Selection of stocks is not isolated from the environment in which the companies operate. Accordingly, investors need to take developments in the wider economy and in certain sectors that can impact profit.

Selection of stocks is not isolated from the environment in which the companies operate. Accordingly, investors need to take developments in the wider economy and in certain sectors that can impact profit.

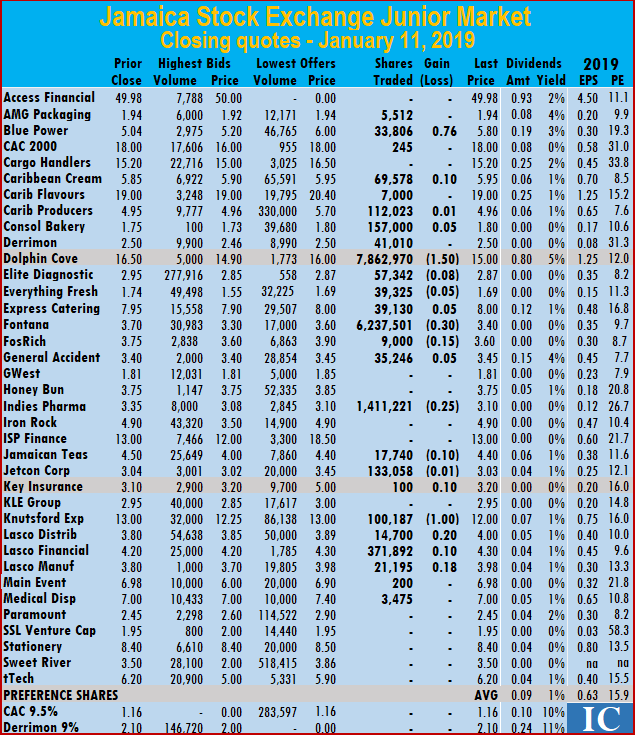

The data available suggest that Junior Market stocks should do better than those in the main market, in 2019. The TOP 15 Junior market stocks, selected based on the lowest PE ratio, using 2019 projected earnings and stock prices at the start of the year, are listed below.

AMG Packaging – PE 6. AMG suffered from losses incurred in their venture into the production of toilet tissue that failed, resulted in losses and dragging down profit in the box making business. Now that the segment of the business is closed, focus can be on their core business for which there is demand. Revenues should grow along powered by growth in the wider economy. The company reported a big jump in profit for the first quarter to November, from an increase in revenues and improved profit margin. The earnings projected is that for the fiscal year that ends in June 2020, when they would have implemented price adjustments to recover the fall in profit margin. IC Insider.com sees management as a weak area of its operation. Hopefully, changes in the composition of the board will address this frontally. Since the start of the year the price has moved up to $2.70 in response to the strong gains in the first quarter profit.Caribbean Cream – PE 9. The company enjoyed increased sales for the nine months to November last year but with flat sales in the second quarter and pick up in the third quarter. Importantly, the raw material prices for a number of production items fell sharply on the world market and will lower cost for them. The latest is the fall in the price of crude oil that will result in cheaper electricity cost as well and as JPS switches to lower electricity production the savings should gather steam during the year. The combination of lower input cost and increased sales will make the stock a winner in the current year. An investment in the stock around the $5.50 level that it is trading at may not pay off until the second half on 2019 when higher profit is expected.

growth in the wider economy. The company reported a big jump in profit for the first quarter to November, from an increase in revenues and improved profit margin. The earnings projected is that for the fiscal year that ends in June 2020, when they would have implemented price adjustments to recover the fall in profit margin. IC Insider.com sees management as a weak area of its operation. Hopefully, changes in the composition of the board will address this frontally. Since the start of the year the price has moved up to $2.70 in response to the strong gains in the first quarter profit.Caribbean Cream – PE 9. The company enjoyed increased sales for the nine months to November last year but with flat sales in the second quarter and pick up in the third quarter. Importantly, the raw material prices for a number of production items fell sharply on the world market and will lower cost for them. The latest is the fall in the price of crude oil that will result in cheaper electricity cost as well and as JPS switches to lower electricity production the savings should gather steam during the year. The combination of lower input cost and increased sales will make the stock a winner in the current year. An investment in the stock around the $5.50 level that it is trading at may not pay off until the second half on 2019 when higher profit is expected. Caribbean Producers – PE 6. The company has more going for it that it has so far

Caribbean Producers – PE 6. The company has more going for it that it has so far

delivered. The interim report to September recorded a loss of $1.3 million, but that was mostly due to write down of computer software cost and cut in the selling prices of some items that affected profit margins negatively. The core business is not affected and margins were, restored in the second quarter. The company benefits from growth in the tourism sectors in both Jamaica and St Lucia where it operates.

General Accident –PE 4.5. Investors are not seriously looking at this stock but they should. The stock is undervalued based on a PE and net asset value. Up to September, the company posted strong gains in profit for the nine months. Reports suggest that the company is looking to expand outside of Jamaica. Increased premium rates and a large pool of investible funds, are expected to deliver higher revenues and profit for the company for awhile. Continued growth in the Jamaican economy will provide a basis for above average growth in premium income and profit.

Fontana – PE 10. The PE is 10 based on current fiscal year’s earning but 7 times based on the next fiscal year results. Investors are unlikely to get this stock in the secondary market close to the IPO price any time soon. Expansion plans will  make it a good investment for long term investors if bough in the $3 region. The company will be opening their newest branch in Kingston by the second half of 2019. That will result in increased revenues and profit for the 2020 fiscal year that ends in June. They also have plans for the opening of 3 more stores in the island, when completed they will result in above average growth in revenues and profit.

make it a good investment for long term investors if bough in the $3 region. The company will be opening their newest branch in Kingston by the second half of 2019. That will result in increased revenues and profit for the 2020 fiscal year that ends in June. They also have plans for the opening of 3 more stores in the island, when completed they will result in above average growth in revenues and profit.

Elite Diagnostic PE is 6. The company recorded increased cost in 2018 as expenses associated with two new branches impacted profit negatively. The second branch is now in operation and reporting profit, while the one to open in St Anns Bay in the middle of this year should lay the foundation for continued above average growth for another year or two.

Iron Rock Insurance – PE 6. Iron Rock made profit in the September quarter for the first time and was set to report a full year of profit. Moving into 2019, revenues from increased premium income and low overhead cost and growth in the local economy are set to land a decent profit for them.

ISP Finance – PE 6. One of the smaller micro lenders ISP continues to grow and had to float a new bond to raise funds to service increased demand for loans. The September 2018 quarterly results show that interest rates charged on loans fell and that may have helped in stimulating increased demand. Loans should continue to rise and profit as well going into 2019, as cash flow from profits is invested in new loans.

Jamaican Teas – PE 7.5. The group will benefit from continued growth in the local economy and increased purchasing power of Jamaicans. The star performer, export sales have grown healthily for a number of years and should continue the growth path again. Added to this, some cost incurred in 2018, are unlikely to repeat in 2019. Importantly, accounting policy IAS 9 will see all gains or losses on investments being booked through the regular profit and loss statement and that could lift profit in 2019 as local stocks continue to grow in value.

Lasco Financial – PE 6.5. The company continues to earn from Money transfer business but the real growth potential rest in the micro lending area that enjoys high profit margin. The area is crowded but entities with size can have an advantage. Additionally, Lasco has a wide network of branches, used to reach a wide potential group for granting loans.

Lasco Manufacturing – PE 8. New products and the streamlining of the business with potential for more product lines that can be added make this entity a compelling long term investment.

Medical disposables – PE 7.5. The company started as a distributor of medical and pharmaceutical distributors but has now broadened their offering to involve consumer products. The base is established for a wider range of products, using a lot of the existing infrastructure that is adding to the attractiveness of the stock. Results for the June quarter showed strong increased revenues and profit but their usually slow second quarter saw modest increased revenues and flat profit. Importantly, gross profit increased well ahead of the growth in revenues and but for a big increase in foreign exchange losses, profit in quarter and six months would have climbed strongly. Revaluation of the Jamaican dollar in the December quarter will result in a reversal of some of the foreign exchange losses.

Stationery & Office Supplies MoBay Office

PTL- PE 7.5. The company reported growth in revenues for the half year to November resulting in improvement in gross profit. Administrative cost grew higher than revenues with depreciation accounting for 25 percent of the increased cost. The company’s joint venture lubricant plant, was operational during the period and resulted in cost and revenues excluded from the six months results but included in the 2017 figures. Only the company’s share of profit is now included in the results amounting to $2 million. The company had moved into the repackaging of chlorine and bleach production in 2018. The last quarterly results have not shown much increased business from these two ventures, while they incurred increased staff cost to serve the market. Major improvement in profit, is not expected until the 2020 fiscal year that starts in June 2019 and will probably hold back the stock price for the greater part of the year.

Stationery and Office Supplies – PE 6. SOS delivered two good years on the Junior Market for early investors. IC Insider.com is forecasting another year of strong stock gains for the company. The company moved into the production of exercise books, mostly for schools and added note pads for the local and overseas markets. Other products could be added to their line up in 2019.

tTech – PE 6. Results for the September quarter almost doubled, with earnings per share reaching 12 cents, versus 6 cents in 2017, with operating revenues rising an attractive 25 percent. Profit for 2018 should hit 40 cents for the year. Management indicates that they are proactive in seeking new business locally and overseas and sees past marketing effort to attract new business now bearing fruit.

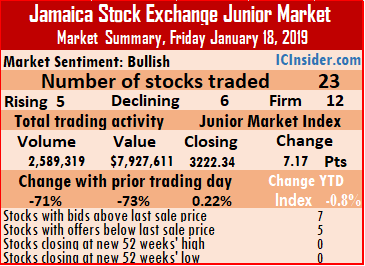

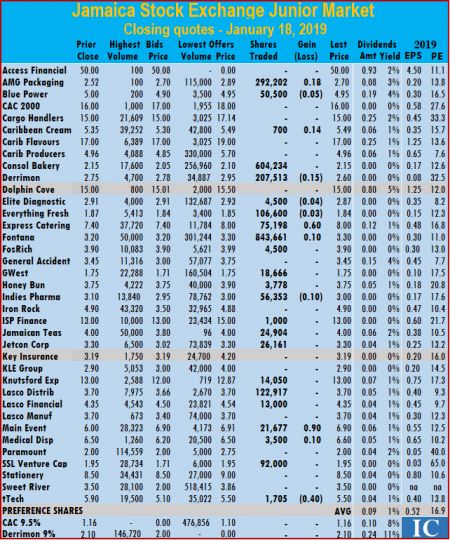

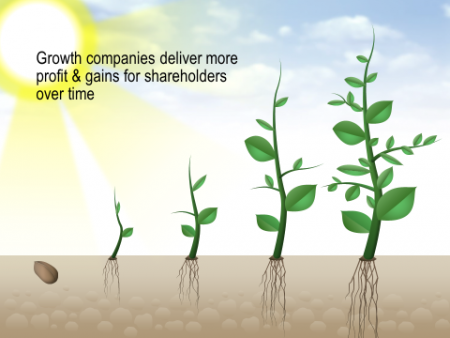

Trading on the Junior Market of the Jamaica Stock Exchange on Friday resulted in an exchange of 2,589,319 units valued at $7,927,611, down from 8,871,009 units valued at $29,431,464 on Thursday.

Trading on the Junior Market of the Jamaica Stock Exchange on Friday resulted in an exchange of 2,589,319 units valued at $7,927,611, down from 8,871,009 units valued at $29,431,464 on Thursday. an exchange of 700 shares. Consolidated Bakeries closed at $2.15, with 604,234 shares trading, Derrimon Trading ended with a loss of 15 cents at $2.60, exchanging 207,513 shares. Elite Diagnostic finished with a loss of 4 cents at $2.87, trading 4,500 stocks, Everything Fresh lost 3 cents to end trading of 106,600 shares at $1.84. Express Catering jumped 60 cents to $8, with 75,198 units changing hands, Fontana gained 10 cents in trading 843,661 shares and closed at $3.30, but the stock closed with more selling than buying, FosRich Group ended trading of 4,500 shares at $3.90. GWest Corporation traded 18,666 shares at $1.75, Honey Bun concluded trading of 3,778 units at $3.75, Indies Pharma fell 10 cents to end at $3, trading 56,353 shares, ISP Finance ended at $13, with just 1,000 units

an exchange of 700 shares. Consolidated Bakeries closed at $2.15, with 604,234 shares trading, Derrimon Trading ended with a loss of 15 cents at $2.60, exchanging 207,513 shares. Elite Diagnostic finished with a loss of 4 cents at $2.87, trading 4,500 stocks, Everything Fresh lost 3 cents to end trading of 106,600 shares at $1.84. Express Catering jumped 60 cents to $8, with 75,198 units changing hands, Fontana gained 10 cents in trading 843,661 shares and closed at $3.30, but the stock closed with more selling than buying, FosRich Group ended trading of 4,500 shares at $3.90. GWest Corporation traded 18,666 shares at $1.75, Honey Bun concluded trading of 3,778 units at $3.75, Indies Pharma fell 10 cents to end at $3, trading 56,353 shares, ISP Finance ended at $13, with just 1,000 units  trading, Jamaican Teas concluded trading with 24,904 shares at $4, Jetcon Corporation finished at $3.30, with 26,161 shares trading. Knutsford Express traded 14,050 units at $13, Lasco Distributors finished trading 122,917 shares at $3.70, Lasco Financial closed at $4.35, trading 13,000 shares. Main Event concluded trading with 21,677 stock units, and gained 90 cents to close at $6.90, Medical Disposables finished 10 cents higher at $6.60, with 3,500 units changing hands, SSL Venture Capital exchanged 92,000 shares to close at $1.95 and tTech finished trading of just 1,705 stock units with a loss of 40 cents at $5.50.

trading, Jamaican Teas concluded trading with 24,904 shares at $4, Jetcon Corporation finished at $3.30, with 26,161 shares trading. Knutsford Express traded 14,050 units at $13, Lasco Distributors finished trading 122,917 shares at $3.70, Lasco Financial closed at $4.35, trading 13,000 shares. Main Event concluded trading with 21,677 stock units, and gained 90 cents to close at $6.90, Medical Disposables finished 10 cents higher at $6.60, with 3,500 units changing hands, SSL Venture Capital exchanged 92,000 shares to close at $1.95 and tTech finished trading of just 1,705 stock units with a loss of 40 cents at $5.50.

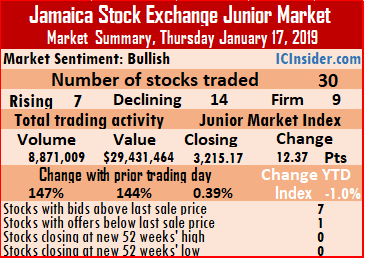

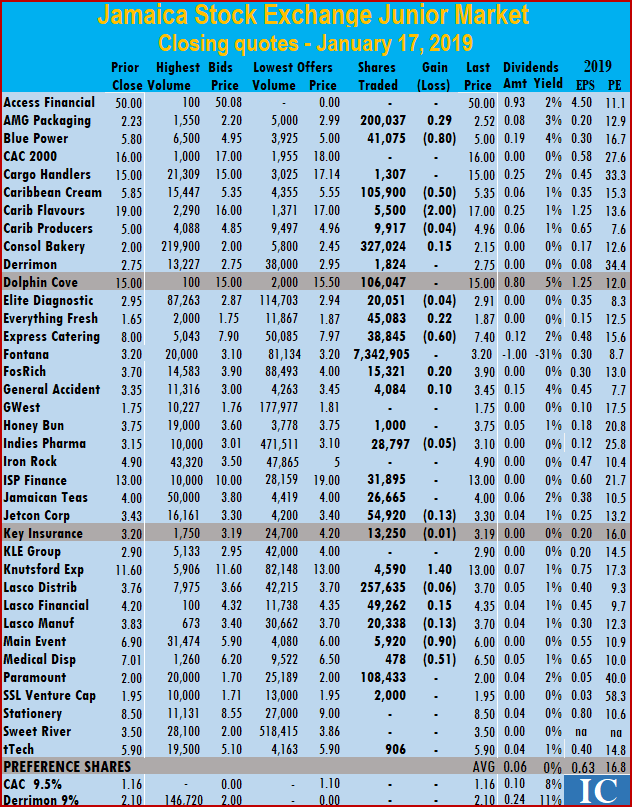

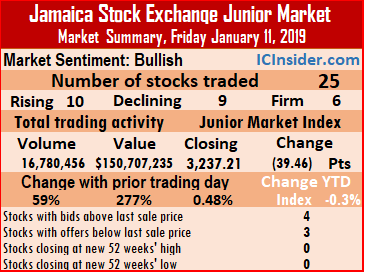

trading at $13, with an exchange of 31,895 shares, Jamaican Teas closed at $4, with 26,665 shares trading, Jetcon Corporation settled with a loss of 13 cents at $3.30, with 54,920 shares changing hands. Key Insurance ended trading with a loss of 1 cent at $3.19, with 13,250 stock units, Knutsford Express finished trading 4,590 shares for $1.40 higher to close at $13, Lasco Distributors closed with a loss of 6 cents at $3.70, trading 257,635 shares, Lasco Financial ended 15 cents higher at $4.35, with 49,262 shares changing hands. Lasco Manufacturing concluded trading of 20,338 stock units with a loss of 13 cents to close at $3.70, Main Event finished with a loss of 90 cents at $6, in exchanging 5,920 units, Medical Disposables settled with a loss of 51 cents at $6.50, with 478 shares trading. Paramount Trading ended at $2, with an exchange of 108,433 shares, SSL Venture Capital exchanged 2,000 shares to close at $1.95 and tTech closed at $5.90, with 906 units changing hands.

trading at $13, with an exchange of 31,895 shares, Jamaican Teas closed at $4, with 26,665 shares trading, Jetcon Corporation settled with a loss of 13 cents at $3.30, with 54,920 shares changing hands. Key Insurance ended trading with a loss of 1 cent at $3.19, with 13,250 stock units, Knutsford Express finished trading 4,590 shares for $1.40 higher to close at $13, Lasco Distributors closed with a loss of 6 cents at $3.70, trading 257,635 shares, Lasco Financial ended 15 cents higher at $4.35, with 49,262 shares changing hands. Lasco Manufacturing concluded trading of 20,338 stock units with a loss of 13 cents to close at $3.70, Main Event finished with a loss of 90 cents at $6, in exchanging 5,920 units, Medical Disposables settled with a loss of 51 cents at $6.50, with 478 shares trading. Paramount Trading ended at $2, with an exchange of 108,433 shares, SSL Venture Capital exchanged 2,000 shares to close at $1.95 and tTech closed at $5.90, with 906 units changing hands. Trading on the Junior Market of the Jamaica Stock Exchange finished on Wednesday with 22 securities changing hands, resulting in an exchange of 3,592,672 units valued at $12,085,054.

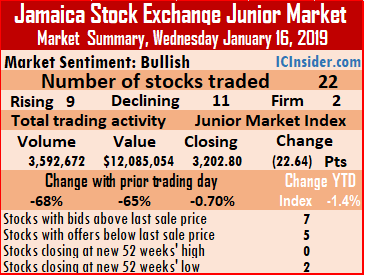

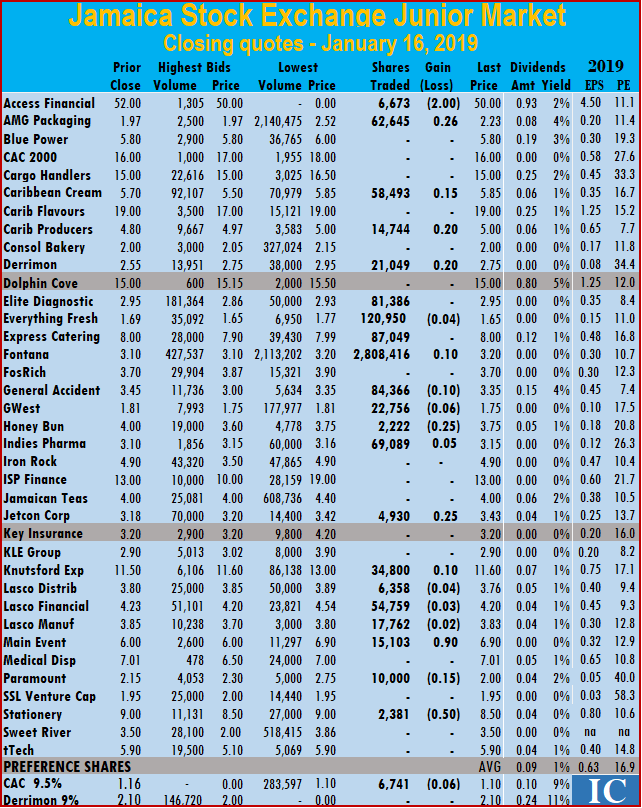

Trading on the Junior Market of the Jamaica Stock Exchange finished on Wednesday with 22 securities changing hands, resulting in an exchange of 3,592,672 units valued at $12,085,054.

loss of 4 cents at $3.76, with 6,358 shares changing hands, Lasco Financial ended with a loss of 3 cents at $4.20, in the swapping of 54,759 shares, Lasco Manufacturing concluded trading 17,762 stock units with a loss of 2 cents at $3.83. Main Event finished 90 cents higher at $6.90, with an exchange of 15,103 units, Paramount Trading ended trading of 10,000 shares with a loss of 15 cents to close at a 52 weeks’ low of $2 and Stationery and Office traded 2,381 shares with a loss of 50 cents at $8.50. In the junior market preference segment, CAC 2000 closed with a loss of 6 cents at 52 weeks’ low of $1.10, with 6,741 shares traded.

loss of 4 cents at $3.76, with 6,358 shares changing hands, Lasco Financial ended with a loss of 3 cents at $4.20, in the swapping of 54,759 shares, Lasco Manufacturing concluded trading 17,762 stock units with a loss of 2 cents at $3.83. Main Event finished 90 cents higher at $6.90, with an exchange of 15,103 units, Paramount Trading ended trading of 10,000 shares with a loss of 15 cents to close at a 52 weeks’ low of $2 and Stationery and Office traded 2,381 shares with a loss of 50 cents at $8.50. In the junior market preference segment, CAC 2000 closed with a loss of 6 cents at 52 weeks’ low of $1.10, with 6,741 shares traded. average of $3,621,958 on Monday. The average volume and value for the month to date amounts to 755,754 units valued at $3,148,757 and previously 810,207 units valued at $3,433,396. In contrast, December ended with an average of 136,222 units at a value of $737,367 for each security traded.

average of $3,621,958 on Monday. The average volume and value for the month to date amounts to 755,754 units valued at $3,148,757 and previously 810,207 units valued at $3,433,396. In contrast, December ended with an average of 136,222 units at a value of $737,367 for each security traded.

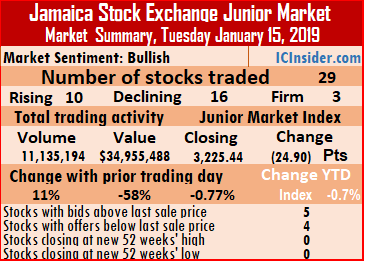

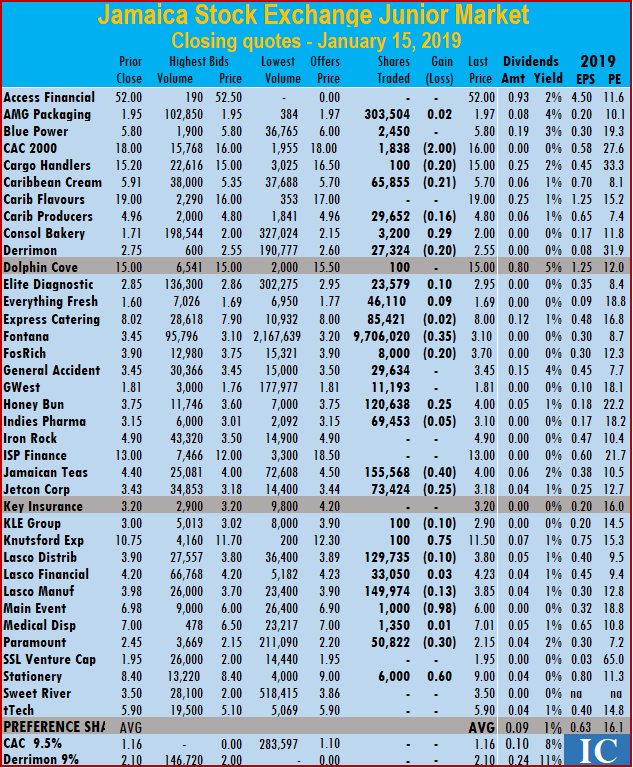

shares, Jamaican Teas finished with a loss of 40 cents at $4, with a swapping of 155,568 shares. Jetcon Corporation settled with a loss of 25 cents at $3.18, trading 73,424 shares, KLE Group traded 100 units with a loss of 10 cents at $2.90, Knutsford Express jumped 75 cents to $11.50 trading 100 shares, Lasco Distributors closed with a loss of 10 cents at $3.80, with 129,735 shares changing hands. Lasco Financial ended 3 cents higher at $4.23, trading 33,050 shares, Lasco Manufacturing concluded trading 149,974 stock units with a loss of 13 cents at $3.85, Main Event finished with a loss of 98 cents at $6, with an exchange of 1,000 units. Medical Disposables settled 1 cent higher at $7.01, trading 1,350 shares, Paramount Trading ended trading 50,822 shares with a loss of 30 cents at $2.15, following release of below par quarterly profit and Stationery and Office traded 6,000 shares with a rise of 60 cents to end at $9.

shares, Jamaican Teas finished with a loss of 40 cents at $4, with a swapping of 155,568 shares. Jetcon Corporation settled with a loss of 25 cents at $3.18, trading 73,424 shares, KLE Group traded 100 units with a loss of 10 cents at $2.90, Knutsford Express jumped 75 cents to $11.50 trading 100 shares, Lasco Distributors closed with a loss of 10 cents at $3.80, with 129,735 shares changing hands. Lasco Financial ended 3 cents higher at $4.23, trading 33,050 shares, Lasco Manufacturing concluded trading 149,974 stock units with a loss of 13 cents at $3.85, Main Event finished with a loss of 98 cents at $6, with an exchange of 1,000 units. Medical Disposables settled 1 cent higher at $7.01, trading 1,350 shares, Paramount Trading ended trading 50,822 shares with a loss of 30 cents at $2.15, following release of below par quarterly profit and Stationery and Office traded 6,000 shares with a rise of 60 cents to end at $9.

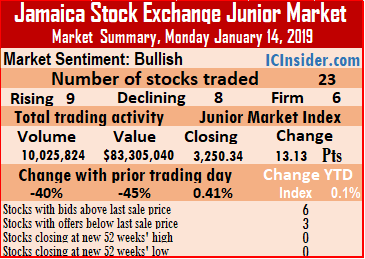

5 cents to close at $3.45, FosRich Group ended trading 2,131 shares 30 cents higher at $3.90, General Accident traded 2,300 shares at $3.45, GWest Corporation finished trading 5,838 shares at $1.81, Honey Bun closed at $3.75, with an exchange of 8,619 stock units. Indies Pharma rose 5 cents, to end at $3.15, trading 90,084 shares, Jetcon Corporation settled 40 cents higher at $3.43, trading 1,000 shares, KLE Group traded 17,617 units for 5 cents higher at $3. Knutsford Express finished trading with a loss of $1.25 at $10.75, with 6,679,341 shares changing hands, as

5 cents to close at $3.45, FosRich Group ended trading 2,131 shares 30 cents higher at $3.90, General Accident traded 2,300 shares at $3.45, GWest Corporation finished trading 5,838 shares at $1.81, Honey Bun closed at $3.75, with an exchange of 8,619 stock units. Indies Pharma rose 5 cents, to end at $3.15, trading 90,084 shares, Jetcon Corporation settled 40 cents higher at $3.43, trading 1,000 shares, KLE Group traded 17,617 units for 5 cents higher at $3. Knutsford Express finished trading with a loss of $1.25 at $10.75, with 6,679,341 shares changing hands, as  An overall view of stocks indicates that the main market continues to be steered higher by an upward sloping support line as well the 45 and 125 day moving averages, lending support just below. The Junior Market is currently guided by an upward rising long-term support line, pointing to more gains ahead.

An overall view of stocks indicates that the main market continues to be steered higher by an upward sloping support line as well the 45 and 125 day moving averages, lending support just below. The Junior Market is currently guided by an upward rising long-term support line, pointing to more gains ahead.

Stocks of companies that have the potential for active expansions, are likely to do better than those companies relying mainly on agronomic growth.

Stocks of companies that have the potential for active expansions, are likely to do better than those companies relying mainly on agronomic growth.

higher at $8, with the trading of 39,130 units, FosRich Group ended trading of 9,000 shares with a loss of 15 cents at $3.60. General Accident traded 5 cents higher at $3.45, in exchanging 35,246 shares. Investors reacted negatively to Indies Pharma full year results with lower profits than for 2017 and sold the stock down by 25 cents, to end at $3.10, trading 1,411,221 shares. Jamaican Teas traded 17,740 shares with a loss of 10 cents to close at $4.40, Jetcon Corporation settled with a loss of 1 cent at $3.03, with 133,058 shares changing hands, Key Insurance ended trading of 100 stock units at 10 cents higher to $3.20, Knutsford Express finished trading of 100,187 shares with a loss of 1 cent at $12. Lasco Distributors closed 20 cents higher at $4, with an exchange of 14,700 shares, Lasco Financial ended 10 cents higher at $4.30, with the trading of 371,892 shares, Lasco Manufacturing concluded trading 18 cents higher at $3.98, with 21,195 stock units, Main Event finished at $6.98, trading 200 units and Medical Disposables settled at $7, with 3,475 shares changing hands.

higher at $8, with the trading of 39,130 units, FosRich Group ended trading of 9,000 shares with a loss of 15 cents at $3.60. General Accident traded 5 cents higher at $3.45, in exchanging 35,246 shares. Investors reacted negatively to Indies Pharma full year results with lower profits than for 2017 and sold the stock down by 25 cents, to end at $3.10, trading 1,411,221 shares. Jamaican Teas traded 17,740 shares with a loss of 10 cents to close at $4.40, Jetcon Corporation settled with a loss of 1 cent at $3.03, with 133,058 shares changing hands, Key Insurance ended trading of 100 stock units at 10 cents higher to $3.20, Knutsford Express finished trading of 100,187 shares with a loss of 1 cent at $12. Lasco Distributors closed 20 cents higher at $4, with an exchange of 14,700 shares, Lasco Financial ended 10 cents higher at $4.30, with the trading of 371,892 shares, Lasco Manufacturing concluded trading 18 cents higher at $3.98, with 21,195 stock units, Main Event finished at $6.98, trading 200 units and Medical Disposables settled at $7, with 3,475 shares changing hands.

$1.81. Honey Bun closed with a loss of 10 cents at $3.75, in exchanging 18,500 stock units, Indies Pharma traded 105,904 shares and rose 15 cents to end at $3.35, Jetcon Corporation settled with a loss of 16 cents at $3.04, with an exchange of 7,000 shares, KLE Group traded 8,000 units and lost 5 cents at $2.95. Knutsford Express finished trading of 7,539 shares at $13, Lasco Distributors fell 9 cents at $3.80, trading 27,240 shares. Lasco Financial closed at $4.20, with an exchange of 96,350 shares, Medical Disposables fell 10 cents in settling at $7, in exchanging 14,682 shares. Paramount Trading ended trading with a loss of 15 cents at $2.45, while trading 8,176 shares and Stationery and Office jumped 40 cents to close at $8.40, while exchanging 19,087 shares.

$1.81. Honey Bun closed with a loss of 10 cents at $3.75, in exchanging 18,500 stock units, Indies Pharma traded 105,904 shares and rose 15 cents to end at $3.35, Jetcon Corporation settled with a loss of 16 cents at $3.04, with an exchange of 7,000 shares, KLE Group traded 8,000 units and lost 5 cents at $2.95. Knutsford Express finished trading of 7,539 shares at $13, Lasco Distributors fell 9 cents at $3.80, trading 27,240 shares. Lasco Financial closed at $4.20, with an exchange of 96,350 shares, Medical Disposables fell 10 cents in settling at $7, in exchanging 14,682 shares. Paramount Trading ended trading with a loss of 15 cents at $2.45, while trading 8,176 shares and Stationery and Office jumped 40 cents to close at $8.40, while exchanging 19,087 shares.