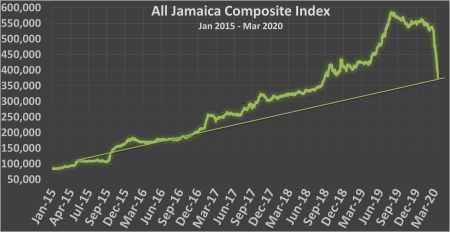

The JSE Main Market continues to surge forward at the close of trading on Monday, as recent heavy selling abates allowing the market all Jamaica Composite index to rise 25,859 points, almost wiping losses suffered from Monday to Wednesday last week.

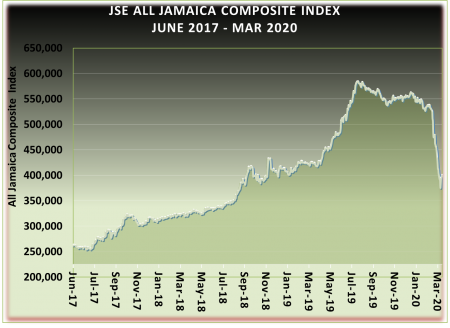

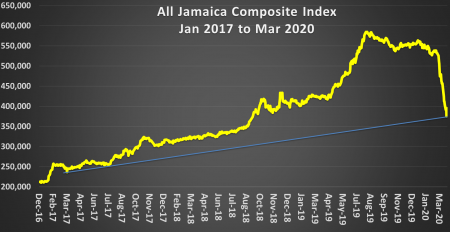

Early signs of a market rebound just showing.

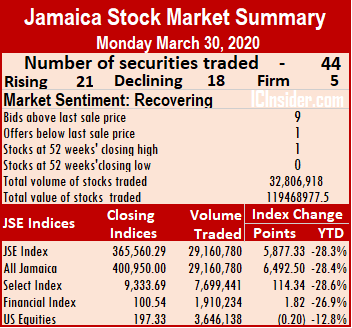

At the close, the JSE All Jamaican Composite Index climbed 6,492.50 points to 400,950.00, the JSE Market Index gained 5,877.33 points to 365,560.29 and the JSE Financial Index rose 1.82 points to 100.54.

The market closed with 44 securities changing hands in the Main and US dollar markets with prices of 21 stocks advancing, 18 declining and five securities trading firm. The JSE Main Market activity ended with 39 securities accounting for 29,160,780 units valued at $111,371,550, in contrast to 23,098,105 units at $104,845,950 from 41 securities on Friday.

Trans Jamaican Highway remained the dominant trade on Monday, with 15 million shares for 51.5 percent of total volume crossing the exchange followed by Wigton Windfarm with 5.8 million units for 20 percent of the day’s trade and Trans Jamaican Highway trading in the US dollar market with 3.6 million units for 12 percent of the market’s volume. Other stocks trading more than one million units were Pulse Investments with 1.9 million units and Sagicor Select Financial Fund with 1.7 million units.

The Market closed with an average of 747,712 units valued $2,855,681 for each security traded, in contrast to 563,368 units valued at an average of $2,557,218 on Friday. The average volume and value for the month to date amount to 1,148,383 units valued at $7,111,386 for each security changing hands compared to 1,166,767 units valued at 7,327,128 for each security traded.

Trading in February resulted in an average of 624,731 units valued at $3,239,665 for each security.

Trading in February resulted in an average of 624,731 units valued at $3,239,665 for each security.IC bid-offer Indicator│ At the end of trading, the Investor’s Choice bid-offer indicator reading shows nine stocks ending with bids higher than their last selling prices and one stock closing with a lower offer. With IC Isider.com switching projections over to 2020 and 2021 fiscal years, PE ratios are down, reflecting higher projected earnings in some cases and leaving average PE of the market at 13.3, while the Main Market ended at 13.9 times 2020/21 earnings.

In the Main Market, Barita Investments climbed $3.99 to $54.99, after trading 80,515 shares, Berger Paints closed $1.54 higher to $11.04, in transferring 22,211 units, Caribbean Cement dived $9, in swapping 166,167 shares to finish at $40. First Rock Capital gained 50 cents exchanging 13,097 units and closed at $10, Grace Kennedy slid $2, with 21,729 shares changing hands to close at $54.50, Jamaica Broilers ended 91 cents lower to $28.09 trading 80,513 shares. Jamaica Producers advanced $2.85 to $19, while 22,817 units passed through the market, Jamaica Stock Exchange rose 47 cents to $19, with 86,297 shares changing hands, JMMB Group closed down by $1.45 to finish at $34 in transferring 536,454 shares.

Kingston Wharves slid $1.50 to $42, trading 7,109 units, Mayberry Investments picked up 60 cents and closed at $5.60, with an exchange of 67,881 shares, Mayberry Jamaican Equities shed 36 cents with 16,100 units trading to end at $6.64. NCB Financial Group declined by $4 to close at $150, with 114,390 shares changing hands, 138 Student Living rose 81 cents to end at $5.50, in swapping a mere 86 units, Proven Investments ended at $35.94, after picking up 94 cents and transferring 35,465 shares. Pulse Investments ended at $3.13, with gains of 60 cents trading 1,882,701 shares, Sagicor Group dropped $2.60 to end at $44, with an exchange of 46,235 units, Sagicor Real Estate Fund closed $1.10 higher to $7.70 with the trading of just 1,901 units. Scotia Group a lost $3.49 and finished at $44.01 with 38,328 units changing hands, Seprod added $3.50 to end at $42.50, after transferring 73,476 units, Stanley Motta lost 39 cents swapping 1,000 units and closed at $4.61 and Supreme Ventures fell 49 cents to end at $13.50, with 253,252 shares traded.

Kingston Wharves slid $1.50 to $42, trading 7,109 units, Mayberry Investments picked up 60 cents and closed at $5.60, with an exchange of 67,881 shares, Mayberry Jamaican Equities shed 36 cents with 16,100 units trading to end at $6.64. NCB Financial Group declined by $4 to close at $150, with 114,390 shares changing hands, 138 Student Living rose 81 cents to end at $5.50, in swapping a mere 86 units, Proven Investments ended at $35.94, after picking up 94 cents and transferring 35,465 shares. Pulse Investments ended at $3.13, with gains of 60 cents trading 1,882,701 shares, Sagicor Group dropped $2.60 to end at $44, with an exchange of 46,235 units, Sagicor Real Estate Fund closed $1.10 higher to $7.70 with the trading of just 1,901 units. Scotia Group a lost $3.49 and finished at $44.01 with 38,328 units changing hands, Seprod added $3.50 to end at $42.50, after transferring 73,476 units, Stanley Motta lost 39 cents swapping 1,000 units and closed at $4.61 and Supreme Ventures fell 49 cents to end at $13.50, with 253,252 shares traded.

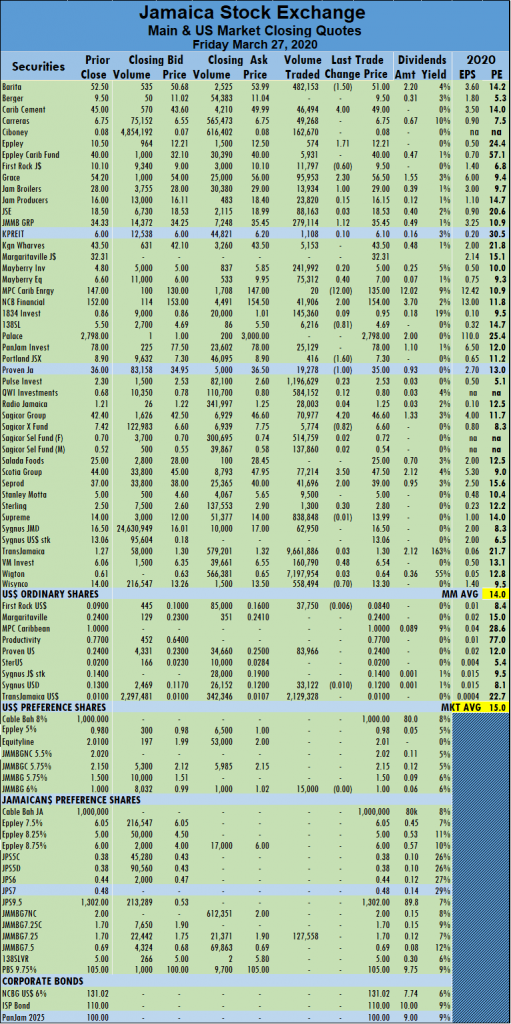

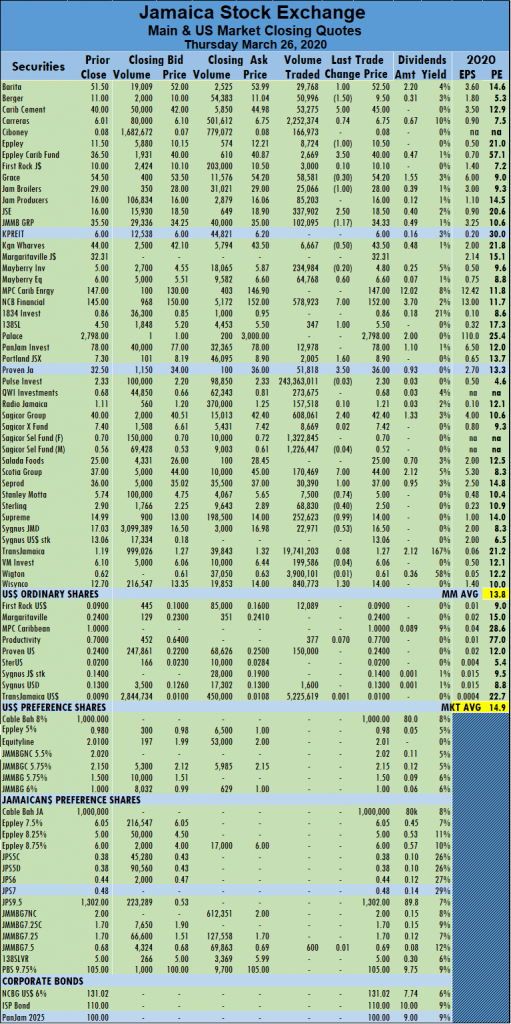

Prices of securities trading are those for the day’s last transaction unless otherwise stated.

Trading in February resulted in an average of 624,731 units valued at $3,239,665 for each security.

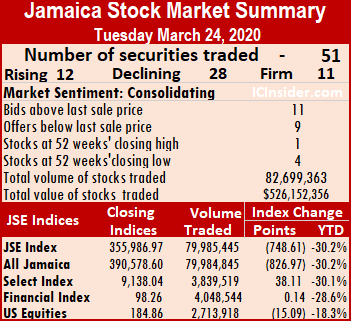

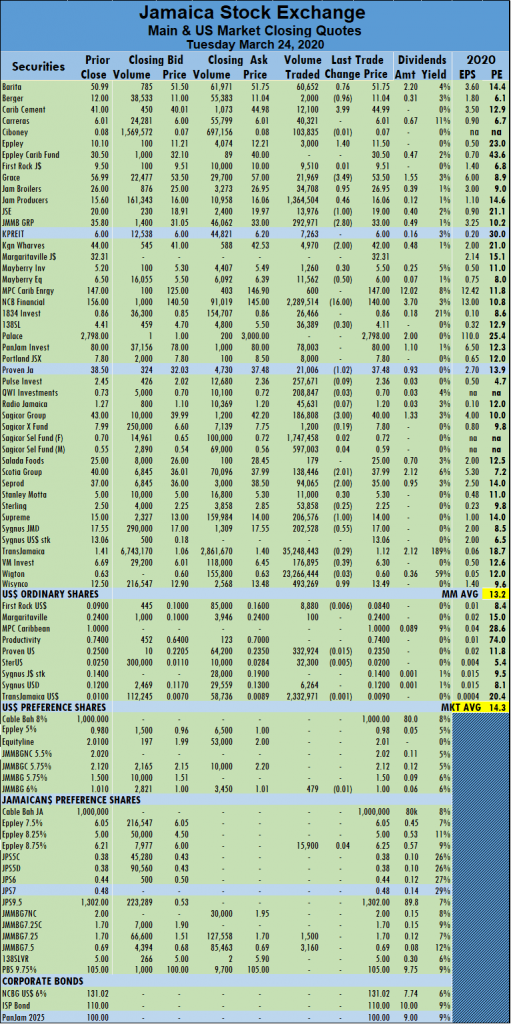

Trading in February resulted in an average of 624,731 units valued at $3,239,665 for each security. NCB Financial Group closed $2 higher at $154, in trading 41,906 shares, 138 Student Living shed 81 cents to end at $4.69 exchanging 6,216 units, Portland JSX closed $1.60 lower to $7.30 after transferring just 416 units. Proven Investments ended at $35, after falling by $1 in trading 19,278 shares, Sagicor Group jumped $4.20 to $46.60, with 70,977 stock units changing hands, Sagicor Real Estate Fund fell 82 cents to $6.60 with the transfer of 5,774 units. Scotia Group climbed $3.50 to finish at $47.50 and trading 77,214 shares, Seprod added $2 to end at $39, with an exchange of 41,696 shares, Sterling Investments picked up 30 cents to close at $2.80, in transferring 1,300 units. Victoria Mutual Investments ended at $6.54, with gains of 48 cents and exchanging 160,790 shares and Wisynco Group closed at $13.30, with a loss of 70 cents after 558,494 shares crossed the exchange.

NCB Financial Group closed $2 higher at $154, in trading 41,906 shares, 138 Student Living shed 81 cents to end at $4.69 exchanging 6,216 units, Portland JSX closed $1.60 lower to $7.30 after transferring just 416 units. Proven Investments ended at $35, after falling by $1 in trading 19,278 shares, Sagicor Group jumped $4.20 to $46.60, with 70,977 stock units changing hands, Sagicor Real Estate Fund fell 82 cents to $6.60 with the transfer of 5,774 units. Scotia Group climbed $3.50 to finish at $47.50 and trading 77,214 shares, Seprod added $2 to end at $39, with an exchange of 41,696 shares, Sterling Investments picked up 30 cents to close at $2.80, in transferring 1,300 units. Victoria Mutual Investments ended at $6.54, with gains of 48 cents and exchanging 160,790 shares and Wisynco Group closed at $13.30, with a loss of 70 cents after 558,494 shares crossed the exchange.

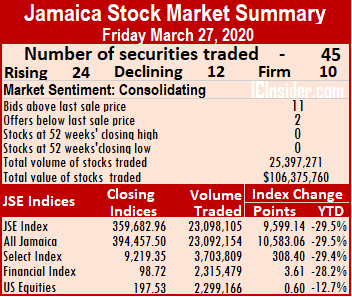

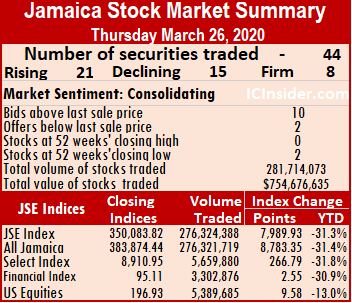

The PE ratio of the market ended at 14.9, while the Main Market ended at 13.8 times 2019 earnings.

The PE ratio of the market ended at 14.9, while the Main Market ended at 13.8 times 2019 earnings. Portland JSX closed $1.60 higher to $8.90 after the transferring of 2,005 units. Proven Investments jumped $3.50 to $36, after exchanging 51,818 shares, Sagicor Group advanced by $2.40 to $42.40, in swapping 608,061 shares, Scotia Group regained ground with gains of $7 to settle at $44, with 170,469 shares changing hands. Seprod added $1 to end at $37, in trading 30,390 units, Stanley Motta shed 74 cents with a transfer of 7,500 units to end at $5. Sterling Investments closed 40 cents lower at $2.50 trading 68,830 units, Supreme Ventures ended at $14, with a loss of 99 cents exchanging 252,623 shares, Sygnus Credit Investments closed 53 cents lower to $16.50, trading 22,971 units and Wisynco Group swapped 840,773 shares at $14, after gaining $1.30.

Portland JSX closed $1.60 higher to $8.90 after the transferring of 2,005 units. Proven Investments jumped $3.50 to $36, after exchanging 51,818 shares, Sagicor Group advanced by $2.40 to $42.40, in swapping 608,061 shares, Scotia Group regained ground with gains of $7 to settle at $44, with 170,469 shares changing hands. Seprod added $1 to end at $37, in trading 30,390 units, Stanley Motta shed 74 cents with a transfer of 7,500 units to end at $5. Sterling Investments closed 40 cents lower at $2.50 trading 68,830 units, Supreme Ventures ended at $14, with a loss of 99 cents exchanging 252,623 shares, Sygnus Credit Investments closed 53 cents lower to $16.50, trading 22,971 units and Wisynco Group swapped 840,773 shares at $14, after gaining $1.30. Trans Jamaican Highway is once more the most dominant traded stock in the Jamaica Stock Exchange US dollar market on Thursday, accounting for 97 percent of the day’s volume, just a fraction up on Wednesday’s level of 96.6 percent of the total volume traded.

Trans Jamaican Highway is once more the most dominant traded stock in the Jamaica Stock Exchange US dollar market on Thursday, accounting for 97 percent of the day’s volume, just a fraction up on Wednesday’s level of 96.6 percent of the total volume traded.

The average volume and value for the month to date amount to 899,129 units valued at $6,578,450 for each security changing hands compared to 775,631 units valued at $6,653,987 for each company traded. Trading in February resulted in an average of 624,731 units valued at $3,239,665 for each security.

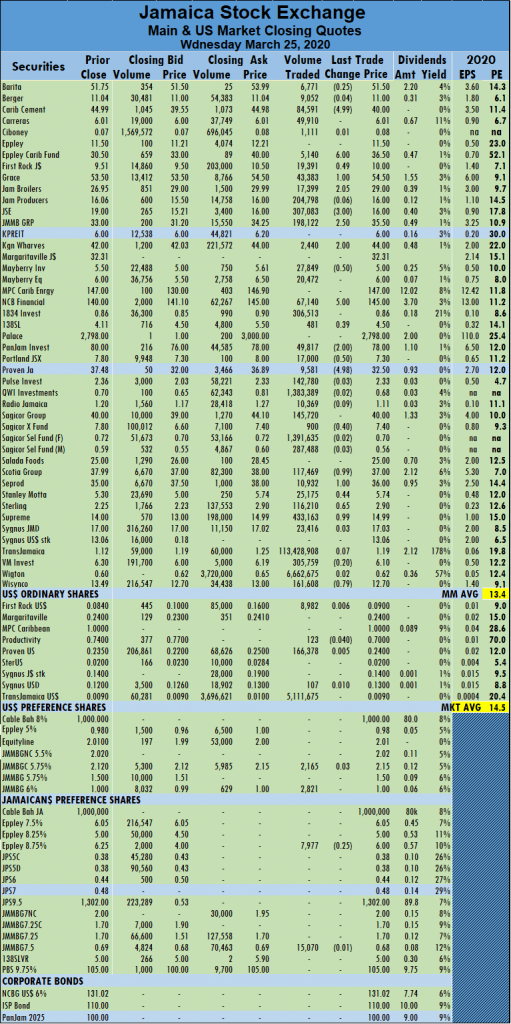

The average volume and value for the month to date amount to 899,129 units valued at $6,578,450 for each security changing hands compared to 775,631 units valued at $6,653,987 for each company traded. Trading in February resulted in an average of 624,731 units valued at $3,239,665 for each security. Kingston Wharves closed, with gains of $2 at $44 in trading 2,440 stock units, Mayberry Investments lost 50 cents transferring 27,849 shares to end at a 52 weeks’ low of $5. NCB Financial advanced $5 to $145, trading 67,140 units, 138 Student Living gained 39 cents to close at $4.50, with an exchange of 481 shares, PanJam Investment declined $2 to $78, with 49,817 units crossing the exchange. Portland JSX shed 50 cents trading 17,000 stock units and closed at $7.30, Proven Investments fell $4.98 to $32.50, after transferring 9,581 units, Sagicor Real Estate Fund lost 40 cents to close at $7.40, in swapping 900 stock units. Scotia Group closed 99 cents lower to end at $37, in exchanging 117,469 shares, Seprod ended the day’s trade at $36, with gains of $1 after 10,932 shares changed hands, Stanley Motta added 44 cents with a transfer of 25,175 units to end at $5.74. Sterling Investments closed 65 cents higher to $2.90, trading 116,210 shares, Supreme Investments ended at $14.99, after gaining 99 cents exchanging 433,163 stock units and Wisynco Group closed at $12.79, with a loss of 79 cents after trading 161,608 shares.

Kingston Wharves closed, with gains of $2 at $44 in trading 2,440 stock units, Mayberry Investments lost 50 cents transferring 27,849 shares to end at a 52 weeks’ low of $5. NCB Financial advanced $5 to $145, trading 67,140 units, 138 Student Living gained 39 cents to close at $4.50, with an exchange of 481 shares, PanJam Investment declined $2 to $78, with 49,817 units crossing the exchange. Portland JSX shed 50 cents trading 17,000 stock units and closed at $7.30, Proven Investments fell $4.98 to $32.50, after transferring 9,581 units, Sagicor Real Estate Fund lost 40 cents to close at $7.40, in swapping 900 stock units. Scotia Group closed 99 cents lower to end at $37, in exchanging 117,469 shares, Seprod ended the day’s trade at $36, with gains of $1 after 10,932 shares changed hands, Stanley Motta added 44 cents with a transfer of 25,175 units to end at $5.74. Sterling Investments closed 65 cents higher to $2.90, trading 116,210 shares, Supreme Investments ended at $14.99, after gaining 99 cents exchanging 433,163 stock units and Wisynco Group closed at $12.79, with a loss of 79 cents after trading 161,608 shares. The other big move for the day, was the substantial fall of $16 in the shares of NCB Financial to close at $140, the lowest price of in a year.

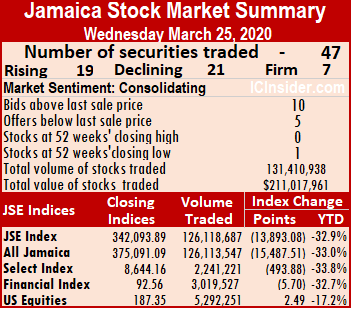

The other big move for the day, was the substantial fall of $16 in the shares of NCB Financial to close at $140, the lowest price of in a year. The Market closed with an average of 1,817,851 units valued $11,653,928 for each security traded, in contrast to 640,893 units valued at an average of $8,466,980 on Monday. The average volume and value for the month to date amount to 775,631 units valued at $6,653,987 for each security changing hands compared to 708,783 units valued at 6,313,433 for each security traded. Trading in February resulted in an average of 624,731 units valued at $3,239,665 for each security.

The Market closed with an average of 1,817,851 units valued $11,653,928 for each security traded, in contrast to 640,893 units valued at an average of $8,466,980 on Monday. The average volume and value for the month to date amount to 775,631 units valued at $6,653,987 for each security changing hands compared to 708,783 units valued at 6,313,433 for each security traded. Trading in February resulted in an average of 624,731 units valued at $3,239,665 for each security. NCB Financial dropped $16 to a 52 weeks’ low of $140, after trading 2,289,514 units, 138 Student Living lost 30 cents to close at $4.11, with 36,389 shares crossing the exchange, Proven Investments slid to $37.48, after losing $1.02 with 21,006 stock units changing hands. Sagicor Group shed $3 after exchanging 186,808 units and closed at $40, Scotia Group fell by $2.01 to close at a 52 weeks’ low of $37.99, in trading 138,446 shares, Seprod ended at $35, with a loss of $2 in swapping 94,065 units. Stanley Motta closed 30 cents higher with a transfer of 11,000 stock units $5.30, Supreme Investments ended at $14, after a loss of $1 and trading 206,576 shares. Sygnus Credit Investments lost 55 cents to close at $17, in transferring 202,528 stock units, Victoria Mutual Investments slipped to $6.30 after losing 39 cents with 176,895 units changing hands and Wisynco Group closed at $13.49, with gains of 99 cents after exchanging 493,269 shares.

NCB Financial dropped $16 to a 52 weeks’ low of $140, after trading 2,289,514 units, 138 Student Living lost 30 cents to close at $4.11, with 36,389 shares crossing the exchange, Proven Investments slid to $37.48, after losing $1.02 with 21,006 stock units changing hands. Sagicor Group shed $3 after exchanging 186,808 units and closed at $40, Scotia Group fell by $2.01 to close at a 52 weeks’ low of $37.99, in trading 138,446 shares, Seprod ended at $35, with a loss of $2 in swapping 94,065 units. Stanley Motta closed 30 cents higher with a transfer of 11,000 stock units $5.30, Supreme Investments ended at $14, after a loss of $1 and trading 206,576 shares. Sygnus Credit Investments lost 55 cents to close at $17, in transferring 202,528 stock units, Victoria Mutual Investments slipped to $6.30 after losing 39 cents with 176,895 units changing hands and Wisynco Group closed at $13.49, with gains of 99 cents after exchanging 493,269 shares.