The Main Market of the Jamaica Stock Exchange closed trading on Wednesday with a significant surge in the value of stocks crossing through the market and a sharp rise in the market index as investors exchanged an increased volume of shares.

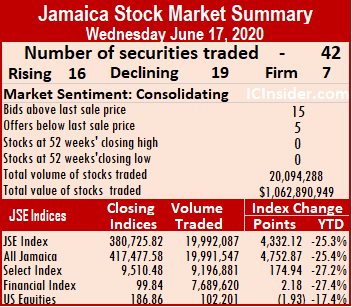

At the close, the JSE All Jamaican Composite Index advanced by 4,752.87 points to 417,477.58, the JSE Market Index climbed 4,332.12 points to 380,725.82 and the JSE Financial Index gained 2.18 points to 99.84. The PE ratio of the market ended at 14.7, with the Main Market ending at 15.0 times ICInsider.com projected 2020-21 earnings.

At the close, the JSE All Jamaican Composite Index advanced by 4,752.87 points to 417,477.58, the JSE Market Index climbed 4,332.12 points to 380,725.82 and the JSE Financial Index gained 2.18 points to 99.84. The PE ratio of the market ended at 14.7, with the Main Market ending at 15.0 times ICInsider.com projected 2020-21 earnings.

The market closed with 42 securities changing hands in the Main and US dollar markets with prices of 16 stocks advancing, 19 declining and seven securities trading firm. The JSE Main Market activity ended with 37 securities accounting for 19,992,087 units valued at $1,058,928,831, in contrast to 16,817,335 units valued at $94,091,208 from 40 securities on Tuesday.

NCB Financial Group led trading with 7 million shares for 35 percent of total volume followed by Sagicor Select Financial Fund with 5.95 million units for 30 percent of the day’s trade and Trans Jamaican Highway with 2.06 million units for 10.3 percent market share.

The securities trading on Tuesday resulted in an average of 540,327 units for $28,619,698, in contrast to 420,433 units at an average of $2,352,280 at the close, Tuesday. The average volume and value for the month to date amount to 418,319 units at $6,613,270, compared to 409,897 units with an average of $4,965,016 on Tuesday. Trading in May resulted in an average of 475,543 units valued at $3,077,280 for each security.

The securities trading on Tuesday resulted in an average of 540,327 units for $28,619,698, in contrast to 420,433 units at an average of $2,352,280 at the close, Tuesday. The average volume and value for the month to date amount to 418,319 units at $6,613,270, compared to 409,897 units with an average of $4,965,016 on Tuesday. Trading in May resulted in an average of 475,543 units valued at $3,077,280 for each security.

IC bid-offer Indicator│ At the end of trading, the Investor’s Choice bid-offer indicator reading shows fifteen stocks ending with bids higher than their last selling prices and five stocks closing with lower offers.

In the Main Market, Barita Investments gave up $1 and closed at $49 after trading 5,985 units, Berger Paints gained 40 cents, transferring 22,661 stock units to end at $12.44, Caribbean Cement closed $1.37 lower at $49.60, with 2,717 units changing hands. Eppley Caribbean Property Fund added 59 cents in swapping 540 units to end at $41.10, First Rock Capital fell $1.64 to $14.11, trading 4,097 units, Grace Kennedy shed 49 cents exchanging 24,545 stock units and closed at $57.50.  Jamaica Broilers lost $1.40 and ended at $26.60, after transferring 43,707 shares, Jamaica Stock Exchange picked up 40 cents in with 3,890 units changing hands and closed at $23.40, JMMB Group finished at $33.15, with a loss of 37 cents after exchanging 31,008 shares. Kingston Wharves fell $4 to $53, with 18,686 stock units crossing the exchange, Mayberry Jamaican Investments closed at $9.50, after shedding 50 cents transferring 55,006 shares, Palace Amusement closed $100 higher at $1,800 trading 68 units. Sagicor Group gained $1.30 to settle at $46.30, with exchanging 6,596 units, Salada Foods closed $2.99 higher at $29.50, in swapping 2,208 units, Scotia Group climbed $2.50 to $46.50, with a transfer of 6,266 units and Seprod advanced by $2.99 to $52.99, in trading 22,244 stock units.

Jamaica Broilers lost $1.40 and ended at $26.60, after transferring 43,707 shares, Jamaica Stock Exchange picked up 40 cents in with 3,890 units changing hands and closed at $23.40, JMMB Group finished at $33.15, with a loss of 37 cents after exchanging 31,008 shares. Kingston Wharves fell $4 to $53, with 18,686 stock units crossing the exchange, Mayberry Jamaican Investments closed at $9.50, after shedding 50 cents transferring 55,006 shares, Palace Amusement closed $100 higher at $1,800 trading 68 units. Sagicor Group gained $1.30 to settle at $46.30, with exchanging 6,596 units, Salada Foods closed $2.99 higher at $29.50, in swapping 2,208 units, Scotia Group climbed $2.50 to $46.50, with a transfer of 6,266 units and Seprod advanced by $2.99 to $52.99, in trading 22,244 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

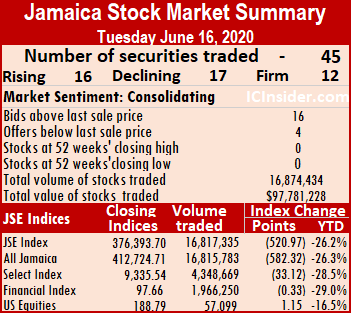

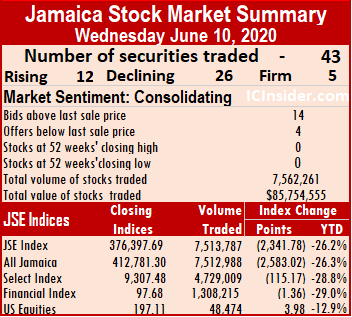

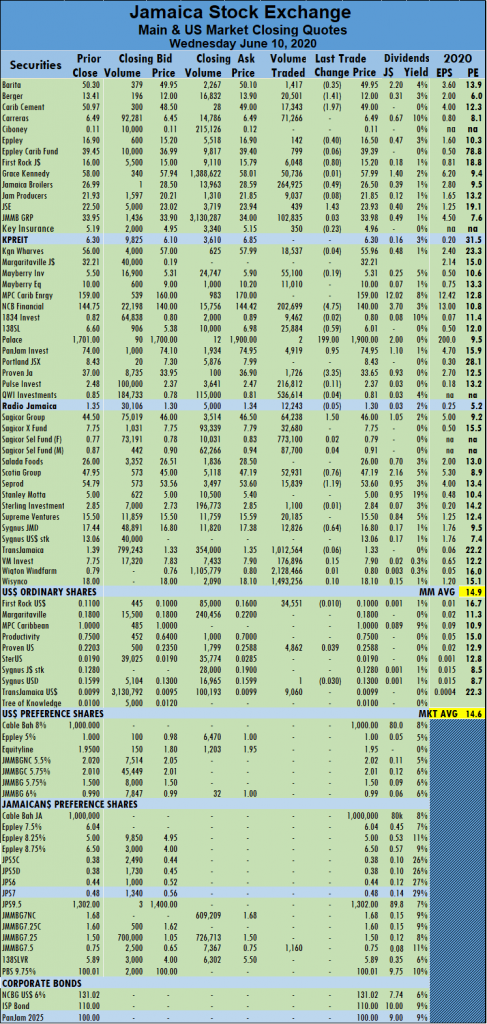

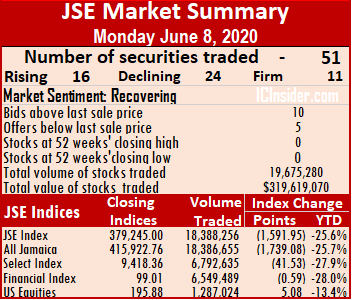

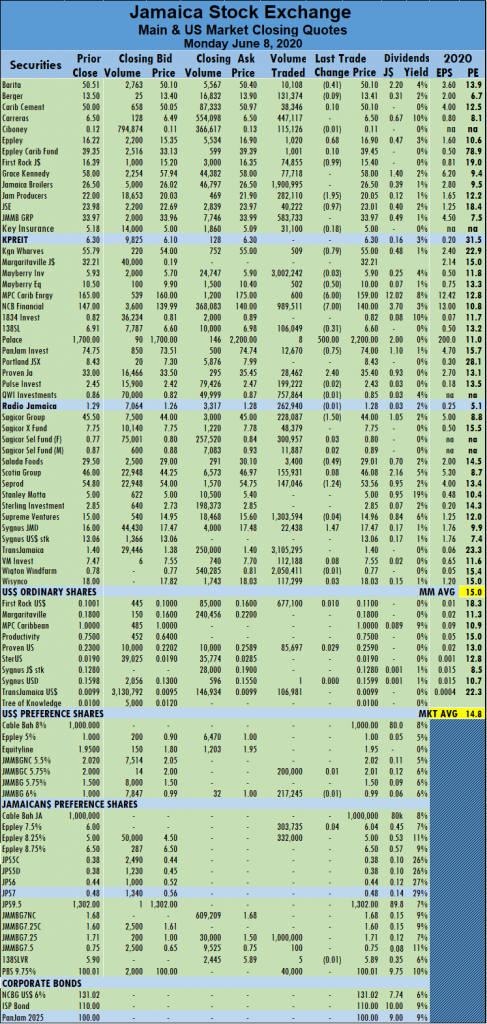

At the close, the JSE All Jamaican Composite Index declined by 582.32 points to 412,724.71, the JSE Market Index shed 520.97 points to 376,393.70 and the JSE Financial Index lost 0.33 points to 97.66. The PE ratio of the market ended at 14.7, while the Main Market ended at 15.0 times ICInsider.com projected 2020-21 earnings.

At the close, the JSE All Jamaican Composite Index declined by 582.32 points to 412,724.71, the JSE Market Index shed 520.97 points to 376,393.70 and the JSE Financial Index lost 0.33 points to 97.66. The PE ratio of the market ended at 14.7, while the Main Market ended at 15.0 times ICInsider.com projected 2020-21 earnings. The average volume for the month to date amounts to 409,897 units at $4,965,016 for each security changing hands, compared to 409,048 units with an average of $5,195,213. Trading in May resulted in an average of 475,543 units valued at $3,077,280 for each security.

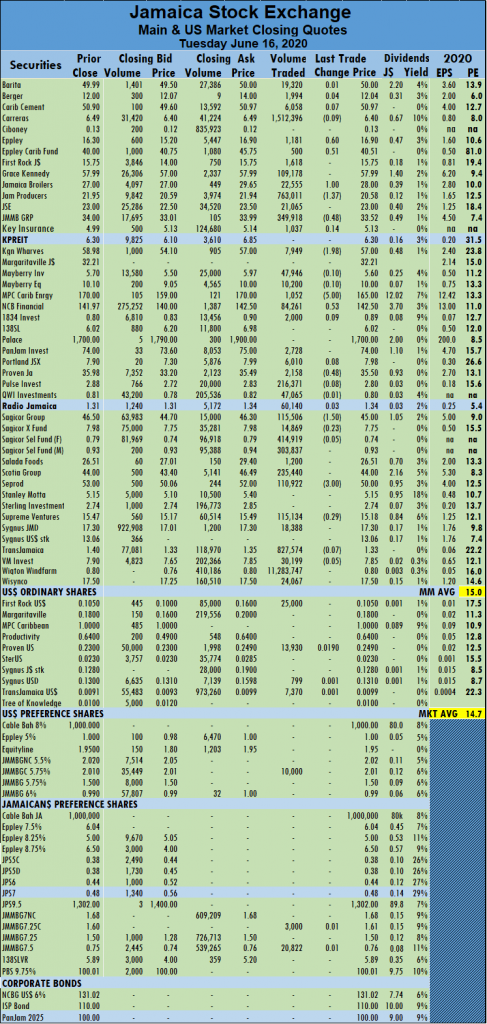

The average volume for the month to date amounts to 409,897 units at $4,965,016 for each security changing hands, compared to 409,048 units with an average of $5,195,213. Trading in May resulted in an average of 475,543 units valued at $3,077,280 for each security. JMMB Group shed 48 cents with 349,918 shares changing hands to end at $33.52, Kingston Wharves finished $1.98 lower at $57, with an exchange of 7,949 units. MPC Caribbean Clean Energy dropped $5 to close at $165, trading 1,052 units, NCB Financial Group gained 53 cents after swapping 84,261 shares to settle at $142.50, Proven Investments shed 48 cents to close at $35.50, with 2,158 units changing hands. Sagicor Group closed $1.50 lower after transferring 115,506 shares to end at $45 and Seprod dropped $3 to settle at $50 in trading 110,922 shares.

JMMB Group shed 48 cents with 349,918 shares changing hands to end at $33.52, Kingston Wharves finished $1.98 lower at $57, with an exchange of 7,949 units. MPC Caribbean Clean Energy dropped $5 to close at $165, trading 1,052 units, NCB Financial Group gained 53 cents after swapping 84,261 shares to settle at $142.50, Proven Investments shed 48 cents to close at $35.50, with 2,158 units changing hands. Sagicor Group closed $1.50 lower after transferring 115,506 shares to end at $45 and Seprod dropped $3 to settle at $50 in trading 110,922 shares. Securities trading on Monday, averaged 401,316 units at $1,930,884, in contrast to 576,109 units valued at an average of $4,671,864 on Friday. The average volume and value for the month to date amount to 409,048 units valued at $5,195,213 for each security changing hands, compared to 409,744 units with an average value of $5,519,274. Trading in May resulted in an average of 475,543 units valued at $3,077,280 for each security.

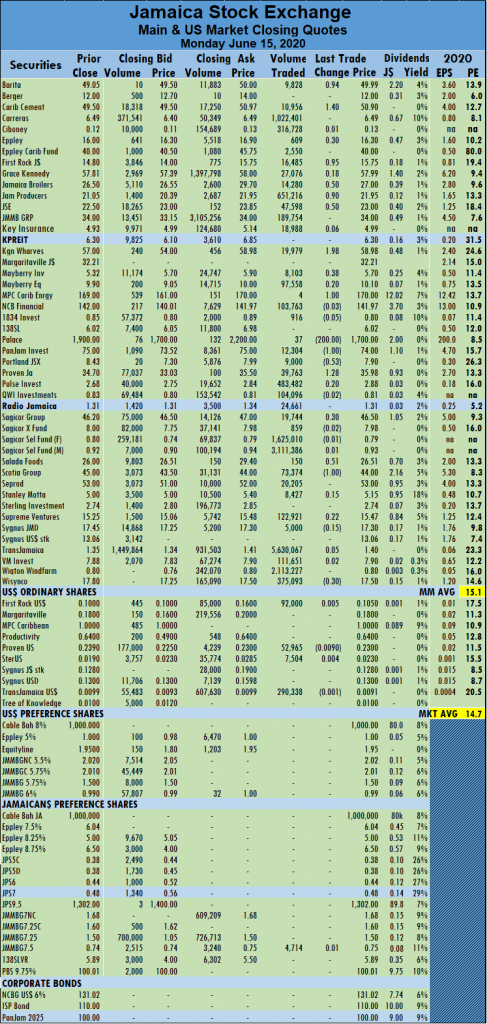

Securities trading on Monday, averaged 401,316 units at $1,930,884, in contrast to 576,109 units valued at an average of $4,671,864 on Friday. The average volume and value for the month to date amount to 409,048 units valued at $5,195,213 for each security changing hands, compared to 409,744 units with an average value of $5,519,274. Trading in May resulted in an average of 475,543 units valued at $3,077,280 for each security. Jamaica Stock Exchange rose 50 cents after transferring 47,598 stock units to settle at $23, Kingston Wharves climbed $1.98 to $58.98, in trading 19,979 units, Mayberry Investments closed at $5.70, with gains of 38 cents and 8,103 units changing hands. MPC Caribbean Clean Energy advanced $1 to $170, after exchanging just four units, Palace Amusement closed $200 lower at $1,700, with 37 units crossing the exchange, PanJam Investment dropped $1 trading 12,304 units to finish at $74. Portland JSX traded 9,000 units at 7.90, after losing 53 cents, Proven Investments advanced by $1.28 to $35.98, with 39,763 stock units changing hands, Sagicor Group closed 30 cents higher at $46.50 trading 19,744 units. Salada Foods gained 51 cents transferring 150 units to settle at $26.51, Scotia Group lost $1 to end at $44, in swapping 73,374 shares and Wisynco Group shed 30 cents transferring 375,093 shares and closed at $17.50.

Jamaica Stock Exchange rose 50 cents after transferring 47,598 stock units to settle at $23, Kingston Wharves climbed $1.98 to $58.98, in trading 19,979 units, Mayberry Investments closed at $5.70, with gains of 38 cents and 8,103 units changing hands. MPC Caribbean Clean Energy advanced $1 to $170, after exchanging just four units, Palace Amusement closed $200 lower at $1,700, with 37 units crossing the exchange, PanJam Investment dropped $1 trading 12,304 units to finish at $74. Portland JSX traded 9,000 units at 7.90, after losing 53 cents, Proven Investments advanced by $1.28 to $35.98, with 39,763 stock units changing hands, Sagicor Group closed 30 cents higher at $46.50 trading 19,744 units. Salada Foods gained 51 cents transferring 150 units to settle at $26.51, Scotia Group lost $1 to end at $44, in swapping 73,374 shares and Wisynco Group shed 30 cents transferring 375,093 shares and closed at $17.50. The market closed with 44 securities changing hands in the Main and US dollar markets with prices of 17 stocks advancing, 16 declining and 11 securities trading firm. The JSE Main Market activity ended with 41 securities accounting for 23,620,498 units valued at $191,546,437, in contrast to 10,464,179 units valued at $256,434,655 from 38 securities on Thursday.

The market closed with 44 securities changing hands in the Main and US dollar markets with prices of 17 stocks advancing, 16 declining and 11 securities trading firm. The JSE Main Market activity ended with 41 securities accounting for 23,620,498 units valued at $191,546,437, in contrast to 10,464,179 units valued at $256,434,655 from 38 securities on Thursday. Other stocks trading more than one million units are Carreras with 1.1 million units and Grace Kennedy with 1.6 million shares.

Other stocks trading more than one million units are Carreras with 1.1 million units and Grace Kennedy with 1.6 million shares. Caribbean Cement gained 30 cents swapping 38,277 stock units and closed at $49.50. Eppley Caribbean Property Fund ended at $40, with gains of 50 cents with 4,184 units changing hands, Jamaica Stock Exchange lost 52 cents and settled at $22.50, after trading 223,160 shares, MPC Caribbean Clean Energy declined by $1 to $169, with 550 units crossing the exchange. NCB Financial Group fell $1.59 to $142, having swapped 194,677 stock units, Proven Investments climbed $2.70 to $34.70, in transferring 41,066 shares, Sagicor Real Estate Fund closed $1 higher at $8 trading 206,150 shares. Scotia Group rose $1.80, exchanging 151,670 shares to end at $45 and Sygnus Credit Investments closed 45 cents higher at $17.45, after a swap of 6,818 units.

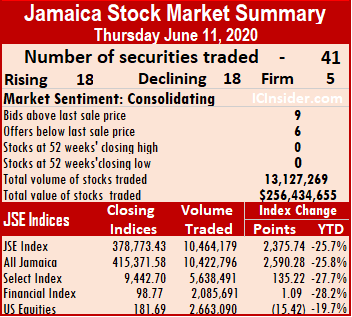

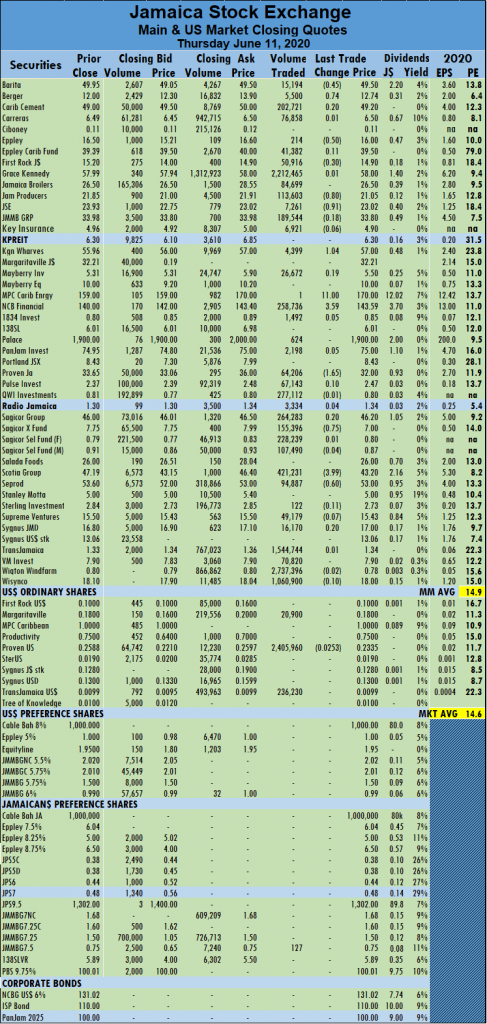

Caribbean Cement gained 30 cents swapping 38,277 stock units and closed at $49.50. Eppley Caribbean Property Fund ended at $40, with gains of 50 cents with 4,184 units changing hands, Jamaica Stock Exchange lost 52 cents and settled at $22.50, after trading 223,160 shares, MPC Caribbean Clean Energy declined by $1 to $169, with 550 units crossing the exchange. NCB Financial Group fell $1.59 to $142, having swapped 194,677 stock units, Proven Investments climbed $2.70 to $34.70, in transferring 41,066 shares, Sagicor Real Estate Fund closed $1 higher at $8 trading 206,150 shares. Scotia Group rose $1.80, exchanging 151,670 shares to end at $45 and Sygnus Credit Investments closed 45 cents higher at $17.45, after a swap of 6,818 units. At the close, the JSE All Jamaican Composite Index climbed 2,590.28 points to 415,371.58, the JSE Market Index gained 2,375.74 points to 378,773.43 and the JSE Financial Index gained 1.09 points to 98.77. The PE ratio of the market ended at 14.6, with the Main Market ending at 14.9 times IC Insider.com projected 2020-21 earnings.

At the close, the JSE All Jamaican Composite Index climbed 2,590.28 points to 415,371.58, the JSE Market Index gained 2,375.74 points to 378,773.43 and the JSE Financial Index gained 1.09 points to 98.77. The PE ratio of the market ended at 14.6, with the Main Market ending at 14.9 times IC Insider.com projected 2020-21 earnings. The average security trading on Thursday amounted to 275,373 units at $6,748,280, in contrast to 192,661 units valued at an average of $2,181,619 on Wednesday. The average volume and value for the month to date amount to 393,268 units valued at $5,612,672 for each security changing hands, compared to 405,183 units with an average of $5,483,471. Trading in May resulted in an average of 475,543 units valued at $3,077,280 for each security.

The average security trading on Thursday amounted to 275,373 units at $6,748,280, in contrast to 192,661 units valued at an average of $2,181,619 on Wednesday. The average volume and value for the month to date amount to 393,268 units valued at $5,612,672 for each security changing hands, compared to 405,183 units with an average of $5,483,471. Trading in May resulted in an average of 475,543 units valued at $3,077,280 for each security. Jamaica Producers lost 80 cents closing at $21.05, after swapping 113,603 units, Jamaica Stock Exchange fell 91 cents to $23.02, with an exchange of 7,261 units, Kingston Wharves closed rose $1.04 to $57, after 4,399 units changed hands. MPC Caribbean Clean Energy climbed $11 trading just one stock unit at $170, NCB Financial Group rose $3.59 to close at $143.59, with 258,736 shares crossing the exchange, Proven Investments declined by $1.65 to $32, in exchanging 64,206 stock units. Sagicor Real Estate Fund lost 75 cents and closed at $7, after transferring 155,396 shares, Scotia Group dropped $3.99 to finish at $43.20, after trading 421,231 shares and Seprod fell 60 cents to $53, in transferring 94,887 shares.

Jamaica Producers lost 80 cents closing at $21.05, after swapping 113,603 units, Jamaica Stock Exchange fell 91 cents to $23.02, with an exchange of 7,261 units, Kingston Wharves closed rose $1.04 to $57, after 4,399 units changed hands. MPC Caribbean Clean Energy climbed $11 trading just one stock unit at $170, NCB Financial Group rose $3.59 to close at $143.59, with 258,736 shares crossing the exchange, Proven Investments declined by $1.65 to $32, in exchanging 64,206 stock units. Sagicor Real Estate Fund lost 75 cents and closed at $7, after transferring 155,396 shares, Scotia Group dropped $3.99 to finish at $43.20, after trading 421,231 shares and Seprod fell 60 cents to $53, in transferring 94,887 shares. Trading in May resulted in an average of 475,543 units valued at $3,077,280 for each security.

Trading in May resulted in an average of 475,543 units valued at $3,077,280 for each security. 138 Student Living closed at $6.01, after losing 59 cents trading 25,884 stock units. Palace Amusement gained $199 in swapping two stock units and closed at $1,900, Pan Jam Investment ended at $74.95, with gains of 95 cents after transferring 4,919 units, Proven Investments declined by $3.35 to end at $33.65, in exchanging 1,726 units. Sagicor Group added $1.50 to end at $46, with 64,238 stock units changing hands, Scotia Group shed 76 cents to finish at $47.19, after trading 52,931 stock units, Seprod fell by $1.19 to $53.60, in transferring 15,839 units and Sygnus Credit Investments ended the day at $16.80, with a loss of 64 cents in exchanging 12,826 units.

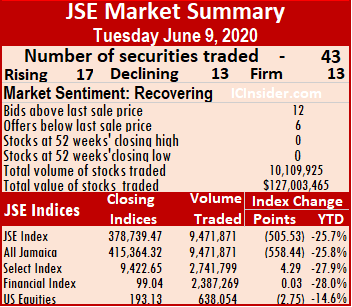

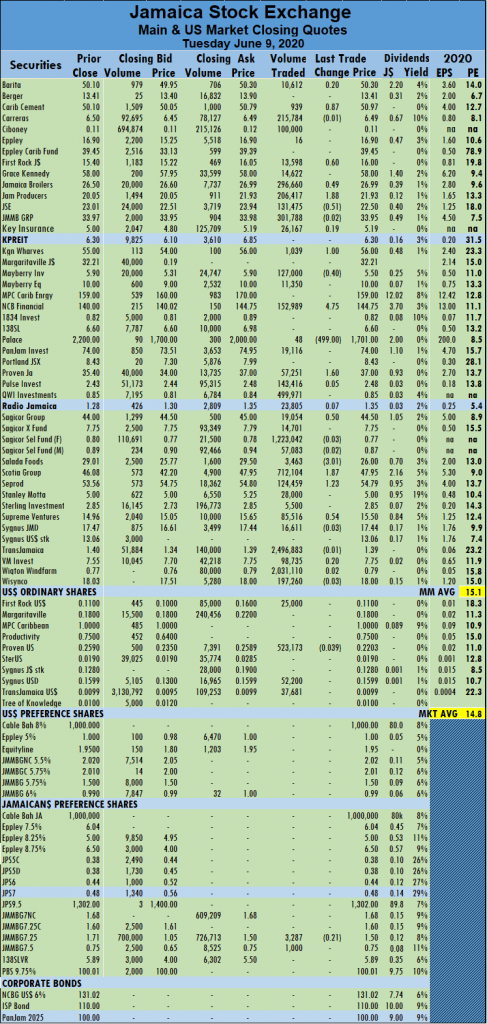

138 Student Living closed at $6.01, after losing 59 cents trading 25,884 stock units. Palace Amusement gained $199 in swapping two stock units and closed at $1,900, Pan Jam Investment ended at $74.95, with gains of 95 cents after transferring 4,919 units, Proven Investments declined by $3.35 to end at $33.65, in exchanging 1,726 units. Sagicor Group added $1.50 to end at $46, with 64,238 stock units changing hands, Scotia Group shed 76 cents to finish at $47.19, after trading 52,931 stock units, Seprod fell by $1.19 to $53.60, in transferring 15,839 units and Sygnus Credit Investments ended the day at $16.80, with a loss of 64 cents in exchanging 12,826 units. At the close of trading, the JSE All Jamaican Composite Index fell by 558.44 points to 415,364.32, the JSE Market Index shed 505.53 points to 378,739.47 and the JSE Financial Index gained 0.03 points to end at 99.04. The PE ratio of the market ended at 14.8, while the Main Market ended at 15.1 times 2020-21 earnings.

At the close of trading, the JSE All Jamaican Composite Index fell by 558.44 points to 415,364.32, the JSE Market Index shed 505.53 points to 378,739.47 and the JSE Financial Index gained 0.03 points to end at 99.04. The PE ratio of the market ended at 14.8, while the Main Market ended at 15.1 times 2020-21 earnings. The average security trading on Thursday amounted to 242,868 units valued at $2,794,626, in contrast to 408,628 units valued at an average of $7,102,646 on Monday. The average volume and value for the month to date amount to 429,778 units valued at $5,919,987 for each security changing hands, compared to 454,239 units with an average value of $6,396,116. Trading in May resulted in an average of 475,543 units valued at $3,077,280 for each security.

The average security trading on Thursday amounted to 242,868 units valued at $2,794,626, in contrast to 408,628 units valued at an average of $7,102,646 on Monday. The average volume and value for the month to date amount to 429,778 units valued at $5,919,987 for each security changing hands, compared to 454,239 units with an average value of $6,396,116. Trading in May resulted in an average of 475,543 units valued at $3,077,280 for each security. Mayberry Investments lost 40 cents to close at $5.50, with the transfer of 127,000 shares, NCB Financial Group advanced by $4.75 to $144.75, with 152,989 stock units changing hands, Palace Amusement ended $499 lower at $1,701 with 48 units crossing the exchange. Proven Investments added $1.60 trading 57,251 stock units and closed at $37, Sagicor Group gained 50 cents to end at $44.50, in transferring 19,054 units, Salada Foods dived $3.01 after exchanging 3,463 stock units to settle at $26. Scotia Group closed $1.87 higher at $47.95, with 712,104 shares crossing the market, Seprod advanced $1.23 to $54.79, with 124,459 shares changing hands and Supreme Ventures ended at $15.50, after gaining 54 cents in trading 85,516 stock units.

Mayberry Investments lost 40 cents to close at $5.50, with the transfer of 127,000 shares, NCB Financial Group advanced by $4.75 to $144.75, with 152,989 stock units changing hands, Palace Amusement ended $499 lower at $1,701 with 48 units crossing the exchange. Proven Investments added $1.60 trading 57,251 stock units and closed at $37, Sagicor Group gained 50 cents to end at $44.50, in transferring 19,054 units, Salada Foods dived $3.01 after exchanging 3,463 stock units to settle at $26. Scotia Group closed $1.87 higher at $47.95, with 712,104 shares crossing the market, Seprod advanced $1.23 to $54.79, with 124,459 shares changing hands and Supreme Ventures ended at $15.50, after gaining 54 cents in trading 85,516 stock units. The average security trading on Monday amounted to 408,628 units at $7,102,646, in contrast to 367,026 units valued at an average of $2,824,785 on Friday. The average volume and value for the month to date amount to 454,239 units valued at $6,396,116 for each security changing hands, compared to 462,352 units with an average of $6,245,434. Trading in May resulted in an average of 475,543 units valued at $3,077,280 for each security.

The average security trading on Monday amounted to 408,628 units at $7,102,646, in contrast to 367,026 units valued at an average of $2,824,785 on Friday. The average volume and value for the month to date amount to 454,239 units valued at $6,396,116 for each security changing hands, compared to 462,352 units with an average of $6,245,434. Trading in May resulted in an average of 475,543 units valued at $3,077,280 for each security. MPC Caribbean Clean Energy dropped $6 to close at $159, with 600 units crossing the exchange, NCB Financial Group sustained a loss of $7 trading 989,511 shares to finish at $140. 138 Student Living lost 31 cents to settle at $6.60, with 106,049 shares changing hands, Palace Amusement jumped $500 to reach $2,200 after a mere eight units traded, PanJam Investment closed 75 cents lower to $74, in exchanging 12,670 units. Proven Investments advanced by $2.40 to $35.40 after transferring 28,462 units, Sagicor Group fell $1.50 to $44 trading 228,087 shares, Salada Foods shed 49 cents to end at $29.01, after swapping 3,400 units. Seprod declined $1.24 in transferring $147,046 shares and closed at $53.56 and Sygnus Credit Investments ended the day at $17.47, with gains of $1.47 trading 22,438 units.

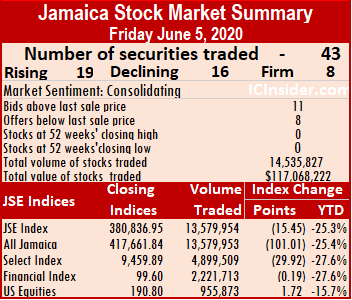

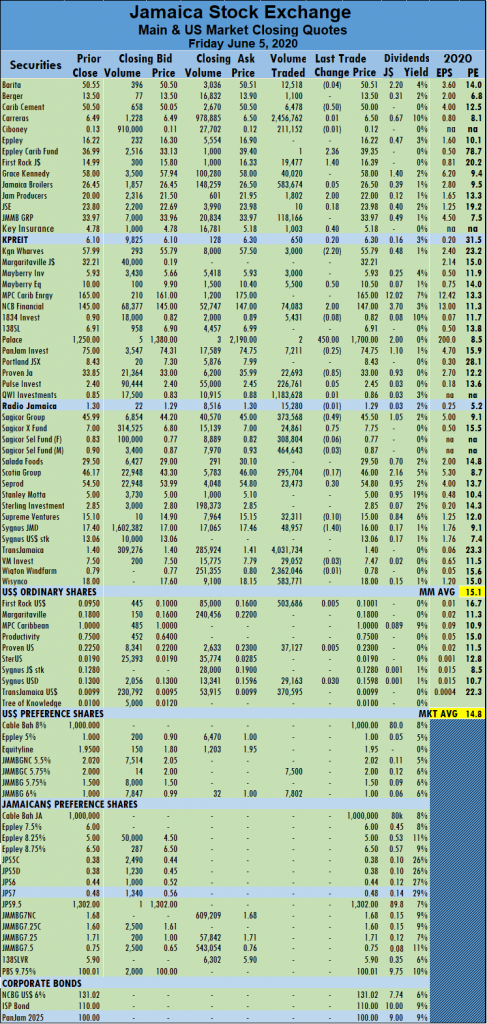

MPC Caribbean Clean Energy dropped $6 to close at $159, with 600 units crossing the exchange, NCB Financial Group sustained a loss of $7 trading 989,511 shares to finish at $140. 138 Student Living lost 31 cents to settle at $6.60, with 106,049 shares changing hands, Palace Amusement jumped $500 to reach $2,200 after a mere eight units traded, PanJam Investment closed 75 cents lower to $74, in exchanging 12,670 units. Proven Investments advanced by $2.40 to $35.40 after transferring 28,462 units, Sagicor Group fell $1.50 to $44 trading 228,087 shares, Salada Foods shed 49 cents to end at $29.01, after swapping 3,400 units. Seprod declined $1.24 in transferring $147,046 shares and closed at $53.56 and Sygnus Credit Investments ended the day at $17.47, with gains of $1.47 trading 22,438 units. At the close, the JSE All Jamaican Composite Index declined by 101.01 points to 417,661.84, the JSE Market Index shed 15.45 points to 380,836.95 and the JSE Financial Index lost 0.19 points to 99.60. The PE ratio of the market ended at 14.8, while the Main Market ended at 15.1 times 2020-21 earnings.

At the close, the JSE All Jamaican Composite Index declined by 101.01 points to 417,661.84, the JSE Market Index shed 15.45 points to 380,836.95 and the JSE Financial Index lost 0.19 points to 99.60. The PE ratio of the market ended at 14.8, while the Main Market ended at 15.1 times 2020-21 earnings. The average security trading on Friday amounted to 367,026 units valued at $2,824,785, in contrast to 211,895 units at an average of $923,118 on Thursday. The average volume and value for the month to date amount to 462,352 units valued at $6,245,434 for each security changing hands, compared to 594,225 units with an average of $6,972,813. Trading in May resulted in an average of 475,543 units valued at $3,077,280 for each security.

The average security trading on Friday amounted to 367,026 units valued at $2,824,785, in contrast to 211,895 units at an average of $923,118 on Thursday. The average volume and value for the month to date amount to 462,352 units valued at $6,245,434 for each security changing hands, compared to 594,225 units with an average of $6,972,813. Trading in May resulted in an average of 475,543 units valued at $3,077,280 for each security. Kingston Wharves fell $2.20 to $55.79, with 3,000 units crossing the market. Mayberry Jamaican Investments gained 50 cents transferring 5,500 units in settling at $10.50, NCB Financial Group closed $2 higher at $147, with 74,083 shares crossing the exchange, Palace Amusement jumped $450 to $1,700, after exchanging only 2 stock units. Proven Investments shed 85 cents to end at $33, in swapping 22,693 units, Sagicor Group lost 49 cents trading 373,568 shares and closed at $45.50, Sagicor Real Estate Fund gained 75 cents in transferring 24,861 units in settling at $7.75. Seprod closed 30 cents higher at $54.80, with 23,473 units changing hands and Sygnus Credit Investments ended at $16, with a loss of $1.40 after trading 48,957 units.

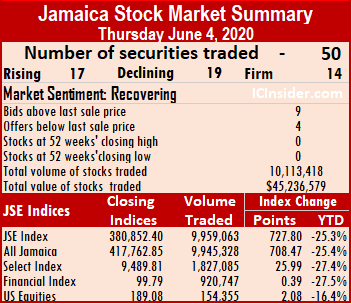

Kingston Wharves fell $2.20 to $55.79, with 3,000 units crossing the market. Mayberry Jamaican Investments gained 50 cents transferring 5,500 units in settling at $10.50, NCB Financial Group closed $2 higher at $147, with 74,083 shares crossing the exchange, Palace Amusement jumped $450 to $1,700, after exchanging only 2 stock units. Proven Investments shed 85 cents to end at $33, in swapping 22,693 units, Sagicor Group lost 49 cents trading 373,568 shares and closed at $45.50, Sagicor Real Estate Fund gained 75 cents in transferring 24,861 units in settling at $7.75. Seprod closed 30 cents higher at $54.80, with 23,473 units changing hands and Sygnus Credit Investments ended at $16, with a loss of $1.40 after trading 48,957 units. At the close, the JSE All Jamaican Composite Index gained 708.47 points to 417,762.85, the JSE Market Index advanced by 727.80 points to 380,852.40 and the JSE Financial Index rose 0.39 points to 99.79. The PE ratio of the market ended at 14.5, while the Main Market ended at 14.9 times 2020-21 earnings.

At the close, the JSE All Jamaican Composite Index gained 708.47 points to 417,762.85, the JSE Market Index advanced by 727.80 points to 380,852.40 and the JSE Financial Index rose 0.39 points to 99.79. The PE ratio of the market ended at 14.5, while the Main Market ended at 14.9 times 2020-21 earnings. IC bid-offer Indicator│ At the end of trading, the Investor’s Choice bid-offer indicator reading shows nine stocks ending with bids higher than their last selling prices and four stocks closing with lower offers.

IC bid-offer Indicator│ At the end of trading, the Investor’s Choice bid-offer indicator reading shows nine stocks ending with bids higher than their last selling prices and four stocks closing with lower offers. MPC Caribbean Clean Energy advanced $4 to $165, in transferring 60 units. NCB Financial Group climbed $5 to $145 trading 67,678 shares, Palace Amusement rose $50 to end at $1,250, after swapping 67 units, Proven Investments closed 85 cents higher exchanging 26,185 stock units to end at $33.85. Sagicor Real Estate Fund lost 50 cents trading 24,533 units to finish at $7, Salada Foods gained 96 cents and closed at $29.50, with 398 units changing hands, Scotia Group settled at $46.17, with a loss of 31 cents in exchanging 25,904 stock units. Seprod closed 30 cents lower at $54.50 after transferring 20,808 stock units and Wisynco Group ended with a loss 44 cents trading 184,883 shares at $18.

MPC Caribbean Clean Energy advanced $4 to $165, in transferring 60 units. NCB Financial Group climbed $5 to $145 trading 67,678 shares, Palace Amusement rose $50 to end at $1,250, after swapping 67 units, Proven Investments closed 85 cents higher exchanging 26,185 stock units to end at $33.85. Sagicor Real Estate Fund lost 50 cents trading 24,533 units to finish at $7, Salada Foods gained 96 cents and closed at $29.50, with 398 units changing hands, Scotia Group settled at $46.17, with a loss of 31 cents in exchanging 25,904 stock units. Seprod closed 30 cents lower at $54.50 after transferring 20,808 stock units and Wisynco Group ended with a loss 44 cents trading 184,883 shares at $18.