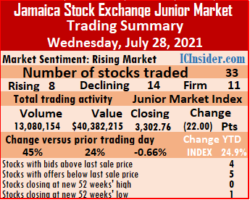

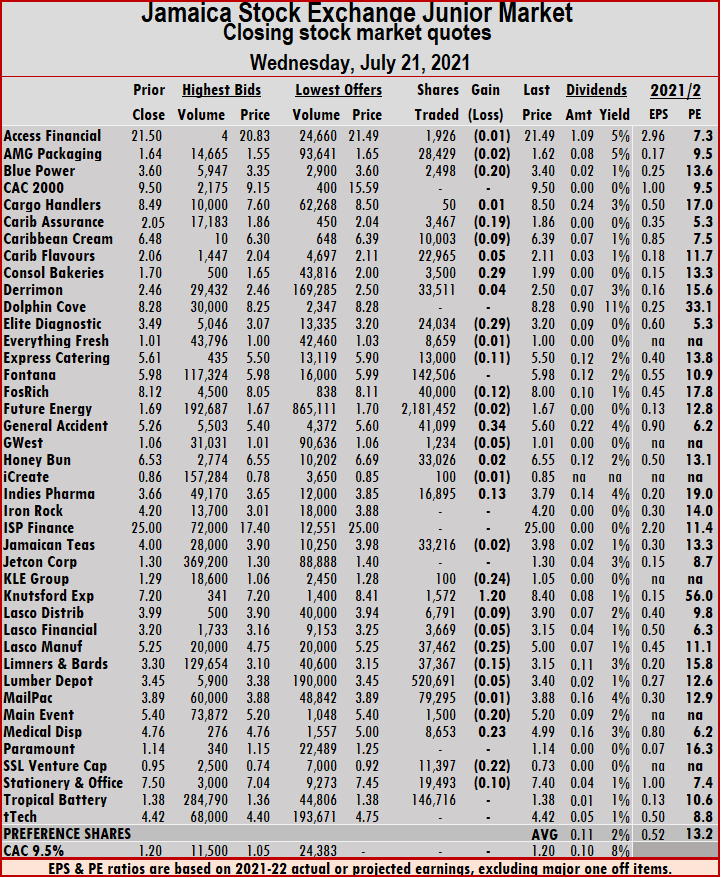

The Junior Market Index dropped a further 22.00 points for a third consecutive day of decline on Wednesday to settle at 3,302.76 as trading closed, with the volume of stocks exchanged climbing 45 percent over Tuesday’s level, with the value up by 24 percent.

Market activity led to 33 securities trading compared to 34 on Tuesday and ended with the prices of just eight stocks rising, 14 declining and 11, closing unchanged.

Market activity led to 33 securities trading compared to 34 on Tuesday and ended with the prices of just eight stocks rising, 14 declining and 11, closing unchanged.

The PE Ratio, a measure used to compute appropriate stock values, averages 12.8 based on ICInsider.com’s 2021-22 earnings forecast.

A total of 13,080,154 shares traded for $40,382,215 compared to 9,034,942 units at $32,570,639 on Tuesday.

Lumber Depot led trading with 78.7 percent of total volume in trading 10.29 million shares followed by Future Energy Source 11.1 percent with 1.46 million units and Tropical Battery 1.4 percent with 178,671 units.

Trading averages 396,368 units at $1,223,703 in contrast to 265,734 at $957,960 on Tuesday. Trading month to date averages, 172,116 units at $504,321, compared to 161,120 units at $469,047 on Tuesday. June trading averaged 225,705 units at $644,459.

Investor’s Choice bid-offer indicator shows four stocks ending with bids higher than their last selling prices and five with lower offers.

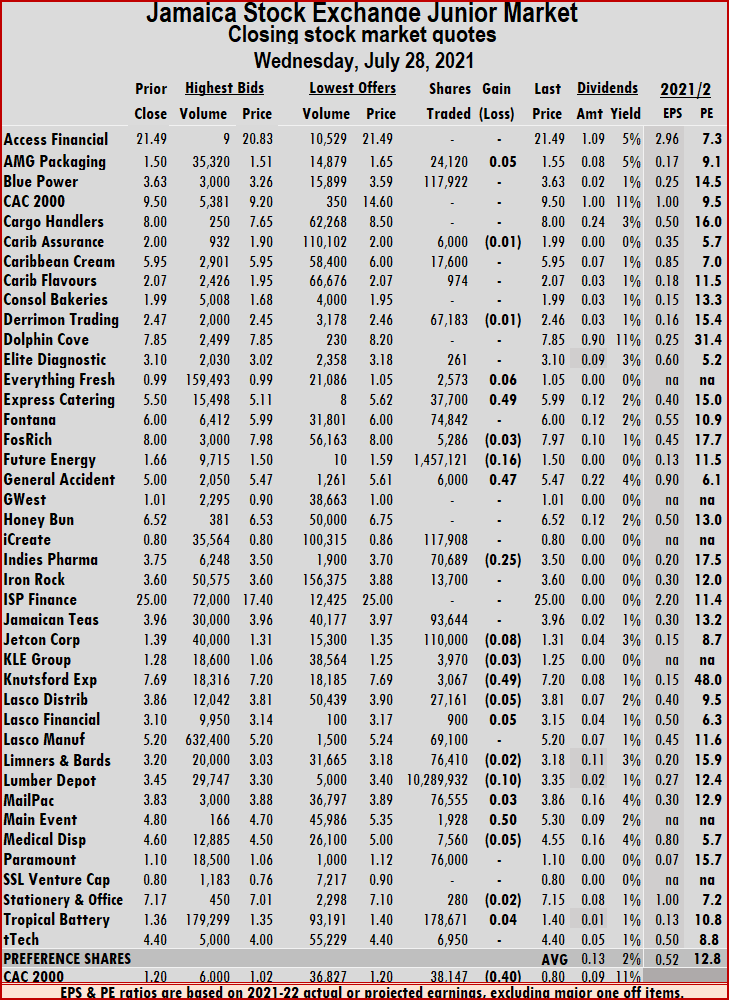

At the close, AMG Packaging rose 5 cents to $1.55, with 24,120 shares traded, Everything Fresh popped 6 cents to $1.05 with an exchange of 2,573 units, Express Catering jumped 49 cents to $5.99 with a transfer of 37,700 stock units. Future Energy Source dropped 16 cents to $1.50, with 1,457,121 stocks changing hands, General Accident rallied 47 cents to $5.47 with a transfer of 6,000 shares, Indies Pharma fell 25 cents to $3.50, with 70,689 units passing through the market. Jetcon Corporation slipped 8 cents to $1.31, with 110,000 stocks traded, Knutsford Express shed 49 cents to settle at $7.20, with an exchange of 3,067 shares, Lasco Distributors slipped 5 cents to $3.81 with a transfer of 27,161 units. Lasco Financial rose 5 cents to $3.15 with investors switching ownership of 900 stocks, Lumber Depot fell 10 cents to $3.35, with 10,289,932 shares traded,  Main Event climbed 50 cents to $5.30 with a transfer of 1,928 stocks and Medical Disposables slipped 5 cents to $4.55 with 7,560 units crossing the exchange.

Main Event climbed 50 cents to $5.30 with a transfer of 1,928 stocks and Medical Disposables slipped 5 cents to $4.55 with 7,560 units crossing the exchange.

In the preference segment, CAC 2000 9.5% dropped 40 cents to close at a 52 weeks’ low of 80 cents, with 38,147 shares changing hands as the yield on the stock climbed to 11%.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

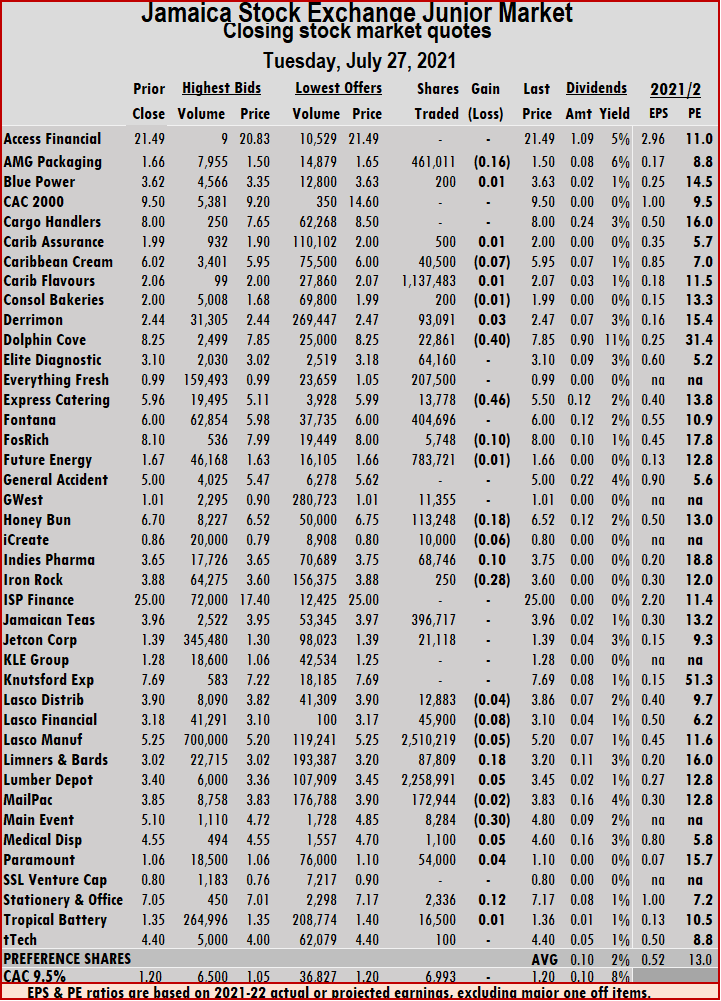

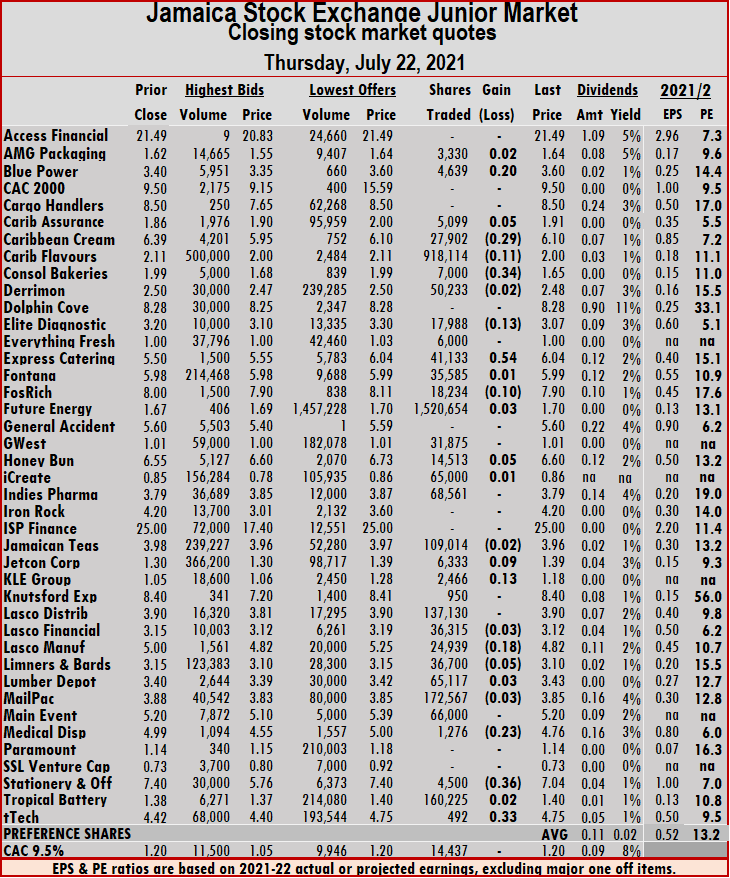

Market activity led to 34 securities trading compared to 37 on Monday and ended with the prices of 11 rising, 15 declining and eight closing unchanged.

Market activity led to 34 securities trading compared to 37 on Monday and ended with the prices of 11 rising, 15 declining and eight closing unchanged. Trading averages 265,734 units at $957,960 compared to 146,823 at $375,550 on Monday. Trading month to date averages 161,120 units at $469,047 compared to 155,553 units at $443,033 on Monday. June closed with an average of 225,705 units at $644,459.

Trading averages 265,734 units at $957,960 compared to 146,823 at $375,550 on Monday. Trading month to date averages 161,120 units at $469,047 compared to 155,553 units at $443,033 on Monday. June closed with an average of 225,705 units at $644,459. Lasco Manufacturing lost 5 cents to settle at $5.20 with an exchange of 2,510,219 units, Limners and Bards spiked 18 cents to $3.20, with 87,809 stock units changing hands. Lumber Depot rose 5 cents to $3.45 with 2,258,991 shares changing hands, Main Event shed 30 cents to finish at $4.80 with a transfer of 8,284 stocks, Medical Disposables added 5 cents to end at $4.60 with investors switching ownership of 1,100 units and Stationery and Office Supplies advanced 12 cents to $7.17, with 2,336 shares crossing the exchange.

Lasco Manufacturing lost 5 cents to settle at $5.20 with an exchange of 2,510,219 units, Limners and Bards spiked 18 cents to $3.20, with 87,809 stock units changing hands. Lumber Depot rose 5 cents to $3.45 with 2,258,991 shares changing hands, Main Event shed 30 cents to finish at $4.80 with a transfer of 8,284 stocks, Medical Disposables added 5 cents to end at $4.60 with investors switching ownership of 1,100 units and Stationery and Office Supplies advanced 12 cents to $7.17, with 2,336 shares crossing the exchange. Market activity led to 37 securities trading compared to 33 on Friday and ended with the prices of 12 rising, 16 declining and nine closing unchanged and two stocks closed at 52 weeks’ low.

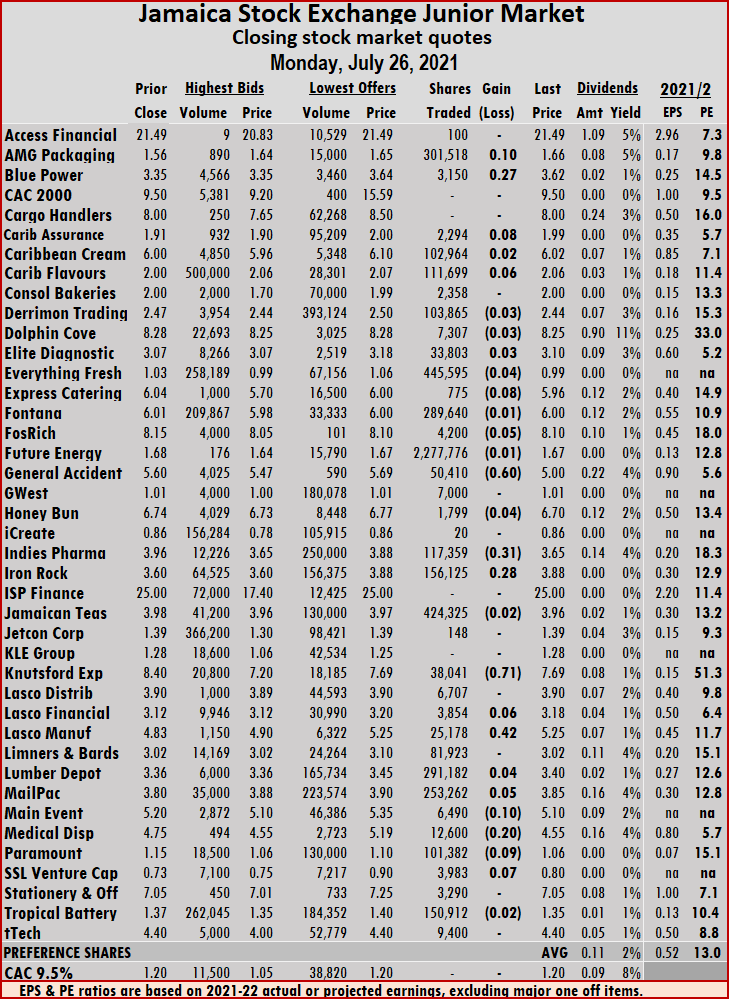

Market activity led to 37 securities trading compared to 33 on Friday and ended with the prices of 12 rising, 16 declining and nine closing unchanged and two stocks closed at 52 weeks’ low. average of 225,705 units at $644,459.

average of 225,705 units at $644,459. Mailpac Group rallied 5 cents to $3.85 with a transfer of 253,262 stock units, Main Event lost 10 cents to end at $5.10 with 6,490 shares traded, Medical Disposables fell 20 cents to $4.55, with 12,600 units passing through the market. Paramount Trading dipped 9 cents to close at a 52 weeks’ low of $1.06, with investors switching ownership of 101,382 stocks and SSL Venture rose 7 cents to 80 cents with 3,983 shares crossing the exchange.

Mailpac Group rallied 5 cents to $3.85 with a transfer of 253,262 stock units, Main Event lost 10 cents to end at $5.10 with 6,490 shares traded, Medical Disposables fell 20 cents to $4.55, with 12,600 units passing through the market. Paramount Trading dipped 9 cents to close at a 52 weeks’ low of $1.06, with investors switching ownership of 101,382 stocks and SSL Venture rose 7 cents to 80 cents with 3,983 shares crossing the exchange.

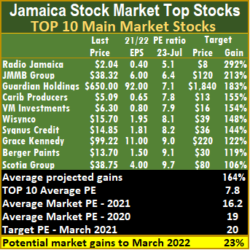

That is one reason why many of the selections at the start of the year have done well. Examples are as such, Caribbean Cream up 43 percent for the year to date started the year at the number 2 spot, Caribbean Producers the number 3 spot selection is up 82 percent, Main Event up 73 percent, Medical Disposables up just 12 percent, Stationery & Office Supplies 55 percent, Lumber Depot 116 percent and Mailpac 32 percent. Later, Future Energy Source was added to the list at the IPO stage and is up an impressive 110 percent. Additionally, Jetcon Corporation up 76 percent and Jamaican Teas 100 percent are not being counted. The Main Market with few overall winners for that market so far also produced winners from the TOP15 list, posted at the start of the year, Grace, Carreras, Caribbean Cement and Jamaica Broilers.

That is one reason why many of the selections at the start of the year have done well. Examples are as such, Caribbean Cream up 43 percent for the year to date started the year at the number 2 spot, Caribbean Producers the number 3 spot selection is up 82 percent, Main Event up 73 percent, Medical Disposables up just 12 percent, Stationery & Office Supplies 55 percent, Lumber Depot 116 percent and Mailpac 32 percent. Later, Future Energy Source was added to the list at the IPO stage and is up an impressive 110 percent. Additionally, Jetcon Corporation up 76 percent and Jamaican Teas 100 percent are not being counted. The Main Market with few overall winners for that market so far also produced winners from the TOP15 list, posted at the start of the year, Grace, Carreras, Caribbean Cement and Jamaica Broilers.  PanJam Investment earnings is downgraded to $4.50 per share and the stock moved out of the TOP10 Main Market listing and is replaced by Scotia Group, now in at tenth spot. There are no changes in or out of the Junior Market list.

PanJam Investment earnings is downgraded to $4.50 per share and the stock moved out of the TOP10 Main Market listing and is replaced by Scotia Group, now in at tenth spot. There are no changes in or out of the Junior Market list. The Junior Market closed the week with an average PE 13.1 based on ICInsider.com’s 2021-22 earnings and currently trades well below the target of 20 and the recent historical average of 17 for the period to March this year based on 2020 earnings. For the Junior Market to trade at the historical average, the PE Ratio would have to rise 30 percent and requires a rise of 53 percent to reach the targeted PE of 20 by March 2022. Main Market stocks would have to rise by 17 percent to hit a PE of 19 and 23 percent to get to the target of 20. The Junior Market Top 10 stocks average PE is a mere 6.8, just 52 percent of the market average, indicating substantial gains ahead.

The Junior Market closed the week with an average PE 13.1 based on ICInsider.com’s 2021-22 earnings and currently trades well below the target of 20 and the recent historical average of 17 for the period to March this year based on 2020 earnings. For the Junior Market to trade at the historical average, the PE Ratio would have to rise 30 percent and requires a rise of 53 percent to reach the targeted PE of 20 by March 2022. Main Market stocks would have to rise by 17 percent to hit a PE of 19 and 23 percent to get to the target of 20. The Junior Market Top 10 stocks average PE is a mere 6.8, just 52 percent of the market average, indicating substantial gains ahead. The JSE Main Market ended the week with an overall PE of 16.4, a little distance from the 19 the market ended at in March, suggesting just a 17 percent rise at a PE of 19 and 23 percent at a PE of 20 from now to March 2022. The Main Market TOP 10 trades at a PE of 7.8 or 48 percent of the PE of that market, well off the potential of 20.

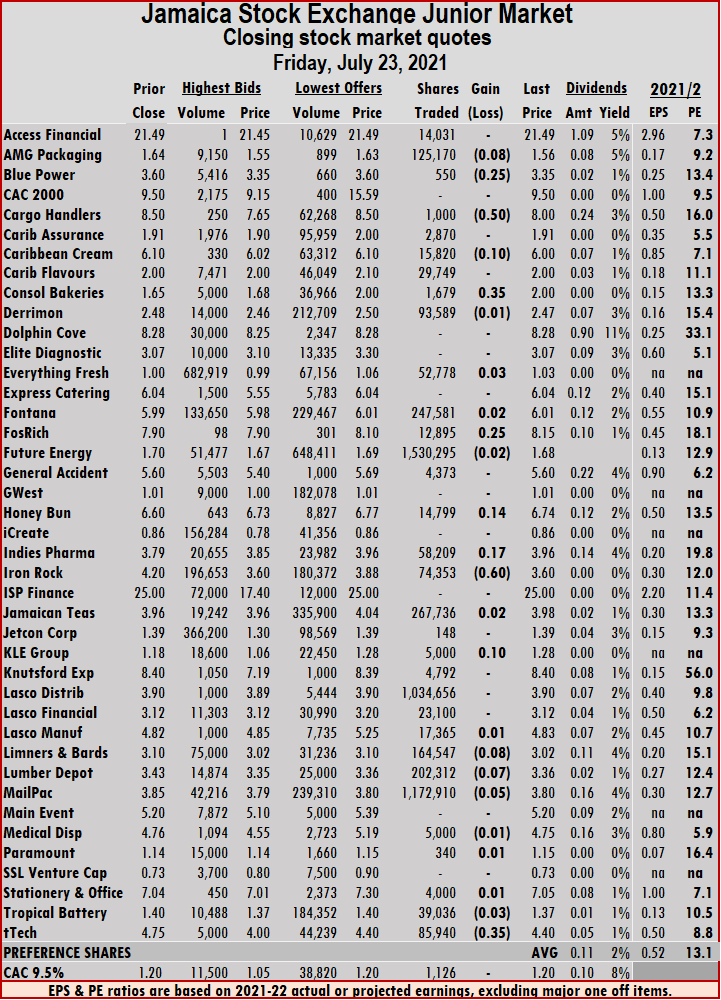

The JSE Main Market ended the week with an overall PE of 16.4, a little distance from the 19 the market ended at in March, suggesting just a 17 percent rise at a PE of 19 and 23 percent at a PE of 20 from now to March 2022. The Main Market TOP 10 trades at a PE of 7.8 or 48 percent of the PE of that market, well off the potential of 20. Market activity led to 33 securities trading, similar to Thursday, and ended with 11 stocks rising, 13 declining and nine ending unchanged.

Market activity led to 33 securities trading, similar to Thursday, and ended with 11 stocks rising, 13 declining and nine ending unchanged. Trading averages 160,841 units at $520,136 versus 111,343 at $263,357 on Thursday. Trading for the month to date averages 156,090 units at $447,181, versus 155,814 units at $442,949 on Thursday. June closed with an average of 225,705 units at $644,459.

Trading averages 160,841 units at $520,136 versus 111,343 at $263,357 on Thursday. Trading for the month to date averages 156,090 units at $447,181, versus 155,814 units at $442,949 on Thursday. June closed with an average of 225,705 units at $644,459. KLE Group rose 10 cents to $1.28 with 5,000 shares changing hands, Limners and Bards lost 8 cents to finish at $3.02 with a transfer of 164,547 stock units, Lumber Depot fell 7 cents to $3.36, with investors switching ownership of 202,312 units. Mailpac Group slipped 5 cents to $3.80, with 1,172,910 stocks traded and tTech dropped 35 cents to $4.40 with 85,940 shares crossing the exchange.

KLE Group rose 10 cents to $1.28 with 5,000 shares changing hands, Limners and Bards lost 8 cents to finish at $3.02 with a transfer of 164,547 stock units, Lumber Depot fell 7 cents to $3.36, with investors switching ownership of 202,312 units. Mailpac Group slipped 5 cents to $3.80, with 1,172,910 stocks traded and tTech dropped 35 cents to $4.40 with 85,940 shares crossing the exchange. At the close, Blue Power advanced 20 cents to $3.60 with an exchange of 4,639 shares, Caribbean Assurance Brokers rose 5 cents to end at $1.91, with 5,099 stocks changing hands, Caribbean Cream dropped 29 cents to finish at $6.10 with 27,902 units traded. Caribbean Flavours fell 11 cents to $2 with a transfer of 918,114 shares, Consolidated Bakeries dropped 34 cents to $1.65, with 7,000 stocks passing through the market, Elite Diagnostic slipped 13 cents to $3.07, with an exchange of 17,988 units. Express Catering rallied by 54 cents to end at $6.04 with 41,133 shares changing hands, Fosrich slipped 10 cents to $7.90 with 18,234 units traded, Honey Bun popped 5 cents to $6.60 with a transfer of 14,513 stocks. Jetcon Corporation rose 9 cents to $1.39 with investors switching ownership of 6,333 units, KLE Group spiked 13 cents to $1.18 with an exchange of 2,466 shares, Lasco Manufacturing slipped 18 cents to $4.82, with 24,939 stocks changing hands.

At the close, Blue Power advanced 20 cents to $3.60 with an exchange of 4,639 shares, Caribbean Assurance Brokers rose 5 cents to end at $1.91, with 5,099 stocks changing hands, Caribbean Cream dropped 29 cents to finish at $6.10 with 27,902 units traded. Caribbean Flavours fell 11 cents to $2 with a transfer of 918,114 shares, Consolidated Bakeries dropped 34 cents to $1.65, with 7,000 stocks passing through the market, Elite Diagnostic slipped 13 cents to $3.07, with an exchange of 17,988 units. Express Catering rallied by 54 cents to end at $6.04 with 41,133 shares changing hands, Fosrich slipped 10 cents to $7.90 with 18,234 units traded, Honey Bun popped 5 cents to $6.60 with a transfer of 14,513 stocks. Jetcon Corporation rose 9 cents to $1.39 with investors switching ownership of 6,333 units, KLE Group spiked 13 cents to $1.18 with an exchange of 2,466 shares, Lasco Manufacturing slipped 18 cents to $4.82, with 24,939 stocks changing hands.  Limners and Bards dipped 5 cents to $3.10 with 36,700 stock units traded, Medical Disposables fell 23 cents to $4.76 with a transfer of 1,276 units, Stationery and Office Supplies shed 36 cents to settle at $7.04 with 4,500 stocks changing hands and tTech jumped 33 cents to $4.75 with 492 shares crossing the exchange.

Limners and Bards dipped 5 cents to $3.10 with 36,700 stock units traded, Medical Disposables fell 23 cents to $4.76 with a transfer of 1,276 units, Stationery and Office Supplies shed 36 cents to settle at $7.04 with 4,500 stocks changing hands and tTech jumped 33 cents to $4.75 with 492 shares crossing the exchange. Market activity led to 34 securities trading compared to 37 on Tuesday and ended, with nine stocks rising, 23 declining and two closing unchanged. At the close, the Junior Market Index fell 22.01 points to settle at 3,347.07.

Market activity led to 34 securities trading compared to 37 on Tuesday and ended, with nine stocks rising, 23 declining and two closing unchanged. At the close, the Junior Market Index fell 22.01 points to settle at 3,347.07. At the close, Blue Power dropped 20 cents to $3.40 with an exchange of 2,498 shares, Caribbean Assurance Brokers fell 19 cents to $1.86 with 3,467 units changing hands, Caribbean Cream lost 9 cents to finish at $6.39, with 10,003 stocks traded. Caribbean Flavours rose 5 cents to $2.11, with a transfer of 22,965 shares, Consolidated Bakeries rallied 29 cents to a 52 weeks’ high of $1.99, with investors switching ownership of 3,500 units, Elite Diagnostic shed 29 cents to $3.20 with an exchange of 24,034 stocks. Express Catering declined 11 cents to $5.50, with 13,000 shares changing hands, Fosrich fell 12 cents to $8 with 40,000 units traded, General Accident advanced 34 cents to $5.60 with a transfer of 41,099 stocks. GWest Corporation slipped 5 cents to $1.01, with 1,234 shares passing through the market, Indies Pharma rallied 13 cents to $3.79 with an exchange of 16,895 units, KLE Group dropped 24 cents to $1.05 with 100 stocks changing hands. Knutsford Express spiked $1.20 to $8.40, with 1,572 shares traded, Lasco Distributors lost 9 cents to close at $3.90 with a transfer of 6,791 units, Lasco Financial slipped 5 cents to $3.15 with 3,669 stocks passing through the market.

At the close, Blue Power dropped 20 cents to $3.40 with an exchange of 2,498 shares, Caribbean Assurance Brokers fell 19 cents to $1.86 with 3,467 units changing hands, Caribbean Cream lost 9 cents to finish at $6.39, with 10,003 stocks traded. Caribbean Flavours rose 5 cents to $2.11, with a transfer of 22,965 shares, Consolidated Bakeries rallied 29 cents to a 52 weeks’ high of $1.99, with investors switching ownership of 3,500 units, Elite Diagnostic shed 29 cents to $3.20 with an exchange of 24,034 stocks. Express Catering declined 11 cents to $5.50, with 13,000 shares changing hands, Fosrich fell 12 cents to $8 with 40,000 units traded, General Accident advanced 34 cents to $5.60 with a transfer of 41,099 stocks. GWest Corporation slipped 5 cents to $1.01, with 1,234 shares passing through the market, Indies Pharma rallied 13 cents to $3.79 with an exchange of 16,895 units, KLE Group dropped 24 cents to $1.05 with 100 stocks changing hands. Knutsford Express spiked $1.20 to $8.40, with 1,572 shares traded, Lasco Distributors lost 9 cents to close at $3.90 with a transfer of 6,791 units, Lasco Financial slipped 5 cents to $3.15 with 3,669 stocks passing through the market.  Lasco Manufacturing shed 25 cents to $5 with an exchange of 37,462 shares, Limners and Bards fell 15 cents to $3.15, with 37,367 units changing hands, Lumber Depot lost 5 cents to settle at $3.40 with 520,691 stocks traded. Main Event dropped 20 cents to $5.20 with a transfer of 1,500 shares, Medical Disposables climbed 23 cents to $4.99 with investors switching ownership of 8,653 stocks, SSL Venture declined by 22 cents to 73 cents with 11,397 units changing hands and Stationery and Office Supplies fell 10 cents to $7.40 with 19,493 shares crossing the exchange.

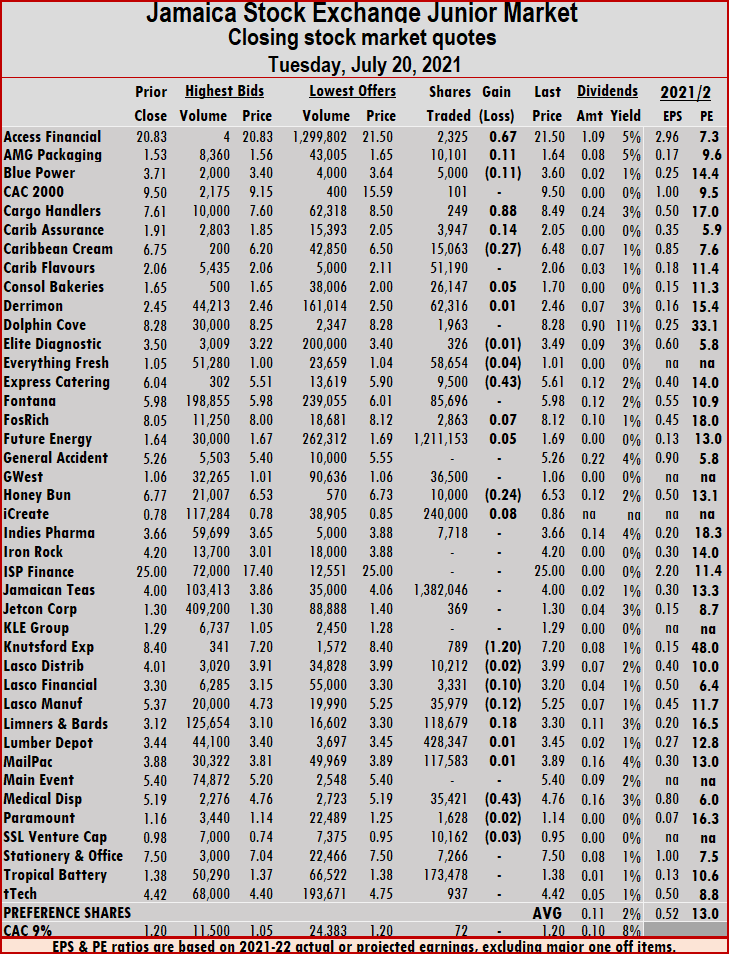

Lasco Manufacturing shed 25 cents to $5 with an exchange of 37,462 shares, Limners and Bards fell 15 cents to $3.15, with 37,367 units changing hands, Lumber Depot lost 5 cents to settle at $3.40 with 520,691 stocks traded. Main Event dropped 20 cents to $5.20 with a transfer of 1,500 shares, Medical Disposables climbed 23 cents to $4.99 with investors switching ownership of 8,653 stocks, SSL Venture declined by 22 cents to 73 cents with 11,397 units changing hands and Stationery and Office Supplies fell 10 cents to $7.40 with 19,493 shares crossing the exchange. At the close, Access Financial climbed 67 cents to $21.50 with an exchange of 2,325 shares,

At the close, Access Financial climbed 67 cents to $21.50 with an exchange of 2,325 shares,  Knutsford Express dropped $1.20 to $7.20 in an exchange of 789 shares, Lasco Financial lost 10 cents to settle at $3.20 with a transfer of 3,331 units. Lasco Manufacturing fell 12 cents to $5.25 with 35,979 stocks traded, Limners and Bards spiked 18 cents to $3.30 with a transfer of 118,679 stock units and Medical Disposables shed 43 cents to $4.76 with 35,421 shares crossing the exchange.

Knutsford Express dropped $1.20 to $7.20 in an exchange of 789 shares, Lasco Financial lost 10 cents to settle at $3.20 with a transfer of 3,331 units. Lasco Manufacturing fell 12 cents to $5.25 with 35,979 stocks traded, Limners and Bards spiked 18 cents to $3.30 with a transfer of 118,679 stock units and Medical Disposables shed 43 cents to $4.76 with 35,421 shares crossing the exchange. At the close, 33 securities traded, down from 37 on Friday and ended with prices of eight rising, 19 declining and six closing firm.

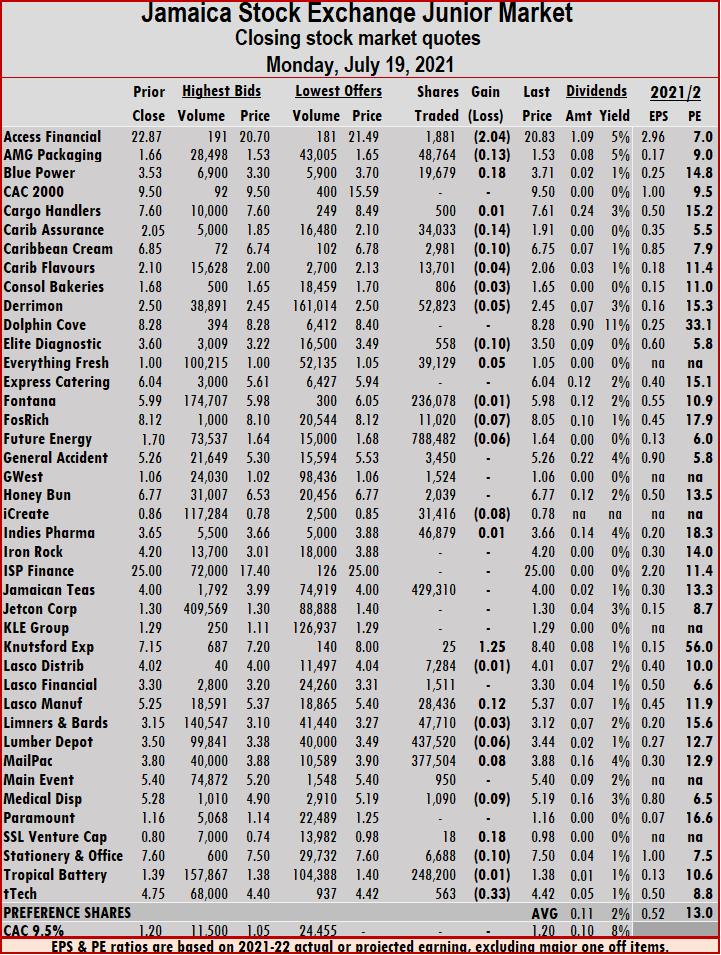

At the close, 33 securities traded, down from 37 on Friday and ended with prices of eight rising, 19 declining and six closing firm. Trading for Monday averages 88,562 units at $270,780, down sharply from 205,836 at $848,518 on Friday. Trading month to date averages 166,238 units at $478,681, compared to 172,172 units at $494,563 on Friday. June closed with an average of 225,705 units at $644,459.

Trading for Monday averages 88,562 units at $270,780, down sharply from 205,836 at $848,518 on Friday. Trading month to date averages 166,238 units at $478,681, compared to 172,172 units at $494,563 on Friday. June closed with an average of 225,705 units at $644,459. Lasco Manufacturing rallied 12 cents to $5.37 with 28,436 units traded, Lumber Depot slipped 6 cents to $3.44 with a transfer of 437,520 stock units, Mailpac Group rose 8 cents to $3.88 with 377,504 shares crossing the market. Medical Disposables lost 9 cents to close at $5.19, with 1,090 stocks changing hands, SSL Venture advanced 18 cents to close at a 52 weeks’ high of 98 cents with 18 units traded, Stationery and Office Supplies dipped 10 cents to $7.50 with a transfer of 6,688 stock units and tTech shed 33 cents to close at $4.42, with 563 shares crossing the exchange.

Lasco Manufacturing rallied 12 cents to $5.37 with 28,436 units traded, Lumber Depot slipped 6 cents to $3.44 with a transfer of 437,520 stock units, Mailpac Group rose 8 cents to $3.88 with 377,504 shares crossing the market. Medical Disposables lost 9 cents to close at $5.19, with 1,090 stocks changing hands, SSL Venture advanced 18 cents to close at a 52 weeks’ high of 98 cents with 18 units traded, Stationery and Office Supplies dipped 10 cents to $7.50 with a transfer of 6,688 stock units and tTech shed 33 cents to close at $4.42, with 563 shares crossing the exchange.

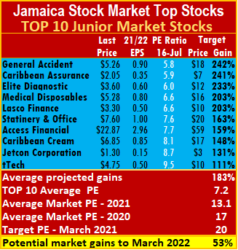

This past week the average gains projected for the Junior Market fell from 202 percent last week to 183 percent and Main Market stocks moved to 176 percent from 170 percent.

This past week the average gains projected for the Junior Market fell from 202 percent last week to 183 percent and Main Market stocks moved to 176 percent from 170 percent. The Junior Market closed the week with an average PE 13.1 based on ICInsider.com’s 2021-22 earnings and currently trades well below the target of 20 as well as the recent historical average of 17 for the period to March this year based on 2020 earnings. For the Junior Market to trade at the historical average, the PE Ratio would have to rise by 30 percent and requires a rise of 53 percent to reach the targeted PE of 20 by March 2022. Main Market stocks would have to rise by 19 percent to hit a PE of 19 and 24 percent to get to the target of 20. The Junior Market Top 10 stocks average PE is a mere 7.2., just 55 percent of the market average, indicating substantial gains ahead.

The Junior Market closed the week with an average PE 13.1 based on ICInsider.com’s 2021-22 earnings and currently trades well below the target of 20 as well as the recent historical average of 17 for the period to March this year based on 2020 earnings. For the Junior Market to trade at the historical average, the PE Ratio would have to rise by 30 percent and requires a rise of 53 percent to reach the targeted PE of 20 by March 2022. Main Market stocks would have to rise by 19 percent to hit a PE of 19 and 24 percent to get to the target of 20. The Junior Market Top 10 stocks average PE is a mere 7.2., just 55 percent of the market average, indicating substantial gains ahead. This week’s focus: Results for

This week’s focus: Results for  IC TOP10 stocks are likely to deliver the best returns up to March 2022 and ranked in order of potential gains, based on likely increase for each company, taking into account the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in movements in and out of the lists weekly. Revisions to earnings per share are ongoing, based on receipt of new information.

IC TOP10 stocks are likely to deliver the best returns up to March 2022 and ranked in order of potential gains, based on likely increase for each company, taking into account the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in movements in and out of the lists weekly. Revisions to earnings per share are ongoing, based on receipt of new information.