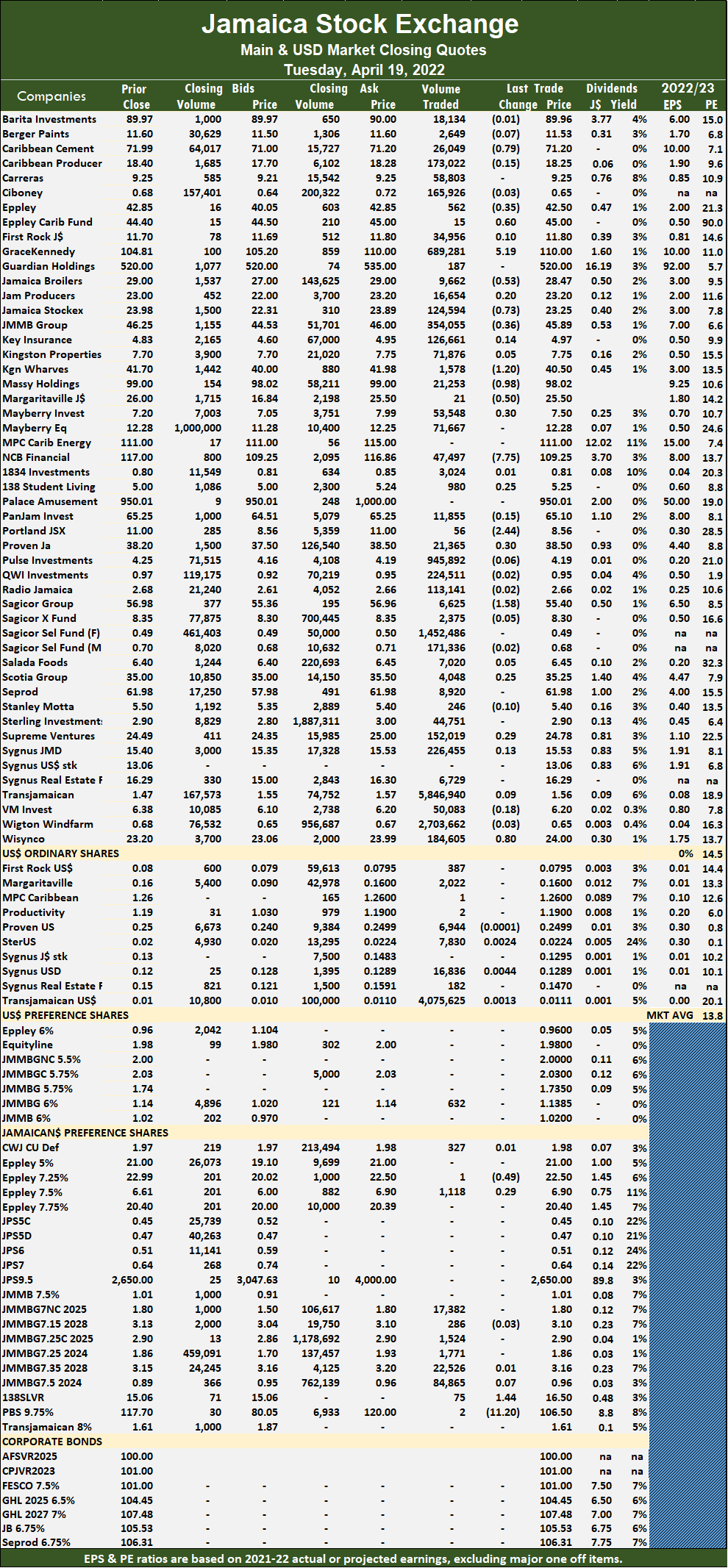

The PE Ratio, a formula for computing appropriate stock values, averages 14.5. The PE ratio for the JSE Main and USD Market closing quotes is based on ICInsider.com earnings forecasts for companies with financial years ending to the end of August 2023.

Overall, 14,387,651 shares were exchanged for $140,647,485 versus 70,371,025 units at $1,275,443,556 on Thursday. Transjamaican Highway led trading with 5.85 million shares for 40.6 percent of total volume, followed by Wigton Windfarm, 2.70 million units for 18.8 percent of the day’s trade and Sagicor Select Financial Fund with 1.45 million units for 10.1 percent market share.

Trading averaged 248,063 units at $2,424,957, down from 1,172,850 shares at $21,257,393 on Thursday and month to date, an average of 717,999 units at $7,333,227 versus 765,733 units at $7,831,791 on the previous trading day. March closed with an average of 610,787 units at $6,967,031.

Trading averaged 248,063 units at $2,424,957, down from 1,172,850 shares at $21,257,393 on Thursday and month to date, an average of 717,999 units at $7,333,227 versus 765,733 units at $7,831,791 on the previous trading day. March closed with an average of 610,787 units at $6,967,031.

Investor’s Choice bid-offer indicator shows six stocks ending with bids higher than their last selling prices and five with lower offers.

At the close, Caribbean Cement lost 79 cents to close at $71.20 after exchanging 26,049 shares, Eppley fell 35 cents to $42.50 trading 562 stock units, Eppley Caribbean Property Fund climbed 60 cents ending at $45, with 15 units clearing the market. strong>GraceKennedy rallied $5.19 in closing at 52 weeks’ closing high of $110 after 689,281 stocks crossed the market, Jamaica Broilers dropped 53 cents to end at $28.47 in trading 9,662 stock units, Jamaica Stock Exchange shed 73 cents to $23.25 with the swapping of 124,594 stocks. JMMB Group declined 36 cents to close at $45.89 in trading 354,055 units, Kingston Wharves declined $1.20 in closing at $40.50 in an exchange of 1,578 shares, Margaritaville dropped 50 cents to end at $25.50 in switching ownership of 21 units. Massy Holdings shed 98 cents in ending at $98.02 with 21,253 stock units changing hands, Mayberry Investments advanced 30 cents to close at $7.50 after trading 53,548 shares, NCB Financial lost $7.75 to $109.25, with 47,497 stocks changing hands.  Portland JSX fell $2.44 in closing at $8.56, with 56 stock units crossing the exchange, Proven Investments gained 30 cents to end at $38.50 while exchanging 21,365 shares, Sagicor Group lost $1.58 to end at $55.40 in an exchange of 6,625 stocks and Wisynco Group rose 80 cents to close at $24 after trading 184,605 units.

Portland JSX fell $2.44 in closing at $8.56, with 56 stock units crossing the exchange, Proven Investments gained 30 cents to end at $38.50 while exchanging 21,365 shares, Sagicor Group lost $1.58 to end at $55.40 in an exchange of 6,625 stocks and Wisynco Group rose 80 cents to close at $24 after trading 184,605 units.

In the preference segment, 138 Student Living Preference shares jumped $1.44 to end at $16.50 after exchanging 75 stocks, Eppley 7.25% Preference share declined 49 cents to $22.50 in trading just one unit and Productive Business Solutions 9.75% Preference share shed $11.20 in closing at $106.50 with an exchange of just two stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Trading jumps but Main Market index drops

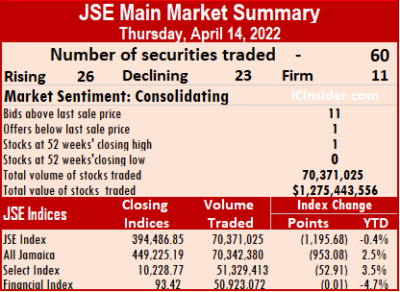

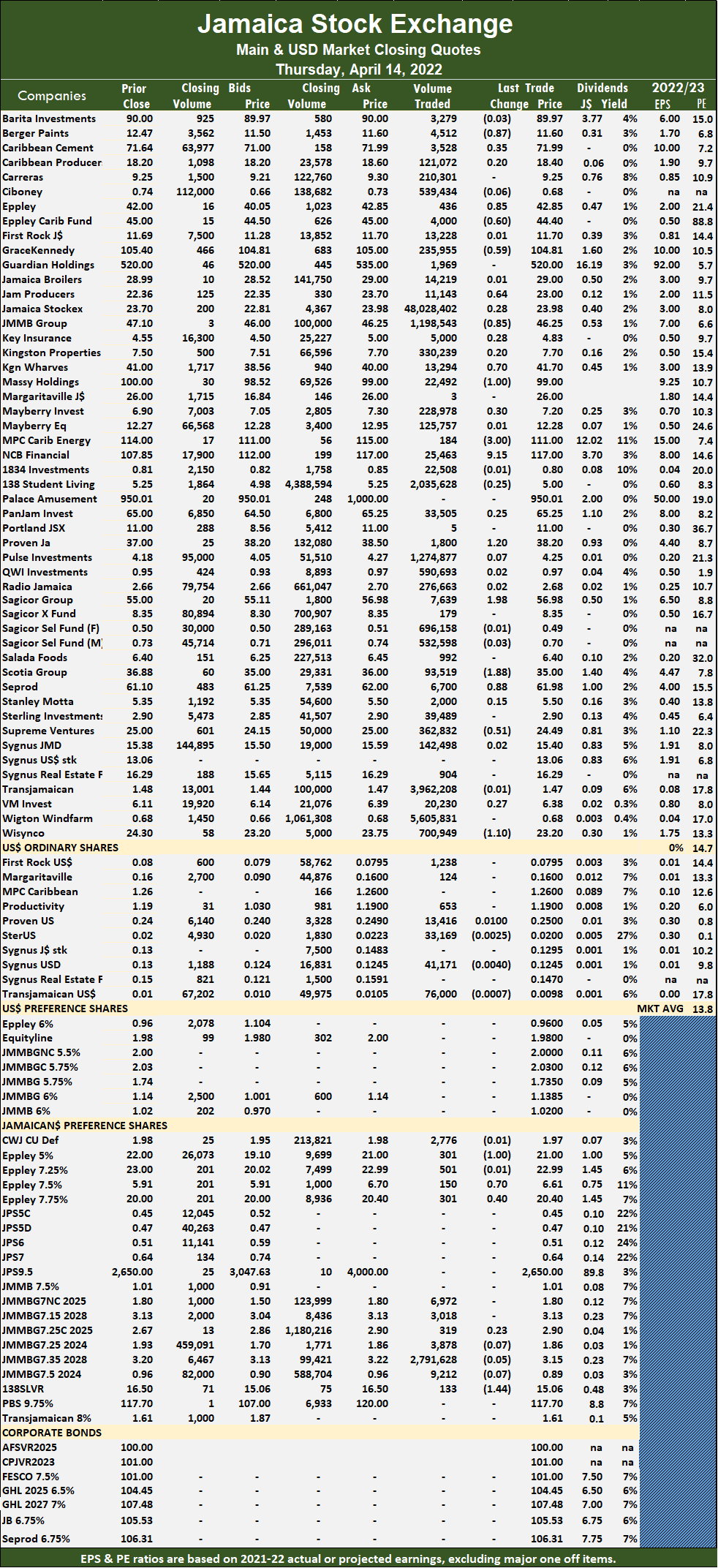

Market activity ended on Thursday, with the volume of shares trading declining by 26 percent with a 28 percent higher value than on in trading 0n Wednesday on the Jamaica Stock Exchange Main Market as rising stocks exceeded those falling.

The All Jamaican Composite Index lost 953.08 points to settle at 449,225.19, the JSE Main Index fell 1,195.68 points to close at 394,486.85 and the JSE Financial Index slipped 0.01 points to 93.42. Trading ended with 60 securities against 59 on Wednesday, with 26 rising, 23 declining and 11 ending unchanged.

The All Jamaican Composite Index lost 953.08 points to settle at 449,225.19, the JSE Main Index fell 1,195.68 points to close at 394,486.85 and the JSE Financial Index slipped 0.01 points to 93.42. Trading ended with 60 securities against 59 on Wednesday, with 26 rising, 23 declining and 11 ending unchanged.

The PE Ratio, a formula for computing appropriate stock values, averages 14.7. The PE ratio for the JSE Main and USD Market closing quotes is based on ICInsider.com earnings forecasts for companies with financial years ending between August 2022 and August 2023.

Overall, 70,371,025 shares were exchanged for $1,275,443,556 versus 95,428,562 units at $992,647,318 on Wednesday. Jamaica Stock Exchange led trading with 48.03 million shares for 68.3 percent of total volume, followed by Wigton Windfarm with 5.61 million units for 8 percent of the day’s trade and Transjamaican Highway ended with 3.96 million units for 5.6 percent market share. JMMB Group 7.35% – 2028 closed with 2.79 million units for 4 percent market share, 138 Student Living ended with 2.04 million units for 2.9 percent market share and Pulse Investments exchanged 1.27 million units for 1.8 percent market share.

JMMB Group 7.35% – 2028 closed with 2.79 million units for 4 percent market share, 138 Student Living ended with 2.04 million units for 2.9 percent market share and Pulse Investments exchanged 1.27 million units for 1.8 percent market share.

Trading averages 1,172,850 units at $21,257,393 versus 1,617,433 shares at $16,824,531 on Wednesday and month to date, an average of 765,733 units at $7,831,791 compared to 717,931 units at $6,255,399 on the previous trading day. March closed with an average of 610,787 units at $6,967,031.

Investor’s Choice bid-offer indicator shows 11 stocks ended with bids higher than their last selling prices and one with a lower offer.

At the close, Berger Paints shed 87 cents to close at $11.60, with 4,512 shares crossing the exchange, Caribbean Cement increased 35 cents to end at $71.99 in trading 3,528 stocks, Caribbean Producers climbed 20 cents to $18.40, with 121,072 units clearing the market. Eppley gained 85 cents in ending at $42.85 and closed after 436 stock units were traded, Eppley Caribbean Property Fund lost 60 cents to $44.40 in switching ownership of 4,000 stock units, GraceKennedy fell 59 cents to $104.81 after 235,955 stocks changed hands. Jamaica Producers popped 64 cents in closing at $23, trading 11,143 units, JMMB Group dropped 85 cents in ending at $46.25 with an exchange of 1,198,543 shares, Kingston Wharves rose 70 cents to close at $41.70 while exchanging 13,294 stock units. Massy Holdings declined $1 to end at $99, with 22,492 shares changing hands, Mayberry Investments advanced 30 cents to close at $7.20, with 228,978 stocks crossing the market, MPC Caribbean Clean Energy lost $3 to close at $111 after exchanging 184 units.  NCB Financial rallied $9.15 to end at $117, with 25,463 units crossing the market, Proven Investments rose $1.20 in closing at $38.20 after exchanging 1,800 stocks, Sagicor Group increased $1.98 to $56.98 in an exchange of 7,639 stock units. Scotia Group dropped $1.88 in ending at $35 after exchanging 93,519 shares, Seprod climbed 88 cents to end at $61.98 with the swapping of 6,700 units, Supreme Ventures declined 51 cents in closing at $24.49 in an exchange of 362,832 stock units and Wisynco Group shed $1.10 to close at $23.20 after trading 700,949 shares.

NCB Financial rallied $9.15 to end at $117, with 25,463 units crossing the market, Proven Investments rose $1.20 in closing at $38.20 after exchanging 1,800 stocks, Sagicor Group increased $1.98 to $56.98 in an exchange of 7,639 stock units. Scotia Group dropped $1.88 in ending at $35 after exchanging 93,519 shares, Seprod climbed 88 cents to end at $61.98 with the swapping of 6,700 units, Supreme Ventures declined 51 cents in closing at $24.49 in an exchange of 362,832 stock units and Wisynco Group shed $1.10 to close at $23.20 after trading 700,949 shares.

In the preference segment, 138 Student Living Preference shares fell $1.44 to $15.06, clearing the market with 133 stocks, Eppley 5% preference share lost $1 to $21, changing hands 301 units. Eppley 7.50% preference share rallied 70 cents in closing at $6.61, crossing the market 150 stock units and Eppley 7.75% preference share advanced 40 cents ending at $20.40 in trading 301 shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

JSE Main market inches higher

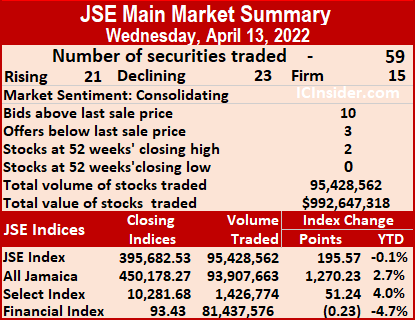

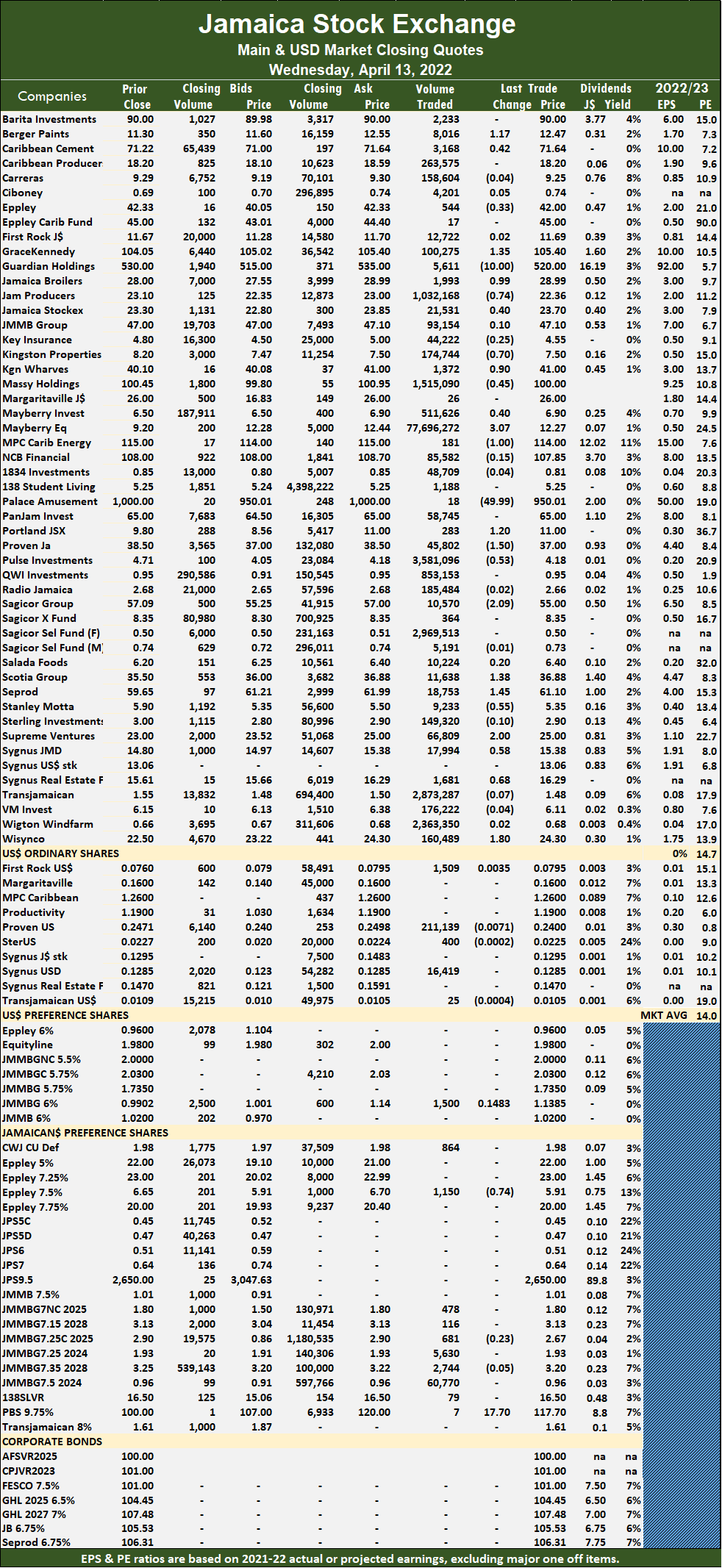

Trading surged on Wednesday on the Jamaica Stock Exchange Main Market Market, with an exchange of 412 percent more shares valued 1,067 percent higher than on Tuesday, resulting in a mild rise in the market indices at the close with rising after rising stocks just edged out by those declining.

The All Jamaican Composite Index rallied 1,270.23 points to 450,178.27, the JSE Main Index edged 195.57 points higher to 395,682.53 and the JSE Financial Index dipped 0.23 points to 93.43.

The All Jamaican Composite Index rallied 1,270.23 points to 450,178.27, the JSE Main Index edged 195.57 points higher to 395,682.53 and the JSE Financial Index dipped 0.23 points to 93.43.

Trading ended with 59 securities compared to 58 on Tuesday, with 21 rising, 23 declining and 15 ending unchanged.

The PE Ratio, a formula used to compute stock values, averages 14.7. The PE ratio for the JSE Main and USD Market closing quotes is based on ICInsider.com earnings forecasts for companies with financial years ending to August 2023.

Overall, 95,428,562 shares traded for $992,647,318 versus 18,631,554 units at $85,039,171 on Tuesday. Mayberry Jamaican Equities led trading with 77.7 million shares accounting for 81.4 percent of total volume, followed by Pulse Investments, 3.58 million units for 3.8 percent of the day’s trade. Sagicor Select Financial Fund exchanged 2.97 million units for 3.1 percent market share, Transjamaican Highway ended with 2.87 million units for 3 percent market share, Wigton Windfarm traded 2.36 million units for 2.5 percent market share and Massy Holdings with 1.52 million units for 1.6 percent market share.

Trading averages 1,617,433 units at $16,824,531, up from 321,234 shares at $1,466,193 on Tuesday and month to date, an average of 717,931 units at $6,255,399, compared to 600,518 units at $4,875,800 on the previous trading day. March closed with an average of 610,787 units at $6,967,031.

Investor’s Choice bid-offer indicator shows ten stocks ended with bids higher than their last selling prices and three with lower offers.

At the close, Berger Paints climbed $1.17 to close at $12.47 with the swapping of 8,016 shares,  Caribbean Cement rose 42 cents to end at $71.64, clearing the market with 3,168 stock units, Eppley dropped 33 cents in closing at $42, with 544 stocks changing hands. GraceKennedy popped $1.35 in, ending at $105.40 after exchanging 100,275 units, Guardian Holdings shed $10 to $520 with an exchange of 5,611 shares, Jamaica Broilers advanced 99 cents to end at $28.99 while 1,993 units changed hands. Jamaica Producers fell 74 cents to $22.36, with 1,032,168 stocks crossing the exchange, Jamaica Stock Exchange gained 40 cents in closing at $23.70 after exchanging 21,531 stock units, Kingston Properties declined 70 cents to close at $7.50 in trading 174,744 units. Kingston Wharves increased 90 cents to $41 with 1,372 shares passing through the market, Massy Holdings lost 45 cents to end at $100, with 1,515,090 stocks crossing the market, Mayberry Investments rallied 40 cents to $6.90 in an exchange of 511,626 stock units. Mayberry Jamaican Equities rose $3.07 to close at a 52 weeks’ high of $12.27 in switching ownership of 77,696,272 stocks, MPC Caribbean Clean Energy shed $1 in ending at $114 after trading 181 shares, Palace Amusement dropped $49.99 in closing at $950.01 with 18 stock units changing hands. Portland JSX climbed $1.20 to $11 in trading 283 units, Proven Investments lost $1.50 to close at $37 after 45,802 stock units crossed the market, Pulse Investments declined 53 cents to end at $4.18 after trading 3,581,096 units.

Caribbean Cement rose 42 cents to end at $71.64, clearing the market with 3,168 stock units, Eppley dropped 33 cents in closing at $42, with 544 stocks changing hands. GraceKennedy popped $1.35 in, ending at $105.40 after exchanging 100,275 units, Guardian Holdings shed $10 to $520 with an exchange of 5,611 shares, Jamaica Broilers advanced 99 cents to end at $28.99 while 1,993 units changed hands. Jamaica Producers fell 74 cents to $22.36, with 1,032,168 stocks crossing the exchange, Jamaica Stock Exchange gained 40 cents in closing at $23.70 after exchanging 21,531 stock units, Kingston Properties declined 70 cents to close at $7.50 in trading 174,744 units. Kingston Wharves increased 90 cents to $41 with 1,372 shares passing through the market, Massy Holdings lost 45 cents to end at $100, with 1,515,090 stocks crossing the market, Mayberry Investments rallied 40 cents to $6.90 in an exchange of 511,626 stock units. Mayberry Jamaican Equities rose $3.07 to close at a 52 weeks’ high of $12.27 in switching ownership of 77,696,272 stocks, MPC Caribbean Clean Energy shed $1 in ending at $114 after trading 181 shares, Palace Amusement dropped $49.99 in closing at $950.01 with 18 stock units changing hands. Portland JSX climbed $1.20 to $11 in trading 283 units, Proven Investments lost $1.50 to close at $37 after 45,802 stock units crossed the market, Pulse Investments declined 53 cents to end at $4.18 after trading 3,581,096 units.  Sagicor Group fell $2.09 in ending at $55 after exchanging 10,570 shares, Scotia Group advanced $1.38 in closing at $36.88 with an exchange of 11,638 stocks, Seprod rallied $1.45 to $61.10, trading 18,753 units. Stanley Motta shed 55 cents to end at $5.35 with 9,233 stock units changing hands, Supreme Ventures gained $2 to close at $25 in an exchange of 66,809 shares, Sygnus Credit Investments popped 58 cents in closing at $15.38 in switching ownership of 17,994 stocks. Sygnus Real Estate Finance increased 68 cents to end at $16.29 after an exchange of 1,681 units and Wisynco Group popped $1.80, in ending at a 52 weeks’ high of $24.30 in trading 160,489 stocks units.

Sagicor Group fell $2.09 in ending at $55 after exchanging 10,570 shares, Scotia Group advanced $1.38 in closing at $36.88 with an exchange of 11,638 stocks, Seprod rallied $1.45 to $61.10, trading 18,753 units. Stanley Motta shed 55 cents to end at $5.35 with 9,233 stock units changing hands, Supreme Ventures gained $2 to close at $25 in an exchange of 66,809 shares, Sygnus Credit Investments popped 58 cents in closing at $15.38 in switching ownership of 17,994 stocks. Sygnus Real Estate Finance increased 68 cents to end at $16.29 after an exchange of 1,681 units and Wisynco Group popped $1.80, in ending at a 52 weeks’ high of $24.30 in trading 160,489 stocks units.

In the preference segment, Eppley7.50% preference share declined 74 cents to $5.91 while exchanging 1,150 shares and Productive Business Solutions 9.75% Preference share gained $17.70 to close at $117.70, with seven stock units clearing the market.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Main Market trading drops

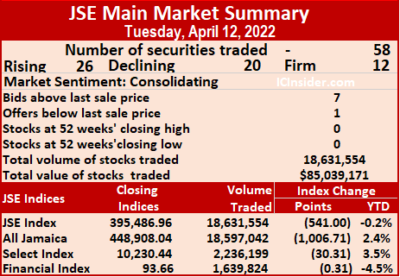

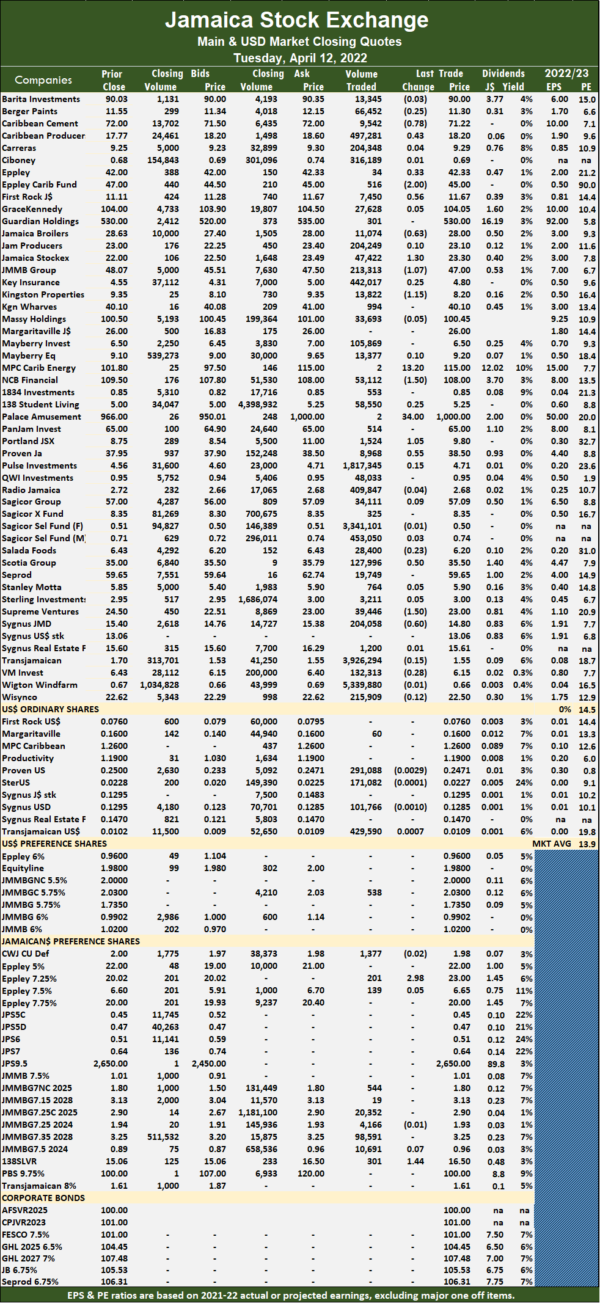

Market activity ended on the Jamaica Stock Exchange Main Market on Tuesday, with the volume of shares trading declining after funds flowing into the market dropped 31 percent from that Monday leading rising stocks to exceed those declining but the market indices slipped at the close.

The All Jamaican Composite Index shed 1,006.71 points to settle at 448,908.04, the JSE Main Index slipped 541 points to 395,486.96 and the JSE Financial Index dipped 0.31 points to settle at 93.66.

The All Jamaican Composite Index shed 1,006.71 points to settle at 448,908.04, the JSE Main Index slipped 541 points to 395,486.96 and the JSE Financial Index dipped 0.31 points to settle at 93.66.

A total of 58 securities traded compared to 57 on Monday, with 26 rising, 20 declining and 12 ending unchanged.

The PE Ratio, a formula for computing appropriate stock values, averages 14.5. The PE ratio for the JSE Main and USD Market closing quotes are based on ICInsider.com earnings forecasts for companies with financial years ending up to August 2023.

Overall, 18,631,554 shares traded for $85,039,171 versus 16,149,953 units at $124,025,246 on Monday. Wigton Windfarm led trading with 5.34 million shares for 28.7 percent of total volume followed by Transjamaican Highway with 3.93 million units for 21.1 percent of the day’s trade. Sagicor Select Financial Fund followed with 3.34 million units for 17.9 percent market share, while Pulse Investments ended with 1.82 million units changing hands for 9.8 percent market share.

Trading averaged 321,234 units at $1,466,193, compared to 283,333 shares at $2,175,882 on Monday and month to date, an average of 600,518 units at $4,875,800, compared to 641,631 units at $5,377,722 on the previous trading day. March closed with an average of 610,787 units at $6,967,031.

Investor’s Choice bid-offer indicator shows seven stocks ended with bids higher than their last selling prices and one with a lower offer.

At the close, Caribbean Cement dropped 78 cents to close at $71.22 while exchanging 9,542 shares, Caribbean Producers gained 43 cents to end at $18.20 in an exchange of 497,281 stocks, Eppley popped 33 cents in closing at $42.33 in trading 34 units. Eppley Caribbean Property Fund shed $2 to $45 after 516 stock units changed hands, First Rock Capital rose 56 cents in ending at $11.67 after trading 7,450 shares, Jamaica Broilers traded 11,074 stocks with the rice falling 63 cents to end at $28. Jamaica Stock Exchange advanced $1.30 to $23.30, with 47,422 units crossing the market, JMMB Group lost $1.07 in closing at $47 with the swapping of 213,313 stock units, Kingston Propertiesdeclined $1.15 to close at $8.20, with 13,822 stock units crossing the market. MPC Caribbean Clean Energy climbed $13.20 in ending at $115, with an exchange of two shares, NCB Financial fell $1.50 to end at $108 after exchanging 53,112 units, Palace Amusement rallied $34 to close at $1000, in exchanging just two stock units.

At the close, Caribbean Cement dropped 78 cents to close at $71.22 while exchanging 9,542 shares, Caribbean Producers gained 43 cents to end at $18.20 in an exchange of 497,281 stocks, Eppley popped 33 cents in closing at $42.33 in trading 34 units. Eppley Caribbean Property Fund shed $2 to $45 after 516 stock units changed hands, First Rock Capital rose 56 cents in ending at $11.67 after trading 7,450 shares, Jamaica Broilers traded 11,074 stocks with the rice falling 63 cents to end at $28. Jamaica Stock Exchange advanced $1.30 to $23.30, with 47,422 units crossing the market, JMMB Group lost $1.07 in closing at $47 with the swapping of 213,313 stock units, Kingston Propertiesdeclined $1.15 to close at $8.20, with 13,822 stock units crossing the market. MPC Caribbean Clean Energy climbed $13.20 in ending at $115, with an exchange of two shares, NCB Financial fell $1.50 to end at $108 after exchanging 53,112 units, Palace Amusement rallied $34 to close at $1000, in exchanging just two stock units.  Portland JSX increased $1.05 after ending at $9.80 after 1,524 stocks changed hands, Proven Investments advanced 55 cents to $38.50 in switching ownership of 8,968 shares, Scotia Group increased 50 cents in closing at $35.50, with 127,996 units changing hands, Supreme Ventures declined $1.50 to close at $23 with an exchange of 39,446 stock units and Sygnus Credit Investments shed 60 cents to $14.80 trading 204,058 stock units.

Portland JSX increased $1.05 after ending at $9.80 after 1,524 stocks changed hands, Proven Investments advanced 55 cents to $38.50 in switching ownership of 8,968 shares, Scotia Group increased 50 cents in closing at $35.50, with 127,996 units changing hands, Supreme Ventures declined $1.50 to close at $23 with an exchange of 39,446 stock units and Sygnus Credit Investments shed 60 cents to $14.80 trading 204,058 stock units.

In the preference segment, 138 Student Living Preference shares rallied $1.44 to $16.50 after switching ownership of 301 units and Eppley 7.25% Preference share rose $2.98 to $23 with the swapping of 201 shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

JSE Main Market falls

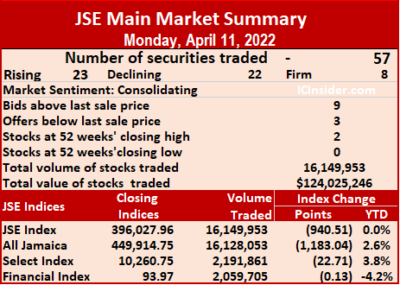

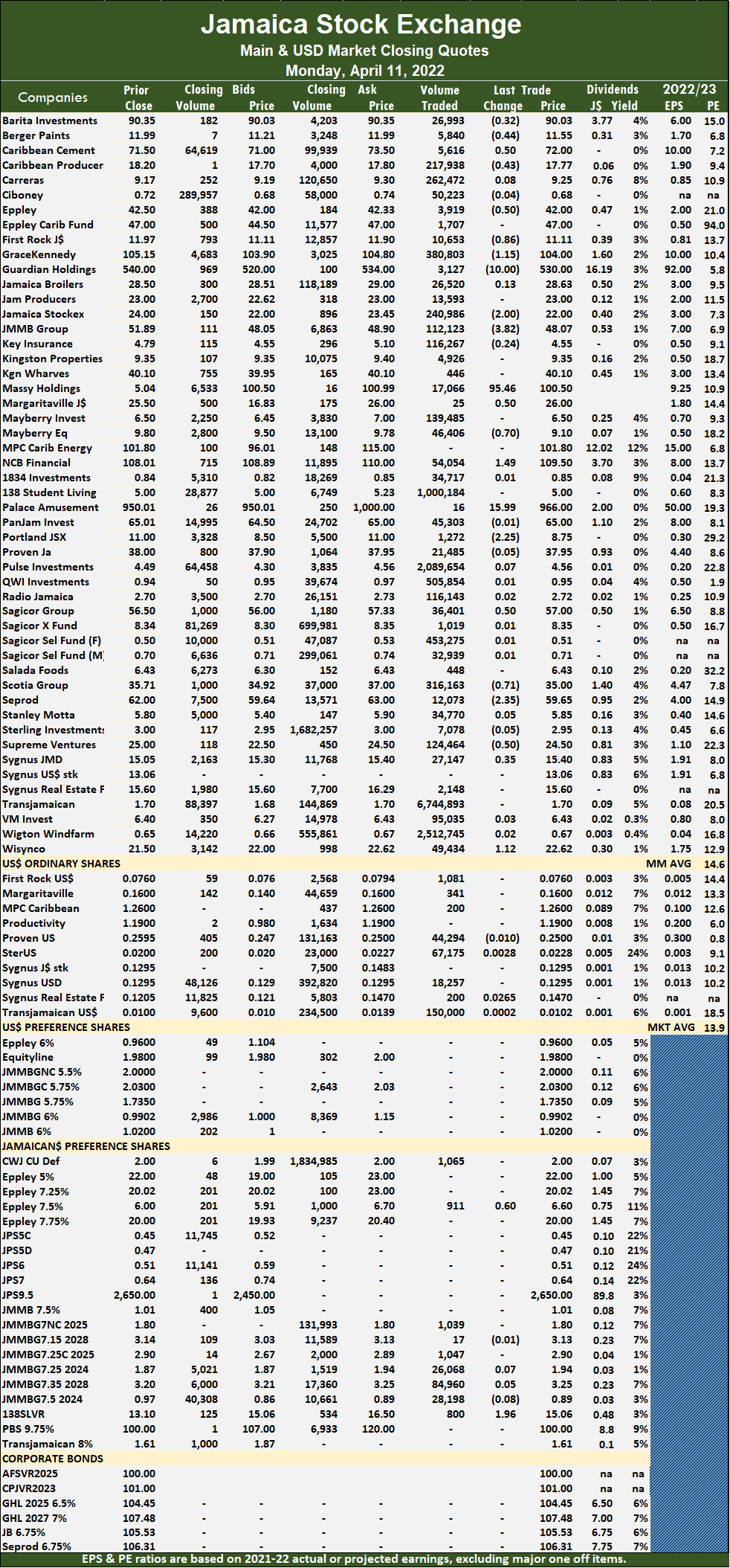

Market activity ended on Monday, with the volume and value of stocks trading declined compared to Friday by 54 percent and 59 percent respectively, on the Jamaica Stock Exchange Main Market as rising stocks just edged out those declining.

The All Jamaican Composite Index fell 1,183.04 points to 449,914.75, the JSE Main Index lost 940.51 points to end at 396,027.96 and the JSE Financial Index slipped 0.13 points to 93.97.

The All Jamaican Composite Index fell 1,183.04 points to 449,914.75, the JSE Main Index lost 940.51 points to end at 396,027.96 and the JSE Financial Index slipped 0.13 points to 93.97.

A total of 57 securities traded up from 55 on Friday, with 23 rising, 22 declining and 12 ending unchanged.

The PE Ratio, a formula for computing appropriate stock values, averages 14.6. The PE ratio for the JSE Main and USD Market closing quotes are based on ICInsider.com earnings forecasts for companies with financial years ending up to August 2023.

Overall, 16,149,953 shares were exchanged for $124,025,246 versus 35,213,318 units at $300,629,178 on Friday. Transjamaican Highway led trading with 6.74 million shares for 41.8 percent of total volume followed by Wigton Windfarm with 2.51 million units for 15.6 percent of the day’s trade, Pulse Investments, 2.09 million units for 12.9 percent market share and 138 Student Living ended with 1.0 million units changing hands for 6.2 percent market share.

Trading averages 283,333 units at $2,175,882, compared to 640,242 shares at $5,465,985 on Friday and month to date, an average of 641,631 units at $5,377,722, compared to 702,233 units at $5,919,280 on the previous trading day. March closed with an average of 610,787 units at $6,967,031.

Investor’s Choice bid-offer indicator shows seven stocks ended with bids higher than their last selling prices and one with a lower offer.

At the close, Barita Investments dropped 32 cents in closing at $90.03 after exchanging 26,993 shares, Berger Paints lost 44 cents to close at $11.55 after trading 5,840 stock units, Caribbean Cement climbed 50 cents in ending at $72 with the swapping of 5,616 units. Caribbean Producers declined 43 cents to $17.77, with 217,938 stocks clearing the market, Eppley shed 50 cents to end at $42, with 3,919 shares crossing the market, First Rock Capital fell 86 cents in closing at $11.11, with 10,653 stocks changing hands. GraceKennedy declined $1.15 to end at $104 in exchanging 380,803 stock units, Guardian Holdings dropped $10 to $530 in trading 3,127 units, Jamaica Stock Exchange shed $2 ending at $22 in an exchange of 240,986 stocks. JMMB Group lost $3.82 to close at $48.07 after exchanging 112,123 units, Margaritaville popped 50 cents to end at $26 trading 25 shares, Massy Holdings fell 30 cents in ending at $100.50 after trading 17,066 stock units. Mayberry Jamaican Equities declined 70 cents to close at $9.10 while exchanging 46,406 stocks, NCB Financial increased $1.49 in closing at $109.50 with an exchange of 54,054 units, Palace Amusement gained $15.99 to end at $966, with 16 stock units crossing the market. Portland JSX shed $2.25 to end at $8.75 in switching ownership of 1,272 shares, Sagicor Group rose 50 cents ending at $57 with an exchange of 36,401 shares, Scotia Group dropped 71 cents in closing at $35 in trading 316,163 stocks.

At the close, Barita Investments dropped 32 cents in closing at $90.03 after exchanging 26,993 shares, Berger Paints lost 44 cents to close at $11.55 after trading 5,840 stock units, Caribbean Cement climbed 50 cents in ending at $72 with the swapping of 5,616 units. Caribbean Producers declined 43 cents to $17.77, with 217,938 stocks clearing the market, Eppley shed 50 cents to end at $42, with 3,919 shares crossing the market, First Rock Capital fell 86 cents in closing at $11.11, with 10,653 stocks changing hands. GraceKennedy declined $1.15 to end at $104 in exchanging 380,803 stock units, Guardian Holdings dropped $10 to $530 in trading 3,127 units, Jamaica Stock Exchange shed $2 ending at $22 in an exchange of 240,986 stocks. JMMB Group lost $3.82 to close at $48.07 after exchanging 112,123 units, Margaritaville popped 50 cents to end at $26 trading 25 shares, Massy Holdings fell 30 cents in ending at $100.50 after trading 17,066 stock units. Mayberry Jamaican Equities declined 70 cents to close at $9.10 while exchanging 46,406 stocks, NCB Financial increased $1.49 in closing at $109.50 with an exchange of 54,054 units, Palace Amusement gained $15.99 to end at $966, with 16 stock units crossing the market. Portland JSX shed $2.25 to end at $8.75 in switching ownership of 1,272 shares, Sagicor Group rose 50 cents ending at $57 with an exchange of 36,401 shares, Scotia Group dropped 71 cents in closing at $35 in trading 316,163 stocks.  Seprod fell $2.35 to close at $59.65 in an exchange of 12,073 stock units, Supreme Ventures fell 50 cents to $24.50 124,464 units crossing the market, Sygnus Credit Investments rallied 35 cents to end at $15.40 in an exchange of 27,147 stocks and Wisynco Group advanced $1.12 to 52 weeks’ high of $22.62 after 49,434 shares crossed the market.

Seprod fell $2.35 to close at $59.65 in an exchange of 12,073 stock units, Supreme Ventures fell 50 cents to $24.50 124,464 units crossing the market, Sygnus Credit Investments rallied 35 cents to end at $15.40 in an exchange of 27,147 stocks and Wisynco Group advanced $1.12 to 52 weeks’ high of $22.62 after 49,434 shares crossed the market.

In the preference segment, 138 Student Living Preference shares advanced $1.96 in ending at $15.06 after 800 units changed hands and Eppley 7.50% preference share increased 60 cents in closing at $6.60 after trading 911 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Retreat for JSE Main Market

Market activity on the Jamaica Stock Exchange Main Market ended on Friday, with the volume of shares trading rising 12 percent and the value climbing 110 percent higher than Thursday, resulting in an equal number of advancing and declining stocks.

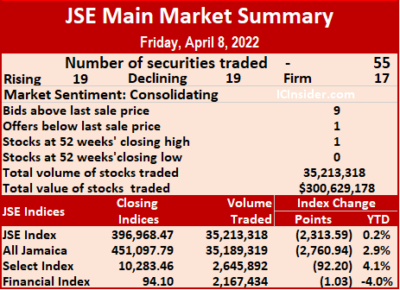

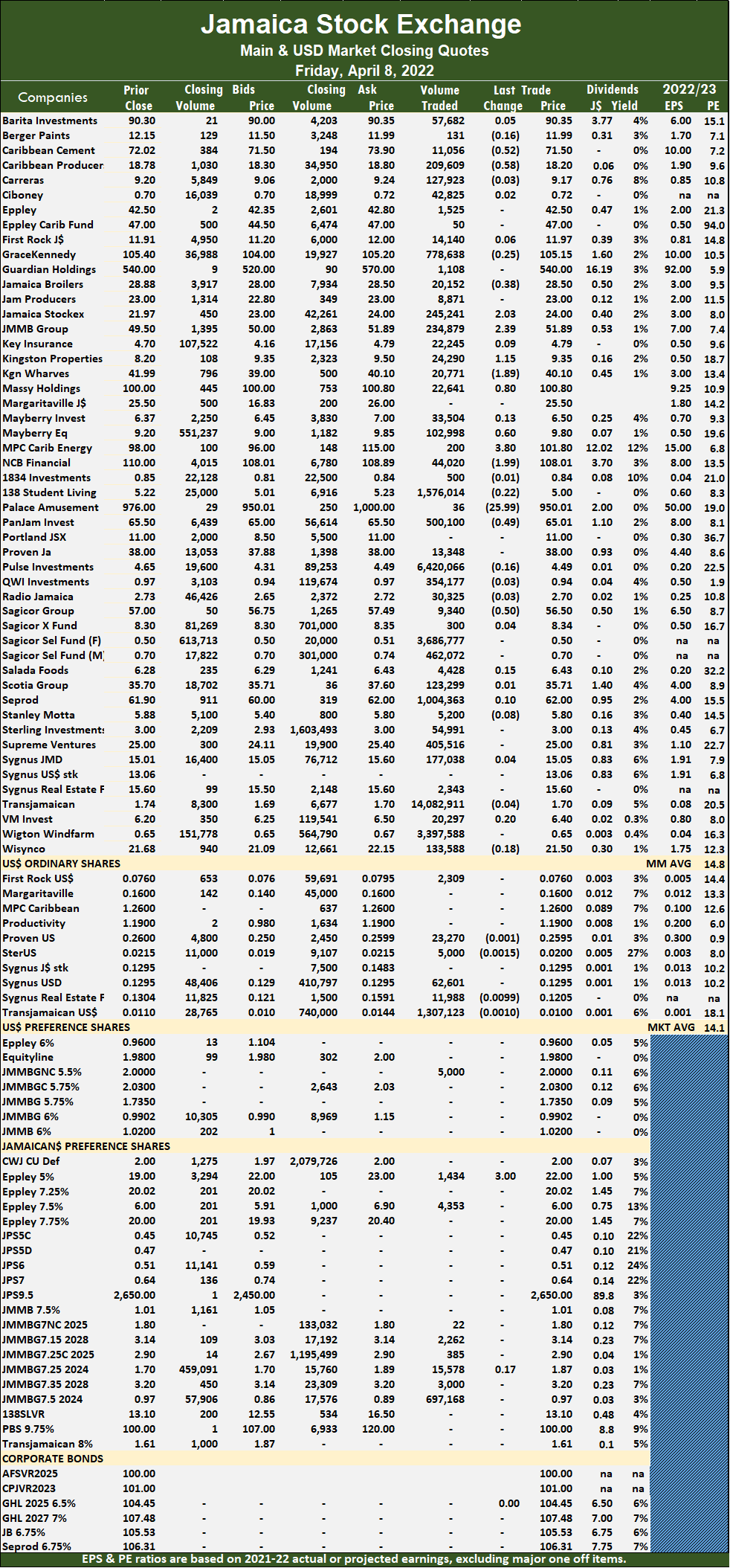

The All Jamaican Composite Index lost 2,760.94 points to end at 451,097.79, the JSE Main Index dipped 2,313.59 points to 396,968.47 and the JSE Financial Index lost 1.03 points to settle at 94.10.

The All Jamaican Composite Index lost 2,760.94 points to end at 451,097.79, the JSE Main Index dipped 2,313.59 points to 396,968.47 and the JSE Financial Index lost 1.03 points to settle at 94.10.

Trading ended with 55 securities cversus 56 on Thursday, with 19 rising, 19 declining and 17 ending unchanged.

The PE Ratio, a formula for computing appropriate stock values, averages 15. The PE ratio for the JSE Main and USD Market closing quotes is based on ICInsider.com earnings forecasts for companies with financial years ending up to August 2023.

Overall, 35,213,318 shares traded for $300,629,178 versus 31,300,525 units at $141,657,125 on Thursday. Transjamaican Highway led trading with 14.08 million shares for 40 percent of total volume, followed by Pulse Investments with 6.42 million units for 18.2 percent of the day’s trade and Sagicor Select Financial Fund with 3.69 million units for 10.5 percent market share. Wigton Windfarm ended with 3.40 million units for 9.6 percent market share, 138 Student Living traded 1.58 million units for 4.5 percent market share and Seprod, 1 million units for 2.9 percent market share.

Wigton Windfarm ended with 3.40 million units for 9.6 percent market share, 138 Student Living traded 1.58 million units for 4.5 percent market share and Seprod, 1 million units for 2.9 percent market share.

Trading averaged 640,242 stock units at $5,465,985, up from 558,938 shares at $2,529,592 on Thursday and month to date an average of 702,233 units at $5,919,280, versus 714,323 units at $6,007,688 on the previous trading day. March closed with an average of 610,787 units at $6,967,031.

Investor’s Choice bid-offer indicator shows nine stocks ended with bids higher than their last selling prices and one with a lower offer.

At the close, Caribbean Cement fell 52 cents to $71.50 after trading 11,056 shares, Caribbean Producers declined 58 cents to $18.20 in switching ownership of 209,609 stock units, Jamaica Broilers dropped 38 cents to $28.50 with an exchange of 20,152 stocks. Jamaica Stock Exchange rose $2.03 to end at a 52 weeks’ high of $24 in an exchange of 245,241 units, JMMB Group rallied $2.39 in closing at $51.89, finishing at 234,879 stocks, Kingston Properties popped $1.15 to end at $9.35 in trading 24,290 shares. Kingston Wharves fell $1.89 to close at $40.10 after exchanging 20,771 stock units, Massy Holdings increased 80 cents to $100.80 in exchanging 22,641 units, Mayberry Jamaican Equities gained 60 cents in closing at $9.80, with 102,998 stock units clearing the market.  MPC Caribbean Clean Energy advanced $3.80 to $101.80 after 200 shares crossed the market, NCB Financial lost $1.99 in closing at $108.01 after trading 44,020 stocks, Palace Amusement slipped $25.99 to $950.01 after an exchange of 36 units. PanJam Investment dropped 49 cents to close at $65.01 with 500,100 stocks crossing the market and Sagicor Group declined 50 cents in ending at $56.50, with 9,340 shares changing hands.

MPC Caribbean Clean Energy advanced $3.80 to $101.80 after 200 shares crossed the market, NCB Financial lost $1.99 in closing at $108.01 after trading 44,020 stocks, Palace Amusement slipped $25.99 to $950.01 after an exchange of 36 units. PanJam Investment dropped 49 cents to close at $65.01 with 500,100 stocks crossing the market and Sagicor Group declined 50 cents in ending at $56.50, with 9,340 shares changing hands.

In the preference segment, Eppley 5% preference share climbed $3 to end at $22 after 1,434 units changed hands.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Solid gains for JSE Main Market

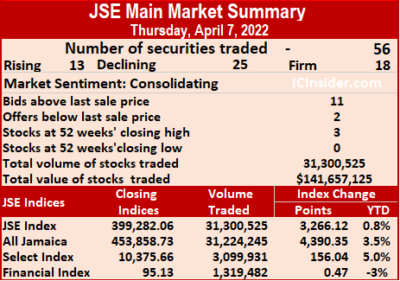

The Jamaica Stock Exchange Main Market made solid gains in trading on Thursday, with the volume of shares trading rising 48 percent over Wednesday after funds flowing through the market fell modestly on a day when prices ended with nearly twice as many stocks falling as rising.

The All Jamaican Composite Index surged 4,390.35 points to 453,858.73, the JSE Main Index jumped 3,266.12 points to end at 399,282.06. The JSE Financial Index popped 0.47 points to settle at 95.13.

The All Jamaican Composite Index surged 4,390.35 points to 453,858.73, the JSE Main Index jumped 3,266.12 points to end at 399,282.06. The JSE Financial Index popped 0.47 points to settle at 95.13.

On Wednesday, trading ended with 56 securities compared to 54, with 13 rising, 25 declining, and 18 ending unchanged.

The PE Ratio, a formula for computing appropriate stock values, averages 15. The PE ratio for the JSE Main and USD Market closing quotes is based on ICInsider.com earnings forecasts for companies with financial years ending to the end of August 2023.

A total of 31,300,525 shares were traded for $141,657,125 versus 21,128,299 units at $143,846,313 on Wednesday. Transjamaican Highway led trading with 9.86 million shares for 31.5 percent of total volume as the stock traded at a record high of $1.78 but finished down at $1.74, for a closing record high.  Wigton Windfarm ended trading 6.96 million units for 22.2 percent of the day’s trade. Pulse Investments ended with 5.99 million units for 19.1 percent market share, while Sagicor Select Financial Fund traded 3.09 million units with 9.9 percent market share.

Wigton Windfarm ended trading 6.96 million units for 22.2 percent of the day’s trade. Pulse Investments ended with 5.99 million units for 19.1 percent market share, while Sagicor Select Financial Fund traded 3.09 million units with 9.9 percent market share.

Trading for the day averaged 558,938 shares at $2,529,592, compared to 391,265 units at $2,663,821 on Wednesday and month to date, an average of 714,323 units at $6,007,688 down from 752,826 units at $6,869,517 on the previous trading day. March closed with an average of 610,787 units at $6,967,031.

Investor’s Choice bid-offer indicator shows 11 stocks ended with bids higher than their last selling prices and two with lower offers.

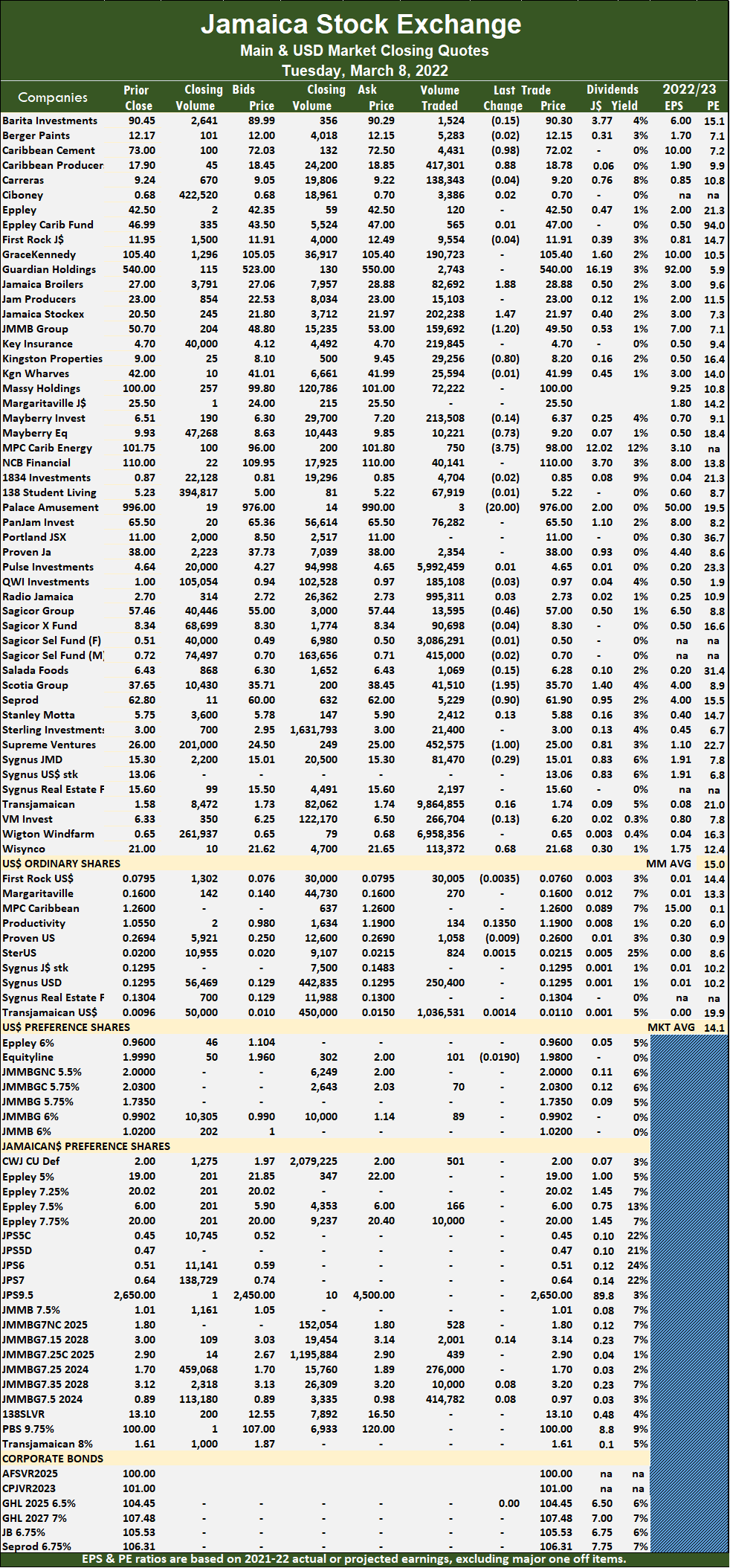

At the close of trading, Caribbean Cement declined 98 cents to $72.02 while exchanging 4,431 shares, Caribbean Producers rallied 88 cents to $18.78 after trading 417,301 stock units, Jamaica Broilers climbed $1.88 to $28.88, with 82,692 stocks clearing the market. Jamaica Stock Exchange rose $1.47 in closing at a 52 weeks’ high of $21.97 after trading 202,238 units, JMMB Group lost $1.20 to end at $49.50, with 159,692 stock units crossing the market, Kingston Properties fell 80 cents to $8.20 in trading 29,256 stocks.  Mayberry Jamaican Equities dropped 73 cents to close at $9.20 with the swapping of 10,221 shares, MPC Caribbean Clean Energy shed $3.75 in closing at $98, with 750 units crossing the market, Palace Amusement shed $20 to end at $976 in switching ownership of three units. Sagicor Group fell 46 cents to $57 in an exchange of 13,595 stocks, Scotia Group lost $1.95 to close at $35.70 with an exchange of 41,510 stock units, Seprod dropped 90 cents in ending at $61.90 after 5,229 shares changed hands. Supreme Ventures declined $1 in closing at $25 after exchanging 452,575 units and Wisynco Group popped 68 cents to a 52 weeks’ closing high of $21.68, with 113,372 stocks changing hands.

Mayberry Jamaican Equities dropped 73 cents to close at $9.20 with the swapping of 10,221 shares, MPC Caribbean Clean Energy shed $3.75 in closing at $98, with 750 units crossing the market, Palace Amusement shed $20 to end at $976 in switching ownership of three units. Sagicor Group fell 46 cents to $57 in an exchange of 13,595 stocks, Scotia Group lost $1.95 to close at $35.70 with an exchange of 41,510 stock units, Seprod dropped 90 cents in ending at $61.90 after 5,229 shares changed hands. Supreme Ventures declined $1 in closing at $25 after exchanging 452,575 units and Wisynco Group popped 68 cents to a 52 weeks’ closing high of $21.68, with 113,372 stocks changing hands.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Big Gains for JSE Main Market

Market activity ended on Wednesday, on the Jamaica Stock Exchange Main Market, with the volume of shares trading declining 83 percent and the value plunging 87 percent below Tuesday’s levels but ending with rising stocks exceeding those declining by a ratio of two to one.

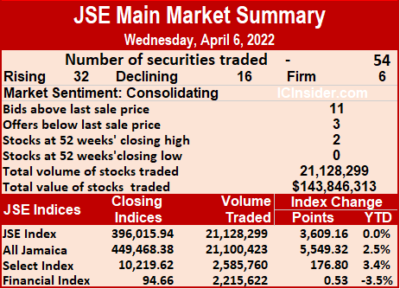

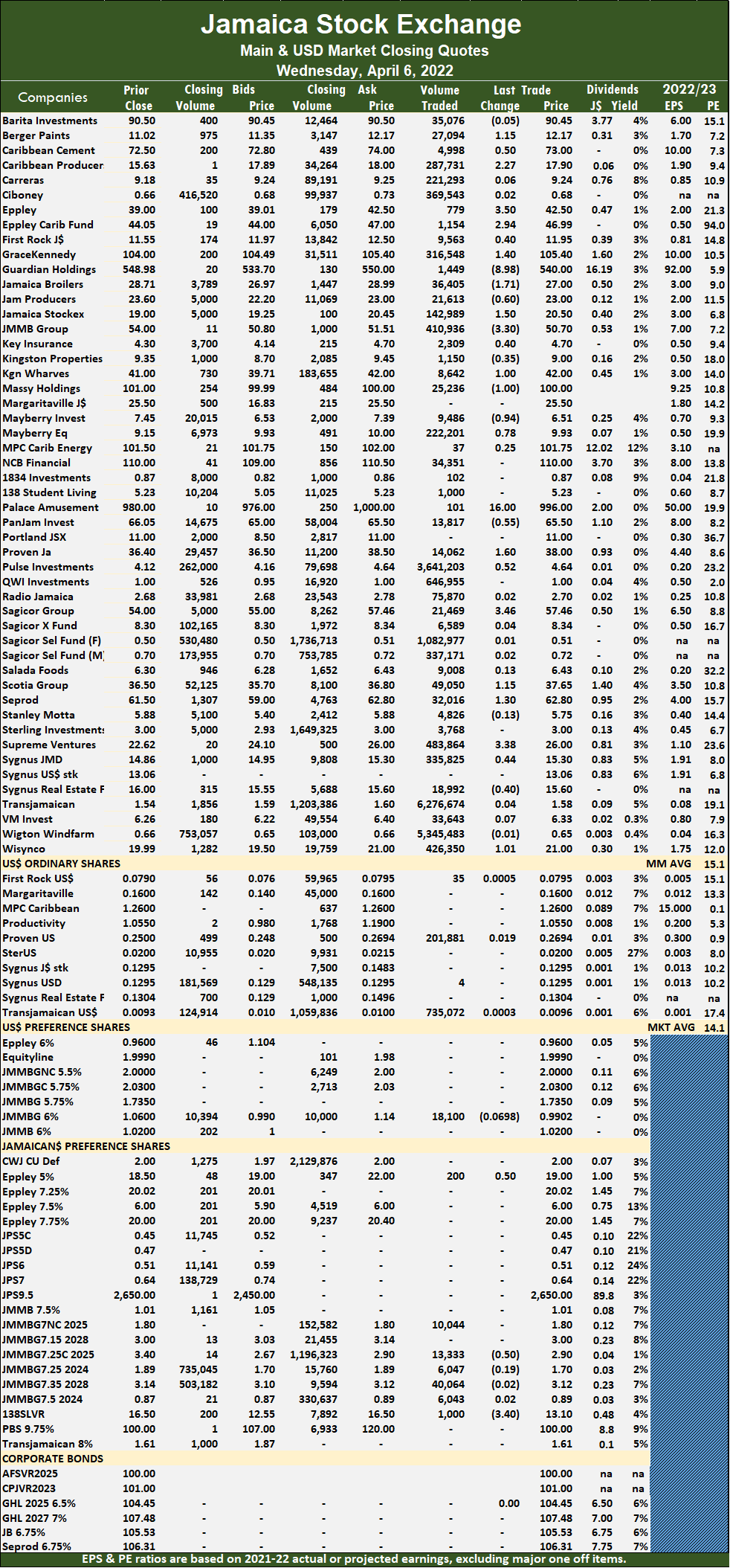

The All Jamaican Composite Index increased 5,549.32 points to settle at 449,468.38, the JSE Main Index rose 3,609.16 points to end at 396,015.94 and the JSE Financial Index rose 0.53 points to settle at 94.66.

The All Jamaican Composite Index increased 5,549.32 points to settle at 449,468.38, the JSE Main Index rose 3,609.16 points to end at 396,015.94 and the JSE Financial Index rose 0.53 points to settle at 94.66.

Trading ended with 54 securities down from 58 on Tuesday, with 32 rising, 16 declining and six ending unchanged.

The PE Ratio, a formula for computing appropriate stock values, averages 15.1. The PE ratio for the JSE Main and USD Market closing quotes are based on ICInsider.com earnings forecasts for companies with financial years ending up to August 2023.

A total of 21,128,299 shares traded for $143,846,313 down from 122,573,847 units at $1,079,970,954 on Tuesday. Transjamaican Highway led trading with 6.28 million shares for 29.7 percent of total volume followed by Wigton Windfarm with 5.35 million units for 25.3 percent of the day’s trade, Pulse Investments, 3.64 million units for 17.2 percent market share and Sagicor Select Financial Fund ended with 1.08 million units changing hands for 5.1 percent market share.

Trading averages 391,265 units at $2,663,821, compared to 2,113,342 shares at $18,620,189 on Tuesday and month to date, an average of 752,826 units at $6,869,517, compared to 866,339 units at $8,189,911 on the previous trading day. March closed with an average of 610,787 units at $6,967,031.

Investor’s Choice bid-offer indicator shows 11 stocks ended with bids higher than their last selling prices and three with lower offers.

At the close, Berger Paints advanced $1.15 in closing at $12.17, with 27,094 shares changing hands, Caribbean Cement gained 50 cents to end at $73 with the swapping of 4,998 stock units, Caribbean Producers popped $2.27 to close at $17.90 in switching ownership of 287,731 units. Eppley increased by $3.50 to $42.50, with 779 stocks clearing the market, Eppley Caribbean Property Fund rallied $2.94 to $46.99, with 1,154 units crossing the market, First Rock Capital climbed 40 cents to $11.95, with 9,563 stock units crossing the market. GraceKennedy rose $1.40 to close at $105.40 in trading 316,548 shares, Guardian Holdings declined $8.98 to end at $540 after exchanging 1,449 stocks, Jamaica Broilers shed $1.71 in closing at $27, with 36,405 stock units crossing the exchange. Jamaica Producers fell 60 cents ending at $23 after trading 21,613 units, Jamaica Stock Exchange rallied $1.50 to $20.50 while exchanging 142,989 shares, JMMB Group lost $3.30 in ending at $50.70 with an exchange of 410,936 stocks. Key Insurance gained 40 cents to end at $4.70 after trading 2,309 shares, Kingston Properties dropped 35 cents to $9 in an exchange of 1,150 stocks, Kingston Wharves advanced $1 in closing at $42 in exchanging 8,642 units. Massy Holdings shed $1 to $100 in exchanging 25,236 stock units, Mayberry Investments fell 94 cents in closing at $6.51 after 9,486 stock units changed hands, Mayberry Jamaican Equities climbed 78 cents to close at $9.93 in an exchange of 222,201 units.

At the close, Berger Paints advanced $1.15 in closing at $12.17, with 27,094 shares changing hands, Caribbean Cement gained 50 cents to end at $73 with the swapping of 4,998 stock units, Caribbean Producers popped $2.27 to close at $17.90 in switching ownership of 287,731 units. Eppley increased by $3.50 to $42.50, with 779 stocks clearing the market, Eppley Caribbean Property Fund rallied $2.94 to $46.99, with 1,154 units crossing the market, First Rock Capital climbed 40 cents to $11.95, with 9,563 stock units crossing the market. GraceKennedy rose $1.40 to close at $105.40 in trading 316,548 shares, Guardian Holdings declined $8.98 to end at $540 after exchanging 1,449 stocks, Jamaica Broilers shed $1.71 in closing at $27, with 36,405 stock units crossing the exchange. Jamaica Producers fell 60 cents ending at $23 after trading 21,613 units, Jamaica Stock Exchange rallied $1.50 to $20.50 while exchanging 142,989 shares, JMMB Group lost $3.30 in ending at $50.70 with an exchange of 410,936 stocks. Key Insurance gained 40 cents to end at $4.70 after trading 2,309 shares, Kingston Properties dropped 35 cents to $9 in an exchange of 1,150 stocks, Kingston Wharves advanced $1 in closing at $42 in exchanging 8,642 units. Massy Holdings shed $1 to $100 in exchanging 25,236 stock units, Mayberry Investments fell 94 cents in closing at $6.51 after 9,486 stock units changed hands, Mayberry Jamaican Equities climbed 78 cents to close at $9.93 in an exchange of 222,201 units.  Palace Amusement popped $16 to end at $996 in trading 101 shares, PanJam Investment dropped 55 cents after ending at $65.50 with an exchange of 13,817 stocks, Proven Investments rose $1.60 to $38, with 14,062 units changing hands. Pulse Investments increased 52 cents to end at $4.64, with 3,641,203 crossing the market shares, Sagicor Group rallied $3.46 in closing at $57.46, with 21,469 stock units clearing the market, Scotia Group increased $1.15 to close at $37.65 with the swapping of 49,050 stocks. Seprod popped $1.30 to $62.80 after an exchange of 32,016 shares, Supreme Ventures gained $3.38 ending at a 52 weeks’ high of $26 in trading 483,864 stocks, Sygnus Credit Investments rose 44 cents to $15.30 in exchanging 335,825 units. Sygnus Real Estate Finance declined 40 cents to end at $15.60 while trading 18,992 stock units and Wisynco Group climbed $1.01 to close at $21 in exchanging 426,350 units.

Palace Amusement popped $16 to end at $996 in trading 101 shares, PanJam Investment dropped 55 cents after ending at $65.50 with an exchange of 13,817 stocks, Proven Investments rose $1.60 to $38, with 14,062 units changing hands. Pulse Investments increased 52 cents to end at $4.64, with 3,641,203 crossing the market shares, Sagicor Group rallied $3.46 in closing at $57.46, with 21,469 stock units clearing the market, Scotia Group increased $1.15 to close at $37.65 with the swapping of 49,050 stocks. Seprod popped $1.30 to $62.80 after an exchange of 32,016 shares, Supreme Ventures gained $3.38 ending at a 52 weeks’ high of $26 in trading 483,864 stocks, Sygnus Credit Investments rose 44 cents to $15.30 in exchanging 335,825 units. Sygnus Real Estate Finance declined 40 cents to end at $15.60 while trading 18,992 stock units and Wisynco Group climbed $1.01 to close at $21 in exchanging 426,350 units.

In the preference segment, 138 Student Living Preference share lost $3.40 in closing at $13.10 in switching ownership of 1,000 stocks, Eppley 5% preference share advanced 50 cents to close at $19, with 200 shares crossing the market and JMMB Group 7.25% preference share dropped 50 cents to $2.90 after trading 13,333 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Another day of gains for JSE Main Market

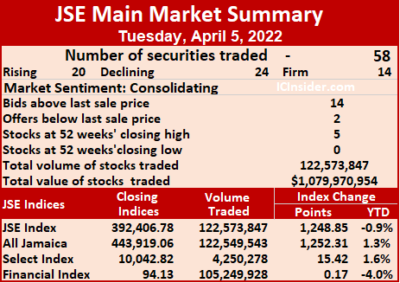

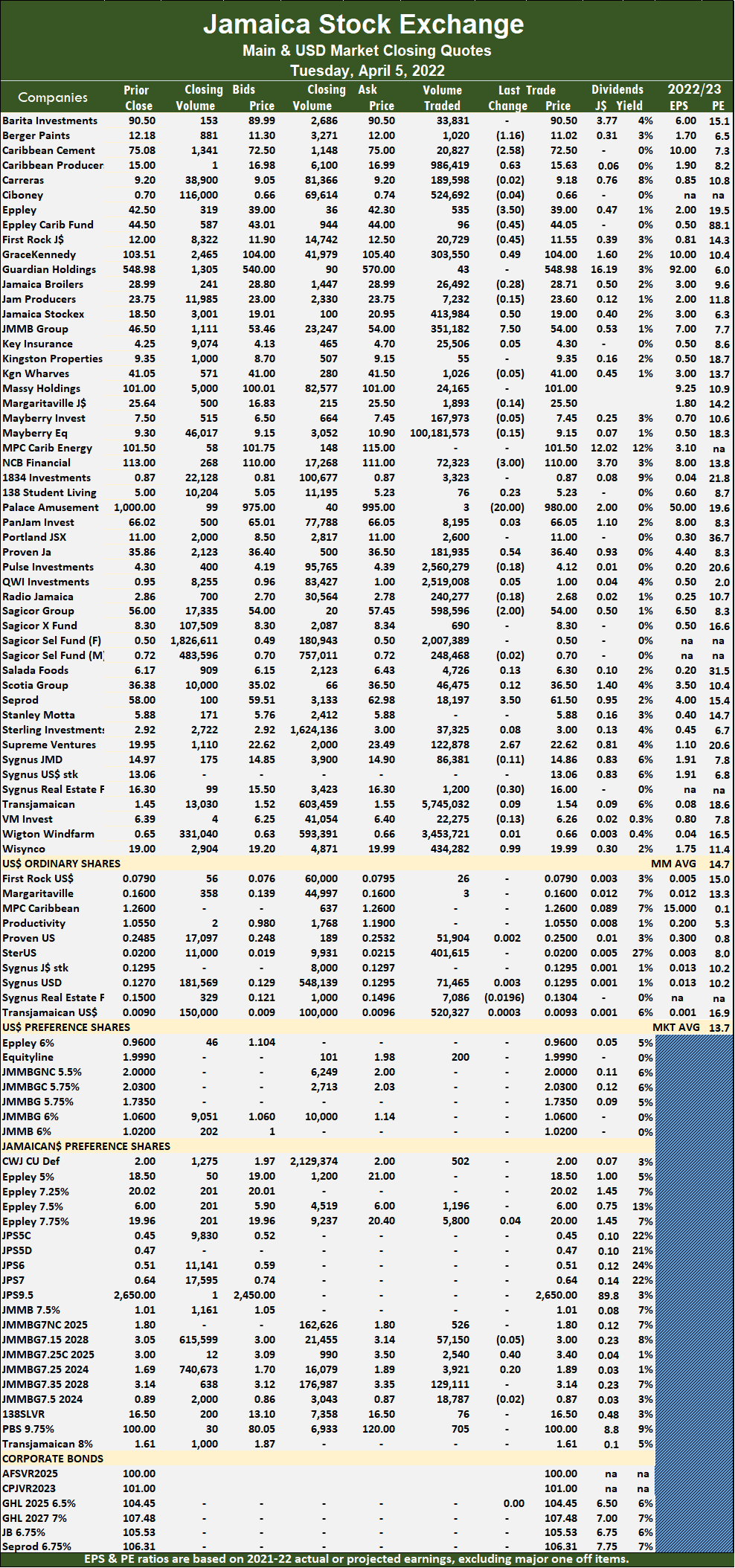

Activity on the Jamaica Stock Exchange Main Market ended on Tuesday, with the volume of shares trading surging 820 percent and the value 597 percent higher than on Monday as 122,573,847 shares were exchanged for $1,079,970,954 versus 13,325,302 units at $155,017,723 on Monday.

At close, the All Jamaican Composite Index advanced 1,252.31 points to close at 443,919.06, the JSE Main Index rallied 1,248.85 to 392,406.78 and the JSE Financial Index inched 0.17 points higher to settle at 94.13.

At close, the All Jamaican Composite Index advanced 1,252.31 points to close at 443,919.06, the JSE Main Index rallied 1,248.85 to 392,406.78 and the JSE Financial Index inched 0.17 points higher to settle at 94.13.

Trading ended with 58 securities compared to 56 on Monday, with 20 rising, 24 declining and 14 ending unchanged. Five stocks ended at 52 weeks’ closing high and one at an intraday high.

The PE Ratio, a formula for computing appropriate stock values, averages 14.7. The PE ratio for the JSE Main and USD Market closing quotes is based on ICInsider.com earnings forecasts for companies with financial years ending to August 2023.

The leading trades for the day are Mayberry Jamaican Equities, with 100.18 million shares for 81.7 percent of total volume, after it traded at an intraday high of $10.90, followed by Transjamaican Highway with 5.75 million units for 4.7 percent of the day’s trade, after trading at a 52 weeks’ high of $1.54. Wigton Windfarm traded 3.45 million units for 2.8 percent market share, Pulse Investments followed, with 2.56 million units for 2.1 percent market share, QWI Investments with 2.52 million units for 2.1 percent market share and Sagicor Select Financial Fund with 2.01 million units for 1.6 percent market share.

The leading trades for the day are Mayberry Jamaican Equities, with 100.18 million shares for 81.7 percent of total volume, after it traded at an intraday high of $10.90, followed by Transjamaican Highway with 5.75 million units for 4.7 percent of the day’s trade, after trading at a 52 weeks’ high of $1.54. Wigton Windfarm traded 3.45 million units for 2.8 percent market share, Pulse Investments followed, with 2.56 million units for 2.1 percent market share, QWI Investments with 2.52 million units for 2.1 percent market share and Sagicor Select Financial Fund with 2.01 million units for 1.6 percent market share.

Trading averages 2,113,342 units at $18,620,189, compared to 237,952 shares at $2,768,174 on Monday and month to date, an average of 866,339 units at $8,189,911, compared to 231,899 shares at $2,883,278 on the previous trading day. March closed with an average of 610,787 units at $6,967,031.

Investor’s Choice bid-offer indicator shows 14 stocks ended with bids higher than their last selling prices and two with lower offers.

At the close, Berger Paints fell $1.16 to close at $11.02 with the swapping of 1,020 shares, Caribbean Cement shed $2.58 in ending at $72.50, after trading 20,827 stock units, Caribbean Producers popped 63 cents in closing at $15.63 in exchanging 986,419 stocks. Eppley declined $3.50 to $39, with 535 units clearing the market, Eppley Caribbean Property Fund lost 45 cents to end at $44.05 with an exchange of 96 stocks, and First Rock Capital dropped 45 cents to end at $11.55 in trading 20,729 stock units. GraceKennedy gained 49 cents to end at $104 after trading 303,550 shares, Jamaica Stock Exchange increased 50 cents to close at a 52 weeks’ high of $19 in an exchange of 413,984 units after it traded as high as $21, JMMB Group rose $7.50 to a 52 weeks’ closing high of $54 after 351,182 stocks traded up to an intraday high of $61.24.  NCB Financial dropped $3 to $110 in switching ownership of 72,323 shares, Palace Amusement shed $20 to close at $980 after exchanging three units, Proven Investments advanced 54 cents to end at $36.40 after trading 181,935 stock units. Sagicor Group fell $2 to $54 while exchanging 598,596 units, Seprod rallied $3.50 to $61.50, with 18,197 shares crossing the market, Supreme Ventures climbed $2.67 in closing at a 52 weeks’ high of $22.62 after 122,878 stock units crossed the market. Sygnus Real Estate Finance declined 30 cents in closing at $16, with 1,200 stocks changing hands and Wisynco Group advanced 99 cents to $19.99 in exchanging 434,282 stock units.

NCB Financial dropped $3 to $110 in switching ownership of 72,323 shares, Palace Amusement shed $20 to close at $980 after exchanging three units, Proven Investments advanced 54 cents to end at $36.40 after trading 181,935 stock units. Sagicor Group fell $2 to $54 while exchanging 598,596 units, Seprod rallied $3.50 to $61.50, with 18,197 shares crossing the market, Supreme Ventures climbed $2.67 in closing at a 52 weeks’ high of $22.62 after 122,878 stock units crossed the market. Sygnus Real Estate Finance declined 30 cents in closing at $16, with 1,200 stocks changing hands and Wisynco Group advanced 99 cents to $19.99 in exchanging 434,282 stock units.

In the preference segment, JMMB Group 7.25% preference share increased 40 cents to $3.40 after exchanging 2,540 stocks.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

- « Previous Page

- 1

- …

- 48

- 49

- 50

- 51

- 52

- …

- 137

- Next Page »