NCB Financial one of the big contributors to the fall in the Main Market of the Jamaica Stock Exchange by knocking approximately 50,000 points off the index roared back in trading on Thursday, with a rise of $7 to close at $152 and in the process helped in pushing the two leading indices sharply higher.

NCB Financial Group contributed around 50,000 to the JSE index near 200,000 decline since the start of the year.

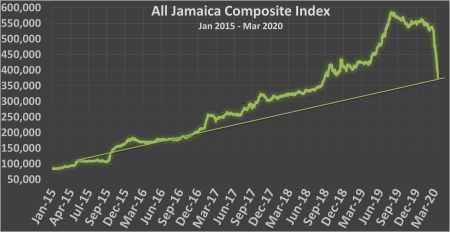

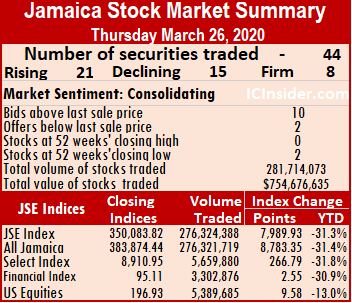

At the close, the market shows signs that it may have bottomed and is about to move higher and is partially reflected with a sharp rise in the JSE All Jamaican Composite Index jumping 8,783.35 points to 383,874.44 and the JSE Market Index climbing 7,989.93 points to 350,083.82. The JSE Financial Index gained 2.55 points to 95.11.

The market closed with 44 securities changing hands in the Main and US dollar markets with prices of 21 stocks advancing, 17 declining and eight securities trading firm. The JSE Main Market activity ended with 39 securities accounting for 276,324,388 units valued at $742,100,927 in contrast to 126,118,687 units valued at $211,017,961 from 40 securities on Wednesday.

Pulse Investments traded an unusually large 243.4 million shares for 88 percent of total volume followed by Trans Jamaican Highway with 19.7 million units for 7 percent of the day’s trade and Trans Jamaican Highway US dollar listing with 5.2 million units for 2 percent of the volume in both markets. Other stocks trading more than one million units were Carreras with 2.2 million units,

Strong signs of the market may have bottomed.

Sagicor Select Financial Fund with 1.3 million shares, Wigton Windfarm with 3.9 million units and Sagicor Select Manufacturing & Distribution Fund with 1.2 million shares.

The Market closed with an average of 7,085,241 units valued at $19,028,229 for each security traded, in contrast to 3,152,967 units valued at an average of $5,275,449 on Wednesday. The average volume and value for the month to date amount to 1,197,347 units valued at $7,209,844 for each security changing hands compared to 899,129 units valued at 6,578,450 for each security traded. Trading in February resulted in an average of 624,731 units valued at $3,239,665 for each security.

IC bid-offer Indicator│ At the end of trading, the Investor’s Choice bid-offer indicator reading shows 10 stocks ending with bids higher than their last selling prices and two stocks closing with lower offers. The PE ratio of the market ended at 14.9, while the Main Market ended at 13.8 times 2019 earnings.

The PE ratio of the market ended at 14.9, while the Main Market ended at 13.8 times 2019 earnings.

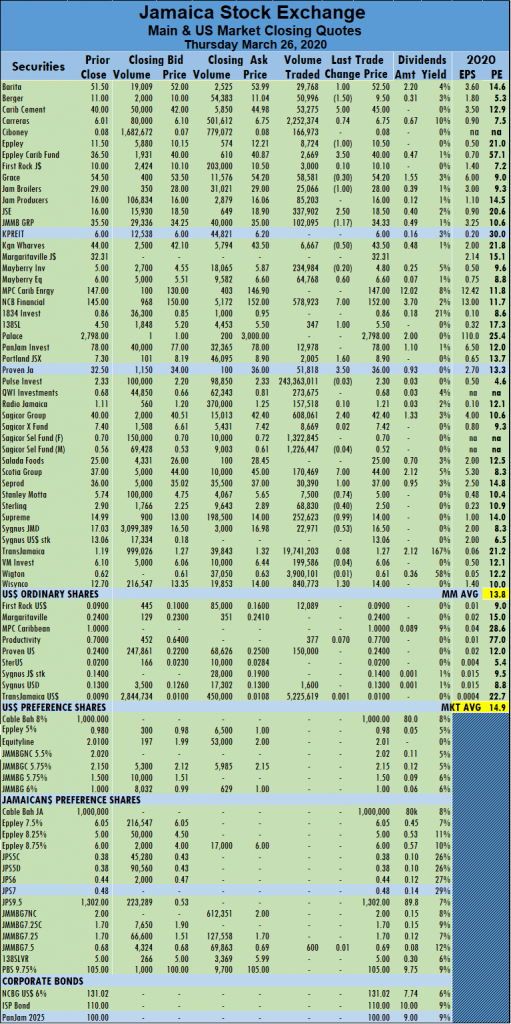

In the Main Market, Barita Investments closed $1 higher to $52.50, with a transfer of 29,768 shares, Berger Paints ended at 52 weeks’ low of $9.50, after a loss of $1.50 and exchanging 50,996 shares, Caribbean Cement gained $5 to end at $45, in trading 53,275 units. Carreras closed 74 cents higher to $6.75, with 2,252,374 shares changing hands, Eppley shed $1 swapping 8,724 units and closed at $10.50, Eppley Caribbean Property Fund added $3.50 to end at $40, in trading 2,669 units. Grace Kennedy picked up 30 cents to finish at $54.20, in trading 58,581 shares, Jamaica Broilers ended at $28, with a loss of $1 with 25,066 units changing hands, Jamaica Stock Exchange climbed $2.50 to $18.50, after the transfer of 337,902 shares. JMMB Group slid$1.17 to $34.33, with an exchange of 102,095 units, Kingston Wharves lost 50 cents to close at $43.50 trading 6,667 units, Mayberry Jamaican Equities gained 60 cents trading 64,768 shares to end at $6.60. NCB Financial jumped $7 to $152, with 578,923 shares crossing the exchange, 138 Student Living added $1 to end at $5.50, with an exchange of 347 units,  Portland JSX closed $1.60 higher to $8.90 after the transferring of 2,005 units. Proven Investments jumped $3.50 to $36, after exchanging 51,818 shares, Sagicor Group advanced by $2.40 to $42.40, in swapping 608,061 shares, Scotia Group regained ground with gains of $7 to settle at $44, with 170,469 shares changing hands. Seprod added $1 to end at $37, in trading 30,390 units, Stanley Motta shed 74 cents with a transfer of 7,500 units to end at $5. Sterling Investments closed 40 cents lower at $2.50 trading 68,830 units, Supreme Ventures ended at $14, with a loss of 99 cents exchanging 252,623 shares, Sygnus Credit Investments closed 53 cents lower to $16.50, trading 22,971 units and Wisynco Group swapped 840,773 shares at $14, after gaining $1.30.

Portland JSX closed $1.60 higher to $8.90 after the transferring of 2,005 units. Proven Investments jumped $3.50 to $36, after exchanging 51,818 shares, Sagicor Group advanced by $2.40 to $42.40, in swapping 608,061 shares, Scotia Group regained ground with gains of $7 to settle at $44, with 170,469 shares changing hands. Seprod added $1 to end at $37, in trading 30,390 units, Stanley Motta shed 74 cents with a transfer of 7,500 units to end at $5. Sterling Investments closed 40 cents lower at $2.50 trading 68,830 units, Supreme Ventures ended at $14, with a loss of 99 cents exchanging 252,623 shares, Sygnus Credit Investments closed 53 cents lower to $16.50, trading 22,971 units and Wisynco Group swapped 840,773 shares at $14, after gaining $1.30.

Prices of securities trading are those for the day’s last transaction unless otherwise stated.