Trading closed on Friday, moved the Jamaica Stock Exchange Junior Market closer to the 3,600 points level ahead of the old record close of August 2019 of 3,662.94 points, with a rise of 16.13 points at the close of Friday to settle at 3,585.75 after trading up to 3,630 points in the early trading session.

Trading calmed, with Spur Tree slipping under 10 million units, but still played a big part in the 16,579,452 shares that traded for $57,855,045, down from 26,022,456 units at $87,517,746 on Thursday. Spur Tree Spices led trading with 8.57 million shares for 51.7 percent of total volume followed by Future Energy Source with 2.3 million units for 13.9 percent of the day’s trade and Jamaican Teas traded 765,118 units for 4.6 percent market share.

Trading calmed, with Spur Tree slipping under 10 million units, but still played a big part in the 16,579,452 shares that traded for $57,855,045, down from 26,022,456 units at $87,517,746 on Thursday. Spur Tree Spices led trading with 8.57 million shares for 51.7 percent of total volume followed by Future Energy Source with 2.3 million units for 13.9 percent of the day’s trade and Jamaican Teas traded 765,118 units for 4.6 percent market share.

A total of 40 securities traded compared to 43 on Thursday and ended with 15 rising, 19 declining and six, closing unchanged.

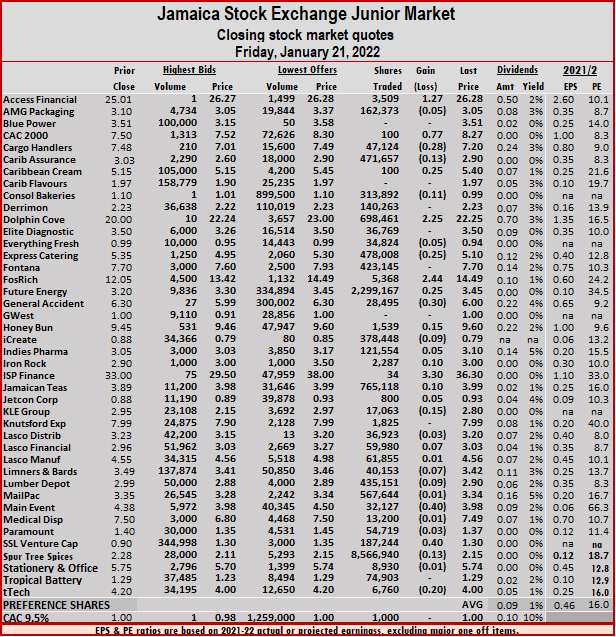

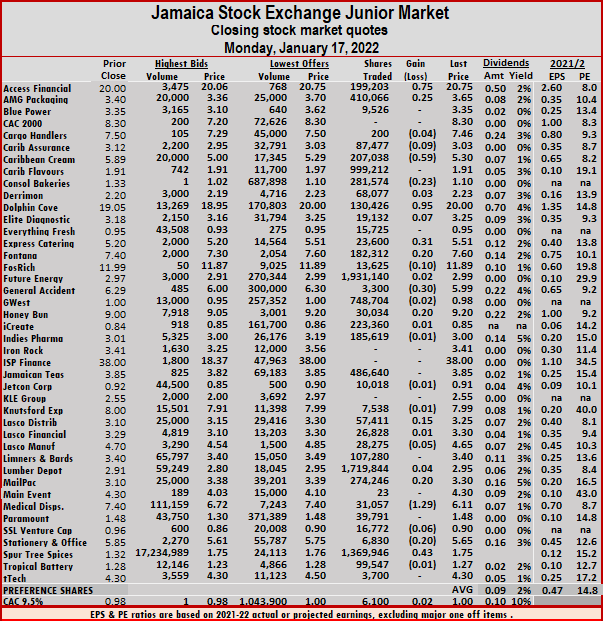

The PE Ratio, a measure used to compute appropriate stock values, averages 16. The PE ratio of each stock shown in the chart below is based on ICInsider.com earnings forecast for companies with financial years up to August 2022.

Trading averaged 414,486 shares at $1,446,376 in contrast to 605,173 shares at $2,035,296 on Thursday and month to date, an average of 332,829 units at $1,278,375, compared to 326,758 units at $1,265,884 on the prior trading day. December closed with an average of 409,209 units at $1,318,877.

Investor’s Choice bid-offer indicator shows two stocks ended with bids higher than their last selling prices and one stock with a lower offer.

At the close, Access Financial rallied $1.27 to end at $26.28 after exchanging 3,509 shares, CAC 2000 rose 77 cents to close at $8.27 after trading 100 units, Cargo Handlers shed 28 cents to $7.20 with the swapping of 47,124 stock units. Caribbean Assurance Brokers dropped 13 cents in closing at $2.90 in switching ownership of 471,657 stocks, Caribbean Cream advanced 25 cents to $5.40 while exchanging 100 shares, Consolidated Bakeries fell 11 cents to close at 99 cents 313,892 units crossing the exchange. Dolphin Cove gained $2.25 to end at $22.25 in trading 698,461 stocks, Express Catering lost 25 cents in closing at $5.10, with 478,008 stock units clearing the market, Fosrich popped $2.44 to a record $14.49 after 5,368 units changed hands. Future Energy Source increased 25 cents ending at $3.45 after trading 2,299,167 stock units, General Accident declined 30 cents to close at $6 in an exchange of 28,495 shares, Honey Bun climbed 15 cents to end at $9.60, with 1,539 stocks crossing the market. iCreate shed 9 cents after ending at 79 cents in exchanging 378,448 units, Iron Rock Insurance gained 10 cents to $3, with 2,287 stocks changing hands, ISP Finance rallied $3.30 in closing at $36.30 trading 34 shares. Jamaican Teas increased 10 cents to $3.99 with an exchange of 765,118 stock units, KLE Group fell 15 cents in ending at $2.80 after exchanging 17,063 stock units, Lasco Financial popped 7 cents in closing at $3.03 with 59,980 shares changing hands.

At the close, Access Financial rallied $1.27 to end at $26.28 after exchanging 3,509 shares, CAC 2000 rose 77 cents to close at $8.27 after trading 100 units, Cargo Handlers shed 28 cents to $7.20 with the swapping of 47,124 stock units. Caribbean Assurance Brokers dropped 13 cents in closing at $2.90 in switching ownership of 471,657 stocks, Caribbean Cream advanced 25 cents to $5.40 while exchanging 100 shares, Consolidated Bakeries fell 11 cents to close at 99 cents 313,892 units crossing the exchange. Dolphin Cove gained $2.25 to end at $22.25 in trading 698,461 stocks, Express Catering lost 25 cents in closing at $5.10, with 478,008 stock units clearing the market, Fosrich popped $2.44 to a record $14.49 after 5,368 units changed hands. Future Energy Source increased 25 cents ending at $3.45 after trading 2,299,167 stock units, General Accident declined 30 cents to close at $6 in an exchange of 28,495 shares, Honey Bun climbed 15 cents to end at $9.60, with 1,539 stocks crossing the market. iCreate shed 9 cents after ending at 79 cents in exchanging 378,448 units, Iron Rock Insurance gained 10 cents to $3, with 2,287 stocks changing hands, ISP Finance rallied $3.30 in closing at $36.30 trading 34 shares. Jamaican Teas increased 10 cents to $3.99 with an exchange of 765,118 stock units, KLE Group fell 15 cents in ending at $2.80 after exchanging 17,063 stock units, Lasco Financial popped 7 cents in closing at $3.03 with 59,980 shares changing hands.  Limners and Bards lost 7 cents to close at $3.42 with an exchange of 40,153 units, Lumber Depot declined 9 cents to end at $2.90 after an exchange of 435,151 stocks, Main Event dropped 40 cents in closing at $3.98, with 32,127 units clearing the market. Spur Tree Spices fell 13 cents to $2.15 in trading 8,566,940 shares, SSL Venture popped 40 cents in ending at a 52 weeks’ high of $1.30 after exchanging 187,244 stock units and tTech declined 20 cents to close at $4 with 6,760 stocks changing hands.

Limners and Bards lost 7 cents to close at $3.42 with an exchange of 40,153 units, Lumber Depot declined 9 cents to end at $2.90 after an exchange of 435,151 stocks, Main Event dropped 40 cents in closing at $3.98, with 32,127 units clearing the market. Spur Tree Spices fell 13 cents to $2.15 in trading 8,566,940 shares, SSL Venture popped 40 cents in ending at a 52 weeks’ high of $1.30 after exchanging 187,244 stock units and tTech declined 20 cents to close at $4 with 6,760 stocks changing hands.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Juniors closing in on old 2019 record close

Big surge in Junior Market on Thursday

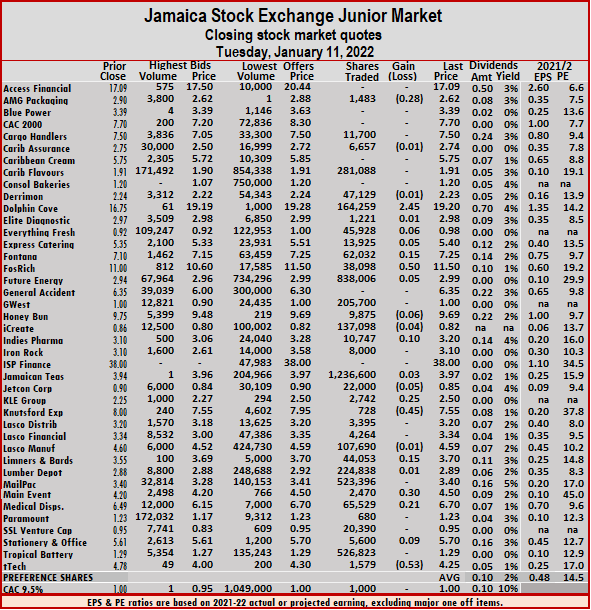

The Jamaica Stock Exchange Junior Market index surged more than 114 points in early trading on Thursday and ended lower but with a healthy increase of 66.87 points, to end at 3,569.62, with the volume of stocks trading declining 52 percent and the value dropping 56 percent from Wednesday’s healthy 55 million units at nearly $200 million.

All 43 securities listed on the Junior Market traded on Thursday, up from 41 on Wednesday and ended with 18 rising, 17 declining and eight ending unchanged.

All 43 securities listed on the Junior Market traded on Thursday, up from 41 on Wednesday and ended with 18 rising, 17 declining and eight ending unchanged.

A total of 26,022,456 shares traded for $87,517,746 down from 54,515,428 units at $197,029,437 Wednesday. Spur Tree Spices led trading with 15.23 million shares for 58.5 percent of total volume, but the stock price pulled back from Wednesday’s record, followed by Express Catering with 2.87 million units for 11 percent of the day’s trade and Future Energy Source, 1.35 million units for 5.2 percent market share and Lumber Depot, 1.32 million units changing hands for 5.1 percent market share.

Trading averaged 605,173 shares at $2,035,296 compared to 1,329,645 shares at $4,805,596 on Wednesday, with the month to date, averaging 326,758 units at $1,265,884, versus 302,573 units at $1,199,046 on the previous day. December closed with an average of 409,209 units at $1,318,877.

Investor’s Choice bid-offer indicator shows five stocks ending with bids higher than their last selling prices and two stocks with lower offers.

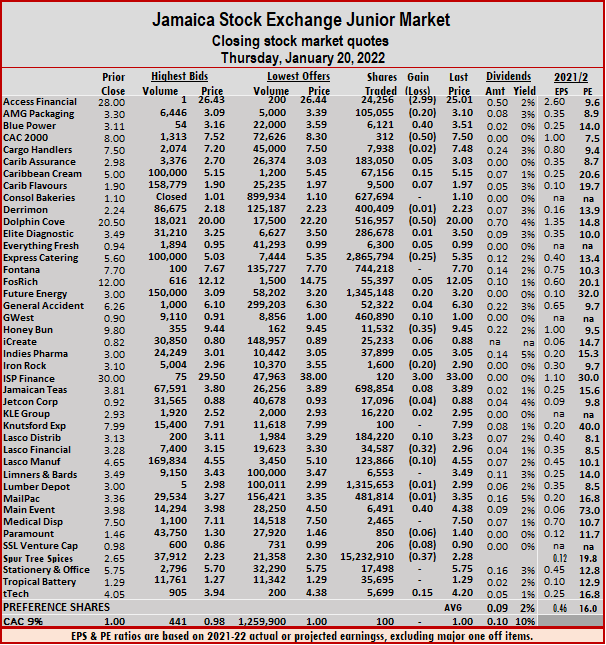

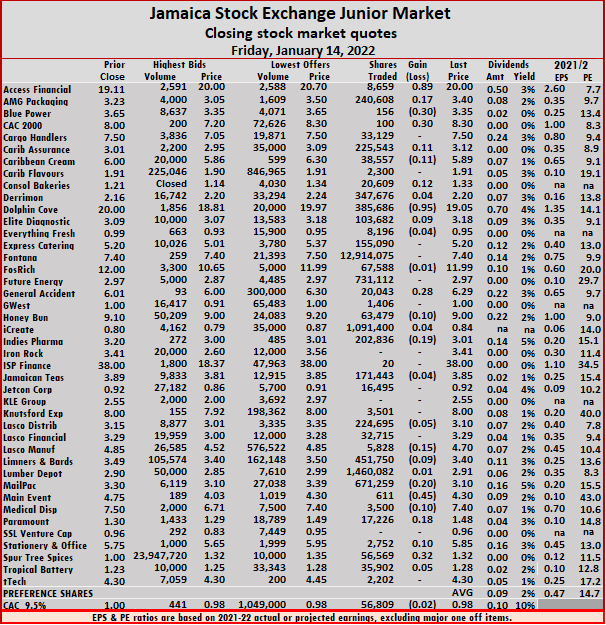

The PE Ratio, a measure used to compute appropriate stock values, averages 16. The PE ratio of each stock in the chart below is based on ICInsider.com earnings forecast for companies with financial years up to August 2022.

The PE Ratio, a measure used to compute appropriate stock values, averages 16. The PE ratio of each stock in the chart below is based on ICInsider.com earnings forecast for companies with financial years up to August 2022.

At the close, Access Financial dropped $2.99 to end at $25.01 in exchanging 24,256 shares, AMG Packaging declined 20 cents to $3.10 trading 105,055 units, Blue Power popped 40 cents to close at $3.51 in an exchange of 6,121 stock units. CAC 2000 fell 50 cents to $7.50, with 312 stocks clearing the market, Caribbean Cream advanced 15 cents to $5.15 in trading 67,156 stocks, Caribbean Flavours increased 7 cents to end at $1.97, with 9,500 stock units changing hands. Dolphin Cove lost 50 cents in closing at $20 after 516,957 units crossed the exchange, Express Catering shed 25 cents to $5.35 trading 2,865,794 shares, Future Energy Source climbed 20 cents to close at $3.20 while exchanging 1,345,148 stocks. GWest Corporation rose 10 cents and ended at $1 as 460,890 stock units crossed the market, Honey Bun declined 35 cents to $9.45 after exchanging 11,532 shares, Iron Rock Insurance shed 20 cents to $2.90, with 1,600 units crossing the market. ISP Finance rallied $3 to end at $33 with an exchange of 120 stocks, Jamaican Teas gained 8 cents in closing at $3.89 after exchanging 698,854 shares, Lasco Distributors advanced 10 cents to close at $3.23 in switching ownership of 184,220 units. Lasco Financial dropped 32 cents to $2.96 after 34,587 stock units changed hands, Lasco Manufacturing fell 10 cents to $4.55 with the swapping of 123,866 stock units, Main Event rose 40 cents to close at $4.38 with an exchange of 6,491 shares. Spur Tree Spices lost 37 cents in closing at $2.28 after exchanging 15,232,910 stock units, SSL Venture lost 8 cents to end at 90 cents, with 206 units crossing the exchange and tTech rallied 15 cents in closing at $4.20 trading 5,699 units.

Lasco Financial dropped 32 cents to $2.96 after 34,587 stock units changed hands, Lasco Manufacturing fell 10 cents to $4.55 with the swapping of 123,866 stock units, Main Event rose 40 cents to close at $4.38 with an exchange of 6,491 shares. Spur Tree Spices lost 37 cents in closing at $2.28 after exchanging 15,232,910 stock units, SSL Venture lost 8 cents to end at 90 cents, with 206 units crossing the exchange and tTech rallied 15 cents in closing at $4.20 trading 5,699 units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Huge trading day for Junior Market stocks

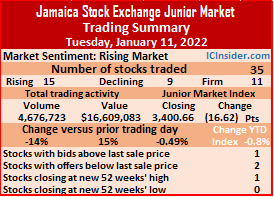

The Jamaica Stock Exchange Junior Market sprang into serious action on Wednesday, with the overall volume of the market surging 182 percent after 240 percent more funds entered the market than on Tuesday and leading to a minor fall in the market index as Spur Tree Spices and Express Catering controlled 86 percent of the volume of stocks traded.

A total of 41 securities traded on Wednesday similar to Tuesday and ended with 18 rising, 13 declining and 10 closing unchanged. At the close, the Junior Market Index shed 15.44 points to settle at 3,502.75.

A total of 41 securities traded on Wednesday similar to Tuesday and ended with 18 rising, 13 declining and 10 closing unchanged. At the close, the Junior Market Index shed 15.44 points to settle at 3,502.75.

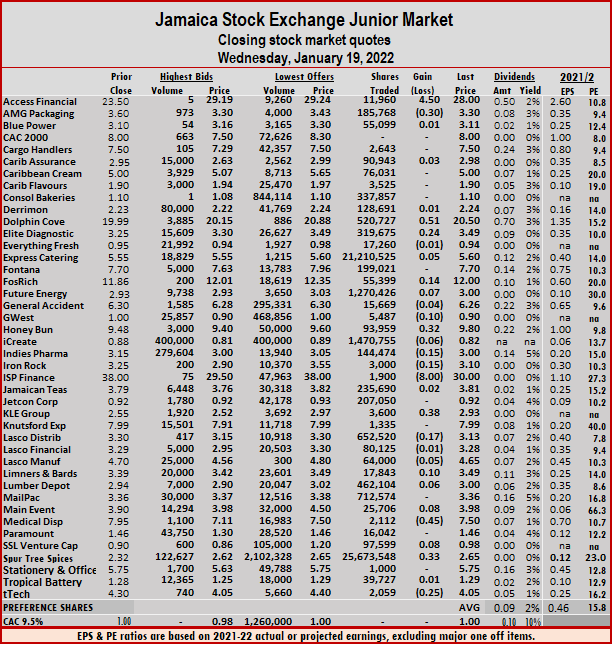

The PE Ratio, a measure used to compute appropriate stock values, averages 15.8. The PE ratio of each stock shown in the chart below is based on ICInsider.com earnings forecast for companies with financial years up to August 2022.

A total of 54,515,428 shares traded for $197,029,437 versus 19,336,528 units at $57,883,987 on Tuesday. Spur Tree Spices led trading with 25.67 million shares for 47.1 percent of total volume followed by Express Catering, 21.21 million units for 38.9 percent of the day’s trade and iCreate with 1.47 million units for 2.7 percent market share. Future Energy Source was the only other stock to exceed a million shares and ended with 1.27 million units changing hands for 2.3 percent market share.

Trading averaged 1,329,645 shares at $4,805,596 up from 471,623 shares at $1,411,805 on Tuesday with month to date, averaging 302,573 units at $1,199,046, compared to 209,819 units at $873,344 previously. December closed with an average of 409,209 units at $1,318,877.

Trading averaged 1,329,645 shares at $4,805,596 up from 471,623 shares at $1,411,805 on Tuesday with month to date, averaging 302,573 units at $1,199,046, compared to 209,819 units at $873,344 previously. December closed with an average of 409,209 units at $1,318,877.

Investor’s Choice bid-offer indicator shows eight stocks ended with bids higher than their last selling prices and one with a lower offer.

At the close, Access Financial climbed $4.50 to a 52 weeks’ high of $28 in an exchange of 11,960 shares, AMG Packaging dropped 30 cents to close at $3.30 after exchanging 185,768 stock units, Dolphin Cove popped 51 cents in closing at $20.50 in trading 520,727 units. Elite Diagnostic rallied 24 cents to $3.49 while exchanging 319,675 stocks, Fosrich increased 14 cents to end at $12, with 55,399 stocks crossing the market, GWest Corporation lost 10 cents in closing at 90 cents after an exchange of 5,487 units. Honey Bun rose 32 cents to $9.80, with 93,959 shares changing hands, Indies Pharma fell 15 cents to $3 in trading 144,474 stock units, Iron Rock Insurance declined 15 cents after ending at $3.10 with an exchange of 3,000 stock units. ISP Finance shed $8 to close at $30 in exchanging 1,900 units, KLE Group advanced 38 cents to $2.93 in switching ownership of 3,600 shares, Lasco Distributors dropped 17 cents to $3.13 clearing the market with 652,520 stocks.  Limners and Bards gained 10 cents to close at $3.49 after trading 17,843 stock units, Medical Disposables fell 45 cents in closing at $7.50 with the swapping of 2,112 shares, Spur Tree Spices advanced 33 cents to end at 52 weeks’ high of $2.65 and closed with 25,673,548 stocks changing hands and tTech declined 25 cents in closing at $4.05 after exchanging 2,059 units.

Limners and Bards gained 10 cents to close at $3.49 after trading 17,843 stock units, Medical Disposables fell 45 cents in closing at $7.50 with the swapping of 2,112 shares, Spur Tree Spices advanced 33 cents to end at 52 weeks’ high of $2.65 and closed with 25,673,548 stocks changing hands and tTech declined 25 cents in closing at $4.05 after exchanging 2,059 units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Spur Tree spices up 132% since listing

Newly listed, Spur Tree Spices, rallied 30 percent in trading on Tuesday for a third consecutive day to gain 132 percent since the IPO in December, on the Jamaica Stock Exchange Junior Market, with investors exchanging nearly 11 million of the company’s shares in pushing the volume of stocks trading for the day up 92 percent and the value 80 percent higher than on Monday as the market index closed 15.21 points higher to 3,518.19.

Market activity led to 41 securities trading compared to 39 on Monday and ended with 17 rising, 16 declining and eight, closing unchanged.

Market activity led to 41 securities trading compared to 39 on Monday and ended with 17 rising, 16 declining and eight, closing unchanged.

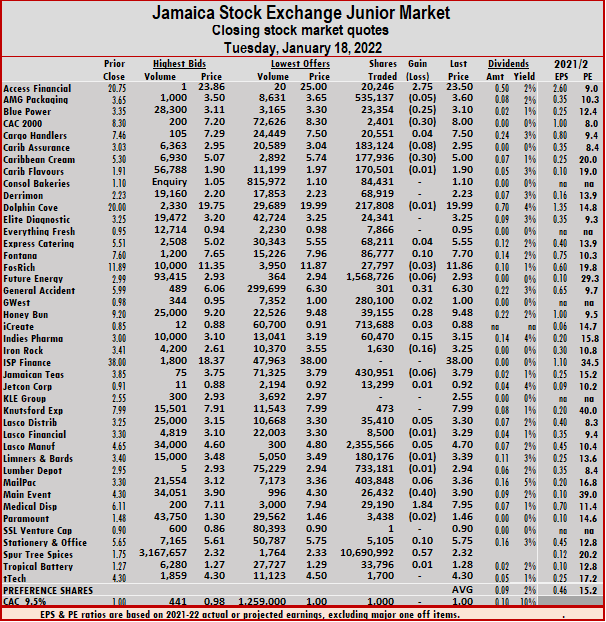

The PE Ratio, a measure used to compute appropriate stock values, averages 15.2. The PE ratio of each stock shown in the chart below is based on ICInsider.com earnings forecast for companies with financial years up to August 2022.

Overall, 19,336,528 shares traded for $57,883,987 up from 10,061,196 units at $32,241,574 on Monday. Recently listed Spur Tree Spices led trading with 10.69 million shares in controlling 55.3 percent of total volume followed by Lasco Manufacturing with 2.36 million units for 12.2 percent of the day’s trade and Future Energy Source with 1.57 million units for 8.1 percent market share.

Trading averaged 471,623 shares at $1,411,805 in contrast to 257,979 shares at $826,707 on Monday and month to date, averaging 209,819 units at $873,344, compared to 183,829 units at $819,889 on Monday. December closed with an average of 409,209 units at $1,318,877.

Investor’s Choice bid-offer indicator shows five stocks ended with bids higher than their last selling prices and one stock with a lower offer.

At the close, Access Financial rose $2.75 ending at $23.50, the highest price since January 2021, with the swapping of 20,246 shares, AMG Packaging shed 5 cents to end at $3.60, with 535,137 stock units crossing the exchange, Blue Power declined 25 cents in closing at $3.10 after 23,354 units changed hands. CAC 2000 fell 30 cents to close at $8 while exchanging 2,401 stocks, Caribbean Assurance Brokers dipped 8 cents to $2.95 after trading 183,124 units, Caribbean Cream lost 30 cents to close at $5, with an exchange of 177,936 stocks. Fontana gained 10 cents in closing at $7.70 trading 86,777 stock units, Future Energy Source lost 6 cents after ending at $2.93 in exchanging 1,568,726 shares, General Accident popped 31 cents to $6.30, with 301 stocks clearing the market. Honey Bun climbed 28 cents to end at $9.48 in exchanging 39,155 shares, Indies Pharma rallied 15 cents to end at $3.15, with 60,470 units crossing the market, Iron Rock Insurance shed 16 cents at $3.25 with an exchange of 1,630 stock units. Jamaican Teas dropped 6 cents in closing at $3.79, with 430,951 stock units changing hands, Lasco Distributors advanced 5 cents to close at $3.30 in exchanging 35,410 units, Lasco Manufacturing gained 5 cents to end at $4.70 in switching ownership of 2,355,566 shares.

At the close, Access Financial rose $2.75 ending at $23.50, the highest price since January 2021, with the swapping of 20,246 shares, AMG Packaging shed 5 cents to end at $3.60, with 535,137 stock units crossing the exchange, Blue Power declined 25 cents in closing at $3.10 after 23,354 units changed hands. CAC 2000 fell 30 cents to close at $8 while exchanging 2,401 stocks, Caribbean Assurance Brokers dipped 8 cents to $2.95 after trading 183,124 units, Caribbean Cream lost 30 cents to close at $5, with an exchange of 177,936 stocks. Fontana gained 10 cents in closing at $7.70 trading 86,777 stock units, Future Energy Source lost 6 cents after ending at $2.93 in exchanging 1,568,726 shares, General Accident popped 31 cents to $6.30, with 301 stocks clearing the market. Honey Bun climbed 28 cents to end at $9.48 in exchanging 39,155 shares, Indies Pharma rallied 15 cents to end at $3.15, with 60,470 units crossing the market, Iron Rock Insurance shed 16 cents at $3.25 with an exchange of 1,630 stock units. Jamaican Teas dropped 6 cents in closing at $3.79, with 430,951 stock units changing hands, Lasco Distributors advanced 5 cents to close at $3.30 in exchanging 35,410 units, Lasco Manufacturing gained 5 cents to end at $4.70 in switching ownership of 2,355,566 shares.  Mailpac Group advanced 6 cents to $3.36 in an exchange of 403,848 stocks, Main Event fell 40 cents to $3.90 trading 26,432 stocks, Medical Disposables increased $1.84 to a 52 weeks’ high of $7.95, with 29,190 stock units crossing the exchange. Spur Tree Spices rallied 57 cents to end at $2.32 in trading 10,690,992 units and Stationery and Office Supplies popped 10 cents to close at $5.75 finishing at 5,105 shares.

Mailpac Group advanced 6 cents to $3.36 in an exchange of 403,848 stocks, Main Event fell 40 cents to $3.90 trading 26,432 stocks, Medical Disposables increased $1.84 to a 52 weeks’ high of $7.95, with 29,190 stock units crossing the exchange. Spur Tree Spices rallied 57 cents to end at $2.32 in trading 10,690,992 units and Stationery and Office Supplies popped 10 cents to close at $5.75 finishing at 5,105 shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Spur Tree up 75% pushes Junior Market higher

Spur Tree Spices on the second day of trading on the Jamaica Stock Exchange Junior Market closed at a record $1.75 to be up 75 percent from the IPO price, with only a small fraction of the more than 23 million shares that were placed on the bid at $1.72 before trading opened on Monday, or the more than 29.6 million on the bid at a few minutes after 11 o’clock in the morning after 1.37 million shares were traded, at the close the bid ended at $1.75 to purchase 17.2 million shares, with just 24,113 on offer at $1.76.

Market activity ended with 39 securities trading compared to 40 on Friday, with the volume of stocks traded declining 49 percent and the value down by 74 percent from Friday activities. At the close 16 stocks gained, 15 declined and eight traded unchanged.

Market activity ended with 39 securities trading compared to 40 on Friday, with the volume of stocks traded declining 49 percent and the value down by 74 percent from Friday activities. At the close 16 stocks gained, 15 declined and eight traded unchanged.

The Junior Market Index jumped 32.81 points to settle at 3,502.98. The PE Ratio, a measure used to compute appropriate stock values, averages 14.8. The PE ratios stocks in the chart below are based on ICInsider.com earnings forecast for companies with financial year ends up to August 2022.

A total of 10,061,196 shares traded for $32,241,574 down from 19,875,289 units at $123,323,735 on Friday. Future Energy Source led trading with 1.93 million shares for 19.2 percent of total volume followed by Lumber Depot with 1.72 million units for 17.1 percent of the day’s trade and Spur Tree Spices with 1.37 million units for 13.6 percent market share.

Trading averaged 257,979 shares at $826,707 in contrast to 496,882 shares at $3,083,093 on Friday with the month to date, averaging 183,829 units at $819,889, compared to 176,097 units at $819,178 on the previous day of trading. December closed with an average of 409,209 units at $1,318,877.

Investor’s Choice bid-offer indicator shows three stocks ended with bids higher than their last selling prices and three stocks with lower offers.

At the close, Access Financial rose 75 cents ending at $20.75 with the swapping of 199,203 shares, as some of the long overhanging of selling seem to be easing, AMG Packaging advanced 25 cents in closing at a 52 weeks’ high of $3.65, with 410,066 stocks changing hands after posting an increase of 146 percent in profits for the first quarter to November after trading on Friday. Caribbean Cream lost 59 cents to $5.30 while exchanging 207,038 units as investors reacted negatively to a loss in the company’s November quarterly results. Consolidated Bakeries declined 23 cents to close at $1.10 after 281,574 stock units crossed the market, Dolphin Cove gained 95 cents to end at $20 in trading 130,426 shares, Express Catering climbed 31 cents to $5.51 trading 23,600 stocks. Fontana increased 20 cents to end at $7.60 in exchanging 182,312 stock units, Fosrich dropped 10 cents in closing at $11.89 after 13,625 units changed hands, General Accident shed 30 cents to close at $5.99 in an exchange of 3,300 stocks. Honey Bun popped 20 cents to $9.20, with 30,034 units crossing the exchange, Lasco Distributors rallied 15 cents to close at $3.25 after exchanging 57,411 stock units, Mailpac Group rose 20 cents to $3.30 with an exchange of 274,246 shares.

At the close, Access Financial rose 75 cents ending at $20.75 with the swapping of 199,203 shares, as some of the long overhanging of selling seem to be easing, AMG Packaging advanced 25 cents in closing at a 52 weeks’ high of $3.65, with 410,066 stocks changing hands after posting an increase of 146 percent in profits for the first quarter to November after trading on Friday. Caribbean Cream lost 59 cents to $5.30 while exchanging 207,038 units as investors reacted negatively to a loss in the company’s November quarterly results. Consolidated Bakeries declined 23 cents to close at $1.10 after 281,574 stock units crossed the market, Dolphin Cove gained 95 cents to end at $20 in trading 130,426 shares, Express Catering climbed 31 cents to $5.51 trading 23,600 stocks. Fontana increased 20 cents to end at $7.60 in exchanging 182,312 stock units, Fosrich dropped 10 cents in closing at $11.89 after 13,625 units changed hands, General Accident shed 30 cents to close at $5.99 in an exchange of 3,300 stocks. Honey Bun popped 20 cents to $9.20, with 30,034 units crossing the exchange, Lasco Distributors rallied 15 cents to close at $3.25 after exchanging 57,411 stock units, Mailpac Group rose 20 cents to $3.30 with an exchange of 274,246 shares.  Medical Disposables fell $1.29 to end at $6.11 with 31,057 shares changing hands, Spur Tree Spices rallied 43 cents ending at a 52 weeks’ high of $1.75 as 1,369,946 units traded and Stationery and Office Supplies fell 20 cents in closing at $5.65, with 6,830 stock units clearing the market.

Medical Disposables fell $1.29 to end at $6.11 with 31,057 shares changing hands, Spur Tree Spices rallied 43 cents ending at a 52 weeks’ high of $1.75 as 1,369,946 units traded and Stationery and Office Supplies fell 20 cents in closing at $5.65, with 6,830 stock units clearing the market.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Spur Tree Spices gains 32% on listing debut

Newly listed Spur Tree Spices gained 32 percent after climbing 32 cents to an all-time high of $1.32 after exchanging 56,569 stocks on the first day listed on the Jamaica Stock Exchange Junior Market on Friday and helping the overall volume of stocks traded to jump 234 percent and the value surging 326 percent higher than on Thursday after nearly 13 million units of Fontana shares passed through the market with a value of $96 million.

A total of 40 securities trading compared to 35 on Thursday and ended with 14 rising, 15 declining and 11, closing unchanged.

A total of 40 securities trading compared to 35 on Thursday and ended with 14 rising, 15 declining and 11, closing unchanged.

At the close, the Junior Market Index lost 13.25 points to end at 3,470.17.

The PE Ratio, a measure used to compute appropriate stock values, averages 14.7 The PE ratio of each stock shown in the chart below is based on ICInsider.com earnings forecast for companies with financial years up to August 2022.

Some 19,875,289 shares traded for $123,323,735 compared to 5,944,460 units at $28,932,503 on Thursday. Fontana led trading with 12.91 million shares for 65 percent of total volume followed by Lumber Depot with 1.46 million stock units for 7.3 percent of the day’s trade and iCreate with 1.09 million units for 5.5 percent market share.

Trading averaged 496,882 shares at $3,083,093 in contrast to 169,842 shares at $826,643 on Thursday with the month to date averaging 176,097 units at $819,178, compared to 137,680 units at $548,051 on Thursday. December closed with an average of 409,209 units at $1,318,877.

Investor’s Choice bid-offer indicator shows no stock ending with the bid higher than the last selling price and four closed with lower offers.

At the close, Access Financial rallied 89 cents to end at $20, with 8,659 shares crossing the exchange, AMG Packaging popped 17 cents in closing at a 52 weeks’ high of $3.40 while exchanging 240,608 units, Blue Power shed 30 cents ending at $3.35 in an exchange of 156 stock units. CAC 2000 rose 30 cents to $8.30 after exchanging 100 stocks, Caribbean Assurance Brokers advanced 11 cents to close at a 52 weeks’ high of $3.12 in switching ownership of 225,543 units, Caribbean Cream lost 11 cents to close at $5.89 in trading 38,557 stocks. Consolidated Bakeries popped 12 cents to $1.33 with 20,609 shares changing hands, Dolphin Cove declined 95 cents to end at $19.05, with 385,686 stock units clearing the market, Elite Diagnostic climbed 9 cents in closing at $3.18 after trading 103,682 stock units. General Accident increased 28 cents in ending at $6.29 after exchanging 20,043 shares, Honey Bun dropped 10 cents in closing at $9 with the swapping of 63,479 units, Indies Pharma fell 19 cents to close at $3.01 in trading 202,836 stocks. Lasco Distributors declined 5 cents to $3.10, with 224,695 units changing hands, Lasco Manufacturing lost 15 cents to end at $4.70 after 5,828 shares crossed the market, Limners and Bards fell 9 cents to $3.40 after an exchange of 451,750 stocks.

At the close, Access Financial rallied 89 cents to end at $20, with 8,659 shares crossing the exchange, AMG Packaging popped 17 cents in closing at a 52 weeks’ high of $3.40 while exchanging 240,608 units, Blue Power shed 30 cents ending at $3.35 in an exchange of 156 stock units. CAC 2000 rose 30 cents to $8.30 after exchanging 100 stocks, Caribbean Assurance Brokers advanced 11 cents to close at a 52 weeks’ high of $3.12 in switching ownership of 225,543 units, Caribbean Cream lost 11 cents to close at $5.89 in trading 38,557 stocks. Consolidated Bakeries popped 12 cents to $1.33 with 20,609 shares changing hands, Dolphin Cove declined 95 cents to end at $19.05, with 385,686 stock units clearing the market, Elite Diagnostic climbed 9 cents in closing at $3.18 after trading 103,682 stock units. General Accident increased 28 cents in ending at $6.29 after exchanging 20,043 shares, Honey Bun dropped 10 cents in closing at $9 with the swapping of 63,479 units, Indies Pharma fell 19 cents to close at $3.01 in trading 202,836 stocks. Lasco Distributors declined 5 cents to $3.10, with 224,695 units changing hands, Lasco Manufacturing lost 15 cents to end at $4.70 after 5,828 shares crossed the market, Limners and Bards fell 9 cents to $3.40 after an exchange of 451,750 stocks. Mailpac Group dropped 20 cents to close at $3.10 trading 671,259 stock units, Main Event shed 45 cents in ending at $4.30 with an exchange of 611 units, Medical Disposables fell 10 cents to $7.40 in an exchange of 3,500 shares. Paramount Trading rose 18 cents in closing at $1.48 while exchanging 17,226 stock units, Stationery and Office Supplies rose 10 cents to $5.85 after exchanging 2,752 shares and Tropical Battery inched 5 cents up to $1.28 in switching ownership of 35,902 units.

Mailpac Group dropped 20 cents to close at $3.10 trading 671,259 stock units, Main Event shed 45 cents in ending at $4.30 with an exchange of 611 units, Medical Disposables fell 10 cents to $7.40 in an exchange of 3,500 shares. Paramount Trading rose 18 cents in closing at $1.48 while exchanging 17,226 stock units, Stationery and Office Supplies rose 10 cents to $5.85 after exchanging 2,752 shares and Tropical Battery inched 5 cents up to $1.28 in switching ownership of 35,902 units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Junior Market stocks end with sharp jump

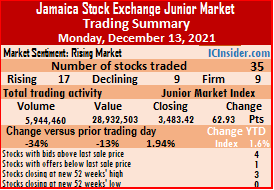

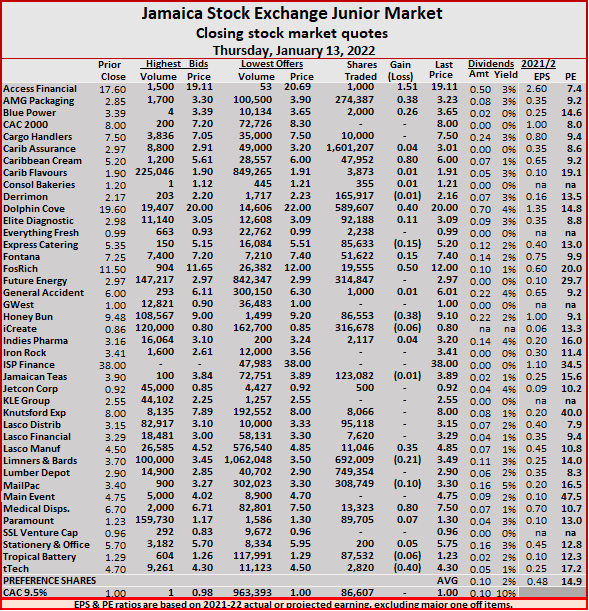

Bulls pushed the Jamaica Stock Exchange up sharply in trading on Thursday, with the Market Index surging 62.93 points to settle at 3,483.42, with the volume of stocks traded declining 34 percent and the value falling by 13 percent lower than on Wednesday on a day when rising stocks outdid those declining on a two to one ratio as three stocks high 52 weeks’ highs.

A total of 35 securities traded versus 39 on Wednesday and ended with 17 rising, nine declining and nine ending unchanged.

A total of 35 securities traded versus 39 on Wednesday and ended with 17 rising, nine declining and nine ending unchanged.

The PE Ratio, a measure used to compute appropriate stock values, averages 14.9. The PE ratio of stocks in the chart below is computed based on ICInsider.com earnings forecast for companies with financial years up to August 2022.

A total of 5,944,460 shares traded for $28,932,503 down from 8,986,092 units at $33,239,994 on Wednesday. Caribbean Assurance Brokers led trading with 1.6 million shares for 26.9 percent of total volume as the price ended at a 52 weeks’ high of $3.01. Lumber Depot followed, with 749,354 units for 12.6 percent of the day’s trade and Limners and Bards with 692,009 units for 11.6 percent market share.

Trading averaged 169,842 shares at $826,643, compared to 230,413 shares at $852,308 on Wednesday and the month to date, averaging 137,680 units at $548,051 versus 133,915 units at $515,440 on Wednesday. December closed with an average of 409,209 units at $1,318,877.

Investor’s Choice bid-offer indicator shows four stocks ending with bids higher than their last selling prices and one stock with a lower offer.

At the close, Access Financial jumped $1.51 to end at $19.11 in switching ownership of 1,000 shares, AMG Packaging climbed 38 cents to end at a 52 weeks’ high of $3.23 with an exchange of 274,387 stock units, Blue Power increased 26 cents to $3.65 after trading 2,000 stocks. Caribbean Cream rallied 80 cents to close at $6 after 47,952 units changed hands, Dolphin Cove gained 40 cents to end at a 52 weeks’ high of $20, with 589,607 stocks clearing the market, Elite Diagnostic popped 11 cents in ending at $3.09 after trading 92,188 shares. Express Catering fell 15 cents to close at $5.20 after an exchange of 85,633 units, Fontana rose 15 cents in closing at $7.40 trading 51,622 stock units, Fosrich spiked 50 cents to end at $12, with 19,555 stock units crossing the market. Honey Bun lost 38 cents to end at $9.10 in exchanging 86,553 shares, Lasco Manufacturing advanced 35 cents in closing at $4.85 with 11,046 units crossing the market, Limners and Bards declined 21 cents in ending at $3.49 with the swapping of 692,009 stocks.

At the close, Access Financial jumped $1.51 to end at $19.11 in switching ownership of 1,000 shares, AMG Packaging climbed 38 cents to end at a 52 weeks’ high of $3.23 with an exchange of 274,387 stock units, Blue Power increased 26 cents to $3.65 after trading 2,000 stocks. Caribbean Cream rallied 80 cents to close at $6 after 47,952 units changed hands, Dolphin Cove gained 40 cents to end at a 52 weeks’ high of $20, with 589,607 stocks clearing the market, Elite Diagnostic popped 11 cents in ending at $3.09 after trading 92,188 shares. Express Catering fell 15 cents to close at $5.20 after an exchange of 85,633 units, Fontana rose 15 cents in closing at $7.40 trading 51,622 stock units, Fosrich spiked 50 cents to end at $12, with 19,555 stock units crossing the market. Honey Bun lost 38 cents to end at $9.10 in exchanging 86,553 shares, Lasco Manufacturing advanced 35 cents in closing at $4.85 with 11,046 units crossing the market, Limners and Bards declined 21 cents in ending at $3.49 with the swapping of 692,009 stocks.  Mailpac Group dipped 10 cents to $3.30, with 308,749 stocks changing hands, Medical Disposables rallied 80 cents to end at $7.50 in an exchange of 13,323 units and tTech shed 40 cents to close at $4.30 in trading 2,820 stock units.

Mailpac Group dipped 10 cents to $3.30, with 308,749 stocks changing hands, Medical Disposables rallied 80 cents to end at $7.50 in an exchange of 13,323 units and tTech shed 40 cents to close at $4.30 in trading 2,820 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Gains for JSE Junior Market

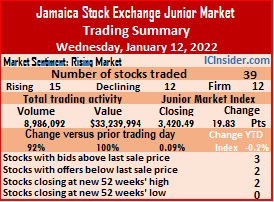

Trading closed on Wednesday, with the volume of stocks traded jumping 92 percent higher and the value rising 100 percent higher than on Tuesday leading to rising stocks outdistancing those falling at the close of the Jamaica Stock Exchange Junior Market.

Market activity led to 39 securities trading, up from 35 on Tuesday and ended with 15 rising, 12 declining and 12 closing unchanged as the Junior Market Index advanced 19.83 points to 3,420.49. The PE Ratio, a measure used to compute appropriate stock values, averages 14.8. The PE ratio of each stock shown in the chart below is based on ICInsider.com earnings forecast for companies with financial years up to August 2022.

Market activity led to 39 securities trading, up from 35 on Tuesday and ended with 15 rising, 12 declining and 12 closing unchanged as the Junior Market Index advanced 19.83 points to 3,420.49. The PE Ratio, a measure used to compute appropriate stock values, averages 14.8. The PE ratio of each stock shown in the chart below is based on ICInsider.com earnings forecast for companies with financial years up to August 2022.

Trading saw an exchange of 8,986,092 shares for $33,239,994, up from 4,676,723 units at $16,609,083 on Tuesday. Lasco Manufacturing led trading with 3.44 million shares for 38.3 percent of total volume followed by Consolidated Bakeries with 1.09 million units for 12.1 percent of the day’s trade and Limners and Bards, 653,067 units, with 7.3 percent market share.

Trading averaged 230,413 shares at $852,308 compared to 133,621 shares at $474,545 on Tuesday and month to date, an average of 133,915 units at $515,440, compared to 119,440 units at $464,910 on Tuesday. December closed with an average of 409,209 units at $1,318,877.

Investor’s Choice bid-offer indicator shows three stocks ending with bids higher than their last selling prices and two stocks with lower offers.

At the close, Access Financial popped 51 cents to end at $17.60 after an exchanging of 1,036 shares, AMG Packaging increased 23 cents ending at $2.85 after trading 318,761 stock units, CAC 2000 gained 30 cents in closing at $8 while exchanging 1,110 stock units. Caribbean Assurance Brokers climbed 23 cents to a 52 weeks’ high of $2.97 with 197,240 units changing hands, Caribbean Cream declined 55 cents to close at $5.20 after trading 37,054 stock units, Derrimon Trading lost 6 cents to close at $2.17 with 208,244 shares crossing the market. Dolphin Cove rose 40 cents to close at a 52 weeks’ high of $19.60 in exchanging 249,869 stocks, Express Catering dropped 5 cents in closing at $5.35 trading 63,402 units, General Accident shed 35 cents in ending at $6 with 34,138 stocks crossing the market. Honey Bun fell 21 cents to $9.48 in switching ownership of 70,350 shares, Iron Rock Insurance popped 31 cents to close at $3.41 following an exchange of 2,013 units, Jamaican Teas dropped 7 cents in closing at $3.90 after 168,702 stock units cleared the market.

At the close, Access Financial popped 51 cents to end at $17.60 after an exchanging of 1,036 shares, AMG Packaging increased 23 cents ending at $2.85 after trading 318,761 stock units, CAC 2000 gained 30 cents in closing at $8 while exchanging 1,110 stock units. Caribbean Assurance Brokers climbed 23 cents to a 52 weeks’ high of $2.97 with 197,240 units changing hands, Caribbean Cream declined 55 cents to close at $5.20 after trading 37,054 stock units, Derrimon Trading lost 6 cents to close at $2.17 with 208,244 shares crossing the market. Dolphin Cove rose 40 cents to close at a 52 weeks’ high of $19.60 in exchanging 249,869 stocks, Express Catering dropped 5 cents in closing at $5.35 trading 63,402 units, General Accident shed 35 cents in ending at $6 with 34,138 stocks crossing the market. Honey Bun fell 21 cents to $9.48 in switching ownership of 70,350 shares, Iron Rock Insurance popped 31 cents to close at $3.41 following an exchange of 2,013 units, Jamaican Teas dropped 7 cents in closing at $3.90 after 168,702 stock units cleared the market.  Jetcon Corporation advanced 7 cents to 92 cents as 15,073 units changed hands, KLE Group rallied 5 cents to $2.55 with an exchange of 1,077 stock units, Knutsford Express climbed 45 cents to end at $8 in trading 8,237 shares. Lasco Distributors fell 5 cents to end at $3.15 with the swapping of 163,671 stocks, Lasco Financial declined 5 cents to $3.29, with 4,619 stocks changing hands, Lasco Manufacturing shed 9 cents in closing at $4.50 after an exchange of 3,442,151 stock units. Main Event increased 25 cents to $4.75 in exchanging 17,000 units and tTech gained 45 cents to close at $4.70, with 3,500 shares clearing the market.

Jetcon Corporation advanced 7 cents to 92 cents as 15,073 units changed hands, KLE Group rallied 5 cents to $2.55 with an exchange of 1,077 stock units, Knutsford Express climbed 45 cents to end at $8 in trading 8,237 shares. Lasco Distributors fell 5 cents to end at $3.15 with the swapping of 163,671 stocks, Lasco Financial declined 5 cents to $3.29, with 4,619 stocks changing hands, Lasco Manufacturing shed 9 cents in closing at $4.50 after an exchange of 3,442,151 stock units. Main Event increased 25 cents to $4.75 in exchanging 17,000 units and tTech gained 45 cents to close at $4.70, with 3,500 shares clearing the market.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

More risers than decliners but index slips

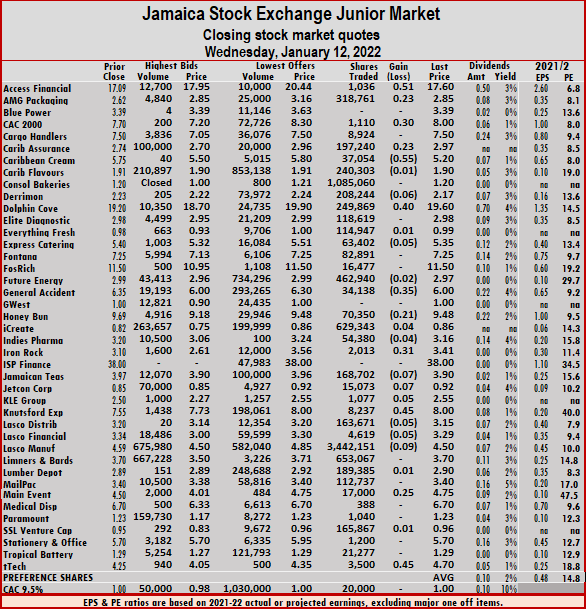

Fewer companies’ stocks traded on Tuesday, leading to a slippage in the volume by 14 percent but the value rising by 15 percent higher than on Monday at the close of the Jamaica Stock Exchange Junior Market.

Dolphin Cove closed at a 52 weeks’ high on Tuesday.

Market activity led to 35 securities trading compared to 38 on Monday and ended with 15 rising, nine declining and 11 closing unchanged. The Junior Market Index dropped 16.62 points to settle at 3,400.66.

The PE Ratio, a measure used to compute appropriate stock values, averages 14.5. The PE ratio of each stock in the chart below is based on ICInsider.com earnings forecast for companies with financial years up to August 2022.

Trading ended with 4,676,723 shares for $16,609,083 compared to 5,461,309 units at $14,393,557 on Monday. Jamaican Teas led trading with 1.24 million shares for 26.4 percent of the total volume followed by Future Energy Source, 838,006 units for 17.9 percent of the day’s trade and Tropical Battery, 526,823 units with 11.3 percent market share.

Trading averaged 133,621 shares at $474,545 compared to 143,719 shares at $378,778 on Monday and month to date, an average of 119,440 units at $464,910, versus 117,234 units at $463,411 on Monday.December closed with an average of 409,209 units at $1,318,877.

Investor’s Choice bid-offer indicator shows one stock ended with the bid higher than the last selling price and two with lower offers.

At the close, AMG Packaging fell 28 cents to $2.62 in trading 1,483 shares, Dolphin Cove rose $2.45 in ending at $19.20 with an exchange of 164,259 stocks, Everything Fresh climbed 6 cents to end at 98 cents in switching ownership of 45,928 units. Express Catering advanced 5 cents to $5.40 trading 13,925 stock units, Fontana popped 15 cents to close at $7.25 after 62,032 stocks changed hands, Fosrich rallied 50 cents to end at $11.50 after exchanging 38,098 stock units. Future Energy Source gained 5 cents to end at $2.99, with 838,006 units clearing the market, Honey Bun dropped 6 cents in closing at $9.69 with the swapping of 9,875 shares, Indies Pharma popped 10 cents to close at $3.20 after trading 10,747 units. Jetcon Corporation fell 5 cents to 85 cents in exchanging 22,000 stocks, KLE Group gained 25 cents in closing at $2.50, with 2,742 stock units changing hands, Knutsford Express declined 45 cents to close at $7.55 in trading 728 shares.

At the close, AMG Packaging fell 28 cents to $2.62 in trading 1,483 shares, Dolphin Cove rose $2.45 in ending at $19.20 with an exchange of 164,259 stocks, Everything Fresh climbed 6 cents to end at 98 cents in switching ownership of 45,928 units. Express Catering advanced 5 cents to $5.40 trading 13,925 stock units, Fontana popped 15 cents to close at $7.25 after 62,032 stocks changed hands, Fosrich rallied 50 cents to end at $11.50 after exchanging 38,098 stock units. Future Energy Source gained 5 cents to end at $2.99, with 838,006 units clearing the market, Honey Bun dropped 6 cents in closing at $9.69 with the swapping of 9,875 shares, Indies Pharma popped 10 cents to close at $3.20 after trading 10,747 units. Jetcon Corporation fell 5 cents to 85 cents in exchanging 22,000 stocks, KLE Group gained 25 cents in closing at $2.50, with 2,742 stock units changing hands, Knutsford Express declined 45 cents to close at $7.55 in trading 728 shares.  Limners and Bards increased 15 cents to end at $3.70 with an exchange of 44,053 units, Main Event rose 30 cents to $4.50, with 2,470 stock units crossing the market, Medical Disposables climbed 21 cents in ending at $6.70 after exchanging 65,529 stocks. Stationery and Office Supplies advanced 9 cents to $5.70 while trading 5,600 shares and tTech shed 53 cents to close at $4.25 in an exchange of 1,579 stocks.

Limners and Bards increased 15 cents to end at $3.70 with an exchange of 44,053 units, Main Event rose 30 cents to $4.50, with 2,470 stock units crossing the market, Medical Disposables climbed 21 cents in ending at $6.70 after exchanging 65,529 stocks. Stationery and Office Supplies advanced 9 cents to $5.70 while trading 5,600 shares and tTech shed 53 cents to close at $4.25 in an exchange of 1,579 stocks.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

The Junior Market could gain 60% in 2022

The Junior Market continues to offer opportunities for supper stock performance in 2022 with an average PE for the market at 9 times 2022 earnings versus close to 15 at the end of 2021, and offering a potential gain of more than 60 percent to the end of 2022. There are 26 Junior Market stocks that can double in 2022.

The Junior Market continues to offer opportunities for supper stock performance in 2022 with an average PE for the market at 9 times 2022 earnings versus close to 15 at the end of 2021, and offering a potential gain of more than 60 percent to the end of 2022. There are 26 Junior Market stocks that can double in 2022.

The market is technically at a support level that is steering the index upwards, more importantly, it is caught in a triangular formation that is set to push the market sharply upwards once it breaks out, which is not far off. The market is also trading in a channel that goes back to May 2020 and is pointing to a record high of more than 4,000 points in a few months.

Last year finished with a number of stocks trading at or above 20 times earnings in the Junior Market if that level of valuation continues into 2022 then the gain in the market could exceed the above potential gains.

The market will continue to benefit from the recovery of some of the companies that suffered major fallout due to the restrictions placed on operations as a result of the COVID19 epidemic in 2020 into 2021. Stocks that could benefit in a big way are, Access Financial, Main Event, Everything Fresh, Express Catering, Knutsford Express, Jetcon Corporation, Dolphin Cove and Stationery and Office Supplies.

Access Financial – Earnings per share are projected at $4.80 for the year to March 2023 and $2.60 for the 2022 fiscal year to March. The company showed signs of recovery from the beating taken in 2020 and 2021 as a result of steep provisioning for doubtful loans and a slowdown in lending. That situation started to reverse in 2021 up to September with loans net of doubtful loans up to $4.38 billion versus $3.9 at the end of September 2020. Revenues and profit in 2021 tripled the September 2020 quarter and the 2020 half year results. This trend is expected to gather pace in 2022 and beyond. See full article on the company recently published.

Access Financial – Earnings per share are projected at $4.80 for the year to March 2023 and $2.60 for the 2022 fiscal year to March. The company showed signs of recovery from the beating taken in 2020 and 2021 as a result of steep provisioning for doubtful loans and a slowdown in lending. That situation started to reverse in 2021 up to September with loans net of doubtful loans up to $4.38 billion versus $3.9 at the end of September 2020. Revenues and profit in 2021 tripled the September 2020 quarter and the 2020 half year results. This trend is expected to gather pace in 2022 and beyond. See full article on the company recently published.

AMG Packaging – Earnings per share is projected at 35 cents for the year to August 2022 as new machinery facilitates cutting costs and creating more flexibility in the manufacturing operations. See full article on the company recently published.

Caribbean Brokers – Earnings per share is projected at 40 cents for 2022. The company reported strong earnings in the September quarter, with EPS at 41 cents for the quarter and 33 cents for the nine months. The company tends to get the bulk of its income in short periods with the other quarters reflecting relatively lower income that does not cover the cost. Unfortunately, the company failed to provide investors with appropriate information to fully glean what the results will mean for the full year and beyond. The end result is that the stock has suffered from investors’ interest when it really should have surged well over $4 per share, based on the latest results and what can be expected for the full year.

Elite Diagnostic – Earnings per share are projected at 80 cents for the year to June 2023. The stock is under pressure but that is due to investors not paying adequate attention to what the company is doing and the improvement in sales, quarter over quarter as well as the strong cash flow it’s generating. See full article on the company recently published.

Medical Disposables – Earnings per share are projected at $1.50 cents for the year to March 2023.

Technical indicators for the Junior Market are pointing to a record high of more than 4,000 points in a few months.

Profit after taxation surged 455 percent to $21.5 million for the second quarter to September from a loss of $6 million in 2020. For the year to date, profit after tax spiked 458 percent to $47 million, up from a loss of $13 million in 2020. Income from sales jumped 49 percent to $936 million for the September quarter, up from $630 million in 2020 and climbed 42 percent for the six months ended September 2021 to $1.62 billion, from $1.14 billion in the prior year. The acquisition of majority ownership of Cornwall Enterprises along with new distributorships helped in fueling the sales surge. See full article on the company recently published

Caribbean Cream – Earnings per share is projected at $1.30 cents for the year February 2023 from 65 cents projected for the 2021 fiscal year. Management is building an enterprise that can go up against the competition successfully and deliver superior returns for shareholders. They have cut costs in the past two years and grew their market reach by setting up a distribution depot in the Ocho Rios region that helped to push sales. The implementation of their own power generating plant will lead to a reduction of energy and other utility costs. Excluding the slowdown in sales in the August quarter when the government introduced no movement days, sales increase is been robust and is expected to be on track again for the second half of the year into the 2023 fiscal year.

Dolphin Cove – Earnings per share is projected at $3 for this year and $1.35 for 2021. This company is in a period of major recovery with profit surging and set to get even better with the tourism industry rebounding strongly and closing in on 2019 arrivals. See full article on the company recently published.

Spur Tree Spices – Earnings per share is projected at 19 cents for this year. A recent IPO, this stock is set to do extremely well over the next few years. Expect local sales to surge as a result of the publicity they received due to the IPO. See full article on the company recently published.

Spur Tree Spices – Earnings per share is projected at 19 cents for this year. A recent IPO, this stock is set to do extremely well over the next few years. Expect local sales to surge as a result of the publicity they received due to the IPO. See full article on the company recently published.

Stationery and Office Supplies – Earnings per share is projected at 95 cents for the current year and reflect a full recovery from the fall out of the Covid19 disruption to sales. The company has made major strides since 2020 when sales were badly affected by the shutdown of businesses and schools. That has changed and the company posted a 175 percent increase in pre-tax profit of $78 million versus $29 million for the nine months to September 2020, from a 13.5 percent rise in revenues. Earnings per share for the third Quarter of 2021 was 8 cents, compared to 3 cents in 2020. For the 9 months ended September 2021 earnings per share was up to 31 cents from 11 cents in 2020. reports are that the company had the best four quarter in its history and the performance seems to have carried over into 2022 and should continue to be robust with opening and expansion in the wider economy.

Lasco Distributors – Earnings per share is projected at 50 cents for the year to March 2023. For the half year to September, revenues rose 15 percent to $11.6 billion and profit increased 6 percent to $615 million as margins were squeezed in the period from higher input cost, followed by delayed price increase. With price adjustments since implemented, margins should increase and result in higher profits. Revenues should pick up as tourist traffic rose sharply throughout the year and schools are now back in operation both activities will impact revenues positively.

With earnings per share of 14 cents for the half year, full year earnings should exceed 30 cents making the stock undervalued at $3.45 with a PE of 11, versus the market average of just over 14.

The company has no borrowed funds and possesses $2.8 billion in cash funds, with annual gross cash flows of over $1.2 billion.

Everything Fresh – Earnings per share is projected at 15 cents for the year. The company seems to have turned the corner with a small profit in the September quarter. Importantly, gross cash flow for the nine months to September was positive at $15 million despite a loss of $20 million. The hotel sector is enjoying a strong rise in visitor arrivals with December last year down 24 percent compared to 2019 compared to a fall of 45 percent for 2021 versus 2019 preliminary data shows, this is a very positive development for the company going forward. The current year should see an even greater number of visitors that should better the performance in December. This is good news for a company that markets the bulk of sales to that sector.

Lasco Financial – Earnings per share is projected at 45 cents for the year March 2023. Net Profit for the second quarter ended at $134 million compared with $30 million in the similar period of 2020. The second quarter suffered revenue reduction from $617 million in 2020 to $554 million in 2021, due to disruption in business during the period as a result of no movement days, while cost rose from $400 million to $424 million leaving profit after tax at $59 million from $136 million in 2020. Earnings per share ended September at 10.5 cents and that should climb sharply in the second half with the impact of the high volume Christmas period having a positive impact. The company has cash funds of $1.7 billion at the end of the period as they curtailed lending.

Lasco Manufacturing – Earnings per share is projected at 60 cents for the year March 2023. For the half year to September, revenues rose 13 percent over the $4.1 billion generated in 2020 to $4.65 billion and profit popped 6 percent to $782 million, but the second quarter saw profit falling 3.8 percent to $380 million from revenues that increased 2.7 percent to $2.34 billion. Earnings per share came in at 19 cents for the half year on target for around 40-45 cents for the full year as margins increase based on price adjustments.

Cash on hand stood at $1.8 billion with borrowings at $600 million.

General Accident – Earnings per share are projected at 80 cents for the year.

General Accident spreading wings

Net profit after tax of $351 million, was generated for the nine months to September up from $125 million in 2020, with earnings per share of 39 cents versus 14 cents in 2020. Profit in the third quarter was $177 million compared to just $12 million in 2020. Earnings per share in the September quarter was 19 cents.

The company is in an expansion mode, with the establishment of operations in Barbados and Trinidad and Tobago, with both operations expected to break even in 2022. Higher interest rates locally and the ability to increase investment in higher yielding assets are measures expected to boost investment income in 2022.

Jetcon Corporation – Earnings per share is projected at 15 cents for the year but don’t be surprised if it ends as high as 25 cents, depending on how rapid sales increase becomes. On a recovery path from the pandemic slump in 2020, revenues to September 2021 were up 30 percent but and should end the year above that level based on what the company reported in the third quarter, that sales for the fourth quarter are strong, with units sold in November back at regular pre-pandemic levels and already exceeded sales for the third quarter, at $196 million with the upward swing continuing into December, and with increased bookings to date. The improved sales position in the final quarter should result in an increased gross profit margin and a better net position than in 2020.

The above developments augur well for 2022 that should see revenues climbing appreciably again, with growth of 50 percent not out of the picture. If that were to happen it could lift profit margins closer to 20 percent from much lower levels in 2020 and 2021.

Bonus Pick

Honey Bun is our bonus pick for the year. Earnings per share are projected at $1 for the year to September 2022, as revenues continue to climb at a healthy pace. Earnings may be too low for it to qualify for the TOP15, but the stock could double from its current price of $9.30 per share during the year.

- « Previous Page

- 1

- …

- 56

- 57

- 58

- 59

- 60

- …

- 187

- Next Page »