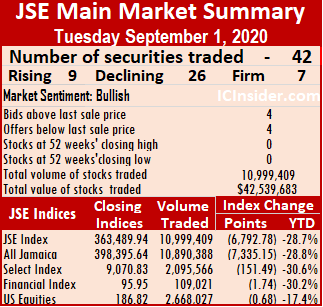

The Jamaica Stock Exchange Main Market suffered a sharp fall at the close of trading on Tuesday with just a few stocks rising compared that that fell on a day there were 54 percent fewer shares changing hands than on Monday.

At the close, the All Jamaican Composite Index dropped 7,335.15 points to 398,395.64, the Main Index declined by 6,792.78 points to 363,489.94 and the JSE Financial Index shed 1.74 points to close at 95.95.

At the close, the All Jamaican Composite Index dropped 7,335.15 points to 398,395.64, the Main Index declined by 6,792.78 points to 363,489.94 and the JSE Financial Index shed 1.74 points to close at 95.95.

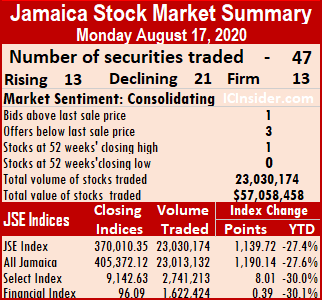

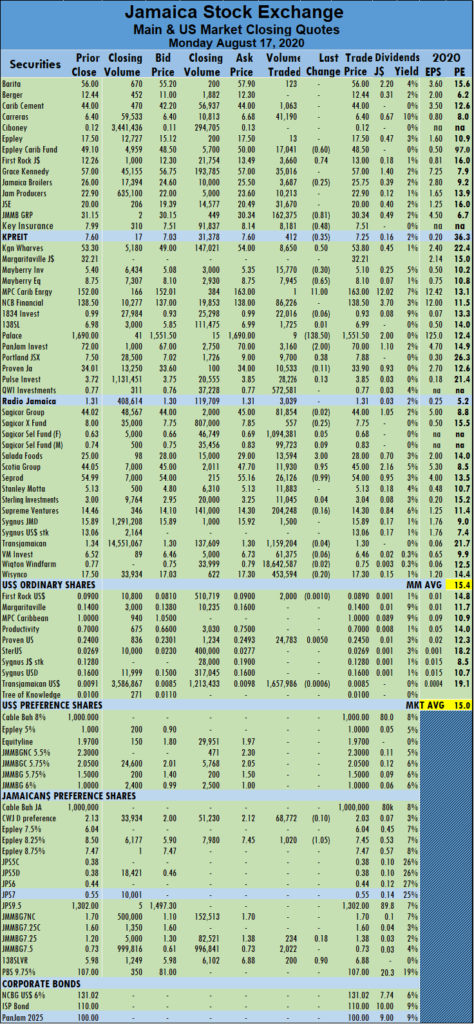

Trading ended with 42 securities changing hands compared to 38 on Monday, with the prices of nine stocks rising, 26 declining and seven remaining unchanged. The average PE Ratio of the market ended at 15 based on IC Insider.com forecast of 2020-21 earnings.

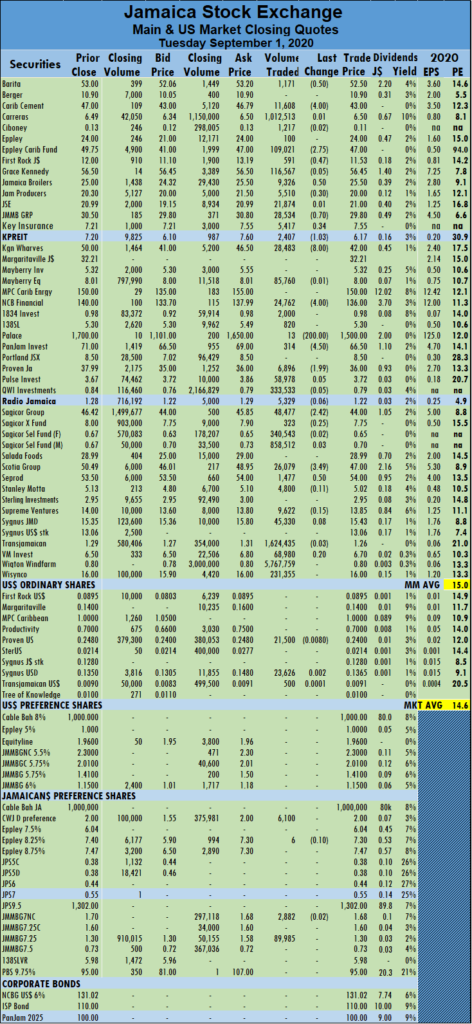

The market closed with an exchange of 10,999,409 shares for $42,539,683 compared to 24,003,466 units at $161,278,819 on Monday. Wigton Windfarm led trading with 5.77 million shares for 52.4 percent of total volume, followed by Transjamaican Highway with 1.62 million units for 14.8 percent of the day’s trade and Carreras with 1.01 million units for 9.2 percent market share.

Trading ended with an average of 261,891 units changing hands at $1,012,850 for each security, in comparison to an average of 631,670 shares at $4,244,179 on Monday.  Trading in August averaged 497,441 units at $3,201,918.

Trading in August averaged 497,441 units at $3,201,918.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading for the market shows four stocks ending with bids higher than their last selling prices and four with lower offers.

At the close of the market, Barita Investments lost 50 cents, trading 1,171 shares in closing at $52.50, Caribbean Cement dropped $4 to $43, in exchanging 11,608 stock units, Eppley Caribbean Property Fund fell $2.75 to $47, with 109,021 shares clearing the market. First Rock Capital ended 47 cents lower at $11.53, in transferring 591 units, Jamaica Broilers Group gained 50 cents to settle at $25.50 after exchanging 9,326 stock units, Jamaica Producers Group lost 30 cents to end at $20 as investors swapped 5,510 stock units. JMMB Group closed at $29.80, after falling 70 cents with 28,534 stock units passing through the market,  Key Insurance gained 34 cents, to close at $7.55 with an exchange of 5,417 stock units, Kingston Properties fell by $1.03 to $6.17, with 2,407 units changing hands. Kingston Wharves dropped $8 after trading 28,483 stock units to close at $42, NCB Financial Group declined by $4 to $136, after exchanging 24,762 stocks, Palace Amusement fell $200 to end at $1,500, with a transfer of 13 units. PanJam Investment fell $4.50 to $66.50 while trading 314 shares, Proven Investments shed $1.99 to close at $36 with an exchange of 6,896 stock units, Sagicor Group finished at $44, after losing $2.42 and the transferring of 48,477 shares. Scotia Group declined by $3.49 to settle at $47 in trading 26,079 stock units and Seprod gained 50 cents to end at $54, with 1,477 units changing hands.

Key Insurance gained 34 cents, to close at $7.55 with an exchange of 5,417 stock units, Kingston Properties fell by $1.03 to $6.17, with 2,407 units changing hands. Kingston Wharves dropped $8 after trading 28,483 stock units to close at $42, NCB Financial Group declined by $4 to $136, after exchanging 24,762 stocks, Palace Amusement fell $200 to end at $1,500, with a transfer of 13 units. PanJam Investment fell $4.50 to $66.50 while trading 314 shares, Proven Investments shed $1.99 to close at $36 with an exchange of 6,896 stock units, Sagicor Group finished at $44, after losing $2.42 and the transferring of 48,477 shares. Scotia Group declined by $3.49 to settle at $47 in trading 26,079 stock units and Seprod gained 50 cents to end at $54, with 1,477 units changing hands.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

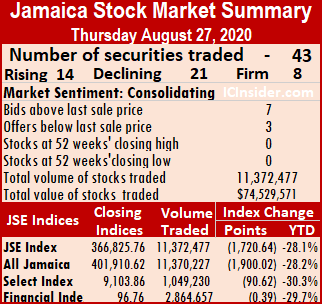

Trading month to date is well ahead of July with an average of 392,128 shares for $2,444,356.

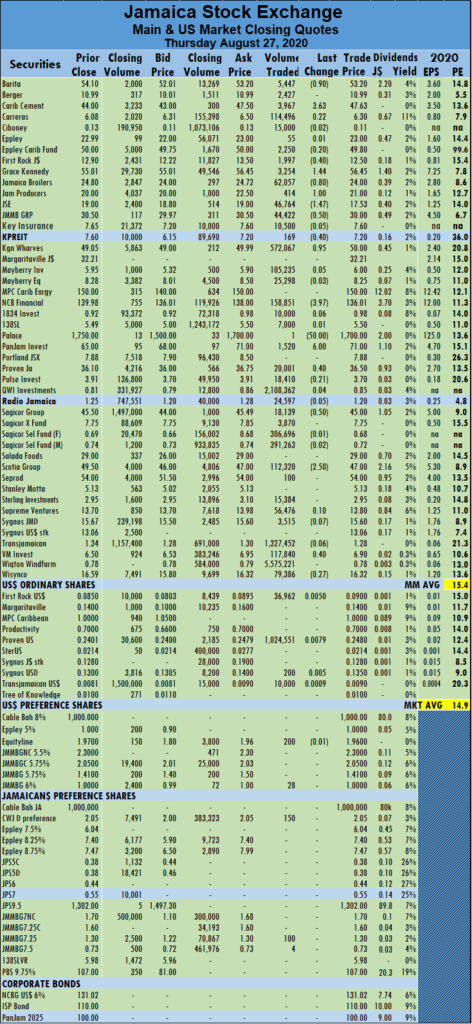

Trading month to date is well ahead of July with an average of 392,128 shares for $2,444,356. JMMB Group carved out a loss 50 cents to close at $30, with 44,422 stocks crossing the market, Kingston Properties shed 40 cents in closing at $7.20 with an exchange of 169 stock units. Kingston Wharves rose 95 cents to close at $50 in exchanging 572,067 stocks, NCB Financial Group dropped $3.97 to end at $136.01 after trading 158,851 shares, Palace Amusement dropped by $50 in closing at $1700 crossing the market one stocks. PanJam Investment gained $6 to end at $71 in trading 1,520 stocks, Proven Investments advanced 40 cents to $36.50 with investors swapping 20,001 stock units, Sagicor Group shed 50 cents to close at $45 after exchanging 18,139 units. Scotia Group dropped by $2.50 in ending at $47, with an exchange of 112,320 shares and Victoria Mutual Investments gained 40 cents and closed $6.90, with investors switching ownership of 117,840 units.

JMMB Group carved out a loss 50 cents to close at $30, with 44,422 stocks crossing the market, Kingston Properties shed 40 cents in closing at $7.20 with an exchange of 169 stock units. Kingston Wharves rose 95 cents to close at $50 in exchanging 572,067 stocks, NCB Financial Group dropped $3.97 to end at $136.01 after trading 158,851 shares, Palace Amusement dropped by $50 in closing at $1700 crossing the market one stocks. PanJam Investment gained $6 to end at $71 in trading 1,520 stocks, Proven Investments advanced 40 cents to $36.50 with investors swapping 20,001 stock units, Sagicor Group shed 50 cents to close at $45 after exchanging 18,139 units. Scotia Group dropped by $2.50 in ending at $47, with an exchange of 112,320 shares and Victoria Mutual Investments gained 40 cents and closed $6.90, with investors switching ownership of 117,840 units. At the close, the All Jamaican Composite Index increased 1,974.17 points to settle at 403,525.65, Main Index gained 1,787.12 points to close at 368,099.13 and the JSE Financial Index advanced by 0.67 points to finish at 96.52.

At the close, the All Jamaican Composite Index increased 1,974.17 points to settle at 403,525.65, Main Index gained 1,787.12 points to close at 368,099.13 and the JSE Financial Index advanced by 0.67 points to finish at 96.52. Trading for the day ended with an average of 229,432 units changing hands for the day at $1,207,987 for each security, in comparison to an average of 441,246 shares at $1,282,200 on Thursday. The average trade for the month to date ended at 460,700 units at $2,591,884, in contrast to 479,152 units at $2,702,302. Trading month to date compares adversely to July with an average of 392,128 shares for $2,444,356.

Trading for the day ended with an average of 229,432 units changing hands for the day at $1,207,987 for each security, in comparison to an average of 441,246 shares at $1,282,200 on Thursday. The average trade for the month to date ended at 460,700 units at $2,591,884, in contrast to 479,152 units at $2,702,302. Trading month to date compares adversely to July with an average of 392,128 shares for $2,444,356. Jamaica Stock Exchange fell 35 cents to settle at $20.14 with 3,815 stock units traded, JMMB Group advanced 60 cents to close at $31.30 with investors switching ownership of 38,865 units, Kingston Properties finished 40 cents higher at $7.60 with 250 stock units changing hands. Kingston Wharves declined by 90 cents to end at $49.10 with an exchange of 3,134 units, NCB Financial Group increased by $1 to close at $139, with 30,821 stocks traded, PanJam Investment climbed $3.50 to end at $68 with investors transferring 932 stock units. Proven Investments carved out a loss of $1.75 to finish at $34.10 with 40,514 stock units changing hands, Scotia Group climbed $1.75 to settle at $48 in the exchange of 27,903 stock units, Seprod dropped 50 cents to end at $54.50 with 5,874 stock units traded and Wisynco Group carved out a loss of 50 cents to close at $16.90 with 48,649 stock units crossing the exchange.

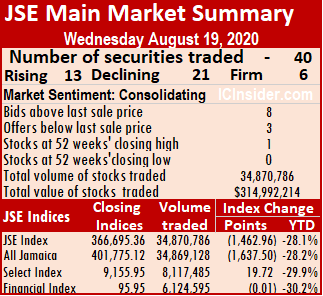

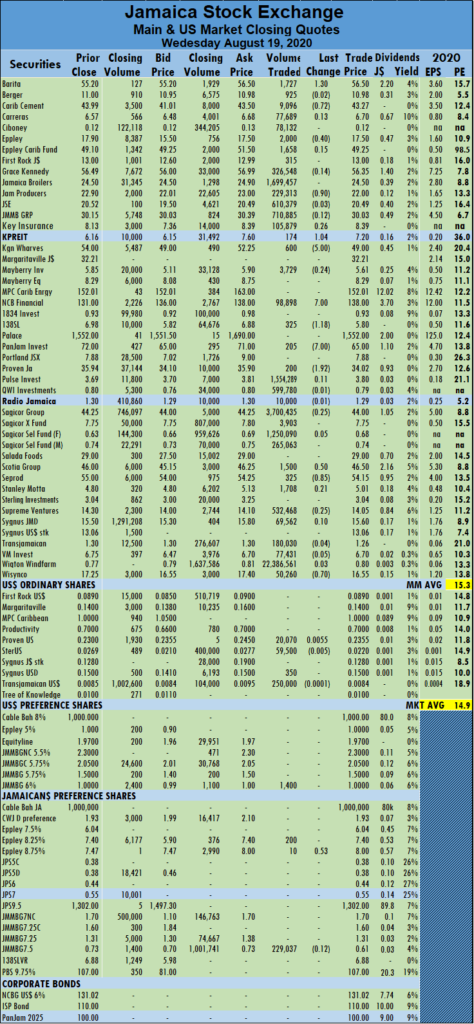

Jamaica Stock Exchange fell 35 cents to settle at $20.14 with 3,815 stock units traded, JMMB Group advanced 60 cents to close at $31.30 with investors switching ownership of 38,865 units, Kingston Properties finished 40 cents higher at $7.60 with 250 stock units changing hands. Kingston Wharves declined by 90 cents to end at $49.10 with an exchange of 3,134 units, NCB Financial Group increased by $1 to close at $139, with 30,821 stocks traded, PanJam Investment climbed $3.50 to end at $68 with investors transferring 932 stock units. Proven Investments carved out a loss of $1.75 to finish at $34.10 with 40,514 stock units changing hands, Scotia Group climbed $1.75 to settle at $48 in the exchange of 27,903 stock units, Seprod dropped 50 cents to end at $54.50 with 5,874 stock units traded and Wisynco Group carved out a loss of 50 cents to close at $16.90 with 48,649 stock units crossing the exchange. At the close, the All Jamaican Composite Index lost 1,637.5 points to settle at 401,775.12, the Main Index lost 1,462.96 points to end at 366,695.36, the JSE Financial Index shed 0.01 point to close at 95.95.

At the close, the All Jamaican Composite Index lost 1,637.5 points to settle at 401,775.12, the Main Index lost 1,462.96 points to end at 366,695.36, the JSE Financial Index shed 0.01 point to close at 95.95. Also trading over a million units are Pulse Investments with 1.55 million shares and Sagicor Select Financial Fund 1.25 million units.

Also trading over a million units are Pulse Investments with 1.55 million shares and Sagicor Select Financial Fund 1.25 million units. Kingston Properties gained $1.04 to end at $7.20 in an exchange of174 stocks, Kingston Wharves dropped by $5 to close at $49 changing hands 600 units, NCB Financial Group increased $7 to close at $138 after exchanging 98,898 shares. 138 Student Living declined by $1.18 ending at $5.80 after exchanging 325 units, PanJam Investment fell $7 in ending at $65 and exchanging 205 stock units, Proven Investments lost $1.92 to end at $34.02, with 200 stock units changing hands, Scotia Group increased 50 cents to settle at $46.50 with investors swapping 1,500 units. Seprod lost 85 cents to close at $54.15 with an exchange of 325 units and Wisynco Group dropped by 70 cents in closing at $16.55 after exchanging 50,260 stock units.

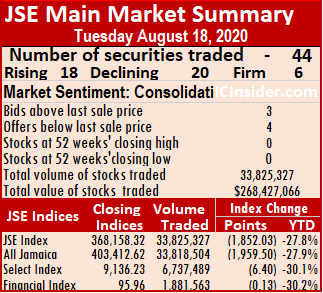

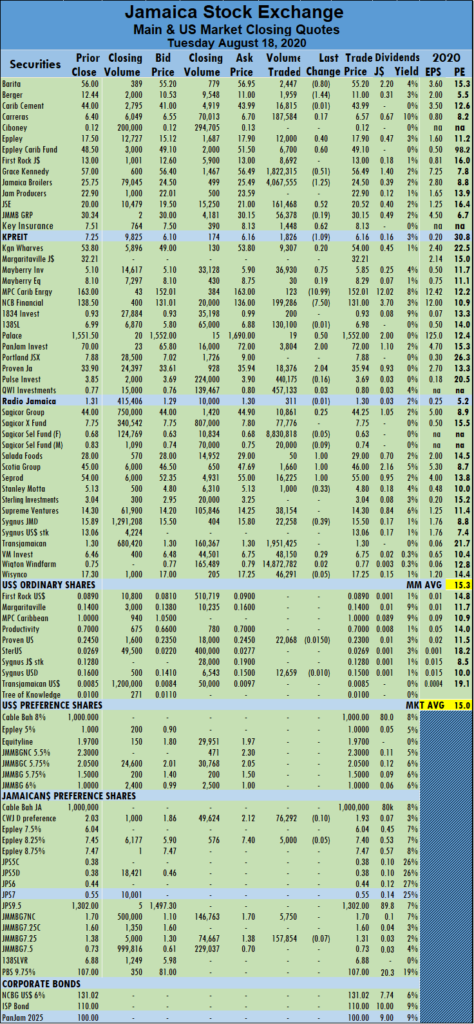

Kingston Properties gained $1.04 to end at $7.20 in an exchange of174 stocks, Kingston Wharves dropped by $5 to close at $49 changing hands 600 units, NCB Financial Group increased $7 to close at $138 after exchanging 98,898 shares. 138 Student Living declined by $1.18 ending at $5.80 after exchanging 325 units, PanJam Investment fell $7 in ending at $65 and exchanging 205 stock units, Proven Investments lost $1.92 to end at $34.02, with 200 stock units changing hands, Scotia Group increased 50 cents to settle at $46.50 with investors swapping 1,500 units. Seprod lost 85 cents to close at $54.15 with an exchange of 325 units and Wisynco Group dropped by 70 cents in closing at $16.55 after exchanging 50,260 stock units. At the close, the All Jamaican Composite Index lost 1,959.50 points to settle at 403,412.62, the Main Index shed 1,852.03 points to close at 368,158.32 and the JSE Financial Index dipped 0.13 points to end at 95.96.

At the close, the All Jamaican Composite Index lost 1,959.50 points to settle at 403,412.62, the Main Index shed 1,852.03 points to close at 368,158.32 and the JSE Financial Index dipped 0.13 points to end at 95.96. Trading month to date compares well, with July that ended with an average of 392,128 shares for $2,444,356.

Trading month to date compares well, with July that ended with an average of 392,128 shares for $2,444,356. Mayberry Investments advanced by 75 cents in closing at $5.85, with 36,930 units passing through the market, MPC Caribbean Clean Energy lost $10.99 to close at $152.01 after exchanging 123 stock units, NCB Financial Group declined by $7.50 to close at $131 and finishing with 199,286 stock units crossing the exchange. Palace Amusement rose 50 cents to close at $1,552 after clearing the market with 19 units, PanJam Investment climbed $2 to close at $72 with investors swapping 3,804 stocks, Proven Investments rose $2.04 to close at $35.94 and finishing trading of 18,376 shares. Salada Foods carved out a gain of $1 to settle at $29 with investors swapping 50 units, Scotia Group rose $1 to end at $46, with 1,660 stock units changing hands, Seprod carved out a gain of $1 to settle at $55 in trading 16,225 stock units. Stanley Motta fell 33 cents in finishing at $4.80 trading 1,000 stocks and Sygnus Credit Investments lost 39 cents to end at $15.50, with 22,258 shares clearing the market.

Mayberry Investments advanced by 75 cents in closing at $5.85, with 36,930 units passing through the market, MPC Caribbean Clean Energy lost $10.99 to close at $152.01 after exchanging 123 stock units, NCB Financial Group declined by $7.50 to close at $131 and finishing with 199,286 stock units crossing the exchange. Palace Amusement rose 50 cents to close at $1,552 after clearing the market with 19 units, PanJam Investment climbed $2 to close at $72 with investors swapping 3,804 stocks, Proven Investments rose $2.04 to close at $35.94 and finishing trading of 18,376 shares. Salada Foods carved out a gain of $1 to settle at $29 with investors swapping 50 units, Scotia Group rose $1 to end at $46, with 1,660 stock units changing hands, Seprod carved out a gain of $1 to settle at $55 in trading 16,225 stock units. Stanley Motta fell 33 cents in finishing at $4.80 trading 1,000 stocks and Sygnus Credit Investments lost 39 cents to end at $15.50, with 22,258 shares clearing the market. IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading for the market shows one stock ended with the bid higher than the last selling price and three with lower offers.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading for the market shows one stock ended with the bid higher than the last selling price and three with lower offers. Mayberry Jamaican Equities lost 65 cents to end at $8.10 with an exchange of 7,945 shares, MPC Caribbean Clean Energy climbed $11 to $163 in trading just one share, Palace Amusement dropped $138.50 to $1,551.50, with nine units crossing the market. PanJam Investment lost $2 to end at $70 trading 3,160 units, Portland JSX advanced by 38 cents to close at $7.88 with an exchange of 9,700 stocks, Salada Foods rose $3 to $28 in trading 13,594 stock units. Scotia Group gained 95 cents in ending at $45 while exchanging 11,930 stock units and Seprod lost 99 cents to end at $54 and crossing the exchange with 26,126 stocks.

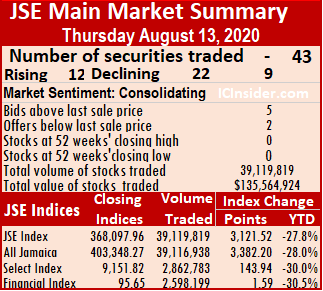

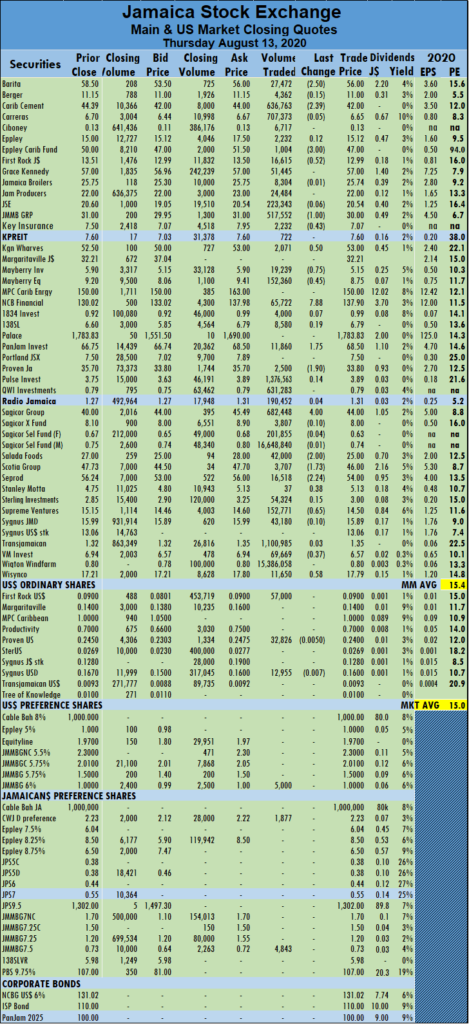

Mayberry Jamaican Equities lost 65 cents to end at $8.10 with an exchange of 7,945 shares, MPC Caribbean Clean Energy climbed $11 to $163 in trading just one share, Palace Amusement dropped $138.50 to $1,551.50, with nine units crossing the market. PanJam Investment lost $2 to end at $70 trading 3,160 units, Portland JSX advanced by 38 cents to close at $7.88 with an exchange of 9,700 stocks, Salada Foods rose $3 to $28 in trading 13,594 stock units. Scotia Group gained 95 cents in ending at $45 while exchanging 11,930 stock units and Seprod lost 99 cents to end at $54 and crossing the exchange with 26,126 stocks. Trading ended with an average of 909,763 units changing hands for the day at $3,152,673 for each security, in comparison to an average of 152,000 shares at $1,199,070 on Wednesday. The average trade for the month to date ended at 401,777 units at $1,737,639 for each security, in contrast to 330,159 units at $1,538,143 on Wednesday. Trading month to date compares well to July with an average of 374,929 units at $2,445,605 (392,128 shares for $2,444,356.

Trading ended with an average of 909,763 units changing hands for the day at $3,152,673 for each security, in comparison to an average of 152,000 shares at $1,199,070 on Wednesday. The average trade for the month to date ended at 401,777 units at $1,737,639 for each security, in contrast to 330,159 units at $1,538,143 on Wednesday. Trading month to date compares well to July with an average of 374,929 units at $2,445,605 (392,128 shares for $2,444,356. Kingston Wharves climbed 50 cents to $53, with just 2,071 units passing through the market, Mayberry Investments carved out a loss 75 cents to settle at $5.15 in an exchange of 19,239 shares, Mayberry Jamaican Equities dropped by 45 cents to close at $8.75 with investors wapping 152,360 units. NCB Financial climbed $7.88 trading 65,722 stock units at $137.90, PanJam Investment rose $1.75 to end at $68.50, with 11,860 shares changing hands, Proven Investments dropped $1.90 in ending at $33.80, with 2,500 stocks passing through the market. Sagicor Group increased by $4 to close at $44 in exchanging 682,448 stocks, Salada Foods shed $2 to settle at $25 after exchanging 42,000 units, Scotia Group dropped $1.73 to end at $46 in an exchange of 3,707 stocks. Seprod lost $2.24 to close at $54 in an exchange of 16,518 stocks, Stanley Motta rose 38 cents to settle at $5.13 with investors switching ownership of 37 shares, Supreme Ventures lost 65 cents to end at $14.50 with investors trading 152,771 shares. Victoria Mutual Investments declined by 37 cents to $6.57 with 69,669 stock units changing hands and Wisynco Group gained 58 cents to end at $17.79, with 11,650 stocks clearing the market.

Kingston Wharves climbed 50 cents to $53, with just 2,071 units passing through the market, Mayberry Investments carved out a loss 75 cents to settle at $5.15 in an exchange of 19,239 shares, Mayberry Jamaican Equities dropped by 45 cents to close at $8.75 with investors wapping 152,360 units. NCB Financial climbed $7.88 trading 65,722 stock units at $137.90, PanJam Investment rose $1.75 to end at $68.50, with 11,860 shares changing hands, Proven Investments dropped $1.90 in ending at $33.80, with 2,500 stocks passing through the market. Sagicor Group increased by $4 to close at $44 in exchanging 682,448 stocks, Salada Foods shed $2 to settle at $25 after exchanging 42,000 units, Scotia Group dropped $1.73 to end at $46 in an exchange of 3,707 stocks. Seprod lost $2.24 to close at $54 in an exchange of 16,518 stocks, Stanley Motta rose 38 cents to settle at $5.13 with investors switching ownership of 37 shares, Supreme Ventures lost 65 cents to end at $14.50 with investors trading 152,771 shares. Victoria Mutual Investments declined by 37 cents to $6.57 with 69,669 stock units changing hands and Wisynco Group gained 58 cents to end at $17.79, with 11,650 stocks clearing the market. For the month to date, the average trade is 330,159 units at $1,538,143 for each security that traded, in contrast to 360,995 units at $1,596,828 to Tuesday. Trading for the month to date compares well to July with an average of 392,128 shares for $2,444,356.

For the month to date, the average trade is 330,159 units at $1,538,143 for each security that traded, in contrast to 360,995 units at $1,596,828 to Tuesday. Trading for the month to date compares well to July with an average of 392,128 shares for $2,444,356. Key Insurance carved out a gain of 50 cents ending at $7.50 with investors swapping 1,135 units, Kingston Properties increased 57 cents to $7.60 after exchanging ten units. Kingston Wharves declined by $1.30 to close at $52.50 passing through the market 7,089 stock units, MPC Caribbean Energy declined by $19.85 to settle at $150 in trading 770 stock units, NCB Financial fell by $6.98 in closing at $130.02, with 222,268 shares passing through the market. Proven Investments increased 30 cents to settle at $35.70 in an exchange of 27,348 shares, Sagicor Group advanced by 90 cents in ending at $40 after trading 52,290 units, Salada Foods dropped by $1 to end at $27 in an exchange of 1,000 shares. Seprod advanced by $1.24 to close at $56.24 after trading 5,507 stocks, Sygnus Credit Investments shed 31 cents to close at $15.99 with 7,381 stocks changing hands and Wisynco Group shed 67 cents to end at $17.21 with investors swapping 82,451 units.

Key Insurance carved out a gain of 50 cents ending at $7.50 with investors swapping 1,135 units, Kingston Properties increased 57 cents to $7.60 after exchanging ten units. Kingston Wharves declined by $1.30 to close at $52.50 passing through the market 7,089 stock units, MPC Caribbean Energy declined by $19.85 to settle at $150 in trading 770 stock units, NCB Financial fell by $6.98 in closing at $130.02, with 222,268 shares passing through the market. Proven Investments increased 30 cents to settle at $35.70 in an exchange of 27,348 shares, Sagicor Group advanced by 90 cents in ending at $40 after trading 52,290 units, Salada Foods dropped by $1 to end at $27 in an exchange of 1,000 shares. Seprod advanced by $1.24 to close at $56.24 after trading 5,507 stocks, Sygnus Credit Investments shed 31 cents to close at $15.99 with 7,381 stocks changing hands and Wisynco Group shed 67 cents to end at $17.21 with investors swapping 82,451 units. Trading month to date compares well to July that ended with an average of 392,128 shares for $2,444,356.

Trading month to date compares well to July that ended with an average of 392,128 shares for $2,444,356. Kingston Wharves gained $1 to end at $51, with 3,270 stocks changing hands. Mayberry Investments climbed 90 cents to close at $5.90 with an exchange of 300 shares, Mayberry Jamaican Equities advanced by 44 cents to end at $9.19 with investors switching ownership of 10,750 units, Palace Amusement rose $11 to close at $1561, with nine units clearing the market. PanJam Investment shed $1 to close at $68 trading 6,594 stocks, Proven Investments carved out a gain of $1.05 to finish at $34.95 with investors switching ownership of 4,371 stock units, Sagicor Group dropped 50 cents to close at $42 with investors exchanging 33,395 stocks. Sagicor Real Estate Fund gained $1.02 to end at $8.88 while exchanging 110 stock units, Seprod gained 96 cents to settle at $56.96, with 36,600 shares crossing the exchange and Wisynco Group advanced 50 cents to $17.60 with investors wapping 85,689 stock units.

Kingston Wharves gained $1 to end at $51, with 3,270 stocks changing hands. Mayberry Investments climbed 90 cents to close at $5.90 with an exchange of 300 shares, Mayberry Jamaican Equities advanced by 44 cents to end at $9.19 with investors switching ownership of 10,750 units, Palace Amusement rose $11 to close at $1561, with nine units clearing the market. PanJam Investment shed $1 to close at $68 trading 6,594 stocks, Proven Investments carved out a gain of $1.05 to finish at $34.95 with investors switching ownership of 4,371 stock units, Sagicor Group dropped 50 cents to close at $42 with investors exchanging 33,395 stocks. Sagicor Real Estate Fund gained $1.02 to end at $8.88 while exchanging 110 stock units, Seprod gained 96 cents to settle at $56.96, with 36,600 shares crossing the exchange and Wisynco Group advanced 50 cents to $17.60 with investors wapping 85,689 stock units. Trading month to date compares well to July that ended with an average of 392,128 shares for $2,444,356.

Trading month to date compares well to July that ended with an average of 392,128 shares for $2,444,356. Kingston Wharves carved out a loss $3.50, with $50 569 units passing through the market. Mayberry Investments lost 99 cents to close at $5 trading 104,727 stocks, Mayberry Jamaican Equities lost 55 cents to end at $8.75 in trading 51,450 units, Palace Amusement dropped by $232.50 to end at $1,550 while exchanging 172 shares. PanJam Investment gained $3 to sit at $69, with 2,258 shares crossing the exchange, Sagicor Group carved out a loss $1.45 to close at $42.50, after 111,287 units changed hands, Scotia Group fell $3.95 to $44.05 in an exchange of 25,815 shares and Sygnus Credit Investments declined by 50 cents to settle at $16 while exchanging 9,658 stock units.

Kingston Wharves carved out a loss $3.50, with $50 569 units passing through the market. Mayberry Investments lost 99 cents to close at $5 trading 104,727 stocks, Mayberry Jamaican Equities lost 55 cents to end at $8.75 in trading 51,450 units, Palace Amusement dropped by $232.50 to end at $1,550 while exchanging 172 shares. PanJam Investment gained $3 to sit at $69, with 2,258 shares crossing the exchange, Sagicor Group carved out a loss $1.45 to close at $42.50, after 111,287 units changed hands, Scotia Group fell $3.95 to $44.05 in an exchange of 25,815 shares and Sygnus Credit Investments declined by 50 cents to settle at $16 while exchanging 9,658 stock units.